Attached files

| file | filename |

|---|---|

| EX-2.1 - SECURITIES EXCHANGE AGREEMENT - Apple Green Holding, Inc. | f8k011014ex2i_bluesunmedia.htm |

| EX-10.1 - JOINT VENTURE AGREEMENT - Apple Green Holding, Inc. | f8k011014ex10i_bluesunmedia.htm |

| EX-10.2 - BUY BACK AGREEMENT - Apple Green Holding, Inc. | f8k011014ex10ii_bluesunmedia.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 10, 2014

|

BLUE SUN MEDIA, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

333-171891

|

27-3436055

|

||

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

30, Jalan PJS 7/19, Bandar Sunway,

46150 Petaling Jaya,

Selangor, Malaysia

|

||

|

(Address of Principal Executive Offices)

|

Tel. +603 5636 1869

Fax +603 5636 1771

Registrant’s telephone number, including area code

9/F., Kam Chung Commercial Building, 19-21 Hennessy Road, Wanchai, Hong Kong

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

TABLE OF CONTENTS

|

Item No.

|

Description of Item

|

Page No.

|

||

|

Item 1.01

|

Entry Into a Material Definitive Agreement

|

3 | ||

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets

|

4 | ||

|

Item 3.02

|

Unregistered Sales of Equity Securities

|

21 | ||

|

Item 5.06

|

Change in Shell Company Status

|

22 | ||

|

Item 9.01

|

Financial Statements and Exhibits

|

22 |

EXPLANATORY NOTE

This Current Report on Form 8-K is being filed for Blue Sun Media, Inc. We are reporting the acquisition of a new business and providing a description of this business and its audited financials below.

|

●

|

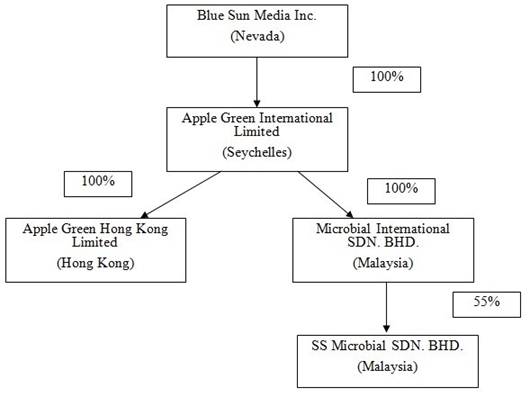

The “Company,” “we,” “us,” or “our,” are references to the combined business of (i) Blue Sun Media, Inc., a Nevada corporation (“BLES”), (ii) Apple Green International Limited, a Seychelles company (“AGIL”), (iii) Apple Green Hong Kong Limited, a Hong Kong limited liability company and a wholly-owned subsidiary of AGIL (“AGHK”), (iv) Microbial International Sdn. Bhd., a Malaysia companyn and a wholly-owned subsidiary of AGIL (“MISB”), and (v) SS Microbial Sdn. Bhd., a company incorporated under the laws of Malaysia and a subsidiary of MISB (“SSM”) and MISB owns 55% of the equity interests of SSM.

|

|

“U.S. dollar,” “$” and “US$” refer to the legal currency of the United States.

|

|

|

●

|

“RM” refers to Malaysian Ringgit.

|

|

●

|

“Securities Act” refers to the Securities Act of 1933, as amended.

|

|

●

|

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended.

|

On January 10, 2014, BLES, AGIL and the sole stockholder of AGIL who collectively own 100% of AGIL (the “AGIL Stockholder”) entered into and consummated transactions pursuant to a Securities Exchange Agreement (the “Securities Exchange Agreement,” such transaction referred to as the “Securities Exchange Transaction”), whereby the Company issued to the AGIL Stockholder an aggregate of 389,800,000 shares of its common stock, par value $.0001 per share (“Common Stock”), in exchange for 100% of equity interests of AGIL held by the AGIL Stockholder. The shares of our Common Stock received by the AGIL Stockholder in the Securities Exchange Transaction constitute approximately 97.45% of our issued and outstanding Common Stock giving effect to the issuance of shares pursuant to the Securities Exchange Agreement. As a result of the Securities Exchange Transaction, AGIL, together with its subsidiaries, AGHK, MISB, and SSM became BLES’s wholly-owned subsidiaries.

The Securities Exchange Agreement contains representations and warranties by us, AGIL and the AGIL Stockholder which are customary for transactions of this type such as, with respect to the Company: organization, good standing and qualification to do business; capitalization; subsidiaries; authorization and validity of the transaction and transaction documents; consents being obtained or not required to consummate the transaction; no conflict or violation of Memorandum and Articles of Association, with respect to AGIL: authorization; capitalization; and title to AGIL’s capital stock being exchanged, and with respect to AGIL Stockholder: authorization; no conflict or violation of law; investment purpose; accredited investor status; reliance on exemption on the Company’s Common Stock to be exchanged; and transfer or resale pursuant to the Securities Act.

Our acquisition of AGIL and its subsidiaries pursuant to the Securities Exchange Agreement was accounted for as a reverse merger and recapitalization effected by a securities exchange. AGIL is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of the acquired entity have been brought forward at their book value and no goodwill has been recognized.

3

Item 2.01 Completion of Acquisition or Disposition of Assets

On January 10, 2014, we completed the acquisition of AGIL pursuant to the Securities Exchange Agreement. The acquisition was accounted for as a reverse merger and recapitalization effected by a securities exchange. AGIL is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of the acquired entity have been brought forward at their book value and no goodwill has been recognized.

OUR CORPORATE STRUCTURE

The following diagram sets forth the structure of the Company as of the date of this Report:

Organizational History of Blue Sun Media, Inc.

Blue Sun Media, Inc. was incorporated in Nevada on November 15, 2010. The business plan of the Company was originally to offer software solutions to help simplify the management and control of the under age 17 group that is using the online market and social network available to them over the Internet. Immediately after the completion of the Securities Exchange Transaction, the Company discontinued its internet business and changed its business plan to develop microorganism recycling products business.

Organizational History of AGIL and its Subsidiaries

Apple Green International Limited was incorporated on February 1, 2013 in Republic of Seychelles and is a development-stage recycling company focusing on development of organic waste recycling business. Apple Green Hong Kong Limited was formed in Hong Kong on December 10, 2004 to produce and manufacture fertilizer. Microbial International Sdn. Bhd. was formed in Malaysia on October 10, 2000 for the purpose of manufacturing fertilizer by collecting solid waste. SS Microbial Sdn. Bhd. was formed in Malaysia on January 7, 2009 to produce and provide organic fertilizer and develop a solid waste management system in Malaysia.

4

OUR BUSINESS

Overview of Our Business

The Company is engaged in the organic waste recycling business. We are a manufacturer which transforms organic waste to organic fertilizer through the technology called PLG Micro Resources Recovery Treatment System (“PLG System”), an organic waste processing method which was supplied by Full Lead Bio- Tech (M) Sdn. Bhd. (“FLM”) through a joint venture & supply agreement (the “Joint Venture & Supply Agreement”) entered on April 17, 2009 between SSM, our subsidiary, and FLM. FLM owns 6% of the equity interest of SSM and is a wholly-owned subsidiary of Full Lead Bio- Tech Co. Ltd., formerly Hung Pai Li Bio Tech. Co., Ltd (“FLT”), a Taiwan Company. Pursuant to the Joint Venture & Supply Agreement, FLM agreed to supply waste regeneration treatment equipment, microbial agent and other processing materials, and any necessary microbial technology support to process the waste, mainly the PLG System, in consideration of US$2,426,058. On May 2, 2009 and in connection with the Joint Venture Agreement, FLT and SSM entered into an Organic Fertilizer Guarantee Buy Back Agreement (the “Buy Back Agreement”), whereby FLT agreed to purchase any unsold organic fertilizer produced by SSM pursuant to the process and methods provided by FLM based on the following price terms:

|

Type of Organic Fertilizer

|

Price Per Kilogram (Malaysian Ringgit )

|

|

|

Organic Fertilizer with N(2%), P (1%), K(1%) content

|

0.80

|

|

|

Organic Fertilizer with N(3%), P (2%), K(2%) content

|

1.00

|

|

|

Organic Fertilizer with N(4%), P (3%), K(3%) content

|

1.20

|

We are currently at development stage and have not sold any of our products. We have incurred losses and have had no revenue to date. Our auditors’ opinion stated that there is substantial doubt about our ability to continue as a going concern.

Our Products

Organic Solid Fertilizer: Organic fertilizer is a processed product that derived from the composition of animal and vegetable materials that contains safe, natural ingredients. The organic fertilizer serves both soils and plants.

Organic Liquid Fertilizer: Organic liquid fertilizer is a liquid product which is more convenient to apply in plant nutrition. It can be sprayed by mixing other foliar spray and easy to apply by farmers.

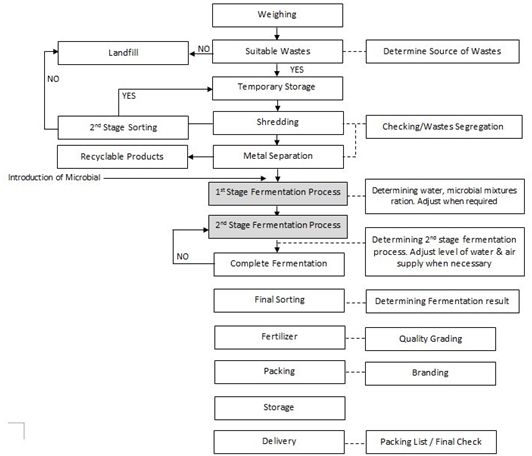

Our Processing Method

PLG Microbial Resource Recovery Treatment System

PLG Microbial Resource Recovery Treatment System (“PLG System”) is a key technology in using the machinery provided by FLM to the Company pursuant to the Joint Venture & Supply Agreement. PLG System is an organic waste processing method utilizing biological and natural scientific concept, with its purpose of linking a balance between organism and environment, achieve target of zero waste for sustainable resources. The system uses microbial agents, which are combination of compounded bacteria, to zymolysis, decompose, reduce and decontaminate organic waste and turn it into natural elements including water, carbon dioxide, nitrogen, phosphorus, and potassium. With the assistance of microbial agents, the waste with salt, oil, food mud and sludge mud, which are difficult to be decomposed with in a usual disposal situation can be zymolysised and decomposed efficiently. In a normal case, after 8 to 24 hours of the introduction of microbial agents, 70% of waste thrown in the system will be reduced, and eventually 98% of waste will be reduced by continuous zymolysis. The waste after treatment of secondary zymolysis can be turned into high quality organic fertilizer to be applied into planting, crops planting, and flower fruit trees.

We are authorized to utilize the PLG System with the proprietary technology owned by FLT pursuant to the Joint Venture & Supply Agreement. FLT is obligated to train and educate our employees on how to operate the PLG System.

5

Below is a chart of the processing chart by utilizing PLG Microbial Resource Recovery Treatment System from organic waste to the organic fertilizer.

Experiment Report of PLG Microbial Agents

There are varies reports from the research centers in Taiwan showing the environmentally friendly characteristic of the PLG System. According to the reports from toxicology Laboratory of National Taiwan University, the microbial agents that are used in the PLG System have no pollution. Another report from Poison Laboratory of Tainan Veterans General Hospital shows that PLG microbial agents have no pathogenicity possibility. In addition, the Microorganism Laboratory of National Cheng Kung University reflects that PLG microbial agents have no pathogen and it can change the sour stink into zymolytic smell and the deodorization rate by applying the PLG technology can be 40% in 24 hours.

Strengths of PLG Microbial Resource Recovery Treatment system

| ● |

The system only requires small space to process and a short processing time

|

Comparing to the common traditional way of waste treatment, the PLG System requires smaller space in the zymolysis process and a shorter time to proceed. The traditional way is to bury the organic waste such as leftover or bodies of poultry or livestock into the ground and let the waste be decomposed by microorganism in soil gradually, after 270 days to 1 year, the waste will be decomposed to powder and turned to fertilizer in soil, whereas the PLG System can supply good microorganism and zymolysis condition in a zymolysis process and finish the first zymolysis of organic waste in about 8 hours. The whole process for producing fertilizer only takes 15 days on average according to the production report, which is far less time than the traditional way. Traditional waste treatment requires large space to produce fertilizer. A factory with 120 tons daily processing load only needs 2500m2 to 3000m2 under PLG System.

6

| ● |

The system has no odor and is cost-effective

|

In addition, the whole zymolysis process is in aerobic state, which will not produce stench or cause air pollution. In the first state of zymolysis, deodorization of PLG System is effective and can reduce stench by 70% in 8 hours. At the same time, the zymolysis can produce 80 centigrade temperature ( and it is not heated manually) in the decomposition process of microorganism, which can turn water inside the waste into vapor thus the weight of waste can be reduced by 70%. In the second phase of zymolysis, water and mechanical can be stirred at one time each day, and the 100% organic fertilizer can be completed in 10 to 14 days.

| ● |

The system can process wide range of organic waste

|

PLG System has a wide range of organic waste application and may utilize various types of wastes to produce organic fertilizer, including plant waste, animal waste, agricultural mud, leftover in meat processing and other food waste.

The Organic Fertilizer Producing Procedure

Below is the flow chart of the standard operating procedure of turning the organic waste raw materials to organic fertilizer:

7

Market Opportunities

The market for fertilizer is growing. In response to attractive agriculture commodities prices in 2007 and first half of 2008, as well as policies promoting fertilizer use in many Asian countries, global fertilizer demand is seen as up by 4.1% in 2007 and 2008. World demand reached 169.4 million metric tons nutrients, compared to 162.7 million metric tons the year before. At regional level, East Asia, Malaysia included, recorded a rise of 3.4% (Heffer & Prud'homme, 2008, International Fertilizer Industry Association). Global fertilizer demand increased by 3.1% in 2008 and reached 174.7 million Metric tons. Average annual growth of fertilizer demand is 3.1% in 2008 (2008, International Fertilizer Industry Association). Global fertilizer market size reached 174.7 million metric tons as reported by International Fertilizer Industry Association (“IFA”) in their 2008 Summary Report, reaching a global consumption of 193.1 million tons nutrient in 2012.

Along with the growing fertilizer market, Malaysia’s fertilizer market witnessed a significant growth. Fertilizer Industry Association of Malaysia reported Malaysia imported 4.2 million tons of fertilizers in 2007. (Matassan, 2008, FIAM). In Malaysia, the application of large quantities of fertilizers is an important component for cultivation of high yield crops. According to the Malaysia Department of Statistic's figures, in 2001 alone, about 1.32 million nutrient tons of mineral fertilizers were imported into Malaysia, costing RM1.14 billion.

There is a gradual trend to complement or substitute mineral fertilizers with organic fertilizers. Currently, mineral fertilizers account for more than 90% of fertilizers used by all types of farming systems in Malaysia. Due to the rapid expansion in crop production, especially of plantation crops, there has been a corresponding increase in the amount of organic fertilizer that was used. The government is promoting the use of organic fertilizer in Malaysia for two main reasons. Firstly, organic agriculture is seen as in important for the sustainable use and management of natural resources. Secondly, in Malaysia’s Third National Agriculture Policy or NAP3 for 1998-2010 (Ministry of Agriculture, 1999) (“NAP 3”), organic agriculture is identified as a niche market opportunity for fruits and vegetables. In the NAP3, the government is prepared to provide additional one-off assistance in infrastructure development of organic farming, in addition to eligibility for existing credit schemes and special loans. In addition, with an effort to reduce the dependency on mineral fertilizers and to move towards more natural and healthier methods of food production, the government is also promoting programs that encourage the recycling and use of agriculture waste.

Under 9th Malaysian Plan from 2006 to 2010, the organic farming shall reach the market value for RM720 million and the organic production area shall reach 20000 hectare in the year of 2010, increasing the local production by 4,000 hectare per year and organic consumption expected to grow by 20% per year. We would therefore, target our market in organic farming, especially in the fertilizers for organic vegetable and fruit crops.

Marketing Strategy

In order to improve the profitability of our Company, and to avoid spending significant investment of time up front, we employ a direct marketing strategy to market the product directly in Malaysian market. We plans to engage with TESCO hypermarket (“TESCO”), an online food delivery company, Lembaga Pemasaran Pertanian Persekutuan (“FAMA”) of Malaysia and Malaysia Agriculture Food Corporation (“MAFC”) to bulk purchase our organic fertilizers for their distribution. Specifically, our marketing partners, TESCO, FAMA, and MAFC would pack our products and supply to the members of the farmers organization in Malaysia. Besides the current marketing partners, it is our plan to engage Giant hypermarket, Carrefour hypermarket on the similar recycling program and packing program of organic fertilizers for retailing in their stores.

We plan to distribute our products through the hypermarket chains of TESCO and Giant hypermarket due to our small manufacturing capacity. Product distribution through FAMA and MAFC shall be established only when our production capacity of production become doubled than our current manufacturing capacity.

8

Strategic Alliance

Strategic alliance is extremely important for our Company in the long term plan for expending its business and value chain. This shall be done on the following 3 main areas:

1. Supply of raw materials

A strategic alliance will be created with lndah Water Konsortium (IWK) to supply the slurry to us in Bachok, Malaysia. The slurry is an excellent raw material for the processing of liquid fertilizer.

2. Supply of microbial

A strategic alliance has been established with FLT through their wholly owned subsidiary FLM to guarantee the supply of microbial agent. The price of the microbial agent is also established and agreed. The price increase is capped at not more than 5% at every 3 years interval.

3. Strategic Partner and Distribution Partner

A similar alliance had been established between the Company and FLT on the guaranteed buy back of organic fertilizer produced by the Company. Besides, we intend to enter relationship with FAMA, MAFC, TESCO, Giant & Carrefour hypermarkets, which will distribute our products through their network.

Supplier

Our main supplier is FLT pursuant to the Joint Venture & Supply Agreement. Pursuant to the Joint Venture & Supply Agreement, FLM, FLM’s wholly owned subsidiary, supplies waste regeneration treatment equipment, microbial agent and other processing materials, and any necessary microbial technology support to process the waste, mainly the PLG System, in consideration of US$2,426,058. We do not have other suppliers therefore dependent on FLT as our sole supplier.

Customers

Our potential customers include:

|

●

|

Food and beverage factories in Malaysia

|

|

●

|

Organic farms in Malaysia

|

| ● |

Individual farmers

|

We plan to sell our fertilizer products to the customers through distributors and hypermarket chains, such as TESCO, FAMA, and MAFC. In addition, pursuant to the Buyback Agreement with FLT, FLT will be obligated to purchase any of our unsold products. Our business is not dependent on any customers.

Competition

There is no direct competition as a number of players in Malaysian market dealing compost manufacturing use mainly Empty Fruit Bunches (EFB) and Palm Oil Mill Effluent (POME) as the raw materials. Whereas our PLG process converts any uncontaminated organic wastes, including organic food waste, animal wastes, garden wastes, kitchen wastes into organic fertilizers.

The nearest competitors identified are as follows:

| ● |

Bio-Systems International (USA). It uses composting palm oil EFB with POME sludge mixture using a combination of mesophilic and thermophilic bacteria, molds & yeasts as main components. However, the process requires regular turning and aeration of windrow. It is not automated as such required large outdoor open bed to process small quantity of compost, which makes investment extremely expensive with a long payback.

|

|

●

|

Bio-Smart Sdn Bhd. It uses special bio-active enzyme to stabilize organic matter and converting bio-waste into useful organic fertilizer. It was reportedly capable of converting palm oil mill bio-waste into organic "Instant-Compost" in less than a day. However, it uses an add-on system to palm oil mill that will process EFB. The fertilizer produced would specifically be applied to the oil palms only.

|

9

|

●

|

Weimar Enterprise Sdn Bhd. It is handling Bio-Mate, which is an in-vessel fully automated on-site composting machine that operates by electricity. It requires very minimal maintenance and it is user friendly. By using high-temperature aerobic enzyme, organic waste can be full compost in between 24-48 hours. This system, however, is only able to process 10 tons of waste daily. The microbial Weimar Enterprise used is imported from Japan and is 14 times more expensive than the PLG microbial agents we use, which substantially decreases the profit margin of Weimar Enterprise.

|

Employees

Currently, we only have two employees, our Chief Executive Officer and our Chief Financial Officer. We intend to hire 10 employees (8 employees for production department, 1 employee for finance department and 1 administration staff ) by the end of 2014.

Compliance with Government Regulation

We will be required to comply with various environmental laws and regulations enacted in the jurisdictions in which we operate which govern the manufacture, importation, handling and disposal of certain materials used in our operations. We are in the process of establishing procedures to address compliance with current environmental laws and regulations and we monitor our practices concerning the handling of environmentally hazardous materials.

We are not required to apply for or have any government approval for our products.

DESCRIPTION OF PROPERTY

The Company has a recycling and composting plant still in the process of construction located at Sandakan landfill at Mile 8th Jalan Sibuga, Sandakan with the land area of 250 acre.

LEGAL PROCEEDINGS

We are not party to any legal proceedings, and none of our property is the subject of any legal proceedings.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

10

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND PLAN OF OPERATIONS

This Current Report on Form 8-K contains forward-looking statements within the meaning of the federal securities laws. These include statements about our expectations, beliefs, intentions or strategies for the future, which we indicate by words or phrases such as “anticipate,” “expect,” “intend,” “plan,” “will,” “we believe,” “management believes” and similar language. Except for the historical information contained herein, the matters discussed in this “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere in this Current Report are forward-looking statements that involve risks and uncertainties. The cautionary language in this Current Report, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from those projected. Except as may be required by law, we undertake no obligation to update any forward-looking statement to reflect events after the date of this Current Report on Form 8-K.

Overview

Reverse Acquisition

On January 10, 2014, AGIL entered into a Securities Exchange Agreement with BLES. Pursuant to the Securities Exchange Agreement, on January 10, 2014, the AGIL Stockholder transferred 100% of the equity interests of AGIL held by it to BLES, in consideration of an aggregate of 389,800,000 shares of BLES’s Common Stock. The shares of BLES’s Common Stock received by AGIL Stockholder in such transaction constituted approximately 97.45% of BLES’s issued and outstanding Common Stock after giving effect of the issuance of shares pursuant to the Securities Exchange Agreement. As a result, AGIL became BLES’s wholly-owned subsidiary. This transaction is being accounted for a reverse acquisition (“Reverse Acquisition”) and AGIL is deemed to be the acquirer. Consequently, the assets and liabilities and the historical operations that will be reflected in our consolidated financial statements prior to the Reverse Acquisition will be those of AGIL.

Business Overview

The Company is engaged in the organic waste recycling business. We are a manufacturer which transforms organic waste to organic fertilizer through the technology called PLG Micro Resources Recovery Treatment System (“PLG System”), an organic waste processing method which was supplied by Full Lead Bio- Tech (M) Sdn. Bhd. (“FLM”) through a Joint Venture & Supply Agreement entered on April 17, 2009 between our subsidiary, SSM and FLM. FLM owns 6% of the equity interest of SSM and is a wholly owned subsidiary of Full Lead Bio- Tech Co. Ltd., formerly Hung Pai Li Bio Tech. Co., Ltd (“FLT”), a Taiwan Company.

Plan of Operations

The Company plans to implement operations and reach their goals and objectives by hiring talented people to play key roles throughout the organization. The Company utilizes a hiring process with a long term successful track record. It has a philosophy in hiring the best talent along with a strong branding and marketing campaign.

The marketing campaign will launch as soon as middle of 2014, which will include a direct marketing campaign in Malaysia. We believe building a national brand and creating market awareness is critical. We plan to focus on sales force and our distribution network.

The Company currently estimates that the plant in Sandakan Malaysia will start operation in last quarter of 2014.

Results of Operations

For the three months ended September 30, 2013 and September 30, 2012

Revenue

We had revenues of $0 and $463 from interest income during the three months ended September 30, 2013 and 2012, respectively.

General and Administrative Expenses

General and administrative expenses for the period three months ended September 30, 2013 and September 30, 2012 were $1,284,007 and $4,344 respectively. Total expenses for three months ended 30 September 2013, consisting primarily of goodwill arise from consolidation written off $1,275,266, professional fees totaling $6,828 and other general and administrative expenses totaling $1,913. For the three months ended September 30, 2012, we incurred total expenses of $4,344, consisting of professional fees totaling $3,730 and other general and administrative expenses totaling $614.

11

Net Loss

Net Loss for the three months ended September 30, 2013 and 2012 was $1,284,007 and $3,881, respectively. The loss was primarily attributable to the general and administrative expenses exceeding our income.

For the nine months ended September 30, 2013 and September 30, 2012

Revenue and Gross Profit

We had revenues of $0 and $1,386 from interest income during the three months ended September 30, 2013 and 2012, respectively.

General and Administrative Expenses

General and administrative expenses for the period nine months ended September 30, 2013 and September 30, 2012 were $1,287,454 and $5,342 respectively. Total expenses for nine months ended September 30, 2013, consisting primarily of goodwill arise from consolidation written off $1,275,266, professional fees totaling $7,498 and other general and administrative expenses totaling $4,690. For the nine months ended September 30, 2012, we incurred total expenses of $5,342, consisting of professional fees totaling $4,728 and other general and administrative expenses totaling $614.

Net Loss

Net loss for the nine months ended September 30, 2013 and 2012 was $1,287,454 and $3,956, respectively. The loss was primarily attributable to the general and administrative expenses exceeding our income.

For the fiscal year ended December 31, 2012 and December 31, 2011

Revenue and Gross Profit

We had revenues of $1,848 and $0 from interest income for the year ended December 31, 2012 and December 31, 2011, respectively.

General and Administrative Expenses

General and administrative expenses for the period for the year ended December 31, 2012 and December 31, 2011 were $5,841 and $10,467 respectively. Total expenses for year ended December 31, 2012, consisting primarily of professional fees totaling $5,227 and other general and administrative expenses totaling $614. For the year ended December 31, 2011, we incurred total expenses of $10,467, consisting of professional fees totaling $8,573 and other general and administrative expenses totaling $1,894.

Net Loss

Net loss for the years ended December 31, 2012 and December 31, 2011 was $3,993 and $10,467, respectively. The loss was primarily attributable to the general and administrative expenses exceeding our income.

Capital Resources and Liquidity

As of September 30, 2013, the balance of our cash and cash equivalents was deficit of $54,176. The Company is funding construction cost for the recycling and composting Plant at Sandakan during the period amounting to $178,647.

Net cash generate from operating activities for the period ended September 30, 2013 was $124,470, the cash inflow is primarily from advance form related parties. The net loss of $1,287,454 consists of non-cash item of goodwill on consolidation written off of $1,275,266. Cash used in operating activities was primarily for general and administrative expenses.

12

As reflected in the accompanying financial statements, the Company has a net loss and net cash used in operations of $1,287,454 and $54,176, respectively, for the nine month period ended September 30, 2013 and a deficit accumulated during the development stage of $1,287,454 as of September 30, 2013.

The ability of the Company to continue its operations is dependent on Management's plans, which include the raising of capital through debt and/or equity markets with some additional funding from other traditional financing sources, including term notes, until such time that funds provided by operations are sufficient to fund working capital requirements. The Company may need to incur additional liabilities with certain related parties to sustain the Company’s existence.

The Company may require additional funding to finance the growth of its current and expected future operations as well as to achieve its strategic objectives. The Company believes its current available cash along with anticipated revenues may be insufficient to meet its cash needs for the near future if it does not receive the anticipated additional funding. There can be no assurance that financing will be available in amounts or terms acceptable to the Company, if at all. In that event, the Company would be required to change its growth strategy and seek funding on that basis, if at all.

The accompanying financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. These financial statements do not include any adjustments relating to the recovery of the recorded assets or the classification of the liabilities that might be necessary should the Company be unable to continue as a going concern.

In response to the above, management will:

|

●

|

seek additional third party debt and/or equity financing;

|

|

●

|

continue with the implementation of the business plan;

|

|

●

|

increase revenue commercialization of the technology.

|

To date all of our funding has been generated from private investments. During the next twelve months we anticipate raising funding to continue expansion; however as of this writing we only have sufficient funds to proceed with basic company operations only. We do not have sufficient funds to fully implement our business plan until such time that we are able to raise additional funding, to which there is no guarantee. If we do not obtain the funds necessary for us to continue our business activities we may need to curtail or cease our operations until such time as we have sufficient funds.

Recent Accounting Pronouncements

There are no recent accounting pronouncements that are expected to have an effect on the Company’s financial statements.

Critical Accounting Policies

Our financial statements and related public financial information are based on the application of accounting principles generally accepted in the United States (“GAAP”). GAAP requires the use of estimates; assumptions, judgments and subjective interpretations of accounting principles that have an impact on the assets, liabilities, revenues and expense amounts reported. These estimates can also affect supplemental information contained in our external disclosures including information regarding contingencies, risk and financial condition. We believe our use of estimates and underlying accounting assumptions adhere to GAAP and are consistently and conservatively applied. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances. Actual results may differ materially from these estimates under different assumptions or conditions. We continue to monitor significant estimates made during the preparation of our financial statements.

13

Our significant accounting policies are summarized in Note 2 of our financial statements. While all these significant accounting policies impact our financial condition and results of operations, we view certain of these policies as critical. Policies determined to be critical are those policies that have the most significant impact on our financial statements and require management to use a greater degree of judgment and estimates. Actual results may differ from those estimates. Our management believes that given current facts and circumstances, it is unlikely that applying any other reasonable judgments or estimate methodologies would cause effect on our consolidated results of operations, financial position or liquidity for the periods presented in this report.

We believe the following critical accounting policies and procedures, among others, affect our more significant judgments and estimates used in the preparation of our consolidated financial statements:

Research and Development Stage Company

The Company's financial statements are presented as those of a research and development stage enterprise. Activities during the development stage primarily include equity based financing and further implementation of the business plan, including research and development.

Off Balance Sheet Arrangements:

We do not have any off-balance sheet arrangements, financings, or other relationships with unconsolidated entities or other persons, also known as “special purpose entities” (SPEs).

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

|

Name

|

Age

|

Position

|

||

|

Vincent Loy Ghee Yaw

|

39

|

Chief Executive Officer, President, Secretary, Treasurer and Director

|

||

|

Hee Chee Keong

|

42

|

Chief Financial Officer and Director

|

||

|

David Chuah

|

41

|

Director

|

VINCENT LOY GHEE YAW

Dr. Vincent Loy Ghee Yaw, aged 39 and a Malaysian, obtained a Doctor of Business Administration (DBA) from United business Institutes, Belgium and Bachelor of Science from Campbell University in the United States, majoring in Information System Engineering.

He has been more than sixteen-year experience in the network infrastructure and manages security industry in both local and regional organization. Dr. Loy’s forte is to use technology to impact business efficiency. He has also achieved a number of technical and management accreditations throughout his career. In 2006, he acquired Ariantec Sdn Bhd (“Ariantec”) and successfully listed the company in ACE Market of Bursa Malaysia on November 2009. He was a Managing Director of Ariantec until he resigned on March 2013.

The Board concluded that Dr. Loy should serve as a Director of the Company based on his extensive experience and knowledge of the history of our Company and of all of its related products.

14

HEE CHEE KEONG

Hee Chee Keong, a Malaysian aged 42, is a Chartered Accountant of the Malaysian Institute of Accountants. He is also a fellow member of Association of Chartered Certified Accountants (FCCA). He has more than eighteen-year working experience in both private and public companies.

During the course of his career, he was involved in various industries including manufacturing, property development, construction, trading, retailing, leisure and entertainment, etc. Besides that, he also has hands-on experience on corporate exercise such as due diligence, IPOs, issuance of warrants, corporate and debt restructuring.

He was a Finance Director in a public listed company in Malaysia namely Global Soft (MSC) Berhad from 2004 to 2008, subsequently resigned as a non-executive director on June 2013.

Mr. Hee’s extensive experience manufacturing industry as well as his financial and accounting background has led the Board of Director to reach a conclusion that he should serve as a Director of the Company.

DAVID CHUAH

David Chuah, aged 41, has sixteen-year experience in corporate finance and venture capital investments. He obtained a bachelor degree of Commerce, with concentration in Finance from University of Alberta in Canada. He had started his career in a Corporate Finance Department of a merchant bank in Kuala Lumpur, where he was involved in numerous Initial Public Offerings, Mergers and Acquisitions and other fund raising projects. After 3 years, he joined a venture capital department of a quasi-government company as a senior investment analyst. During that time, he was involved in investment evaluation as well as in seeking funds from external sources such as government agencies and foreign investment houses. In 2002, he joined one of the largest integrated logistics company in Malaysia, Metroport Group Berhad. He was instrumental in negotiating, securing of contract and the setting up of the warehousing and distribution requirements for one of the largest mobile phone distribution companies in Malaysia. At present, he is an Adviser in Firesticks PE Sdn Bhd, a company involved in structuring debt and equity deals for expansionary companies.

The Board concluded that Mr. Chuah should serve as a Director of the Company because of his experience and background in product distribution business.

Committees

We do not have a standing nominating, compensation or audit committee. Rather, our full board of directors performs the functions of these committees. We do not believe it is necessary for our board of directors to appoint such committees because the volume of matters that come before our board of directors for consideration permits the directors to give sufficient time and attention to such matters to be involved in all decision making. Additionally, because our Common Stock is not listed for trading or quotation on a national securities exchange, we are not required to have such committees.

Director Independence

Our securities are not listed on a national securities exchange or in an inter-dealer quotation system which has requirements that directors be independent. No member of the Company’s board of directors qualifies as an independent director pursuant to the definition of “independent director” under the Rules of NASDAQ, Marketplace Rule 5605(a)(2). We do not have majority of independent directors.

Code of Ethics

We do not have a code of ethics but intend to adopt one in the near future that applies to all of our directors, officers and employees, including our principal executive officer, principal financial officer and principal accounting officer. The new code will address, among other things, honesty and ethical conduct, conflicts of interest, compliance with laws, regulations and policies, including disclosure requirements under the federal securities laws, confidentiality, trading on inside information, and reporting of violations of the code.

Meetings of the Board of Directors

During its fiscal year ended December 31, 2013, the Board of Directors did not meet on any occasion, but rather transacted business by unanimous written consent.

15

EXECUTIVE COMPENSATION

Summary Compensation

The following is a summary of the compensation we paid to our executive officers and Directors, for the two fiscal years ended December 31, 2013 and 2012, and compensation paid by AGIL for the fiscal year ended December 31, 2013.

|

Name and Principal Position

|

Year

|

Salary

($)

|

Bonus

($)

|

Stock

Awards

($)

|

Option

Awards

($)

|

All Other

Compensation

($)

|

Totals

($)

|

|||||||||||||||||

|

Vincent Loy Ghee Yaw (1)

CEO, President, Director of the Company;

|

FY2013

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||||||

|

Hee Chee Keong(2)

CFO and Director of the Company;

|

FY2013

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||||||

|

David Chuah(3)

Director of the Company

|

FY2013

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||||||

|

Sin Sook Chen(4)

Director of AGIL

|

FY2013

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||||||

|

Elise Travertini(5)

CEO, CFO, Director of the Company

|

FY2013

FY2012

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||||||

|

(1)

|

Mr. Vincent was appointed as BLES’ Chief Executive Officer, Chief Financial Officer and Chairman on June 25, 2013.

|

|

(2)

|

Mr. Hee was appointed as BLES’ Chief Financial Officer and Director on June 25, 2013.

|

|

(3)

|

Mr. Chuah was appointed as BLES’ Director on June 25, 2013.

|

|

(4)

|

Ms. Sin was appointed as AGIL’s director as of February 1, 2013.

|

|

(5)

|

Mr. Travertini was BLES’ Chief Executive Officer, Chief Financial Officer, President, Treasurer and Secretary from our inception to June 25, 2013.

|

Aggregated Option Exercises and Fiscal Year-End Option Value Table

There were no stock options exercised since the date of inception of the Company through the date of this Current Report on Form 8-K by the executive officers named in the Summary Compensation Tables.

16

Long-Term Incentive Plan (“LTIP”) Awards Table

There were no awards made to any named executive officers in the last completed fiscal year under any LTIP.

Employment Agreements

We currently do not have any employment agreements.

Compensation of Directors

For the fiscal year ended December 31, 2013, none of the members of our Board of Directors received compensation for his service as a director. We do not currently have an established policy to provide compensation to members of our Board of Directors for their services in that capacity.

Option Plan

We currently do not have a Stock Option Plan. However, we may to issue stock options pursuant to a Stock Option Plan in the future. Such stock options may be awarded to management, employees, members of the Company’s Board of Directors and consultants of the Company.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDPENDENCE

Our policy is that a contract or transaction either between the Company and a director, or between a director and another company in which he is financially interested is not necessarily void or void-able if the relationship or interest is disclosed or known to the board of directors and the stockholders are entitled to vote on the issue, or if it is fair and reasonable to our company.

On April 17, 2009, our subsidiary, SSM entered into a Joint Venture & Supply Agreement with FLM, which owns 6% of the equity interest of SSM and a wholly owned subsidiary of FLT. Pursuant to the Joint Venture & Supply Agreement, FLM supplies waste regeneration treatment equipment, microbial agent and other processing materials, and any necessary microbial technology support to process the waste, mainly the PLG System, in consideration of US$2,426,058. On May 2, 2009, FLT and SSM have entered into an Organic Fertilizer Guarantee Buy Back Agreement (the “Buy Back Agreement”), whereby FLT agrees to purchase the unsold organic fertilizer produced by SSM for any organic fertilizer that are produced by SSM by the process and methods provided by FLM. Both of the Joint Venture & Supply Agreement and the Buy Back Agreements are arms-length agreements between the signing parties.

On December 7, 2011, a total of 9,000,000 shares of common stock were issued to our former officer and director, Elise Travertini in consideration of $9,000.

On June 25, 2013, our former officer and director Mr. Travertini sold to 16 investors his 9,000,000 shares of the Company’s common stock representing approximately 88.24% of the then issued and outstanding shares of common stock for $263,167 pursuant to a Securities Purchase Agreement dated as of the same date.

As of the date of this report, the directors of SSM has advanced loan to the Company in the total amount of $2,546,710. Such advances are short-term advances that are non-interest bearing and will be due on demand.

Except the above transactions or as otherwise set forth in this report or in any reports filed by the Company with the SEC, the Company was not a party to any transaction (where the amount involved exceeded the lesser of $120,000 or 1% of the average of our assets for the last two fiscal years) in which a director, executive officer, holder of more than five percent of our common stock, or any member of the immediate family of any such person have or will have a direct or indirect material interest and no such transactions are currently proposed. The Company is currently not a subsidiary of any company.

The Company’s Board conducts an appropriate review of and oversees all related party transactions on a continuing basis and reviews potential conflict of interest situations where appropriate. The Board has not adopted formal standards to apply when it reviews, approves or ratifies any related party transaction. However, the Board believes that the related party transactions are fair and reasonable to the Company and on terms comparable to those reasonably expected to be agreed to with independent third parties for the same goods and/or services at the time they are authorized by the Board.

17

The following table provides the names and addresses of each person known to us to own more than 5% of our outstanding shares of common stock as of the date of this report, and by the officers and directors, individually and as a group. Except as otherwise indicated, all shares are owned directly and the shareholders listed possesses sole voting and investment power with respect to the shares shown. The address for each officer, director is 30, Jalan PJS 7/19, Bandar Sunway, 46150 Petaling Jaya, Selangor, Malaysia.

|

Name

|

Office

|

Shares

Beneficially

Owned(1)

|

Percent of

Class(2)

|

|||||||

|

Officers and Directors

|

||||||||||

|

Vincent Loy Ghee Yaw

|

CEO, President and Director

|

2,040,000

|

0.51

|

%

|

||||||

|

Hee Chee Keong

|

CFO and Director

|

600,000

|

0.15

|

%

|

||||||

|

David Chuah

|

Director

|

600,000

|

0.15

|

%

|

||||||

|

All officers and directors as a group (3 persons named above)

|

3,240,000

|

0.81

|

%

|

|||||||

|

5% Securities Holders

|

||||||||||

|

Apple Green Venture Sdn. Bhd.

|

389,800,000

|

97.45

|

%

|

|||||||

|

(1)

|

Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities.

|

|

(2)

|

Based on 400,000,000 shares of the Company’s common stock issued and outstanding as of the date of this Current Report.

|

18

DESCRIPTION OF SECURITIES

General

Our authorized capital stock consists of 500,000,000 shares of common stock, with a par value of $0.0001 per share, and 20,000,000 shares of preferred stock, par value $0.0001 per share.

Common Stock

Our common stock is entitled to one vote per share on all matters submitted to a vote of the stockholders, including the election of directors. Except as otherwise required by law or provided in any resolution adopted by our board of directors with respect to any series of preferred stock, the holders of our common stock will possess all voting power. Generally, all matters to be voted on by stockholders must be approved by a majority (or, in the case of election of directors, by a plurality) of the votes entitled to be cast by all shares of our common stock that are present in person or represented by proxy, subject to any voting rights granted to holders of any preferred stock. Holders of our common stock representing fifty percent (50%) of our capital stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of our stockholders. A vote by the holders of a majority of our outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to our Articles of Incorporation. Our Articles of Incorporation do not provide for cumulative voting in the election of directors.

Subject to any preferential rights of any outstanding series of preferred stock created by our board of directors from time to time, the holders of shares of our common stock will be entitled to such cash dividends as may be declared from time to time by our board of directors from funds available therefore.

Subject to any preferential rights of any outstanding series of preferred stock created from time to time by our board of directors, upon liquidation, dissolution or winding up, the holders of shares of our common stock will be entitled to receive pro rata all assets available for distribution to such holders.

In the event of any merger or consolidation with or into another company in connection with which shares of our common stock are converted into or exchangeable for shares of stock, other securities or property (including cash), all holders of our common stock will be entitled to receive the same kind and amount of shares of stock and other securities and property (including cash). Holders of our common stock have no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to our common stock.

As of the date of this report, there were 400,000,000 shares of common stock issued and outstanding, giving effect to the shares of Common Stock issued in the Securities Exchange Transaction.

Preferred Stock

The Company’s Board of Directors is authorized by its Articles of Incorporation to issue Preferred Stock from time to time in one or more series with such designations, preferences and relative participating, optional or other special rights and qualifications, limitations or restrictions, thereof, as shall be stated in the resolutions adopted by the Company’s Board of Directors providing for the issuance of the Preferred Stock. The Company’s Board of Directors is authorized, within any limitations prescribed by law and the Company’s Articles of Incorporation, to fix and determine the designations, rights, qualifications, preferences, limitations and terms of the shares of any series of Preferred Stock. There is no preferred stock issued or outstanding at the date of this Current Report.

Warrants

There are currently no outstanding warrants.

Options

There are currently no outstanding options.

19

MARKET PRICE OF AND DIVIDENDS ON OUR COMMON

EQUITY AND RELATED STOCKHOLDER MATTERS

There is limited public trading market for our Common Stock, our Common Stock is quoted on the OTC Markets OTCQB, under the symbol “BLES.” Our Common Stock did not trade prior to June 24, 2013. The Company obtained their symbol on October 4, 2011.

The market price of our Common Stock is subject to significant fluctuations in response to variations in our quarterly operating results, general trends in the market and other factors, over many of which we have little or no control. In addition, broad market fluctuations, as well as general economic, business and political conditions, may adversely affect the market for our Common Stock, regardless of our actual or projected performance.

Holders

As of January 10, 2014, we had 400,000,000 shares of our common stock par value, $.0001 issued and outstanding. There were approximately 36 beneficial owners of our common stock.

The Transfer Agent for our capital stock is VStock Transfer, LLC at 77 Spruce Street, Suite 201, Cedarhurst, NY 11516. Their telephone number is (212)828-8436.

Penny Stock Regulations

The Securities and Exchange Commission has adopted regulations which generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share. Our Common Stock, when and if a trading market develops, may fall within the definition of penny stock and be subject to rules that impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000, or annual incomes exceeding $200,000 individually, or $300,000, together with their spouse).

For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of such securities and have received the purchaser’s prior written consent to the transaction. Additionally, for any transaction, other than exempt transactions, involving a penny stock, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the Securities and Exchange Commission relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Consequently, the “penny stock” rules may restrict the ability of broker-dealers to sell our Common Stock and may affect the ability of investors to sell their Common Stock in the secondary market.

Dividend Policy

We have not paid any cash dividends to our shareholders. Any future determination as to the declaration and payment of dividends on shares of our Common Stock will be made at the discretion of our board of directors out of funds legally available for such purpose. We are under no contractual obligations or restrictions to declare or pay dividends on our shares of Common Stock. In addition, we currently have no plans to pay such dividends.

20

LEGAL PROCEEDINGS

There are no material proceedings to which any director or officer, or any associate of any such director or officer, is a party that is adverse to our Company or any of our subsidiaries or has a material interest adverse to our Company or any of our subsidiaries. No director or executive officer has been a director or executive officer of any business which has filed a bankruptcy petition or had a bankruptcy petition filed against it during the past ten years. No director or executive officer has been convicted of a criminal offense or is the subject of a pending criminal proceeding during the past ten years. No director or executive officer has been the subject of any order, judgment or decree of any court permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities during the past ten years. No director or officer has been found by a court to have violated a federal or state securities or commodities law during the past ten years.

In addition, there are no material proceedings to which any affiliate of our Company, or any owner of record or beneficially of more than five percent of any class of voting securities of our Company, is a party that is adverse to our Company or any of our subsidiaries or has a material interest adverse to our Company or any of our subsidiaries. Currently there are no legal proceedings pending or threatened against us. We are not currently involved in any litigation that we believe could have a materially adverse effect on our financial condition or results of operations.

There is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of the executive officers of our Company or any of our subsidiaries, threatened against or affecting our Company, our common stock, any of our subsidiaries or of our Company’s or our Company’s subsidiaries’ officers or directors in their capacities as such, in which an adverse decision could have a material adverse effect.

However, from time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. Litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business.

RECENT SALES OF UNREGISTERED SECURITIES

Reference is made to Item 3.02 of this Current Report on Form 8-K for a description of recent sales of unregistered securities, which is hereby incorporated by reference.

INDEMNIFICATION OF OFFICERS AND DIRECTORS

Our by-laws provide for the indemnification of our directors, officers, employees, and agents, under certain circumstances, against attorney's fees and other expenses incurred by them in any litigation to which they become a party arising from their association with or activities on our behalf. We will also bear the expenses of such litigation for any of our directors, officers, employees, or agents, upon such persons promise to repay us therefore if it is ultimately determined that any such person shall not have been entitled to indemnification. This indemnification policy could result in substantial expenditures by us, which it may be unable to recoup.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore unenforceable.

At the present time, there is no pending litigation or proceeding involving a director, officer, employee or other agent of ours in which indemnification would be required or permitted. We are not aware of any threatened litigation or proceeding which may result in a claim for such indemnification.

Please refer to Item 1.01 - “Entry into a Material Definitive Agreement” for a description of the unregistered sales of equity securities as a result of the Securities Exchange Transaction.

The issuances of these securities were exempt from registration under the Securities Act pursuant to Section 4(2) of the Securities Act and Regulation S promulgated thereunder.

21

As a result of the Securities Exchange Transaction as described in Items 1.01 and 2.01, which description is incorporated by reference in this Item 5.06 of this report, the Company ceased to be a shell company as such term is defined in Rule 12b-2 under the Exchange Act.

(a) Financial Statements of Business Acquired. The combined financial statements of AGIL, AGHK, MISB, and SSB are appended to this Current Report beginning on page F-1, and unaudited proforma financial statements of the Company are appended to this report beginning on page F-17.

(d) Exhibits. The following exhibits are filed with this report:

|

Description

|

||

|

2.1

|

Form of Securities Exchange Agreement dated January 10, 2014 by and among the Company, Apple Green International Limited and Apple Green International Limited’s sole shareholder

|

|

|

10.1

|

Form of Joint Venture & Supply Agreement between SS Microbial Sdn. Bhd. and Full Lead Bio- Tech (M) Sdn. Bhd.

|

|

|

10.2

|

Form of Organic Fertilizer Guarantee Buy Back Agreement between SS Microbial Sdn. Bhd. and Full Lead Bio- Tech Co. Ltd.

|

22

APPLE GREEN INTERNATIONAL LIMITED AND SUBSIDIARIES

(A DEVELOPMENT STAGE COMPANY)

INDEX TO FINANCIAL STATEMENT

|

Page(s)

|

|

|

Consolidated Balance Sheet as of September 30, 2013 (unaudited) and December 31, 2012

|

F-1

|

|

Consolidated Statement of Operation the three months and the nine months ended September 30, 2013 and September 30, 2012 (unaudited)

|

F-2

|

|

Consolidated Statements of Change in Stockholders’ Equity for the nine months ended September 2013 and the year ended December 31, 2012 (unaudited)

|

F-3

|

|

Statements of Cash Flows for the nine months ended September 30, 2013 and September 30, 2012

|

F-4

|

|

Notes to Consolidated Financial Statements

|

F-6 – F-8

|

|

Report of Independent Registered Public Accounting Firm

|

F-9

|

|

Combined Balance Sheets as of December 31, 2012 and December 31, 2011

|

F-10

|

|

Combined Statements of Operations for the year ended December 31, 2012 and December 31, 2011

|

F-11

|

|

Combined Statement of Change in Stockholders’ Equity for the years ended December 31, 2012 and December 31, 2011

|

F-12

|

|

Combined Statements of Cash Flows for year ended December 31, 2012 and December 31, 2011

|

F-13

|

|

Notes to Combined Financial Statements

|

F-14 – F-16

|

|

Unaudited Pro Forma Condensed Combined Balance Sheet as of September 30, 2013

|

F-17

|

|

Unaudited Pro Forma Condensed Combined Statement of Operations for the period ended September 30, 2013

|

F-18

|

|

Unaudited Pro Forma Condensed Combined Statement of Operations for the year ended December 31, 2012

|

F-19

|

|

Notes to Unaudited Pro Forma condensed combined financial information

|

F-20

|

APPLE GREEN INTERNATIONAL LIMITED AND SUBSIDIARIES

(A DEVELOPMENT STAGE COMPANY)

CONSOLIDATED BALANCE SHEETS

SEPTEMBER 30, 2013 AND DECEMBER 31, 2012

(UNAUDITED)

|

September 30,

2013

|

December 31,

2012

|

|||||||

|

Assets

|

||||||||

|

Non-current assets

|

||||||||

|

Construction in progress

|

$

|

576,318

|

$

|

397,671

|

||||

|

Current assets

|

||||||||

|

Other receivable

|

$

|

749,628

|

$

|

858,798

|

||||

|

Cash and cash equivalent

|

178,102

|

$

|

232,278

|

|||||

|

Total current assets

|

927,730

|

1,091,076

|

||||||

|

Total assets

|

$

|

1,504,048

|

$

|

1,488,747

|

||||

|

Liabilities and Stockholders' Equity

|

||||||||

|

Liabilities:

|

||||||||

|

Accounts payable and accrued expenses

|

$

|

229,828

|

$

|

15,308

|

||||

|

Due to related party

|

2,546,710

|

315,961

|

||||||

|

Total liabilities

|

2,776,538

|

331,269

|

||||||

|

Stockholders' (Deficit) Equity

|

||||||||

|

Capital Stock

|

1

|

3,808,976

|

||||||

|

Deficit accumulated during the development stage

|

(1,285,846

|

)

|

(2,651,498

|

)

|

||||

|

Non-controlling interest

|

13,355

|

-

|

||||||

|

Total Stockholders' Equity

|

(1,272,490

|

)

|

1,157,478

|

|||||

|

Total Liabilities and Stockholders' Equity

|

$

|

1,504,048

|

$

|

1,488,747

|

||||

The accompanying notes are an integral part of these consolidated financial statements.

F-1

APPLE GREEN INTERNATIONAL LIMITED AND SUBSIDIARIES

(A DEVELOPMENT STAGE COMPANY)

CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2013 AND 2012,

AND FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2013 AND 2012

(UNAUDITED)

|

For the Three

|

For the Three

|

For the Nine

|

For the Nine

|

|||||||||||||

|

Months Ended

|

Months Ended

|

Months Ended

|

Months ended

|

|||||||||||||

|

September 30, 2013

|

September 30, 2012

|

September 30, 2013

|

September 30, 2012

|

|||||||||||||

|

Revenues

|

||||||||||||||||

|

Interest income

|

$ | - | $ | 463 | $ | - | 1,386 | |||||||||

|

Total revenues

|

- | 463 | - | 1,386 | ||||||||||||

|

Expenses

|

||||||||||||||||

|

General and administrative

|

(1,913 | ) | (614 | ) | (4,690 | ) | (614 | ) | ||||||||

|

Professional fees

|

(6,828 | ) | (3,730 | ) | (7,498 | ) | (4,728 | ) | ||||||||

|

Goodwill on consol. written off

|

(1,275,266 | ) | - | (1,275,266 | ) | - | ||||||||||

|

Total expenses

|

(1,284,007 | ) | (4,344 | ) | (1,287,454 | ) | (5,342 | ) | ||||||||

|

Net loss

|

$ | (1,284,007 | ) | $ | (3,881 | ) | $ | (1,287,454 | ) | (3,956 | ) | |||||

|

Net loss attributable to the non-controlling interest

|

992 | 332 | 1,608 | 409 | ||||||||||||

|

Net loss attributable to Apple Green International Limited and subsidiaries

|

$ | (1,283,015 | ) | $ | (3,549 | ) | $ | (1,285,846 | ) | (3,547 | ) | |||||

The accompanying notes are an integral part of these consolidated financial statements.

F-2

APPLE GREEN INTERNATIONAL LIMITED AND SUBSIDIARIES

(A DEVELOPMENT STAGE COMPANY)

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2013

AND FOR THEYEAR ENDED DECEMBER 31, 2012

(UNAUDITED)

|

Shares

|

Deficit

Accumulated

During the

Development

Stage

|

Stockholders’

Equity

|

Non-controlling

interest

|

Stockholders’

Equity

|

||||||||||||||||

|

Balance 1st Jan 2011

|

3,558,121 | $ | (2,637,037 | ) | $ | 921,084 | - | 921,084 | ||||||||||||

|

Issue of share

|

103,700 | 103,700 | - | 103,700 | ||||||||||||||||

|

Loss for the year ended December 31, 2011

|

- | (10,467 | ) | (10,467 | ) | - | (10,467 | ) | ||||||||||||

|

Balance – December 31 ,2011

|

3,661,821 | (2,647,504 | ) | 1,014,317 | - | 1,014,317 | ||||||||||||||

|

Issue of share

|

147,155 | 147,155 | - | 147,155 | ||||||||||||||||

|

Loss for the year ended December 31, 2012

|

- | (3,993 | ) | (3,993 | ) | - | (3,993 | ) | ||||||||||||

| 3,808,976 | (2,651,498 | ) | 1,157,478 | - | 1,157,478 | |||||||||||||||

|

Consolidation

|

(3,808,976 | ) | 2,651,498 | (1,157,478 | ) | - | (1,157,478 | ) | ||||||||||||

|

Issue of share

|

1 | 1 | ||||||||||||||||||

|

Loss for the nine months ended September 30, 2013

|

- | (1,285,846 | ) | (1,285,846 | ) | 13,355 | (1,272,491 | ) | ||||||||||||

|

|

||||||||||||||||||||

|

Balance – September 30, 2013

|

1 | $ | (1,285,846 | ) | $ | (1,285,845 | ) | 13,355 | (1,272,490 | ) | ||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

F-3

APPLE GREEN INTERNATIONAL LIMITED AND SUBSIDIARIES

(A DEVELOPMENT STAGE COMPANY)

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2013

AND FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2012

(UNAUDITED)

|

Nine months

ended

|

Nine months

ended

|

|||||||

|

September 30, 2013

|

September 30, 2012

|

|||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

||||||||

|

Net loss

|

$

|

(1,287,454

|

)

|

$

|

(3,955

|

)

|

||

|

Add:

|

||||||||

|

Goodwill on consolidation written off

|

1,275,266

|

-

|

||||||

|

Interest income

|

(1,386

|

)

|

||||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Increase /(Decrease) in:

|

||||||||

|

Other receivable

|

109,170

|

127,013

|

||||||

|

Accounts payable and accrued expenses

|

214,520

|

1,503

|

||||||

|

Due to related party

|

(187,032

|

) |

(22,712

|

) | ||||

|

Net Cash Used in Operating Activities

|

124,470

|

100,463

|

||||||

|

Interest income

|

1,386

|

|||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

||||||||

|

Construction in progress

|

(178,647

|

) |

(61,707

|

) | ||||

|

Net Cash Provided By Investing Activities

|

(178,647

|

) |

(61,707

|

) | ||||

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

||||||||

|

Issue of common stock

|

1

|

147,155

|

||||||

|

Net Cash Provided By Financing Activities

|

1

|

147,155

|

||||||

|

CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD

|

(54,176

|

) |

187,297

|

|||||

|

SUPPLEMENTARY CASH FLOW INFORMATION:

|

||||||||

|

Cash Paid During the Period for:

|

||||||||

|

Income taxes

|

$

|

-

|

$

|

-

|

||||

|

Interest

|

$

|

-

|

$

|

-

|

||||

The accompanying notes are an integral part of these consolidated financial statements.

F-4

APPLE GREEN INTERNATIONAL LIMITED AND SUBSIDIARIES

(A DEVELOPMENT STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2013

(UNAUDITED)

Note 1 General Organization and Business

Apple Green International Limited (“AGIL” or the “Company”) was formed on February 1, 2013, in Republic of Seychelles.

AGIL owns 100% of Apple Green Hong Kong Limited (“AGHK”), a limited liability company formed in Hong Kong on December 10, 2004. AGHK’s purpose is to promote and market the organic fertilizer produced by SS Microbial Sdn. Bhd. (“SSM”).

AGIL also owns 100% of Microbial International Sdn. Bhd. (“MISB”), a company formed in Malaysia on October 10, 2000.

MISB owns 55% of SSM, a limited liability company incorporated in Malaysia on January 7, 2009. SSM is engaged in the business of solid waste recycling to turn the organic waste to organic fertilizer via PLG Microbial Resource Recovery Treatment System. On April 17, 2009, SSM entered into a Joint Venture & Supply Agreement with Full Lead Bio- Tech (M) Sdn. Bhd. (“FLM”), a wholly owned subsidiary of a Taiwan company namely Full Lead Bio- Tech Co. Ltd. (formerly known as HPL Bio-Tech Bio- Tech Co. Ltd., “FLT”), whereby FLM supplies waste regeneration treatment equipment, material and providing microbial technology (PLG Microbial Resources Recovery system) support to SSM for the processing of solid waste to organic fertilizer. On the May 2, 2009, FLT and SSM have entered into an Organic Fertilizer Guarantee Buy Back Agreement, whereby FLT agrees to purchase back the organic fertilizer produced by SSM for any unsold organic fertilizer produced according to the process and technology provided by FTM.

Note 2 Summary of Significant Accounting Policies

Basis of presentation

Accounting Basis

The Company’s policy is to maintain its books and prepare its consolidated financial statements on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America.

Principles of consolidation

The accompanying consolidated financial statements include the activities of AGIL, AGHK, MISB and SSM. All intercompany transactions have been eliminated in these consolidated financial statements.

Investments in entities are consolidated when the entities meet the definition of a variable interest entity (“VIE”) and the Company absorbs the majority of the entity’s expected losses, receives a majority of the entity’s expected residual returns, or both, as a result of ownership, contractual or other financial interests in the entity. For those entities that do not meet the definition of a VIE, an assessment is made of control under Accounting Standards Codification (“ASC”) 810, Consolidation. If the Company has effective control under ASC 810, the entities are consolidated; otherwise, they are accounted for under the equity method or the cost method.