Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Sagent Pharmaceuticals, Inc. | d658421d8k.htm |

Sagent

Pharmaceuticals 32

nd

Annual J.P. Morgan

Healthcare Conference

January 15, 2014

A Global Pharmaceutical

Company

Exhibit 99.1 |

2

Disclaimer

The

following

information

contains,

or

may

be

deemed

to

contain,

“forward-looking

statements”

(as

defined

in

and

made

pursuant

to

the

safe

harbor

provisions

of

the

U.S.

Private

Securities

Litigation

Reform

Act

of

1995).

Most

forward-looking

statements

contain

words

that

identify

them

as

forward-looking,

such

as

“may”,

“plan”,

“seek”,

“will”,

“expect”,

“intend”,

“estimate”,

“anticipate”,

“believe”,

“project”,

“opportunity”,

“target”,

and

“continue”

or

other

words

that

relate

to

future

events,

as

opposed

to

past

or

current

events.

By

their

nature,

forward-looking

statements

are

not

statements

of

historical

facts

and

involve

risks

and

uncertainties

because

they

relate

to

events

and

depend

on

circumstances

that

may

or

may

not

occur

in

the

future.

These

statements

give

our

current

expectation

of

future

events

or

our

future

performance

and

do

not

relate

directly

to

historical

or

current

events

or

our

historical

performance.

As

such,

our

future

results

may

vary

from

any

expectations

or

targets

expressed

in,

or

implied

by,

the

forward

looking

statements

included

in

this

presentation,

possibly

to

a

material

degree.

We

cannot

assure

you

that

the

assumptions

made

in

preparing

any

of

the

forward-looking

statements

will

prove

accurate

or

that

any

performance

targets

will

be

realized.

We

expect

that

there

will

be

differences,

which

could

be

significant,

between

performance

targets

and

actual

results.

All

forward-looking

statements

included

in

this

presentation

speak

only

as

of

the

date

made,

and

we

undertake

no

obligation

to

update

or

revise

publicly

any

such

forward-looking

statements,

whether

as

a

result

of

new

information,

future

events,

or

otherwise.

In

particular,

we

caution

investors

not

to

place

undue

weight

on

certain

forward-looking

statements

pertaining

to

potential

growth

opportunities

or

performance

targets

set

forth

herein.

Actual

results

may

vary

significantly

from

these

statements.

For

a

discussion

of

some

of

the

important

factors

that

could

cause

our

results

to

differ

materially

from

those

expressed

in,

or

implied

by,

the

forward-looking

statements

included

in

this

presentation,

investors

should

refer

to

our

risk

factors,

as

they

may

be

amended

from

time

to

time,

set

forth

in

our

Quarterly

Report

on

Form

10-Q

filed

with

the

SEC

on

August

6,

2013.

This

presentation

includes

a

discussion

of

certain

non-GAAP

financial

measures.

Please

refer

to

the

appendix

to

this

presentation

for

further

definition

of

these

measures

and

a

reconciliation

of

such

non-GAAP

measures

to

the

most

closely

comparable

GAAP

measures. |

3

Investment Highlights

•

Fastest growing Generic Injectable company in U.S. Market , a consolidating industry

with high barriers to entry

•

Extensive global partner network with state-of-the-art facilities enabling

accelerated growth relative to conventional start-ups

•

Solid relationships at all levels of the supply chain enhance responsiveness to

industry demands

•

Vertical integration through acquisition of SCP complements partnering model, as

well as provides additional growth opportunities and a footprint

in China

•

Exceptional quality and safety track record; global excellence in manufacturing

•

Strong sequential margin and revenue growth driven by diverse and deep product

portfolio

•

Experienced management team with great track record, has delivered on product

approvals and financial performance |

4

Track Record of Success

•

Jeffrey Yordon, Founder, CEO and Chairman

–

Formerly COO and President of APP; held senior

positions with LyphoMed, YorPharm, Gensia and

Faulding

–

Expert in China and India pharmaceutical

industries

–

43 years experience in injectable

pharmaceuticals; including leading four

successful injectable start-ups

Unique Business Model with Strong Track Record

Sagent Pharmaceuticals has revolutionized the way injectable generic drugs are produced and

delivered. Our ground-breaking business model is changing the industry dynamic and

providing access to a wide range of critical drugs when and how our customers need it

most. As a result,

we can satisfy the demands of today and anticipate the needs of tomorrow. Key Highlights

•

Track record of strong performance on product

launches, ANDA approvals and ANDA submissions

•

Extensive pipeline with 69 ANDAs pending approval

or launch

(1)

•

53 marketed products, 144 presentations

(1)

•

Indications: anti-infective, oncolytic and critical care

•

Presentations: single and multi-dose vials, pre-filled

ready-to-use syringes and premix bags

(1) As of December 31, 2013 |

5

Corporate Evolution

Company founded in 2006

•

Built upon long-standing expertise and experience

in Generic Injectables

•

Virtual model based upon global network of

strong partner relationships

•

Product development focused on high volume,

low margin opportunities to build scale

2006

2010

Sales of $74 million in 2010,

including addressing the market

shortage in Heparin

2011

2012

Launched 16 new products,

driving nearly break-even

operating performance in the

fourth quarter

2013

Completed a successful IPO

and listed on NASDAQ in

April 2011

2014

Formal guidance to be provided Mid February, 2014

•

Estimated

launch

of

10

-

15

products

•

Continued investment in SCP to support product

development initiatives and capacity expansion

•

Market consolidation driving increased partnering

opportunities and accelerated investment in

product development

•

FDA timelines impact approval timelines

Revised revenue guidance of $230MM -

$250MM

•

YTD reported adjusted margins exceed long-term

targets, validating P&L leverage

•

Vertical Integration capabilities supplementing

virtual base model via consolidation of SCP facility

•

Launched 12 new products, including Zoledronic

Acid at market formation

•

Completed a successful secondary offering in

September 2013 to support SCP investment, pipeline

development and business development activity |

6

Extensive Global Partner Network

Sagent’s Fundamental Initiative with Partners

•

Quality

–

Facility Support, cGMP training, audit

assistance and integration of Sagent System

•

Regulatory

–

Submission and Compliance Expertise and

become Regulatory Agent for partner

•

Sales/Marketing/Distribution

–

Ability to navigate the complex US distribution

network and in the future others

Industry Consolidation has accelerated the rate of partnering opportunities to a level never

experienced in our history |

Sagent

Pharmaceuticals

Strategic Growth

Drivers

A Global Pharmaceutical

Company |

8

Drivers of Long-Term Growth

Strong

Industry

Dynamics

Deep

Development

Pipeline

Investing For

the Future

Growing

Product

Portfolio

Industry

Leading

Sales

Organization |

9

New Significant Initiative

Strong Industry Dynamics

Several significant macro economic and industry factors are driving demand and shaping

opportunity for Sagent Pharmaceuticals

Drug Shortage Crisis

•

U.S has had as many as 300 drug shortages annually

–

82% of hospitals have delayed patient treatment as a

result of a shortage

–

63% of hospitals were unable to provide recommended

treatment

•

The vast majority of these shortages are injectable products

•

Reasons contributing to shortages

–

2003 Medicare Act

–

Limited global capacity, with a dated domestic platform

–

Industry consolidation

–

Hoarding

–

API

•

Sagent’s Commitment to shortage reduction

–

Product selection

–

SCP objectives

–

Broad global network, providing supply alternatives:

Sodium Bicarbonate

Generic Market Growth

•

Generic market to increase by $100 Billion in 5 years

–

Global market to hit $231 billion by 2017

–

Largest opportunity in injectable drugs with annual

growth rate 10%

Not Price

•

Growth Statistics per Frost & Sullivan

GPOs

Hospitals

Wholesalers

Distributors

•

Industry consolidation creating vast opportunities

•

Huge potential in China, India, Russia, Brazil, Turkey and

S. Korea –

current footprint and business partners |

10

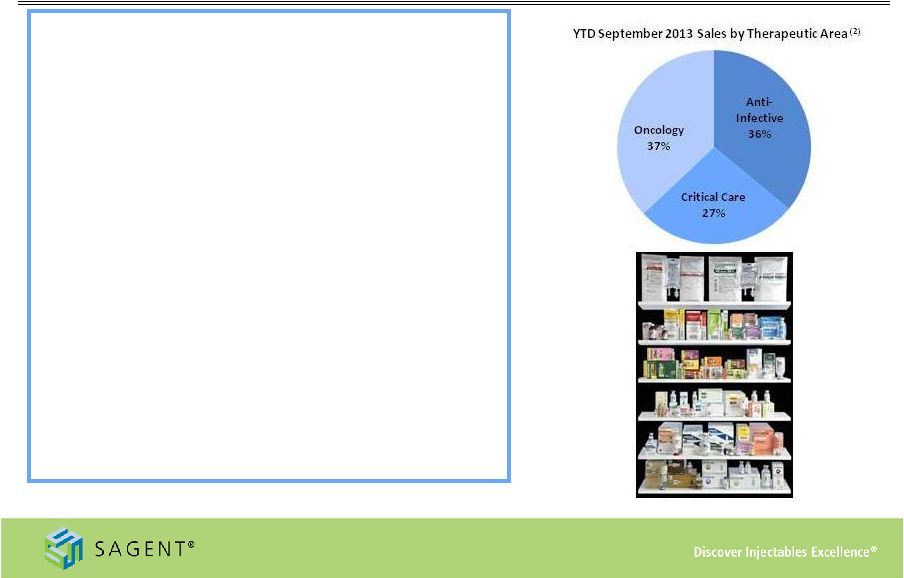

Growing Product Portfolio

•

Diverse marketed products -

53 products/144

SKUs

(1)

•

Key indication areas and products include:

–

Oncology:

Calcium Leucovorin, Docetaxel,

Fludarabine, Gemcitabine, Oxaliplatin, Topotecan,

Zoledronic Acid

–

Anti-Infective:

Azithromycin, Cefepime, Fluconazole,

Levofloxacin, Nafcillin, Oxacillin

–

Critical Care:

Adenosine, Heparin, Propofol,

Rocuronium

–

Filed an additional 12 products in 2013

(2) As of September 30, 2013

(1) As of December 31, 2013

More than 25% of our product portfolio holds the

#1 or #2 market position |

11

Growing Product Portfolio

Approximately $6 billion of potential IMS market value in planned launches from 2013 through

2016 |

12

Deep Development Pipeline

•

New product pipeline includes 39

products, represented by 69 ANDAs

(1)

•

Sagent currently has two approved

products represented by seven ANDAs

pending commercial launch

(1)

•

10 to 15 product launches expected in

FY’14

(1) As of December 31, 2013

Sagent’s ANDA Submission Rate

An additional 24 products represented by

41 ANDAs under initial development

(1) |

13

Industry Leading Sales Organization

•

34 person sales and marketing team

–

Average tenure of sales

representatives is about 25 years in

same geographic location

–

Contracting professionals have an

average of approximately 30 years

experience

•

Customer relationships are a key strength

–

Management and key executives hold

long-standing relationships with key

GPO, distributor and wholesaler

decision-makers |

14

Investing for the Future

Portfolio Breadth |

Sagent

Pharmaceuticals

Recent

Developments

A Global Pharmaceutical

Company |

16

Sagent China Pharmaceuticals (SCP)

Vertical Integration

•

Completed the acquisition of our partner’s 50% interest

in KSCP for $25 million, in June of 2013. Payable in

installments through September 2015

–

State-of-the-art isolation technology for aseptic filing

–

FDA and current Good Manufacturing Practices

compliant facility

–

Facility received EIR in the first half of 2013; first

product launched in November

–

Multiple products developed and filed from SCP in 2013

•

Provides for increased responsiveness to drug shortages:

SGNT controls its own products

•

Pursuing additional investment in product development

and capacity expansion

–

$12 -

$16 million annual operating costs

–

$30 -

$35 million capital expansion in final stages of

development, high speed isolator technology |

Sagent China

Pharmaceuticals (SCP) Key Initiatives

•

Develop injectable formulations for

the US and domestic Chinese markets

•

Focus on developing and formulating

niche products and complex

molecules

•

Housed in a leading Science and

Technology Center in Chengdu, China

•

Positions SCP as a local thought leader

and long-term positioning to enter

domestic market

•

Expected to be 2

largest

pharmaceutical market by 2015

•

Market growth driven by increasing

demand in cities and counties and

growth of the middle class

•

Demand for high quality drugs

growing and price is aligning with

developed markets

•

Regulatory pathway evolving

Global Development Center

China Pharma Market

nd |

18

Key Products Driving Growth

Recent launches

•

Propofol

–

Launched three single-dose, single-patient vial presentations in 2013 in 20mL,

50 mL and 100mL sizes

–

Market is approximately $230 million, based on IMS data, with limited

number of competitors

–

Product is highly valued by our customers and has experienced intermittent

shortages over the last few years

•

Docetaxel

–

Launched in August 2013

–

Market is approximately $330 million, based upon November 2013 IMS data, with

limited number of competitors

–

Received early FDA approval in anticipation of potential market shortages driven

by API supply issues

•

Zoledronic Acid

–

Launched vials in March 2013 at market formation, followed by

4mg and 5mg pre-mixed bags in second half 2013

–

Market is approximately $600 million, based upon November 2013 IMS data with

continued price erosion

–

Multiple presentation strategy demonstrates the strength of Sagent’s model

|

19

Key Products Driving Growth

Future launches

•

Iron Sucrose

–

Generic form of Venofer®

–

High barrier to entry for generic manufacturing

–

Received

FDA

Complete

Response

Letter,

December

2013.

Currently

developing

comprehensive response, which should be filed first half 2014, 2014 approval unlikely.

–

Market is approximately $325 million based on November 2013 IMS data

•

Pentobarbital

–

Generic form of Nembutal®

–

High barrier to entry for generic manufacturing, Sagent will be first generic

–

Anticipate approval in first half of 2014

–

Market estimated to be approximately $30 million

•

Adenosine Injection

–

Generic form of Adenoscan®

–

Approved ANDA, launch pending first to file 6 month exclusivity to expire March 2014

–

Market is approximately $55 million based on November 2013 IMS data

–

Sagent sales organization has extensive historical experience with the product

|

20

Strong & Experienced Management Team

Excel Rx, Premier, VA

Albert Patterson

EVP, Nat’l Accts & Corp Dev

Michael Logerfo

EVP Legal

APP, Fujisawa, LyphoMed

APP, Fujisawa

Landauer, Cardinal Health, KPMG

Nanolnk, Ovation Pharmaceuticals, NeoPharm, Physican Quality

Care, Bristol Myers Squibb

APP, LyphoMed, YorPharm, Gensia, Faulding

Jeffrey Yordon

CEO and Chairman

James Hussey

President

Jonathon Singer

EVP and CFO

Lorin Drake

Corp VP Sales

Ravi Malhotra

CSO

Flavine Holding Co, Attorney |

Sagent

Pharmaceuticals

Financial Highlights

A Global Pharmaceutical

Company |

22

Sequential Growth

Heparin

Topotecan

Levofloxacin

Gemcitabine

Cefepime

Azithromycin

Oxaliplatin

Oxacillin

Leucovorin

Key

Launches

•Indicates

mid-point

of

2013

revenue

guidance

range;

2013

Adjusted

Gross

Margin

is

the

midpoint

of

the

guidance

range,

both

as

reported

in

the

third

quarter

earnings

release,

dated

November

5,

2013

•Adjusted

Gross

Profit

is

a

non-GAAP

measure.

Please

refer

to

slide

#26:

Appendix

–

Non

GAAP

Reconciliation

for

further

detail.

Zoledronic Acid

Docetaxel |

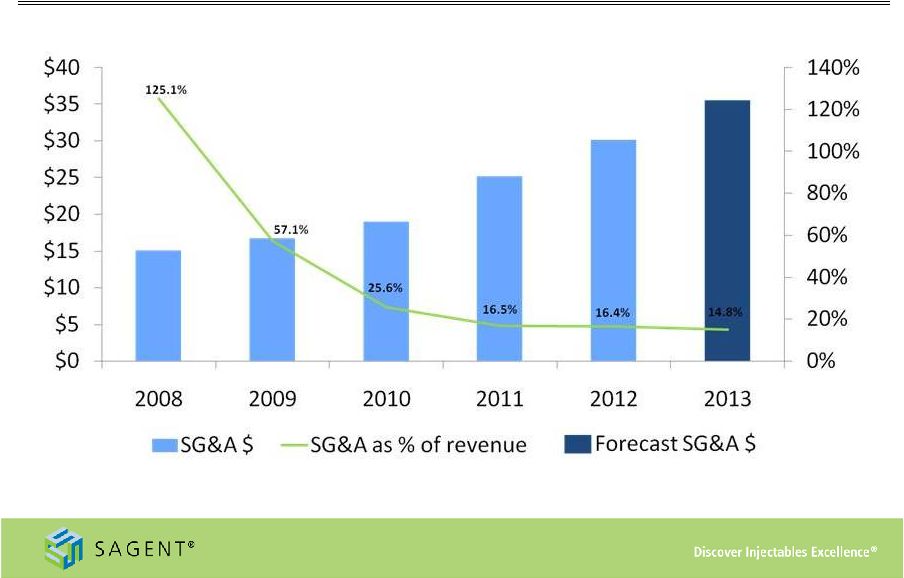

23

SG&A Spending

*

Midpoint

of

expected

2013

SG&A

Expense

and

Revenue

as

reported

in

the

third

quarter

earnings

release,

dated

November

5,

2013 |

24

YTD 2013 Financial Performance

New product launches drive increases in revenue and record earnings

Key Developments in 2013

•

Successful secondary stock offering

•

Acquired remaining 50% interest in SCP

•

Launch of Zoledronic acid at market formation

•

James Hussey joined as President

•

Amended supply agreement with Actavis

•

Approval and launch of first product from SCP facility

Operating Performance

•

Net revenue of $180.6 million, 38% increase from first

nine months of 2012

•

Adjusted gross profit

(2)

of $62.2 million, or 34% of net revenue

–

Increase from $23.6 million, or 18% of net revenue in 2012

•

Net income of $26.0 million, compared to net loss of $16.8

million in first nine months of 2012

–

Diluted EPS of $0.90 per share in first nine months of 2013

(1)

As of September 30, 2013

(2)

Adjusted

Gross

Profit

is

a

non-GAAP

measure.

Please

refer

to

slide

#26:

Appendix

–

Non

GAAP

Reconciliation

for

further

detail |

25

Investment Highlights

•

Fastest growing Generic Injectable company in U.S. Market , a consolidating industry

with high barriers to entry

•

Extensive global partner network with state-of-the-art facilities enabling

accelerated growth relative to conventional start-ups

•

Solid relationships at all levels of the supply chain enhance responsiveness to

industry demands

•

Vertical integration through acquisition of SCP complements partnering model, as

well as provides additional growth opportunities and a footprint

in China

•

Exceptional quality and safety track record; global excellence in manufacturing

•

Strong sequential margin and revenue growth driven by diverse and deep product

portfolio

•

Experienced management team with great track record, has delivered on product

approvals and financial performance |

Appendix

– Non-GAAP Reconciliation

Nine months ended

Nine months ended

September 30,

September 30,

2008

2009

2010

2011

2012

2013

2008

2009

2010

2011

2012

2013

Adjusted Gross Profit

73

$

435

$

9,460

$

20,833

$

36,746

$

62,172

$

0.6%

1.5%

12.8%

13.7%

20.0%

34.4%

Sagent portion of gross

profit earned by Sagent

Agila joint venture

-

(2)

417

2,064

5,639

1,909

0.0%

0.0%

0.6%

1.4%

3.1%

1.1%

Gross Profit

73

$

437

$

9,043

$

18,769

$

31,107

$

60,263

$

0.6%

1.5%

12.2%

12.3%

16.9%

33.4%

Reconciliation of GAAP to non-GAAP Information (in thousands)

Sagent Pharmaceuticals, Inc.

Year ended December 31,

Year ended December 31,

Percentage of net revenues

We use the non-GAAP financial measure “Adjusted Gross Profit” and corresponding

ratios. We define Adjusted Gross Profit as gross profit plus our share of the gross

profit earned through our Sagent Agila joint venture which is included in the Equity in net (income) loss of joint ventures line on

the Consolidated Statements of Operations. We believe that Adjusted Gross Profit is

relevant and useful supplemental information for our investors. Our management believes

that the presentation of this non-GAAP financial measure, when considered together with our GAAP financial measures

and the reconciliation to the most directly comparable GAAP financial measure, provides a more

complete understanding of the factors and trends affecting Sagent than could be

obtained absent these disclosures. Management uses Adjusted Gross Profit and corresponding ratios to make

operating and strategic decisions and evaluate our performance. We have disclosed this

non-GAAP financial measure so that our investors have the same financial data that

management uses with the intention of assisting you in making comparisons to our historical operating results and analyzing

our underlying performance. Our management believes that Adjusted Gross Profit provides

a useful supplemental tool to consistently evaluate the profitability of our products

that have profit sharing arrangements. The limitation of this measure is that it includes an item that does not have an

impact on gross profit reported in accordance with GAAP. The best way that this

limitation can be addressed is by using Adjusted Gross Profit in combination with our

GAAP reported gross profit. Because Adjusted Gross Profit calculations may vary among other companies, the Adjusted Gross

Profit figures presented below may not be comparable to similarly titled measures used by

other companies. Our use of Adjusted Gross Profit is not meant to and should not be

considered in isolation or as a substitute for, or superior to, any GAAP financial measure. You should carefully evaluate

the following table reconciling Adjusted Gross Profit to our GAAP reported gross profit for

the period presented (dollars in thousands). Adjusted Gross

Profit 26 |

|