Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NAUTILUS, INC. | d654964d8k.htm |

JANUARY 14, 2014

Orlando, Florida

ICR Xchange Conference

Exhibit 99.1 |

Safe Harbor

Statement This presentation includes forward-looking statements (statements which

are not historical facts) within the meaning of the Private Securities Litigation

Reform Act of 1995, including statements concerning the Company's prospects, resources, capabilities, current or future financial trends

or operating results, demand for the Company‘s products, future plans for introduction

of new products and the anticipated outcome of new business initiatives, estimates of

market size and growth, planned capital expenditures and statements concerning our ability to finance growth plans with

cash generated from our operations. Factors that could cause Nautilus, Inc.'s actual results

to differ materially from these forward-looking statements include our ability to

acquire inventory from sole source foreign manufacturers at acceptable costs, within timely delivery schedules and

that meet our quality control standards, availability and price of media time consistent

with our cost and audience profile parameters, a decline in consumer spending due to

unfavorable economic conditions in one or more of our current or target markets, an adverse change in the availability of

credit for our customers who finance their purchases, our ability to pass along vendor raw

material price increases and increased shipping costs, our ability to effectively

develop, market and sell future products, our ability to protect our intellectual property, and the introduction of competing

products. Additional assumptions, risks and uncertainties are described in detail in our

registration statements, reports and other filings with the Securities and Exchange

Commission, including the "Risk Factors" set forth in our Annual Report on

Form 10-K, as supplemented by our quarterly reports on Form 10-Q. Such

filings are available on our website or at www.sec.gov. You are cautioned that such statements are not guarantees of

future performance and that actual results or developments may differ materially from those

set forth in the forward-looking statements. We undertake no obligation to

publicly update or revise forward-looking statements to reflect subsequent events or circumstances.

Unless otherwise indicated, all information regarding our operating results pertain to

continuing operations. ©

Nautilus, Inc. 2014

2 |

Presentation Overview

•

Who We Are:

A team focused on providing

innovative fitness solutions and superior results

•

Business Strategies:

Strategic Innovation,

Operational Excellence, Footprint Expansion

•

Financial Overview:

Robust top and bottom line

growth; Strong Balance Sheet

3 |

Who We

Are 4 |

A Team That

Delivers Superior Results PRELIMINARY* UNAUDITED Q4 AND FULL YEAR 2013

RESULTS (CONTINUING

OPERATIONS) •

Q4 Revenues grew 18.5% over Q4 last year

Direct business -

3.7% growth

Retail business -

47.0% growth

•

Full Year 2013 Revenues grew 12.8% over 2012

Direct business -

9.3% growth

Retail business -

20.2% growth

•

Non-GAAP Q4 EPS is expected to be between $0.29 and $0.31 per share**

Versus $0.23 last year

•

Non-GAAP full year EPS is expected to be between $0.46 and $0.48 per

share†

Versus $0.34 last year

5

* All Q4 2013 and full year 2013 financial information is preliminary

and unaudited; see preliminary earnings release dated January 13, 2014. **

Excludes income tax expense resulting from partial reestablishment of a valuation allowance against the Company’s deferred tax assets.

†

Excludes partial reversal of a valuation allowance recorded against the Company’s

deferred tax assets. Non-GAAP Information, see Nautilus’ website under

“Investor Relations” for a reconciliation to GAAP.

|

Who

We Are Today A

leading

provider

of

fitness

equipment

and

related

products

for

use

in,

and

around,

the

home

Industry leading capabilities in product innovation and quality

Growing company which has

dramatically improved profitability

Strong portfolio of

brands, including #1 in the fitness industry (Bowflex)*

Unique

three-pronged business model

An organization focused on increasing shareholder value

6

Our goal is to provide products which allow consumers to

achieve their health and fitness goals

* Based on 2012 National Consumer Research Study |

Strongest

Brands in Fitness Equipment 7

* Based on 2012 National Consumer Research Study |

Winning Product

Portfolio of Existing Heritage Products Cardio

Unique technologies and modalities have driven growth

Strength

TreadClimber®

SelectTech®

Home Gym

8

AD6 |

Recent

Innovations Bowflex MAX Trainer™

Schwinn®

Cardio MY13

Bowflex Boost ™

UpperCut®

Schwinn®

Elliptical MY13

9 |

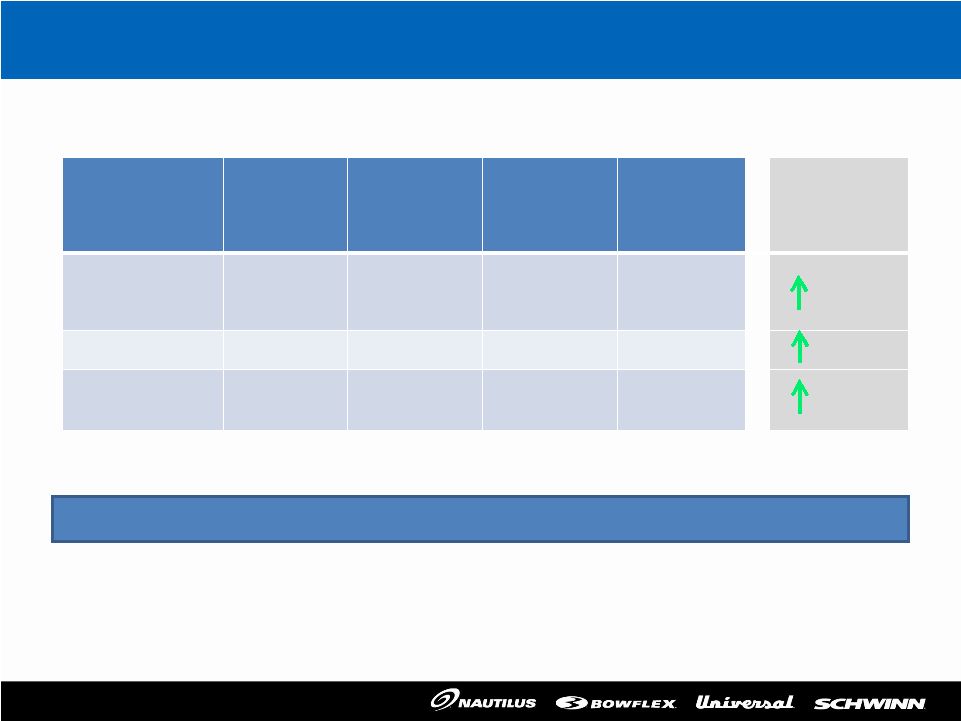

Growing in all

Our Channels % of 2013

Revenue*

2013 Full

Year Gross

Margin*

Op-ex

Profile*

2013

Full

Year

Cont.

Margin**

Revenue

Growth

in 2013*

Direct to

Consumer

63%

59-61%

Higher

(due to

advertising)

10-11%

9%

Retail

35%

24-26%

Very Low

14-16%

20%

Licensing

Royalties

2%

~100%

Minimal

100%

6%

Plus…

Complementary business drivers across channels

* All Q4 2013 and full year 2013 financial information is preliminary and

unaudited; see preliminary earnings release dated January 13, 2014. ** Excluding

unallocated corporate expense. 10 |

Our Six

Philosophies 1.

Focus on profitable growth while leveraging and tightly

controlling expenses

2.

Deliver a steady flow of consumer driven innovations

3.

Continue investing in our brands and new product launches

•

Longer term view

4.

Emphasis on high opportunity initiatives for maximum success

•

Carefully scrutinize deployment of resources

5.

Apply sense of urgency and intense focus on strategy and

execution

•

Achieve what we say we’re going to do

6.

Support and nurture our vibrant culture of organizational

excellence

Continue to drive positive shareholder return!

11 |

Business

Strategies 12 |

Key

Drivers •

Emphasis on new product development for both the Direct and

Retail channels; guided by a focus on consumer needs/wants

•

Utilize our unique multi-channel business model to gain share and

secure traction on new products

•

Diversify our product offering and geographic footprint

•

Utilize new marketing approaches to energize our brands and build

deeper customer relationships

Utilize combination of “core growth”

and “plus growth”

initiatives to strengthen core and extend our reach

13 |

Growth

Opportunities •

Launch

New

Direct

to

Consumer

Products:

Lead

with

new

MAX

Trainer,

leverage

our

unique

market’s

capabilities

•

Large

Domestic

Retail

Market:

We

are

under-represented

but

well

poised

to

take

share

•

International

Market

Opportunity:

Where

we

are

almost

non-

existent

today,

but

our

brands

are

already

well-known

•

Expand

Licensing

Royalty

Base:

Utilize

both

IP

and

Brands

•

Tap

Into

Adjacent

Product

Categories:

That

are

growing

and

compliment

our

core

competencies

14 |

Global Market

Opportunity *Compilation of Industry and Internal Data

15

Estimated Wholesale Retail Market Size by Region* |

“The Road Map”

16

•New Price Points

•New Core Categories

•Plus Growth Opportunities

•Access to Broader Audience

•Licensing

•Process Rigor

•IP Portfolio

•Brand Engagement

•Margin Discipline

•Leverage Infrastructure

•Continuous Cost

Improvements •Supply Chain

Efficiency •Media

Planning Our approach to

profitable growth focuses

on three major areas: |

Financial

Overview 17 |

Revenue growing

at 9.1% CAGR* *All Q4 2013 and full year 2013 financial information is preliminary and

unaudited; see preliminary earnings release dated January 13, 2014. Note: Net Revenue

and Operating Income are for Continuing Operations. Consistent Revenue and Profitability

Growth 18 |

Note: All Q4

and full year financial information is preliminary and unaudited; see preliminary earnings release January 13, 2014.

* Non-GAAP Information, see Nautilus’

website under “Investor Relations”

for a reconciliation to GAAP

* Net Revenue and EBITDA are rolling four quarter totals, Continuing Operations

EBITDA Outpacing Revenue Growth

19 |

Strong Balance

Sheet •

Approximately $41M* of cash and no debt as of December

31, 2013

•

$31.6M of deferred net tax assets as of September 30, 2013

•

Working capital utilization metrics are best in the industry

•

Internal cash generation expected to finance growth plans

•

Modest capital expenditures of approximately $2 -

$3M per

year range expected

*All Q4 2013 and full year 2013 financial information is preliminary and unaudited; see

preliminary earnings release dated January 13, 2014. 20 |

Longer Term

Expectations Stated Strategic Goal

Run Rate

2013 Preliminary

Results vs. 2012*

Revenue Growth

9-10% year

12.8% vs. 7.5% (L.Y.)

Gross Margin

Sustain gains in each

channel

2-4 point improvement in

both channels

Operating Expense

Leverage

1-3 points better

Expenses flat to up slightly

Operating Income

7-10% of revenue

Absolute dollars increasing

at double digit pace

7.0-7.2% vs. 5.5% (L.Y.)

45-49% growth

EBITDA Growth

Strong (outpacing revenue)

39-42% growth vs. 84% (L.Y.)

21

*All Q4 2013 and full year 2013 financial information is preliminary and unaudited; see

preliminary earnings release dated January 13, 2014. |

Key Take

Aways Our company is achieving growth and significantly improved

profitability

Capabilities have been built to deliver long-term profitability

Strategic growth drivers and opportunities have been identified and

are being pursued

Strong asset position is unique and leverage-able

•

Brands, IP, balance sheet, business model, human capital

Our plan is solid and it is working

22 |

23

|

Nautilus, Inc.

Reconciliation of Non-GAAP Financial Measure

Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA)

Management considers EBITDA, a non-GAAP financial measure, to be useful for investors in evaluating our operating performance. We calculate EBITDA by adding income from continuing operations, plus (i) interest expense net of interest income, (ii) income tax expense and (iii) depreciation and amortization. A reconciliation of EBITDA to income from continuing operations is as follows (in millions).

| 2010 | 2011 | 2012 | 2013(2) | |||||||||||||

| Income (loss) from continuing operations(1) |

$ | (9.8 | ) | $ | 2.5 | $ | 10.6 | $ | 47.7-48.3 | |||||||

| Interest expense (income), net |

0.1 | 0.4 | (0.1 | ) | 0.0 | |||||||||||

| Income tax expense (benefit) of continuing operations |

0.6 | 0.7 | (0.2 | ) | (32.0)-(32.3 | ) | ||||||||||

| Depreciation and amortization |

6.6 | 3.8 | 3.3 | 3.3 | ||||||||||||

| EBITDA from continuing operations |

$ | (2.5 | ) | $ | 7.4 | $ | 13.7 | (3) | $ | 19.0-19.4 | (3) | |||||

| (1) | Management does not include the results of discontinued operation in its calculation of EBITDA and, therefore, EBITDA was not reconciled to net income including discontinued operation. |

| (2) | Full year 2013 financial information is preliminary and unaudited. |

| (3) | May not add due to rounding. |

Nautilus, Inc.

Reconciliation of Non-GAAP Financial Measure

Net Income and Earnings Per Diluted Share Excluding a Partial Reversal of a

Valuation Allowance

Nautilus presents adjusted net income and earnings per diluted share results because management believes that due to the non-recurring nature of the partial reversal of a valuation allowance recorded against the Company’s deferred tax assets resulting in an income tax benefit, including the non-GAAP results assists investors in assessing the Company’s operational performance relative to its competitors and its historical financial performance.

Continuing Operations Income and Diluted EPS (as reported and excluding non-recurring items) (unaudited and in millions, except per share amounts):

| Three Months Ended December 31, 2013 | ||||||||||||

| Prelim Results (est range) (1) |

Less non- recurring items(2) |

Excluding non- (est range) |

||||||||||

| Income from continuing operations |

$ | 8.0-8.6 | $ | (1.1 | ) | $ | 9.1-9.7 | |||||

| Diluted net income per share |

$ | 0.25-0.27 | $ | (0.04 | ) | $ | 0.29-0.31 | |||||

| Twelve Months Ended December 31, 2013 | ||||||||||||

| Prelim Results (est range) (1) |

Less non- recurring items(2) |

Excluding non- (est range)(3) |

||||||||||

| Income from continuing operations |

$ | 47.7-48.3 | $ | 33.0 | $ | 14.6-15.2 | ||||||

| Diluted net income per share |

$ | 1.52-1.54 | $ | 1.05 | $ | 0.46-0.48 | ||||||

| (1) | Full year and fourth quarter 2013 financial information is preliminary and unaudited. |

| (2) | Such items were offset by the after-tax impact of an income tax benefit (expense) related to a partial reversal of a valuation allowance recorded against the Company’s deferred tax assets. |

| (3) | May not add due to rounding. |