Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BIOLASE, INC | d658407d8k.htm |

BIOLASE,

Inc. Federico Pignatelli, Chairman and CEO

Alexander K. Arrow, President and COO

NASDAQ: BIOL

www.biolase.com

Investor Update

January 2014

PAGE 1

Exhibit 99.1 |

Safe Harbor

Statement PAGE 2

This presentation may contain forward-looking statements that are based on our

current expectations, estimates and projections about our industry as well as

management’s beliefs and assumptions. Words such as “anticipates,”

“expects,” “intends,” “plans,”

“believes,” “seeks,” “estimates,” “may,” “will,” and variations of these words or similar

expressions are intended to identify forward-looking statements. These statements

include projections about our future earnings and margins and speak only as of

the date hereof. Such statements are based upon the information available to us

now and are subject to change. We will not necessarily inform you of such changes. These statements are not

guarantees of future performance and are subject to certain risks, uncertainties and

assumptions that are difficult to predict. Therefore our actual results could

differ materially and adversely from those expressed in any forward-looking

statements as a result of various factors. The important factors which could cause

actual results to differ materially from those in the forward-looking

statements include, among others, a downturn or leveling off of demand for our products

due to the availability and pricing of competing products and technologies, adverse

international market or political conditions, a domestic economic recession, the

volume and pricing of product sales, our ability to control costs, intellectual

property disputes, the effects of natural disasters and other events beyond our control and other factors

including those detailed in BIOLASE’s filings with the Securities and Exchange

Commission including its prior filings on Form 10-K and 10-Q. |

DIAGNOSIS:

The BEST 2D &

3D Imaging.

RESTORATION:

The BEST digital

impressions.

DESIGN:

The BEST

design tools.

MILLING:

The BEST chair-

side milling.

TREATMENT:

The BEST laser

technology.

THE TOTAL

TECHNOLOGY

SOLUTION FROM

BIOLASE

PAGE 3 |

With WaterLase,

BIOLASE has: •

Invented,

•

Developed,

•

Patented, and

•

Been granted FDA clearance

PAGE 4

for a fundamentally different kind

of revolutionary tissue-cutting tool. |

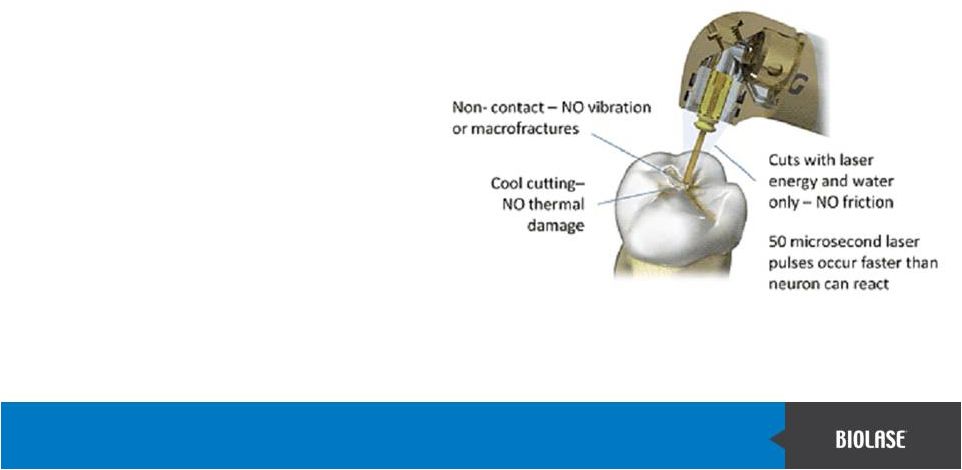

•

Water molecules in tissue absorb laser energy

from WaterLase and vaporize, resulting in an

atraumatic ablation of the tissue.

–

Very little trauma or bleeding,

–

No heat or vibration, and

–

Little or no pain

–

Significantly reduces cross contamination

WaterLase All-Tissue Lasers

PAGE 5

•

Extensive patent protection

•

Multiple other medical applications

•

A medical breakthrough that has been used

already on approximately 8 million people |

Patient

Testimony PAGE 6 |

How It Works:

WaterLase High Speed Cutting PAGE 7 |

WaterLase

Atraumatic

Pediatric

Tooth

Extraction

The aiming beam

does not cut the

tissue nor

generate heat.

The tissue is cut

biologically, with

little or no pain,

when the laser

energizes water

at the molecular

level.

PAGE 8 |

PAGE

9 |

Other Hard Tissue

Laser Systems compared to the Waterlase iPlus Waterlase iPlus

Fiber Delivery

Fotona Lightwalker

Articulated Arm

Er:YSGG,

Latest Technology

Er:YAG,

25-year old Technology

PAGE 10

An articulated arm is

awkward to use

Fiber delivery is

ergonomic and natural

for the dentist to use |

Soft-tissue medical lasers:

The EPIC-S (surgical & ENT) and

EPIC-V (veterinary).

Soft-tissue

dental

diode

lasers:

The

EPIC

10

Soft Tissue laser, which in June 2013 won the

MDE gold medal in medical device design, and

the iLase, a portable diode laser with no foot

pedal, power cord, or external controls.

All-tissue dental lasers:

The WaterLase iPlus, our

flagship all-tissue laser, and the MDX and MD Turbo.

Laser Products

PAGE 11 |

Digital

Radiography and CAD/CAM Products NewTom 3D

CBCT cone

beam:

•

Medical grade

imaging

technology.

•

Less cost, less

radiation

exposure.

•

Exclusive U.S.

& Canada

distribution

agreement

through Feb

2015.

PAGE 12

TRIOS CAD/CAM

intra-oral

scanner: •

Digital

impression

taking.

•

Hand held

scanner,

operator's

control cart,

and software.

•

North American

distribution

agreement

through Aug

2017. |

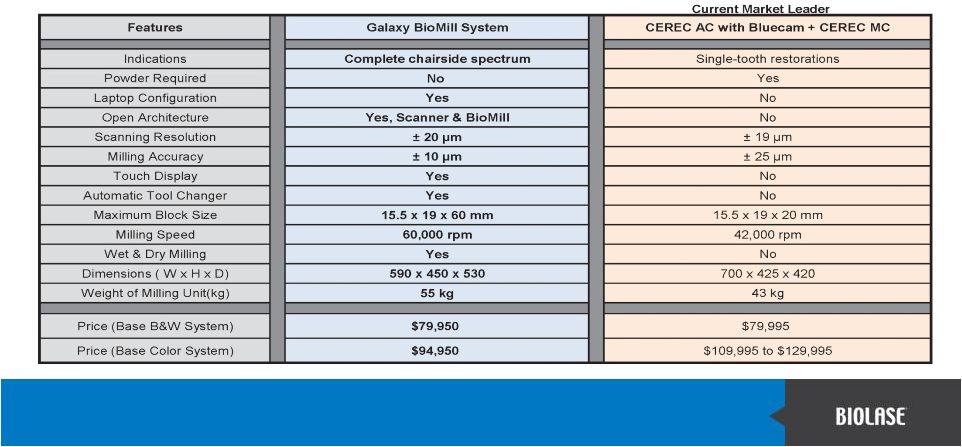

The Galaxy

BioMill completes the CAD/CAM

segment of BIOLASE’s

Total Technology Solution.

GALAXY BioMill System

PAGE 13 |

•

A $500 million market in 2013, growing at approximately 20%

•

Historical CAD/CAM Systems for the Dental Office are Obsolete compared

with Laptop Scanners and Tabletop Milling Modules

Chair-Side Milling Market

PAGE 14 |

GALAXY BioMill

System •

Developed in conjunction with imes-

icore and 3Shape.

•

Open architecture.

•

Introduced at the Greater NY Dental

Meeting in December 2013.

•

Expected to be ready to ship by end

of Q1 or beginning of Q2 2014.

•

High quality at two-thirds the price of

the industry leader in a $500M

annual market.

PAGE 15 |

Feature

Comparison: GALAXY BioMill System PAGE 16 |

Why Should

Dentists Buy a WaterLase iPlus? Monthly Finance Payment

New Monthly Revenue Generated

Approx. $1,300

$5,000 –

$15,000

A dentists’

return on investment

can be 500% to 1,500%

Return on Investment

PAGE 17

•

WaterLase

enables

dentists

to

perform

procedures

that

they

would

otherwise

refer

to

specialists,

for example:

•

Gingivectomy = $160-$200

•

Perio Treatment = $375-$1,000

•

Hard-tissue Crown Lengthening = $500-$700

•

Herpetic

or

Aphthous

Ulcer

=

$300-$500

•

Frenectomy = $400-$600

•

These procedures are easy to learn and training is included in the cost.

•

With no anesthesia, the WaterLase also increases efficiency and allows the dentist to work in

multiple quadrants in a single visit., equating to $250-$750 per day in additional

revenue. |

•

WaterLase

dentists

offer

their

patients

more

procedures

and

they

have

a

higher

rate

of

acceptance

from

their

patients.

This

is

because

patients are more likely to accept treatment when it

does not hurt them.

•

Case

Study:

Doctor

David

Peck

(Springfield,

MA)

–

Practice running at approximately $1M per year in

2010; purchased a WaterLase iPlus in January 2011.

–

Grew practice to approximately $1.7M in 2011; for

example, Dr. Peck performed ~75 frenectomies in 2011

which generated about $35,000 in a few hours of work.

–

Purchased second WaterLase iPlus in Sept 2012; grew

practice to approximately $2.0M in 2012.

Value Proposition of WaterLase

PAGE 18 |

PAGE 19

|

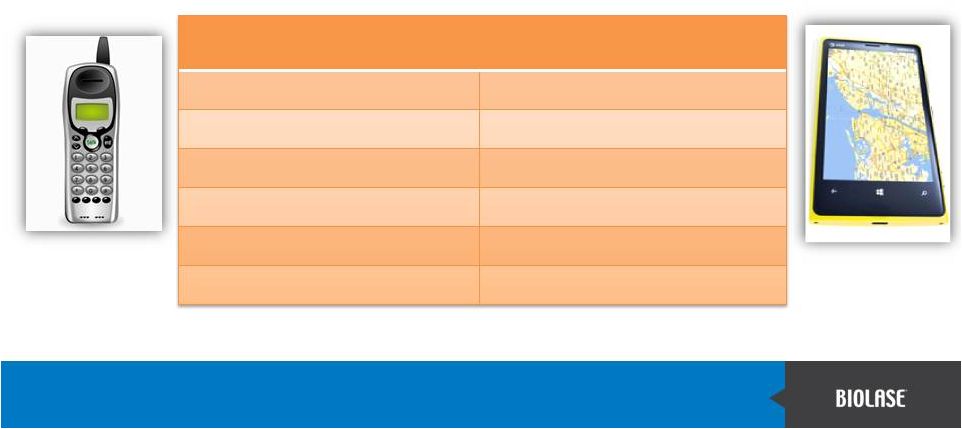

Telephone versus

Smart Phone PAGE 20

•

Phone calls

•

Phone calls

•

Texting

•

Web browsing

•

Navigation

•

Photos and videos

•

Scheduling

Telephone

Smart Phone |

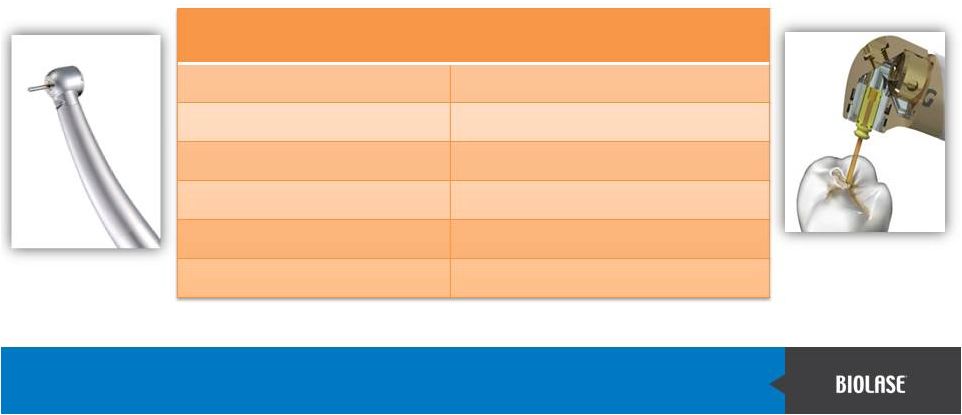

Conventional

Dental Drill versus WaterLase PAGE 21

Dental Drill

Waterlase

•

Cutting (hard tissue)

•

Cutting (hard and soft tissue)

•

Polishing

•

Surface modification

•

Coagulation

•

Disinfection

•

Bio

stimulation

•

Desensitization

- |

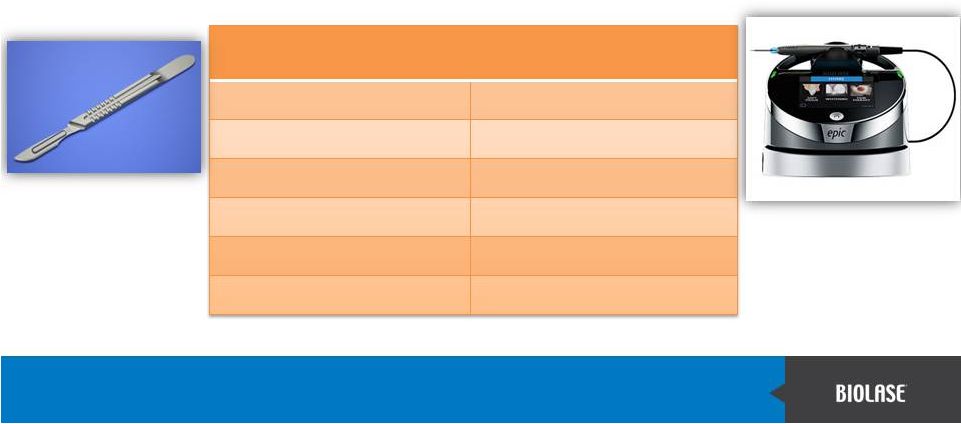

Scalpel versus

the EPIC diode PAGE 22

Scalpel

Epic Laser

•

Cutting

•

Cutting

•

Teeth whitening

•

Coagulation

•

Disinfection

•

Bio

stimulation

•

Desensitization

- |

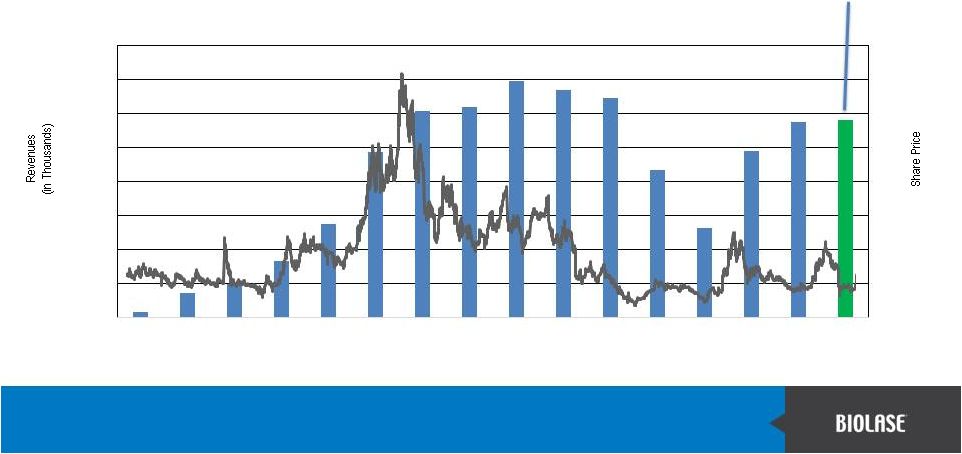

Annual Net

Revenue and Stock Price $20

$15

$10

$5

Projected revenue guidance of

$57-$59 million, last updated

November 12, 2013.

PAGE 23

$

-

$10,000

$20,000

$30,000

$40,000

$50,000

$60,000

$70,000

$80,000

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013 |

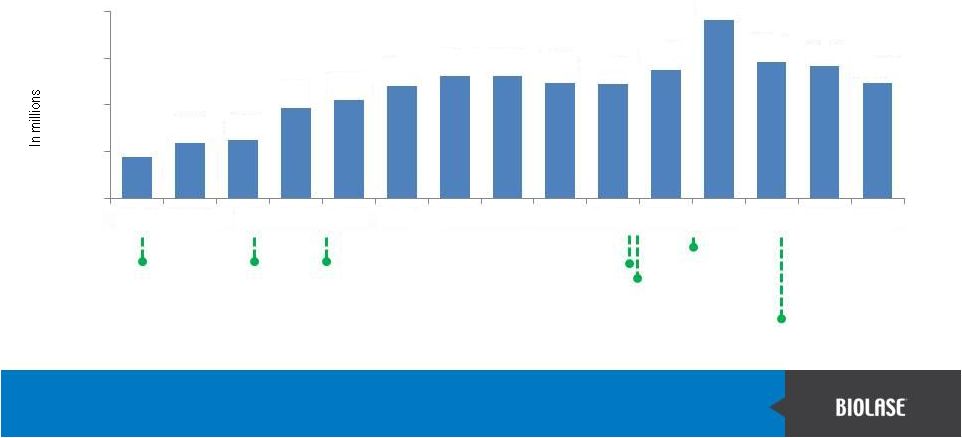

Quarterly

Net

Revenue

and

Influencers

in

Turnaround

Launched

Cefla’s NewTom

Cone Beam

Imaging products

Introduced iLase

hand-held soft-

tissue diode

laser

Launched

WaterLase

®

iPlus™

all-tissue laser

Launched 3Shape’s

TRIOS™

intra-oral

scanner

CE Mark & FDA

clearance for EPIC 10

New management

with F. Pignatelli as

Chairman and CEO

ends exclusive

global distribution

Introduced

WaterLase

®

MDX™

all-

tissue lasers

PAGE 24

$4.4

$5.9

$6.2

$9.7

$10.6

$12.1

$13.1

$13.2

$12.3

$12.2

$13.8

$19.1

$14.6

$14.2

$12.3

$0.0

$5.0

$10.0

$15.0

$20.0

Q1 10

Q2 '10

Q3 10

Q4 10

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Q2 12

Q3 12

Q4 12

Q1 13

Q2 13

Q3 13 |

Filling our Open

Territories 3Q 2013

1Q 2014

PAGE 25 |

Reasons for

Optimism in 2014 •

We believe the low point of our restructuring cycle is behind us

•

New sales leadership and open territories are filled

•

Imaging specialist force means that our reps will no longer be distracted

from selling Waterlase

•

Galaxy

BioMill

System;

entry

into

new

$500

million

yearly

market

growing

at

20-25%

•

Cone Beam and CAD/CAM positioned for high growth in 2014

•

Now present in the three most exciting fields of high-tech dentistry:

–

Lasers

–

High-End Imaging

–

Chairside Milling

PAGE 26 |

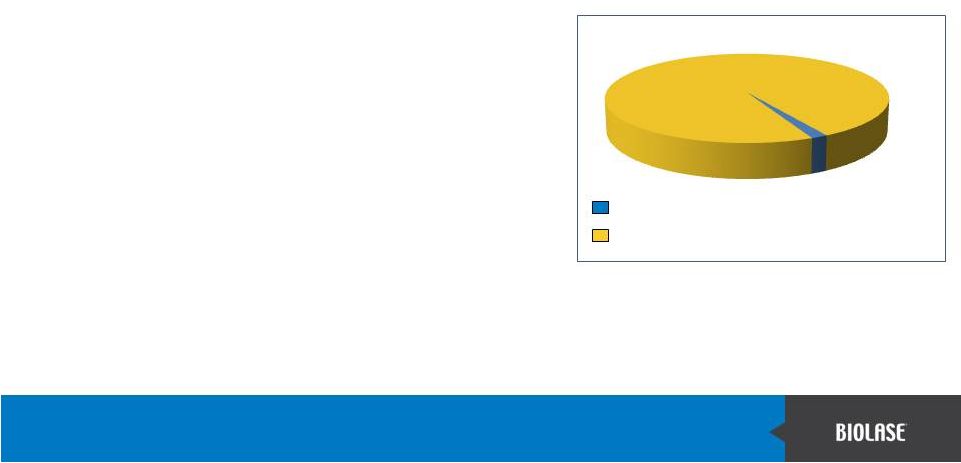

•

160,000

dentists

in

US

&

Canada.

1

•

Approximately 1.5 M dentists

–

rapid

growth

in

emerging

economies.

2

•

Current market penetration.

–

approx.

3%-5%

of

dental

practices

in

US.

–

approx. 1% worldwide.

•

Each incremental 1% market penetration is $600M revenue.

•

Dental laser market opportunity may > $50B in 20 years.

BIOLASE’s Market Opportunity

Est. total global market

BIOLASE systems sold worldwide 1998-present

1

American Dental Association.

2

World Federation of Dentistry.

PAGE 27

1,500,000

24,000+ |

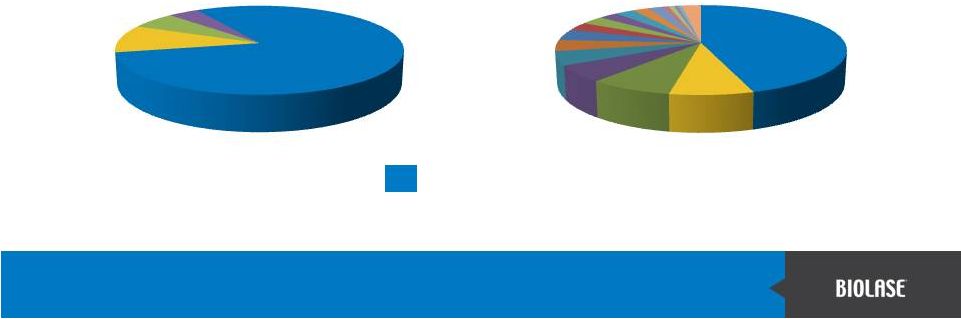

Dominant Market

Position •

WW Hard-tissue Dental Laser Market

•

WW Total Dental Laser

Market

80%

45%

BIOLASE Market Share

PAGE 28 |

Otolaryngology

(ENT) opportunity •

9,000 otolaryngologists in the U.S.

•

700,000 nasal turbinate reductions per

year

•

30% of them need revisions

•

600,000 sinuloplasties per year

•

The EPIC-S is the most precise, ergonomic,

and newest laser available for

otolaryngologists

•

Launched in 4Q 2013

PAGE 29 |

Veterinary

opportunity •

52,000 veterinarians in the U.S.

•

The EPIC-V is a versatile tool for

veterinary dental, dermatological, and

surgical procedures on virtually every

mammalian and bird species

•

In use by KOL veterinarians

•

Launched in 3Q 2013

PAGE 30 |

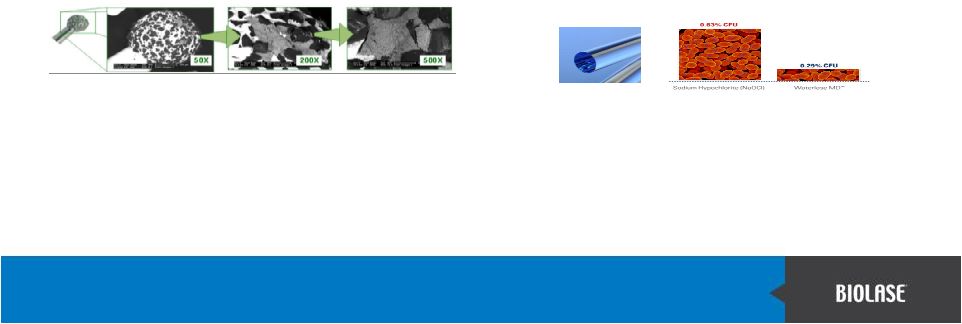

WaterLase

Technology Substantially Reduces the Risk of Cross Contamination and

Contagion Burs

and

Endo

Files:

WaterLase

Tips:

•Complex and rugged bur surface

difficult to sterilize. •Smooth tip surface does not harbor debris or

bacteria like abrasive surface of burs or files.

•YSGG

laser

energy

is

bacteriacidal.

3

•Disposable

tips

work

without

the

need

to

contact

tissue.

Also eliminates accidental sticks with contaminated burs.

•15%

of

“sterilized”

burs

and

up

to

76%

of

“sterilized”

endodontic

files

carry

pathogenic

micro-organisms.

1,

2

•Autoclaving fails one out of

every seven times to decontaminate

burs.

1

PAGE 31

1. Dental Burs and Endodontic Files: Are Routine Sterilization Procedures Effective?: Archie

Morrison, DDS, MS, FRCD(C); Susan Conrod, DDS JCDA • www.cda-adc.ca/jcda • February 2009, Vol. 75, No. 1. 2. Contaminated dental instruments: Smith

A, Dickson M, Aitken J, Bagg J.J Hosp Infect. 2002 Jul;51(3):233-5. 3. The

antimicrobial efficacy of the erbium, chromium:yttrium-scandium-gallium-garnet laser with radial emitting tips on root canal dentin walls infected with Enterococcus faecalis:

Wanda Gordon, DMD, Vahid A. Atabakhsh, DDS, Fernando Meza, DMD, Aaron Doms, DDS, Roni Nissan,

DMD, Ioana Rizoiu, MS and Roy H. Stevens, DDS, MS JADA 2007; 138(7): 992-1002 |

Changing

Attitudes Toward Cross-Contamination •

Cross-Contamination

beginning to appear

in mainstream

dental ads to

dentists

•

Expected that this

will soon begin

targeted to patients

as well

Page 32 |

•

Over 310 patents issued & pending.

•

70% are related to WaterLase technology & medical lasers.

Extensive Patent Portfolio

Issued &

Active

Pending

Total

U.S.

80

45

125

International

80

105

185

Total

160

150

310

PAGE 33 |

•

Sustained, consistent top line growth

•

Non-GAAP profitability, GAAP profitability, becoming cash flow positive

•

Launching 1-2 major new products per year

•

Entering one new non-dental market per year

•

Alleviating working capital constraints that have been hurting our

operating margins and our progress

•

Return to our reputation as a product-driven company

Corporate Goals

PAGE 34 |

BIOLASE Corporate Headquarters in Irvine, California

•

Sales offices in Floss (Germany), Madrid (Spain),

Shanghai (China), and Mumbai (India); expansion

planned in Dubai (UAE), and Rio de Janero (Brazil).

•

Floss also has service and manufacturing capabilities.

•

Training facilities through the United States with the

main one at corporate HQ in Irvine.

BIOLASE Europe in Floss, Germany

•

57,000 sq. ft. facility in Irvine, California, includes

manufacturing and development facilities.

•

Can accommodate growth to $250 million.

•

Over 225 employees worldwide.

BIOLASE Facilities & Employees

PAGE 35 |

A Growth Story

with Proof-of-Concept

PAGE 36

•

The “big story” potential of pipeline products in at least six new markets (orthopedics,

ophthalmology, ENT surgery, podiatry, pain therapy, and veterinary surgery) •

The stability and risk-reduction of an established growing business in its first

market: dentistry

•

With BIOLASE, you get both advantages in one company: –

(1) potential upside from a deep pipeline, and –

(2) an established growth business – at a very low multiple of revenues |

•

Federico Pignatelli, Chairman

•

Alexander Arrow, MD

•

Samuel Low, DDS

•

Frederic Moll, MD

•

Norman Nemoy, MD

•

Jim Talevich

Management and Board of Directors

PAGE 37

Management

Board of Directors

•

Federico Pignatelli, CEO

Salary $1, ownership position 5.5%

•

Alexander Arrow, President & COO

Ownership position: 1.5%

•

Frederick Furry, CFO

Ownership position: 0.7%

•

Dmitri Boutoussov, VP R&D

•

Bill Brown, VP Bus Dev & Intl. Sales

•

Brian Jaffe, VP NA Sales & Marketing

•

Colleen Boswell, VP RA/QA

–

–

– |