Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - AMERICAN CRYOSTEM Corp | ex31_1.htm |

| EX-32.1 - EXHIBIT 32.1 - AMERICAN CRYOSTEM Corp | ex32_1.htm |

| EX-31.2 - EXHIBIT 31.2 - AMERICAN CRYOSTEM Corp | ex31_2.htm |

| EXCEL - IDEA: XBRL DOCUMENT - AMERICAN CRYOSTEM Corp | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended: September 30, 2013 | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Commission file number: 000-54672 | |

American CryoStem Corporation

(Exact name of registrant as specified in its charter)

| Nevada | 26-4574088 | |

| (State or other jurisdiction

of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

1 Meridian Road, Suite 5 Eatontown, NJ 07724 |

||

| (Address of principal executive offices) | ||

| (732) 747-1007 | ||

| (Registrant’s telephone number, including area code) | ||

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.001

Indicate by checkmark if registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by checkmark if registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See definition of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | o | Accelerated Filer | o |

| Non-Accelerated Filer | o | Smaller reporting company | x |

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Act). Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant based on a closing price of $0.33 on March 29, 2013 (the last business day of the registrants most recently completed second fiscal quarter) was approximately $2,065,919.

As of January 7, 2013, the registrant had 32,574,221 shares of its common stock, par value $0.001, outstanding.

Documents incorporated by reference: none.

TABLE OF CONTENTS

| 2 |

FORWARD LOOKING STATEMENTS

Included in this Form 10-K are “forward-looking” statements, as well as historical information. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we cannot assure you that the expectations reflected in these forward-looking statements will prove to be correct. Our actual results could differ materially from those anticipated in forward-looking statements as a result of certain factors, including matters described in the section titled “Risk Factors.” Forward-looking statements include those that use forward-looking terminology, such as the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “project,” “plan,” “will,” “shall,” “should,” and similar expressions, including when used in the negative. Although we believe that the expectations reflected in these forward-looking statements are reasonable and achievable, these statements involve risks and uncertainties and we cannot assure you that actual results will be consistent with these forward-looking statements. We undertake no obligation to update or revise these forward-looking statements, whether to reflect events or circumstances after the date initially filed or published, to reflect the occurrence of unanticipated events or otherwise.

| Item 1. | Business |

Company Overview

History

American CryoStem Corporation, which we refer to as “American CryoStem,” “we,” “us,” “our” and “our Company” was incorporated in the state of Nevada on March 13, 2009. On April 20, 2011, we acquired, through our wholly owned subsidiary American CryoStem Acquisition Corporation, substantially all of the assets from, and assumed substantially all of the liabilities of, ACS Global, Inc. (“ACS”) in exchange for our issuance of 21,000,000 shares of our common stock, par value $0.001 per share, to ACS (the “Asset Purchase”). We filed a Current Report on Form 8-K with the Securities and Exchange Commission (SEC) on April 27, 2011 disclosing the Asset Purchase and certain related matters including, but not limited to, the appointment of our present officers and directors as well as the resignation by the former chief executive officer and sole director. Our fiscal year ends September 30 of each calendar year.

Upon the closing of the Asset Purchase: (i) ACS Global became our majority shareholder, (ii) John Arnone was appointed as our chief executive officer and president and Anthony Dudzinski was appointed as our chief operating officer, treasurer and secretary, and (iii) John Arnone and Anthony Dudzinski were appointed to our board of directors, with Mr. Arnone being appointed as Chairman of the Board. Mr. Dudzinski is also a director and the president and treasurer of ACS Global and Mr. Arnone is a director and secretary of ACS Global. Contemporaneously with the Asset Purchase Closing, we sold 1,860,000 shares of Common Stock to accredited investors in a private placement at a purchase price of $0.50 per share for aggregate gross proceeds of $930,000.

Our Business

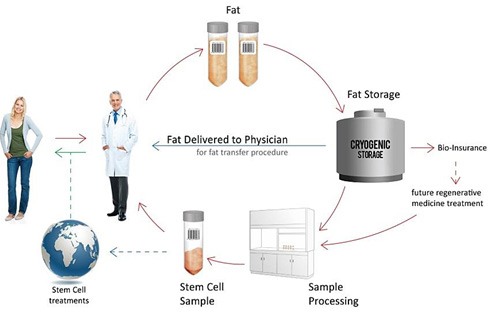

American CryoStem is a developer, marketer and global licensor of patented adipose tissue-based cellular technologies, bio-materials and related proprietary services with a focus on clinical processing, commercial bio-banking and application development for adipose (fat) tissue and adipose-derived stem cells (ADSCs). We maintain a strategic portfolio of intellectual property and patent applications that form our Adipose Tissue Processing Platform, which supports and promotes a growing pipeline of biologic products and processes, clinical services and international licensing opportunities. Through our ACS Laboratories division, we operate an FDA registered, cGMP compliant human tissue processing, cryo-storage cell culture and differentiation media development facility in Mount Laurel, New Jersey at the Burlington County College Science Incubator.

Our growth strategy is centered on expanding our research and development through scientific collaborations and developing revenue through the sale and licensing of our patented products and services to fully capitalize on: (1) adipose tissue and adipose derived stem cell (ADSC) technologies (2) scientific breakthroughs incorporating ADSCs that have been rapidly shaping the fast growing Regenerative and Personalized Medicine industries; (3) providing these growth industries with a standardized cell processing platform and, (4) enhancing the delivery of healthcare through cellular-based therapies and applications which address disease treatment, wound and burn healing, joint repair and management, and personalized health and beauty care, and (5) building a network of physicians for the delivery of our products and services.

| 3 |

We market a proprietary, patented clinical processing methodology for the collection, preparation and cryopreservation of adipose tissue in its raw form without manipulation, bio-generation or the addition of animal-derived products or other chemical materials requiring removal upon retrieval. We believe that this core process makes each sample suitable for use in cosmetic tissue grafting procedures or for further processing to adult stem cells for other types of cellular therapies. Currently, there are over 100 therapeutic and orthopedic applications for adipose tissue and adult stem cell treatments identified or in use globally, and more discoveries are being made each day.

Products and Services

American CryoStem is focused on developing multiple high margin business lines capable of generating sustainable, recurring revenue streams from each of our developed products and services. Our products and services are the result of more than four years of scientific development and investment of approximately $5 million dollars. The Company also incorporates all of its proprietary and patented or patent pending laboratory products, such as our ACSelerate™ cell culture media, into all of our processing product production and contract manufacturing services.

To date, we have generated minimal revenue; however, subject to, among other factors, obtaining the requisite financing, management believes that we are well positioned to leverage our developed products and services as the basis for a host of Regenerative Medicine uses and future applications.

The following products and services are designed to become the basis of, or an integral part of, numerous planned revenue generating and cellular therapy development activities: Our products and services are:

| ● | CELLECT® | ● | Tissue Collection methodology designed for physicians to facilitate the collection and overnight shipping of an individual’s adipose tissue to our FDA registered laboratory; |

| ● | ATGRAFT™ | ● | Tissue processing at our Laboratory of a customer’s adipose tissue and its preparation for long term storage in different configuration sizes allowing future retrieval for tissue grafting procedures or Regenerative Medicine applications |

| 4 |

| ● | ATCELL™ | ● | Clinical Processing to separate the component parts (cells) of an individual’s adipose tissue removing the adipocytes and red blood cells thereby creating the ATCELL™ stem cell lines for storage, expansion, or differentiation |

| ● | Clinical and Research grade donor ATCELL™ lines for use with collaborative partners in cellular therapy research and application development and optimization, cell morphology and characterization assays, and growth analysis. | ||

| ● | ACS Laboratories™ | ● | Manufacturing and sale of our patented ACSelerate-SFM™ and ACSelerate-LSM™ cell culture media products |

| ● | Creation and sale of research grade ATCELL™ | ||

| ● | Participation and support of all collaborative research projects | ||

| ● | Contract manufacturing, including Autokine-CM® | ||

|

● |

Provide testing services for physicians performing in-office procedures and tissue processing | |

| ● | International Licensing™ | ● | Standard Operating Procedures (SOPs) and all associated components and products |

| ● | Consulting and Marketing Review and Assessment | ||

| ● | CELLECT® | ||

| ● | ATGRAFT™ | ||

| ● | ATCELL™ | ||

| ● | Adipose tissue processing, cellular expansion and product manufacture |

CELLECT® Validated Collection, Transportation, and Storage System – An unbreakable “chain of custody” clinical solution for physicians to collect and deliver adipose tissue samples utilizing proprietary and patent pending methods and materials. The CELLECT® service is monitored in real-time and assures the highest tissue and cell viability upon laboratory receipt.

We believe American CryoStem is the first tissue bank to globally incorporate through its CELLECT® service the International Blood Banking identification and labeling and product identification coding system. The coding was developed in conjunction with the American Association of Blood Banks (AABB), the American Red Cross and the International Society of Blood Transfusion (ISBT). These groups formed the International Council for Commonality in Blood Banking Automation (ICCBBA) and developed the ISBT 128 Standard for machine readable labeling. This labeling system is an acceptable machine readable labeling standard, product description, and bar coding system for FDA Center for Biologics Evaluation and Research under 21 CFR 606.12(c) 13. American CryoStem conforms to this standard in its Mount Laurel facility and all cellular and tissue products produced at the facility carry our W3750 ICCBBA facility identifier allowing any physician, hospital, clinic, laboratory and regulator worldwide to identify the origin and obtain additional information of any sample produced at an American CryoStem facility. The Company will promote this standard in all laboratories that license or utilize our technology. The CELLECT® service is included in our pending patent application PCT/US2011/39260.

ATGRAFT™ Adipose Tissue Storage Service – A clinical fat storage solution allowing physicians to provide their patients with multiple tissue/stem cell storage options. The ATGRAFT™ Service, through one liposuction procedure allows individuals the benefit of multiple cosmetic or regenerative procedures by using their own stored adipose tissue as a natural biocompatible filler or cellular therapy application without the trauma of further liposuctions. Potential ATGRAFT™ uses and procedures include breast reconstruction, layered augmentation, buttocks enhancement or volume corrections of the hands, feet, face and neck areas that experience significant adipose tissue (fat) volume reduction as we age. ATGRAFT™ is processed and stored utilizing our cGMP standards so that any stored fat tissue sample may be retrieved in the future and re-processed to create ATCELL™ our clinical grade stem cell product for use in Regenerative Medicine applications. The AGRAFT™ products and services are incorporated into our pending patent application PCT/US13/44621.

| 5 |

The standard fees for ATGRAFT™ tissue processing and initial storage ranges from $750 to $2,500, depending on the volume of tissue processed. The annual storage fee is $200 for up to 100ml of tissue. Storage of tissue over 100ml is billed an additional $1 per 1ml annually. These fees may be paid by the collecting/treating physician or the consumer. The Company earns additional fees ranging from $100 to $500 plus shipping costs, paid by the physician upon retrieval, for the thawing, packaging and shipment of the stored samples to the physician for immediate use upon receipt.

ATGRAFT™ Storage Retrieval fees are determined by the storage configuration as follows:

| ● | Small Sample package – for storages of 100ml of adipose tissue or less. Storages sizes are 4ml vials and 25ml cryo storage bags or a single 100ml cryo-storage bag. The small storage package is ideally suited for the physician to market additional procedures to the client for hands, feet, face and neck and for the correction of small surgical defects. | |

| ● | Medium Sample package – for storage of 100ml to 300ml of adipose tissue. Storage sizes are 25ml and 100ml cryo storage bags. The medium storage package is ideally suited for the physician to use in follow up corrections to same day tissue transfers and minor surgical defect corrections as well as larger procedures to the hands, feet, face and neck and breasts. | |

| ● | Large Storage package – for storage of over 300ml of adipose tissue. Storage sizes are available in 25ml and 100ml cryo storage bags. The large storage package is ideally suited for secondary large volume procedures such as layered breast augmentation and buttock lifts and corrections following large surgical procedures. | |

| ● | Custom Package – storage configuration for pre planned procedures. The company adjusts the fees based upon the final storage configuration. This package permits a physician to pre-plan reconstructive procedures prior to any initial planned surgical procedure such as post mastectomy or lumpectomy reconstructions and corrections. |

The ATGRAFT™ service creates patient retention and a significant revenue opportunity for the participating physician to promote additional procedures and generate additional fees from waste material collected during liposuction procedures. These additional fees can be generated with significantly lower physician costs by eliminating the overhead associated with performing a liposuction for each procedure. Physician cost savings may include: materials, supplies, equipment, and the expenses of utilizing a surgical center, hospital operating room or an in-office aseptic procedure room. The ATGRAFT™ service is designed to operate under the minimally manipulated regulations contained in both 21 CFR 1271.10 and PHS 361.

ATCELL™ Adipose Derived Stem Cells (ADSCs) – Multiple lines of clinically processed and characterized ADSCs created using the Company’s propitiatory SOPs and patented cell culture media. ATCELL™ is the Company’s trademarked name for its ADSC and differentiated cell products. The Company has created multiple master and differentiated lines and labels them according to their characterization. (i.e. ATCELL-SVF™ (stromal vascular fraction), ATCELL–CH™ (differentiated chondrocytes) etc.) The ATCELL™ lines are custom created for patients desiring to store their cells for future or current use. Donated research samples are prepared for sale to researchers for use in application development collaborations. The Company charges fees ranging from $750 to process a previously stored ATGRAFT™ sample and a minimum of $1,500 for newly collected tissue samples seeking further component processing. All customer and donated research samples submitted for processing must utilize the CELLECT® collection system to conform to our internal cGMP Standard Operating Procedures (SOPs).

The Company earns additional fees based upon the storage configuration of the final ATCELL™ samples, and for additional culturing in the ACSelerate™ cell culture and differentiation media. Cell culturing and differentiation can be performed upon receipt of the sample or at any time following the initial processing and cryopreservation of the ATGRAFT™, SVF or ATCELL™ samples. ATCELL™ is ideally suited for expansion and differentiation into additional cell types utilizing the ACSelerate-SFM™ (serum free media) or ACSelerate-LSM™ (low serum media) differentiation media. The ATCELL products and services are incorporated into our pending patent filing US Serial No. 13/646,647.

ACSelerate™ Cell Culture Media Products – Patented cell culture media products for growing human stromal cells (including all cells found in human skin, fat and other connective tissue). ACSelerate™ cell culture media is available animal free (serum free), which is suitable for human clinical and therapeutic uses; and a low serum version for application development and research purposes.

| 6 |

On August 2, 2011, the Company was issued United States patent number 7,989,205 for “Cell Culture Media, Kits and Methods of Use.” The granted claims include media variations for cellular differentiation of ADSCs into osteoblasts (bone), chondrocytes (cartilage), adipocytes (fat), neural cells, and smooth muscles cells in both HSA (clinical) grade and FBS (research) grade. This patent covers both non-GMP research grades and GMP clinical grades suitable for cell culture of adipose-derived stem cells intended for use in humans.

The most widely used cell culture medium today for growing and differentiating stem cell cultures for in vitro diagnostics and research contains 10% or more fetal bovine serum (FBS). The use of FBS and other animal products in clinical cellular therapy application development and manufacture raises concerns and generates debates within the scientific and regulatory community relating to potential human/animal cross-contamination. These same concerns may also need to be addressed through additional expensive and expansive testing and documentation with the FDA during the application and approval process for new cellular therapies. FDA concerns are evidenced in their Guidance’s and Guidelines regarding cellular therapy involving human cells, tissues and products (HCT/Ps) published and maintained by the FDA such as: Guidance for Industry: Source Animal, Product, Preclinical and Clinical Issues Concerning the Use of Xenotransplantation Products in Humans, FDA Final Guidance, April 2003. It is our belief that eliminating or greatly reducing FBS in cellular manufacturing, applications and products can eliminate or ease these scientific and regulatory concerns and may prove to be a winning strategy for cellular therapy application developers seeking FDA approval. Similar concerns exist worldwide in markets that are governed by agencies similar to the FDA, such as the EMA in the European Union and the controlling regulatory bodies in Japan, Korea and China, among others.

The patented ACSelerate™ cell culture media line was specifically developed to address increasing industry demand for animal serum-free cell culture products and for the acceleration of products from the laboratory to the patient.

Currently, our media products are being utilized by our research partners engaged in developing novel new cellular applications and treatments. The Company supports these efforts by also making non-client donated ATCELL™ samples available for research purposes and for internal product development through our research programs. These cell lines are highly sought after by private researchers and universities for use in pre-clinical trial studies and in-vitro research. The ability of the Company to provide clinical grade materials for these research and development collaborators, partners and other third parties further extends the Company’s ability to become a primary source of clinical grade materials and services necessary to support approved applications and treatments.

The Company manufactures several versions of its ACSelerate™ cell culture media including:

| ● | ACSelerate-SFM™ - our flagship, clinical grade, cGMP manufactured animal product and serum free cell culture media, which is ideally suited for the rapid expansion of adipose-derived cell samples for direct use or further culturing into other cell types; | |

| ● | ACSelerate-CY™ - for differentiation of ATCELL™ into chondrocytes (ATCELL-CY™), which are suitable for use in cartilage repair applications in knees and other joints for patients suffering from joint injury, osteoarthritis and other diseases that cause degeneration of joint cartilage; | |

| ● | ACSelerate-OB™ - for differentiation of ATCELL™ into osteoblasts (ATCELL-OB™) for the repair of bone injuries resulting from traumatic injury and musculoskeletal diseases; | |

| ● | ACSelerate-AD™ - for differentiation of ATCELL™ into adipocytes (ATCELL-AD™) for the repair of adipose tissue defects resulting from injury or surgical procedures and is designed for those patients without an appropriate amount of body fat for corrective tissue transfer procedures; | |

| ● | ACSelerate-MY™ - for differentiation of ATCELL ™ into myocytes (ATCELL-MY™) for the repair of muscle defects and loss as the result of traumatic injury, surgery or systemic disease; | |

| ● | ACSelerate-GY™ - a clinical grade, non-DMSO (Dimethyl Sulfoxide) cellular cryopreservation media designed to conform to certain FDA and PHS 361 exemptions available for marketing our ATGRAFT™ service. |

The Company is optimizing additional versions of the ACSelerate™ media product line to address differentiation of ATCELL™, ADSCs into neural, lung and other specific cell types that may be necessary for use in future clinical applications. Many of these applications are not currently approved by the US Food and Drug Administration.

| 7 |

ACS Laboratories™: Laboratory Product Sales, Contract Manufacturing and Professional Services–ACS Laboratories™ is an unincorporated subsidiary of American CryoStem Corporation, responsible for the sale and licensing of all the Company’s patented and patent pending cellular, cell culture, processing and testing products to professional, institutional and commercial clients. The Company operates a separate website (acslaboratories.com) to distinguish the sale of commercial and research products from its consumer products and services, which are marketed on its main website (americancryostem.com). ACS Laboratories™ manufactures the full line of ACSelerate™ cell culture media and ATCELL™ products; and provides these products to our collaborative partners as further discussed below.

ACS Laboratories™ also provides services to physicians and other medical professionals that perform tissue transfer and other cellular therapy services in same day procedures in their own office. Physicians can arrange to submit samples to the laboratory for sterility, viability, cellular density and growth assay analysis. Many physicians that provide tissue transfer services do not have the facilities and equipment necessary to perform this type of testing. Large diagnostic and testing laboratories do not currently offer these services. The Company’s fees range from $200 for sterility testing up to $1000 for comprehensive testing and analysis.

Contract Manufacturing, Autokine-CM® Anti-Aging, Autologous Skin Care Product Line

Under agreement with Personal Cell Sciences (PCS), we manufacture the key ingredient Autokine-CM® (autologous adipose derived stem cell conditioned medium) for PCS’ U-Autologous™ anti-aging topical formulation. Each product is genetically unique to the patient and custom blended, deriving its key ingredients from the individual client’s own stem cells. The Company provides its CELLECT® Tissue Collection service to collect the required tissue to manufacture the U-Autologous™ product and processes it under the same cGMP standard operating procedures that it developed for the ATGRAFT™ and ATCELL™ cell processing services utilizing ACSelerate™ cell culture media. The Company receives collection, processing and long term storage fees and earns a royalty on all U-Autologous™ product sales. The utilization of the Company’s core services in its contract manufacturing relationship provides opportunities for the Company to promote its ATGRAFT™ and ATCELL™ products for an individual’s cosmetic purposes.

Our Company’s contract manufacturing services can be extended to develop custom and/or white label products and services for both local and global cosmetic and regenerative medicine companies, physicians, wellness clinics and med spas. The Company intends to expand its relationships and contract manufacturing regionally through its physician networks and globally through its International Licensing Program.

Product Development

Our strategic approach is to design, develop and launch new products and services that utilize our existing products and services to provide the Company with opportunities to produce near term cash flow, strong recurring revenue streams, strong international licensing partners and complementary scientific data. We focus on products, services and applications that require tissue collection and processing as the initial requirement to produce cellular therapies and products. These products and services can include adipose tissue and stem cell sample processing and storage as a form of personal “bio-insurance,” adipose tissue (fat) storage for cosmetic fat engraftment procedures, and the creation and production of topical applications and ingredients used by other companies in the wound care and cosmetic industries.

We are focusing our efforts on the expansion of our products and services pipelines based upon our intellectual property portfolio, collaborative development relationships, product sales and distribution, and international licensing and partnering opportunities. Our current activities include supporting our university and industry collaborations by providing our products and services with the expectation that our products and services become the basis for new adipose tissue and stem cell based Regenerative Medicine and cellular therapy applications. This strategy allows for our research partners and their application development to begin with clinically harvested and processed adipose tissue and ADSCs (ATCELL™), which we believe can be a significant step toward accelerating the development of new treatments.

Collaboration and Partnering Opportunities

Protein Genomics and Formation of Autogenesis Corporation

In 2012, American CryoStem entered into a Memorandum of Understanding (MOU) outlining our initial collaborative efforts with Protein Genomics, Inc. (PGEN) to test and develop new products by combining certain components of our respective intellectual property and patented products. We have provided PGEN and its research partner, Development Engineering Sciences (DES), with Adipose Derived Stem Cells (ATCELL™) and our patented cell culture mediums (ACSelerate™) for testing with PGEN’s patented products designed for the wound healing market. Research and development has been ongoing since late 2012 and notable progress has been achieved. In October of this year, the early results of this initiative was the subject of local media coverage in Arizona showcasing the groundwork laid by PGEN, DES and American CryoStem in providing assistance in what we believe is a quicker way to heal skin injuries using a patient’s stem cells.

| 8 |

As a result of the success realized in the early stage of this research collaboration, we recently entered into a formal joint venture with Protein Genomics through the incorporation of Autogenesis, Corp. as required in the 2012 MOU. Each company (CRYO and PGen) initially has an equal 50% ownership interest. All products capable of being commercialized, as well as any new intellectual property, resulting from the ongoing scientific collaboration will be wholly-owned by Autogenesis. This is a very exciting turn of events for us and is representative of how we believe additional research collaborations with our Company’s technology may evolve in the future.

Rutgers University

In May of this year, American CryoStem entered into Material Transfer Agreements with three research scientists at Rutgers University allowing them to utilize the Company’s autologous Adipose-Derived Stem Cells (ATCELL™) and patented, serum free, GMP grade cell culture and differentiation mediums (ACSelerate™) for evaluation with the anticipation to implement additional agreements to research, develop and commercialize innovative new cellular therapies targeting incurable diseases, neurological disorders and the $5 billion global wound care market.

In December of this year, American CryoStem and Rutgers University executed a Collaboration and Research Agreement involving stem cell differentiation molecules and molecular biological reagents under the direction and supervision of Dr. KiBum Lee, the PRINCIPAL INVESTIGATOR (PI) for the research. Our collaborative efforts have advanced rapidly and new intellectual property is anticipated to result from this work. Based on the collaborative efforts under the Collaboration and Research Agreement, our Company’s patent counsel is preparing two patent applications based upon earlier developments which are now optioned to American CryoStem. In addition, American CryoStem’s agreement with Rutgers University allows us the use of intellectual property and biomaterials developed by Dr. Lee and his team in combination with our ATCELL™ and ACSelerate™ products for the development of new cellular therapies and regenerative medicine applications. To support the new discoveries, Dr. Lee and our professionals will develop, file and publish patent applications, research papers, government and private grant funding applications to support future clinical studies as appropriate.

Further collaboration and research agreements are currently in negotiation with Rutgers researchers focusing on wound healing and topical delivery of our innovative products.

Institutional Review Board Approval of Protocols

In an effort to make it easier for other physicians and researchers to study the safety of SVF and ADSCs (ATCELL™), we sought approval from the Institutional Review Board (IRB) of the International Cell Surgical Society (ICSS) of our protocols for the processing of ATCELL-SVF™ and culturing of stem cells from adipose tissue ATCELL™. The two protocols, titled: Autologous Adipose Tissue-Derived Stromal Vascular Fraction (SVF) Containing Adult Stem Cells with Isolation of SVF, and Culturing of Adipose Derived Stem Cells (ADSCs) For Use in Institutional Review Board Studies, provide appropriate processing, storage and testing methods necessary to move the clinical investigative process towards uniform treatments. The collection of cGMP processing and outcome data from IRB approved protocols is required by prevailing FDA regulations and guidance for approval of regenerative cellular therapies including, at a minimum, potency (cell count), contamination testing and cell viability.

The ICSS IRB thoroughly evaluated every step of our standardized processing protocols (SOPs), which serve to isolate the SVF or ADSCs from a patient’s adipose tissue. The objective of the IRB is to assess these protocols to ensure the highest patient safety possible and to minimize the risks for those participating in innovative research and investigational studies. Shortly following the end of the third fiscal quarter, ended June 30, 2013, the ICSS IRB approved the protocols.

| 9 |

The Company is making available its processing services utilizing the IRB-approved protocols to physicians and clinical researchers for inclusion in their studies. By adopting these standardized and repeatable protocols (SOPs) and utilizing our laboratory services, researchers can focus their resources on application development rather than creating, validating and managing a clinical laboratory for the preliminary processing of tissue and cellular samples. These studies do not currently involve actual human clinical trials, but affords the IRB the opportunity to endorse our repeatable, standardized and validated processing methodologies for the isolation of SVF and for tissue culture expansion of ADSCs obtained from SVF as the basis for future human clinical study.

Management intends to pursue additional collaborative and partnering opportunities as a strategic method to enhance awareness of and expand the distribution of our patented products, services, technologies and expertise in the IRB-approved clinical processing of adult adipose tissue for autologous (self) use and ADSCs. We believe that as the pace of clinical trials and result reporting increase and scientific and peer reviewed papers are published, new opportunities to market our existing products, services and Intellectual Property portfolio may also emerge.

Additionally, on November 21, 2013 the Company was approved by ICSS for an IRB titled, “Comparative Viability Assessment of Human Adipose Tissue Before and After Cryopreservation” to support a pending clinical study of our ATGRAFT™ products and services and the development of publications in support of our patented technologies.

Moreover, we believe that the combination of our validated cellular processing capabilities and patented products give us an economical platform to develop and produce cellular therapy applications for injection or intravenous therapy, topical applications, burn and wound healing, joint repair, disease treatments and Cosmeceuticals. The clinical methods and products we have developed are designed to permit a variety of treatments for any patient with their own genetically matched raw materials ATCELL™ and ATGRAFT™. Autologous cellular therapies have shown promising results for safety and efficacy in a variety of applications in published early stage clinical trial results and application studies.

Our Company has filed multiple patent applications for our products and methods to be used in the IRB studies, which include:

| ● | ACSelerate-SF™ (animal serum free) and ACSelerate-LS™ (low dose bovine serum) adipose stromal cell culture and differentiation medium in clinical and research grades; | |

| ● | The CELLECT® collection and tracking system for collecting tissue and cellular samples; | |

| ● | Adipose tissue, stromal vascular fraction (SVF) and adipose-derived mesenchymal cell processing, expansion and differentiation; | |

| ● | Storage preparation methods for adipose tissue, stromal vascular fraction (SVF) and adipose derived cellular samples; | |

| ● | Testing and quality management methods, systems, data collection and maintenance; | |

| ● | Cryoprotectant for the storage of adipose tissue samples; and | |

| ● | The ATGRAFT™ service for the collection, preparation, storage and retrieval of adipose tissue as biocompatible fillers for cosmetic and plastic surgery. |

Regulatory Information

The Company has spent years developing processing methodologies and the testing laboratory facilities which are designed to be in compliance with all current Good Manufacturing Practices (cGMP) and current Good Tissue Practices (cGTP) as defined by the United States Public Health Service Act (“PHS” or the “PHS Act”) and the Food and Drug Administration (FDA) regulations as they relate to the operation of a tissue processing and storage facility.

The Company’s Mount Laurel facility has been registered with the FDA (FEI 3008307548) as a processing and storage facility for Human Cells, Tissues and Cellular and Tissue Based Products (HCT/Ps) since 2010. In 2013, we further registered the facility with the State of New York (CP169TP136) and the State of California (CNC80948). These state registrations required the submission of our SOPs for review by the respective State Health Departments, and annual updates to maintain the registrations are required. In addition, we have discussed our operations with the State of New Jersey Health Department and Department of Environmental Protection (DEP) to ascertain any special regulations to which we may be subject. Based upon these discussions, and our use of a registered medical waste disposal company, we do not believe at this time we have any special registrations or regulations for compliance with the State of New Jersey. Our New Jersey Medical Waste Generator registration number is 036439.

| 10 |

The Company is also subject to complying with a significant body of FDA and PHS regulation; the regulations governing our business are mainly contained within 21 CFR 1271.10, 800, 600, 200, 210 and 211. The forgoing regulations govern all aspects of the Company’s SOPs, which we have reviewed with our FDA consultants.

Our SOPs are the key to properly operating a clinical tissue processing facility. To ensure delivery of the highest quality services, we have also designed them to provide a basis for accreditation by the American Association of Blood Banks (AABB), the American Association of Tissue Banks (AATB) and the Foundation for the Accreditation of Cellular Therapy (FACT-JACIE). We have consistently endeavored to ensure that our processes, methodologies and procedures are and remain among the highest standards in the global tissue collection, processing and storage market. To this end, we have equipped ourselves with state-of-the-art quality processing and testing equipment, which help to ensure that every sample that is collected and processed is sterile (free from bacterial contamination and adventitious agents), viable and capable of significant growth and expansion. While published studies generally report total viable cells, our assessment testing also reports each sample’s sterility and growth capabilities.

Quality Management

The Company’s quality management program ensures that during processing and testing of each adipose tissue or SVF sample, the appropriate quality management tests and processing methodologies are performed and the data is collected, recorded and reviewed by the laboratory management team.

Chain of Custody Control

Central to the individual sample testing is an unbroken chain of custody and tracking. Sample tracking begins with the creation of each collection box. All samples, processing, quality management, batch, and storage documents and records, are coded with a unique number. All records and testing samples are cross referenced and verified as required by the standard operating procedures.

Testing Design and Standard Operating Procedures

Testing methods are standardized and operate under a complete set of validated SOPs and Quality Management (QM) processes. All SOPs are designed to be in compliance with the US Food and Drug Administration’s cGMP/cGTP regulations and guidance for aseptic processing. Strict QM is enforced to avoid and/or record any process deviations.

Intellectual Property

From our very early stages, our strategy has been to invest in intellectual property protection. This strategy is intended to strengthen our Company’s foundation in any defensive or offensive legal challenge. In addition, we are developing our IP portfolio to ensure and enhance our business flexibility and allow us to gain favorable terms in potential future collaborative partnerships with third parties. Our intellectual property portfolio currently includes one issued U.S. patent (No. 7989205, Cell Culture Media Kits and Methods of Use); and five pending patent applications which are detailed in the following chart:

| PATENT TITLE | USE OF PATENT | APPLICATION # |

| A Business Method for “Collection, Cryogenic Storage and Distribution of a Biological Sample Material" | Company Core Tissue Collection Processing and Storage Methodology | (PCT/US2011/39260) filed June 6, 2011, and claiming a priority date of June 7, 2010 from provisional application 61/352,217 |

| Systems and Methods for “The Digestion of Adipose Tissue Samples Obtained From a Client for Cryopreservation" | Adipose Tissue Digestion Laboratory Processing Methods | U.S. Serial No. 13/646,647 filed October 5, 2012, and claiming a priority date of October 6, 2011 from provisional application 61/544,103 |

| Compositions and Methods for “Collecting, Washing, Cyroprocessing, Recovering and Return of Lipoaspirate to Physicians for Autologous Adipose Transfer Procedures” | Company Adipose Tissue Storage Platform for Cosmetic Procedures | PCT/US13/44621 Filed June 6, 2013 and claiming a priority date of June 7, 2012

|

| Stem Cell-Based Therapeutic Devices and Methods | Combining ADSCs with Biomaterials for healing and tissue growth | U. S. Serial No. 61/773,112 filed March 10, 2013 |

| Autologous Serum for Transport of Isolated Stromal Vascular Fraction or Adipose Derived Stem Cells | Utilization of Autologous Blood Components for the Transport of Adipose Derived Cells to a Patient | U.S. Serial No. 61/810,970 filed April 11, 2013 |

| 11 |

Trademarks

In addition to patents, the Company has registered or filed application for the following trademarks with the U.S. Patent and Trademark Office: American CryoStem®, CELLECT® and ATGRAFT™. We plan to file for registration additional trademarks for our current and future products, slogans and themes used in our branding and marketing initiatives, including, for example, ACSelerate-SFM™, ACSelerate- LSM™ and ATCELL™.

The Company has also secured a number of online domain names relevant to its business, including www.americancryostem.com and www.acslaboratories.com.

Market Size and Opportunities

By leveraging and capitalizing on our proprietary Adipose Tissue Processing Platform, our Company is working to address multiple high growth, multi-billion dollar market opportunities, including those prevailing within the Regenerative Medicine, Cosmeceuticals and Cell Culture Media and Medical Tourism markets.

Regenerative Medicine Market

According to a leading research firm focused on the biotechnology, healthcare and life sciences industries, TriMark Publications categorizes the Regenerative Medicine market into three main categories:

| ● | Tissue Engineering; | |

| ● | Biomaterials; and | |

| ● | Biomolecules (scaffolds, growth factors and stem cell therapy). |

TriMarkPublications.com cites in its “Regenerative Medicine Markets” report (March 2013) “…the Regenerative Medicine market continues to witness significant advances in clinical efficacy, regulatory approval and product commercialization of cell based therapies which will catapult to over $35 billion by 2019. Affirmative results produced from the application of adult stem cells have resulted in greater government and private sector investment in research and development of new cell therapies. Investment made into the regenerative medicine market include firms that harvest, process, purify, expand, cryopreserve, store or administer stem cells.”1

Medical Tourism

1 http://www.trimarkpublications.com/regenerative-medicine-markets/

| 12 |

KPMG International’s 2011 report on medical tourism credits the industry’s success to the ease of global transportation which is attracting an increasing number of people taking advantage of cost-effective, quality medical care at low cost destinations with world-class medical capabilities.

KPMG reported, “This increase in demand for global medical tourism has grown the industry at a rate of 20%-30% annually with a market size of $100 billion in 2012 up from $78.5 billion in 2010. Patients from developed countries are traveling abroad for medical care due to rising healthcare costs, demographic changes and delays in obtaining access to care at home. The rapidly aging population and a growing shortage of healthcare providers is creating a demand gap likely to widen with the baby boomer population coming to senior age. This need for healthcare will continue to grow and individuals will seek out novel opportunities obtain care further fueling the medical tourism industry.”2

Cell Culture Market

The Cell Culture market is $2.3 billion according to a report in Genetic Engineering & Biotechnology News (January 12, 2012 Vol. 32 No.2) “…and is expected to grow to $3.9 billion by 2015; this equates to 70% growth over a six-year period.”3 “This expected growth may be further enhanced by an expected shortage of bovine serum, a major component in research and the manufacture of certain cellular therapy products.” according to “Peak Serum: Implications of serum supply for cell therapy manufacturing,” a commentary by David A. Brindley published in RegenMed (2012, January 7(1), 7-13), which further states: “Without a sustainable supply or viable alternatives to these components, the commercial-scale production of cell therapies will be impossible, halting the momentum of the industry.”4

Cosmeceutical Market

Many industry experts agree that Cosmeceuticals have become the fastest growing segment of the Cosmetics and Personal Care industry. Cosmeceutical products have a big emphasis on scientifically advanced formulations and often contain active ingredients that can also be found in pharmaceutical products. This continued emergence of increasingly sophisticated active ingredients is said to be the main driving force behind the growth of this segment, which is rapidly evolving into a significant category of the personal care industry.

US retail sales of Cosmeceuticals in 2011 totaled $9.7 billion with ongoing annual sales gains expected to boost the market to $11.7 billion by 2016, according to a Packaged Facts report released in July 2012.

In a report titled Global Cosmeceuticals Market Outlook 2016, published February 2013, RNCOS reports that the worldwide market is estimated to be valued at $30.5 billion and is likely to grow at a consistent CAGR of 7.7% during the period 2012 through 2016.5

Marketing and Distribution

A key objective of our marketing strategy is to position American CryoStem in the market as the “Gold Standard” for adipose tissue processing, cellular processing and cell storage, cellular expansion, therapeutic applications, and, research and commercial uses of adipose tissue within the current regulatory framework. The combination of a traditional sales approach supported by continuous internal and external marketing programs will be closely coordinated with the expansion of our laboratory processing capabilities. Our initial marketing efforts are intended to disseminate current and future uses of adipose tissue and adult stem cells which support our business model, products and services. We intend to employ both print advertising and social media sales campaigns. In addition, we plan to utilize key leaders, and early adopters in the medical community as a marketing resource to enhance awareness of our proprietary, patented products and services and to increase the number of surgeons who join our network and collaborate with us.

2 http://www.kpmg.com/CH/en/Library/Articles-Publications/Documents/Sectors/pub-20120207-issues-monitor-healthcare-medical-tourism-en.pdf

3 http://www.genengnews.com/gen-articles/cell-culture-media-market-maturing/3981/

4 http://www.futuremedicine.com/doi/abs/10.2217/rme.11.112?journalCode=rme

5 http://www.researchandmarkets.com/research/mbmvbh/global

| 13 |

We have also initiated a direct marketing program focused on reaching plastic and cosmetic surgeons and have an initial group of providers that have begun to offer our services to their patients. This marketing initiative has been implemented using a traditional sales approach common to the pharmaceutical and biotechnology industries. This fundamental sales approach at the core of our marketing activities is being strategically and tactically expanded using a combination of in-house sales personnel and outside independent channels.

Our plan provides for a comprehensive integrated marketing approach using various traditional and new media, such as the Internet, social media/blogging, video, print, TV, radio and trade shows to reach targeted potential consumers and promote awareness of our Company and our branded products and services. The essence of this targeted strategy is to reach the end-users as quickly as possible and to accelerate the adoption curve of our products and services. We also plan to utilize outside marketing resources and trade groups to increase the number of surgeons willing to offer our products and services to their patients.

Development of Regional U.S. Markets

Physician Network

The Company continues to develop regional relationships to leverage its new products and services through existing cosmetic surgery and regenerative medicine practices. American CryoStem continues to develop and expand its network of physicians seeking to adopt its products and services initially focusing on surgeons performing liposuction, tissue transfer and regenerative procedures involving the use of adipose tissue. The Company intends to expand its efforts to medical professionals interested in Regenerative Medicine applications utilizing ADSCs and establish itself as a primary source of collection processing and preparation of cellular therapies as they are developed and approved for patient use by the FDA.

The Stern Center

During our first fiscal quarter ended December 31, 2012, we announced the initiation of adult stem cell and adipose tissue collection at the Stern Center for Aesthetic Surgery in Bellevue Washington. Dr. Frederick Stern, a member of the Company’s Scientific and Medical Advisory Board, founded the Stem Center in 1997. The Stern Center offers state-of-the-art laser and cosmetic surgical techniques to patients throughout the western U.S., and is one of the premier laser-assisted liposuction centers in the Pacific Northwest.

Dr. Park Avenue

In September 2013, we announced the opening of three new adipose tissue collection centers at Dr. Park Avenue’s New Jersey locations. Dr. Park Avenue is a leading provider of aesthetic and cosmetic services in the Tri-State area with locations in Brick Township, Franklin Lakes and Hoboken, New Jersey. Dr. Park Avenue’s newest center, located in Hoboken, held its grand opening in late September; in conjunction with the opening, Dr. Park Avenue formally introduced our ATGRAFT™ service for patients interested in fat grafting as an alternative to artificial fillers by using their own stored fat tissue to undergo transfer procedures to the face, hands, breast and buttocks.

Development of International Markets

International Licensing Program

Globally, many jurisdictions outside the US currently permit use of cellular therapies and regenerative medicine applications. The Company has received numerous inquiries concerning the sale or licensing of our products and services in foreign jurisdictions. The Company believes that the inquiries to date are a result of the global boom in Medical Tourism and the slow pace of approval of cellular therapies and regenerative medicine applications in the U.S. To address these inquiries and to expand the Company’s sales, marketing and branding opportunities the Company has designed and is offering an International Licensing Program.

| 14 |

The program is designed to permit the licensing of the company’s products and services to organizations that meet the Company’s financial and technical criteria. The licensing program allows for a variety of business relationship including franchising, partnering and joint venturing. Marketing efforts to date have been to clinics, physician and hospitals in foreign jurisdictions capable of rapidly building or committing the appropriate facilities and personnel to create the required laboratory facilities to operate the CELLECT®, ATGRAFT™ and ATCELL™ services in their local market. Strategically, the Company’s international licensees will maintain the branding of the Company’s services along the lines of the highly publicized “Intel Inside” branding program.

Qualified Licensees can quickly take advantage of the rapidly expanding opportunity to collect, process, store and culture individual stem cell samples for their clients with the comfort and confidence that they are providing services that have been developed to U.S. FDA Standards. Core to the relationship is the developed proprietary and patent pending processing and laboratory operational methodologies contained in our Standard Operating Procedures (SOPs), Training Programs, Continuous Quality Management (QM) and Product Testing Programs, and Laboratory Operation manuals.

The licensing program may be initiated through a letter of intent (LOI) agreement between the Company and the prospective licensee. This agreement is designed for due diligence and facility qualifications purposes. The Company may receive an initial fee under the agreement which is credited toward future royalty payments.

Our licensing program can be broken down into four operating levels, CELLECT®, ATGRAFT™, ATCELL™ and Contract Manufacturing:

| ● | Level One is the opportunity for a licensee or partner to secure a territory and implement the CELLECT® program for the collection, transportation, tracking and monitoring of tissue samples which are delivered to a laboratory for processing and storage until needed. A Level One licensee can quickly offer our branded services without, equipping and staffing their own local facility. Level One licensees are generally treatment facilities operated by physicians with limited laboratory facilities. |

| ● | Level Two is the opportunity for an existing laboratory facility to expand its services to include a CELLECT® and ATGRAFT™ services and to perform these services in a defined geographic location. A level two licensee must be capable of maintaining the services and provide local storage services in line with ACS requirements, guidelines and SOPs. |

| ● | Level Three is the opportunity for an existing stem cell laboratory with basic experience in the processing and storage of stem cells, umbilical cords or other tissues to quickly adopt complete turnkey adipose derived stem cell processing capabilities by incorporating the Company’s CELLECT®, ATGRAFT™ and ATCELL™ services and ACSelerate™ products. A Level Three licensee will also be able to participate in clinical application production and research in conjunction with the ACS Mount Laurel laboratory facility. |

| ● | Level Four is the opportunity for an existing hospital, biotechnology manufacturer, research university or large laboratory facility to implement all of the Company’s services in a defined geographic territory. A Level Four licensee may become a regional processing and manufacturing hub with the ability to manufacture and distribute the Company’s patented products, initiate and develop new treatments and applications and participate in local and global research and development of cellular therapies and regenerative medicine applications. |

Significant to our international development activities is our continuous reinforcement of American CryoStem’s branded services and patented products, services, technologies and SOPs as the highest quality core platform for standardized, repeatable and verifiable method to implement cellular therapies and regenerative medicine utilizing ADSCs.

BALS Institute

On April 23, 2013, we announced receipt of our first commercial international shipment of adipose tissue for processing and long term cryostorage. The master sample was shipped to the Company by BALS (Biomedical and Life Sciences) Institute (BALS), a Hong Kong-based regenerative medicine company and client of Personal Cell Sciences Corp. (PCS), the developer of U-Autologous skin care products and formulations. The product uses an individual’s own adult stem cells to create and supply that individual with his or her own personalized anti-aging skin care line.

| 15 |

As part of the contract manufacturing arrangement between American CryoStem and PCS, we are responsible for clinically testing, processing, culturing and storing samples shipped from PCS clients to create Autokine-CM, the key ingredient in the U-Autologous formulation. BALS Institute has teamed with PCS to ensure the people in Greater China gain access to safe, quality and effective life science technologies through partnerships with leading international corporations.

We have committed extensive resources to establishing and perfecting our international shipping methodologies and protocols, ensuring that our processes meet the highest possible standards of regulatory compliance for shipment of biologic materials. As a result, our FDA registered laboratory and cryostorage facilities in New Jersey are now able to send and receive viable tissue samples to and from clients globally.

Scientific and Medical Advisory Board

As part of our marketing campaign to reach and educate physicians, we are actively seeking to bring highly qualified peer leaders onto our Scientific and Medical Advisory Board to assist us in our industry speaking and education platform. This physician education platform is designed to focus on industry needs and demands as they relate to current and future treatments using our adipose tissue and adult stem cell technologies. Additionally certain members of our advisory board provide assistance and input to management on the oversight of our research relationships, laboratory development and quality management systems. To date, we have succeeded in winning the following members to our Scientific and Medical Advisory Board:

| ● | David K. Moscatello, Ph.D. − Chief Scientist | |

| Dr. Moscatello earned his Bachelor of Science degree in Microbiology from Pennsylvania State University in 1975, and a PhD in Biology with a focus on cancer cell biology from Purdue University in 1984. He has held teaching positions at Purdue University and Richard Stockton College of New Jersey. He returned to research as an NIH Post-Doctoral fellow at the Kimmel Cancer Institute at Thomas Jefferson University working in the laboratory of Dr. Albert Wong. In October 1999, Dr. Moscatello accepted a position at Coriell Institute to pursue his own research interests. He is a member of the American Association for the Advancement of Science, the American Association for Cancer Research and the American Society for Cell Biology. Dr. Moscatello’s primary research interests involve the isolation, culture and characterization of adult tissue-derived stem cells, i.e. stem and multi-potent progenitor cells other than embryonic stem cells. He has had articles published in a variety of media, including Nature, Journal of Biological Chemistry, International Journal of Cancer, British Journal of Cancer and Cancer Research. Dr. Moscatello advises American CryoStem regarding its laboratory operations and processing. |

| ● | Fredric A. Stern, MD, FACS | |

| Dr. Stern is the founder and Medical Director of the Stern Center for Aesthetic Surgery in Bellevue, Washington. Following his education at Columbia University Medical School, Dr. Stern earned his Board Certification in Ophthalmology at the University of Washington, and underwent extensive additional training in oculofacial plastic and laser surgery. In 1987, he joined Virginia Mason Medical Center in Seattle, serving as Director of the Oculoplastic Surgery Division for ten years. While at Virginia Mason, Dr. Stern performed an extensive number of cosmetic laser procedures. He is honored to have been chosen as one of a select group of instructors of the Botox Cosmetic® National Education Faculty, as well as the Radiesse™ Medical Education Faculty. Dr. Stern is also an instructor for the Sciton™ Laser. In 2011, he was voted the Best Plastic Surgeon in Western Washington by KING 5 (NBC affiliate) TV’s viewing audience. Dr. Stern is a Fellow of the American College of Surgeons, the American Academy of Facial Plastic and Reconstructive Surgeons, the American Academy of Cosmetic Surgery, and the American Society of Liposuction Surgery, as well as a member of the International Society of Hair Restoration Surgery. In addition, over the past several years, he has appeared on Northwest Afternoon, Evening Magazine, as well as KOMO, KIRO and Q13 news, discussing and demonstrating the latest techniques in facial and eyelid laser cosmetic surgery, Botox® and laser-assisted liposuction. He is also an accomplished winemaker & published novelist. Dr. Stern’s latest novel is a medical thriller titled, The Sigma Project. |

| ● | Richard Jacoby, MD – Laboratory Director | |

| Dr. Jacoby is a board certified dermatologist, pathologist and dermatopathologist. Dr. Jacoby’s extensive career includes a significant body of peer reviewed publications, numerous medical journal editorial positions and professional and academic lecture invitations. Dr. Jacoby is or has been a member of numerous professional and scientific societies including the American Academy of Dermatology, the American Medical Association and the International Society of Dermatopathology. In addition to his role with American CryoStem, he is also part of the academic faculty, specializing in Health Policy, at a major Philadelphia, Pa. university medical center. Dr. Jacoby received his BA in psychology from New York University and his MD from Jefferson Medical College of Thomas Jefferson University. He has practiced clinical dermatology and dermatopathology in academic, private and corporate settings. His past corporate positions include Chief Medical Officer of two pathology laboratory companies and Regional Managing Director of a publicly traded laboratory company. |

| 16 |

| ● | Mel Bircoll, MD | |

| Dr. Bircoll was the first plastic surgeon to perform liposuction in North America. He pioneered that operation and saw it from its early beginnings to become what is now the most frequently performed cosmetic procedure worldwide. Dr. Bircoll is also the originator of Fat Transfer (Autologous Fat Transplantation, AFT). His landmark presentation of Fat Transfer Using Liposuction Techniques (1984) established this procedure for breast augmentation, facial rejuvenation, hand rejuvenation and a host of reconstructive procedures. He is board certified by the American Board of Plastic Surgery and the American Board of Cosmetic Surgery. He is a member of the American Society of Plastic Surgery and the American Academy of Cosmetic Surgery. Dr. Bircoll is retired from 25 years of private practice in Beverly Hills, California. He is currently actively lecturing and teaching the techniques of Fat Transfer and Fat Storage for stem cell extraction, as well as cosmetic and reconstructive applications. Dr. Bircoll recently presented the latest application of his Fat Transfer/Storage/Serial Injection concepts for breast cancer prevention surgery. |

| ● | Burt D. Ensley, Ph.D. | |

| Dr. Ensley is the Chief Executive Officer and Chairman of Protein Genomics, Inc. He previously served as Chief Executive Officer of Phytotech, Inc. and President of NuCycle Therapy, Inc. prior to their sale. In addition, Dr. Ensley headed the Specialty Chemicals Group at Amgen, Inc. for nearly a decade. He holds a PhD in Microbiology from University of Georgia; is a Fellow of the American Academy of Microbiology; served on the BIO Directorate Board of the National Science Foundation; and is the Board Co-Chair of the University of Arizona’s BIO5 Institute. Dr. Ensley holds 19 issued U.S. patents. |

| ● | Dayong Gao, Ph.D. | |

| Dr. Gao is a world-renowned Professor of Mechanical Engineering and Biomedical Engineering at the University of Washington in Seattle. He has been actively engaged in cryopreservation research for more than 20 years, with specific emphasis on fundamental and applied cryobiology, which is the investigation of mechanisms in cryo-injury and cryo-protection with respect to living biological systems at low temperatures; with the development of optimal methods and technologies for the cryopreservation; and with the banking of living cells and tissues for biomedical applications. Dr. Gao has published 175 research papers in prestigious scientific/biomedical journals, with over 250 papers/abstracts in conference proceedings. He has obtained 16 patents, and authored two scientific books and numerous chapters in 17 scientific books. He currently serves on the Editorial Board, as Editor-in-Chief, of six scientific journals, and is the Editor of the Cryopreservation Engineering section of Biopreservation and Biobanking. His research in cryobiology and cryopreservation has been funded by the National Institutes of Health, the American Cancer Society, the Bill and Melinda Gates Foundation, the American Heart Association, the Whitaker Foundation, the Washington Research Foundation and the Kentucky Science Foundation, among others. Dr. Gao graduated with B.Sc. degree from the University of Science and Technology in China, and received a Ph.D. in Mechanical Engineering from Concordia University, Montreal, Canada. |

| ● | Richard Goldfarb, MD, FACS | |

| Dr. Goldfarb established the Center for SmartLipo with the vision of providing advanced treatments and techniques to help patients restore and maintain a more youthful appearance. He has formed a team of specialists, each with a unique strength in treating the various parts of the face and body. Included are Aesthetic Laser and Liposuction Specialists, Facial Plastic Surgeons, a Plastic and Reconstructive Surgeon and a Medical Weight Loss team. As a group, they are unequaled in their ability to provide comprehensive consultative and treatment options to achieve an individual’s aesthetic goals. Doctors visit the Center for SmartLipo from all over the world on a regular basis to learn state-of-the-art cosmetic treatments and techniques from Dr. Goldfarb and his team. In view of his unrivaled expertise and skills, Dr. Goldfarb is highly sought after to lecture and train physicians internationally on numerous cosmetic laser and surgery topics. He is board certified and a Fellow of the American College of Surgeons, in addition to the American Society of Laser Medicine and Surgery. Dr. Goldfarb graduated from the University of Health Sciences / Finch University, The Chicago Medical School with top honors in Surgery. He completed his surgical training at Northeastern Ohio College of Medicine. He completed additional training in Cosmetic Surgery at the University of Pennsylvania, Department of Plastic Surgery and Yale University. He has over 30 years of General and Vascular Surgery experience, and is a Cosmetic Surgery Specialist. |

| 17 |

| ● | Roy D. Mittman, MD, PA | |

| Dr. Mittman currently serves as a senior partner of Seaview Orthopaedic and Medical Associates (SOMA) located in Ocean, New Jersey. He has assembled a team of highly qualified board certified, fellowship trainedphysicians to practice at SOMA specializing in general orthopaedics, as well as surgery of the Spine, Hand/Wrist, Knee/Shoulder, Total Joints, Foot and Ankle, Sports Medicine, Pain Management and Osteoporosis. SOMA currently operates six locations committed to providing quality care in Monmouth and Ocean Counties. After earning a Bachelor of Arts degree at John Hopkins University, Dr. Mittman earned his Medical Degree at the Albert Einstein College of Medicine in New York and completed orthopaedic training in 1978 at Montefiore Hospital in New York. He is a member of the New Jersey Orthopaedic Society, Orthopaedic Surgeons of New Jersey, Monmouth County Medical Society and the American College of Sports Medicine. |

| ● | Peter Levitch, BA, MA | |

| Mr. Levitch is President of his own consulting firm, Peter Levitch and Associates, located in New Jersey. He provides clients guidance in the development of pharmaceuticals, medical devices, biologics and diagnostics. Mr. Levitch also possesses a background in the clinical evaluation and FDA regulatory approval phases of product development in the biotechnology industry. He has consulted for more than 200 pharmaceutical and biotechnology companies including Amgen, Inc.; Genentech, Inc.; DuPont; Monsanto Company; Johnson & Johnson Family of Companies, Beckman Coulter, Inc.; Chiron Corp.; Eastman Kodak Company and EMD Serono, Inc. He has authored several papers for publication and has lectured all over the country on various topics including Good Manufacturing Practices (GMP), the FDA approval process, and preparing INDs and NDAs. Peter has also served as an FDA liaison for FDA/company meetings. He is listed in Who’s Who in Finance and Industry, is the co-founder of the Regulatory Affairs Professional Society, and a member of the Drug Information Association and the New York Academy of Sciences. |

| ● | Alan H. Davis | |

| Mr. Davis is currently a partner in and the Chief Operating Officer of Novare, LLC. NovareBiologistics was created to meet the need of transporting and storing laboratory materials, including biological samples at required temperature anywhere within the U.S. Over the past 20 years, Mr. Davis has concentrated on business development and sales in biotechnology, manufacturing and software technology. Previously, he was primarily involved in retailing. |

Corporate Information

Our principal executive offices are located at 1 Meridian Road, Eatontown, New Jersey 07724 and our telephone number is (732) 747-1007. Our website is www.americancryostem.com. We also lease and operate a tissue processing laboratory in Mount Laurel, New Jersey at the Burlington County College Science Incubator located on the Burlington County College campus. Our laboratory website address is www.acslaboratories.com.

Employees

Currently, we have six employees and continue to use consultants on an as needed basis. As we grow, we will need to attract an unknown number of additional qualified employees, however we could be unsuccessful in attracting and retaining the persons needed.

Available information

We file electronically with the U.S. Securities and Exchange Commission (SEC) our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934. The public can obtain materials that we file with the SEC through the SEC’s website at http://www.sec.gov or at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information on the operation of the Public Reference Room is available by calling the SEC at 800-SEC-0330.

| 18 |

| Item 1A. | Risk Factors |

You should carefully consider the risks described below, together with all of the other information included in this report, in considering our business and prospects. The risks and uncertainties described below are not the only ones facing the Company. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. The occurrence of any of the following risks could harm our business, financial condition or results of operations.

Recurring losses and negative cash flows from operations raise substantial doubt about our ability to continue as a going concern and we may not be able to continue as a going concern.

Our recurring losses from operations and negative cash flows from operations raise substantial doubt about our ability to continue as a going concern and as a result, our independent registered public accounting firm included an explanatory paragraph in its report on our financial statements for the fiscal year ended September 30, 2013 with respect to this uncertainty. Substantial doubt about our ability to continue as a going concern may create negative reactions to the price of our Common Stock and we may have a more difficult time obtaining financing.

We expect to incur increased operating expenses for the foreseeable future. The amount of net losses and the time required for us to reach and sustain profitability are uncertain. The likelihood of our success must be considered in light of the problems, expenses, difficulties, and delays frequently encountered in connection with a development stage business, including, but not limited to, uncertainty as to development and the time required for our planned services to become available in the marketplace. There can be no assurance that we will ever generate revenues or achieve profitability at all or on any substantial basis. These matters raise substantial doubt about our ability to continue as a going concern. If we cease or curtail our development activities, it is highly likely that you would lose your entire investment in our Company.

We will require substantial additional capital to pursue our business plan.

We have incurred negative cash flows since inception from our developmental activities, and at this time as well as for the foreseeable future will finance (until we can generate sufficient revenues, if ever, to cover expenses) our activities and overhead expenses through the issue and sale of debt or equity securities. The recoverability of the costs incurred by us to date is highly uncertain and is dependent upon achieving commercial production and sales of our services, of which no assurances can be given. Our prospects must be considered in light of the risks, expenses and difficulties which are frequently encountered by companies in the development stage in the emerging industry that we hope to commence operations in.

We have financed our development activities since inception through the sale of securities. Our capital requirements will depend on many factors, including, among other things, the cost of developing our business and marketing activities, the efficacy and effectiveness of our proposed services, costs (whether or not foreseen), the length of time required to collect accounts receivable we may in the future generate, competing technological and market developments and acceptance. Changes in our proposed business or business plan could materially increase our capital requirements. We cannot assure you that our proposed plans will not change or that changed circumstances will not result in the depletion of our capital resources more rapidly than currently anticipated.

We will need to obtain substantial additional financing to, among other things, fund the future development of any services we attempt to undertake and for general working capital purposes. Any additional equity financing, if available, may be dilutive to stockholders and any such additional equity securities may have rights, preferences or privileges that are senior to those of the holders of shares of our Common Stock. Debt financing, if available, will require payment of interest and may involve our granting security interests on our assets and restrictive covenants that could impose limitations on our operating flexibility.

Our ability to obtain needed financing may be impaired by such factors as the capital markets, our capital structure, our development stage, the lack of an active market for shares of our Common Stock, and our lack of profitability, all of which would impact the availability or cost of future financings. We cannot assure prospective investors that we will be able to obtain requisite financing in a timely fashion or at all and, if obtained, on acceptable terms. Our inability to obtain needed financing on acceptable terms would have a material adverse effect on the implementation of our proposed business plan.

| 19 |

Our future plans and operations are dependent on our ability to secure adequate funding and the absence of unexpected delays or adverse developments. We may not be able to secure required funding.