Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT OF MATERIAL EVENTS OR CORPORATE CHANGES - Fossil Group, Inc. | a14-3341_18k.htm |

| EX-99.1 - EX-99.1 - Fossil Group, Inc. | a14-3341_1ex99d1.htm |

Exhibit 99.2

|

|

ICR XCHANGE – JANUARY 13, 2014 |

|

|

Certain statements contained herein that are not historical facts constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and involve a number of risks and uncertainties. The actual results of the future events described in such forward-looking statements could differ materially from those stated in such forward-looking statements. Among the factors that could cause actual results to differ materially are: changes in economic trends and financial performance, changes in consumer demands, tastes and fashion trends, lower levels of consumer spending resulting from a general economic downturn, shifts in market demand resulting in inventory risks, changes in foreign currency exchange rates, and the outcome of current and possible future litigation, as well as the risks and uncertainties set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended December 29, 2012 and its Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission (the “SEC”). SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 |

|

|

1. GLOBAL GROWTH COMPANY 2. DIVERSIFIED BUSINESS MODEL 3. OPPORTUNITIES FOR LEVERAGE COMPELLING INVESTMENT OPPORTUNITY |

|

|

[LOGO] |

|

|

[LOGO] |

|

|

[LOGO] |

|

|

[LOGO] |

|

|

STRATEGIC GROWTH DRIVERS LARGE GROWING CATEGORY COMPETITIVE ADVANTAGES RISE OF LIFESTYLE BRANDS |

|

|

GLOBAL WATCH INDUSTRY GROWTH Watch market continues to outpace GDP growth Fossil Group consolidated growth 2008-2013: 15.7% CAGR Source: Euromonitor International 2013 (watch market values reflect year-over-year exchange rates and current prices) Global watch market represented at retail in billions. |

|

|

COMPETITIVE ADVANTAGES MANUFACTURING AND SOURCING DESIGN AND CREATIVITY GLOBAL SUPPORT STRUCTURE GLOBAL MANAGEMENT GLOBAL DISTRIBUTION |

|

|

RISE OF LIFESTYLE BRANDS Global Watch Market Share Gainers & Losers (Share Gain/Loss 2008 - 2012 for watches < $1,000) Source: Euromonitor International 2013 Traditional Watch Companies +1.5% +3.0% +2.0% 0 +0.5% -1.0% +1.0% -0.5% -1.5% +2.5% +3.5% |

|

|

MANAGEMENT TEAM REDEFINED REGIONAL STRUCTURE INVESTMENTS TO DRIVE EFFICIENCIES CREATING SHAREHOLDER VALUE |

|

|

1. GLOBAL GROWTH COMPANY COMPELLING INVESTMENT OPPORTUNITY |

|

|

FOSSIL GROUP SALES GROWTH * Trailing Twelve Months ended Q3 2013. Dollars in billions. |

|

|

1. GLOBAL GROWTH COMPANY COMPELLING INVESTMENT OPPORTUNITY |

|

|

COMPELLING INVESTMENT OPPORTUNITY |

|

|

BRANDS PRICE POINTS CATEGORIES REGIONS DIVERSIFIED BUSINESS MODEL |

|

|

OPPORTUNITIES RETAIL PRODUCTIVITY OUTLET EXPANSION SHOP IN SHOPS BRAND LEVERAGE AMERICA DISTRIBUTION 273 RETAIL STORES DEPARTMENT STORES SPECIALTY CHAINS INDEPENDENT RETAILERS LICENSED BOUTIQUES ECOMMERCE * Trailing Twelve Months ended Q3 2013. MAJOR MARKETS UNITED STATES CANADA MEXICO SALES: $1.7B* |

|

|

OPPORTUNITIES RETAIL PRODUCTIVITY NEWER MARKETS BRAND LEVERAGE OUTLET EXPANSION EUROPE DISTRIBUTION 167 RETAIL STORES INDEPENDENT WATCH DEALERS DEPARTMENT STORES SHOP IN SHOPS CONCESSIONS ECOMMERCE * Trailing Twelve Months ended Q3 2013. MAJOR MARKETS GERMANY UK FRANCE DISTRIBUTOR MARKETS SALES: $1.0B* |

|

|

OPPORTUNITIES CHINA DISTRIBUTION BRAND LEVERAGE SWISS ASIA DISTRIBUTION 103 RETAIL STORES CONCESSIONS SPECIALTY RETAILERS DEPARTMENT STORES BOUTIQUES * Trailing Twelve Months ended Q3 2013. MAJOR MARKETS JAPAN SOUTH KOREA AUSTRALIA CHINA SALES: $0.5B* |

|

|

MARKET SHARE OPPORTUNITY Source: Euromonitor International 2013 2013 Market Size & Growth for Watches < $1,000 Forecasted 2013 – 2018 CAGR Market Share |

|

|

1. GLOBAL GROWTH COMPANY 2. DIVERSIFIED BUSINESS MODEL COMPELLING INVESTMENT OPPORTUNITY |

|

|

COMPELLING INVESTMENT OPPORTUNITY |

|

|

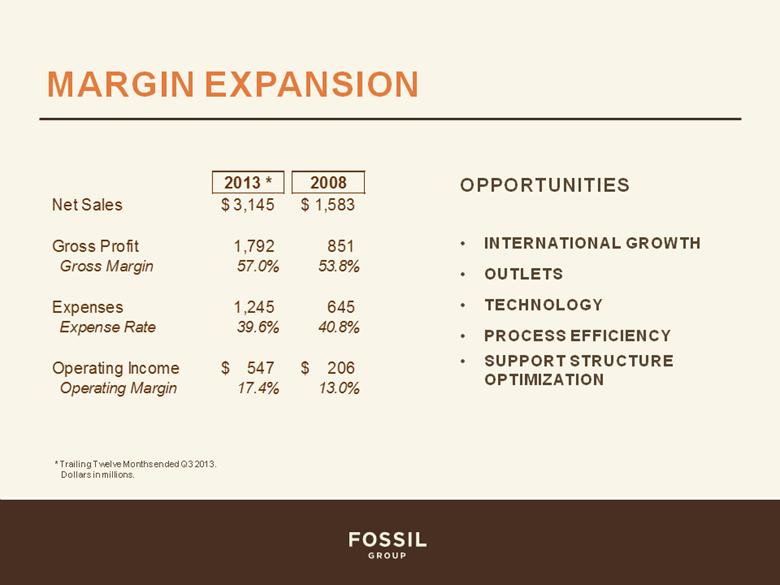

MARGIN EXPANSION OPPORTUNITIES INTERNATIONAL GROWTH OUTLETS TECHNOLOGY PROCESS EFFICIENCY SUPPORT STRUCTURE OPTIMIZATION * Trailing Twelve Months ended Q3 2013. Dollars in millions. 2013 * 2008 Net Sales 3,145 $ 1,583 $ Gross Profit 1,792 851 Gross Margin 57.0% 53.8% Expenses 1,245 645 Expense Rate 39.6% 40.8% Operating Income 547 $ 206 $ Operating Margin 17.4% 13.0% |

|

|

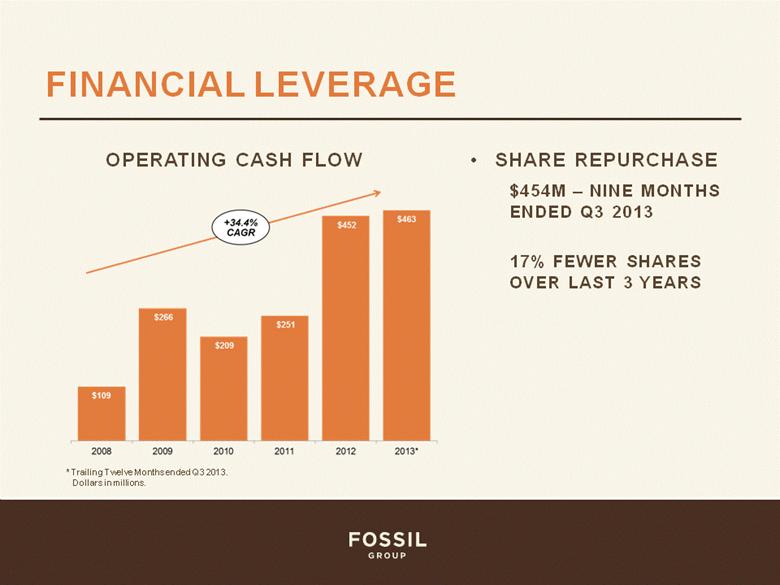

FINANCIAL LEVERAGE SHARE REPURCHASE $454M – NINE MONTHS ENDED Q3 2013 17% FEWER SHARES OVER LAST 3 YEARS OPERATING CASH FLOW * Trailing Twelve Months ended Q3 2013. Dollars in millions. |

|

|

1. GLOBAL GROWTH COMPANY 2. DIVERSIFIED BUSINESS MODEL 3. OPPORTUNITIES FOR LEVERAGE COMPELLING INVESTMENT OPPORTUNITY |

|

|

THANKS FOR STOPPING BY! |