Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PARETEUM Corp | v365198_8k.htm |

Exhibit 99.1

January 2014 NYSE MKT: ETAK

This presentation may contain forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 , about Elephant Talk . Forward - looking statements are based largely on expectations and projections about events and future trends and are subject to numerous assumptions, risks and uncertainties, which change over time . Forward - looking statements can be identified by terminology such as “anticipate,” “believe,” “could,” “could increase the likelihood,” “estimate,” “expect, “intend,” “is planned,” “may,” “should,” “will,” “will enable,” “would be expected,” “look forward," “may provide,” “would” or similar terms, variations of such terms or the negative of those terms . Elephant Talk’s actual results could differ materially from those anticipated in forward - looking statements and you should not place any undue reliance on such forward - looking statements . This presentation includes annualized revenue models and proforma financial information that is based upon assumptions and estimates that management believes are reasonable based on currently available information ; however, management's assumptions and the Company’s future performance are subject to a wide range of business risks and uncertainties, and there is no assurance that these goals and projections can or will be met . Any number of factors could cause actual results to differ materially from expectations . Factors that could cause actual performance to differ from these forward - looking statements include the risks and uncertainties disclosed in Elephant Talk’s filings with the SEC . Elephant Talk’s filings with the SEC are accessible on the SEC’s website at (http : ///www . sec . gov) . Forward looking statements speak only as of the date they are made, and Elephant Talk assures no obligation to update, amend or clarify any forward - looking statements . Safe Harbor Statement 1

Elephant Talk : L eading vendor /provider of M obile Software DNA™ Platform and Services 2 Mission : » To provide an end - to - end service portfolio enabling and securing Big Data in the mobile cloud Vision: » We empower Mobile Network Operators (MNOs) and Mobile Virtual Network Operators (MVNOs) in providing: o Tier One, innovative , on premise or cloud based, outsourced mobile communications infrastructure o Full suite of off - the - shelf Services & Features o Full range of MNO & MVNO support services o All required third p arty interfaces » Cyber Security Technology - We enable organizations to secure all cloud and electronic based customer financial transaction channels within a single platform

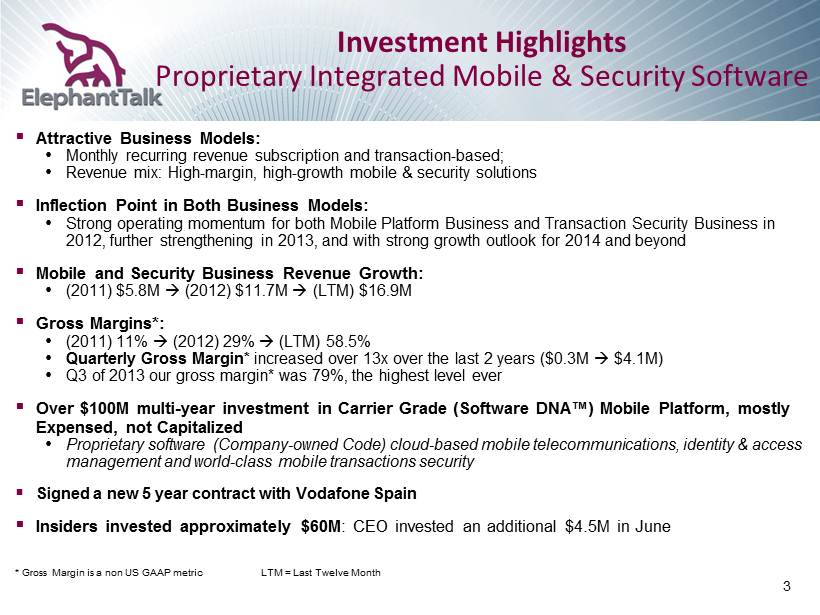

Investment Highlights Proprietary Integrated M obile & Security Software ▪ Attractive Business M odels: • Monthly recurring revenue subscription and transaction - based; • Revenue mix: High - margin , high - growth mobile & security solutions ▪ Inflection Point in Both Business Models: • Strong operating momentum for both Mobile P latform B usiness and T ransaction S ecurity B usiness in 2012, further strengthening in 2013, and with strong growth outlook for 2014 and beyond ▪ Mobile and Security Business Revenue Growth: • (2011) $5.8M (2012) $11.7M (LTM) $16.9M ▪ Gross Margins*: • (2011) 11 % (2012) 29 % (LTM) 58.5% • Quarterly Gross Margin* increased over 13x over the last 2 years ($0.3M $4.1M) • Q3 of 2013 our gross margin* was 79%, the highest level ever ▪ Over $100M multi - year investment in Carrier Grade (Software DNA™ ) Mobile Platform, mostly E xpensed, not Capitalized • P roprietary software (Company - owned Code) cloud - based mobile telecommunications, identity & access management and world - class mobile transactions security ▪ Signed a new 5 year contract with Vodafone Spain ▪ Insiders invested approximately $60M : CEO invested an additional $4.5M in June * Gross Margin is a non US GAAP metric LTM = Last Twelve Month 3

Revenue Development 96% of Revenue is High Margin Mobile & Security Solution after Transition from Low Margin Landline Business 4 Quarterly Mobile & Security Revenue Mix (% of Total Revenue) Mobile & Security Revenue Contribution Material improvement over last several quarters LTM = Last Twelve Month 28% 39% 44% 52% 59% 89% 96% 1Q-2012 2Q-2012 3Q-2012 4Q-2012 1Q-2013 2Q-2013 3Q-2013 $2.8 $5.8 $11.7 $13.1 $14.8 $16.9 2010 2011 2012 LTM-Q113 LTM-Q213 LTM-Q313

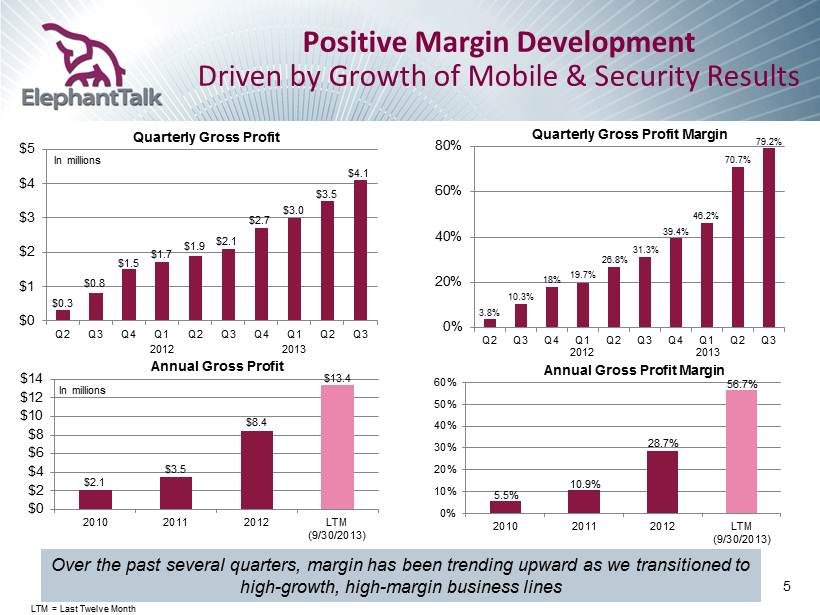

Positive Margin Development Driven by Growth of Mobile & Security Results 5 LTM = Last Twelve Month Over the past several quarters, margin has been trending upward as we transitioned to high - growth, high - margin business lines $0 $2 $4 $6 $8 $10 $12 $14 2010 2011 2012 LTM (9/30/2013) Annual Gross Profit 0% 10% 20% 30% 40% 50% 60% 2010 2011 2012 LTM (9/30/2013) Annual Gross Profit Margin $0 $1 $2 $3 $4 $5 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Quarterly Gross Profit 0% 20% 40% 60% 80% Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Quarterly Gross Profit Margin In millions 2012 2013 In millions 2012 2013 $1.9 $2.1 $2.7 $3.0 $3.5 $4.1 $2.1 $3.5 $8.4 26.8% 31.3% 39.4% 46.2% 70.7% 79.2% 5.5% 10.9% 28.7% $13.4 56.7% $0.3 $0.8 $1.7 $1.5 19.7% 18% 10.3% 3.8%

Elephant Talk Communications Fiscal Year End: December 31 st NYSE MKT: ETAK Stock Price (1/6/14): $1.54 52 Week Trading Range: $0.55 - $1.84 Shares Outstanding: (9/30/13) 140 million Market Cap: $215 million Average Daily Volume (1 Month): 906,000 Revenue (TTM): $23.6 million Gross Profit (TTM): $13.4 million Recent Events* 12/13/2013 – New 5 Year Contract with Existing MNO Client in Europe 12/3/2013 – ValidSoft Joins FIDO Alliance to Support the Creation and Adoption of Simpler, Stronger Authentication Methodologies 11/14/2013 – ValidSoft Secures UK Patent for Dual - Wireless Network Authentication System 11/12/13 – High - Margin Mobile and Security Business Comprises 96% of Total Revenue Achieving Total Company Margin of 79 % 11/ 7 / 13 - ValidSoft Announces Appointment of Paul Burmester as Chief Executive Officer, Pat Carroll to assume role of Executive Chairman 11/6/13 – FICO adoption of ValidSoft Technology brings Safety of Payment Card Transactions to UK Banks 11/ 4 / 13 - Elephant Talk Announces Preliminary Third Quarter Revenue of $5.2 Million as Company Margins Increased to 79 % 6 LTM = Last Twelve Month * Dates denote press release dates. Please refer to SEC filings for specific contract/agreement dates.

7 Elephant Talk Philosophy: A Network without Borders & Limitations ▪ IT as enabling factor , minimizing users complexity and maximizing controllability, customized and flexible, combined with cutting edge security ▪ Deep understanding of the mobile eco system ▪ Ownership of critical components and modules for fine tuned interfaces: each module for highest efficiency cooperation ▪ In control, not relying on external vendors: ability to really offer end - to - end responsibility ▪ Creation of virtualized processing environments that can run modules parallel in real time instead of in sequence ▪ Development of (geo)redundant processing platforms with huge processing and storage power ▪ Mobile Software DNA™ architecture: steering through a single interface for multiple modules/sites/countries. Key clients include Vodafone in Spain, Zain in Saudi Arabia, lusacell in Mexico

Elephant Talk Platform Components Verticals seamlessly combine any module they need MVNO Radio Network GSM Radio Network GPRS Radio Network UMTS Radio Network HSDPA SIM Logistics Multi - IMSI 4G (LTE - DECT - .Wi - Max - IMS) Number Porting Lawful Intercept OTA SIM & Handset Roaming (CAP - Callback) Deep Packet Inspection Video - Call Premium Messaging MNO Elephant Talk Intelligent Mobile Service Platform Online Rating & Charging Prepaid Postpaid Billing Invoicing Fraud management Reporting Self - Service UI/API CRM Provisioning Credit Check Multi - Channel Top - Up 1 - to - 1 Communication Voice Mail Promotions Package Parents Control m - Banking Contactless mPayment Distribution HLR GGSN IN WAP SMS MMS IVR Multi - MSISDN USSD Radio Network WIMAX Radio Network WIFI Other Networks Marketing Sales Customer Care Healthcare mCommerce / Loyalty STP Roadmap M2M Radio Network LTE 8

ValidSoft Authentication & Authorization Solutions: Key Factor for Cyber Security & Cloud Security 9 ▪ With the move from 2G/3G/traditional GSM & CDMA systems towards 4G/ LTE, most traditional telecom equipment will be decommissioned. ▪ MNOs are not able to rely anymore on existing traditional security layers. They have the same challenges as anyone offering services in the cloud. ▪ Authentication and Authorization will be key elements in securing networks. ▪ Cyber Security leader - built up an expanding patent portfolio of ring - fenced technologies. ▪ Turning raw network data , in real time into contextual decision info to support mission critical applications through the cloud , like financial services, medical records, government benefits, digital rights management, confidential info. ▪ Data protection + privacy compliant: ValidSoft positions us to be the only cloud security offering with 3 privacy seals for all financial applications. ▪ Several UK banks are now developing deployment plans for a new FICO service, which has been developed in partnership with ValidSoft . • FICO proximity matching trials show up to 70% reduction of “false positives” on international financial transactions. ▪ Voice Biometrics plays a key part in this new security architecture. ValidSoft has the leading custom designed commercial Voice Biometrics for the mobile world. Key clients, such as, FICO/ Adeptra , Banco Santander along with financial institutions in the USA, UK, Australia and governmental agencies in Europe

VALid® – Indigenous 5 - Factor Solution Redefining Fraud Prevention 10

ValidSoft Partner Access to Large Addressable Markets 11 1BN+ transactions 5BN+ transactions 10BN + transactions Increased Volume Incremental Transaction Risk Top Banks Merchant Acquirers / Payment Processors / Schemes Mobile Payments (Mobile banking, Mobile Commerce, P2P) Machine - to - Machine • Customers • Transaction Volume • Partnership Relevance (target) Spindle

Elephant Talk Communications Corp. Financial and Business Model Discussion 12

Business Summary Growing Fast, Strong Pipeline, World Class Platform Elephant Talk Overview ▪ Recent contract wins in telecom and transactional security – positioned well for recurring revenue growth • Signed new 5 year contract with Vodafone Spain ▪ Strategic geographical focus: Americas, EMEA, Europe ▪ Strong pipeline of mobile telecoms and cloud security transactions ▪ World Class Mobile Cloud Management & Security Delivery Platform - unique product positioning ▪ Strong client base for outsourcing services, including mobile leaders as : • Vodafone • Zain • Iusacell 13

Business Summary Growing Fast, Strong Pipeline, World Class Platform ValidSoft Overview ▪ World Class multi - layer, multi - factor authentication and transaction verification platform, custom - designed for the mobile world ▪ Only indigenous 5 Factor authentication solution in the world ▪ World Class Voice Biometrics capability (NIST tested), a key element assuring Cyber Security, custom - designed for the mobile world ▪ Only security software company accredited with 3 European Privacy Seals ▪ Security transaction contracts awarded: • Several UK banks are now developing deployment plans for the new FICO service powered by ValidSoft • Banco Santander • Newcastle Permanent Building Society • US Financial Institution • Leading UK Bank • Leading UK Building Society 14

Monthly Recurring Revenue Business Model Key factor in building up growing Revenue B ase ▪ Elephant Talk and ValidSoft are focused on recurring revenue models, following a trend among customers: • From Capex to Opex , freeing up resources • From Fixed to Variable Cost ; “pay as you go” model • From Complicated, Point Solutions to One - Stop Shop Solutions 15 Solution Segment Revenue Model Average Pricing Gross Margin Managed Services • Subscription - based • $1.00 / month / subscriber 90+% Managed Services + Airtime (Bundled Offering) • Subscription - based • $10.00 - $20.00 / month / subscriber 20+% Transaction Verification • Transaction - based • Subscription - based • $0.20 - 0.01 / verification • $0.30 - $0.50 / month / subscriber 60+%

Reducing Cash Burn Rate Major Focus for the Company 16 *) Adjusted EBITDA is a non - GAAP measure ($3.560) ($2.878) ($2.665) ($2.126) ($1.832) ($1.449) ($0.949) ($0.085) ($4.0) ($3.5) ($3.0) ($2.5) ($2.0) ($1.5) ($1.0) ($0.5) $0.0 Q4-'11 Q1-'12 Q2-'12 Q3-'12 Q4-'12 Q1-'13 Q2-'13 Q3-'13 Millions EBITDA Adjusted *)

17 Elephant Talk ValidSoft ▪ S igned Software DNA™ contract with lusacell in Mexican market • Outsourcing Platform will have initial capacity for 10m SIMs; over time to be expanded to at least 20m SIMs • Initial Migration of 1.5m • E ntered US Telco market – Acquired 100% of assets of Telnicity April 1, 2013 ▪ Vodafone Enabler Spain Platform • Managing over 1.3 million SIMs • Positioned to double SIMs over the next 2 years • Signed new 5 year contract ▪ Saudi Arabia: Axiom won 1 of the 3 MVNO licenses, using the network of Zain, another key ETAK managed services client ▪ Several UK banks are now developing deployment plans for the new FICO service, which has been developed in partnership with ValidSoft ▪ SIM Swap live with a leading global financial institution (10M+ transactions) ▪ Awarded contract with le ading US financial institution for VALid and Voice Biometrics ▪ Awarded contract with le ading UK financial institution for SIM and POS ▪ Signed $1m+ contract with leading Building Society for our patented Authentication & Transaction Integrity solution: VALid® ▪ Release of Zero Latency Correlation™ ▪ Partner with VEN to Bring Advanced Cyber Security and Identity Theft Protection Solutions to Virtual Currencies Recent Milestones Getting to Operational Cash Flow Positive

Investment Highlights Proprietary Integrated M obile & Security Software ▪ Attractive Business M odels: • Monthly recurring revenue subscription and transaction - based; • Revenue mix: High - margin , high - growth mobile & security solutions ▪ Inflection Point in Both Business Models: • Strong operating momentum for both Mobile P latform B usiness and T ransaction S ecurity B usiness in 2012, further strengthening in 2013, and with strong growth outlook for 2014 and beyond ▪ Mobile and Security Business Revenue Growth: • (2011) $5.8M (2012) $11.7M (LTM) $16.9M ▪ Gross Margins*: • (2011) 11 % (2012) 29 % (LTM) 58.5% • Quarterly Gross Margin* increased over 13x over the last 2 years ($0.3M $4.1M) • Q3 of 2013 our gross margin* was 79%, the highest level ever ▪ Over $100M multi - year investment in Carrier Grade (Software DNA™ ) Mobile Platform, mostly E xpensed, not Capitalized • P roprietary software (Company - owned Code) cloud - based mobile telecommunications, identity & access management and world - class mobile transactions security ▪ Signed new 5 year contract with Vodafone Spain ▪ Insiders invested approximately $60M : CEO invested an additional $4.5M in June * Gross Margin is a non US GAAP metric LTM = Last Twelve Month 18

19 Contact Us Corporate Headquarters: Elephant Talk Communications Corp. Cross Rock Place Executive Suites No. 102 3600 NW 138 th , Oklahoma City, OK , USA (813) 926 8920 www.elephanttalk.com Investor Relations: ▪ Steve Gersten steve.gersten@elephanttalk.com Phone: (813) 926 - 8920 ▪ Alan Sheinwald asheinwald@allianceadvisors.net Phone : (212)398 - 3486