Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ELAH Holdings, Inc. | d657132d8k.htm |

Exhibit 99.1

POWERPOINT PRESENTATION, DATED JANUARY 2014

Signature

Group Holdings Inc.

January 10, 2014

Signature

Group Holdings Inc.

Cautionary Statement Regarding Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding the future performance of Signature Group Holdings, Inc. and its subsidiaries (collectively, “Signature,” the “Company,” “we” or “us”). These forward-looking statements are based on current expectations, estimates, and projections about our business and prospects, as well as management’s beliefs and assumptions. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “may,” “should,” “will” or similar words are intended to identify forward-looking statements. These statements include, but are not limited to, statements about the Company’s expansion and business strategies and anticipated growth opportunities and the amount of fundraising necessary to achieve these.

Such statements are not guarantees of future performance and are subject to certain risks, uncertainties, and assumptions that are difficult to predict. Our actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors, including, but not limited to, our ability to successfully identify, consummate and integrate the acquisitions of other businesses; changes in our business or other market conditions; the difficulty of keeping expense growth at modest levels while increasing revenues; our ability to successfully defend against current and new litigation matters as well as demands by investment banks for defense, indemnity, and contribution; obtaining the expected benefits of the reincorporation; and other risks detailed from time to time in our Securities and Exchange Commission filings, including, but not limited to, the most recently filed Annual Report on Form 10-K, subsequent reports on Forms 10-Q and 8-K, and the Definitive Proxy Statement for our December 30, 2013 Special Meeting.

These forward-looking statements speak only as of the date hereof and are subject to change. The Company undertakes no obligation to publicly revise or update any forward-looking statements for any reason.

2

Signature

Group Holdings Inc.

OVERVIEW

Introduction

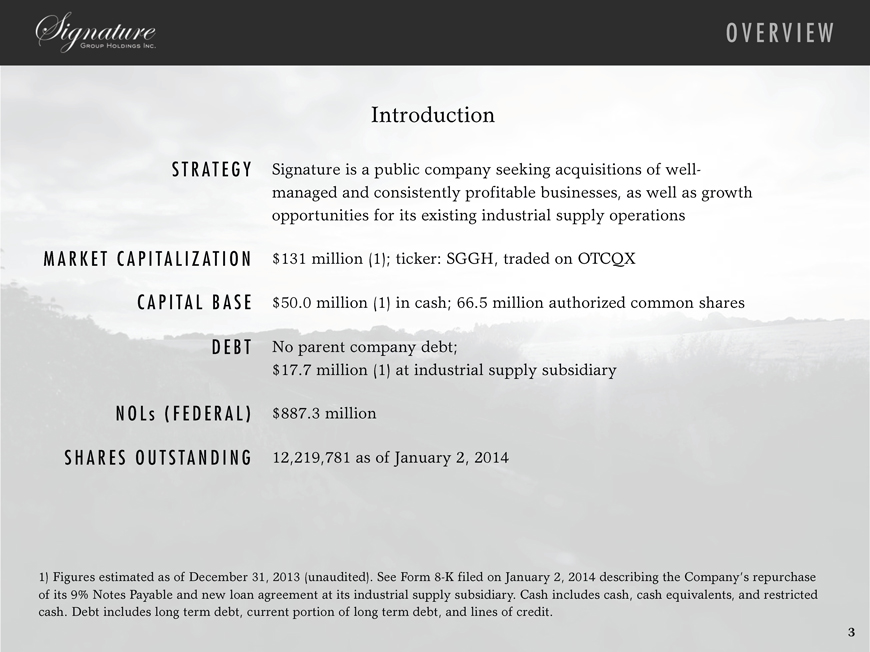

STRATEGY Signature is a public company seeking acquisitions of well-managed and consistently profitable businesses, as well as growth opportunities for its existing industrial supply operations

MARKET CAPITALIZATION $131 million (1); ticker: SGGH, traded on OTCQX

CAPITAL BASE $50.0 million (1) in cash; 66.5 million authorized common shares

DEBT No parent company debt; $17.7 million (1) at industrial supply subsidiary

NOLs (FEDERAL) $887.3 million

SHARES OUTSTANDING 12,219,781 as of January 2, 2014

1) Figures estimated as of December 31, 2013 (unaudited). See Form 8-K filed on January 2, 2014 describing the Company’s repurchase of its 9% Notes Payable and new loan agreement at its industrial supply subsidiary. Cash includes cash, cash equivalents, and restricted cash. Debt includes long term debt, current portion of long term debt, and lines of credit.

3

Signature

Group Holdings Inc.

MILESTONES

Noteworthy management achievements and corporate events in the second half of 2013 included:

Increase in authorized common share count to 66.5 million (split adjusted)

Effective universal shelf registration statement on Form S-3 to raise up to $300 million in equity and/or debt capital

Completed a one-for-ten reverse stock split of our common stock, resulting in a security which Signature believes is more attractive to institutional stockholders and potential acquisition targets

Stockholder approval to reincorporate into a Delaware holding company

Redeemed publicly traded bonds, which is projected to reduce interest expense by $3.4 million per year

Eliminated most of the annualized $6 million cash from operations burn which existed in the first half of 2013 by reducing headcount, SG&A and interest. This trend continues into 2014 as we move out of the existing headquarters building in Sherman Oaks

continued, next slide…

4

Signature

Group Holdings Inc.

MILESTONES

continued

continued… Noteworthy management achievements and corporate objectives in the second half of 2013 included:

Completed the sale of the remaining residential mortgage loans; more than $27 million in cash generated from the 2013 sales

Largely exited special situations investments in order to fully focus on an acquisition strategy

Opened four new locations for our Industrial Supply subsidiary, including its first international location

Refinanced the intercompany debt of the Industrial Supply subsidiary generating approximately $11 million in cash on hand

5

Completion of these milestones has positioned Signature for acquisition-driven growth in 2014 and beyond

6

Signature

Group Holdings Inc.

ACQUISITION STRATEGY

Signature is actively seeking acquisitions of large, well-managed and consistently profitable businesses.

GENERAL INVESTMENT CRITERIA

Business consistently producing pre-tax income of $25–75 million

Sustainable competitive advantage that can be maintained long-term

Proven management teams with the ability to operate with relative autonomy

Industry agnostic

STRUCTURE

Signature must own 80.1% or more of a business

Flexible approach with sellers on deal consideration, including potentially using Signature common stock

continued, next slide…

7

Signature

Group Holdings Inc.

ACQUISITION STRATEGY

continued

continued… Signature is actively seeking acquisitions of large, well-managed and consistently profitable businesses.

TARGET SITUATIONS

High-margin businesses with low ongoing capital expenditure needs

Businesses with modest to low growth; consistency is more important

Industries or sectors where Signature can serve as a platform for growth via additional acquisitions/consolidation

Legacy private equity or hedge fund holdings seeking an exit

Family businesses

Companies with limited or declining tax deductions

Carve-outs of non-core divisions of larger enterprises

8

Signature

Group Holdings Inc.

PARTNERING WITH SIGNATURE

Raising Equity Capital & NOLs

• Signature has Federal NOLs of approximately $887.3 million as of 12/31/12, which do not begin to expire until 2027

• Signature has no Section 382 limitation on annual usage of its Federal NOLs

- No restriction with regards to line of business

- Signature has bylaws in place that prohibit stockholders from accumulating more than a 5% interest, without Company approval

• Signature has the ability to issue a substantial number of additional shares without jeopardizing NOLs

- Signature may use rights offerings to raise capital from existing stockholders to minimize any potential ownership shift issues

9

Signature

Group Holdings Inc.

PARTNERING WITH SIGNATURE

continued

Why Signature?

• Permanent capital

• Ability to close quickly

• Our structure can help propel a good management team/company to industry leadership

• Our investment horizon is long-term

• Holding company structure allows operating management autonomy

• Public vehicle provides access to capital/liquidity for sellers and management teams

• Stockholder-aligned Board of Directors focused on stock price appreciation

10

Signature

Group Holdings Inc.

MANAGEMENT TEAM

CRAIG BOUCHARD

Chief Executive Officer

Mr. Bouchard became the Chairman of the Board and Chief Executive Officer of Signature in June 2013 after leading a proxy battle to remove the company’s existing board. This was Mr. Bouchard’s second successful hostile take-over on Wall Street. In 2010 Mr. Bouchard founded Shale-Inland. Shale-Inland is the nation’s leading master distributor of stainless steel pipe, valves and fittings, to the US energy industry. In 2004, Mr. Bouchard co-founded Esmark Inc. and grew the business from $4 million of revenue in 2003 to nearly $4 billion in 2008, becoming the highest appreciating stock on the NASDAQ for the full year 2008. From 1998-2003, Mr. Bouchard was the President and Chief Executive Officer of New York based NumeriX. Prior to that, Mr. Bouchard was the Head of Asia Pacific, and The Global Head of Derivative Trading and Quantitative Research at The First National Bank of Chicago.

Mr. Bouchard is a New York Times Best Selling author of The Caterpillar Way: Lessons in Leadership, Growth and Shareholder Value, which was released in October of 2013 and reached #1 on the Barnes & Noble Best Seller List, and #8 on the New York Times Best Seller list in the business category. (McGraw Hill.)

Mr. Bouchard holds a Bachelor’s degree from Illinois State University (1975), a Master’s Degree in Economics from Illinois State University (1977), and an MBA from the University of Chicago (1981). He has been a member of the Board of Trustees of Boston

University and the Foundation of the University of Montana. He is currently a member of the Board of the Department of Athletics, Duke University. Mr. Bouchard is an alumnus of Leadership Greater Chicago, and was a finalist for the Ernst and Young Entrepreneur of the Year award (Illinois) in the year 2005.

11

Signature

Group Holdings Inc.

MANAGEMENT TEAM

Continued

KYLE ROSS

Executive Vice President and Chief Financial Officer

Mr. Ross is Executive Vice President and Chief Financial Officer of Signature. Mr. Ross co-founded Signature Capital Partners, a special situations investment company, in 2004 where he was directly involved in all of Signature Capital’s transactions, including playing an active role in structuring, underwriting, closing and managing the exit of investments. Mr. Ross previously spent over four years with the boutique investment banking firm Murphy Noell Capital where he was directly involved in over 25 transactions including both healthy and distressed capital raises, M&A transactions, and debt restructuring. He was also responsible for managing the firm’s analyst and associate staff. Previously, he was a summer analyst at Sutro & Co. Mr. Ross holds Bachelor of Science and Bachelor of Arts degrees from the University of California, Berkeley.

CHRIS MANDERSON

Executive Vice President and General Counsel

Mr. Manderson has served as our Executive Vice President, General Counsel and Secretary since November 2012. Prior to joining the Company, Mr. Manderson founded Manderson, Schafer & McKinlay LLP, an independent law firm specializing in business and transactional law, in February 2009 with two colleagues from Paul, Hastings, Janofsky & Walker LLP. From 2009 to 2010, Mr. Manderson and his firm represented Signature Group Holdings, LLC as the successful plan proponent against four competing plans of reorganization in the Fremont General Corporation bankruptcy. Mr. Manderson also represented the Company in its July 2011 acquisition of North American Breaker Co., LLC. Prior to that, he worked as a corporate lawyer, specializing in mergers and acquisitions and securities law, at several international law firms, including Paul, Hastings, Janofsky & Walker LLP from June 2004 to January 2009 and Skadden, Arps, Slate, Meagher & Flom LLP. Mr. Manderson holds a Bachelor of Arts degree from University of California, Santa Barbara and a Juris Doctor degree from the UCLA School of Law.

12