Attached files

| file | filename |

|---|---|

| 8-K/A - AMENDMENT NO. 1 TO FORM 8-K - GYRODYNE CO OF AMERICA INC | t1400067_8k.htm |

Exhibit 99.1

Gyrodyne: Corporate Transformation and Upcoming Distributions to Shareholders

Presentation to Shareholders of

Gyrodyne Company of America, Inc.,

December 27, 2013

SIGNIFICANT DATES

| November 2005 | New York State Seized 245.5 Acres Under Eminent Domain |

| December 9, 2005 | Company presents strategic plan to position Company for one or more liquidity events in reasonable period of time that would give shareholders maximum cash or marketable securities in tax efficient manner. Plan calls for REIT conversion, redeployment of assets in tax efficient manner, maximizing value of remaining 68 acres of Flowerfield and rigorous pursuit of condemnation case for just compensation. |

| March 27, 2006 | New York State Paid $26.315 Million for the Seized Property ($107,189 Per Acre – Accepted as an Advanced Payment) |

| May 1, 2006 | Company’s Conversion to a REIT |

| April 9, 2007 | Paid a Dividend of $5.16 Million ($4/Share) |

| June 27, 2007 | Port Jefferson Property Purchased for $8,850,000 |

| June 2, 2008 | Cortlandt Manor Purchased for $7,000,000 (Additional Parcels Later Purchased for $1,025,000) |

| March 31, 2009 | Fairfax Medical Purchased for $12,891,000. Purchase qualified for IRC Section 1033 deferral treatment and completed reinvestment of $26.3 million advance payment. |

| July 3, 2012 | $98,685,000 Additional Damages, $67,341,716 Interest and $1,474,941 Costs received from New York State ("2012 Proceeds") |

| August 2012 | Corporate strategic review commenced. Skadden, Arps, Slate, Meagher & Flom LLP and Rothschild, Inc. retained |

| December 14, 2012 | Special Dividend of $56,786,652 ($38.30/Share) paid |

| March 20, 2013 | Private Letter Ruling Requested |

| 2 |

| August 28, 2013 | IRS Issues Private Letter Ruling. The PLR concludes that the Company's receipt of the 2012 Proceeds occurred outside of the applicable recognition period for 2012, and therefore permits the Company to distribute by means of a dividend (such as the First Special Dividend) the gains realized from the receipt of the 2012 Proceeds, subject to a 4% excise tax but without incurring corporate level tax (for which Company previously recorded $61,649,000 deferred income tax expense). |

| September 12, 2013 | Board Adopted Plan of Liquidation. The tax liquidation must be completed within two year period from adoption of the Plan. Gyrodyne intends to accomplish the tax liquidation by the Merger (described below) which is intended to occur in early 2014. |

| September 13, 2013 | First Special Dividend Declared: aggregate of $98,685,000 to be paid December 30, consisting of $68,000,000 ($45.86 per share) to be paid in cash and $30,685,000 in interests in Gyrodyne Special Distribution, LLC. This dividend will satisfy 2012 REIT income distribution requirement. |

| October 21, 2013 | Filed Preliminary Proxy with SEC for Plan of Merger of Gyrodyne into a limited liability company |

| November 1, 2013 | First Special Dividend Record Date |

| November 19, 2013 | SEC comments on October 21st proxy filing. Based on timing, management determines to postpone vote on merger until 2014. |

| November 27, 2013 | Proxy for annual meeting disseminated. |

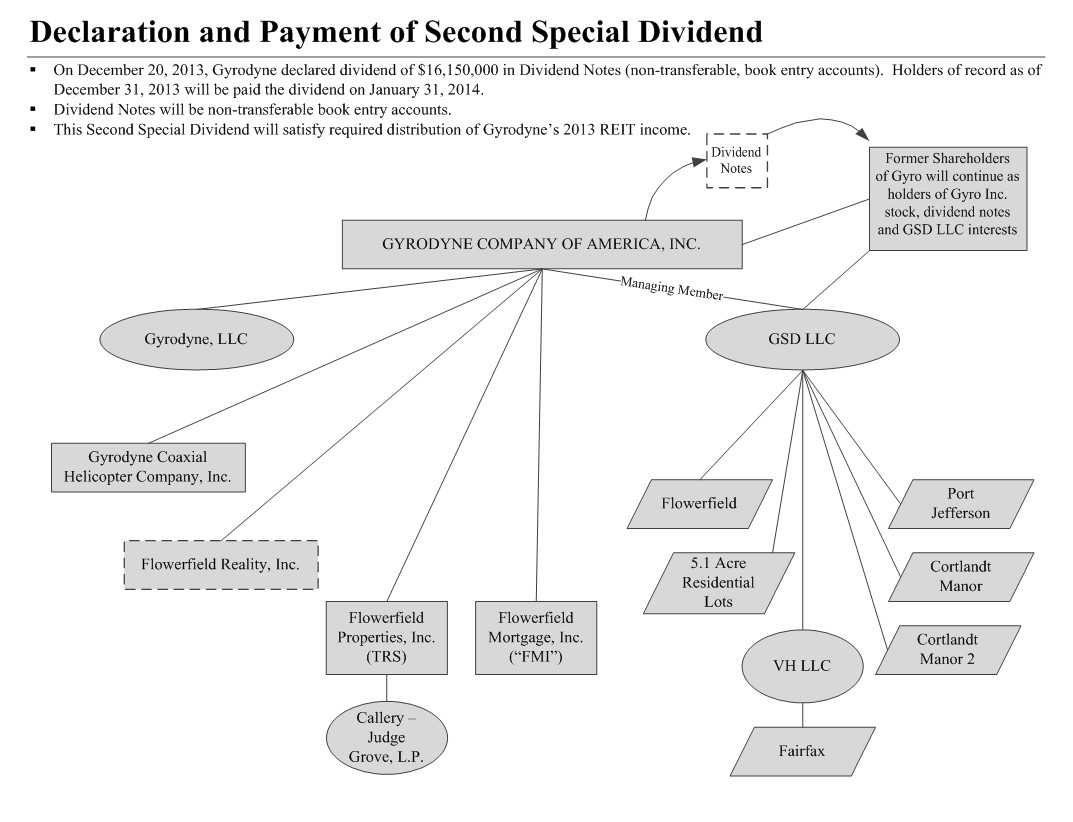

| December 20, 2013 | Press Release Announcing Final Details of First Special Dividend and Declaration of Second Special Dividend, consisting of $16,150,000 in Dividend Notes ($10.89 per share). The Second Special Dividend will satisfy 2013 REIT income distribution requirement |

| December 30, 2013 | First Special Dividend Payment Date |

| December 31, 2013 | Second Special Dividend Record Date |

| January 31, 2014 | Second Special Dividend Payment Date |

| 3 |

FINANCIAL RESULTS (in thousands, except net income per share)

|

2013 (9) |

2012 |

2011 |

2010 | ||

| Revenues | $3,790 | $4,989 | $5,520 | $5,551 | |

| Condemnation Income (Costs) | — | $167,371 | ($333) | ($109) | |

| Federal Tax Provision (Benefit) | ($58,182) | $61,649 | — | $109 | |

| Net Income | $47,380 (1) | $99,048 | ($1,125) | ($1,081) | |

| Per Share Income | $31.96 | $66.80 | ($0.84) | ($0.84) | |

| Funds from Operations (FFO) | ($7,932) | ($5,713) | ($179) | ($234) | |

| ADS. Funds from Operations (AFFO) | $286 | ($49) | $183 | ($125) | |

| (1) | After Strategic Alternative Expenses | $2,803 | $1,013 | ||

| Impairment Charges | $2,100 | — | |||

| Incentive Compensation | $5,097 | $4,250 | |||

| 4 |

| 5 |

| 6 |

| 7 |

| 8 |

Illustrative Financial Effects

(unaudited)

|

Pro Forma** | ||||

|

Gyro Inc. |

First Special |

Gyro Inc. |

GSD | |

| Assets | ||||

| Cash and marketable securities | $85,000,000 | $(68,000,000) | $17,000,000 | $0 |

| Real Estate (net) | 32,700,000 | 0 | 32,700,000 | |

| Mortgage Receivable | 0 | 14,000,000 | 0 | |

| Other |

800,000 |

600,000 |

200,000 | |

| Total | 118,500,000 | 31,600,000 | 32,900,000 | |

| Liabilities | ||||

| Mortgage Payable | 0 | 0 | 14,000,000 | |

| Other | 7,500,000 | 7,000,000 | 500,000 | |

| Equity | 111,000,000 | (68,000,000) cash | 24,600,000 | 18,400,000 |

| (30,685,000)* | ||||

| Total Liabilities and Equity |

118,500,000 |

31,600,000 |

32,900,000 | |

| * | Value of distributed property as determined by Board of Directors, net of $14,000,000 of mortgages payable to subsidiary of Gyrodyne. |

| ** | Estimate for purposes of illustrating effects of first special dividend and new structure. This presentation should not be construed as an actual forecasted preliminary balance sheet. |

| 9 |

Illustrative Financial Effects

(unaudited)

|

Gyro Inc. |

Second Special Dividend |

Pro Forma

| |

| Assets | $31,600,000 | $31,600,000 | |

| Liabilities | |||

| Other | 7,000,000 | 7,000,000 | |

| Dividend Notes | 0 | $16,150,000 | 16,150,000 |

| Equity |

24,600,000 |

(16,150,000) |

8,450,000 |

| 31,600,000 | 31,600,000 |

| * | Estimate for purposes of illustrating effects of second special dividend and new structure. This presentation should not be construed as an actual forecasted preliminary balance sheet. |

| 10 |

Hypothetical Holdings

of a Gyrodyne

Shareholder

after First Special Dividend and Second Special Dividend

| 11 |

| 12 |

| 13 |

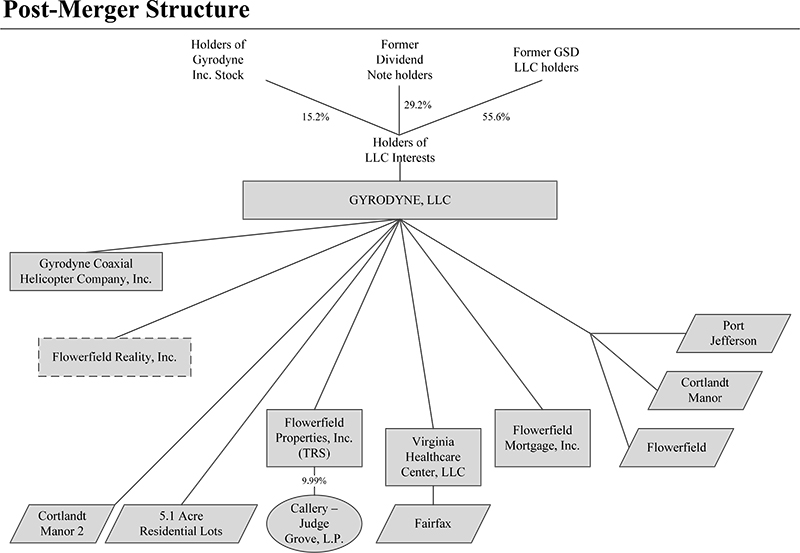

Post Merger Impact

on Gyrodyne Shares

| 14 |

Forward-Looking Statement Safe Harbor

The statements made in this presentation that are not historical facts constitute “forward-looking information” within the meaning of the Private Securities Litigation Reform Act of 1995, and Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, both as amended, which can be identified by the use of forward-looking terminology such as “may,” “will,” “anticipates,” “expects,” “projects,” “estimates,” “believes,” “seeks,” “could,” “should,” or “continue,” the negative thereof, other variations or comparable terminology as well as statements regarding the evaluation of strategic alternatives. Important factors, including certain risks and uncertainties, with respect to such forward-looking statements that could cause actual results to differ materially from those reflected in such forward-looking statements include, but are not limited to, risks and uncertainties relating to the process of exploring strategic alternatives, risks associated with Gyrodyne’s ability to implement the tax liquidation, plan of liquidation or the plan of merger, the risk that the proceeds from the sale of Gyrodyne’s assets may be substantially below Gyrodyne’s estimates, the risk that the proceeds from the sale of our assets may not be sufficient to satisfy Gyrodyne’s obligations to its current and future creditors, the risk of shareholder litigation against the tax litigation, the plan of liquidation or the plan of merger and other unforeseeable expenses related to the proposed liquidation, the tax treatment of condemnation proceeds, the effect of economic and business conditions, including risks inherent in the real estate markets of Suffolk and Westchester Counties in New York, Palm Beach County in Florida and Fairfax County in Virginia, risks and uncertainties relating to developing Gyrodyne's undeveloped property in St. James, New York and other risks detailed from time to time in Gyrodyne's SEC reports.

Important Information for Investors and Shareholders

This communication does not constitute a solicitation of any vote or approval. The implementing transaction related to the plan of merger will be submitted to Gyrodyne's shareholders for their consideration. In connection with the proposed transaction, Gyrodyne will file a proxy statement with the SEC. GYRODYNE SHAREHOLDERS ARE ADVISED TO READ THE PROXY STATEMENT AND RELATED DOCUMENTS CAREFULLY (WHEN THEY BECOME AVAILABLE) AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The proxy statement and other documents containing other important information about Gyrodyne filed or furnished to the SEC (when they become available) may be read and copied at the SEC's public reference room located at 100 F Street, N.E., Washington, D.C. 20549. Information on the operation of the Public Reference Rooms may be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website, www.sec.gov, from which any electronic filings made by Gyrodyne may be obtained without charge. In addition, investors and shareholders may obtain copies of the documents filed with or furnished to the SEC upon oral or written request without charge. Requests may be made in writing by regular mail by contacting Gyrodyne at the following address: One Flowerfield, Suite 24, St. James, NY 11780, Attention: Investor Relations. The proxy statement also will be available on the Company's web site located at www.gyrodyne.com.

| 15 |

Gyrodyne and its directors, executive officers and employees and other persons may be deemed to be participants in the solicitation of proxies in respect of the proposed merger. Information regarding Gyrodyne's directors and executive officers and their ownership of Gyrodyne common stock is available in Gyrodyne's proxy statement for its 2013 meeting of stockholders, as filed with the SEC on Schedule 14A on November 27, 2013. Other information regarding the interests of such individuals as well as information regarding Gyrodyne's directors and officers will be available in the proxy statement with respect to the merger when it becomes available. These documents can be obtained free of charge from the sources indicated above.

| 16 |