Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - BANCORPSOUTH INC | d655943dex992.htm |

| 8-K - 8-K - BANCORPSOUTH INC | d655943d8k.htm |

BancorpSouth, Inc.

Acquisition of Ouachita

Bancshares Corporation

January 9, 2014

Exhibit 99.1 |

Forward Looking Information

Certain statements contained in this presentation and the accompanying slides may not be based on

historical facts and are “forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These forward-looking statements may be identified by reference to a future

period or by the use of forward-looking terminology, such as “anticipate,”

“believe,” “estimate,” “expect,” “foresee,” “may,” “might,” “will,” “intend,” “could,” “would” or “plan,” or future or conditional

verb tenses, and variations or negatives of such terms. These forward-looking statements include,

without limitation, statements about the terms and closing of the proposed transaction with

Ouachita Bancshares Corp., acceptance by customers of Ouachita Bancshares Corp. of BancorpSouth’s

products and services, the opportunities to enhance market share in certain markets and market

acceptance of BancorpSouth generally in new markets. We caution you not to place undue reliance on the forward-looking statements contained in this news release, in that actual

results could differ materially from those indicated in such forward-looking statements as a result

of a variety of factors. These factors include, but are not limited to, the ability to obtain required

shareholder and regulatory approvals for the merger, the ability of BancorpSouth and Ouachita

Bancshares Corp. to close the merger, BancorpSouth’s ability to successfully integrate the

operations of Ouachita Independent Bank after the merger, the ability of BancorpSouth to provide

competitive services and products in new markets and grow market share in existing markets, the

ability of BancorpSouth to assimilate and retain key personnel after the merger, conditions in the financial markets and economic conditions generally, the adequacy of BancorpSouth’s

provision and allowance for credit losses to cover actual credit losses, the credit risk associated

with real estate construction, acquisition and development loans, losses resulting from the

significant amount of BancorpSouth’s other real estate owned, limitations on BancorpSouth’s

ability to declare and pay dividends, the impact of legal or administrative proceedings, the

availability of capital on favorable terms if and when needed, liquidity risk, governmental regulation

and supervision of BancorpSouth’s operations, the short-term and long-term impact of

changes to banking capital standards on BancorpSouth’s regulatory capital and liquidity, the

impact of regulations on service charges on BancorpSouth’s core deposit accounts, the susceptibility

of BancorpSouth’s business to local economic or environmental conditions, the soundness of other

financial institutions, changes in interest rates, the impact of monetary policies and economic

factors on BancorpSouth’s ability to attract deposits or make loans, volatility in capital and

credit markets, reputational risk, the impact of hurricanes or other adverse weather events, any

requirement that BancorpSouth write down goodwill or other intangible assets, diversification in the

types of financial services BancorpSouth offers, BancorpSouth’s ability to adapt its products

and services to evolving industry standards and consumer preferences, competition with other financial

services companies, BancorpSouth’s growth strategy, interruptions or breaches in

BancorpSouth’s information system security, the failure of certain third party vendors to perform,

unfavorable ratings by rating agencies, dilution caused by BancorpSouth’s issuance of additional

shares of its common stock to raise capital or acquire other banks, bank holding companies, financial

holding companies and insurance agencies,, other factors generally understood to affect the

financial results of financial services companies and other factors detailed from time to time in the Company’s press releases and filings with the Securities and Exchange Commission.

Forward-looking statements speak only as of the date they were made, and, except as required by

law, we do not undertake any obligation to update or revise forward-looking statements to

reflect events or circumstances after the date of this presentation. Certain tabular presentations may

not reconcile because of rounding. Unless otherwise noted, any quotes in this presentation can be

attributed to company management. Any pro forma information

presented herein, while helpful in illustrating certain characteristics of the combined companies based on certain assumptions, does not reflect the impact of, for

example, asset dispositions or runoff, that may result as a consequence of the business combination

and, accordingly, does not attempt to predict or suggest future results. It also does not

necessarily reflect what the historical loan composition of the combined operations would have been had

the companies been combined as of the date indicated. If not otherwise attributed to a

particular source, factual information was obtained or derived from third-party public sources

believed by BancorpSouth management to be reliable, but BancorpSouth has not undertaken an

independent review to verify the accuracy of this information as of the date of this

presentation. To the extent that such information predicts future results, BancorpSouth can make no

assurance that such results will occur.

In connection with the proposed merger, BancorpSouth, Inc. will file a registration statement on Form

S-4 with the Securities and Exchange Commission. Shareholders of BancorpSouth and

Ouachita Bancshares Corp. are encouraged to read the registration statement, including the proxy statement/prospectus that will be a part of the registration

statement, because it will contain important information about the merger, BancorpSouth and Ouachita

Bancshares Corp. After the registration statement is filed with the SEC, the proxy

statement/prospectus and other relevant documents will be available for free on the SEC’s web site (www.sec.gov), and the proxy statement/prospectus will also be made

available for free from the Corporate Secretary of each of BancorpSouth and Ouachita Bancshares

Corp. |

3

Strategic Rationale

Strengthens BancorpSouth’s presence in the

Louisiana market

Improves overall demographic profile of our Company

Similar cultures and operating styles

Cost-saving opportunities with current market overlap

Meaningful accretion to earnings per share

Deploys capital while maintaining BancorpSouth’s

well-capitalized position

Pro forma deposit market share in Louisiana increases

from 11

th

to

7

th

based

on

6/30/13

FDIC

market

share

data

Significantly enhances market share in the attractive

markets of the I-20 corridor |

Footprint

4

Source: SNL Financial

BancorpSouth (256)

Ouachita (12) |

5

Source: SNL Financial

Shreveport and Monroe

BancorpSouth (7)

Ouachita Bancshares (4)

BancorpSouth (4)

Ouachita Bancshares (6) |

6

Market Overview

Shreveport –

Bossier City

Shreveport

is

the

third

largest

city

in

Louisiana

and

109

th

largest

city in the U.S.

Benteler Steel recently broke ground on a $900M manufacturing

facility, which is expected to be completed over two phases and

add 675 new jobs plus another 1,500 indirect jobs in coming years

Bossier Parish is home to Barksdale Air Force Base, which

employs over 12,000 people

Other major employers include the State of Louisiana, Caddo

Public Schools, University Hospital, and the Willis-Knighton Health

System.

Monroe

Home of the University of Louisiana at Monroe, which has

approximately 10,000 faculty, staff, and students

CenturyLink, a Fortune 500 company and the nation’s third largest

telecommunications company, is headquartered in Monroe –

currently undergoing expansion to add 800 new jobs by 2015,

bringing total local employment to approximately 2,200

Strong healthcare presence led by St. Francis Hospital and

Glenwood

Hospital

–

St.

Francis

is

currently

undergoing

expansion

which will bring total employment to 2,500 by late 2014

Other major employers include the Ouachita Parish School Board

and Graphic Packaging Corporation

Information obtained from third-party public sources

|

7

Deposit Market Share

Source: SNL Financial

Note: Deposit data as of 6/30/13

Market

BXS Market

Share Rank

6/30/13

Total BXS

Deposits

6/30/13

Percentage

of Total

Company

Deposits

BXS Market

Share 2013

(%)

Ouachita

Bancshares

Corporation

Deposits

6/30/13

Pro Forma

Deposits

6/30/13

Pro Forma

Percentage of

Total

Company

Deposits

Pro Forma

Market Share

Rank 6/30/13

Pro Forma

Market Share

2013 (%)

Market YoY

Deposit

Growth

2013 (%)

Mississippi

3

5,069,157

$

46.4%

10.6%

-

$

5,069,157

$

44.2%

3

10.6%

2.6%

Arkansas

7

1,733,083

15.9%

3.3%

-

1,733,083

15.1%

7

3.3%

-0.5%

Louisiana

11

955,359

8.7%

1.0%

533,685

1,489,044

13.0%

7

1.6%

5.3%

Tennessee

15

1,184,566

10.8%

1.0%

-

1,184,566

10.3%

15

1.0%

0.1%

Texas

65

826,576

7.6%

0.1%

-

826,576

7.2%

65

0.1%

8.9%

Alabama

13

824,116

7.5%

1.0%

-

824,116

7.2%

13

1.0%

1.8%

Missouri

66

317,286

2.9%

0.2%

-

317,286

2.8%

66

0.2%

6.2%

Florida

246

19,351

0.2%

0.0%

-

19,351

0.2%

246

0.0%

4.1%

Total

10,929,494

$

100.0%

533,685

$

11,463,179

$

100.0%

6/30/13 Deposit Market Share ($ in thousands) |

8

Branch Listing

Source: SNL Financial

Note: Deposit data as of 6/30/13

Branch Address

City

Total Deposits

2013 ($000)

Branch Address

City

Total Deposits

2013 ($000)

1

909 N 18th St

Monroe

99,755

$

1

1220 N 18th St

Monroe

48,711

$

2

2002 N 7th St

West Monroe

70,343

2

3501 Cypress St

West Monroe

23,754

3

701 McMillan Rd

West Monroe

59,669

3

1701 N 7th St

West Monroe

16,499

4

7950 Desiard St

Monroe

25,983

4

5000 Forsythe Bypass

Monroe

6,103

5

4370 Sterlington Rd

Monroe

25,314

95,067

$

6

1270 Hwy 15

West Monroe

7,882

288,946

$

5

6025 Line Ave

Shreveport

207,193

$

6

8585 Fern Avenue

Shreveport

185,736

7

6801 Fern Ave

Shreveport

61,880

$

7

418 Travis St

Shreveport

49,483

8

9010 Ellerbe Rd

Shreveport

55,465

8

9200 Mansfield Rd

Shreveport

37,690

9

800 Garrett Dr

Bossier City

31,662

9

1263 N Market St

Shreveport

33,308

10

4200 Benton Rd

Bossier City

29,272

10

3003 Airline Dr

Bossier City

32,905

178,279

$

11

6832 Pines Rd

Shreveport

7,216

553,531

$

11

311 N Franklin St

Bastrop

39,749

$

12

1503 E Madison Ave

Bastrop

26,711

12

300 N Trenton St

Ruston

24,392

$

66,460

$

13

107 Glenda St

Rayville

71,706

96,098

$

TOTAL DEPOSITS

533,685

$

TOTAL MARKET DEPOSITS

744,696

$

OTHER

Ouachita Bancshares Corp.

BancorpSouth, Inc. -

North Louisiana Division

MONROE

SHREVEPORT-BOSSIER CITY

BASTROP

MONROE

SHREVEPORT-BOSSIER CITY |

9

Ouachita Bancshares Corp. Deposit Market Share

Source: SNL Financial

Note: Deposit data as of 6/30/13

Total Deposit

Rank 2013

Parent Company Name

Parent City

Parent State

Total Active

Branches

2013

Total Deposits

2013 ($000)

Total Deposit

Market Share

2013 (%)

YoY Deposit

Growth 2013

(%)

1

Community Trust Financial Corp.

Ruston

LA

9

601,297

$

20.72

5.65

2

JPMorgan Chase & Co.

New York

NY

12

550,245

18.96

5.58

BancorpSouth Inc. Pro Forma

384,013

13.24

3

IBERIABANK Corp.

Lafayette

LA

5

316,225

10.90

0.18

4

Ouachita Bancshares Corp.*

Monroe

LA

6

288,946

9.96

12.54

5

Regions Financial Corp.

Birmingham

AL

4

274,915

9.47

0.62

10

BancorpSouth Inc.*

Tupelo

MS

4

95,067

3.28

5.39

1

Capital One Financial Corp.

McLean

VA

21

1,660,460

$

23.84

(4.05)

2

Regions Financial Corp.

Birmingham

AL

13

1,183,932

17.00

(1.10)

3

JPMorgan Chase & Co.

New York

NY

16

1,013,556

14.55

3.73

BancorpSouth Inc. Pro Forma

731,810

10.51

4

BancorpSouth Inc.*

Tupelo

MS

7

553,531

7.95

1.73

5

Citizens National Bancshares Bossier Inc.

Bossier City

LA

9

522,815

7.51

12.61

10

Ouachita Bancshares Corp.*

Monroe

LA

4

178,279

2.56

0.03

1

Capital One Financial Corp.

McLean

VA

1

79,167

$

27.40

6.97

2

Ouachita Bancshares Corp.*

Monroe

LA

2

66,460

23.00

3.43

3

Oak Ridge Bancshares Inc.

Oak Ridge

LA

1

43,324

15.00

0.95

4

Mer Rouge State Bank

Mer Rouge

LA

1

38,895

13.46

2.96

5

Regions Financial Corp.

Birmingham

AL

1

22,104

7.65

11.52

MONROE

SHREVEPORT-BOSSIER CITY

BASTROP

6/30/13 Deposit Market Share ($ in thousands) |

Financial

Highlights

–

Ouachita

Bancshares

Corp.

10

•

Recognized by SNL as 2012 top

performing bank in Louisiana with

assets between $500M & $5B and

top 50 nationally

•

Operates 12 full-service locations

along I-20 corridor

•

Diverse and economically

attractive markets

Year ended

As of

Dollars in thousands

12/31/12

9/30/13

Balance Sheet

Total Assets

622,232

$

664,161

$

Total Loans & Leases (Excl HFS)

437,968

462,326

Securities

118,684

117,193

Deposits

511,425

555,140

Total Equity

51,294

50,975

Tangible Equity

51,294

50,975

Balance Sheet Ratios

Loans / Deposits (%)

85.64

83.28

Tangible Equity / Tangible Assets (%)

8.24

7.68

Leverage Ratio (%)

7.38

7.64

Tier 1 Capital Ratio (%)

9.57

9.95

Total Capital Ratio (%)

14.35

14.64

Income Statement*

Net Interest Income

23,135

$

18,580

$

Provision Expense

1,038

453

Noninterest Income

7,127

4,793

Securities Gains (Losses)

38

94

Noninterest Expense

19,226

14,894

Net Income

6,523

5,278

Profitability Ratios*

Return on Average Assets (%)

1.09

1.11

Returne on Average Equity (%)

13.18

14.25

Net Interest Margin - FTE (%)

4.31

4.25

Efficiency Ratio - FTE (%)

61.11

62.69

Fee Income / Operating Revenue (%)

23.55

20.51

Source: SNL Financial

*Reported income and profitability metrics adjusted to reflect estimated effective tax rate of

35%. |

11

Pro Forma Loan Composition

Pro forma information excludes purchase accounting adjustments

Loan yields represent weighted average yields for the quarter ended 9/30/13

Based on Call Reports filed by BancorpSouth and Ouachita Bancshares as of

9/30/13 Loan Portfolio ($000)

Amount

%

Loan Portfolio ($000)

Amount

%

Loan Portfolio ($000)

Amount

%

Commercial and industrial

1,503,809

$

17.1%

Commercial and industrial

81,395

$

17.6%

Commercial and industrial

1,585,204

$

17.2%

Real estate

Real estate

Real estate

Consumer mortgages

1,931,171

22.0%

Consumer mortgages

63,756

13.8%

Consumer mortgages

1,994,927

21.6%

Home equity

490,361

5.6%

Home equity

18,159

3.9%

Home equity

508,520

5.5%

Agricultural

234,547

2.7%

Agricultural

27,381

5.9%

Agricultural

261,928

2.8%

Commercial and industrial-owner occupied

1,422,077

16.2%

Commercial and industrial-owner occupied

96,740

20.9%

Commercial and industrial-owner occupied

1,518,817

16.4%

Construction, acquisition and development

723,609

8.2%

Construction, acquisition and development

37,903

8.2%

Construction, acquisition and development

761,512

8.2%

Commercial real estate

1,795,352

20.5%

Commercial real estate

127,863

27.7%

Commercial real estate

1,923,215

20.8%

Credit cards

105,112

1.2%

Credit cards

-

0.0%

Credit cards

105,112

1.1%

All other

567,077

6.5%

All other

9,129

2.0%

All other

576,206

6.2%

Total loans

8,773,115

$

100.0%

Total loans

462,326

$

100.0%

Total loans

9,235,441

$

100.0%

Yield on Loans: 4.55%

Yield on Loans: 5.37%

Yield on Loans: 4.59%

BancorpSouth, Inc.

Ouachita Bancshares Corp.

Pro Forma |

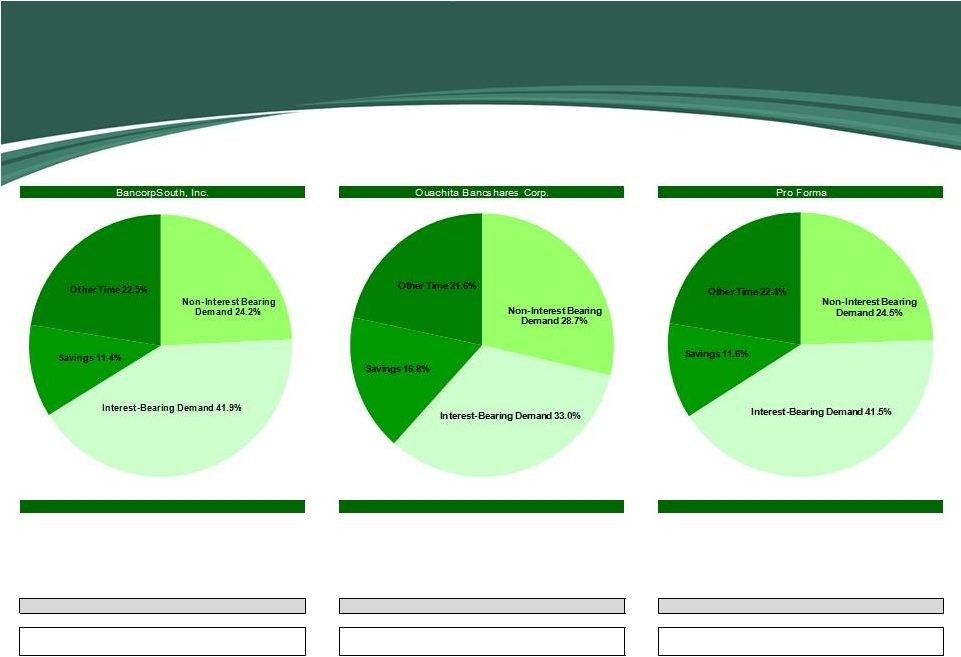

12

Pro Forma Deposit Composition

Pro forma information excludes purchase accounting adjustments

Deposit costs represent weighted average costs for the quarter ended 9/30/13

Deposit Portfolio ($000)

Amount

%

Deposit Portfolio ($000)

Amount

%

Deposit Portfolio ($000)

Amount

%

Non-Interest Bearing Demand

2,597,762

$

24.2%

Non-Interest Bearing Demand

159,207

$

28.7%

Non-Interest Bearing Demand

2,756,969

$

24.5%

Interest-Bearing Demand

4,493,359

41.9%

Interest-Bearing Demand

182,975

33.0%

Interest-Bearing Demand

4,676,334

41.5%

Savings

1,220,227

11.4%

Savings

93,020

16.8%

Savings

1,313,247

11.6%

Other Time

2,406,598

22.5%

Other Time

119,938

21.6%

Other Time

2,526,536

22.4%

Total deposits

10,717,946

$

100.0%

Total deposits

555,140

$

100.0%

Total deposits

11,273,086

$

100.0%

Cost of Deposits: 0.36%

Cost of Deposits: 0.54%

Cost of Deposits: 0.37% |

13

Transaction Terms

Merger Partner:

Ouachita Bancshares Corp.

Aggregate Deal Value:

$112.0 million

Consideration Structure:

Maximum of 3,675,000 shares of BancorpSouth, Inc. plus $22,875,000 of cash

Consideration Mix:

80% stock / 20% cash

Consideration Cap:

$112.0 million (shares adjusted as necessary)

Consideration Floor:

$99.0 million (cash adjusted as necessary)

Required Approvals:

Customary regulatory approval; Ouachita Bancshares Corp. shareholder approval

Due Diligence:

Complete

Anticipated Closing:

Second quarter of 2014

Based on a per

share

price

of

BancorpSouth,

Inc.

common

stock

of

$24.77,

which

represents

the

closing

price

as

of

1/8/14 |

14

Transaction Summary

Source: SNL Financial

Based

on

a

per

share

price

of

BancorpSouth,

Inc.

common

stock

of

$24.77,

which

represents

the

closing

price

as

of

1/8/14

$112.0

Transaction Multiples

Last Twelve Months Earnings ($7.1mm)*

15.8x

2013 Annualized Earnings ($7.0mm)*

15.9x

Book Value ($51.0mm)

2.20x

Tangible Book Value ($51.0mm)

2.20x

Deposit Premium ($555.1mm)

11.0%

*Adjusted to reflect estimated effective tax rate of 35% as Ouachita Bancshares pays no income

tax due to S-Corporation status.

Aggregate Deal Value ($mm) |

15

Financial Impact

Source: SNL Financial and company internal documents

(1) Includes estimated preliminary purchase accounting adjustments

BancorpSouth, Inc.

Ouachita Bancshares Corp.

Pro Forma (1)

Financial Impact

9/30/13

9/30/13

9/30/13

Balance Sheet

Total Assets

12,916,153

$

664,161

$

13,602,268

$

Total Loans & Leases (Excl HFS)

8,773,115

462,326

9,227,441

Deposits

10,717,946

555,140

11,273,086

Total Equity

1,480,611

50,975

1,569,720

Tangible Equity

1,190,259

50,975

1,211,850

Regulatory Capital (%)

Tangible Equity / Tangible Assets (%)

9.43

7.68

9.15

Leverage Ratio (%)

9.93

7.64

9.62

Tier 1 Capital Ratio (%)

13.25

9.95

12.79

Total

Capital Ratio (%) 14.50

14.64

14.04

|

16

Summary

In-market expansion

Meaningful enhancement to Louisiana market share position

Footprint overlap in Shreveport and Monroe

Attractive opportunity

Track record of strong profitability

Good credit quality

First bank acquisition since 2007

Completed six bank transactions between 2000 and 2007

Will provide efficiency opportunities

Operating leverage from back office and support functions

Preliminary review suggests five branch consolidation opportunities

Mortgage team expansion |