Attached files

| file | filename |

|---|---|

| 8-K - AMERICAN SPECTRUM REALTY, INC. 8-K - AMERICAN SPECTRUM REALTY INC | a50777802.htm |

| EX-99.1 - EXHIBIT 99.1 - AMERICAN SPECTRUM REALTY INC | a50777802ex99_1.htm |

| EX-10.2 - EXHIBIT 10.2 - AMERICAN SPECTRUM REALTY INC | a50777802ex10_2.htm |

Exhibit 10.1

DUNHAM & ASSOCIATES HOLDINGS, INC.

December 30, 2013

American Spectrum Dunham Properties LLC

American Spectrum Realty, Inc.

William J. Carden

2401 Fountain View, Suite 750

Houston, TX 77057

Re: Loan/Issue of Warrant

The purpose of this letter ("Letter Agreement") is to set forth the agreements and understandings of Dunham & Associates Holdings, Inc. ("Dunham"), American Spectrum Dunham Properties LLC ("American Spectrum") and American Spectrum Realty, Inc. ("ASR"). Dunham, American Spectrum and ASR agree as follows:

1. Loan. Dunham, or its designated affiliate, agrees to loan or to arrange for a loan from a third party or parties (collectively, the “Lender”) to American Spectrum and American Spectrum agrees to borrow from Lender, the original principal amount of $6,000,000 (the "Loan") upon the terms and conditions set forth in this Letter Agreement. Dunham shall cause Lender to advance to American Spectrum $3,000,000 (the "Tranche 1 Loan") within five (5) business days after the date of the closing of the transactions set forth in that certain Contribution Agreement and Joint Escrow Instructions, by and between D&A Daily Mortgage Fund III, L.P., D&A Semi-Annual Mortgage Fund III, L.P., D&A Intermediate-Term Mortgage Fund III, L.P., American Spectrum, American Spectrum Realty Operating Partnership, L.P. and ASR, dated December 30, 2013 (the “Contribution Agreement”) and Dunham shall cause the Lender to advance to American Spectrum an additional $3,000,000 (the "Tranche 2 Loan") on or prior to ninety (90) days after the date of this Letter Agreement, the date of such advance being determined by Lender in its sole discretion. The Loan, or so much thereof as is advanced pursuant to this Letter Agreement, shall bear simple interest at the per annum rate of 8% from the date of advance thereof to American Spectrum until the first anniversary of the date of this Letter Agreement and thereafter shall bear simple interest at the rate of 12% per annum. Subject to compliance with applicable law, Dunham may identify the Lender(s) for the Loan in its sole discretion and American Spectrum and ASR acknowledge and agree that it shall not have approval rights over such Lender and that the Lender under the Tranche 1 Loan need not be the Lender(s) under the Tranche 2 Loan. The Loan shall be guaranteed by ASR.

2. Repayment of the Loan. The Tranche 1 Loan and the Tranche 2 Loan shall each be evidenced by a separate promissory note (each a "Note") in the form attached hereto as Exhibit A, executed by American Spectrum in favor of Lender. The Note for Tranche 1 shall be delivered by American Spectrum to Dunham concurrently with the execution of this Letter Agreement. The Note for Tranche 2 shall be delivered by American Spectrum to Dunham concurrently with its initial funding. The Note evidencing the Tranche 1 Loan shall be referred to herein as the “Tranche 1 Note” and the Note evidencing the Tranche 2 Loan shall be referred to herein as the “Tranche 2 Note.” American Spectrum shall pay interest only on the Loan to Lender, in arrears, on the first (1st) day of each calendar month, commencing on the first day of the month following the month in which the Tranche 1 Loan is advanced. All accrued interest and unpaid principal outstanding under each of the Notes shall be paid in full on the fifth anniversary of the date of this Letter Agreement ("Maturity Date"). In the event of any disagreement between the terms of any Note and this Letter Agreement, the terms set forth in the applicable Note shall prevail in such dispute. The Tranche 1 Loan and/or the Tranche 2 Loan may be advanced by more than one Lender in an aggregate amount of up to $3,000,000, in which case, each such Lender shall be issued a Note for the aggregate amount of its share of the applicable Loan and the form of Note shall be amended to provide that all of the Notes issued with respect to the Tranche 1 Loan and/or the Tranche 2 Loan, as applicable, shall be held on a pari passu basis and that all payments due and owing with respect to such Notes shall be made amongst the holders thereof on a pro rata basis in accordance with the relative principal amount outstanding under each such Note. ASR acknowledges that Dunham Trust Company may serve as Lender in its capacity as a trustee for one or more third-parties and that in such case Dunham shall hold the applicable Note for the benefit of such third-parties in its capacity as trustee.

3. Prepayment. The outstanding principal amount owing under each of the Notes may be prepaid at any time without the prior written consent of Lender.

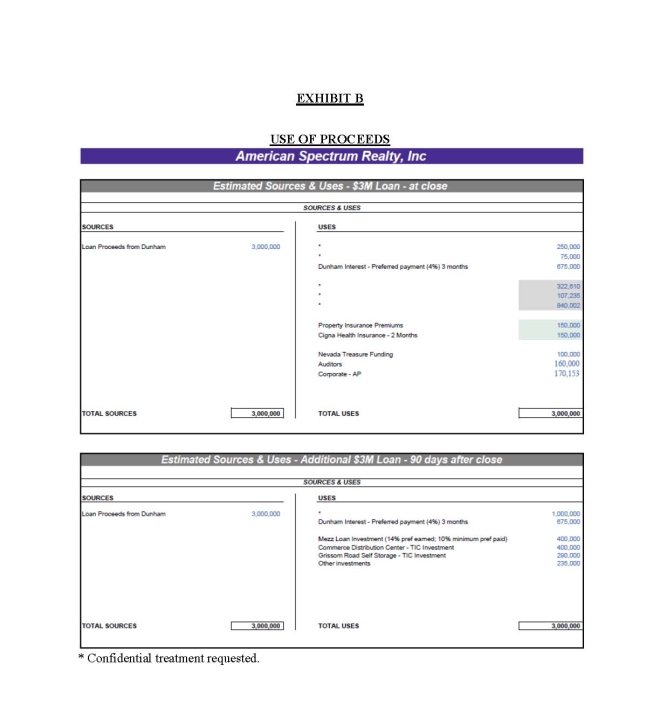

4. Use of Proceeds. American Spectrum agrees to the use of the proceeds from the Loan for the uses and purposes set forth in Exhibit B attached hereto.

5. Security for the Loan. Concurrently with the execution of this Letter Agreement, American Spectrum shall grant to Lender a first lien on the property commonly referred to by Dunham and American Spectrum as San Jacinto (the "Tranche 1 Loan Property") securing the repayment of the Tranche 1 Note. The lien shall be evidenced by a deed of trust securing repayment of the Tranche 1 Note in the form attached hereto as Exhibit C, which shall be executed, acknowledged and delivered by American Spectrum to Lender upon execution of this Letter Agreement. Lender shall have the right, at the cost of American Spectrum, to obtain from First American Title Insurance Company, a lender's policy of title insurance insuring the first priority of the lien created by such deed of trust on the Tranche 1 Loan Property. Concurrently with the initial funding of the loan to be evidenced by the Tranche 2 Note, American Spectrum shall grant to Lender a first lien on the property commonly referred to by Dunham and American Spectrum as Calimesa and a second lien on the property commonly referred to by Dunham and American Spectrum as Murrieta (the "Tranche 2 Loan Properties") securing repayment of the Tranche 2 Note. The lien shall be evidenced by a deed of trust securing repayment of the Tranche 2 Note in the form attached hereto as Exhibit C, which shall be executed, acknowledged and delivered by American Spectrum to Lender upon the initial funding of the loan to be evidenced by the Tranche 2 Note. Lender shall have the right, at the cost of American Spectrum, to obtain from First American Title Insurance Company, a lender's policy of title insurance insuring the priority of the lien created by such deed of trust on the Tranche 2 Loan Properties as described herein.

6. Substitution of Security for the Loan. At any time American Spectrum desires to refinance or sell a Tranche 1 Loan Property or one of the Tranche 2 Loan Properties (the "Released Property"), it shall have the right to do so, and upon request of American Spectrum, Lender shall release such Released Property from the lien of the applicable deed of trust on the condition that either (a) the applicable Note is paid in full in connection with such sale, or (b) American Spectrum grants to Lender a first lien on substitute real property to secure repayment of the applicable Note in place of the Released Property (the "Substitute Property"). The lien against the Substitute Property shall be evidenced by a deed of trust securing repayment of the applicable Note in the form attached hereto as Exhibit C. The Substitute Property shall be acceptable to Lender in its reasonable discretion; provided, however, that American Spectrum may, without Lender’s consent, elect to replace a Released Property with a Substitute Property that is a property being contributed to American Spectrum pursuant to the Contribution Agreement on the sole condition that the Project Allocation Amount of such Substitute Property equals or exceeds the Project Allocation Amount of the Released Property. In any event, the Lender shall be granted a first priority lien on any such Substitute Property. American Spectrum shall give Lender written notice at least five (5) business days prior to the sale of any Property or Substitute Property, which notice shall include any request or decision (as the case may be) to replace such property with a Substitute Property in accordance with the terms of the Note. The Lender shall have the right, at the cost of American Spectrum, to obtain from First American Title Insurance Company a Lender's Policy of Title Insurance insuring the priority of the lien created on any Substitute Property.

-2-

If American Spectrum sells (a) the Released Property or (b) a Substitute Property which is a property contributed to American Spectrum pursuant to the Contribution Agreement, and in connection with such transaction, such property is replaced with a Substitute Property, then for purposes of calculating the “Sale Payment” under the Contribution Agreement, the amount owing under the applicable Note shall not be included in calculating the aggregate indebtedness repaid in connection with the sale of such property.

7. Representations and Warranties.

In addition to the express agreements of the parties contained in this Letter Agreement, the following constitutes representations and warranties of each party to the other parties:

7.1 Due Formation. Such party is duly formed and validly existing under the laws of its organization and has the requisite power and authority to carry out its businesses now being conducted and such party is duly qualified or licensed in each state in which it conducts business and is in good standing in such state to the extent required by law.

7.2 Power. Each party has the legal power, right and authority to enter into this Letter Agreement and the instruments referenced in this Letter Agreement and to consummate the transactions contemplated by this Letter Agreement.

7.3 Required Action. All requisite action has been taken by each party in connection with (a) the entering into of this Letter Agreement and the instruments referenced in this Letter Agreement, (b) the performance of its obligations under this Letter Agreement, and (c) the consummation of the transactions contemplated by this Letter Agreement. No other consent of any member, partner, shareholder, creditor, investor, judicial or administrative body, governmental authority or other person is required in connection therewith.

-3-

7.4 Authority. The individuals executing this Letter Agreement and the instruments referenced herein on behalf of such party have the legal power, right and actual authority to bind the party to the terms and conditions of this Letter Agreement and such instruments.

7.5 Enforcement. This Letter Agreement and all documents required hereby to be executed by such party is and shall be valid, legally binding obligations of and enforceable against such party in accordance with their terms subject only to applicable bankruptcy, insolvency, reorganization, moratorium laws or similar laws or equitable principles affecting or limiting the rights of contracting parties generally.

7.6 No Conflict. Neither the execution and delivery of this Letter Agreement and the documents in this Letter Agreement nor the incurrence of the obligations set forth in this Letter Agreement, nor the consummation of the transactions contemplated by this Letter Agreement, nor compliance with the terms of this Letter Agreement and the documents referenced in this Letter Agreement conflict with or result in the material breach of any terms, conditions or provisions of or constitute a default under any bond, note or other evidence of indebtedness or any contract, indenture, mortgage, deed of trust, loan, partnership agreement, lease or other agreements or instruments to which such party is a party.

7.7 Prohibited Person in Transactions. No party or, to such party's knowledge, its affiliates, is in violation of any laws relating to terrorism, money laundering, or the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Action of 2001, Public Law 107-56 and Executive Order No. 13224 (blocking property and prohibiting transactions with person who commit, threaten to commit, or support terrorism), nor is any party, or, to the best of such party's knowledge, its affiliates, acting directly or indirectly on behalf of any person who is in violation of such Order.

8. Issuance of Warrants. In consideration of Dunham or its designated affiliate providing for and arranging for the Loan and the disbursement thereof, ASR shall issue to Dunham or its designated affiliate warrants (the "Warrants") to purchase up to 600,000 shares of the common stock of ASR (the "Common Shares") at any time prior to December 31, 2018 at a price per Common Share of two dollars ($2.00). The terms of such Warrants shall be governed by the terms of the Warrant to Purchase Common Stock being issued by ASR to Dunham concurrently herewith in the form attached hereto as Exhibit D.

9. Participation Rights. In the event ASR or its affiliates negotiates for the redemption of any of ASR’s issued and outstanding stock (or securities exercisable or convertible into ASR capital stock), other than the redemption and/or purchase of any ASR preferred stock, including the Senior Preferred Stock issued in connection with the Contribution Agreement (a “Non-Preferred Stock Transaction”), ASR shall give Dunham notice of such Non-Preferred Stock Transaction not less than thirty (30) days prior to the closing of such Non-Preferred Stock Transaction, which notice shall set forth the terms and conditions of such Non-Preferred Stock Transaction. Dunham shall have a period of twenty-five (25) days following receipt of notice of such Non-Preferred Stock Transaction to elect to purchase up to fifty percent (50%) of the shares of issued and outstanding capital stock (or securities exercisable or convertible into ASR capital stock) subject to the Non-Preferred Stock Transaction on the same terms and conditions set forth in the applicable notice delivering written notice of such election to ASR. The terms of this Section 9 shall survive the repayment in full of the Notes.

-4-

10. Miscellaneous.

10.1 Entire Agreement. This Letter Agreement, together with the Notes, the Deeds of Trust and the Warrant, is the final expression of and contains the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior understandings with respect thereto. This Letter Agreement may not be modified, changed, supplemented or terminated, nor may any obligations hereunder be waived, except by instrument signed by the party to be charged or by its agent duly authorized in writing. No party hereto intends to confer any benefit under this Letter Agreement on any person other than the parties hereto.

10.2 Agreement Binding on Parties. This Letter Agreement, and the terms, covenants, and conditions herein contained, shall inure to the benefit of and be binding upon the heirs, personal representatives, successors, and assigns of the parties hereto.

10.3 Governing Law. This Letter Agreement and all documents executed and delivered in connection herewith shall be construed in accordance with the internal laws of the State of California without regard to the principles of choice of law or conflicts of law.

10.4 Notice. Any notice, communication, request, reply or advice provided for or permitted by this Letter Agreement to be made by a party must be in writing, and must be given or served on the other parties (a) by depositing the same in the United States mail, postage paid, certified, and addressed to the party to be notified, with return receipt requested, (b) by delivering the same to such party, or an agent of such party, in person or by commercial courier, (c) by facsimile transmission, evidenced by confirmed receipt and concurrently followed by a "hard" copy of same delivered to the party by mail, personal delivery or overnight delivery pursuant to clauses (a), (b) or (c) hereof, or (d) by depositing the same into custody of a nationally recognized overnight delivery service such as Federal Express, Overnight Express, Airborne Express, Emery or Purolator. Any such notices shall be addressed as follows:

If to American Spectrum or ASR:

American Spectrum, Inc.

2401 Fountain View, Suite 750

Houston, TX 77057

Attn: William J. Carden, President

Tel: (713) 706-6200

Fax: (713) 706-6201

If to Dunham:

Dunham & Associates Holdings, Inc.

10251 Vista Sorrento Parkway, Suite 200

San Diego, CA 92121

Attn: Jeffrey Dunham

Tel: (858) 964-0500

Fax: (858) 964-0505

-5-

10.5 Multiple Counterparts. This Letter Agreement may be executed in multiple counterparts, each of which is to be deemed original for all purposes. This Letter Agreement may be executed by facsimile or PDF electronic transmission.

The undersigned have executed this Letter Agreement effective as of the date first set forth above.

| DUNHAM & ASSOCIATES HOLDINGS, INC. | ||

| By: | /s/ Jeffrey A. Dunham | |

| Name: | Jeffrey A. Dunham | |

| Title: | President and CEO | |

| AMERICAN SPECTRUM DUNHAM PROPERTIES LLC, | ||

| a Delaware limited liability company | ||

| By: | /s/ William J. Carden | |

| Name: | William J. Carden | |

| Title: | President | |

| AMERICAN SPECTRUM REALTY, INC., | ||

| a Maryland corporation | ||

| By: | /s/ William J. Carden | |

| Name: | William J. Carden | |

| Title: | President | |

-6-

EXHIBIT A

FORM OF NOTES

SECURED PROMISSORY NOTE

(the "Note")

(Tranche 1)

| San Diego, California | |

| December ___, 2013 |

$3,000,000

FOR VALUE RECEIVED, American Spectrum Dunham Properties LLC, a Delaware Limited Liability Company, ("Borrower") promises to pay to the order of Dunham Trust Company, Trustee of the Balgrosky Hinshaw Children's Trust, or the lawful holder of this Note (the "Holder"), without grace, deduction, offset, extension, credit, notice or demand, at the address set forth below, or at such other place or to such other party as the Holder may from time to time designate in writing, the principal sum of Three Million ($3,000,000). This Note shall bear interest at the rate of Eight Percent (8%) to Borrower per annum upon the principal amount outstanding from time to time until the first anniversary of the date of this Note whereupon this Note shall bear interest at the rate of Twelve Percent (12%) per annum upon the principal amount outstanding from time to time. Interest only payments shall be payable, in arrears, on the first day of each calendar month beginning January 1, 2014, without notice, grace, demand, deduction or offset, until the Maturity Date, as that term is defined below, on which date, the principal amount hereof, together with all accrued and unpaid interest and other charges payable hereunder, shall be all due and payable.

The interest rate on this Note shall be computed on the basis of a 360-day year, based on the number of days actually elapsed. Payments for any month which is not a full calendar month shall be prorated on the basis of a thirty (30) day month, based on the actual number of days elapsed. All payments under this Note shall be paid electronically via a wire transfer of immediately available funds to an account designated by the Holder.

Holder and Borrower acknowledge and agree that the proceeds advanced by Holder to Borrower hereunder shall only be used by Borrower as set forth on Schedule 1, attached hereto.

This Note shall mature on the first to occur of (a) the transfer, sale, conveyance or assignment of the Property (as defined below) or the Substitute Property (as defined below), unless such Property or Substitute Property is replaced with a Substitute Property in accordance with the provisions of this Note, or (b) December 31, 2018 (the "Maturity Date"). On the Maturity Date, the balance of the outstanding principal sum of this Note, together with any and all accrued but unpaid interest and other charges payable under this Note shall all be due and payable. After the Maturity Date, all amounts owing under this Note are due on demand. All installments of principal and interest of this Note, and other amounts paid or due hereunder, shall be payable in lawful money of the United States of America, in immediately available funds, to the Holder via a wire transfer of immediately available funds to an account designated by Holder, or such other place(s) as the Holder may designate in writing to Borrower from time to time. Each payment hereunder shall, when made, be credited first to any late charges and other expenses then payable to Holder, then to interest, and the remainder to principal.

EXHIBIT A

-1-

The occurrence of any of the following events shall constitute an “Event of Default” hereunder: (a) Borrower's failure to pay any installment of interest, principal or other charges when due hereunder (whether by scheduled maturity, acceleration, demand or otherwise) and such breach is not cured within thirty (30) days; (b) Borrower's failure to perform or comply with any of the terms, conditions, covenants or agreements contained herein or in the other Loan Documents (as defined below) and such breach or failure is not cured within thirty (30) days of the date of such failure; (c) any warranty, representation or statement made in this Note or in the other Loan Documents by the Borrower proves to be false or incorrect in any material respects, and such breach is not cured (to the extent it is capable of being cured) within thirty (30) days of the date of such breach or failure; (d) (i) a proceeding under any bankruptcy, reorganization, arrangement of debt, insolvency, readjustment of debt or receivership law or statute is filed by or against the Borrower; (ii) the Borrower makes an assignment for the benefit of creditors or takes any action to authorize any of the foregoing; or, (iii) in the case of an involuntary proceeding filed against the Borrower, such proceedings not discharged or dismissed within 60 days; or (e) the Borrower voluntarily or involuntarily dissolved or the Borrower is dissolved or becomes insolvent or fails generally to pay its debts as they become due. Upon the occurrence of any Event of Default and, at the option of the Holder hereof, the entire debt then remaining unpaid shall at once become due and payable without presentment, demand, protest or further notice of any kind; provided, however, that if an Event of Default described in clause (d) or (e) of such definition exists or occurs, all of the amounts owing with respect to this Note automatically, without notice of any kind, shall become immediately due and payable. During the period commencing upon the occurrence of any such Event of Default and continuing until such Event of Default is cured, but without limiting or waiving, in any way, Borrower's liability resulting from such Event of Default, and without limiting any rights or remedies of Holder under this Note, the other Loan Documents, or at law or equity, any and all delinquent amounts shall be added to the principal balance hereunder and shall bear interest at the rate set forth in this Note. In addition, upon any Event of Default, the interest rate hereunder on the principal amount hereof shall automatically increase to an interest rate of Fifteen Percent (15%) per annum. Any references in this Note or in any of the other Loan Documents to the "rate set forth in the Note" or similar designation shall be deemed to include such increased interest rate. In addition, such increased interest rate shall take effect and continue irrespective of any bankruptcy or similar action affecting Borrower and irrespective of the commencement or continuation of any legal proceedings (including judicial and/or non-judicial foreclosure proceedings) by Holder.

Borrower recognizes that default by Borrower in making any payment herein agreed to be paid when due will result in the Holder incurring additional expenses in servicing the loan, in loss to the Holder of the use of the money due and in frustration to the Holder in meeting its other financial and loan commitments. Borrower agrees that, if for any reason Borrower fails to pay any amounts due under this Note or under the other Loan Documents when due, Holder shall be entitled to compensation for the detriment caused thereby, but that it is extremely difficult and impractical to ascertain the amount of such compensation. Borrower therefore agrees that a sum equal to Two Percent (2.0%) of each payment of principal, interest, or other amounts to be paid hereunder which becomes delinquent is a reasonable estimate of said compensation to the Holder of this Note, which sum Borrower agrees to pay upon the earlier of (a) ten (10) days after the date that the applicable missed payment was due and payable to Holder, or (b) on demand of the Holder. This clause is not intended to limit Borrower's liability resulting from its Event of Default in any way, or Holder's rights or remedies with respect to such Event of Default, but is intended solely to compensate Holder in the event of Borrower's delay in making any payment due hereunder.

EXHIBIT A

-2-

The Borrower and endorsers severally waive presentment, protest and demand, notice of protest, demand and of dishonor and nonpayment of this Note, and expressly agree that this Note, or any payment hereunder, may be extended from time to time without in any way affecting the liability of the Borrower and endorsers hereof.

The payment of this Note and all interest and other charges thereon, whether now or hereafter owing, arising, due or payable, is secured by a first priority lien on certain real property and improvements thereon commonly referred to by Borrower and Holder as the San Jacinto Property (collectively, the “Property”) pursuant to that certain Deed of Trust, Assignment of Rents and Security Agreement and Fixture Filing (the “Deed of Trust”), executed by Borrower in favor of Holder on or about even date hereof. For purposes hereof, this Note, the Deed of Trust and the Guaranty (defined below) shall be collectively referred to as the "Loan Documents". Holder shall have the right, at Borrower’s sole cost and expense, to obtain from First American Title Insurance Company, a lender’s policy of title insurance insuring first priority of the lien created by the Deed of Trust. In the event Borrower desires to refinance or sell the Property, it shall have the right to do so, and upon request of Borrower, Holder shall release the Property from the lien of the Deed of Trust on the condition that either (a) this Note is paid in full in connection with such transaction, or (b) Borrower grants to Holder a first lien on substitute real property to secure repayment of the Note (the “Substitute Property”). The lien against the Substitute Property shall be evidenced by a deed of trust securing repayment of the Note in substantially the form as the original Deed of Trust. The Substitute Property shall be acceptable to Holder in its reasonable discretion; provided, however, that Borrower may, without Holder’s consent, elect to replace the Property with a Substitute Property that is a property being contributed to Borrower pursuant to that certain Contribution Agreement and Joint Escrow Instructions, dated December 30, 2013, by and between D&A Daily Mortgage Fund III, L.P., D&A Semi-Annual Mortgage Fund III, L.P., D&A Intermediate-Term Mortgage Fund III, L.P., American Spectrum Realty, Inc., American Spectrum Realty Operating Partnership, L.P. and American Spectrum Dunham Properties (the “Contribution Agreement”) on the only condition that that the Project Allocation Amount (as such term is defined in the Contribution Agreement) of such Substitute Property equals or exceeds the Project Allocation Amount of the Property. Borrower shall give Holder written notice at least five (5) business days prior to the sale of any Property or Substitute Property, which notice shall include any request or decision (as the case may be) to replace such property with a Substitute Property in accordance with the terms hereof. Holder shall have the right, at the cost of Borrower, to obtain from First American Title Insurance Company, a lender’s policy of title insurance insuring the priority of the lien created by such replacement Deed of Trust.

If the Borrower sells (a) the Property or (b) a Substitute Property which is a property contributed to the Borrower pursuant to the Contribution Agreement (either, a "Released Property"), and in connection with such transaction, the Released Property is replaced with a Substitute Property, then for purposes of calculating the "Sale Payment" under the Contribution Agreement, the amount owing under this Note shall not be included in calculating the aggregate indebtedness repaid in connection with the sale of such Released Property.

EXHIBIT A

-3-

The Borrower promises to pay all attorneys' fees and costs and/or other fees, costs and charges relating thereto (including, without limitation, trustees', accountants', and appraisers' fees and expenses) incurred by the Holder hereof in connection with the interpretation, collection or enforcement of the Loan Documents (whether or not legal proceedings are brought by Holder), and/or the protection of the security under the Deed of Trust, including, without limitation any such fees and expenses incurred by Holder in connection with, related to, or arising out of any judicial or non-judicial foreclosure proceedings.

If fulfillment of any provision hereof or of the other Loan Documents shall be deemed by a court of competent and final jurisdiction to violate any applicable usury restrictions, then, ipso facto, the obligation to be fulfilled shall be reduced to the limit of such validity, and any amount received in excess of such limit shall be applied to reduce the unpaid principal balance hereof and not to the payment of interest, it being understood that in no event shall interest or any other amount paid or agreed to be paid to Holder for the use, forbearance or detention of money to be advanced hereunder or pursuant to the other Loan Documents exceed the highest lawful rate permissible under applicable usury laws.

The obligations of Borrower under this Note and the Deed of Trust shall be guaranteed by American Spectrum Realty, Inc., pursuant to a separate Guaranty to be entered into concurrently herewith (the “Guaranty”).

The Borrower hereby represents and warrants to Holder as follows:

(i) Borrower is duly formed and validly existing under the laws of its organization and has the requisite power and authority to carry out its businesses now being conducted and is duly qualified or licensed in each state in which it conducts business and is in good standing in such state to the extent required by law;

(ii) Borrower has the legal power, right and authority to enter into Note and to consummate the transactions contemplated by Note;

(iii) All requisite action has been taken by Borrower in connection with (a) the entering into of this Note, (b) the performance of its obligations under Note, and (c) the consummation of the transactions contemplated by this Note. No other consent of any member, partner, shareholder, creditor, investor, judicial or administrative body, governmental authority or other person is required in connection therewith;

(iv) The individuals executing this Note on behalf of Borrower have the legal power, right and actual authority to bind the Borrower to the terms and conditions of this Note;

(v) The Loan Documents are and shall be the valid, legally binding obligation of and enforceable against Borrower in accordance with their terms subject only to applicable bankruptcy, insolvency, reorganization, moratorium laws or similar laws or equitable principles affecting or limiting the rights of contracting parties generally;

EXHIBIT A

-4-

(vi) Neither the execution and delivery of this Note nor the incurrence of the obligations set forth herein, nor compliance with the terms of this Note conflict with or result in the material breach of any terms, conditions or provisions of or constitute a default under any bond, note or other evidence of indebtedness or any contract, indenture, mortgage, deed of trust, loan, partnership agreement, lease or other agreements or instruments to which Borrower is a party; and

(vii) The Borrower is and, upon the incurrence of the obligations set forth herein, will be, solvent. For purposes hereof, “solvent” means (a) that the value of the assets of the Borrower (both at fair value and present fair saleable value) is greater than the total amount of liabilities (including contingent and unliquidated liabilities) of the Borrower, (b) that the Borrower is able to pay its liabilities as such liabilities mature, and (c) that the Borrower does not have unreasonably small capital.

The Borrower covenants and agrees that so long as any of the obligations set forth herein remain outstanding:

(i) the Borrower will give notice to the Holder of the following: (a) any and all Events of Default as soon as practicable (but in any event not more than five (5) days after the Borrower obtains knowledge of the occurrence of an event or the existence of a circumstance giving rise to any Event of Default), or (b) with reasonable promptness, such other business or financial data as the Holder may reasonably request;

(ii) the Borrower will at all times preserve and keep in full force and effects it existence in its jurisdiction of organization and all rights and franchises material to its business;

(iii) the Borrower shall comply with the requirements of all applicable laws, rules, regulations and orders of any government authority (including all environmental laws), noncompliance with which could reasonably be expected to result in, individually or in the aggregate, a material adverse effect on the business or financial condition of Borrower;

(iv) the Borrower will maintain or cause to be maintained, with financially sound and reputable insurers, such insurance as may customarily be carried or maintained under similar circumstances by persons of established reputation of similar size engaged in similar businesses; and

(v) the Borrower will continue to be engaged in the businesses engaged in by the Borrower on the date hereof.

This Note (a) remains in full force and effect until payment in full of the obligations owing hereunder, (b) is binding upon Borrower, its respective permitted successors and assigns, and (c) inures to the benefit of and in enforceable by the Holder and it successors, transferees and assigns. Borrower acknowledges and agrees that Holder has the right to transfer, assign or hypothecate all or any part of the Note, and/or the other Loan Documents, to sell participations therein (provided, however, that such transfer, assignment, hypothecation or participation shall be at no expense to Borrower). Borrower agrees that it shall cooperate fully with Holder in connection with this paragraph and shall execute, and where appropriate, acknowledge, such documents as Holder may require in connection therewith. The Borrower may not voluntarily assign or transfer its rights under this Note without the Holder’s prior written consent.

EXHIBIT A

-5-

No single or partial exercise of any power granted to Holder under this Note or the other Loan Documents or any other agreement shall preclude any other or further exercise thereof or the exercise of any other power. No delay or omission on the part of Holder in exercising any right under this Note or the other Loan Documents shall operate as a waiver of such right or any other right.

Holder shall have the full right, but not the obligation, to cure any default under, or to acquire, pay down, pay off or otherwise satisfy, any lien, encumbrance, security interest or claim which affects or may affect the Property, or any part thereof or interest therein (whether or not prior to the Deed of Trust), and if Holder pays or satisfies any such lien, encumbrance, security interest or claim or makes any payment or cures any default thereunder, or makes any other advance hereunder or under the Deed of Trust, Holder may add any amounts so paid to the amounts secured by the Deed of Trust, and any and all such amounts shall be paid by Borrower to Holder upon demand, shall bear interest at the same rate specified to be paid on outstanding indebtedness under this Note, until paid, and all such amounts shall be secured by the Deed of Trust until paid.

Borrower represents and warrants for the benefit of Holder that it does not intend to use the proceeds of the Note for personal, family or household purposes. Borrower further represents for the benefit and reliance of Holder that the proceeds of this Note will be solely used for a business or commercial enterprise.

If "Borrower" consists of more than one person or entity, each and every such person and/or entity shall be jointly and severally liable with respect to all obligations of "Borrower" under this Note.

EACH PARTY HEREBY WAIVES THE RIGHT TO TRIAL BY JURY IN ANY ACTION, CLAIM, LAWSUIT OR PROCEEDING BASED UPON, ARISING OUT OF, OR IN ANY WAY RELATING TO: (i) THE NOTE OR ANY SUPPLEMENT OR AMENDMENT THERETO; OR (ii) ANY OTHER PRESENT OR FUTURE INSTRUMENT OR AGREEMENT BETWEEN ANY OF THE PARTIES HERETO; (iii) ANY BREACH, CONDUCT, ACTS OR OMISSIONS OF ANY OF THE PARTIES HERETO OR ANY OF THEIR RESPECTIVE DIRECTORS, OFFICERS, EMPLOYEES, AGENTS, ATTORNEYS OR ANY OTHER PERSON AFFILIATED WITH OR REPRESENTING ANY OF THE PARTIES HERETO; IN EACH OF THE FOREGOING CASES, WHETHER SOUNDING IN CONTRACT OR TORT OR OTHERWISE.

This Note shall be governed by and construed in accordance with the laws of the State of California.

Borrower hereby irrevocably submits to the jurisdiction of any California court, or federal court sitting in San Diego County, over any suit, action or proceeding arising out of or relating to this Note or the Loan Documents; and Borrower consents to San Diego County as the venue for any such suit, action or proceeding and irrevocably waives to the fullest extent permitted by law, any objection to such venue as being an inconvenient forum.

EXHIBIT A

-6-

Any notice, request, or other communication required or permitted under this Note must be in writing and will be deemed to have been duly given (except as otherwise specifically provided in this Note) (i) when received if personally delivered, (ii) within five days after being sent by registered or certified mail, return receipt requested, postage prepaid, (iii) upon receipt after being sent by facsimile, with confirmed answer back or (iv) within one business day of being sent by priority delivery by established overnight courier to the parties at their respective addresses set forth as follows:

If to Borrower:

American Spectrum Dunham Properties

2401 Fountain View, Suite 750

Houston, TX 77057

Attn: William J. Carden

Tel: (713) 706-6200

Fax: (713) 706-6201

If to Holder:

Dunham Trust Company

241 Ridge Street, Suite 100

Reno, NV 89501

Attn: Shanna Coressel

Tel: (775) 826-7900

Fax: (775) 826-7904

This Note and the Deed of Trust represent the entire agreement of the parties with regard to the subject matter of this Note and the terms of any letters and other documentation entered into between the Borrower and the Holder prior to the execution of this Note which relate to loans to be made by Holder to Borrower shall be replaced by the terms of this Note and the Deed of Trust. This Note is in all respects a continuing agreement and remains in full force and effect until the obligations have been paid in full.

None of the terms or provisions of this Note may be waived, altered, modified or amended except as the Holder may agree in writing.

BORROWER:

| AMERICAN SPECTRUM DUNHAM PROPERTIES LLC | ||

| By: | ||

| Name: | William J. Carden | |

| Title: | President | |

EXHIBIT A

-7-

EXHIBIT B

USE OF PROCEEDS

EXHIBIT B

-1-

EXHIBIT C

FORM OF DEED OF TRUST

RECORDING REQUESTED BY

AND WHEN RECORDED, MAIL TO:

Dunham Trust Company

241 Ridge Street, Suite 100

Reno, Nevada 89501

|

APN:

|

436-040-001-0 (Affects Parcel A), 436-040-002-1 (Affects Parcel C) and 436-040-005-4 (Affects Parcel B).

|

DEED OF TRUST, ASSIGNMENT OF RENTS,

SECURITY AGREEMENT AND FIXTURE FILING

(Tranche 1)

This Deed of Trust, Assignment of Rents, Security Agreement and Fixture Filing ("Deed of Trust") is made to be effective as of December __, 2013, by American Spectrum Dunham Properties LLC, a Delaware limited liability company, ("Trustor"), whose address is 2401 Fountainview, Suite 750, Houston, TX 77057, to Asset Managers, Inc., a California corporation ("Trustee"), for the benefit of Dunham Trust Company, Trustee of the Balgrosky Hinshaw Children's Trust, as Beneficiary (including its assignees, "Lender").

THIS DEED OF TRUST ALSO CONSTITUTES A FIXTURE FILING UNDER DIVISION 9 OF THE CALIFORNIA UNIFORM COMMERCIAL CODE AND COVERS GOODS WHICH ARE OR ARE TO BECOME FIXTURES ON THE REAL PROPERTY DESCRIBED ON EXHIBIT "A" ATTACHED HERETO AND MADE A PART HEREOF. TRUSTOR IS A RECORD OWNER OF AN INTEREST IN SAID REAL PROPERTY.

GRANT IN TRUST:

Trustor irrevocably grants, transfers and assigns to Trustee, in trust, for the benefit of Lender, with power of sale, all of Trustor's interest in that certain real property located in the County of Riverside, California, described as:

[SEE EXHIBIT "A" ATTACHED HERETO AND

INCORPORATED HEREIN BY THIS REFERENCE]

TOGETHER WITH: All right, title and interest which Trustor now has or may later acquire in such real property and all appurtenances, easements, covenants, rights of way, tenements, hereditaments and appurtenances thereunto belonging or in any way appertaining thereto now or hereafter, and all of the estate, right, title, interest, claim, demand, reversion or remainder whatsoever of Trustor therein or thereto, at law or in equity, now or hereafter in possession or expectancy, including, without limitation, all mineral, oil, and gas rights and royalties and profits therefrom, all water and water rights and shares of stock pertaining to water and water rights, and all sewers, pipes, conduits, wires and other facilities furnishing utility or services to the real property (collectively, the "Land");

TOGETHER WITH: All right, title and interest which Trustor now has or may later acquire in and to all buildings, structures and improvements now or hereafter erected on the Land, including, without limitation, all plant equipment, apparatus, machinery and fixtures of every kind and nature whatsoever now or hereafter located on and affixed to said buildings, structures and improvements (collectively, the "Improvements"; the Land and Improvements being hereinafter sometimes collectively referred to as the "Premises");

TOGETHER WITH: All right, title and interest which Trustor now has or may later acquire in and to the land lying in the bed of any street, road, highway or avenue now or hereafter in front of or adjoining the Premises;

TOGETHER WITH: All right, title and interest which Trustor now has or may later acquire in any and all awards heretofore or hereafter made by any governmental authorities (federal, state, local or otherwise) to Trustor and all subsequent owners of the Property (as defined below) which may be made with respect to the Property as a result of the exercise of the right of eminent domain, the alteration of the grade of any street or any other injury to or decrease of value of the Premises, which said award or awards are hereby assigned to Lender;

TOGETHER WITH: All right, title and interest which Trustor now has or may later acquire in any and all unearned premiums accrued, accruing or to accrue, and the proceeds of insurance now or hereafter in effect with respect to all or any portion of the Property;

TOGETHER WITH: Any and all claims or demands which Trustor now has or may hereafter acquire against anyone with respect to any damage to all or any portion of the Property;

TOGETHER WITH: All right, title and interest which Trustor now has or may later acquire in any and all claims under and proceeds of any insurance policies by reason of or related to a loss of any kind sustained to the Property, now or hereafter, whether or not such policies name Lender as an insured and whether or not such policies are required by Lender, and whether or not such claims thereunder are characterized as personal claims;

TOGETHER WITH: All right, title and interest which Trustor now has or may later acquire in any and all instruments, investment property, deposit accounts, accounts, contract rights, general intangibles, and other intangible property and rights now or hereafter relating to the foregoing property, or the operation thereof or used in connection therewith, including, without limitation, all options, letters of intent, and rights of first refusal of any nature whatsoever, covering all or any portion of such property, together with any modifications thereof, and deposits or other payments made in connection therewith, existing and future development rights, permits and approvals, air rights, density bonus rights, and transferable development rights; all of Trustor's right, title, and interest in and to any awards, remunerations, settlements, or compensation heretofore made or hereafter made by any and all courts, boards, agencies, commissions, offices, or authorities, of any nature whatsoever for any governmental unit (federal, state, local or otherwise) to the present or any subsequent owner of the foregoing property, including those for any vacation of, or change of grade in, any streets affecting the foregoing property and all licenses and privileges obtained by Trustor from non-governmental sources;

-2-

TOGETHER WITH: All right, title and interest which Trustor now has or may later acquire in any and all leases of the Premises, Fixtures (as defined below), or any part thereof, now or hereafter entered into and all right, title and interest of Trustor thereunder, including, without limitation, cash or securities deposited thereunder to secure performance by the lessees of their obligations thereunder (whether such cash or securities are to be held until the expiration of the terms of such leases or applied to one or more of the installments of rent coming due immediately prior to the expiration of such terms); all other rights and easements of Trustor now or hereafter existing pertaining to the use and enjoyment of the Premises; and all right, title and interest of Trustor in and to all declarations of covenants, conditions and restrictions as may affect or otherwise relate to the Property;

TOGETHER WITH: All right, title and interest which Trustor now has or may later acquire in any and all permits, plans, licenses, specifications, subdivision rights, security interests, contracts, contract rights, public utility deposits, prepaid sewer and water hook-up charges, or other rights as may affect or otherwise relate to the Property;

TOGETHER WITH: All right, title and interest which Trustor now has or may later acquire in any and all rents, income, issues and profits (subject, however, to the rights given in this Deed of Trust to Lender to collect and apply same), including, without limitation, prepaid municipal and utility fees, bonds, revenues, income, and other benefits to which Trustor may now or hereafter be entitled to, or which are derived from, the Property or any portion thereof or interest therein.

The foregoing listing is intended only to be descriptive of the property encumbered hereby, and not exclusive or all inclusive. It is the intent of Trustor to encumber hereby all real property located or to be located upon the above-described real property in which Trustor now has or may later acquire an interest. Said real property (or the leasehold estate if this Deed of Trust encumbers a leasehold estate), Premises, buildings, Improvements, appurtenances, Fixtures, additions, accretions, and other property are hereinafter referred to as the "Property." As used herein, the term "Fixtures" shall include all articles of personal property hereinabove described (in which Trustor now has or may later acquire an interest), now or hereafter affixed to the Property, but shall not include trade fixtures. As used herein, the term "Property" shall include all affixed furniture, furnishings, equipment, machinery, goods, contract rights, general intangibles, revenues, equipment leases, vehicles, money, deposit accounts, instruments, accounts, chattel paper and other personal property (in which Trustor now has or may later acquire an interest) of any kind or character now existing or hereafter arising or acquired in connection with Trustor's business operations at the Property, and all products and proceeds thereof.

Trustor makes the foregoing grant to Trustee, and to Lender, as applicable, to hold the Property in trust for the benefit of Lender and for the purposes and upon the terms and conditions hereinafter set forth.

-3-

FOR THE PURPOSE OF SECURING:

(1) Payment of the sum of Three Million ($3,000,000), together with interest thereon and certain additional costs and expenses related to or incurred in connection with or as provided in that certain Secured Promissory Note of even date herewith (the "Note"), executed by Trustor payable to Lender, or order, and all extensions, modifications or renewals thereof (including, without limitation, any extension, modification, or renewal of the Note at a different rate of interest or on different terms);

(2) Payment of all other sums, with interest, advanced, paid, or incurred by Lender or Trustee under the terms of this Deed of Trust to protect the Property or Lender's security interest therein;

(3) Payment of such additional sums, with interest, as the then record owner of the Property may later borrow from Lender, in those instances in which the later obligations are evidenced by a promissory note or notes reciting that it or they are so secured (which additional obligations shall be referred to as "future advances" in this Deed of Trust); and

TRUSTOR AND LENDER AGREE AS FOLLOWS:

RIGHTS AND DUTIES OF THE PARTIES:

PAYMENT AND PERFORMANCE BY TRUSTOR; TITLE: Trustor represents and warrants to and for the benefit of Lender and Trustee that Trustor holds good and marketable title of record to the Land and Improvements in fee simple. Trustor shall promptly: (a) pay when due all sums payable under the Note and all future advances; and (b) perform each and every term, covenant and condition of this Deed of Trust and any other obligation secured by this Deed of Trust.

PAYMENT BY TRUSTOR OF TAXES AND OTHER IMPOSITIONS: The term "Taxes" shall mean all taxes, bonds and assessments, both general and special, affecting or levied upon the Property or any part thereof, assessments on water company stock, if any, all taxes or excises levied or assessed against Trustor, the Property, or any part thereof, in addition to or as a substitution in whole or in part for any real estate taxes or assessments, all taxes or excises measured by or based in whole or in part upon the rents, operating income, or any other factor relating to the Property, or any part thereof, and all license fees, taxes and excises imposed upon Lender (but not any federal or state income taxes imposed upon Lender) and measured by or based in whole or in part upon the obligations secured hereby. The term "Other Impositions" shall mean any fine, fee, charge, or other imposition in connection with the Property or Trustor, payment of which Lender shall deem to be necessary to protect, preserve, and defend Lender's interests hereunder. Trustor shall pay all Taxes, insurance premiums, and Other Impositions attributable to the Property, at least five (5) days before delinquency directly to the payee thereof, or in such other manner as Lender may designate in writing. Trustor shall promptly furnish to Lender all notices of amounts due under this Paragraph, and if Trustor shall make payment directly, Trustor shall furnish to Lender receipts evidencing payments of Taxes before delinquency and shall promptly deliver to Lender receipts evidencing all other payments above required.

-4-

In the event of the passage, after the date of this Deed of Trust, of any law or judicial decision deducting from the value of the Property for the purposes of taxation any lien thereon, or changing in any way the laws now in force for the taxation of deeds of trust or obligations secured by deeds of trust, or the manner of operation of any such Taxes so as to adversely affect the interest of Lender, or imposing payment of the whole or any portion of any Taxes upon Lender, then and in such event, Trustor shall bear and pay the full amount of such Taxes; provided that if for any reason payment by Trustor of any such new or additional Taxes would be unlawful or if the payment thereof would constitute usury or render the Note, or other indebtedness secured hereby, wholly or partially usurious under any of the terms or provisions of the Note, or this Deed of Trust, or otherwise, Lender may, at its option, upon thirty (30) days' written notice to Trustor, or (i) pay that amount or portion of such Taxes as render the Note, or other indebtedness secured hereby, unlawful or usurious, in which event Trustor shall concurrently therewith pay the remaining lawful nonusurious portion or balance of such Taxes, or (ii) in the event that Lender is prohibited from collecting such payment as provided in (i) declare the whole indebtedness secured by this Deed of Trust, together with accrued interest thereon, to be immediately due and payable.

TRUSTOR TO PAY GROUND RENTS AND OBLIGATIONS THAT COULD RESULT IN LIENS ON THE PROPERTY: Trustor shall fully and faithfully pay and perform each and every obligation, and otherwise satisfy all conditions and covenants, which are or may be secured by any deed of trust upon the Property, or any portion thereof, existing of record as of the date this Deed of Trust is recorded. Trustor shall pay at or prior to the due date, or, if applicable, at maturity, any and all ground rents and any liens, charges and encumbrances that are, later become, claim to be or appear to Lender to be prior or superior to the lien of this Deed of Trust, including, without limiting the generality of the foregoing, any and all claims for (a) work or labor performed, (b) materials and services supplied in connection with any work of demolition, alteration, improvement of or construction upon the Property, and (c) fees, charges and liens for utilities provided to the Property.

TRUSTOR TO MAINTAIN INSURANCE: (a) Trustor shall maintain insurance covering the Property against loss or damage by fire, and other risks as shall from time to time be reasonably required by Lender as necessary to protect the security interest of Lender in the Property. The insurance shall be maintained with such companies, in such amounts, for such terms, and in form and content satisfactory to Lender, in Lender's reasonable opinion and judgment. Lender shall be named as loss payee and mortgagee/additional insured, if possible, under all of the insurance policies, and Trustor shall assure that Lender receive a certificate from each insurance company that acknowledges Lender's position as loss payee and that states that the insurance policy cannot be terminated as to Lender except upon thirty (30) days' prior written notice to Lender. Such policies of insurance shall include, without limitation, the following: (i) insurance against loss or damage to the Property (including contents) by fire or other risk embraced by coverage of the type known as the broad form or extended coverage (or special extended coverage) in the amount required by Lender, but in no event less than one hundred percent (100%) of the full replacement cost of the Improvements and Fixtures included within the Property without deduction for depreciation of any kind or the unpaid balance of the Note, whichever is greater, (ii) insurance against the loss of rental value of the Property on a "rented or vacant basis," including business interruption insurance, arising out of the perils insured against pursuant to clause (i) above in the amount not less than one (1) year's gross rental income and other revenues from the Property, and (iii) commercial general liability insurance against claims for personal injury, death, or property damage occurring on, in, or about the Property, or arising from or connected with the use, conduct, or operation of Trustor's business in the amount from time to time reasonably required by Lender; (b) If such insurance, together with written evidence of the premium having been paid, are not delivered to Lender at least five (5) days prior to the expiration of such insurance, Lender shall have the right, but without obligation to do so, without notice to or demand upon Trustor and without releasing Trustor from any obligation under this Deed of Trust, to obtain such insurance or like insurance through or from any insurance agency or company acceptable to it, pay the premium for such insurance, and add the amount of the premium to the loan secured by this Deed of Trust, and this amount shall bear interest at the applicable rate of interest set forth in the Note. Neither the Trustee nor Lender shall be responsible for such insurance or for the collection of any insurance monies, or for any insolvency of any insurer or insurance underwriter. (c) In the event that the Property is sold to Lender at any trustee's sale under this Deed of Trust (see Paragraph 17, below), Trustor hereby assigns to Lender all unearned premiums on all policies of insurance covering the Property and agrees that any and all unexpired insurance covering the Property shall inure to the benefit of and pass to Lender at the time of such Trustee's sale.

-5-

INSURANCE PROCEEDS, CONDEMNATION PROCEEDS AND OTHER RECOVERIES: (a) All settlements, awards, damages and proceeds received by Trustor or any other person under any fire, earthquake or other hazard insurance policy, for losses existing as of or occurring after the effective date of this Deed of Trust, or in connection with any condemnation for public use of or injury to the Property (or any part of or interest in the Property) are assigned to Lender and may, at the option of Lender, be applied by Lender as provided in section (c) of this Paragraph 5. (b) All right, title and interest which Trustor now has or may later acquire in and to all causes of action, whether accrued before or after the date of this Deed of Trust, of any type for any damage or injury to the Property (or any portion of or interest in the Property), or adversely affecting the value of the Property (or any portion of or interest in the Property), including causes of action arising in tort or contract and causes of action in fraud or concealment of a material fact, are assigned to Lender, and the proceeds of any such causes of action may, at the option of Lender, be applied by Lender as provided in section (c) of this Paragraph 5. Subsequent to a default hereunder, which is not remedied during any applicable cure period, Lender may, at its option, appear in and prosecute in its own name any action or proceeding to enforce any such cause of action and may make any compromise or settlement of any such action or proceeding. Trustor agrees to execute such further assignments of any settlements, awards, damages and causes of action as Lender from time to time may reasonably request. (c) Subject to the further provisions of this Paragraph 5, settlements, awards, proceeds and damages (collectively, "Awards") received by Lender under the provisions of section (a) and section (b) of this Paragraph 5, at the option of Lender, may (i) be applied by Lender to the outstanding balance due on the Note, or any other obligation secured by this Deed of Trust, in such order as Lender may determine; (ii) be used by Lender, without reducing the principal balance of the Note or any other obligation secured by this Deed of Trust, to replace, restore or reconstruct the Property to its condition just prior to the loss, as determined by Lender; or (iii) any such amount may be divided in any manner among any such application, use or release. No such application, use or release of the Award shall cure or waive any default or invalidate any act done pursuant to any notice of such default, except to the extent such default is actually cured.

-6-

Trustor agrees to endorse in favor of Lender any Award which is made payable to Trustor or to Lender and Trustor and deliver same to Lender immediately upon receipt. Notwithstanding anything herein to the contrary, the amount collected under any fire or other insurance policy may be applied by Lender, first, to reimbursement of all costs of collection of the proceeds. Thereafter, the proceeds shall be applied to repair, replace, restore or construct the Property (hereafter collectively referred to as "Repair") to its physical condition immediately prior to the act or occurrence that caused the loss, damage or destruction, as the case may be, but only if (a) no default has occurred hereunder and is continuing and (b) the insurance proceeds (together with such additional funds as are required to be paid by Trustor pursuant to this Paragraph), are sufficient for the Repair. Otherwise, at the election of Lender, in Lender's reasonable opinion and judgment, the proceeds may be applied to reduce the principal balance of the Note or any obligation secured hereby in such order as Lender may determine, whether or not then due, unless such application is prohibited by applicable law, or be released to Trustor. Such application or release shall not cure or waive any default, except to the extent such default is actually cured, invalidate any act done pursuant to any notice of such default or extend due dates of payments or modify any obligations of Trustor.

Should insurance proceeds be used for Repair, Lender may condition such application upon (a) evidence satisfactory to Lender, in Lender's discretion, that Trustor has sufficient additional funds on hand from its own financial resources as Lender reasonably determines are necessary to pay all costs of Repair; (b) delivery of plans and specifications, executed construction contracts, and cost breakdowns satisfactory to Lender, in its reasonable opinion and judgment; (c) establishment of a procedure satisfactory to Lender for lien waivers and disbursement of funds, disbursement being conditioned upon Lender having sufficient proceeds to pay the cost of Repair free of liens; and (d) evidence acceptable to Lender that the Property after completion will be in at least the same condition as existed prior to the damage, destruction or loss, as the case may be, and that there has been no material adverse change in the financial condition of Trustor since the date of this Deed of Trust. In the event Trustor does not comply with the foregoing conditions within sixty (60) days of the casualty, Lender may, at its option, use the proceeds to reduce the principal balance of the Note or pay any other obligation secured by this Deed of Trust.

Trustor shall: (i) keep the Property, and every portion thereof, in good condition and repair and replace from time to time, or at any time, any Fixtures, or other items comprising the Property which may become obsolete or worn out, with Fixtures, or other items of at least the same utility, quality and value, each such replacement to be free of any liens or security interests of any kind or character other than the lien of this Deed of Trust, or any other document or instrument securing the indebtedness hereunder; (ii) not remove or demolish the Property, or any part thereof, except as part of alterations to the Property permitted hereunder; (iii) complete or restore promptly and in good and workmanlike manner the Property, or any part thereof, which may be damaged or destroyed; (iv) comply with and not suffer violations of (A) any and all laws, ordinances, rules, regulations, standards and orders, including, without limitation, making any alterations or additions required to be made to, or safety appliances and devices required to be installed or maintained in or about, the Property, or any portion thereof, under any such laws, ordinances, rules, regulations, standards or orders now or hereafter adopted, enacted or made applicable to the Property, or any portion thereof, and payment of any fees, charges or assessments arising out of or in any way related to treatment of the Property, or any portion thereof, as a source of air pollution, traffic, storm water runoff, or other adverse environmental impacts or effects, and (B) any and all covenants, conditions, restrictions, equitable servitudes and easements, whether public or private, of every kind and character, and (C) any and all requirements of insurance companies and any bureau or agency which establishes standards of insurability, which laws, covenants or requirements affect the Property and/or pertain to acts committed or conditions existing thereon, or the use, management, operation or occupancy thereof by Trustor and anyone holding under Trustor, including (but without limitation) such work of alteration, improvement or demolition as such laws, covenants or requirements mandate; (v) not commit or permit waste of the Property, or any portion thereof; (vi) do all other acts which from the character or use of the Property may be reasonably necessary to maintain, preserve and enhance its value, including, without limitation, keeping all plants, lawns and other landscaping in a good and thriving condition, and otherwise performing such appropriate upkeep and maintenance to the Property to insure that the Property, and each part thereof, is maintained in the manner and retains at all times the same appearance and condition, as exists as of the date of this Deed of Trust, reasonable wear and tear excepted, such upkeep to include, without limitation, appropriate measures to protect wood, stucco and concrete surfaces from weathering, deterioration and aging, and to protect from and immediately remove graffiti or other defacement from such surfaces; (vii) perform all obligations required to be performed in leases or conditional sales or like agreements affecting the Property or the operation, occupation or use thereof (and, if not previously assigned, in the event of default, all right, title and interest of Trustor under any such leases, conditional sales or like agreements shall be automatically assigned to Lender hereunder, together with any deposits made in connection therewith); (viii) make payment of any and all charges, assessments or fees imposed in connection with the delivery, installation or maintenance of any utility services or installations on, to or for the Property, or any portion thereof; (ix) not create any deed of trust, liens or encumbrances upon the Property subsequent hereto, the parties hereby having specifically bargained in contemplation of the fact that any subsequent encumbrance upon the Property would adversely affect Lender's reasonable security interests hereunder; (x) make no further assignment of rents of the Property; and (xi) execute and, where appropriate, acknowledge and deliver such further documents or instruments as Lender or Trustee deem necessary or appropriate to preserve, continue, perfect and enjoy the security provided for herein, including (but without limitation) assignments of Trustor's interest in leases of the Property.

-7-

Trustor shall not undertake or suffer to be made pursuant to section (a) of this Paragraph 6, any material alterations, additions, repairs, expansions, relocations, remodeling or demolition of, or structural or other material changes in, any Improvements or Fixtures comprising the Property that would materially diminish the value of the Property except as permitted pursuant to the written consent of Lender, which consent shall not be unreasonably withheld. All such work shall be performed promptly and in good and workmanlike manner, using first quality materials in conformity with plans and specifications approved in advance by Lender, and shall be diligently prosecuted to completion free of liens and encumbrances, other than this Deed of Trust and any other document or instrument evidencing or securing the indebtedness secured hereby.

Trustor further warrants, represents and covenants to Lender that Trustor will not, permit any lessee or other user of the Property to use, store, manufacture, generate, transport to or from, release or dispose of any toxic substances, hazardous materials, hazardous wastes, radioactive materials, flammable explosives or related materials on or in connection with the Property or the business of said lessee or other user of the Property, except as currently in existence. Without the prior written consent of Lender, Trustor shall not seek, make or consent to any change in the zoning, conditions of use, or any other applicable land use permits, approvals or regulations pertaining to the Property, or any portion thereof, which would constitute a violation of the warranties, representations and covenants herein contained, or would otherwise impair the ability of Trustor to complete construction of any improvements now underway or to be constructed, constituting the Property, or would change the nature of the use or occupancy of the Property. Within five (5) days of (i) any contact from any federal, state, or local governmental agency concerning any environmental protection laws, including, but not limited to, any notice of any proceeding or inquiry with respect to the presence of any hazardous wastes, toxic substances or hazardous materials on the Property or the migration thereof from or to other property, (ii) any and all claims made or threatened by any third party against or relating to the Property concerning any loss or injury resulting from toxic substances, hazardous wastes, or hazardous materials, or (iii) Trustor's discovery of any occurrence or condition on any property adjoining or in the vicinity of the Property that could cause the Property, or any part thereof, to be subject to any restrictions on the ownership, occupancy, transferability, or loss of the Property under any federal, state, or local laws, ordinances, rules, or regulations, Trustor shall deliver to Lender a report regarding such contact and setting forth in detail and describing any action which Trustor proposes to take with respect thereto, signed by Trustor.

-8-

LEGAL ACTIONS AND PAYMENT OF RELATED COSTS: Trustor shall appear in and defend any action or proceeding that may, in Lender's judgment, affect Lender's security interest under this Deed of Trust or any of the rights or powers of Lender or Trustee under this Deed of Trust. Whether or not Trustor so appears or defends, Trustor shall pay all costs and expenses, including, without limitation, cost of evidence of title and reasonable attorneys' fees, that are incurred by Trustor, Lender or Trustee in any such action or proceeding in which Lender or Trustee may appear, by virtue of being made a party defendant or otherwise, and irrespective of whether the interest of Lender or Trustee in the Property is directly questioned by such action or proceeding or whether Lender's rights or interests are otherwise adversely affected thereby, or whether Lender is or shall become a party, including by way of intervention. Trustor promises and agrees to give Lender notice in writing of the pendency of any such action or proceeding promptly, but in any event no later than five (5) days, after Trustor first obtains knowledge of the pendency of such action or proceeding. Trustor shall cooperate with Lender in any action that is brought by Lender to protect its security interest under this Deed of Trust. Trustor will, upon demand by Lender, commence any action or proceeding reasonably required to protect or facilitate Lender's recovery of Awards under Paragraph 5 of this Deed of Trust. If Trustor fails to bring any such action or proceeding, then Lender may, but need not, do so, and Trustor shall pay to Lender all costs, expenses and reasonable attorneys' fees that are incurred by Lender in doing so. Whenever, under this Deed of Trust, or any other document or instrument evidencing or securing the indebtedness secured hereby, Trustor is obligated to appear in and defend Lender or defend or prosecute any action or proceeding, Lender shall have the right of full participation in any such action or proceeding, with counsel of Lender's choice, and all costs and expenses incurred by Lender in connection with such participation (including, without limitation, reasonable attorneys' fees) shall be reimbursed by Trustor to Lender immediately upon demand. In addition, Lender shall have the right to approve any counsel retained by Trustor in connection with the prosecution or defense of any such action or proceeding by Trustor, which approval shall not be unreasonably withheld. All costs or expenses required to be reimbursed by Trustor to Lender hereunder shall, if not paid upon demand by Lender, thereafter bear interest at the applicable rate of interest set forth in the Note. As used herein, "proceeding" shall include litigation (whether by way of complaint, answer, cross-complaint, counter claim or third party claim), arbitration and administrative hearings or proceedings, and shall include commencement of any case or the filing of any petition for relief or other action under any Chapter of the U.S. Bankruptcy Code.

-9-

LENDER'S RIGHTS TO INSPECT THE PROPERTY: Subject to the rights of tenants occupying all or any portion of the Property, Lender and its agents, employees and contractors, may enter upon the Property at any reasonable time to inspect the Property for any purpose relating to Lender's rights and interests under the terms of this Deed of Trust, including, but not limited to, Trustor's compliance with the terms of Paragraph 6.

SUBSTITUTION OF TRUSTEE: From time to time, by an instrument signed and acknowledged by Lender, and recorded in the Office of the Recorder of the County in which the Property is located, Lender may appoint a substitute trustee or trustees in place of the Trustee. Such instrument shall refer to this Deed of Trust and shall set forth the date and instrument number or book and page of its recordation. Upon recordation of such instrument, the Trustee shall be discharged and the new trustee so appointed shall be substituted as Trustee under this Deed of Trust with the same effect as if originally named Trustee in this Deed of Trust. An instrument recorded pursuant to the provisions of this Paragraph 9 shall be conclusive proof of the proper substitution of such new Trustee.

MISCELLANEOUS POWERS OF LENDER AND TRUSTEE: In addition to any other powers granted in this Deed of Trust to the Trustee, from time to time, upon the written request of Lender and upon the presentation of this Deed of Trust and any obligation secured by this Deed of Trust for endorsement, and without affecting any obligation secured by this Deed of Trust or the performance of the obligations set forth in this Deed of Trust, the Trustee may, without liability and without notice to any person: reconvey all or any part of the Property to Trustor, consent to the making of any map or plat of the Property, join in granting any easement on the Property, join in any agreement subordinating the lien of this Deed of Trust, release any obligation secured by this Deed of Trust, in whole or in part, with regard to any Trustor, extend or renew the Note or any other obligation secured by this Deed of Trust, accept or release any additional security under this Deed of Trust, or accept and release the guaranty of any additional person or any obligation secured by this Deed of Trust.

Trustor hereby assigns absolutely to Lender the rents of the Property, with a revocable license to collect such rents as they become due and payable, prior to any default by Trustor under Paragraph 14 of this Deed of Trust, being retained by Trustor.

-10-

Upon any default by Trustor under Paragraph 14 of this Deed of Trust which default is not remedied during any applicable cure period, such license will, automatically, be deemed revoked without the necessity for any act or notice by Lender, and Lender, in person, by agent or by judicially appointed receiver, shall be entitled to enter upon, take possession of and manage the Property and may collect the rents of the Property, and, after so taking possession, shall be entitled to collect any rents that are past due. Lender has, however, no duty to produce rents from the Property or any responsibility for pursuing or collecting claims or rights of Trustor. If Trustor, at or immediately prior to such taking of possession by or on behalf of Lender, has operated a business upon the Property other than the rental thereof, the authority granted herein to so take possession of the Property shall also include the authority and power to take possession of the receipts of such business and, if appropriate, to operate such business, and the receipts thereof shall be deemed herein to be a form of rents. All rents collected by Lender or the receiver shall be applied first to payment of the costs of management of the Property and of collection of rents, including, but not limited to, costs and expenses of any receivership and reasonable attorneys' fees incurred by Lender in connection with the receivership, and then to the Note and any other obligations secured by this Deed of Trust. Lender and the receiver shall be liable to account only for those rents actually received.