Attached files

Table of Contents

As filed with the Securities and Exchange Commission on January 6, 2014.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

ALDEXA THERAPEUTICS, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 2834 | 20-1968197 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

15 New England Executive Park

Burlington, MA 01803

Telephone: (781) 270-0630

(Address, including zip code and telephone number, including area code, of registrant’s principal executive offices)

Todd C. Brady, M.D., Ph.D.

President and Chief Executive Officer

Aldexa Therapeutics, Inc.

15 New England Executive Park

Burlington, MA 01803

Telephone: (781) 270-0630

(Name, address, including zip code and telephone number, including area code, of agent for service)

Copies to:

| Jay K. Hachigian Keith J. Scherer Gunderson Dettmer Stough Villeneuve Franklin & Hachigian, LLP 850 Winter Street Waltham, MA 02451 Telephone: (781) 890-8800 Telecopy: (781) 622-1622 |

Scott L. Young Chief Operating Officer 15 New England Executive Park Burlington, MA 01803 Telephone: (781) 270-0630 |

Ivan K. Blumenthal Avisheh Avini Mintz Levin Cohn Ferris Glovsky and Popeo PC 666 Third Avenue New York, NY 10017 Telephone: (212) 935-5000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company x | |||

| (Do not check if a smaller reporting company) | ||||||

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

Proposed Maximum Offering Price(1)(2) |

Amount of Registration Fee (3) | ||

| Common Stock, $0.001 par value per share(4) |

$20,000,000 | $2,576 | ||

| Representative’s Warrant to Purchase Common Stock(5) |

- | - | ||

| Common Stock Underlying Representative’s Warrant(4)(6) |

$800,000 | $104 | ||

| TOTAL REGISTRATION FEE |

$20,800,000 | $2,680 | ||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes the offering price of shares of common stock that the underwriters have the option to purchase to cover over-allotments, if any. |

| (3) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price. |

| (4) | Pursuant to Rule 416 under the Securities Act of 1933, as amended, the shares of common stock registered hereby also include an indeterminate number of additional shares of common stock as may from time to time become issuable by reason of stock splits, stock dividends, recapitalizations or other similar transactions. |

| (5) | No registration fee pursuant to Rule 457(g) under the Securities Act, as amended. |

| (6) | Estimated solely for the purposes of calculating the registration fee pursuant to Rule 457(g) under the Securities Act. The warrants are exercisable at a per share exercise price equal to 125% of the public offering price. As estimated solely for the purpose of recalculating the registration fee pursuant to Rule 457(g) under the Securities Act, the proposed maximum aggregate offering price of the representative’s warrant is $800,000 (which is equal to 4% of $20,000,000). |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED JANUARY 6, 2014 |

Shares

Common Stock

This is the initial public offering of shares of common stock of Aldexa Therapeutics, Inc. No public market currently exists for our shares. We are offering all of the shares of common stock offered by this prospectus. We expect the public offering price of our shares of common stock to be between $ and $ per share.

We intend to apply to list our common stock on The NASDAQ Capital Market under the symbol “ALDX.” No assurance can be given that our application will be approved.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012, and, as such, we have elected to take advantage of certain reduced public company reporting requirements for this prospectus and future filings.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 8 of this prospectus for a discussion of information that should be considered in connection with an investment in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount and commissions(1) |

$ | $ | ||||||

| Offering proceeds to us before expenses |

$ | $ | ||||||

| (1) | Does not include a non-accountable expense allowance equal to 1% of the gross proceeds of this offering payable to Aegis Capital Corp., the representative of the underwriters. See “Underwriting” for a description of compensation payable to the underwriters. |

We have granted a 45-day option to the representative of the underwriters to purchase up to additional shares of common stock solely to cover over-allotments, if any.

The underwriters expect to deliver our shares to purchasers in the offering on or about , 2014.

Aegis Capital Corp

Table of Contents

Table of Contents

| Page | ||||

| 1 | ||||

| 8 | ||||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 41 | ||||

| 43 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 45 | |||

| 60 | ||||

| 78 | ||||

| 87 | ||||

| 98 | ||||

| 100 | ||||

| 102 | ||||

| 106 | ||||

| 109 | ||||

| 113 | ||||

| 122 | ||||

| 122 | ||||

| 122 | ||||

| 122 | ||||

| F-1 | ||||

Neither we nor the underwriters have authorized anyone to provide you with information that is different from that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. When you make a decision about whether to invest in our common stock, you should not rely upon any information other than the information in this prospectus or in any free writing prospectus that we may authorize to be delivered or made available to you. Neither the delivery of this prospectus nor the sale of our common stock means that the information contained in this prospectus or any free writing prospectus is correct after the date of this prospectus or such free writing prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy the shares of common stock in any circumstances under which the offer or solicitation is unlawful.

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market share, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Special Note Regarding Forward-Looking Statements.”

Aldexa Therapeutics and our logo are our pending trademarks that are used in this prospectus. This prospectus may also include other trademarks, tradenames and service marks that are the property of their respective holders. Solely for convenience, trademarks and tradenames referred to in this prospectus may appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or that the applicable holder will not assert its rights, to these trademarks and tradenames.

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information you should consider before investing in our common stock. You should read this prospectus carefully, especially the risks set forth under the heading “Risk Factors” and our financial statements and related notes included elsewhere in this prospectus, before making an investment decision. References in this prospectus, unless the context otherwise requires, to “Aldexa,” “our company,” “we,” “us” and “our” and other similar references refer to Aldexa Therapeutics, Inc. during the periods presented unless the context requires otherwise.

ALDEXA THERAPEUTICS, INC.

Overview

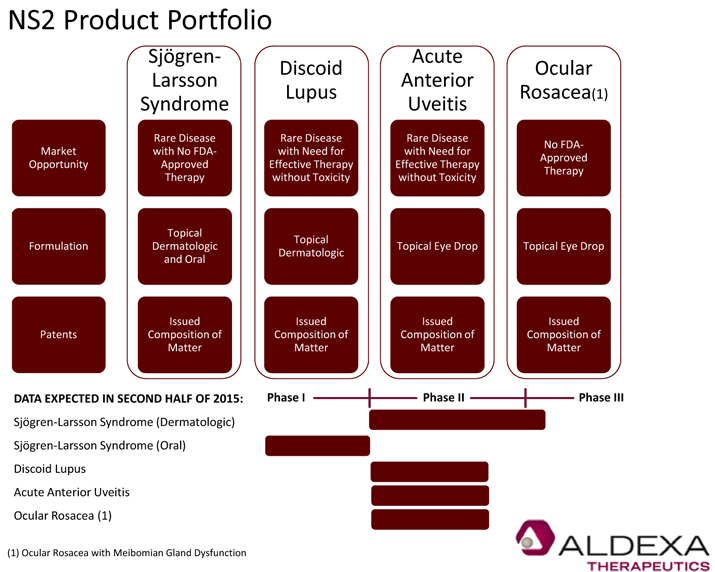

We are a biotechnology company focused primarily on the development of products to treat immune-mediated, inflammatory, orphan, and other diseases that are thought to be related to a naturally occurring toxic chemical species known as free aldehydes. We discovered and are developing NS2, a product candidate that is designed to trap and allow for disposal of free aldehydes, for the treatment of the following diseases: Sjögren-Larsson Syndrome (SLS), a rare disease caused by mutations in an enzyme that metabolizes fatty aldehydes; discoid lupus, an autoimmune condition that affects skin; acute anterior uveitis, an inflammatory eye disease; and ocular rosacea with meibomian gland dysfunction, a dry eye disease associated with rosacea, an inflammatory dermal condition.

We believe there is significant unmet medical need for the therapies we intend to develop. We are not aware of any therapy that has been approved by the United States Food and Drug Administration, or the FDA, for SLS or ocular rosacea with meibomian gland dysfunction. We believe that therapies for discoid lupus are moderately to poorly effective in controlling or curing the disease without drug related toxicity. Acute anterior uveitis is often treated with corticosteroids (commonly used anti-inflammatory agents), but prolonged use of corticosteroids can lead to significant morbidity. In addition, SLS, discoid lupus, and acute anterior uveitis are rare conditions. We intend to request orphan drug designation from the FDA for the drugs that we are developing to treat rare diseases.

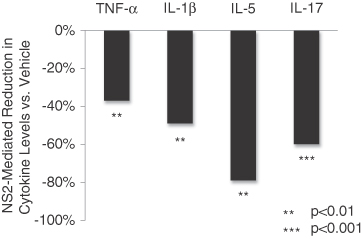

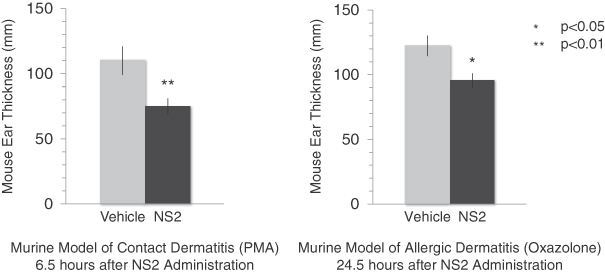

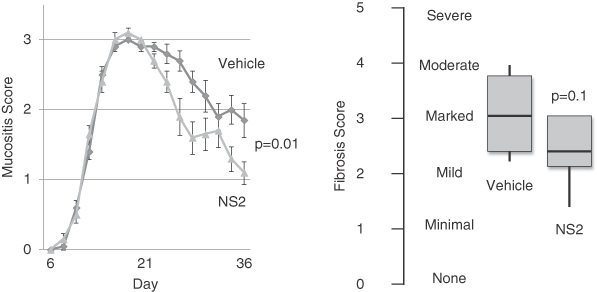

NS2 has been tested in a variety of in vitro and preclinical models, and has demonstrated the ability to trap free aldehydes, diminish inflammation, reduce healing time, protect key cellular constituents from aldehyde damage, and lower the potential for scarring or fibrosis. NS2 has been tested in a variety of toxicity studies in animals and appears to be generally safe and well tolerated. We are also developing aldehyde traps distinct from NS2 that have the potential to treat diseases other than those described above.

We have evaluated NS2 in a Phase I clinical trial in 48 healthy volunteers where NS2 was observed to be safe and well tolerated when administered as an eye drop up to four times per day over seven days. In 2014, we plan to initiate the following clinical trials, the data from all of which are expected to be available in the second half of 2015:

| · | Phase II clinical trials with our NS2 eye drop in acute anterior uveitis and in ocular rosacea with meibomian gland dysfunction; |

| · | Phase II/III clinical trial in SLS with a topical dermatologic formulation of NS2; |

| · | Phase II clinical trial in discoid lupus with a topical dermatologic formulation of NS2; and |

| · | Phase I clinical trial of NS2 administered orally to healthy volunteers. |

We are raising capital to fund these clinical trials with NS2 as well as to develop different aldehyde traps for the treatment of other diseases, and for general corporate purposes. We believe that NS2 has the potential to be the first in class of aldehyde traps for the diseases described above and potentially for inflammatory and other diseases generally. None of our products have been approved for sale in the United States or elsewhere.

1

Table of Contents

Risks Related to Our Business

An investment in our common stock involves a high degree of risk. Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors”. These risks represent challenges to the successful implementation of our strategy and to the growth and future profitability of our business. Some of these risks include the following:

| · | We have incurred significant operating losses since our inception, and we expect to incur significant losses for the foreseeable future. We may never become profitable or, if achieved, be able to sustain profitability. |

| · | Our business is dependent in large part on the success of a single product candidate, NS2, which has not entered a clinical trial to demonstrate efficacy in humans. We cannot be certain that we will be able to obtain regulatory approval for, or successfully commercialize, NS2. |

| · | Because we have limited experience developing clinical-stage compounds, there is a limited amount of information about us upon which you can evaluate our product candidates and business prospects. |

| · | The results of preclinical studies and early clinical trials are not always predictive of future results. Any product candidate we or any of our future development partners advance into clinical trials, including NS2, may not have favorable results in later clinical trials, if any, or receive regulatory approval. |

| · | Because NS2 and our other product candidates are, to our knowledge, new chemical entities, it is difficult to predict the time and cost of development and our ability to successfully complete clinical development of these product candidates and obtain the necessary regulatory approvals for commercialization. |

| · | Aldehyde trapping is an unproven approach, the safety and efficacy of which has not been demonstrated in humans. |

| · | NS2 and our other product candidates are subject to extensive regulation, compliance with which is costly and time consuming, and such regulation may cause unanticipated delays, or prevent the receipt of the required approvals to commercialize our product candidates. |

| · | Any termination or suspension of, or delays in the commencement or completion of, our planned clinical trials could result in increased costs to us, delay or limit our ability to generate revenue and adversely affect our commercial prospects. |

| · | Any product candidate we or any of our future development partners advance into clinical trials may cause unacceptable adverse events or have other properties that may delay or prevent its regulatory approval or commercialization or limit its commercial potential. |

| · | If our competitors develop treatments for the target indications of our product candidates that are approved more quickly than ours, marketed more successfully or demonstrated to be safer or more effective than our product candidates, our commercial opportunity will be reduced or eliminated. |

| · | We are currently highly dependent on the services of our two senior employees and certain key consultants. |

| · | Even if we receive regulatory approval for NS2 or any other product candidate, we still may not be able to successfully commercialize it and the revenue that we generate from its sales, if any, could be limited. |

For further discussion of these and other risks you should consider before making an investment in our common stock, see the section titled “Risk Factors” beginning on page 8 of this prospectus.

Our Corporate Information

Our principal executive offices are located at 15 New England Executive Park, Burlington, MA 01803, and our telephone number is (781) 270-0630. Our website address is www.aldexatherapeutics.com. Our website and the information contained

2

Table of Contents

in, or accessible through, our website will not be deemed to be incorporated by reference into this prospectus and does not constitute part of this prospectus. You should not rely on any such information in making your decision whether to purchase our common stock.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in gross revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or JOBS Act. An emerging growth company may take advantage of specified reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| · | being permitted to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in this prospectus; |

| · | exemption from complying with the auditor attestation requirements under Section 404 of the Sarbanes-Oxley Act, regarding the effectiveness of our internal controls over financial reporting; |

| · | reduced disclosure obligations regarding the company’s executive compensation arrangements in our periodic reports, proxy statements and registration statements; and |

| · | exemptions from the requirements of holding a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute arrangements not previously approved. |

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement under the Securities Act of 1933, as amended, or the Securities Act, which such fifth anniversary will occur in 2019, or until such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.0 billion in annual gross revenue, the date at which we become a large accelerated filer, or issue more than $1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage of some but not all of these reduced burdens.

We have elected to take advantage of certain of the reduced disclosure obligations and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

We have irrevocably elected not to avail ourselves of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the JOBS Act and, as a result, we will adopt new or revised accounting standards on the relevant dates on which adoption of such standards is required for other public companies.

3

Table of Contents

The Offering

| Common stock offered by us |

shares of our common stock. |

| Common stock to be outstanding after this offering |

shares of our common stock. |

| Over-allotment option |

We have granted the underwriters a 45-day option to purchase up to additional shares of our common stock at the public offering price, less underwriting discounts and commissions. |

| Use of proceeds |

We intend to use the net proceeds of this offering for research and development activities, including our planned clinical trials of NS2, to develop aldehyde traps for the treatment of other diseases and for working capital and other general corporate purposes. See “Use of Proceeds.” |

| Dividend policy |

We do not currently intend to declare dividends on shares of our common stock. See “Dividend Policy.” |

| Risk factors |

You should read the “Risk Factors” section of this prospectus for a discussion of factors that you should consider carefully before deciding to invest in shares of our common stock. |

| Proposed trading symbol |

“ALDX” |

The number of shares of our common stock to be outstanding after this offering is based on 47,642,078 shares of our common stock outstanding as of December 31, 2013 assuming the anticipated conversion of all then outstanding shares of Series A convertible preferred stock and Series B convertible preferred stock into common stock, and excludes:

| · | 7,318,187 shares of common stock issuable upon exercise of stock options outstanding as of December 31, 2013, at a weighted-average exercise price of approximately $0.123 per share; |

| · | 280,677 shares of common stock reserved for issuance under our 2010 equity incentive plan; |

| · | 7,500,000 shares of common stock reserved for future issuance under our 2013 equity incentive plan, or the 2013 plan, which become effective in October 2013 but with respect to which no awards will be granted prior to the effective date of the registration statement of which this prospectus is a part, subject to automatic annual adjustment in accordance with the terms of the plan; |

| · | shares of common stock to be issued upon the expected net exercise of outstanding warrants to purchase shares of our Series A convertible preferred stock assuming an initial public offering price of $ per share, the midpoint of the initial public offering price range reflected on the cover page of this prospectus and the subsequent conversion of such shares of Series A convertible preferred stock into shares of common stock; |

| · | shares of common stock to be issued upon the expected net exercise of outstanding warrants to purchase shares of our Series B convertible preferred stock assuming an initial public offering price of $ per share, the midpoint of the initial public offering price range reflected on the cover page of this prospectus and the subsequent conversion of such shares of Series B convertible preferred stock into shares of common stock; |

| · | shares of common stock issuable upon exercise of warrants to be issued to the representative of the underwriters in connection with this offering, at an exercise price per share equal to 125% of the public offering price, as described in the “Underwriting –Representative’s Warrants” section of this prospectus assuming an initial public offering price of $ per share, the midpoint of the initial public offering price range reflected on the cover page of this prospectus; and |

| · | shares of common stock issuable upon conversion of a convertible promissory note issued in the original principal amount of $170,000 at the public offering price per share assuming an initial public offering price of $ per share, the midpoint of the initial public offering price range reflected on the cover page of this prospectus. |

4

Table of Contents

Unless otherwise indicated, this prospectus reflects and assumes the following:

| · | the filing of our amended and restated certificate of incorporation and the adoption of our amended and restated bylaws, which will occur immediately prior to the closing of this offering; |

| · | the automatic conversion of all outstanding shares of our Series A convertible preferred stock into 27,913,466 shares of our common stock immediately prior to the closing of the offering; |

| · | the automatic conversion of all outstanding shares of our Series B convertible preferred stock into 15,800,191 shares of our common stock immediately prior to the closing of the offering; |

| · | a one-for- reverse stock split of our common stock to be effected before the completion of this offering; |

| · | no exercise of the outstanding options or the warrants to be issued to the representative of the underwriters described above; and |

| · | no exercise by the underwriters of their option to purchase additional shares of our common stock to cover over-allotments, if any. |

5

Table of Contents

SUMMARY FINANCIAL DATA

The following tables set forth, for the periods and as of the dates indicated, our summary financial data. The statements of operations data for the years ended December 31, 2011 and 2012 are derived from our audited financial statements included elsewhere in the prospectus. The statements of operations data for the nine months ended September 30, 2012 and 2013 and the balance sheet data as of September 30, 2013 are derived from our unaudited financial statements included elsewhere in this prospectus. The unaudited financial statements include, in the opinion of management, all adjustments, consisting of only normal recurring adjustments, that management considers necessary for the fair presentation of the financial information set forth in those statements. You should read the following information together with the more detailed information contained in “Selected Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the related notes included elsewhere in the prospectus. Our historical results are not indicative of the results to be expected in the future and results of interim periods are not necessarily indicative of results for the entire year.

| Years Ended December 31, | Nine Months Ended September 30, | Cumulative for the Period from August 13, 2004 (Inception) to September 30, 2013 |

||||||||||||||||||

| 2011 | 2012 | 2012 | 2013 | |||||||||||||||||

| (Unaudited) | (unaudited) | |||||||||||||||||||

| Statements of Operations: |

||||||||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Research and development(1) |

$ | 1,364,598 | $ | 469,270 | $ | 373,103 | $ | 1,141,323 | $ | 12,446,791 | ||||||||||

| General and administrative(1) |

743,941 | 644,941 | 624,687 | 1,302,361 | 5,527,485 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss from operations |

(2,108,539) | (1,114,211) | (997,790) | (2,443,684) | (17,974,276) | |||||||||||||||

| Other income (expenses): |

||||||||||||||||||||

| Change in fair value of preferred stock warrant liabilities |

- | (9,000) | 800 | 627,100 | 618,100 | |||||||||||||||

| Change in fair value of preferred stock investor purchase rights and warrant purchase rights |

- | (125,500) | - | 5,628,986 | 4,993,086 | |||||||||||||||

| Value provided in excess of issuance price of Series B convertible preferred stock |

- | (21,484,762) | - | - | (21,484,762) | |||||||||||||||

| Other income |

5,406 | 871 | - | - | 250,756 | |||||||||||||||

| Interest income |

5,001 | 101 | 93 | 23 | 188,730 | |||||||||||||||

| Other expenses |

- | - | (4,773) | (1,987) | (44,553) | |||||||||||||||

| Interest expense |

(279,932) | (342,014) | (330,393) | (45,172) | (875,000) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total other income (expenses), net |

(269,525) | (21,960,304) | (334,273) | 6,208,950 | (16,353,643) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) and comprehensive income (loss) |

(2,378,064) | (23,074,515) | (1,332,063) | 3,765,266 | (34,327,919) | |||||||||||||||

| Accretion of issuance costs on preferred stock |

(215,036) | (389,487) | (166,570) | (463,046) | (1,577,133) | |||||||||||||||

| Allocation of undistributed earnings to preferred stockholders | - | - | - | (2,986,631) | (2,986,631) | |||||||||||||||

| Deemed dividend to Series A preferred stockholders |

- | (15,661,898) | - | - | (15,661,898) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) attributable to common stockholders |

$ | (2,593,100) | $ | (39,125,900) | $ | (1,498,633) | $ | 315,589 | $ | (54,553,581) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) per share attributable to common stockholders: |

||||||||||||||||||||

| Basic (2) |

$ | (0.69) | $ | (10.37) | $ | (0.40) | $ | 0.08 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Diluted |

$ | (0.69) | $ | (10.37) | $ | (0.40) | $ | (0.16) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Weighted average common shares outstanding: |

||||||||||||||||||||

| Basic (2) |

3,773,044 | 3,773,044 | 3,773,044 | 3,779,665 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Diluted |

3,773,044 | 3,773,044 | 3,773,044 | 15,737,618 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

Footnotes on following page

6

Table of Contents

| As of September 30, 2013 | ||||||||||||

| Actual | Pro Forma | Pro Forma As Adjusted |

||||||||||

| (unaudited) | ||||||||||||

| Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 2,764,455 | $ | - | $ | - | ||||||

| Working capital |

2,567,971 | - | - | |||||||||

| Total assets |

2,818,953 | - | - | |||||||||

| Credit facility |

350,758 | - | - | |||||||||

| Accrued deferred offering costs |

50,000 | - | - | |||||||||

| Convertible preferred stock liabilities |

13,981,000 | - | - | |||||||||

| Redeemable convertible preferred stock |

37,957,794 | - | - | |||||||||

| Total stockholders’ equity (deficit) |

(49,721,581) | - | - | |||||||||

The pro forma column in the balance sheet data table above reflects the automatic conversion of all outstanding shares of our convertible preferred stock into an aggregate of 43,713,657 shares of common stock and the issuance of shares of common stock upon the expected net exercise of outstanding warrants to purchase shares of our Series A preferred stock and Series B preferred stock assuming an initial public offering price of $ per share, the midpoint of the initial public offering price range reflected on the cover page of this prospectus and the subsequent conversion of such shares of preferred stock into shares of common stock; and the related reclassification of $ of other long-term liabilities into stockholders equity (deficit).

The pro forma as adjusted column in the balance sheet data table above reflects (1) the automatic conversion of all outstanding shares of our convertible preferred stock as of September 30, 2013 into an aggregate of 43,713,657 shares of common stock upon completion of this offering, (2) the issuance of shares of common stock upon the expected net exercise of outstanding warrants to purchase shares of our Series A preferred stock and Series B preferred stock assuming an initial public offering price of $ per share, the midpoint of the initial public offering price range reflected on the cover page of this prospectus and the subsequent conversion of such shares of preferred stock into shares of common stock and the related reclassification of $ of other long-term liabilities into stockholders equity (deficit), and (3) our sale of shares of common stock in this offering at an assumed initial public offering price of $ per share, the midpoint of the initial public offering price range reflected on the cover page of this prospectus, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. Each $1.00 increase (decrease) in the assumed initial public offering price of $ per share would increase (decrease) the pro forma as adjusted amount of each of cash and cash equivalents, working capital, total assets and total stockholders’ equity (deficit) by approximately $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, each increase (decrease) of 1.0 million shares in the number of shares offered by us at the assumed initial public offering price would increase (decrease) each of cash and cash equivalents, working capital, total assets and total stockholders’ equity (deficit) by approximately $ million. The pro forma information discussed above is illustrative only and will be adjusted based on the actual initial public offering price and other terms of our initial public offering determined at pricing.

Footnotes from prior page:

| (1) | Includes stock-based compensation as follows: |

| Year Ended | Nine Months Ended | |||||||||||||||

| December 31, 2011 |

December 31, 2012 |

September 30, 2012 |

September 30, 2013 |

|||||||||||||

| (unaudited) | ||||||||||||||||

| Research and development |

$ | 42,897 | $ | 79,415 | $ | 44,370 | $ | 400,936 | ||||||||

| General and administrative |

6,695 | 4,986 | 3,858 | 927,539 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 49,592 | $ | 84,401 | $ | 48,228 | $ | 1,328,475 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (2) | Please see Note 2 to our financial statements included elsewhere in this prospectus for an explanation of the method used to calculate net income allocable to preferred stockholders and net income (loss) attributable to common stockholders, including the method used to calculate the number of shares used in the computation of the per share amount. |

7

Table of Contents

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus, including our financial statements and related notes, before deciding whether to purchase shares of our common stock. If any of the following risks is realized, our business, financial condition, results of operations, and prospects could be materially and adversely affected. In that event, the price of our common stock could decline and you could lose part or all of your investment.

Risks Related to our Business

We have incurred significant operating losses since inception, and we expect to incur significant losses for the foreseeable future. We may never become profitable or, if achieved, be able to sustain profitability.

We have incurred significant operating losses since we were founded in 2004 and expect to incur significant losses for the next several years as we continue our clinical trial and development programs for NS2 and our other product candidates. Net loss for the year ended December 31, 2012 was approximately $23.1 million and net income for the nine months ended September 30, 2013 was approximately $3.8 million, which includes a non-cash income adjustment of $6.3 million related to the change in fair value of our derivative instrument liabilities. As of September 30, 2013, we had a deficit accumulated during the development stage of of approximately $50.6 million. Losses have resulted principally from costs incurred in our clinical trials, research and development programs and from our general and administrative expenses. In the future, we intend to continue to conduct research and development, clinical testing, regulatory compliance activities and, if NS2 or any of our other product candidates is approved, sales and marketing activities that, together with anticipated general and administrative expenses, will likely result in our incurring further significant losses for the next several years.

We currently generate no revenue from sales, and we may never be able to commercialize NS2 or our other product candidates. We do not currently have the required approvals to market any of our product candidates and we may never receive them. We may not be profitable even if we or any of our future development partners succeed in commercializing any of our product candidates. Because of the numerous risks and uncertainties associated with developing and commercializing our product candidates, we are unable to predict the extent of any future losses or when we will become profitable, if at all.

Our business is dependent in large part on the success of a single product candidate, NS2, which has not entered a clinical trial to demonstrate efficacy in humans. We cannot be certain that we will be able to obtain regulatory approval for, or successfully commercialize, NS2.

Our product candidates are in the early stage of development and will require additional preclinical studies, substantial clinical development and testing, and regulatory approval prior to commercialization. We have only one product candidate that has been the focus of significant development: NS2, a novel small molecule chemical entity that is believed to trap and allow for the disposal of free aldehydes, toxic chemical species suspected to cause and exacerbate numerous diseases in humans and animals. We are largely dependent on successful continued development and ultimate regulatory approval of this product candidate for our future business success. We have invested, and will continue to invest, a significant portion of our time and financial resources in the development of NS2. We will need to raise sufficient funds for, and successfully enroll and complete, our planned clinical trials of NS2, which we intend to commence in 2014. The future regulatory and commercial success of this product candidate is subject to a number of risks, including the following:

| · | we may not have sufficient financial and other resources to complete the necessary clinical trials for NS2; |

| · | we may not be able to provide evidence of safety and efficacy for NS2; |

| · | the results of our planned clinical trials may not confirm the results of our Phase I trial of NS2 as an eye drop in healthy volunteers, particularly because the safety of NS2 has not been confirmed in a diseased population nor has NS2 been tested in humans in any other dosage form other than an eye drop; |

| · | we have not demonstrated efficacy of NS2 in any clinical trial; |

| · | there may be variability in patients, adjustments to clinical trial procedures and inclusion of additional clinical trial sites; |

8

Table of Contents

| · | the results of our clinical trials may not meet the level of statistical or clinical significance required by the United States Food and Drug Administration, or FDA, or comparable foreign regulatory bodies for marketing approval; |

| · | patients in our clinical trials may die or suffer other adverse effects for reasons that may or may not be related to NS2; |

| · | if approved for certain diseases, NS2 will compete with well-established products already approved for marketing by the FDA, including corticosteroids and other agents that have demonstrated efficacy in some of the diseases for which we may attempt to develop NS2; and |

| · | we may not be able to obtain, maintain or enforce our patents and other intellectual property rights. |

Of the large number of drugs in development in the pharmaceutical industry, only a small percentage result in the submission of a New Drug Application (NDA) to the FDA and even fewer are approved for commercialization. Furthermore, even if we do receive regulatory approval to market NS2, any such approval may be subject to limitations on the indicated uses for which we may market the product. Accordingly, even if we are able to obtain the requisite financing to continue to fund our development programs, we cannot assure you that NS2 will be successfully developed or commercialized. If we or any of our future development partners are unable to develop, or obtain regulatory approval for or, if approved, successfully commercialize, NS2, we may not be able to generate sufficient revenue to continue our business.

Because we have limited experience developing clinical-stage compounds, there is a limited amount of information about us upon which you can evaluate our product candidates and business prospects.

We commenced our first clinical trial in 2010, and we have limited experience developing clinical-stage compounds upon which you can evaluate our business and prospects. In addition, as an early-stage clinical development company, we have limited experience in conducting clinical trials, and we have never conducted clinical trials of a size required for regulatory approvals. Further, we have not yet demonstrated an ability to successfully overcome many of the risks and uncertainties frequently encountered by companies in new and rapidly evolving fields, particularly in the biopharmaceutical area. For example, to execute our business plan we will need to successfully:

| · | execute our product candidate development activities, including successfully completing our clinical trial programs; |

| · | obtain required regulatory approvals for our product candidates; |

| · | manage our spending as costs and expenses increase due to the performance and completion of clinical trials, attempting to obtain regulatory approvals, manufacturing and commercialization; |

| · | secure substantial additional funding; |

| · | develop and maintain successful strategic relationships; |

| · | build and maintain a strong intellectual property portfolio; |

| · | build and maintain appropriate clinical, sales, distribution, and marketing capabilities on our own or through third parties; and |

| · | gain broad market acceptance for our product candidates. |

If we are unsuccessful in accomplishing these objectives, we may not be able to develop product candidates, raise capital, expand our business, or continue our operations.

The scientific rationale for our Sjögren-Larsson Syndrome clinical program does not necessarily predict the clinical success of NS2.

Sjögren-Larsson Syndrome (SLS) is a rare disease afflicting an estimated 1 in 250,000 people worldwide, equivalent to approximately 1,000 patients in the United States and a larger number in Europe. SLS is caused by genetic

9

Table of Contents

mutations in an enzyme, Fatty Aldehyde Dehydrogenase (FALDH), that converts long-chain aldehydes into fatty acids. In addition to manifesting what is believed to be severe aldehyde toxicity, SLS patients also have elevated levels of fatty alcohols and may manifest diminished levels of fatty acids.

The dermal pathology of SLS is thought to be due to aldehyde-mediated damage of lipids (fats) that contribute to the formation of the dermal moisture barrier. As a result, SLS patients are thought to lose water from skin, leading to compensatory mechanisms that include proliferation of the superficial layers of skin that may be partially effective in preventing water loss. Increased levels of skin proliferation in SLS patients lead to ichthyosis, a severe skin disorder characterized by plaques and scales, thickening, redness, inflammation and pruritus (itching).

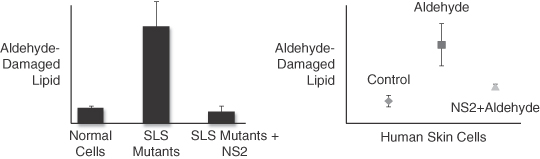

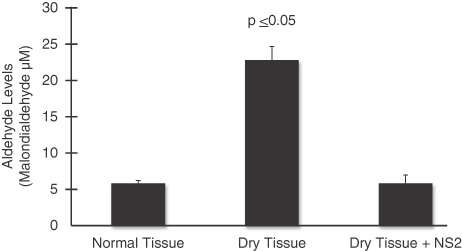

NS2 traps aldehydes and has been shown to prevent fatty aldehyde-mediated modification of lipids in vitro, in human skin cells and in cells that have been genetically modified to lack FALDH. Thus, NS2 may be partially or wholly effective in preventing and treating ichthyosis or other dermal symptoms, signs, or pathologies in SLS. However, the proposed mechanism of action of NS2 in SLS has not been demonstrated in humans. Further, our assumptions about the pathogenesis of skin disease in SLS patients may not be accurate. For instance, SLS skin disease may be caused by elevated fatty alcohol levels or decreased fatty acid levels, neither of which NS2 is predicted to affect directly.

The results of preclinical studies and early clinical trials are not always predictive of future results. Any product candidate we or any of our future development partners advance into clinical trials, including NS2, may not have favorable results in later clinical trials, if any, or receive regulatory approval.

Drug development has inherent risk. We or any of our future development partners will be required to demonstrate through adequate and well-controlled clinical trials that our product candidates are safe and effective, with a favorable benefit-risk profile, for use in their target indications before we can seek regulatory approvals for their commercial sale. Drug development is a long, expensive and uncertain process, and delay or failure can occur at any stage of development, including after commencement of any of our clinical trials. In addition, success in early clinical trials does not mean that later clinical trials will be successful because product candidates in later-stage clinical trials may fail to demonstrate sufficient safety or efficacy despite having progressed through initial clinical testing. Furthermore, our future trials will need to demonstrate sufficient safety and efficacy for approval by regulatory authorities in larger patient populations. Companies frequently suffer significant setbacks in advanced clinical trials, even after earlier clinical trials have shown promising results. In addition, only a small percentage of drugs under development result in the submission of an NDA to the FDA and even fewer are approved for commercialization.

Because NS2 and our other product candidates are to our knowledge, new chemical entities, it is difficult to predict the time and cost of development and our ability to successfully complete clinical development of these product candidates and obtain the necessary regulatory approvals for commercialization.

Our product candidates are, to our knowledge, new chemical entities, and unexpected problems related to such new technology may arise that can cause us to delay, suspend or terminate our development efforts. NS2 administered as an eye drop has completed a Phase I clinical trial in healthy volunteers. NS2 has not been administered to humans by any other route. Further, NS2 has not demonstrated efficacy in humans for any disease. Because NS2 is a novel chemical entity with limited use in humans, short and long-term safety, as well as prospects for efficacy, are poorly understood and difficult to predict due to our and the regulatory agencies’ lack of experience with them. Regulatory approval of new product candidates such as NS2 can be more expensive and take longer than approval for other more well-known or extensively studied pharmaceutical or biopharmaceutical product candidates.

Aldehyde trapping is an unproven approach, the safety and efficacy of which has not been demonstrated in humans.

Aldehydes are thought to be mediators of inflammation and other pathology. However, we are aware of only a limited number of attempts to lower aldehyde levels and modulate disease in animals or humans. Thus, there is only moderate justification for the approach of lowering aldehyde levels to treat disease. Despite evidence suggestive of benefit in animal models, clinical trials may indicate that aldehyde trapping has no effect or negative effects on the diseases we intend to test. Animal studies may not predict safety or efficacy in humans.

10

Table of Contents

Our dermatologic topical formulation of NS2 is unlikely to affect other clinical manifestations of SLS, which may decrease the likelihood of regulatory and commercial acceptance.

While the primary day-to-day complaint of SLS patients and their caregivers are symptoms associated with severe skin disease, SLS patients also manifest varying degrees of mental delay, spasticity and retinal disease. Due to expected low systemic exposure of NS2 when administered topically to the skin, it is unlikely that NS2 will affect the non-dermatologic conditions of SLS. Lack of effect in neurologic and ocular manifestations of SLS may negatively impact regulatory discussions with the FDA and may also negatively impact reimbursement, pricing and commercial acceptance of NS2.

If we are not able to test NS2 in SLS or in other diseases, we will not be able to initiate clinical trials necessary for demonstrating drug safety and efficacy in patients.

NS2 and the activities associated with its development and potential commercialization, including its testing, manufacture, safety, efficacy, recordkeeping, labeling, storage, approval, advertising, promotion, sale and distribution, are subject to comprehensive regulation by the FDA and other regulatory agencies in the United States and by comparable authorities in other jurisdictions.

We have not submitted an Investigational New Drug (IND) application to investigate NS2 as a topical dermatologic in SLS or discoid lupus and we have not updated our active IND for NS2 administered as an eye drop to include acute anterior uveitis and ocular rosacea with meibomian gland dysfunction. Submission of an IND for NS2 as a treatment for SLS and discoid lupus will require new data, including dermatologic toxicity studies, that we have not yet generated. In addition, our active NS2 IND for ocular administration was originally filed to test an eye disease other than uveitis and ocular rosacea and thus the FDA may require new data that we have not yet generated. We are not permitted to test a drug under a new IND in the United States until the FDA has no objection to the initial IND submission. To date, we have completed one Phase I clinical trial for NS2 administered as an eye drop in healthy volunteers. We will have to submit separate INDs for each of the other indications that we intend to study which could mean additional delays in the commencement of each of the related trials and the performance of additional preclinical studies. We have not demonstrated efficacy of NS2 in any patient population.

We currently plan to commence five clinical trials in 2014: a Phase I trial of orally administered NS2 in healthy volunteers, a Phase II/III trial of NS2 administered as a topical dermatologic to patients with SLS, a Phase II trial of NS2 administered as a topical dermatologic to patients with discoid lupus, and two Phase II trials of NS2 administered as an eye drop to patients with acute anterior uveitis and ocular rosacea with meibomian gland dysfunction. There is no guarantee that these clinical trials or any other future trials will be allowed by the FDA to proceed or generate successful results, or that regulators will agree with our assessment of the clinical trials for NS2. In addition, we expect to rely on consultants and third party contract research organizations to assist us with regulatory filings and the conduct of our clinical trials. The FDA and other regulators have substantial discretion and may refuse to accept any application or may decide that our current data is insufficient for clinical trial initiation and require additional clinical trials, or preclinical or other studies.

NS2 and our other product candidates are subject to extensive regulation, compliance with which is costly and time consuming, and such regulation may cause unanticipated delays, or prevent the receipt of the required approvals to commercialize our product candidates.

The clinical development, manufacturing, labeling, storage, record-keeping, advertising, promotion, import, export, marketing, and distribution of our product candidates are subject to extensive regulation by the FDA in the United States and by comparable authorities in foreign markets. In the United States, we are not permitted to market our product candidates until we receive regulatory approval from the FDA. The process of obtaining regulatory approval is expensive, often takes many years, and can vary substantially based upon the type, complexity, and novelty of the products involved, as well as the target indications, and patient population. Approval policies or regulations may change and the FDA has substantial discretion in the drug approval process, including the ability to delay, limit, or deny approval of a product candidate for many reasons. Despite the time and expense invested in clinical development of product candidates, regulatory approval is never guaranteed.

The FDA or comparable foreign regulatory authorities can delay, limit, or deny approval of a product candidate for many reasons, including:

| · | such authorities may disagree with the design or implementation of our or any of our future development partners’ clinical trials; |

11

Table of Contents

| · | we or any of our future development partners may be unable to demonstrate to the satisfaction of the FDA or other regulatory authorities that a product candidate is safe and effective for any indication; |

| · | such authorities may not accept clinical data from trials which are conducted at clinical facilities or in countries where the standard of care is potentially different from the United States; |

| · | the results of clinical trials may not demonstrate the safety or efficacy required by such authorities for approval; |

| · | we or any of our future development partners may be unable to demonstrate that a product candidate’s clinical and other benefits outweigh its safety risks; |

| · | such authorities may disagree with our interpretation of data from preclinical studies or clinical trials; |

| · | such authorities may find deficiencies in the manufacturing processes or facilities of third-party manufacturers with which we or any of our future development partners contract for clinical and commercial supplies; or |

| · | the approval policies or regulations of such authorities may significantly change in a manner rendering our or any of our future development partners’ clinical data insufficient for approval. |

With respect to foreign markets, approval procedures vary among countries and, in addition to the aforementioned risks, can involve additional product testing, administrative review periods and agreements with pricing authorities. In addition, events raising questions about the safety of certain marketed pharmaceuticals may result in increased cautiousness by the FDA and comparable foreign regulatory authorities in reviewing new drugs based on safety, efficacy or other regulatory considerations and may result in significant delays in obtaining regulatory approvals. Any delay in obtaining, or inability to obtain, applicable regulatory approvals would prevent us or any of our future development partners from commercializing our product candidates.

Any termination or suspension of, or delays in the commencement or completion of, our planned clinical trials could result in increased costs to us, delay or limit our ability to generate revenue and adversely affect our commercial prospects.

Before we can initiate clinical trials in the United States for our product candidates, we need to submit the results of preclinical testing to the FDA as part of an IND application, along with other information including information about product candidate chemistry, manufacturing, and controls and our proposed clinical trial protocol. We may rely in part on preclinical, clinical, and quality data generated by contract research organization (CROs) and other third parties for regulatory submissions for our product candidates. If these third parties do not make timely regulatory submissions for our product candidates, it will delay our plans for our clinical trials. If those third parties do not make this data available to us, we will likely have to develop all necessary preclinical and clinical data on our own, which will lead to significant delays and increase development costs of the product candidate. In addition, the FDA may require us to conduct additional preclinical testing for any product candidate before it allows us to initiate clinical testing under any IND, which may lead to additional delays and increase the costs of our preclinical development. Delays in the commencement or completion of our planned clinical trials for NS2 or other product candidates could significantly affect our product development costs. We do not know whether our planned trials will begin on time or be completed on schedule, if at all. The commencement and completion of clinical trials can be delayed for a number of reasons, including delays related to:

| · | the FDA failing to grant permission to proceed or placing the clinical trial on hold; |

| · | subjects failing to enroll or remain in our trial at the rate we expect; |

| · | subjects choosing an alternative treatment for the indication for which we are developing NS2 or other product candidates, or participating in competing clinical trials; |

| · | lack of adequate funding to continue the clinical trial; |

| · | subjects experiencing severe or unexpected drug-related adverse effects; |

12

Table of Contents

| · | a facility manufacturing NS2, any of our other product candidates or any of their components being ordered by the FDA or other government or regulatory authorities, to temporarily or permanently shut down due to violations of current Good Manufacturing Practices, or cGMP, or other applicable requirements, or infections or cross-contaminations of product candidates in the manufacturing process; |

| · | any changes to our manufacturing process that may be necessary or desired; |

| · | third-party clinical investigators losing the licenses or permits necessary to perform our clinical trials, not performing our clinical trials on our anticipated schedule or consistent with the clinical trial protocol, Good Clinical Practice or regulatory requirements, or other third parties not performing data collection or analysis in a timely or accurate manner; |

| · | inspections of clinical trial sites by the FDA or the finding of regulatory violations by the FDA or an institutional review board, or IRB, that require us to undertake corrective action, result in suspension or termination of one or more sites or the imposition of a clinical hold on the entire trial, or that prohibit us from using some or all of the data in support of our marketing applications; |

| · | third-party contractors becoming debarred or suspended or otherwise penalized by the FDA or other government or regulatory authorities for violations of regulatory requirements, in which case we may need to find a substitute contractor, and we may not be able to use some or all of the data produced by such contractors in support of our marketing applications; or |

| · | one or more IRBs refusing to approve, suspending or terminating the trial at an investigational site, precluding enrollment of additional subjects, or withdrawing its approval of the trial. |

Product development costs will increase if we have delays in testing or approval of NS2 or if we need to perform more or larger clinical trials than planned. Additionally, changes in regulatory requirements and policies may occur and we may need to amend clinical trial protocols to reflect these changes. Amendments may require us to resubmit our clinical trial protocols to IRBs for reexamination, which may impact the costs, timing or successful completion of a clinical trial. If we experience delays in completion of or if we, the FDA or other regulatory authorities, the IRB, other reviewing entities, or any of our clinical trial sites suspend or terminate any of our clinical trials, the commercial prospects for a product candidate may be harmed and our ability to generate product revenues will be delayed. In addition, many of the factors that cause, or lead to, termination or suspension of, or a delay in the commencement or completion of, clinical trials may also ultimately lead to the denial of regulatory approval of a product candidate. Further, if one or more clinical trials are delayed, our competitors may be able to bring products to market before we do, and the commercial viability of NS2 or other product candidates could be significantly reduced.

Any product candidate we or any of our future development partners advance into clinical trials may cause unacceptable adverse events or have other properties that may delay or prevent its regulatory approval or commercialization or limit its commercial potential.

Unacceptable adverse events caused by any of our product candidates that we advance into clinical trials could cause us or regulatory authorities to interrupt, delay, or halt clinical trials and could result in the denial of regulatory approval by the FDA or other regulatory authorities for any or all targeted indications and markets. This in turn could prevent us from completing development or commercializing the affected product candidate and generating revenue from its sale.

We have not yet completed testing of any of our product candidates in humans for the treatment of the indications for which we intend to seek approval, and we currently do not know the extent of adverse events, if any, that will be observed in patients who receive any of our product candidates. NS2, for example, has been observed to be toxic at high concentrations in in vitro human dermal tissue. If any of our product candidates cause unacceptable adverse events in clinical trials, we may not be able to obtain regulatory approval or commercialize such product candidate.

Final marketing approval for NS2 or our other product candidates by the FDA or other regulatory authorities for commercial use may be delayed, limited, or denied, any of which would adversely affect our ability to generate operating revenues.

After the completion of our clinical trials and, assuming the results of the trials are successful, the submission of an NDA, we cannot predict whether or when we will obtain regulatory approval to commercialize NS2 or our other product

13

Table of Contents

candidates and we cannot, therefore, predict the timing of any future revenue. We cannot commercialize NS2 or our other product candidates until the appropriate regulatory authorities have reviewed and approved the applicable applications. We cannot assure you that the regulatory agencies will complete their review processes in a timely manner or that we will obtain regulatory approval for NS2 or our other product candidates. In addition, we may experience delays or rejections based upon additional government regulation from future legislation or administrative action or changes in FDA policy during the period of product development, clinical trials and FDA regulatory review. If marketing approval for NS2 or our other product candidates is delayed, limited or denied, our ability to market the product candidate, and our ability to generate product sales, would be adversely affected.

Even if we obtain marketing approval for NS2 or any other product candidate, it could be subject to restrictions or withdrawal from the market and we may be subject to penalties if we fail to comply with regulatory requirements or if we experience unanticipated problems with our product candidate, when and if any of them are approved.

Even if United States regulatory approval is obtained, the FDA may still impose significant restrictions on a product’s indicated uses or marketing or impose ongoing requirements for potentially costly and time consuming post-approval studies, post-market surveillance or clinical trials. Following approval, if any, of NS2 or any other product candidates, such candidate will also be subject to ongoing FDA requirements governing the labeling, packaging, storage, distribution, safety surveillance, advertising, promotion, recordkeeping and reporting of safety and other post-market information. In addition, manufacturers of drug products and their facilities are subject to continual review and periodic inspections by the FDA and other regulatory authorities for compliance with cGMP requirements relating to quality control, quality assurance and corresponding maintenance of records and documents. If we or a regulatory agency discovers previously unknown problems with a product, such as adverse events of unanticipated severity or frequency, or problems with the facility where the product is manufactured, a regulatory agency may impose restrictions on that product, the manufacturing facility or us, including requesting recall or withdrawal of the product from the market or suspension of manufacturing.

If we or the manufacturing facilities for NS2 or any other product candidate that may receive regulatory approval, if any, fail to comply with applicable regulatory requirements, a regulatory agency may:

| · | issue warning letters or untitled letters; |

| · | seek an injunction or impose civil or criminal penalties or monetary fines; |

| · | suspend or withdraw regulatory approval; |

| · | suspend any ongoing clinical trials; |

| · | refuse to approve pending applications or supplements or applications filed by us; |

| · | suspend or impose restrictions on operations, including costly new manufacturing requirements; or |

| · | seize or detain products, refuse to permit the import or export of product, or request us to initiate a product recall. |

The occurrence of any event or penalty described above may inhibit our ability to commercialize our product candidates and generate revenue.

The FDA has the authority to require a risk evaluation and mitigation strategy plan as part of a NDA or after approval, which may impose further requirements or restrictions on the distribution or use of an approved drug, such as limiting prescribing to certain physicians or medical centers that have undergone specialized training, limiting treatment to patients who meet certain safe-use criteria and requiring treated patients to enroll in a registry.

In addition, if NS2 or any of our other product candidates is approved, our product labeling, advertising and promotion would be subject to regulatory requirements and continuing regulatory review. The FDA strictly regulates the promotional claims that may be made about prescription products. In particular, a product may not be promoted for uses that are not approved by the FDA as reflected in the product’s approved labeling. If we receive marketing approval for a product candidate, physicians may nevertheless prescribe it to their patients in a manner that is inconsistent with the approved label. If

14

Table of Contents

we are found to have promoted such off-label uses, we may become subject to significant liability. The FDA and other agencies actively enforce the laws and regulations prohibiting the promotion of off-label uses, and a company that is found to have improperly promoted off-label uses may be subject to significant sanctions. The federal government has levied large civil and criminal fines against companies for alleged improper promotion and has enjoined several companies from engaging in off-label promotion. The FDA has also requested that companies enter into consent decrees or permanent injunctions under which specified promotional conduct is changed or curtailed.

Even if we receive regulatory approval for NS2 or any other product candidate, we still may not be able to successfully commercialize it and the revenue that we generate from its sales, if any, could be limited.

Even if our product candidates receive regulatory approval, they may not gain market acceptance among physicians, patients, healthcare payors, and the medical community. Coverage and reimbursement of our product candidates by third-party payors, including government payors, is also generally necessary for commercial success. The degree of market acceptance of our product candidates will depend on a number of factors, including:

| · | demonstration of clinical efficacy and safety compared to other more-established products; |

| · | the limitation of our targeted patient population and other limitations or warnings contained in any FDA-approved labeling; |

| · | acceptance of a new formulation by health care providers and their patients; |

| · | the prevalence and severity of any adverse effects; |

| · | new procedures or methods of treatment that may be more effective in treating or may reduce the incidences of SLS or other conditions for which our products are intended to treat; |

| · | pricing and cost-effectiveness; |

| · | the effectiveness of our or any future collaborators’ sales and marketing strategies; |

| · | our ability to obtain and maintain sufficient third-party coverage or reimbursement from government health care programs, including Medicare and Medicaid, private health insurers and other third-party payors; |

| · | unfavorable publicity relating to the product candidate; and |

| · | the willingness of patients to pay out-of-pocket in the absence of third-party coverage. |

If any product candidate is approved but does not achieve an adequate level of acceptance by physicians, hospitals, healthcare payors or patients, we may not generate sufficient revenue from that product candidate and may not become or remain profitable. Our efforts to educate the medical community and third-party payors on the benefits of NS2 or any of our other product candidates may require significant resources and may never be successful. In addition, our ability to successfully commercialize our product candidate will depend on our ability to manufacture our products, differentiate our products from competing products and defend the intellectual property of our products.

Reimbursement may be limited or unavailable in certain market segments for our product candidates, which could make it difficult for us to sell our product candidates profitably.

Market acceptance and sales of our product candidates will depend significantly on the availability of adequate insurance coverage and reimbursement from third-party payors for any of our product candidates and may be affected by existing and future health care reform measures. Government authorities and third-party payors, such as private health insurers and health maintenance organizations, decide which drugs they will pay for and establish reimbursement levels. Reimbursement by a third-party payor may depend upon a number of factors including the third-party payor’s determination that use of a product candidate is:

| · | a covered benefit under its health plan; |

15

Table of Contents

| · | safe, effective, and medically necessary; |

| · | appropriate for the specific patient; |

| · | cost-effective; and |

| · | neither experimental nor investigational. |

Obtaining coverage and reimbursement approval for a product candidate from a government or other third-party payor is a time-consuming and costly process that could require us to provide supporting scientific, clinical and cost effectiveness data for the use of the applicable product candidate to the payor. We may not be able to provide data sufficient to gain acceptance with respect to coverage and reimbursement. We cannot be sure that coverage or adequate reimbursement will be available for any of our product candidates. Further, we cannot be sure that reimbursement amounts will not reduce the demand for, or the price of, our product candidates. If reimbursement is not available or is available only in limited levels, we may not be able to commercialize certain of our product candidates profitably, or at all, even if approved.

As a result of legislative proposals and the trend toward managed health care in the United States, third-party payors are increasingly attempting to contain health care costs by limiting both coverage and the level of reimbursement of new drugs. They may also refuse to provide coverage of approved product candidates for medical indications other than those for which the FDA has granted market approvals. As a result, significant uncertainty exists as to whether and how much third-party payors will reimburse patients for their use of newly approved drugs, which in turn will put pressure on the pricing of drugs. We expect to experience pricing pressures in connection with the sale of our product candidates due to the trend toward managed health care, the increasing influence of health maintenance organizations, and additional legislative proposals as well as country, regional or local healthcare budget limitations.

If we fail to develop and commercialize other product candidates, we may be unable to grow our business.

As part of our growth strategy, we plan to evaluate the development and commercialization of other therapies related to immune-mediated, inflammatory, orphan and other diseases. We will evaluate internal opportunities from our compound libraries, and also may chose to in-license or acquire other product candidates as well as commercial products to treat patients suffering from immune-mediated or orphan or other disorders with high unmet medical needs and limited treatment options. These other product candidates will require additional, time-consuming development efforts prior to commercial sale, including preclinical studies, clinical trials and approval by the FDA and/or applicable foreign regulatory authorities. All product candidates are prone to the risks of failure that are inherent in pharmaceutical product development, including the possibility that the product candidate will not be shown to be sufficiently safe and/or effective for approval by regulatory authorities. In addition, we cannot assure you that any such products that are approved will be manufactured or produced economically, successfully commercialized or widely accepted in the marketplace or be more effective than other commercially available alternatives.

Orphan drug designation from the FDA may be difficult or not possible to obtain, and if we are unable to obtain orphan drug designation for NS2 or our other product candidates, regulatory and commercial prospects may be negatively impacted.

The FDA designates orphan status to drugs that are intended to treat rare diseases with fewer than 200,000 patients in the United States or that affect more than 200,000 persons but are not expected to recover the costs of developing and marketing a treatment drug. Orphan status drugs do not require prescription drug user fees with a marketing application, may qualify the drug development sponsor for certain tax credits, and can be marketed without generic competition for seven years. We believe that NS2 will qualify as an orphan drug for SLS, discoid lupus, and acute anterior uveitis. However, we cannot guarantee that we will be able to receive orphan drug status from the FDA for NS2. If we are unable to secure orphan drug status for NS2 or our other product candidates, our regulatory and commercial prospects may be negatively impacted.

We rely and will continue to rely on outsourcing arrangements for many of our activities, including clinical development and supply of NS2 and our other product candidates.

We currently have only two full-time employees and, as a result, we rely, and expect to continue to rely, on outsourcing arrangements for a significant portion of our activities, including clinical research, data collection and analysis,

16

Table of Contents