Attached files

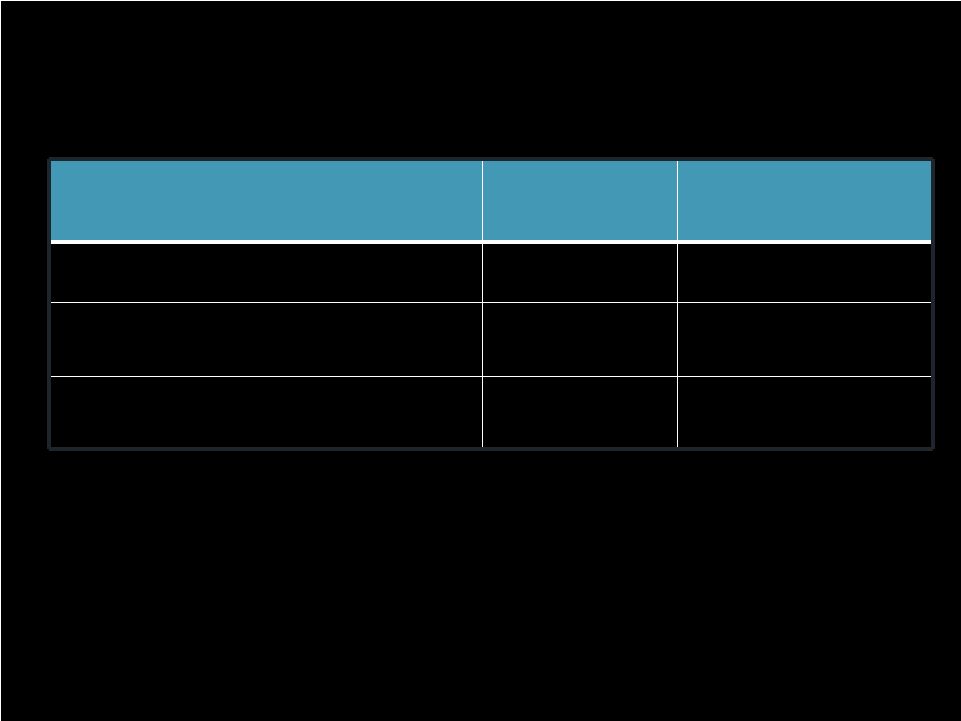

| file | filename |

|---|---|

| 8-K - FORM 8-K - FireEye, Inc. | d652058d8k.htm |

| EX-2.1 - EX-2.1 - FireEye, Inc. | d652058dex21.htm |

| EX-99.1 - EX-99.1 - FireEye, Inc. | d652058dex991.htm |

| EX-10.2 - EX-10.2 - FireEye, Inc. | d652058dex102.htm |

| EX-10.1 - EX-10.1 - FireEye, Inc. | d652058dex101.htm |

| EX-10.3 - EX-10.3 - FireEye, Inc. | d652058dex103.htm |

January 2nd, 2014

Reimagined

Security

FireEye Conference Call and Webcast

Exhibit 99.2 |

Copyright ©

2014, FireEye, Inc. All rights reserved.

2

Safe Harbor

This presentation contains forward-looking statements about the expectations, beliefs, plans,

intentions and strategies of FireEye relating to FireEye’s acquisition of Mandiant. Such

forward-looking statements include statements regarding future product offerings; expected

benefits to FireEye, Mandiant and their respective customers; expected financial impact of the

acquisition on FireEye; and plans regarding Mandiant and Mandiant personnel. These statements

reflect the current beliefs of FireEye and are based on current information available to us as

of the date hereof, and we do not assume any obligation to update the forward-looking statements

provided to reflect events that occur or circumstances that exist after the date on which they were

made. The

ability of FireEye to achieve these business objectives involves many risks and uncertainties that could cause

actual outcomes and results to differ materially and adversely from those expressed in any

forward-looking statements. These risks and uncertainties include the failure to achieve

expected synergies and efficiencies of operations between FireEye and Mandiant; the ability of

FireEye and Mandiant to successfully integrate their respective market opportunities,

technology, products, personnel and operations; the failure to timely develop and achieve

market acceptance of combined products and services; the potential impact on the business of Mandiant

as a result of the acquisition; the loss of any Mandiant customers; the ability to coordinate strategy

and resources between FireEye and Mandiant; the ability of FireEye and Mandiant to retain and

motivate key employees of Mandiant; general economic conditions; as well as those risks and

uncertainties included under the captions “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations,” in our Form

10-Q filed with the Securities and Exchange Commission on November 14, 2013 for the quarter ended

September 30, 2013, which is available on the Investor Relations section of our website at

investors.FireEye.com This presentation includes certain non-GAAP financial measures

as defined by the SEC rules. As required by Regulation G, we have provided a

reconciliation of those measures to the most directly comparable GAAP measures, which is

available in the appendix.

and

on

the

SEC

website

at

www.sec.gov. |

January 2nd, 2014

Reimagined

Security

Unifying leading security companies to create a complete platform

to combat advanced cyber threats

FireEye Acquires Mandiant |

FIREEYE & MANDIANT UNITED

David DeWalt

Chairman and Chief Executive Officer, FireEye

MANDIANT AT A GLANCE

Kevin Mandia

Chief Operating Officer, FireEye

FINANCIAL OVERVIEW

Michael Sheridan

Chief Financial Officer, FireEye

Copyright ©

2014, FireEye, Inc. All rights reserved.

4

AGENDA |

State of Cyber Security

PERFECT OPPORTUNITY

Innovation

Creates Perfect

Platform of Evil

Current Security

Models Ineffective

New Models

Required

Cyber Threats

More Advanced

& Complex than

Ever |

Creates the

ONLY company

that can deliver a

comprehensive

platform to detect,

resolve, and

prevent advanced

attacks on a

global basis

Brings together the leading advanced threat detection

vendor and the leader in incident response

management

Accelerates DEPLOYMENT of FireEye’s MVX

technology from network to endpoint

Combines FireEye’s real-time intelligence gathered

from 2M+ VMs and Mandiant’s real-time monitoring of

2M+ endpoints to create the most comprehensive

platform

Increases global scale and time to profitability for the

combined company

Significantly expands TAM (from $11.6Bn to ~$30Bn) to

include endpoint products, cloud offerings, services,

and managed defense (MSP)

Presents strong synergy opportunities for cross selling,

up-selling respective product lines

FireEye and Mandiant United

Copyright ©

2014, FireEye, Inc. All rights reserved.

6 |

Copyright ©

2014, FireEye, Inc. All rights reserved.

7

VIRTUAL MACHINE

BASED PRODUCTS

CONTINUOUS

MONITORING

MANAGED

DEFENSE

INCIDENT RESPONSE

24x7 Global

Support

Significantly

reduced time

to remediation

Real

Time

FireEye and Mandiant United

SERVICES |

Copyright ©

2014, FireEye, Inc. All rights reserved.

8

Significant Revenue Synergy Potential

Cross Sell

International

Expansion

Product

Enhancements

FireEye’s broader

international footprint

accelerates Mandiant’s

international go-to market

efforts

Sell email and web into

Mandiant’s customer base

FireEye product development

excellence can accelerate

Mandiant's efforts

Positions the combined

company to offer a

differentiated IPS solution

Bolsters the value of DTI

threat data

Mandiant accelerates

FireEye’s efforts to proliferate

MVX onto endpoints

Provide an enhanced cloud

offering to the combined

customer base

Sell endpoint into FireEye’s

customer base |

At

Mandiant We Live the Headlines Every Day Copyright ©

2014, FireEye, Inc. All rights resered.

9 |

Copyright ©

2014, FireEye, Inc. All rights reserved.

10

Mandiant’s Solutions Resolve Security Incidents

Security incident

response

management platform

& managed service

High-end, white glove

incident response &

security consulting

services

Unmatched intelligence about tools & tactics of

advanced attack groups directly from the front lines

PRODUCTS

SERVICES

THREAT

INTEL |

11

Addressing the Entire Advanced Threat Lifecycle

Stop Attacks

Virtual machine-

based detection

to stop attacks.

Investigate &

Respond

Endpoint forensics &

incident response

expertise.

* Median # of days attackers are present on a victim network before detection

(source: Mandiant M-Trends 2013). RESPOND

& CONTAIN

PREVENT

DETECT

243

Days*

Network-Based

Threat Detection

Best-in class

products for

detecting threats

on the Network.

Endpoint-Based

Threat Detection

Best-in class

products for finding

threats on

Endpoints. |

Mandiant Overview

THE LEADER IN SECURITY INCIDENT RESPONSE MANAGEMENT

Founded in 2004

Undisputed leader in

incident response

Category creator for

endpoint threat

detection & response

products

Curator of unparalleled

threat intelligence

repository

Industry

Thought Leaders

2013 sales >$100M

3-Year revenue CAGR

of ~50%

Profitable while

growing rapidly

Strong Financial

Position

“Who’s Who”

of the

Fortune 1000

More than 33% of

the Fortune 100

2012 top 25

customers >$1MM

Diversified Enterprise

Customer Base

Copyright ©

2014, FireEye, Inc. All rights reserved.

12

50%+ sales from

endpoint products and

subscriptions |

Copyright ©

2014, FireEye, Inc. All rights reserved.

13

Billings

$48.5M

$82M -

$86M

$95M -

$100M

96% -

106%

Revenue

$31.7M

$52M -

$54M

$55M -

$57M

74% -

80%

Billings

$129.6M

$254M -

$259M

96% -

100%

Revenue

$83.3M

$159M -

$161M

91% -

93%

2013 Preliminary Results: FireEye Standalone

$240M -

$245M

$156M -

$158M

Q4 ‘12 Actual

Q4 ’13 Guidance

(Provided in Q3 2013

Earnings Call)

Preliminary

Q4 ‘13 Results

%’s are growth rates

2012 Actual

2013 Guidance

Preliminary

2013 Results

(Provided in Q3 2013

Earnings Call)

%’s are growth rates |

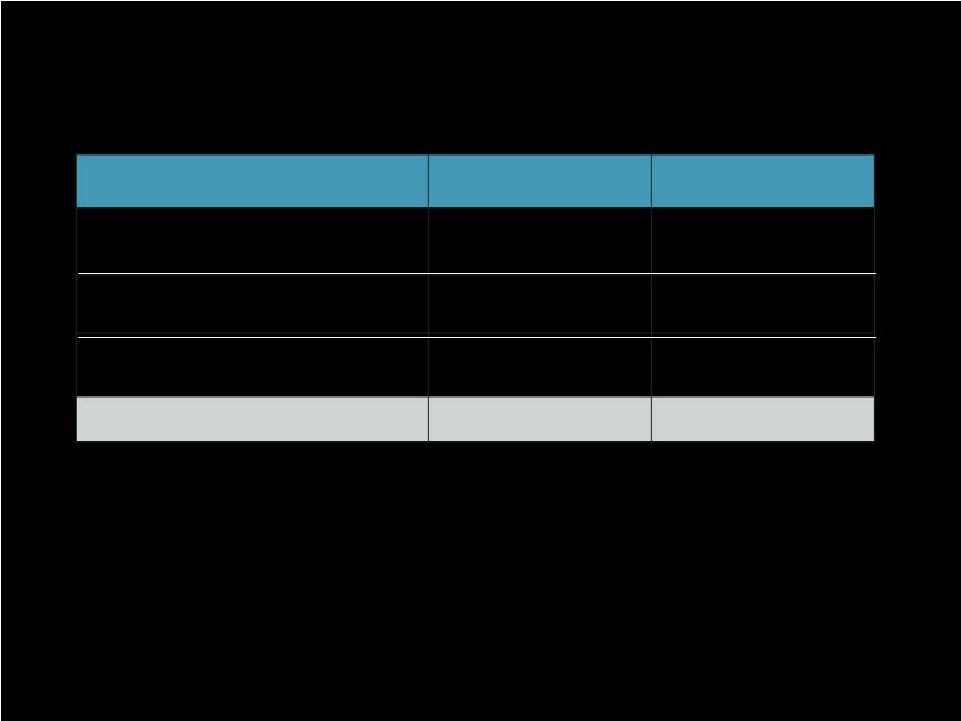

Mandiant –

Historical Financial Metrics

Operating margin and cash flow have historically been breakeven to slightly

positive. Copyright ©

2014, FireEye, Inc. All rights reserved.

14

40% -

50%

Total

100%

70% -

74%

Product Subscriptions and

Support

Product

Incident Response Services

Revenue Category

% of Total Revenue

Gross Margin %

30% -

40%

10% -

20%

77% -

82%

72% -

77%

60% -

65% |

Copyright ©

2014, FireEye, Inc. All rights reserved.

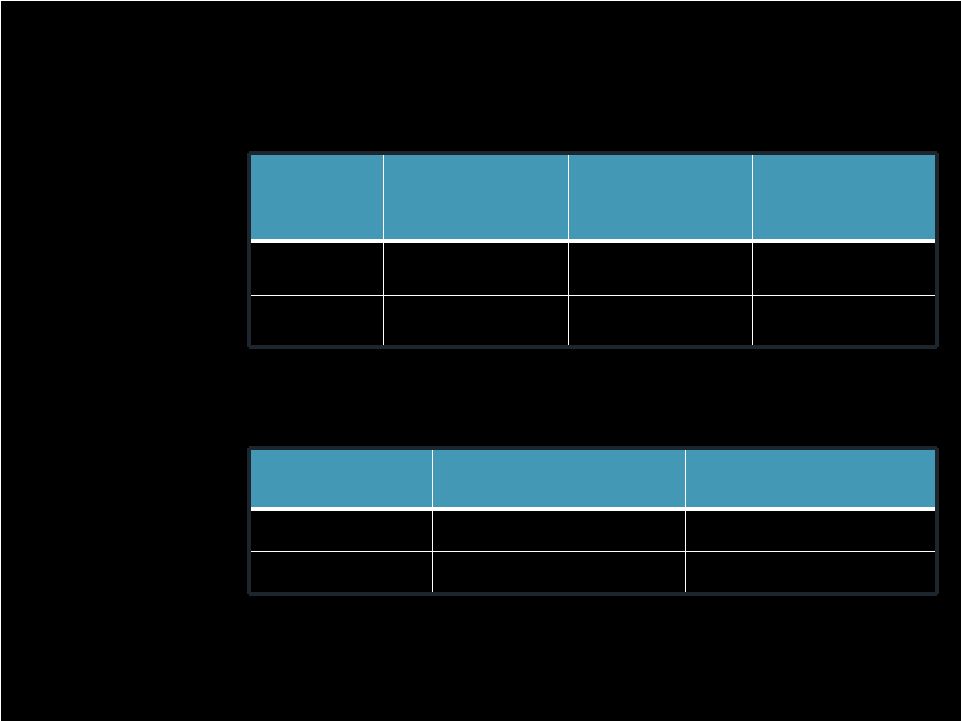

15

2013 Guidance

(Provided in Q3 2013

Earnings Call)

2014 Guidance

(Provided in Q3 2013

Earnings Call)

Midpoint of

Guidance

Growth Rates

Billings

48%

Revenue

56%

Combined 2014

Guidance

Midpoint of Guidance

Growth Rates

Billings

$540M -

$560M

42%

Revenue

$400M -

$410M

50%

FireEye Standalone

Guidance Recap

Combined Company

2014 Guidance

2014 Combined Guidance: Revenues & Billings

$240M -

$245M

$156M -

$158M

$350M -

$370M

$240M -

$250M |

Copyright ©

2014, FireEye, Inc. All rights reserved.

16

FireEye

YTD Q3 2013

Combined

Company 2014

Product

54%

40% -

45%

Product Subscription and

Support

44%

40% -

45%

Incident Response &

Professional Services

2%

15% -

17%

% of Total Revenue

2014 Combined Guidance: Other Financial Metrics

•

Gross Margins stable at 70% -

73% for combined company

•

Combination expected to improve non-GAAP operating

margins and cash flows as a percentage of revenue |

Copyright ©

2014, FireEye, Inc. All rights reserved.

17

Key Integration Priorities

•

Sales Capacity Expansion

–

Leverage FireEye recruiting resources

•

International Expansion

–

Leverage existing FireEye international infrastructure

•

Operations & Systems

–

Integrate ERP and CRM systems

–

Integrate Finance, Legal & HR

–

Facilitate cross-sell, up-sell & TCV expansion through

integration of GTM strategies and product management

infrastructure |

Copyright ©

2014, FireEye, Inc. All rights reserved.

18

Transaction Overview

~$1 billion in transaction value

16.9 million FireEye shares and ~$106.5 million cash

Assumed 4.6 million options

Equity issued represents ~13% pro forma ownership

Cash funded from FireEye’s balance sheet

Consideration

Financial

Timeline

Significant increase in revenue

Sustained high growth rate for combined company

Combination expected to improve non-GAAP

operating margins and cash flow as a % of revenue

Regulatory clearance filed early and received prior to close

Approved by both Boards, signed and closed on

December 30 |

Copyright ©

2014, FireEye, Inc. All rights reserved.

19

Creates complete end to end provider of solutions to protect

against advanced targeted attacks

Enhances our competitive positioning against incumbents

Enhances our scale and time to profitability

Expands our TAM

Significant top line and bottom line synergy opportunities

FireEye and Mandiant United! |

Appendix |

Copyright ©

2014, FireEye, Inc. All rights reserved.

21

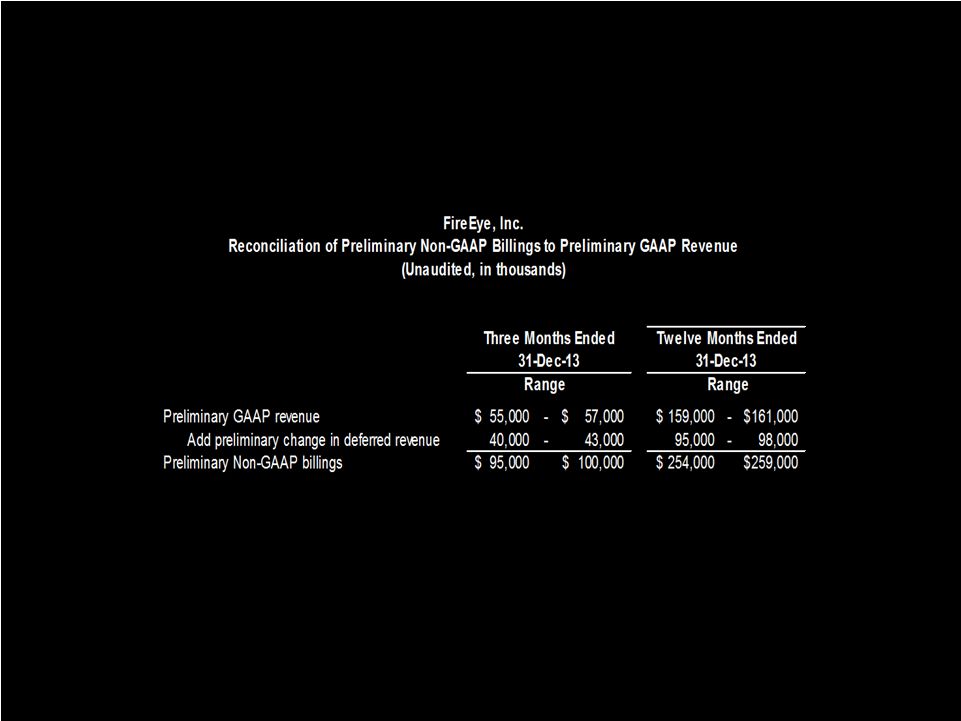

Reconciliation of Preliminary Q4’13 and

Fiscal Year Billings to Revenue |

Reimagined

Security |