Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WESTMORELAND COAL Co | f8k_122313i101701.htm |

| EX-99.1 - EXHIBIT 99.1 - WESTMORELAND COAL Co | exh99-1_122413.htm |

| EX-99.2 - EXHIBIT 99.2 - WESTMORELAND COAL Co | exh99-2_122413.htm |

Westmoreland Announces Transformational Acquisition of Sherritt’s Coal Operations December 24, 2013 Westmoreland Coal Company westmoreland.com NASDAQ:WLB

Westmoreland Coal Company 1 Presenters Keith Alessi Executive Chairman of the Board Bob King President and Chief Executive Officer Kevin Paprzycki Chief Financial Officer & Treasurer

Westmoreland Coal Company 2 Disclaimer Forward Looking Statements This document may contain “forward-looking statements.” Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects” and similar references to future periods. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. We therefore caution you against relying on any of these forward-looking statements. They are statements neither of historical fact nor guarantees or assurances of future performance. Important factors that could cause actual results to differ materially from those in the forward-looking statements include political, economic, business, competitive, market, weather and regulatory conditions and the following: Changes in our post-retirement medical benefit and pension obligations and the impact of the recently enacted healthcare legislation; Changes in our black lung obligations, changes in our experience related to black lung claims, and the impact of the recently enacted healthcare legislation; Our potential inability to expand or continue current coal operations due to limitations in obtaining bonding capacity for new mining permits; Our potential inability to maintain compliance with debt covenant and waiver agreement requirements; The potential inability of our subsidiaries to pay dividends to us due to restrictions in our debt arrangements, reductions in planned coal deliveries or other business factors; Risks associated with the structure of our power plants' contracts with its lenders, coal suppliers and power purchaser, which could dramatically affect the overall profitability of our power plants; The effect of Environmental Protection Agency inquiries and regulations on the operations of power plants; The effect of prolonged maintenance or unplanned outages at our operations or those of our major power generating customers; Future legislation and changes in regulations, governmental policies and taxes, including those aimed at reducing emissions of elements such as mercury, sulfur dioxides, nitrogen oxides, particulate matter or greenhouse gases; and Other factors as described in “Risk Factors” found in our Annual Report on Form 10-K. Any forward-looking statements made by us in this document speak only as of the date on which they are made. Factors or events that could cause our actual results to differ may emerge from time-to-time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future developments or otherwise, except as may be required by law. In addition, Canadian reserve reporting and IFRS auditing standards differ from the standards applicable to public reporting companies in the United States. As such, the numbers reported herein may differ in immaterial amounts from the final numbers that will be reported following the IFRS to GAAP financial statement conversion process.

Westmoreland Coal Company 3 Westmoreland to Acquire Sherritt’s Coal Operations Westmoreland Coal Company (“Westmoreland”) has entered into an agreement to acquire the Prairie and Mountain coal mining operations of Sherritt International Corporation (“Sherritt”) for approximately $435 million $293 million in cash consideration $142 million in capital lease assumptions BMO Capital Markets and Deutsche Bank have provided Westmoreland with fully- committed financing that will enable Westmoreland to fund the full purchase price and the reclamation bonding obligations and transaction expenses The transaction is unanimously approved by the Boards of both companies Closing is expected towards the end of Q1 2014 subject to certain conditions Note: All figures in presentation in US$ unless otherwise noted

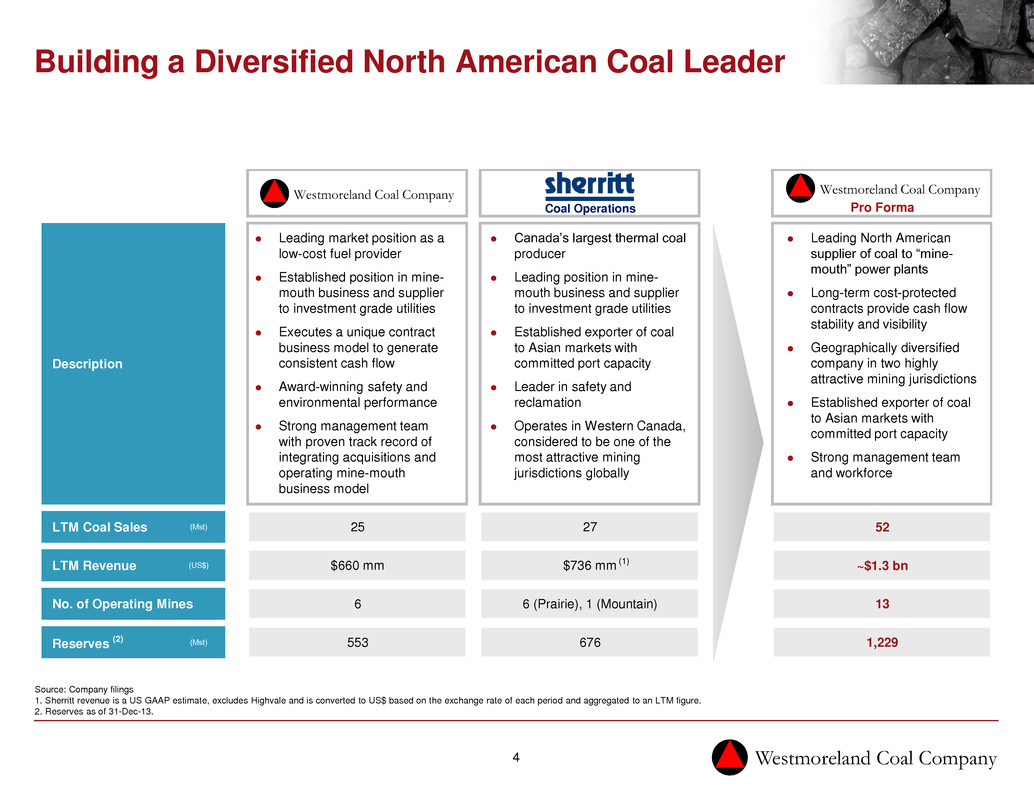

Westmoreland Coal Company 4 Pro Forma Description LTM Coal Sales (Mst) 25 27 52 LTM Revenue (US$) $660 mm $736 mm ~$1.3 bn No. of Operating Mines 6 6 (Prairie), 1 (Mountain) 13 Reserves (2) (Mst) 553 676 1,229 (1) Building a Diversified North American Coal Leader Westmoreland Coal Company Leading market position as a low-cost fuel provider Established position in mine- mouth business and supplier to investment grade utilities Executes a unique contract business model to generate consistent cash flow Award-winning safety and environmental performance Strong management team with proven track record of integrating acquisitions and operating mine-mouth business model Canada’s largest thermal coal producer Leading position in mine- mouth business and supplier to investment grade utilities Established exporter of coal to Asian markets with committed port capacity Leader in safety and reclamation Operates in Western Canada, considered to be one of the most attractive mining jurisdictions globally Leading North American supplier of coal to “mine- mouth” power plants Long-term cost-protected contracts provide cash flow stability and visibility Geographically diversified company in two highly attractive mining jurisdictions Established exporter of coal to Asian markets with committed port capacity Strong management team and workforce Source: Company filings 1. Sherritt revenue is a US GAAP estimate, excludes Highvale and is converted to US$ based on the exchange rate of each period and aggregated to an LTM figure. 2. Reserves as of 31-Dec-13. Westmoreland Coal Company Coal Operations

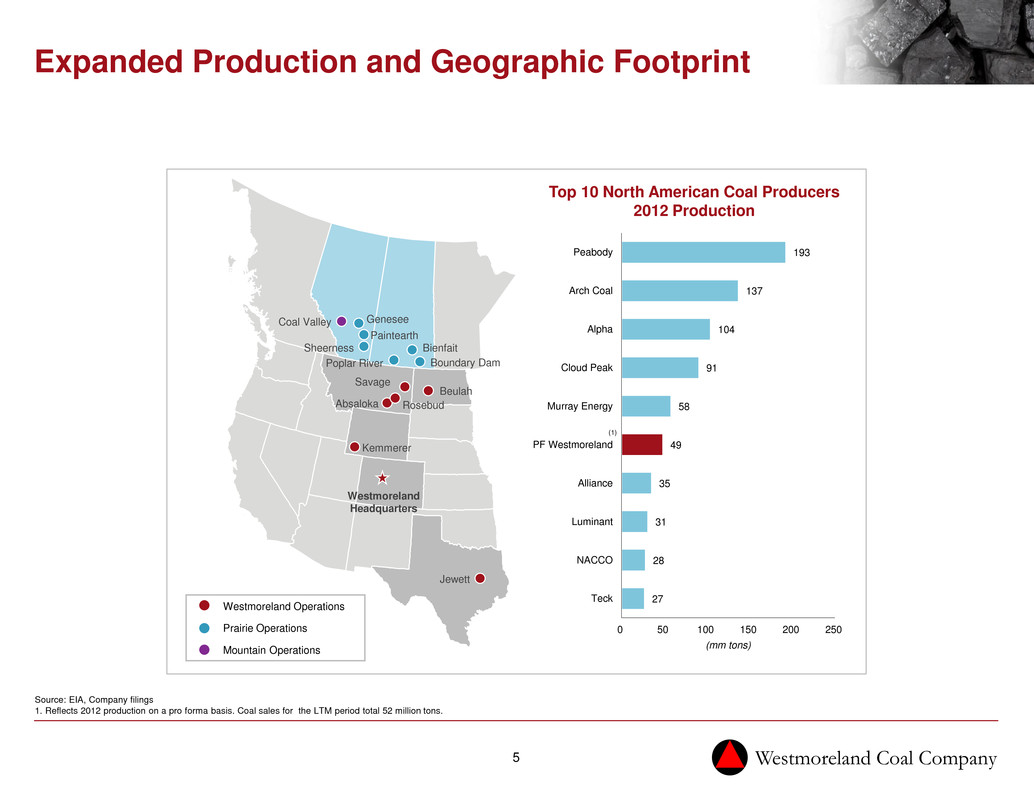

Westmoreland Coal Company 5 Expanded Production and Geographic Footprint Westmoreland Headquarters Jewett Kemmerer Beulah Savage Absaloka Rosebud Paintearth Genesee Sheerness Boundary Dam Bienfait Poplar River Coal Valley Westmoreland Operations Prairie Operations Mountain Operations 193 137 104 91 58 49 35 31 28 27 0 50 100 150 200 250 Peabody Arch Coal Alpha Cloud Peak Murray Energy PF Westmoreland Alliance Luminant NACCO Teck (mm tons) Top 10 North American Coal Producers 2012 Production Source: EIA, Company filings 1. Reflects 2012 production on a pro forma basis. Coal sales for the LTM period total 52 million tons. (1)

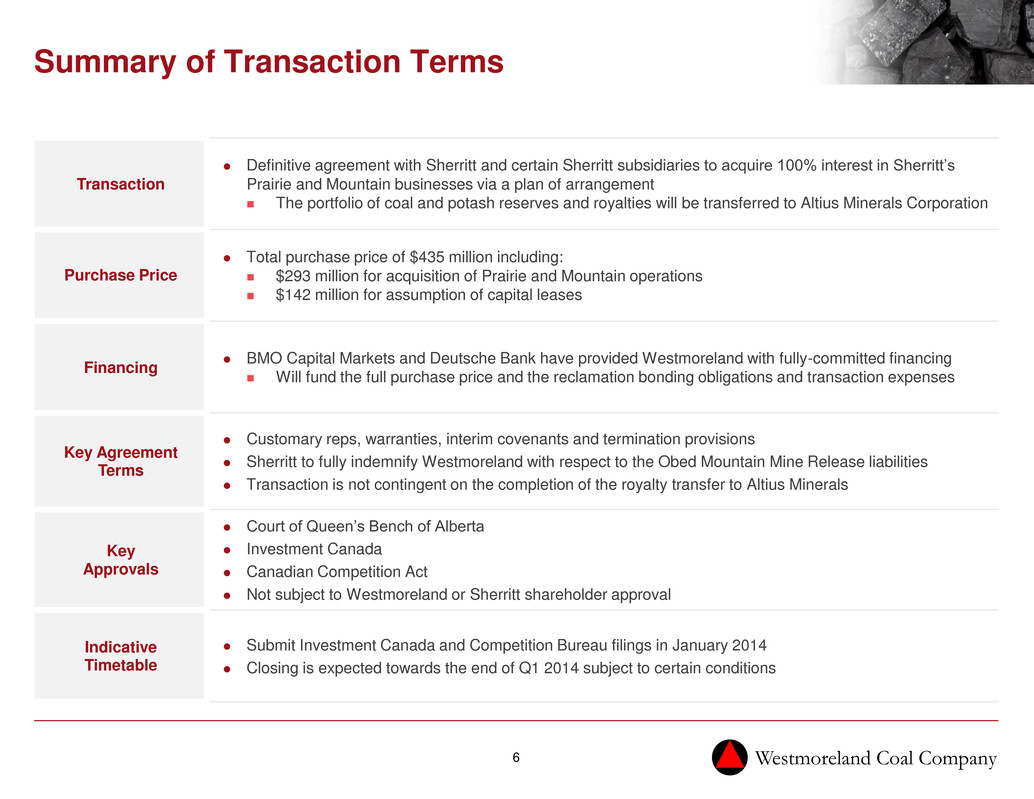

Westmoreland Coal Company 6 Summary of Transaction Terms Transaction Definitive agreement with Sherritt and certain Sherritt subsidiaries to acquire 100% interest in Sherritt’s Prairie and Mountain businesses via a plan of arrangement The portfolio of coal and potash reserves and royalties will be transferred to Altius Minerals Corporation Purchase Price Total purchase price of $435 million including: $293 million for acquisition of Prairie and Mountain operations $142 million for assumption of capital leases Financing BMO Capital Markets and Deutsche Bank have provided Westmoreland with fully-committed financing Will fund the full purchase price and the reclamation bonding obligations and transaction expenses Key Agreement Terms Customary reps, warranties, interim covenants and termination provisions Sherritt to fully indemnify Westmoreland with respect to the Obed Mountain Mine Release liabilities Transaction is not contingent on the completion of the royalty transfer to Altius Minerals Key Approvals Court of Queen’s Bench of Alberta Investment Canada Canadian Competition Act Not subject to Westmoreland or Sherritt shareholder approval Indicative Timetable Submit Investment Canada and Competition Bureau filings in January 2014 Closing is expected towards the end of Q1 2014 subject to certain conditions

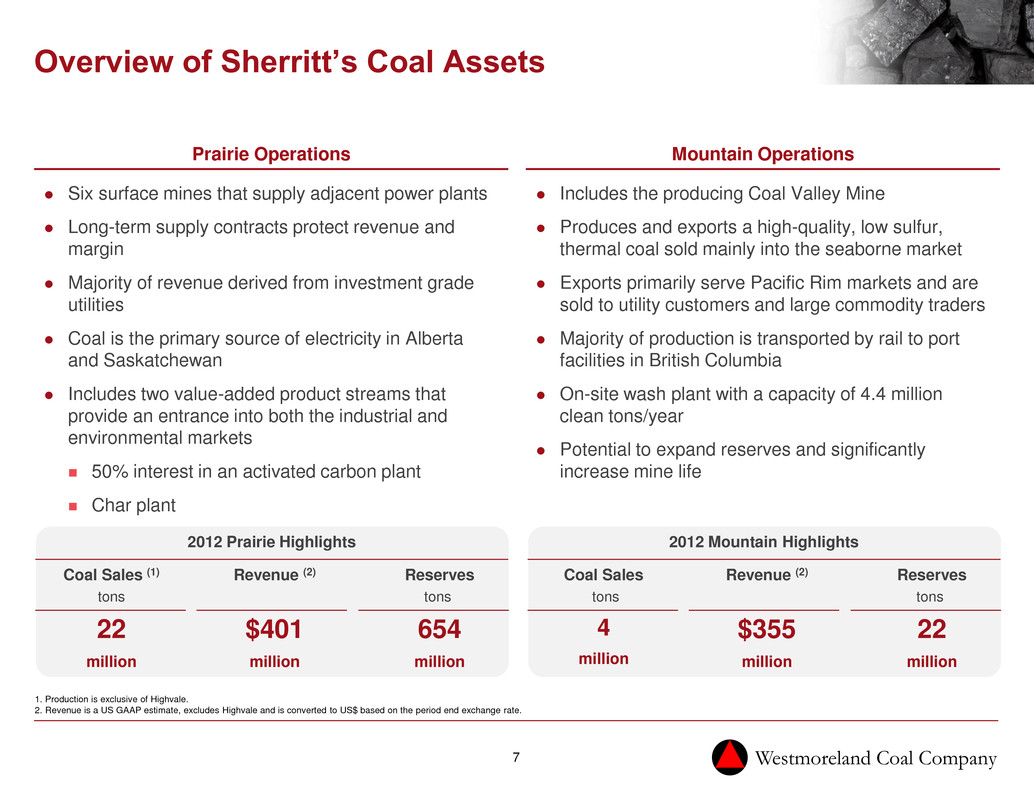

Westmoreland Coal Company 7 Overview of Sherritt’s Coal Assets Prairie Operations Mountain Operations Six surface mines that supply adjacent power plants Long-term supply contracts protect revenue and margin Majority of revenue derived from investment grade utilities Coal is the primary source of electricity in Alberta and Saskatchewan Includes two value-added product streams that provide an entrance into both the industrial and environmental markets 50% interest in an activated carbon plant Char plant Includes the producing Coal Valley Mine Produces and exports a high-quality, low sulfur, thermal coal sold mainly into the seaborne market Exports primarily serve Pacific Rim markets and are sold to utility customers and large commodity traders Majority of production is transported by rail to port facilities in British Columbia On-site wash plant with a capacity of 4.4 million clean tons/year Potential to expand reserves and significantly increase mine life 2012 Prairie Highlights Coal Sales (1) tons 22 million Revenue (2) $401 million Reserves tons 654 million 2012 Mountain Highlights Coal Sales tons 4 million Revenue (2) $355 million Reserves tons 22 million 1. Production is exclusive of Highvale. 2. Revenue is a US GAAP estimate, excludes Highvale and is converted to US$ based on the period end exchange rate.

Westmoreland Coal Company 8 Westmoreland’s Plan for Sherritt’s Coal Assets Westmoreland plans to leverage its experienced team to: Ensure business continuity and control Implement transition and synergy initiatives Integrate operations teams Initiate implementation of Westmoreland’s operating and capital spending philosophy Execute upon identified opportunities for additional cost and capital savings Key operational areas of focus for cost improvements include the following: Prairie Improved dragline procedures and utilization Improved capital and operational planning Mountain Improved coal segregation, cleaning and blending practices Improved coal recovery and plant availability Implementation of use of augers to increase resource recovery and lower costs Improved capital and operational planning

Westmoreland Coal Company 9 Transaction Rationale Significantly Increases Westmoreland’s Scale Annual production from Prairie and Mountain operations will double Westmoreland’s production creating the 6th largest North American coal producer as measured by 2012 production Long mine lives supported by a combined reserve base of over 1.2 billion tons will provide sustainability and will support Westmoreland’s long-term cash flows Highly Complementary to Existing Operating Model Complementary to Westmoreland’s core surface mining, mine-mouth business model with long-term cost protected contracts Opportunities identified to further optimize the Prairie and Mountain operations based on Westmoreland’s experience at existing operations Safe and environmentally responsible operations Enhances Westmoreland’s Asset Portfolio Asset diversification into Canada, one of the world’s most favorable mining jurisdictions Mountain operations provides entry point into the export market and strategic access to port facilities Existing workforce and management teams at the Prairie and Mountain operations are expected to be highly complementary to Westmoreland’s team Financially Accretive to Westmoreland The acquisition is expected to be financially accretive to Westmoreland on a free cash flow basis Opportunities have been identified to further optimize the mining operations based on Westmoreland’s experience, synergies and economies of scale On a combined basis, the pro forma company’s estimated LTM U.S. GAAP revenue would have been approximately US$1.3 billion Note: Sherritt revenue based on US GAAP estimate, excludes Highvale and is converted to US$ based on the exchange rate of each period and aggregated to an LTM figure.

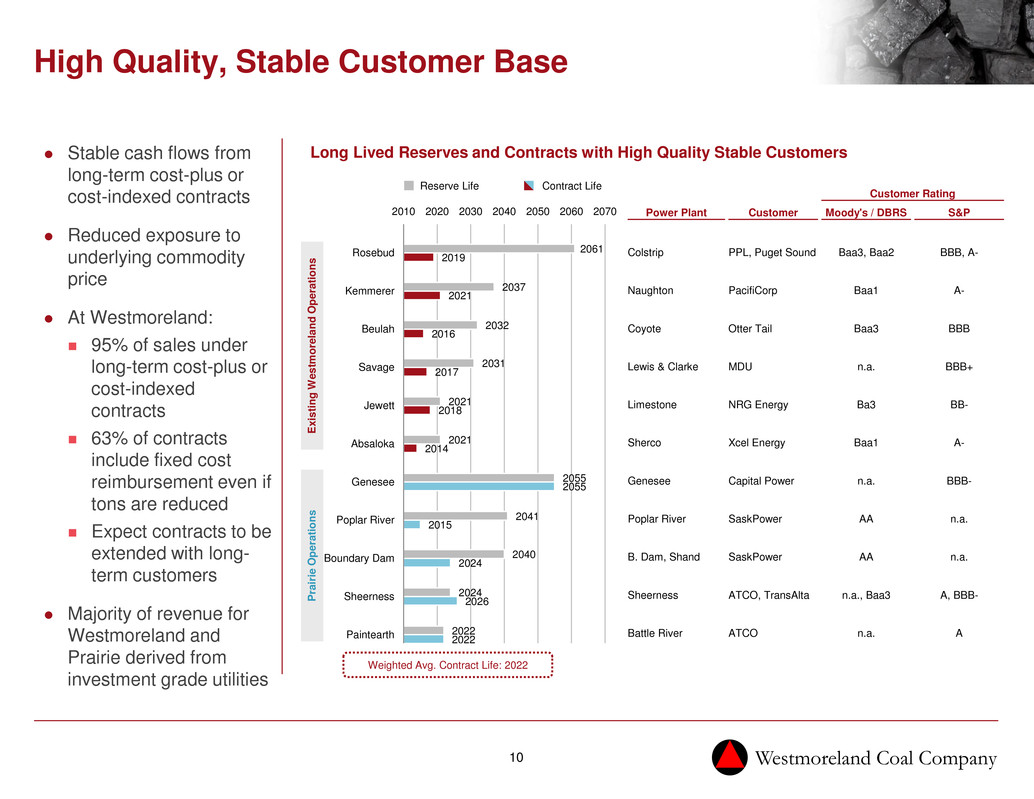

Westmoreland Coal Company 10 High Quality, Stable Customer Base Stable cash flows from long-term cost-plus or cost-indexed contracts Reduced exposure to underlying commodity price At Westmoreland: 95% of sales under long-term cost-plus or cost-indexed contracts 63% of contracts include fixed cost reimbursement even if tons are reduced Expect contracts to be extended with long- term customers Majority of revenue for Westmoreland and Prairie derived from investment grade utilities Long Lived Reserves and Contracts with High Quality Stable Customers Reserve Life Contract Life Customer Rating Power Plant Customer Moody's / DBRS S&P Colstrip PPL, Puget Sound Baa3, Baa2 BBB, A- Naughton PacifiCorp Baa1 A- Coyote Otter Tail Baa3 BBB Lewis & Clarke MDU n.a. BBB+ Limestone NRG Energy Ba3 BB- Sherco Xcel Energy Baa1 A- Genesee Capital Power n.a. BBB- Poplar River SaskPower AA n.a. B. Dam, Shand SaskPower AA n.a. Sheerness ATCO, TransAlta n.a., Baa3 A, BBB- Battle River ATCO n.a. A 2061 2037 2032 2031 2021 2021 2055 2041 2040 2024 2022 2019 2021 2016 2017 2018 2014 2055 2015 2024 2026 2022 2010 2020 2030 2040 2050 2060 2070 Rosebud Kemmerer Beulah Savage Jewett Absaloka Genesee Poplar River Boundary Dam Sheerness Paintearth Pr ai rie Op er at ion s Ex is ting W es tm or el an d Op er at ion s Weighted Avg. Contract Life: 2022

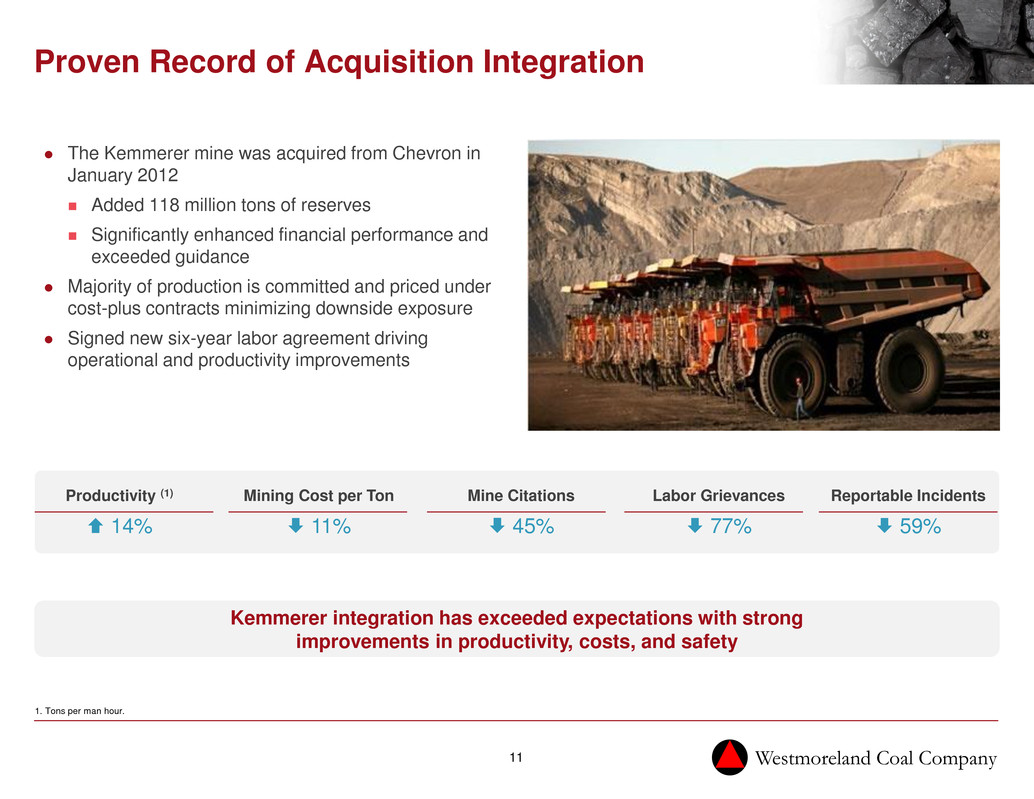

Westmoreland Coal Company 11 Proven Record of Acquisition Integration The Kemmerer mine was acquired from Chevron in January 2012 Added 118 million tons of reserves Significantly enhanced financial performance and exceeded guidance Majority of production is committed and priced under cost-plus contracts minimizing downside exposure Signed new six-year labor agreement driving operational and productivity improvements Kemmerer integration has exceeded expectations with strong improvements in productivity, costs, and safety 1. Tons per man hour. Productivity (1) 14% Reportable Incidents 59% Labor Grievances 77% Mine Citations 45% Mining Cost per Ton 11%

Westmoreland Coal Company 12 Building a North American Coal Leader Leading North American supplier of coal to “mine-mouth” power plants Long-term cost-protected contracts provide cash flow stability and visibility Geographically diversified company in two highly attractive mining jurisdictions Established exporter of coal to Asian markets with committed port capacity Strong management team with proven track record of integrating acquisitions and operating mine-mouth business model Exceptional workforce with an outstanding safety and environmental record

Westmoreland Coal Company 13 Investor Relations For investor relations please contact: Kevin Paprzycki Chief Financial Officer and Treasurer Westmoreland Coal Company 9540 South Maroon Circle Suite 200 Englewood, CO 80112 (720) 354-4489 Toll Free: (855) 922-6463