Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CREATIVE REALITIES, INC. | c-20131223x8k.htm |

EXHIBIT 10

NOTE AND WARRANT PURCHASE AGREEMENT

THIS NOTE AND WARRANT PURCHASE AGREEMENT (“Agreement”) is entered into as of December 17, 2013, by and among Wireless Ronin Technologies, Inc., a Minnesota corporation (the “Company” or the “Issuer”), and the parties indicated as Purchasers on one or more counterpart signature pages hereof (each a “Purchaser” and collectively the “Purchasers”).

RECITALS

WHEREAS, the Issuer desires to issue and sell up to $1,500,000 in face value of unsecured convertible promissory notes (“Notes”) and warrants for the purchase of up to 1,500,000 shares of the common stock of the Company (“Warrants”), and the Purchasers desire to purchase the Notes to be issued by the Issuer in substantially the form attached hereto as Exhibit “A”, and the Warrants to be issued by the Issuer in substantially the form attached hereto as Exhibit “B”.

NOW, THEREFORE, in consideration of the foregoing recitals and the mutual promises hereinafter set forth, the parties hereto, intending to be legally bound hereby, agree as follows:

|

1. |

Purchase and Sale of Notes and Warrants. |

|

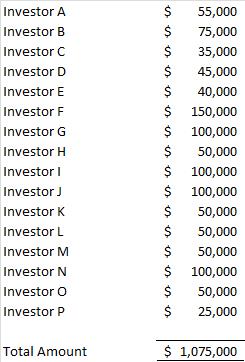

1.1 Purchase and Sale. Subject to the terms and conditions hereof, at the Closing (as hereinafter defined), the Issuer shall sell, issue and deliver, and each Purchaser shall purchase, a Note and a Warrant in the amounts indicated on the schedule attached hereto as Exhibit “C”. |

|

1.2 Purchase Price. The purchase price of each Note and associated Warrant (the “Purchase Price”) shall be equal to the principal amount of such Note. |

|

2. |

Closing, Delivery, and Payment. |

|

2.1 Closing. The transactions contemplated by this Agreement shall be effectuated at a Closing (“Closing”) which shall take place at 10:00 a.m. no later than December 13, 2013, at the offices of the Company at 5929 Baker Road, Suite 475, Minnetonka, MN 55345 (“Closing Date”), or at such other time or place as the Company and the Purchasers may mutually agree, with such other subsequent Closings at such other times and places as the Company and the Purchasers shall determine. |

|

2.2 Delivery and Payment. At Closing, subject to the terms and conditions hereof, the Issuer shall deliver to each Purchaser the applicable Note, against payment by such Purchaser of the amount of the Purchase Price payable by such Purchaser by wire transfer (to the account identified by the Company). |

|

3. |

Representations and Warranties of the Company. |

The Issuer hereby represents and warrants to each Purchaser as of the date of this Agreement and as of the date of Closing as follows:

1

|

3.1 Organization, Good Standing and Qualification. The Company is a corporation duly organized, validly existing, and in good standing under the laws of the State of Minnesota. The Company has all requisite power and authority to own and operate its properties and assets; to execute, deliver, and perform this Agreement, the Notes and the other documents and instruments contemplated hereby or thereby or otherwise made or delivered in connection herewith or therewith (collectively, the “Transaction Documents”) to which it is a party; to issue, sell, and deliver the Notes and the shares of common stock issuable upon conversion thereof (the “Securities”), and the Warrants; and to carry on its business as presently conducted and as presently proposed to be conducted. The Company is duly qualified, authorized to do business, and in good standing as a foreign corporation in all jurisdictions in which the nature of its activities and properties makes such qualification necessary. |

|

3.2 Capitalization. The authorized capital of the Company (“Capital Stock”) is as set forth in its quarterly report for the quarterly period ended September 30, 2013 filed with the United States Securities and Exchange Commission (the “Commission”). All issued and outstanding shares of Capital Stock have been duly authorized and validly issued and are fully paid and non-assessable. The Securities have been duly and validly reserved for issuance. The Securities, when issued upon conversion of the Notes, shall be validly issued, fully paid, and non-assessable. |

|

3.3 Authorization; Binding Obligations. All corporate action on the part of the Company necessary for the authorization, sale, issuance, and delivery of the Notes and, upon conversion thereof, the Securities; the authorization, execution, and delivery of this Agreement and the other Transaction Documents; and, the performance of all obligations of the Company hereunder and thereunder, has been taken. This Agreement, the Notes, the Warrants and the other Transaction Documents to which it is a party, when executed and delivered, shall be valid and binding obligations of the Company enforceable against it in accordance with their respective terms. |

|

3.4 Financial Statements. The Company’s quarterly report for the quarterly period ended September 30, 2013 and annual report for the period ended December 31, 2012, both filed with the Commission, present fairly, in all material respects, the consolidated financial position of the Company and its subsidiaries as of the dates thereof, and the consolidated results of its operations and its cash flows for the nine months and year then ended in conformity with U.S. generally accepted accounting principles. |

|

3.5 Agreements. Each of the contracts and agreements material to the conduct of the business of the Issuer as it is presently conducted, assuming due execution and delivery by the other parties to such contracts, agreements, and leases, is legal, valid, and binding, and in full force and effect, and enforceable by the Company in accordance with its terms. |

|

3.6 Intellectual Property. The Issuer owns or possesses adequate licenses or other rights to use all trademarks, service marks, trade names, copyrights, trade secrets, manufacturing processes, software, formulae, know-how, and other proprietary rights and patents necessary or appropriate for its business as now conducted and as presently proposed to be conducted, without any infringement of the rights of others. |

2

|

3.7 Compliance with Other Instruments. The Issuer is in compliance with all of the provisions of its Articles of Incorporation and By-Laws. Except with respect to the Permitted Indebtedness (as defined in Section 6.2(b) below), the execution, delivery, and performance by the Issuer of this Agreement and each of the other Transaction Documents, the issuance of the Notes and, upon conversion thereof, the Securities, and the fulfillment and compliance with respective terms hereof and thereof by the Issuer, do not and will not (a) conflict with or result in a material breach or violation of the terms, conditions, or provisions of any indenture, agreement, or instrument to which the Issuer is bound, (b) constitute a default under such indenture, agreement, or instrument, (c) result in the creation of any lien, security interest, charge, or encumbrance upon the Company’s Capital Stock or assets pursuant to any such indenture, agreement, or instrument, (d) give any third party the right to accelerate any obligation under any such indenture, agreement, or instrument, or (e) require any authorization, consent, approval, exemption, or other action by or notice to any court, administrative or governmental body, or any third party pursuant to, the Articles or By-Laws of the Issuer, or any law, statute, rule, or regulation to which any Issuer is subject, or any agreement, instrument, order, judgment or decree to which any Issuer is subject, other than the filing of a Form D with the Commission and appropriate blue sky filings with state securities commissions as applicable. |

|

3.8 Litigation. There is no material action, suit, claim, investigation, arbitration, or other legal or administrative proceeding pending or, to the Issuer’s knowledge, threatened against the Issuer and, to the Issuer’s knowledge, there is no basis for any of the foregoing. There are no unsatisfied judgments, penalties, or awards against or affecting the Issuer or its respective businesses, properties, or assets. |

|

3.9 Compliance with Laws; Regulatory Permits. The Issuer is not in violation, in any material respect, of any applicable statute, rule, regulation, order, or restriction of any domestic or foreign government or any instrumentality or agency thereof in respect of the conduct of its business or the ownership of its properties. The Issuer has all necessary approvals, clearances, permits, licenses, registrations, and any similar authority necessary for the conduct of its business as now being or presently being proposed to be conducted by it. |

|

3.10 Offering Valid. Assuming the accuracy of the representations and warranties of the Purchaser contained in Section 4.2 hereof, the offer, sale, and issuance of the Notes and, upon conversion thereof, the issuance of the Securities, shall be exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), and are exempt from registration and qualification under the registration or qualification requirements of applicable state securities laws. No Issuer nor any agent on behalf of any Issuer has solicited or shall solicit any offers to sell or has offered to sell or shall offer to sell all or any part of the Securities to any Person so as to bring the sale of such Securities by the Issuer within the registration provisions of the Securities Act or applicable state securities laws. |

|

3.11 Tax Returns and Payments. All federal, state, local, and foreign tax returns and reports of the Issuer required by law to be filed as of the date of this Agreement have been filed, and such returns and reports are correct and complete, and amounts equal to all taxes and other fees that are due and payable have been fully and timely paid or, in the case of taxes not yet due, fully provided for in the Financial Statements. |

3

|

3.12 Environmental Regulations. No notice, notification, demand, request for information, citation, summons, complaint, or order has been received by, and, to each Issuer’s knowledge, no action, claim, suit, proceeding, review, or investigation is pending or threatened against, any Issuer with respect to any matters relating to or arising out of any Environmental Law. As used herein, “Environmental Law” means any federal, state, local or foreign statute, law, judicial decision, regulation, ordinance, rule, judgment, order, code, injunction, permit, or governmental agreement relating to human health or the environment. |

|

3.13 Periodic reports filed with the Commission. As of the date of this Agreement, (A) the Company has not sustained any material loss or interference with its business from fire, explosion, flood or other calamity, whether or not covered by insurance, or from any labor dispute or court or governmental action, order or decree, otherwise than as set forth in the Company’s periodic reports and other information filed with the Commission, and (B) there has not been any change in the capital stock of the Company (other than a change in the number of outstanding shares of the Company’s common stock, $0.01 par value (the “Common Stock”) due to the issuance of shares upon the exercise of outstanding options or warrants and restricted stock awards granted in connection with standard director compensatory arrangements) or any material adverse change in the business, affairs, operations, properties, financial condition or results of operations of the Company taken as a whole, otherwise than as set forth in the Company’s previously filed periodic reports and other information filed with the Commission. |

|

3.14 Labor Relations. There are no pending or, to each Issuer’s knowledge, threatened or anticipated (a) employment discrimination charges or complaints against or involving the Issuer before any federal, state, or local board, department, commission, or agency, or (b) unfair labor practice charges or complaints, disputes, or grievances affecting the Issuer. None of the employees of the Issuer are represented by any labor unions nor, to the Issuer’s knowledge, is any union organization campaign in progress. |

|

3.15 Insurance. The Issuer has in full force and effect fire, casualty, liability, and other insurance policies of such types and amounts and with such coverage as are typically carried by companies of established reputations in a business and position similar to that of the Issuer. |

|

3.16 Disclosure. The Issuer has only provided each Purchaser with the information that such Purchaser has requested in deciding whether to purchase any Notes. In addition, the Issuer has required each Purchaser to acknowledge receipt and review of (i) the Company’s most recent Cautionary Statement, filed with the Commission on May 23, 2013, and (ii) the Liquidity and Capital Resources discussion from the Company’s Form 10-Q for the quarter ended September 30, 2013, filed with the Commission on November 8, 2013, each of which are attached hereto as Exhibit “D”, prior to making an investment decision regarding the Notes. |

|

4. |

Representations and Warranties of Purchasers. |

Each Purchaser hereby represents and warrants to the Issuer, effective as of the date of this Agreement and as of the date of Closing, as follows:

4

|

4.1 Requisite Power and Authority. The Purchaser, if an entity and not a natural person, is duly organized or incorporated and validly existing under the laws of the jurisdiction of its organization or incorporation and has full partnership, corporate, or other power and authority under its governing instruments and such laws to conduct its business as now conducted and to execute and deliver this Agreement and the other Transaction Documents to which it is a party. All action on the part of the Purchaser necessary for the authorization, execution, delivery, and performance of all obligations of the Purchaser under this Agreement and the other Transaction Documents to which it is a party has been taken prior to or concurrently with the Closing. Upon their execution and delivery, this Agreement and the other Transaction Documents to which it is a party shall be valid and binding obligations of the Purchaser, enforceable against it in accordance with their respective terms, except as limited by applicable bankruptcy, insolvency, reorganization, moratorium, or other laws of general application affecting enforcement of creditors’ rights, and by general principles of equity that restrict the availability of equitable remedies. |

|

4.2 Investment Representations. The Purchaser understands that the issuance of the Notes, the Common Stock issuable upon conversion of the Notes (the “Conversion Shares,”), the Warrants, and the Common Stock issuable upon exercise of the Warrants (the “Warrant Shares”) have not been registered under the Securities Act. The Purchaser also understands that such securities are being offered and sold pursuant to an exemption from registration contained in the Securities Act based in part upon the Purchaser’s representations contained in the Agreement. The Purchaser hereby represents and warrants to the Company as follows: |

|

(a) Purchaser Bears Economic Risk. The Purchaser has substantial experience in evaluating and investing in private placement transactions of securities in companies similar to the Company so that it is capable of evaluating the merits and risks of its investment in the Company and has the capacity to protect such Purchaser’s own interests. The Purchaser must bear the economic risk of this investment indefinitely unless the Notes, Conversion Shares, Warrants, or Warrant Shares are registered pursuant to the Securities Act, or an exemption from registration is available. The Purchaser understands that the Company has no intention of registering the Notes, Conversion Shares, Warrants, or Warrant Shares. The Purchaser also understands that there is no assurance that any exemption from registration under the Securities Act will become available and that, even if it becomes available, such exemption may not allow the Purchaser to transfer all or any portion of the Notes, Conversion Shares, Warrants, or Warrant Shares under the circumstances, in the amounts or at the times the Purchaser might propose. |

|

(b) Acquisition for Own Account. The Purchaser is acquiring the Notes, Conversion Shares, Warrants, and Warrant Shares for the Purchaser’s own account for investment only, and not with a view towards their distribution. |

|

(c) Purchaser Can Protect Its Interest. The Purchaser acknowledges that the Issuer has not prepared and distributed any disclosure documents in connection with the issuance of the Notes, Conversion Shares, Warrants, or Warrant Shares except for this Agreement (including its exhibits and schedules). The Purchaser acknowledges that it has had an opportunity to review the Issuer’s public filings with the Commission, and to

5

|

ask questions of and receive answers from the Issuer, or a person or persons acting on its behalf, concerning the terms and conditions and all other aspects of investment in the Company and the Notes. The Purchaser represents that by reason of its, or of its management’s, business or financial experience, the Purchaser has the capacity to protect its own interests in connection with the transactions contemplated in this Agreement. |

|

(d) Accredited Purchaser. The Purchaser represents that it is an accredited investor within the meaning of Rule 506 of Regulation D under the Securities Act, as more specifically set forth on the Accredited Investor Certification attached hereto as Exhibit “E”. |

|

(e) Risk Factors. The Purchaser hereby acknowledges receipt, review and understanding of the Cautionary Statement and Liquidity and Capital Resources disclosure attached hereto as Exhibit D. |

|

(f) OFAC. To comply with applicable U.S. laws, including but not limited to the International Anti-Money Laundering and Financial Anti-Terrorism Abatement Act of 2001 (Title III of the USA PATRIOT Act), Purchaser represents and warrants that all payments by such Purchaser to the Company and all securities or payments made or distributions paid to the Purchaser from the Company will be made only in the Purchaser’s name and to and from a bank account of a bank based or incorporated in or formed under the laws of the United States. |

|

(g) Brokers. No agent, broker, investment banker, person or firm acting on behalf of or under the authority of such Purchaser is or will be entitled to any broker’s or finder’s fee or any other commission directly or indirectly in connection with the transactions contemplated by this Agreement. Such Purchaser agrees to indemnify the Company for any claims, losses or expenses incurred by the Company in connection with any claim for any such fees or commissions. |

|

4.3 Investment Representations. The Purchaser understands and agrees that the Notes are expressly subordinated to the Company’s senior debt to Silicon Valley Bank, as described in Schedule 6.2(b). At Closing the Purchaser will enter into a Subordination Agreement with Silicon Valley Bank in the form attached as Exhibit “F”. |

|

5. |

Survival of Representations and Warranties. |

|

5.1 The representations and warranties made herein are made as of the date of this Agreement and as of the date of Closing. |

6

|

6. |

Post-Closing Covenants. |

|

6.1 Affirmative Covenants of the Issuer. From the date hereof until the date on which all Notes, or any successor, substitute, or replacement Notes shall have been paid in full or converted pursuant to the terms herein and contained in the Notes, the following shall be true and/or the Issuer shall take, or permit or cause to be taken, each of the following actions, as applicable, unless otherwise provided by the prior written consent of Majority Purchasers (as defined below): |

|

(a) Information Rights. The Issuer shall maintain a standard system of accounts in accordance with generally accepted accounting principles consistently applied, and shall keep full and complete financial records, and shall file with the EDGAR system of the Commission quarterly and year-to-date financial statements, and audited financial statements, within the statutorily required period pursuant to Rule 12b-2 of the Securities Exchange Act of 1934. |

|

(b) Corporate Existence. The Issuer shall at all times preserve and keep in full force and effect its corporate existence and licenses, authorizations, permits, rights, and franchises material to the business of the Issuer, and shall qualify to do business as a foreign corporation in all jurisdictions in which the nature of its activities and properties (both owned and leased) makes such qualification necessary. |

|

(c) Payment of Taxes. The Issuer shall pay and discharge all taxes, assessments, and governmental charges or levies imposed upon such Issuer or upon its respective income or profits, or upon any respective properties belonging to it, prior to the date on which penalties attach thereto, and all lawful claims that, if unpaid, might become a lien or charge upon any such properties, provided that the Issuer shall not be required to pay any such tax, assessment, charge, levy, or claim which is being contested in good faith and by proper proceedings if such Issuer shall have set aside on its books adequate reserves with respect thereto. |

|

(d) Compliance with Laws, etc. The Issuer shall comply in all material respects with all applicable laws, rules, regulations and orders of any governmental authority. |

|

(e) Reservation of Securities. The Company shall at all times reserve and keep available out of its authorized but unissued shares of Common Stock, a number of shares sufficient to allow the conversion in full of all of the Notes. The Company shall take all such actions as may be necessary to assure that all the Securities may be issued without violation of any applicable law or governmental regulation or any requirements of any domestic securities exchange upon which such Securities may be listed (except for official notice of issuance which shall be immediately transmitted by the Company upon issuance). |

|

(f) Notice of Adverse Change. The Company shall as promptly as practicable under the circumstances, but in any event within three (3) days, give notice to each

7

|

Purchaser after becoming aware of the existence of any condition or event which constitutes, or the occurrence of, any of the following: |

|

(i) any Event of Default (as defined in the Notes); |

|

(ii) any other event of noncompliance by the Issuer under this Agreement; or |

|

(iii) the institution of an action, suit, or proceeding against the Issuer before any court, administrative agency, or arbitrator including, without limitation, any action of a foreign government or instrumentality, which, if adversely decided, could materially adversely affect the business, prospects, properties, financial condition, or results of operations of Issuer, taken as a whole, whether or not arising in the ordinary course of business. |

|

6.2 Negative Covenants of the Issuer. From the date hereof until the date on which all Notes, or any successor, substitute or replacement Notes, shall be paid in full or converted, the Issuer shall not take, or permit or cause to be taken, any of the following actions without the prior written consent of Purchasers holding a majority of the aggregate outstanding principal amount of the Notes (“Majority Purchasers”): |

|

(a) Redeem or repurchase any outstanding Capital Stock or declare or pay or set aside for payment any dividend or distribution to any stockholder or on account of any Capital Stock of the Company; |

|

(b) Create, incur, or suffer to exist any indebtedness other than the following (collectively, “Permitted Indebtedness”): (i) indebtedness existing on the date hereof and set forth in Schedule 6.2(b); (ii) any indebtedness approved by Majority Purchasers at any time, or (iii) indebtedness which is expressly subordinated to the Notes. |

|

7. |

Conditions to Closing. |

The obligation of any Purchaser to pay the Purchase Price of any Note being purchased by such Purchaser on the Closing Date is, at its option, subject to the satisfaction, on or before the Closing Date, of each of the following conditions:

(a)All required Transaction Documents shall be fully-executed and delivered;

(b)All of the representations and warranties of the Issuer contained in this Agreement shall be true as of the date of this Agreement. All of such representations and warranties shall be deemed to have been made again as of the Closing Date and shall be true as of the time of Closing; and

(c)Issuer shall have caused all covenants, agreements, and conditions required by this Agreement to be performed or complied with by them prior to or at the Closing to be so performed or complied with.

8

|

8. |

Consent of Purchasers. |

|

8.1 Any action, election, consent, or other right of a Purchaser hereunder (including but not limited to any consent required pursuant to Section 9.6 hereof) may be made, given, and/or exercised in writing by the Majority Purchasers in their sole discretion. Such action, election, consent, or other right exercised may be affected by any available legal means, including at a meeting, by written consent, or otherwise. Any such action, election, consent, or other right exercised by Majority Purchasers shall apply to and be binding upon all Purchasers. |

|

9. |

Miscellaneous. |

|

9.1 Governing Law. This Agreement shall be governed in all respects by the laws of the State of Delaware, without reference to its conflicts of law principles. |

|

9.2 Successors and Assigns. The Issuer may not assign its rights hereunder or any part thereof to any other Person, and any attempted assignment shall be void. Any Purchaser may assign or transfer any Note that it owns, provided that the assignee of such Note becomes, as of the effective date of any such assignment, a party to this Agreement, and executes an Accredited Investor Certification. Subject to the foregoing, the provisions hereof shall inure to the benefit of, and be binding upon, the successors, assigns, heirs, executors and administrators of the parties hereto and shall inure to the benefit of and be enforceable by each Person who shall be a holder of the Securities from time to time. |

|

9.3 Further Assurance. Each party shall execute such other documents and instruments, give such further assurance and perform such acts as are or may become necessary or appropriate to effectuate and carry out the provisions of this Agreement. |

|

9.4 Entire Agreement. This Agreement, the Notes, the Warrants and the other Transaction Documents constitute the entire agreement between the Issuer and the Purchasers with respect to the purchase and sale of the Notes and supersede all prior communications and agreements of the Issuer and the Purchaser with respect to the subject matter hereof and thereof. All Exhibits and Schedules hereto are hereby incorporated herein by reference. Nothing in this Agreement, express or implied, is intended to confer upon any third party any rights, remedies, obligations, or liabilities under or by reason of this Agreement, except as expressly provided in this Agreement. |

|

9.5 Severability. In case any provision of the Agreement shall be invalid, illegal, or unenforceable, the validity, legality, and enforceability of the remaining provisions shall not in any way be affected or impaired thereby. |

|

9.6 Amendment. This Agreement may be amended or modified by the mutual agreement of the Issuer and Majority Purchasers. |

|

9.7 Notices. Any notice provided or permitted to be given under this Agreement must be in writing and may be served by depositing same in the United States mail, addressed to the party to be notified, postage prepaid and registered or certified with return receipt requested; by delivering the same in person to such party; by depositing with a nationally recognized overnight courier, specifying next day delivery, with written verification of receipt; or by facsimile,

9

|

telecopy or electronic mail. Notice given in accordance herewith shall be effective the date the same is deposited in the mail, delivered to a nationally recognized overnight courier, telecopied, faxed or delivered by electronic mail. All notices to the Issuer shall be sent in care of the Company at 5929 Baker Road, Suite 475, Minnetonka MN 55345, FAX: (952) 974 7787, Attention: Chief Executive Officer, skoller@wirelessronin.com, with a copy to Briggs and Morgan, PA, 80 S. 8th St. Suite 2200, Minneapolis, MN 55402, Attention: Brett D. Anderson, banderson@briggs.com. All notices to Purchasers shall be sent to the address set forth on the signature pages hereof. Either the Issuer or the Purchasers may designate a new address for notices upon ten (10) days’ advance written notice to the other parties. |

|

9.8 Titles and Subtitles. The titles of the sections and subsections of the Agreement are for convenience of reference only and are not to be considered in construing this Agreement. |

|

9.9 Counterparts. This Agreement may be executed in any number of counterparts, each of which shall be an original, but all of which together shall constitute one instrument. Signatures delivered via electronic mail utilizing .pdf or other format shall be deemed original signatures for all purposes hereunder. |

|

9.10 Waiver of Trial by Jury. TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, EACH ISSUER AND EACH PURCHASER HEREBY IRREVOCABLY AND UNCONDITIONALLY WAIVES TRIAL BY JURY IN ANY LEGAL ACTION OR PROCEEDING RELATING TO THIS AGREEMENT OR ANY OTHER TRANSACTION DOCUMENT AND FOR ANY COUNTERCLAIM THEREIN. |

|

9.11 Pronouns. All pronouns contained herein, and any variations thereof, shall be deemed to refer to the masculine, feminine or neutral, singular or plural, as to the identity of the parties hereto may require. |

{remainder of page intentionally left blank}

10

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first set forth above.

WIRELESS RONIN TECHNOLOGIES, INC.

By: /s/ Scott Koller

Scott Koller, President & Chief Executive Officer

11

PURCHASER SIGNATURE PAGE

TO NOTE AND WARRANT PURCHASE AGREEMENT

Aggregate Purchase Price to be Paid by the Purchaser: $__________________________

Please confirm that the foregoing correctly sets forth the agreement between us by signing in the space provided below for that purpose.

Dated as of: December __, 2013

PURCHASER

By:

Print Name:

Title:

E-mail address:

Name in which Note(s)

are to be registered:

Mailing Address:

__________________________________________________________

__________________________________________________________

State of residence (for securities compliance purposes): __________

Address for delivery of Note(s) (if different):

__________________________________________________________

__________________________________________________________

Taxpayer Identification Number:

Manner of Settlement: As described in Section 2.2 of the Note and Warrant Purchase Agreement

12

EXHIBIT A

FORM OF NOTE

NEITHER THIS NOTE NOR ANY OF THE SECURITIES ISSUABLE UPON CONVERSION HEREOF HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR THE SECURITIES LAWS OF ANY OTHER JURISDICTION. BY ACQUIRING THIS NOTE, THE HOLDER REPRESENTS THAT THE HOLDER WILL NOT SELL OR OTHERWISE DISPOSE OF THIS NOTE OR ANY SECURITIES INTO WHICH IT MAY BE CONVERTED WITHOUT REGISTRATION OR COMPLIANCE WITH AN EXEMPTION FROM REGISTRATION UNDER THE AFORESAID ACTS AND THE RULES AND REGULATIONS THEREUNDER.

UNSECURED CONVERTIBLE PROMISSORY NOTE

$[ ] [December __], 2013

FOR VALUE RECEIVED, Wireless Ronin Technologies, Inc., a Minnesota corporation (the “Company” or the “Maker”), intending to be legally bound, hereby promises to pay to the order of _______________, or its successors, heirs or assigns (the “Holder”), in lawful money of the United States of America, the principal sum of __________________ Dollars ($_____________), together with interest on the outstanding principal amount under this Note outstanding from time to time.

1.Purpose. This Note is one of a series of 4% Unsecured Convertible Promissory Notes (the “Notes”) made and delivered by the Maker pursuant to the terms of that certain Note and Warrant Purchase Agreement (the “Purchase Agreement”) dated as of [December ], 2013 (the “Original Issue Date”), by and among the Maker and the purchasers of the Notes thereunder (the “Holders”). This Note, and the associated Company common stock warrants, is issued by the Maker under the Purchase Agreement. All capitalized terms used and not defined herein shall have the meanings ascribed to them in the Purchase Agreement.

2.Interest. Interest on this Note shall accrue from the date hereof until payment in full of all amounts payable hereunder, at an annual rate equal to four percent (4%) (the “Interest Rate”), and be payable until the earlier of the Maturity Date (as defined below) or conversion or repayment pursuant to Section 5 below. Interest shall be calculated on the basis of a 360-day year of twelve 30-day months, based on the actual number of days elapsed. From and after the occurrence of any Event of Default (as defined below) and during the pendency thereof, the Interest Rate shall be an annual rate equal to fifteen percent (15%), and any accrued but unpaid interest shall be compounded annually.

3.Maturity Date. Unless converted by the Holder pursuant to the terms of Section 5 below, the principal amount of this Note, together with all accrued interest thereon, shall be due and payable in full on [December ], 2015 (“Maturity Date”).

A-1

4.Prepayment. On or after three months after the Original Issue Date, the Maker may prepay all or any portion of the outstanding principal balance or accrued interest hereunder.

5.Conversion; Repayment.

5.1Optional Conversion. The unpaid principal amount of this Note and/or any accrued and unpaid interest may be converted, in whole or in part from time to time, at the option of the Holder at any time, into shares of the Company’s common stock, $0.01 par value (the “Common Stock”) at a conversion price of $0.50 per share (the “Conversion Price”).

5.2Procedure. Upon conversion of this Note into shares of Common Stock pursuant to Section 5.1 hereof, the Holder shall present this Note to the Company accompanied by an executed conversion notice, the form of which is attached hereto as Exhibit A (the “Conversion Notice”). The Conversion Notice shall state the name or names (with address(es)) in which the certificate or certificates for shares of Common Stock issuable on such conversion (the “Conversion Shares”) shall be issued, and the amount of principal and/or accrued interest to be converted. As soon as practicable after the receipt of such Conversion Notice and the presentation of this Note, the Company shall (a) issue and deliver to the Holder a certificate or certificates for the Conversion Shares, (b) provide for any fractional shares as provided in Section 5.4 hereof, and (c) if such conversion is of less than the entire balance of principal and accrued and unpaid interest hereunder, issue and deliver to the Holder a replacement Note in substantially the form of this Note, in the amount of the balance not converted. Such conversion shall be deemed to have been effected on the earliest date (the “Conversion Date”) the Conversion Notice shall have been received by the Company and this Note shall have been presented as aforesaid. Upon the Conversion Date, the Holder’s rights under this Note shall cease (to the extent this Note is so converted) and the person or persons in whose name or names any certificate or certificates for the Conversion Shares shall be issuable upon such conversion shall be deemed to have become the holder or holders of record of such Conversion Shares.

5.3Equitable Adjustment. If the Company, at any time while this Note is outstanding, shall (a) pay a stock dividend or otherwise make a distribution or distributions on shares of its Common Stock or any other equity or equity equivalent securities payable in shares of Common Stock, (b) subdivide outstanding shares of Common Stock into a larger number of shares, (c) combine (including by way of reverse stock split) outstanding shares of Common Stock into a smaller number of shares, or (d) issue shares of capital stock of the Company by reclassification or conversion of shares of the Common Stock or any class of preferred stock, then the Conversion Price shall be equitably adjusted based upon the proportionate increase of outstanding shares resulting from such action (i.e., if shares of capital stock increase by 2.0%, the conversion price shall be decreased by the same percentage). Any adjustment made pursuant to this Section shall become effective immediately after the record date for the determination of stockholders entitled to receive such dividend, distribution or actual conversion and shall become effective immediately after the effective date in the case of a subdivision, conversion, combination or re-classification.

5.4Fractional Shares. No fractional shares of Common Stock shall be issuable upon conversion of this Note, but a payment in cash will be made in respect of any fraction of a share

A-2

which would otherwise be issuable upon the surrender of this Note, or portion hereof, for conversion.

5.5Mandatory Conversion. The unpaid principal amount of this Note and/or any accrued and unpaid interest will be mandatorily converted, by the Company sending a written notice of conversion, with accounting of such conversion to the Holder within 10 days of the following events: (i) on or after twelve (12) months after the Original Issuance Date, the average price of the Company’s Common Stock (on any exchange or trading platform other than the OTC Pink marketplace) is equal to or greater than one dollar and fifty cents ($1.50) for twenty (20) consecutive trading days; or (ii) on or after six (6) months after the Original Issuance Date, the Company closes on the issuance of additional equity or equity-linked capital in an amount equal to or greater than three million dollars ($3,000,000) in aggregate.

5.6Repayment on Fundamental Transaction. If, at any time while the Notes are outstanding, (i) the Company, directly or indirectly, in one or more related transactions effects any merger or consolidation of the Company with or into another individual, corporation, partnership, limited liability company, trust, business trust, association, joint stock company, joint venture, sole proprietorship, unincorporated organization, or governmental authority (“Person”), (ii) the Company, directly or indirectly, effects any sale, lease, license, assignment, transfer, conveyance or other disposition of all or substantially all of its assets in one or a series of related transactions, (iii) any, direct or indirect, purchase offer, tender offer or exchange offer (whether by the Company or another Person) is completed pursuant to which holders of Common Stock are permitted to sell, tender or exchange their shares for other securities, cash or property and has been accepted by the holders of 50% or more of the outstanding shares of Common Stock, (iv) the Corporation, directly or indirectly, in one or more related transactions effects any reclassification, reorganization or recapitalization of the Common Stock or any compulsory share exchange pursuant to which the Common Stock is effectively converted into or exchanged for other securities, cash or property, or (v) the Corporation, directly or indirectly, in one or more related transactions consummates a stock or share purchase agreement or other business combination (including, without limitation, a reorganization, recapitalization, spin-off or scheme of arrangement) with another Person or Persons whereby such other Person or Persons acquires more than 50% of the outstanding shares of Common Stock (not including any shares of Common Stock held by the other Person or other Persons making or party to, or associated or affiliated with the other Persons making or party to, such stock or share purchase agreement or other business combination) (each, a “Fundamental Transaction”), then, the principal and accrued but unpaid interest of this Note shall be due and immediately payable upon closing of any Fundamental Transaction (or in the case of a Fundamental Transaction with multiple closing, the initial closing), at the Holder’s option.

6.Priority. The Maker represents, warrants, covenants, and agrees that the Notes are senior to any existing indebtedness of the Company as of the issuance date of the Notes; provided, however, that the Notes are subordinate to the Company’s existing indebtedness to Silicon Valley Bank pursuant to that certain Loan and Security Agreement dated March 18, 2010, as amended from time to time.

7.Defaults.

A-3

7.1Events of Default. The occurrence of any one or more of the following events shall constitute an event of default hereunder (“Event of Default”):

7.1.1The Maker fails to make any payment of principal, interest or both when due under this Note, which failure continues for a period of five (5) days;

7.1.2The Maker fails to observe and perform any other covenant or agreement on the Maker’s part to be observed or performed under this Note, which failure continues for a period of ten (10) days after notice of such failure has been delivered to the Company;

7.1.3The Maker fails to observe and perform any of the covenants or agreements on their part to be observed or performed under the Purchase Agreement or any other Transaction Document and such failure shall continue for more than ten (10) days after notice of such failure has been delivered to the Company;

7.1.4Any representation or warranty made by the Company in the Purchase Agreement or any other Transaction Document is untrue in any material respect as of the date of such representation or warranty;

7.1.5The Maker defaults beyond any period of grace provided with respect thereto in the payment of principal of or interest on any obligation (other than the Notes) in respect of borrowed money;

7.1.6The Maker admits in writing its inability to pay its debts generally as they become due, files a petition in bankruptcy or a petition to take advantage of any insolvency act, makes an assignment for the benefit of its creditors, consents to the appointment of a receiver of itself or of the whole or any substantial part of its property, on a petition in bankruptcy filed against it be adjudicated a bankrupt, or files a petition or answer seeking reorganization or arrangement under the Federal bankruptcy laws or any other applicable law or statute of the United States of America or any State thereof;

7.1.7A court of competent jurisdiction enters an order, judgment or decree appointing, without the consent of the Maker, a receiver of the Maker or of the whole or any substantial part of its property, or approving a petition filed against the Maker seeking reorganization or arrangement of the Maker under the federal bankruptcy laws or any other applicable law or statute of the United States of America or any State thereof, and such order, judgment or decree shall not be vacated or set aside or stayed within 60 days from the date of entry thereof;

7.1.8Any court of competent jurisdiction assumes custody or control of the Maker or of the whole or any substantial part of its property under the provisions of any other law for the relief or aid of debtors, and such custody or control is not be terminated or stayed within 60 days from the date of assumption of such custody or control; or

7.1.9Final judgment for the payment of money in excess of $100,000 is rendered by a court of record against the Maker and the Maker does not discharge the same or provide for its discharge in accordance with its terms, or procure a stay of execution thereon within 60 days from the date of entry thereof and within said period of 60 days, or such longer period, during

A-4

which execution of such judgment shall have been stayed, appeal therefrom and cause the execution thereof to be stayed during such appeal.

7.2Notice by the Maker. The Maker shall notify the Holder in writing as soon as practicable under the circumstances but in any event within three (3) days after the occurrence of any Event of Default of which the Maker acquires knowledge.

7.3Remedies. Upon the occurrence of any Event of Default, the entire unpaid principal balance hereunder plus all interest accrued and unpaid thereon and all other sums due and payable to the Holder under this Note shall, at the option of the Holder, become due and payable immediately without presentment, demand, notice of nonpayment, protest, notice of protest or other notice of dishonor, all of which are hereby expressly waived by the Maker. To the extent permitted by law, the Maker waives the right to and stay of execution and the benefit of all exemption laws now or hereafter in effect. In addition to the foregoing, upon the occurrence of any Event of Default, the Holder may forthwith exercise singly, concurrently, successively or otherwise any and all rights and remedies available to the Holder by law, equity or otherwise.

7.4Remedies Cumulative, etc.

7.4.1No right or remedy conferred upon or reserved to the Holder under this Note, or now or hereafter existing at law or in equity or by statute or other legislative enactment, is intended to be exclusive of any other right or remedy, and each and every such right or remedy shall be cumulative and concurrent, and shall be in addition to every other such right or remedy, and may be pursued singly, concurrently, successively or otherwise, at the sole discretion of the Holder, and shall not be exhausted by any one exercise thereof but may be exercised as often as occasion therefor shall occur. No act of the Holder shall be deemed or construed as an election to proceed under any one such right or remedy to the exclusion of any other such right or remedy; furthermore, each such right or remedy of the Holder shall be separate, distinct and cumulative and none shall be given effect to the exclusion of any other.

7.4.2The Maker waives personal service of process and agree that a summons and complaint commencing an action or proceeding in any such court shall be properly served if served by registered or certified mail and electronic mail to the attention of the Company in accordance with the notice provisions set forth in the Purchase Agreement and the Maker expressly waives any and all defenses to an exercise of personal jurisdiction by any such court.

7.5Costs and Expenses. The Maker will pay upon demand all reasonable costs and expenses of the Holder, including attorneys’ fees, incurred by the Holder in enforcing its rights and remedies hereunder. Any amount thereof not paid promptly following demand therefor shall be added to the principal sum hereunder and shall bear interest at the Interest Rate from the date of such demand until paid in full. If the Holder brings suit (or files any claim in any bankruptcy, reorganization, insolvency or other proceeding) to enforce any of its rights hereunder and shall be entitled to judgment (or other recovery) in such action (or other proceeding), then the Holder may recover, in addition to all other amounts payable hereunder, its reasonable expenses in connection therewith, including attorneys’ fees, and the amount of such expenses shall be included in such judgment (or other form of award).

A-5

8.Exchange or Replacement of Note.

8.1Exchange. The Holder, at its option, may in person or by duly authorized attorney surrender the Note for exchange at the office of the Company, and at the expense of the Maker receive in exchange therefor a new Note in the same aggregate principal amount as the aggregate unpaid principal amount of the Note so surrendered and bearing interest at the same annual rate as the Note so surrendered, each such new Note to be dated as of the Original Issue Date and to be in such principal amount and payable to such person or persons, or order, as such holder may designate in writing.

8.2Replacement. Upon receipt by the Maker of evidence satisfactory to it of the loss, theft, destruction or mutilation of this Note and (in case of loss, theft or destruction) of indemnity satisfactory to it, and upon surrender and cancellation of this Note, if mutilated, the Maker will make and deliver a new Note of like tenor in lieu of this Note.

9.Miscellaneous.

9.1Amendments, Waivers and Consents. This Note may be amended, modified, or supplemented, and waiver or consents to departures from the provisions of the Note may be given, if the Maker and one or more Holders comprising the Majority Purchasers consent to the amendment, modification, waiver, or consent.

9.2Severability. In the event that for any reason one or more of the provisions of this Note or their application to any person or circumstance shall be held to be invalid, illegal or unenforceable in any respect or to any extent, such provision shall nevertheless remain valid, legal and enforceable in all such other respects and to such extent as may be permissible. In addition, any such invalidity, illegality or unenforceability shall not affect any other provisions of this Note, but this Note shall be construed as if such invalid, illegal or unenforceable provision had never been contained herein.

9.3Assignment; Binding Effect. The Maker may not assign this Note without the prior written consent of the Holder. Any attempted assignment in violation of this Section 9.3 shall be null and void. Subject to the foregoing, this Note inures to the benefit of the Holder, its successors and assigns, and binds each of the Maker, and its successors and permitted assigns, and the words “Holder” and “Maker” whenever occurring herein shall be deemed and construed to include such respective successors and assigns.

9.4Notice Generally. All notices required to be given to any of the parties hereunder shall be given as set forth in the Purchase Agreement.

9.5Governing Law. This Note will be governed by the laws of the State of Delaware without regard to its conflicts of laws principles.

9.6Waiver of Jury Trial. TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, EACH MAKER AND THE HOLDER HEREBY IRREVOCABLY AND UNCONDITIONALLY WAIVES TRIAL BY JURY IN ANY LEGAL ACTION OR PROCEEDING RELATING TO THIS NOTE OR ANY OTHER TRANSACTION DOCUMENT AND FOR ANY COUNTERCLAIM THEREIN.

A-6

9.7Section Headings, Construction. The headings of Sections in this Note are provided for convenience only and will not affect its construction or interpretation. All references to “Section” or “Sections” refer to the corresponding Section or Sections of this Note unless otherwise specified. All words used in this Note will be construed to be of such gender or number as the circumstances require. Unless otherwise expressly provided, the words “hereof” and “hereunder” and similar references refer to this Note in its entirety and not to any specific section or subsection hereof.

A-7

IN WITNESS WHEREOF, the Maker has executed and delivered this Note as of the date first stated above.

WIRELESS RONIN TECHNOLOGIES, INC.

/s/ Scott Koller

Scott Koller

President & Chief Executive Officer

A-8

EXHIBIT A

WIRELESS RONIN TECHNOLOGIES, INC.

UNSECURED CONVERTIBLE PROMISSORY NOTE

CONVERSION NOTICE

To Whom It May Concern:

The undersigned holder of this Note hereby exercises the option to convert this Note, plus accrued and unpaid interest, in whole or in part as set forth below, into shares of Common Stock of Wireless Ronin Technologies, Inc., a Minnesota corporation, in accordance with the terms of the Unsecured Convertible Promissory Note, dated [December ], 2013, and directs that the shares issuable and deliverable upon the conversion be issued in the name of and delivered to the undersigned unless a different name has been indicated below. If this conversion involves fractional shares, please issue the related check to the same person entitled to receive the shares.

Dated: ____________________

Amount of principal to be converted: $________________________

Amount of accrued but unpaid interest to be converted: $________________________

If shares are to be issued

otherwise than to owner:

Tax Identification

Number of Transferee ________ ___________________________________

Signature of the Holder

(Please print name and address of transferee (including zip code))

__________________________

__________________________

__________________________

A-9

EXHIBIT B

FORM OF WARRANT

Wireless Ronin Technologies, Inc.

WARRANT TO PURCHASE COMMON STOCK

Neither this Warrant nor any of the securities issuable upon exercise of this Warrant have been registered under the Securities Act of 1933 or under the securities laws of any other jurisdiction. By acquiring this Warrant, the Holder represents that the Holder will not sell or otherwise dispose of this Warrant or the securities into which it may be exercised without registration or compliance with an exemption from registration under the aforesaid acts and the rules and regulations thereunder.

Number of Shares of Common Stock: [__________]

Date of Issuance: December __, 2013 (“Issuance Date”)

THIS CERTIFIES THAT, for value received, [______________] (including its permitted registered assigns, the “Holder”), is entitled to purchase from Wireless Ronin Technologies, Inc., a Minnesota corporation (the “Company”), up to [____________] shares of Common Stock (the “Warrant Shares”) at the Exercise Price then in effect. This warrant (the “Warrant”) is issued by the Company as of the date hereof pursuant to that certain Note and Warrant Purchase Agreement dated December __, 2013 between the Company and the Holder (the “Purchase Agreement”). For purposes of this Warrant, “Exercise Price” shall mean $0.75 per share, subject to adjustment as provided herein, and “Exercise Period” shall mean the period commencing on December __, 2013 and ending on 5:00 p.m. New York time on December __, 2016.

1.EXERCISE OF WARRANT.

(a)Mechanics of Exercise. Subject to the terms and conditions hereof, the rights represented by this Warrant may be exercised in whole or in part at any time or times during the Exercise Period by delivery of a written notice, in the form attached hereto as Exhibit A (the “Exercise Notice”), of the Holder’s election to exercise this Warrant. The Holder shall not be required to deliver the original Warrant in order to effect an exercise hereunder. Execution and delivery of the Exercise Notice with respect to less than all of the Warrant Shares shall have the same effect as cancellation of the original Warrant and issuance of a new Warrant evidencing the right to purchase the remaining number of Warrant Shares. On or before the third (3rd) Trading Day following the date on which the Company has received the Exercise Notice, and upon receipt by the Company of (i) payment to the Company of an amount equal to the applicable Exercise Price multiplied by the number of Warrant Shares as to which this Warrant is being exercised (the “Aggregate Exercise Price” and together with the Exercise Notice, the “Exercise Delivery Documents”) in cash or by wire transfer of immediately available funds or (ii) notification from the Holder that this Warrant is being exercised pursuant to a Cashless Exercise (as defined in Section 1(c)), the Company shall issue and dispatch by overnight courier to the address as specified in the Exercise Notice, a certificate, registered in the Company’s share register in the name of the Holder or its designee, for the number of shares of Common Stock to which the Holder is entitled pursuant to such exercise. Upon delivery of the Exercise Delivery Documents, the Holder shall be deemed for all corporate purposes to have become the holder of record of the Warrant Shares with respect to which this Warrant has been exercised, irrespective of the date of delivery of the certificates evidencing such Warrant Shares. If this Warrant is submitted in connection with any exercise pursuant to this Section 1(c) and the number of Warrant Shares represented by this Warrant submitted for exercise is greater than the number of Warrant Shares being acquired upon an exercise, then the Company shall as

B-1

soon as practicable and in no event later than three business days after any exercise and at its own expense, issue a new Warrant (in accordance with Section 6) representing the right to purchase the number of Warrant Shares purchasable immediately prior to such exercise under this Warrant, less the number of Warrant Shares with respect to which this Warrant is exercised.

(b)No Fractional Shares. No fractional shares shall be issued upon the exercise of this Warrant as a consequence of any adjustment pursuant hereto. All Warrant Shares (including fractions) issuable upon exercise of this Warrant may be aggregated for purposes of determining whether the exercise would result in the issuance of any fractional share. If, after aggregation, the exercise would result in the issuance of a fractional share, the Company shall, in lieu of issuance of any fractional share, pay the Holder otherwise entitled to such fraction a sum in cash equal to the product resulting from multiplying the then current fair market value of a Warrant Share by such fraction.

(c)Cashless Exercise. The Holder may, in its sole discretion, exercise this Warrant in whole or in part and, in lieu of making the cash payment otherwise contemplated to be made to the Company upon such exercise in payment of the Aggregate Exercise Price, elect instead to receive upon such exercise the “Net Number” of shares of Common Stock determined according to the following formula (a “Cashless Exercise”):

Net Number = (A x B) - (A x C)

B

For purposes of the foregoing formula:

A= the total number of shares with respect to which this Warrant is then being exercised.

B= the Weighted Average Price of the shares of Common Stock for the five consecutive Trading Days ending on the date immediately preceding the date of the Exercise Notice.

C= the Exercise Price then in effect for the applicable Warrant Shares at the time of such exercise.

2.ADJUSTMENTS. The Exercise Price and the number of Warrant Shares shall be adjusted from time to time as follows:

(a)Subdivision or Combination of Common Stock. If the Company at any time on or after the date of the Purchase Agreement subdivides (by any stock split, stock dividend, recapitalization or otherwise) one or more classes of its outstanding shares of Common Stock into a greater number of shares, the Exercise Price in effect immediately prior to such subdivision will be proportionately reduced and the number of Warrant Shares will be proportionately increased. If the Company at any time on or after the date of the Purchase Agreement combines (by combination, reverse stock split or otherwise) one or more classes of its outstanding shares of Common Stock into a smaller number of shares, the Exercise Price in effect immediately prior to such combination will be proportionately increased and the number of Warrant Shares will be proportionately decreased. Any adjustment under this Section 2(a) shall become effective at the close of business on the date the subdivision or combination becomes effective.

(b)Distribution of Assets. If the Company shall declare or make any dividend or other distribution of its assets (or rights to acquire its assets) to holders of shares of Common Stock, by way of return of capital or otherwise (including, without limitation, any distribution of cash, stock or other securities, property or options by way of a dividend, spin off, reclassification, corporate

B-2

rearrangement, scheme of arrangement or other similar transaction) (a “Distribution”), at any time after the issuance of this Warrant, then, in each such case:

(i)any Exercise Price in effect immediately prior to the close of business on the record date fixed for the determination of holders of shares of Common Stock entitled to receive the Distribution shall be reduced, effective as of the close of business on such record date, to a price determined by multiplying such Exercise Price by a fraction of which (i) the numerator shall be the Closing Sale Price of the shares of Common Stock on the Trading Day immediately preceding such record date minus the value of the Distribution (as determined in good faith by the Company’s Board of Directors) applicable to one share of Common Stock, and (ii) the denominator shall be the Closing Sale Price of the shares of Common Stock on the Trading Day immediately preceding such record date; and

(ii)the number of Warrant Shares shall be increased to a number of shares equal to the number of shares of Common Stock obtainable immediately prior to the close of business on the record date fixed for the determination of holders of shares of Common Stock entitled to receive the Distribution multiplied by the reciprocal of the fraction set forth in the immediately preceding clause (i); provided that in the event that the Distribution is of shares of common stock of a company (other than the Company) whose common stock is traded on a national securities exchange or a national automated quotation system (“Other Shares of Common Stock”), then the Holder may elect to receive a warrant to purchase Other Shares of Common Stock in lieu of an increase in the number of Warrant Shares, the terms of which shall be identical to those of this Warrant, except that such warrant shall be exercisable into the number of shares of Other Shares of Common Stock that would have been payable to the Holder pursuant to the Distribution had the Holder exercised this Warrant immediately prior to such record date and with an aggregate exercise price equal to the product of the amount by which the exercise price of this Warrant was decreased with respect to the Distribution pursuant to the terms of the immediately preceding clause (i) and the number of Warrant Shares calculated in accordance with the first part of this clause (ii).

(c)Other Events. If any event occurs of the type contemplated by the provisions of this Section 2 but not expressly provided for by such provisions (including, without limitation, the granting of stock appreciation rights, phantom stock units or other rights with equity features pro rata to the holders of the Company’s Common Stock), then the Company’s Board of Directors will make an appropriate adjustment in the Exercise Price and the number of Warrant Shares so as to protect the rights of the Holder. For the avoidance of doubt, the parties agree this Section 2(c) shall not apply to (i) the issuance of Common Stock upon the exercise of options or warrants disclosed as outstanding in the SEC Reports, or (ii) the issuance of Common Stock, stock options, stock appreciation rights, restricted stock units, or other forms of equity compensation under the Company’s equity incentive plans or employee stock purchase plan described in the SEC Reports.

3.PURCHASE RIGHTS; FUNDAMENTAL TRANSACTIONS.

(a)Purchase Rights. In addition to any adjustments pursuant to Section 2 above, if at any time the Company grants, issues or sells any stock or other securities directly or indirectly convertible into or exercisable or exchangeable for shares of Common Stock or other property, including options, warrants or other rights to purchase stock, warrants, securities or other property, pro rata to the record holders of any class of shares of Common Stock (the “Purchase Rights”), then the Holder will be entitled to acquire, upon the terms applicable to such Purchase Rights, the aggregate Purchase Rights which the Holder could have acquired if the Holder had held the number of shares of Common Stock acquirable upon complete exercise of this Warrant (without regard to any limitations on the exercise of this Warrant) immediately before the date on which a record is taken for the grant, issuance or sale of

B-3

such Purchase Rights, or, if no such record is taken, the date as of which the record holders of shares of Common Stock are to be determined for the grant, issue or sale of such Purchase Rights.

(b)Fundamental Transactions. If, at any time while this Warrant is outstanding, (i) the Company effects any merger of the Company with or into another entity and the Company is not the surviving entity, (ii) the Company effects any sale of all or substantially all of its assets in one or a series of related transactions, (iii) any tender offer or exchange offer (whether by the Company or by another individual or entity, and approved by the Company) is completed pursuant to which holders of Common Stock are permitted to tender or exchange their shares of Common Stock for other securities, cash or property or (iv) the Company effects any reclassification of the Common Stock or any compulsory share exchange pursuant to which the Common Stock is effectively converted into or exchanged for other securities, cash or property (other than as a result of a subdivision or combination of shares of Common Stock covered by Section 2(a) above) (in any such case, a “Fundamental Transaction”), then, upon any subsequent exercise of this Warrant, the Holder shall have the right to receive the number of shares of Common Stock of the successor or acquiring corporation or of the Company and any additional consideration (the “Alternate Consideration”) receivable upon or as a result of such reorganization, reclassification, merger, consolidation or disposition of assets by a holder of the number of shares of Common Stock for which this Warrant is exercisable immediately prior to such event (disregarding any limitation on exercise contained herein solely for the purpose of such determination). For purposes of any such exercise, the determination of the Exercise Price shall be appropriately adjusted to apply to such Alternate Consideration based on the amount of Alternate Consideration issuable in respect of one share of Common Stock in such Fundamental Transaction, and the Company shall apportion the Exercise Price among the Alternate Consideration in a reasonable manner reflecting the relative value of any different components of the Alternate Consideration. If holders of Common Stock are given any choice as to the securities, cash or property to be received in a Fundamental Transaction, then the Holder shall be given the same choice as to the Alternate Consideration it receives upon any exercise of this Warrant following such Fundamental Transaction. To the extent necessary to effectuate the foregoing provisions, any successor to the Company or surviving entity in such Fundamental Transaction shall issue to the Holder a new warrant consistent with the foregoing provisions and evidencing the Holder’s right to exercise such warrant into Alternate Consideration. Notwithstanding anything to the contrary, in the event of a Fundamental Transaction, then the Company or any successor entity shall at the Holder’s option, exercisable at any time concurrently with or within thirty (30) days after the consummation of the Fundamental Transaction, purchase this Warrant from the Holder by paying to the Holder an amount of cash equal to the value of this Warrant as determined in accordance with the Black-Scholes Option Pricing Model obtained from the “OV” function on Bloomberg using (i) a price per share of Common Stock equal to the Weighted Average Price of the Common Stock for the Trading Day immediately preceding the date of consummation of the applicable Fundamental Transaction, (ii) a risk-free interest rate corresponding to the U.S. Treasury rate for a period equal to the remaining term of this Warrant as of the date of consummation of the applicable Fundamental Transaction and (iii) an expected volatility equal to the lesser of (A) the thirty (30) day volatility obtained from the “HVT” function on Bloomberg determined as of the end of the Trading Day immediately following the public announcement of the applicable Fundamental Transaction or (B) 70%.

4.NONCIRCUMVENTION. The Company hereby covenants and agrees that the Company will not, by amendment of its articles of incorporation, bylaws or through any reorganization, transfer of assets, consolidation, merger, scheme of arrangement, dissolution, issue or sale of securities, or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms of this Warrant, and will at all times in good faith carry out all the provisions of this Warrant and take all action as may be required to protect the rights of the Holder. Without limiting the generality of the foregoing, the Company (i) shall not increase the par value of any shares of Common Stock receivable upon the exercise of this Warrant above the Exercise Price then in effect, (ii) shall take all such actions as may be necessary or appropriate in order that the Company may validly and legally issue fully paid and nonassessable shares of Common Stock upon the exercise of this Warrant, and (iii) shall, so long as this

B-4

Warrant is outstanding, have authorized and reserved, free from preemptive rights, a sufficient number of shares of Common Stock to provide for the exercise of the rights represented by this Warrant (without regard to any limitations on exercise).

5.WARRANT HOLDER NOT DEEMED A SHAREHOLDER. Except as otherwise specifically provided herein, this Warrant, in and of itself, shall not entitle the Holder to any voting rights or other rights as a shareholder of the Company. In addition, nothing contained in this Warrant shall be construed as imposing any liabilities on the Holder to purchase any securities (upon exercise of this Warrant or otherwise) or as a shareholder of the Company, whether such liabilities are asserted by the Company or by creditors of the Company.

6.REISSUANCE OF WARRANTS.

(a)Lost, Stolen or Mutilated Warrant. If this Warrant is lost, stolen, mutilated or destroyed, the Company may, on such terms as to indemnity or otherwise as it may reasonably impose (which shall, in the case of a mutilated Warrant, include the surrender thereof), issue a new Warrant of like denomination and tenor as this Warrant so lost, stolen, mutilated or destroyed.

(b)Issuance of New Warrants. Whenever the Company is required to issue a new Warrant pursuant to the terms of this Warrant, such new Warrant shall be of like tenor with this Warrant, and shall have an issuance date, as indicated on the face of such new Warrant which is the same as the Issuance Date.

7.TRANSFER.

(a)Notice of Transfer. The Holder, by acceptance hereof, agrees to give written notice to the Company before transferring this Warrant or transferring any Warrant Shares of such Holder’s intention to do so, describing briefly the manner of any proposed transfer. Promptly upon receiving such written notice, the Company shall present copies thereof to the Company’s counsel. If the proposed transfer may be effected without registration or qualification (under any federal or state securities laws), the Company, as promptly as practicable, shall notify the Holder thereof, whereupon the Holder shall be entitled to transfer this Warrant or to dispose of Warrant Shares received upon the previous exercise of this Warrant, all in accordance with the terms of the notice delivered by the Holder to the Company; provided that an appropriate legend may be endorsed on this Warrant or the certificates for such Warrant Shares respecting restrictions upon transfer thereof necessary or advisable in the opinion of counsel and satisfactory to the Company to prevent further transfers which would be in violation of Section 5 of the Securities Act of 1933, as amended (the “Securities Act”) and applicable state securities laws; and provided further that the prospective transferee or purchaser shall execute the Assignment of Warrant attached hereto as Exhibit B and such other documents and make such representations, warranties, and agreements as may be required solely to comply with the exemptions relied upon by the Company for the transfer or disposition of the Warrant or Warrant Shares.

(b)If the proposed transfer or disposition of this Warrant or such Warrant Shares described in the written notice given pursuant to this Section 7 may not be effected without registration or qualification of this Warrant or such Warrant Shares, the Holder will limit its activities in respect to such transfer or disposition as are permitted by law.

8.NOTICES. Whenever notice is required to be given under this Warrant, unless otherwise provided herein, such notice shall be given in accordance with Section 9.7 of the Purchase Agreement. The Company shall provide the Holder with prompt written notice of all actions taken pursuant to this Warrant, including in reasonable detail a description of such action and the reason therefore. Without limiting the generality of the foregoing, the Company will give written notice to the Holder (i) immediately upon any adjustment of the Exercise Price, setting forth in reasonable detail, and certifying,

B-5

the calculation of such adjustment and (ii) at least twenty (20) days prior to the date on which the Company closes its books or takes a record (A) with respect to any dividend or distribution upon the shares of Common Stock, (B) with respect to any grants, issuances or sales of any stock or other securities directly or indirectly convertible into or exercisable or exchangeable for shares of Common Stock or other property, pro rata to the holders of shares of Common Stock or (C) for determining rights to vote with respect to any Fundamental Transaction, dissolution or liquidation, provided in each case that such information shall be made known to the public prior to or in conjunction with such notice being provided to the Holder.

9.AMENDMENT AND WAIVER. The terms of this Warrant may be amended or waived (either generally or in a particular instance and either retroactively or prospectively) only with the written consent of the Company and the Holder.

10.GOVERNING LAW. This Warrant and all rights, obligations and liabilities hereunder shall be governed by, and construed in accordance with, the internal laws of the State of Delaware, without giving effect to the principles of conflicts of law that would require the application of the laws of any other jurisdiction.

11.DISPUTE RESOLUTION. In the case of a dispute as to the determination of the Exercise Price, the Closing Sale Price or the arithmetic calculation of the Warrant Shares, the Company or the Holder (as the case may be) shall submit the disputed determinations or arithmetic calculations via facsimile (a) within two (2) business days after receipt of the applicable notice giving rise to such dispute to the Company or the Holder, as the case may be, or (b) if no notice gave rise to such dispute, at any time after the Holder learned of the circumstances giving rise to such dispute. If the Holder and the Company are unable to agree upon such determination or calculation of the Exercise Price, Closing Sale Price or the Warrant Shares within three (3) business days of such disputed determination or arithmetic calculation being submitted to the Company or the Holder (as the case may be), then the Company shall, within two (2) business days thereafter submit via facsimile (x) the disputed determination of the Exercise Price or Closing Sale Price to an independent, reputable investment bank selected by the Company and approved by the Holder or (y) the disputed arithmetic calculation of the Warrant Shares to the Company’s independent, outside accountant. The Company shall cause at its expense the investment bank or the accountant, as the case may be, to perform the determinations or calculations and notify the Company and the Holder of the results no later than ten (10) business days from the time it receives the disputed determinations or calculations. Such investment bank’s or accountant’s determination or calculation, as the case may be, shall be binding upon all parties absent demonstrable error.

12.REMEDIES, OTHER OBLIGATIONS, BREACHES AND INJUNCTIVE RELIEF. The remedies provided in this Warrant shall be cumulative and in addition to all other remedies available under this Warrant and the Purchase Agreement, at law or in equity (including a decree of specific performance and/or other injunctive relief), and nothing herein shall limit the right of the Holder to pursue actual damages for any failure by the Company to comply with the terms of this Warrant. The Company acknowledges that a breach by it of its obligations hereunder will cause irreparable harm to the Holder and that the remedy at law for any such breach may be inadequate. The Company therefore agrees that, in the event of any such breach or threatened breach, the holder of this Warrant shall be entitled, in addition to all other available remedies, to an injunction restraining any breach, without the necessity of showing economic loss and without any bond or other security being required.

13.ACCEPTANCE. Receipt of this Warrant by the Holder shall constitute acceptance of and agreement to all of the terms and conditions contained herein.

14.CERTAIN DEFINITIONS. For purposes of this Warrant, the following terms shall have the following meanings:

B-6

(a)“Bloomberg” means Bloomberg Financial Markets.