Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TTM TECHNOLOGIES INC | d647346d8k.htm |

| EX-1.2 - EX-1.2 - TTM TECHNOLOGIES INC | d647346dex12.htm |

| EX-99.2 - EX-99.2 - TTM TECHNOLOGIES INC | d647346dex992.htm |

| EX-99.1 - EX-99.1 - TTM TECHNOLOGIES INC | d647346dex991.htm |

| EX-99.3 - EX-99.3 - TTM TECHNOLOGIES INC | d647346dex993.htm |

| EX-10.32 - EX-10.32 - TTM TECHNOLOGIES INC | d647346dex1032.htm |

| EX-10.30 - EX-10.30 - TTM TECHNOLOGIES INC | d647346dex1030.htm |

| EX-10.31 - EX-10.31 - TTM TECHNOLOGIES INC | d647346dex1031.htm |

| EX-10.33 - EX-10.33 - TTM TECHNOLOGIES INC | d647346dex1033.htm |

| EX-4.8 - EX-4.8 - TTM TECHNOLOGIES INC | d647346dex48.htm |

| EX-10.29 - EX-10.29 - TTM TECHNOLOGIES INC | d647346dex1029.htm |

| EX-10.34 - EX-10.34 - TTM TECHNOLOGIES INC | d647346dex1034.htm |

Exhibit 5.1

December 20, 2013

TTM Technologies, Inc.

December 20, 2013

Page 2

our opinions, we also have assumed that the Company has paid all taxes, penalties, and interest that are due and owing to the state of Delaware.

Based on and subject to the foregoing, we are of the opinion that:

1. When duly executed and delivered by the Company, authenticated by the Trustee in accordance with the terms of the Indenture and issued and delivered to the Underwriters thereof against payment therefor as specified in the Underwriting Agreement and otherwise in accordance with the Indenture and the Underwriting Agreement, the Notes will be valid and legally binding obligations of the Company enforceable against the Company in accordance with their terms, except that enforcement thereof may be subject to bankruptcy, insolvency, reorganization, moratorium, or other similar laws now or hereafter relating to or affecting the rights of creditors or by general equitable principles.

2. The Conversion Shares have been duly authorized and, when issued in accordance with the terms of the Notes and the Indenture, will be validly issued, fully paid, and non-assessable.

We express no opinion as to the applicability or effect of any laws, orders, or judgments of any state or other jurisdiction other than the General Corporation Law of the state of Delaware, the Delaware Constitution, the internal laws of the state of New York, and the federal securities laws. Further, our opinion is based solely upon existing laws, rules, and regulations, and we undertake no obligation to advise you of any changes that may be brought to our attention after the date hereof.

We hereby consent to the filing of this opinion letter as Exhibit 5.1 to a Current Report on Form 8-K and to the reference to our firm under the caption “Legal Matters” in the Prospectus. In giving this consent, we do not thereby admit that we are an “expert” within the meaning of the Act.

Very truly yours,

/s/ Greenberg Traurig, LLP

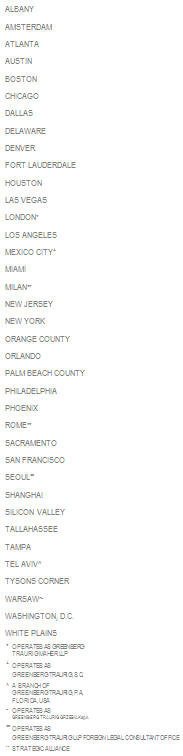

GREENBERG TRAURIG, LLP