UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 20, 2013

SLM CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 001-13251 | 52-2013874 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| 300 Continental Drive, Newark, Delaware | 19713 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (302) 283-8000

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01. Regulation FD Disclosure.

Forward-Looking and Cautionary Statements

This Form 8-K contains “forward-looking” statements and information based on management’s current expectations as of the date of this document. Statements that are not historical facts, including statements about our beliefs, opinions, or expectations and statements that assume or are dependent upon future events, are forward-looking statements. Where, in any forward-looking statement, an expectation or belief as to future results or events is expressed, such expectation or belief is based on the current plans and expectations of our management and expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the expectation or belief will result or be achieved or accomplished. In particular, information included under “The Spin-off,” “SLM BankCo Following the Separation and Distribution,” “Pro Forma Financial Information,” and “Risk Factors” contain forward-looking statements. Forward-looking statements are subject to risks, uncertainties, assumptions and other factors that may cause actual results to be materially different from those reflected in such forward-looking statements. These factors include, among others, the risks and uncertainties set forth in “Risk Factors” in this Form 8-K and in Item 1A “Risk Factors” and elsewhere in the 2013 quarterly reports on Form 10-Q, the 2012 annual report on Form 10-K and subsequent filings of SLM Corporation (“Existing SLM”) with the Securities and Exchange Commission (“SEC”); increases in financing costs; limits on liquidity; increases in costs associated with compliance with laws and regulations; changes in accounting standards and the impact of related changes in significant accounting estimates; any adverse outcomes in any significant litigation to which Existing SLM or the other SLM entities mentioned herein are a party; credit risk associated with exposure to third parties, including counterparties to derivative transactions; and changes in the terms of student loans and the educational credit marketplace (including changes resulting from new laws and the implementation of existing laws). Existing SLM or the other SLM entities mentioned herein could also be affected by, among other things: changes in their funding costs and availability; reductions to their credit ratings or the credit ratings of the United States of America; failures of their operating systems or infrastructure, including those of third-party vendors; damage to their reputation; failures to successfully implement cost-cutting initiatives and adverse effects of such initiatives on their business; risks associated with restructuring initiatives, including their recently announced strategic plan to separate their existing operations into two, separate, publicly traded companies; changes in the demand for educational financing or in financing preferences of lenders, educational institutions, students and their families; changes in law and regulations with respect to the student lending business and financial institutions generally; increased competition from banks and other consumer lenders; the creditworthiness of customers; changes in the general interest rate environment, including the rate relationships among relevant money-market instruments and those of earning assets versus our funding arrangements; changes in general economic conditions; the ability to successfully effectuate any acquisitions and other strategic initiatives; and changes in the demand for debt management services. The preparation of pro forma condensed consolidated financial statements also requires management to make certain estimates and assumptions including estimates and assumptions about future events. These estimates or assumptions may prove to be incorrect. All forward-looking statements contained in this Form 8-K are qualified by these cautionary statements and are made only as of the date of this document.

2

Existing SLM does not undertake any obligation to update or revise these forward-looking statements to conform the statement to actual results or changes in its expectations, including as to its expectations regarding the terms of the spin-off or the relationship between SLM BankCo and NewCo after the spin-off.

Background

On May 29, 2013, Existing SLM first announced that it intends to separate into two distinct publicly-traded entities — an education loan management business and a consumer banking business. The education loan management business will be comprised primarily of Existing SLM’s portfolios of education loans not held by Sallie Mae Bank (the “Bank”) at the effective date of the spin-off, as well as servicing and collection activities on these loans and loans held by third parties. The consumer banking business, comprised primarily of the Bank and its private education loan origination business, the private education loans it holds and a related servicing business, will be a consumer banking franchise with expertise in helping families save, plan and pay for college.

Existing SLM is in the process of implementing its announced separation by way of a spin-off of its education loan management business in a new public company (“NewCo”), which is to be preceded by a related internal corporate reorganization. In connection with the spin-off, a newly incorporated, publicly-traded holding company (“SLM BankCo”) will succeed and continue to operate Existing SLM’s consumer banking business through the Bank and Upromise, Inc. and the insurance business. SLM BankCo will continue using the brand name “Sallie Mae” and trade under the symbol “SLM”.

Private education loan origination will continue to be operated out of the Bank as a subsidiary of SLM BankCo. The Bank was chartered in 2006 and is a Utah industrial bank regulated by the Utah Department of Financial Institutions (the “UDFI”) and the Federal Deposit Insurance Corporation (the “FDIC”). The Bank had total assets of $9.7 billion as of September 30, 2013, $6.2 billion of which were private education loans.

Existing SLM will have the sole and absolute discretion to determine (and change) the terms of, and whether to proceed with, the spin-off of NewCo and, if it determines to proceed, to determine the distribution date for the shares of NewCo common stock to the U.S. holders of Existing SLM’s common stock. It is expected that the spin-off, if completed, will occur in the first half of 2014. The ability of Existing SLM to timely effect the spin-off is subject to customary conditions, including receipt of a private letter ruling from the Internal Revenue Service (“IRS”) to the effect the spin-off will be tax-free to SLM BankCo and Existing SLM stockholders. Existing SLM cannot assure that it will be able to complete the spin-off in a timely fashion, if at all. For these and other reasons, the spin-off may not be completed on the terms or timeline contemplated . Further, if the spin-off is completed, it may not achieve the intended results or SLM BankCo may, following the spin-off, not be composed as described in this Form 8-K. Any such difficulties could adversely affect Existing SLM’s business, results of operations or financial condition. Further information on the spin-off and SLM BankCo may be contained in future filings of Existing SLM with the SEC to the extent Existing SLM determines, in its sole discretion, to provide such information.

3

The Spin-off

If Existing SLM determines to proceed with the spin-off, there will first be an internal corporate reorganization of Existing SLM followed by a distribution of the shares of common stock of NewCo, on a 1-to-1 basis, to the holders of shares of Existing SLM common stock that implements the actual separation of the education loan management business. Before the spin-off can be effected, the Existing SLM board of directors will need to approve the record date and distribution date for the distribution of all of the issued and outstanding shares of NewCo.

For more information about NewCo and the spin-off, please refer to NewCo’s registration statement on Form 10 which was filed by New Corporation (the temporary name of NewCo) with the SEC on December 6, 2013 and which can be accessed at www.sec.gov/edgar. In reviewing the Form 10, investors should note that the plans regarding NewCo have not been finalized, and that the Form 10 is subject to amendment as those plans continue to evolve as well as in response to comments which may be received from the SEC.

Internal Corporate Reorganization

In connection with and just prior to the spin-off, Existing SLM will undergo an internal corporate reorganization. This reorganization is necessary to implement the separation of the education loan management business from the consumer banking business in a manner intended to be largely tax-free to SLM BankCo.

As part of the internal corporate reorganization, Existing SLM will form the following three new companies:

| • | NewCo, which is initially a wholly owned subsidiary of Existing SLM; |

| • | SLM BankCo, which is initially a wholly owned subsidiary of Existing SLM; and |

| • | A limited liability company wholly owned by SLM BankCo that is referred to as “Merger Sub.” |

Pursuant to Section 251(g) of the Delaware General Corporation Law (“DGCL”), by action of the Existing SLM board of directors and without the requirement for a stockholder vote, Existing SLM will merge with and into Merger Sub (the “SLM Merger”). As a result of the SLM Merger:

| • | All issued and outstanding shares of Existing SLM common stock will be converted, through no action on the part of the holders thereof and by operation of law, into shares of SLM BankCo common stock, on a 1-to-1 basis; |

| • | Each series of issued and outstanding shares of Existing SLM’s 6.97% cumulative redeemable preferred stock, Series A, par value $.20 per share (the “Series A Preferred Stock”) and its floating rate non-cumulative preferred stock, Series B, par value $.20 per share (the “Series B Preferred Stock”) will be converted, through no action on the part of the holders thereof and by operation of law, into the same series of substantially identical shares of SLM BankCo preferred stock, on a 1-to-1 basis; and |

4

| • | Existing SLM will become a limited liability company wholly owned by SLM BankCo and will change its name. |

SLM BankCo will change its name to “SLM Corporation.” Following the SLM Merger, through a series of internal transactions, all of the assets and liabilities related to the consumer banking business of Existing SLM, including the Bank, a new private education loan servicing company, the Upromise Rewards business and the insurance business, will be distributed by Existing SLM to SLM BankCo. Existing SLM will also distribute the capital stock of NewCo to SLM BankCo. In addition, SLM BankCo will retain $566 million primarily to offset the liability represented by SLM BankCo becoming the issuer of the Series A Preferred Stock and the Series B Preferred Stock as a result of the SLM Merger. Existing SLM, which will continue to hold substantially all of the assets and liabilities related to its education loan management businesses, will then be contributed by SLM BankCo to NewCo. Existing SLM’s liabilities included, as of September 30, 2013, its outstanding unsecured public debt of $18.7 billion and derivative contracts with a net liability of $792 million.

Once the internal corporate reorganization is completed, SLM BankCo (as the publicly-traded successor holding company to Existing SLM) will distribute all of the issued and outstanding shares of NewCo common stock, on the basis of one share of NewCo common stock for each share of Existing SLM common stock issued and outstanding as of the close of business on the record date for the distribution. The completion of the internal corporate reorganization is a condition to the distribution. For additional information regarding the internal corporate reorganization, please refer to NewCo’s Form 10.

SLM BankCo’s Post-Separation Relationship with NewCo

SLM BankCo will enter into a separation and distribution agreement with Existing SLM and NewCo (the “separation and distribution agreement”). In connection with the closing of the spin-off, SLM BankCo will enter into various other agreements with NewCo to effect the separation and provide a framework for its relationship with NewCo after the separation, such as a transition services agreement, a tax sharing agreement, an employee matters agreement, a loan servicing and administration agreement, a joint marketing agreement, a key services agreement, a data sharing agreement and a master lease agreement. For additional information regarding the separation and distribution agreement and the other transaction agreements, see the sections entitled “Risk Factors” and “Certain Relationships and Related Party Transactions“in this Form 8-K.

5

Reasons for the Separation

The Existing SLM board of directors believes that separating Sallie Mae into two companies—an education loan management business and a consumer banking business—is in the best interests of Existing SLM and its stockholders for a number of reasons, including that:

| • | The consumer banking business and the education loan management business have evolved independently over time. The spin-off will allow investors to separately value SLM BankCo and NewCo based on their unique operating identities and strategies, including the merits, performance and future prospects of their respective businesses. The spin-off will also provide investors with two distinct and targeted investment opportunities. |

| • | SLM BankCo would be expected to have future cash flows that significantly exceed its future Series A Preferred Stock and Series B Preferred Stock dividend and debt service obligations. |

| • | The spin-off will allow each of SLM BankCo and NewCo to more effectively pursue its respective distinct operating priorities and strategies, which have diverged over time, and will enable the management of each company to focus on pursuing unique opportunities for long-term growth and profitability. The FFELP loan portfolio and related servicing businesses generate highly predictable income, but are in wind down as the universe of FFELP loans amortizes over a period of approximately 20 years. By contrast, the private education loan business is expected to grow over time as the Bank continues to originate and service more private education loans. |

| • | SLM BankCo and NewCo will have distinct regulatory profiles post-separation: |

| • | The Bank, a Utah industrial bank and insured depository institution, will continue to be subject to prudential bank regulatory oversight and periodic examination by both the UDFI and the FDIC. The Bank has voluntarily entered into the FDIC’s large bank supervision program. In addition, it is further expected that by the end of 2014 the Bank and SLM BankCo will be subject to the requirements established under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) applicable to institutions with total assets greater than $10 billion, including regulation by the Consumer Financial Protection Bureau (the “CFPB”) and the establishment of an independent risk committee. |

| • | NewCo will continue to be subject to CFPB enforcement, supervisory and examination authority. As a FFELP loan servicer, NewCo will continue to be subject to the Higher Education Act and related regulations, in addition to regulation, and periodic examinations, by the U.S. Department of Education. As a third-party service provider to financial institutions, NewCo will also continue to be subject to examination by the Federal Financial Institutions Examination Council. Although NewCo will not be subject to direct regulatory oversight by the FDIC, certain subsidiaries of NewCo that will continue to be third-party vendors of services to, and “institution affiliated parties” of, the Bank will continue to be subject to the FDIC’s examination and enforcement authority. In addition, to facilitate compliance with certain consumer information privacy laws during an information technology transition period post-separation in which both NewCo and SLM BankCo loans and associated customer accounts will continue to be serviced from a single information technology system hosted by Sallie Mae, Inc. (“SMI”), SMI will remain an affiliate of each of NewCo and SLM BankCo for broader bank regulatory purposes for the duration of that transition period. Among other things, this will mean that transactions between SMI and the Bank will remain subject to the affiliate transaction restrictions of Sections 23A and 23B of the Federal Reserve Act during this transition period. |

6

| • | The separation of NewCo from SLM BankCo will reduce the complexity of both organizations, creating greater transparency for investors and potentially unlocking further value in each company. |

| • | The spin-off will create an independent equity structure for each of SLM BankCo and NewCo that will afford each company direct access to the capital markets for the purpose of pursuing their unique operating strategies and facilitate the ability of each company to effect future alliances and acquisitions utilizing their respective common stock. |

The Existing SLM board of directors also considered a number of potentially negative factors in evaluating the spin-off, including risks relating to the creation of a new publicly-traded company, increased expenses and one-time separation costs and the diversion of management time to oversee the separation and transition of services and functions between the two companies, but concluded that the potential benefits of the spin-off outweighed these factors. For more information, see the section entitled “Risk Factors” included in this Form 8-K.

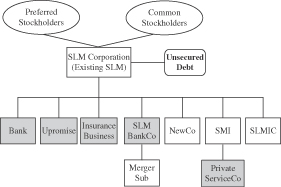

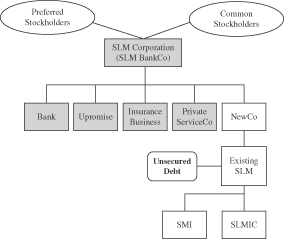

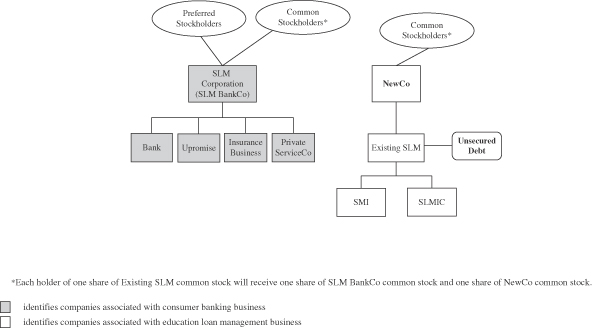

Transaction Structure (simplified for illustrative purposes)

The diagram below shows the structure of Existing SLM before the internal corporate reorganization and the spin-off:

7

The diagram below shows the structure of SLM BankCo, as the publicly-traded successor to Existing SLM, immediately after completion of the internal corporate reorganization but before the spin-off:

The diagram below shows the structure of SLM BankCo and NewCo immediately after completion of the spin-off:

8

See the section entitled “The Spin-off—Internal Corporate Reorganization of Existing SLM Prior to the Distribution” for more information. As used in the three diagrams above and the descriptions of the internal corporate reorganization in this Form 8-K:

| • | “Existing SLM” refers to the Delaware corporation that is SLM Corporation as of the date of this Form 8-K. As part of the internal corporate reorganization, Existing SLM will become a limited liability company and ultimately be contributed to, and become a wholly owned subsidiary of, NewCo. |

| • | “SLM BankCo” refers to New BLC Corporation, a newly-formed Delaware corporation that (a) is currently a subsidiary of Existing SLM and (b) after the internal corporate reorganization, will replace Existing SLM as the publicly-traded parent company pursuant to the SLM Merger and change its name to “SLM Corporation.” SLM BankCo will own and operate the consumer banking business and will be the company that distributes all of the issued and outstanding shares of NewCo common stock in the spin-off. |

| • | “NewCo” refers to New Corporation, a Delaware corporation that (a) is currently a subsidiary of Existing SLM, (b) as part of the internal corporate reorganization will be transferred by Existing SLM to, and become a subsidiary of, SLM BankCo and (c) will be distributed to the Existing SLM stockholders pursuant to the spin-off. NewCo was formed to own and operate Existing SLM’s education loan management business. |

| • | “Bank” refers to Sallie Mae Bank, a Utah industrial bank that (a) is currently a subsidiary of Existing SLM and (b) as part of the internal corporate reorganization, will be transferred by Existing SLM to, and become a subsidiary of, SLM BankCo. |

| • | “Upromise” refers to Upromise, Inc., a Delaware corporation that operates the Upromise Rewards program that (a) is currently a subsidiary of Existing SLM and (b) as part of the internal corporate reorganization will be transferred by Existing SLM to, and become a subsidiary of, SLM BankCo. |

| • | “Insurance Business” refers to the Existing SLM insurance services business which offers tuition insurance, renters insurance and student health insurance to college students and higher education institutions. The Insurance Business (a) is currently operated through one or more subsidiaries of Existing SLM and (b) as part of the internal corporate reorganization will be transferred by Existing SLM to, and be operated through one or more subsidiaries of, SLM BankCo. |

| • | “SMI” refers to Sallie Mae, Inc., a Delaware corporation that is currently a subsidiary of Existing SLM and is responsible for most of its servicing and collection businesses. In connection with the internal corporate reorganization, SMI will contribute some of the assets and liabilities of its private education loan servicing business to a new subsidiary, referred to herein as Private ServiceCo. After the internal corporate reorganization, SMI will remain a subsidiary of Existing SLM and be an indirect subsidiary of NewCo. |

9

| • | “Private ServiceCo” refers to SMB Servicing Company, Inc., a Delaware corporation formed to hold the private education loan services assets to be transferred to it by SMI. Private ServiceCo is currently a subsidiary of SMI and as part of the internal corporate reorganization will be transferred to, and become a subsidiary of, SLM BankCo. |

| • | “SLMIC” refers to Sallie Mae Investment Corporation, a Rhode Island corporation that owns the residual interests of the FFELP Loans and private education loans that have been funded through securitization trusts. SLMIC is currently a subsidiary of Existing SLM and after the internal corporate reorganization will remain a subsidiary of Existing SLM and be an indirect subsidiary of NewCo. |

| • | “Unsecured Debt” refers to Existing SLM’s unsecured public indebtedness of $18.7 billion outstanding as of September 30, 2013, consisting of the senior notes and medium term notes. After the internal corporate reorganization, the Unsecured Debt will remain the obligation of Existing SLM, which will be a subsidiary of NewCo. |

| • | “Preferred Stockholders” refers to the holders of Existing SLM’s outstanding shares of the Series A Preferred Stock and the Series B Preferred Stock. As part of the internal corporate reorganization and pursuant to the SLM Merger, all of the outstanding shares of Existing SLM Series A Preferred Stock and Series B Preferred Stock will be converted, on a 1-to-1 basis, into shares of SLM BankCo preferred stock without any action being required by these holders. |

SLM BankCo Following the Spin-off

Existing SLM, more commonly known as Sallie Mae, continues to be the nation’s leading saving, planning and paying for education company. For over 40 years, Sallie Mae has made a difference in students’ and families’ lives, helping more than 31 million Americans pay for college. SLM BankCo will continue the Sallie Mae tradition of promoting responsible financial habits that help our customers dream, invest and succeed by providing a range of products to help families whether college is a long way off or right around the corner.

SLM BankCo will continue to originate private education loans by promoting products on campus through the financial aid office and through direct marketing to students and their families in the education loan market. “Private educations loans” means education loans that are non-federal loans, not insured, and subject to the full credit risk of the customer and co-signor. Private education loans are generally not dischargeable in bankruptcy.

SLM BankCo will provide ongoing private education loan servicing and collection on loans it originates and sells to third parties as a secondary fee-based business. It will also continue to offer various products both to help families save for college – including its free Upromise service that provides financial rewards on everyday purchases – and to protect their college investment through tuition, rental and life insurance services.

SLM BankCo will continue to fund private education loan originations through retail and brokered deposits, and obtain additional funding through sales of private education loans and their securitization.

10

Business of SLM BankCo

The following description of the business of SLM BankCo is based in part on the Bank’s current business plan. The Bank’s business plan has been approved and is subject to periodical review by the board of directors of each of Existing SLM and the Bank. The Bank’s business plan is also being reviewed annually by the FDIC as the Bank’s regulator. The business plan is based on assumptions and other factors that are subject to change.

Private Education Loans. SLM BankCo will market, price, underwrite and disburse its private education loan products. To maintain high credit standards, it will:

| • | focus its business on helping students attending four year and graduate schools; |

| • | continue the use of regularly revised and updated statistical underwriting models utilizing ten or more years of proprietary credit performance data; |

| • | generally require a credit qualified co-signer as a co-obligor; and |

| • | certify and disburse all private education loans through schools. |

In 2009, Existing SLM introduced, and SLM BankCo will continue, the Smart Option private education loan product emphasizing in-school payment features to minimize total finance charges. The product features three repayment types. The first two, Interest Only and $25 Fixed Pay options, require monthly payments while the student is in school and they accounted for approximately 57 percent of the private education loans originated during the nine months ended September 30, 2013. The third repayment option is the more traditional deferred private education loan product where customers do not begin making payments until after graduation.

Private Education Loan Servicing. A subsidiary of SLM BankCo (“Private ServiceCo”) will provide servicing and loan collection for private education loans originated and held by the Bank, as well as those sold or securitized by SLM BankCo to third parties. As part of the separation of the consumer banking business and the education loan management business, SLM BankCo will obtain ownership and transition into management and operation of all assets and personnel needed to operate all aspects of its private education loan business from asset origination to asset servicing to asset funding. Over time, SLM BankCo’s business plan contemplates seeking additional funding, liquidity and revenue from the sale or securitization of loan assets it originates as well as the servicing of these loan assets it sells to third parties. SLM BankCo’s business plan does not contemplate servicing financial assets originated by other institutions. The physical and logical separation of SLM BankCo’s servicing and collection platforms from those of NewCo is currently expected to be completed within twelve months after completion of the separation, but could take significantly longer. During that period, SLM BankCo private education loan servicing will be conducted by NewCo, the Bank and Private ServiceCo employees pursuant to various transition agreements. For further detail on these agreements, see below at “Certain Relationships and Related Party Transactions” and “Risk Factors.”

11

Upromise Rewards. The Upromise Rewards save-for-college membership program stands alone as a consumer service committed exclusively to helping Americans save money for higher education. Membership is free and each year more than one million customers enroll as members to use the service. Members earn money for college by receiving cash back when shopping at on-line or brick-and-mortar retailers, booking travel, dining out or buying gas or groceries at participating merchants or by using their Upromise MasterCard. As of September 30, 2013, more than 800 merchants participated by providing discounts on purchases that are returned to the customer. Since inception, Upromise Rewards members have saved nearly $800 million for college, and more than 300,000 members actively use the Upromise Rewards credit card for everyday purchases.

SallieMae Insurance Services. Through the existing Sallie Mae Insurance Services venture, SLM BankCo will continue to partner with an established insurance brokerage to offer America’s college students and young adults insurance programs that address their unique life-stage needs, including tuition insurance, renters insurance, life insurance and health insurance.

SLM BankCo Funding Sources

Deposits. The Bank gathers low cost retail deposits through its direct banking platform which serves as an important source of funding. The Bank also utilizes brokered deposits as needed to supplement its funding needs and enhance its liquidity position. As of September 30, 2013, the Bank had $8.0 billion of customer deposits, representing 81 percent of interest earning assets, composed of $2.8 billion of retail deposits, $4.7 billion of brokered deposits and $0.5 billion of other deposits on a pro forma basis.

Loan Sales and Securitizations. Prior to the spin-off, Existing SLM operates its private education loan business as an integrated set of activities and uses various subsidiaries to perform the functions necessary to underwrite, originate, fund in the short-term, fund long-term, service and collect private education loans. These private education loans are originated by the Bank and funded with its deposits. During the nine-month period ended September 30, 2013 and the year-ended December 31, 2012, the Bank sold loans to Existing SLM affiliates in the amount of $2.3 billion and $2.6 billion, respectively. During the same periods, the Bank originated $3.2 billion and $3.3 billion of private education loans.

After the spin-off, SLM BankCo may continue to sell private education loans to third parties through an open auction process as well as through securitization transactions. It may retain servicing of these transferred private education loans at prevailing market rates for such services. As such, it may incur gains and losses on sales in future periods. Loan sales and securitization volumes will be determined to prudently manage SLM BankCo’s asset values, growth rates, and capital and liquidity needs. NewCo may participate in any open auction process on arm’s length terms. While there may be limited, near-term private education loans sales to NewCo to facilitate an orderly transition after the spin-off, neither SLM BankCo nor NewCo will have any ongoing obligation to buy or sell private education loans to the other.

12

Competitive Strengths

SLM BankCo will have the following competitive strengths:

Industry Leader with the Most Recognized Brand in Education Loan Industry. SLM BankCo will continue operating the private education loan origination business of Existing SLM under the brand “Sallie Mae”. Once the separation from Existing SLM is complete, SLM BankCo operations will contain all the capabilities, resources and personnel responsible for generating Existing SLM’s private education loan originations.

Simple Low Cost Delivery System. SLM BankCo will leverage an experienced regional-based sales force and a well-established loan origination network that operates through financial aid offices, direct marketing and the internet without the need for a physical distribution infrastructure. It will also benefit from the ability of the Bank to gather deposits and to service accounts online without need of a branch network.

Disciplined Credit Approach. SLM BankCo will continue a disciplined approach to credit. It will use a proprietary scorecard and deploy experienced credit analysts for selective review. Since the introduction of the Smart Option loan in 2009, approximately 90 percent of Existing SLM Smart Option loans have co-signers. As of September 30, 2013, the average FICO score at origination for Existing SLM Smart Option loans was 745. To reinforce responsible borrowing, SLM BankCo will continue to disburse loan proceeds directly to schools, encourage customers to make payments while in school, and send statements to borrowers and cosigners during matriculation.

Strong Capital Position and Experienced Funding Capabilities. The Bank is well-capitalized. As of September 30, 2013, it had a Tier 1 risk-based capital ratio of 15.43 percent.

In addition, as currently proposed as part of the separation, SLM BankCo will serve as an additional source of strength by having approximately $70 million of equity from subsidiaries other than the Bank at the closing date of the spin-off plus $165 million of Series A Preferred Stock and $400 million of Series B Preferred Stock. The existing Series B Preferred Stock could potentially qualify as Additional Tier 1 capital under Basel III standards were Basel III to apply at the SLM BankCo level.

SLM BankCo will also retain that Existing SLM’s experienced capital markets team currently responsible for securitizing Existing SLM’s private education loans in the asset-backed market.

Attractive Customer Base. SLM BankCo’s customer base will be dominated by college students, graduate students and credit qualified co-signers. SLM BankCo’s customer base also includes more than 12 million Upromise members who enroll in the college saving service. Customers who are customers of Existing SLM or will become customers of SLM BankCo through the Sallie Mae and Upromise brands following the spin-off may also use SLM BankCo’s other products. Approximately 49 percent of the Bank’s depositors have another product with Existing SLM.

13

Experienced Management Team. SLM BankCo’s management team are experienced industry professionals with extensive expertise in managing rigorous underwriting, marketing, servicing, collection and financing platforms. Most have at least 25 years of experience in the financial services and consumer banking industries. The SLM BankCo leadership team have been key players in the development and execution of the private education loan and consumer banking strategy of Existing SLM, including the design of the Smart Option product.

Private Education Loan Market

SLM BankCo will continue to encourage families to adopt a “1-2-3 approach” to paying for college: First, use scholarships, grants, saving, and current income; second, explore more economical federal loan options; and third, use private education loans to fund any remaining gap.

Private education loans help students and families fill the gap between their own resources, financial aid, federal education loans, and the total cost of college. Historically, private education loans have not replaced federal grants and education loans or state and institutional grants.

The interplay between federal and private education loans, their respective lending limits, terms, conditions and interest rate structures has changed significantly over time. Most notably, federal education lending has increased borrowing limits on undergraduate borrowing and expanded to include loans made to graduate students and parents of undergraduate students sufficient to cover the full cost of college and graduate school attendance. The evolution of the Smart Option private education loan products might allow SLM BankCo to effectively compete on interest rates and terms with these expanded federal education loan offerings to graduate students and parents.

Key Drivers of Private Education Loan Market Growth

The size of the private education loan market is based on three primary factors: college enrollment levels, the costs of attending college and the availability of funds from the federal government to pay for a college education. The amounts that students and their families can contribute toward a college education and the availability of scholarships and institutional grants are also important. If the cost of education continues to increase at a pace exceeding family income and savings growth and the availability of federal fund grants, and scholarships remains constant or decreases, more students and families can be expected to borrow privately. If enrollment levels or college costs decline or the availability of federal fund grants, and scholarships significantly increase, private education loan originations could decrease.

For Academic Year (“AY”) 2012-2013, private education loans were primarily originated by Existing SLM, six large lenders and numerous credit unions.

14

College Enrollment Levels

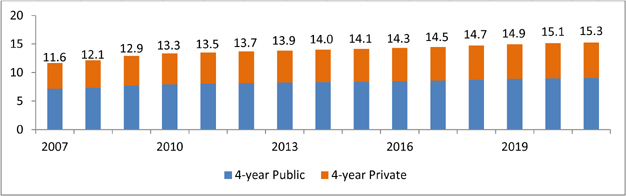

Undergraduate and graduate enrollments at 4-year institutions increased by approximately 16 percent from 2007 to 2011 and enrollment is projected to increase by 11 percent from 2012 to 2021.

Historical and Projected Enrollment at Four-Year Degree-Granting Institutions

(in millions)

|

Source: U.S. Department of Education, National Center for Education Statistics, Projections of Education Statistics to 2021 (NCES 2013-008, January 2013), tables 23 and 25; 2011 actual data from Digest of Education Statistics, 2012, table 226. |

Costs of Attending College

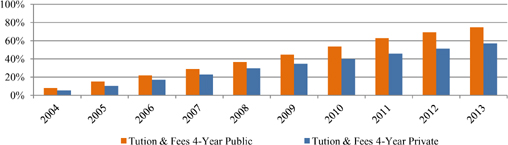

Average tuition and fees at four-year public institutions and four-year private institutions were $8,893 and $30,094, respectively for AY 2013-2014 and have increased at a compound annual growth rate of 6.7 percent and 4.7 percent, respectively, since AY 2003-2004.

Cost of Attendance(1)

Cumulative % Increase from AY 2003-2004

|

(1) Source: The College Board — Trends in College Pricing 2013. © 2013 The College Board. www.collegeboard.org. (1) Cost of attendance is in current dollars and includes tuition, fees and on-campus room and board. |

15

Tuitions and fees represent only a portion of total costs of attendance. Based on data on room and board, books and supplies and transportation costs available to it, Existing SLM estimates that total costs of college attendance have grown from approximately $324 billion for AY 2007-2008 to approximately $438 billion for AY 2012-2013.

Availability of Federal and Private Funds

There has been a 48 percent increase in borrowing from federal loan programs since AY 2007-2008. In the AY 2012-2013, according to the College Board (Source: The College Board – Trends in Student Aid 2013. © 2013 The College Board. www.collegeboard.org), borrowing from federal loan programs totaled $101.5 billion, an increase of 136 percent since AY 2002-2003. Besides growth from increased enrollments, a substantial portion of this increase was driven by the creation of the Grad PLUS program in 2006 and increases in federal borrowing limits in 2007 and 2008 – the first increase in loan limits since 1993. The College Board also reported that, over the same time period, federal grants increased 198 percent to $47 billion. In AY 2012-2013, borrowing from private education loan programs increased to an estimated $7.2 billion, up 13 percent over the previous year, an increase of 3 percent as compared to AY 2002-2003 levels. The recent drop in borrowing from private education loan programs from the peak of $21 billion in AY 2007-2008 may have been caused in large measure by increases in federal loan limits and the availability of federal funds, as well as the subsequent strengthening of private education loan underwriting standards.

Key Performance Metrics

Net Interest Margin. Initially, SLM BankCo’s principal source of revenue will be net interest margin, the difference between the interest income it will receive on interest-earning assets (primarily private education loans) and the interest expense SLM BankCo will incur on interest-bearing liabilities (primarily deposits). Non-interest income sources will include gains from the periodic sales of student loans, fees generated from Upromise Rewards and servicing fees earned from loans sold to third parties. For additional information relevant to SLM BankCo’s net interest margin pro forma for the effects of the separation and distribution, see “Certain Financial and Statistical Information of SLM BankCo and the Bank–Net Interest Margin.”

Key Credit Quality Indicators. The key credit quality indicators for private education loans are FICO scores, the existence of a cosigner, the loan status and loan seasoning. The FICO score is assessed at origination and maintained through the traditional/non-traditional loan designation. The other private education loan key quality indicators can change and are incorporated quarterly into the allowance for loan losses calculation. For additional information relevant to the Bank’s key credit quality indicators, see “Certain Financial and Statistical Information of SLM BankCo and the Bank– Key Credit Quality Indicators.”

Supervision and Regulation

The Bank was chartered in 2006 and is a Utah industrial bank regulated by the FDIC and the UDFI. SLM BankCo is currently not, and as a result of the spin-off will not be, a bank holding company and therefore is not and will not be subject to the regulation applicable to bank holding companies. However, SLM BankCo and its non-bank subsidiaries are, and will following the spin-off continue to be, subject to regulation and oversight as institution-affiliated parties.

16

The following discussion sets forth some of the elements of the bank regulatory framework that is, and will following the spin-off continue to be, applicable to SLM BankCo, the Bank and its other non-bank subsidiaries. The below is not a comprehensive description of the applicable bank regulatory framework and other statutory and regulatory provisions apply. To the extent that the following information describes any provisions, it is qualified in its entirety by reference to the particular statutory or regulatory provision.

General

The Bank is currently, and will following the spin-off continue to be, subject to primary regulation and examination by the FDIC and the UDFI. Numerous other federal and state laws as well as regulations promulgated by the FDIC and the state banking regulator govern almost all aspects of the operations of the Bank and, to some degree, SLM BankCo and its non-bank subsidiaries as institution-affiliated parties.

The Bank’s, and indirectly SLM BankCo’s, current bank regulatory framework is and will continue to be impacted by the Dodd-Frank Act. The Dodd-Frank Act was adopted to reform and strengthen regulation and supervision of the U.S. financial services industry. It contains comprehensive provisions to govern the practices and oversight of financial institutions and other participants in the financial markets. It imposes significant regulations, additional requirements and oversight on almost every aspect of the U.S. financial services industry, including increased capital and liquidity requirements, limits on leverage and enhanced supervisory authority. It requires the issuance of many implementing regulations which will take effect over several years, making it difficult to anticipate the overall impact to SLM BankCo, the Bank, their customers, or the financial industry more generally. While the overall impact cannot be predicted with any degree of certainty, SLM BankCo and its affiliates, including the Bank, are and will continue to be affected by the Dodd-Frank Act in a wide range of areas.

The Consumer Financial Protection Act, a part of the Dodd-Frank Act, established the CFPB, which has broad authority to write regulations under federal consumer financial protection laws and to directly or indirectly enforce those laws and examine financial institutions for compliance. It is authorized to collect fines and provide consumer restitution in the event of violations, engage in consumer financial education, track consumer complaints, request data and promote the availability of financial services to underserved consumers and communities. It has authority to prevent unfair, deceptive or abusive practices by issuing regulations that define the same or by using its enforcement authority without first issuing regulations. The CFPB has been active in its supervision, examination and enforcement of financial services companies, most notably bringing enforcement actions imposing fines and mandating large refunds to customers of several large banking institutions for practices relating to the sale of additional products associated with the extension of consumer credit.

Listed below are some of the most significant existing rules and regulations and some of the most recent and pending regulatory changes that have the potential to affect one or more of the businesses of SLM BankCo, the Bank and SLM BankCo’s non-bank affiliates.

17

Actions by Federal and State Regulators

Like all depository institutions, the Bank is regulated extensively under federal and state law. Under federal and state laws and regulations pertaining to the safety and soundness of insured depository institutions, the UDFI and separately the FDIC as the insurer of bank deposits have the authority to compel or restrict certain actions on the Bank’s part if they determine that it has insufficient capital or other resources, or is otherwise operating in a manner that may be deemed to be inconsistent with safe and sound banking practices. Under this authority, the Bank’s regulators can require it to enter into informal or formal supervisory agreements, including board resolutions, memoranda of understanding, written agreements and consent or cease and desist orders, pursuant to which the Bank would be required to take identified corrective actions to address cited concerns and to refrain from taking certain actions.

Enforcement Powers

The Bank and SLM BankCo and its nonbank subsidiaries as “institution-affiliated parties,” including their management, employees, agents, independent contractors and consultants, such as attorneys and accountants and others who participate in the conduct of the institution’s affairs, are generally subject to potential civil and criminal penalties for violations of law, regulations or written orders of a government agency. Violations can include failure to timely file required reports, filing false or misleading information or submitting inaccurate reports. Civil penalties may be as high as $1,000,000 a day for such violations and criminal penalties for some financial institution crimes may include imprisonment for 20 years. Regulators have flexibility to commence enforcement actions against institutions and institution-affiliated parties, and the FDIC has the authority to terminate deposit insurance. When issued by a banking agency, cease-and-desist and similar orders may, among other things, require affirmative action to correct any harm resulting from a violation or practice, including restitution, reimbursement, indemnifications or guarantees against loss. A financial institution may also be ordered to restrict its growth, dispose of certain assets, rescind agreements or contracts, or take other actions determined to be appropriate by the ordering agency. The federal banking regulators also may remove a director or officer from an insured depository institution (or bar them from the industry) if a violation is willful or reckless.

The Bank is currently subject to a cease and desist order originally issued in August 2008 by the FDIC and the UDFI. In July 2013, the FDIC notified the Bank that it plans to replace the existing cease and desist order with a new formal enforcement action that will more specifically address certain cited violations of Section 5 of the Federal Trade Commission Act (the “FTC Act”), including with respect to the Servicemembers Civil Relief Act (the “SCRA”), and the Equal Credit Opportunity Act (the “ECOA”) and its implementing regulation, Regulation B. In November 2013, the FDIC notified the Bank that the new formal enforcement action will include civil money penalties and restitution obligations. The Bank has been notified by the UDFI that it does not intend to join the FDIC in issuing the new enforcement action. With respect to the alleged civil violations of Section 5 of the FTC Act relating to the SCRA, Existing SLM is currently also in discussions with the Department of Justice (the “DOJ”), as the agency having primary authority for enforcement of SCRA matters, regarding settlement, remediation and a comprehensive restitution plan. The Bank is included in this inquiry as the originator of the loans serviced by SMI. Following the spin-off, the Bank will continue to oversee significant activities performed outside the Bank by affiliates and SLM BankCo and the Bank may be required to, or otherwise determine to, make changes to the business practices and products of the Bank and SLM’s other affiliates to respond to regulatory concerns. It is currently impossible to estimate a range of potential exposure, if any, to amounts that may be payable or costs that must be incurred to comply with the terms of any order in connection with the above pending regulatory enforcement actions.

18

Standards for Safety and Soundness

The Federal Deposit Insurance Act (the “FDIA”) requires the federal bank regulatory agencies such as the FDIC to prescribe, by regulation or guideline, operational and managerial standards for all insured depository institutions, such as the Bank, relating to: internal controls, information systems and audit systems, loan documentation, credit underwriting, interest rate risk exposure, and asset quality. The agencies also must prescribe standards for asset quality, earnings, and stock valuation, as well as standards for compensation, fees and benefits. The federal banking regulators have adopted regulations and interagency guidelines prescribing standards for safety and soundness to implement these required standards. These guidelines set forth the safety and soundness standards used to identify and address problems at insured depository institutions before capital becomes impaired. Under the regulations, if a regulator determines that a bank fails to meet any standards prescribed by the guidelines, the regulator may require the bank to submit an acceptable plan to achieve compliance, consistent with deadlines for the submission and review of such safety and soundness compliance plans.

Dividends

SLM BankCo is a legal entity separate and distinct from its subsidiaries, including the Bank. A substantial portion of SLM BankCo’s funds after the spin-off will be received in the form of dividends paid by the Bank as its principal subsidiary and its other non-bank subsidiaries. The Federal Deposit Insurance Corporation Improvement Act generally prohibits a depository institution from making any capital distribution, including payment of a dividend, or paying any management fee to its holding company if the institution would thereafter be undercapitalized. In addition, federal banking regulation applicable to the Bank require minimum levels of capital that limit the amounts available for payment of dividends. In addition, many regulators have a policy, but not a requirement, that a dividend payment should not exceed net income to date in the current year. Finally, the ability of the Bank to pay dividends, and the contents of its respective dividend policy, could be impacted by a range of regulatory changes made pursuant to the Dodd-Frank Act, many of which will require final implementing rules to become effective. While all of these factors restrict the Bank’s ability to pay dividends, the Bank may, subject to regulatory approval, make dividend payments to SLM BankCo once it is operating as a stand-alone institution following the spin-off.

19

Capital Requirements under Basel III

The current risk-based capital guidelines that apply to the Bank are based on the 1988 Basel I capital accord. In 2007, the federal banking regulators established capital standards based on the advanced internal ratings-based approach for credit risk and the advanced measurement approaches for operational risk contained in the Basel Committee’s second capital accord, referred to as “Basel II,” for the largest and most internationally active U.S. banking organizations, which do not and, following the spin-off, will not include the Bank. In December 2010, the Basel Committee reached agreement on a revised set of regulatory capital standards: Basel III. These new standards, which are aimed at increasing the quality and quantity of regulatory capital, seek to further strengthen financial institutions’ capital positions by mandating a higher minimum level of common equity to be held, along with a capital conservation buffer to withstand future periods of stress.

In July 2013, the federal banking regulators issued the U.S. Basel III final rule. The final rule implements the Basel III capital framework and certain provisions of the Dodd-Frank Act, including the Collins Amendment. Certain aspects of the final rule, such as the new minimum capital ratios and the revised methodology for calculating risk-weighted assets, will become effective on January 1, 2015 for the Bank. Other aspects of the final rule, such as the capital conservation buffer and the new regulatory deductions from and adjustments to capital, will be phased in over several years beginning on January 1, 2015.

Consistent with the Basel Committee’s Basel III capital framework, the U.S. Basel III final rule includes a new minimum ratio of Common Equity Tier 1 capital to risk-weighted assets of 4.5 percent and a Common Equity Tier 1 capital conservation buffer of greater than 2.5 percent of risk-weighted assets that will apply to all U.S. banking organizations, including the Bank. Failure to maintain the capital conservation buffer will result in increasingly stringent restrictions on a banking organization’s ability to make dividend payments and other capital distributions and pay discretionary bonuses to executive officers. The final rule also increases the minimum ratio of Tier 1 capital to risk-weighted assets from 4 percent to 6 percent, while maintaining the current minimum total risk-based capital ratio of 8 percent. In addition, for the largest and most internationally active U.S. banking organizations, which do not, and following the spin-off will not, include the Bank, the final rule includes a new minimum supplementary leverage ratio that takes into account certain off-balance sheet exposures.

The U.S. Basel III final rule focuses regulatory capital on Common Equity Tier 1 capital, and introduces new regulatory adjustments and deductions from capital as well as narrower eligibility criteria for regulatory capital instruments. The new eligibility criteria for regulatory capital instruments results in, among other things, cumulative perpetual preferred stock not qualifying as Tier 1 capital.

For additional information on the Bank’s capital, please see “Pro Forma Financial Information” and “Certain Financial and Statistical Information of SLM BankCo and the Bank—Bank Capital”.

20

Stress Testing Requirements

As of September 30, 2013, the Bank had total assets of $9.7 billion and, by the end of 2013, its total assets may exceed $10 billion. Once the Bank’s average total assets over four consecutive quarters exceed $10 billion, it will subsequently become subject to annual Dodd-Frank stress testing requirements.

The Dodd-Frank Act imposes stress test requirements on banking organizations with total consolidated assets of more than $10 billion. The FDIC’s implementing regulations require FDIC-regulated depository institutions, such as the Bank, to conduct annual company-run stress test scenarios provided by the FDIC and publish a summary of those results.

Deposit Insurance and Assessments

Deposits at the Bank are insured by the Deposit Insurance Fund (the “DIF”) as administered by the FDIC, up to the applicable limits established by law. The Dodd-Frank Act amended the statutory regime governing the DIF. Among other things, the Dodd-Frank Act established a minimum designated reserve ratio (“DRR”) of 1.35 percent of estimated insured deposits, required that the fund reserve ratio reach 1.35 percent by September 30, 2020, and directed the FDIC to amend its regulations to redefine the assessment base used for calculating deposit insurance assessments. Specifically, the Dodd-Frank Act requires the assessment base to be an amount equal to the average consolidated total assets of the insured depository institution during the assessment period, minus the sum of the average tangible equity of the insured depository institution during the assessment period and an amount the FDIC determines is necessary to establish assessments consistent with the risk-based assessment system found in the FDIA.

In December of 2010, the FDIC adopted a final rule setting the DRR at 2.0 percent. Furthermore, on February 7, 2011, the FDIC issued a final rule changing its assessment system from one based on domestic deposits to one based on the average consolidated total assets of a bank minus its average tangible equity during each quarter. The February 7, 2011, final rule modifies two adjustments added to the risk-based pricing system in 2009 (an unsecured debt adjustment and a brokered deposit adjustment), discontinues a third adjustment added in 2009 (the secured liability adjustment), and adds an adjustment for long-term debt held by an insured depository institution where the debt is issued by another insured depository institution. Under the February 7, 2011, final rule, the total base assessment rates will vary depending on the DIF reserve ratio.

On November 12, 2009, the FDIC imposed a requirement on all financial institutions to prepay three years of FDIC insurance premiums.

With respect to brokered deposits, an insured depository institution must be well-capitalized in order to accept, renew or roll over such deposits without FDIC clearance. An adequately capitalized insured depository institution must obtain a waiver from the FDIC in order to accept, renew or roll over brokered deposits. Undercapitalized insured depository institutions generally may not accept, renew or roll over brokered deposits. For more information on the Bank’s deposits, see “Certain Financial and Statistical Information of SLM BankCo and the Bank—Deposits.”

21

Regulatory Examinations

The Bank currently undergoes, and will following the spin-off continue to undergo, regular on-site examinations by the Bank’s regulators, which examine for adherence to a range of legal and regulatory compliance responsibilities. A bank regulator conducting an examination has complete access to the books and records of the examined institution. The results of the examination are confidential. The cost of examinations may be assessed against the examined institution as the agency deems necessary or appropriate.

Consumer Protection Regulations

The activities of the Bank are, and will following the spin-off be, subject to a variety of statutes and regulations designed to protect consumers. Interest and other charges collected or contracted for by the Bank are subject to state usury laws and federal laws concerning interest rates. Loan operations are also subject to federal laws applicable to credit transactions, such as:

| • | The federal Truth-In-Lending Act and Regulation Z issued by the Board of Governors of the Federal Reserve System (the “Federal Reserve Board”), governing disclosures of credit terms to consumer borrowers; |

| • | The ECOA and Regulation B issued by the Federal Reserve Board, prohibiting discrimination on the basis of race, creed or other prohibited factors in extending credit; |

| • | The Fair Credit Reporting Act and Regulation V issued by the Federal Reserve Board, governing the use and provision of information to consumer reporting agencies; |

| • | The Fair Debt Collection Act, governing the manner in which consumer debts may be collected by collection agencies; and |

| • | The SCRA applying to all debts incurred prior to commencement of active military service (including credit card and other open-end debt) and limiting the amount of interest, including service and renewal charges and any other fees or charges (other than bona fide insurance) that is related to the obligation or liability. |

The Bank’s deposit operations also are subject to:

| • | The Truth in Savings Act and Regulation DD issued by the Federal Reserve Board, which require disclosure of deposit terms to consumers; |

| • | Regulation CC issued by the Federal Reserve Board, which relates to the availability of deposit funds to consumers; |

22

| • | The Right to Financial Privacy Act, which imposes a duty to maintain the confidentiality of consumer financial records and prescribes procedures for complying with administrative subpoenas of financial records; and |

| • | The Electronic Funds Transfer Act and Regulation E issued by the Federal Reserve Board, which governs automatic deposits to and withdrawals from deposit accounts and customers’ rights and liabilities arising from the use of automated teller machines and other electronic banking services. |

There are also a number of significant consumer protection standards that apply to functional areas of operation and consumer protection regulations related to automated overdraft payment programs offered by financial institutions.

Consumer Financial Protection Bureau

The CFPB has assumed regulatory oversight of the private education loan industry. Oversight responsibilities of most consumer protection laws and regulations transferred from a bank’s primary regulator to the CFPB. Once the Bank has four consecutive quarters with total assets of at least $10 billion, the CFPB will become its primary compliance supervisor. The UDFI and FDIC will remain the prudential regulatory authorities with respect to the Bank’s financial strength.

Education Loan Industry

The CFPB’s July 2012 Report on the industry provided many insights on the evolution of the industry and the CFPB’s continuing concerns. The CFPB’s primary recommendations to Congress in the Report are not likely to negatively affect SLM BankCo’s portfolio of private education loans. But future efforts by Congress or the CFPB to make the terms on which private education loan interest may be charged or principal collected more in conformance with federal education loan programs could significantly and materially affect the profitability of SLM BankCo’s loan portfolio. The CFPB’s focus on the concerns of students extends beyond the terms and conditions of private education loans and includes the following:

| • | The Dodd-Frank Act created a Private Education Loan Ombudsman within the CFPB to receive and attempt to informally resolve inquiries about private education loans. The Private Education Loan Ombudsman reports to Congress annually on the trends and issues that it identifies through this process. On October 16, 2012, the Ombudsman submitted its first report based on 2,900 inquiries, finding that borrowers tended to report problems with their loan servicing and repayment options. The report draws conclusions about problems in education loan servicing and suggests Congress consider further steps to provide loan modifications or refinancing opportunities for troubled borrowers. Most of the inquiries that received from customers via the CFPB process are made by borrowers facing difficulty in repayment due to unemployment and underemployment due to the faltering economy. |

23

| • | The CFPB announced on February 21, 2013 that it is seeking information on options available to borrowers having difficulty repaying their loans. The deadline for submission of information to the CFPB was April 8, 2013. |

| • | On May 8, 2013, the CFPB published a report highlighting the ways in which private student loan debt can be a roadblock to financial soundness for consumers. The report analyzes the impacts of private student loan burdens on the broader economy, assesses recent actions of policymakers in the student loan market and discusses policy options put forth by the public regarding private student loans. Reports such as these may continue to influence regulatory developments in the student lending market. The report proposed a number of considerations for policymakers and market participants, such as refinancing relief and monthly payments more closely correlated with a borrower’s debt-to-income ratio. Certain of these CFPB recommendations in the report could negatively affect SLM BankCo’s private education loan portfolio if implemented. |

Source of Strength

Under the Dodd-Frank Act, SLM BankCo is required to serve as a source of financial strength to the Bank and to commit resources to support the Bank in circumstances when SLM BankCo might not do so absent the statutory requirement. Any loans by SLM BankCo to the Bank would be subordinate in right of payment to depositors and to certain other indebtedness of the Bank.

Community Reinvestment Act

The Community Reinvestment Act requires the FDIC to evaluate the record of the Bank in meeting the credit needs of its local community, including low and moderate income neighborhoods. These evaluations are considered in evaluating mergers, acquisitions and applications to open a branch or facility. Failure to adequately meet these criteria could result in additional requirements and limitations on the Bank.

24

Privacy Laws

Financial institutions are required to disclose their policies for collecting and protecting confidential customer information. Customers generally may prevent financial institutions from sharing nonpublic personal financial information with nonaffiliated third parties, with some exceptions, such as the processing of transactions requested by the consumer. Financial institutions generally may not disclose certain consumer or account information to any nonaffiliated third-party for use in telemarketing, direct mail marketing or other marketing. Federal and state banking agencies have prescribed standards for maintaining the security and confidentiality of consumer information, and the Bank is subject to such standards, as well as certain federal and state laws or standards for notifying consumers in the event of a security breach.

In addition, certain privacy laws, including the Gramm-Leach-Bliley Act, require that certain of subsidiaries of NewCo will continue to be third-party vendors of services to, and “institution affiliated parties” of, the Bank and be subject to the FDIC’s examination and enforcement authority following the spin-off. In order to facilitate compliance with certain consumer information privacy laws during an information technology transition period post-spin-off in which SLM BankCo and NewCo loans and associated customer accounts will continue to be serviced from a single information technology system hosted by SMI, SMI will remain an affiliate of each of SLM BankCo and Newco for broader bank regulatory purposes for the duration of that transition period. Among other things, this will mean that transactions between SMI and the Bank will remain subject to the affiliate transaction restrictions of Sections 23A and 23B of the Federal Reserve Act during this transition period.

Pro Forma Financial Information

The following unaudited condensed consolidated financial information of SLM BankCo for the nine months ended September 30, 2013 and the year ended December 31, 2012 adjusted pro forma for the effects of the spin-off has been derived from Existing SLM’s unaudited consolidated financial statements for the nine months ended September 30, 2013 and its audited consolidated financial statements for the year ended December 31, 2013. The historical financial information of Existing SLM has first been adjusted to carve out and represent only those operations, assets, liabilities and equity that will form part of SLM BankCo on a stand-alone basis.

The stand-alone SLM BankCo financial information is comprised of financial information relating to the Bank, Upromise Rewards, the Sallie Mae insurance business, and the private education loan origination functions. Also included are certain general corporate overhead expenses and shared costs allocated to SLM BankCo. The stand-alone SLM BankCo financial information as shown herein is also reported in the “Unaudited Pro Forma Condensed Consolidated Financial Statements” in the column headed “Stand-alone SLM BankCo” in the registration statement on Form 10 that NewCo filed with the SEC on December 6, 2013.

The stand-alone SLM BankCo financial information has then been adjusted to give effect to the internal corporate reorganization and the separation of the education loan management business by way of a share distribution. The unaudited condensed consolidated income statements of SLM BankCo for the year ended December 31, 2012 and the nine months ended September 30, 2013 are adjusted pro forma for the effects of the separation and distribution as if it had been completed on January 1, 2012. The stand-alone SLM BankCo Financial Information has further been adjusted pro forma for the effects of the spin-off by reflecting the following: The spin-off will be accounted for as a distribution by means of a tax-free distribution of the shares of common stock of NewCo, on a 1-to-1 basis, to the holders of shares of Existing SLM common stock that implements the actual separation of the education loan management business from SLM BankCo. The spin-off will also account for the transfer of certain assets and liabilities that were historically operated by NewCo and that will be held by SLM BankCo, SLM BankCo’s anticipated post-separation capital structure and the impact of, and transactions contemplated by, certain agreements entered into by SLM BankCo in connection with the spin-off.

25

The unaudited condensed consolidated financial statements of SLM BankCo adjusted pro forma for the effects of the spin-off do not give effect to future estimated annual cost increases after the spin-off, attributable to various factors such as the following:

| • | Personnel required to operate as a stand-alone public company; |

| • | Possible changes in compensation with respect to new and existing positions; |

| • | The level of assistance required from professional service providers; |

| • | Differences in insurance premiums and bonding costs as a stand-alone public company; |

| • | Differences in health and welfare costs associated with changes in employee benefit plans; and |

| • | The amount of capital expenditures for information technology infrastructure investments associated with being a stand-alone public company. |

In addition, prior to the spin-off, the Bank sold loans to affiliates for two reasons: (1) to fund the loans to term through the issuance of an asset back securitization and (2) to enable the affiliates to manage loans that were granted forbearance or were 90 days or more past due. As a result of these past practices, the Bank’s historical credit results do not reflect charge-offs or recoveries. The following results, pro forma for the effects of the spin-off, have not been adjusted to reflect what the delinquencies, charge-offs and recoveries would have been, had the Bank not sold these loans to its affiliates. After the spin-off, the Bank’s results will reflect delinquencies and related charge-offs/recoveries as it is contemplated that it will retain loans throughout the life of the account.

The unaudited condensed consolidated financial statements of SLM BankCo adjusted pro forma for the effects of the spin-off have been prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”).

26

The pro forma adjustments are based on preliminary estimates, accounting judgments and currently available information and assumptions that Existing SLM’s management believes are reasonable. The unaudited financial information of SLM BankCo adjusted pro forma for the effects of the spin-off has been prepared for illustrative purposes only and is not necessarily indicative of the financial position or results of operations had the spin-off actually occurred on the date indicated, nor is such unaudited pro forma financial information necessarily indicative of the results to be expected for any future period. A number of factors may affect the results. See “Risk Factors” and “Forward-Looking Statements” in the Form 8-K.

For additional information on the preparation of the unaudited pro forma condensed consolidated financial statements of NewCo and the structure and accounting of the separation and distribution, please review the registration statement on Form 10 that NewCo filed with the SEC on December 6, 2013, which can be accessed at www.sec.gov/edgar.

27

Below is the unaudited condensed consolidated balance sheet for SLM BankCo pro forma for the effects of the spin-off as of September 30, 2013.

SLM BANKCO

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED BALANCE SHEET

AS OF SEPTEMBER 30, 2013

(In millions)

| Stand-alone SLM BankCo(1) |

Separation Adjustments |

Pro Forma SLM BankCo |

||||||||||

| Assets |

||||||||||||

| Interest earning assets: |

||||||||||||

| Cash and investments |

$ | 1,810 | $ | 566 | (a) | $ | 2,376 | |||||

| Private Education Loans (net of allowance for losses of $54) |

6,162 | — | 6,162 | |||||||||

| FFELP Loans (net of allowance for losses of $5) |

1,215 | — | 1,215 | |||||||||

| Other interest-earning assets |

4 | — | 4 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total interest-earning assets |

9,191 | 566 | 9,757 | |||||||||

| Other assets |

455 | — | 455 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total assets |

$ | 9,646 | $ | 566 | $ | 10,212 | ||||||

|

|

|

|

|

|

|

|||||||

| Liabilities and Equity |

||||||||||||

| Deposits |

$ | 7,952 | $ | — | $ | 7,952 | ||||||

| Other liabilities |

527 | — | 527 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total liabilities |

8,479 | — | 8,479 | |||||||||

|

|

|

|

|

|

|

|||||||

| Preferred stock, par value $.20 per share, 20 million shares authorized |

||||||||||||

| Series A: 3.3 million shares issued, respectively, at stated value of $50 per share |

— | 165 | (b) | 165 | ||||||||

| Series B: 4 million shares issued, respectively, at stated value of $100 per share |

— | 400 | (b) | 400 | ||||||||

| Common stock |

— | — | — | |||||||||

| Additional paid-in capital |

752 | 1 | (c) | 753 | ||||||||

| Accumulated other comprehensive income |

40 | — | 40 | |||||||||

| Retained earnings |

370 | — | 370 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total stockholders’ equity |

1,162 | 566 | 1,728 | |||||||||

| Non-controlling interest |

5 | — | 5 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total equity |

1,167 | 566 | 1,733 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total liabilities and equity |

$ | 9,646 | $ | 566 | $ | 10,212 | ||||||

|

|

|

|

|

|

|

|||||||

| (1) | Represents the operations, assets, liabilities and equity of SLM BankCo, which will be comprised of the Bank, Upromise Rewards, the Sallie Mae insurance business, and the private education loan origination functions. Included in these amounts are certain general corporate overhead expenses related to SLM BankCo. |

Notes:

| (a) | In connection with the spin-off, SLM BankCo, by reason of a statutory merger, will succeed Existing SLM as the issuer of the Series A Preferred Stock and the Series B Preferred Stock. SLM BankCo will retain $566 million cash, $565 million of which will offset the obligation attributable to the principal of the Series A Preferred Stock and the Series B Preferred Stock. The remainder of $1 million will be treated as additional paid-in capital. |

| (b) | SLM BankCo, by reason of a statutory merger, will succeed Existing SLM as the issuer of the Series A Preferred Stock and the Series B Preferred Stock. |

| (c) | Following the spin-off, SLM BankCo will retain $1 million as additional paid-in capital. |

28

Below is the unaudited pro forma condensed consolidated income statement for SLM BankCo pro forma for the effects of the spin-off for the nine months ended September 30, 2013.

SLM BANKCO

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED INCOME STATEMENT

NINE MONTHS ENDED SEPTEMBER 30, 2013

(In millions)

| Stand-alone SLM BankCo(1) |

Separation Adjustments |

Pro Forma SLM BankCo |