Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Insys Therapeutics, Inc. | insy20131219_8k.htm |

Exhibit 10.1

OFFICE LEASE

By and Between

CAZ 1 LLC, an Arizona limited liability company,

as Landlord

and

Insys Therapeutics, Inc., a Delaware corporation

as Tenant

Article One: BASIC TERMS/DEFINITIONS

This Article One contains the Basic Terms and Definitions of this Lease between the Landlord and Tenant named below. Other Articles, Sections and Paragraphs of the Lease referred to in this Article One explain and define the Basic Terms and are to be read in conjunction with the Basic Terms.

Section 1.01 Date of Lease. December 18, 2013

Section 1.02 Landlord (include legal entity). CAZ 1 LLC, an Arizona limited liability company.

Address of Landlord: 11452 El Camino Real, Suite 200

San Diego, California 92130

Phone: (858) 793-0202

Fax: (858) 793-5363

Section 1.03 Tenant (include legal entity). Insys Therapeutics, Inc., a Delaware corporation.

Address of Tenant prior to the Commencement Date:

Insys Therapeutics, Inc.

444 South Ellis Street

Chandler, Arizona 85224

Phone: (602) 910-2617

Fax: (602) 910-2627

The address of Tenant following the Commencement Date shall be the Premises address.

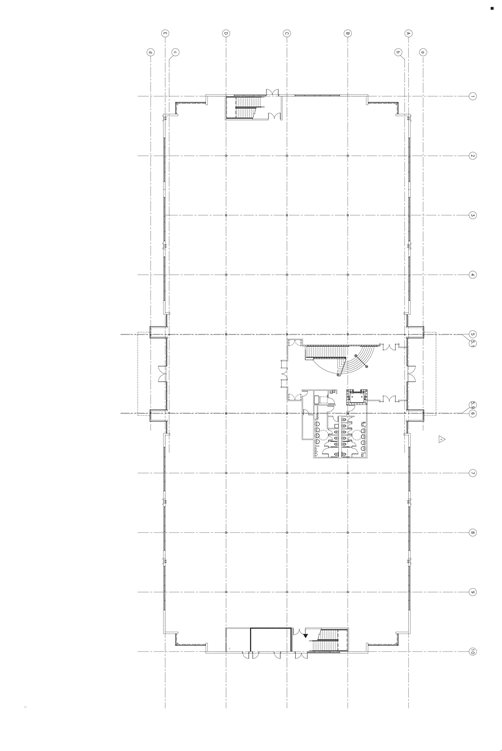

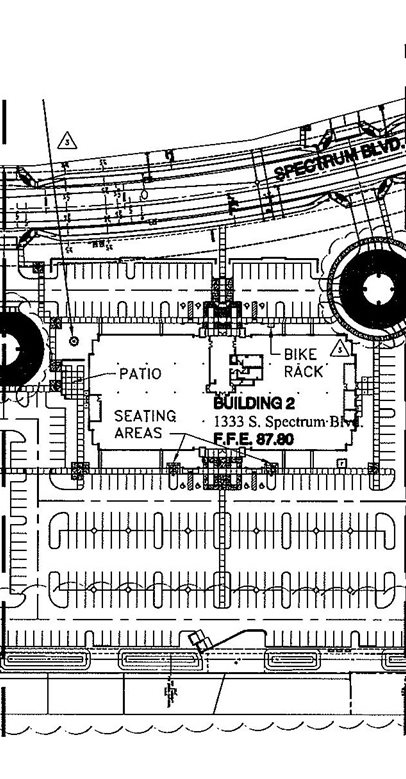

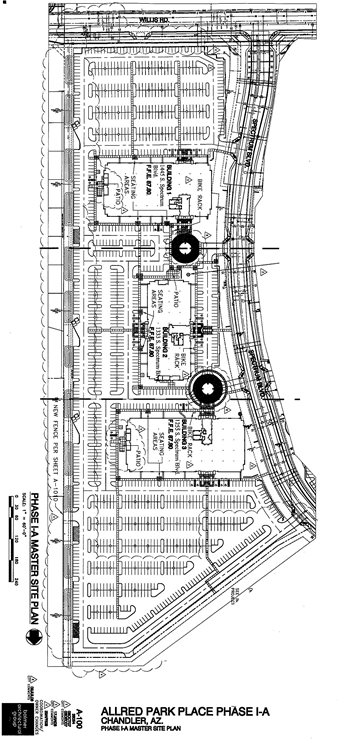

Section 1.04 Premises. The Premises is that certain office suite(s) located on the first floor, designated as Suite 100, containing approximately 34,945 rentable square feet as indicated on the space plan attached hereto as Exhibit A-1 (the “Premises”). The office building of which the Premises form a part is in the commercial office complex commonly known as Allred Park Place located at 1333 South Spectrum Boulevard, Chandler, AZ 85286 as shown on the site plan attached hereto as Exhibit A-2, such building being Building 2 consisting of approximately 68,866 rentable square feet (the “Building”). The real property described on Exhibit A-3 hereto and all improvements thereon, including without limitation the Building and Common Areas (detailed below), are hereinafter collectively referred to as the “Project.” In addition to the Premises, Tenant shall have the non-exclusive use of the Common Areas (defined below) subject to the terms of this Lease, applicable covenants, conditions and restrictions and the rules and regulations. The stated rentable square footage of the Premises and Building set forth above is approximate, but Landlord and Tenant agree that the stated rentable square footage shall be used for all purposes under this Lease and is not subject to adjustment.

Section 1.05 Lease Term. Eighty-four (84) months beginning on the later of (i) substantial completion of the Tenant Improvements pursuant to the Work Letter Agreement attached hereto as Exhibit “B”, or (ii) May 1, 2014 (the “Commencement Date”), and ending on the last day of the month following a full eighty-four (84) months thereafter (the “Expiration Date”). Landlord and Tenant shall execute an addendum to this Lease in the form attached hereto as Exhibit “D” confirming the Commencement Date and the Expiration Date of the original Lease Term. Failure to execute such Exhibit shall not affect the validity or enforceability of this Lease.

Section 1.06 Permitted Uses. (See Article Five) Tenant may use and occupy the Premises for executive and general office purposes only, and no other use of the Premises shall be permitted without the express written consent of Landlord. Tenant’s use of the Premises shall be subject to the following restrictions of record:

(a) Master Declaration of Covenants, Conditions, Restrictions, Development Standards and Easements for Spectrum Chandler dated August 3, 2006, recorded with the Maricopa County Recorder at No. 2006-1065128 on August 10, 2006, as amended from time to time (the “Master CC&Rs”).

(b) Declaration Of Covenants, Conditions, And Restrictions And Grant of Easements, with CAZ 1 LLC, an Arizona limited liability company, as Declarant, dated October 29, 2008, recorded with the Maricopa County Recorder at No. 2008-0954135, on November 5, 2008, as amended from time to time (the “CC&Rs”).

Section 1.07 Tenant’s Guarantor. (If none, so state) (See Section 11.05) None.

Section 1.08 Brokers. (See Article Fourteen) (If none, so state)

Landlord’s Broker: CB Richard Ellis

Mark S. Krison

2415 E. Camelback Road

Phoenix, Arizona 85016

Phone: (602) 735-5670

Fax: (602) 735-5105

Tenant’s Broker: Cassidy Turley Commercial Real Estate

Bruce Calfee and Josh Wyss

2375 E. Camelback Road, Suite 300

Phone: (602) 954-9000

Fax: (602) 468-8588

Section 1.09 Commission Payable to Landlord’s Broker. (See Article Fourteen) Pursuant to separate agreement.

Section 1.10 Initial Security Deposit. (See Section 3.02) None.

Section 1.11 Vehicle Parking Spaces Allocated to Tenant. (See Section 5.14) One hundred seventy-four (174) total spaces (one hundred fifty-four (154) uncovered and unreserved spaces and twenty (20) covered and reserved spaces). Landlord shall provide the twenty (20) covered and reserved parking spaces for an additional charge of thirty dollars ($30.00) per covered parking space per month (“Covered Parking Rent”) for the Lease Term and any extended term. The Covered Parking Rent shall be abated for the first eighteen (18) months of the Lease Term.

Section 1.12 Rent and Other Charges Payable by Tenant.

(a) BASE RENT: The Base Rent for the Lease Term commencing on the Commencement Date is as follows:

|

Term |

Rent | |

| Months 1-4* | $0.00 per rentable square foot per month for a total of $0.00 per month, plus applicable rental and privilege taxes. | |

|

Months 5-24 |

$25.50 per rentable square foot per year for a total of $891,097.50 per year ($74,258.13 per month), plus applicable rental and privilege taxes. | |

| Months 25-48 |

$27.03 per rentable square foot per year for a total of $944,563.35 per year ($78,713.61 per month), plus applicable rental and privilege taxes. | |

| Months 49-72 |

$28.65 per rentable square foot per year for a total of $1,001,237.15 per year ($83,436.43 per month), plus applicable rental and privilege taxes. | |

| Months 73-84 |

$30.37 per rentable square foot per year for a total of $1,061,311.38 per year ($88,442.62 per month), plus applicable rental and privilege taxes. | |

|

* Notwithstanding anything to the contrary, Tenant shall receive four (4) full months of abated rent. |

(b) ADDITIONAL RENT: (i) Tenant’s Pro-Rata Share of Operating Expenses (See Section 4.02); (ii) Utilities (See Section 4.03); (iii) Impounds for Insurance Premiums, if applicable (See Section 4.04(e)); and (iv) Covered Parking Rent (See Section 1.11); including all applicable rental and privilege taxes on said Additional Rent. All charges payable by Tenant to Landlord other than Base Rent are called “Additional Rent.” Unless this Lease provides otherwise, Tenant shall pay all Additional Rent then due with the next monthly installment of Base Rent. The terms “rent” or “Rent” shall mean Base Rent and Additional Rent.

Section 1.13 Tenant’s Pro-Rata Share of Operating Expenses. (See Section 4.01(a)) 50.7434%

Section 1.14 Expense Stop. (See Section 4.02) The Expense Stop shall be established by using the actual expenses of the Building during the calendar year 2014, grossed up to reflect a 95% occupied building as well as a fully assessed building for property tax purposes. Landlord shall provide Tenant with written notice of the Expense Stop within thirty (30) days after the end of the year.

Section 1.15 Landlord’s Share of Profit on Assignment or Sublease. (See Section 9.05) Fifty percent (50 %) of the Profit (the “Landlord’s Share”).

Section 1.16 Rentable Square Feet/Footage. The rentable square footage of the Premises shall be established using the Building Owners and Managers Association International, ANSI Z65.1-1996 (“BOMA”) method of measurement using Gross Building Area (which includes the R/U Ratio applicable to the load factor). BOMA is incorporated herein by reference.

Section 1.17 Common Areas. All areas within the Project which are available for the common use of tenants of the Project and which are not leased or held for the exclusive use of Tenant or other tenants, including, but not limited to, parking areas, driveways, sidewalks, loading areas, access roads, landscaping, planted areas, lobbies, corridors, hallways, elevator foyers, restrooms, mail rooms, mechanical and electrical rooms, janitorial closets, and other similar facilities used by tenants or for the benefit of tenants on a non-exclusive basis. Access to certain Common Areas may be restricted from time to time by Landlord. Landlord, from time to time, may change the size, location, nature and use of any of the Common Areas, convert Common Areas into leaseable areas, construct additional parking facilities (including parking structures) in the Common Areas, and increase or decrease Common Area land and/or facilities. In addition, Landlord shall be entitled to change the land and buildings comprising the Project by removing land, buildings and Common Areas from the Project, dividing the land, buildings and applicable Common Areas into separate parcels, selling any separate parcels to other parties, or any such other action Landlord deems necessary. Tenant acknowledges that such activities may result in inconvenience to Tenant. Such activities and changes are permitted if they do not materially affect Tenant’s use of the Premises. Landlord shall maintain the Common Areas in good order, condition and repair unless such maintenance is assumed by an association pursuant to the CC&Rs or the Master CC&Rs. In the event the use of any of the Common Areas change from the common use of the tenants of the Project to the exclusive use of the Tenant, said Common Areas shall be added to the Premises and Tenant’s rentable square footage, Base Rent, Additional Rent and Tenant’s Pro Rata Share of the Operating Expenses shall be adjusted accordingly.

Section 1.18 Riders/Exhibits. The following Riders or Exhibits are attached to and made a part of this Lease:

Exhibit A-1 – Premises

Exhibit A-2 – Building

Exhibit A-3 – Project

Exhibit B – Work Letter Agreement

Exhibit C – Rules and Regulations

Exhibit D – Commencement Notice

Section 1.19 Building Hours of Operation. The Building Hours of Operation shall be 7:00 AM to 6:00 PM, Monday through Friday, and 8:00 AM to 1:00 PM on Saturday, excluding holidays. The Building Hours of Operation shall be subject to adjustment at the reasonable discretion of Landlord and as may be consistent with other first-class office buildings in Maricopa County, Arizona. Tenant shall be permitted to access the Premises before and after the Building Hours of Operation.

Article Two: LEASE TERM

Section 2.01 Lease of Premises For Lease Term. Landlord leases the Premises to Tenant and Tenant leases the Premises from Landlord for the Lease Term. The Lease Term is for the period stated in Section 1.05 above and shall begin and end on the dates specified in Section 1.05 above, unless the beginning or end of the Lease Term is changed under any provision of this Lease. The “Commencement Date” shall be the date specified in Section 1.05 above for the beginning of the Lease Term, unless advanced or delayed under any provision of this Lease.

Section 2.02 Delay in Commencement. If Landlord delayed in delivering the Premises to Tenant for any reason whatsoever (including, without limitation, the holding over of a previous occupant or Landlord's inability to complete any required construction), Landlord shall not be liable to Tenant for any damages or losses resulting therefrom and this Lease shall continue in full force and effect.

Section 2.03 Holding Over. Tenant shall vacate the Premises upon the expiration or earlier termination of this Lease. Tenant shall reimburse Landlord for and indemnify Landlord against all damages which Landlord incurs from Tenant's delay in vacating the Premises. If Tenant does not vacate the Premises upon the expiration or earlier termination of the Lease and Landlord thereafter accepts rent from Tenant, Tenant's occupancy of the Premises shall be a "month-to-month" tenancy, subject to all of the terms of this Lease and any governmental statutes which are applicable to a month-to-month tenancy, but do not conflict with any provision contained in this Lease, except that the Base Rent then in effect shall be increased by one hundred fifty percent (150%). Landlord's right to collect such rent shall be in addition to and shall not preclude concurrent, alternative or successive exercise of any other rights or remedies available to Landlord.

Section 2.04 Early Occupancy. If Tenant occupies the Premises prior to the Commencement Date, Tenant’s occupancy of the Premises shall be subject to all of the provisions of this Lease. Early occupancy of the Premises shall not advance the expiration date of this Lease. Tenant shall pay Base Rent, Additional Rent and all other charges specified in this Lease for the early occupancy period.

Section 2.05 Option to Extend Lease Term. At the expiration of the original Term, Tenant may extend this Lease for two (2) extended terms of five (5) years each (each an “Option Term”) by giving Landlord written notice of its intention to do so not later than twelve (12) months prior to the expiration of the original Lease Term, and thereafter twelve (12) months prior to the expiration of the applicable Option Term; provided, however, that Tenant is not in material default beyond any applicable cure period under the Lease on the date of giving such notice or on the date of commencement of such Option Term. Any termination of the Lease shall result in automatic termination of this option. Tenant’s right to extend the Lease term provided herein is personal to Tenant and may not be assigned or otherwise transferred. Each Option Term shall be upon all of the terms and conditions of this Lease, except that the following rights of Tenant during the original Term of this Lease shall not apply during such Option Terms: (a) any right to rent-free possession; (b) any right to further extension of the term of the Lease beyond the Option Terms set forth herein above; (c) any right to continue to pay the same Base Rent; (d) any right to additional Tenant Allowance; and (e) any right to terminate the Option Terms early. In no event shall the Base Rent for any Option Term be less than the Base Rent payable by Tenant during the full month immediately preceding the Option Term.

The Base Rent for the first twelve (12) months of the initial Option Term shall be equal to the Base Rent during the period immediately preceding the initial Option Term, and thereafter the Base Rent shall increase by six percent (6%) every twenty-four (24) months during the initial Option Term and any subsequent Option Term.

Section 2.06 Fixturization Period. Tenant will have two (2) weeks prior to the Commencement Date (“Fixturization Period”) to complete its interior improvements and fixturization so long as said improvements and fixturization do not interfere with Landlord’s construction of the Tenant Improvements pursuant to the Work Letter Agreement. There shall be no Base Rent or Additional Rent during the Fixturization Period but all other terms of this Lease shall, however, be in effect during such period. The Fixturization Period shall not affect the Expiration Date.

Article Three: BASE RENT

Section 3.01 Time and Manner of Payment. Upon execution of this Lease, Tenant shall pay Landlord the Base Rent and Additional Rent in the amount stated for the fifth (5th) full month of the Lease Term in Section 1.12(a) above (“Initial Payment Upon Execution”). The Initial Payment Upon Execution shall be held by Landlord and applied to charges due for the fifth (5th) full calendar month of the Lease Term. If the Commencement Date falls on a day other than the first day of the month, Tenant shall pay Landlord the Base Rent and Additional Rent due for the resulting first partial month within ten (10) days of receipt of Landlord’s invoice. Any such first partial month Base Rent and Additional Rent shall be calculated on a prorated basis by multiplying the Base Rent and Additional Rent amounts applicable for the fifth (5th) month of the Lease Term by a fraction, the numerator of which shall be the actual number of days from the Commencement Date to the end of month and the denominator of which shall be the total number of days in the month. On the first day of the sixth (6th) full month of the Lease Term and each month thereafter, Tenant shall pay Landlord the Base Rent and Additional Rent, in advance, without offset, deduction or prior demand. In the event the payment made upon execution of this Lease for the fifth (5th) month Base Rent and Additional Rent differs from the actual fifth (5th) month Base Rent and Additional Rent charges due from Tenant, any resulting credit or balance due shall be credited against or added to, respectively, the amount due from Tenant for the sixth (6th) full month of the Lease. The Base Rent and Additional Rent shall be payable at Landlord’s address or at such other place as Landlord may designate in writing. Payments of Base Rent and Additional Rent for any fractional calendar month shall be prorated.

Section 3.02 Security Deposit. Upon the execution of this Lease in addition to payment of the first month's Base Rent and applicable taxes, Tenant shall deposit with Landlord a cash Security Deposit in the amount set forth in Section 1.10 above, as security for the full performance by Tenant of its obligations hereunder. Each time the Base Rent is increased, Tenant shall deposit additional funds with Landlord sufficient to increase the Security Deposit to an amount which bears the same relationship to the adjusted Base Rent as the initial Security Deposit bore to the initial Base Rent. If Tenant defaults under any provision hereof, Landlord shall be entitled, at its option, to apply or retain all or any part of the Security Deposit for the payment of any Base Rent, Additional Rent, Tenant's Pro Rata Share, other sum owing by Tenant to Landlord, or any amount which Landlord may become obligated to spend because of Tenant's default, or to compensate Landlord for any loss or damage which Landlord may suffer because of Tenant's default. If any portion of the Security Deposit is so used or applied, Tenant shall, within five (5) days after written demand therefor, deposit cash with Landlord in an amount sufficient to restore the Security Deposit to its original amount. Tenant’s failure to do so shall be a material default under this Lease. Landlord shall not be required to keep the Security Deposit separate from its other accounts and no trust relationship is created with respect to the Security Deposit. Tenant shall not be entitled to interest on the Security Deposit. If Tenant fully performs every provision of this Lease to be performed by it, the Security Deposit or any balance thereof shall be returned to Tenant at the expiration of the term of this Lease or any period of holding over. Landlord's rights with respect to the Security Deposit shall be in addition to and shall not preclude concurrent, alternative or successive exercises of any other rights or remedies available to Landlord.

Section 3.03 Termination; Advance Payments. Upon termination of this Lease under Article Seven (Damage or Destruction), Article Eight (Condemnation) or any other termination not resulting from Tenant’s default, and after Tenant has vacated the Premises in the manner required by this Lease, Landlord shall refund or credit to Tenant (or Tenant’s successor) the unused portion of the Security Deposit, any advance rent or other advance payments made by Tenant to Landlord, and any amounts paid for real property taxes and other reserves which apply to any time periods after termination of the Lease.

Section 3.04 Rental/Privilege Taxes. Tenant shall pay Landlord any and all privilege, commercial rental tax, transactional, excise or other taxes (not including Landlord’s income taxes) imposed or levied by any taxing authority against Landlord for, or on Landlord’s right to receive or the receipt by Landlord of, Base Rent, Additional Rent and any other charges or sums payable by Tenant under this Lease, said taxes to be paid and due at the time provided for payment of said Base Rent, Additional Rent or other sums or charges by Tenant.

Article Four: OTHER CHARGES PAYABLE BY TENANT

Section 4.01 Definitions. For purposes of this Article 4 and the Lease:

(a) “Tenant’s Pro-Rata Share” means the ratio, expressed as a percentage, of the rentable square feet in the Premises, to the entire rentable square footage in the Building. Tenant’s Pro Rata Share as of the date of this Lease is as set forth in Section 1.13 above. The numerator of Tenant’s Pro Rata Share is subject to adjustment if the rentable square footage of the Premises changes pursuant to the provisions of this Lease, and the denominator of Tenant’s Pro Rata Share is subject to adjustment if the rentable square footage available at the Building changes.

(b) “Calendar Year” shall mean the 12-month period beginning January 1 and ending December 31 and each 12-month period thereafter.

(c) “Real Estate Taxes” shall mean all taxes, assessments, levies, and other charges, improvement lien assessments including, but not limited to, City of Chandler Spectrum Improvement District assessments, general and special, ordinary and extraordinary, foreseen and unforeseen, of any kind and nature whatsoever, which shall or may be during the Lease Term assessed, levied, charged, confirmed, or imposed upon or become payable out of or become a lien on the Project or any portion thereof (including personal property taxes on equipment, fixtures and other property of Landlord located on the Project and used in connection with the operation thereof), but shall not include any estate, succession, inheritance, or transfer taxes, or any income, profits, or revenue tax imposed upon the rent received as such by Landlord under this Lease; provided, however, that if at any time during the Lease Term, the present method of real estate taxation or assessment shall be so changed that there shall be substituted for the whole or any part of such taxes, assessments, levies, impositions, or charges now or hereafter levied, assessed, or imposed on real estate and improvements, a capital tax or other tax imposed on the rents or income received by Landlord from the Project or the rents or income reserved herein, or any part thereof, then all such capital taxes or other taxes shall, to the extent that they are so substituted, be deemed to be included within the term “Real Estate Taxes.” Tenant shall pay all taxes charged against trade fixtures, furnishings, equipment or any other personal property belonging to Tenant. Tenant shall use Tenant’s best efforts to have personal property taxed separately from the Premises. If any of Tenant’s personal property is taxed with the Premises, Tenant shall pay Landlord the taxes for the personal property within fifteen (15) days after Tenant receives a written statement from Landlord for such personal property taxes.

(d) “Operating Expenses” means for the purposes hereof all costs, expenses, and fees incurred by Landlord in owning, managing, maintaining, repairing and operating the Premises, Building and surrounding parking lots, entryways and Common Area within the Project (whether or not now customary or in the contemplation of the parties) during any Calendar Year or portion thereof, including, but not limited to, the following: (a) Real Estate Taxes; (b) property management and building superintendent fees (which may include market rate fees for such services payable to Landlord or its related entities who perform such services); the cost of security personnel and services of independent contractors; and wages, charges, taxes, fringe benefits or other labor costs; (c) equipment, supplies and materials (new or replacement); the cost of water, sewer service, gas, electricity and other utilities and services (except telephone, cable and internet service for the Tenant, which shall be the obligation of each Tenant, and any utilities for which a separate meter has been installed for the Premises, which shall be paid directly to the supplier by Tenant; utilities paid directly to the supplier by other tenants pursuant to the terms of their leases shall also be excluded from Operating Expenses); the cost of refuse, garbage and trash removal, collection and disposal and the cost of pest control; (d) the cost of janitorial service; the cost of upkeep, repair and maintenance of the Premises and Building, including but not limited to, the roof and structural elements thereof and any elevators, plumbing, electrical, heating and air conditioning systems; the cost of upkeep and maintenance of any parking areas (including any covered parking canopies), sidewalks, hallways, stairways, toilets and other common facilities; the cost of landscaping and landscape maintenance; the cost of cleaning and other care of the Project, the Premises, the Building and the improvements comprising the same; (e) insurance premiums and other costs for fire and extended coverage insurance, comprehensive public liability insurance and other insurance paid by Landlord in such amounts as Landlord may determine in accordance with Sections 4.04(a) and 4.04(b); any deductible amount under Landlord’s insurance maintained pursuant to Section 4.04; (f) expenditures for improvements normally designated as capital improvements which result in operational or maintenance economies or which are imposed or required by or result in operational or maintenance economies or which are imposed or required by or result from statutes or regulations, or interpretations thereof, promulgated by any governmental authority; provided, however, the cost of any such capital improvements shall be amortized in accordance with generally accepted accounting principals and only the portion of such amortization applicable to any calendar year shall be included as an expense for that calendar year; and (g) the expenses incurred by or payable by Landlord for the operation, maintenance and repair of the Common Area of the Project and the expenses payable by Landlord under the Master CC&Rs and CC&Rs. Operating Expenses shall include the following: (i) costs, expenses, and fees incurred by Landlord in owning, managing, maintaining, repairing and operating the Project which costs, expenses, and fees shall be allocated proportionally to each building within the Project as reasonably determined by Landlord; (ii) costs, expenses, and fees incurred by Landlord in owning, managing, maintaining, repairing and operating the Building which costs, expenses, and fees shall be allocated proportionally to each tenant within the Building as reasonably determined by Landlord; and (iii) costs, expenses, and fees incurred by Landlord in owning, managing, maintaining, repairing and operating the Premises which costs, expenses, and fees shall be allocated to Tenant.

Section 4.02 Operating Expenses; Late Charges; Interest.

(a) Common Area Expense Payment. In addition to the Base Rent, for each Calendar Year during the Term, Tenant shall pay Landlord Tenant’s Pro-Rata Share of the Operating Expenses (calculated on a per rentable square foot per annum basis) over the Expense Stop (the “Common Area Expense Payment”). The Common Area Expense Payment shall be made by Tenant to Landlord in accordance with the terms of this Section 4.02 and shall be subject to adjustment as provided for in this Section 4.02.

(b) Monthly Payment of Estimated Amount. For each Calendar Year, Tenant shall pay, at the time of payment of each monthly installment of Base Rent, an amount equal to one-twelfth (1/12) of Landlord’s reasonable estimate of the sum of the Common Area Expense Payment to be due for the then current Calendar Year, if any. Said monthly payments shall be an estimate of the Common Area Expense Payment for the then current Calendar Year and shall be subject to adjustment based upon the final calculation of the Common Area Expense Payment as provided for in this Section 4.02.

(i) Within ninety (90) days after the end of each Calendar Year, Landlord shall furnish to Tenant a written statement setting forth the Operating Expenses for the most recently completed Calendar Year and Tenant’s Common Area Expense Payment. Landlord’s failure to render a statement with respect to increases in Operating Expenses for any Calendar Year shall not prejudice Landlord’s right to thereafter render a statement with respect thereto or with respect to any other Calendar Year.

(ii) After the end of each Calendar Year, Tenant shall make or receive for any Calendar Year, a payment or a credit equal to any excess or deficiency between the actual Common Area Expense Payment, if any, owed by Tenant for the most recent Calendar Year and the amounts paid by Tenant as an estimate of the Common Area Expense Payment. Tenant shall pay such Common Area Expense Payment or receive such credit against future payments within fifteen (15) days following receipt of notice thereof and receipt of the statement described herein.

(iii) Tenant’s obligation with respect to the Common Area Expense Payment shall survive the expiration or early termination of the Lease, and all such payments shall be prorated to reflect the actual term of this Lease.

(iv) Landlord agrees that upon written request of Tenant made within thirty (30) days of receiving the annual statement of Tenant’s Pro Rata Share, Landlord shall make the books and records for said prior year available for audit at its offices in the greater Phoenix area or the greater San Diego area during normal business hours. Any audit shall be conducted by a regional or national accounting firm. If the audit confirms that the actual Operating Expenses charged to Tenant during the prior Calendar Year have been overstated by Landlord by more than five percent (5%), Landlord shall immediately refund the entire excess. If the audit confirms that the Operating Expenses charged to Tenant during the prior Calendar Year have been undercharged by Landlord by more than five percent (5%), Tenant shall immediately pay the entire amount understated. The annual statement of Tenant’s Pro Rata Share shall be deemed binding and conclusive unless Tenant timely provides an audit notice to Landlord, thereafter audits the books and records within ninety (90) days of the notice date and said audits confirms an over or understated amount.

(c) Late Charges. Tenant’s failure to pay Rent promptly may cause Landlord to incur unanticipated costs. The exact amount of such costs are impractical or extremely difficult to ascertain. Such costs may include, but are not limited to, processing and accounting charges and late charges which may be imposed on Landlord by any ground lease, mortgage or trust deed encumbering the Premises. Therefore, if Landlord does not receive any rent payment within ten (10) days after it becomes due, Tenant shall pay Landlord a late charge equal to ten percent (10%) of the overdue amount. The parties agree that such late charge represents a fair and reasonable estimate of the costs Landlord will incur by reason of such late payment.

(d) Interest on Past Due Obligations. Any amount owed by Tenant to Landlord which is not paid when due shall bear interest at the rate of eighteen percent (18%) per annum from the due date of such amount. However, interest shall not be payable on late charges to be paid by Tenant under this Lease. The payment of interest on such amounts shall not excuse or cure any default by Tenant under this Lease. If the interest rate specified in this Lease is higher than the rate permitted by law, the interest rate is hereby decreased to the maximum legal interest rate permitted by law.

Section 4.03 Utilities and Services to the Premises. Tenant shall pay directly to the appropriate supplier, the cost of all telephone, cable, internet, and such other similar utilities and services supplied directly to the Premises. Electrical power to the Premises shall be provided by Landlord utilizing a Cutler Hammer PowerBill eNet submeter system. All natural gas, sewer service, water and refuse disposal and other such services for the Premises are jointly metered with other property and shall be provided by Landlord. All utilities and services provided by Landlord shall be included within Operating Expenses as set forth in more detail in Sections 4.01 and 4.02 and shall be provided during the Building Hours of Operation. Tenant shall not make connection to the utilities except by or through existing outlets and shall not install or use machinery or equipment in or about the Premises that uses excess water, lighting or power, or suffer or permit any act that causes extra burden upon the utilities or services, including but not limited to security services, over standard office usage for the Building. Landlord shall require Tenant to reimburse Landlord for any excess expenses or costs that may arise out Tenant’s use of the Premises over standard office usage and/or beyond the Building Hours of Operation . Landlord may, in its sole discretion, install supplemental equipment and/or separate metering applicable to Tenant’s excess usage or loading. Tenant shall pay Landlord for such excess usage as Additional Rent and such excess expenses shall not be subject to the Expense Stop.

Section 4.04 Insurance Policies.

(a) Liability Insurance. During the Lease Term and any fixturization period, Tenant shall maintain a policy of commercial general liability insurance (sometimes known as broad form comprehensive general liability insurance) insuring Tenant against liability for bodily injury, property damage (including loss of use of property) and personal injury arising out of the operation, use or occupancy of the Premises. Tenant shall name Landlord as an additional insured under such policy. The initial amount of such insurance shall be Five Million Dollars ($5,000,000) per occurrence and shall be subject to periodic increase based upon inflation, increased liability awards, recommendation of Landlord’s professional insurance advisors and other relevant factors. The liability insurance obtained by Tenant under this Section 4.04(a) shall (i) be primary and non-contributing; (ii) contain cross-liability endorsements; and (iii) insure Landlord against Tenant’s performance under Section 5.08, if the matters giving rise to the indemnity under Section 5.08 result from the negligence or other acts or failure to act where a duty to act exists on the part of Tenant. The amount and coverage of such insurance shall not limit Tenant’s liability nor relieve Tenant of any other obligation under this Lease. Tenant shall be liable for the payment of any deductible amount under Tenant’s insurance policies maintained pursuant to this Section 4.04. Landlord may also obtain comprehensive public liability insurance in an amount and with coverage determined by Landlord insuring Landlord against liability arising out of ownership, operation, use or occupancy of the Project. The policy obtained by Landlord shall not be contributory and shall not provide primary insurance. Tenant shall also obtain such other insurance and in such amounts as may from time to time be reasonably required by Landlord against other insurable hazards which at the time are customarily insured against in the case of premises similarly situated in Maricopa County, Arizona, with due consideration for the height and type of building, its construction, use and occupancy.

(b) Property and Rental Income Insurance. During the Lease Term, Landlord shall maintain policies of insurance covering loss of or damage to the Building in the full amount of its replacement value. Such policy shall contain an Inflation Guard Endorsement and shall provide protection against all perils included within the classification of fire, extended coverage, vandalism, malicious mischief, special extended perils (all-risk), sprinkler leakage and any other perils which Landlord deems reasonably necessary. Landlord shall have the right to obtain flood and earthquake insurance if required by any lender holding a security interest in the Building. Landlord shall not obtain insurance for Tenant’s fixtures or equipment or building improvements installed by Tenant on the Premises. During the Lease Term, Landlord shall also maintain a rental income insurance policy, with loss payable to Landlord, in an amount equal to one year’s Base Rent, plus, to the extent available and deemed appropriate by Landlord, the Additional Rent. Tenant shall be liable for the payment of Tenant’s Pro Rata Share of any deductible amount under Landlord’s insurance covering damage to the Building or Tenant’s insurance policies maintained pursuant to this Section 4.04, in an amount not to exceed Fifty Thousand Dollars ($50,000).

(c) Tenant Activities. Tenant shall not engage in or permit any activity which will cause the cancellation or increase the existing premium rate of fire, liability, or other insurance on or relating to the Premises, the Building or the Project. In the event Tenant engages in or permits any activity that causes an increase in the existing premium rate of any such insurance, in addition to any other remedies available to Landlord under the terms of this Lease, Landlord shall have the right to demand and receive from Tenant an amount equal to the increase in the existing premium rate. Tenant shall not sell or permit to remain in or about the Premises any article that may be prohibited by special form, fire, and extended coverage insurance policies. Tenant shall comply with all requirements pertaining to the use of the Premises necessary for maintenance of such fire and public liability insurance as Landlord may from time to time obtain for the Premises, the Building, or the Project.

(d) Payment of Premiums. Tenant shall timely pay all premiums for the insurance policies obtained by Tenant and described in Sections 4.04(a) and (b). Premiums for insurance policies obtained by Landlord and described in Sections 4.04(a) and (b) shall be paid by Landlord and included within Operating Expenses as set forth in more detail in Section 4.01(d).

(e) Impounds for Insurance Premiums. If requested by any ground lessor or lender to whom Landlord has granted a security interest in the Project, or if Tenant is more than ten (10) days late in the payment of rent more than once in any consecutive twelve (12) month period, Tenant shall pay Landlord a sum equal to one-twelfth (1/12) of the annual insurance premiums payable by Tenant under this Lease for insurance policies obtained by Tenant, together with each payment of Base Rent. Landlord shall hold such payments in a non-interest bearing impound account. If unknown, Landlord shall reasonably estimate the amount of insurance premiums when due. Tenant shall pay any deficiency of funds in the impound account to Landlord upon written request. If Tenant defaults under this Lease, Landlord may apply any funds in the impound account to any obligation then due under this Lease.

(f) General Insurance Provisions.

(i) Before the Commencement Date, Tenant shall deliver to Landlord a copy of any policy of insurance which Tenant is required to maintain under this Section 4.04. At least thirty (30) days prior to the expiration of any such policy, Tenant shall deliver to Landlord a renewal of such policy. As an alternative to providing a policy of insurance, Tenant shall have the right to provide Landlord a certificate of insurance, executed by an authorized officer of the insurance company, showing that the insurance which Tenant is required to maintain under this Section 4.04 is in full force and effect and containing such other information which Landlord reasonably requires.

(ii) Any insurance which Tenant is required to maintain under this Lease shall include a provision which requires the insurance carrier to give Landlord not less than thirty (30) days’ written notice prior to any cancellation or modification of such coverage.

(iii) If Tenant fails to deliver any policy, certificate or renewal to Landlord required under this Lease within the prescribed time period or if any such policy is cancelled or modified during the Lease Term without Landlord’s consent, Landlord may obtain such insurance, in which case Tenant shall reimburse Landlord for the cost of such insurance within fifteen (15) days after receipt of a statement that indicates the cost of such insurance.

(iv) Tenant shall maintain all insurance required under this Lease with companies holding a “Best’s Financial Strength Rating” of A+ or better, as set forth in the most current issue of “Best’s Credit Rating”. Landlord and Tenant acknowledge the insurance markets are rapidly changing and that insurance in the form and amounts described in this Section 4.04 may not be available in the future. Tenant acknowledges that the insurance described in this Section 4.04 is for the primary benefit of Landlord. If at any time during the Lease Term, Tenant is unable to maintain the insurance required under the Lease, Tenant shall nevertheless maintain insurance coverage which is customary and commercially reasonable in the insurance industry for Tenant’s type of business, as that coverage may change from time to time. Landlord makes no representation as to the adequacy of such insurance to protect Landlord’s or Tenant’s interests.

(v) Unless prohibited under any applicable insurance policies maintained, Landlord and Tenant each hereby waive any and all rights of recovery against the other, or against the officers, employees, agents or representatives of the other, for loss of or damage to its property or the property of others under its control, if such loss or damage is covered by any insurance policy in force (whether or not described in this Lease) at the time of such loss or damage. Upon obtaining the required policies of insurance, Landlord and Tenant shall give notice to the insurance carriers of this mutual waiver of subrogation.

Article Five: USE OF PROPERTY

Section 5.01 Permitted Uses. Tenant may use the Premises only for the Permitted Uses set forth in Section 1.06 above. Such use by Tenant shall be on a non-exclusive basis with other tenants of the Project entitled to such non-exclusive use.

Section 5.02 Manner of Use/Compliance with Laws. Tenant shall not cause or permit the Premises to be used in any way which constitutes a violation of any law, ordinance (including but not limited to zoning ordinance), or governmental regulation or order, or which annoys or interferes with the rights of tenants of the Project, or which constitutes a nuisance or waste. Tenant shall be responsible for ensuring that its use of the Premises is permitted by all applicable zoning and land use regulations and restrictions of record. Tenant shall obtain and pay for all permits, including a Certificate of Occupancy, required for Tenant’s occupancy of the Premises and shall promptly take all actions necessary to comply with all applicable statutes, ordinances, rules, regulations, covenants, restrictions, orders and requirements regulating the use by Tenant of the Premises, including the Occupational Safety and Health Act.

Section 5.03 Waste, Nuisance, Etc. Tenant shall not commit or permit any waste on the Premises or in any manner deface or injure the Premises, the Building, or the Project, and shall not use the Premises for the production or distribution of pornographic materials or other purposes which Landlord, in its sole discretion, deems offensive or immoral, or commit or permit on the Premises or any part of the Project any offensive, noisy or dangerous activity or other nuisance or other activity or thing which may disturb the quiet enjoyment or peaceable possession of any other tenant in the Project. Tenant shall not overload the floor of the Premises beyond the limit established by Landlord. Tenant shall not employ any sound emitting device in or about the Premises that is audible outside the Premises, except fire and burglar alarms.

Section 5.04 Trash. Tenant shall place all refuse or trash in receptacles provided by Landlord in the Common Areas.

Section 5.05 Sidewalks, Signs, Exterior, Etc. Tenant shall not display or exhibit any products, goods, wares or merchandise and shall not distribute advertising materials within the Project. Tenant shall not erect or place on or about the exterior of the Building wherein the Premises are located or the Project, or on any windows, glass partitions or doors thereof, any signs or other written information unless approved in writing by Landlord. Tenant’s signage shall be in compliance with Landlord’s existing sign criteria at the Premises and all applicable covenants, conditions and restrictions and applicable laws, statues and ordinances. Tenant shall not conduct or permit any auctions or sheriff’s sales at the Premises. Landlord shall provide and maintain in the lobby of the main entrance level of the Building a directory listing all tenants in the Building. The directory shall list each tenant’s name and its location in the Building designated by floor or by such designation as the Landlord may deem appropriate. Tenant shall not install exterior lighting on or decorate, paint or otherwise alter or improve the structure or roof of the Building. Tenant shall not install any objects on the roof of the Building and shall not take any action that will invalidate any warranty held by Landlord for the roof, HVAC Systems, or any other applicable warranty. Tenant shall not store products, containers or merchandise outside of the Premises or inside of the Premises which are visible from the Common Areas.

Section 5.06 Rules and Regulations. Tenant, its employees, agents, contractors, customers and invitees, shall comply with the Rules and Regulations of the Project attached to the Lease as Exhibit C and made a part hereof by reference, and with such modifications thereto as Landlord, in its sole discretion, may hereafter make for the Project; provided, however, that such Rules and Regulations shall not contradict or abrogate any right or privilege herein expressly granted to Tenant. Tenant agrees to faithfully observe and comply with the Rules and Regulations and all modifications thereto from time to time in effect, and any violation of such Rules and Regulations by Tenant, its employees, agents, contractors, customers or invitees shall constitute a breach of this Lease. Landlord shall not be responsible to Tenant for the non-performance by any other tenant or occupant of the Project of the Rules and Regulations or any modifications thereof.

Section 5.07 Hazardous Materials. As used in this Lease, the term “Hazardous Material” means any flammable items, explosives, radioactive materials, hazardous or toxic substances, material or waste or related materials, including any substance defined as or included in the definition of “hazardous substances”, “hazardous wastes”, “hazardous materials” or “toxic substances” now or subsequently regulated under any applicable federal, state or local laws or regulations, including without limitation petroleum-based products, paints, solvents, lead, cyanide, DDT, printing inks, acids, pesticides, ammonia compounds and other chemical products, asbestos, PCBs and similar compounds, and including any different products and materials which are subsequently found to have adverse effects on the environment or the health and safety of persons. Tenant shall not cause or permit any Hazardous Material to be generated, produced, brought upon, used, stored, treated or disposed of in or about the Premises by Tenant, its agents, employees, contractors, sublessees or invitees without the prior written consent of Landlord; provided, however, Tenant shall be allowed to store and use nominal amounts of commercially available cleaning products without the consent of Landlord. Tenant shall provide Landlord with ten (10) days advance written notice, setting forth an itemization of all such Hazardous Materials, with a detailed description thereof, and the intended volume, location and use of such Materials at the Premises, prior to the use or allowance of any such cleaning products or any other products, materials or substances which are Hazardous Materials as defined above or which have or may have adverse effects on the environment or the health and safety of persons. Landlord shall be entitled to take into account such other factors or facts as Landlord deems to be relevant in determining whether to grant or withhold consent to Tenant’s proposed activity with respect to Hazardous Material. In no event, however, shall Landlord be required to consent to the installation or use of any storage tanks in or on the Premises.

To the extent Tenant is allowed to store and use any Hazardous Materials in or about the Premises in accordance with the provisions of this Section, Tenant shall be obligated to provide Landlord with a Phase I Environmental Report prepared in accordance with current ASTM standards (“Phase I”). The Phase I, addressed and certified to Landlord and Landlord’s lender, if any, shall be dated as of the date Tenant vacates the Premises. Tenant shall bear the cost of the Phase I and shall also be responsible for any and all costs, penalties and fines incurred for any environmental contamination and subsequent remediation at the Project. Should Tenant fail to timely deliver to Landlord the Phase I, Landlord may cause a Phase I to be prepared to like effect and Tenant shall be liable to Landlord for one hundred thirty percent (130%) of the cost of said Phase I. Should the Phase I provided by either Landlord or Tenant state that a hazardous condition exists in or on the Project or that the Premises cannot be used or leased in a hazard- free condition (unless the hazardous condition existed prior to the Commencement Date under the Lease), Tenant shall forthwith cause the hazardous condition to be fully corrected at Tenant’s expense. In addition, Tenant shall be required to pay to Landlord monthly, on or before the first day of each month, an amount equal to one hundred thirty percent (130%) of Base Rent and Additional Rent due under the Lease for the last year of the Lease Term, for any period following expiration of the Lease Term until the Premises is restored to a hazard free condition. This requirement shall not be construed as an extension of an expired or terminated Lease, but solely as damages to Landlord due to such hazardous condition(s) existing at the Project which prevent Landlord from re-leasing the Premises. Tenant, following such expiration or termination of this Lease, shall be allowed access to the Project, only to the extent necessary to remove or otherwise correct any hazardous condition, and shall conduct no gainful business activity whatsoever at said Premises. The provisions of this Section shall survive the expiration or any termination of this Lease.

Section 5.08 Indemnity. Tenant shall indemnify Landlord against and hold Landlord harmless from any and all costs, claims or liability arising from: (a) Tenant’s use of the Premises; (b) the conduct of Tenant’s business or anything else done or permitted by Tenant to be done in or about the Premises, including any contamination of the Premises or any other property resulting from the presence or use of Hazardous Material caused or permitted by Tenant; (c) any breach or default in the performance of Tenant’s obligations under this Lease; (d) any misrepresentation or breach of warranty by Tenant under this Lease; or (e) other acts or omissions of Tenant. Tenant shall defend Landlord against any such cost, claim or liability at Tenant’s expense with counsel selected by Landlord or at Landlord’s election, Tenant shall reimburse Landlord for any legal fees or costs incurred by Landlord in connection with any such claim. As a material part of the consideration to Landlord, Tenant assumes all risk of damage to property or injury to persons in or about the Premises arising from any cause, and Tenant hereby waives all claims in respect thereof against Landlord, except for any claim arising out of Landlord’s negligence or willful misconduct. As used in this Section, the term “Tenant” shall include Tenant’s employees, agents, contractors, invitees and guests, if applicable.

Section 5.09 Landlord’s Access. Landlord or its agents may enter the Premises at all reasonable times (a) during the last year of the Lease Term to show the Premises to potential buyers, investors, tenants or other parties, (b) to do any other act or to inspect and conduct tests in order to monitor Tenant’s compliance with all applicable environmental laws and all laws governing the presence and use of Hazardous Material, or (c) or for any other purpose Landlord deems necessary. Landlord shall give Tenant prior notice of such entry, except in the case of an emergency. Landlord may place customary “For Sale” or “For Lease” signs on the Premises, the Building and/or Project, as applicable.

Section 5.10 Quiet Possession. If Tenant pays the rent and complies with all other terms of this Lease, Tenant may peaceably and quietly occupy and enjoy the Premises for the full Lease Term, subject to the provisions of this Lease.

Section 5.11 Tenant ADA Obligations. Landlord represents and warrants that upon commencement of the Lease Term the shell Building shall comply with the requirements of Title III of the Americans with Disabilities Act of 1990 (42 U.S.C. 12181, et seq., the Provisions Governing Public Accommodations and Services Operated by Private Entities), and all regulations promulgated thereunder (the “ADA”). At all times during the term of this Lease, Tenant, at Tenant’s sole cost and expense, shall cause all alterations and improvements in the Premises, and Tenant’s use and occupancy of the Premises, and Tenant’s performance of its obligations under this Lease, to comply with the ADA, and all amendments, revisions or modifications thereto now or hereafter adopted or in effect in connection therewith and to take such actions and make such alterations and improvements as are necessary for such compliance; provided, however, that Tenant shall not make any such alterations or improvements except upon Landlord’s prior written consent pursuant to the terms and conditions of this Lease. If Tenant fails to diligently take such actions or make such alterations or improvements as are necessary for such compliance, Landlord may, but shall not be obligated to, take such actions and make such alterations and improvements and may recover all of the costs and expenses of such actions, alterations and improvements from Tenant as Additional Rent. Notwithstanding anything in this Lease to the contrary, no act or omission of Landlord, including any approval, consent or acceptance by Landlord or Landlord’s agents, employees or other representatives, shall be deemed an agreement, acknowledgment, warranty or other representation by Landlord that Tenant has complied with the ADA or that any action, alteration or improvement by Tenant complies or will comply with the ADA or constitutes a waiver by Landlord of Tenant’s obligations to comply with the ADA under this Lease or otherwise.

Section 5.12 Use of Common Areas. Tenant shall have the nonexclusive right (in common with other tenants and all others to whom Landlord has granted or may grant such rights) to use the Common Areas for the purposes intended, subject to such reasonable rules and regulations as Landlord may establish from time to time. Tenant shall abide by such rules and regulations and shall use its best effort to cause others who use the Common Areas with Tenant’s express or implied permission to abide by Landlord’s rules and regulations. At any time, Landlord may close any Common Areas to perform any acts in the Common Areas as, in Landlord’s judgment, are desirable to improve the Project. Tenant shall not interfere with the rights of Landlord, other tenants or any other person entitled to use the Common Areas. Tenant shall pay all costs, expenses, fines, penalties or damages that Landlord may incur by reason of Tenant’s failure to comply with the provisions of this Section 5.12 and, at Tenant’s sole cost and expense, Tenant shall indemnify, defend and hold Landlord harmless for, from and against all losses and liabilities arising from such non-compliance, utilizing counsel reasonably satisfactory to Landlord.

In the event Landlord determines that Tenant’s use of the Common Areas is disproportionate to the use by other tenants in the Project, Landlord reserves the right: (i) to charge Tenant extra for said increased usage which charge shall reflect the increased cost of Landlord’s maintenance of the Common Areas due to Tenant’s usage; (ii) to provide separate trash receptacles for Tenant which cost shall be the sole responsibility of Tenant and shall be paid by Tenant as Additional Rent; and/or (iii) to require Tenant to arrange for its own separate trash receptacles and collection at Tenant’s sole cost and expense using a contractor satisfactory to Landlord.

Section 5.13 Spectrum Chandler Park. Allred Park Place is a business park within a larger business park known as Spectrum Chandler (the “Spectrum Chandler Park”). Tenant, its agents, assigns, customers, designees, employees, guests, invitees, licensees, representatives, servants, successors, tenants, visitors, and others, shall also have the nonexclusive right to use all drives, sidewalks and other common areas and facilities (collectively, the “Spectrum Chandler Park Common Areas”) located within Spectrum Chandler Park, jointly with Landlord, other owners, tenants and occupants therein, and their respective agents, assigns, customers, designees, employees, guests, invitees, licensees, representatives, servants, successors, tenants, visitors, and others as set forth in the Master CC&Rs. Tenant, its agents, assigns, customers, designees, employees, guests, invitees, licensees, representatives, servants, successors, tenants, visitors, and others, shall not use any of the Spectrum Chandler Common Areas in a manner which obstructs or interferes with the reasonable use thereof by others and shall at all time comply with the Master CC&Rs and any rules and regulations associated therewith.

Section 5.14 Specific Provision re: Vehicle Parking. Tenant shall be entitled to use only the number of vehicle parking spaces in the Project allocated to Tenant in Section 1.11 of the Lease without paying any Additional Rent. Tenant acknowledges and agrees that Landlord may assign parking spaces at a later date. Landlord shall have the option to provide, at a later date, parking spaces covered by Landlord for an additional charge, per covered parking space; provided, however, that Landlord’s option to provide covered parking spaces at the Project shall not reduce the total number of parking spaces allocated to Tenant hereunder, and provided, further, that Tenant shall be under no obligation to obtain any such covered parking spaces. During any extended term the monthly charge for covered parking spaces shall be subject to periodic review, and may be adjusted higher or lower in Landlord’s sole discretion; provided, however, that monthly rate for covered parking set forth above shall not be adjusted (i) in excess of five (5%) percent or (ii) more frequently than once every twelve (12) months. Tenant’s parking shall be limited to vehicles no larger than standard size automobiles or pickup utility vehicles. Tenant shall not cause or allow any vehicles, large trucks or other large vehicles to be parked within the Project or on the adjacent public streets. Temporary parking of large delivery vehicles in the Project may be permitted by the rules and regulations established by Landlord. Vehicles shall be parked only in striped parking spaces and not in driveways, loading areas or other locations not specifically designated for parking. Handicapped spaces shall only be used by those legally permitted to use them. Tenant shall not permit any equipment, structure or other object to be placed in any areas designated for vehicle parking. In the event Tenant does permit any equipment, structure or other object in any areas designated for vehicle parking, any parking spaces used by Tenant for such purposes shall correspondingly reduce the total number of parking spaces allotted Tenant pursuant to this Lease. If Tenant parks more vehicles in the parking area than the number set forth in Section 1.11 of this Lease, such conduct shall be a material breach of this Lease if Tenant fails to rectify such matter within three (3) business days following written notice from Landlord of such conduct, or provided more than two (2) such notices have been given within any consecutive twelve (12) month period. In addition to Landlord’s other remedies under the Lease, Tenant shall pay a daily charge determined by Landlord for each such additional vehicle.

Section 5.15 Exterior Improvements. Tenant shall not be permitted to make any improvements outside of Tenant’s Premises unless approved by Landlord in its sole discretion. Any such improvements approved by Tenant shall be at Tenant’s sole cost and expense or subject to the Tenant Allowance provided for in the Work Letter Agreement attached hereto. In the event the improvements by Tenant reduce the parking available at the Building, the parking spaces allocated to Tenant in Section 1.11 shall be reduced accordingly.

Article Six: CONDITION OF PREMISES; MAINTENANCE, REPAIRS AND ALTERATIONS

Section 6.01 Tenant’s Acknowledgement. Tenant acknowledges, represents, warrants and agrees to the following: (i) Tenant shall be responsible for making its own inspection and investigation of the Premises, the Building wherein the Premises are located, and the Project, (ii) Tenant shall be responsible for investigating and establishing the suitability of the Premises for Tenant's intended use thereof, and all zoning and regulatory matters pertinent thereto, and (iii) Tenant is leasing the Premises "AS IS" based on its own inspection, inquiry and investigation regarding the condition of the Premises, Building and Project and not in reliance on any statement, representation, inducement or agreement of Landlord or any Broker except as expressly set forth herein. By taking possession of the Premises, Tenant shall be deemed to have accepted the Premises as being in satisfactory condition and completed in accordance with any requirements of Tenant set forth herein. Tenant accepts the Premises in its condition as of the Commencement Date of the Lease, subject to all recorded matters, laws, ordinances, and governmental regulations and orders. Except as provided herein, Tenant acknowledges that neither Landlord nor any agent of Landlord has made any representation as to the condition of the Premises or the suitability of the Premises for Tenant’s intended use.

Section 6.02 Exemption of Landlord from Liability. Landlord shall not be liable for any damage or injury to the person, business (or any loss of income therefrom), goods, wares, merchandise or other property of Tenant, Tenant’s employees, invitees, customers or any other person in or about the Premises, whether such damage or injury is caused by or results from: (a) fire, steam, electricity, water, gas or rain; (b) the breakage, leakage, obstruction or other defects of pipes, sprinklers, wires, appliances, plumbing, air conditioning or lighting fixtures or any other cause; (c) conditions arising in or about the Premises or upon other portions of the Project wherein the Premises is located, or from other sources or places; or (d) any act or omission of any other tenant of the project wherein the Premises is located. Landlord shall not be liable for any such damage or injury even though the cause of or the means of repairing such damage or injury are not accessible to Tenant. The provisions of this Section 6.02 shall not, however, exempt Landlord from liability for Landlord’s negligence or willful misconduct.

Section 6.03 Landlord’s Obligations.

(a) Except as provided in Article Seven (Damage or Destruction) and Article Eight (Condemnation) and unless such maintenance or repairs are required because of any negligent or intentional act or omission of Tenant or its agents, employees, contractors, customers or invitees, Landlord shall be responsible for and shall keep the following in good order, condition and repair: the foundations, exterior walls and roof of the Premises (including painting the exterior surface of the exterior walls of the Premises not more often than once every five (5) years, if necessary); the heating and air conditioning systems servicing the Premises (“HVAC System”); parking lot surfaces; Common Areas; and all components of electrical, mechanical, and plumbing located outside of the Premises which are used in common by tenants of the Project, reasonable wear and tear excluded. However, Landlord shall not be obligated to maintain or repair interior windows, doors, plate glass or the interior surfaces of exterior walls. Landlord shall make repairs under this Section 6.03 within a reasonable time after receipt of written notice from Tenant of the need for such repairs. In no event shall Tenant be entitled to undertake any such maintenance or repairs, whether at the expense of Tenant or Landlord, and Tenant hereby waives the benefits of any law now or hereafter in effect which would otherwise provide Tenant with such right.

(b) Tenant shall pay or reimburse Landlord for all reasonable costs Landlord incurs under Section 6.03(a) above as Operating Expenses as provided in Section 1.12(b) of the Lease. Tenant waives the benefit of any statute in effect now or in the future which might give Tenant the right to make repairs at Landlord’s expense or to terminate this Lease due to Landlord’s failure to keep the Premises in good order, condition and repair.

Section 6.04 Tenant’s Obligations.

(a) Except as provided in Section 6.03, Article Seven (Damage or Destruction) and Article Eight (Condemnation), Tenant shall keep all portions of the Premises (including structural, nonstructural, interior, systems and equipment) in good order, condition and repair (including interior repainting and refinishing, as needed) whether or not such portion of the Premises requiring repair, or the means of repairing the same, are reasonably or readily accessible, and whether or not the need for such repairs occurs as a result of Tenant's use, any prior use, the elements or the age of such portion of the Premises. If any portion of the Premises or any system or equipment in the Premises which Tenant is obligated to repair cannot be fully repaired or restored, Tenant shall promptly replace such portion of the Premises or system or equipment in the Premises, regardless of whether the benefit of such replacement extends beyond the Lease Term; but if the benefit or useful life of such replacement extends beyond the Lease Term (as such term may be extended by exercise of any options), the useful life of such replacement shall be prorated over the remaining portion of the Lease Term (as extended), and Tenant shall be liable only for that portion of the cost which is applicable to the Lease Term (as extended). If any part of the Premises or the Project is damaged by any act or omission of Tenant, its agents, employees, contractors, customers or invitees, Tenant shall pay Landlord the cost of repairing or replacing such damaged property, whether or not Landlord would otherwise be obligated to pay the cost of maintaining or repairing such property. It is the intention of Landlord and Tenant that at all times Tenant shall maintain the portions of the Premises which Tenant is obligated to maintain in an attractive, first-class and fully operative condition.

(b) The amps of electric capacity provided at the Premises shall be in an amount determined by Landlord in its sole discretion, such service to be made available at the electrical riser room in the Building wherein the Premises is located, and shall provide any necessary maintenance or replacement thereof when required. Tenant shall be responsible to obtain electrical service from the power provider of its choice, and Landlord shall not be responsible for interruptions in such service. Tenant shall be responsible for and provide distribution of the power and electrical service from the electrical riser room in the Building to the areas required for use thereof by Tenant, and Tenant shall be responsible for all repairs, maintenance and replacement of such electrical service and related equipment from the electrical riser room in the Building during the Lease Term. The foregoing responsibilities of Tenant shall include payment for the cost and expense of installation and any repairs, replacements, or upgrades, of such power and electrical service from said electrical riser room to the remainder of the building used or occupied by Tenant and all costs related to installing and causing service to commence, including payment of any security deposits required by any utility company serving the Premises.

(c) Tenant shall fulfill all of Tenant’s obligations under this Section 6.04 at Tenant’s sole expense. If Tenant fails to maintain, repair or replace the Premises as required by this Section 6.04, Landlord may, upon ten (10) days prior notice to Tenant (except that no notice shall be required in the case of an emergency), perform such maintenance or repair (including replacement, as needed) on behalf of Tenant. In such case, Tenant shall reimburse Landlord for all costs incurred in performing such maintenance or repair immediately upon demand.

(d) Prior to installing any specialized flooring, Tenant shall, at Tenant’s sole cost and expense, make such tests and investigation as recommended by the manufacturer of such flooring prior to execution of this Lease, to determine and satisfy Tenant as to the condition of the floor of the Premises for installation of such specialized flooring or the condition of any flooring existing at the Premises. If Tenant installs any specialized flooring, such flooring shall be installed in accordance with all specifications and recommendations of the manufacturer of such flooring and all costs associated therewith shall be deducted from the Tenant Improvement Allowance (as defined in the Work Letter Agreement). Tenant hereby waives and relinquishes any claims against or liability of Landlord as to such specialized flooring, or any damages or losses occurring by reason of any defect in, or inadequacy of, such specialized flooring, including, without limitation, any right or claim against Landlord for repair, maintenance or replacement thereof during the Lease Term.

Section 6.05 Alterations, Additions, and Improvements.

(a) Tenant shall not make any alterations, additions or improvements to the Premises without Landlord’s prior written consent, such consent not to be unreasonably withheld, conditioned or delayed, except for non-structural alterations, additions or improvements which do not cumulatively exceed a total cost of Ten Thousand Dollars ($10,000) in cost cumulatively over the Lease Term and which are not visible from the outside of any building of which the Premises is part. Landlord may require Tenant to provide demolition and/or lien and completion bonds in form and amount satisfactory to Landlord. Tenant shall promptly remove any alterations, additions, or improvements constructed in violation of this Section 6.05(a) upon Landlord’s written request. All alterations, additions, and improvements shall be done in a good and workmanlike manner, in accordance with plans, specifications and drawings approved in writing by Landlord, and in conformity with all applicable laws and regulations, and by a licensed contractor approved by Landlord. Upon completion of any such work, Tenant shall provide Landlord with “as built” plans, copies of all construction contracts, a certificate of completion by the architect who supervised the construction and proof of payment for all labor and materials including appropriate lien releases. Landlord shall have no responsibility or liability for any death or injury to persons, including but not limited to Tenant, Tenant’s officers, directors, members, employees, personnel, contractors, invitees and/or any third persons in or upon the real property of Landlord, or for damage to property caused by alterations, additions or improvements made to the Premises by Tenant, whether or not made pursuant to Landlord’s prior written consent as required herein, and Tenant hereby indemnifies Landlord against any such liability, obligation, cost or expense arising therefrom.

(b) Tenant shall pay when due all claims for labor and material furnished to the Premises. Tenant shall give Landlord at least twenty (20) days prior written notice of the commencement of any work on the Premises, regardless of whether Landlord’s consent to such work is required. Landlord may elect to record and post notices of non-responsibility on the Premises. Tenant shall keep the Premises, the Building and the Project free and clear of any liens arising out of any work performed, materials furnished or obligations incurred by or on behalf of Tenant. If any such lien is filed against the Premises, the Building or the Project, Tenant shall, within ten (10) days thereafter, cause the lien to be fully discharged by either paying the obligation secured thereby or obtaining and recording a payment bond in accordance with the provisions of Section 33-1004, Arizona Revised Statutes. Tenant shall indemnify and hold Landlord harmless from any claims for lien waivers. Tenant is not authorized to act for on behalf of Landlord as its agent, or otherwise, for the purpose of constructing any improvements to the Premises, and neither Landlord nor Landlord's interest in the Premises shall be subject to any obligations incurred by Tenant. Landlord shall be entitled to post on the Premises during the course of any construction by Tenant such notices of non-responsibility as Landlord deems appropriate for the protection of Landlord and its interest in the Premises. If Tenant fails to fully discharge any such lien within a 10-day period, Landlord may (but shall not be so obligated) pay the claim secured by such lien, and the amount so paid, together with any costs and reasonable attorneys' fees incurred in connection therewith, shall be immediately due and owing from Tenant to Landlord, and Tenant shall pay the same to Landlord with interest at the rate provided in Section 4.01(c) from the dates of Landlord's payments. Should any claims of lien be filed against the Premises or any action affecting the title to such property be commenced, the party receiving notice of such lien or action shall forthwith give the other party written notice thereof.

(c) Unless Landlord requires the removal thereof upon the termination of this Lease, all alterations, additions or improvements to the Premises by Tenant (except movable furniture, equipment and trade fixtures) shall become a part of the Premises and the property of Landlord immediately upon installation thereof. Any alteration, addition or improvement which Tenant is required or permitted to remove hereunder, together with any movable furniture, equipment and trade fixtures, shall be removed at Tenant's expense upon the termination of this Lease, and Tenant shall promptly repair any damage to the Premises caused by such removal. In no event, however, shall Tenant remove any of the following materials or equipment (which shall be deemed Landlord’s property) without Landlord’s prior written consent: any power wiring or power panels; lighting or lighting fixtures; wall coverings; drapes, blinds or other window coverings; carpets or other floor coverings; heaters, air conditioners or any other heating or air conditioning equipment; fencing or security gates; or other similar building operating equipment and decorations.

Section 6.06 Condition upon Termination or Expiration. Upon the termination or expiration of the Lease, Tenant shall surrender the Premises and all alterations, additions and improvements to Landlord, broom clean and in the same condition as received except for ordinary wear and tear which Tenant was not otherwise obligated to remedy under any provision of this Lease. However, Tenant shall not be obligated to repair any damage which Landlord is required to repair under Article Seven (Damage or Destruction). In addition, Landlord may require Tenant to remove any alterations, additions or improvements (whether or not made with Landlord’s consent) prior to the expiration of the Lease and to restore the Premises to its prior condition, all at Tenant’s expense.