Attached files

| file | filename |

|---|---|

| EX-99.5 - PRO FORMA STATEMENTS - Toshoan Holdings, Inc. | proforma.htm |

| EX-10.1 - SPA - Toshoan Holdings, Inc. | spafishery.htm |

| EX-99.1 - DIRECTOR RESOLUTION - STOCK ISSUANCE - Toshoan Holdings, Inc. | directorresolution.htm |

| EX-99.2 - SHAREHOLDER RESOLUTIONS - STOCK ISSUANCE - Toshoan Holdings, Inc. | shareholderresstock.htm |

| EX-99.4 - RESOLUTIONS - ACQUISITION - Toshoan Holdings, Inc. | resolution_acquisition.htm |

| EX-3.3 - ARTICLES OF INC. TOA FISHERY (TRANSLATED) - Toshoan Holdings, Inc. | toafisheryarticlesofinc.htm |

| EX-3.4 - CERTIFICATE OF AMENDMENT COPY - PREFERRED STOCK - Toshoan Holdings, Inc. | amendment_seriesa.htm |

| EX-10.2 - EXCLUSIVE SUPPLIER AGREEMENT - TUNA - Toshoan Holdings, Inc. | exclusivesupplieragreement.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15 (D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) December 19, 2013

Toshoan Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 000-54893 | N/A |

(State or other jurisdiction of incorporation or organization) |

(Commission File Number) | (I.R.S. Employer Identification No.) |

C/O Toa Shoko, 1-1-36, Nishiawaji,

Higashiyodogawa-ku, Osaka 533-0031, Japan

(Address of Principal Executive Offices)

Telephone: +81-6-6325-5035

(Registrant's telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

-1-

FORWARD LOOKING STATEMENTS

This Current Report on Form 8-K contains forward-looking statements which involve risks and uncertainties, principally in the sections entitled “Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” All statements other than statements of historical fact contained in this Current Report on Form 8-K, including statements regarding future events, our future financial performance, business strategy and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” or “should,” or the negative of these terms or other comparable terminology. Although we do not make forward-looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in this Current Report on Form 8-K, which may cause our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time and it is not possible for us to predict all risk factors, nor can we address the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements included in this document are based on information available to us on the date hereof, and we assume no obligation to update any such forward-looking statements, except as expressly required by law.

You should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this Current Report on Form 8-K. Before you invest in our securities, you should be aware that the occurrence of the events described in the section entitled “Risk Factors” and elsewhere in this Current Report on Form 8-K could negatively affect our business, operating results, financial condition and stock price. Except as required by law, we undertake no obligation to update or revise publicly any of the forward-looking statements after the date of this Current Report on Form 8-K to conform our statements to actual results or changed expectations.

All dollar amounts used throughout this Report are in US Dollars, unless otherwise stated. All amounts in Japanese yen used throughout this Report are preceded by JPY, for example JPY 500, is referring to 500 Japanese yen.

-2-

TABLE OF CONTENTS

| Page | ||

| Item 1.01 Entry into a Material Definitive Agreement | 4 | |

| Item 2.01 Completion of Acquisition or Disposition of Assets | 4 | |

| BUSINESS | 5 | |

| RISK FACTORS | 8 | |

| FINANCIAL INFORMATION | 15 | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 15 | |

| DIRECTORS AND EXECUTIVE OFFICER | 15 | |

| EXECUTIVE COMPENSATION | 16 | |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 17 | |

| LEGAL PROCEEDINGS | 18 | |

| RECENT SALES OF UNREGISTERED SECURITIES | 18 | |

| DESCRIPTION OF SECURITIES | 18 | |

| INDEMNIFICATION OF OFFICERS AND DIRECTORS | 19 | |

| FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 19 | |

| Item 3.02 Unregistered Sales of Equity Securities | 19 | |

| Item 5.03 Amendments to Certificate of Incorporation; Change in Fiscal Year | 19 | |

| Item 5.06 Change in Shell Company Status | 19 | |

| Item 9.01 Financial Statements And Exhibits | 20-22 | |

| EXHIBITS AND SIGNATURES | 23 |

-3-

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On December 13, 2013, Toshoan Holdings, Inc., a Delaware company (the “Company”), entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) with Hajime Abe, our President, sole Director and Officer. Pursuant to the Agreement, Hajime Abe transferred to Toshoan Holdings, Inc., 20 shares of the common stock of TOA Fishery Co., Ltd., a Japanese corporation (“TOA Fishery”), which represents all of its issued and outstanding shares in consideration of 1,000,000 JPY ($10,089 USD). Following the effective date of the share purchase transaction on December 13, 2013 , Toshoan Holdings, Inc. gained a 100% interest in the issued and outstanding shares of TOA Fishery’s common stock and TOA Fishery became a wholly owned subsidiary of Toshoan Holdings. Toshoan Holdings, Inc. is now the controlling and sole shareholder of TOA Fishery.

TOA Fishery conducts a trade business that concentrates on the distribution of sea food products, in particular tuna, to wholesalers in the country of Japan. Following the effective date of the Stock Purchase Agreement on December 15th, 2013 Toshoan Holdings, Inc. adopted the business plan of TOA Fishery.

A copy of the Stock Purchase Agreement is attached hereto and is hereby incorporated by this reference. All references to the Stock Purchase Agreement and other exhibits to this Current Report are qualified, in their entirety, by the text of such exhibits.

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS.

Effective December 13, 2013, “the Company”, Toshoan Holdings, Inc., and Mr. Hajime Abe consummated the Stock Purchase Agreement, and TOA Fishery became a 100% wholly-owned subsidiary of the Company.

FORM 10 DISCLOSURE

As disclosed elsewhere in this report, the Company completed a Stock Purchase Agreement, which caused the Company to cease being defined as a “shell company” under the Securities Act of 1933, as amended. Item 2.01(f) of Form 8-K requires that if a registrant was a shell company, immediately before the transaction disclosed under Item 2.01, then the registrant must disclose the information that would be required if the registrant were filing a general form for registration of securities on Form 10. Accordingly, we are providing below the information that would be included in a Form 10 if we were to file a Form 10. Please note that the information provided below relates to the combined enterprises after the closing of the Stock Purchase Agreement, except that information relating to periods prior to the date of the Stock Purchase Agreement only relates to the Company, unless otherwise specifically indicated.

-4-

Business

Corporate History of Toshoan Holdings, Inc.

The Company was originally incorporated with the name Gold Eagle Acquisition, Inc., under the laws of the State of Delaware on January 11, 2013, with an objective to acquire, or merge with, an operating business.

On June 20, 2013, Jeffrey DeNunzio of 780 Reservoir Avenue, #123, Cranston, RI 02910, the sole shareholder of the Company, entered into a Share Purchase Agreement with Hajime Abe, C/O Toa Shoko, 1-1-36, Nishiawaji, Higashiyodogawa-ku, Osaka 533-0031, Japan. Pursuant to the Agreement, Mr. DeNunzio transferred to Hajime Abe, 20,000,000 shares of our common stock which represented all of our issued and outstanding shares.

Following the effective date of the share purchase transaction with Mr. DeNunzio, Hajime Abe gained a 100% interest in the issued and outstanding shares of our common stock. Mr. Hajime Abe is and remains the controlling shareholder of the Company. Commensurate with the closing, the Company filed with the Delaware Secretary of State, a Certificate of Amendment to change the name of Registrant to Toshoan Holdings, Inc.

On June 20, 2013, Mr. DeNunzio resigned as our President, Secretary, Treasurer and Director, such resignation is to be effective ten days after the filing and mailing of an Information Statement required by Rule 14f-1 under the Securities Exchange Act of 1934, as amended. The resignation was not the result of any disagreement with us on any matter relating to our operations, policies or practices.

On June 20, 2013, Mr. Hajime Abe was appointed as Director, President, Secretary and Treasurer, to hold such office ten days after the filing and mailing of an Information Statement required by Rule 14f-1 under the Securities Exchange Act of 1934, as amended.

On December 2, 2013, the Company issued 1,000,000 shares of restricted Series A preferred stock valued at $100 to Hajime Abe as director’s compensation.

On December 2, 2013, the Company issued 50,000,000 shares of restricted common stock valued at $5,000 to Hajime Abe as director’s compensation.

On December 11, 2013, the Company engaged MaloneBailey, LLP (“Malone”) of Houston, Texas, as its new registered independent public accountant.

On December 11, 2013, Mr. Hajime Abe entered into stock purchase agreements with approximately 702 Japanese shareholders. Pursuant to these agreements, Mr. Abe sold 65,738,000 shares of common stock in total to these individuals.

We claim an exemption from registration afforded by Section 4(2) and/or Regulation S of the Securities Act of 1933, as amended ("Regulation S") for the above sales of the stock since the sales of the stock were made to non-U.S. persons (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates, or any person acting on behalf of any of the foregoing.

On December 13, 2013, Toshoan Holdings, Inc. entered into a Stock Purchase Agreement with Hajime Abe. Pursuant to the Agreement, Hajime Abe, at the effective date transferred to Toshoan Holdings, Inc., 20 shares of the common stock of TOA Fishery which represents all of its issued and outstanding shares in consideration of 1,000,000 JPY ($10,089 USD). Following the closing of the share purchase transaction on December 13, 2013, Toshoan Holdings, Inc. gained a 100% interest in the issued and outstanding shares of TOA Fishery’s common stock. Toshoan Holdings, Inc. is now the controlling shareholder of TOA Fishery.

-5-

Overview of Our Subsidiary: TOA Fishery Co., Ltd

TOA Fishery Co., Ltd., also referenced in this document as “TOA Fishery”, was initially formed as an Osaka, Japan Corporation on October 31, 2013.

TOA Fishery is a trade company engaged in a range of global business activities including worldwide trading of marine products and food products. As of December 14, 2013, TOA Fishery began concentrating their business activities on the importation and sale of tuna which are called “maguro” in the country of Japan.

Tuna (“Maguro”) industry

Tuna, also referred to as “Maguro” by the Japanese, is one of the most commonly consumed seafood products in Japan. According to statistics from the Food and Agriculture Organization of the United Nations (FAO), the global tuna industry, which includes catch and culture in 2011 was 195 million tons, and consumption of tuna alone in Japan was 42 million tons that same year. Japanese consumption of tuna makes up about 22 percent of total worldwide consumption of tuna.

Tuna are consumed throughout many households and restaurants in the country of Japan and in many instances raw tuna is served as “sashimi” or sushi, a very popular Japanese tradition.

Tuna have many species as well as price ranges that they call for on the open market. Many times some variations of tuna species are treated as a delicacy and can be an expensive luxury in Japan. It is very common for Japanese wholesalers and food service companies to seek out fresh tuna at a lower price point to satisfy the high demand for tuna and make a profit.

Business

Outline of the Structure of Our Business

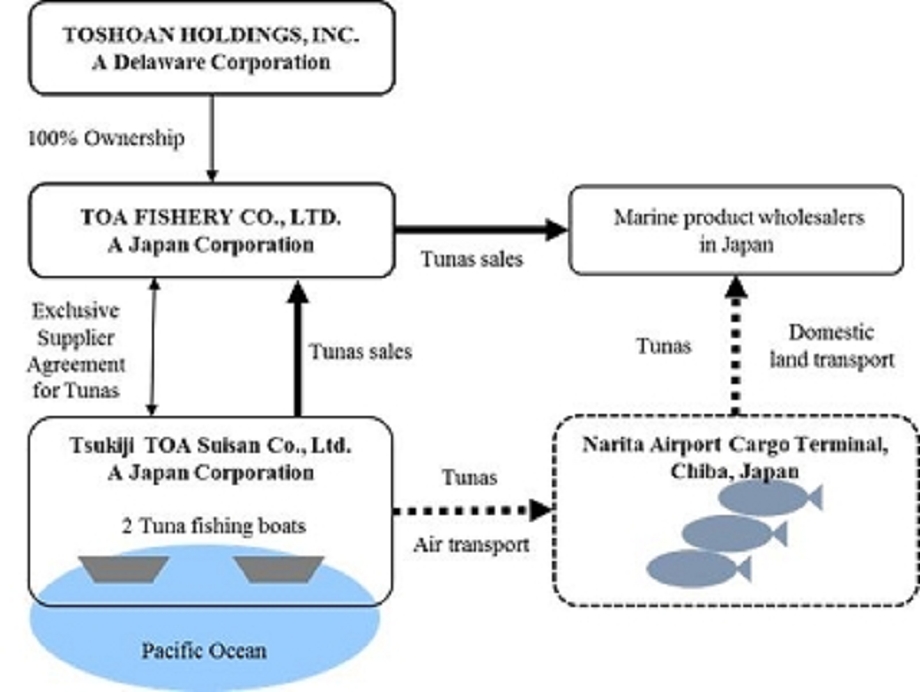

Supplier

TOA Fishery purchases tuna from their supplier, Tsukiji TOA Suisan Co., Ltd., whose address is 4-10-16, Tsukiji, Chuo-ku, Tokyo 104-0045, Japan, a Japan Corporation (“Tsukiji”).

On November, 4 2013, TOA Fishery entered into an Exclusive Supplier Agreement to purchase tuna from Tsukiji TOA Suisan Co., Ltd., “Tsukiji” *This supplier agreement can be found as exhibit 10.2 to this Super 8-K filed.

As of December 19, 2013, Tsukiji owns two tuna fishing boats that are used to carry out fishing operations in the Pacific Ocean. Both fishing boats are anchored at Port Authority of Guam whose address is 1026 Cabras Highway, Suite 201 Piti, Guam 96915. After the catch is completed the tuna are unloaded at the same port.

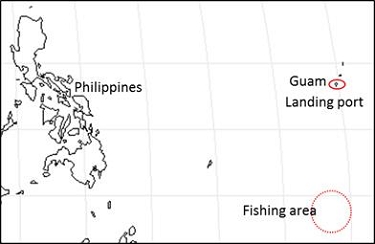

Tsukiji’s current fishing area is in the Pacific Ocean. Each fishing expedition lasts about two weeks, therefore each of Tsukiji’s fishing boats can make two fishing expeditions each month. Currently, both fishing boats catch about 15 tons of tuna each trip they make out into open waters. Below is a diagram of the fishing area where the tuna are caught.

Sales

Once TOA Fishery confirms the tuna catch from Tsukiji, and coordinates the pickup of tuna, TOA Fishery informs their customers of the quantity of tuna caught and the delivery schedule of the product to their stores. Usually, tuna orders are processed between TOA Fishery and all of their customers within only a few hours. TOA Fishery’s customers are sea food wholesalers throughout Japan.

Currently, as of December 19, 2013 TOA Fishery has nineteen (19) different sea food wholesalers that they plan to deliver tuna to . These customers however, do not have definitive agreements to continue purchasing product with TOA Fishery.

Logistics

Once the fishing boats owned and operated by Tsukiji return to port from their fishing expeditions in the Pacific Ocean they unload the large quantities of tuna into freezer containers. Next the freezer containers are brought to a nearby airport where they are transported by air, through Tsukiji, to Narita Airport.

Once these containers arrive at Narita Airport by plane, the tuna are then unloaded by TOA Fishery at the Cargo Terminal. Next the tuna are then sorted and shipped by TOA Fishery to their customers who purchased the tuna. The tuna is shipped to the wholesalers by domestic land transporters.

- 6 -

Quantity and Price

The profits, distribution of profits, and operations can be summarized below.

| Catch of Tsukiji TOA | Prices | Profit Plan | |||||

| Tuna

catch per month per boat |

# of boats | Tuna

catch per month |

Purchase

price per kg |

Sales

price per kg |

Revenue per month |

Cost

of revenue per month |

Gross

profit per month |

| tons | tons | JPY | JPY | JPY | JPY | JPY | |

| 30 | 2 | 60 | 800 | 1,200 | 72,000,000 | 48,000,000 | 24,000,000 |

| about | about | about | about | about | |||

| US$7.92 | US$11.88 | US$712,871 | US$475,248 | US$237,624 | |||

TOA Fishery will purchase its product from Tsukiji at a price of JPY 800 per kilogram of tuna, and will resell the product to sea food wholesalers across the country of Japan at a price of JPY 1,200. The currency conversions are displayed above to US dollars.

TOA Fishery estimates a gross profit per month of JPY 24,000,000 or USD $237,624.

Employees

The Company has no full-time employees and four part-time employees as of December 19, 2013.

Competition

The industry in which TOA Fishery competes is highly competitive. Our main competitors are other Japanese trade companies and also fishing companies. Moreover, all of our potential business partners, for supply of products and services could also be competitors. To ensure our competitiveness, we strive to continue to successfully acquire new customers and meet the changing needs of our customers and suppliers.

Because we are a small company with a limited operating history, we are at a competitive disadvantage against the large and well-capitalized companies in Japan which have a track record of success and operations. Therefore, our primary method of competition involves promoting the benefits of using our services over those of our competitors, including the price, delivery, quality and effectiveness of our services.

-7-

RISK FACTORS

An investment in our common stock is highly speculative, and should only be made by persons who can afford to lose their entire investment in us. You should carefully consider the following risk factors and other information in this report before deciding to become a holder of our common stock. If any of the following risks actually occur, our business and financial results could be negatively affected to a significant extent.

Risks Relating to Our Company and Our Industry

We will require additional funds in the future to achieve our current business strategy and our inability to obtain funding will cause our business to fail.

We will need to raise additional funds through public or private debt or equity sales in order to fund our future operations and fulfill contractual obligations in the future. These financings may not be available when needed. Even if these financings are available, it may be on terms that we deem unacceptable or are materially adverse to your interests with respect to dilution of book value, dividend preferences, liquidation preferences, or other terms. Our inability to obtain financing would have an adverse effect on our ability to implement our current business plan and develop our products, and as a result, could require us to diminish or suspend our operations and possibly cease our existence.

Even if we are successful in raising capital in the future, we will likely need to raise additional capital to continue and/or expand our operations. If we do not raise the additional capital, the value of any investment in our Company may become worthless. In the event we do not raise additional capital from conventional sources, it is likely that we may need to scale back or curtail implementing our business plan.

The Company, being a Developmental Stage Company has not generated any revenues since our inception in January 2013.

We are a development stage company. Our ability to continue as a going concern is dependent upon our ability to commence a commercially viable operation and to achieve profitability. Since our inception in January 2013, we have yet to generate any revenues, and currently have only limited operations, as we are presently in the planning stage of our business development as an exploration stage company. These factors raise substantial doubt about our ability to continue as a going concern. We may not be able to generate any revenues in the future and as a result the value of our common stock may become worthless. There are no assurances that we will be successful in raising additional capital or successfully developing and commercializing our products and become profitable.

We have a limited operating history that you can use to evaluate us, and the likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays that we may encounter because we are a small developing company. As a result, we may not be profitable and we may not be able to generate sufficient revenue to develop as we have planned.

We were incorporated in Delaware in January of 2013. We have no significant assets or financial resources. The likelihood of our success must be considered in light of the expenses and difficulties in development of worldwide clients, recruiting and keeping clients and obtaining financing to meet the needs of our plan of operations. Since we have a limited operating history we may not be profitable and we may not be able to generate sufficient revenues to meet our expenses and support our anticipated activities.

We are an early stage company with an unproven business strategy and may never be able to implement our business plan or achieve profitability.

We are at an early stage of development of our operations as a company. We have not begun to operate any global trading activities, and have not begun to generate revenues from any operations. A commitment of substantial resources to conduct time-consuming research in many respects will be required if we are to complete the development of our company into one that is profitable. There can be no assurance that we will be able to implement our business plan at reasonable costs or successfully operate. We expect it will take several years to implement our business plan fully, if at all.

Our limited operating history makes it difficult for us to accurately forecast net sales and appropriately plan our expenses.

We have a limited operating history in the trading industry. As a result, it is difficult to accurately forecast our net sales and plan our operating expenses. We base our current and future expense levels on our operating forecasts and estimates of future net sales. Net sales and operating results are difficult to forecast because they generally depend on the volume and timing of the orders we receive, which are uncertain. Some of our expenses are fixed, and, as a result, we may be unable to adjust our spending in a timely manner to compensate for any unexpected shortfall in net sales. This inability could cause our net income in a given quarter to be lower than expected.

- 8 -

The effect of the recent economic crisis may impact our business, operating results financial conditions.

The recent global crisis has caused disruption and extreme volatility in global financial markets and increased rates of default and bankruptcy, and has impacted levels of consumer spending. These macroeconomic developments may affect our business, operating results or financial condition in a number of ways. For example, our potential customers may never start spending with us, may have difficulty paying us or may delay paying us for previously purchased services. A slow or uneven pace of economic recovery would negatively affect our ability to start our distribution business and obtain financing.

Because we will obtain our sea food products from a company other than our own, a disruption in the delivery of products may have a greater effect on us than on our competitors.

We will purchase our tuna supply from Tsukiji TOA Suisan Co., Ltd. Deliveries of our tuna products that we first purchase from “Tsukiji” may be disrupted through factors such as:

(1) marine products shortages, work stoppages, strikes and political unrest;

(2) problems with ocean, land, and air shipment of product, including work stoppages and shipping container shortages;

(3) increased inspections of import shipments or other factors causing delays in shipments; and

(4) economic crises, international disputes and wars.

If our competitors are able to deliver products when we cannot, our reputation may be damaged and we may lose customers to our competitors.

Currently, we rely heavily on the existence of Tsukiji TOA Suisan Co., Ltd. as they are our exclusive supplier of tuna that we then sell to customers throughout Japan. Any financial or legal issues faced by Tsukiji may greatly impact our business and cause a loss or complete loss in your investment.

Because all of our products come directly from Tsukiji TOA Suisan Co., Ltd., if they face financial troubles such as bankruptcy, or legal disputes they may not be able to continue their normal course of business, leaving us with little or no sea food products to deliver to our customers. If in the event that Tsukiji was forced to cease operations due to bankruptcy or any other reason, we would be left without a supplier of tuna. This would be extremely detrimental to us as we would be left with no product to sell to wholesalers throughout Japan. This could cause a loss or complete loss in your investment if this were to occur.

Because we will be delivering perishable products such as seafood we may face obstacles in maintaining the quality, and freshness of our product. If we are unable to do so we may loser customers.

Generally, the freshness and quality of tuna is a determining factor in the purchase of tuna by wholesalers. If for whatever reason, whether it be issues with transportation, time delays, or damaged goods, we may face challenges in maintaining the quality of our seafood products. This could lead to fewer customers as well as fewer sales, if we are unable to provide high quality goods to our customers. In turn this could lead to a loss in your investment.

Currently, our customers do not have any agreements with us for the future purchase of tuna. All of our orders with our existing customers that we have in place are the result of recurring orders, not contracts that we have in place. We face the possibility that we may lose some of these customers for reasons such as lower purchase price from competitors, lack of freshness of our goods, or delays in our delivery of goods.

Our customers do not have any legally binding agreements with us for the future purchase of tuna. All of our orders with our current customers that we have in place are the result of recurring orders, or “orders that have been placed on a single shipment basis”, meaning a one time shipment. If for whatever reason we are late in delivering goods, do not deliver high quality goods, or our competitors offer lower prices for tuna, we may lose the customers that we have and our profits will be negatively effected. This could lead to a loss in your investment.

We operate in a highly competitive environment, and if we are unable to compete with our competitors, our business, financial condition, results of operations, cash flows and prospects could be materially adversely affected.

We operate in a highly competitive environment. Our competition includes small, mid-sized, and large companies, and many of them may distribute similar seafood products or the same products at competitive prices. A highly competitive environment could materially adversely affect our business, financial condition, results of operations, cash flows and prospects.

Because we are small and do not have much capital, our marketing campaign may not be enough to attract sufficient clients to operate profitably. If we do not make a profit, we will suspend or cease operations.

Due to the fact we are small and do not have much capital, we must limit our marketing activities and may not be able to make our product known to potential customers. Because we will be limiting our marketing activities, we may not be able to attract enough customers to operate profitably. If we cannot operate profitably, we may have to suspend or cease operations.

Because the Company’s headquarters and assets are located outside the United States in Japan, investors may experience difficulties in attempting to effect service of process and to enforce judgments based upon US Federal Securities Laws against the Company and its non-US resident officers and directors.

While we are organized under the laws of State of Delaware, our officers and Directors are non-US residents and our headquarters and assets are located outside the United States in Japan. Consequently, it may be difficult for investors to affect service of process on them in the United States and to enforce in the United States judgments obtained in United States courts against them based on the civil liability provisions of the United States securities laws. Since all our assets will be located outside U.S. it may be difficult or impossible for U.S. investors to collect a judgment against us.

- 9 -

We expect our quarterly financial results to fluctuate.

We expect our net sales and operating results to vary significantly from quarter to quarter due to a number of factors, including changes in:

• Demand for our products;

• Our ability to retain existing customers or encourage repeat purchases;

• Our ability to manage our product inventory;

• General economic conditions;

• Advertising and other marketing costs;

• Costs of expanding to other seafood products.

As a result of the variability of these and other factors, our operating results in future quarters may be below the expectations of public market analysts and investors.

Our future success is dependent, in part, on the performance and continued service of Hajime Abe, our President and CEO. Without their continued service, we may be forced to interrupt or eventually cease our operations.

We are presently dependent to a great extent upon the experience, abilities and continued services of Hajime Abe, our President and CEO. We currently do not have an employment agreement with Mr. Abe. The loss of his services would delay our business operations substantially.

Our current officers and directors do not have experience in the trade business.

Although management has extensive business experience, they do not have extensive experience in the trade business. Therefore, without industry-specific experience, their business experience may not be enough to effectively start-up and maintain a global trading company. As a result, the implementation of our business plan may be delayed, or eventually, unsuccessful.

Because our current President has other business interests, he may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail.

Hajime Abe, our president and director, currently devotes approximately twenty hours per week providing management services to us. While he presently possesses adequate time to attend to our interest, it is possible that the demands on him from other obligations could increase, with the result that he would no longer be able to devote sufficient time to the management of our business. The loss of Hajime Abe to our company could negatively impact our business development.

If Hajime Abe, our President and Director, should resign or die, we will not have a Chief Executive Officer that could result in our operations suspending. If that should occur, you could lose your investment.

We are extremely dependent on the services of our president and director, Hajime Abe, for the future success of our business. The loss of the services of Hajime Abe could have an adverse effect on our business, financial condition and results of operations. If he should resign or die we will not have a chief executive officer. If that should occur, until we find another person to act as our chief executive officer, our operations could be suspended. In that event it is possible you could lose most if not all of your entire investment.

- 10 -

Our future success is dependent on our implementation of our business plan. We have many significant steps still to take.

Our success will depend in large part in our success in achieving several important steps in the implementation of our business plan, including the following: acquiring business information, development of clients, development of suppliers, implementing order processing and customer service capabilities, and management of business process. If we are not successful, we will not be able to implement or expand our business plan.

Our success depends upon our ability to attract and hire key personnel. Since many of our personnel will be required to be bilingual, or to have other special skills, the pool of potential employees may be small and in high demand by our competitors. Our inability to hire qualified individuals will negatively affect our business, and we will not be able to implement or expand our business plan.

Our business is greatly dependent on our ability to attract key personnel. We will need to attract, develop, motivate and retain highly skilled technical employees. Competition for qualified personnel is intense and we may not be able to hire or retain qualified personnel. Our management has limited experience in recruiting key personnel which may hurt our ability to recruit qualified individuals. If we are unable to retain such employees, we will not be able to implement or expand our business plan.

If we cannot effectively increase and enhance our sales and marketing capabilities, we may not be able to increase our revenues.

We need to further develop our sales and marketing capabilities to support our commercialization efforts. If we fail to increase and enhance our marketing and sales force, we may not be able to enter new or existing markets. Failure to recruit, train and retain new sales personnel, or the inability of our new sales personnel to effectively market and sell our products, could impair our ability to gain market acceptance of our products.

Shareholders who hold unregistered shares of our common stock are subject to resale restrictions pursuant to Rule 144, due to our status as a former “Shell Company.”

Pursuant to Rule 144 of the Securities Act of 1933, as amended (“Rule 144”), a “shell company” is defined as a company that has no or nominal operations; and, either no or nominal assets; assets consisting solely of cash and cash equivalents; or assets consisting of any amount of cash and cash equivalents and nominal other assets. As such, we were previously a “shell company” pursuant to Rule 144 prior to December 13, 2013 and as such, sales of our securities pursuant to Rule 144 are not able to be made until we have ceased to be a “shell company” and we are subject to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, and have filed all of our required periodic reports for at least the previous one year period prior to any sale pursuant to Rule 144; and a period of at least twelve months has elapsed from the date “Form 10 information” (i.e., information similar to that which would be found in a Form 10 Registration Statement filing with the SEC has been filed with the Commission reflecting the Company’s status as a non-“shell company.” Because none of our non-registered securities can be sold pursuant to Rule 144, until one year after filing Form 10 like information with the SEC which we did on February 7, 2013, any non-registered securities we sell in the future or issue to consultants or employees, in consideration for services rendered or for any other purpose will have no liquidity until and unless such securities are registered with the Commission and/or until 12 after we cease to be a “shell company” and have complied with the other requirements of Rule 144, as described above. As a result, it may be harder for us to fund our operations and pay our consultants with our securities instead of cash. Furthermore, it will be harder for us to raise funding through the sale of debt or equity securities unless we agree to register such securities with the Commission, which could cause us to expend additional resources in the future. Our status as a “shell company” could prevent us from raising additional funds, engaging consultants, and using our securities to pay for any acquisitions (although none are currently planned), which could cause the value of our securities, if any, to decline in value or become worthless.

Our current Chief Executive Officer and President, Hajime Abe, beneficially owns approximately or has the right to vote 61.3% of our outstanding common stock and preferred stock. As a result, he will have the ability to control substantially all matters submitted to our stockholders for approval including:

• Election of our board of directors;

• Removal of any of our directors;

• Amendment of our Certificate of Incorporation or bylaws;

• Adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us.

As a result of his ownership and position, he is able to influence all matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions. In addition, the future prospect of sales of significant amounts of shares held by him could affect the market price of our common stock if the marketplace does not orderly adjust to the increase in shares in the market and the value of your investment in our company may decrease. Mr. Abe's stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

- 11 -

Our growth will place significant strains on our resources.

The Company is currently in the exploration stage, with only limited operations, and has not generated any revenues since inception in January 2013. The Company's growth, if any, is expected to place a significant strain on the Company's managerial, operational and financial resources. Moving forward, the Company's systems, procedures or controls may not be adequate to support the Company's operations and/or the Company may be unable to achieve the rapid execution necessary to successfully implement its business plan. The Company's future operating results, if any, will also depend on its ability to add additional personnel commensurate with the growth of its operations, if any. If the Company is unable to manage growth effectively, the Company's business, results of operations and financial condition will be adversely affected.

The recently enacted JOBS Act will allow the Company to postpone the date by which it must comply with certain laws and regulations intended to protect investors and to reduce the amount of information provided in reports filed with the SEC.

The recently enacted JOBS Act is intended to reduce the regulatory burden on “emerging growth companies”. The Company meets the definition of an “emerging growth company” and so long as it qualifies as an “emerging growth company,” it will, among other things:

-be exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that its independent registered public accounting firm provide an attestation report on the effectiveness of its internal control over financial reporting;

-be exempt from the "say on pay” provisions (requiring a non-binding shareholder vote to approve compensation of certain executive officers) and the "say on golden parachute” provisions (requiring a non-binding shareholder vote to approve golden parachute arrangements for certain executive officers in connection with mergers and certain other business combinations) of The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and certain disclosure requirements of the Dodd-Frank Act relating to compensation of Chief Executive Officers;

-be permitted to omit the detailed compensation discussion and analysis from proxy statements and reports filed under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and instead provide a reduced level of disclosure concerning executive compensation; and

-be exempt from any rules that may be adopted by the Public Company Accounting Oversight Board (the “PCAOB”) requiring mandatory audit firm rotation or a supplement to the auditor’s report on the financial statements.

Although the Company is still evaluating the JOBS Act, it currently intends to take advantage of all of the reduced regulatory and reporting requirements that will be available to it so long as it qualifies as an “emerging growth company”. The Company has elected not to opt out of the extension of time to comply with new or revised financial accounting standards available under Section 102(b)(1) of the JOBS Act. Among other things, this means that the Company's independent registered public accounting firm will not be required to provide an attestation report on the effectiveness of the Company's internal control over financial reporting so long as it qualifies as an “emerging growth company”, which may increase the risk that weaknesses or deficiencies in the internal control over financial reporting go undetected. Likewise, so long as it qualifies as an “emerging growth company”, the Company may elect not to provide certain information, including certain financial information and certain information regarding compensation of executive officers, which would otherwise have been required to provide in filings with the SEC, which may make it more difficult for investors and securities analysts to evaluate the Company. As a result, investor confidence in the Company and the market price of its common stock may be adversely affected.

Notwithstanding the above, we are also currently a “smaller reporting company”, meaning that we are not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent company that is not a smaller reporting company and have a public float of less than $75 million and annual revenues of less than $50 million during the most recently completed fiscal year. In the event that we are still considered a “smaller reporting company”, at such time are we cease being an “emerging growth company”, the disclosure we will be required to provide in our SEC filings will increase, but will still be less than it would be if we were not considered either an “emerging growth company” or a “smaller reporting company”. Specifically, similar to “emerging growth companies”, “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, being required to provide only two years of audited financial statements in annual reports. Decreased disclosures in our SEC filings due to our status as an “emerging growth company” or “smaller reporting company” may make it harder for investors to analyze the Company’s results of operations and financial prospects.

We are an “emerging growth company” under the JOBS Act of 2012, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We are choosing to take advantage of the extended transition period for complying with new or revised accounting standards. As a result, our financial statements may not be comparable to those of companies that comply with public company effective dates.

We will remain an “emerging growth company” for up to five years, although we will lose that status sooner if our revenues exceed $1 billion, if we issue more than $1 billion in non-convertible debt in a three year period, or if the market value of our common stock that is held by non-affiliates exceeds $700 million.

As we are a publicly reporting company, we will continue to incur significant costs in staying current with reporting requirements. Our management will be required to devote substantial time to compliance initiatives. Additionally, the lack of an internal audit group may result in material misstatements to our financial statements and ability to provide accurate financial information to our shareholders.

Our management and other personnel will need to devote a substantial amount of time to compliance initiatives to maintain reporting status. Moreover, these rules and regulations, that are necessary to remain as an SEC reporting Company, will be costly as an external third party consultant(s), attorney, or firm, may have to assist in some regard to following the applicable rules and regulations for each filing on behalf of the company.

We currently do not have an internal audit group, and we will eventually need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge to have effective internal controls for financial reporting. Additionally, due to the fact that we only have one officer and Director, who has minor experience as an officer or Director of a reporting company, such lack of experience may impair our ability to maintain effective internal controls over financial reporting and disclosure controls and procedures, which may result in material misstatements to our financial statements and an inability to provide accurate financial information to our stockholders.

Moreover, if we are not able to comply with the requirements or regulations as an SEC reporting company, in any regard, we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would require additional financial and management resources.

- 12 -

Our officers and Directors lack experience in and with the reporting and disclosure obligations of publicly-traded companies.

While we rely heavily on Hajime Abe, he lacks experience in and with the reporting and disclosure obligations of publicly-traded companies and with serving as an officer or Director of a publicly-traded company. Such lack of experience may impair our ability to maintain effective internal controls over financial reporting and disclosure controls and procedures, which may result in material misstatements to our financial statements and an inability to provide accurate financial information to our stockholders. Consequently, our operations, future earnings and ultimate financial success could suffer irreparable harm due to our officers and directors ultimate lack of experience in our industry and with publicly-traded companies and their reporting requirements in general. Additionally, due to the fact that all of our officers and Directors are currently located in Japan; having employment outside of the Company; and lacking experience with companies in our industry, we may be unable to successfully implement our business plan, and/or manage our future growth if any. Our officers and Directors do not currently believe that their outside employment affects the day to day operations of the Company. While the Company believes that the time and resources that our officers and Directors are able to provide to the Company, and/or which they may be willing to provide to us in the future, as well as our outside consultants are adequate to support the Company’s business plan, our operations and growth (if any) may be adversely affected by the fact that our officers and Directors are located in another country, only being able to provide a limited number of hours of service to the Company per week and/or their outside employment.

There is uncertainty as to our ability to enforce civil liabilities both in and outside of the United States due to the fact that our officers, Directors and certain of our assets are not located in the United States.

Our office is not located in the United States. Our officers and Directors are located in Japan and the operations and assets of TOA Fishery are located in Japan. As a result, it may be difficult for shareholders to effect service of process within the United States on our officers and Directors. In addition, investors may have difficulty enforcing judgments based upon the civil liability provisions of the securities laws of the Unites States or any state thereof, both in and outside of the United States.

Risks Relating to the Company’s Securities

We may never have a public market for our common stock or that the common stock will ever trade on a recognized exchange. Therefore, you may be unable to liquidate your investment in our stock.

There is no established public trading market for our securities. Our shares are not and have not been listed or quoted on any exchange or quotation system.

In order for our shares to be quoted, a market maker must agree to file the necessary documents with the National Association of Securities Dealers, which operates the OTC Bulletin Board. In addition, it is possible that, such application for quotation may not be approved and even if approved it is possible that a regular trading market will not develop or that if it did develop, will be sustained. In the absence of a trading market, an investor may be unable to liquidate their investment.

We may in the future issue additional shares of our common stock, which may have a dilutive effect on our stockholders.

Our Certificate of Incorporation authorizes the issuance of 500,000,000 shares of common stock, of which 70,000,000 shares are issued and outstanding as of December 19, 2013. The future issuance of our common shares may result in substantial dilution in the percentage of our common shares held by our then existing stockholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

We may issue shares of preferred stock in the future that may adversely impact your rights as holders of our common stock.

Our Certificate of Incorporation authorizes us to issue up to 20,000,000 shares of preferred stock. Accordingly, our board of directors will have the authority to fix and determine the relative rights and preferences of preferred shares, as well as the authority to issue such shares, without further stockholder approval. Currently, our series A preferred stock entitles the holder thereof to 100 votes on all matters upon which the holders of the common stock of the Company are entitled to vote. Series A Preferred Stock does not have any dividend, conversion, liquidation, or other rights or preferences, including redemption or sinking fund provisions. However, our board of directors could authorize the issuance of a series of preferred stock that would grant to holders preferred rights to our assets upon liquidation, the right to receive dividends before dividends are declared to holders of our common stock, and the right to the redemption of such preferred shares, together with a premium, prior to the redemption of the common stock. To the extent that we do issue such additional shares of preferred stock, your rights as holders of common stock could be impaired thereby, including, without limitation, dilution of your ownership interests in us. In addition, shares of preferred stock could be issued with terms calculated to delay or prevent a change in control or make removal of management more difficult, which may not be in your interest as holders of common stock.

We do not currently intend to pay dividends on our common stock and consequently, your ability to achieve a return on your investment will depend on appreciation in the price of our common stock.

We have never declared or paid any cash dividends on our common stock and do not currently intend to do so for the foreseeable future. We currently intend to invest our future earnings, if any, to fund our growth. Therefore, you are not likely to receive any dividends on your common stock for the foreseeable future and the success of an investment in shares of our common stock will depend upon any future appreciation in its value. There is no guarantee that shares of our common stock will appreciate in value or even maintain the price at which our stockholders have purchased their shares.

- 13 -

We may be exposed to potential risks resulting from requirements under Section 404 of the Sarbanes-Oxley Act of 2002.

As a reporting company we are required, pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, to include in our annual report our assessment of the effectiveness of our internal control over financial reporting. We do not have a sufficient number of employees to segregate responsibilities and may be unable to afford increasing our staff or engaging outside consultants or professionals to overcome our lack of employees.

We do not currently have independent audit or compensation committees. As a result, our directors have the ability, among other things, to determine their own level of compensation. Until we comply with such corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance may leave our stockholders without protections against interested director transactions, conflicts of interest and similar matters and investors may be reluctant to provide us with funds necessary to expand our operations.

The costs to meet our reporting and other requirements as a public company subject to the Exchange Act of 1934 is and will be substantial and may result in us having insufficient funds to expand our business or even to meet routine business obligations.

As a public entity, subject to the reporting requirements of the Exchange Act of 1934, we will continue to incur ongoing expenses associated with professional fees for accounting, legal and a host of other expenses for annual reports and proxy statements. We estimate that these costs will range up to $35,000 per year for the next few years and will be higher if our business volume and activity increases. As a result, we may not have sufficient funds to grow our operations.

State Securities Laws may limit secondary trading, which may restrict the states in which and conditions under which you can sell Shares.

Secondary trading in our common stock may not be possible in any state until the common stock is qualified for sale under the applicable securities laws of the state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in the state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, the common stock in any particular state, the common stock cannot be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the liquidity for the common stock could be significantly impacted.

- 14 -

FINANCIAL INFORMATION

Management's Discussion and Analysis of Financial Condition and Results of Operations

The following summarizes the factors affecting the operating results and financial condition of the Company following the closing of the Stock Purchase Agreement. This discussion should be read together with the financial statements of TOA Fishery and the notes to financial statements included elsewhere in this current report. In addition to historical financial information, the following discussion and analysis contain forward-looking statements that involve risks, uncertainties and assumptions. Our actual results and timing of selected events may differ materially from those anticipated in these forward-looking statements as a result of many factors, including those discussed under “Risk Factors” and elsewhere in this report. We encourage you to review our “Cautionary Note Regarding Forward-Looking Statements and Industry Data” at the front of this current report, and our “Risk Factors” set forth above.

Results of Operations of TOA Fishery Co., Ltd.

TOA Fishery was incorporated on October 31, 2013. As of November 30, 2013, TOA Fishery generated no revenues and $3,166 of deficits from inception.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As of December 19, 2013, the Company has 70,000,000 shares of common stock and 1,000,000 shares of preferred stock issued and outstanding, which number of issued and outstanding shares of common stock and preferred stock have been used throughout this report.

| Name and Address of Beneficial Owner | Shares of Common Stock Beneficially Owned | Common Stock Voting Percentage Beneficially Owned | Voting Shares Preferred Stock Are Able to Vote | Preferred Stock Voting Percentage Beneficially Owned | Total Voting Percentage Beneficially Owned (1) |

| Executive Officers and Directors | |||||

| Hajime Abe | 4,262,000 | 6.1% | 1,000,000 | 100.0% | 61.3% |

5% Shareholders None |

Beneficial ownership has been determined in accordance with Rule 13d-3 under the Exchange Act. Under this rule, certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire shares (for example, upon exercise of an option or warrant) within 60 days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares is deemed to include the amount of shares beneficially owned by such person by reason of such acquisition rights. As a result, the percentage of outstanding shares of any person as shown in the following table does not necessarily reflect the person’s actual voting power at any particular date.

DIRECTORS AND EXECUTIVE OFFICERS

Biographical information regarding the officers and Directors of the Company, who will continue to serve as officers and Directors of the Company and TOA Fishery following the consummation of the Stock Purchase Agreement are provided below:

| NAME | AGE | POSITION | |||||

| Hajime Abe | 61 | President, Chief Executive Officer, and Director | |||||

Hajime Abe

Mr. Hajime Abe began his career in 1969 as an employee of Nissan Motor Company as a car salesman. Following this, in 1974, he incorporated Abe Motor Sales Co., Ltd., a Japan Corporation. A decade later in 1989, he incorporated Koa Commerce Co., Ltd., a Japan Corporation and in 1993 incorporated another Japanese company known as World Liberty Co., Ltd. More recently, in 2007 Mr. Abe incorporated the Japanese company IKL Holdings Co., Ltd. and in 2010 was appointed as President and Director of Oidon Co., Ltd, a Wyoming Corporation that he recently resigned from this past July of 2012. On January 22, 2013, he was appointed as Director, President, Secretary and Treasurer of TOA Holdings, Inc., a Delaware Corporation. On January 28, 2013, he incorporated TOA Shoko Japan, a Japan corporation. On January 28, 2013, he was appointed as the Chairman of Dong A Sang Gong Co., Ltd, a Korean Corporation. On July 2, 2013, he was appointed as the chairman of BJK Global LTD., a Bangladesh Corporation.

Corporate governance

The Company promotes accountability for adherence to honest and ethical conduct; endeavors to provide full, fair, accurate, timely and understandable disclosure in reports and documents that the Company files with the Securities and Exchange Commission (the “SEC”) and in other public communications made by the Company; and strives to be compliant with applicable governmental laws, rules and regulations. The Company has not formally adopted a written code of business conduct and ethics that governs the Company’s employees, officers and Directors as the Company is not required to do so.

In lieu of an Audit Committee, the Company’s Board of Directors, is responsible for reviewing and making recommendations concerning the selection of outside auditors, reviewing the scope, results and effectiveness of the annual audit of the Company's financial statements and other services provided by the Company’s independent public accountants. The Board of Directors reviews the Company's internal accounting controls, practices and policies.

Committees of the Board

Our Company currently does not have nominating, compensation, or audit committees or committees performing similar functions nor does our Company have a written nominating, compensation or audit committee charter. Our sole Director believes that it is not necessary to have such committees, at this time, because the Director(s) can adequately perform the functions of such committees.

Audit Committee Financial Expert

Our Board of Directors has determined that we do not have a board member that qualifies as an "audit committee financial expert" as defined in Item 407(D)(5) of Regulation S-K, nor do we have a Board member that qualifies as "independent" as the term is used in Item 7(d)(3)(iv)(B) of Schedule 14A under the Securities Exchange Act of 1934, as amended, and as defined by Rule 4200(a)(14) of the FINRA Rules.

We believe that our Director(s) are capable of analyzing and evaluating our financial statements and understanding internal controls and procedures for financial reporting. The Director(s) of our Company does not believe that it is necessary to have an audit committee because management believes that the Board of Directors can adequately perform the functions of an audit committee. In addition, we believe that retaining an independent Director who would qualify as an "audit committee financial expert" would be overly costly and burdensome and is not warranted in our circumstances given the stage of our development and the fact that we have not generated any positive cash flows from operations to date.

Involvement in Certain Legal Proceedings

Our Directors and our executive officers have not been involved in any of the following events during the past ten years:

| 1. | any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

| 2. | any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| 3. | being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; or |

| 4. | being found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated. |

Independence of Directors

We are not required to have independent members of our Board of Directors, and do not anticipate having independent Directors until such time as we are required to do so.

Code of Ethics

We have not adopted a formal Code of Ethics. The Board of Directors evaluated the business of the Company and the number of employees and determined that since the business is operated by a small number of persons, general rules of fiduciary duty and federal and state criminal, business conduct and securities laws are adequate ethical guidelines. In the event our operations, employees and/or Directors expand in the future, we may take actions to adopt a formal Code of Ethics.

Shareholder Proposals

Our Company does not have any defined policy or procedural requirements for shareholders to submit recommendations or nominations for Directors. The Board of Directors believes that, given the stage of our development, a specific nominating policy would be premature and of little assistance until our business operations develop to a more advanced level. Our Company does not currently have any specific or minimum criteria for the election of nominees to the Board of Directors and we do not have any specific process or procedure for evaluating such nominees. The Board of Directors will assess all candidates, whether submitted by management or shareholders, and make recommendations for election or appointment.

A shareholder who wishes to communicate with our Board of Directors may do so by directing a written request addressed to our President, at the address appearing on the first page of this Information Statement.

- 15 -

EXECUTIVE COMPENSATION

Summary Compensation Table:

Name and principal position (a) |

Year ended January 31 (b) |

Salary ($) (c) |

Bonus ($) (d) |

Stock Awards ($) (e) |

Option Awards ($) (f) |

Non-Equity Incentive Plan Compensation ($) (g) |

Nonqualified Deferred Compensation Earnings ($) (h) |

All Other Compensation ($) (i) |

Total ($) (j) |

||||||||||||||||||||||||

Hajime Abe, President |

2014(1) | - | - | 5,100 (2) | - | - | - | - | $ | 5,100 | |||||||||||||||||||||||

(1) On June 20, 2013, Mr. DeNunzio, as the Company’s then sole Director, appointed Hajime Abe as Director of the Company. Immediately thereafter, Mr. DeNunzio resigned as an officer and Director of the Company and appointed Mr. Abe as the President, Chief Executive Officer, Secretary and Treasurer of the Company.

(2) On December 2, 2013, the Company issued 1,000,000 shares of Series A preferred stock valued at $100 and 50,000,000 shares of restricted common stock valued at $5,000 to Hajime Abe as director’s compensation.

Compensation of Directors

The table below summarizes all compensation of our directors as of December 19, 2013.

| DIRECTOR COMPENSATION | ||||||||||||||||||||||||||||

| Name | Fees Earned or Paid in Cash ($) |

Stock Awards ($) |

Option Awards ($)(2) |

Non-Equity Incentive Plan Compensation ($) |

Non-Qualified Deferred Compensation Earnings ($) |

All Other Compensation ($) |

Total ($) |

|||||||||||||||||||||

| Hajime Abe (1) | - | 5,100 (2) | - | - | - | - | 5,100 | |||||||||||||||||||||

(1) On December 2, 2013, the Company issued 1,000,000 shares of Series A preferred stock valued at $100 and 50,000,000 shares of restricted common stock valued at $5,000 to Hajime Abe as director’s compensation.

Summary of Compensation

Toshoan Holdings, Inc. was incorporated January 24, 2013 and has paid $5,100 as stock compensation to our sole Director and Officer to date.

Stock Option Grants

We have not granted any stock options to our executive officers since our incorporation.

Employment Agreements

We do not have an employment or consulting agreement with any officers or Directors.

- 16 -

Compensation Discussion and Analysis

Director Compensation

Our Board of Directors does not currently receive any consideration for their services as members of the Board of Directors. The Board of Directors reserves the right in the future to award the members of the Board of Directors cash or stock based consideration for their services to the Company, which awards, if granted shall be in the sole determination of the Board of Directors.

Executive Compensation Philosophy

Our Board of Directors determines the compensation given to our executive officers in their sole determination. Our Board of Directors reserves the right to pay our executive or any future executives a salary, and/or issue them shares of common stock issued in consideration for services rendered and/or to award incentive bonuses which are linked to our performance, as well as to the individual executive officer’s performance. This package may also include long-term stock based compensation to certain executives, which is intended to align the performance of our executives with our long-term business strategies. Additionally, while our Board of Directors has not granted any performance base stock options to date, the Board of Directors reserves the right to grant such options in the future, if the Board in its sole determination believes such grants would be in the best interests of the Company.

Incentive Bonus

The Board of Directors may grant incentive bonuses to our executive officer and/or future executive officers in its sole discretion, if the Board of Directors believes such bonuses are in the Company’s best interest, after analyzing our current business objectives and growth, if any, and the amount of revenue we are able to generate each month, which revenue is a direct result of the actions and ability of such executives.

Long-term, Stock Based Compensation

In order to attract, retain and motivate executive talent necessary to support the Company’s long-term business strategy we may award our executive and any future executives with long-term, stock-based compensation in the future, in the sole discretion of our Board of Directors, which we do not currently have any immediate plans to award.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

On June 20, 2013, Hajime Abe entered into a Share Purchase Agreement with Jeffrey DeNunzio. Pursuant to this agreement, Mr. DeNunzio transferred to Hajime Abe, 20,000,000 shares of our common stock which represents all of our issued and outstanding shares.

On December 2, 2013, the Company issued 1,000,000 shares of Series A preferred stock valued at $100 and 50,000,000 shares of restricted common stock valued at $5,000 to Hajime Abe as director’s compensation.

Certain Relationships and Related Transactions Related to TOA Fishery

On October 31, 2013, TOA Fishery was incorporated under the Japanese Companies Act with the purpose to conduct trading operations. Mr. Hajime Abe was appointed as Director and President of TOA Fishery.

On December 13, 2013, Hajime Abe entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) with Toshoan Holdings, Inc., a Delaware corporation (the “Company”). Pursuant to the Agreement, Hajime Abe will and has si transferred to Toshoan Holdings, Inc., 20 shares of the common stock of TOA Fishery Co., Ltd., a Japanese corporation (“TOA Fishery”), which represents all of its issued and outstanding shares in consideration of 1,000,000 JPY ($10,089 USD). Following the closing of the share purchase transaction on December 13, 2013, Toshoan Holdings, Inc. gained a 100% interest in the issued and outstanding shares of TOA Fishery’s common stock. Toshoan Holdings, Inc. is now the controlling shareholder of TOA Fishery.

Review, Approval and Ratification of Related Party Transactions

Given our small size and limited financial resources, we have not adopted formal policies and procedures for the review, approval or ratification of transactions, such as those described above, with our executive officer(s), Director(s) and significant stockholders. We intend to establish formal policies and procedures in the future, once we have sufficient resources and have appointed additional Directors, so that such transactions will be subject to the review, approval or ratification of our Board of Directors, or an appropriate committee thereof. On a moving forward basis, our Directors will continue to approve any related party transaction.

Corporate Governance

The Company promotes accountability for adherence to honest and ethical conduct; endeavors to provide full, fair, accurate, timely and understandable disclosure in reports and documents that the Company files with the Securities and Exchange Commission (the “SEC”) and in other public communications made by the Company; and strives to be compliant with applicable governmental laws, rules and regulations. The Company has not formally adopted a written code of business conduct and ethics that governs the Company’s employees, officers and Directors as the Company is not required to do so.

In lieu of an Audit Committee, the Company’s Board of Directors, is responsible for reviewing and making recommendations concerning the selection of outside auditors, reviewing the scope, results and effectiveness of the annual audit of the Company's financial statements and other services provided by the Company’s independent public accountants. The Board of Directors, the Chief Executive Officer and the Chief Financial Officer of the Company review the Company's internal accounting controls, practices and policies.

- 17 -

LEGAL PROCEEDINGS

From time to time, we may become party to litigation or other legal proceedings that we consider to be a part of the ordinary course of our business. We are not currently involved in legal proceedings that could reasonably be expected to have a material adverse effect on our business, prospects, financial condition or results of operations. We may become involved in material legal proceedings in the future.

RECENT SALES OF UNREGISTERED SECURITIES

On December 11, 2013, Mr. Hajime Abe entered into stock purchase agreements with 702 Japanese shareholders (“Japanese Shareholders”). Pursuant to these agreements, Mr. Abe sold 65,738,000 shares of common stock of the Company to these individuals.

We claim an exemption from registration afforded by Section 4(2) and/or Regulation S of the Securities Act of 1933, as amended ("Regulation S") for the above sales of the stock since the sales of the stock were made to non-U.S. persons (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates, or any person acting on behalf of any of the foregoing.

On December 13, 2013, Toshoan Holdings, Inc., a Delaware company (the “Company”), entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) with Hajime Abe, our President, sole Director and Officer. Pursuant to the Agreement, Hajime Abe transferred to Toshoan Holdings, Inc., 20 shares of the common stock of TOA Fishery Co., Ltd., a Japanese corporation (“TOA Fishery”), which represents all of its issued and outstanding shares in consideration of 1,000,000 JPY ($10,089 USD). Following the effective date of the share purchase transaction on December 13, 2013, Toshoan Holdings, Inc. gained a 100% interest in the issued and outstanding shares of TOA Fishery’s common stock and TOA Fishery became a wholly owned subsidiary of Toshoan Holdings. Toshoan Holdings, Inc. is now the controlling and sole shareholder of TOA Fishery.

DESCRIPTION OF SECURITIES

We have authorized capital stock consisting of 500,000,000 shares of common stock, $0.0001 par value per share (“Common Stock”) and 20,000,000 shares of preferred stock, $0.0001 par value per share (“Preferred Stock”). As of the date of this filing and taking into account the Share Transactions, we have 70,000,000 shares of Common Stock and 1,000,000 of Preferred Stock issued and outstanding.

Common Stock

The holders of outstanding shares of Common Stock are entitled to receive dividends out of assets or funds legally available for the payment of dividends of such times and in such amounts as the board from time to time may determine. Holders of Common Stock are entitled to one vote for each share held on all matters submitted to a vote of shareholders. There is no cumulative voting of the election of directors then standing for election. The Common Stock is not entitled to pre-emptive rights and is not subject to conversion or redemption. Upon liquidation, dissolution or winding up of our company, the assets legally available for distribution to stockholders are distributable ratably among the holders of the Common Stock after payment of liquidation preferences, if any, on any outstanding payment of other claims of creditors.

Preferred Stock