Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Sooner Holdings, Inc. | d646782d8k.htm |

| EX-2.1 - EX-2.1 - Sooner Holdings, Inc. | d646782dex21.htm |

| EX-2.2 - EX-2.2 - Sooner Holdings, Inc. | d646782dex22.htm |

| EX-99.1 - EX-99.1 - Sooner Holdings, Inc. | d646782dex991.htm |

Agreement to Sell Substantially All

Assets to Renewable Energy Group,

Inc. in Exchange for Shares

December 17, 2013

Exhibit 99.2 |

2

Forward Looking Statements

This document contains certain forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995, as amended, including

statements regarding the benefits of the transactions for investors in

Syntroleum Corporation (“Syntroleum”) and Renewable Energy Group, Inc.

(“REG”), the benefits of the transactions to the business of the

combined company, the estimated amounts available for distribution to

Syntroleum stockholders in connection with the dissolution and the timing of the

closing of the asset sale. Forward-looking statements may also include

statements relating to the Fischer-Tropsch ("FT") process,

Syntroleum ®

Process, Synfining ®

Process, and related technologies including, gas-to-liquids

("GTL"), coal-to- liquids ("CTL") and

biomass-to-liquids ("BTL"), and Syntroleum’s renewable fuels Bio-Synfining ®

technology.

These forward-looking statements are based on current expectations,

estimates, assumptions and projections

that are subject to change, and actual results may differ materially from the

forward-looking statements. Factors that could cause actual results to

differ materially include, but are not limited to, risks associated with obtaining

Syntroleum’s stockholder approval and the failure to satisfy other closing

conditions to the asset sale; REG’s ability to integrate

Syntroleum’s business with its own, changes or events affecting the business, financial

condition or results of operations of either Syntroleum or REG prior to the closing

of the asset sale; the risk that Syntroleum will discover or incur

unanticipated liabilities or expenses in connection with the dissolution that would

limit or eliminate distributions to Syntroleum stockholders; and

other risks and uncertainties described from time

to time in REG's annual report on Form 10-K, quarterly reports on Forms

10-Q and other periodic filings with the SEC and Syntroleum’s

annual report on Form 10-K, quarterly reports on Forms 10-Q and other periodic filings

with

the

SEC.

The

forward-looking

statements

are

made

as

of

the

date

of

this

press

release

and

neither

REG

nor

Syntroleum undertakes to update any forward-looking statements based on new

developments or changes in expectations. |

Additional Information

3

Additional Information about the Proposed Transactions and Where

to Find It

REG plans to file with the SEC a registration statement on Form S-4 in

connection with the transactions discussed in this presentation, which will

include Syntroleum’s preliminary proxy statement and REG’s preliminary

prospectus for such transactions. REG and Syntroleum will also file other documents

with the SEC related to the proposed transactions. Syntroleum will mail a

definitive proxy statement/prospectus to its stockholders as of a record

date to be established for voting on the proposed transactions. THE REGISTRATION STATEMENT AND

THE

DEFINITIVE

PROXY

STATEMENT/PROSPECTUS

WILL

CONTAIN

IMPORTANT

INFORMATION

ABOUT

REG, SYNTROLEUM, THE PROPOSED TRANSACTIONS AND RELATED MATTERS. BEFORE MAKING ANY

VOTING

AND

INVESTMENT

DECISION

WITH

RESPECT

TO

THE

TRANSACTIONS,

INVESTORS

AND

STOCKHOLDERS OF SYNTROLEUM ARE URGED TO READ THE REGISTRATION STATEMENT AND

DEFINITIVE PROXY STATEMENT/PROSPECTUS CAREFULLY WHEN THEY ARE AVAILABLE. The

registration

statement,

the

proxy

statement/prospectus

and

other

documents,

when

filed

with

the

SEC

by

REG

and Syntroleum,

can

be

obtained

free

of

charge

through

the

website

maintained

by

the

SEC

at

www.seg.gov,

at

REG’s

website

at

www.regi.com

under

the

tab

“Investor

Relations”

and

then

“Financial

Information”

and

“SEC

Filings,”

at

Syntroleum’s

website

at

www.syntroleum.com

under

the

tab

“Investor

Relations”

and

then

“SEC

Filings,”

from Renewable Energy Group Investor Relations, 416 S. Bell Avenue, Ames, Iowa

50010, telephone: 515-239-8091, or from Syntroleum Investor

Relations, 5416 S. Yale Ave., Suite 400, Tulsa, Oklahoma 74135, telephone:

281-224-9862. |

Disclaimer; Proxy Solicitations

4

Disclaimer

This communication shall not constitute an offer to sell or the solicitation of an

offer to buy any securities, nor shall there be any sale of securities in

any jurisdiction in which the offer, solicitation or sale would be unlawful

prior to the registration or qualification under the securities laws of any such

jurisdiction. No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities Act of

1933, as amended. Participants in the Solicitation

Syntroleum and REG and their respective directors and executive officers may be

deemed participants in the solicitation of proxies from Syntroleum

stockholders in connection with the transactions discussed in this

presentation. Information regarding the special interests of these directors

and executive officers in the proposed transactions will be included in the definitive proxy

statement/prospectus referred to above. Additional information regarding

Syntroleum’s directors and executive officers is also included in

Syntroleum’s proxy statement for its 2013 Annual Meeting of

Stockholders, which was filed with the SEC on November 1, 2013. Additional

information regarding REG’s directors and executive officers is also

included in REG’s proxy statement for its 2013 Annual Meeting of

Stockholders, which was filed with the SEC on April 4, 2013. These proxy statements are

available

free

of

charge

at

the

SEC’s

website

at

www.sec.gov

and

from

Syntroleum

and

REG

by

contacting them as described above. Other information about the participants in the

proxy solicitation will be contained in the proxy

statement/prospectus. |

Transaction Overview

•

Syntroleum’s Board unanimously approved on December 17th an agreement

to sell to Renewable Energy Group (REG) substantially all of Syntroleum’s

assets including:

–

50% interest in Dynamic Fuels

–

Global renewable fuels intellectual property

–

Gas to liquids intellectual property

•

Syntroleum would retain certain liabilities

•

Purchase consideration: 3,796,000 shares of REG

–

$40.3 mm value as of 12/16 ($4.04 per share), capped at $49 million, and subject

to adjustment based on cash to be delivered to REG at closing (1)

–

37% premium to SYNM 10 day average price (1)

–

Approximately 9.2% of combined company (2)

–

Syntroleum currently intends to issue REG shares as a liquidating dividend to

stockholders, subject to satisfaction by Syntroleum of its retained

liabilities 5

(1)

Based on share prices as of 12/16/13.

(2)

Calculated based on the number of REG shares outstanding post-transaction on a

fully-diluted basis, assuming 3,796,000 shares issued to

Syntroleum. |

Transaction Rationale

•

Consolidates SYNM renewable diesel IP and assets into a leading

renewable fuel producer

–

Provides asset diversification to stockholders

•

Platform and resources to invest in next generation synthetic fuel and

chemicals growth opportunities

–

Natural gas to liquids (GTL), biomass to liquids (BTL)

–

Phase change material (“PCM”)

–

Specialty renewable products (drilling and frac fluids)

•

Syntroleum IP and technologies a key driver for REG

6

REG:

A Leading U.S.

Biodiesel

Producer

SYNM:

Next Gen

Technologies –

Renewable

Diesel, GTL,

PCM

Strong Platform

for Growth |

Proposed RFS2 Changes By EPA =

Potentially Reduced Mandates

•

EPA published proposed reduced 2014 mandates versus guidelines

established in Energy Policy Act of 2009

–

Total renewable fuel of 15.21 vs. expected of 18.15 billion gallons

–

Reduced advanced biofuel to 2.2 vs. expected of 3.75 billion gallons

–

1.28 billion gallons biomass based diesel, which is the same as 2013

•

Significant excess biomass based diesel capacity likely

•

Flexible feedstock capability, economies of scale and flexible fuels

will be important

•

Proposal now under public comment period until January 28, 2014

7

Best positioned players have flexible feedstock assets,

flexible fuel capabilities + economies of scale |

REG/SYNM = Largest Portfolio of

Flexible Feedstock Capable Assets

8

Plant

Location

Nameplate

Capacity MMGY

High FFA

Capable

Dynamic Fuels (50% interest) (a)

Louisiana

37.5

X

REG Albert Lea

Minnesota

30.0

X

REG Danville

Illinois

45.0

X

REG Houston

Texas

35.0

REG Mason City (b)

Iowa

30.0

X

REG New Boston

Texas

15.0

X

REG Newton

Iowa

30.0

X

REG Ralston

Iowa

12.0

REG Seneca

Illinois

60.0

X

Total

294.5

247.5

REG Plants Partially Completed

GA, KS, LA, NM

150.0

X

Total

444.5

397.5

a) Operations suspended in Q4 2012

b) Currently being upgraded for multiple feedstock |

Result

of Comprehensive Review of Strategic Alternatives

•

Board conducted comprehensive review of strategic

alternatives

–

Assisted by outside financial and legal advisors

•

Piper Jaffray provided a fairness opinion to the Board

stating the aggregate purchase price to be received by

Syntroleum in consideration for the asset sale was fair,

from a financial point of view, to Syntroleum

•

Board firmly believes that this transaction is in the best

interest of all Syntroleum stockholders

9

Board unanimously recommends Syntroleum

stockholders vote in favor of transaction |

Roadmap to Completion

•

Transaction is subject to customary closing

conditions and regulatory approvals

•

Syntroleum stockholder approval required

–

Stockholders expected to receive proxy materials in

February, subject to SEC review

–

Stockholder meeting expected to take place in March

2014, subject to SEC review

10 |

Renewable Energy Group Overview

•

Headquarters

–

Ames,

Iowa

•

Share

Listing

–

NASDAQ

/

REGI

•

Shares

Outstanding

–

36.5

million

•

Current

Market

Capitalization

–

$387

million

as

of

12/16/13

11

Sources: Shares outstanding from REG 9/30/13 10Q, market capitalization from

Yahoo Finance. |

REG =

Fully Integrated Biodiesel Platform

12

Ability to process a wide

variety of lower cost

feedstocks

into biodiesel

12

biodiesel

plants,

8

in

production and 4 partially

completed, with existing

capacity of 257 MMGPY

Leading producer of

biodiesel in the United

States

marketing both REG

biodiesel and biodiesel

produced by others

Source: REG 2012 annual results presentation, updated for new REG plants.

|

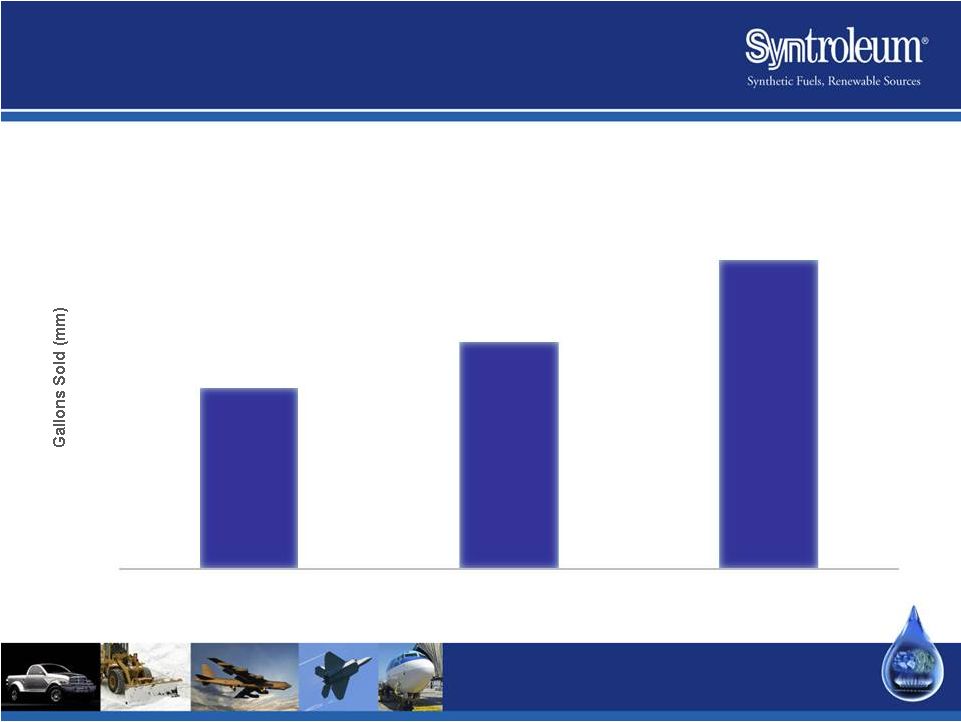

REG

is a Leading Biodiesel Producer 13

1)

1Q-3Q

actual

plus

midpoint

of

REG

guidance

for

4Q

of

65

-

75

million.

2)

Source: Compiled from data presented in REG quarterly results

presentations. 150

188

256

0

50

100

150

200

250

300

2011

2012

2013E (1)

GALLONS SOLD |

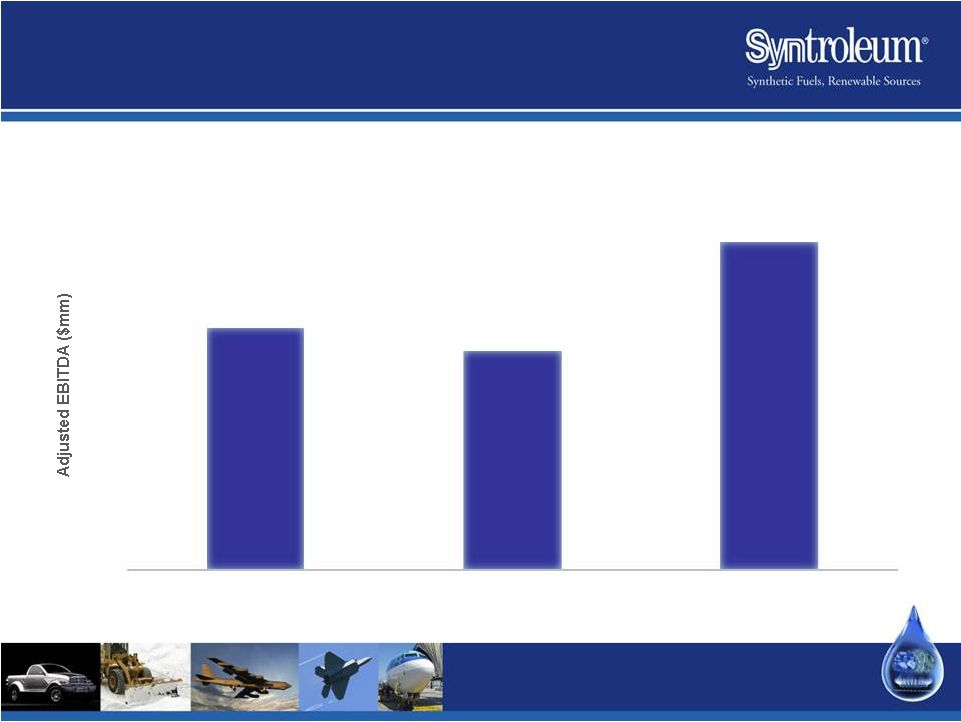

REG

Generates Significant EBITDA 14

1)

1Q-3Q

actual

plus

midpoint

of

REG

guidance

for

4Q

of

$25

-

$40

million.

Source: Compiled from data presented in REG quarterly results

presentations. $107

$97

$145

$0

$20

$40

$60

$80

$100

$120

$140

$160

2011

2012

2013E (1)

ADJUSTED

EBITDA |

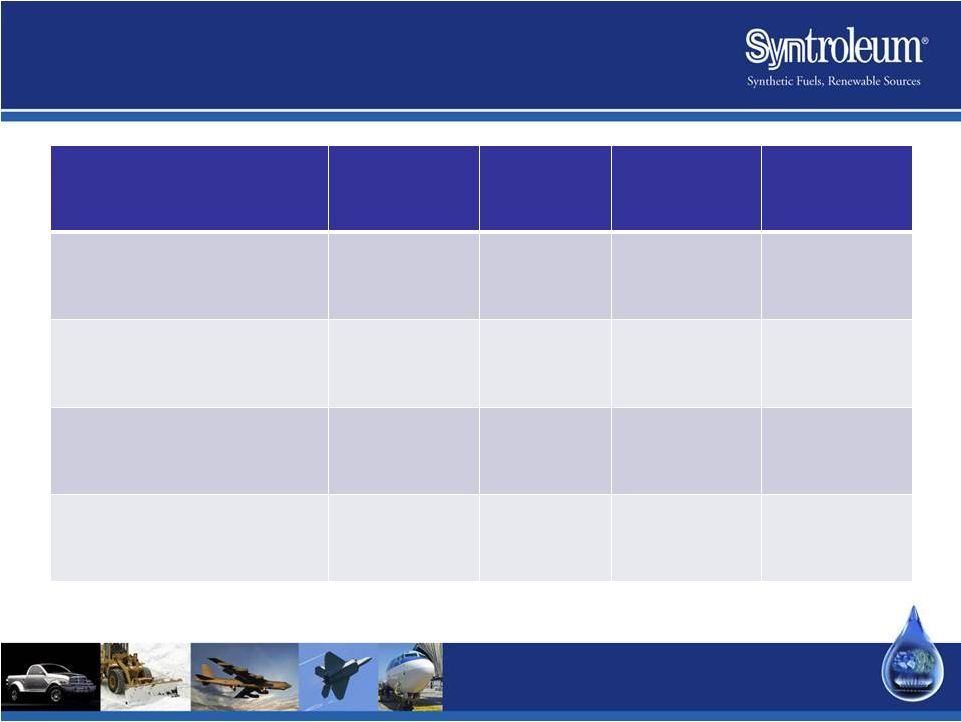

REG

Has a Strong Balance Sheet ($ in millions)

09/30/13

12/31/12

12/31/11

12/31/10

Cash

$135.9

$66.8

$33.6

$6.9

Term Debt

$35.5

$37.0

$85.6

$86.6

Term Debt / Total

Assets

5.1%

7.5%

17.7%

23.4%

Net Book Value

$552.4

$324.8

$120.6

$35.1

15

Source: REG 3Q 2013 Presentation |

Transaction Overview and Rationale

•

Board thoroughly evaluated strategic alternatives with a goal of

maximizing stockholder value

•

Enables combined company to pursue revenue growth from PCM and

GTL businesses

•

Board unanimously recommends Syntroleum stockholders vote in favor

of the transaction with REG

16

Compelling transaction is a win-win for all

Syntroleum stakeholders

–

Combination with REG provides strong platform for stockholders

–

Confident transaction is in the best interest of all Syntroleum

stockholders |

Syntroleum Progress Report |

Gas-to-Liquids Opportunity

•

Natural gas abundant due to shale gas development

–

Low gas prices/high oil price support strong GTL economics

•

Syntroleum has a leading GTL technology

•

Significant market opportunity (licensing and participation)

–

4,000 to 5,000 BPD GTL plants

–

Feedstock flexible (methane, ethane, propane, butane)

–

Manageable natural gas volumes –

40 to 50 million cubic ft/day

–

Developed at the field, product sold locally

•

Right technology timeline, right commercial environment

18

GTL a long term strategy with significant potential payoff

|

Execution of GTL Strategy

19

Steam Methane Reformer or

Autothermal Reformer

•

Demonstrated

technology

•

Many exist in the world

today

•

Capital cost well defined

•

Process guarantees

available

•

50% of project cost

Step 1: Synthesis Gas

Step 2: Fischer Tropsch

Step 3: Refining

Syntroleum’s Catoosa Demo Plant

Dynamic Fuels Geismar Plant

•

Operated 80 bpd Catoosa

Demo Facility 2004-2006

–

Produced military grade

fuels

–

Sinopec validation

•

Efficacy insurance may

mitigate technology risk

•

Similar technology as

Geismar Plant

•

Demonstrated technology at

commercial scale

Nat

Gas

Fuels

–

Reactor design

–

Hydroprocessing

catalyst |

Build

Plants Integrated to the Gas Field –

Field GTL

•

Why 4,000 to 5,000 BPD?

–

Manageable gas volumes (40 –

50 million cubic ft/day)

–

Manageable construction project (pre-fabricated sections)

–

Sized to local, dedicated gas reserves (20 years = 300-400 bn cubic ft)

–

Fuel products target local diesel markets

–

Manageable capital, risk profile

•

Why near the gas field?

–

Field proximity lowers gathering and transmission cost

•

Why an integrated project?

–

Physically hedges the integrated project

–

Higher margins better support debt financing

20 |

GTL

Project Under Development •

4,000 -

5,000 bpd GTL project with upstream oil

and gas company integrated to gas reserves

–

Signed MOU in July 2013 to develop engineering

feasibility study and business plan

–

Engineering design well under way

–

Site

selection

proceeding

–

multiple

sites

under

consideration

21 |

What

is Phase Change Material (PCM)? •

A PCM is a substance capable of

storing and releasing energy via

melting and solidification

–

Ice cubes in water regulates the

temperature to 32

o

F

•

Building energy efficiency PCM

regulates

temperature

from

70

o

–

73

o

F

–

Ideal for building materials & textiles

–

Multiple military applications

–

10 –

15% energy reduction targets

•

Many possible delivery formats

–

Sheets

–

Pellets

•

Composition of matter patent for

renewable PCM

22 |

PCM

Applications •

Building materials

–

Insulation

–

PCM sheets

•

HVAC

–

Peak load reduction, resulting sized A/C units

–

Reduction in size of military portable units

•

Textiles, Outerwear

–

Clothing

–

Hat inserts

–

Vests

–

Specialized applications

23 |

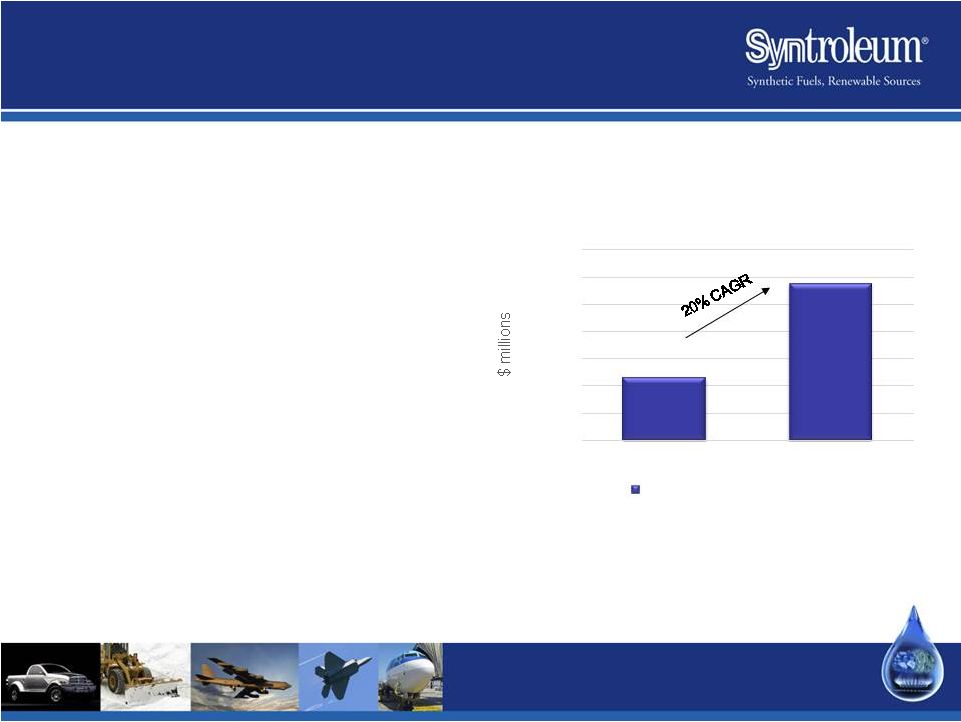

PCM:

Potential Market Opportunity •

Global PCM market is

$460 million

•

Expected to reach $1.15

billion by 2018

•

Building products, which

ideally suits Syntroleum’s

PCM, is one of the largest

segments

24

1) “Advanced Phase Change Material (PCM) Market, By Type and Application,

Global Trends & Forecast to 2018”, MarketsandMarkets, 2013

$460

$1,150

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

2013

2018

Global PCM Market

1

Global PCM Market

1 |

PCM

Commercialization Strategy •

Phase I: Continue market development work for

renewable PCM

•

Phase II: Become renewable PCM supplier using

contract manufacturers

•

Phase III: Construct a renewable PCM plant

–

Stand-alone or as add-on to a GTL plant

•

Phase IV: Evaluate forward vertical integration into

branded PCM products

25 |

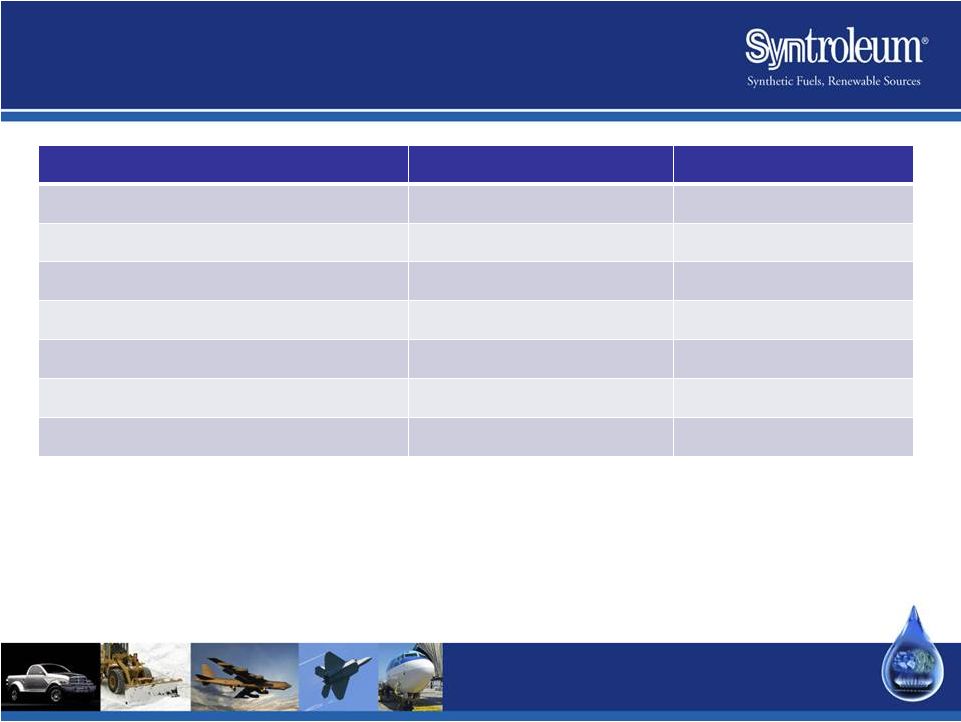

Syntroleum Robust and Growing IP

Portfolio

2012

2013

Renewables

Total Patents

7

14

Total Patents Pending

19

25

Fischer Tropsch

Total Patents

56

58

Total Patents Pending

4

4

Total

86

101

26 |

Questions and Answers |