Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BNC BANCORP | v363305_8k.htm |

Acquisitions of Community First Financial Group, Inc. South Street Financial Corp. – OTCQB: SSFC

2 Forward Looking Statements This presentation contains certain forward - looking information about BNC Bancorp and subsidiaries (collectively, “BNCN”) that is intended to be covered by the safe harbor for “forward - looking statements” provided by the Private Securities Litigation Reform Act of 1995 . All statements other than statements of historical fact, are forward - looking statements . In some cases, you can identify forward - looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future” or the negative of those terms or other words of similar meaning . You should carefully read forward - looking statements, including statements that contain these words, because they discuss the future expectations or state other “forward - looking” information about BNCN . Such statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond the control of BNCN . Forward - looking statements speak only as of the date they are made and BNCN assumes no duty to update such statements . In addition to factors previously disclosed in reports filed by BNCN with the Securities and Exchange Commission (“SEC”), additional risks and uncertainties may include, but are not limited to : the possibility that any of the anticipated benefits of the proposed mergers will not be realized or will not be realized within the expected time period ; the risk that integration of operations with those of BNCN will be materially delayed or will be more costly or difficult than expected ; the inability to complete the mergers due to the failure of shareholder approval to adopt the respective merger agreements ; the failure to satisfy other conditions to completion of the mergers, including receipt of required regulatory and other approvals ; the failure of the proposed mergers to close for any other reason ; the effect of the announcement of the mergers on customer relationships and operating results ; the possibility that the mergers may be more expensive to complete than anticipated, including as a result of unexpected factors or events ; and general competitive, economic, political and market conditions and fluctuations . As stated previously, additional factors affecting BNCN are discussed in BNCN’s Annual Report on Form 10 - K, its Quarterly Reports on Form 10 - Q and its Current Reports on Form 8 - K, filed with the SEC . Please refer to the SEC’s website at www . sec . gov where you can review those documents .

3 Transaction Benefits ▪ Three branches in Dynamic Chapel Hill Market (Raleigh - Durham - Chapel Hill CSA) ▪ Four branches in Metro Charlotte Market (Charlotte - Concord CSA) ▪ Low - cost core deposit base (approx. 29 bps) ▪ 100+ year old franchise with 100% core deposits ▪ Over 32% in non - interest bearing DDA ▪ Loan portfolio – over 70% retail ▪ Additional $200 million of deposits in Raleigh - Durham - Chapel Hill area, bringing total region to $385 million ▪ Additional $235 million of deposits in Metro - Charlotte, bringing total region to $725 million Combined transactions 12%+ accretive to 2015 EPS* Tangible Book Value earnback inside 1.5 years* Parent: Community First Financial Group, Inc. Parent: South Street Financial Corp. – OTCQB: SSFC *Does not include fair value accretion or revenue synergies

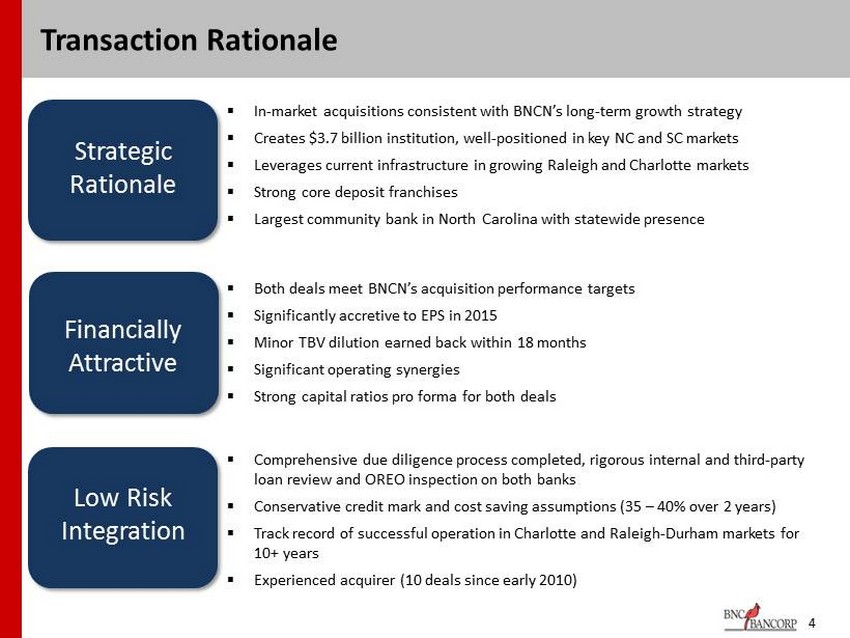

4 Transaction Rationale Strategic Rationale ▪ In - market acquisitions consistent with BNCN’s long - term growth strategy ▪ Creates $3.7 billion institution, well - positioned in key NC and SC markets ▪ Leverages current infrastructure in growing Raleigh and Charlotte markets ▪ Strong core deposit franchises ▪ Largest community bank in North Carolina with statewide presence Financially Attractive ▪ Both deals meet BNCN’s acquisition performance targets ▪ Significantly accretive to EPS in 2015 ▪ Minor TBV dilution earned back within 18 months ▪ Significant operating synergies ▪ Strong capital ratios pro forma for both deals Low Risk Integration ▪ Comprehensive due diligence process completed, rigorous internal and third - party loan review and OREO inspection on both banks ▪ Conservative credit mark and cost saving assumptions (35 – 40% over 2 years) ▪ Track record of successful operation in Charlotte and Raleigh - Durham markets for 10+ years ▪ Experienced acquirer (10 deals since early 2010)

5 Transaction Terms Harrington Bank Home Savings Bank Aggregate Common Consideration (as of close on December 17) $24.2 million $23.7 million Cash Fixed Price $5.90 $8.85 Exchange Ratio 0.4069x 0.6000x* Consideration 75% stock / 25% cash 80% stock / 20% cash Price to Stated TBV 99% 101% Required Approvals Customary regulatory and shareholder approval Customary regulatory and shareholder approval Expected Closing May 31, 2014 April 30, 2014 *Current, subject to certain collars

6 Pro Forma Branch Franchise NC SC Charlotte Greensboro Raleigh Myrtle Beach Charleston Greenville Asheville Legacy BNCN Branch Harrington Branch Home Savings Bank Branch Source: SNL Financial Charlotte Branches Loans ($000) Deposits ($000) 10 864,000 725,000 Piedmont Triad - Greensboro Branches Loans ($000) Deposits ($000) 18 913,000 1,570,000 Raleigh - Durham - Chapel Hill Branches Loans ($000) Deposits ($000) 6 518,000 385,000 Coastal South Carolina Branches Loans ($000) Deposits ($000) 8 239,000 280,000 Western Carolinas - Asheville Branches Loans ($000) Deposits ($000) 4 131,000 130,000

7 Harrington Bank Headquarters: Chapel Hill, NC Established: 1999 Branches: 3 Total Assets: $228.5 million Total Loans: $178.6 million Total Deposits: $198.8 million Tier 1 Leverage Ratio: 9.56% TCE / TA: 10.73% NPAs / Assets: 13.98% Rank Institution: Deposits ($M): Market Share: 1 Wells Fargo $2,151 29.0% 2 SunTrust $1,771 23.8% 3 BB&T $975 13.1% 4 Bank of America $801 10.8% 5 PNC $391 5.3% 6 First Citizens $364 4.9% -- Pro Forma $285 3.8% 7 Harrington $193 2.6% 8 Roxboro Savings $146 2.0% 9 Yadkin $144 1.9% 10 M&F $108 1.5% 11 Bank of North Carolina $92 1.2% Source: SNL Financial Franchise Summary As of September 30, 2013 Market Share: Chapel Hill - Durham As of June 30, 2013

8 Market Highlights – Raleigh / Durham / Chapel Hill Overview Demographic Highlights ▪ Part of North Carolina’s “Research Triangle” • Major research universities include University of North Carolina, North Carolina State University, and Duke University • Research Triangle Park houses 140 corporate, academic, and government agencies • Focal point of high - tech and biotech research ▪ Retail shipping point for eastern North Carolina and grocery industry ▪ Population of Raleigh / Durham MSA • 1,698,375 ▪ Projected Population Growth • 11.1% ▪ Projected 2017 Household Income • $61,126 ▪ Projected Household Income Growth • 13.6% Source: SNL Financial

9 Home Savings Bank of Albemarle Headquarters: Albemarle, NC Established: 1911 Branches: 4 Total Assets: $274.1 million Total Loans: $195.5 million Total Deposits: $238.1 million Tier 1 Leverage Ratio: 9.57% TCE / TA: 9.11% NPAs / Assets: 7.87% Rank Institution: Deposits ($M): Market Share: 1 Uwharrie Bank $297 32.3% 2 HSB of Albemarle $238 25.9% 3 Wells Fargo $137 14.9% 4 First Bank $93 10.1% 5 SunTrust $79 8.6% 6 First Citizens $75 8.2% 7 Woodforest $2 0.2% Source: SNL Financial Franchise Summary As of September 30, 2013 Market Share: Albemarle As of June 30, 2013

10 Market Highlights – Metro Charlotte Overview Demographic Highlights ▪ Well - diversified economy ▪ Major U.S. financial center ▪ Cluster for corporate headquarters • 9 Fortune 500 companies (Lowe’s, Goodrich, BOA, Chiquita) • Major U.S. airline hub ▪ Center for U.S. motorsports industry ▪ Large base of energy - oriented organizations ▪ Growing trucking and freight transportation hub for the East Coast ▪ Population of Charlotte MSA • 1,812,360 ▪ Projected Population Growth • 8.8% ▪ Projected 2017 Household Income • $58,244 ▪ Projected Household Income Growth • 11.8% Source: SNL Financial

11 Credit Highlights Due Diligence Overview Estimated Credit Mark ▪ Rigorous due diligence process to evaluate both Harrington’s and Home Savings’ credit portfolios • All non - performing and classified credits reviewed and larger properties visited • All OREO properties reviewed and larger properties visited • Expansive sample of performing credits reviewed • Loan review was completed by internal BNC team and independently by a highly respected regional firm Harrington Home Savings Aggregate loan mark 12% 7% Nonaccrual loan mark 22% 40% Performing loan mark 10% 6% OREO property mark 40% 28%

12 Combined Financial Impact of Both Transactions Merger Assumptions Pro Forma Analysis Post Closing 6/30/2014 ▪ Gross credit mark of 12.0%, $21.2 million on Harrington Bank ▪ Gross credit mark of 7.0%, $13.6 million on Home Savings Bank ▪ Pre - tax merger related costs of $2.4 million and $5.0 million on Harrington and Home Savings, respectively ▪ Expected aggregate TBV dilution of approximately 3.0%, with earnback inside 1.5 years ▪ Expected aggregate 2015 earnings accretion of 12.0% (Does not include fair value accretion) ▪ Expected aggregate cost savings of 35 - 40% ▪ Acquiring 7 offices, closing 2 ▪ Both deals are projected to close in Q2 2014 ▪ Balance Sheet (Bancorp) • Total assets $3.7 billion* • Total loans $2.7 billion* • Total deposits $3.1 billion* • TCE $247.0 million* ▪ Capital Ratios Bancorp Bank • TCE / TA 7.72% 8.41% • Tier 1 Leverage 7.68% 8.41% • Tier 1 RBC 10.03% 10.99% • Total RBC 11.17% 12.13% *approximate

13 An Experienced Acquirer Beach First National Bank Regent Blue Ridge KeySource First Trust Bank Carolina Federal Savings Bank Randolph Bank & Trust Headquarters: Myrtle Beach, SC Greenville, SC Asheville, NC Durham, NC Charlotte, NC Charleston, SC Asheboro, NC Deal Type: FDIC Whole Bank FDIC Whole Bank Whole Bank FDIC Whole Bank Announce Date: 4/9/2010 9/8/2011 10/14/2011 12/21/2011 6/4/2012 6/8/2012 5/31/2013 Commentary: Hired market president for SC, closed 3 offices, opened 1 Closed 7 offices, relocated 1 Workout completed , loans growing Closed 3 offices, opened 1 New City Exec hired, new office opened Enhances operating leverage Deal Value ($mm): FDIC $9.8 FDIC $13.7 $36.0 FDIC $19.2 Price / TBV (%): FDIC 124% FDIC 60% 72% FDIC 62% Consideration: FDIC 100% Cash FDIC 100% Stock 70% Stock FDIC 80% Stock Bargain Purchase Gain ($mm): $19.3 – $7.8 – $5.0 $7.7 – Strategic Rationale: • Entrance into SC market • Grow core deposit franchise • Access to attractive Greenville, SC market • Solid core deposit base • Good deposit growth • Dramatically increased Triangle presence • Dramatically increased Charlotte presence • Very attractive financial transaction • Expands Piedmont Triad and Triangle franchise Source: SNL Financial, internal Company documents

▪ Transaction drives EPS growth and overall shareholder value for BNCN, Harrington and Home Savings shareholders ▪ Increased presence in the key strategic markets of Charlotte and Raleigh - Durham with the right personnel and the right platform to support growth ▪ Greatly accelerates BNCN’s execution on strategic plan to be $1B in the Metro Charlotte market and $1B in the Raleigh - Durham - Chapel Hill market ▪ Pro forma institution is stronger, well - capitalized and remains one of the acquirers of choice in the Carolina markets ▪ Pro forma comparable companies trade at considerably higher multiples than stand - alone peers ▪ Continues to increase stock liquidity ▪ Increases ability to serve larger, more prominent customers with whom the management team is familiar ▪ Convenience of expanded branch network with 46 locations throughout the Carolinas 14 Transaction Summary

15 Investor Contacts Richard D. Callicutt II President & Chief Executive Officer David B. Spencer Senior Executive Vice President & Chief Financial Officer BNC Bancorp 3980 Premier Drive, Suite 210 High Point, NC 27265 (366) 869 - 9200 www.bankofnc.com

In connection with each proposed merger, BNC Bancorp will file with the Securities and Exchange Commission a Registration Statements on Form S - 4 that will include a Proxy Statement of Community First Financial Group, Inc. or South Street Financial Corp. and a Prospectus of BNC Bancorp, as well as other relevant documents concerning each proposed transaction. SHAREHOLDERS ARE STRONGLY URGED TO READ THE REGISTRATION STATEMENTS AND THE PROXY STATEMENT/PROSPECTUS REGARDING EACH PROPOSED MERGER WHEN EACH BECOMES AVAILABLE AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION REGARDING EACH PROPOSED MERGER. A free copy of each Proxy Statement/Prospectus, as well as other filings containing information about BNC Bancorp, may be obtained after their filing at the SEC’s Internet site ( http://www.sec.gov ) in addition, free copies of documents filed by BNC Bancorp with the SEC may be obtained on the BNC Bancorp website at www.bncbancorp.com . BNC Bancorp and each of Community First Financial Group and South Street Financial Corp. and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from each of Community First Financial Group’s, and South Street Financial Corp.’s shareholders in connection with each respective transaction. Information about the directors and executive officers of BNC Bancorp and each of Community First Financial Group, Inc. and South Street Financial Corp. and information about other persons who may be deemed participants in each solicitation will be included in each respective proxy Statement/Prospectus. Information about BNC Bancorp's executive officers and directors can be found in BNC Bancorp’s definitive proxy statement in connection with its 2013 Annual Meeting of Shareholders filed with the SEC on April 16, 2013. Additional information regarding the interests of those persons and other persons who may be deemed participants in the transaction may be obtained by reading the Proxy Statement/Prospectus regarding each proposed merger when each becomes available. You may obtain free copies of each document as described in the preceding paragraph . 16 Additional Information