Attached files

| file | filename |

|---|---|

| EX-3.4 - UNITED HELIUM, INC. | ex3-4.htm |

| EX-3.7 - UNITED HELIUM, INC. | ex3-7.htm |

| EX-5.1 - UNITED HELIUM, INC. | ex5-1.htm |

| EX-3.8 - UNITED HELIUM, INC. | ex3-8.htm |

| EX-3.5 - UNITED HELIUM, INC. | ex3-5.htm |

| EX-3.1 - UNITED HELIUM, INC. | ex3-1.htm |

| EX-3.3 - UNITED HELIUM, INC. | ex3-3.htm |

| EX-3.6 - UNITED HELIUM, INC. | ex3-6.htm |

| EX-3.2 - UNITED HELIUM, INC. | ex3-2.htm |

| EX-23.1 - UNITED HELIUM, INC. | ex23-1.htm |

|

As filed with the Securities and Exchange Commission on ________.

|

Registration No._______

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

UNITED HELIUM, INCORPORATED

(Name of small business issuer in its charter)

|

COLORADO

|

2813

|

46-2906756

|

||

|

(State or jurisdiction of

|

(Primary Standard Industrial

|

(I.R.S. Employer

|

||

|

incorporation or organization)

|

Classification Code Number)

|

Identification No.)

|

7109 East 2nd St., Suite G, Scottsdale, AZ 85251

(480)-949-2755

(Address and telephone number of principal executive offices and place of business)

Peter G. Trimarco

10267 Celestine Place, Parker, Colorado 80134

(303)-910-1884

(Name, address and telephone number of agent for service)

Copies of communication to:

Aaron D. McGeary

The McGeary Law Firm, P.C.

1600 Airport Fwy., Suite 300 Bedford, Texas 76022

Telephone (817)-282-5885 Fax (817)-282-5886

Approximate date of proposed sale to the public: The proposed date of sale will be as soon as practicable after the Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the Prospectus is expected to be made pursuant to Rule 434, please check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting Company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting Company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

o (Do not check if a smaller reporting company)

|

Smaller reporting company

|

x

|

CALCULATION OF REGISTRATION FEE

|

Title of each class of

Securities to be

Registered

|

Amount of

Shares to be

Registered

|

Proposed

Maximum offering

Price per share

|

Proposed

Maximum

Aggregate offering

Price

|

Amount of

Registration

Fee

|

|||||

|

Common Stock

|

11,896,151

|

$5.00

|

$59,480,755

|

$7,661.12

|

|||||

|

Total

|

11,896,151

|

$5.00

|

$59,480,755

|

$7,661.12

|

(1) Registration Fee (to be paid).

(2) The offering price was arbitrarily determined by United Helium, Incorporated

(3) Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457 under the Securities Act of 1933, as amended (the "Securities Act").

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement is filed with the Securities and Exchange Commission and becomes effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION, DATED ________, 2013

UNITED HELIUM, INCORPORATED

11,896,151 Shares of Common Stock

Our existing shareholders are offering for sale 11,896,151shares of common stock. There are no underwriters.

By means of this prospectus a number of our shareholders are offering to sell up to 11,896,151 shares of our common stock at a price of $5.00 per share. If and when our stock becomes quoted on the OTC Bulletin Board (“OTCBB”) or listed on a securities exchange, the shares owned by the selling shareholders may be sold in the over-the-counter market, or otherwise, or at prices and terms then prevailing or at prices related to the then current market price, or in negotiated transactions.

As of the date of this prospectus there was no public market for our common stock. We expect to apply for the inclusion of our common stock in the OTCBB; such efforts, however, may not be successful and a public market may never materialize.

The Company is not a shell company as defined in Rule 405 under the Securities Act (17 CFR 230.405) and Rule 12b-2 under the Exchange Act (17 CFR 240.12b-2).

There are no underwriters, discounts or commissions. All proceeds will be distributed to the existing selling shareholders. This prospectus will not be used before the effective date of the registration statement. Information in this prospectus will be amended or completed as needed. This registration statement has been filed with the securities exchange commission. These securities will not be sold until the registration statement becomes effective.

THESE SECURITIES ARE SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK. FOR A DESCRIPTION OF CERTAIN IMPORTANT FACTORS THAT SHOULD BE CONSIDERED BY PROSPECTIVE INVESTORS, SEE UNDERSTAND “RISK FACTORS” STARTING ON PAGE 6 OF THIS PROSPECTUS.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

The information in this Prospectus is not complete and may be changed. The Selling Security Holders may not sell these securities until the registration statement filed with the Securities and Exchange Commission becomes effective. This Prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted or would be unlawful prior to registration or qualification under the securities laws of any such state.

TABLE OF CONTENTS

|

Page

|

||

|

PROSPECTUS SUMMARY

|

1

|

|

|

SUMMARY FINANCIAL INFORMATION

|

4

|

|

|

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

|

5

|

|

|

RISK FACTORS

|

6

|

|

|

USE OF PROCEEDS

|

12

|

|

|

DETERMINATION OF OFFERING PRICE

|

12

|

|

|

DILUTION

|

12

|

|

|

SELLING SECURITY HOLDERS

|

12

|

|

|

PLAN OF DISTRIBUTION

|

13

|

|

|

DESCRIPTION OF SECURITIES

|

14

|

|

|

INTEREST OF NAMED EXPERTS AND COUNSEL

|

15

|

|

|

DESCRIPTION OF BUSINESS

|

16

|

|

|

DESCRIPTION OF PROPERTY

|

32

|

|

|

SHELL COMPANY STATUS

|

34

|

|

|

LEGAL PROCEEDINGS

|

34

|

|

|

MARKET FOR COMMON EQUITY AND OTHER RELATED STOCKHOLDER MATTERS

|

34

|

|

|

MANAGEMENT DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

34

|

|

|

CHANGES AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

41

|

|

|

DIRECTORS, EXECUTIVE OFFICER, AND CONTROL PERSONS

|

41

|

|

|

EXECUTIVE COMPENSATION

|

43

|

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

44

|

|

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

|

44

|

|

|

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION OF SECURITIES ACT LIABILITIES

|

45

|

|

|

FINANCIAL STATEMENTS

|

F-1

|

|

You should rely only on the information contained in this Prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information provided by this Prospectus is accurate as of any date other than the date on the front cover page of this Prospectus.

DEALER PROSPECTUS DELIVERY OBLIGATION

Until ninety (90) Days after the later of (1) the effective date of the registration statement or (2) the first date on which the securities are offered publicly, all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

PROSPECTUS SUMMARY

The following is only a summary of the information, financial statements and the notes included in this Prospectus. You should read the entire Prospectus carefully, including “Risk Factors” and our Financial Statements and the notes to the Financial Statements before making any investment decision. Unless the context indicates or suggests otherwise, the terms “Company”, “we,” “our” and “us” means United Helium, Incorporated.

Principal Offices

Our principal executive offices are located at 7109 East 2nd Street, Suite G, Scottsdale, Arizona 85251. Our telephone number is 480-949-2755.

Our Business

United Helium, Incorporated (“UHEI”, “United Helium”, or the "Company") was incorporated according to the laws of the State of Colorado on April 9, 1998. On June 6, 2013 the company changed its name to United Helium Incorporated from Cayenne Entertainment, Inc. On March 28, 2001, Cayenne Entertainment, Inc., organized in the State of Nevada on November 13, 2000, merged with Boeing Run, Inc., formerly a public company, organized in the State of Colorado with the Colorado entity being the legal survivor.

The Company is engaged in the business of addressing the supply of helium to industry, government, medical and the research communities. The Company’s helium and other reservoir gases, are contained in its “working interests” oil and gas lease holdings. Recoverable helium reserves contained in geologic structures, will be identified by drilling and third party engineering analysis. The field will be developed through production well drilling and completion, and infrastructure gathering system construction. United Helium will utilize its unique mobile processing equipment to separate and refine helium at the wellhead or from a field gathering system, and transport to its customers. Owners of oil and gas mineral rights have collectively contributed their reserves by assigning “working interests” to the Company which could not previously be economically produced and/or transported to commercial helium processing plants. This combined effort and unique approach will enable United Helium to unlock the potential that many in the industry have known existed, but previously were unable to successfully develop. The Company’s technology and business methods will assure a future supply of this rare and important resource. Although not the primary focus of the Company, to the extent that hydrocarbons, including oil, are discovered on the leasehold properties, the Company intends to take advantage of those opportunities should they arise.

We are committed to responsible stewardship in our operations, both above ground as well as below. In furtherance of this commitment, the Company intends, where practical to utilize indigenous sources, including natural gas and solar energy to reduce the energy costs of operations. The development and processing of helium makes us part of the community in many rural western locations. Being part of the community and making a difference is a priority for us, and a commitment we readily accept.

The helium reserves controlled, or which may be acquired, by United Helium are in mineral leases issued by state, the Bureau of Land Management, or private land owners. Mineral rights leases (oil & gas) are obtained from the owner(s) who are compensated with a royalty interest and typically a per acre fee for the rights to extract oil and/or gases. Drilling permit applications are submitted to the governmental authority having jurisdiction over the leasehold and accepted applications will be issued a drilling permit. United Helium will operate each well during the drilling, completion and production phases.

With respect to Mineral Rights Leases on federal lands, helium by statute, is reserved to the federal government which may enter into agreements with private parties, such as United Helium, for the recovery and disposal of helium on federal lands. United Helium will apply for the right to extract and sell the helium.

United Helium will implement a compact mobile cryogenic plant, which produces commercial grade quality helium at the helium field. This mobile cryogenic plant eliminates the expensive two step processing to commercial grade helium, which requires gas transport to one of the few domestic cryogenic helium plants. Most cryogenic plants are generally large scale and are supplied with gas transported by pipeline from large natural gas fields or obtained from the Federal Helium Reserve.

1

United Helium holds an 80% working interest (64.60% Net Revenue Interest “NRI” ) in the Holbrook North leases which encompasses 6,489 acres of State of Arizona leases and includes acreage that has contained some of the richest helium fields discovered in the world. (Rauzi, S.L. and Fellows L.D.; “Arizona Has Helium”, Arizona Geology, 2003, Vol. 33. No.4, Published by the Arizona, Geological Survey). United Helium holds an 87.5% working interest (70% Net Revenue Interest “NRI”) in the Holbrook Central private land leases which encompasses 26,646 acres. United helium holds an 87.5% working interest (76.6% Net Revenue Interest “NRI”) in the Holbrook Central State of Arizona leases which encompasses 2,607 acres.

We are a developmental stage Company with minimal revenues and a limited operating history. As of the date of this prospectus, we have had minimal revenues, have not begun operations and have $ 18,036.62 in cash as of October 31, 2013. As of the date of this prospectus, the Company’s offering expenses of approximately $23,325 have been paid.

Our Company has no employees at the present time. All business functions are managed by our officers and directors.

Any investment in the shares offered herein involves a high degree of risk. The principal risks and limitations that we face are those related to our business, our industry, our financial condition, and this offering. All of these risks are discussed in detail under the section "Risk Factors", which should be carefully read. You should only purchase shares if you can afford a loss of your investment. Our independent registered public accountant has issued an audit opinion for United Helium, Inc., which includes a statement expressing substantial doubt as to our ability to continue as a going concern. This means that we do not have adequate financial resources at this time to repay our debt and credit obligations, and without additional funding, we may not be able to remain in business.

There is no current public market for our securities. As our stock is not publicly traded, investors should be aware they probably will be unable to sell their shares and their investment in our securities is not liquid.

Penny Stock Rules

Our common stock will be considered a “penny stock”, and subject to the requirements of Rule 15g-9, promulgated under the Securities Exchange Act of 1934, as amended. “Penny stock” is generally defined as any equity security not traded on an exchange or quoted on NASDAQ that has a market price of less than $5.00 per share. Under such rule, broker-dealers who recommend low-priced securities to persons other than established customers and accredited investors must satisfy special sales practice requirements, including a requirement that they make an individualized written suitability determination for the purchaser and receive the purchaser's consent prior to the transaction. The Securities Enforcement Remedies and Penny Stock Reform Act of 1990, also requires additional disclosure in connection with any trades involving a stock defined as a penny stock.

The required penny stock disclosures include the required delivery, prior to any transaction, of a disclosure schedule explaining the penny stock market and the risks associated with it. Such requirements could severely limit the market liquidity of the securities and the ability of purchasers to sell their securities in the secondary market. In addition, various state securities laws impose restrictions on transferring "penny stocks" and as a result, investors in the common stock may have their ability to sell their shares of the common stock impaired.

2

The Offering

| Common stock offered by selling security holders | 11,896,151 shares of common stock. This number represents 10.3375(%) percent of our current outstanding common stock (1). |

|

Common stock outstanding before the offering

|

115,078,000 common shares as of October 31, 2013.

|

|

Common stock outstanding after the offering

|

115,078,000 shares.

|

|

No Public Market

|

There is no public market for our common stock. We cannot give any assurance that the shares being offered will have a market value, or that they can be resold at the offered price if and when an active secondary market might develop, or that a public market for our securities may be sustained even if developed. The absence of a public market for our stock will make it difficult to sell your shares. If in the future a market does exist for our securities, it is likely to be highly illiquid and sporadic.

We intend to apply to the OTCBB, through a market maker that is a licensed broker dealer, to allow the trading of our common stock upon our becoming a reporting company.

|

|

Terms of the Offering

|

The selling security holders will offer the shares at $5.00 per share until a trading market for the shares develops, at which time the shares will be sold at market price.

|

|

Termination of the Offering

|

The offering will conclude upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) such time as all of the common stock becomes eligible for resale without volume limitations pursuant to Rule 144 under the Securities Act, or any other rule of similar effect.

|

|

Use of proceeds

|

We are not selling any shares of the common stock covered by this prospectus.

|

|

Need for Additional Financing:

|

We believe that we may need to raise additional capital in the future.

|

|

Risk Factors

|

An investment in our common stock involves a high degree of risk. You should carefully consider the risk factors set forth under “Risk Factors” on page 6 and the other information contained in this prospectus before making an investment decision regarding our common stock

|

(1) Based on 115,078,000 shares of common stock outstanding as of October 31, 2013.

3

SUMMARY FINANCIAL INFORMATION

The following is a summary of our financial information and is qualified in its entirety by our unaudited financial statements as of October 31, 2013.

Balance Sheet Data

|

October 31,

|

April 30,

|

|||||||

|

2013

|

2013

|

|||||||

|

(Unaudited)

|

(Audited)

|

|||||||

|

ASSETS

|

||||||||

|

Current Assets

|

||||||||

|

Cash

|

$ | 18,037 | $ | - | ||||

|

Total Current Assets

|

18,037 | - | ||||||

|

Oil, gas and helium properties

|

6,000 | - | ||||||

|

Total Assets

|

$ | 24,037 | $ | - | ||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

||||||||

|

Liabilities

|

||||||||

|

Accrued Liabilities

|

$ | - | $ | - | ||||

|

Operational Loans

|

4,350 | - | ||||||

|

Total Liabilities

|

4,350 | - | ||||||

|

Stockholders' Equity

|

||||||||

|

Preferred Stock, authorized

|

||||||||

|

5,000,000 shares, no par value,

|

||||||||

|

issued and outstanding on

|

||||||||

|

July 31, 2013 and April 30, 2013

|

||||||||

|

is zero shares respectively

|

- | - | ||||||

|

Common Stock, authorized

|

||||||||

|

50,000,000 shares, no par value,

|

||||||||

|

issued and outstanding on

|

||||||||

|

October 31, 2013 and April 30, 2013 is

|

||||||||

|

115,078,000 and 11,576,500 shares

|

||||||||

|

respectively

|

1,588,293 | 1,542,793 | ||||||

|

Additional Paid in Capital

|

2,058 | 2,058 | ||||||

|

Deficit Accumulated During the

|

||||||||

|

Development Stage

|

(1,570,664 | ) | (1,544,851 | ) | ||||

|

Total Stockholders' Equity

|

19,687 | - | ||||||

|

Total Liabilities and Stockholders' Equity

|

$ | 24,037 | $ | - | ||||

4

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus may contain forward-looking statements. Forward-looking statements include statements concerning our plans, objectives, goals, strategies, future events, future revenue or performance, capital expenditures, financing needs and other information that is not historical information. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “intend,” “potential,” “continue,” “seek” or the negative of these terms or other comparable terminology or by discussions of strategy.

All forward-looking statements, including, without limitation, our examination of historical operating trends, are based upon our current expectations and various assumptions. We believe there is a reasonable basis for our expectations and beliefs, but they are inherently uncertain. We may not realize our expectations and our beliefs may not prove correct. Actual results could differ materially from those described or implied by such forward-looking statements.

We believe that it is important to communicate our future expectations to our investors. However, there may be events in the future that we are not able to accurately predict or control and that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements. Except as required by applicable law, including the securities laws of the U.S. and the rules and regulations of the Securities and Exchange Commission, we do not plan to publicly update or revise any forward-looking statements after we distribute this prospectus, whether as a result of any new information, future events or otherwise. Consequently, forward-looking statements should be regarded solely as our current plans, estimates and beliefs. Potential investors should not place undue reliance on our forward-looking statements. Before investing in our common stock, investors should be aware that the occurrence of any of the events described in the “Risk Factors” section and elsewhere in this prospectus could have a material adverse effect on our business, results of operations, financial condition, cash flows, customer relationships and value of our proprietary products. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

5

RISK FACTORS

An investment in these securities involves an exceptionally high degree of risk and is extremely speculative in nature. Following are what we believe are all the material risks involved if you decide to purchase shares in this offering.

The risks described below are the ones we believe are most important for you to consider. These risks are not the only ones that we face. If events anticipated by any of the following risks actually occur, our business, operating results or financial condition could suffer and the price of our common stock could decline.

Risks Relating To Our Business

WE ARE A DEVELOPMENT STAGE COMPANY WITH LIMITED OPERATING HISTORY, AND AN INVESTMENT IN US IS CONSIDERED A HIGH RISK INVESTMENT WHEREBY YOU COULD LOSE YOUR ENTIRE INVESTMENT.

The Company is a developmental stage company with limited operating history. The Company is currently operating at a loss, and there is no assurance that the business development plans and strategies of the Company will ever be successful, or that the Company will ever be able to operate profitably. If we cannot operate profitably, you could lose your entire investment. We may not generate revenues in the next twelve months sufficient to support our operations and therefore may rely solely on the cash we raise from investments.

WE HAVE RECEIVED A GOING CONCERN OPINION FROM OUR AUDITORS AND WE ARE CURRENTLY OPERATING AT A LOSS, WHICH RAISES SUBSTANTIAL DOUBT ABOUT OUR ABILITY TO CONTINUE AS A GOING CONCERN.

We have received a “Going Concern” opinion from our auditors. As reflected in the accompanying financial statements, the Company is in the development stage having just begun operations and with no revenue earned since inception. This raises substantial doubt about its ability to continue as a going concern. The ability of the Company to continue as a going concern is dependent on the Company’s ability to raise additional capital and implement its business plan.

WE NEED ADDITIONAL CAPITAL TO DEVELOP OUR BUSINESS. IF WE FAIL TO OBTAIN ADDITIONAL CAPITAL WE MAY NOT BE ABLE TO IMPLEMENT OUR BUSINESS PLAN.

The Company has limited cash on hand. Its business plan calls for ongoing expenses in connection with meeting funding obligations for the development and execution of planned projects. The Company will require additional funding in order to finance the full development of its business plan. If the Company is unable to raise the funds necessary, the Issuer may have to delay the implementation of its business plan. The Company does not have any alternate arrangements for financing and can provide no assurance that it will be able to obtain the required financing when needed.

IT IS LIKELY THAT WE WILL NEED TO SEEK ADDITIONAL FINANCING THROUGH SUBSEQUENT FUTURE PRIVATE OFFERING OF OUR SECURITIES.

Because the Company does not currently have any financing arrangements, and may not be able to secure favorable terms for future financing, the Company may need to raise capital through the sale of its common stock. The sale of additional equity securities will result in dilution to our stockholders.

BECAUSE WE HAVE A LIMITED OPERATING HISTORY, WE FACE A HIGH RISK OF BUSINESS FAILURE.

The Company has a limited operating history upon which to base an evaluation of its business and prospects. The Company’s business and prospects must be considered in light of the risks, expenses and difficulties frequently encountered by companies in an early stage of development, particularly companies in competitive and unpredictable industries like the oil and gas industry which encompasses the exploration, development, and production, of oil and gas, including commercial and industrial gases such as helium. As a result of the Company’s limited operating history, it is difficult to accurately forecast net profits and management has limited historical financial data upon which to base planned operating expenses.

6

WE DEPEND ON KEY PERSONNEL TO MANAGE OUR BUSINESS EFFECTIVELY AND THEY MAY BE DIFFICULT TO REPLACE.

The Company’s performance substantially depends on the efforts and abilities of its management team and key employees. Furthermore, much of the Company’s success is based on the expertise, experience and know-how of its key personnel regarding the oil and gas industry, and helium processing and refining. The loss of key employees could have a negative effect on the Issuer’s business, revenues, results of operations and financial condition.

THE SUCCESS OF UNITED HELIUM’S BUSINESS PLAN DEPENDS ON A NUMBER OF FACTORS OVER WHICH THE COMPANY HAS LITTLE OR NO CONTROL.

The Company’s business plan requires permits, approvals, and agreements from various state, federal and in some cases, Native American governmental agencies. For instance, the company must obtain an agreement from the Secretary of Interior Bureau of Land Management to recover and dispose of (sell) helium on those mineral rights leaseholds located on federal lands. While we anticipate that they will be obtained in due course, we may experience delays or encounter objections from these agencies or third parties. In addition, there is no assurance that economically recoverable reserves of helium will be discovered as a part of the Company’s drilling operations.

Risks Relating To Our Industry

WE FACE STRONG COMPETITION FROM OTHER ENTITIES.

The Company faces strong competition from several large global competitors. Introduction by competitors of new technologies, competing products, or new sources of helium could weaken demand for or impact pricing of the Company’s products, negatively impacting financial results. In addition, competitors’ pricing policies could materially affect the Company’s profitability.

WE OPERATE IN A HIGHLY COMPETITIVE ENVIRONMENT AND SUCH COMPETITION COULD NEGATIVELY IMPACT US.

The U.S. industrial gas industry is a highly competitive environment. Competition is generally based on price, reliable product delivery, product availability, technical support, quality and service. If the Issuer is unable to compete effectively, it may suffer lower revenue and/or a loss of market share, which could result in lower profits and adversely affect its financial condition and cash flows.

WE FACE RISKS RELATED TO GENERAL ECONOMIC CONDITIONS, WHICH MAY IMPACT THE DEMAND FOR AND SUPPLY OF PRODUCTS AND RESULTS OF OPERATIONS.

Demand for the Company’s products depends in part on the general economic conditions affecting the United States and, to a lesser extent, the rest of the world. Broad decline in general economic conditions could result in customers postponing capital projects and could negatively impact the demand for products and services. Falling demand could lead to lower sales volumes, lower pricing, and/or lower profit margins. A protracted period of lower product demand and profitability could result in diminished values for both tangible and intangible assets, increasing the possibility of future impairment charges. If economic conditions deteriorate, operating profit, financial condition and cash flows could be adversely affected.

INCREASES IN PRODUCT AND ENERGY COSTS COULD REDUCE PROFITABILITY.

The production of gases and refining of helium requires significant amounts of electric energy. Therefore, industrial gas prices have historically increased as the cost of electric power increases. Price increases for oil and natural gas have historically resulted in electric power surcharges. In addition, a significant portion of our distribution expenses consists of diesel fuel costs. Energy prices can be volatile and may rise in the future. Such volatility could negatively impact operations, financial results or liquidity.

7

Risks Related To This Offering

NO MARKET CURRENTLY EXISTS FOR OUR SECURITIES AND WE CANNOT ASSURE YOU THAT SUCH A MARKET WILL EVER DEVELOP, OR IF DEVELOPED, WILL BE SUSTAINED.

Our common stock is not currently eligible for trading on any stock exchange and there can be no assurance that our common stock will be listed on any stock exchange in the future. We intend to apply for to be quoted on the OTC Bulletin Board trading system, but there can be no assurance we will obtain such a listing. In order to apply for a quotation, our security must be sponsored by a market maker application on Form 211 and demonstrate compliance with Rule 15c2-11. At this time, the Company has not formally engaged a market maker to make such an application. Although there are no formal requirements to be eligible for quotation on the OTC Bulletin Board trading system, the Company will need to be a mandatory filer pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. The Company does not currently meet this requirement, but the Company intends to apply to be a mandatory filer once its registration on Form S-1 is deemed effective by the SEC.

The bulletin board tends to be highly illiquid, in part because there is no national quotation system by which potential investors can track the market price of shares except through information received or generated by a limited number of broker-dealers that make a market in particular stocks. There is a greater chance of market volatility for securities that trade on the bulletin board as opposed to a national exchange or quotation system. This volatility may be caused by a variety of factors, including: the lack of readily available price quotations; the absence of consistent administrative supervision of "bid" and "ask" quotations; lower trading volume; and general market conditions. If no market for our shares materializes, you may not be able to sell your shares or may have to sell your shares at a significantly lower price.

In the event we become a listed Company, there are no assurances that our shares will be liquid. As a Company, we may be an unattractive investment for the general investors because our business is limited primarily to the Oil and Gas Industry, and Specialty Gas sector, even though we believe there are a limited number of commercial global sources of helium. In light of limited knowledge in our business, investors may find that we are not an attractive public company worthy of investing. We may be required to offer discounted premiums for our shares to investors if perceive our shares as being illiquid.

The typical factors affecting stock liquidity normally are: adequate capitalization, investor perception and interest, revenues, earning, firm size, compression of ownership structure, level of information asymmetry, utilization rate of margin trading, and investor’s stock demand. The level of capitalization can impact the company’s operations and may have an effect on stock price. The level of investor interest may determine extent of Company’s capitalization and respective stock price. Further, revenues and earnings have a direct correlation on the value of the company and therefore impact stock price accordingly. In some cases, the size of the Company affects liquidity, and in our case the small size may cause less liquidity. Some other factors that can affect liquidity are as follows: (1) the more scattered ownership structure is, the higher the liquidity may be; (2) the higher margin trading utilization is, the higher the stock liquidity may be; (3) the liquidity of an individual stock is positively related to the liquidity of the entire market; and (4) the more investor's perceptions are absorbed, the higher the stock liquidity.

IF OUR SHARES OF COMMON STOCK ARE ACTIVELY TRADED ON A PUBLIC MARKET, THEY WILL IN ALL LIKELIHOOD BE PENNY STOCKS AND SHALL BE DIFFICULT TO TRANSACT DUE TO VOLUME LIMITATIONS AND EXEMPTION RESTRICTIONS.

Broker-dealer practices in connection with transactions in “penny stocks” are regulated by certain penny stock rules adopted by the SEC. Penny stocks generally are equity securities with a price per share of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ Stock Market, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules generally require that prior to a transaction in a penny stock the broker-dealer make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that becomes subject to the penny stock rules.

8

WE WILL INCUR ONGOING COSTS AND EXPENSES FOR SEC REPORTING AND COMPLIANCE WITHOUT REVENUE WE MAY NOT BE ABLE TO REMAIN IN COMPLIANCE, MAKING IT DIFFICULT FOR INVESTORS TO SELL THEIR SHARES, IF AT ALL.

Once our S-1 Registration Statement becomes effective, we plan to engage a market maker immediately following the close of the offering and apply to have the shares quoted on the OTC Electronic Bulletin Board. To be eligible for quotation, issuers must remain current in their filings with the SEC. In order for us to remain in compliance with our on-going reporting requirements, we will require additional capital and/or future revenues to cover the cost of these filings, which could comprise a substantial portion of our available cash resources. If we are unable to further capitalize the company or generate sufficient revenues to remain in compliance, it may be difficult for you to resell any shares you may purchase, if at all. There will be ongoing costs and expenses for SEC reporting, including the general booking and accounting costs for the preparation of the financial quarterlies (10Qs) and annual filings (10Ks), and auditor’s fees. Further, there will be processing costs in preparing and converting documents and disclosures through the EDGAR filing system, including certain cost for the new language XBRL that will be required as part of the EDGAR filing. As such, there will be cost relating to the filing of all and any reporting of material changes in the company through the 8-K’s, S-8 registrations, disclosure Forms 3, 4 and 5, and any other SEC filing requirement in the corporate governance of a reporting issuer to the SEC. We estimate that these costs could result up to $75,000 per year initial ongoing costs that would need to be included in the financing of the company.

INVESTING IN OUR COMPANY IS HIGHLY SPECULATIVE AND COULD RESULT IN THE ENTIRE LOSS OF YOUR INVESTMENT.

Purchasing the offered shares is highly speculative and involves significant risk. The offered shares should not be purchased by any person who cannot afford to lose their entire investment. Our business objectives are also speculative, and it is possible that we would be unable to accomplish them. Our shareholders may be unable to realize any return on their purchase of the offered shares and may lose their entire investment. For this reason, each prospective purchaser of the offered shares should read this prospectus and all of its exhibits carefully and consult with their attorney, business and/or investment advisor.

WE MAY ISSUE ADDITIONAL SHARES OF COMMON STOCK OR DERIVATIVE SECURITIES THAT WILL DILUTE THE PERCENTAGE OWNERSHIP INTEREST OF OUR EXISTING SHAREHOLDERS AND MAY DILUTE THE BOOK VALUE PER SHARE OF OUR COMMON STOCK AND ADVERSELY AFFECT THE TERMS ON WHICH THE COMPANY MAY OBTAIN ADDITIONAL CAPITAL.

Our authorized capital consists of 250,000,000 shares of common stock no par value and 5,000,000 shares of preferred stock, no par value. The Board of Directors has the authority, without action by or vote of our shareholders, to issue all or part of the authorized shares of common stock for any corporate purpose, including for the conversion or retirement of debt. We are likely to seek additional equity capital in the future as we develop our business and expand our operations. Any issuance of additional shares of common stock or derivative securities, such as convertible promissory notes, will dilute the percentage ownership interest of our shareholders and may dilute the book value per share of our common stock. Additionally, the exercise or conversion of derivative securities could adversely affect the terms on which the Company can obtain additional capital. Holders of derivative securities are most likely to voluntarily exercise or convert their derivative securities when the exercise or conversion price is less than the market price for the underlying common stock. Holders of derivative securities will have the opportunity to profit from any rise in the market value of our common stock or any increase in our net worth without assuming the risks of ownership of the underlying shares of our common stock. It is possible that, due to additional share issuances, you could lose a substantial amount, or all, of your investment.

9

Our Board of Directors may attempt to use non-cash consideration to satisfy obligations, which would likely consist of restricted shares of our common stock. Our Board of Directors may attempt to use non-cash consideration to acquire additional, technical or industry expertise, oil and gas working interest lease holdings, acquire helium gas distributions assets, and helium refining assets. Our Board of Directors has authority, without action or vote of the shareholders, to issue all or part of the authorized but unissued shares of common stock. In addition, if a trading market develops for our common stock, we may attempt to raise capital by selling shares of our common stock, possibly at a discount to market. These actions will result in dilution of the ownership interests of existing shareholders, may further dilute common stock book value, and that dilution may be material. Such issuances may also serve to enhance existing management’s ability to maintain control of the Company because the shares may be issued to parties or entities committed to supporting existing management.

WE HAVE NOT PAID AND DO NOT CURRENTLY PLAN TO PAY DIVIDENDS, AND YOU MUST LOOK TO PRICE APPRECIATION ALONE FOR ANY RETURN ON YOUR INVESTMENT.

Some investors favor companies that pay dividends, particularly in general downturns in the stock market. We have not declared or paid any cash dividends on our common stock. We currently intend to retain any future earnings for funding growth, and we do not currently anticipate paying cash dividends on our common stock in the foreseeable future. Because we may not pay dividends, your return on this investment likely depends on selling our stock at a profit.

SHARES OF OUR COMMON STOCK MAY BE "PENNY STOCKS”.

At all times when the current market price per share of our common stock is less than $5.00, our shares of common stock will be considered "penny stocks" as defined in the Securities Exchange Act of 1934, as amended. As a result, an investor may find it more difficult to dispose of or obtain accurate quotations as to the price of the shares of our common stock being issued under this prospectus. In addition, the penny stock rules adopted by the Securities and Exchange Commission under the Exchange Act would subject the sale of shares of our common stock to regulations which impose sales practice requirements on broker-dealers. For example, broker-dealers selling penny stocks must, prior to effecting the transaction, provide their customers with a document which discloses the risks of investing in penny stocks.

Furthermore, if the person purchasing penny stocks is someone other than an accredited investor, as defined in the Securities Act, or an established customer of the broker-dealer, the broker-dealer must also approve the potential customer's account by obtaining information concerning the customer's financial situation, investment experience and investment objectives. The broker-dealer must also make a determination whether the transaction is suitable for the customer and whether the customer has sufficient knowledge and experience in financial matters to be reasonably expected to be capable of evaluating the risk of transactions in penny stocks. Accordingly, the SEC's rules may limit the number of potential purchasers of shares of our common stock. Moreover, various state securities laws impose restrictions on transferring penny stocks, and, as a result, investors in our common stock may have their ability to sell their shares impaired.

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, deliver a standardized risk disclosure document prepared by the Commission, which (i) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (ii) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to violation to such duties or other requirements of Securities' laws; (iii) contains a brief, clear, narrative description of a dealer market, including "bid" and "ask" prices for penny stocks and significance of the spread between the "bid" and "ask" price; (iv) contains a toll-free telephone number for inquiries on disciplinary actions; (v) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (vi) contains such other information and is in such form (including language, type, size and format), as the Commission shall require by rule or regulation. The broker-dealer also must provide, prior to effecting any transaction in penny stock, the customer (i) with bid and offer quotations for the penny stock; (ii) the compensation of the broker-dealer and its salesperson in the transaction; (iii) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (iv) monthly account statements showing the market value of each penny stock held in the customer's account.

10

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitably statement. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for a stock that becomes subject to the penny stock rules. If any of the Company's securities become subject to the penny stock rules, holders of those securities may have difficulty selling those securities. Stockholders should be aware that, according to Securities and Exchange Commission Release No. 34-29093, dated April 17, 1991, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include:

(i) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer;

(ii) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases;

(iii) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons;

(iv) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and

(v) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses.

RESTRICTIONS ON THE USE OF RULE 144 BY FORMER SHELL COMPANIES MAY AFFECT SHAREHOLDERS ABILITY TO SELL THEIR SHARES PUBLICLY.

Although no public market exists for our stock, if in the future our shares were tradable in the public market our history as a shell company could impact a shareholders ability to use Rule 144. Historically, the SEC staff had taken the position that Rule 144 is not available for the resale of securities initially issued by companies that are, or previously were, blank check companies, like us. The SEC has codified and expanded this position by prohibiting the use of Rule 144 for resale of securities issued by any shell companies (other than business combination related shell companies) or any issuer that has been at any time previously a shell company. The SEC has provided an important exception to this prohibition if certain conditions are met. As a result, it is likely if we do not meet those conditions then, resale will not be available pursuant to Rule 144.

FINANCIAL INDUSTRY REGULATORY AUTHORITY ("FINRA") SALES PRACTICE REQUIREMENTS MAY ALSO LIMIT YOUR ABILITY TO BUY AND SELL OUR COMMON STOCK, WHICH COULD DEPRESS THE PRICE OF OUR SHARES.

FINRA rules require broker-dealers to have reasonable grounds for believing that an investment is suitable for a customer before recommending that investment to the customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status and investment objectives, among other things. Under interpretations of these rules, FINRA believes that there is a high probability such speculative low-priced securities will not be suitable for at least some customers. Thus, FINRA requirements may make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our shares, have an adverse effect on the market for our shares, and thereby depress our share price.

11

USE OF PROCEEDS

We will not receive any proceeds from the sale of common stock by the selling security holders. All of the net proceeds from the sale of our common stock will go to the selling security holders as described below in the sections entitled “Selling Security Holders” and “Plan of Distribution”. We have agreed to bear the expenses relating to the registration of the common stock for the selling security holders.

DETERMINATION OF OFFERING PRICE

The fixed offering price of $5.00 per share of common stock was not determined by the price of the common stock that was sold to our security holders pursuant to an exemption under Section 4(2) of the Securities Act of 1933 and Rule 506 of Regulation D promulgated under the Securities Act of 1933.

The offering price of the shares of our common stock does not necessarily bear any relationship to our book value, assets, past operating results, financial condition or any other established criteria of value. The facts considered in determining the offering price were our financial condition and prospects, our limited operating history and the general condition of the securities market. The offering price per share of our common stock is fixed until such time as a market for the common stock develops at which time the common stock will be sold at prevailing market prices.

Although our common stock is not listed on a public exchange, we will be filing to obtain a listing on the OTCBB concurrently with the filing of this prospectus. In order to be quoted on the OTCBB, a market maker must file an application on our behalf in order to make a market for our common stock. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, which operates the OTC Bulletin Board, nor can there be any assurance that such an application for quotation will be approved.

DILUTION

The shares offered for sale by the selling shareholders are already outstanding and, therefore, do not contribute to dilution.

SELLING SECURITY HOLDERS

The following table sets forth the names of the selling shareholders, the number of shares of common stock beneficially owned by the selling shareholders, the number of shares of common stock which may be offered for sale pursuant to this prospectus by such selling shareholders, the number of shares beneficially owned by such selling shareholders after the offering, and the percentage ownership after the offering. Because the selling shareholders may sell all or part of the shares of common stock offered hereby, the following table assumes that all shares offered under this prospectus have been sold by the selling shareholders. The offered shares of common stock may be offered from time to time by each of the selling shareholders named below. However the selling shareholders are under no obligation to sell all or any portion of the shares of common stock offered, neither are the selling shareholders obligated to sell such shares of common stock immediately under this prospectus.

|

Name Of Selling Stockholder

|

Number Of

Shares

Beneficially

Owned

Prior To

Offering

|

Percentage of

Outstanding

Shares

Owned

Prior To

Offering

|

Number Of

Shares

Offered

Pursuant

To This

Prospectus

|

Number Of

Shares

Beneficially

Owned After

The Offering (1)

|

Percentage of

Outstanding

Shares To Be

Owned After

The Offering (1)

|

|

Dragonfly Mediaworks, LLC

|

4,676,000

|

4.0633%

|

467,600

|

4,208,400

|

3.657%

|

|

Mesquite Energy Partners, LLC (1)

|

60,000,000

|

52.1385%

|

10,000,000

|

50,000,000

|

43.449%

|

|

Don Meyers (2)

|

265,514

|

0.2307%

|

26,551

|

238,963

|

0.208%

|

|

Smashville Records

|

1,324,000

|

1.1505%

|

1,324,000

|

0

|

0%

|

|

David Simonton

|

4,000

|

0.0035%

|

4,000

|

0

|

0%

|

|

Steve Simonton

|

4,000

|

0.0035%

|

4,000

|

0

|

0%

|

|

Windmills, LLC

|

50,000

|

0.0434%

|

50,000

|

0

|

0%

|

|

Ronald Monat

|

20,000

|

0.0174%

|

20,000

|

0

|

0%

|

|

(1)

|

Mesquite Energy Partners, LLC is owned by Ray Hobbs (Chief Executive Officer and Director), Gordon LeBlanc Jr. (Director), and Gordon E. Dudley (Secretary and Director).

|

|

(2)

|

Mr. Meyers is the Company’s accountant.

|

12

PLAN OF DISTRIBUTION

Following this registration statement becoming effective, the selling stockholders may from time to time, sell, transfer or otherwise dispose of any or all of their shares of common stock or interests in shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. Until such time as a market develops, the shares will be sold at a fixed price of $5.00 per share.

Our shares of common stock offered hereby by the selling stockholders may be sold from time to time by such stockholders, or by pledges, donees, transferees and other successors in interest thereto. These pledgees, donees, transferees and other successors in interest will be deemed “selling stockholders” for the purposes of this prospectus. Our shares of common stock may be sold:

|

|

·

|

on one or more exchanges or in the over-the-counter market (including the OTC Bulletin Board); or

|

|

|

·

|

in privately negotiated transactions.

|

The shares may also be sold in compliance with Rule 144 of the Securities Act, after the end of the applicable holding periods, as then in effect.

The selling stockholders may also sell their shares directly to market makers acting as principals or brokers or dealers, who may act as agents or acquire the common stock as principals.

Any broker or dealer participating in such transactions as agent may receive a commission from the selling stockholders, or if they act as agent for the purchaser of such common stock, from such purchaser. The selling stockholders will likely pay the usual and customary brokerage fees for such services. Brokers or dealers may agree with the selling stockholders to sell a specified number of shares at a stipulated price per share and, to the extent such broker or dealer is unable to do so acting as agent for the selling stockholders, to purchase, as principal, any unsold shares at the price required to fulfill the respective broker’s or dealer’s commitment to the selling stockholders. Brokers or dealers who acquire shares as principals may thereafter resell such shares from time to time in transactions in a market or on an exchange, in negotiated transactions or otherwise, at market prices prevailing at the time of sale or at negotiated prices, and in connection with such re-sales may pay or receive commissions to or from the purchasers of such shares. These transactions may involve cross and block transactions that may involve sales to and through other brokers or dealers. If applicable, the selling stockholders may distribute shares to one or more of their partners who are unaffiliated with us. Such partners may, in turn, distribute such shares as described above. We can provide no assurance that all or any of the common stock offered will be sold by the selling stockholders.

We are bearing all costs relating to the registration of the common stock. The selling stockholders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the common stock.

The selling stockholders must comply with the requirements of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended, in the offer and sale of the common stock. In particular, during such times as the selling stockholders may be deemed to be engaged in a distribution of the common stock, and therefore be considered to be an underwriter, they must comply with applicable law and we have informed them that they may not, among other things:

|

1.

|

engage in any stabilization activities in connection with the shares;

|

|

|

|

2.

|

effect any sale or distribution of the shares until after the prospectus shall have been appropriately amended or supplemented, if required, to describe the terms of the sale or distribution; and

|

|

|

3.

|

bid for or purchase any of the shares or rights to acquire the shares or attempt to induce any person to purchase any of the shares or rights to acquire the shares, other than as permitted under the Securities Exchange Act of 1934.

|

13

DESCRIPTION OF SECURITIES

The authorized capital stock of the Company consists of 250,000,000 shares of common stock, no par value and 5,000,000 shares of preferred stock, no par value. The following statements relating to the capital stock are summaries and do not purport to be complete. Reference is made to the more detailed provisions of, and such statements are qualified in their entirety by reference to, the Articles of Incorporation and the By-laws, copies of which are filed as exhibits to this registration statement.

Common Stock

Holders of shares of common stock are entitled to one vote for each share on all matters to be voted on by the stockholders. Holders of common stock do not have cumulative voting rights. Holders of common stock are entitled to share ratably in dividends, if any, as may be declared from time to time by the Board of Directors in its discretion from funds legally available therefor. In the event of a liquidation, dissolution or winding up of the Company, the holders of common stock are entitled to share pro rata all assets remaining after payment in full of all liabilities. All of the outstanding shares of common stock are, and the shares of common stock offered by the Company pursuant to this offering will be, when issued and delivered, fully paid and non-assessable.

Holders of common stock have no pre-emptive rights to purchase the Company's common stock. There are no conversion or redemption rights or sinking fund provisions with respect to the common stock.

Preferred Stock

The Company's Articles of Incorporation authorizes the issuance of 5,000,000 shares of preferred stock, no par value, of which no shares have been issued. The Board of Directors is authorized to provide for the issuance of shares of preferred stock in series and, by filing a certificate pursuant to the applicable law of Colorado, to establish from time to time the number of shares to be included in each such series, and to fix the designation, powers, preferences and rights of the shares of each such series and the qualifications, limitations or restrictions thereof without any further vote or action by the shareholder. Any shares of preferred stock so issued would have priority over the common stock with respect to dividend or liquidation rights. Any future issuance of preferred stock may have the effect of delaying, deferring or preventing a change in control of the Company without further action by the shareholder and may adversely affect the voting and other rights of the holders of common stock. At present, the Company has no plans to issue any preferred stock nor adopt any series, preferences or other classification of preferred stock.

The issuance of shares of preferred stock, or the issuance of rights to purchase such shares, could be used to discourage an unsolicited acquisition proposal. For instance, the issuance of a series of preferred stock might impede a business combination by including class voting rights that would enable the holder to block such a transaction, or facilitate a business combination by including voting rights that would provide a required percentage vote of the stockholders. In addition, under certain circumstances, the issuance of preferred stock could adversely affect the voting power of the holders of the common stock. Although the Board of Directors is required to make any determination to issue such stock based on its judgment as to the best interests of the stockholders of the Company, the Board of Directors could act in a manner that would discourage an acquisition attempt or other transaction that some, or a majority, of the stockholders might believe to be in their best interests or in which stockholders might receive a premium for their stock over the then market price of such stock. The Board of Directors does not at present intend to seek stockholder approval prior to any issuance of currently authorized stock, unless otherwise required by law or stock exchange rules. The Company has no present plans to issue any preferred stock.

14

Dividends

The Company does not expect to pay dividends. Dividends, if any, will be contingent upon the Company's revenues and earnings, if any, capital requirements and financial conditions. The payment of dividends, if any, will be within the discretion of the Company's Board of Directors. The Company presently intends to retain all earnings, if any, for use in its business operations and accordingly, the Board of Directors does not anticipate declaring any dividends in the foreseeable future.

Transfer Agent and Registrar

The Secretary of the Company as authorized by Board resolution will carry out the transfer and issuance of the Company’s shares and may utilize the services of a professional stock transfer agent to assist in effectuating such transfer and issuance. The Secretary will issue the certificates for shares purchased and will transfer the shares of the Company and maintain a record of the shareholders.

The name and address of the Company’s Transfer Agent:

First American Stock Transfer, Inc.

4747 N. 7th Street, Suite 170

Phoenix, Arizona 85014

Phone: 602 485 1346

INTERESTS OF NAMED EXPERTS AND COUNSEL

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

The McGeary Law Firm, P.C. located at 1600 Airport Fwy., Suite 300, Bedford, Texas 76022 pass on the validity of the common stock being offered pursuant to this registration statement.

The financial statements of United Helium Incorporated., a Colorado corporation have been included in this Prospectus and elsewhere in the registration statement in reliance on the report of Shelley International CPA, an independent registered public accounting firm, given on the authority of that firm as experts in auditing and accounting, located at 1012 S Stapley Drive #114, Mesa, Arizona 85204.

15

INFORMATION WITH RESPECT TO UNITED HELIUM, INCORPORATED

DESCRIPTION OF BUSINESS

Cayenne Entertainment, Inc. (Cayenne or the Company), was organized in the state of Colorado on April 9, 1998 under the name of Boeing Run, Incorporated to engage in any lawful corporate undertaking. On March 28, 2001, the Company merged with Cayenne Entertainment, Inc. organized in the state of Nevada on November 13, 2000 and changed its name to Cayenne Entertainment, Inc. with the Colorado company being the legal survivor.

On April 6, 2001 four private Arizona entertainment corporations were merged into the Company: Cayenne Records, Inc. organized on January 20, 1999, Sunbird Records, Inc. organized on June 7, 2000, Butter Dream Music, Inc. organized on December 21, 2000 and Red Truck Productions, Inc. organized on December 12, 2000.

As a result of events beginning September 11, 2001 the company discontinued operations and remained dormant. Because the Company failed to make the required filings with the SEC after its form 10-QSB for the period ended January 31, 2001 the SEC, on October 31, 2012, ordered that the Company bring its filings current or withdraw its registration. Accordingly, with the Company’s offer and consent, on November 28, 2012 its registration with the SEC was revoked. On June 6, 2013 the company changed its name to United Helium, Incorporated from Cayenne Entertainment, Inc.

The Company is engaged in the business of addressing the supply of helium to industry, government, medical and the research communities. The Company’s helium and other reservoir gases, are contained in its “working interests” oil and gas lease holdings. Recoverable helium reserves contained in geologic structures, will be identified by drilling and third party engineering analysis. The field will be developed through production well drilling and completion, and infrastructure gathering system construction. United Helium will utilize its unique mobile processing equipment to separate and refine helium at the wellhead or from a field gathering system, and transport to its customers. Owners of oil and gas mineral rights have collectively contributed their reserves by assigning “working interests” to the Company which could not previously be economically produced and/or transported to commercial helium processing plants, . This combined effort and unique approach will enable United Helium to unlock the potential that many in the industry have known existed, but previously were unable to successfully develop. The Company’s technology and business methods will assure a future supply of this rare and important resource. Although not the primary focus of the Company, to the extent that hydrocarbons, including oil, are discovered on the leasehold properties, the Company intends to take advantage of those opportunities should they arise.

We are committed to responsible stewardship in our operations, both above ground as well as below. In furtherance of this commitment, the Company intends, where practical to utilize indigenous sources, including natural gas and solar energy to reduce the energy costs of operations. The development and processing of helium makes us part of the community in many rural western locations. Being part of the community and making a difference is a priority for us, and a commitment we readily accept.

The helium reserves controlled by United Helium, or which may be acquired, are in mineral leases issued by state, the Bureau of Land Management, or private land owners. Mineral right leases (oil & gas) are obtained from the owner(s) who are compensated with a royalty interest and a per acre fee for the rights to extract oil and/or gases. Drilling permit applications are submitted to the governmental authority having jurisdiction over the leasehold and accepted applications will be issued a drilling permit. United Helium will operate each well during the drilling, completion and production phases.

With respect to Mineral Rights Leases on federal lands, helium by statute, is reserved to the federal government which may enter into agreements with private parties, such as United Helium, for the recovery and disposal of helium on federal lands. United Helium will apply for the right to extract and sell the helium.

United Helium will implement a compact mobile cryogenic plant, which produces commercial grade quality helium at the helium field. This mobile cryogenic plant eliminates the expensive two step processing to commercial grade helium, which requires gas transport to one of the few domestic cryogenic helium plants. Most cryogenic plants are generally large scale and are supplied with gas transported by pipeline from large natural gas fields or obtained from the Federal Helium Reserve.

16

The Company’s mission is to profitable produce helium, oil, and natural gas from its oil and gas leasehold holdings which currently consists of approximately 35,742 acres in the Holbrook Basin of Apache County, Arizona. United Helium obtained working interest assignments from Mesquite Energy Partners (MEP). The leaseholds are on State of Arizona and private land, which are grouped into two geographic areas, Holbrook North and Holbrook Central. The Holbrook North lease assignments from MEP were completed in July 2013. Negotiations for the Holbrook Central lease between MEP and HNZ Potash, LLC were completed on September 4, 2013, and the assignment to United Helium was completed on Sept 24, 2013. The Company’s working interest assignments have been recorded with the Apache County Recorder.

United Helium holds an 80% working interest (64.60% Net Revenue Interest “NRI” based upon BLM Crude Helium price index at the well head) in the Holbrook North leases which encompasses 6,489 acres State of Arizona leases and includes acreage that has contained some of the richest helium fields discovered in the world (Rauzi, S.L. and Fellows L.D.; “Arizona Has Helium”, Arizona Geology, 2003, Vol. 33. No.4, Published by the Arizona, Geological Survey). United Helium holds an 87.5% working interest (70% Net Revenue Interest “NRI” based upon BLM Crude Helium price index at the well head) in the Holbrook Central private land leases which encompasses 26,646 acres. United helium holds an 87.5% working interest (76.6% Net Revenue Interest “NRI” based upon BLM Crude Helium price index at the wellhead) in the Holbrook Central State of Arizona leases which encompasses 2,607 acres.

Where we find helium

The exploration, development, operations, and production of helium gas from the ground is identical to the production of hydrocarbon gas. Helium is typically derived from the radioactive decay of uranium and thorium deep within the earth. When these radioactive materials decay, alpha particles are generated which are the nucleus of a helium atom. When Alpha particles are attached electrons, a stable and inert (i.e., non-radioactive) helium atom is created. The helium atom is small and will migrate up and through the layers of sedimentary rock where hydrocarbons are often times (though not always) generated. Where reservoir quality rock is encountered along with a suitable trap, helium gas will accumulate along with any other gases and liquids that find their way to the same reservoir through migration. Virtually all of the world’s helium production has been derived from conventional natural gas operations (e.g. the Hugoton Basin gas field (which spans portions of Kansas, Oklahoma and Texas) has been the largest source of helium to the world’s supply since its discovery in the early 1920s).

Helium in natural gas is generally considered to be of commercial value if its concentration is more than 0.3 percent. In the Holbrook Basin and Four Corners areas, helium concentrations range from trace amounts to as much as 10 percent. Both areas have high potential for discovery and production of helium. Helium has been found in the Holbrook Basin and Four-Corners with large concentrations of carbon dioxide, nitrogen gas, and natural gas.

17

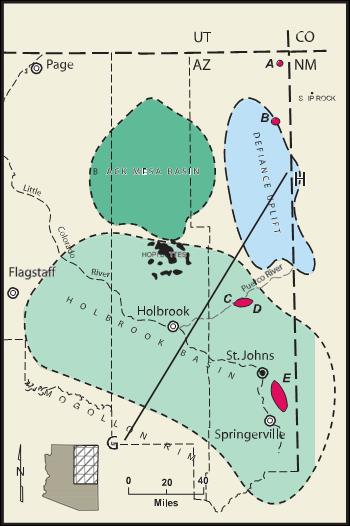

Picture 1: The Company’s working interest lease holdings are shown in blue in the Holbrook Basin of Arizona.

18

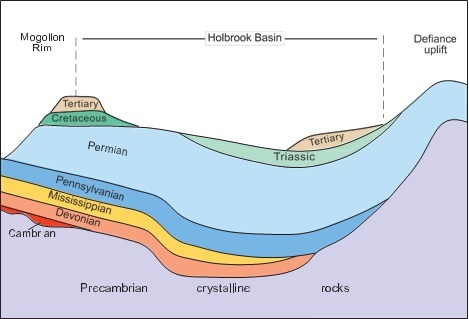

Figure 1: Northern Arizona showing location of major geologic features and fields where helium has been produced or where significant concentrations of helium have been encountered in wells. (A) Tohache Wash field, (B) Dineh-bi-Keyah field, (C) Pinta Dome field, (D) Navajo Springs field, and (E) St. Johns-Springerville area. During the 1960s and 1970s, some of the richest helium- bearing gas in the world was produced from wells in the Holbrook Basin in northeastern Arizona See Figure 2 for cross section G-H. The distance from G to H is about 150 miles - Rauzi, S.L. and Fellows L.D.; “Arizona Has Helium”, Arizona Geology, 2003, Vol. 33. No.4, Published by the Arizona, Geological Survey.

19