Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Sonus, Inc. | a13-26245_28k.htm |

| EX-99.2 - EX-99.2 - Sonus, Inc. | a13-26245_2ex99d2.htm |

| EX-99.1 - EX-99.1 - Sonus, Inc. | a13-26245_2ex99d1.htm |

Exhibit 99.3

Leveraging Synergies across Diameter and SIP Signaling in 4G/LTE Networks

Today, the mobile industry is in the midst of a fundamental transformation. Circuit-switched TDM technology, which has been the mainstay of Analog/2G/3G networks, is evolving to or being replaced by all-IP networks with the advent of 4G/LTE. As part of the network evolution to IP Multimedia Subsystem (IMS) architectural framework for 4G/LTE, SS7 signaling, which has been the workhorse of TDM-based mobile and fixed networks for a very long time, is being replaced by newer and more efficient IP-based signaling protocols - SIP and Diameter. These protocols can handle the deluge of signaling traffic that is expected from smartphones, tablets and other mobile devices.

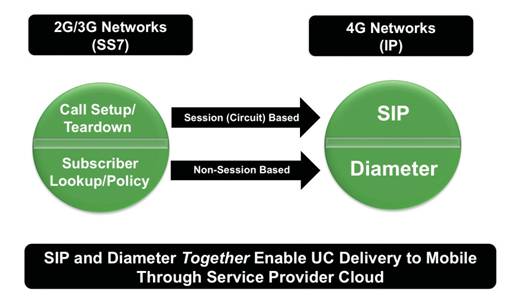

Figure 1: Signaling evolution from 2G/3G to 4G/LTE

SIP and Diameter complement each other, and work in tandem to provide the complete signaling needs of 4G/LTE networks. SIP handles call control for establishing voice, video, messaging and IM sessions in 4G/LTE networks. For example, a Voice Over LTE (VoLTE) session is established using SIP signaling. Diameter, on the other hand, is responsible for data signaling. Diameter is used for signaling between policy servers, subscriber databases and charging systems to provide AAA (Authentication, Authorization and Accounting) functions in 4G networks.

Both Diameter and SIP are essential to the growing importance of the Mobile Internet, which is being driven by the BYOD trend. In fact, 51% of the total time spent online by U.S. users is via smartphones and tablets. By integrating mobile devices running across mobile networks to enable real-time communications for voice, video and collaboration, mobile operators can offer ubiquitous Unified Communications (UC) service to its subscriber base. Mobile UC utilizes SIP and Diameter signaling to authenticate subscribers, apply policies and establish/teardown sessions.

Why Diameter is Important

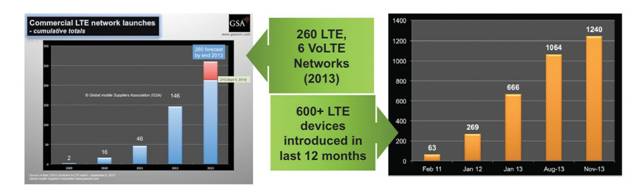

The growth potential of SIP signaling traffic is well understood and documented. This growth is the result of the widespread adoption of VoIP, UC and other IP-based real-time communications. However, what is less understood is the projected growth of Diameter signaling traffic. This growth is being driven primarily by the deployment of LTE networks worldwide. According to the GSA (Global mobile Suppliers Association), there will be 260 commercial LTE networks in 93 countries by the end of 2013. GSA reports that 499 mobile operators are investing in LTE networks in 143 countries today. In every single LTE/IMS network, Diameter traffic flows through 75 different arteries.

Key Takeaways

· Growth expected in Diameter traffic is 50% CAGR over the next several years

· Mobile roaming revenues are anticipated to exceed US$80 billion by 2017

· SIP and SS7 expertise are important - Inter Working Function to remain important for the next several years

· Integrated SBC and Diameter Signaling helps drives differentiation at the edge

![]()

Figure 2: © GSA, www.gsacom.com

As more mobile operators begin to deploy 4G/LTE networks to meet the mobile broadband demand of smartphones and tablets, the number of Diameter signaling messages in 4G/LTE networks is expected to grow. Smartphones, for example, generate several Diameter signaling messages in the core network each time they access an application, download data, roam on a different network, and even when they’re simply turned on and off. Multiply dozens of Diameter signaling messages by millions of smartphones, and you suddenly have a large amount of Diameter signaling traffic in the network.

Some have likened the complexity of Diameter signaling to the problems originally presented by Signaling System 7 (SS7) in the first wave of mobile networks. Others have found a more recent parallel in the increase of SIP traffic that appeared with the popularization of VoIP. And just as the need to handle large amounts of SIP traffic led to the development of the Session Border Controller (SBC), the anticipated increase in Diameter signaling traffic has resulted in the introduction of a new product category, the Diameter Signaling Controller (DSC) and it subsets, the Diameter Routing Agent (DRA) and the Diameter Edge Agent (DEA).

Synergies between SIP and Diameter

In many ways, a DSC handles Diameter the way that an SBC handles SIP: by routing messages more efficiently, preventing network overloads, providing security, and interworking different variations of Diameter signaling between devices. Instead of a complex mesh of Diameter signaling messages flowing between dozens of IMS/4G network elements, a DSC acts as a central mediator that streamlines the flow of Diameter signaling messages in the network. Beyond reducing the amount of Diameter signaling traffic in the core network, DSCs (like SBCs) provide a variety of other benefits to the network including:

· Provide load balancing of Diameter signaling traffic to prevent network element overload or service interruptions

· Interwork Diameter and MAP protocols for LTE interoperability with 2G/3G networks

· Further secure the network border through IPsec encryption, DoS protection, network topology hiding, etc.

· Enforce Diameter interoperability through manipulation of Attribute Value Pairs (AVPs)

· Simplify the provisioning of Diameter elements

· Enforce business logic through message manipulation and intelligent routing

Figure 3: Role of SBC and DSC in 4G/LTE Networks

SS7 Heritage Matters

Signaling in pre-4G networks (2G/3G) is based on SS7. Commercial 2G and 3G networks worldwide make extensive use of SS7 signaling both within their own network and between networks. 2G/3G (especially 3G) networks will continue to exist and be used in conjunction with 4G/LTE networks until all the networks fully migrate to 4G/LTE in the long term. In fact, 2G will represent half of all mobile connections through 2017 (source: https://gsmaintelligence.com/analysis/2012/11/half-of-all-mobile-connections-running-on-3g-4g- networks-by-2017/359/). According to a press release issued by Juniper Research on October 3, 2013, mobile roaming revenues are expected to be over US$80 billion by 2017.

Interworking between SS7 and Diameter will be very important to the smooth operation of these dual technology networks, and to ensure a high quality of experience for the subscribers. Reliability and security of the signaling networks are critical since any failure can disrupt roaming operations, leading to revenue losses. Support for roaming between 3G and 4G/LTE networks will be required for the foreseeable future.

SIP Legacy Matters

Mobile operators will start to deploy VoIP and other SIP based communications at scale for the first time in their 4G/LTE networks. Meanwhile, the wireline community has been deploying and running SIP based VoIP networks for a decade or more. The Enterprise IP-PBX was launched more than 10 years ago, and service providers such as SoftBank launched VoIP service 10 years ago (in 2002 for SoftBank). There are many lessons to be learned from wireline networks when deploying real time SIP based communication in mobile networks. Some of them include: the need and ability to optimize the network to maximize quality of service (QoS), the need to provide robust security at scale for SIP communications, and support for intelligent policy and routing mechanism that will enforce routing policies on a per-session basis. Experience in deploying and optimizing large scale SIP-based VoIP networks is particularly important since 4G/LTE networks are expected to have a large volume of active subscribers. Vendors, such as Sonus, that have deployed and optimized SIP-based VoIP in some of the largest networks for over a decade, have a significant advantage in this regard.

Simplifying 4G/LTE Signaling at The Edge

Figure 4: Exploiting SIP and Diameter synergies at the Edge

Both the Diameter Edge Agent (DEA) and Session Border Controller (SBC) are the first point of entry for inbound interconnect traffic, and the exit point for outbound interconnect traffic. There are a set of functions that are common to both elements, such as security, interworking, policy based routing, and network management system. An integrated SBC/DEA solution makes it possible to realize operational efficiencies and performance improvements by making common some functions.

The concept of NFV (Network Function Virtualization) is gaining interest from IMS and 4G/LTE core networks, according to some industry analysts. As these networks evolve to a software-based NFV (Network Function Virtualization) architecture, the integrated SBC/DEA approach will become even more appealing. In such an integrated NFV architecture, it becomes possible to introduce new functionality that is common to both SBC and DEA, such as a robust policy engine that supports both SIP and Diameter, in a short time frame.

In summary, an integrated approach to SIP and Diameter signaling at the network edge is one that offers many advantages over a separate multi-box approach, both in the short term, and in the long term as networks evolve to a virtualized software environment.

Steps To Take

· Mobile operators should consider an integrated signaling solution at the network edge that supports both SIP and Diameter.

· Mobile operators should deploy an interworking function that supports 4G to 3G/LTE roaming (Diameter and SS7 roaming).

· When deploying a robust mobile UC solution, mobile operators must consider implementing DRA and SBC in their network.

· Fixed and Interconnect Service Providers who support IMS and LTE traffic should consider deploying an edge SBC/DEA solution.

Important Information Regarding Forward-Looking Statements

The information in this release contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, which are subject to a number of risks and uncertainties. All statements other than statements of historical facts contained in this report are forward-looking statements. Without limiting the foregoing, the words “anticipates”, “believes”, “could”, “estimates”, “expects”, “intends”, “may”, “plans”, “seeks”, “projects” and other similar language, whether in the negative or affirmative, are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Examples of forward-looking statements include, but are not limited to, statements regarding the following: the parties’ ability to close the transaction and the expected closing date of the transaction; the anticipated benefits and synergies of the transaction; the anticipated future combined operations, products and services; the impact of the transaction on Sonus’ financial results, business performance and product offerings; and projected growth in the DSC market.

Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including, but not limited to, uncertainties as to the timing and results of the PT stockholder vote; the possibility that various closing conditions for the transaction may not be satisfied or waived; the effects of disruption from the transaction, making it more difficult to maintain relationships with employees, customers, business partners or governmental entities; the success of the companies in implementing their integration strategies; the actual benefits realized from this transaction; disruptions to our business and financial conditions as a result of this transaction or other investments or acquisitions; the timing of our recognition of revenues; our ability to recruit and retain key personnel; difficulties supporting our new strategic focus on channel sales; difficulties retaining and expanding our customer base; difficulties leveraging market opportunities; restructuring activities; litigation; actions taken by significant stockholders; difficulties providing solutions that meet the needs of customers; market acceptance of our products and services; rapid technological and market change; our ability to protect our intellectual property rights; our ability to maintain partner, reseller, distribution and vendor support and supply relationships; higher risks in international operations and markets; the impact of increased competition; currency fluctuations; changes in the market price of our common stock; and/or failure or circumvention of our controls and procedures. Important factors that could cause actual results to differ materially from those in these forward-looking statements are discussed in Part I, Item 2 “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, Part I, Item 3 “Quantitative and Qualitative Disclosures About Market Risk” and Part II, Item 1A “Risk Factors” in the Company’s most recent Quarterly Report on Form 10-Q.

We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. We therefore caution you against relying on any of these forward-looking statements, which speak only as of the date made. Sonus is a registered trademark of Sonus Networks, Inc. All other company and product names may be trademarks of the respective companies with which they are associated.

Additional Information About the Merger and Where to Find It:

In connection with the proposed merger, PT plans to file a proxy statement with the Securities and Exchange Commission (the “SEC”). Additionally, PT and Sonus will file other relevant materials in connection with the proposed acquisition of PT by Sonus pursuant to the terms of the Merger Agreement by and among Sonus, PT, and Purple Acquisition Subsidiary, Inc. The definitive proxy statement will be sent to stockholders of PT and will contain important information about PT, Sonus, the proposed merger and related matters. Investors and security holders of PT are urged to read the definitive proxy statement and other relevant materials carefully when they become available before making any voting or investment decision with respect to the proposed merger because they will contain important information about the merger and the parties to the merger.

Sonus and PT, and their respective directors, executive officers, and other members of their management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of PT stockholders in connection with the transactions contemplated by the merger agreement. Information regarding Sonus’ directors and executive officers is contained in Sonus’ Annual Report on Form 10-K for the year ended December 31, 2012 and its proxy statement dated April 25, 2013, and other relevant materials filed with the SEC when they become available. Investors and security holders may obtain detailed information regarding the names, affiliations and interests of certain of PT’s executive officers and directors in the solicitation by reading PT’s most recent Annual Report on Form 10-K for the year ended December 31,2012, its proxy statement dated April 22, 2013, and other relevant materials filed with the SEC when they become available. Information concerning the interests of PT’s participants in the solicitation, which may, in some cases, be different from those of PT’s stockholders generally, will be set forth in the proxy statement relating to the merger when it becomes available. As of December 9, 2013, PT’s directors and executive officers beneficially owned 1,897,488 shares (of which 909,584 shares are issuable upon exercise of options currently exercisable), or 15.8%, of PT’s common stock.

The materials to be filed by Sonus and PT with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, security holders will be able to obtain free copies of the proxy statement from PT when filed by contacting PT Investor Relations by e-mail at finance@pt.com or by telephone at 1-585-784-7276.

|

Sonus Networks North American Headquarters 4 Technology Park Drive Westford, MA 01886 U.S.A. Tel: +1-855-GO-SONUS |

|

Sonus Networks APAC Headquarters 1 Fullerton Road #02-01 One Fullerton Singapore 049213 Singapore Tel: +65-68325589 |

|

Sonus Networks Limited EMEA Headquarters Edison House Edison Road Dorcan, Swindon Wiltshire SN3 5JX Tel: +44-0-1793-601-400 |

|

To learn more, call Sonus at 855-GO-SONUS or visit us online at www.sonus.net |

|

|

The content in this document is for informational purposes only and is subject to change by Sonus Networks without notice. While reasonable efforts have been made in the preparation of this publication to assure its accuracy, Sonus Networks assumes no liability resulting from technical or editorial errors or omissions, or for any damages resulting from the use of this information. Unless specifically included in a written agreement with Sonus Networks, Sonus Networks has no obligation to develop or deliver any future release or upgrade or any feature, enhancement or function.

Copyright © 2013 Sonus Networks, Inc. All rights reserved. Sonus is a registered trademark of Sonus Networks, Inc. All other trademarks, service marks, registered trademarks or registered service marks may be the property of their respective owners.