Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Summit Materials, LLC | d638509d8k.htm |

| EX-12.1 - EX-12.1 - Summit Materials, LLC | d638509dex121.htm |

Exhibit 99.1

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This current report on Form 8-K (this “Report”) contains “forward-looking statements” within the meaning of the federal securities laws, which involve risks and uncertainties. Forward-looking statements include all statements that do not relate solely to historical or current facts, and you can identify forward-looking statements because they contain words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “intends,” “plans,” “estimates,” “projects” or “anticipates” or similar expressions that concern our strategy, plans or intentions. All statements made relating to our estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results are forward-looking statements. These forward-looking statements are subject to risks and uncertainties that may change at any time, and, therefore, our actual results, performance or achievements may differ materially from those expected. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, it is very difficult to predict the affect of known factors, and, of course, it is impossible to anticipate all factors that could affect our actual results.

Some of the important factors that could cause actual results to differ materially from our expectations are disclosed under “Risk Factors” and elsewhere in this Report. All subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements.

In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us or any other person that the results or conditions described in such statements or our objectives and plans will be realized. Important factors could affect our results and could cause results to differ materially from those expressed in our forward-looking statements, including but not limited to the factors discussed in the section entitled “Risk Factors” in our prospectus dated June 10, 2013 (the “Prospectus”), filed with the Securities and Exchange Commission (the “SEC”) in accordance with Rule 424(b) of the Securities Act of 1933, as amended, on June 10, 2013, any factors discussed in the section entitled “Risk Factors” of this report, and the following:

| • | our substantial current level of indebtedness; |

| • | our dependence on the construction industry and the strength of the local economies in which we operate; |

| • | our ability to acquire other businesses in our industry, successfully integrate them with our existing operations and retain key employees of such acquired businesses; |

| • | the cyclical nature of our business; |

| • | declines in public sector construction and reductions in governmental funding, including the funding of transportation authorities and other state agencies; |

| • | conditions in the credit markets; |

| • | our ability to accurately estimate the overall risks, requirements or costs when we bid on or negotiate a contract that is ultimately awarded to us; |

| • | risks related to weather and seasonality; |

| • | competition within our local markets; |

| • | our dependence on securing and permitting aggregate reserves in strategically located areas; |

| • | risks associated with our capital-intensive business; |

| • | any failure to meet schedule or performance requirements of our contracts; |

| • | changes in environmental, health, safety and climate change laws or governmental requirements or policies concerning zoning and land use; |

| • | our dependence on senior management and inability to attract and retain qualified management personnel; |

| • | special hazards related to our operations that may cause personal injury or property damage not covered by insurance; |

| • | material costs and losses as a result of claims that our products do not meet regulatory requirements or contractual specifications; |

| • | cancellation of significant contracts or our disqualification from bidding for new contracts; |

| • | our reliance on exemptions from certain disclosure requirements due to our status as an “emerging growth company”; |

| • | interruptions in our information technology systems and infrastructure; and |

| • | other factors as described in the Prospectus. |

1

All subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements.

Any forward-looking statement that we make speaks only as of the date of this report. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

CERTAIN DEFINITIONS

As used in this Report, unless otherwise noted or the context otherwise requires,

| • | “we,” “our,” “us,” and “the Company” refer to Summit Materials, LLC and its subsidiaries as a combined entity, including Summit Materials Finance Corp., the co-issuer of the notes; |

| • | “Parent” refers only to Summit Materials Holdings L.P., our indirect parent entity; |

| • | “Summit Materials” refers only to Summit Materials, LLC and not its subsidiaries; |

| • | “Finance Corp.” refers only to Summit Materials Finance Corp., a wholly-owned subsidiary of Summit Materials; |

| • | “the Issuers” refers to Summit Materials and Finance Corp. as co-issuers of the notes but not to any of their subsidiaries; |

| • | “Harper Contracting” refers collectively to substantially all the assets of Harper Contracting, Inc., Harper Sand and Gravel, Inc., Harper Excavating, Inc., Harper Ready Mix Company, Inc. and Harper Investments, Inc.; |

| • | “Norris” refers to Norris Quarries, LLC; |

| • | “Kay & Kay” refers to certain assets of Kay & Kay Contracting, LLC; |

| • | “Sandco” refers to certain assets of Sandco Inc.; |

| • | “Lafarge” refers to Lafarge North America, Inc.; and |

| • | “Westroc” refers to Westroc, LLC. |

| • | “Blackstone” refers to certain investment funds affiliated with Blackstone Capital Partners V L.P.; |

| • | “Sponsors” refers to Blackstone and certain investment funds affiliated with Silverhawk Summit, L.P.; |

2

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL INFORMATION

The following unaudited pro forma condensed consolidated financial information has been prepared to give effect to our acquisitions of Norris, Kay & Kay and Sandco, which were completed on February 29, 2012, October 5, 2012 and November 30, 2012, respectively, as if they occurred on January 1, 2012. The acquisitions of Norris, Kay & Kay and Sandco are considered business combinations in accordance with Financial Accounting Standards Board Accounting Standards Codification 805, “Business Combinations.”

The following unaudited pro forma condensed consolidated financial information has been derived from our audited consolidated financial statements for the year ended December 29, 2012 included elsewhere in this Report along with the pre-acquisition financial information for Norris, Kay & Kay and Sandco. The historical consolidated financial information has been adjusted in the accompanying unaudited pro forma condensed consolidated statements of operations to give effect to pro forma events that are (i) directly attributable to the transaction, (ii) factually supportable, and (iii) expected to have a continuing effect on us. The unaudited pro forma condensed consolidated statements of operations exclude $1.7 million in non-recurring charges directly attributable to the Norris, Kay & Kay and Sandco acquisitions, including transaction-related costs such as financial advisory, accounting and legal fees.

The unaudited pro forma condensed consolidated financial information is presented for illustrative and informative purposes only and is not intended to represent or be indicative of what our results of operations would have been had the acquisitions of Norris, Kay & Kay and Sandco actually occurred on January 1, 2012. The unaudited pro forma condensed consolidated financial information should be read in conjunction with the information contained in “Selected Historical Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations of Summit Materials, LLC” and the audited consolidated financial statements of Summit Materials included elsewhere in this Report. The unaudited pro forma condensed consolidated financial information should not be considered representative of our future results of operations or financial position.

Unaudited Pro Forma Condensed Consolidated Statements of Operations

for the year ended December 29, 2012

| Summit Materials, LLC | ||||||||||||||||

| (in thousands) | Summit Materials, LLC |

Pre- acquisition results of Norris, Kay & Kay and Sandco 1/1/2012 – 11/30/2012 |

Pro Forma adjustments for the acquisition of Norris, Kay & Kay and Sandco |

Pro Forma Combined |

||||||||||||

| Revenue |

$ | 926,254 | $ | 13,895 | $ | — | $ | 940,149 | ||||||||

| Cost of revenue (exclusive of items shown separately below) |

713,346 | 11,502 | — | 724,848 | ||||||||||||

| General and administrative expenses |

127,215 | 1,000 | — | 128,215 | ||||||||||||

| Depreciation, depletion, amortization and accretion |

68,290 | 1,008 | 81 | (a) | 69,379 | |||||||||||

| Transaction costs |

1,988 | — | (1,742 | ) (b) | 246 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income |

15,415 | 385 | 1,661 | 17,461 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other (income) expense, net |

(1,182 | ) | 15 | — | (1,167 | ) | ||||||||||

| Loss on debt refinancing |

9,469 | — | — | 9,469 | ||||||||||||

| Interest expense |

58,079 | 2 | 200 | (c) | 58,281 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (Loss) income from continuing operations before income taxes |

$ | (50,951 | ) | $ | 368 | $ | 1,461 | $ | (49,122 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

See accompanying notes to unaudited pro forma condensed consolidated financial information, which are an integral part of this information.

3

Notes to Unaudited Pro Forma Condensed Consolidated Financial information

| (a) | The depreciation expense adjustment relates to the step up in fair value of fixed assets acquired in the Norris, Kay & Kay and Sandco acquisitions. A summary of the effects of the adjustment to depreciation expense for the year ended December 29, 2012 is as follows (dollars in thousands): |

| Estimated depreciation expense |

$ | 330 | ||

| Elimination of historical depreciation expense |

(249 | ) | ||

|

|

|

|||

| Depreciation expense adjustment |

$ | 81 | ||

|

|

|

| (b) | This adjustment is to eliminate historical transaction costs incurred in connection with the Norris acquisition, principally legal and financial advisory fees due to the non-recurring nature of these expenses. There was no income tax benefit recorded on the transaction costs in the historical consolidated results of operations, accordingly, no pro forma tax adjustment has been recorded for this adjustment. The transaction costs removed for the year ended December 29, 2012 is $1.7 million. |

| (c) | A summary of the effects of the adjustment to interest expense for the year ended December 29, 2012 is as follows (dollars in thousands): |

| Estimated interest expense on debt from Norris acquisition(i) |

$ | 196 | ||

| Elimination of historical interest expense(ii) |

(2 | ) | ||

| Estimated interest associated with acquisition liabilities(iii) |

6 | |||

|

|

|

|||

| Interest expense adjustment |

$ | 200 | ||

|

|

|

| (i) | This adjustment is to reflect the estimated incremental interest expense based on the average interest rate between January 1, 2012 and February 29, 2012, the acquisition date, of approximately 4.75% on the debt incurred for the Norris acquisition as if incurred on January 1, 2012. |

| (ii) | This adjustment is to eliminate the interest expense in the historical statements of operations. |

| (iii) | We recorded certain acquisition-related liabilities at present value; accordingly, we began to record interest expense on the accretion of those liabilities. This adjustment is to record additional interest expense for the pre-acquisition period, assuming we had acquired Norris and recorded the acquisition-related liabilities at present value on January 1, 2012. |

4

SELECTED HISTORICAL CONSOLIDATED FINANCIAL DATA

The following table sets forth, for the periods and as of the dates indicated, our selected predecessor and successor consolidated financial data. For financial statement presentation purposes, Hamm, Inc., which had a fiscal year end of March 31 prior to its acquisition by Summit Materials on August 26, 2009, has been identified as the predecessor. The selected predecessor statements of operations data for the period from April 1, 2009 to August 25, 2009 and for the year ended March 31, 2009 are derived from the audited consolidated financial statements not included in this Report. Summit Materials is the successor company. The selected successor statements of operations data for the three years ended December 29, 2012, December 31, 2011 and December 31, 2010 and the selected balance sheet data as of December 29, 2012 and December 31, 2011 are derived from our audited consolidated financial statements included elsewhere in this Report. The selected successor statements of operations data for the period from August 26, 2009 to December 31, 2009 and the selected balance sheet data as of December 31, 2010 and December 31, 2009 are derived from audited consolidated financial statements not included in this Report. The predecessor selected balance sheet data as of March 31, 2009 is derived from Hamm’s audited financial statements not included in this report. In 2011, Summit Materials adopted a “4-4-5” fiscal calendar in place of the calendar year it previously used. Under the 4-4-5 fiscal period, each year is divided into four quarters and each quarter consists of two four week “months” and one five week “month.” Historical results are not indicative of the results to be expected in the future.

You should read the following information together with the more detailed information contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations of Summit Materials, LLC” and the consolidated financial statements and the accompanying notes appearing elsewhere in this Report.

| Summit Materials, LLC (Successor) | Hamm, Inc. (Predecessor) | |||||||||||||||||||||||||

| ($ in thousands) | Year Ended December 29, 2012(1) |

Year Ended December 31, 2011(1) |

Year Ended December 31, 2010(1) |

Period from August 26, 2009 to December 31, 2009 |

Period From April 1, 2009 to August 25, 2009 |

Year Ended March 31, 2009 |

||||||||||||||||||||

| Statements of Operations Data: |

||||||||||||||||||||||||||

| Revenue |

$ | 926,254 | $ | 789,076 | $ | 405,297 | $ | 29,348 | $ | 36,195 | $ | 104,407 | ||||||||||||||

| Cost of revenue (exclusive of items shown separately below) |

713,346 | 597,654 | 284,336 | 21,582 | 24,940 | 83,152 | ||||||||||||||||||||

| General and administrative expenses |

127,215 | 95,826 | 48,557 | 4,210 | 1,639 | 2,993 | ||||||||||||||||||||

| Depreciation, depletion, amortization and accretion |

68,290 | 61,377 | 33,870 | 3,148 | 3,187 | 8,101 | ||||||||||||||||||||

| Transaction costs |

1,988 | 9,120 | 22,268 | 4,682 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Operating income (loss) |

15,415 | 25,099 | 16,266 | (4,274 | ) | 6,429 | 10,161 | |||||||||||||||||||

| Other (income) expense, net |

(1,182 | ) | (21,244 | ) | 1,583 | 192 | 484 | (1,220 | ) | |||||||||||||||||

| Loss on debt refinancing |

9,469 | — | 9,975 | — | — | — | ||||||||||||||||||||

| Interest expense |

58,079 | 47,784 | 25,430 | 574 | — | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (Loss) income from continuing operations before income taxes |

(50,951 | ) | (1,441 | ) | (20,722 | ) | (5,040 | ) | 5,945 | 11,381 | ||||||||||||||||

| Income tax (benefit) expense |

(3,920 | ) | 3,408 | 2,363 | 216 | 2,303 | 4,152 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (Loss) income from continuing operations |

$ | (47,031 | ) | $ | (4,849 | ) | $ | (23,085 | ) | $ | (5,256 | ) | $ | 3,642 | $ | 7,229 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Cash Flow Data: |

||||||||||||||||||||||||||

| Net cash provided by (used for): |

||||||||||||||||||||||||||

| Operating activities |

$ | 62,279 | $ | 23,253 | $ | (20,529 | ) | $ | 3,897 | $ | 6,320 | $ | 17,430 | |||||||||||||

| Investing activities |

(85,340 | ) | (192,331 | ) | (499,381 | ) | (46,669 | ) | 31,255 | (18,492 | ) | |||||||||||||||

| Financing activities |

7,702 | 146,775 | 575,389 | 52,379 | (44,649 | ) | (2,045 | ) | ||||||||||||||||||

| Balance Sheet Data (as of period end): |

||||||||||||||||||||||||||

| Cash and cash equivalents |

$ | 27,431 | $ | 42,790 | $ | 65,093 | $ | 9,614 | $ | 10,419 | ||||||||||||||||

| Total assets |

1,281,213 | 1,284,265 | 1,101,581 | 111,775 | 100,719 | |||||||||||||||||||||

| Total debt (including current portion of long-term debt) |

639,843 | 608,981 | 559,980 | 28,750 | — | |||||||||||||||||||||

| Capital leases |

3,092 | 3,158 | 3,217 | — | — | |||||||||||||||||||||

| Total member’s interest |

382,428 | 436,372 | 345,993 | — | — | |||||||||||||||||||||

| Redeemable Noncontrolling interests |

22,850 | 21,300 | 21,300 | — | — | |||||||||||||||||||||

| Other Financial Data (as of period end): |

||||||||||||||||||||||||||

| Total hard assets(2) |

$ | 906,584 | $ | 906,166 | $ | 775,457 | $ | 92,309 | $ | 32,571 | ||||||||||||||||

| Ratio of earnings to fixed charges(3) |

0.1 | 1.0 | 0.2 | N/A | 364.0 | 341.4 | ||||||||||||||||||||

| (1) | Amounts are shown net of the results of operations associated with certain non-core businesses sold or wound down in 2013 and 2012 and classified as discontinued operations. |

| (2) | Defined as the balance sheet book value of the sum of (a) property, plant and equipment, net and (b) inventories. |

| (3) | The ratio of earnings to fixed charges is determined by dividing earnings, as adjusted, by fixed charges. Fixed charges consist of interest on all indebtedness plus that portion of operating lease rentals representative of the interest factor (deemed to be 33% of operating lease rentals). Earnings were insufficient to cover fixed charges for the period from August 26, 2009 to December 31, 2009 by $5.6 million. |

5

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS OF SUMMIT MATERIALS, LLC

You should read the following discussion of our results of operations and financial condition with the “Unaudited Pro Forma Condensed Consolidated Financial Information” and the “Selected Historical Consolidated Financial Data” sections of this Report and our audited consolidated financial statements for the years ended December 29, 2012, December 31, 2011 and December 31, 2010 and the related notes thereto included elsewhere in this Report. This discussion contains forward-looking statements and involves numerous risks and uncertainties. Factors that may cause differences between actual results and those contemplated by forward-looking statements include, but are not limited to, those discussed in the section entitled “Risk Factors” in the Prospectus and any factors discussed in the sections entitled “Cautionary Note Regarding Forward-Looking Statements”. Our actual results may differ materially from those contained in any forward-looking statements.

Overview

We are a leading, vertically-integrated, geographically-diverse heavy-side building materials company. We supply aggregates, cement and related downstream products such as asphalt paving mix, ready-mixed concrete, concrete products and paving and related construction services for a variety of end-uses in the U.S. construction industry, including public infrastructure projects, as well as private residential and non-residential construction. We have organized the business by geographic region and have three operating segments, which are also our reporting segments: Central; West; and East regions. Across the three regions, we believe we are a top 15 supplier of aggregates, a top 20 supplier of cement, a top 10 producer of asphalt paving mix and a major producer of ready-mixed concrete in the United States by volume. As of December 29, 2012, we had 1.2 billion tons and 0.4 billion tons of proven and probable aggregates reserves serving our aggregates and cement businesses, respectively, and operated over 120 sites and plants. We believe that we have adequate road, barge and/or railroad access to all of our sites and plants. We do not perform annual reserve audits. From time to time, in connection with certain acquisitions, we engage a third party engineering firm to perform a reserve audit.

Our production volumes and average selling prices for our primary products in 2012, 2011 and 2010 are as follows:

| 2012 | 2011 | 2010 | ||||||||||||||||||||||

| Volume(1) | Average Selling Price(2) |

Volume(1) | Average Selling Price(2) |

Volume(1) | Average Selling Price(2) |

|||||||||||||||||||

| Aggregate |

16,728 | $ | 8.49 | 13,844 | $ | 8.17 | 7,972 | $ | 8.82 | |||||||||||||||

| Asphalt |

4,553 | 53.31 | 4,074 | 48.17 | 1,590 | 50.29 | ||||||||||||||||||

| Ready-mixed concrete |

1,210 | 88.29 | 1,053 | 89.48 | 352 | 77.63 | ||||||||||||||||||

| (1) | Volumes are shown in tons for aggregates and asphalt and in cubic yards for ready-mixed concrete. |

| (2) | Average selling prices are shown on a per ton basis for aggregates and asphalt and on a per cubic yard basis for ready-mixed concrete. |

The growth in our volumes in 2012 and 2011 is primarily a result of our acquisitions, which have also affected our average selling prices, as we entered into new markets with different pricing structures. Our cement volume has increased, but pricing has decreased as a result of changes in customer mix.

Our estimate of proven and probable reserves for which we have permits for extraction and that we consider to be recoverable aggregates of suitable quality for economic extraction by segment are shown in the table below along with average annual production over the past three years. The number of producing quarries shown on the table below includes the underground mine supporting our cement plant, which is currently in development.

| Number of producing quarries |

Tonnage of reserves for each general type of aggregate |

Annual production (tons) |

Average years until depletion at current production |

Percent of reserves owned and percent leased |

||||||||||||||||||||||||

| Hard Rock | Sand & Gravel |

|||||||||||||||||||||||||||

| Segment |

Owned | Leased* | ||||||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||||||

| Central |

53 | 865,142 | 18,672 | 9,902 | 89 | 17 | % | 83 | % | |||||||||||||||||||

| West |

38 | 148,905 | 170,756 | 4,586 | 70 | 37 | % | 63 | % | |||||||||||||||||||

| East |

21 | 419,519 | 5,614 | 4,194 | 101 | 33 | % | 67 | % | |||||||||||||||||||

| Total |

112 | 1,433,566 | 195,042 | 18,682 | ||||||||||||||||||||||||

| * | Lease terms range from monthly to on-going with an average lease expiry in 2020. |

6

We were formed in September 2008. Since July 2009, the Sponsors and certain of our officers, directors and employees have made $794.5 million of funding commitments to Parent. We have grown rapidly as a result of our disciplined acquisition strategy, utilizing approximately $457.3 million of the $463.9 million of equity commitments funded to Parent by the Sponsors and certain other investors. Today, our nine operating companies make up our three distinct geographic segments that span 18 states and 23 metropolitan areas. We believe each of our operating companies has a top three market share position in its local market area and an extensive operating history, averaging over 35 years. Our highly experienced management team, led by 30-year industry veteran, CEO Tom Hill has successfully enhanced the operations of acquired companies by focusing on scale advantages, cost efficiencies and pricing discipline to improve profitability and cash flow.

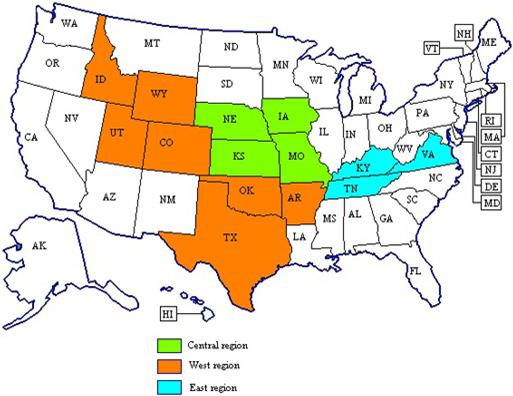

Of the 18 states in which we operate, we currently have assets in 14 states. The map below illustrates our geographic footprint:

Our revenue is derived from multiple end-use markets, including public infrastructure construction as well as private residential and non-residential construction. For the year ended December 29, 2012, approximately 62% of our revenue related to public infrastructure construction and the remaining 38% related to residential and non-residential construction. Public construction includes spending by federal, state and local governments for roads, highways, bridges, airports and other public infrastructure construction projects. A significant portion of our construction revenues are from public construction projects, a historically more stable portion of state and federal budgets. Our acquisitions to date are focused in states with constitutionally-protected transportation funding sources, which we believe serves to limit our exposure to state and local budgetary uncertainties. Private construction includes both new residential and non-residential construction and repair and remodel markets, which have been significantly affected by the downturn in the overall economy and the construction industry, in particular. We believe exposure to various markets affords us greater stability through economic cycles and positions us to capitalize on upside opportunities when recoveries in residential and non-residential construction occur.

Business Trends and Conditions

The U.S. heavy-side building materials industry is composed of four primary sectors: (i) aggregates; (ii) cement; (iii) asphalt paving mix; and (iv) ready-mixed concrete, each of which is widely used in most forms of construction activity. Participants in these sectors typically range from small, privately-held companies focused on a single product or market to multinational corporations that offer a wide array of construction materials and services. Markets are defined in part by the distance materials may be efficiently transported, resulting in largely local or regional operations.

7

Transportation infrastructure projects, driven by both state and federal funding programs, represent a significant share of the U.S. heavy-side building materials market. In July 2012, Moving Ahead for Progress in the 21st Century (“MAP-21”) was enacted and took effect in October 2012. MAP-21 is a 27-month, approximately $105 billion transportation funding program that provides for $40.4 billion and $41.0 billion in highway infrastructure investments in fiscal years 2013 and 2014, respectively. The spending levels are consistent with the preceding federal transportation funding program. In addition to federal funding, highway construction and maintenance funding is also available through state, county and local agencies. Our five largest states by revenue (Texas, Kansas, Kentucky, Missouri and Utah, which represented approximately 28%, 17%, 15%, 12% and 11%, respectively, of our total revenue for the year ended December 29, 2012) each have funds whose revenue sources are constitutionally protected and may only be spent on transportation projects:

| • | Texas’ 2012 - 2013 Department of Transportation budget is $19.8 billion, a $3.9 billion increase from the previous 2010-2011 biennium budget |

| • | Kansas has a 10-year $8.2 billion highway bill that was passed in May 2010 |

| • | Kentucky has a two-year $4.5 billion highway bill that was passed in April 2012 |

| • | Missouri has an estimated $0.7 billion in annual construction funding committed to essential road and bridge programs |

| • | Utah’s fiscal year 2013 transportation fund increased to $12.0 billion |

Currently, there is uncertainty as to what will succeed MAP-21, which expires in September 2014. We are hopeful a new highway bill will be passed by the end of 2014, which will require Continuing Resolutions between September 2014 and the date a new bill is passed. We are not expecting a significant change in funding levels through the Continuing Resolutions or a new bill. Within many of our markets, the federal, state and local governments have taken actions to maintain or grow highway funding during a time in which many areas of spending are facing significant cuts. However, we could still be affected by any economic improvement or slowdown, which could vary by local region and market. Our sales and earnings are sensitive to national, regional and local economic conditions and particularly to cyclical changes in construction spending, especially in the private sector.

In addition to being subject to cyclical changes in the economy, our business is seasonal in nature. Almost all of our products are produced and consumed outdoors. Severe weather, seasonal changes and other weather-related conditions can significantly affect the production and sales volumes of our products. Normally, the highest sales and earnings are in the second and third quarters and the lowest are in the first and fourth quarters. Winter weather months are generally periods of lower sales as we, and our customers, normally cannot cost-effectively mobilize and demobilize equipment and manpower during this period under adverse weather conditions. Periods of heavy rainfall also adversely affect our work patterns and therefore demand for our products. Our working capital may vary greatly during these peak periods, but generally return to average levels as our operating cycle is completed each fiscal year.

Financial Highlights

The principal factors in evaluating our financial condition and operating results for fiscal year 2012 compared to 2011 are:

| • | Total revenue of $926.3 million in 2012, increased 17.4%, or $137.2 million, from 2011, primarily as a result of acquisitions. Approximately 64% of our revenue is from product sales, which is the result of sales volume and pricing across our product lines. As presented in the table below, our volumes increased from 2011 to 2012, primarily from acquisitions, across all of our product lines. The 18.0% increase in cement volumes was organic, as we had no acquisitions in 2012 or 2011 affecting our cement sales. |

| Volume Increases in 2012 Compared to 2011 |

||||

| Aggregates |

20.8 | % | ||

| Asphalt |

11.8 | % | ||

| Ready-mixed concrete |

14.9 | % | ||

| Cement |

18.0 | % | ||

In 2012, we experienced modest price growth across our product lines. We realized increases in aggregates and asphalt average selling prices across the Company and a decrease in ready-mixed concrete due to a shift in product mix, despite increased prices across the ready-mixed concrete products on a like-for-like basis. The average selling price for cement decreased 2.2% per ton from 2011 to 2012 due to a change in customer mix.

8

| Average Selling Prices in 2012 Compared to 2011 |

||||

| Aggregates |

3.8 | % | ||

| Asphalt |

10.7 | % | ||

| Ready-mixed concrete |

(1.3 | )% | ||

| Cement |

(2.2 | )% | ||

| • | Operating income of $15.4 million compared to $25.1 million in 2011. The decrease in operating income is primarily attributable to $8.0 million of charges recorded in 2012 on an indemnification agreement in the West region, compared to $1.9 million in 2011, and low-margin legacy contracts and cost overruns in our construction business. These losses were offset by increased operating income from 2012 to 2011 acquisitions. |

| • | Cash provided by operations of $62.3 million improved from $23.3 million in 2011 due primarily to improved cash management. |

| • | Cash paid for acquisitions of $48.8 million decreased from $161.1 million in 2011. We acquired three companies in 2012, compared to eight in 2011. |

Acquisitions

On February 29, 2012, we acquired certain assets of Norris Quarries, LLC in Missouri. The Norris acquisition expanded our market position in the Central region. It is a 100% aggregates company geographically situated between existing businesses in Missouri and Kansas.

On October 5, 2012, we acquired certain assets of Kay & Kay Contracting, LLC in Kentucky. The Kay & Kay acquisition expands our market presence in the southeastern region of Kentucky producing both aggregates and asphalt.

On November 30, 2012, we acquired the stock of Sandco, Inc. in Colorado. The Sandco acquisition expands our market presence in the western region of Colorado producing both aggregates and ready-mixed concrete.

Discontinued Operations

As part of our strategy to focus on our core business as a heavy-side building materials company, we have exited certain activities, including certain concrete paving operations, our railroad construction and maintenance business (referred to herein as the “railroad business”), which involved building and repairing railroad sidings, and our environmental remediation business, which primarily involved the repair of retaining walls along highways in Kentucky and the removal and remediation of underground fuel storage tanks. The concrete paving operations were wound down in the second quarter of 2013; management expects the related assets to be sold within the next twelve months. The railroad and environmental remediation businesses were sold in separate transactions in 2012 for an aggregate of $3.1 million. Prior to recognition as discontinued operations, all of these businesses were included in the East region’s operations.

Aggregates

According to the February 2013 U.S. Geological Survey, approximately 1.28 billion tons of crushed stone with a value of approximately $11.5 billion was produced in the United States in 2012, in line with 1.28 billion tons in 2011. Sand and gravel production was approximately 907 million tons in 2012 valued at approximately $6.25 billion, up from 894 million tons in 2011. The U.S. aggregate industry is highly fragmented relative to other building product markets, with numerous participants operating in localized markets and the top six players controlling approximately 30% of the national market in 2011. The January 2013 U.S. Geological Survey reported that a total of 1,550 companies operating 4,000 quarries and 91 underground mines produced or sold crushed stone in 2012 in the United States.

We believe that the long-term growth of the market for aggregates is largely driven by growth in population, jobs and households, which affect transportation infrastructure spending and changes in population density. In the past few years, the recession in the United States has led to a decrease in overall private construction activity. Despite the increase in federal stimulus spending, public construction activity has declined over this period, albeit less than private construction markets. Through the prior three U.S. recessions (July 1990 through March 1991, March 2001 through November 2001 and December 2007 through June 2009), highway spending in real dollars grew 1.8% annually on average in years with a recession as compared to 0.9% annually on average in years without a recession. While short-term demand for aggregates fluctuates with economic cycles, the declines have historically been followed by strong recovery, with each peak establishing a new historical high.

9

Cement

Cement production is a capital-intensive business with variable costs dominated by raw materials and energy required to fuel the kiln. Building new plants is challenging given the extensive permitting that is required and significant costs. New plant construction costs in the United States are estimated at $250-300 per ton according to the PCA. Assuming construction costs of $275 per ton, a 1.25 million ton facility, such as the one Continental Cement operates, would cost approximately $343.8 million to construct.

As reported by the PCA in the 2012 North American Cement Industry Annual Yearbook, consumption is down significantly from the industry peak of 141 million tons in 2005 to 79 million tons in 2011 because of the decline in U.S. construction sector activity. Domestic cement consumption has at times outpaced domestic production capacity with the shortfall being supplied with imports, primarily from China, Canada, Columbia, Mexico and South Korea. The PCA reports that cement imports have declined since their peak of 39 million tons in 2006 to 7 million tons in 2011, in a manner indicative of the industry’s general response to the current demand downturn. Despite the reduction in imports, capacity utilization declined from 95% in 2006 to 59% in 2011 according to the PCA. Continental Cement operated at 75% capacity utilization in 2011 and 81% in 2012, which is above the 2011 industry mean of 68% capacity utilization as its markets did not suffer the pronounced demand declines seen in states like Florida, California and Arizona. Demand is seasonal in nature with nearly two-thirds of U.S. consumption occurring between May and October, coinciding with end-market construction activity.

In the cement industry, calcium oxide (“CaO”) content is the traditional measurement of limestone quality and purity. Limestone of 100% purity as measured by calcium carbonate (“CaCO3”) contains 56% CaO. Continental Cement’s mineable reserves have an average grade of 51.9% CaO, or 92.7% CaCO3. The mineable reserve calculation is based on a 70-foot mining height and a recovery ratio of 71.3% over the approximately 3,000 acre plant site.

Cement production in the United States is distributed among 101 production facilities located across 36 states. The EPA has new emission standards for Portland cement plants (“NESHAP”) that are due to come into effect in 2015. On December 20, 2012, the EPA signed the NESHAP final rule, which was less stringent than the previous draft. The PCA had estimated based on the draft rule that 18 plants could be forced to close due to the inability to meet NESHAP standards or because the compliance investment required may not be justified on a financial basis. These potential closures represent approximately 20 million tons of clinker capacity, or 20% of current capacity in the United States.

Continental Cement’s plant utilizes coal, petroleum coke and alternative fuel (hazardous and non-hazardous) and, as a result, is subject to HWC-MACT standards, rather than NESHAP. We expect HWC-MACT standards to generally conform to NESHAP, for which we are mostly in compliance, ahead of the effective date of the NESHAP standards. Any additional costs to comply with the NESHAP standards are not expected to have a material adverse effect on our financial position, results of operations or liquidity.

Asphalt Paving Mix

Asphalt paving mix is produced by mixing aggregates and asphalt cement, a petroleum based product that serves as the binder, at elevated temperatures. These high production temperatures are needed to allow the asphalt binder to become viscous enough to completely coat the aggregates in the paving mix, have good workability during laying and compaction, and provide durability during traffic exposure. A high weight-to-value ratio and the need to maintain the asphalt paving mix at a sufficiently high temperature during the paving process typically limits the delivery time to a one-hour haul from production plant to the paving location. Consequently, the asphalt paving mix market is highly localized with a fragmented ownership base.

According to the National Asphalt Pavement Association, there are approximately 4,000 asphalt paving mix plants in the United States. As reported by the National Asphalt Pavement Association, an estimated 366 million tons of asphalt paving mix was produced in 2011 which was broadly in line with the estimated 360 million tons produced in 2010.

The use of warm mix asphalt (“WMA”) or “green” asphalt is gaining popularity. The immediate benefit to producing WMA is the reduction in energy consumption required by burning fuels to heat traditional hot mix asphalt (“HMA”) to temperatures in excess of 300°F at the production plant. WMA can reduce the temperature by 50 to 70°F, resulting in lower emissions, fumes and odors generated at the plant and the paving site.

The asphalt paving mix sector is heavily exposed to public infrastructure spending as the vast majority of public roads and highways are paved with asphalt. Demand is seasonal in nature and focused on the April to November period in most states as asphalt paving requires a certain minimum ambient temperature to achieve the desired performance. Asphalt cement or liquid asphalt is a major input material. As a petroleum product, its price is driven by many factors and a fluctuation in the price of inputs, such as asphalt cement and burner fuel, which is typically either natural gas or recycled oil, may not be immediately recovered from the end customer.

10

Ready-Mixed Concrete

As a result of the transportation constraints, the ready-mixed concrete market is highly localized, with an estimated 5,500 ready-mixed concrete plants in the United States, per the NRMCA. According to the NRMCA, 291 million cubic yards of ready-mixed concrete was produced in 2012, which is a 9% increase from the 266 million cubic yards in 2011, but a 36% decrease from the industry peak of 458 million cubic yards in 2005. Ready mixed concrete demand is driven in large part by private residential and non-residential building demand and the decline of demand since 2005 is strongly correlated with the decline in construction spending in these end-use markets during this period.

The major raw material inputs for ready-mixed concrete are aggregates and cement, the price of which has generally tended to increase over time in a predictable manner. Ready-mixed concrete is almost always delivered to the end-user by the supplier via purposely designed vehicles. Consequently, fuel prices are also an important cost component. Many suppliers reduce their exposure to changes in fuel costs by including sales price adjustment provisions for changes in fuel prices.

Components of Operating Results

Revenue

We derive our revenue predominantly by selling construction materials and providing construction services. Construction materials consist of aggregates and related downstream products, including asphalt, ready-mixed concrete, cement and concrete products. Construction services primarily relate to asphalt paving and other highway construction services.

The following summarizes our revenue recognition policy with respect to construction materials and services:

| • | Revenue derived from construction material sales are recognized when risks associated with ownership have passed to unaffiliated customers. Typically this occurs when products are shipped. Product revenue generally includes sales of aggregates and related downstream products, cement and other materials to customers, net of discounts, allowances and taxes, if any. |

| • | Revenue derived from construction service contracts are recognized on the percentage-of-completion method, measured by the cost incurred to date compared to estimated total cost of each project. This method is used because management considers cost incurred to be the best available measure of progress on these contracts. Due to the inherent uncertainties in estimating costs, it is at least reasonably possible that the estimates used will change over the life of the contract. |

Operating costs and expenses

The key components of our operating costs and expenses consist of the following:

Cost of revenue (excluding items shown separately below)

Cost of revenue consists of all production and delivery costs and primarily includes labor, repair and maintenance, utilities, raw materials, fuel, transportation, subcontractor costs and manufacturing overhead. Our cost of revenue is directly affected by fluctuations in commodity energy prices, primarily diesel fuel, liquid asphalt and other petroleum-based resources. As a result, our operating profit margins can be significantly affected by changes in the underlying cost of certain raw materials if they are not recovered through corresponding changes in revenue. We attempt to limit our exposure to changes in commodity energy prices by entering into forward purchase commitments when appropriate. In addition, we have sales price adjustment provisions that provide for adjustments based on fluctuations outside a limited range in certain energy-related production costs. These provisions are in place for most of our public contracts and we aggressively seek to include similar price adjustment provisions in our private contracts.

General and administrative expenses

General and administrative expenses consist primarily of salaries and personnel costs for our sales and marketing, administration, finance and accounting, legal, information systems and human resources employees. Additional expenses include audit, consulting and professional fees, travel, insurance and other corporate expenses.

Transaction costs

Transaction costs consist primarily of third party accounting, legal, valuation and financial advisory fees incurred in connection with acquisitions.

11

Depreciation, depletion, amortization and accretion

Our business is relatively capital-intensive. We carry property, plant and equipment at cost, net of applicable depreciation, depletion and amortization on our balance sheet. Depreciation on property, plant and equipment is computed on a straight-line basis or based on the economic usage over the estimated useful life of the asset. The general range of depreciable lives by fixed asset category, excluding mineral reserves which are depleted based on the units of production method on a quarry-by-quarry basis, is as follows:

| Buildings and improvements |

7 - 40 years | |||

| Plant, machinery and equipment |

3 - 40 years | |||

| Truck and auto fleet |

3 - 10 years | |||

| Mobile equipment and barges |

3 - 20 years | |||

| Landfill airspace and improvements |

5 - 60 years | |||

| Other |

2 - 10 years |

Amortization expense is the periodic expense related to our intangible assets, which were acquired as part of certain of our acquisitions. The intangible assets are amortized on a straight-line basis over the estimated useful lives of the assets.

Accretion of accrued mining reclamation liabilities and landfill closure and post-closure liabilities is recorded using the effective interest method.

Results of Operations

The following discussion of our results of operations is focused on the material financial measures we use to evaluate the performance of our business from both a consolidated and operating segment perspective. We have three operating segments, which are also our reporting segments: Central; West; and East regions. Operating income and margins are discussed in terms of changes in volume, pricing and mix of revenue source (e.g., type of product sales or service revenue). The majority of our service revenue is generated by long-term contracts. As discussed further under “—Components of Operating Results” above, we generally account for revenue under these contracts using the percentage of completion method of accounting. Under this method, revenue is recognized as work progresses. Performance on service contracts refers to changes in contract earnings rates during the term of the contract based on revisions to estimates of profit at completion on individual contracts. These revisions result from increases or decreases to the estimated value of the contract and/or the estimated costs required to complete the contract. The following discussion of results of operations provides additional disclosure to the extent that a significant or unusual event causes a material change in the profitability of a contract.

The following table includes revenue and operating income (loss) by segment for the periods indicated. Operating income (loss) by segment is computed as earnings from continuing operations before interest, taxes and other income / expense.

| 2012 | 2011 | 2010 | ||||||||||||||||||||||

| (in thousands) |

Revenue | Operating income (loss) |

Revenue | Operating income (loss) |

Revenue | Operating income (loss) |

||||||||||||||||||

| Central |

$ | 302,113 | $ | 37,560 | $ | 264,008 | $ | 38,105 | $ | 211,238 | $ | 27,178 | ||||||||||||

| West |

484,922 | (6,625 | ) | 362,577 | (455 | ) | 59,337 | (4,691 | ) | |||||||||||||||

| East |

139,219 | (245 | ) | 162,491 | 2,687 | 134,722 | 4,287 | |||||||||||||||||

| Corporate(1) |

— | (15,275 | ) | — | (15,238 | ) | — | (10,508 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

$ | 926,254 | $ | 15,415 | $ | 789,076 | $ | 25,099 | $ | 405,297 | $ | 16,266 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | Corporate results primarily consist of compensation expense for employees included in our headquarters. |

Non-GAAP Performance Measures

Our chief operating decision maker evaluates the performance of our segments and allocates resources to them based on several factors, including a measure we call segment profit, or Adjusted EBITDA by segment. We define Adjusted EBITDA as earnings (loss) before loss from discontinued operations, income tax (benefit) expense, interest expense and depreciation, depletion, amortization and accretion. Accretion expense is recognized on our asset retirement obligations and reflects the time value of money. Given that accretion is similar in nature to interest expense, it is treated consistently with interest expense in determining Adjusted EBITDA. Adjusted EBITDA is determined before considering the loss from discontinued operations as results from discontinued operations are not viewed by management as part of our core business. When management assesses the performance of our segments and the allocation of resources, it is not included in Adjusted EBITDA. Adjusted EBITDA reflects an additional way of viewing aspects of our business that, when viewed with our GAAP results and the accompanying reconciliations to GAAP financial measures included in the tables below, may provide a more complete understanding of factors and trends affecting our business. However, it should not be construed as being more important than other comparable GAAP measures and must be considered in conjunction with GAAP measures. In addition, non-GAAP financial measures are not standardized; therefore it may not be possible to compare such financial measures with other companies’ non-GAAP financial measures having the same or similar names. We strongly encourage investors to review our consolidated financial statements in their entirety and not rely on any single financial measure.

12

| Reconciliation of Net Loss to Adjusted EBITDA | 2012 | 2011 | 2010 | |||||||||

| (in thousands) | ||||||||||||

| Net loss |

$ | (50,577 | ) | $ | (10,050 | ) | $ | (23,863 | ) | |||

| Income tax (benefit) expense |

(3,920 | ) | 3,408 | 2,363 | ||||||||

| Interest expense |

58,079 | 47,784 | 25,430 | |||||||||

| Depreciation, depletion and amortization |

67,665 | 60,687 | 33,345 | |||||||||

| Accretion |

625 | 690 | 525 | |||||||||

| Loss from discontinued operations |

3,546 | 5,201 | 778 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA |

$ | 75,418 | $ | 107,720 | $ | 38,578 | ||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA by Segment | ||||||||||||

| (in thousands) | ||||||||||||

| Central |

$ | 65,767 | $ | 65,651 | $ | 43,639 | ||||||

| West |

14,429 | 36,442 | (1,710 | ) | ||||||||

| East |

10,782 | 15,504 | 7,045 | |||||||||

| Corporate |

(15,560 | ) | (9,877 | ) | (10,396 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA |

$ | 75,418 | $ | 107,720 | $ | 38,578 | ||||||

|

|

|

|

|

|

|

|||||||

In 2011, we adopted a “4-4-5” fiscal calendar in the place of the calendar year we previously used.

13

Consolidated Results of Operations

The tables below set forth our consolidated results from operations for the fiscal years indicated.

| 2012 | 2011 | 2010 | ||||||||||

| (in thousands) | ||||||||||||

| Revenue |

$ | 926,254 | $ | 789,076 | $ | 405,297 | ||||||

| Cost of revenue (excluding items shown separately below) |

713,346 | 597,654 | 284,336 | |||||||||

| General and administrative expenses |

127,215 | 95,826 | 48,557 | |||||||||

| Depreciation, depletion, amortization and accretion |

68,290 | 61,377 | 33,870 | |||||||||

| Transaction costs |

1,988 | 9,120 | 22,268 | |||||||||

|

|

|

|

|

|

|

|||||||

| Operating income |

15,415 | 25,099 | 16,266 | |||||||||

| Other (income) expense, net |

(1,182 | ) | (21,244 | ) | 1,583 | |||||||

| Loss on debt financings |

9,469 | — | 9,975 | |||||||||

| Interest expense |

58,079 | 47,784 | 25,430 | |||||||||

|

|

|

|

|

|

|

|||||||

| Loss from continuing operations before taxes |

(50,951 | ) | (1,441 | ) | (20,722 | ) | ||||||

| Income tax (benefit) expense |

(3,920 | ) | 3,408 | 2,363 | ||||||||

|

|

|

|

|

|

|

|||||||

| Loss from continuing operations |

(47,031 | ) | (4,849 | ) | (23,085 | ) | ||||||

| Loss from discontinued operations |

3,546 | 5,201 | 778 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net loss |

(50,577 | ) | (10,050 | ) | (23,863 | ) | ||||||

| Net income attributable to noncontrolling interest |

1,919 | 695 | 86 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net loss attributable to member of Summit Materials, LLC |

$ | (52,496 | ) | $ | (10,745 | ) | $ | (23,949 | ) | |||

|

|

|

|

|

|

|

|||||||

Fiscal year 2012 compared to 2011

| ($ in thousands) | 2012 | 2011 | Variance | |||||||||||||

| Revenue |

$ | 926,254 | $ | 789,076 | $ | 137,178 | 17.4 | % | ||||||||

| Operating income |

15,415 | 25,099 | (9,684 | ) | (38.6 | )% | ||||||||||

| Operating margin |

1.7 | % | 3.2 | % | (46.9 | )% | ||||||||||

| Adjusted EBITDA |

$ | 75,418 | $ | 107,720 | $ | (32,302 | ) | (30.0 | )% | |||||||

|

Revenue in 2012 increased to $926.3 million compared to $789.1 million in 2011. The $137.2 million increase was driven by acquisitions and $17.7 million from net pricing increases. Revenue from business acquired in 2012 totaled $24.7 million and the incremental revenue in 2012 from business acquired in 2011 was $149.7 million. Revenue growth from price increases and acquisitions was partially offset by $16.3 million of volume decreases across our product lines; excluding our cement business where we had an 18% increase from 2011 and from a decline in construction services revenue.

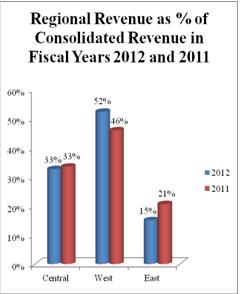

The West region experienced the most revenue growth in 2012 as compared to 2011. It was established in the second half of 2010 and grew significantly in 2011 through acquisitions. As a result, 2012 was the first year with a full year of results from these acquisitions. The West region composed 52% of consolidated revenue in 2012 compared to 46% in 2011 and the East region revenue declined from 21% to 15% of consolidated revenue. Revenue, as a percentage of consolidated revenue, remained constant in the Central region in 2012 as compared to 2011. |

14

Operating income decreased $9.7 million from $25.1 million in 2011 to $15.4 million in 2012. Operating income reflects our profit after taking into consideration cost of revenue, general and administrative expenses, depreciation, depletion, amortization and accretion and transaction costs. The components of cost of revenue generally increase ratably with revenue as labor, transportation costs and subcontractor costs are recorded in cost of revenue. As a result of our revenue growth occurring primarily through acquisitions, our general and administrative costs and depreciation, depletion, amortization and accretion generally have grown ratably with revenue. Our transaction costs fluctuate with the number and size of acquisitions consummated each year.

We are subject to commodity price risk with respect to price changes in liquid asphalt and energy, including fossil fuels and electricity for aggregates, cement, asphalt paving mix and ready-mixed concrete production, natural gas for hot mix asphalt production and diesel fuel for distribution vehicles and production related mobile equipment. Liquid asphalt escalators in most of our public contracts, other than those in Texas, limit our exposure to price fluctuations in this commodity. We often obtain similar escalators on private and commercial contracts. In addition, we enter into various firm purchase commitments with terms generally less than one year for certain raw materials, including commodities, in the ordinary course of business. As a result of the contract escalation clauses and effective use of the firm purchase commitments, commodity prices did not have a material effect on our results of operations in 2012 as compared to 2011.

As a percentage of revenue, the individual components of operating income remained relatively consistent from 2011 to 2012; operating margin, which we define as operating income as a percentage of revenue, declined from 3.2% in 2011 to 1.7% in 2012. Operating margin was affected by $8.0 million of costs recognized in connection with an indemnification agreement in 2012, compared to $1.9 million recognized in 2011, low-margin contracts and higher costs on certain construction projects, primarily in the West region. During 2012, we performed work on certain grading and structural projects that were generally bid and awarded prior to our acquisition of the respective entities. These non-core structural projects were bid without cost escalators for raw materials, fuel, etc., which resulted in cost escalations in 2012 as work was performed on the projects. In addition, in the East region, we were affected by low margins on certain projects from a highly competitive environment.

We experienced a decline in Adjusted EBITDA from $107.7 million in 2011 to $75.4 million in 2012 related to the following:

| • | In 2012, we recognized $8.0 million in losses on an indemnification agreement, compared to $1.9 million in 2011. |

| • | In 2012, a $9.5 million loss associated with a debt refinancing was recognized. |

| • | In 2011, we recognized $12.1 million of bargain purchase gains on certain acquisitions in the West region. The amount of the bargain purchase gain is equal to the amount by which the fair value of net assets acquired exceeded the consideration transferred. We believe that the resulting bargain purchase gain is reasonable as the sellers were highly motivated. For a further discussion of the bargain purchase gain, see note 2 to our audited consolidated financial statements included elsewhere in this Report. |

| • | In 2011 we recognized a $10.3 million favorable fair value adjustment on contingent consideration, compared to $0.4 million in 2012. The $10.3 million adjustment in 2011 was due primarily to revised estimates of the probability of achieving the specified targets related to certain acquisitions. |

| • | Transaction fees decreased $7.1 million in 2012 due to a decrease in acquisition activity. We closed eight acquisitions in 2011 with an average purchase price of $23.6 million compared to three in 2012 for an average purchase price of $19.8 million. |

Other Financial Information

Other income, net

Other income decreased to $1.2 million in 2012 from $21.2 million in 2011. Included in other income in 2011 were $12.1 million of bargain purchase gains on certain acquisitions in the West region and a $10.3 million gain from fair value adjustments to contingent consideration, compared to a $0.4 million fair value adjustment in 2012.

Loss on debt refinancing

We refinanced our long-term debt and accrued interest in January 2012 resulting in a $9.5 million charge. We did not refinance our long-term debt in 2011.

Interest expense

Interest expense increased $10.3 million, or 21.5%, to $58.1 million in 2012 compared to $47.8 million in 2011. The increase in our interest expense reflects an increase in our average debt. Our debt, without giving effect to original issuance discount, increased to $648.0 million at December 29, 2012 from $609.0 million at December 31, 2011. In addition, although our outstanding borrowings on our revolver were zero at year-end 2012, we carried an average balance of $36.7 million during 2012. The additional borrowings were primarily used to fund acquisitions ($48.8 million) and seasonal working capital requirements.

15

Income tax expense

Summit Materials is a limited liability company and passes its tax attributes for federal and state tax purposes to its parent entities and is generally not subject to federal or state income tax. However, the consolidated financial statements of the Company include federal and state income tax provisions for subsidiaries organized as taxable entities. In 2012, we recorded an income tax benefit of $3.9 million compared to expense of $3.4 million in 2011. The decrease in the income tax expense is due to taxable losses incurred by taxable entities in 2012.

Discontinued operations

As part of our strategy to focus on our core business as a heavy-side building materials company, we have exited certain activities, including concrete paving in the East region, our railroad business, which involved building and repairing railroad sidings, and our business of repairing retaining walls along highways in Kentucky and the removal and remediation of underground fuel storage tanks (referred to herein as the environmental remediation business). The concrete paving operations were wound down in the second quarter of 2013; management expects the related assets to be sold within the subsequent twelve months. The railroad and environmental remediation businesses were sold in 2012 in separate transactions for an aggregate $3.1 million. Prior to recognition as discontinued operations, all of these businesses were reported in the East region’s operations. Revenue from these discontinued operations was $50.2 million and $49.5 million in 2012 and 2011, respectively. The loss from discontinued operations, inclusive of the immaterial gain on the sale, was $3.5 million and $5.2 million in 2012 and 2011, respectively.

Fiscal year 2011 compared to 2010

| ($ in thousands) | 2011 | 2010 | Variance | |||||||||||||

| Revenue |

$ | 789,076 | $ | 405,297 | $ | 383,779 | 94.7 | % | ||||||||

| Operating income (loss) |

25,099 | 16,266 | 8,833 | 54.3 | % | |||||||||||

| Operating margin |

3.2 | % | 4.0 | % | (20.0 | )% | ||||||||||

| Adjusted EBITDA |

$ | 107,720 | $ | 38,578 | $ | 69,142 | 179.2 | % | ||||||||

Our revenue increased significantly in 2011 to $789.1 million compared to $405.3 million in 2010. The $383.8 million increase was almost entirely driven by acquisitions. Revenue from business acquired in 2011 totaled $117.0 million and the incremental revenue in 2011 from business acquired in 2010 was $248.1 million.

|

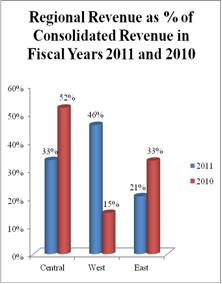

The West region saw the most revenue growth in 2011 as compared to 2010. It was established in the second half of 2010 and grew significantly in 2011 through acquisitions. As a result of this growth, the West region composed 46% of consolidated revenue in 2011 compared to 15% in 2010, thereby reducing the percentage of consolidated revenue contributed by the Central and East regions. Revenue, as a percentage of consolidated revenue, decreased 19% and 12% in the Central and East regions, respectively, in 2011 as compared to 2010.

Operating income increased $8.8 million from $16.3 million in 2010 to $25.1 million in 2011. Operating income reflects our profit after taking into consideration cost of revenue, general and administrative expenses, depreciation, depletion, amortization and accretion and transaction costs. The components of cost of revenue generally increase ratably with revenue as labor, transportation costs and subcontractor costs are recorded in cost of revenue. As a result of our revenue growth occurring primarily through acquisitions, our general and administrative costs and depreciation, depletion, amortization and accretion generally have grown ratably with revenue. Our transaction costs fluctuate with the number and size of acquisitions consummated each year. |

16

We are subject to commodity price risk with respect to price changes in liquid asphalt and energy, including fossil fuels and electricity for aggregates, cement, asphalt paving mix and ready-mixed concrete production, natural gas for hot mix asphalt production and diesel fuel for distribution vehicles and production related mobile equipment. Liquid asphalt escalators in most of our public contracts, other than those in Texas, limit our exposure to price fluctuations in this commodity. We often obtain similar escalators on private and commercial contracts. In addition, we enter into various firm purchase commitments with terms generally less than one year for certain raw materials, including commodities, in the ordinary course of business. As a result of the contract escalation clauses and effective use of the firm purchase commitments, commodity prices did not have a material effect on our results of operations in 2011 as compared to 2010.

As a percentage of revenue, the individual components of operating income remained relatively consistent from 2010 to 2011 with the exception of the West region, the effect of which led to a decline in operating margin, from 4.0% in 2010 to 3.2% in 2011. The West region’s operating margin is the lowest of our three regions and with their operations representing a higher proportion of the consolidated company, operating margins contracted in 2011. The West region’s operating margins, as compared to the other regions, have been affected by the timing of the acquisitions. We acquired two businesses in Austin, Texas in August and October 2011. Our business is seasonal with our peak earnings occurring between April and November of each year. With these acquisitions occurring late in the season, coupled with transaction fees associated with the acquisitions, an operating loss was recognized in 2011 in the West region. West region acquisitions were similarly timed in 2010 (August and November 2010) resulting in operating losses in 2010 as well. Underperformance on certain construction and paving contracts also affected operating margins in the West region.

We experienced significant Adjusted EBITDA growth in 2011 from $38.6 million in 2010 to $107.7 million primarily related to the following:

| • | Adjusted EBITDA from 2011 acquisitions was $21.2 million, which includes a $12.1 million bargain purchase gain recognized with certain acquisitions in the West region |

| • | Incremental Adjusted EBITDA in 2011 from 2010 acquisitions was $26.7 million, which includes a $10.3 million favorable fair value adjustment recognized on contingent consideration in the West and East regions |

| • | Transaction fees decreased $13.1 million in 2011 due to a decrease in acquisition activity. We closed eight acquisitions in 2011 with an average purchase price of $20.1 million compared to twelve acquisitions in 2010 with an average purchase price of $40.2 million |

| • | In 2010, a $10.0 million loss associated with two debt refinancings was recognized |

Other Financial Information

Other (income) expense, net

Other income increased to $21.2 million in 2011 from expense of $1.6 million in 2010. Included in other income in 2011 were $12.1 million of bargain purchase gains on certain acquisitions in the West region and a $10.3 million gain from fair value adjustments to contingent consideration.

Loss on debt refinancing

We refinanced our term debt in February 2010 and again in December 2010 resulting in a $10.0 million charge for financing fees. We did not refinance our long-term debt in 2011.

Interest expense

Interest expense increased $22.4 million, or 87.9%, to $47.8 million in 2011 compared to $25.4 million in 2010. The increase in our interest expense reflects an increase in our term loan in December 2010 from $136.4 million to $400.0 million, and the increase in borrowings under our revolver facility associated with our 2011 acquisition activity. We amended one of our credit facilities in December 2010 to fund future acquisitions and take advantage of more favorable interest rates.

17

Income tax expense

Summit Materials is a limited liability company and passes its tax attributes for federal and state tax purposes to its parent entities and is generally not subject to federal or state income tax. However, the consolidated financial statements of the Company include federal and state income tax provisions for subsidiaries organized as taxable entities. In 2011, we recorded income tax expense of $3.4 million compared to $2.4 million in 2010. The increase in the income tax expense is due to an increase in taxable income from the taxable entities.

Discontinued operations

As part of our strategy to focus on our core business as a heavy-side building materials company, we have exited certain activities, including concrete paving in the East region, our railroad business, which involved building and repairing railroad sidings, and our business of repairing retaining walls along highways in Kentucky and the removal and remediation of underground fuel storage tanks (referred to herein as the environmental remediation business). The concrete paving operations were wound down in the second quarter of 2013; management expects the related assets to be sold within the subsequent twelve months. The railroad and environmental remediation businesses were sold in 2012 in separate transactions for an aggregate $3.1 million. Prior to recognition as discontinued operations, all of these businesses were reported in the East region’s operations. Revenue from these discontinued operations was $49.5 million and $45.6 million in 2011 and 2010, respectively. The loss from discontinued operations was $5.2 million and $0.8 million in 2011 and 2010, respectively.

Segment results of operations

Central region fiscal year 2012 compared to 2011

| (in thousands) |

2012 | 2011 | Variance | |||||||||||||

| Revenue |

$ | 302,113 | $ | 264,008 | $ | 38,105 | 14.4 | % | ||||||||

| Operating income |

37,560 | 38,105 | (545 | ) | (1.4 | )% | ||||||||||

| Operating margin |

12.4 | % | 14.4 | % | ||||||||||||

| Adjusted EBITDA |

$ | 65,767 | $ | 65,651 | $ | 116 | 0.2 | % | ||||||||

Revenue in the Central region increased $38.1 million, or 14.4%, in 2012 to $302.1 million from $264.0 million in 2011 due to acquisitions and a $15.4 million increase in cement sales, driven by a 17% increase in cement volumes. Revenue from a business acquired in 2012 totaled $23.3 million and the incremental revenue in 2012 from a business acquired in 2011 was $1.5 million.

Operating margin declined in 2012 to 12.4% from 14.4% in 2011 primarily due to a $3.4 million gain on landfill closure obligations in 2011, as a result of revisions to landfill closure plans. After adjusting for this non-recurring gain, operating margin in 2012 was generally consistent with 2011.

Adjusted EBITDA remained relatively consistent from $65.7 million in 2011 to $65.8 million in 2012.

Central region fiscal year 2011 compared to 2010

| (in thousands) |

2011 | 2010 | Variance | |||||||||||||

| Revenue |

$ | 264,008 | $ | 211,238 | $ | 52,770 | 25.0 | % | ||||||||

| Operating income |

38,105 | 27,178 | 10,927 | 40.2 | % | |||||||||||

| Operating margin |

14.4 | % | 12.9 | % | ||||||||||||

| Adjusted EBITDA |

$ | 65,651 | $ | 40,790 | $ | 24,861 | 60.9 | % | ||||||||

Revenue in the Central region increased $52.8 million, or 25.0%, in 2011 to $264.0 million compared to $211.2 million in 2010 due primarily to acquisitions. Revenue from a business acquired in 2011 totaled $2.4 million and the incremental revenue in 2011 from businesses acquired in 2010 was $57.5 million. These revenue increases were partially offset by completion of a significant construction project with the Kansas Turnpike Authority in northeast Kansas which contributed approximately $10.9 million of additional revenue in 2010 as compared to 2011.

Operating margin improved in 2011 to 14.4% from 12.9% in 2010 primarily due to a $3.4 million gain on landfill closure obligations, as a result of revisions to landfill closure plans. After adjusting for this non-recurring gain, operating margin in 2011 was generally consistent with 2010.

18

The Adjusted EBITDA growth of $24.9 million from $40.8 million in 2010 to $65.7 million in 2011 was primarily due to the following:

| • | Adjusted EBITDA from 2011 acquisitions was $0.9 million. |

| • | Incremental Adjusted EBITDA in 2011 from 2010 acquisitions was $12.4 million. |

| • | $3.4 million gain on landfill closure obligations as a result of revisions to landfill closure plans. |

| • | $8.7 million decrease in transactions costs. In 2010, we acquired four entities for an average purchase price of $66.0 million compared to one acquisition in 2011 for $8.7 million. |

West region fiscal year 2012 compared to 2011

| (in thousands) |

2012 | 2011 | Variance | |||||||||||||

| Revenue |

$ | 484,922 | $ | 362,577 | $ | 122,345 | 33.7 | % | ||||||||

| Operating income |

(6,625 | ) | (455 | ) | (6,170 | ) | (1,356.0 | )% | ||||||||

| Operating margin |

(1.4 | )% | (0.1 | )% | ||||||||||||

| Adjusted EBITDA |

$ | 14,429 | $ | 36,442 | $ | (22,013 | ) | (60.4 | )% | |||||||

Revenue in the West region increased $122.3 million, or 33.7%, in 2012 to $484.9 million compared to $362.6 million in 2011. The majority of the increase is due to a full year of revenue from the six acquisitions that expanded our presence in Utah, Texas and Colorado in 2011. Incremental revenue from businesses acquired in 2011 totaled $147.4 million. These increases were partially offset by volume declines in the Utah market.

Operating margin remained relatively consistent at (0.1)% in 2011 and (1.4)% in 2012. The negative margin in 2011 was affected by $6.0 million of transaction costs related to the acquisitions, while 2012 was affected by $8.0 million in losses on an indemnification agreement, compared to $1.9 million in 2011, and lower margins on legacy construction projects due to cost overruns.

Adjusted EBITDA declined $22.0 million from $36.4 million in 2011 to $14.4 million in 2012 primarily due the following:

| • | In 2012, we recognized $8.0 million in losses on an indemnification agreement, compared to $1.9 million in 2011. |

| • | In 2011, we recognized $12.1 million of bargain purchase gains on our acquisitions in Colorado. |

| • | In 2011, we recognized a $4.8 million gain from a fair value adjustment to contingent consideration, compared to $0.4 million in 2012. |

West region fiscal year 2011 compared to 2010

| (in thousands) |

2011 | 2010 | Variance | |||||||||||||

| Revenue |

$ | 362,577 | $ | 59,337 | $ | 303,240 | 511.0 | % | ||||||||

| Operating income |

(455 | ) | (4,691 | ) | 4,236 | 90.3 | % | |||||||||

| Operating margin |

(0.1 | )% | (7.9 | )% | ||||||||||||

| Adjusted EBITDA |

$ | 36,442 | $ | (1,710 | ) | $ | 38,152 | 2,231.1 | % | |||||||