Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ANI PHARMACEUTICALS INC | v362571_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - ANI PHARMACEUTICALS INC | v362571_ex99-1.htm |

A Specialty Pharmaceutical Company NASDAQ: ANIP HIGH POTENCY DRUGS – NARCOTIC DRUGS – RX LIQUIDS AND TABLETS – CONTRACT MANUFACTURING Corporate Presentation December 2013

2 Cautionary Statement Concerning Forward - Looking Statements This presentation and certain information incorporated herein by reference contain forward - looking statements under the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about the Company’s plans, objectives, expectations and intentions with respect to future operations and products, the anticipated financial position, operating results and growth prospects of the Company and other statements that are not historical in nature, particularly those that utilize terminology such as “anticipates,” “will,” “expects,” “plans,” “potential,” “future,” “believes,” “intends,” “continue,” other words of similar meaning, derivations of such words and the use of future dates. Forward - looking statements by their nature address matters that are, to different degrees, uncertain. Uncertainties and risks may cause the Company’s actual results to be materially different than those expressed in or implied by such forward - looking statements. Uncertainties and risks include the risk that the Company may in the future be required to seek FDA approval for its unapproved products or withdraw such products from the market; the Company may in the future fail to meet NASDAQ listing requirements; general business and economic conditions; the Company’s need for and ability to obtain additional financing; the difficulty of developing pharmaceutical products, obtaining regulatory and other approvals and achieving market acceptance; and the marketing success of the Company’s licensees or sublicensees . More detailed information on these and additional factors that could affect the Company’s actual results are described in the Company’s filings with the Securities and Exchange Commission, including its most recent annual report on Form 10 - K and quarterly report on Form 10 - Q, as well as its proxy statement/prospectus, filed with the Securities and Exchange Commission on May 8, 2013. All forward - looking statements in this presentation speak only as of the date made and are based on the Company’s current beliefs and expectations. The Company undertakes no obligation to update or revise any forward - looking statement, whether as a result of new information, future events or otherwise. 2

3 3 ANI Mission Statement ANI Pharmaceuticals is an emerging specialty pharmaceutical company developing, manufacturing and marketing branded and generic prescription pharmaceuticals. ANI’s mission is to market niche generic pharmaceuticals, focusing on opportunities in pain management (narcotics), anti - cancer (oncolytics), women’s health (hormones and steroids), and complex formulations including extended release and combination products.

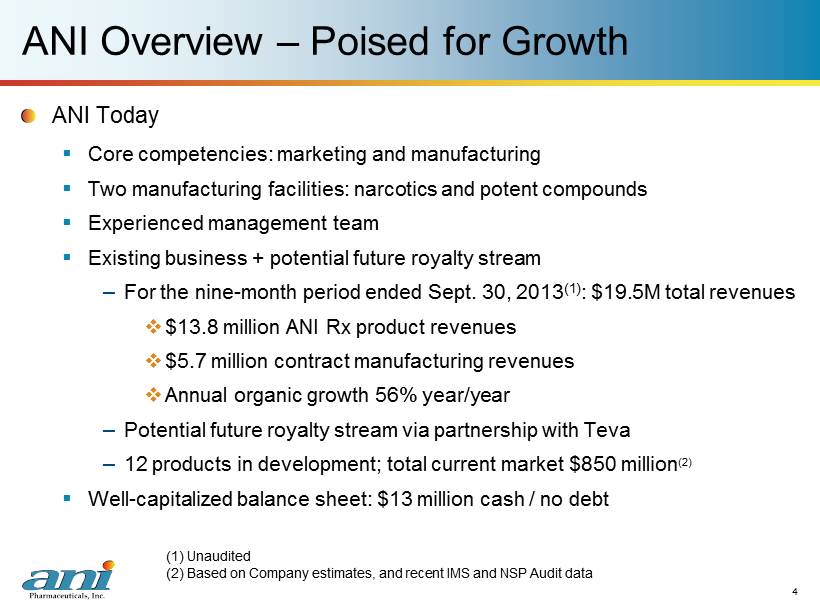

4 ANI Overview – Poised for Growth ANI Today ▪ Core competencies: marketing and manufacturing ▪ Two manufacturing facilities: narcotics and potent compounds ▪ Experienced management team ▪ Existing business + potential future royalty stream – For the nine - month period ended Sept. 30, 2013 (1) : $19.5M total revenues □ $13.8 million ANI Rx product revenues □ $5.7 million c ontract m anufacturing revenues □ Annual organic growth 56% year/year – Potential future royalty stream via partnership with Teva – 12 products in development; total current market $850 million (2) ▪ Well - capitalized balance sheet: $13 million cash / no debt (1) Unaudited (2) Based on Company estimates, and recent IMS and NSP Audit data 4

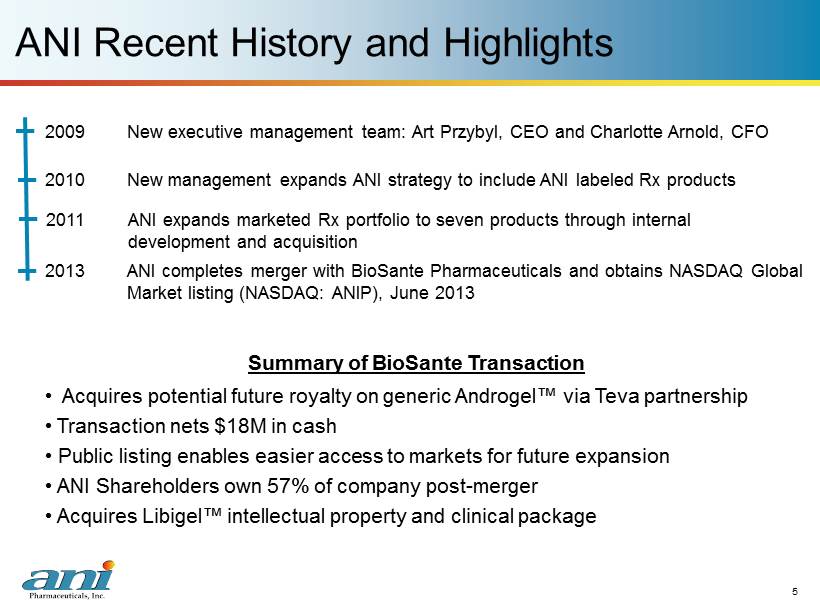

5 5 ANI Recent History and Highlights 2009 New executive management team: Art Przybyl, CEO and Charlotte Arnold, CFO 2010 New management expands ANI strategy to include ANI labeled Rx products 2011 ANI expands marketed Rx portfolio to seven products through internal development and acquisition 2013 ANI completes merger with BioSante Pharmaceuticals and obtains NASDAQ Global Market listing (NASDAQ: ANIP), June 2013 Summary of BioSante Transaction • Acquires potential future royalty on generic Androgel ™ via Teva partnership • Transaction nets $18M in cash • Public listing enables easier access to markets for future expansion • ANI Shareholders own 57% of company post - merger • Acquires Libigel ™ intellectual property and clinical package

6 6 Sales and Marketing / Financial Overview

7 $9 $17 $20 $20 $28.6 $0 $5 $10 $15 $20 $25 $30 2010 2011 2012 2013 2013E ANI Historical Revenue Growth 7 $s in millions +30% Year/Year growth 39% 42% 43% 34% C ost of sales as a percentage of net revenues, excluding depreciation and amortization 1 (1) Unaudited (1Q – 3Q) (Guidance)

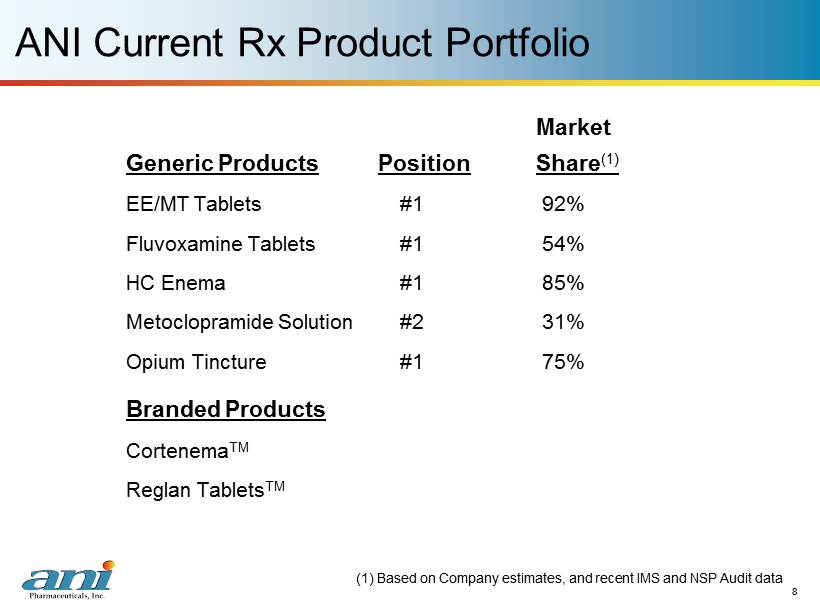

8 ANI Current Rx Product Portfolio Market Generic Products Position Share (1) EE/MT Tablets #1 92% Fluvoxamine Tablets #1 54% HC Enema #1 85% Metoclopramide Solution #2 31% Opium Tincture #1 75% 8 Branded Products Cortenema TM Reglan Tablets TM (1) Based on Company estimates, and recent IMS and NSP Audit data

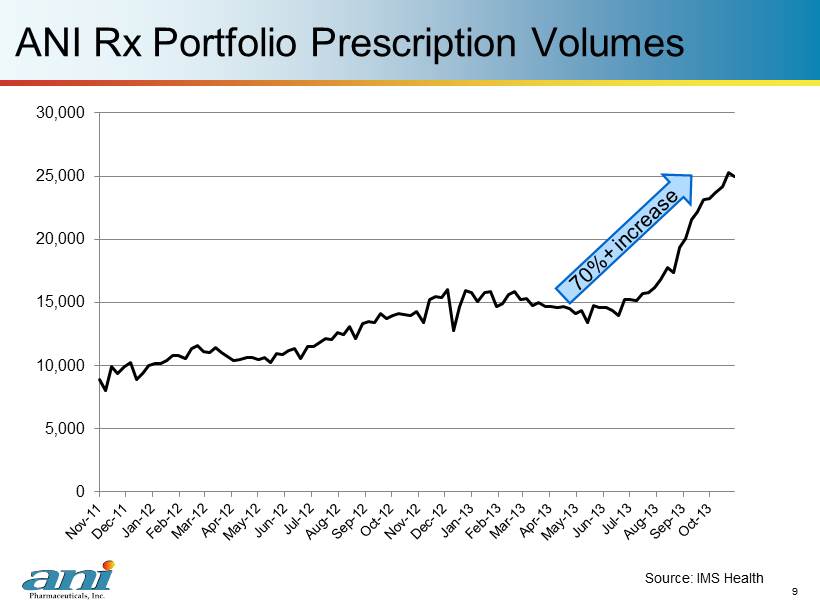

9 ANI Rx Portfolio Prescription Volumes 9 Source: IMS Health 0 5,000 10,000 15,000 20,000 25,000 30,000

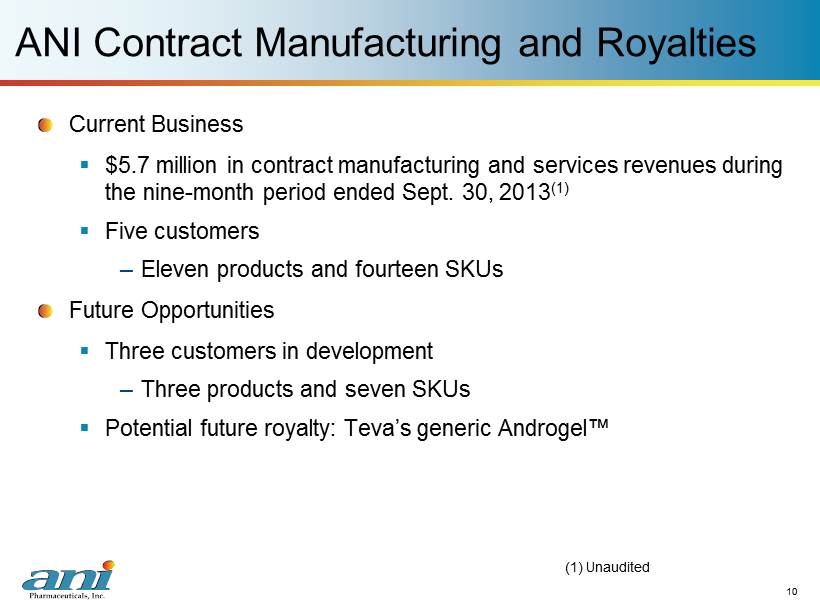

10 ANI Contract Manufacturing and Royalties 10 Current Business ▪ $5.7 million in contract manufacturing and services revenues during the nine - month period ended Sept. 30, 2013 (1) ▪ Five customers – Eleven products and fourteen SKUs Future Opportunities ▪ Three customers in development – Three products and seven SKUs ▪ Potential future royalty: Teva’s generic Androgel ™ (1) Unaudited

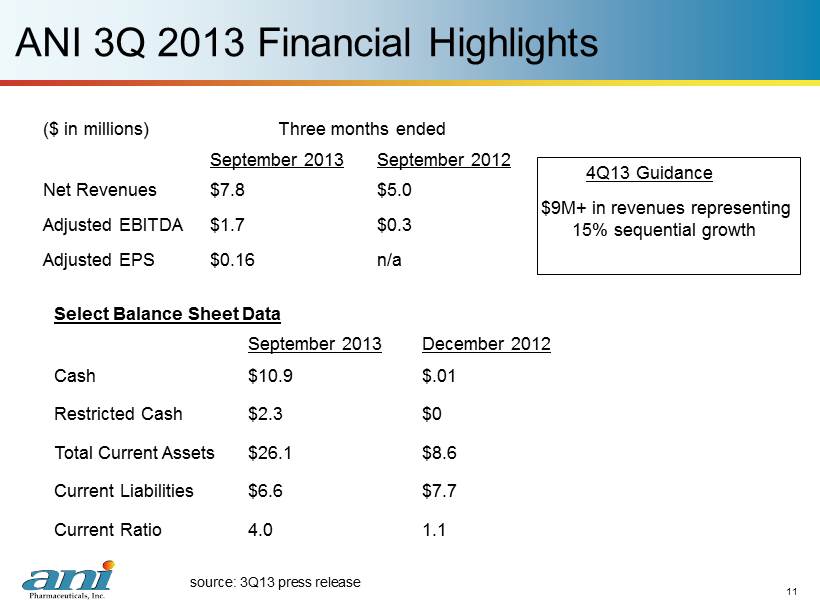

11 ANI 3Q 2013 Financial Highlights 11 4Q13 Guidance $9M+ in revenues representing 15% sequential growth source: 3Q13 press release ($ in millions) Three months ended September 2013 September 2012 Net Revenues $7.8 $5.0 Adjusted EBITDA $1.7 $0.3 Adjusted EPS $0.16 n/a Select Balance Sheet Data September 2013 December 2012 Cash $10.9 $.01 Restricted Cash $2.3 $0 Total Current Assets $26.1 $8.6 Current Liabilities $6.6 $7.7 Current Ratio 4.0 1.1

12 12 Product Development / Business Development Overview

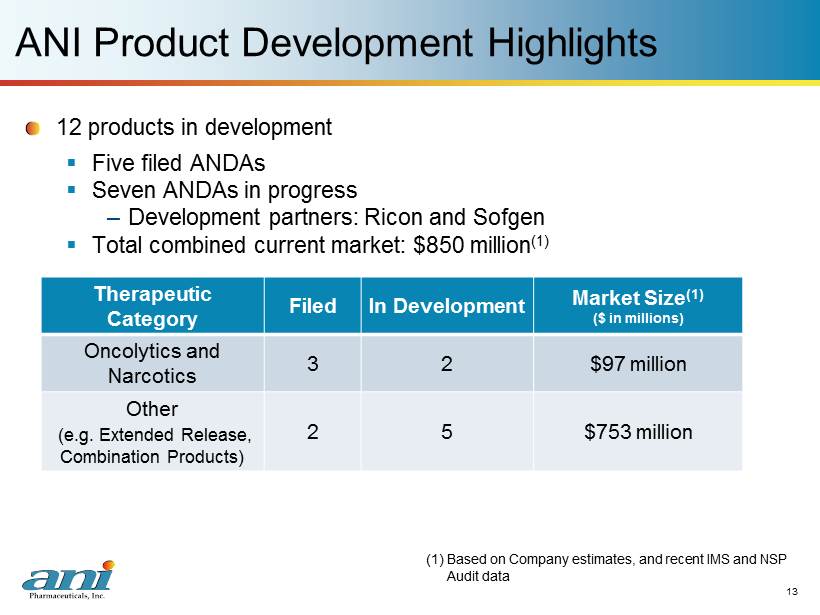

13 13 ANI Product Development Highlights 12 p roducts in development ▪ Five filed ANDAs ▪ Seven ANDAs in progress – Development partners: Ricon and Sofgen ▪ Total combined current market: $850 million (1) Therapeutic Category Filed In Development Market Size (1) ($ in millions) Oncolytics and Narcotics 3 2 $97 million Other (e.g. Extended Release, Combination Products) 2 5 $753 million (1) Based on Company estimates, and recent IMS and NSP Audit data

14 14 ANI Business Development Highlights Acquired undisclosed A NDA, March 2010 Acquired Reglan TM tablets, June 2011 Product development partnership with Ricon , June 2011 Acquired royalty arrangement with Teva , June 2013 Product development partnership with Sofgen , August 2013 Business Development Focus Enhancing generic product pipeline through development partnerships Acquiring / In - licensing approved or development stage ANDAs Acquiring revenue generating products / companies

15 15 Manufacturing Overview

16 16 ANI Manufacturing – Main Street Facility Location: Baudette , Minnesota ▪ 52,000 square feet of manufacturing , packaging, and warehouse facilities ▪ Rx solutions , suspensions , topicals , tablets , and capsules ▪ DEA - licensed for Schedule II controlled substances ▪ 17,000 square feet of laboratory space for product development and analytical testing

17 17 ANI Manufacturing – IDC Road Facility Location: Baudette, Minnesota ▪ Fully - contained h igh potency facility with capabilities to manufacture h ormone , steroid , and oncolytic products ▪ 47,000 square feet of manufacturing and packaging, and warehouse facilities ▪ 100 nano - gram per eight - hour weighted average maximum exposure limit to ensure employee safety ▪ DEA Schedule IIIN capability

18 ANI Summary ANI is an emerging specialty/generic pharmaceutical firm with: ▪ Profitable base business generating organic growth ▪ Well capitalized balance sheet ▪ Experienced management team ANI is focused on: ▪ Internal product development ▪ Partnerships/strategic alliances ▪ Accretive acquisitions 18