Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - Spectrum Brands Holdings, Inc. | d642045dex311.htm |

| EX-31.2 - EX-31.2 - Spectrum Brands Holdings, Inc. | d642045dex312.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

(Amendment No. 1)

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2013

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO .

Commission file number: 1-4219

Harbinger Group Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 74-1339132 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

450 Park Avenue, 30th Floor, New York NY 10022

(Address of principal executive offices, including zip code)

Registrant’s Telephone Number, Including Area Code: (212) 906-8555

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $0.01 par value | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known, seasoned issuer, as defined in Rule 405 of the Securities Act: Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act: Yes ¨ No þ

Indicate by check mark whether the Issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a small reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | þ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the common stock held by non-affiliates of the registrant, computed by reference to the closing price as of the last business day of the registrant’s most recently completed second fiscal quarter, March 31, 2013, was approximately $271.1 million. For the sole purpose of making this calculation, the term “non-affiliate” has been interpreted to exclude directors and executive officers and other affiliates of the registrant and persons affiliated with Harbinger Capital Partners LLC. Exclusion of shares held by any person should not be construed as a conclusion by the registrant, or an admission by any such person, that such person is an “affiliate” of the Company, as defined by applicable securities laws.

As of December 2, 2013, the registrant had outstanding 145,243,773 shares of common stock, $0.01 par value.

Documents Incorporated By Reference:

None.

Table of Contents

EXPLANATORY NOTE

Unless otherwise indicated or the context requires otherwise, references herein to the “Company,” “HGI,” “we,” “us” or “our” refers to Harbinger Group Inc. and, where applicable, its consolidated subsidiaries; “Harbinger Capital” refers to Harbinger Capital Partners LLC; “FGL” refers to Fidelity & Guaranty Life (formerly, Harbinger F&G, LLC) and, where applicable, its consolidated subsidiaries; “Fiscal 2011” refers to fiscal year ended September 30, 2011; “Fiscal 2012” refers to fiscal year ended September 30, 2012; “Fiscal 2013” refers to fiscal year ended September 30, 2013; “Fiscal 2014” refers to fiscal year ending September 30, 2014; “Front Street” refers to FS Holdco Ltd. and, where applicable, its consolidated subsidiaries; “HCP Stockholders” refers, collectively, to Harbinger Capital Partners Master Fund I, Ltd. (the “Master Fund”), Harbinger Capital Partners Special Situations Fund, L.P. (the “Special Situations Fund”) and Global Opportunities Breakaway Ltd. (the “Global Fund”); “Spectrum Brands” refers to Spectrum Brands Holdings, Inc. and, where applicable, its consolidated subsidiaries and “Zap.Com” refers to Zap.Com Corporation.

This Amendment No. 1 on Form 10-K/A (this “Form 10-K/A”) to the Annual Report on Form 10-K of the Company for Fiscal 2013, filed with the Securities and Exchange Commission (the “SEC”) on November 27, 2013 (the “Original 10-K”) is being filed solely for the purpose of including the information required by Part III of Form 10-K.

As required by Rule 12b-15, in connection with this Form 10-K/A, the Company’s Chief Executive Officer and Chief Financial Officer are providing Rule 13a-14(a) certifications as included herein.

Except as described above, this Form 10-K/A does not modify or update disclosure in, or exhibits to, the Original 10-K. Furthermore, this Form 10-K/A does not change any previously reported financial results, nor does it reflect events occurring after the date of the Original 10-K. Information not affected by this Form 10-K/A remains unchanged and reflects the disclosures made at the time the Original 10-K was filed.

2

Table of Contents

| Page | ||||||

| PART III |

||||||

| Item 10. | Directors, Executive Officers and Corporate Governance | 4 | ||||

| Item 11. | Executive Compensation | 14 | ||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 35 | ||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 39 | ||||

| Item 14. | Principal Accounting Fees and Services | 40 | ||||

3

Table of Contents

PART III

| Item 10. | Directors, Executive Officers and Corporate Governance |

BOARD OF DIRECTORS

Our board of directors (our “Board”) as of the date of this Form 10-K/A consists of eight members, as determined in accordance with our Bylaws (our “Bylaws”). In accordance with our Certificate of Incorporation (our “Charter”), our Board is divided into three classes (designated as Class I, Class II, and Class III, respectively). The three classes are currently comprised of the following directors:

Class I Directors – Term Expiring 2014

Lap Wai Chan, age 47, has served as a director of HGI since October 2009. From September 2009 to September 2010 he was a consultant to MatlinPatterson Global Advisors (“MatlinPatterson”), a private equity firm focused on distressed control investments across a range of industries. From July 2002 to September 2009, Mr. Chan was a Managing Partner at MatlinPatterson. Prior to that, Mr. Chan was a Managing Director at Credit Suisse First Boston H.K. Ltd. (“Credit Suisse”). From March 2003 to December 2007, Mr. Chan served on the board of directors of Polymer Group, Inc. MatlinPatterson, Credit Suisse and Polymer Group, Inc. are not affiliates of HGI.

Keith M. Hladek, age 38, has served as a director of HGI since October 2009. Mr. Hladek is also a director of Zap.Com, a subsidiary of HGI. Mr. Hladek is also the Chief Financial Officer and Co-Chief Operating Officer of Harbinger Capital, an affiliate of HGI. Mr. Hladek is responsible for all accounting and operations of Harbinger Capital (including certain affiliates of Harbinger Capital and their management companies), including portfolio accounting, valuation, settlement, custody, and administration of investments. Prior to joining Harbinger Capital in 2009, Mr. Hladek was Controller at Silver Point Capital, L.P., where he was responsible for accounting, operations and valuation for various funds and related financing vehicles. Mr. Hladek is a Certified Public Accountant in New York. Prior to joining Silver Point Capital, L.P. Mr. Hladek was the Assistant Controller at GoldenTree Asset Management and a fund accountant at Oak Hill Capital Management. Mr. Hladek started his career in public accounting and received his Bachelor of Science in Accounting from Binghamton University. None of the companies Mr. Hladek worked with before joining Harbinger Capital is an affiliate of HGI.

Robin Roger, age 56, has served as a director of HGI since May 2011. Previously, Ms. Roger served as a director for Spectrum Brands and Fidelity and Guaranty Life, each a subsidiary of HGI. Ms. Roger is a Managing Director, General Counsel, Co-Chief Operating Officer and Chief Compliance Officer of Harbinger Capital, an affiliate of the Company. Prior to joining Harbinger Capital in 2009, Ms. Roger was General Counsel at Duff Capital Advisors, a multi-strategy investment advisor. She previously served as General Counsel to Jane Street Capital, a proprietary trading firm, and Moore Capital Management. Ms. Roger worked at Morgan Stanley from 1989 to 2006. While there, she headed the equity sales and trading legal practice group and served as General Counsel of the Institutional Securities Division (which encompassed the investment banking as well as sales and trading activities of the firm), and performed other roles at the corporate level. She received a B.A. from Yale College and a J.D. from Harvard Law School. None of the companies Ms. Roger worked with before joining Harbinger Capital is an affiliate of HGI.

Class II Directors – Terms Expiring 2015

Philip A. Falcone, age 51, has served as a director, Chairman of the Board and Chief Executive Officer of HGI since July 2009. From July 2009 to July 2011, Mr. Falcone served as the President of HGI. He is Chief Investment Officer and Chief Executive Officer of Harbinger Capital, an affiliate of HGI, is Chief Investment Officer of the HCP Stockholders and other Harbinger Capital affiliates. Mr. Falcone co-founded the Master Fund in 2001. Mr. Falcone is also the Chairman of the Board, President and Chief Executive Officer of Zap.Com, a

4

Table of Contents

subsidiary of HGI. Mr. Falcone has over two decades of experience in leveraged finance, distressed debt and special situations. Prior to joining the predecessor of Harbinger Capital, Mr. Falcone served as Head of High Yield trading for Barclays Capital. From 1998 to 2000, he managed the Barclays High Yield and Distressed trading operations. Mr. Falcone held a similar position with Gleacher Natwest, Inc., from 1997 to 1998. Mr. Falcone began his career in 1985, trading high yield and distressed securities at Kidder, Peabody & Co. Mr. Falcone received an A.B. in Economics from Harvard University. None of the companies Mr. Falcone worked with before co-founding the Master Fund is an affiliate of HGI. For information regarding certain legal proceedings involving Mr. Falcone, see Part I, Item 1A. of the Original 10-K “Risk Factors —Risks Related to HGI—We are dependent on certain key personnel; Harbinger Capital and certain key personnel exercise significant influence over us and our business activities; and the business activities, legal matters and other matters that affect Harbinger Capital and certain of our key personnel could adversely affect our ability to execute our business strategy.”

David M. Maura, age 40, has served as Managing Director and Executive Vice President of Investments of HGI effective as of October 2011 and as a director of HGI since May 2011. Mr. Maura has also served as the Chairman of Spectrum Brands, a subsidiary of HGI, since July 2011 and as the interim Chairman of the board of directors of Spectrum Brands and as one of its directors since June 2010. Prior to becoming Managing Director and Executive Vice President of Investments at HGI, Mr. Maura was a Vice President and Director of Investments of Harbinger Capital, an affiliate of HGI. Prior to joining Harbinger Capital in 2006, Mr. Maura was a Managing Director and Senior Research Analyst at First Albany Capital, where he focused on distressed debt and special situations, primarily in the consumer products and retail sectors. Prior to First Albany, Mr. Maura was a Director and Senior High Yield Research Analyst in Global High Yield Research at Merrill Lynch & Co. Mr. Maura was a Vice President and Senior Analyst in the High Yield Group at Wachovia Securities, where he covered various consumer product, service and retail companies. Mr. Maura began his career at ZPR Investment Management as a Financial Analyst. During the past five years, Mr. Maura has served on the board of directors of Russell Hobbs, Inc. (formerly Salton, Inc.), Applica Incorporated and Ferrous Resources Ltd. Mr. Maura received a B.S. in Business Administration from Stetson University and is a CFA charterholder. None of the companies Mr. Maura worked with before joining Harbinger Capital is an affiliate of HGI.

Class III Directors – Terms Expiring 2016

Omar M. Asali, age 43, has served as President of HGI effective as of October 2011, as Acting President since June 2011, and as a director of HGI since May 2011. Mr. Asali is also the Vice Chairman of Spectrum Brands and a director of FGL, Front Street, Zap.Com and the recently formed oil and gas partnership with EXCO Resources, Inc. (“EXCO”), each of which is a subsidiary of HGI. Mr. Asali is responsible for overseeing the day-to-day activities of HGI, including M&A activity and overall business strategy for HGI and HGI’s underlying subsidiaries. Mr. Asali has been directly involved in all of HGI’s acquisitions across all sectors, and he is actively involved in HGI’s management and investment activities. Prior to becoming President of HGI, Mr. Asali was a Managing Director and Head of Global Strategy of Harbinger Capital, an affiliate of HGI, where he was responsible for global portfolio strategy and business development. Before joining Harbinger Capital in 2009, Mr. Asali was the co-head of Goldman Sachs Hedge Fund Strategies (“Goldman Sachs HFS”) where he helped manage approximately $25 billion of capital allocated to external managers. Mr. Asali also served as co-chair of the Investment Committee at Goldman Sachs HFS. Before joining Goldman Sachs HFS in 2003, Mr. Asali worked in Goldman Sachs’ Investment Banking Division, providing M&A and strategic advisory services to clients in the High Technology Group. Mr. Asali previously worked at Capital Guidance, a boutique private equity firm. Mr. Asali began his career working for a public accounting firm. Mr. Asali received an MBA from Columbia Business School and a B.S. in Accounting from Virginia Tech. None of the companies Mr. Asali worked with before joining Harbinger Capital is an affiliate of HGI.

Frank Ianna, age 64, has served as a director of HGI since April 2013. Mr. Ianna has served as director of Sprint Corporation since 2009 and as director of Tellabs, Inc. since 2004. He served as a director of Clearwire Corporation from November 2008 until June 2011. Mr. Ianna served on the board of trustees of the Stevens

5

Table of Contents

Institute of Technology between 1997 and 2007 and as chairman of its subsidiary, Castle Point Holdings, Inc., between 2006 and 2007. Mr. Ianna has also served as a director of a number of private companies and non- profit organizations. Mr. Ianna retired from AT&T, Inc. in 2003 after a 31-year career serving in various executive positions, most recently as President of AT&T Network Services. Mr. Ianna serves as a consultant for McCreight & Company, a consulting company based in Connecticut. Mr. Ianna received his Undergraduate Degree from the Stevens Institute in Electrical Engineering in 1971 (BEEE), and his Master’s Degree from MIT in 1972 (MSEE) and completed the Program for Management Development (PMD), an Executive Education Program of the Harvard Business School in 1985. None of the companies Mr. Ianna worked with at this time are an affiliate of HGI.

Gerald Luterman, age 69, has served as a director of HGI since April 2013. Mr. Luterman has been a director of NRG Energy, Inc. (“NRG”) since April 2009. He also served as Interim Chief Financial Officer of NRG from November 2009 through May 2010. Mr. Luterman was Executive Vice President and Chief Financial Officer of KeySpan Corporation from August 1999 to September 2007. Mr. Luterman has more than 30 years of experience in senior financial positions with companies including American Express Company, Booz Allen & Hamilton, Inc., Emerson Electric Company and Arrow Electronics. Mr. Luterman also served as a director of IKON Office Solutions, Inc. from November 2003 until August 2008 and U.S. Shipping Partners L.P. from May 2006 until November 2009. Mr. Luterman qualified as a Canadian Chartered Accountant in 1967 and graduated from McGill University in Montreal, earning a Bachelor of Commerce Degree in Economics in 1965 and a MBA from the Harvard Business School in 1967. None of the companies Mr. Luterman worked with at this time are an affiliate of HGI.

6

Table of Contents

EXECUTIVE OFFICERS

The following sets forth certain information with respect to the executive officers of the Company. All officers of the Company serve at the discretion of the Company’s Board.

| Name |

Position | |

| Philip A. Falcone |

Chairman of the Board, Chief Executive Officer and Director | |

| Omar M. Asali |

Director and President | |

| Thomas A. Williams |

Executive Vice President and Chief Financial Officer | |

| David M. Maura |

Director and Executive Vice President of Investments | |

| Michael Kuritzkes |

Executive Vice President and General Counsel | |

| Michael Sena |

Vice President and Chief Accounting Officer | |

For information regarding Messrs. Falcone, Asali and Maura, see “Board of Directors” above.

Thomas A. Williams, age 54, has been the Executive Vice President and Chief Financial Officer of HGI since March 2012. Mr. Williams has also been the Executive Vice President and Chief Financial Officer of Zap.Com since March 2012. Mr. Williams is also a director of Front Street Cayman. Prior to joining HGI, Mr. Williams was President, Chief Executive Officer and a director of RDA Holding Co. and its subsidiary Reader’s Digest Association, Inc. (together, “RDA”) from April 2011 until September 2011. Previously, Mr. Williams was RDA’s Chief Financial Officer from February 2009 until April 2011 where his primary focus was on developing business restructuring plans for the company. RDA later filed for bankruptcy protection in February 2013. Prior to joining RDA, Mr. Williams served as Executive Vice President and Chief Financial Officer for Affinion Group Holdings, Inc., a portfolio company of Apollo Management, L.P., from January 2007 until February 2009 where his primary focus was on growing enterprise value, finance, accounting, treasury, tax, investor relations and compliance with the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”). Previously, Mr. Williams spent more than 21 years with AT&T, Inc., where he held a progression of senior financial and officer positions including Chief Financial Officer, AT&T Networks; Chief Financial Officer, AT&T Global Network Technology Services; Chief Financial Officer, AT&T Laboratories; and AT&T Chief Process Officer. Mr. Williams started at AT&T with Bell Laboratories in June 1985. Prior to his tenure at AT&T, Mr. Williams was International Controller of McLean Industries Inc. from 1984 to 1985, Industry Analyst of Interpool Ltd. from 1982 to 1984 and Commodity Trading Associate with Bache Halsey Stuart Shields, Inc. from 1981 to 1982. Mr. Williams received a BA in Economics from the University of South Florida. None of the companies Mr. Williams worked with before joining HGI is an affiliate of HGI.

Michael Kuritzkes, age 53, has served as Executive Vice President and General Counsel of HGI since June 2013. From April 2012 through June 2013, Mr. Kuritzkes served as the Executive Vice President and General Counsel for Digital First Media, Inc., Journal Register Company (“JRC”) and MediaNews Group, Inc. which owned and managed 75 daily newspapers, several hundred weekly publications and related websites and advertising networks throughout the United States and had approximately 9,000 employees. During his time at JRC, the Company filed for voluntary bankruptcy protection. From October 2010 through April 2012, Mr. Kuritzkes served as General Counsel for Philadelphia Media Network which owned and operated The Philadelphia Inquirer, The Philadelphia Daily News, Philly.com and related assets. In August 1997, Mr. Kuritzkes joined Sunoco, Inc. as a General Attorney, and he served as Sunoco’s Senior Vice President and General Counsel from May 2000 through February 2010, overseeing the legal affairs of Sunoco’s refining, marketing, commodity chemicals and metallurgical coke businesses as well as the formation of Sunoco Logistics Partners and Sunoco’s role as general partner of SXL. From May 1991 through May 1997, he held a progression of legal roles with Ultramar Inc., a New York Stock Exchange-listed refining and marketing company with operations in the United States and Canada. From 1985 through 1991, Mr. Kuritzkes was a transactional lawyer

7

Table of Contents

in the New York offices of Kaye Scholer and Battle Fowler representing issuers and underwriters in mergers and acquisitions, financings and general corporate matters. Mr. Kuritzkes received his undergraduate degree in Industrial and Labor Relations from Cornell University and his Juris Doctor from The University of Pennsylvania, where he was a member of the Law Review. None of the companies Mr. Kuritzkes worked with before joining HGI is an affiliate of HGI.

Michael Sena, age 40, has been the Vice President and Chief Accounting Officer of HGI since November 2012. Mr. Sena is also the Vice President and Chief Accounting Officer of Zap.Com. From January 2009 until November 2012, Mr. Sena held various accounting and financial reporting positions with the Reader’s Digest Association, Inc., last serving as Vice President and North American Controller. Before joining the Reader’s Digest Association, Inc., Mr. Sena served as Director of Reporting and Business Processes for Barr Pharmaceuticals from July 2007 until January 2009. Prior to that Mr. Sena held various positions with PricewaterhouseCoopers. Mr. Sena is a Certified Public Accountant and holds a B.S. in Accounting from Syracuse University. None of the companies Mr. Sena worked with before joining HGI is an affiliate of HGI.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 (as amended, the “Exchange Act”) requires our directors, executive officers, and the persons who beneficially own more than 10% of the common stock, par value $0.01 per share, of the Company (the “Common Stock”) and securities convertible into shares of Common Stock (together with the Common Stock, “Subject Shares”), to file with the SEC initial reports of ownership and reports of changes in ownership of Subject Shares. Directors, officers and greater than 10% beneficial owners of the Subject Shares are required by the SEC’s regulations to furnish us with copies of all forms they file with the SEC pursuant to Section 16(a) of the Exchange Act. Based solely on the reports received by us and on the representations of the reporting persons, we believe that these persons have complied with all applicable filing requirements during the fiscal year ended September 30, 2013 except that Messrs. Luterman, Ianna and Kuritzkes filed their respective Form 3 Initial Statements of Beneficial Ownership later than the time prescribed by the SEC.

8

Table of Contents

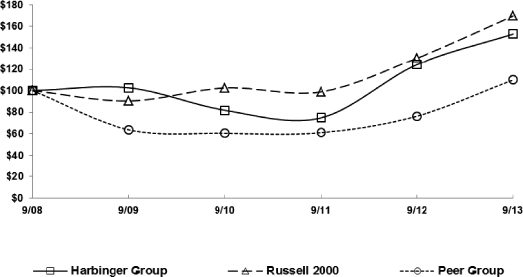

PERFORMANCE GRAPH

Set forth below is a line-graph presentation comparing the cumulative stockholder return on our Common Stock against cumulative total returns of following: (a) the Russell 2000 and (b) a peer group of companies consisting of Leucadia National Corp., Carlisle Companies Inc., Apollo Global Management, LLC and Standex International Corp. The performance graph shows the total return on an investment of $100 for the period beginning September 30, 2008 and ending September 30, 2013. The Company believes that the peer group of companies provides a reasonable basis for comparing total stockholder returns. The stockholder return shown on the graph below is not necessarily indicative of future performance, and we will not make or endorse any predictions as to future stockholder returns. The graph and related data were furnished by Research Data Group, Inc.

Comparison of 5 Year Cumulative Total Return*

Among Harbinger Group, the Russell 2000 Index, and a Peer Group

| * | $100 invested on September 30, 2008 in stock or index, including reinvestment of dividends. |

Fiscal year ending September 30.

9

Table of Contents

CORPORATE GOVERNANCE

On September 27, 2013, following the consummation of certain dispositions of HGI’s common stock by the HCP Stockholders, we ceased to qualify as a “controlled company” for the purposes of Section 303A of the New York Stock Exchange Listed Company Manual (the “NYSE Rules”). Prior to September 27, 2013, the HCP Stockholders controlled more than 50% of the voting power of HGI, and, accordingly, we availed ourselves of the “controlled company” exceptions. During such time, we had determined to voluntarily form a compensation committee (the “Compensation Committee”) with a written charter and composed entirely of independent directors, and not to have a nominating and corporate governance committee (“NCG Committee”). See Item 12. “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” herein for the HCP Stockholders ownership of HGI common stock.

In accordance with the NYSE Rules, we currently have a NCG Committee and a Compensation Committee, each of which have written charters addressing each such committee’s purpose and responsibilities and are comprised entirely of independent directors. Both prior to and after September 27, 2013, our audit committee (“Audit Committee”) has, and continues to have, a written charter and is comprised entirely of independent directors.

Director Independence

Our Board has determined that Messrs. Chan, Ianna and Luterman are independent directors under the NYSE Rules. Under the NYSE Rules, no director qualifies as independent unless the board of directors affirmatively determines that the director has no material relationship with HGI. Based upon information requested from and provided by each director concerning their background, employment and affiliations, our Board has determined that each of the directors named above has no material relationship with HGI, nor has any such person entered into any material transactions or arrangements with HGI or its subsidiaries, and is therefore independent under the NYSE Rules.

Corporate Governance Guidelines and Code of Ethics and Business Conduct

Our Board has adopted Corporate Governance Guidelines to assist it in the exercise of its responsibilities. These guidelines reflect our Board’s commitment to monitor the effectiveness of policy and decision making both at our Board and management level, with a view to enhancing stockholder value over the long term. The Corporate Governance Guidelines address, among other things, our Board and Board committee composition and responsibilities, director qualifications standards and selection of the Chairman of our Board and our Chief Executive Officer.

Our Board has adopted a Code of Business Conduct and Ethics for Directors, Officers and Employees and a Code of Ethics for Chief Executive and Senior Financial Officers to provide guidance to all our directors, officers and employees, including our principal executive officer, principal accounting officer or controller or persons performing similar functions. Our Board has adopted a corporate governance policy prohibiting HGI’s directors and executive officers from (i) hedging the economic risk associated with the ownership of HGI’s common stock, or (ii) pledging our common stock, after the date the policy was adopted, unless first pre-approved by HGI’s legal department. In Fiscal 2013 our Board adopted an equity retention policy for the Company’s senior management.

Meetings of Independent Directors

We generally hold executive sessions at each Board and committee meeting. The Chairman of the Audit Committee presides over executive sessions of the entire Board and the chairman of each committee presides over the executive session of that committee.

10

Table of Contents

Board Structure and Risk Oversight

Mr. Falcone serves as the Chairman of our Board and our Chief Executive Officer. Mr. Falcone has extensive investment and leadership expertise. The Board believes that HGI has benefited from this structure and, based upon Mr. Falcone’s extensive investment and leadership expertise, Mr. Falcone’s continuation as our Chairman and Chief Executive Officer is in the best interests of our stockholders.

Our management is responsible for understanding and managing the risks that we face in our business, and our Board is responsible for overseeing management’s overall approach to risk management. Starting as of September 27, 2013, our Board has been assisted by our NCG Committee with, among other things, its oversight of risk. Our Board receives reports on the operations of our businesses from members of management and members of management of our subsidiaries as appropriate and discusses related risks. Our Board also fulfills its oversight role through the operations of our NCG Committee, Audit Committee and Compensation Committee. As appropriate, these committees of the Board provide periodic reports to our Board on their activities. Our Audit Committee is responsible for oversight of corporate finance and financial reporting related risks, including those related to our accounting, auditing and financial reporting practices. Our Compensation Committee is responsible for the oversight of our compensation policies and practices, including conducting annual risk assessments of our compensation policies and practices. Our NCG Committee is responsible for assisting our Board with the oversight of risks and reviewing and making recommendations to our Board regarding our overall corporate governance, including board and committee composition, board nominees, size and structure and director independence, our corporate governance profile and ratings, and our political participation and contributions.

Governance Documents Availability

We have posted our Corporate Governance Guidelines, Code of Business Conduct and Ethics for Directors, Officers and Employees, Code of Ethics for Chief Executive and Senior Financial Officers, Audit Committee Charter, Compensation Committee Charter and NCG Committee Charter on our website under the heading “Corporate Governance” at www.harbingergroupinc.com. We intend to disclose any amendments to, and, if applicable, any waivers of, these governance documents on that section of our website. These governance documents are also available in print without charge to any stockholder of record that makes a written request to HGI. Inquiries must be directed to the Investor Relations Department at Harbinger Group Inc., 450 Park Avenue, 30th floor, New York, New York 10022.

11

Table of Contents

INFORMATION ABOUT COMMITTEES OF THE BOARD OF DIRECTORS

Our Audit Committee and Compensation Committee were our Board’s only standing committees during Fiscal 2013. We created our NCG Committee on September 27, 2013. In addition, a special committee of the independent directors of our Board operated on an ad hoc basis in Fiscal 2013.

Audit Committee

Currently, our Audit Committee is composed of Messrs. Gerald Luterman (Chairman), Frank Ianna and Lap Wai Chan. Messrs. Thomas Hudgins and Robert V. Leffler, Jr. also served as members of our Audit Committee from the commencement of Fiscal 2013 until April 8, 2013. Messrs. Gerald Luterman and Frank Ianna joined as members of our Board and our Audit Committee on April 8, 2013. Mr. Chan has served as a member of our Board and our Audit Committee for the entirety of Fiscal 2013.

Our Board determined that all members of our Audit Committee qualify as independent under applicable SEC rules, NYSE Rules and the Company’s Corporate Governance Guidelines. Messrs. Luterman, Chan and Hudgins qualified as “audit committee financial experts” as defined by Item 407(d)(5)(ii) of Regulation S-K. Our Audit Committee held 5 meetings during Fiscal 2013.

Our Audit Committee operates under, and has the responsibility and authority set forth in, the written charter adopted by our Board, which can be viewed on our website, www.harbingergroupinc.com, under the heading “Corporate Governance.”

Compensation Committee

Currently, our Compensation Committee is composed of Messrs. Frank Ianna (Chairman), Gerald Luterman and Lap Wai Chan. Messrs. Robert V. Leffler, Jr. (former Chairman) and Thomas Hudgins also served as members of our Compensation Committee from the commencement of Fiscal 2013 until April 8, 2013. Messrs. Frank Ianna and Gerald Luterman joined as members of our Board and our Compensation Committee on April 8, 2013. Mr. Chan has served as a member of our Board and our Compensation Committee for the entirety of Fiscal 2013.

Our Board determined that all members of our Compensation Committee qualify as independent under applicable SEC rules, NYSE Rules and the Company’s Corporate Governance Guidelines. Our Compensation Committee held 15 meetings during Fiscal 2013. Our Compensation Committee has been delegated the authority to, among other things, (i) review and recommend to our Board corporate goals and objectives relevant to our executive officer compensation and recommend to our Board the compensation level of our executive officers; (ii) make recommendations to our Board with respect to executive officer compensation and benefits, including incentive-compensation and equity-based plans for executive officers; (iii) review and recommend to our Board any employment agreements or severance or termination arrangements to be made with any of our executive officers; and (iv) review and discuss with management our compensation discussion and analysis disclosure and compensation committee reports in order to comply with our public reporting requirements. Our Compensation Committee operates under, and has the responsibility and authority set forth in, the written charter adopted by our Board, which can be viewed on our website, www.harbingergroupinc.com, under the heading “Corporate Governance.”

NCG Committee

Currently, our NCG Committee is composed of Messrs. Frank Ianna (Chairman), Gerald Luterman, and Lap Wai Chan. As described under the heading “Corporate Governance—Controlled Company” above, HGI formed our NCG Committee on September 27, 2013. Accordingly, we did not have a NCG Committee for a substantially all of Fiscal 2013.

12

Table of Contents

Our Board determined that all members of our NCG Committee qualify as independent under applicable SEC rules, NYSE Rules and the Company’s Corporate Governance Guidelines. Our NCG Committee held one meeting during Fiscal 2013.

Our NCG Committee has been delegated the authority to, among other things, (i) develop and recommend to our Board for approval the criteria for Board membership and identify individuals qualified to become members of our Board, (ii) as directed by our Board from time to time, either select or recommend to our Board for selection director nominees for the next annual meeting of shareholders or to fill vacancies on our Board, (iii) assist the Board in determining whether individual directors have material relationships with our Company that may interfere with their independence and (iv) develop, review and assess at least annually the adequacy of the Company’s corporate governance principles and guidelines, the Board’s and management’s review of the Company’s risk oversight process, and make recommendations to the Board as the Committee deems appropriate. The NCG Committee operates under, and has the responsibility and authority set forth in, the written charter adopted by our Board, which can be viewed on our website, www.harbingergroupinc.com, under the heading “Corporate Governance.”

13

Table of Contents

| Item 11. | Executive Compensation |

COMPENSATION DISCUSSION AND ANALYSIS

This section provides an overview and analysis of our compensation program and policies, the material compensation decisions made under those programs and policies, and the material factors considered in making those decisions. The discussion below is intended to help you understand the detailed information provided in our executive compensation tables and put that information into context within our overall compensation program. The series of tables following this Compensation Discussion and Analysis provides more detailed information concerning compensation earned or paid in Fiscal 2013, Fiscal 2012 and Fiscal 2011 for the following individuals (each a “named executive officer” as of September 30, 2013):

| • | Philip A. Falcone, the Chairman of our Board and our Chief Executive Officer; |

| • | Omar M. Asali, a Director and our President; |

| • | Thomas A. Williams, our Executive Vice President and Chief Financial Officer; |

| • | David M. Maura, a Director and our Managing Director and Executive Vice President of Investments; and |

| • | Michael Sena, our Vice President and Chief Accounting Officer, effective as of November 19, 2012. |

Executive Summary

Fiscal 2013 Business Highlights

| • | Closed on a transaction with EXCO to create an oil and gas joint venture (the “EXCO/HGI JV”) to operate certain of EXCO’s producing U.S. conventional oil and natural gas assets in the Permian Basin and the Cotton Valley of East Texas and North Louisiana; and subsequently, closed a tuck-in acquisition at EXCO/HGI JV to purchase shallow Cotton Valley assets from an affiliate of BG Group; |

| • | Completed Spectrum Brands’ acquisition of Stanley Black & Decker, Inc.’s Hardware & Home Improvement Group, including the acquisition of the Taiwanese residential lockset business, Tong Lung Metal Industry. |

| • | Refinanced $500.0 million of HGI’s 10.625% senior secured notes on more favorable terms, and further increased financial flexibility through the issuance of an aggregate $925.0 million of HGI’s 7.875% senior secured notes; and |

| • | Purchased $12.3 million of our common stock in the fourth quarter pursuant to a $50.0 million share repurchase program. |

Fiscal 2013 Results Highlights

| • | Our total revenues for Fiscal 2013 increased to $5,543.4 million, or 23.7%, from $4,480.7 million in Fiscal 2012, driven by strong growth across all operating segments. |

| • | Our consolidated operating income increased 80.1% to $737.4 million in Fiscal 2013 from $409.5 million in Fiscal 2012; |

| • | We received dividends of approximately $127.1 million from our subsidiaries, including $93.0 million from FGL, $22.8 million from Spectrum Brands, $7.5 million from the EXCO/HGI JV, and $3.8 million from Salus Capital Partners, LLC. In addition, at the close of the EXCO/HGI JV transaction, HGI received a $22.7 million benefit, in the form of a purchase price reduction; |

| • | Our consumer products segment’s operating profit for Fiscal 2013 increased $49.4 million, or 16.4%, to $351.2 million from $301.8 million for Fiscal 2012; |

14

Table of Contents

| • | Our insurance segment’s operating profit for Fiscal 2013 increased by $363.0 million to $522.9 million from $159.9 million for Fiscal 2012 (our Insurance segment’s adjusted operating income increased by $163.5 million, or 282.4%, to $221.4 million); |

| • | Our financial services segment reported operating profit of $10.4 million for Fiscal 2013, compared to $2.5 million earned during Fiscal 2012, an increase of $7.9 million; |

| • | Our energy segment reported revenues of $90.2 million and an operating loss of $45.2 million primarily as a result of a non cash impairment charge of $54.3 million of oil and natural gas properties; and |

| • | We ended Fiscal 2013 with corporate cash and short-term investments of approximately $301.2 million (primarily held at HGI and our wholly-owned subsidiary, HGI Funding LLC), which can be used to support our business strategy and grow of our existing businesses. |

The foregoing is a highlight summary of certain of HGI’s performance measures. For a more complete understanding and evaluation of the business of the Company and its subsidiaries, you are encouraged to read the Company’s other reports filed with the SEC.

Summary of Sound Governance Features of our Compensation Programs

Our compensation programs, practices, and policies are reviewed and re-evaluated periodically, and are subject to change from time to time. Our executive compensation philosophy is focused on pay for performance and is designed to reflect appropriate governance practices aligned with the needs of our business. Listed below are some of the Company’s more significant practices and policies that were in effect during Fiscal 2013, which were adopted to drive performance and to align our executives’ interests with those of our stockholders.

What We Did For Fiscal 2013

| • | Pay for Performance Philosophy: Our executive compensation programs are designed to pay for performance, with a significant portion of executive compensation not guaranteed. Target compensation is established for our executive officers at the beginning of the performance period by our Compensation Committee. Our named executive officers (excluding Mr. Falcone, who, other than minor perquisites discussed in “Compensation and Benefits – Summary Compensation Table” herein, did not receive compensation from the Company for his services in Fiscal 2013) had an opportunity to earn actual compensation that varied from target, based on achievement against pre-established performance targets. Variable compensation rewards performance and contribution to both short-term and long-term corporate financial performance. For Fiscal 2013, variable pay represented 97.6%, 93.7%, 97.5% and 80.0% of total compensation for Messrs. Asali, Williams, Maura and Sena, respectively, each of whom participated in our Fiscal 2013 bonus program. |

| • | Independent Executive Compensation Consultants: The Compensation Committee works with Mercer, Inc. (“Mercer”), Inc. and Hodak Value Advisors (“Hodak”), two independent executive compensation consultant firms, and separate outside counsel, Wilmer Cutler Pickering Hale and Dorr LLP (“WilmerHale”). |

| • | Mitigation of Undue Risk: Our compensation plans have provisions to mitigate undue risk, including bonus plan mechanisms that defer significant portions of awards, partially subject to forfeiture (see “Clawback Policy” and “Malus Provision” below), and relate future target performance to past performance in a manner that closely ties awards to sustainable performance over time. |

| • | Postemployment Restrictive Covenants: Our employment agreements provide for post employment non-competition, non-solicitation and non-disparagement provisions. |

| • | Clawback Policy: Our equity awards allow the Company to recover payouts in the event that recoupment is required by applicable law (including pursuant to Sarbanes-Oxley and the Dodd-Frank |

15

Table of Contents

| • | Wall Street Reform and Consumer Protection Act) or a participant receives for any reason any amount in excess of what should have been received (including, without limitation, by reason of a financial restatement, mistake in calculations or other administrative error). |

| • | Malus Provision: Our annual bonus program provides for an automatic deferral of payouts in excess of two times the target bonus pool, with cash deferrals subject to reduction if the Company does not meet certain specified performance criteria in subsequent years. |

| • | Negative Discretion: Our Compensation Committee reserves the right to exercise negative discretion to reduce awards under the annual bonus plan. For Fiscal 2013, the Chief Executive Officer recommended the use of negative discretion to reduce the corporate bonus pool by $24.268 million to $60.663 million. The Compensation Committee reviewed and accepted the Chief Executive Officer’s recommendations. |

| • | Award Caps: Amounts that can be earned by any individual under the annual bonus program are capped at $20 million per year (“Award Cap”). |

| • | Equity Retention: Our Board adopted an equity retention policy during Fiscal 2013 for senior management, requiring each member of senior management to retain ownership of at least 25% of his or her covered shares, net of taxes and transaction costs, until the earlier of (i) the date of such senior management member’s termination of employment with the Company or (ii) the date such person is no longer a member of senior management. |

What We Did Not Do for Fiscal 2013

| • | No 280G or Section 409A Excise Tax Gross-Ups: We do not provide “gross-ups” for any taxes imposed with respect to Section 280G (change of control) or Section 409A (nonqualified deferred compensation) of the Internal Revenue Code. |

| • | No Pensions or Supplemental Pensions: Our named executive officers are not provided with pension or supplemental executive retirement plans. |

| • | No Change in Control Enhanced Payments or Single Trigger Equity Acceleration: In Fiscal 2013, we did not provide “single-trigger” equity vesting or enhanced payments upon a change of control of the Company. |

| • | No Repricing of Underwater Stock Options without Stockholder Approval: We do not lower the exercise price of any outstanding stock options, unless stockholders approve this. |

| • | No Discounted Stock Options: The exercise price of our stock options is not less than 100% of the fair market value of our common stock on the date of grant. |

| • | No Unauthorized Hedging or Pledging: The Board has adopted a corporate governance policy prohibiting our directors and executive officers from (i) hedging the economic risk associated with the ownership of our common stock and (ii) pledging our common stock, after the date the policy was adopted, unless first pre-approved by the Company’s legal department. |

Compensation Philosophy and General Objectives

Our executive compensation philosophy is focused on pay for performance and is designed to reflect appropriate governance practices aligned with the needs of our business. We grant target levels of compensation that are designed to attract and retain employees who are able to meaningfully contribute to our success. Our Compensation Committee considers several factors in designing target levels of compensation, including, but not limited to, historical levels of pay for each executive, actual turnover in the executive ranks, market data on the compensation of executive officers at similar companies, and its judgment about retention risk with regards to each executive relative to their importance to the Company. In reviewing market data, our Compensation Committee has reviewed the total compensation for each executive officer relative to executives in the same or

16

Table of Contents

similar positions in an appropriate market comparison group, which includes seventeen business development or private equity companies, adjusting the total compensation observed at these peers for their size relative to the Company. The seventeen companies are American Capital, Ltd., Apollo Global Mgmt., Blackstone Group LP, Capital Southwest Corp, Carlyle Group, Compass Diversified Holdings, Harris & Harris Group, Hercules Tech Growth Cap, Icahn Enterprises, KKR, Kohlberg Capital Corp, Leucadia National Corp, Loews Corp, Main Street Capital Corp, MCG Capital Corp, Safeguard Scientifics Inc., and Triangle Capital Corp. While median, size-adjusted total compensation is initially presumed to be competitive market pay, the Compensation Committee does not attempt to target a specific percentile within a peer group or otherwise rely exclusively on that data to determine named executive officer compensation. The Compensation Committee does not use market data to target specific components of total compensation, such as salary or bonuses, and instead determines the target total level of compensation necessary to be competitive for each executive in the relevant market for that executive’s talent.

The Company’s mix of fixed versus variable compensation, within the target total level of pay, is driven by the Company’s emphasis on pay for performance. The Company uses variable compensation, including performance-based equity grants, as well as management’s accumulated equity holdings, both vested and unvested, to enhance alignment of our named executive officers’ and stockholders’ interests.

Components of Executive Compensation

Our compensation program has four basic elements: salary, initial equity grants, incentive compensation, and other benefits. Salary and benefits are designed to aid in the retention of our employees. Initial equity grants are generally, though not necessarily, awarded upon hiring or promotion, and may consist of restricted stock or stock options with a vesting period. Incentive compensation generally consists of bonuses for individual and company performance, and may be awarded as cash or equity. Equity awards will typically be vested over a period of years to enhance both retention and alignment of interests.

We believe that the various components of our executive compensation program are effective in attracting and retaining our employees and providing a strong alignment of their interests with those of our stockholders. Although each element of compensation described below is considered separately, our Compensation Committee makes its determinations regarding each individual component of the compensation program in the context of the aggregate effect on total compensation for each named executive officer.

During Fiscal 2013, other than minor perquisites discussed in “Compensation and Benefits – Summary Compensation Table” herein, Mr. Falcone did not receive compensation from the Company for his services. The Compensation Committee is currently considering entering into an employment agreement with Mr. Falcone and providing him with compensation. While the Compensation Committee is discussing potential arrangements with Mr. Falcone, there can be no assurances on the outcome of such discussions.

The principal elements of compensation for our named executive officers in Fiscal 2013, other than Mr. Falcone, were:

| • | base salary; |

| • | variable compensation potential consisting of cash and equity payouts; and |

| • | limited benefits. |

In addition, Mr. Sena was granted an initial long-term equity grant consisting of a stock option and restricted stock award.

17

Table of Contents

How We Determine Each Element of Compensation

Role of Our Compensation Committee and Compensation Consultants

Our Compensation Committee is responsible for our executive compensation program design and administration, including a regular review of our compensation programs and evaluation of management performance and awards consistent with our bonus plan. In approving the compensation program and awards for Fiscal 2013, our Compensation Committee considered a number of factors including, but not limited to, the responsibilities of the position, the executives’ experience and contributions, the competitive marketplace for executive talent, and corporate performance.

Since July 2011 and through the date of this report, our Compensation Committee has been advised by independent compensation consultants, Hodak, a consulting and research firm specializing in designing and implementing performance measures and management incentives, and Mercer, a global leader for human resources, in its review of the Company’s compensation elements, levels of pay and potential programs for short and long term compensation and by separate outside legal counsel, Wilmer Hale. Throughout Fiscal 2013, Mercer, Hodak and WilmerHale worked with our Compensation Committee on the Company’s compensation program, including target levels of compensation for current and new employees, bonus plans or equity awards, and other compensation policies affecting executive officers and directors. Our Compensation Committee met 15 times during Fiscal 2013.

In light of new SEC rules and new NYSE Rules, our Compensation Committee considered the independence of each of our compensation consultants, Hodak and Mercer, including assessment of the following factors: (i) other services provided to the Company by the consultant; (ii) fees paid as a percentage of the consulting firm’s total revenue; (iii) policies or procedures maintained by the consulting firm that are designed to prevent a conflict of interest; (iv) any business or personal relationships between the individual consultants involved in the engagement and any member of our Compensation Committee; (v) any Company stock owned by the individual consultants involved in the engagement; and (vi) any business or personal relationships between our executive officers and the consulting firm or the individual consultants involved in the engagement. Our Compensation Committee has concluded that no conflict of interest exists that would prevent our consultants from independently representing our Compensation Committee.

Base Salary

The base salary of our named executive officers is intended to provide a level of fixed compensation that contributes to the attraction or retention of our executive officers. For Fiscal 2013, our Compensation Committee determined that, at $500,000 per year for each of Messrs. Asali, Williams and Maura and $250,000 per year for Mr. Sena, the salaries represented an appropriate level of fixed compensation relative to each such named executive officer’s respective target total compensation, which varies by position in accordance with each such executive officer’s job responsibilities and contributions to our Company.

During Fiscal 2012, the Company entered into an employment agreement with each of Messrs. Asali, Williams and Maura, and during Fiscal 2013 the Company entered into an employment agreement with Mr. Sena. These employment agreements provide for a fixed base salary and other compensation and were negotiated in connection with Messrs. Asali, Williams, Maura and Sena joining the Company and were approved by our Compensation Committee.

Annual Bonus Plan

Messrs. Asali, Williams, Maura and Sena participated in the bonus plan for Fiscal 2013 (the “2013 Bonus Plan”) along with other key employees of the Company. The 2013 Bonus Plan is designed to (i) offer target variable compensation that provide competitive levels of total pay to executives if they achieve target results and (ii) reward and encourage value creation by executives. It provides for annual bonuses comprised of two components. The first component is an individual bonus (the “individual bonus”) based on the achievement of

18

Table of Contents

personal performance goals. The second component is a corporate bonus (the “corporate bonus”) based on the achievement of corporate performance measured in terms of the change in the Company’s “Net Asset Value” (as defined below) from the beginning of the Company’s fiscal year to the end of the Company’s fiscal year end (“NAV Return”), in excess of a threshold NAV Return, which for Fiscal 2013 was set at $96.6 million (the “Fiscal 2013 Threshold NAV Return”), representing a 7% increase in the Compensation Committee’s approved Net Asset Value per share at the beginning of Fiscal 2013. Please see the discussion below for additional details for the calculation of the NAV Return.

NAV Return is believed to be a good proxy for creation of value for the Company and its stockholders because it encourages, among other things, the generation of cash flow by the Company’s subsidiaries and transactions resulting in appreciation of the assets of the Company and its subsidiaries. Corporate bonuses are awarded annually with a portion immediately vested and a portion subject to vesting over a number of years. A portion of the unvested amounts are subject to forfeiture if the NAV Return thresholds are not satisfied in the following years. Our Compensation Committee believes that paying a corporate bonus consistently based on NAV Return, subject to vesting over a number of years, encourages a long-term focus on value creation for the benefit of our stockholders. If in Fiscal 2013, the Company had not produced a NAV Return greater than $96.6 million, no corporate bonuses would have been earned.

For Fiscal 2013, NAV Return was based on the amount calculated as the product of (i) the percentage increase in the Net Asset Value per share of the Company from the beginning of Fiscal 2013 to the end of Fiscal 2013 multiplied by (ii) the Net Asset Value at the beginning of Fiscal 2013. The 2013 Bonus Plan provides that 12% of the excess, if any, of the NAV Return for Fiscal 2013 over the Fiscal 2013 Threshold NAV Return is to be allocated to fund the corporate bonus pool for bonuses to all named executive officers and other key employees. This amount was then reduced (as discussed in greater detail below) by our Compensation Committee pursuant to its exercise of its negative discretion.

For the purpose of the foregoing calculation, the Company’s “Net Asset Value” is generally calculated by (i) starting with the value of the Company’s “Net Asset Value,” as such term is defined in the Company’s Certificate of Designation of Series A Participating Convertible Preferred Stock of the Company dated as of May 12, 2011 (the “Preferred Stock Certificate”), (ii) then subtracting from such amount the Company’s deferred tax liabilities, (iii) then adding to such amount the Company’s capital contributions to fund start-up businesses, which is subject to a $20 million cap, (iv) then adding to such amount the Company’s deferred financing costs, (v) then adding to such amount the value of the Company’s assets that have not been appraised, which is subject to a $50 million cap, (vi) then eliminating the effect of any increase in legacy liabilities associated with our predecessor entity, Zapata Corporation and its subsidiaries, (vii) then adding to such amount expenses incurred in connection with completing any acquisitions by the Company within the past twelve months, and (viii) excluding any accretion on preferred stock (calculated in the manner contained in the Preferred Stock Certificate). The Company then makes adjustments to eliminate the effects of any conversion of preferred stock into common stock.

Our Company achieved a NAV Return of $804,360,494 during Fiscal 2013. Accordingly, pursuant to the 2013 Bonus Plan, 12% of the portion of the Fiscal 2013 NAV Return that is in excess of $96.6 million, or $84.931 million, was allocated to fund the corporate bonus pool for bonuses to all named executive officers and other key employees. The overall bonus pool was preliminarily divided among all plan participants based on their individual target bonuses as a proportion to the sum of target bonuses. Our Chief Executive Officer, who did not participate in the 2013 bonus plan, then made recommendations to our Compensation Committee with regard to the overall bonus pool and the allocation of awards to all plan participants relative to their respective contributions. For Fiscal 2013, our Chief Executive Officer recommended the use of negative discretion to reduce the corporate bonus pool by $24.268 million to $60.663 million. Our Compensation Committee reviewed and accepted our Chief Executive Officer’s recommendations. There were no adjustments to the corporate bonus award for any named executive officer in Fiscal 2013, except for Mr. Asali, whose total bonus award for Fiscal 2013 was limited to $20 million by the Award Cap.

19

Table of Contents

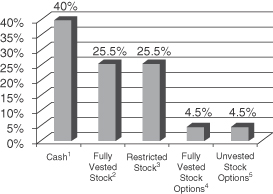

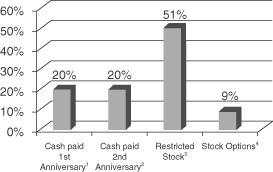

Pursuant to the 2013 Bonus Plan, awards are paid out in a mix of cash (40%) and equity (60%). The 2013 Bonus Plan was designed such that all awards for Fiscal 2013 greater than two times the target bonus for each plan participant are deferred to subsequent years, in each case, in the proportions as set forth in the charts below. Deferred cash payments may be reduced in subsequent years, if the NAV Return in such years is below a threshold return.

The corporate bonus earned is distributed to participants as follows:

| Up to two times the target corporate bonus pool could be paid out in Fiscal 2013 in the following proportion: |

Amounts in excess of two times the corporate bonus pool could be paid out in the following proportion: | |

|

|

| |

| 1. Cash

2. Fully Vested Stock

3. Restricted stock (subject to continued employment) vests on the first anniversary of the grant date.

4. Fully vested stock options.

5. Stock options (subject to continued employment) vest on the first anniversary of the grant. |

1. Cash paid on the first anniversary of the original payment date.

2. Cash paid on the second anniversary of the original payment date.

3. Restricted stock (subject to continued employment) vests in substantially equal installments on the second and third anniversaries of the grant date.

4. Stock options (subject to continued employment) vest in substantially equal installments on the second and third anniversaries of the grant date. | |

As stated above, for Fiscal 2013 a portion of the annual bonus (namely, the individual bonus), was based on individual performance achievement against certain pre-established goals. For Messrs. Asali and Maura, for Fiscal 2013 85% of their target annual bonus was the corporate bonus (based on NAV Return) and 15% was the individual bonus based on performance of individual goals. For Mr. Williams, for Fiscal 2013 60% of his target annual bonus consisted of a corporate bonus and 40% was an individual bonus. For Mr. Sena, for Fiscal 2013 50% of his target annual bonus consisted of a corporate bonus and 50% was an individual bonus. The performance goals for the individual bonus were determined by our Compensation Committee on an individual basis. Participants earned between 0 and 200% of their individual target bonus based on achievement of the individual performance goals, and the individual bonuses could be earned even if NAV Return during Fiscal 2013 did not exceed the Fiscal 2013 Threshold NAV Return. Each of the named executive officers earned 200% of their individual target bonuses based on achievement of their individual performance goals during Fiscal 2013.

For Fiscal 2013, our Compensation Committee established only objective performance goals for Mr. Asali’s individual bonus, which were (i) receipt of $100 million of dividends by the Company from its subsidiaries, (ii) the Company raising capital to replace the $500 million of senior debt and (iii) the improvement of the

20

Table of Contents

Company’s credit rating by at least one major credit rating agency. For Fiscal 2013, Mr. Asali’s total target bonus was $2.5 million. Our Compensation Committee determined that Mr. Asali achieved or exceeded each of his individual performance measures. Accordingly, for Fiscal 2013, our Compensation Committee awarded Mr. Asali an individual bonus and corporate bonus in excess of his target amounts, which were comprised of immediately vested and deferred cash and equity. See “Compensation and Benefits – Summary Compensation Table” and “Significant Events after Fiscal 2013 – Equity Grants Pursuant to the 2013 Bonus Plan” for details regarding the amount of Mr. Asali’s individual bonus and corporate bonus and its allocation among immediately vested and deferred cash and equity.

For Fiscal 2013, our Compensation Committee established only objective performance goals for Mr. Williams’ individual bonus, which were (i) receipt of $100 million of dividends by the Company from its subsidiaries, (ii) the Company raising capital to replace the $500 million of senior debt, (iii) the improvement of the Company’s credit rating by at least one major credit rating agency, (iv) the Company’s compliance with all existing or new debt covenants and (v) timely and accurate completion of all external financial reporting by the Company. For Fiscal 2013, Mr. Williams’s total target bonus was $1 million. Our Compensation Committee determined that Mr. Williams achieved or exceeded each of his individual performance measures. Accordingly, for Fiscal 2013, our Compensation Committee awarded Mr. Williams an individual bonus and corporate bonus in excess of his target amounts, which were comprised of immediately vested and deferred cash and equity. See “Compensation and Benefits – Summary Compensation Table” and “Significant Events after Fiscal 2013 – Equity Grants Pursuant to the 2013 Bonus Plan” for details regarding the amount of Mr. Williams’ individual bonus and corporate bonus and its allocation among immediately vested and deferred cash and equity.

For Fiscal 2013, our Compensation Committee established only objective performance goals for Mr. Maura’s individual bonus, which were (i) Spectrum Brands’ achievement of $495 million of adjusted EBITDA (as defined below), (ii) Spectrum Brands’ achievement of $210 million of adjusted free cash flow and (iii) receipt of $30 million of dividends by the Company from Spectrum Brands. For the purposes of Mr. Maura’s performance measure, “adjusted EBITDA” was defined as reported operating income plus certain defined add-backs for depreciation, amortization, acquisition, integration and restructuring related charges. For Fiscal 2013, Mr. Maura’s total target bonus was $2 million. Our Compensation Committee determined that Mr. Maura achieved or exceeded each of his individual performance measures. Accordingly, for Fiscal 2013, our Compensation Committee awarded Mr. Maura an individual bonus and corporate bonus in excess of his target amounts, which were comprised of immediately vested and deferred cash and equity. See “Compensation and Benefits – Summary Compensation Table” and “Significant Events after Fiscal 2013 – Equity Grants Pursuant to the 2013 Bonus Plan” for details regarding the amount of Mr. Maura’s individual bonus and corporate bonus and its allocation among immediately vested and deferred cash and equity.

For Fiscal 2013, our Compensation Committee established both objective and subjective performance goals for Mr. Sena’s individual bonus, which were (i) preparing debt and equity offering memorandums and debt and equity registrations as directed by the Company’s Chief Financial Officer (ii) timely and successful completion of all external auditor reviews and audits of the Company, and (iii) timely and accurate completion of all financial reporting by the Company. For Fiscal 2013, Mr. Sena’s total target bonus was $200,000. Our Compensation Committee determined that Mr. Sena achieved or exceeded each of his individual performance measures. Accordingly, for Fiscal 2013, our Compensation Committee awarded Mr. Sena an individual bonus and corporate bonus in excess of his target amounts, which were comprised of immediately vested and deferred cash and equity. See “Compensation and Benefits – Summary Compensation Table” and “Significant Events after Fiscal 2013 – Equity Grants Pursuant to the 2013 Bonus Plan” for details regarding the amount of Mr. Sena’s individual bonus and corporate bonus and its allocation among immediately vested and deferred cash and equity.

The maximum bonus payment to any individual under our Bonus Plan with respect to any year is subject to the $20 million Award Cap. For Fiscal 2013, this cap limited the total bonus awarded to Mr. Asali in contrast to the amount he would have otherwise earned for Fiscal 2013.

21

Table of Contents

Cash amounts payable pursuant to the 2013 Bonus Plan are included in the column titled “Non-Equity Incentive Plan Compensation” in the Summary Compensation Table for Fiscal 2013 (although no amounts are actually payable until after the end of Fiscal 2013). However, in the case of equity awards, the SEC disclosure rules require that the Summary Compensation Table and the Grants of Plan-Based Awards Table include for each fiscal year the aggregate fair value, as of the grant date, of equity awards granted only during the applicable fiscal year. The equity awards that were earned by our named executive officers pursuant to the 2013 Bonus Plan in respect of Fiscal 2013 performance were granted on November 29, 2013 and December 2, 2013. As these equity awards will be granted after the end of Fiscal 2013, they are not included in the Summary Compensation Table and Grants of Plan-Based Awards Table in this report, but in accordance with SEC rules will be included in next year’s table for our named executive officers in Fiscal 2014. Notwithstanding the foregoing, we do disclose these awards in this report under “Significant Events after Fiscal 2013 – Equity Grants Pursuant to the 2013 Bonus Plan.”

Initial Long Term Equity Grant

Our practice is to grant service-based equity to named executive officers when our Compensation Committee or Board determines that it would be to the advantage and in the best interests of the Company and its stockholders to grant such equity as an inducement to enter into or remain in the employ of the Company and as an incentive for increased efforts during such employment.

In Fiscal 2013, in accordance with the execution of his employment agreement, Mr. Sena received a one-time initial grant of shares of restricted stock and nonqualified stock options, pursuant to the Harbinger Group Inc. 2011 Omnibus Equity Award Plan (the “2011 Plan”). The number of equity awards granted was determined pursuant to his employment agreement. On November 19, 2012, Mr. Sena was granted 10,000 shares of restricted stock and nonqualified stock options to purchase 30,000 shares of our common stock. Subject to his continued employment, Mr. Sena’s restricted stock will vest on November 19, 2015 and his option awards will vest 25% per year on the first, second, third and fourth anniversaries of November 19, 2012.

Benefits

During Fiscal 2013, we provided our named executive officers with standard medical, dental, vision, disability and life insurance benefits available to employees generally.

We limit the use of perquisites as a method of compensation and provide executive officers with only those perquisites that we believe are reasonable and consistent with our overall compensation program to better enable us to attract and retain superior employees for key positions. Our named executive officers are eligible to participate in a flexible perquisite account under our FlexNet Program, which permits them to be reimbursed for certain eligible personal expenses, up to a per year cap of $50,000 for Messrs. Asali, Williams and Maura and $10,000 for Mr. Sena. Eligible expenses include, but are not limited to, reimbursement for tax preparation, legal services, education programs, health and wellness programs, technology and personal computers, wills and estate planning services and transportation services. Participants are responsible for payment of taxes on FlexNet payments. Reimbursements, at participants’ elections, can be net of taxes and/or include an estimated tax payment, subject to the annual maximum reimbursement cap. The perquisites provided to the named executive officers are quantified in the Summary Compensation Table below.

We sponsor a 401(k) Retirement Savings Plan (the “401(k) Plan”) in which eligible participants may defer a fixed amount or a percentage of their eligible compensation, subject to limitations. In Fiscal 2013 we made discretionary matching contributions of up to 5% of eligible compensation.

Risk Review

Our Compensation Committee has reviewed, analyzed and discussed the incentives created by our executive compensation program. Our Compensation Committee does not believe that any aspect of our executive compensation encourages the named executive officers to take unnecessary or excessive risks.

22

Table of Contents

Our compensation program has provisions to mitigate undue risk, including bonus plan mechanisms that defer significant portions of awards, which are partially subject to forfeiture if the performance that merited the award is not sustained. Furthermore, a significant portion of the deferred awards consist of unvested equity, and the vested portion is subject to the Company’s stock ownership guidelines. We believe that the additional alignment created by this exposure to the Company’s stock price serves to moderate an appetite for undue risk. We also relate future target performance to past actual performance in a manner that closely ties awards to performance over multiple years, which we believe reduces the incentive for short-term decisions or actions that increase current performance at the expense of future growth.

Compensation in Connection with Termination of Employment and Change-In-Control

In determining our employees’ compensation packages, our Compensation Committee recognizes that an appropriate incentive in attracting talent is to provide reasonable protection against loss of income in the event the employment relationship terminates without fault of the employee. Thus, compensation practices in connection with termination of employment generally have been designed to achieve our goal of attracting highly qualified executive talent. Messrs. Asali, Williams, Maura and Sena have employment agreements which provide for termination compensation in the form of payment of bonuses and salary and benefit continuation ranging from six to twelve months following involuntary termination of employment. During Fiscal 2013, our compensation programs did not provide for any “golden parachute” tax gross-ups to any named executive officer. During Fiscal 2013, we also did not provide any “single-trigger” payments due to the occurrence of a change of control to any of our named executive officers.

You can find additional information regarding our practices in providing compensation in connection with termination of employment to our named executive officers under the heading “Payments Upon Termination and Change of Control” below.

Impact of Tax Considerations

With respect to taxes, Section 162(m) of the Internal Revenue Code imposes a $1 million limit on the deduction that a company may claim in any tax year with respect to compensation paid to each of its Chief Executive Officer and three other named executive officers (other than the Chief Financial Officer), unless certain conditions are satisfied. Certain types of performance-based compensation are generally exempted from the $1 million limit. Performance-based compensation can include income from stock options, performance-based restricted stock, and certain formula driven compensation that meets the requirements of Section 162(m). One of the factors that we may consider in structuring the compensation for our named executive officers is the deductibility of such compensation under Section 162(m), to the extent applicable. However, this is not the driving or most influential factor. Our Compensation Committee may approve non-deductible compensation arrangements after taking into account several factors, including our ability to utilize deductions based on projected taxable income, and specifically reserves the right to do so.

Advisory Vote on Executive Compensation

Our Compensation Committee and our Board considered the results of our stockholder vote regarding the non-binding resolution on executive compensation presented at the 2011 Annual Meeting, where 97.31% of votes cast approved the compensation program described in the Company’s proxy statement for the 2011 Annual Meeting. Our Compensation Committee and our Board have continued to maintain a generally similar compensation philosophy but have implemented new compensation plans, including annual bonus plans, commensurate with the expansion of our roster of executives since the 2011 Annual Meeting.

At the 2011 Annual Meeting, a majority of our stockholders approved, as recommended by our Board, a proposal for our stockholders to be provided with the opportunity to cast a non-binding advisory vote on compensation of our named executive officers every three years. Our Board believed that this frequency is appropriate as a triennial vote would provide the Company with sufficient time to engage with stockholders to

23

Table of Contents

understand and respond to the “say-on-pay” vote results and to put in place any changes to the Company’s compensation program as a result of such discussions, if necessary. The next stockholder advisory (non-binding) vote on executive compensation will be held at our upcoming 2014 Annual Meeting.

Other Events during Fiscal 2013