Attached files

| file | filename |

|---|---|

| 8-K - 8-K - InfuSystem Holdings, Inc | d638824d8k.htm |

InfuSystem

Holdings, Inc. LD MicroCap Event

December 5, 2013

Eric K. Steen, CEO

Jonathan P. Foster, CFO

Exhibit 99.1

1 |

Safe Harbor

Statement Certain statements contained in this release are forward-looking

statements and are based on future expectations, plans and prospects for InfuSystem

Holdings, Inc.’s (“InfuSystem”, “INFU”, “the Company”,

“We”) business and operations that involve a number of risks and uncertainties.

InfuSystem’s outlook for 2013 and other forward-looking statements in this

release are made as of December 5, 2013, and the Company disclaims any duty to

supplement, update or revise such statements on a going-forward basis, whether as a

result of subsequent developments, changed expectations or otherwise. In connection with the

“safe harbor” provisions of the Private Securities Litigation Reform Act of 1995,

the Company is identifying certain factors that could cause actual results to differ,

perhaps materially, from those indicated by these forward-looking statements. Those

factors, risks and uncertainties include, but are not limited to, potential changes in

overall healthcare reimbursement – including CMS competitive bidding, sequestration,

concentration of customers, increased focus on early detection of cancer, competitive

treatments, dependency on Medicare Supplier Number, availability of chemotherapy drugs,

global financial conditions, changes and enforcement of state and federal laws, natural

forces, competition, dependency on suppliers, risks in acquisitions & joint

ventures, US Healthcare Reform, relationships with healthcare professionals and

organizations, technological changes related to infusion therapy, dependency on websites and

intellectual property, the ability of the Company to successfully integrate acquired

businesses, dependency on key personnel, dependency on banking relations and covenants,

and other risks associated with our common stock, as well as any other litigation to

which the Company may be subject from time to time; and other risk factors as discussed

in the Company’s annual report on Form 10-K for the year ended December 31, 2012 and

in other filings made by the Company from time to time with the Securities and Exchange

Commission. 2 |

Innovative

provider and supplier of infusion services

Market leader in oncology home

infusion with 40,000 patients a year

–

25 Year business model

World-class pump rentals and

service to providers, manufacturers,

and other rental companies in the

US and Canada

46,000 InfuSystem pump fleet

generating revenue from both

payors and providers

InfuSystem at a Glance

2013 9-Month Financials

Revenues $45.1M (Up 6%)

AEBITDA $11.5M (Up 8%)

Free Cash Flow $9.2M (Up 73%)

Market Cap $37.65M @ $1.72

Company Overview

3 |

Device &

Pharma Manufacturer,

Distributor, GPO, ACO

Full Line Multi-Therapy & Multi-Point Offering

Partners

Provider

Patient

Payor

4 |

Positioned For

Growth •

InfuSystem

is

uniquely

positioned to take

advantage of

market trends

•Leadership can

now focus on

running a business

for first time in

over a year

•Transformational

strategy is

developed and

being implemented

Strategy

Leadership

Market Trends

5 |

InfuSystem

Niche – Extension of Clinic to Home

Ambulatory Home Infusion

25-year old business model in

DME billing

At home, at work, at play, all

while receiving the drug

High satisfaction scores

24/7 on-call oncology nurses

Proven outcomes with

continuous home infusion

Oncology, Post Surgical Pain,

Special Disease States

TPP Payor Contracts

Bills patient insurance

250+ Commercial and

Government Payor

Contracts

Commercial Payors

reimburse more

therapies than CMS

Awarded contracts in

all 9

MSAs (1 of 3

National Vendors)

Average cuts of ~21%

for our category, per

CMS ($250,000 per yr)

6 |

US Population

Growing… Aging

Population Stats

At-risk lifestyles persist

(red, processed meats)

Growth in all types of

cancers

Cancer

1,650,000 new cancer

cases in 2013

Can be treated

effectively by

continuous infusion

Colo-rectal

3

rd

most common in US

and Worldwide

9% of all new cases

145,000 new cases per

year

7 |

8

TPP Pump Return on Investment

Average Cost

~$1,500/pump

Pump Lifespan

15 years

Average Monthly

Revenue

~$300/pump

Lifetime

Revenue/Pump

Approx. ~$20,000+ |

Increasing

Therapy Offerings to Payors Special

Disease

States

Surgery

Infectious

Disease

Oncology

Payor

9 |

Rentals, Sales

& Service to Providers Pump Rentals, Sales and

Asset Management

Pump Experts

Direct sales, rental, and

lease of device and

supplies in US and

Canada

Pump Broker Expertise –

ability to acquire and

dispose of CAP EX in cost

effective way

Asset management,

rental and lease

Preventative Maint.

Annual Pump

Recertification

Preventative

Maintenance

Warranty

Repair

World-Class ISO

Certified service

facilities

Regional Distribution

West, South, East &

Canada

28 Certified Technicians

10 |

Oncology

Acute

Care

Emergency

Services

Long Term

Care

Provider

Home

Infusion

Offering Infusion to All Points of Care

11 |

Continued

Revenue Diversification 2009 Revenues $39M

2012 Revenues $59M

12 |

Connectivity

through EMR , Web Portal and System Interface

13 |

Connectivity

through EMR , Web Portal and System Interface

Electronic

Data

Exchange

Interface Effects

Customer investment

in interface makes for

sticky relationships.

Ties customer to

InfuSystem.

14 |

For Faster

Turnaround and Improved Utilization Kansas City

Service Center

Madison Heights

Service Center

Future New Jersey

Service Center

Future Atlanta

Service Center

Los Angeles Area

Service Center

Houston

Service Center

Toronto Canada

Service Center

InfuSystem Distribution

High-density Metro

Markets

Reduced cost of air

shipments

Improved

utilization of pumps

Increased market

share of same-day

rental market

15 |

Where Does

This Get INFU In Three Years ? Aging Population and Cancer Growth

More Patients Home IV , Commercial Pay

Recognizing Value, CMS Competitive Bidding

Peripheral Nerve Block and Smart Pump

Growth

Revenue Growth in High Single Digits Through

2015

16 |

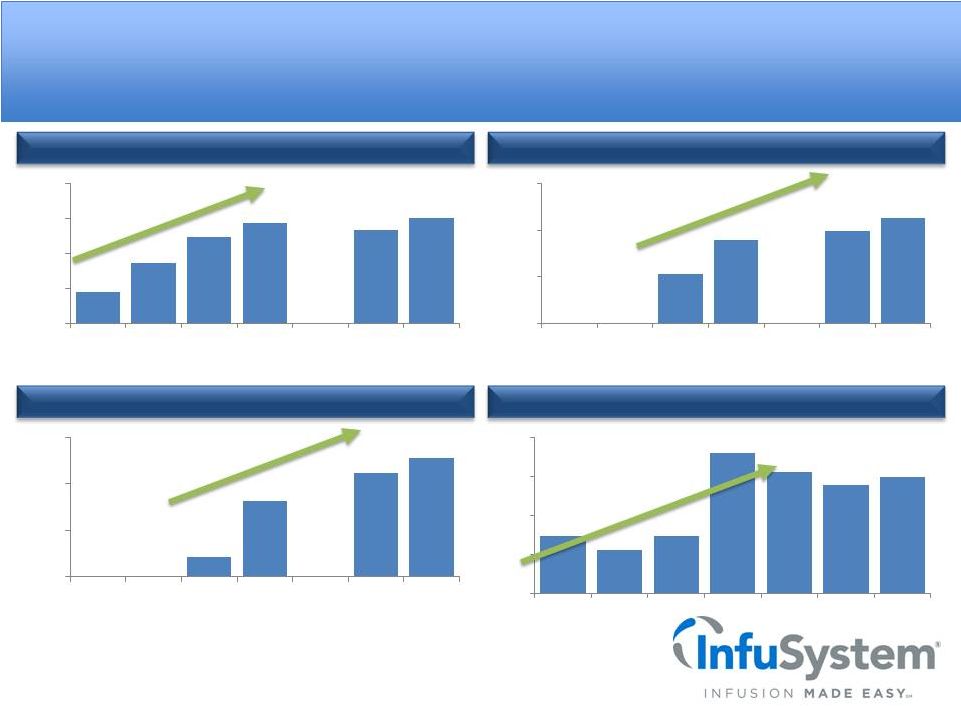

Financial

Review 17 |

Financial

Overview (1)

Free

Cash

Flow

=

Adjusted

EBITDA

less

CapEx

and

Purchases

of

Medical

Equipment

$38,964

$47,229

$54,637

$58,828

$56,793

$60,137

$30m

$40m

$50m

$60m

$70m

FY2009

FY2010

FY2011

FY2012

9M 2012

Annualized

9M 2013

Annualized

Revenues

Growing

$10,256

$13,126

$13,969

$15,028

$6m

$10m

$14m

$18m

FY2011

FY2012

9M 2012

Annualized

9M 2013

Annualized

AEBITDA

Growing

$5,754

$10,568

$12,915

$14,244

$4m

$8m

$12m

$16m

FY2011

FY2012

9M 2012

Annualized

9M 2013

Annualized

FCF

Growing

$2,931

$2,226 `

$2,935

$7,211

$6,249

$5,537

$5,955

$0m

$2m

$4m

$6m

$8m

1Q 2012

2Q 2012

3Q 2012

4Q 2012

1Q 2013

2Q 2013

3Q 2013

Liquidity

Improved

Revenues

Adjusted EBITDA

Free Cash Flow (1)

Unrestricted Liquidity

18 |

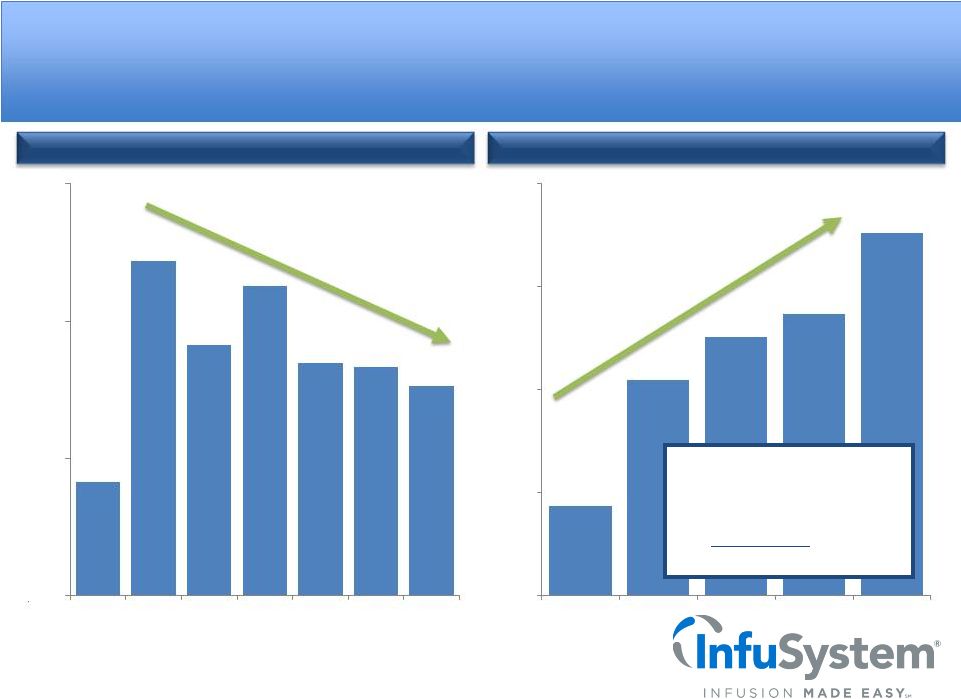

19

Uses of Free Cash Flow

(1)

Free

Cash

Flow

=

Adjusted

EBITDA

less

CapEx

and

Purchases

of

Medical

Equipment

$24,141

$32,197

$29,127

$31,268

$28,466

$28,328

$27,619

$20m

$25m

$30m

$35m

FY2009

FY2010

FY2011

FY2012

1Q 2013

2Q 2013

3Q 2013

Debt

Declining

$31,734

$34,193

$35,026

$35,474

$37,040

$30m

$32m

$34m

$36m

$38m

FY2011

FY2012

Q1 2013

Q2 2013

Q3 2013

Rental Fleet

Increasing

Total Debt

PP&E and Medical Equipment in Service (at cost)

Every

$1.00

invested

in

the rental fleet returns

~$1.50 in revenue

every

year

for

the

life of the pump |

Take Away

20 |

Positioned For

Growth Market Trends

•

InfuSystem

is

uniquely

positioned to take

advantage of

market trends

Leadership

•Leadership can

now focus on

running a business

for first time in

over a year

Strategy

•Transformational

strategy is

developed and

being implemented

21 |

Thank You for

Your Interest! IR Contact Info:

The Dilenschneider Group

212-922-0900

Rob

Swadosh,

rswadosh@dgi-nyc.com

Patrick

Malone,

pmalone@dgi-nyc.com

22 |

Appendix: INFU

Overview 23 |

Compelling

Value Proposition In-House Service & Repairs

Convenience & Flexibility

Pre-Owned Equipment Expertise

One-Stop Shopping Solution

Convenience and flexibility of rentals and

financing minimize customer capital outlays

Rental and financing eliminates the need

for

in-house maintenance/service

Option

to

own,

rent

or

finance

–

designed

to

fit

customers’

operating and financial parameters

Shorter and longer-term financing options

One-stop shopping solution for ambulatory large

volume pump and other movable medical devices

Sales

Rentals

Supplies

Service

Financing

World-class biomedical repair and

service for pumps, defibrillators and

most other general medical

equipment

Allows InfuSystem to purchase, clean,

repair and certify any used medical

equipment the Company buys for

subsequent sale, rental or financing to

customers

“ONE-STOP SHOP”

SERVICE &

REPAIRS

CONVENIENCE &

FLEXIBILITY

PRE-OWNED

EQUIPMENT

EXPERTISE

Unique ability to source and deploy pre-

owned movable medical equipment

Consistent, fair and knowledgeable

market maker for pre-owned pump

disposals

Market knowledge results in attractive

equipment acquisition costs

Complementary core competencies allow InfuSystem to offer superior selection, flexibility,

pricing and services 24 |

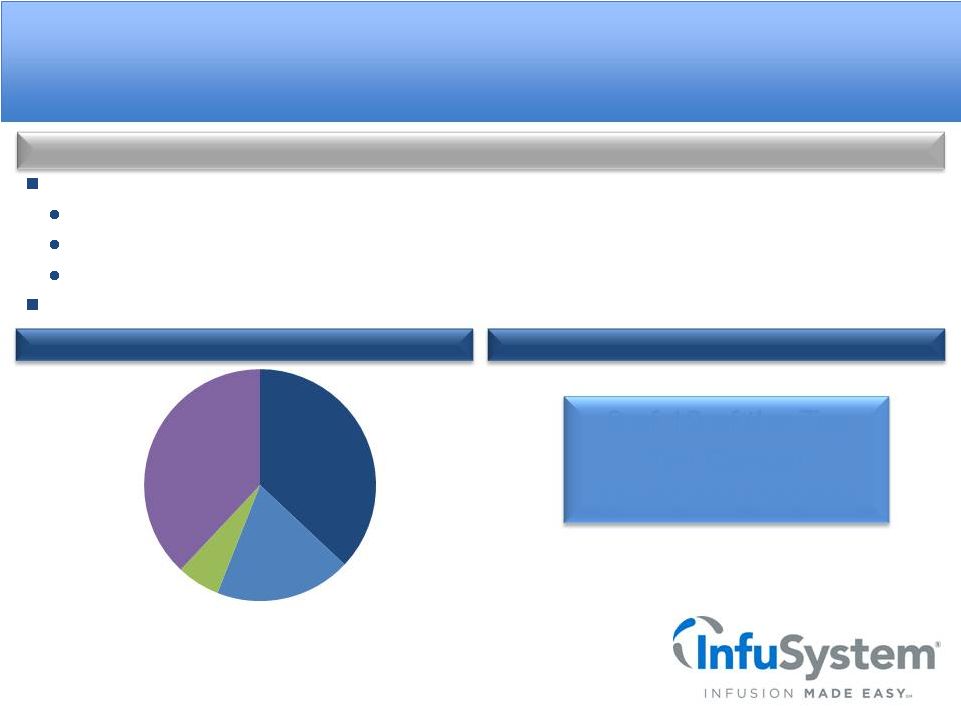

Payor &

Customer Mix Leading Cancer Institution Customers

Revenue by Payor (FY2012)

High diversification of providers and payors

No single healthcare provider represents more than 7% of Third-Party Payor revenues

Strong payor mix among Medicare, other commercial insurers, Blue Cross/Blue Shield, and

Medicaid Less

than

5%

of

revenues

received

directly

from

patients

through

co-pays

or

otherwise

Broad coverage further diversifies revenue streams

InfuSystem has strong relationships with the largest third-party payors and the leading

cancer institutions 9 of 10 of the Top

Ten Cancer

Treatment Centers

Medicare and

Medicaid

37%

BCBS

19%

Patient

6%

Commercial

38%

CMS: Centers for Medicare and Medicaid Services

25 |

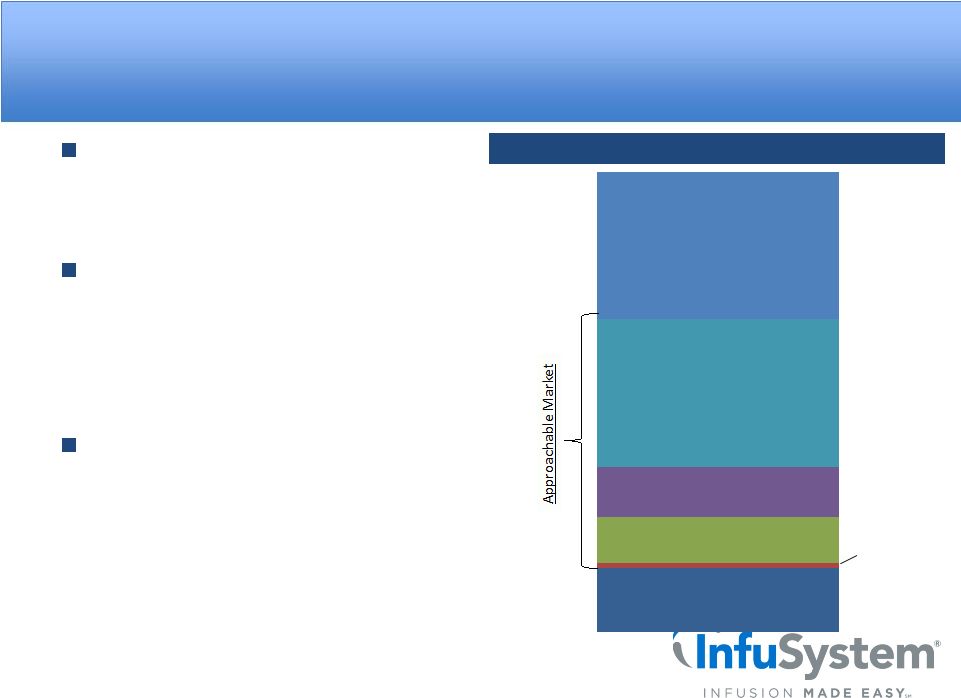

Competitive

Landscape InfuSystem measures its market

share not in terms of the number of

practices, but the pool of

addressable patients

The breakdown of the Company’s

current market share shows that

despite being the predominant

national player in continuous

infusion, there is ample room for

organic growth

The Company competes for market

share in all but the Captive Health

Plans which represent health plans

in which all

services are rendered

by one common payor/provider

(e.g., Kaiser Permanente)

Market Share for Oncology Continuous Infusion

Source: American Cancer Society, CMS, National Comprehensive Cancer

Network, National Home Infusion Association

InfuSystem

32%

Home Infusion Providers

32%

Facility Owned Pumps

11%

Competitor DME Providers

10%

Disposable

Pumps

1%

Captive Health Plan

14%

26 |

InfuSystem’s Direct Payor business is focused primarily on the sale, rental, financing

and accompanying service of movable

medical

equipment

to

hospitals

and

alternate

care

sites

who

pay

InfuSystem

directly

–

no

third-party

reimbursement

Founded in 1998 and headquartered in Olathe, KS with distribution/service centers in Santa Fe

Springs, CA and Mississauga, Ontario

InfuSystem

services –

ISO

9001

-

and

repairs

movable

medical

equipment

Leading provider to alternate site healthcare facilities and hospitals in the United States

and Canada Home infusion providers, long-term care, physician clinics, research

facilities, etc. Transacts

directly

with

healthcare

providers

–

no

third-party

reimbursement

revenue

Infusion pumps

Enteral pumps

Direct Payor Business Model

Service & Repair

Products

InfuSystem sells, rents and finances a wide variety of new

and used large volume and ambulatory pumps

InfuSystem services and repairs both its own fleet of

pumps and many types of other movable medical

equipment

Syringe pumps

Ambulatory pumps

Large volume pumps

Ambulatory pumps

Fluid collection

Medical equipment

27 |

InfuSystem

offers new pumps from top brands Broker-dealer trading desk

In addition, over 70 models and versions of pre-owned pumps

are offered

Pre-owned pumps are re-built and certified by in-house

biomedical technicians to be patient ready

Warranty offered on pre-owned pumps

A variety of financing options to fit customers’

operating,

budgeting and financing parameters

Nationwide, industry-leading ISO 9001 service programs

Launching branch service center in Houston

Direct Payor Offerings

Renting new or pre-owned equipment

Rent pumps by the day, week or month to

match swings in patient count

Free shipping on all rentals

Industry leader in sales of pre-owned

equipment, creating significant savings

Competitive pricing on new equipment

Option to sell back pre-owned pumps

Leasing plans offered

ISO 9001 Service offered

Service plans offered

Local service expansion

2 existing; 1 planned

Coordinate with TPP

Loaner pumps available

Pre-Owned & New Pumps from Top Manufacturers

Leading Provider of New and Pre-Owned Pumps

Full Spectrum of Ownership Options for Customers

Rental

Sales

Asset Management

28 |

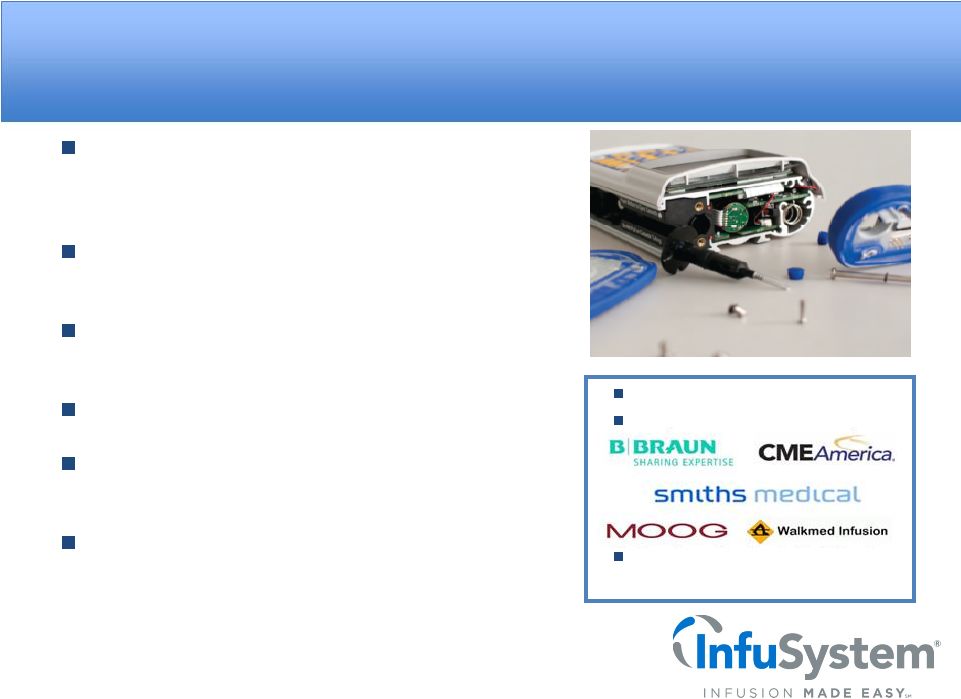

Medical

Equipment Service & Repair In addition to supporting and repairing

InfuSystem’s in-house fleet, the Company certifies,

recalibrates, repairs and services a variety of

infusion pumps

Pumps require scheduled maintenance and

calibration in accordance with manufacturer’s

specifications and regulatory guidelines

Service and repair capabilities on high demand

services reaching end of life that are no longer

supported by manufacturers

ISO certification and an established quality system

strengthens relationships with major customers

Provides InfuSystem an opportunity to establish a

business relationship with customers that acquired

pumps through other sources

Continuing and increased need for compliance

with current as well as anticipated regulations

28 highly qualified service technicians

5 major manufacturer relationships:

3 service centers, located in California,

Toronto and Kansas

29 |

Ambulatory

Pump Rental Fleet With over 26,000+ pumps in TPP Rental Fleet, InfuSystem maintains the

largest fleet of ambulatory infusion pumps in the industry

DPP Rental Fleet has over 20,000 pumps

The Company has a complete inventory of virtually every model pump from every leading

manufacturer, allowing InfuSystem to provide the right pump for any patient’s prescribed

protocol

Purchases of pumps have a high return on investment and an useful life of 10-15

years All Rentals (Both DP and TPP) -

YE 2011

YE 2012

Q1 2013

Q2 2013

Q3 2013

Rental Revenue ($K)

$ 46,795

$ 53,471

$ 13,445

$ 13,618

$ 14,493

Medical

Equipment

in

Service

-

Cost

($K)

$ 31,734

$ 34,193

$ 35,026

$ 35,474

$ 37,040

Rental Revenue Per Dollar of

Medical

Equipment

in

Service

Invested

–

Annualized

$ 1.47

$ 1.56

$ 1.54

$ 1.54

$ 1.57

Annual Rental Revenue per $1 Rental Fleet Cost (“Revenue Ratio”)

30 |

Competitive

Bidding Overview InfuSystem was not involved in Round 1 nor

Round 2 of Competitive Bidding

CMS announced a Recompete of Round 1

competitive bidding on April 17th

External infusion pumps/supplies added as a

new product category

A supplier must bid on all items within the

product category to have its RFP considered

Recompete covers 9 Metropolitan Statistical

Areas (MSAs)

Competitive Bidding Overview

InfuSystem’s Response to Competitive Bidding

InfuSystem has engaged consultants and industry

professionals to discuss directly with CMS, advise

on positioning the Company for potential

regulatory changes, and facilitate potential

strategic partnership opportunities

InfuSystem was awarded contracts in all 9 MSAs

with average cuts of ~21% for our category per

CMS. 1 of 3 National Vendors to receive

contracts in all 9 markets.

“Competitive environment will vary in accordance

with the level of cuts by CMS”

CMS

Competitive

Bidding

“Target”

Timetable

CMS will institute some form of competitive

CMS will institute some form of competitive

bidding nationwide by January 2016.

bidding nationwide by January 2016.

CMS began the pre-

bidding supplier

awareness program

CMS announced bidding

schedule, start bidder

education and begin a

bidder registration period

Bid window

opens

Current Round 1 bid

contracts expire

CMS announces Round

1 Recompete bid

results –

INFU impact

$250K annually

Bid window

closes

Implementation of

Round 1 bid contracts

and prices

Spring

2012

08/16/12

10/15/12

12/14/12

10/1/13

12/31/13

01/01/14

31 |

Summary Income

Statement ($000's)

FY2009

FY2010

FY2011

FY2012

9 Mo 2012

9 Mo 2013

Net revenues:

Rentals

46,795

$

53,471

$

38,903

$

41,556

$

Product sales

7,842

$

5,357

$

3,692

$

3,547

$

Net revenues

38,964

$

47,229

$

54,637

$

58,828

$

42,595

$

45,103

$

Cost of revenues:

Product, service and supply costs

6,200

$

7,730

$

9,128

$

9,165

$

6,760

$

8,174

$

Pump depreciation and loss on disposal

4,127

$

5,954

$

10,154

$

6,752

$

4,928

$

4,836

$

Gross profit

35,355

$

42,911

$

30,907

$

32,093

$

Provision for doubtful accounts

4,006

$

4,515

$

4,099

$

5,251

$

3,119

$

4,782

$

Amortization of intangibles

1,827

$

2,259

$

2,662

$

2,734

$

2,028

$

1,972

$

Asset impairment charges

67,592

$

Selling and marketing

5,258

$

7,087

$

9,371

$

9,864

$

7,635

$

7,281

$

General and administrative

12,218

$

20,622

$

17,987

$

23,062

$

17,688

$

14,622

$

Operating income (loss)

5,328

$

(938)

$

(66,356)

$

2,000

$

437

$

3,436

$

Total other (loss)

(3,577)

$

(2,285)

$

(2,221)

$

(4,152)

$

(2,921)

$

(2,307)

$

Loss before income taxes

1,751

$

(3,223)

$

(68,577)

$

(2,152)

$

(2,484)

$

1,129

$

Income tax benefit

(977)

$

1,371

$

23,134

$

663

$

774

$

(324)

$

Net income (loss)

774

$

(1,852)

$

(45,443)

$

(1,489)

$

(1,710)

$

805

$

EBITDA

11,199

$

7,745

$

(57,336)

$

9,590

$

6,122

$

9,747

$

EBITDA (ex. Impairment Charges)

11,199

$

7,745

$

10,256

$

9,590

$

6,122

$

9,747

$

Adjusted EBITDA

NA

NA

10,256

$

13,126

$

10,477

$

11,271

$

32 |

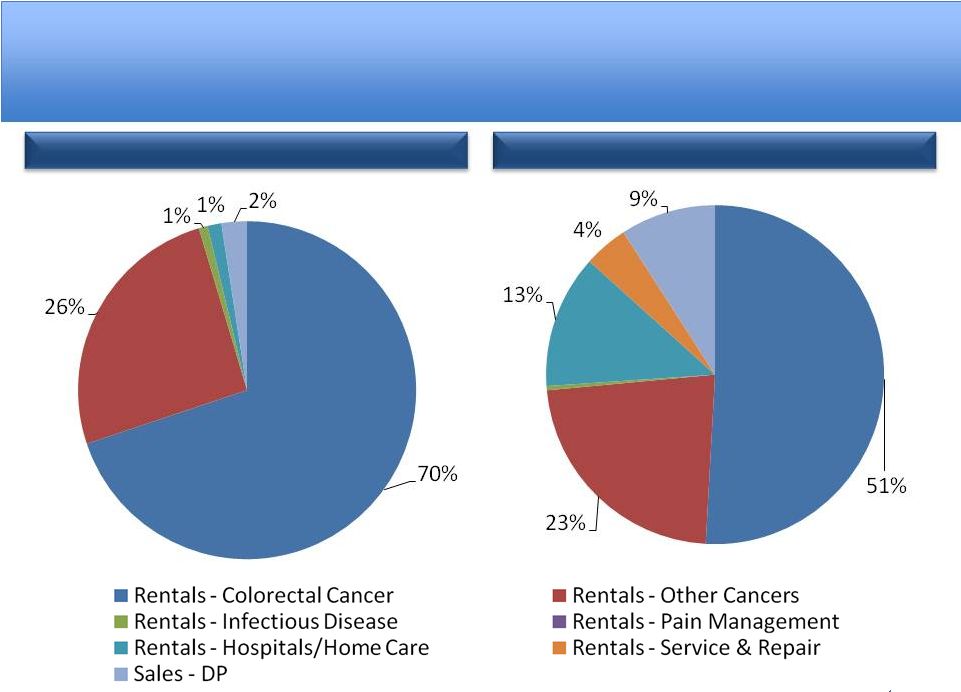

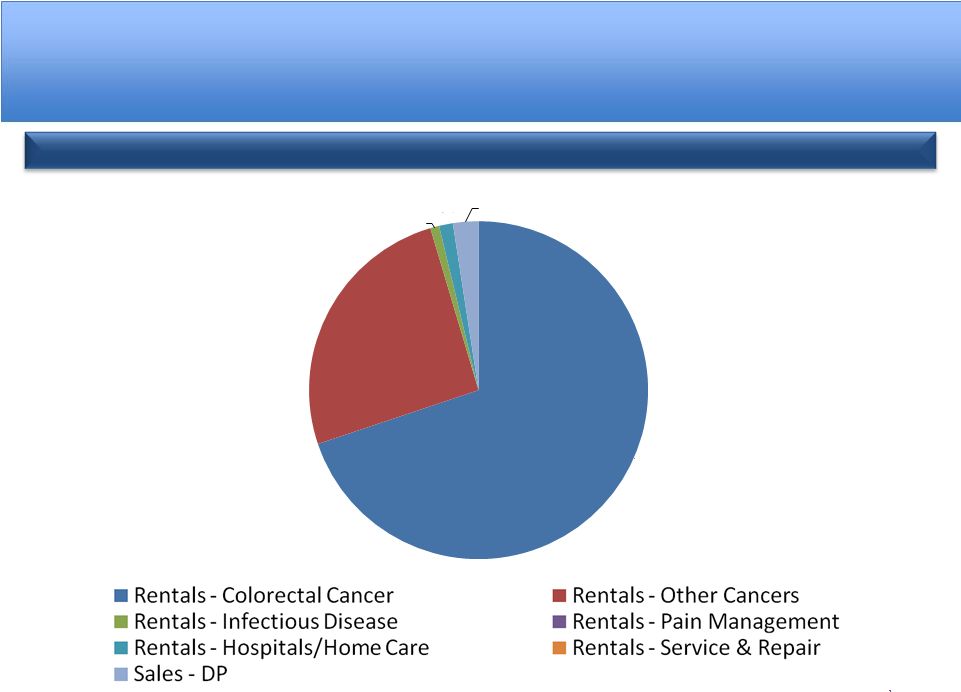

Continued

Revenue Diversification 2009 Revenue

70%

26%

1%

1%

2%

33 |

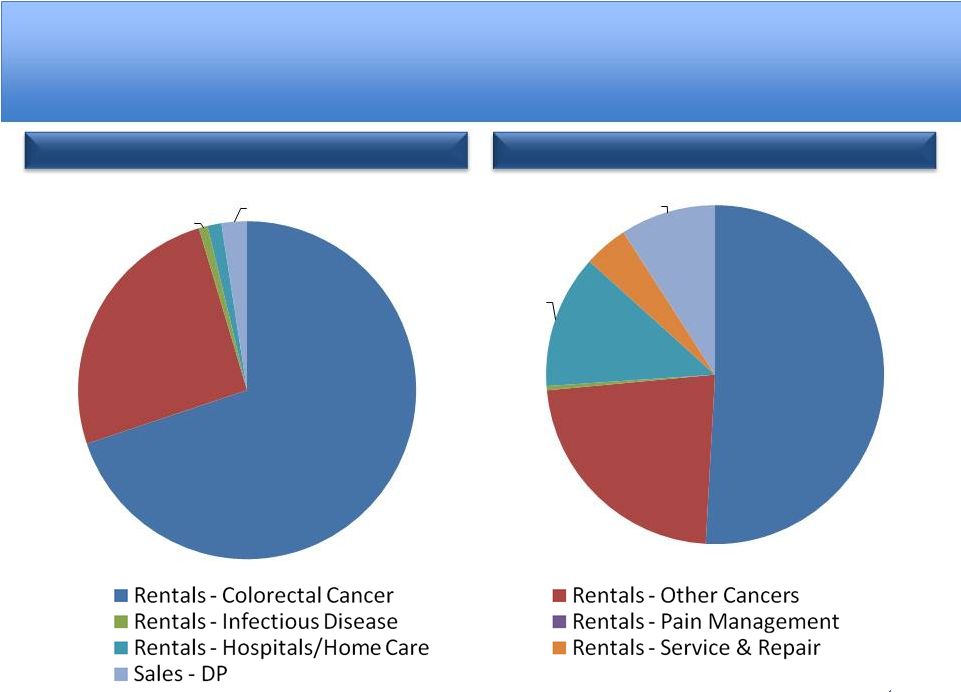

Continued

Revenue Diversification 70%

26%

1%

1%

2%

51%

23%

13%

4%

9%

2009 Revenues $39M

2012 Revenues $59M

34 |

Summary

Balance Sheet ($000's)

12/31/09

12/31/10

12/31/11

12/31/12

3/31/13

6/30/13

9/30/13

ASSETS

Current Assets:

Cash and cash equivalents

7,750

$

5,014

$

799

$

2,326

$

472

$

102

$

908

$

Account receivable - total, net of allowance

5,517

$

6,679

$

7,448

$

8,511

$

9,570

$

9,440

$

9,291

$

Inventory

925

$

1,699

$

1,309

$

1,339

$

1,378

$

1,379

$

1,343

$

Prepaid expenses and other current assets

395

$

750

$

934

$

684

$

832

$

713

$

625

$

Deferred income taxes

125

$

1,147

$

682

$

1,971

$

1,986

$

1,986

$

1,986

$

Total Current Assets

14,712

$

15,289

$

11,172

$

14,831

$

14,238

$

13,620

$

14,153

$

Total PP&E and Medical Equipment

13,499

$

16,672

$

17,672

$

16,564

$

16,653

$

17,958

$

18,749

$

Deferred debt issuance costs, net

781

$

658

$

421

$

2,362

$

2,232

$

2,106

$

1,972

$

Total Goodwill and Intangible assets, net

85,491

$

97,344

$

28,221

$

25,541

$

24,871

$

24,221

$

24,075

$

Deferred income taxes

18,187

$

17,806

$

17,755

$

17,689

$

17,259

$

Other assets

207

$

401

$

590

$

419

$

477

$

157

$

184

$

Total Assets

114,690

$

130,364

$

76,263

$

77,523

$

76,226

$

75,751

$

76,392

$

LIABILITIES AND STOCKHOLDERS' EQUITY

Current Liabilities:

Account payable - total

1,306

$

2,016

$

4,063

$

2,144

$

3,056

$

3,833

$

4,329

$

Accrued expenses and other

1,573

$

4,631

$

2,235

$

4,098

$

4,182

$

2,782

$

2,824

$

Derivative liabilities

2,670

$

183

$

258

$

-

$

-

$

-

$

Current portion of long-term debt

5,501

$

5,551

$

6,576

$

3,953

$

3,872

$

3,124

$

3,239

$

Total Current Liabilities

11,050

$

12,381

$

13,132

$

10,195

$

11,110

$

9,739

$

10,392

$

Long Term Debt, net of current portion

18,640

$

26,646

$

22,551

$

27,315

$

24,594

$

25,204

$

24,380

$

Deferred income taxes

3,314

$

5,788

$

Other Liabilities

221

$

406

$

415

$

-

$

-

$

-

$

-

$

Total Liabilities

33,225

$

45,221

$

36,098

$

37,510

$

35,704

$

34,943

$

34,772

$

Total Stockholderrs' Equity

81,465

$

85,143

$

40,165

$

40,013

$

40,522

$

40,808

$

41,620

$

Total Liabilities and Equity

114,690

$

130,364

$

76,263

$

77,523

$

76,226

$

75,751

$

76,392

$

Total Debt

24,141

$

32,197

$

29,127

$

31,268

$

28,466

$

28,328

$

27,619

$

35 |

Cash

Flow ($000's)

FY2009

FY2010

FY2011

FY2012

9 Mo 2012

9 Mo 2013

OPERATING ACTIVITIES

Net Income

774

$

(1,852)

$

(45,443)

$

(1,489)

$

Adjustments:

Provision for doubtful accounts

4,006

$

4,515

$

4,099

$

5,251

$

Depreciation

4,122

$

5,357

$

6,386

$

5,668

$

Loss on disposal of pumps

342

$

994

$

1,731

$

237

$

Amortization of intangible assets

1,827

$

2,259

$

2,662

$

2,734

$

Asset impairment charges

67,592

$

-

$

Stock-based compensation

753

$

3,860

$

1,185

$

964

$

Total Other Adjustments

2,827

$

(1,581)

$

(26,021)

$

(1,971)

$

Changes in assets and liabilities (ex. acquisitions)

(4,943)

$

(2,740)

$

(5,445)

$

(5,942)

$

NET CASH PROVIDED BY OPERATING ACTIVITIES

9,708

$

10,812

$

6,746

$

5,452

$

5,834

$

4,765

$

INVESTING ACTIVITIES

Total Purchases of PP&E, Med. Eq., and Other Assets, net

(4,611)

$

(2,444)

$

(4,502)

$

(2,558)

$

(791)

$

(588)

$

Acquisition of intangible assets

(625)

$

-

$

Cash paid for acquisition, net of cash acquired

-

$

(16,616)

$

NET CASH PROVIDED BY INVESTING ACTIVITIES

(4,611)

$

(19,060)

$

(5,127)

$

(2,558)

$

(791)

$

(588)

$

FINANCING ACTIVITIES

Net Borrowing on term loan, revolver, and capital leases

(8,565)

$

7,377

$

(5,369)

$

1,619

$

(4,247)

$

(5,517)

$

Capitalized debt issuance costs

-

$

(808)

$

-

$

(2,842)

$

Common stock withholding on stock based compensation

(135)

$

(167)

$

(102)

$

(144)

$

(131)

$

(78)

$

Treasury shares repurchased

-

$

(68)

$

(363)

$

-

$

-

$

-

$

Principal payments on capital lease obligations

(160)

$

(822)

$

NET CASH PROVIDED BY FINANCING ACTIVITIES

(8,860)

$

5,512

$

(5,834)

$

(1,367)

$

(4,378)

$

(5,595)

$

Net change in cash and cash equivalents

(3,763)

$

(2,736)

$

(4,215)

$

1,527

$

665

$

(1,418)

$

Cash and cash equivalents, beginning of period

11,513

$

7,750

$

5,014

$

799

$

799

$

2,326

$

Cash and cash equivalents, end of period

7,750

$

5,014

$

799

$

2,326

$

1,464

$

908

$

Free Cash Flow (EBITDA less CapEx & Purchases of ME)

6,588

$

5,301

$

5,754

$

7,032

$

5,331

$

9,159

$

Free Cash Flow (Adj. EBITDA less CapEx & Purchases of ME)

5,754

$

10,568

$

9,686

$

10,683

$

Revenue Growth (%)

21.2

%

15.7

%

7.7

%

5.9

%

36 |