Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT - SADLER GIBB & ASSOCIATES - XLI Technologies, Inc. | consentsadlergibbassoicates.htm |

As filed with the Securities and Exchange Commission on December 4, 2013 Registration No. 333-190652

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1A

(Amendment No. 2)

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MINERIA Y EXPLORACIONES OLYMPIA, INC.

(Name of registrant as specified in its charter)

|

Nevada

|

1499

|

30-0785773

|

|

(State or jurisdiction of

|

(Primary Standard Industrial

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Classification Code Number)

|

Identification No.)

|

Calle San Pablo

No. 8 Bo. Buenos Aires

Municipio Monsenor Novel

Dominican Republic

(Tel) 809-223-2353 (Fax) 809-970-2353 (E-mail) getup84@hotmail.com

(Address and telephone number of principal executive offices and place of business)

________________

Francisco Antonio Jerez Garcia

Chief Executive Officer

c/o American Corporate Enterprises, Inc.

Suite 129 – 123 W. Nye Lane, Carson City, Nevada, 89706

775-884-9380

(Name, address and telephone number of agent for service)

________________

Copies to:

Lawler & Associates

4960 S. Gilbert Road, Suite 1-111

Chandler, Arizona 85012

Tel: (602) 466-3666 Fax: (602) 633-1617 (E-Mail) wsl@lawlerfirm.com

Approximate date of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. R

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

|

Non-accelerated filer

(Do not check if a smaller reporting company)

|

o

|

Smaller reporting company

|

x

|

CALCULATION OF REGISTRATION FEE

|

Proposed

Maximum aggregate offering price

|

||||

|

Title of each class of

securities to be registered

|

Amount of

shares to be

Registered

|

Proposed

maximum offering

price per share

|

Amount of

Registration fee

|

|

|

Common Stock

|

25,000,000

|

$ 0.002

|

$ 50,000

|

$ 6.82

|

|

Total

|

25,000,000

|

$ 0.002

|

$ 50,000

|

$ 6.82

|

The registrant amend this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

SUBJECT TO COMPLETION, DECEMBER, 2013

The information in this Prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell securities and it is not soliciting an offer to buy these securities in any state where the offering or sale is not permitted.

MINERIA Y EXPLORACIONES OLYMPIA, INC.

25,000,000 Shares

Common Stock

We are registering 25,000,000 shares of common stock for resale by our Selling Security Holder. The Selling Security Holder is our sole director and officer. We will not receive any of the proceeds from the sale of the shares of common stock by the Selling Security Holder. The number of shares of Mineria Y Exploraciones Olympia, Inc. common stock being registered by Selling Security Holder represents 33.33% of our currently issued and outstanding shares of common stock. The Selling Security Holder is selling his shares of common stock at $0.002 per share. The offering price of $0.002 per share was arbitrarily determined by the Selling Security Holder.

There is no public market for Mineria Y Exploraciones Olympia, Inc.’s common stock. Subsequent to our offering, it is our intention to seek quotation on the OTC Bulletin Board (“OTCBB”). There is no assurance our application to the Financial Industry Regulatory Authority (“FINRA”) to seek quotation on the OTCBB will be approved.

The Selling Security Holder will sell his shares at a fixed price of $0.002 per shares for the duration of this offering. This offering will terminate nine months after the effective date of the registration statement.

Because the Selling Security Holder consists of our only shareholder who is also our sole officer and director, such Selling Security Holder is an "underwriter" within the meaning of the Securities Act of 1933, as amended (the “1933 Act”). Any commission received by a broker or dealer in connection with sales of the shares is an underwriting commissions or discounts under the 1933 Act. Any discounts, commissions, concessions or profit earned on any resale of the shares may be underwriting discounts and commissions under the Securities Act. The Selling Shareholder, who is an "underwriter" within the meaning of Section 2(11) of the Securities Act, is subject to the prospectus delivery requirements of the Securities Act.

We are an Emerging Growth Company as defined in the Jumpstart Our Business Startups Act.

INVESTING IN OUR COMMON STOCK INVOLVES A HIGH DEGREE OF RISK. SEE “RISK FACTORS” BEGINNING ON PAGE 6 OF THIS PROSPECTUS.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Dealer Prospectus Delivery Instructions

Until [90 days after effective date], 2013 all dealers that effect transactions in these shares of common stock , whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

The date of this Prospectus is December, 2013.

-1-

TABLE OF CONTENTS

|

Page

|

|

|

Prospectus Summary

|

3

|

|

Disclosure Regarding Forward-Looking Statements

|

5

|

|

Risk Factors

|

6

|

|

Use Of Proceeds

|

10

|

|

Market For Common Equity And Related Stockholders Matters

|

10

|

|

Management’s Discussion And Analysis Or Plan Of Operations

|

11

|

|

Description Of Business

|

16

|

|

Legal Proceedings

|

30

|

|

Management

|

31

|

|

Executive Compensation

|

32

|

|

Security Ownership Of Certain Beneficial Owners And Management

|

33

|

|

Certain Relationships And Related Transactions

|

33

|

|

Selling Security Holders

|

34

|

|

Plan Of Distribution

|

34

|

|

Description Of Securities

|

35

|

|

Disclosure Of Commission Position Of Indemnification For Securities Act Liabilities

|

36

|

|

Legal Matters

|

37

|

|

Experts

|

37

|

|

Transfer Agent And Registrar

|

37

|

|

Where You Can Find More Information

|

37

|

|

Financial Statements

|

38

|

You should rely only on the information contained in this Prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information provided by this Prospectus is accurate as of any date other than the date on the front cover page of this Prospectus.

-2-

PROSPECTUS SUMMARY

Overview

The following is only a summary of the information, financial statements and the notes included in this Prospectus. You should read the entire Prospectus carefully, including “Risk Factors” and our Financial Statements and the notes to the Financial Statements before making any investment decision. Unless the context indicates or suggests otherwise, the terms “we,” “our”, “us” and “Mineria” means Mineria Y Exploraciones Olympia, Inc.

Our Business

We were incorporated in the State of Nevada on August 22, 2012. We are a start-up, pre-exploration stage company engaged in the search for gold and related minerals. We do not have any joint venture partners. At the present time we have only one wholly owned subsidiary by the name of Consorcio de Mineria Y Exploraciones Olympia, SR incorporated in the Dominican Republic on August 15, 2012. We have no mining operations and have no revenues. We have incurred losses since inception and must raise additional capital to fund our operations. There is no assurance we will be able to raise this capital.

The Company is considered to be in the pre-exploration stage as defined in ASC 915 "Accounting and Reporting by Development Stage Enterprises" as interpreted by the Securities and Exchange Commission for mining companies in Industry Guide 7. The Company is engaged in such activities as raising capital, exploring its mineral claim in hopes of eventually developing revenue. The Company has not yet reached its fullest, mature stage of substantial business and therefore has many risks attached to its operation. The Company is devoting substantially all of its efforts to the execution of its business plan. Under ASC 915, an entity is considered a development stage entity if it has not commenced its planned principal operations or if such operations have commenced, but the entity has not yet generated any significant revenue from those operations.

Our auditors have assumed the Company will continue as a going concern but have expressed in their audit opinion dated August 15, 2013, and included herein, the need for the Company to raise additional working capital for its future development but there is substantial doubt about our ability to continue as a going concern. As of August 31, 2013 we had cash of $19,013 which is not sufficient to meet our estimate of cash required over the next twelve months of $94,664 which includes future exploration on the Olympia Gold Claim. The estimated cost of this offering, being estimated at $19,306, exceeds the amount of cash we have on hand. The only way we will be able to meet our financial obligations on a timely basis is to raise additional funds either from advances from our sole director or from the sale of our common shares. The latter would be difficult to do unless our Company has a quotation on a recognized stock exchange. If we are unable to raise funds we would have to cease operations.

We are an Emerging Growth Company as defined in the Jumpstart Our Business Startups Act.

We shall continue to be deemed an emerging growth company until the earliest of—

(A) the last day of the fiscal year of the issuer during which it had total annual gross revenues of $1,000,000,000 (as such amount is indexed for inflation every 5 years by the Commission to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest 1,000,000) or more;

-3-

(B) the last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective registration statement under this title;

(C) the date on which such issuer has, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or

(D) the date on which such issuer is deemed to be a ‘large accelerated filer’, as defined in section 240.12b-2 of title 17, Code of Federal Regulations, or any successor thereto.

As an emerging growth company we are exempt from Section 404(b) of Sarbanes Oxley. Section 404(a) requires Issuers to publish information in their annual reports concerning the scope and adequacy of the internal control structure and procedures for financial reporting. This statement shall also assess the effectiveness of such internal controls and procedures.

Section 404(b) requires that the registered accounting firm shall, in the same report, attest to and report on the assessment on the effectiveness of the internal control structure and procedures for financial reporting.

As an emerging growth company we are exempt from Section 14A(a) and (b) of the Securities Exchange Act of 1934 which require the shareholder approval of executive compensation and golden parachutes.

We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the Act.

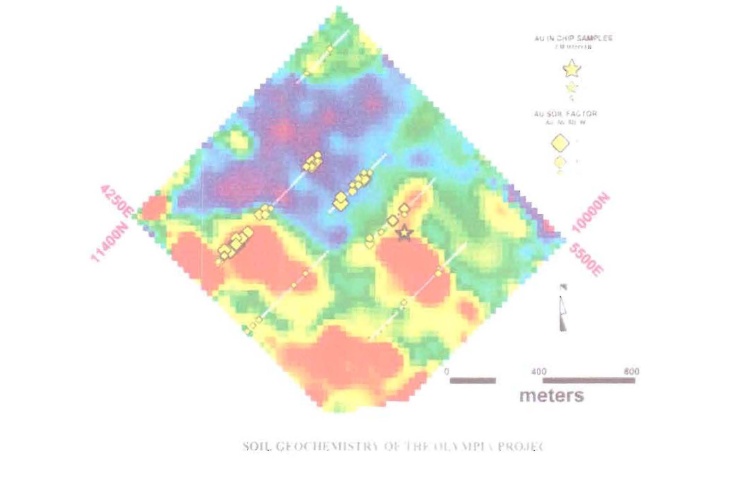

Our sole asset is a 100% interest in the Olympia Gold Claim (“Olympia”) located in the Dominican Republic. We acquired the Olympia claim for the sum of $13,000 from the Ministry of Mines in the Dominican Republic. We own no property other than the Olympia. As of the date of this Prospectus, we have conducted exploration work under Phase I on the Olympia. We engaged Hilario Sosa, a Geological Consultant, to explore and summarize the exploration potential of the Olympia and to make recommendations. Under this report, Mr. Sosa recommended undertaking Phase II of our exploration program consisting of soil geochemistry and diamond drilling of locations identified as having some value as shown during Phase I. The cost for Phase II is estimated at $65,752. We will have to raise funds to pay for the Phase II since at present we do not have sufficient funds to complete it as outlined by Mr Sosa.

There is no assurance that a commercially viable mineral deposit or reserve exists at our mineral claim or may exist until sufficient and appropriate exploration is completed and a comprehensive evaluation of such work concludes economic and legal feasibility. Such work could take many years of exploration and would require expenditure of a substantial amount of capital, capital which we do not currently have and may never be able to raise.

We have no full-time employees and our management devotes a small percentage of his time to the affairs of the Company.

Our administrative office is located at Calle San Pablo, No. 8 Bo, Buenos Aires, Municipio Monsenor Novel, Dominican Republic. Our telephone number is 809-223-2353. We do not maintain a web site.

-4-

The Offering

The following is a brief summary of this offering:

|

Common stock offered by Selling Security Holders

|

25,000,000 shares offered by the Selling Security Holder, who is our sole officer and director, detailed in the section of the Prospectus entitled “Selling Security Holder” beginning on page 34 .

|

|

Common stock outstanding as

of the date of this Prospectus

|

75,000,000 Shares

|

|

Use of proceeds

|

We will not receive any proceeds from the sale of shares of common stock by the Selling Security Holder.

|

|

Plan of Distribution

|

The offering is made by the Selling Security Holder named in this Prospectus to the extent he sells shares. There is no market for our shares of common stock. We intend to seek quotation of our common stock on the OTCBB; however, no assurance can be given that our common stock will be approved for quotation. The Selling Security Holder is an underwriter as defined under the Securities Act. The Selling Security Holder intends to sell his shares of common stock for $0.002 per share. This offering will terminate nine months after the effective date of this registration statement.

|

|

Risk Factors

|

You should carefully consider all the information in this Prospectus. In particular, you should evaluate the information set forth in the section of the Prospectus entitled “Risk Factors” beginning on page 6 before deciding whether to invest in our common stock.

|

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus contains statements that constitute forward-looking statements. The words “expect,” “estimate,” “anticipate,” “predict,” “believe,” and similar expressions and variations thereof are intended to identify forward-looking statements. Such forward-looking statements include statements regarding, among other things, (a) our growth strategies, (b) anticipated trends in our industry, (c) our future financing plans, (d) our anticipated needs for working capital and (e) the benefits related to ownership of our common stock. This information may involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from the future results, performance, or achievements expressed or implied by any forward-looking statements for the reasons, among others, described within the various sections of this Prospectus, specifically the section entitled “Risk Factors” beginning on page 6 below. These statements may be found under “Management’s Discussion and Analysis or Plan of Operations” and “Description of Business,” as well as in this Prospectus generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this Prospectus will in fact occur as projected. We undertake no obligation to release publicly any updated information about forward-looking statements to reflect events or circumstances occurring after the date of this Prospectus or to reflect the occurrence of unanticipated events.

-5-

RISK FACTORS

An investment in our common stock involves an exceptionally high degree of risk and is extremely speculative. In addition to the other information regarding Mineria Y Exploractiones Olympia, Inc. contained in this Prospectus, any future investor in our common shares should be aware that our business faces numerous financial, market, economic and business risks.

The following risk factors reflect the potential and substantial material risks which could be involved if you decide to purchase shares in this offering.

Risks Associated with Our Business

Our auditors have substantial doubt as to whether we will be able to continue as a going concern.

Our auditors, in their report dated August 15, 2013, have assumed the consolidated financial statements, included herein, have been prepared assuming our Company will continue as a going concern. They have indicated we will need additional working capital for our future development, including the exploration of the Olympia claim and for meeting our financial obligations over the next twelve months, which raises substantial doubt about our ability to continue as a going concern. With an estimate of $113,657 required over the next twelve months and with cash on hand as at August 31, 2013 of $19,013 there is not sufficient cash to meet our financial obligations over the next twelve months. Unless future funds can be raised we will have to cease operations.

We have no revenues, lack profitable operations, and have incurred losses which we expect to continue into the future.

We were incorporated in 2012 and have not yet conducted any significant exploration activities on the Olympia. We have no revenues. We have no exploration history upon which you can evaluate the likelihood of our future success or failure. We operations are not profitable and our net loss from inception to August 31, 2013 is $63,081. Based upon current plans, we expect to incur operating losses in future periods in connection with our exploration and evaluation of our mining claim.

We need to raise capital to continue our exploration program and to supply funds for operating expenses.

We estimate that we have sufficient cash to continue operations for twelve months but not sufficient funds to complete Phase II of our exploration program as recommended by Hilario Sosa, Professional Geologist. We are in the exploration stage. If the results of Phase II are positive, we intend to initiate further exploration activities. We will need to raise additional capital to undertake further exploration activities. No assurance can be given that we are successful in raising additional capital. You may be investing in a company that will not have the funds necessary to conduct any meaningful exploration activity due to our inability to raise additional capital. If that occurs we will have to delay or cease our exploration program which may result in the loss of your investment.

-6-

We have no known ore reserves and we cannot guarantee that we will find any gold and/or other valuable mineralization or, if we find gold and/or valuable mineralization, that it may be economically extracted. If we fail to find any gold and/or other valuable mineralization or if we are unable to find gold and/or valuable mineralization that may be economically extracted, we will have to cease operations.

We have no known ore reserves. Even if we find gold and/or other valuable mineralization we cannot guarantee that any gold and/or other valuable mineralization will be of sufficient quantity so as to warrant recovery. Additionally, even if we find gold and/or other valuable mineralization in sufficient quantity to warrant recovery, we cannot guarantee that the ore will be recoverable. Finally, even if any gold and/or other valuable mineralization is recoverable, we cannot guarantee that this can be done at a profit. Failure to locate gold deposits in economically recoverable quantities will cause us to cease operations. Our ability to achieve profitability and positive cash flow in the future is dependent upon:

|

*

|

our ability to locate a profitable mineral property;

|

|

|

*

|

our ability to locate an economic ore reserve; and

|

|

|

*

|

our ability to profitably extract the mineral and generate revenues

|

Because we are small company, have limited capital and have only one claim, we will be limited in our exploration costs.

The possibility of development of and production from the Olympia depends upon the results of exploration programs and/or feasibility studies and the recommendations of duly qualified professional engineers and geologists. We are small company and do not have much capital. We must limit our exploration activity which may adversely affect our ability to find ore reserves since we do not have the capital that other larger companies may have to find ore. Further, because of our limited capital we can afford to explore only one mining claim which increases our risk due to lack of diversification.

Because the probability of an individual prospect ever having reserves is extremely remote, in all probability the Olympia does not contain any reserves, and any funds spent on exploration will be lost.

Because the probability of an individual prospect, such as the Olympia, ever having reserves is extremely remote, in all probability our sole property, the Olympia, does not contain any reserves, and any funds spent on exploration will be lost. If we cannot raise further funds as a result, we may have to suspend or cease operations entirely which would result in the loss of your investment.

Even with positive results during exploration, the Olympia might never be put into commercial production due to inadequate tonnage, low metal prices or high extraction costs.

We might be successful, during future exploration programs, in identifying a source of minerals of good grade but not in the quantity, the tonnage, required to make commercial production feasible. If the cost of extracting any minerals that might be found on the Olympia is in excess of the selling price of such minerals, we would not be able to develop the claim. Accordingly even if ore reserves were found on the Olympia, without sufficient tonnage we would still not be able to economically extract the minerals from the claim in which case we would have to abandon the Olympia and seek another mineral property to develop, or cease operations altogether.

-7-

Mineral exploration and development activities are inherently risky. If such an adverse event were to occur it may result in a loss of your investment.

The business of mineral exploration and extraction involves a high degree of risk. Few properties that are explored are ultimately developed into production. Most exploration projects do not result in the discovery of commercially mineable deposits of ore. The Olympia, our sole property, does not have a known body of commercial ore. Should our mineral claim be found to have commercial quantities of ore, we would be subject to additional risks respecting any development and production activities. Unusual or unexpected formations, formation pressures, fires, power outages, labor disruptions, flooding, explosions, cave-ins, landslides and the inability to obtain suitable or adequate machinery, equipment or labor are other risks involved in extraction operations and the conduct of exploration programs. We do not carry liability insurance with respect to our mineral exploration operations and we may become subject to liability for damage to life and property, environmental damage, cave-ins or hazards. There are also physical risks to the exploration personnel working in the rugged terrain of the Olympia. Previous mining exploration activities may have caused environmental damage to the Olympia. It may be difficult or impossible to assess the extent to which such damage was caused by us or by the activities of previous operators, in which case, any indemnities and exemptions from liability may be ineffective.

Because our sole officer and director has other outside business activities and may not be in a position to devote a majority of his time to our exploration activity, our exploration activity may be sporadic which may result in periodic interruptions or suspensions of exploration.

Our President will be devoting only 15% of his time, approximately 24 hours per month, to our business unless we are undertaking an exploration program whereby his hours will increase during those months. As a consequence of the limited devotion of time to the affairs of the Company expected from our sole director and officer, our business may suffer. For example, because our officer and director has other outside business activities due to being a professional geologist who at times contacts his services to other exploration companies our exploration activity may be sporadic or may be periodically interrupted or suspended.

Currency conversion control could adversely affect the Company’s operations and profitability.

The Company’s financial statements are reported in U.S. dollars. We intend to conduct exploration activity on the Olympia located in the Dominican Republic. Accordingly, the Company’s value of its assets and reporting of its operations may be adversely affected by negative changes in the exchange rate of the Dominican peso against the U.S. dollar.

Risks Associated with this Offering.

Our sole officer and director owns a substantial amount of our common stock and will have substantial influence over our operations.

Our sole director and officer currently owns 75,000,000 shares of common stock representing 100% of our outstanding shares. Mr. Garcia purchased his shares for $0.001 per share. He has registered for resale 25,000,000 of his shares at a price of $0.002 per share. Assuming that Mr. Garcia is able to sell his 25,000,000 shares, he will still own 50,000,000 shares of common stock representing 66.67% of our outstanding shares. As a result, he will have substantial influence over our operations and can effect certain corporate transaction without further shareholders’ approval. This concentration of ownership may also have the effect of delaying or preventing a change in control.

-8-

There is no market for our shares of common stock.

Our common stock is not listed on any exchange or quotation system, and there is no market for our common stock. Therefore, the ability of our future shareholders to sell their shares of common stock may be limited which may affect the price of our shares of common stock. We intend to apply for a quotation on the OTCBB whereby:

|

●

|

We will have to be sponsored by a participating market maker who will file a Form 211 on our behalf since we will not have direct access to the FINRA

personnel; and

|

|

●

|

We will not be quoted on the OTCBB unless we are current in our periodic reports filed with the SEC.

|

From the date of this Prospectus, we estimate that it will take us between twelve to eighteen weeks to be approved for a quotation on the OTCBB. However, there can be no assurance that our shares will be listed for quotation on the OTCBB.

Even if a market develops for our shares our shares may be thinly traded, with wide share price fluctuations, low share prices and minimal liquidity.

Even if our shares of common stock are quoted on the OTCBB, our share price may be volatile with wide fluctuations in response to several factors, including but not limited to:

|

●

|

Potential investors’ anticipated feeling regarding our results of operations;

|

|

●

|

Increased competition and/or variations in mineral prices;

|

|

●

|

Our ability or inability to generate future revenues; and

|

|

●

|

Market perception of the future of the mineral exploration industry.

|

Further, our share price may be impacted by factors that are unrelated or disproportionate to our operating performance. Our share price might be affected by general economic, political and market conditions, such as recessions, changes in interest rates or international currency fluctuations. In addition, even if our stock is approved for quotation by a market maker through the OTCBB, stocks traded over this quotation system are usually thinly traded, highly volatile and not followed by analysts. These factors, which are not under our control, may have a material effect on our share price.

The number of shares being registered for sale in this Prospectus is significant in relation to our outstanding shares and may depress our share price.

The shares being registered by this Prospectus, 25,000,000, if sold in the market all at once or at about the same time, could depress the market price during the period the registration statement remains effective.

We will need to sell additional shares of common stock for additional capital for our operations that will result in ownership dilution to our existing shareholders.

We need to raise additional capital through the sale of our common stock. This will result in ownership dilution to our shareholders whereby their percentage ownership interest in the Company is reduced. The magnitude of this dilution effect will be determined by the number of shares we will have to issue in the future to obtain the funds required.

-9-

Penny Stock Regulations Affect Our Stock Price, Which May Make It More Difficult For Investors To Sell Their Stock.

Broker-dealer practices in connection with transactions in “penny stocks” are regulated by certain penny stock rules adopted by the SEC. Penny stocks generally are equity securities with a price per share of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ Stock Market, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules generally require that prior to a transaction in a penny stock the broker-dealer make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that becomes subject to the penny stock rules. Our securities are subject to the penny stock rules, and investors may find it more difficult to sell their securities.

USE OF PROCEEDS

This Prospectus relates to shares of our common stock that may be offered and sold from time to time by the Selling Security Holder. We will not receive any proceeds from the sale of shares of common stock in this offering. We will pay all expenses associated with this offering estimated at $19,306.82 as shown on page 14.

MARKET FOR COMMON EQUITY AND RELATED

STOCKHOLDERS MATTERS

Market Information

There is no market price for our shares. There are no shares of common stock that are subject to outstanding options, warrants or securities convertible into common stock of our Company.

Holders

Mineria Y Exploraciones Olympia, Inc. has one shareholder as at the date of this Prospectus.

Dividend Policy

We have not paid any dividends on our common stock and do not anticipate paying any cash dividends in the foreseeable future. We intend to retain earnings, if any, to finance the growth of the business. We cannot assure you that we will ever pay cash dividends. Our ability to pay cash dividends in the future will depend on the Company’s financial condition and results of operations and other factors that the Board of Directors will consider.

Securities Authorized for Issuance under Equity Compensation Plans

The Company has not adopted any equity compensation plans although it may do so in the future if it hires additional employees.

-10-

MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATIONS

You should read the following discussion of our financial condition and results of operations in conjunction with the financial statements and the notes thereto included elsewhere in this prospectus. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to these differences include those discussed below and elsewhere in this prospectus, particularly in the sections titled “Risk Factors” and “Forward-Looking Statements.”

Overview

Mineria Y Exploraciones Olympia, Inc. was incorporated on August 22, 2012 under the laws of the State of Nevada and is currently in good standing with the Secretary of State. On September 2, 2012 the Company incorporated a wholly owned subsidiary in the Dominican Republic named Consorcio de Mineria & Exloraciones Olympia, SR. Though its subsidiary the Company acquired the mineral rights to the Olympia located north of the city of Santo Domingo in the Dominican Republic. In order to determine if there existed any mineralization on the Olympia the subsidiary undertook ground exploration in the early part of 2013 and in February obtained a geological report authored by Hilario Santos Sosa, Professional Geologist, which is included in part in this prospectus under the heading “Description of Business”. Based on these results the Company is contemplating a further exploration program on the Olympia during the spring of 2014. It might not have the available funds to undertake the recommended drilling program as set forth in the geological report mentioned above and hence is considering the less expensive exploration program concentrating on soil, rock and sediment samples taken from areas where high concentration of mineralization were obtained during its first exploration program.

Sadler Gibb & Associates, Inc. have stated in their audit report included in this prospectus that we might cease as a going concern. Their wording in their report is as follows:

“The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. The Company will need additional working capital for its planned activity, which raises substantial doubt about its ability to continue as a going concern. Management's plans in regard to these matters are described in the notes to the financial statements. These financial statements do not include any adjustments that might result from the outcome of this uncertainty”.

Our auditors believe there is substantial doubt that our company can continue as an on-going business for the next twelve months unless there is an addition injection of capital into our company. We are not producing any revenue from the Olympia and it might take years before we are able to develop the claim to a degree that it is able to produce revenue and ensure our future success. Therefore we must seek other sources of funds other than from the Olympia in order for us to be a going concern. One way is to seek funds from new investors or to have our current director and officer advance funds to us.

PLAN OF OPERATIONS

Our financial commitments for the next twelve months consist of primarily related expenses of approximately $19,300 to this offering and becoming a reporting company, various expenses required to maintain the company during the next twelve months and approximately $65,752 associated with the mineral exploration program for a total estimate of outlay of funds of $113,677 less cash on hand as of August 31, 2013 of $19,013. Including mineral exploration program, we will have to incur the following estimated expenses over the next twelve months:

-11-

|

Expenses

|

Amount

|

Description

|

|

Accounting

|

$ 4,095

|

Fees to the independent accountant for preparing the quarter and annual financial statements to be reviewed and examined by the independent accountants.

|

|

Audit

|

7,000

|

Review of the quarterly financial statements and examination of the annual financial statements.

|

|

Claim maintenance and taxes

|

4,124

|

To maintain the Olympic in good standing for a year at approximately $4,000 and taxes of $142.

|

|

Legal and Consulting Fees

|

1,500

|

Estimated legal for opinion under Exhibit 5 and consent to use of name as expert in this prospectus.

|

|

Mineral exploration program

|

65,752

|

Phase II mineral exploration program as set forth on page 29.

|

|

Edgar filing service fees

|

7,400

|

Engagement of Edgar service entity to file reports with the SEC; future Forms 10-K and 10-Q.

|

|

Offering costs

|

19,306

|

Estimated cost of the prospectus offering costs as shown on page 14

|

|

Office

|

1,000

|

General office supplies.

|

|

Transfer agent’s fees

|

2,000

|

Annual maintenance fee and preparation of share certificates and other documents periodically required.

|

|

Miscellaneous

|

1,500

|

Printing of prospectus, photocopy and courier.

|

|

Estimated expenses

|

113,677

|

|

|

Less: Cash

|

(19,013)

|

Cash as at August 31, 2013

|

|

Cash Requirements

|

$ 94,664

|

Our engineering consultant has recommended an exploration program for the $65,752 for us to undertake Phase II. Currently, we do not presently have the requisite funds to complete the recommended exploration program. If we cannot raise money to complete the exploration program, we may be required to cease operation or look for a joint venture partner. As at the date of this prospectus, management has not identified any joint venture partners.

Even if we raise the sufficient funds to complete the exploration program under Phase II, we expect we will be required to raise additional funds for further exploration activities on the Olympia.

Nevertheless the Company is considering a further ground exploration program, undertaking further soil, sediment and rock samples, which would cost approximately $19,000 and be undertaken in the spring of 2014.

We do not intend to hire any employees at this time. All of the work on the Olympia will be conducted by unaffiliated independent contractors that we will hire under the supervision of our President, who is a geologist himself.

RESULTS OF OPERATIONS

Foreign Currency and Exchange Rates

Our mineral property is located in the Dominican Republic. However, costs expressed in the geological report on the Olympia are expressed in United States Dollars. Any future work to be conducted on the Olympia is expected to be paid in United States dollars although wages to the workers will be paid in Dominican Pesos after conversion from United States currency. The functional currency is considered to be US dollars.

-12-

Results of Operations for the Period From August 22, 2012 (date of inception) to August 31, 2013

For the period from August 22, 2012 to August 31, 2013, we had a net loss of $63,081. This represents a net loss of $0.00 per share for the period based on 75,000,000 shares outstanding. Our loss to date represents various expenses incurred with organizing the company and its wholly owned subsidiary, commissioning the geological report, undertaking initial exploration work on the Olympia, preparation of financial statements for submission to the independent accountants and general office expenses which can be broken down as follows:

|

Expense

|

Amount

|

Description

|

|

Accounting and audit

|

$ 5,875

|

Independent accountant and auditors for preparation and examination of May 31 financial statements.

|

|

Consulting

|

5,250

|

For preparation of Form S-1.

|

|

Entertainment

|

210

|

Various meeting with geologists, lawyers and other persons need in evaluating the potential of the Olympia claim.

|

|

Exploration expenses

|

26,799

|

Undertaking exploration work on the Olympia.

|

|

Filing fees

|

825

|

Annual report of the director and officer as filed with the State of Nevada.

|

|

Impairment loss on mineral claim

|

13,000

|

Write-off of the cost of acquiring the Olympia.

|

|

Incorporation costs

|

3,375

|

Incorporation in the State of Nevada and in the Dominican Republic.

|

|

Office

|

281

|

Printing cost of maps of the Olympia.

|

|

Legal

|

5,044

|

Property investigation and preparation of documents for the Company’s wholly owned subsidiary.

|

|

Transfer agent fees

|

853

|

Fees paid to our transfer agent.

|

|

Travel

|

1,569

|

Travelling to Santo Domingo to meet with Department of Mines on various occasions

|

|

Total

|

$ 63,081

|

|

Liquidity and Capital Resources

As of August 31, 2013, the Company had cash of $19,013 with outstanding debt to creditors of $7,094 including $107 owed to related parties representing a positive working capital of $11,919.

Our auditors, in their audit report dated August 15, 2013, have indicated there is substantial doubt about our abilities to continue as a going concern since we will require additional working capital to undertake our planned objectives. At the present time, we do not have adequate funds to meet our financial obligations over the next twelve months and to undertake further exploration work on the Olympia.

We are not receiving any of the proceeds from the offering under this prospectus and therefore will have to seek other avenues of obtaining additional funds. Several methods available to the Company are for our sole director and officer to advance the needed funds to the Company to meet its financial obligations over the next twelve months or to undertake a further issuance of shares. No decision in this regard has been made by management. If funds are not available the Company will have to cease operations and lose the rights to the minerals on the Olympia. The Company could seek out a business arrangement with another company whereby a percentage interest in the Olympia would be given in order for exploration work to be undertaken. No entity has been identified at this time and there is a strong possible none will ever be identified.

-13-

We cannot assure that additional capital required to finance our operations will be available on acceptable terms, if at all. Any failure to secure additional financing may force us to modify our business plan. In addition, we cannot be assured of profitability in the future.

Our Company is a development stage company and is not considered a blank check company due to having a specific business plan; the exploration of the Olympia Gold claim. Our Company is not engaged in any mergers or acquisitions with any unidentified company or companies, other entity, or person.

Milestones We Must Achieve

The milestones we have achieved since inception and what we plan to achieve in the future are as follows:

|

1.

|

Incorporated a wholly owned subsidiary in the Dominican Republic and identified through our director the Olympia.

|

|

2.

|

Undertook an exploration program on the Olympia wherein soil, rock and sediment samples were taken an analyzed by Acme Laboratories in Canada.

|

|

3.

|

Analysis of Phase I of our exploration program on the Olympia has been completed and a geological report has been prepared on the samples assayed for mineralization. Based on these results our director is considering extending the sampling program during the springr of 2014. This program is estimated to cost approximately $19,000.

|

|

4.

|

Completion of Phase II drilling program during the spring/summer of 2014 will be at a cost of $65,752. This program will also include further ground sampling, comprising soil, rock and sediment samples in areas of the Olympia not previous explored.

|

|

5.

|

File a registration statement with the Securities Commission at an estimated further cost of:

|

|

SEC registration fee

|

$ 6.82

|

|

Accounting fees and expenses (*)

|

5,500.00

|

|

Form S-1 preparation(*)

|

10,000.00

|

|

Legal fees and expenses (*)

|

1,500.00

|

|

Miscellaneous fees, including printing and Edgar filing service fees (*)

|

2,300.00

|

|

Total

|

$ 19,306.82

|

(*) Estimated

|

6.

|

Consolidated financial statements for the year ended May 31, 2013 and for the three months ended August 31, 2013 have been completed and are a part of this prospectus.

|

|

7.

|

If the registration statement becomes effective during the next twelve months, it is the intention of management to find a market maker to file a Form 211 so that our shares can be quoted on the OTCBB. It is our understanding there is no cost associated with this process other than minor expenses for printing and delivery of documents; such cost estimated at less than a $1,000.

|

-14-

Risk Associated with the Olympia

Our Company is aware of certain risk associated with the Olympia as follows:

|

1.

|

We realize that any money spent on the Olympia might be lost money never to be recovered. Very few mineral claims that are explored ever turn into actual mines which produce saleable minerals.

|

|

2.

|

We realize that even though we actual discover mineralization on the Olympia that it might not be of the tonnage nor grade to make it profitable to mine it. Without the tonnage or grade there is no point in our Company trying to mine and sell the mineral on the Olympia. Another factor which must be borne in mind is that the world price for minerals fluctuates on a daily bases and hence even if the tonnage and grades are there the price per ounce might be too low to make it worthwhile for us to extract the minerals. For example, during 2013 international gold prices have decreased in value significantly and there is no certainty that they will again rise to their previous prices.

|

|

3.

|

Because we are small and have not undertaken sufficient exploration work on the Olympia we might find it extremely difficult to raise money for future exploration work. If our director wishes to continue exploring he may have to contribute the funds to the Company himself.

|

|

4.

|

We have never undertaken a survey of the Olympia to determine the exact boundaries of our claim. If we are fortunate enough to discover an ore body of merit we might become involved in a legal dispute with another party as to our boundaries. This will be expensive and time consuming to our Company and presently we do not have the funds to dispute a long-term court case.

|

|

5.

|

Mining has many risks attached to it which we are presently not insured against and may never be. For example, the Olympia might be subject to cave-ins or moving rocks which will injure our workers and which might lead to court action and government intervention. Without insurance any funds we have on hand would have to be directed to disputing any claim made against us.

|

Critical Accounting Policies

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make a wide variety of estimates and assumptions that affect: (1) the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements, and (2) the reported amounts of expenses during the reporting periods covered by the financial statements. Our management routinely makes judgments and estimates about the effect of matters that are inherently uncertain. As the number of variables and assumptions affecting the future resolution of the uncertainties increases, these judgments become even more subjective and complex. We have identified certain accounting policies that are most important to the portrayal of our current financial condition and results of operations. Our significant accounting policies are disclosed in Note 2 of the Notes to the Consolidated Financial Statements, and several of those critical accounting policies are as follows:

-15-

Exploration Properties. Mineral exploration expenditures are expensed as incurred. Property acquisition costs relating to exploration properties are also expensed until the economic viability of the project is determined and proven and probable reserves quantified. Costs associated with economically viable projects are depreciated and amortized in accordance with the policies described above.

Stock-Based Compensation and Equity Transactions. We will, in the future, account for stock-based compensation pursuant to SFAS No. 123R, Share-Based Payment, an amendment of FASB Statements 123 and 95, which requires us to measure the compensation cost of stock options and other stock-based awards to employees and directors at fair value at the grant date and recognize compensation expense over the requisite service period for awards expected to vest.

Except for transactions with future employees and our director that are within the scope of ASC 718, all transactions in which goods or services are the consideration received for the issuance of equity instruments are accounted for based on the fair value of the consideration received or the fair value of the equity instruments issued, whichever is more reliably measurable. Additionally, in accordance with ASC 505-50-30, the Company has determined that the dates used to value the transaction are either: (1) the date at which a commitment for performance by the counter party to earn the equity instruments is established; or (2) the date at which the counter party’s performance is complete.

Trends

Management is unaware of any trends either currently or in the past which will have an impact on our operations. Any known risks to our future shareholders are detailed starting on page 6 under “Risk Factors”.

DESCRIPTION OF BUSINESS

Our primary asset consists of the Olympia. We engaged Hilario Sosa to explore and summarize the exploration potential of the Olympia and to make recommendations for further work under Phase II. His analysis and summary follow the Glossary of Geological and Technical Terms shown below.

Glossary of Geological and Technical Terms

The following represents various geological and technical terms used in this prospectus which the reader may not be familiar with.

|

Geological Term

|

Definition

|

|

Amphibolite

|

A crystalloblastic rock consisting mainly of amphibole (containing silica) and plagioclase (breaking obliquely) with little or no quartz.

|

|

Assay

|

An analysis to determine the quantity of one or more elemental components contained in a sample.

|

|

Barium

|

A silvery-white, metallic element, belonging to the alkaline earth group.

|

|

Basalt

|

A dark-gray to black, dense to fine-grain igneous rock.

|

|

Bismuth

|

A white crystalline, brittle metal with a pinkish tinge.

|

|

Breccias

|

A rock which has angular fragments which appear to be cemented together.

|

|

Calcareous

|

Said of a substance that contains calcium carbonate.

|

|

Claim

|

A mining right obtained from the government which comprises a land mass.

|

|

Clastic

|

Often referred to of fragments of minerals and rocks that have been moved from their original location.

|

|

Deposit

|

Mineral deposit or ore deposits is used to designate natural occurrence of a useful mineral, or an ore, in sufficient extent and degree of concentration to invite exploration.

|

|

Epithermal

|

Fluids, coming off a hot intrusive body of molten rock, which solidify.

|

|

Hyaloclastite

|

Said of the texture of porphyritic igneous rock in which crystals and glassy groundmass are equal or nearly equal in volumetric proportions.

|

|

Intrusives

|

A rock mass formed below the earth’s surface from molten magma which was intruded into a pre-existing rock mass and cooled to a solid.

|

-16-

|

Mafic

|

Pertaining to some igneous rocks and their constituent rocks.

|

|

Metamorphism

|

The mineralogical, chemical, and structural adjustment of solid rocks to physical and chemical conditions that have been generally been imposed at depth below the surface zones of weathering and cementation, and that differ from the conditions under which the rock in question originated.

|

|

Mineralization

|

Potential economic concentration of commercial metals occurring in nature.

|

|

Molybdenum

|

A silvery-white, very hard, metallic element which does not occur naturally and is a valuable alloying agent with steel and nickel.

|

|

Ore

|

The natural occurring mineral from which a mineral or minerals of economic value can be extracted profitable or to satisfy social or potential objectives.

|

|

Phenocryst

|

A term for large crystals or mineral grains floating in the matrix or groundmass of a porphyry.

|

|

Plagioclase

|

Any of a group of feldspar containing a mixture of sodium and calcium feldspar.

|

|

Pyrite

|

A brownish yellow metal of no significant value.

|

|

Quartz

|

It is the most common of all minerals and can either be transparent or made up of colors – red, grey, etc.

|

|

Reserve

|

(1) That part of a mineral deposit which could be economically and legally extracted or produced at the time the reserve is determined.

(2) Prove: Reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, working or drilling holes, grade and/or quality are computed from the results of detailed sampling and (b) the site for inspection, sampling and measurement are spaced to close and the geologic character is so well defined that size, shape and mineral content of reserves are well-established.

(3) Probable: Reserves for which quantity and grade and/or quality are computed similar to that used for proven (measure) reserves, but the site of inspection, sampling, and measurement are further apart or are otherwise less adequately spaced. The degree of assurance, although lower than for proven (measured) reserves, is high enough to assume continuity between points of observation.

|

|

Rhyolite

|

The extrusive equivalent to granite.

|

-17-

|

Schistose

|

Said of a rock displaying schistosity – the foliation in schist or other course-grained, crystalline rock due to the parallel, planar arrangement of mineral grains of the platy, prismatic, or ellipsodidal types, usually mica.

|

|

Selenium

|

A nonmetallic element and member of the sulfur family. Used in photocells, exposure meters, solar cells and extensively in rectifiers.

|

|

Sericite schist

|

A white, fine-grained potassium mica occurring in small scales as an alternation product of various aluminosilicate minerals, having a silky luster, and found in various metamorphic rocks or in the wall rock, fault gouge, and vein filings of many ore deposits.

|

|

Sulfide

|

A mineral compound characterized by the linkage of sulfur with a metal or semimetal.

|

|

Tectonics

|

A branch of geology dealing with the broad architecture of the outer part of the Earth; ie., the regional assembling of structure or deformational features, a study of their mutual relations, origin, and historical evolution.

|

|

Tholeiitic

|

A silica-oversaturated basalt.

|

|

Vein or veinlets

|

A fissure, fault or crack in rock filled by minerals that have traveled upwards from some deep source.

|

|

Volcanic rocks

|

Igneous rocks formed from magna that has flowed out of, or have been violently ejected from, a volcano,

|

|

Zone

|

A belt, band, or strip of earth material, however disposed; characterized as distinct from surrounding parts by some particular secondary enrichment.

|

-18-

Overview

Olympia Gold Claim

The following independent geological mapping report was undertaken at the request of the management of Consorcio de Mineria y Exploraciones Olympia, S.R.L., to comply with the international exploration standards for the Olympia. The author of the report was Mr. Hilario Sosa, Professional Geologist, who graduated from the Universidad Tecnologica de Santiago as an Engineer of Geology in 1994 and obtained in 1996 his Master’s of Science from UMAM University fo Mexico. He has been a geologist for 18 years and visited the Olympia between November 25th and December 13, 2012. Since 1995 he has worked for Kuky Silverio Industrial (for nine years), Pato Alto Mining Company (for five years) and Barrick Mining (for one year).

Our President, Mr. Garcia, was instrumental in deciding upon the Olympia Gold Claim being the initial project for the Company. Being a professional geologist for a number of years and being familiar with the geology in the Dominican Republic, he researched the geological information previously developed by the Ministry of Mines in many areas of the country. In 2000, the European Union gave a non-refundable loan of 30,000.000 Euros to undertake exploration activities over the majority of the country. In addition to aerial surveying ground samples were taken and assayed as to mineral content. This information was compiled and is available to anyone interested in the geological structure of the Dominican Republic. The information reviewed by Mr. Garcia at the offices of the Ministry of Mines contained geological mapping, aerial and ground geophysical studies as well as structural geology. From this information made available to him he selected what he felt was the best mineral claim in the San Jose de Ocoa area of the Dominican Republic ; an area he is interested in.

The Company’s wholly owned subsidiary was incorporated in Puerto Plata in the Dominican Republic on August 15, 2012 and on August 28, 2012 it acquired the Olympia Gold Claim by filing an exploration concession application with the Ministry of Mines. There were no contractual agreements entered into with any party; merely an exploration concession application made to the Ministry.

The mineral claim was assigned to Consorcio de Mineria Y Exploraciones Olympia, S.R.L., and the designation was filed with the Ministry of Industry and Commerce and Mining Directorate of the Government of the Dominican Republic.

Consorcio de Mineria y Exploraciones Olympia, SRL, has submitted and registered an exploration concession application to the Dominican government which was granted on October 9, 2013. The Dominican mining law grants Licenses of Exploration Concessions for a period of three years with two, one-year extensions allowed. .

Consorcio de Mineria y Exploraciones Olympia, SRL, is a Limited Liability Company, incorporated the date of August 15, 2012, under the laws and regulations of the Dominican Republic, with its Mercantile Registry No. 20514-PP and Tax ID No. 130-940134, both up to date.

The taxation years the subsidiary runs from 01st of January to 31st of December, being the annual filing every 30th of April. The Company has made the applicable tax filing as at April 30, 2013.

Mining Law in the Dominican Republic

Mining in the Dominican Republic is governed by the General Mining Law No. 146 of 4 June 1971, and Regulation No. 207-98 of 3 June 1998. The mining authority is the General Mining Directorate (Dirección General de Minería - DGM) which is part of the Secretary of State of Industry and Commerce.

-19-

The properties are simply known and recorded in their respective property name under a License of Metallic Exploration Concession. Title is valid for three years. Two separate one-year extensions are allowed. After five years the concessions may be reapplied for giving the concessions a further three to five years.

The taxes are paid every six months during the first weeks of January and June. The full yearly amount is paid at the start of the year. The annual amount for each concession ranges between US$4,000 and US$25,000 (based on the current exchange rate). Every six months a full report has to be submitted to the Department of Mines summarizing work completed during the previous six months, work plans and budget for the next six months, and any geochemical data. There is no specified level of work commitment per concession.

Determination of the Boundaries of the Olympia

The Olympia concession have not been surveyed, however the claim owner, Consorico de Mineria Y Exploraciones Olympia, has erected a reference monument centrally within the property as required in the claim staking process and this is surveyed by the Mines Department. A detailed description of the procedure follows:

• The claim system in place revolves around one principal survey point PP (Punto de Partida or Departure Point), as opposed to staking all corner points with a physical stake as would be done in Canada or Australia.

• Three types of sample points that need to be calculated, a Punto de Partida (PP), a Punto de Referencia (Reference Point, PR) and three visually recognizable points (Visuales or Visuals, V1, V2 & V3).

• The PP point is a visual point from which the proposed claim boundary point can be clearly seen by line of sight. The PP point is usually a topographic high with a distance to the proposed claim boundary greater than 100 meters.

• From the PP point a second point the “Punto de Referencia” (PR) is selected. The PR point is usually another topographic high or a distinctive topographic feature such as river confluence or a road / trail junction. The bearing and distance between the PP and PR points are calculated and tabulated.

• From the PR point three separate visually identifiable points V1, V2 and V3 are selected, usually distinctive topographic feature such as confluences of rivers or road / trail junctions. The bearing and distances between the PR point and three visual points V1, V2 & V3 are calculated and tabulated.

|

Visuals

|

Magnetic Route

|

Distance (Meters)

|

|

PR – PP

|

S 69°50’ W

|

102.00

|

|

PR – V1

|

N 69°55’ W

|

66.90

|

|

PR – V2

|

N 70°10’ E

|

73.40

|

|

PR – V3

|

“E” franc

|

71.1 0

|

• From the PP point the distance to the proposed claim boundary a north-south or east-west line (no less than 100 m) is calculated. From the point at which this line intersects the claim boundary the corner points of the claim area are calculated. The corner points (Puntos de conneccion) are defined by north-south or east-west lines from the point at which the line intersects the boundary and then from each other until the boundary is completed. There is no limit to the number of points that can be used and no minimum size of claim.

-20-

• A government surveyor is sent out to review all survey points in the field after legal and fiscal verification of the claim application by the mines department.

The Exploration Concession grants its holder the right to carry out activities above or below the earth’s surface in order to define the areas containing mineral deposits by using any technical and scientific methods. For such purposes the holder may construct buildings, install machinery, communication lines and any other equipment that his research requires. No additional permitting is required until the drilling stage, which requires an environmental permit (unless drilling is no deeper than 20 meters)

An Exploitation Concession may be requested at any time during the exploration stage, and grants the right to prepare and extract all mineral substances found in the area, allowing the beneficiary to exploit, smelt and use for any business purpose the extracted materials. This type of concession is granted for a period of 75 years.

Exploitation properties in the Dominican Republic are subject to annual surface fees and a net smelter return (NSR) of 5%. A 5% net profits interest (NPI) is also payable to the municipality in

which mining occurs as an environmental consideration. The value added tax is 18%. The NSR is deductible from income tax and is assessed on concentrates, but not smelted or refined product. Income Tax payable is a minimum of 1.5% of annual gross proceeds.

Environmental Regulations

The environment is governed by the General Law of the Environment and Natural Resources No. 64-00 of 18 August 2000. The environmental authority is Sub Secretary of Environmental Affairs of the Secretary of State of the Environment and Natural Resources. An environmental permit is required for trenching and drilling. The main steps in the procedure to obtain this are as follows:

|

1.

|

Complete the Prior Analysis Form with the project data including name of the project, name of the company, location on a 1:50,000 scale map, and name of the legal representative.

|

2. Description of the planned work including type of equipment to be used, size of the drill platforms, amount of water that will be required, environmental management plans for fuel, oil and grease, and recirculation of water.

3. Authorization of the land owners with copy of property title.

4. Pay a tax of RD$5,000.00 (about US$141.50).

5. Copy of the Resolution of the Exploration License title.

6. UTM coordinates of the vertices of the Exploration Concession.

-21-

Deposit Types and Mineralization

The island of Hispaniola evolved as a complex island arc associated with bi-polar subduction through Cretaceous to Late Eocene time. Since then, the island has straddled the left-lateral strike-slip fault zone that separates the North American and Caribbean Plates and has largely been volcanically inactive. The Tertiary stratigraphic succession is dominated by sedimentary rocks. The most important rock units in terms of gold and base metal mineralization are the Los Ranchos, Maimon, Tireo and Duarte Formations.

Model lead isotope ages and paleontological evidence yield early Cretaceous ages for both the Los Ranchos and Maimon Formations. Together, they constituted a composite arc associated with NW-directed subduction of the proto-Caribbean plate. The Maimon Formation represents a primitive, bimodal fore-arc assemblage composed of tholeiitic basalts and subordinate felsic volcanics and meta-sedimentary rocks whereas the Los Ranchos Formation represents the axial portion of the associated island arc. The Loma Caribe peridotite, which now hosts the nickel laterite mines, and the Duarte Formation amphibolite would have been part of the oceanic crust that floored the proto-Caribbean Sea.

The volcanic arc underwent a change in polarity in Mid-Cretaceous (Aptian to Early Albanian) time, likely triggered by the collision of the Caribbean Oceanic Plateau with Hispaniola. North-vergent obduction of the Loma Caribe peridotite also took place at this time and the arc was tectonically shortened by major thrust faulting. Shearing and metamorphism was stronger in the fore-arc (Maimon) than the island arc (Los Ranchos).

Renewed calc-alkaline arc volcanism began in the Late Cretaceous (Cenomanian), associated with SW-directed subduction of the North Atlantic Plate beneath Hispaniola. This formed the volcanic arc now represented by the Tireo and Duarte Formations of the Central Cordillera.

Calc-alkaline volcanism continued until Middle/Late Eocene time, when the Bahama Platform (North Atlantic Plate) collided with Hispaniola and the island underwent NE-SW contraction. The Loma Caribe peridotite was emplaced over Late Cretaceous basalts of the Peralvillo Formation. Earlier faults and penetrative fabrics were steepened and overprinted by folds and Mid-Cretaceous thrusts were re-activated.

The Maimon Formation is separated from Late Cretaceous basalts (Peralvillo Formation) and the Loma Caribe peridotite by the NW-striking, left-lateral Ozama Shear Zone which is Eocene or younger. From Late Eocene time until the present, Hispaniola has been subjected to left-lateral transpression and left-lateral strike-slip faulting.

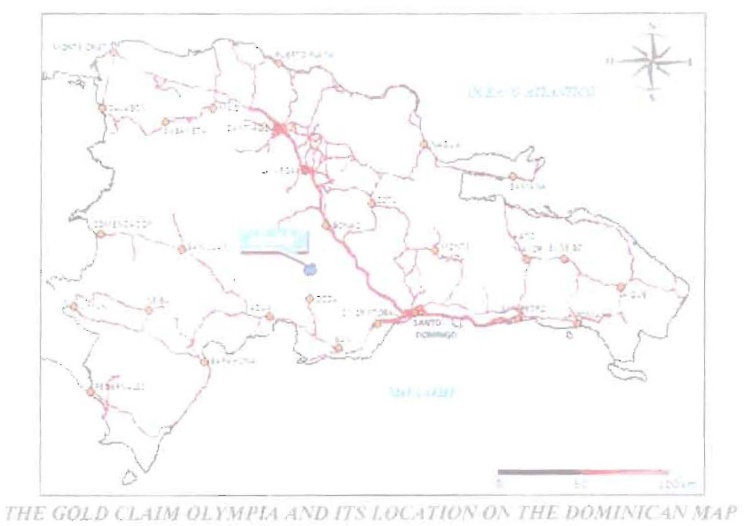

Property Description and Location

The Olympia Gold Claim consist of 3,315 (Three Thousand Three Hundred and Fifteen Mining Hectares) or 8,191 acres, located in the province of San Jose de Ocoa, municipality of San Jose de Ocoa, in the Southwestern region of the country, at about 112 kilometers from the city of Santo Domingo, capital of the Dominican Republic. The project is located in the Central Cordillera mountain belt at an altitude of 990 m, in steeply incised topography. Land use is cattle ranching, and the higher elevations are wooded. It is in the upper part of the Ocoa River basin at the section of Sabana Larga, the main town of the province. The access to the area claim has middle to low difficulty as it is located in a mountain region; nevertheless, the access to the claim is easy by 4x4 wheel drive or by horse riding.

-22-

The concession is located within the topographic sheet No.6172-II and Arroyo Cano topographic sheet No. 6172-III 1:50,000 scale, the boundaries are given by the UTM coordinates (19Q): 345.198 mE and 2'089, 000 - 2'069,826 mN. Google coordinates would be: 18’ 44’18”.12 N – 70’ 29’31”.99 O with an elevation of 990 meters.

Accessibility, Climate, Local Resources, Infractructure and Physiography

Accessibility

Access to the Olympia is from Santo Domingo to Villa Altagracia by paved highway, a distance of 112 km which takes 1 hour and 20 minutes. From Villa Altagracia to San Jose de Ocoa it is a 20 km drive on a road which is surfaced paved too.

The nearest international airport is the Airport of the Americas on the east side of Santo Domingo, about a one and a half hour drive from San Jose de Ocoa.

-23-

Climate

The mean annual temperature in San Jose de Ocoa is 22.2°C with a mean annual high of 27.8°C and a mean annual low of 16.7°C. The hottest month is July with a mean monthly high of 29.8°C, and the coolest month is January with a mean low of 15.5°C. The average annual rainfall is 1,435 mm. Rain falls all year with the wettest months being April-May and October to December (data from www.climate-charts.com, average data for 1961 to 1990). The weather is dominated by north east trade winds from the Atlantic.

Geological Setting

Olympia is located in the San Jose de Ocoa block in the Central Cordillera of Hispaniola which is a composite of oceanic derived accreted terrains bounded by left-lateral strike slip fault zones, and is part of the Early Cretaceous to Paleogene Greater Antilles island arc. Hispaniola is located on the northern margin of the Caribbean plate which is a left-lateral transform plate boundary. The tectonic collage is the result of west south west to south west directed oblique convergence of the continental margin of the North American plate with the Greater Antilles island arc, which began in the Eocene to Early Miocene and continues today.

The project geology comprises rhyolites, often altered to sericite schist, overlain by calcareous siltstones and mafic volcanic rocks. Massive sulfide mineralization occurs at the contact between the rhyolites and the calcareous siltstones at Rio Ocoa. Disseminated gold mineralization occurs in sericite schists at Olympia and other near areas.

-24-

The rhyolite forms a north west-trending body about 1,000 m wide at Olympia, narrowing to the north west. The sediment horizon occurs on the north east side and has been mapped for 3.5 km strike length, with a width of 40 to 90 m. Mafic volcanic rocks occur to the north east and south west of the rhyolite.

The rhyolites have phenocrysts of quartz and plagioclase and textures vary from cohesive, with flow banding, to volcaniclastic, often with hyaloclastite texture. They are interpreted to be lavas and/or domes with hyaloclastite breccias and sandstones, indicating extrusion and brecciation by chilling in a subaqueous environment. The sericite schists are altered and deformed rhyolite and predominate over unaltered and undeformed rhyolite. The schistose texture develops progressively as the amount of sericite increases, and there is a transition between rhyolite and sericite schist. The two names were used as descriptive lithological terms in mapping and core logging. Hydrothermal sericite alteration greatly lowers the competency of rhyolite resulting in development of schistosity in response to regional tectonics, and partial to complete destruction of the volcanic texture. Textural variations reflect different volcanic and volcaniclastic units. The sericite schists are pale green to white with quartz phenocrysts and sericite pseudomorphs of plagioclase and biotite, and a strong schistose foliation with open to tight, second-stage folding.