Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Endurance International Group Holdings, Inc. | d638783d8k.htm |

Credit Suisse

Tech Conference December 4, 2013

Exhibit 99.1 |

endurance.com

/

FORWARD LOOKING STATEMENTS AND OTHER IMPORTANT CAUTIONS

2

Statements in this presentation which are not statements of historical fact, including but

not limited to statements concerning our financial guidance for fiscal year 2013 and

our long term annual growth rate expectations, are “forward-looking statements” (as

defined in the U.S. Private Securities Litigation Reform Act of 1995). These

forward-looking statements are based on our current expectations and beliefs, as

well as a number of assumptions concerning future events. These statements are subject to risks,

uncertainties, assumptions and other important factors set forth in the our SEC filings,

many of which are outside our control, that could cause actual results to differ

materially from the results discussed in the forward-looking statements. Some of the key factors

that could cause actual results to differ from our expectations include: the rate of growth

of the SMB market for our solutions; our inability to maintain a high level of

subscriber satisfaction; our inability to continue to add new subscribers and increase sales to our

existing subscribers; system or Internet failures; our dependence on establishing and

maintaining strong brands; our inability to maintain or improve our competitive

position or market share; the loss of strategic relationships or alliances with third parties; our

inability to integrate recent or potential future acquisitions; the business risks of

international operations; the loss or unavailability of any of our co-located

data centers; our recognition of revenue for subscription-based services over the term of the applicable

subscriber agreement; the occurrence of security or privacy breaches; and adverse

consequences of our substantial level of indebtedness. You are

cautioned to not place undue reliance on such forward-looking statements because actual results may vary materially from

those expressed or implied. All forward-looking statements are based on information

available to us on this date and we assume no obligation to, and expressly disclaim

any obligation to, update or revise any forward-looking statements, whether as a result of new

information, future events or otherwise. This

presentation includes data based on our internal estimates. While we believe that our internal estimates are reasonable, no

independent source has verified such estimates.

The information on, or that can be accessed through, any of our websites is not deemed to be

incorporated in this presentation or to be part of this presentation. |

endurance.com

/

AGENDA

3

•

Introduction to Endurance

•

Third Quarter Results

•

Supplemental Information

Hari Ravichandran

Founder, CEO

Tiv Ellawala

CFO |

INTRODUCTION

TO ENDURANCE 4 |

endurance.com

/

WE ARE A TECHNOLOGY PLATFORM

THAT TRANSFORMS THE WAY

SMBs DO BUSINESS

5 |

endurance.com

/

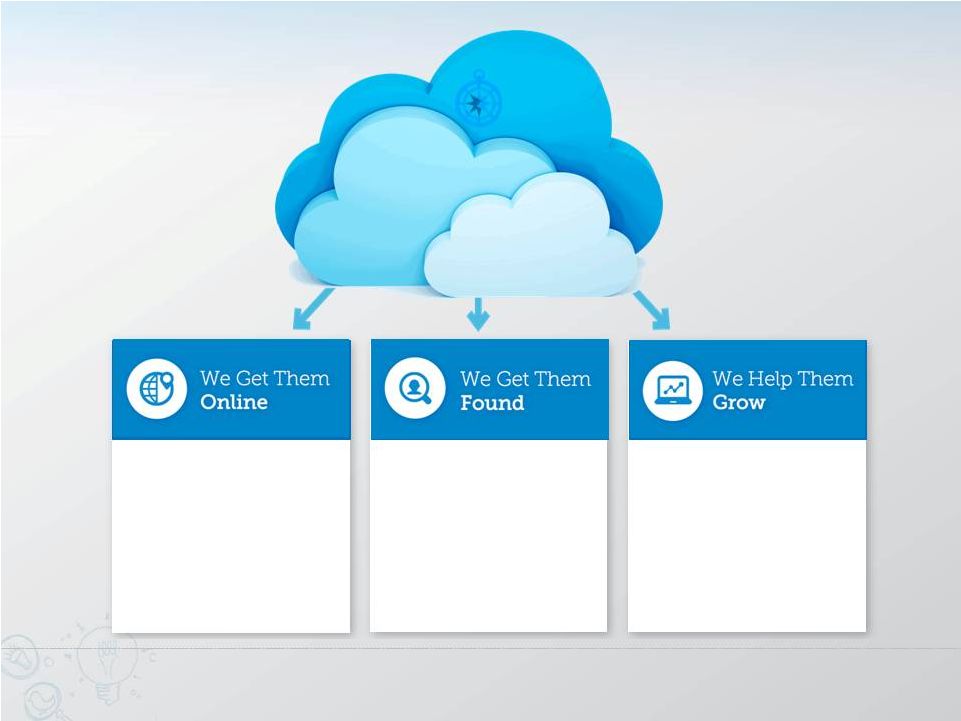

6

WHAT WE DO

Cloud

Enablement

Platform

•

Domains

•

Email

•

Site Builders

•

Shared Hosting

•

Security

•

Site Backup

•

Mobile

•

AdWords

•

SEM / SEO Services

•

Social Media

•

BI and Analytics

•

Virtualized / Managed

Hosting

•

Email Marketing

•

Productivity Solutions

•

eCommerce

•

Professional Services |

endurance.com

/

7

HOW WE DO IT

•

400,000 online referral

partners

•

Success-based marketing

•

Better conversion

•

Customer

segmentation

•

Better adoption rates

•

Better customer education

•

Most current products

•

Higher priced products |

endurance.com

/

GROWING SUBSCRIBERS

MULTI-CHANNEL

8 |

endurance.com

/

GROWING SUBSCRIBERS

MULTI-BRAND

9 |

endurance.com

/

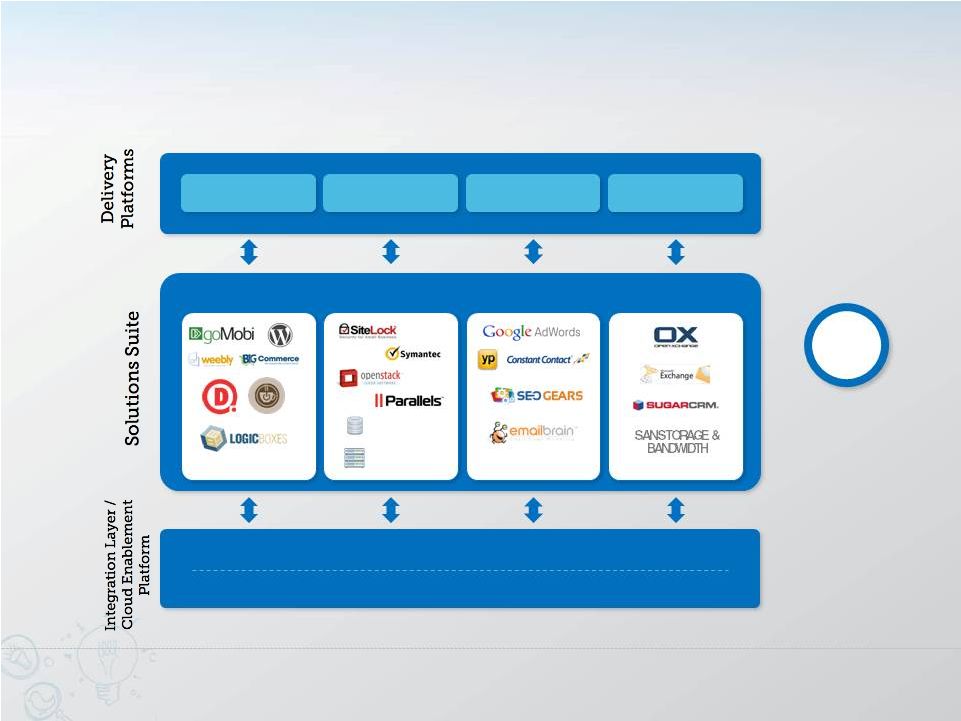

GROWING ARPS

MULTI-PRODUCT

Our proposed acquisition of Directi is targeted to close during the fourth quarter of

2013. 10

Brand Sites

Control Panel

Sales Floor

Marketplace

Catalog

Provisioning

Billing

Support

Storage

Network

Compute

Data

MySQL Databases

Site Backup & Restore

90%

90% of revenues from

Endurance owned

products

Web Presence

Compute & Security

Marketing

Productivity |

endurance.com

/

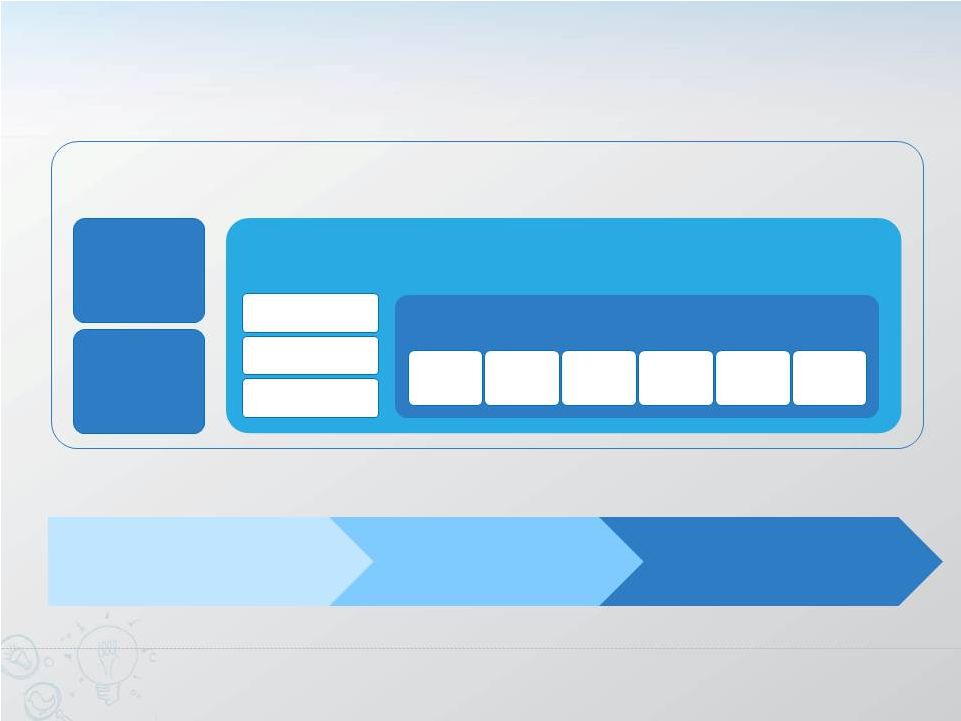

GROWING ARPS

MULTI-ENGAGEMENT

11

Engaging Subscribers At The Right Time

Life Stage

Event

Triggered

Event

With the Right Messages

Listen

Teach

Sell

In the Right Channel & Touchpoint

Website

Email

Advisor

Social

Mojo

Mobile

Observe their behavior

across touchpoints

Engage them where

they are most active

Promote only where

they are responsive

In the Right Way |

endurance.com

/

THE ENDURANCE DIFFERENCE

12

SUPERIOR PERFORMANCE

attracts

who demand

Best in class

Cloud Enablement Technology Platform

High quality

Subscribers

who

view web presence as mission critical

High quality

Products

that

drive revenue growth

When combined, these advantages

yield SUPERIOR PERFORMANCE

Cloud

Enablement

Technology

Platform |

endurance.com

/

13

OPPORTUNITIES FOR GROWTH |

THIRD QUARTER

RESULTS 14 |

endurance.com

/

Q3 BUSINESS HIGHLIGHTS

15

Closed Refinancing

Exceeded Revenue, Adjusted EBITDA & UFCF Estimates

Increased Total Subscribers on Platform

9 months ended September 30, Revenue of $384M, Adjusted EBITDA

of $161M and Unlevered Free Cash Flow (UFCF) of $129M

Increased total subscribers on platform to over 3.440M

Grew ARPS while maintaining favorable MRR churn rate

Significant and increasing cash flow generation

Strong cash flow conversion |

endurance.com

/

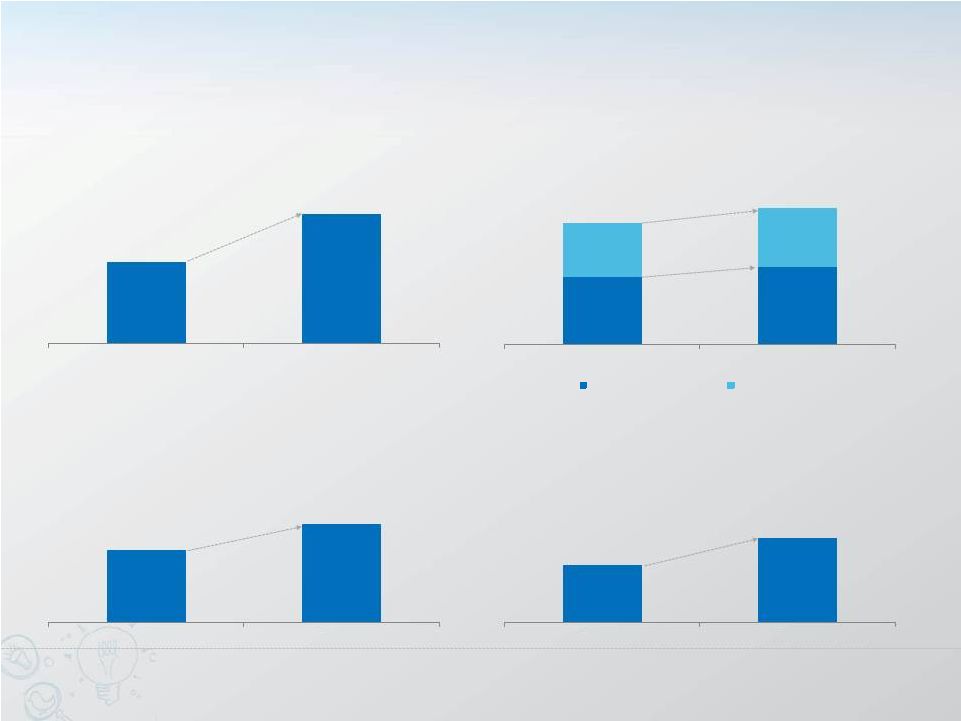

Q3 OPERATING METRICS

Subscriber data is pro-forma for acquisitions and represents organic growth in

subscribers. 16

Total Subscribers (‘000s)

MRR Retention Rate

ARPS ($)

12.95

13.14

2%

9%

Added 70,000 organic subscribers in Q3

10%

CAGR

2,857

2,972

3,059

3,114

3,223

3,315

3,370

3,440

Q4 2011

Q1 2012

Q2 2012

Q3 2012

Q4 2012

Q1 2013

Q2 2013

Q3 2013

10.51

11.48

Q3 2012 PF

Q3 2013

Without 2012 acquisitions

2012 acquisitions

99%

99%

Q3 2012 PF

Q3 2013 |

endurance.com

/

Q3 KEY FINANCIAL METRICS

17

GAAP Revenue ($M)

UFCF ($M)

Adj. Revenue ($M)

Adj. EBITDA ($M)

59%

12%

36%

48%

15%

120.2

134.2

83.4

132.9

Q3 2012

Q3 2013

67.3

77.4

Q3 2012 PF

Q3 2013

Without 2012 acquisitions

2012 acquisitions

37.1

50.3

Q3 2012

Q3 2013

29.2

43.1

Q3 2012

Q3 2013 |

endurance.com

/

REST OF YEAR GUIDANCE

18

Q4 2013

~$525M

~$204M

FY 2013

~$33M

~$162M

~$43M

~$134M

Long Term Annual

Growth

Mid-teens

High-teens

High-teens

Adjusted Revenue

Adjusted EBITDA

Unlevered FCF

Figures above are estimates based on our expectations as of the date of this

presentation. |

endurance.com

/

endurance.com

/

SUPPLEMENTAL INFORMATION

19 |

endurance.com

/

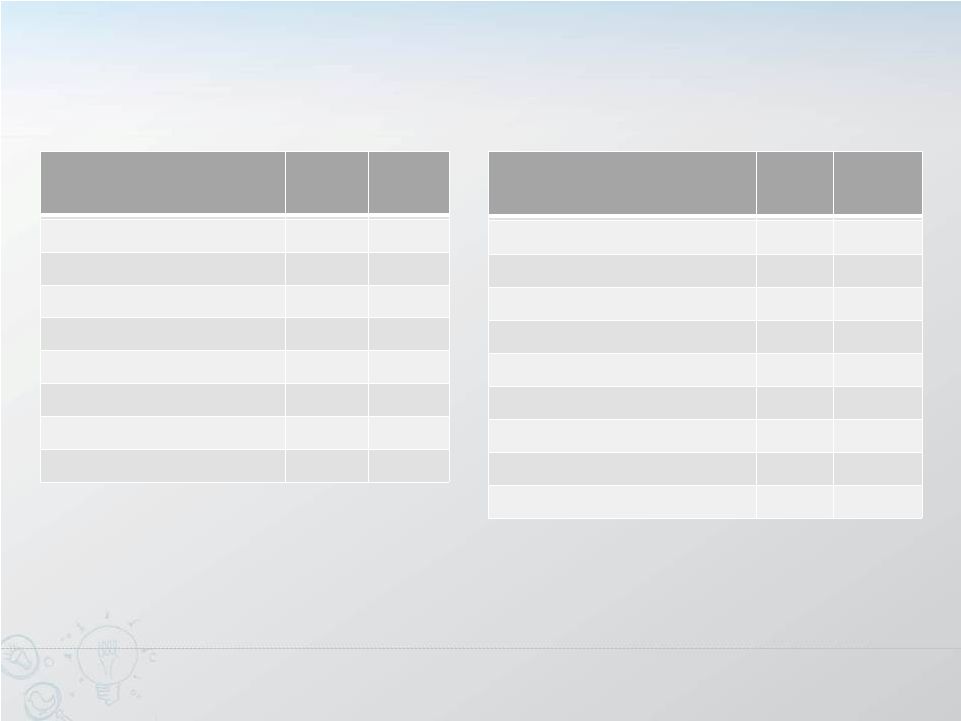

SUMMARY BALANCE SHEET

*Does not give pro forma effect to IPO and loan refinance.

20

($M)

December 31,

2012

September

30, 2013*

Unaudited

Cash & Cash Equivalents

23.2

33.4

Restricted Cash

0.9

1.2

Other Current Assets

44.0

54.0

Current Assets

68.1

88.6

Property

&

Equipment

–

Net

34.6

46.6

Goodwill

&

Other

Intangible

Assets

–

Net

1,417.4

1,346.8

Other Assets

18.0

37.2

Total Assets

1,538.1

1,519.2

($M)

December

31, 2012

September 30,

2013*

Unaudited

Accounts Payable & Accrued Expenses

39.3

43.5

Deferred Revenue

187.4

233.3

Other Liabilities

34.0

35.4

Revolver

15.0

-

Term Debt

1,115.0

1,198.8

Deferred Consideration

77.4

28.7

Total Liabilities

1,468.0

1,539.7

Shareholder’s Equity

70.2

-20.5

Total Liabilities & Shareholder’s Equity

1,538.1

1,519.2 |

endurance.com

/

NON –

GAAP RECONCILIATION

STATEMENT

21

Three months

ended 9/30

Nine months

ended 9/30

2012

2013

2012

2013

Revenue

$83

$133

$175

$384

Purchase accounting

24

1

$57

7

Pre-acquisition revenue from acquired properties

13

0

116

1

Adjusted revenue

$120

$134

$349

$391

Total subscribers

3,114

3,440

3,114

3,440

ARPS

$12.95

$13.14

$12.84

$13.02

Adjusted revenue attributable to 2012 acquisitions

53

57

156

166

Adjusted revenue excluding revenue attributable to 2012 acquisitions

$67

$77

$193

$225

Total subscribers excluding subscribers attributable to 2012 acquisitions

2,151

2,247

2,151

2,247

ARPS excluding 2012 acquisitions

$10.51

$11.48

$10.22

$11.12

Net loss

$(28)

$(27)

$(67)

$(92)

Stock-based compensation

0

0

1

1

Amortization of long-lived assets related to acquisitions

26

26

57

79

Amortization of deferred financing costs

2

0

4

0

Changes in deferred revenue (inclusive of impact of purchase accounting)

26

11

94

44

Transaction expenses

8

2

10

6

Integration and restructuring expenses

0

9

0

40

Severance

0

0

0

0

Legal and professional expenses

0

1

0

5

Tax-affected impact of adjustments

(24)

(1)

(64)

(5)

Adjusted net income

$11

$21

$36

$79

Depreciation

2

5

4

13

Current and deferred tax benefit

8

2

27

3

17

22

34

66

Adjusted EBITDA

$37

$50

$101

$161

Change in operating assets and liabilities, net of acquisitions

(2)

0

(14)

(7)

Capital expenditures

(5)

(7)

(12)

(25)

Unlevered free cash flow

$29

$43

$74

$129

Interest expense, net (net of impact of amortization of deferred financing costs) |

endurance.com

/

NON-GAAP FINANCIAL MEASURES

Adjusted net income, adjusted EBITDA, unlevered free cash flow, adjusted revenue and average

revenue per subscriber are non-GAAP financial measures and should not be

considered as alternatives to net income, revenue or any other measure of financial performance calculated and

presented in accordance with GAAP. We believe these non-GAAP financial measures are

helpful to investors because we believe they reflect the operating performance of our

business and help management and investors gauge our ability to generate cash flow, excluding some recurring and

non-recurring expenses that are included in the most directly comparable measures

calculated and presented in accordance with GAAP. Adjusted Net Income -

Adjusted net income is a non-GAAP financial measure that we calculate as net income

(loss) plus changes in deferred revenue inclusive of purchase accounting adjustments

related to acquisitions, amortization, stock-based compensation expense, severance,

expenses related to restructurings or integration of acquisitions, any dividend-related

payments accounted for as compensation expense, costs associated with litigation

matters and preparation for the initial public offering and the estimated tax effects of the foregoing adjustments. Due to our

history of acquisitions and financings, we have incurred accounting charges and expenses

that obscure the operating performance of our business. We believe that adjusting for

these items and the use of adjusted net income is useful to investors in evaluating the performance of our company.

Adjusted EBITDA -

Adjusted EBITDA is a non-GAAP financial measure that we calculate as adjusted net

income plus interest expense, depreciation, amortization and change in deferred

taxes. We manage our business based on the cash collected from our subscribers and the cash required to

acquire and service those subscribers. We believe highlighting cash collected and cash spent

in a given period is valuable insight for an investor to gauge the overall health of

our business. Under GAAP, although subscription fees are paid in advance, we recognize the associated revenue over

the subscription term, which does not fully reflect short-term trends in our operating

results. Unlevered

Free

Cash

Flow

-

Unlevered

free

cash

flow,

or

UFCF,

is

a

non-GAAP

financial

measure

that

we

calculate

as

adjusted

EBITDA

plus

changes

in

operating

assets

and

liabilities

(other

than

deferred

revenue)

net

of

acquisitions

less

capital

expenditures.

We

believe

the

most

useful

indicator of our operating performance is the cash generating potential of our company prior

to the impact of our capital structure and prior to any accounting charges related to

our acquisitions. We have substantial indebtedness primarily as a result of the December 2011 acquisition of a

controlling interest in our company by investment funds and entities affiliated with Warburg

Pincus and Goldman Sachs and a substantial dividend payment in November 2012. We also

believe that because our business has meaningful data center and related infrastructure requirements, the

level of capital expenditures required to run our business are an important factor for

investors. We believe UFCF is a useful measure that captures the effects of these

issues. 22 |

endurance.com

/

NON-GAAP FINANCIAL MEASURES

(CONT.) Adjusted Revenue -

Adjusted revenue is a non-GAAP financial measure that we calculate as GAAP revenue

adjusted to exclude the impact of any fair value adjustments to deferred revenue

resulting from acquisitions and to include the revenue generated from subscribers we added through

business acquisitions as if those acquired subscribers had been our subscribers since the

beginning of the period presented. We believe that excluding fair value adjustments

to deferred revenue is useful to investors because it shows our revenue prior to purchase accounting charges

related to our acquisitions, and that including revenue from acquired subscribers in this

manner provides a helpful comparison of the revenues generated from our subscribers

from period to period. Average

Revenue

Per

Subscriber

-

Average

revenue

per

subscriber,

or

ARPS,

is

a

non-GAAP

financial

measure

that

we

calculate

as

the

amount

of

adjusted revenue we recognize from subscribers in a period divided by the average of the

number of total subscribers at the beginning of the period and

at

the

end

of

the

period.

We

believe

ARPS

is

an

indicator

of

our

ability

to

optimize

our

product

and

service

mix

and

pricing,

and

to

sell

products

and services to new and existing subscribers.

Our non-GAAP financial measures may not provide information that is directly comparable

to that provided by other companies in our industry, as other companies in our

industry may calculate non-GAAP financial results differently. In addition, there are limitations in using non-GAAP financial

measures because they are not prepared in accordance with GAAP, may be different from

non-GAAP financial measures used by other companies and exclude expenses that may

have a material impact on our reported financial results. Further, interest expense, which is excluded from some of

our non-GAAP measures, has and will continue to be for the foreseeable future a

significant recurring expense in our business. The presentation of non-GAAP

financial information is not meant to be considered in isolation or as a substitute for the directly comparable financial measures prepared

in accordance with GAAP. We urge you to review the reconciliations of our non-GAAP

financial measures to the comparable GAAP financial measures

included

with

this

presentation,

and

not

to

rely

on

any

single

financial

mseasure

to

evaluate

our

business.

23 |