Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CRAWFORD & CO | d637358d8k.htm |

Crawford &

Company New York City

December 4, 2013

Exhibit 99.1 |

Crawford

& Company FORWARD-LOOKING STATEMENTS AND ADDITIONAL INFORMATION

2

Forward-looking statements

Revenues Before Reimbursements (“Revenues”)

Segment and Consolidated Operating Earnings

Earnings Per Share

Non-GAAP Financial Information

–This presentation contains forward-looking statements, including

statements about the future financial condition, results of operations and earnings

outlook of Crawford & Company. Statements, both qualitative and

quantitative, that are not statements of historical fact may be

“forward-looking

statements”

as defined in the Private Securities Litigation Reform Act of 1995 and other

securities laws. Forward-looking statements involve a number of

risks and uncertainties that could cause actual results to differ materially from historical experience or Crawford & Company’s present

expectations. Accordingly, no one should place undue reliance on

forward-looking statements, which speak only as of the date on which they are

made. Crawford & Company does not undertake to update

forward-looking statements to reflect the impact of circumstances or events that may

arise or not arise after the date the forward-looking statements are made.

Results for any interim period presented herein are not necessarily

indicative of results to be expected for the full year or for any other future

period. For further information regarding Crawford & Company, and the

risks and uncertainties involved in forward-looking statements, please read

Crawford & Company’s reports filed with the United States Securities and

Exchange Commission and available at www.sec.gov or in the Investor Relations

section of Crawford & Company’s website at

www.crawfordandcompany.com.

–Crawford’s business is dependent, to a significant extent, on case

volumes. The Company cannot predict the future trend of case volumes for a

number of reasons, including the fact that the frequency and severity of

weather-related claims and the occurrence of natural and man-made

disasters, which are a significant source of claims and revenue for the Company,

are generally not subject to accurate forecasting. –Revenues Before

Reimbursements are referred to as “Revenues” in both consolidated

and segment charts, bullets and tables throughout this presentation.

–Under

the

Financial

Accounting

Standards

Board’s

Accounting

Standards

Codification

Topic

280,

“Segment

Reporting,”

the

Company

has

defined

segment operating earnings as the primary measure used by the Company to evaluate

the results of each of its four operating segments. Segment operating

earnings exclude income taxes, interest expense, amortization of customer-relationship intangible assets, stock option expense, earnings or

loss attributable to non-controlling interests, certain unallocated corporate

and shared costs and credits, and special charges and credits.

Consolidated operating earnings is the total of segment operating earnings and

certain unallocated and shared costs and credits. –In certain periods,

the Company has paid a higher dividend on CRDA than on CRDB. This may result in a different earnings per share ("EPS") for

each class of stock due to the two-class method of computing EPS as required

by the guidance in Accounting Standards Codification Topic 260 -

"Earnings Per Share". The two-class method is an earnings allocation

method under which EPS is calculated for each class of common stock

considering both dividends declared and participation rights in undistributed

earnings as if all such earnings had been distributed during the period.

Further references to EPS in this presentation will generally be

only for CRDB, as that is the more dilutive measure.

–For additional information about certain non-GAAP financial information

presented herein, see the Appendix following this presentation. |

Crawford

& Company Crawford & Company at a Glance

at market close November 29, 2013

Exchange/Tickers:

NYSE: CRDA and CRDB

Trailing 52 week High/Low:

CRDA: $4.65-$8.48

CRDB: $5.62-$11.30

Market Capitalization :

$488.0 million

Quarterly Dividend/ Normalized Yield:

CRDA: $0.05/quarter or 2.6% yield

CRDB: $0.04/quarter or 1.6% yield

Analyst Coverage:

Adam Klauber, William Blair

Mark Hughes, Suntrust

Greg Peters, Raymond James

3 |

Crawford

& Company A Business Services Leader since 1941

The world’s largest independent provider of global claims management solutions

Multiple globally recognized brand names: Crawford, Broadspire, GCG

Clients include multinational insurance carriers, brokers and local insurance firms

as well as over 200 of the Fortune 500 companies

4

EMEA-A/P

Americas

Broadspire

Legal Settlement

Administration

Serves the U.K., European,

Middle Eastern, African and

Asia Pacific markets

Serves the U.S., Canadian

and Latin American markets

Serves large national

accounts, carriers and self-

insured entities

Provides administration for

class action settlements and

bankruptcy matters |

Crawford

& Company $1.2 Billion Revenue Company

700 Locations

70+ Countries

8,500 Employees

OUR GLOBAL STRENGTH

5 |

Crawford

& Company Diversified Business and Clients

2012 Revenues of Approximately $1.2 Billion

•

Property and Casualty

Services

•

Global Technical

Services

•

Third Party

Administration

•

Global Markets

28.6%

21.6%

17.1%

EMEA/AP

Americas

•

Property and Casualty Services

•

Catastrophe Management Services

•

Contractor Connection

•

Centralized Claim Administration

•

Affinity Programs

32.7%

Legal Settlement Administration

•

Class Actions

–

Securities

–

Product Liability

•

Bankruptcy Administration

Broadspire

•

Workers’

Compensation and

Liability Claims Administration

•

Medical and Case Management

•

Long-Term Care Services

•

Integrated Disability Management

•

Risk Management Information

Systems (RSG)

•

Claim Triage Solution (e-Triage)

6 |

Crawford

& Company Catalysts/Drivers

7

Cyclical Positive Industry Claim Trends:

Increased underwriting pressure creates a positive claim

trend.

Weather/Catastrophe Trends:

Catastrophic events worldwide are increasing in severity

and frequency. Crawford is uniquely positioned to serve

these markets.

Healthcare Reform:

Increased healthcare spending is a positive for

Broadspire’s medical case management and cost

containment services.

Future Inflation:

Rising interest rates drive interest income in Broadspire

and lower the Company’s anticipated pension obligations.

Market Position:

Leading market position in each of our segments. |

Crawford

& Company Crawford Provides More Than Claims Services

8

P&C outsourced claims services provided

about $575 million, or 49%, of total

Crawford revenue in 2012

•

Claims services is a mature business in most geographies

•

Revenues are driven by claims volume, which is affected by

regional economies, economic growth

•

Severe weather and natural disasters can create volatility in

claims volume

•

Global Technical Services is the leader in mega-claims

$600 million, or 51%, was derived from

higher-value added business services

•

Third Party Administration

•

Direct repair services

•

Legal Settlement Administration

•

Medical Management

•

Analytics

•

Forensic Accounting

–BPO

–Consulting |

Crawford’s

Expertise Claims Services: Thai Flooding Catastrophe Response

Business Process Outsourcing: Deepwater Horizon

Consulting: Medical Management |

Crawford

& Company Catastrophe Response: Thai Flooding

Top ten historic insurance loss

Crawford handled losses in excess of $4

billion

Flooding affected an area the size of

South Carolina

Leveraged global capabilities through

deployment of 160 staff including 50

support staff and 35 senior adjusters

from other locations globally

In-house forensic accountants utilized

10 |

Crawford

& Company Natural catastrophes worldwide 1980 –

2012

Natural catastrophes per year more than doubled over period

Crawford is uniquely positioned to respond on a global basis

11

Global Natural Catastrophe Update

©

2013 Munich Re

Source: Geo Risks Research, NatCatSERVICE –

As at January 2013 |

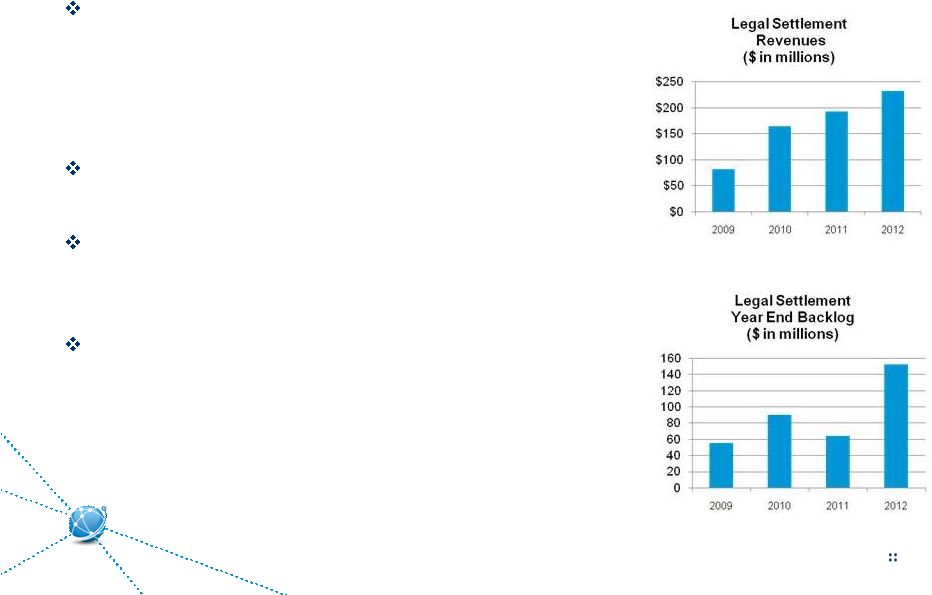

Crawford

& Company High-Volume Claims Services: Deepwater Horizon

12

The Garden City Group (GCG) is the recognized

leader in legal administration services for class

action settlements and other claims

administration, bankruptcy cases and legal

noticing programs

Largest program is the combined GCCF/Deepwater

Horizon settlement

This special project resolves economic loss and

property damage claims related to the Deepwater

Horizon Incident

GCG’s other high-profile distribution matters

include:

–the

General Motors bankruptcy –the $6.15 billion WorldCom settlement

–the

$3.4 billion Native American Trust Settlement –the $3.05 billion VisaCheck/MasterMoney Antitrust settlement. |

Crawford

& Company Garden City Group Ranks First

Among Claims Administrators

13

Source: Securities Class Action Services Report, Most Frequent Claims Administrators in SCAS

100, Jan. 2013 |

Crawford

& Company 14

Consulting: Medical Management

Medical costs are currently 60% of workers compensation cost and

are estimated to be over 70% by 2016, increasing the importance of

effective medical cost containment.

Broadspire case managers proactively manage medical treatment in

the rehabilitation process, enabling our clients’

employees to

recover as quickly as possible in the most cost-effective manner.

Healthcare reform is expected to increase activity in the healthcare

market overall, which could negatively impact access to providers

and slow return to work, which could increase medical and workers

compensation cost and potentially increase claims frequency.

Broadspire’s in-house integrated model provides services to mitigate

increasing medical costs, ultimately decreasing our clients’

overall

loss costs. This is a key element of Broadspire’s value proposition to

clients.

|

Financial

Review and Operational Focus |

Crawford

& Company 2012 Business Summary

16

Record revenues of $1.177 billion

Record consolidated operating earnings of $110.2 million

Record operating cash flow of $92.9 million

Including special payment, dividends of $0.20 per CRDA and $0.16

per CRDB |

Crawford

& Company YTD September 2013 Business Summary

17

Revenues increased 2% to $878.6 million

Consolidated operating earnings increased 5% to $74.7 million

Improvement in Broadspire and Americas operating results

Net income increased 16% to $40.2 million

Diluted earnings per share of $0.74 for CRDA and $0.71 for CRDB |

Crawford

& Company Year To Date 2013 Financials

18

Crawford & Company Income Statement Highlights

Unaudited ($ in thousands, except per share amounts)

Nine months ended September 30,

2013

2012

% Change

Revenues

$878,566

$863,736

2%

Costs of Services

638,049

625,001

2%

Selling, General, and Administrative

174,077

173,967

0%

Corporate Interest Expense, Net

4,762

6,785

-30%

Special Charges

- 2,794

nm

Total Costs and Expenses

816,888

808,547

1%

Other Income

2,800

1,473

90%

Income Before Income Taxes

64,478

56,662

14%

Provision for Income Taxes

24,221

21,213

14%

Net Income

40,257

35,449

14%

Add: Net Income Attributable to Noncontrolling Interests

105

744

-86%

Net Income Attributable to Shareholders of Crawford & Company

$40,152

$34,705

16%

Earnings Per Share - Diluted:

Class A Common Stock

0.74

$

0.65

$

14%

Class B Common Stock

0.71

$

0.62

$

15%

Cash Dividends Per Share:

Class A Common Stock

0.13

$

0.10

$

30%

Class B Common Stock

0.10

$

0.07

$

43%

nm=not meaningful |

Crawford

& Company Operational Focus

19

Sustain Operating Performance through Improved Profitability

Americas improvement in U.S. Property & Casualty and Canada

Continued progress in Broadspire

EMEA/AP improvement in the United Kingdom

Strengthen the Balance Sheet

Manage debt levels and pension obligations

Drive operating cash flow to support business growth

Enhance Total Return to Shareholders

Dividend policy to provide meaningful yield

Seek opportunities to repurchase outstanding shares below

intrinsic value |

Crawford

& Company 2013 Guidance

20

Consolidated revenues before reimbursements between $1.13 and $1.15 billion

Consolidated operating earnings between $95.0 and $99.0 million

Consolidated cash provided by operating activities between $50.0

and $55.0

million

Consolidated net income attributable to shareholders of Crawford

& Company

between $51.5 and $54.0 million, or $0.90 to $0.95 diluted earnings per CRDB

share

On November 4, 2013, Crawford & Company affirmed and updated certain

aspects of its full year 2013 guidance as follows: |

Crawford

& Company Enhanced Return to Shareholders

21

Dividends and Buyback:

TTM Total Return (12/3/12 to 11/29/13):

After the 2013 third quarter, Crawford declared a regular quarterly

dividend of $0.05 on CRDA and $0.04 on CRDB

During the first nine months of 2013, Crawford has paid dividends of $0.13

per

share

on

CRDA

and

$0.10

per

share

on

CRDB,

compared

to

$0.10

and

$0.07, respectively, for the comparable 2012 period

Through September 30, 2013, Crawford has repurchased 933,249 shares of

CRDA at an average cost of $5.07

CRDA price increased 57.6%. Total return was 62.1%

CRDB price increased 65.2%. Total return was 68.1% |

Crawford

& Company Crawford Capital Structure

22

Improving Balance Sheet Supports Return to

Shareholders

Debt reduced by $62 million, or 25% since 2010

through 2012

Pension risk management program driving positive

results

Material improvement in cash flow from both

operations and working capital management

Net debt of $95.2 million at December 31, 2012 |

Crawford

& Company 23

Crawford Dynamic Investment Policy Glide Path

9/30/13

Desired

Liability Hedging

60%

Plan Status

Frozen

Funded Status

82%

Asset Allocation

38/62

Road Map

Trade Equities for Long Bonds as Funded Status Improves

Hedging

60%

Hedging

60%

Hedging

60%

Hedging

66%

Hedging

74%

Return

Seeking

40%

Return

Seeking

40%

Return

Seeking

40%

Return

Seeking

40%

Return

Seeking

34%

Hedging

90%

Hedging

82%

Hedging

60%

Return

Seeking

10%

Return

Seeking

18%

Return

Seeking

26%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

<70%

70%

75%

80%

85%

90%

95%

100% +

Asset Allocation by Funded Status

Plan Status

De-risk & Maintain

Funded Status

Fully Funded

Asset Allocation

Risk Optimized

Liability Hedging

100% Hedged |

Crawford

& Company Management Alignment with Shareholders

Short-Term Incentive Compensation Plan Matrix:

Metric:

Weight:

Revenues

30%

Operating Earnings

25%

Operating Margin

25%

DSO

20%

24

Stock Ownership Guidelines:

Multiple of

Officer:

Base Salary:

President/CEO

3x

CFO/EVPs

2x

Balanced short and long term system focused on strategic priorities and

aligned with shareholders

Long-term incentive compensation plan based on three-year EPS performance

tied to the Company’s strategic plan |

Crawford

& Company Capital Structure and Governance

Class A and B Shares:

As of October 31, 2013, there were approximately 29.9 million shares of Class A Common

Stock and 24.7 million shares of Class B Common Stock outstanding.

The two classes of stock are substantially identical, except with respect to voting rights and

the Company's ability to pay greater cash dividends on the non-voting Class A Common

Stock than on the voting Class B Common Stock, subject to certain limitations.

In addition, with respect to mergers or similar transactions, holders of Class A Common

Stock must receive the same type and amount of consideration as holders of Class B

Common Stock, unless different consideration is approved by the holders

of 75% of the Class A

Common Stock, voting as a class.

Insider Ownership:

The Jesse C. Crawford family beneficially owned 40.1% of outstanding Class A shares and

52.0% of outstanding Class B shares as of March 5, 2013.

Board Diversification and Makeup:

Eight of nine members are independent, with the exception of the

CEO, Jeff Bowman. CEO

and chairman roles are split.

25 |

Crawford

& Company Global Footprint

World’s largest independent provider of

claims management solutions

Diverse customer base

Global catastrophe response

Innovative Technology

Platforms

Analytics

RiskTech

Risk Sciences Group/Dmitri

Claims Management System (CMS)

Command Center

Specialized Resources

Legal Settlement Administration (GCG)

Global Technical Services (GTS)

Medical Cost Containment

Contractor Connection

Business Process Outsourcing

Gaining Market Share

North American vertical

Positioned to benefit from expected global

consolidation of TPA vendors

Emerging Asia Pacific and

Latin American markets

26

CRAWFORD IS POSITIONED FOR STRONG RETURNS |

Crawford &

Company Appendix |

Crawford

& Company Appendix: Non-GAAP Financial Information

28

Measurements of financial performance not calculated in accordance with GAAP should be

considered as supplements to, and not substitutes for, performance measurements

calculated or derived in accordance with GAAP. Any such

measures are not necessarily comparable to other similarly-titled measurements employed by

other companies. Reimbursements for Out-of-Pocket Expenses

In the normal course of our business, our operating segments incur certain

out-of-pocket expenses that are thereafter reimbursed by our clients. Under

GAAP, these out-of-pocket expenses and associated reimbursements are

required to be included when reporting expenses and revenues,

respectively, in our consolidated results of operations. In this

presentation, we do not believe it is informative to include the GAAP-required

gross up of our revenues and expenses for these pass-through reimbursed

expenses. The amounts of reimbursed expenses and related revenues offset each

other in our consolidated results of operations with no impact to our net income

or operating earnings (loss). Unless noted in this presentation, revenue and

expense amounts exclude reimbursements for out-of-pocket expenses. Segment and

Consolidated Operating Earnings Operating earnings is the primary financial

performance measure used by our senior management and chief operating decision maker

(“CODM”) to

evaluate the financial performance of our Company and operating segments, and make

resource allocation and certain compensation decisions. Management

believes operating earnings is useful to others in that it allows them to evaluate segment and consolidated operating

performance using

the same criteria our management and chief operation decision maker use.

Consolidated operating earnings (loss) represent segment earnings (loss)

including certain unallocated corporate and shared costs and credits, but before

net corporate interest expense, stock option expense, amortization of

customer-relationship intangible assets, special charges and credits, income

taxes, and net income or loss attributable to noncontrolling

interests.

Net debt

Net debt is computed as the sum of long-term debt, capital leases and

short-term borrowings less cash and cash equivalents. Management believes

that net debt is useful because it provides investors with an estimate of what the

Company’s debt would be if all available cash was used to pay down the

debt of the Company. The measure is not meant to imply that management

plans to use all available cash to pay down debt. |

Crawford

& Company Non-GAAP Financial Information

29

Unaudited ($ in thousands)

2008

2009

2010

2011

2012

YTD through

September 30, 2013

YTD through

September 30, 2012

Revenues Before Reimbursements

Total Revenues

1,135,916

$

1,048,202

$

1,110,801

$

1,211,362

$

1,266,138

$

946,710

$

930,608

$

Reimbursements

(87,334)

(78,334)

(80,384)

(86,007)

(89,421)

(68,144)

(66,872)

Revenues Before Reimbursements

1,048,582

$

969,868

$

1,030,417

$

1,125,355

$

1,176,717

$

878,566

$

863,736

$

YTD through

September 30, 2013

YTD through

September 30, 2012

Costs of Services Before Reimbursements

Total Costs of Services

706,193

$

691,873

$

Reimbursements

(68,144)

(66,872)

Costs of Services Before Reimbursements

638,049

$

625,001

$

2008

2009

2010

2011

2012

YTD through

September 30, 2013

YTD through

September 30, 2012

Operating Earnings (Loss)

Americas

28,766

$

29,394

$

20,748

$

19,851

$

11,877

$

17,355

$

7,429

$

EMEA/AP

32,999

23,401

24,828

28,421

48,585

19,486

30,267

Broadspire

3,526

(1,602)

(11,712)

(11,434)

27

4,475

(573)

Legal Settlement Administration

10,814

13,130

47,661

51,307

60,284

38,714

42,114

Unallocated corporate and shared costs, net

(6,362)

(10,996)

(5,841)

(9,555)

(10,613)

(5,355)

(7,930)

Consolidated Operating Earnings

69,743

53,327

75,684

78,590

110,160

74,675

71,307

(Deduct) Add:

Goodwill and intangible asset impairment charges

-

(140,945)

(10,788)

-

-

-

-

Net corporate interest expense

(17,622)

(14,166)

(15,002)

(15,911)

(8,607)

(4,762)

(6,785)

Stock option expense

(861)

(914)

(761)

(450)

(408)

(652)

(322)

Amortization expense

(6,025)

(5,994)

(5,995)

(6,177)

(6,373)

(4,783)

(4,744)

Special charges and credits

(788)

(4,059)

(4,650)

2,379

(11,332)

-

(2,794)

Income before income taxes

44,447

$

(112,751)

$

38,488

$

58,431

$

83,440

$

64,478

$

56,662

$

|

Crawford

& Company Non-GAAP Financial Information, continued

30

Unaudited ($ in thousands)

December 31,

2012

Net Debt

Short-term borrowings

13,275

$

Current installments of long-term debt and capital leases

838

Long-term debt and capital leases, less current installments

152,293

Total debt

166,406

Less: Cash and cash equivalents

71,157

Net debt

95,249

$

Reconciliation of Non-GAAP Items |

Crawford &

Company |