Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AERIE PHARMACEUTICALS INC | d636249d8k.htm |

| EX-99.1 - EX-99.1 - AERIE PHARMACEUTICALS INC | d636249dex991.htm |

Leading Innovation in Glaucoma

Leading Innovation in Glaucoma

The Next Generation

The Next Generation

Company Overview

December 4, 2013

Exhibit 99.2 |

2

Important Information

Important Information

Any

discussion

of

the

potential

use

or

expected

success

of

our

product

candidates

is

subject

to

our

product

candidates

being

approved

by

regulatory

authorities.

In

addition,

any

discussion

of

clinical

data

results

for

our

AR-13324

product

candidate

relate

to

the

results

in

our

Phase

2

clinical

trials.

Our

product

candidate

PG324

has

only

been

tested

in

preclinical

animal

models.

The

information

in

this

presentation

is

current

only

as

of

its

date

and

may

have

changed

or

may

change

in

the

future.

We

undertake

no

obligation

to

update

this

information

in

light

of

new

information,

future

events

or

otherwise.

We

are

not

making

any

representation

or

warranty

that

the

information

in

this

presentation

is

accurate

or

complete.

Certain

statements

in

this

presentation

are

“forward-looking

statements”

within

the

meaning

of

the

federal

securities

laws,

including

beliefs,

expectations,

estimates,

projections

and

statements

relating

to

our

business

plans,

prospects

and

objectives,

and

the

assumptions

upon

which

those

statements

are

based.

Words

such

as

“may,”

“will,”

“should,”

“would,”

“could,”

“believe,”

“expects,”

“anticipates,”

“plans,”

“intends,”

“estimates,”

“targets,”

“projects”

or

similar

expressions

are

intended

to

identify

these

forward-

looking

statements.

These

statements

are

based

on

the

Company’s

current

plans

and

expectations.

Known

and

unknown

risks,

uncertainties

and

other

factors

could

cause

actual

results

to

differ

materially

from

those

contemplated

by

the

statements.

In

evaluating

these

statements,

you

should

specifically

consider

various

factors

that

may

cause

our

actual

results

to

differ

materially

from

any forward-

looking

statements.

These

risks

and

uncertainties

are

described

more

fully

in

our

prospectus

filed

with

the

SEC

on

October

28,

2013,

particularly

in

the

sections

titled

“Risk

Factors”

and

“Management’s

Discussion

and

Analysis

of

Financial

Condition

and

Results

of

Operation.”

Such

forward-looking

statements

only

speak

as

of

the

date

they

are

made.

We

undertake

no

obligation

to

publicly

update

or

revise

any

forward-looking

statements,

whether

because

of

new

information,

future

events

or

otherwise,

except

as

otherwise

required

by

law. |

3

•

Large Market Opportunity -

$4.5B US/EU/JP Market

-

Significant unmet needs -

50% of patients require more than one drug

-

No PGA fixed-combination products approved in the US

•

Proprietary, Differentiated First-in-Class Glaucoma Pipeline

-

Both ROCK & NET inhibition -

First new MOAs in two decades

•

AR-13324: Novel Dual-Action, Once-Daily Therapy

-

Phase 3 expected to begin mid-2014; efficacy data expected mid-2015

-

NDA filing expected by mid-2016

•

PG324: Breakthrough Triple-Action, Once-Daily Therapy

-

Fixed combination of AR-13324 and PGA latanoprost

-

Phase 2b data expected mid-2014; Phase 3 readiness expected mid-2015

•

All Products Developed Internally -

Own Class & Compounds

-

Patent protection through at least 2030 in the US

-

All rights retained with no partnerships

Aerie –

Aerie –

Next Generation in Glaucoma Therapies

Next Generation in Glaucoma Therapies |

4

Aerie Strategy Overview

Aerie Strategy Overview

Establish Commercial

Capabilities

Expand Commercial

Offerings

Maximize Portfolio

Value Ex-US

•

Explore partnership opportunities outside US

through collaborations & licensing

•

Global reach to Europe, Japan and emerging

markets

•

Build own US commercial infrastructure with ~100

sales representatives

•

Target ~10,000 high-prescribing eye care

professionals

•

Explore additional ophthalmic product

candidates

Advance First-in-Class

Glaucoma Treatments

•

AR-13324 Phase 3 efficacy results expected mid-2015;

NDA filing expected mid-2016

•

PG324 Phase 2b results expected mid-2014; Initiate

prep for Phase 3 trials mid 2014-2015 |

5

Aerie’s Experienced Leadership Team

Aerie’s Experienced Leadership Team

Executive Team

Vince Anido, Jr., PhD

Chairman & CEO

Thomas Mitro

President & COO

Brian Levy, OD, MSc

CMO

Casey Kopczynski, PhD

CSO

Richard Rubino

CFO

Board Experience

Investors |

6

•

Discovered new Rho Kinase Inhibitors

and the novel

Dual-Action

ROCK/NET

Inhibitor

drug class

-

>1,500 ROCK and ROCK/NET inhibitors screened and

characterized

Pursued parallel clinical development of two franchises to

allow data driven selection of best product candidates

•

Dual-Action AR-13324 franchise selected for future

development

-

Superior efficacy profile in clinic

-

Longer duration of action

-

10-160x more potent than previous clinical stage ROCK inhibitors

-

Superior safety profile in long-term ocular toxicology study

-

Consistent IOP lowering regardless of baseline IOP

Aerie is a Leader in Rho Kinase R&D

Aerie is a Leader in Rho Kinase R&D

ROCK/NET: Rho Kinase / Norepinephrine Transporter |

7

Aerie’s Pipeline is Advancing Rapidly

Dual-Action

2014

Triple-Action

P2b 2014

P3 Prep

To mid 2015

2016

Dual-Action

Clinical Trials for Glaucoma Recruit Quickly

and Have Clear Endpoints |

8

Glaucoma Market |

9

Largest Rx market in ophthalmology

-

US 28.5M Rx; annual US sales $1.9B ($4.5B US/EU/JP)

2.2M glaucoma patients in the US and growing due to

aging of population

-

Glaucoma is a leading cause of blindness in US and WW

~50% of patients use multiple medications to control

disease –

compliance and tolerability are issues

No drugs launched with new MOA in the past 20 years

Significant Glaucoma Market Opportunities |

10

Currently Prescribed Glaucoma Therapies

Once Daily

2-3 Times

Daily

Non-PGA

Market

PGA: Prostaglandin Analogue; BB: Beta Blocker; AA: Alpha Agonist; CAI: Carbonic

Anhydrase Inhibitor Half of TRx are Written for Non-PGA Products

US Glaucoma Market

IMS TRx data, FY 2012

PGA

Market |

11

increase

Inflow (fluid production)

AA, BB, CAI

decrease

increase

Novel Dual-

and Triple-Action Products Address

All IOP Control Mechanisms

Triple Action

PG324

Outflow

Secondary Drain

(Uveoscleral)

Outflow

Primary Drain

(Trabecular Meshwork) |

12

The Competitive Landscape

Clinical

Efficacy

Dosing/

Day

Tolerability

Peak Product

Sales*

(US/EU)

Targeting

Diseased

Tissue

PGA

High

1x

Hyperemia

Iris Color

$1.7B

No

Beta

Blocker

Moderate

2x

Cardiopulmonary

Contraindications

>$500M

No

CAI

Low

2 -

3x

Sulfonamide

Contraindication

Bitter Taste

>$500M

No

Alpha

Agonist

Low

2 -

3x

Allergy

Drowsiness

>$400M

No

AR-13324

High;

Moderate

1x

Hyperemia

Yes

PG324

Potentially

Highest

1x

TBD

Yes

* Peak sales for best-in-class franchise |

13

New PGAs -

not usable as add-on to current PGAs

Glaucoma Competitors in Pipeline

AR-13324 is the only new MOA drug dosed once-daily

|

14

Single drop, once-daily

1 drug -

2 MOAs

Well tolerated; no systemic

drug-related AEs

Efficacy expected to

be

current

non-PGA

drugs

Single drop, once-daily

Combination of 2 drugs -

3 MOAs

Well tolerated; no systemic

drug-related AEs

Efficacy expected to be superior

to PGA monotherapy

AR-13324 Dual-Action

PG324 Triple-Action

Future non-PGA drug of choice

Future drug of choice for all

glaucoma patients

Aerie Franchise: Highly

Differentiated

Product Profiles

PGA: Prostaglandin Analogue |

15

New Dual-Action Drug Class:

AR-13324 |

16

About Open-Angle Glaucoma

*Early

Manifest

Glaucoma

Trial

(Heijl,

2002;

Leske,

2003);

Ocular

Hypertension

Treatment

Study

(Kass,

2002)

•

Open-angle glaucoma is a progressive, irreversible and

chronic disease of the eye

-

Typical patient age >60 years

•

Elevated intraocular

pressure

(IOP) can lead to loss of

vision

and eventual blindness

•

Lowering IOP slows or

halts

progression

-

5 mmHg IOP reduction

reduces

risk of disease progression by 50%*

•

Cause of elevated IOP is degeneration of primary

fluid drain

(trabecular meshwork) |

17

~80% of Glaucoma IOPs Are 26

mmHg at Time

of Diagnosis Baseline IOP

(mmHg)

Percentage of POAG

Patients Identified

Cumulative Percentage

<

15

13%

13%

16-18

24%

37%

19-21

22%

59%

22-24

19%

78%

25-29

10%

88%

30-34

9%

97%

35

3%

100%

10,444 individuals were

screened for the prevalence of Primary Open-Angle Glaucoma (POAG)

Baltimore Eye Survey |

18

AR-13324 Demonstrated Strong IOP Lowering

AR-13324 Demonstrated Strong IOP Lowering

in Phase 2b

in Phase 2b

Once-daily PM dosing of

0.02% AR-13324 is highly

effective

-

IOP -5.7 and -6.2 mmHg on

D28 and D14

-

Consistent efficacy through

D28

AR-13324 efficacy results

current non-PGA drugs

Favorable tolerability profile

No systemic side effects

Diurnal Average IOP -

Entry IOP 22-36 mmHg (n=221)

13 glaucoma NCEs advanced from Phase 2 to Phase 3

since 1970s -

All approved

AR-13324 Efficacy at 8 AM |

19

The only AR-13324 finding of note was hyperemia

-

Scored as trace, mild or moderate, and transient for majority of

patients

-

No drug-related systemic adverse events

On last day of study (Day 28 at 8 AM), mild and moderate

conjunctival hyperemia was observed in 24% of AR-13324

0.02% patients and 11% of latanoprost patients

-

Frequency of hyperemia decreased throughout the study for AR-13324

and increased for latanoprost

A 12-week study by Parrish et. al. (2003) compared the three

most highly prescribed PGAs for frequency of hyperemia

-

Latanoprost: 16% frequency

-

Travoprost: 27% frequency

-

Bimatoprost: 35% frequency

AMERICAN JOURNAL OF OPHTHALMOLOGY, VOL. 135, NO. 5 (2003)

AR-13324 Phase 2b Safety and Tolerability |

20

AR-13324 and latanoprost

clinically and statistically

equivalent in patients with

moderately elevated IOPs of

22 -

26 mmHg

Latanoprost loses ~1 mmHg

efficacy in patients with IOPs of

22 -

26 mmHg vs. 22 -

36 mmHg

AR-13324 maintains consistent

efficacy in patients with moderately

elevated IOPs

Phase

2b

baseline

IOP

entry

requirements:

24,

22,

22

mmHg

(8am,

10am,

4pm)

Differentiated AR-13324 Efficacy

Profile

Differentiated AR-13324 Efficacy

Profile Informs

Phase 3 Study Design Informs Phase 3 Study Design

Baseline

Baseline

22 36 mmHg

22 36 mmHg

(n=221)

(n=221)

Baseline

Baseline

22 26 mmHg

22 26 mmHg

(n=106)

(n=106)

Full Patient Population

Moderately Elevated IOP

0.02%

AR-13324

0.02%

AR-13324

Latanoprost

Latanoprost |

21

Latanoprost and Timolol Show Reduced Efficacy

Latanoprost and Timolol Show Reduced Efficacy

at Lower Baseline IOPs

at Lower Baseline IOPs

Latanoprost and timolol

lose 0.5 mmHg efficacy for

every 1 mmHg drop in

baseline IOP

Timolol less effective

than

latanoprost at all baselines

AR-13324 equivalent/

non-inferior

to latanoprost

at baselines 22 –

26 mmHg

Timolol is the standard

comparator for glaucoma

Phase 3 trials

Pooled data from three latanoprost registration studies.

Hedman and Alm; European Journal Ophthalmology;2000

0

-2

-4

-6

-8

-10

-12

-14

-16

Timolol (n = 369)

Latanoprost (n = 460)

16

18

20

22

24

26

28

30

32

34

36

38

Untreated diurnal IOP (mmHg) |

22

AR-13324 Registration Trial Design

AR-13324 Registration Trial Design

Primary efficacy endpoint: IOP at all

time points through Day 90

Non-inferiority design vs. timolol

-

95% CI within 1.5 mmHg at all time points,

within 1.0 mmHg at a majority of time points

Planned entry IOP:

Minimum

21 mmHg, maximum 26-30 mmHg

-

FDA has agreed to Aerie proposal for entry IOPs

with no impact on label

-

AR-13324 non-inferior to latanoprost at entry

IOPs of 22-26 mmHg in Phase 2b

Start mid-2014; 90 day safety and

efficacy data expected mid-2015;

NDA filing expected mid-2016

Phase 3 Protocol

Phase 3 Protocol

AR-13324 0.02%

AR-13324 0.02%

dosed QD PM

dosed QD PM

vs.

vs.

Timolol

Timolol

dosed BID

dosed BID

~1200 patients

~1200 patients

90 days efficacy

90 days efficacy

100 patients for 1 year

100 patients for 1 year

safety

safety |

23

Triple-Action Fixed Combination:

Triple-Action Fixed Combination:

PG324

PG324 |

24

Triple-Action PG324 Combination Product

Triple-Action PG324 Combination Product

Ciliary Processes

Cornea

Uveoscleral

Outflow

Latanoprost

TM

Outflow

AR-13324 FIXED COMBINATION WITH

LATANOPROST

1.

ROCK inhibition restores TM outflow

2.

NET inhibition reduces fluid production

3.

PGA receptor

activation

increases

uveoscleral

outflow

AR-13324

NET

NET

RKI

RKI

NET

NET

RKI

RKI |

25

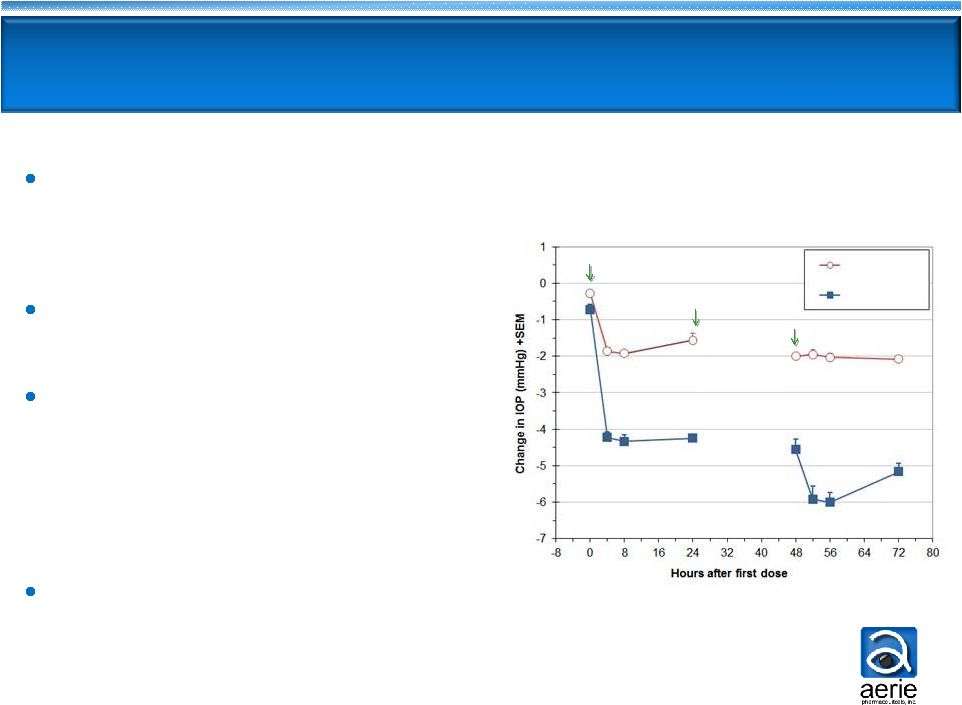

PG324: Triple-Action Fixed Combination

PG324: Triple-Action Fixed Combination

First product to lower IOP through

all three known mechanisms

-

Once-daily: 1 drop, 2 drugs, 3 MOAs

High efficacy in predictive

primate model

Human proof of concept

established in prior ROCKi/PGA

combination trials

-

Demonstrated significant IOP

lowering beyond PGA alone

Potential for maximal medical

therapy in a single eye drop

Day 2 -

No IOP

measured

Dose

Dose

Dose

Latanoprost

0.02% PG324

PG324 vs. Latanoprost, Primates (n=6/group) |

26

PG324: A Breakthrough Triple-Action Product Candidate

PG324: A Breakthrough Triple-Action Product Candidate

AR-13324 formulated with market-leading latanoprost

-

Latanoprost has largest prescription base in glaucoma

-

Facilitates use as first-line therapy

-

Eases switch from latanoprost monotherapy

Combinations constitute an important growth

segment

of glaucoma market internationally

-

US lags -

no PGA fixed-combination glaucoma drugs in the US

-

Powerful compliance rationale for life-long medication users

-

Beneficial to payors and patients

Expected to be first PGA fixed-combination product in the US

|

27

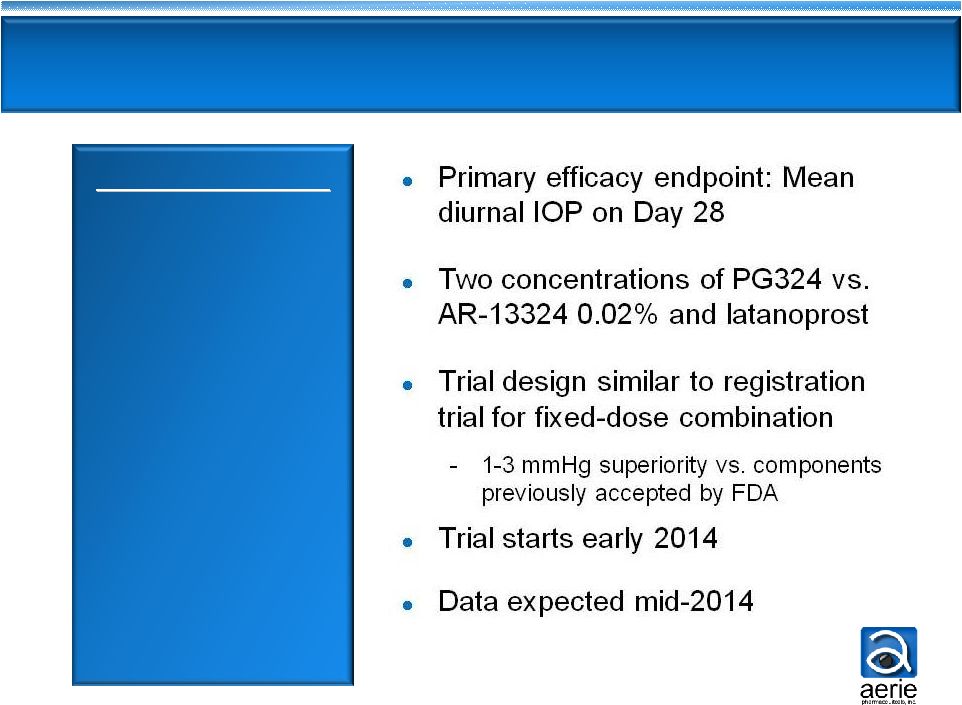

PG324 Phase 2b Clinical Trial Design

PG324 Phase 2b Clinical Trial Design

Phase 2b Protocol

Phase 2b Protocol

PG324 0.01%

PG324 0.01%

vs.

vs.

PG324 0.02%

PG324 0.02%

vs.

vs.

AR-13324 0.02%

AR-13324 0.02%

vs.

vs.

Latanoprost

Latanoprost

All dosed QD PM

All dosed QD PM

~300 patients

~300 patients

28 days

28 days |

28

Key Milestones

Key Milestones

Early-2014: PG324

Start Phase 2b clinical trial

H1 2014

H1 2014

H2 2014

H2 2014

H2 2015

H2 2015

H1 2015

H1 2015

Mid-2014: AR-13324

Start Phase 3

registration trials

Mid-2014: PG324

Results from Phase

2b expected

Mid-2015: AR-13324

Efficacy results from

Phase 3 expected

H1 2016

H1 2016

Mid-2015: PG324

Phase 3-prep

Mid-2016: AR-13324

NDA filing expected |

29

•

Large Market Opportunity -

$4.5B US/EU/JP Market

-

Significant unmet needs -

50% of patients require more than one drug

-

No PGA fixed-combination products approved in the US

•

Proprietary, Differentiated First-in-Class Glaucoma Pipeline

-

Both ROCK & NET inhibition -

First new MOAs in two decades

•

AR-13324: Novel Dual-Action, Once-Daily Therapy

-

Phase 3 expected to begin mid-2014; efficacy data expected mid-2015

-

NDA filing expected by mid-2016

•

PG324: Breakthrough Triple-Action, Once-Daily Therapy

-

Fixed combination of AR-13324 and PGA latanoprost

-

Phase 2b data expected mid-2014; Phase 3 readiness expected mid-2015

•

All Products Developed Internally -

Own Class & Compounds

-

Patent protection through at least 2030 in the US

-

All rights retained with no partnerships

Aerie –

Aerie –

Next Generation in Glaucoma Therapies

Next Generation in Glaucoma Therapies |