Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Renew Energy Resources, Inc. | form8k.htm |

Renew Energy Resources, Inc.

Business Plan

January 2014

Overview

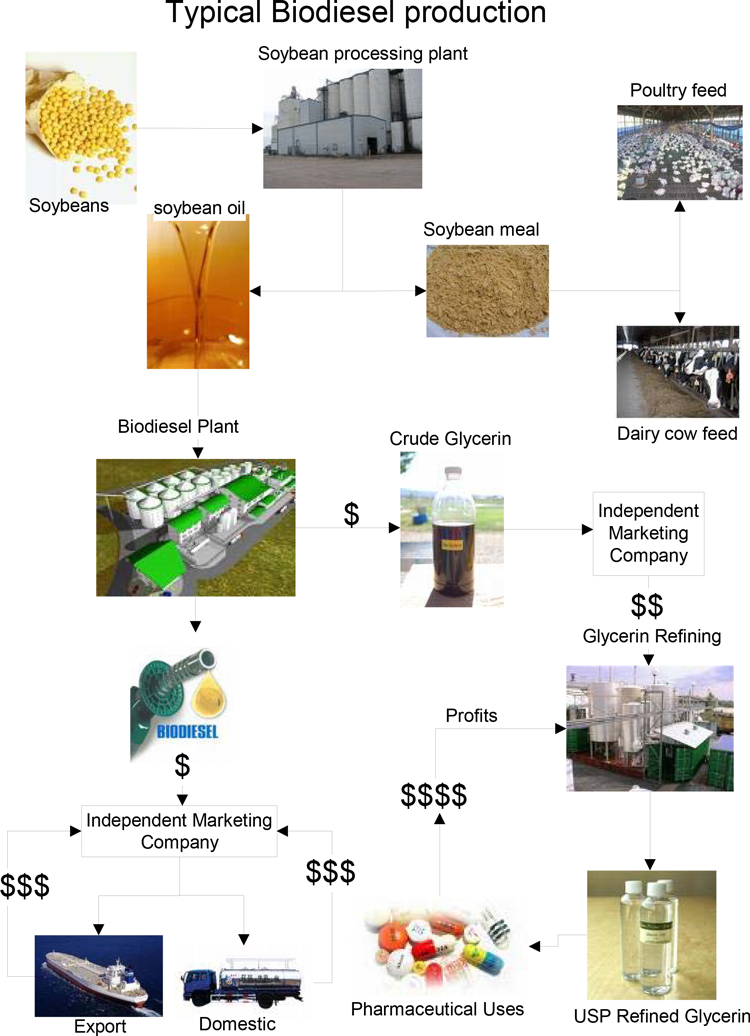

Renew Energy Resources’ mission is to vertically integrate the renewable energy markets of biodiesel and ethanol. Vertical integration will include facility ownership as well as facility management, strategic feedstock agreements and off take contracts to large end users, value-added refinement of glycerin and other by-products, distribution, sales, marketing and financing of domestic and export sales contracts. The Company has completed preparation for the start of vertical integration in the biodiesel market, and anticipates newly integrated ethanol markets in the latter part of 2013/early 2014.

Industries

Biodiesel

RENEW’s initial business line, scheduled to commence in January 2014, is to integrate the financing, production and off take of feedstock agnostic based biodiesel for domestic distribution to fulfill open demand by large national distributors. Subsequent to the development of domestic channels of distribution, RENEW plans to integrate the finance, production and export of blended biodiesel to maximize supply train driven initiatives on a worldwide basis. The Company is currently exploring opportunities to operate and ultimately purchase a domestic based biodiesel producer, which meets its supply train criteria of water, rail and road access in the United States and is evaluating and opportunity of an overseas acquisition. The Company is uniquely place in the industry with negotiated feedstock and off-take agreements, which will allow for the creation of a multinational alternative energy company

Ethanol

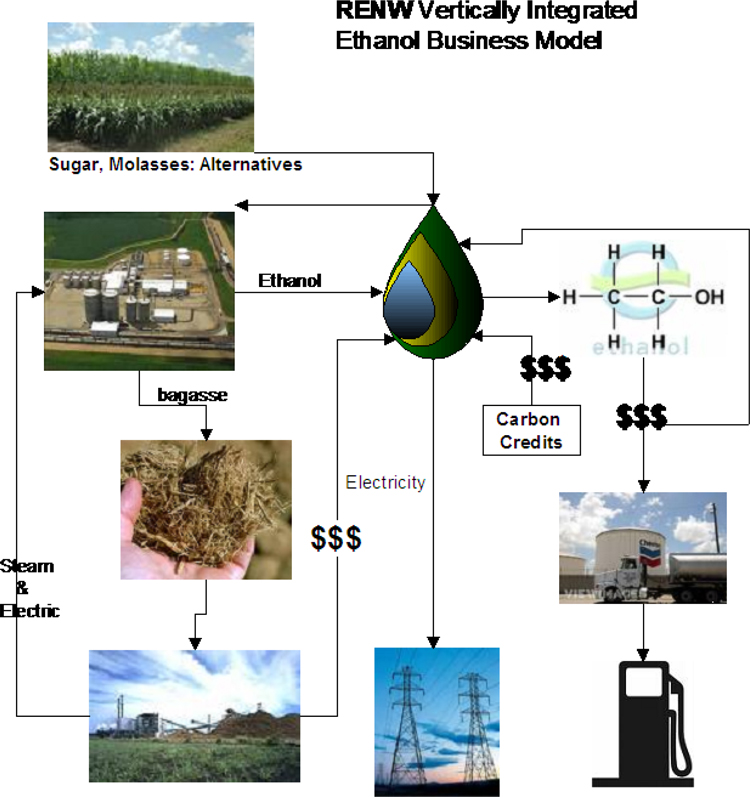

Current US based ethanol companies that are utilizing corn based processes, which has led to volatility in both the Ethanol market and the Corn food markets. RENEW will focus on ethanol produced from Sucrose based feedstock which can be both locally obtained and imported, allowing for the acquisition of a stable low cost Ethanol such as is available in Central and South America. This vertical integration of the ethanol production model significantly reduces commodity risk. If financing can be obtained, the Company would like to construct and operate multiple ethanol processing plants based on Sucrose and a relatively new energy crop called Sweet Sorghum.

The Company envisions eventual investments in projects in Southeastern Louisiana, Florida and various Caribbean nations that have ideal economic, political and energy climates for these types of vertically integrated ethanol/electric facilities. If developed, the ethanol produced would be exported and the electricity produced during the process would be sold to the respective countries’ power system. Sweet Sorghum has great potential, as there are many semi-arid climates across the world where this crop can be grown to provide renewable electricity, as well as ethanol.

In the typical business model, corn is either sold to a grain elevator or directly to the ethanol plant. The ethanol plant does not own the production of the crop and is susceptible to commodity risk. The co product from the dry mill ethanol process is distiller’s grain. It is a corn feed product that is primarily fed to cattle and to a much smaller extent poultry and swine. The market for distiller’s grains is saturated. As the volume of distillers increases with more dry mill ethanol plants coming on line, supply is outstripping demand. In addition to commodity risk, the ethanol plants have also been negatively impacted by increased natural gas and electricity costs, which is the second largest input cost after corn.

The production of ethanol from sucrose based feedstock like Sugar, Molasses, and Sweet Sorghum or Energy Cane minimizes the commodity risk because, under its current business plan, the Company will partner with the producers of the multiple feed stocks used. The production process continually produces excess electricity that can be sold to the power grid. Because the production process does not consume non-renewable sources of energy like coal or natural gas, the process will qualify for carbon credits.

COMPANY STRATEGY

Generate Immediate Cash Flow with low risk domestic distribution – The Company’s immediate focus is on integrating supply, production and sales to domestic distributors. Vertical integration of the domestic supply chain requires less working capital and involves less risk. There are several identified animal fat biodiesel producers struggling with limited working capital, technology issues and lack of good sales contracts. RENEW intends to bring additional working capital to these plants through a management partnership that will correct production problems and increase the volume of product that can be processed. Finally RENEW will deliver the biodiesel to distributors based on petroleum index based pricing. Index pricing is not prevalent in the biodiesel industry and makes it very difficult to predict and control margins. Simply put, because plants cannot predict what their finished product will sell for, they can’t determine what they should or can pay for feedstock. RENEW’s vertically integrated business model addresses this industry-wide problem.

Value Added Processing of Biodiesel Co-Products – Glycerin is produced during the manufacturing of biodiesel. Glycerin sold as unrefined or crude can fetch as much as 0.28/lb, but usually brings less than that depending on the quality of the crude glycerin. Glycerin that is refined into either technical or pharmaceutical grade will increase the sale price substantially. Only a handful of plants in the US have the capacity to refine the glycerin to technical or pharmaceutical grade. Refining glycerin is technically challenging and requires additional capital, which the biodiesel plants lack.

Fulfill larger International Contracts as Working Capital becomes more available - After the Company demonstrates the success of the integrated model, RENEW will replicate the model with European biodiesel traders and distributors. Moving large volumes of biodiesel to Europe creates a new series of challenges, not the least of which is the significant amount of working capital required to support the transaction.