Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Rockwood Holdings, Inc. | a13-25290_18k.htm |

| EX-99.1 - EX-99.1 - Rockwood Holdings, Inc. | a13-25290_1ex99d1.htm |

Exhibit 99.2

|

|

Maximizing Shareholder Value Investor Presentation December 2013 |

|

|

Forward Looking Statements This presentation contains, and management may make, certain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts may be forward-looking statements. Words such as "may,” “will,” “should,” “could,” “likely,” “anticipates," “intends,” "believes," "estimates," "expects," "forecasts," “plans,” “projects,” "predicts" and “outlook” and similar words and expressions are intended to identify forward-looking statements. Examples of our forward-looking statements include, among others, statements relating to our outlook, our future operating results on a segment basis, our dividend yield, the timing of the closing of this transaction, the impact on earnings per share, expected lithium reserves, the expected timing and closing of the announced divestitures and the proceeds from the announced divestitures, our future Adjusted EBITDA, Adjusted EBITDA margins and free cash flows, our share repurchase plans and our strategic initiatives. Although they reflect Rockwood’s current expectations, they involve a number of known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied, and not guarantees of future performance. These risks, uncertainties and other factors include, without limitation, Rockwood’s business strategy; changes in general economic conditions in North America and Europe and in other locations in which Rockwood currently does business; competitive pricing or product development activities affecting demand for Rockwood’s products; technological changes affecting production of Rockwood’s materials; fluctuations in interest rates, exchange rates and currency values; availability and pricing of raw materials; governmental and environmental regulations and changes in those regulations; fluctuations in energy prices; changes in the end-use markets in which Rockwood’s products are sold; hazards associated with chemicals manufacturing; Rockwood’s ability to access capital markets; Rockwood’s high level of indebtedness; risks associated with competition and the introduction of new competing products, especially from the Asia-Pacific region; risks associated with international sales and operations; risks associated with information securities and the risks, uncertainties and other factors discussed under "Risk Factors" and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Rockwood's Form 10-K for the year ended December 31, 2012 and other periodic reports filed with or furnished to the Securities and Exchange Commission. Rockwood does not undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. |

|

|

TO BUY 49% OF |

|

|

What is Talison? Headquartered in Perth, Western Australia LTM 9/30/2013 Financials: Sales: A$ 158 million; Adjusted EBITDA: A$64 million; Margin: 40%(1) Talison produces lithium-bearing mineral spodumene and produces lithium concentrate at Greenbushes, Australia, located approximately 250 kilometers south of Perth Talison owns the largest spodumene mine worldwide with 61.5Mt of proven and probable mineral reserves at 2.8% Li2O(2), with current mine life of 40 years Lowest cost producer of technical and chemical grade lithium concentrates Technical-grade lithium concentrates which have low iron content for use in the manufacture of, among other applications, glass, ceramics and heat-proof cookware High-yielding chemical-grade lithium concentrate which is used as raw material to produce lithium chemicals which form the basis for manufacture of, among other applications, lithium-ion batteries for laptop computers, mobile phones, electric bicycles and electric vehicles Talison supplies the majority of China’s lithium concentrate needs (1) Per Australian GAAP. (2) As of September 2012. Source: NI43-101 Technical Report dated December 21, 2012. 1 2 3 4 5 6 |

|

|

Talison – Positioned for Growth: Recent Capacity Expansion In June 2012, Talison completed and commissioned a new chemical-grade concentrate processing plant to double Talison’s production capacity to 740,000 tons per year of concentrate (~100,000 tones lithium carbonate equivalent per annum) New capacity is approximately two-thirds of estimated current global demand Expansion was designed to be large scale to provide operational efficiencies and enable Talison to support growing global demand for lithium Capacity utilization is expected to be progressively increased as market demand grows; however, the expansion also provides Talison with the capacity to respond rapidly to changing conditions in the lithium market |

|

|

Who Will Own the Other 51% of Talison? Our partner will be Chengdu Tianqi Industry Group They are the most technically advanced lithium carbonate and lithium hydroxide producer in China |

|

|

Our Partner: Chengdu Tianqi Industry Group Tianqi is a privately owned Chinese company and is the world’s largest hard rock lithium converter Offers a diverse portfolio of products ranging from lithium carbonate to lithium metals Tianqi is one of the most important raw material providers for the clean energy industry in China Tianqi conducts its operations from China and has customers, business partners and suppliers throughout the United States, Europe, Australia and Japan |

|

|

Why is Rockwood Making this Acquisition? Secure access to another significant lithium reserve, in addition to our resources in the U.S. and Chile; Talison’s mine is estimated to be the world’s largest and richest sources of spodumene lithium Significantly strengthen Rockwood’s position as the global leader in lithium Develop a constructive and cooperative relationship with China’s leading lithium company A totally logical use of cash on hand in our core business consistent with our strategic plan |

|

|

Background In January 2013, Rockwood announced a significant strategic transformation plan to focus its portfolio on two key businesses – Lithium and Surface Treatment As of November 2013, 7 non-strategic business units were sold with total proceeds of $3.9 billion Now we are in the next phase of utilizing the cash to further strengthen our core businesses |

|

|

Rockwood’s Strategic Transformation: ProForma Financials for Core Businesses + Est. Cash on Hand Note: See Appendix for reconciliation of non-GAAP measures. |

|

|

Rockwood Strategy to Further Enhance Shareholder Value Drive top tier growth in core businesses: Lithium and Surface Treatment Allocate a significant amount of our cash on hand to: Promote organic growth; and Make acquisitions that are accretive, create value, and meet Rockwood’s strategic criteria: Leading global market position with #1 or #2 market share Adjusted EBITDA margin of 25%+ Global industry technology leader Limited exposure to oil-based raw materials Continue return of capital to shareholders Announced (November 12) New Share Repurchase authorization of up to $500 million over the next 2 years Targeted dividend yield of 2.8% to 3.2% |

|

|

Talison Acquisition is a Perfect Match to Our Strategic Criteria for Acquisitions Rockwood’s Investment Criteria Market-leading business niche positions Technology leadership Adjusted EBITDA margins in the mid-30% Strong Free Cash Flow Limited exposure to oil-based raw materials |

|

|

This acquisition has the potential to be accretive to Rockwood’s results by 50 to 55 cents per share in the first year (1) (1) Including interest income. |

|

|

Appendix |

|

|

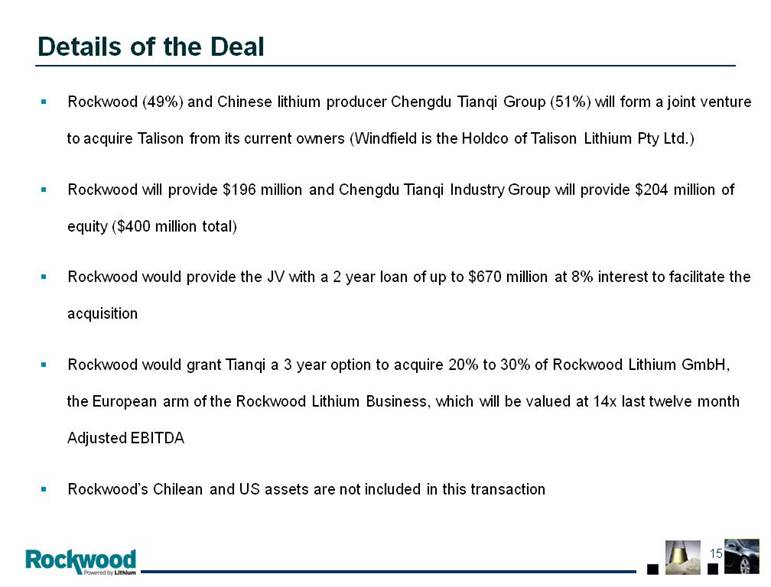

Details of the Deal Rockwood (49%) and Chinese lithium producer Chengdu Tianqi Group (51%) will form a joint venture to acquire Talison from its current owners (Windfield is the Holdco of Talison Lithium Pty Ltd.) Rockwood will provide $196 million and Chengdu Tianqi Industry Group will provide $204 million of equity ($400 million total) Rockwood would provide the JV with a 2 year loan of up to $670 million at 8% interest to facilitate the acquisition Rockwood would grant Tianqi a 3 year option to acquire 20% to 30% of Rockwood Lithium GmbH, the European arm of the Rockwood Lithium Business, which will be valued at 14x last twelve month Adjusted EBITDA Rockwood’s Chilean and US assets are not included in this transaction |

|

|

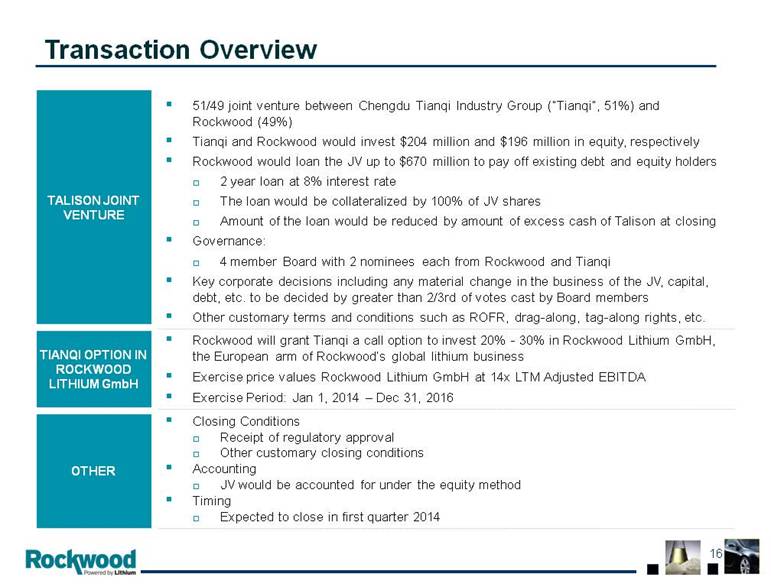

Transaction Overview TIANQI OPTION IN ROCKWOOD LITHIUM GmbH OTHER TALISON JOINT VENTURE 51/49 joint venture between Chengdu Tianqi Industry Group (“Tianqi”, 51%) and Rockwood (49%) Tianqi and Rockwood would invest $204 million and $196 million in equity, respectively Rockwood would loan the JV up to $670 million to pay off existing debt and equity holders 2 year loan at 8% interest rate The loan would be collateralized by 100% of JV shares Amount of the loan would be reduced by amount of excess cash of Talison at closing Governance: 4 member Board with 2 nominees each from Rockwood and Tianqi Key corporate decisions including any material change in the business of the JV, capital, debt, etc. to be decided by greater than 2/3rd of votes cast by Board members Other customary terms and conditions such as ROFR, drag-along, tag-along rights, etc. Rockwood will grant Tianqi a call option to invest 20% - 30% in Rockwood Lithium GmbH, the European arm of Rockwood’s global lithium business Exercise price values Rockwood Lithium GmbH at 14x LTM Adjusted EBITDA Exercise Period: Jan 1, 2014 – Dec 31, 2016 Closing Conditions Receipt of regulatory approval Other customary closing conditions Accounting JV would be accounted for under the equity method Timing Expected to close in first quarter 2014 |

|

|

[LOGO] |