Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Quest Resource Holding Corp | d634686d8k.htm |

Exhibit 99.1

| Investor Presentation December 2013 |

| SEC Safe Harbor This material may contain forward-looking statements that involve risks, uncertainties, and assumptions. If any such risks or uncertainties materialize or if any of the assumptions prove incorrect, the results of Quest Resource Holding Corporation could differ materially from the results expressed or implied by the forward-looking statements the company makes. All statements other than statements of historical fact contained in this presentation may be deemed forward-looking statements under federal securities laws, and the Company intends that such forward-looking statements be subject to the safe-harbor created thereby. Such forward-looking statements include, but are not limited to statements regarding the Company's belief that it is positioned to gain significant market share in a multi-billion dollar industry; the Company's belief that the business is highly scalable as companies continue to outsource their waste minimization solutions; the Company's position that it has an asset-light business model that requires minimal capital investment and that is positioned to significantly improve margins; the Company's goals; the Company's markets, market share, and opportunity; and the Company's growth strategies. The Company cautions that these statements are qualified by important factors that could cause actual results to differ materially from those reflected by such forward-looking statements. Such factors include the demand for the Company's services, the Company's growth opportunities, the success of new services or acquisitions, and other risks detailed from time to time in the Company's reports filed with the SEC. Certain information contained in this material is made available to Quest Resource Holding Corporation by third parties. Quest Resource Holding Corporation is not responsible for the content of any information made available to it by any third party. Quest Resource Holding Corp. disclaims any liability to any person for any delays, inaccuracies, errors, omissions, or defects in any such information or the transmission thereof, or for any actions taken by any person in reliance on such information or any damages arising from or relating to any use of such information. Information prepared by Quest Resource Holding Corporation that is included in this material speaks only as of the date that it was prepared. This information may be incomplete or may have become out of date. Quest Resource Holding Corporation makes no commitment, and disclaims any duty, to update or revise such information. 2 |

| Key Facts Trading Symbol (OTC) QRHC Corporate Headquarters Frisco, TX Stock Price (11/14/13) $2.75 Shares Outstanding (November 1, 2013) 95.815 million Diluted Shares 109.905 million Market Capitalization (at $2.75 per share) $263 million Insider Ownership 86.89% Cash on Hand* $3.6 million Long-term Debt* (principal) $22 million Annualized Revenue (Q3 - 2013) $139 million Full-Time Employees 70 Fiscal Year End December 31 Web Addresses www.QRHC.com www.questrmg.com www.earth911.com 3 *As of 9-30-2013 |

| Management Brian S. Dick has served as President, Chief Executive Officer, and director of our company since July 2013. Mr. Dick took Quest from a startup company in 2007 to a growing, vibrant enterprise with over $130 million in revenue in less than six years. Mr. Dick was a Ernst & Young Entrepreneur of the year finalist in 2013. The company was named one of the fastest growing companies by Inc. 5000 twice in a row, ranked 6th in the DFW area for fastest growing businesses by SMU and received the coveted AT&T sustainability supplier award. Mr. Dick served as Vice President - Southeast Region of Atlantic Industrial Services, Inc., an industrial waste management and environmental contracting services company, from September 2001 to March 2007. From March 1998 to September 2001, Mr. Dick served as Regional Health and Safety Manager of Safety-Kleen Systems, Inc., an environmental services company. Laurie L. Latham has served as a Senior Vice President and Chief Financial Officer of our company since January 2013. Ms. Latham is a senior executive with the ability to effectively operate and collaborate in an entrepreneurial environment, to translate complex ideas to simple terms for operational and informational purposes and to apply strong interpersonal and negotiating skills in developing customer and business relationships. Her operational and financial experience spans public and private entities including over 20 years within technology driven businesses. In addition, Ms. Latham has been in public practice with national and regional accounting firms, including KPMG Peat Marwick, and her earlier career experience included roles within the oil and gas, real estate, and agricultural industries. Ms. Latham is a Certified Public Accountant. 4 |

| Quest Resource Holding Corporation Quest provides the full spectrum of the recycling life cycle, providing innovative waste reduction and landfill diversion solutions for recycling and proper disposal of commercial and consumer waste streams Our comprehensive programs are designed to enable regional and national companies to have a single point of contact for managing a variety of waste streams and recyclables We are a leader in the industry and have grown revenues from $3M to $130M over the last 6 years (revenues are typically recurring) Company is positioned to gain significant market share in a multi-billion dollar industry Our business is highly scalable as companies continue to outsource their waste minimization solutions 5 |

| Overview We maximize the value of recyclables and lower costs to our customers while reducing their liability Asset-light business model requires minimal capital investment - positioned to significantly improve margins We have significant expertise and offer companies a one-stop shop recycling solution across the entire waste stream We manage integrated recycling solutions at over 15,000 client locations every month - leverage a national footprint and sizable commodity stream Proven business model and our clients include some of the largest companies in the world Well received story as business aligns with corporate responsibility and green movement 6 |

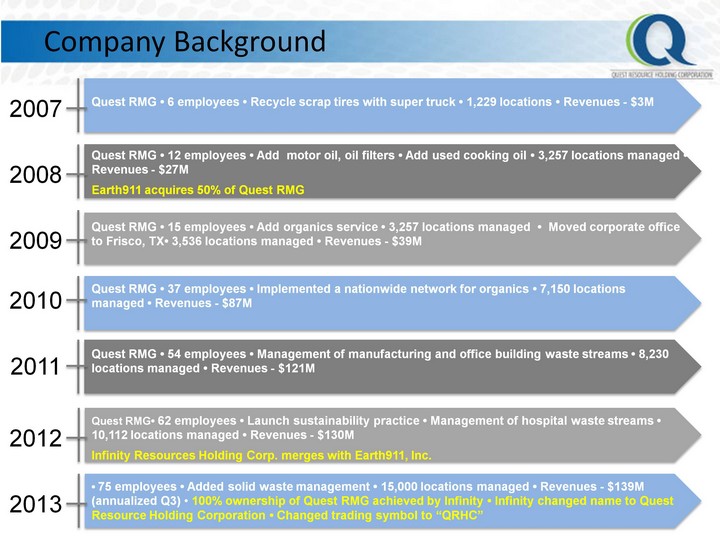

| Company Background 7 Quest RMG • 6 employees • Recycle scrap tires with super truck • 1,229 locations • Revenues - $3M 2007 Quest RMG • 12 employees • Add motor oil, oil filters • Add used cooking oil • 3,257 locations managed • Revenues - $27M Earth911 acquires 50% of Quest RMG 2008 Quest RMG • 15 employees • Add organics service • 3,257 locations managed • Moved corporate office to Frisco, TX• 3,536 locations managed • Revenues - $39M 2009 Quest RMG • 37 employees • Implemented a nationwide network for organics • 7,150 locations managed • Revenues - $87M 2010 Quest RMG • 54 employees • Management of manufacturing and office building waste streams • 8,230 locations managed • Revenues - $121M 2011 2012 • 75 employees • Added solid waste management • 15,000 locations managed • Revenues - $139M (annualized Q3) • 100% ownership of Quest RMG achieved by Infinity • Infinity changed name to Quest Resource Holding Corporation • Changed trading symbol to "QRHC" 2013 Quest RMG• 62 employees • Launch sustainability practice • Management of hospital waste streams • 10,112 locations managed • Revenues - $130M Infinity Resources Holding Corp. merges with Earth911, Inc. |

| Our Products and Services 8 OVERVIEW Comprehensive sustainability, recycling and waste management programs Maximize value of recyclables and lower costs Network of pre-approved collection and recycling companies Take advantage of regional marketplaces One point of contact for all service needs INDUSTRIES • Automotive • Industrial •Municipalities • Fleet • Hospitality • Foodservice • Healthcare • Multi family apartment • Office buildings PROGRAM GOALS • Maximize value of recyclable commodities• Environmental sustainability • Liability protection and environmental compliance •Centralized point of contact •Accurate tracking of clients' Key Performance Indicators for their programs SOLUTIONS • Used oil and oil filters • Scrap tires • Hazardous waste• Electronic waste• Universal waste •Parts cleaners • Plastics, cardboard and glass • Cooking oil and grease traps • Municipal solid waste • Sustainability strategic planning• Carbon, waste, water footprint analysis • Tracking and reporting• LEED(r) • GreenGlobe(tm) • Energy modeling |

| Key Materials Recycled Annually Key Materials Recycled Annually 9 22 million gallons of motor oil 15 million pounds of oil filters 15 million scrap tires 815 million pounds of food waste 158 million pounds of meat & seafood 8.6 million gallons of used cooking oil |

| Quest Operational Snap Shot 10 Coverage in all 50 states, Canada and Puerto Rico Management over 15,000 customer locations every month Leverage of 5,000+ fully permitted, audited partners 30,000 continuously trained professionals 24,000 trucks 600 recycling facilities Recycled over 1.6 billion pounds of materials in 2012 Achieved over 99% landfill diversion Over 20 LEED(r) certification, energy modeling and building commissioning projects completed 96% of calls are answered in less than 10 seconds Client satisfaction score of 3.5/4 Millions of square feet of green programs managed |

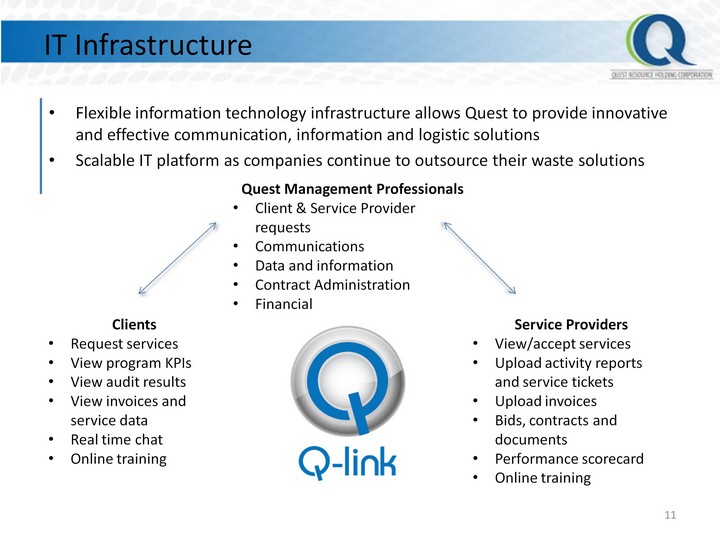

| IT Infrastructure Flexible information technology infrastructure allows Quest to provide innovative and effective communication, information and logistic solutions Scalable IT platform as companies continue to outsource their waste solutions 11 Clients Request services View program KPIs View audit results View invoices and service data Real time chat Online training Service Providers View/accept services Upload activity reports and service tickets Upload invoices Bids, contracts and documents Performance scorecard Online training Quest Management Professionals Client & Service Provider requests Communications Data and information Contract Administration Financial |

| Earth911, Inc. Overview Key Offerings: The consumer lifestyle website Earth911.com focuses on: Low waste living Do it Yourself projects Actionable (non activist) environmental ideas The largest, most accurate proper disposal directory in the U.S. 360 searchable material profiles 1.6 million recycling opportunities Syndicated via earth911.com, 1-800cleanup, iRecycle and through partner websites as Data as a Service model Recycling mobile search application Web site data 8,253,771 visits year to date* 31,158,772 page views year to date* 3.78 average page view per visit* 13,000 local municipalities and counties with recycling data 12 *as of November 27, 2013 |

| Target Industries 13 Business Segment Motor oil Scrap tires Used Cooking Oil (UCO) Used Cooking Oil (UCO) Meat Meat Food waste Food waste E waste E waste Plastics, Cardboard, Glass Solid Waste Solid Waste Hazardous Waste Sustainability Planning LEED or Green Globe Fleet Dealerships Automotive after market Big box retailer Grocery store Industrial Hospitality Office Building/ Multi family Apartment opportunity |

| Industry Overview 14 Quest's total initial target market is $2.5 billion. $55 billion U.S. waste management industry Waste collection: $34 billion Transporting & processing waste and recyclables: $6 billion Waste disposal: $13 billion Waste-to-energy: $2 billion "Economics, public opinion and government mandates will increasingly demand that more value is recovered from our waste materials." "Municipalities are moving forward with diversion programs-in many cases motivated by state mandates. And leading solid waste companies will continue the process of re-branding themselves as businesses that also extract value from the materials they collect." Sources: http://www.wastebusinessjournal.com/overview.htm, http://ebionline.org/updates/1244-us-solid-waste-industry-reaches-55-billion-in-revenues-innovative-conversion-technologies-poised-to-shake- up-the-industry |

| Market Share and Opportunity 15 Quest currently has a 5% market share of its initial target market and a 0.2% market share of the total market opportunity Market Size ($ in millions) 2012 Quest Revenue ($ in millions) Market Share Top 50 Grocery Store Chains $668 S80 12% Top 100 Dealership Groups $25 $6 23% Top 100 Fleets $470 $43 9% Top 100 Universities $5 - 0% Top 100 REITs $43 - 1% Top 100 School Districts $63 - 0% Top 100 Manufacturing $1,205 $1 0% Total in Top 100 $2,478 $130 5% Total Market Size1 $55,000 $130 0.2% 1 Waste Business Journal, 2012. |

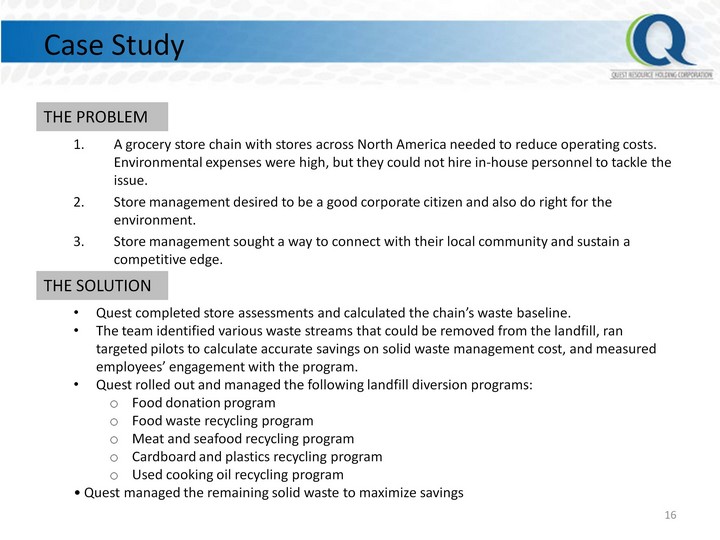

| Case Study A grocery store chain with stores across North America needed to reduce operating costs. Environmental expenses were high, but they could not hire in-house personnel to tackle the issue. Store management desired to be a good corporate citizen and also do right for the environment. Store management sought a way to connect with their local community and sustain a competitive edge. 16 THE PROBLEM THE SOLUTION Quest completed store assessments and calculated the chain's waste baseline. The team identified various waste streams that could be removed from the landfill, ran targeted pilots to calculate accurate savings on solid waste management cost, and measured employees' engagement with the program. Quest rolled out and managed the following landfill diversion programs: Food donation program Food waste recycling program Meat and seafood recycling program Cardboard and plastics recycling program Used cooking oil recycling program • Quest managed the remaining solid waste to maximize savings |

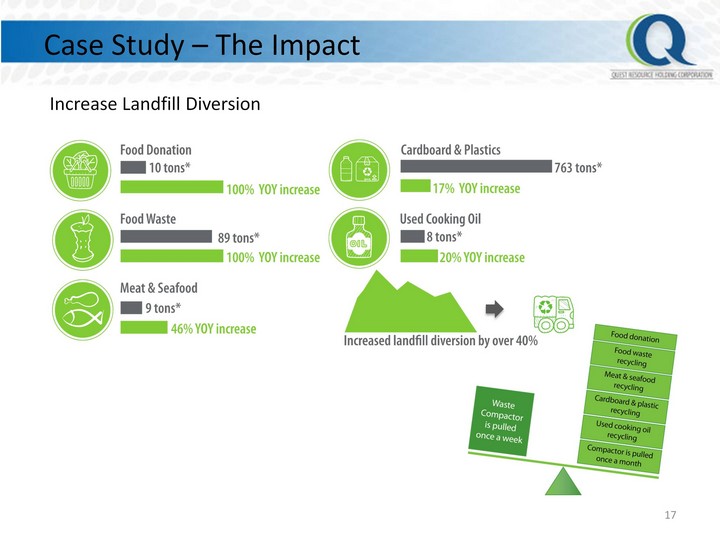

| Increase Landfill Diversion Case Study - The Impact 17 |

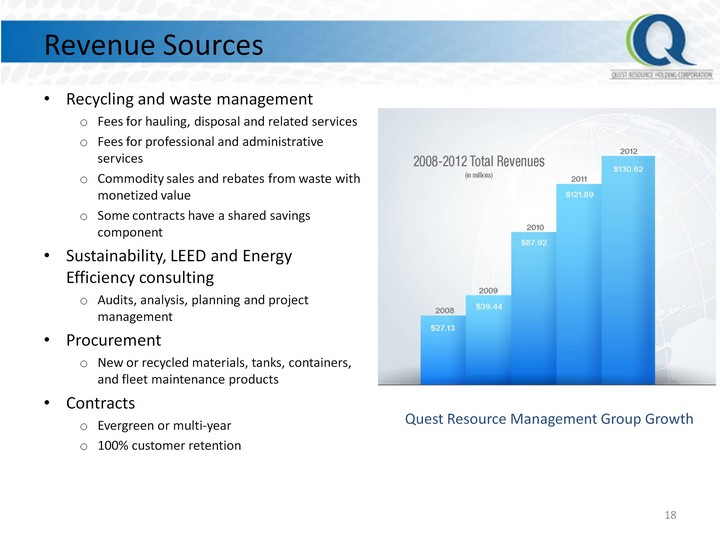

| Revenue Sources Recycling and waste management Fees for hauling, disposal and related services Fees for professional and administrative services Commodity sales and rebates from waste with monetized value Some contracts have a shared savings component Sustainability, LEED and Energy Efficiency consulting Audits, analysis, planning and project management Procurement New or recycled materials, tanks, containers, and fleet maintenance products Contracts Evergreen or multi-year 100% customer retention 18 Quest Resource Management Group Growth |

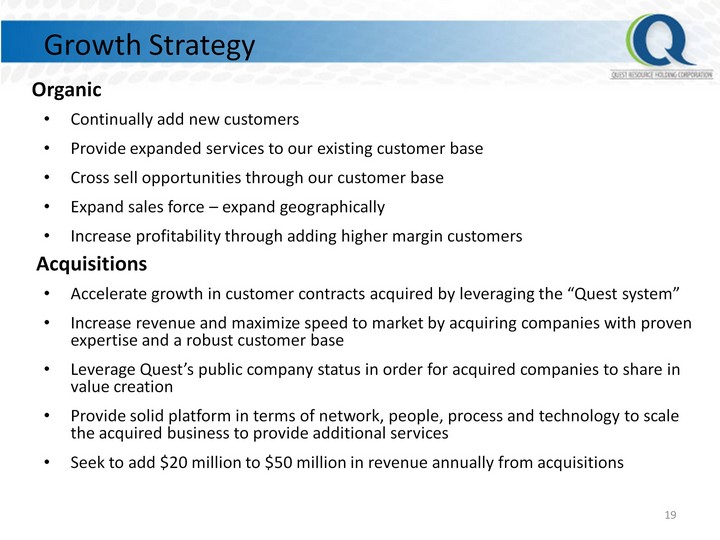

| Growth Strategy Continually add new customers Provide expanded services to our existing customer base Cross sell opportunities through our customer base Expand sales force - expand geographically Increase profitability through adding higher margin customers Accelerate growth in customer contracts acquired by leveraging the "Quest system" Increase revenue and maximize speed to market by acquiring companies with proven expertise and a robust customer base Leverage Quest's public company status in order for acquired companies to share in value creation Provide solid platform in terms of network, people, process and technology to scale the acquired business to provide additional services Seek to add $20 million to $50 million in revenue annually from acquisitions 19 Organic Acquisitions |

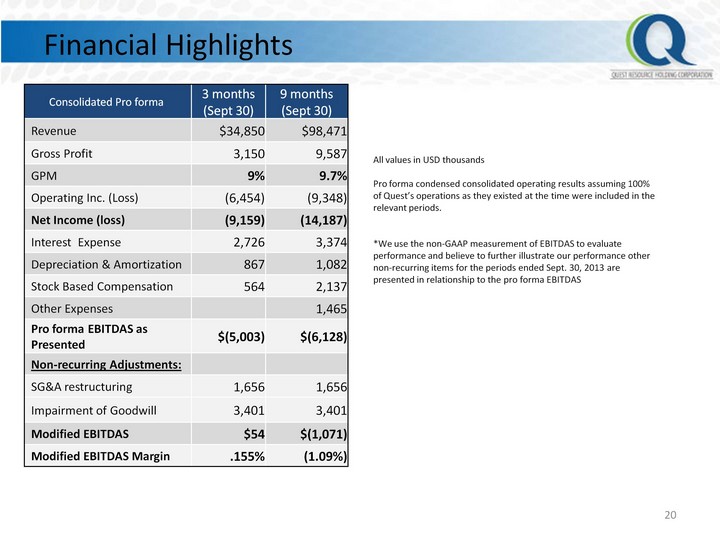

| Financial Highlights 20 Consolidated Pro forma 3 months (Sept 30) 9 months (Sept 30) Revenue $34,850 $98,471 Gross Profit 3,150 9,587 GPM 9% 9.7% Operating Inc. (Loss) (6,454) (9,348) Net Income (loss) (9,159) (14,187) Interest Expense 2,726 3,374 Depreciation & Amortization 867 1,082 Stock Based Compensation 564 2,137 Other Expenses 1,465 Pro forma EBITDAS as Presented $(5,003) $(6,128) Non-recurring Adjustments: SG&A restructuring 1,656 1,656 Impairment of Goodwill 3,401 3,401 Modified EBITDAS $54 $(1,071) Modified EBITDAS Margin .155% (1.09%) All values in USD thousands Pro forma condensed consolidated operating results assuming 100% of Quest's operations as they existed at the time were included in the relevant periods. *We use the non-GAAP measurement of EBITDAS to evaluate performance and believe to further illustrate our performance other non-recurring items for the periods ended Sept. 30, 2013 are presented in relationship to the pro forma EBITDAS |

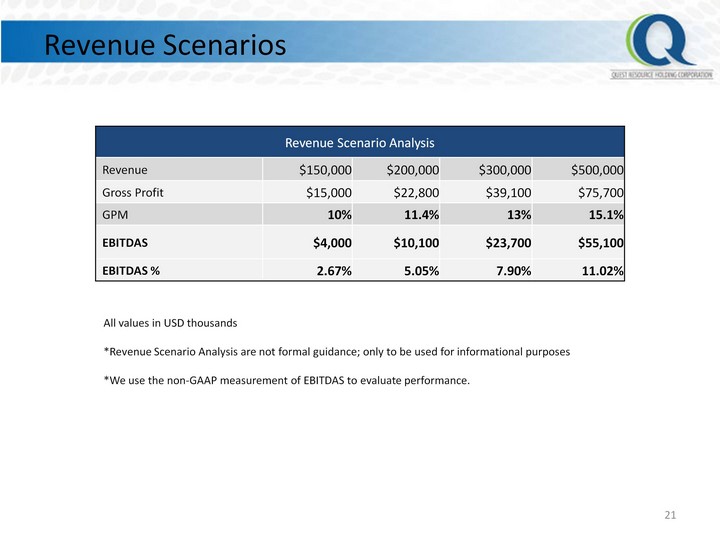

| Revenue Scenarios 21 Revenue Scenario Analysis Revenue Scenario Analysis Revenue Scenario Analysis Revenue Scenario Analysis Revenue Scenario Analysis Revenue $150,000 $200,000 $300,000 $500,000 Gross Profit $15,000 $22,800 $39,100 $75,700 GPM 10% 11.4% 13% 15.1% EBITDAS $4,000 $10,100 $23,700 $55,100 EBITDAS % 2.67% 5.05% 7.90% 11.02% All values in USD thousands *Revenue Scenario Analysis are not formal guidance; only to be used for informational purposes *We use the non-GAAP measurement of EBITDAS to evaluate performance. |

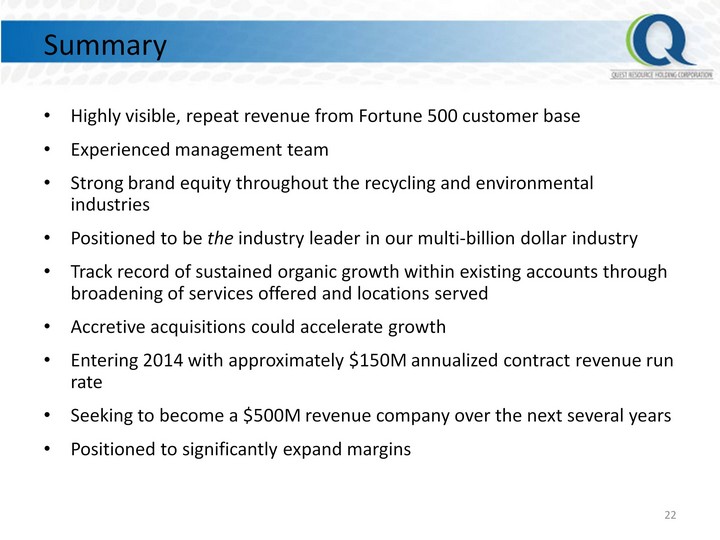

| Summary Highly visible, repeat revenue from Fortune 500 customer base Experienced management team Strong brand equity throughout the recycling and environmental industries Positioned to be the industry leader in our multi-billion dollar industry Track record of sustained organic growth within existing accounts through broadening of services offered and locations served Accretive acquisitions could accelerate growth Entering 2014 with approximately $150M annualized contract revenue run rate Seeking to become a $500M revenue company over the next several years Positioned to significantly expand margins 22 |

| Appendix 23 |

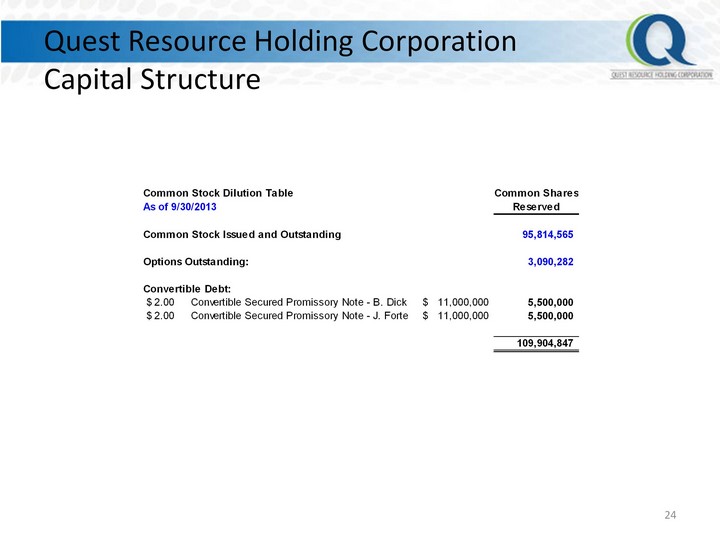

| Quest Resource Holding Corporation Capital Structure 24 |

| July 2013 QRMG Acquisition On July 16, 2013, we purchased the remaining 50% membership interest of Quest Resource Management Group, LLC. ("QRMG") from Quest Resource Group LLC ("QRG") for the following: 12M shares of QRHC common stock to Brian Dick, owner of QRG and CEO of Quest 10M shares of QRHC common stock to Jeffrey Forte, owner of QRG and former President of QRMG $11M note to each seller for aggregate of $22M, term of 3 years and 7% annual interest rate The $22M of sellers notes are convertible into common stock at $2.00 per share under the following circumstances: The two year anniversary of the notes has passed The principal amount of each sellers notes have been paid down by $5M because of capital raises The common stock trades on the a major exchange The common stock has traded at 4 times the $2.00 conversion price, as adjusted for either/or any stock splits or reverse stock splits The 50% membership interest was conveyed to Earth911, which held a 50% of the membership interest in Quest for several years, and thus now holds 100% of the issued and outstanding membership interests of Quest We consolidated 100% of Quest's operating activities into our operations subsequent to July 16, 2013 25 |

| 26 Brian Dick Chief Executive Officer BrianD@QuestRMG.com Laurie Latham Chief Financial Officer LaurieL@QuestRMG.com Quest Resource Holding Corporation 6175 Main Street, Suite #420 Frisco, Texas 75034 877.321.1811 - Main www.QHRC.com www.questrmg.com www.earth911.com |