Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FRANK'S INTERNATIONAL N.V. | d635051d8k.htm |

Investor Presentation

Investor Presentation

Fourth Quarter 2013

Fourth Quarter 2013

0

Exhibit 99.1 |

Corporate Information

1

Keith Mosing

Chairman, President and CEO

John Walker

Vice President,

International Operations

John Sinders

Senior Vice President,

Finance and Investor Relations

Mark Margavio

Vice President and CFO

Thomas Dunavant

Investor Relations Manager

Ph: (713) 358-7343

thomas.dunavant@franksintl.com

Frank’s International N.V.

10260 Westheimer, Suite 700

Houston, TX 77042

www.franksintl.com

Disclaimer

This

presentation

contains

forward-looking

statements

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933

and

Section

21E

of

the

Securities

Exchange

Act

of

1934.

All

statements,

other

than

statements

of

historical

facts,

included

in

this

press

release

that

address

activities,

events

or

developments

that

the

Company

expects,

believes

or

anticipates

will

or

may

occur

in

the

future

are

forward-looking

statements.

Without

limiting

the

generality

of

the

foregoing,

forward-looking

statements

contained

in

this

press

release

specifically

include

statements,

estimates

and

projections

regarding

the

Company’s

future

business

strategy

and

prospects

for

growth,

cash

flows

and

liquidity,

financial

strategy,

budget,

projections

and

operating

results,

the

amount,

nature

and

timing

of

capital

expenditures,

the

availability

and

terms

of

capital,

the

level

of

activity

in

the

oil

and

gas

industry,

volatility

of

oil

and

gas

prices,

unique

risks

associated

with

offshore

operations,

political,

economic

and

regulatory

uncertainties

in

international

operations,

the

ability

to

develop

new

technologies

and

products,

the

ability

to

protect

intellectual

property

rights,

the

ability

to

employ

and

retain

skilled

and

qualified

workers,

the

level

of

competition

in

the

Company’s

industry

and

other

guidance.

These

statements

are

based

on

certain

assumptions

made

by

the

Company

based

on

management’s

experience,

expectations

and

perception

of

historical

trends,

current

conditions,

anticipated

future

developments

and

other

factors

believed

to

be

appropriate.

Forward-looking

statements

are

not

guarantees

of

performance.

Although

the

Company

believes

the

expectations

reflected

in

its

forward-looking

statements

are

reasonable

and

are

based

on

reasonable

assumptions,

no

assurance

can

be

given

that

these

assumptions

are

accurate

or

that

any

of

these

expectations

will

be

achieved

(in

full

or

at

all)

or

will

prove

to

have

been

correct.

Moreover,

such

statements

are

subject

to

a

number

of

assumptions,

risks

and

uncertainties,

many

of

which

are

beyond

the

control

of

the

Company,

which

may

cause

actual

results

to

differ

materially

from

those

implied

or

expressed

by

the

forward-looking

statements.

These

include

the

factors

discussed

or

referenced

in

the

“Risk

Factors”

section

of

the

Company’s

prospectus

filed

with

the

U.S.

Securities

and

Exchange

Commission

(the

“SEC”)

on

August

9,

2013

and

its

subsequent

filings

with

the

SEC.

Accordingly,

you

should

not

place

undue

reliance

on

any

of

the

Company’s

forward-looking

statements.

Any

forward-looking

statement

speaks

only

as

of

the

date

on

which

such

statement

is

made,

and

the

Company

undertakes

no

obligation

to

correct

or

update

any

forward-looking

statement,

whether

as

a

result

of

new

information,

future

events

or

otherwise,

except

as

required

by

applicable

law,

and

we

caution

you

not

to

rely

on

them

unduly.

This

presentation

includes

the

non-GAAP

financial

measures

of

Adjusted

EBITDA

and

Adjusted

EBITDA

margin,

which

may

be

used

periodically

by

management

when

discussing

the

Company’s

financial

results

with

investors

and

analysts.

Adjusted

EBITDA

and

Adjusted

EBITDA

margin

are

presented

because

management

believes

these

metrics

provide

additional

information

relative

to

the

performance

of

the

Company’s

business.

These

metrics

are

commonly

employed

by

financial

analysts

and

investors

to

evaluate

the

operating

and

financial

performance

of

the

Company

from

period

to

period

and

to

compare

it

with

the

performance

of

other

publicly

traded

companies

within

the

industry.

You

should

not

consider

Adjusted

EBITDA

and

Adjusted

EBITDA

margin

in

isolation

or

as

a

substitute

for

analysis

of

the

Company’s

results

as

reported

under

GAAP.

Because

Adjusted

EBITDA

and

Adjusted

EBITDA

margin

may

be

defined

differently

by

other

companies

in

the

Company’s

industry,

the

Company’s

presentation

of

Adjusted

EBITDA

and

Adjusted

EBITDA

margin

may

not

be

comparable

to

similarly

titled

measures

of

other

companies,

thereby

diminishing

their

utility.

For

a

reconciliation

of

each

to

the

nearest

comparable

measure

in

accordance

with

GAAP,

please

see

the

Appendix. |

Outline

2

FI Overview

Industry Update –

Rig Counts

FI Business Segments

Services

US Land

Offshore (US and International)

Tubular Sales

Financial Update |

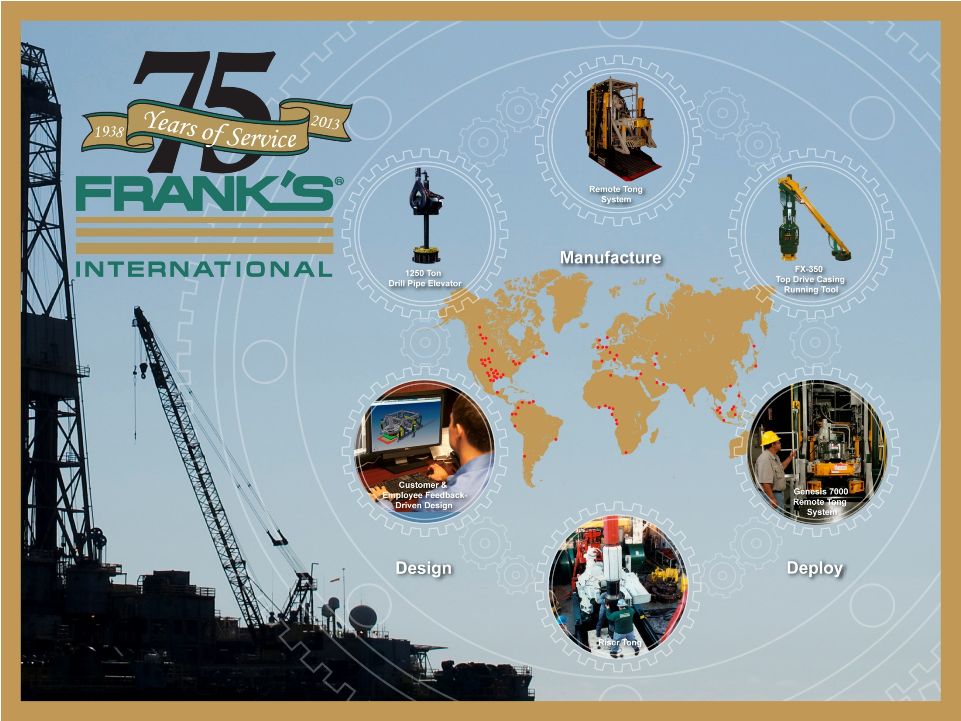

Frank’s: A Leading Global Provider of Tubular Services

Tubular Services Critical to Drilling

and Completion

Frank’s is a Market Leader

Frank’s Financial Results

Demonstrate Value

$3.3

bn

market

growing

at

~13%

/

year

(1)

Key to successful and safe well completion

Requires specialized equipment and

capabilities

–

especially

offshore

Minimizes costly rig time when performed

efficiently and properly

#1 or #2 market share in all major oil and gas

markets

(1)

69% of revenue generated offshore

Proprietary

equipment

–

104

patents

granted

and 37 currently pending (U.S.)

Global footprint with blue chip customer base

Reputation earned over eight decades

$1,056

mm

of

revenue

in

2012

(3)

$447

mm

of

2012

Adjusted

EBITDA

(2)

–

42%

Adjusted

EBITDA

margin

(2)

Less than $1mm debt

1% annualized dividend yield

3

1)

“Casing & Tubing Running Market”

analysis prepared by Spears & Associates, May 2013.

2)

Adjusted EBITDA is a non-GAAP financial measure. See reconciliation of net

income to adjusted EBITDA included in the appendix. 3)

Not Adjusted for Discontinued Operations.

Frank’s Unique Set of Capabilities

Focused Provider of Tubular Services

Innovate Well Solutions

Deeper Wells/Deeper Water Depth

Hostile Environments

Remote Geographies |

Strong Position in Deep Water Markets

Frank’s Offshore Exposure (% of Total Revenue)

Typical Industry Casing Costs per Well

(2)

Frank’s Offshore Exposure By Segment

(3)

1)

Per IHS.

2)

“Casing & Tubing Running Market”

analysis prepared by Spears & Associates, May 2013.

3)

2012 revenue by segment.

Opportunity for continued growth in offshore drilling with more than 60% of

deep water reserves currently

in

appraisal,

developing

or

discovery

status

(1)

$467 mm

International Services

$423 mm

U.S. Services

$166 mm

Pipe and Products

4 |

Focused Provider of Tubular Services

Structural String

Conductor String

Surface Casing

Intermediate Casing

Liner Strings

Production Liner

and Tie Back

String

7”

x 9 7/8”

@ 19,000’

Rig Floor 75’

36”

@ 5,000’

28”

@ 6,000’

22”

@ 8,000’

18”

@ 9,000’

16”

@ 12,000’

13 5/8”

@ 13,000’

11 7/8”

@ 17,000’

9 7/8”

@ 18,000’

Proper

well

construction

helps

ensure

well

integrity,

safety

and

productivity

5

Onshore Well

Offshore Well |

Cobra –

Completion

Control Line

Manipulating System

Solutions –

Frank’s Proprietary Tools

Fluid Grip

Automated Tong

1250 Ton Landing

String Handling

Tools

Clamp

Type

Elevator

Specialized Tools Provide Unique Solutions

Over 100 patents issued and 37 patents pending

Automated Tong

Cassette System

FX-350 Top Drive

Casing Running

Tool

Challenge

Onshore

Offshore

Horizontal drilling

Longer laterals

Automated rigs

Deeper water

Deeper wells

Very heavy casing and

landing strings

Dual mast rigs,

automated rig floor

Corrosion-resistant

alloy tubulars

Downhole instruments

and valves with control

cables

6 |

Deepest Completed Well

Casing and landing string

installation for the Chevron

Northwood well in the U.S.

Gulf of Mexico, to a total depth

of 31,866 feet in a water depth

of 6,000 feet (2013)

7 |

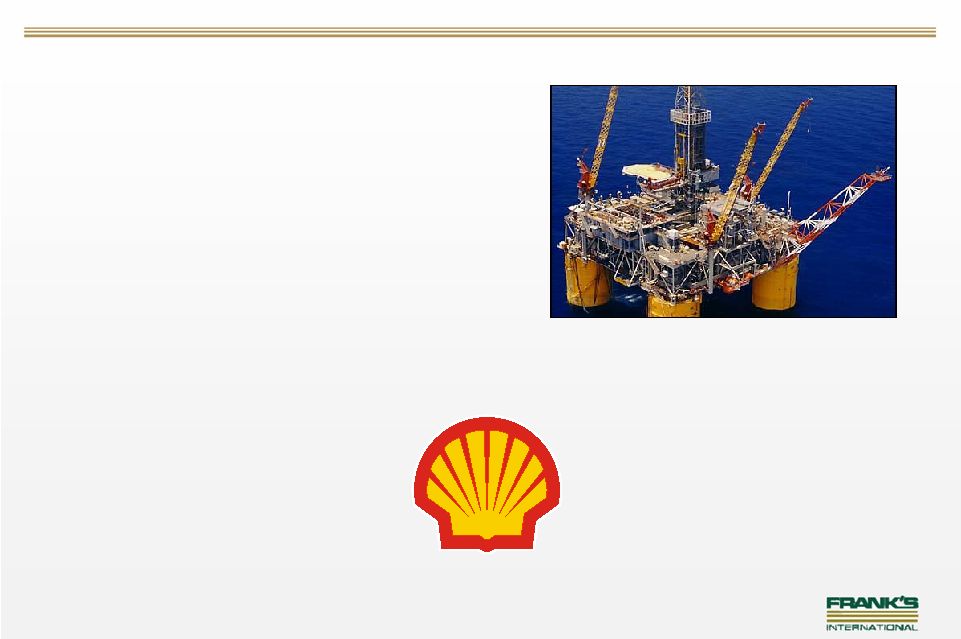

Greatest Hook Load

Broke our own record for

greatest hook load recorded at

1,140 tons while lifting 24,500

feet of combined casing and

landing string for Shell’s

Stones development in the

U.S. Gulf of Mexico (2012)

8 |

Hostile Environment

Selected for BP’s Shah Deniz

Project, an ongoing multiple

well project offshore of

Azerbaijan due to its ability to

provide “zero marking”

handling of corrosion-resistant

alloy tubulars (2006 –

present)

9 |

Well Integrity

Provided all tubular services

for the relief well drilled by BP

to contain the Macondo well in

the U.S. Gulf of Mexico (2010)

10 |

Outline

11

FI Overview

Industry Update –

Rig Counts

FI Business Segments

Services

US Land

Offshore (US and International)

Tubular Sales

Financial Update |

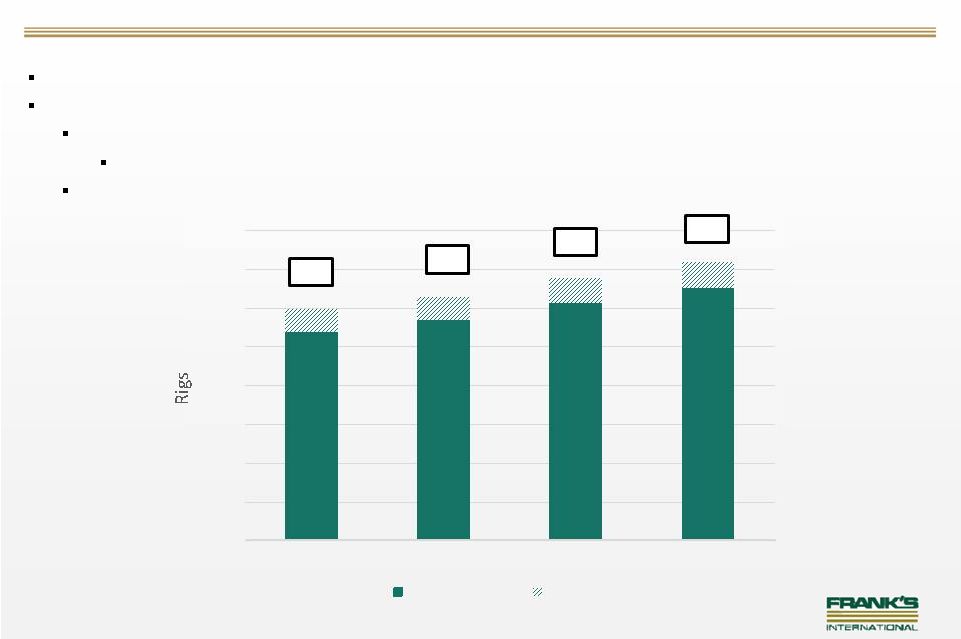

Worldwide Offshore Rig Count Continues to Increase

Total Semi-Submersible and Drillship count increasing 8% in 2014

Anticipated Newbuilds

2014 –

27 Drillships and 6 Semi-Submersibles

Gulf

of

Mexico

rig

activity

increasing

with

8

newbuilds

–

all

Drillships

2015 –

17 Drillships and 7 Semi-Submersibles

12

Source: ISI, RigLogix

Note:

Rig

count

is

average

for

4 quarter

th

270

285

307

326

29

30

32

34

0

50

100

150

200

250

300

350

400

2012

2013

2014e

2015e

Contracted

Not Contracted

299

315

339

360 |

US Land Rig Count Decreasing

13

Overall US Land rig count has decreased with a decline in gas rigs

Horizontal drilling has steadily increase from 2011 to 2013, averaging 62.4% of

rigs Overall well count has remained flat at 9,175 for 3Q13

Source: Baker Hughes IR |

Outline

14

FI Overview

Industry Update –

Rig Counts

FI Business Segments

Services

US Land

Offshore (US and International)

Tubular Sales

Financial Update |

US Land Segment

15

Competitive environment -

Increased pricing pressure

Recent revenue decline –

focused on maintaining

margins

More complex well

architecture in oil basins

creates opportunity for FI

FI has ability to relocate

crews and equipment to

areas of demand |

Offshore (Gulf of Mexico and International)

16

Increasing deep and ultra-deep

rig count

Deep and Ultra-Deep water

drilling increases well

complexity

FI has high market share in deep

and ultra-deep water

Opportunity for FI to growth

geographically

YTD Revenue growth in US

Offshore and International

markets |

Tubular Sales Segment (Formerly Pipe & Products)

17

Specialize in large OD pipe for

conductor casing and TLP

tendons

Manufacture a range of

connectors for large OD pipe

(20”–36”+)

80 acre Port of Iberia facility |

Global Footprint Provides Access to Attractive Markets

Frank’s U.S. Operations

Frank’s International

Operations

18

Over 90 sales and support offices in 60 countries

Operations in nearly all major markets |

Outline

19

FI Overview

Industry Update –

Rig Counts

FI Business Segments

Services

US Land

Offshore (US and International)

Tubular Sales

Financial Update |

Financial & Investment Highlights

Attractive End-Markets Driven by Continued Oil & Gas Exploration

and Development

Global Market Leader

Focused Service Provider with Unique Engineering Capabilities

and Favorable Reputation

Strong Position in Deep Water Offshore Markets

Historically Maintenance CapEx has averaged 5-7% of revenue

Strong Free Cash Flow Generation Supports Dividend

20 |

3 Quarter and YTD Highlights

Growth in US Offshore offset by decline in US Land

$8 million in bad debt expense relating to Latin America

$40 million YTD increase in Tubular Sales deferred revenue

21

Sep 30,

Sep 30,

2013

Q/Q

Y/Y

2013

Y/Y

Revenue from External Customers

International Services

121,680

$

0.7%

5.0%

353,041

$

4.0%

U.S. Services

108,126

-6.5%

-3.7%

321,295

1.8%

Tubular Sales

40,296

-28.7%

5.3%

121,314

11.1%

Total

270,102

$

-7.8%

1.4%

795,650

$

4.1%

Segment Adjusted EBITDA:

International Services

48,752

$

-10.4%

-12.9%

153,134

$

-7.7%

U.S. Services

47,215

-20.6%

-17.4%

149,494

0.2%

Tubular Sales

5,338

-62.0%

116.6%

25,893

61.3%

Corporate and other

(33)

-

-

3

-

Total

101,272

$

-21.0%

-12.4%

328,524

$

-0.8%

EBITDA margin

International Services

40.1%

43.4%

U.S. Services

43.7%

46.5%

Tubular Sales

13.2%

21.3%

Total

37.5%

41.3%

Three Months Ended

Nine Months Ended

rd |

Increasing Well Complexity Driving Financial Results

Numerous Domestic Acquisitions

Accelerated International Expansion

Financial Crisis / GOM

Moratorium

Increasing Well Complexity

1)

Adjusted EBITDA is a non-GAAP financial measure. See reconciliation of net

income to adjusted EBITDA included in the appendix. 2)

Not Adjusted for Discontinued Operations.

22 |

$1,510

$1,425

$1,340

$1,243

$1,075

$875

$3,050

$2,800

$2,475

$2,074

$1,725

$1,600

$4,560

$4,225

$3,815

$2,800

$2,475

$3,317

$0

$1,000

$2,000

$3,000

$4,000

$5,000

2010

2011

2012

2013E

2014E

2015E

Onshore

Offshore

$2,175

$2,025

$1,765

$1,600

$1,275

$1,050

$2,385

$2,200

$2,050

$1,717

$1,525

$1,425

$4,560

$4,225

$3,815

$2,800

$2,475

$3,317

$0

$1,000

$2,000

$3,000

$4,000

$5,000

2010

2011

2012

2013E

2014E

2015E

North America

International

Tubular Services: A Growing Market Worldwide

Source: “Casing & Tubing Running Market”

analysis prepared by Spears & Associates, May 2013.

Tubular Services Market By Geography

Tubular Services Market by Location

23

($mm)

($mm) |

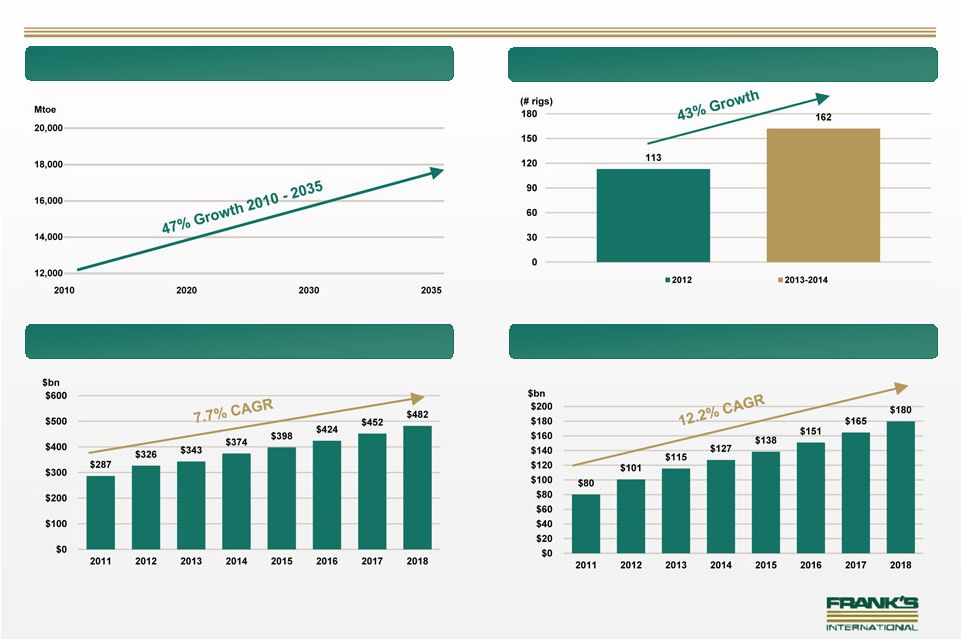

Attractive End Markets Driven by Energy Growth and Development

Projected Global Energy Demand

Global Offshore Equipment & Service Market

Source: IEA Energy Outlook 2012.

DW Rigs -

5 Largest Offshore Drillers

Global Oilfield Equipment & Service Market

Source:

“Casing

&

Tubing

Running

Market”

analysis

prepared

by

Spears & Associates, May 2013.

Source:

“Casing

&

Tubing

Running

Market”

analysis

prepared

by

Spears & Associates, May 2013.

Source:

“Casing

&

Tubing

Running

Market”

analysis

prepared

by

Spears & Associates, May 2013.

24 |

Questions?

25 |