Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HomeStreet, Inc. | form8-kinvestorpresentatio.htm |

THIRD QUARTER 2013 (updated) NASDAQ:HMST

Important Disclosures Forward-Looking Statements In accordance with Section 21E of the Securities Exchange Act of 1934, as amended, we caution you that we may make forward-looking statements about our industry, our future financial performance and business activity in this presentation that are subject to many risks and uncertainties. These forward-looking statements are based on our management's current expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts, as well as a number of assumptions concerning future events. These statements are subject to risks, uncertainties, assumptions and other important factors set forth in our SEC filings, including but not limited to our most recent Annual Report on Form 10-K for the fiscal year ended December 31, 2012, and our most recent Quarterly Report on Form 10-Q. Many of these factors are beyond our control. Such factors could cause actual results to differ materially from the results discussed or implied in the forward-looking statements. These risks include statements predicated on our ability to integrate our recent acquisitions and to continue to expand our banking operations geographically and across market sectors, grow our franchise and capitalize on market opportunities; our ability to manage these efforts cost-effectively and to attain the desired operational and financial outcomes; our ability to manage the losses inherent in our loan portfolio; our ability to make accurate estimates of the value of our non-cash assets and liabilities; our ability to respond to an increasingly restrictive and complex regulatory environment; and our ability to attract and retain key personnel. Actual results may fall materially short of our expectations and projections, and we may change our plans or take additional actions that differ in material ways from our current intentions. Accordingly, we can give no assurance of future performance, and you should not rely unduly on forward- looking statements. All forward looking statements are based on information available to the Company as of the date hereof, and we do not undertake to update or revise any forward looking statements, for any reason. Basis of Presentation of Financial Data Unless noted otherwise in this presentation, all reported financial data is being presented as of the period ending September 30, 2013. 2

Established Pacific Northwest Franchise 3 • 92-year old diversified financial services company headquartered in Seattle • Leading Northwest mortgage lender and commercial & consumer bank • Pro forma assets of approximately $3.1 billion with branch network in Pacific Northwest, California and Hawaii (1) • Pro forma deposits of $2.37 billion (2) • 30 retail deposit branches, 41 stand-alone home loan centers and four stand-alone commercial lending centers (3) • Attractive PNW demographics Population growth Household/business formation Employment base, job creation Concentration of large high-growth employers Housing recovery (1) Assets are pro forma and include assets acquired from AmericanWest, Fortune Bank and Yakima National Bank based on data at 9/30/13. (2) Deposits are pro forma and include deposits acquired from AmericanWest, Fortune Bank and Yakima National Bank based on data at 9/30/13. (3) Includes acquisition of four Yakima National Bank locations and two AmericanWest Bank retail deposit branches .Two acquired Fortune Bank branches will be consolidated into existing HomeStreet Bank branches in Q1-2014.

Strategy 4 Build Single Family Mortgage origination market share • Organic growth opportunities driven by attractive market demographics Expand Commercial & Consumer Banking activities Expand multifamily mortgage banking – Fannie Mae DUS® program and B2B Grow portfolio lending – C&I, CRE and Construction Increase density of retail deposit branch network • Growth via acquisition of smaller institutions in-market and in new markets where we have established a meaningful market presence • Continue opportunistic expansion (market share and footprint) of Single Family mortgage banking activities • Target Western states major market franchise • Business and personnel growth create expense inefficiencies in the short run • Long-term target efficiency ratio in the mid to low 60% range • Deploy capital in support of growth objectives • Shareholder dividends consistent with peers • Target long-term 15%+ ROE Expand Commercial & Consumer Banking Ongoing expense management Optimize use of capital To grow and diversify earnings by expanding our Commercial & Consumer Banking business and continue to build Mortgage Banking market share in new and existing markets

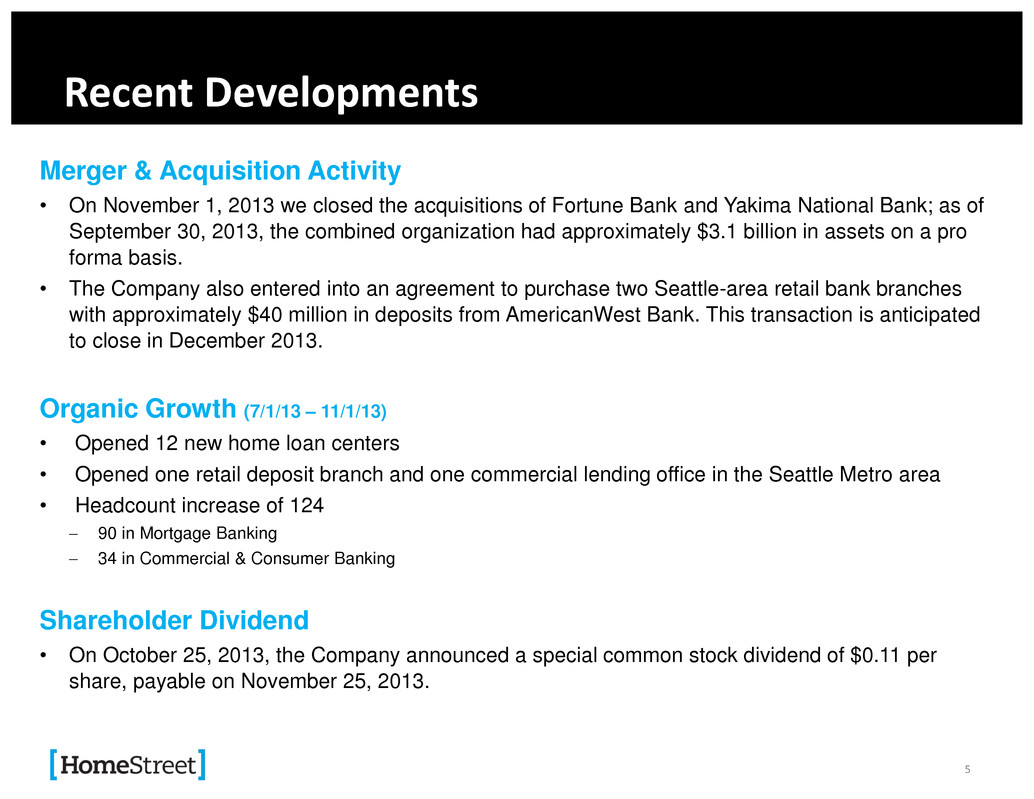

Recent Developments Merger & Acquisition Activity • On November 1, 2013 we closed the acquisitions of Fortune Bank and Yakima National Bank; as of September 30, 2013, the combined organization had approximately $3.1 billion in assets on a pro forma basis. • The Company also entered into an agreement to purchase two Seattle-area retail bank branches with approximately $40 million in deposits from AmericanWest Bank. This transaction is anticipated to close in December 2013. Organic Growth (7/1/13 – 11/1/13) • Opened 12 new home loan centers • Opened one retail deposit branch and one commercial lending office in the Seattle Metro area • Headcount increase of 124 90 in Mortgage Banking 34 in Commercial & Consumer Banking Shareholder Dividend • On October 25, 2013, the Company announced a special common stock dividend of $0.11 per share, payable on November 25, 2013. 5

Results of Operations 6 For the three months ended (1) Interest expense for the first quarter included $1.4 million related to the correction of the cumulative effect of an error in prior years resulting from the under-accrual of deferred interest due on TruPS. The Company’s Net Interest Margin for the three months ended March 31, 2013, excluding the impact of this correction, was 3.06%. For the nine months ended For the three months ended ($ in thousands) Sept. 30, 2013 Jun. 30, 2013 Mar. 31, 2013 Dec. 31, 2012 Sept. 30, 2012 Net interest income $ 20,412 $ 17,415 $ 15,235 $ 16,591 $ 16,520 Provision for loan losses (1,500) 400 2,000 4,000 5,500 Noninterest income 38,174 57,556 58,943 71,932 69,091 Noninterest expense 58,116 56,712 55,799 55,966 45,934 Net income before taxes 1,970 17,859 16,379 28,557 34,177 Income taxes 308 5,791 5,439 7,060 12,186 Net income $ 1,662 $ 12,068 $ 10,940 $ 21,497 $ 21,991 Diluted EPS $ 0.11 $ 0.82 $ 0.74 $ 1.46 $ 1.50 ROAA 0.24% 1.86% 1.75% 3.46% 3.60% ROAE 2.45% 17.19% 15.95% 32.80% 38.02% Net Interest Margin 3.41% 3.10% 2.81% (1) 3.06% 3.12% Tier 1 Leverage Ratio (Bank) 10.85% 11.89% 11.97% 11.78% 10.86% Total Risk-Based Capital (Bank) 18.44% 19.15% 20.47% 19.31% 18.01%

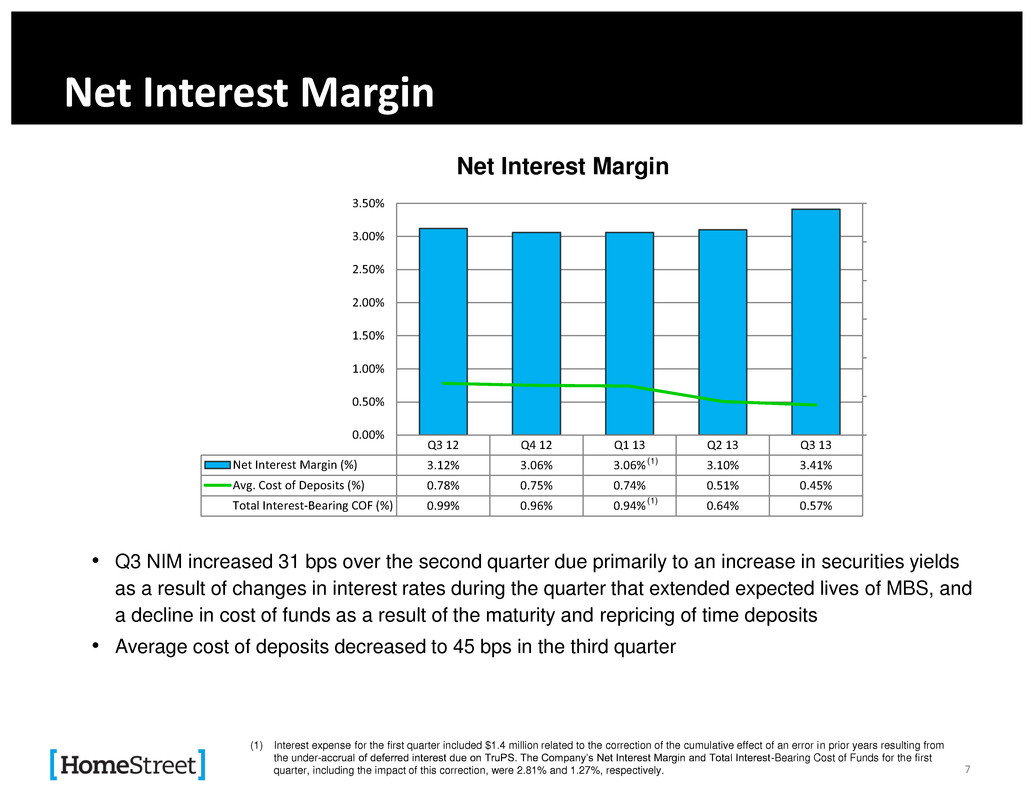

Net Interest Margin • Q3 NIM increased 31 bps over the second quarter due primarily to an increase in securities yields as a result of changes in interest rates during the quarter that extended expected lives of MBS, and a decline in cost of funds as a result of the maturity and repricing of time deposits • Average cost of deposits decreased to 45 bps in the third quarter 7 (1) (1) Interest expense for the first quarter included $1.4 million related to the correction of the cumulative effect of an error in prior years resulting from the under-accrual of deferred interest due on TruPS. The Company’s Net Interest Margin and Total Interest-Bearing Cost of Funds for the first quarter, including the impact of this correction, were 2.81% and 1.27%, respectively. (1) Q3 12 Q4 12 Q1 13 Q2 13 Q3 13 Net Interest Margin (%) 3.12% 3.06% 3.06% 3.10% 3.41% Avg. Cost of Deposits (%) 0.78% 0.75% 0.74% 0.51% 0.45% Total Interest-Bearing COF (%) 0.99% 0.96% 0.94% 0.64% 0.57% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% Net Interest Margin

Interest-Earning Assets • Average loans held for investment increased by $78 million or 5.6% in Q3 − New originations in mortgage, commercial lending, commercial real estate and residential construction − New loan commitments totaled $242 million for the third quarter, an increase of 15% over the second quarter • Total average interest-earning assets increased by $153 million or 6.6% 8 Avg. Yield 3.94% 3.82% 3.80% 3.63% 3.88% 3.00% 3.20% 3.40% 3.60% 3.80% 4.00% 0.0 0.5 1.0 1.5 2.0 2.5 3.0 Q3 12 Q4 12 Q1 13 Q2 13 Q3 13 $ i n bi ll io n s Average Interest-Earning Assets Cash & Cash Equivalents Investment Securities Loans Held for Sale Loans Held for Investment Average Yield

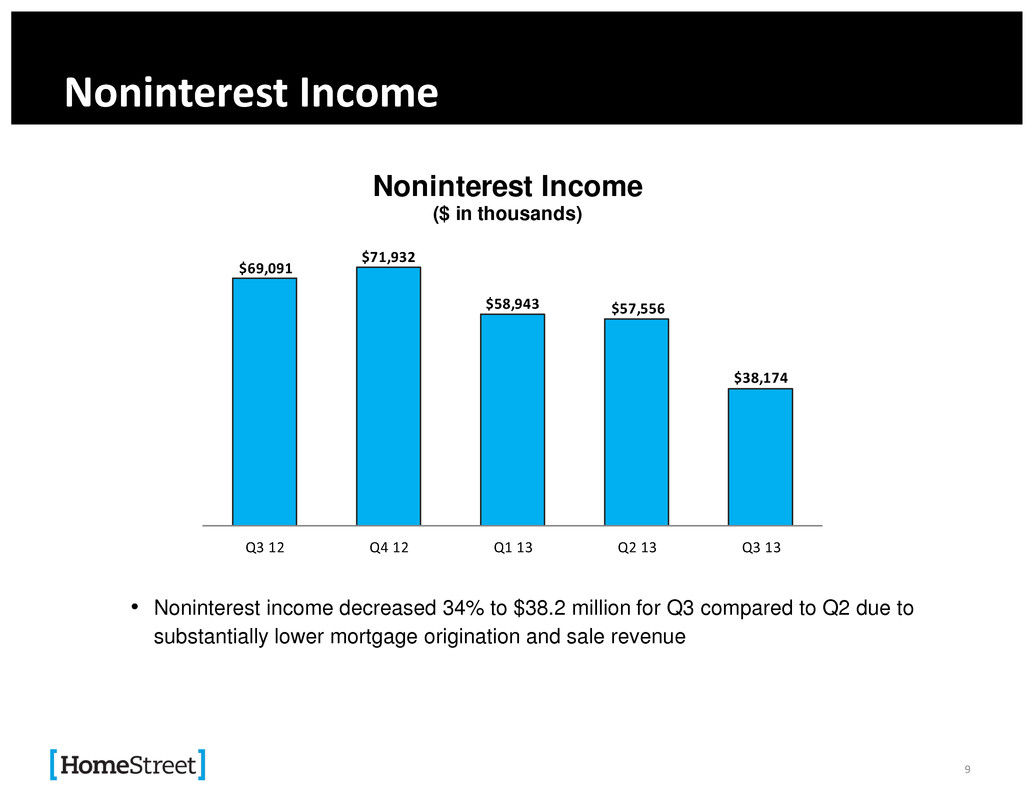

Noninterest Income • Noninterest income decreased 34% to $38.2 million for Q3 compared to Q2 due to substantially lower mortgage origination and sale revenue 9 $69,091 $71,932 $58,943 $57,556 $38,174 Q3 12 Q4 12 Q1 13 Q2 13 Q3 13 Noninterest Income ($ in thousands)

Noninterest Expense • Headcount increased by 9% in Q3 • Increased salaries and related costs due primarily to net addition of 82 mortgage origination and fulfillment headcount, partially offset by lower commissions paid on lower production volume • Noninterest expense will continue to vary based on headcount and mortgage origination volume 10 Q3 12 Q4 12 Q1 13 Q2 13 Q3 13 Total noninterest expense $45,934 $55,966 $55,799 $56,712 $58,116 Salaries & related costs $31,573 $38,680 $35,062 $38,579 $39,689 General & administrative $7,148 $8,534 $10,930 $10,270 $9,234 Occupancy $2,279 $2,425 $2,802 $3,381 $3,484 Information services $2,411 $2,739 $2,996 $3,574 $3,552 Other noninterest expense $2,523 $3,588 $4,009 $908 $2,157 Headcount 998 1,099 1,218 1,309 1,426 Efficiency ratio 53.65% 63.22% 75.22% 75.65% 99.20% - 200 400 600 800 1,000 1,200 1,400 1,600 $0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 Noninterest Expense ($ in thousands) Headcount

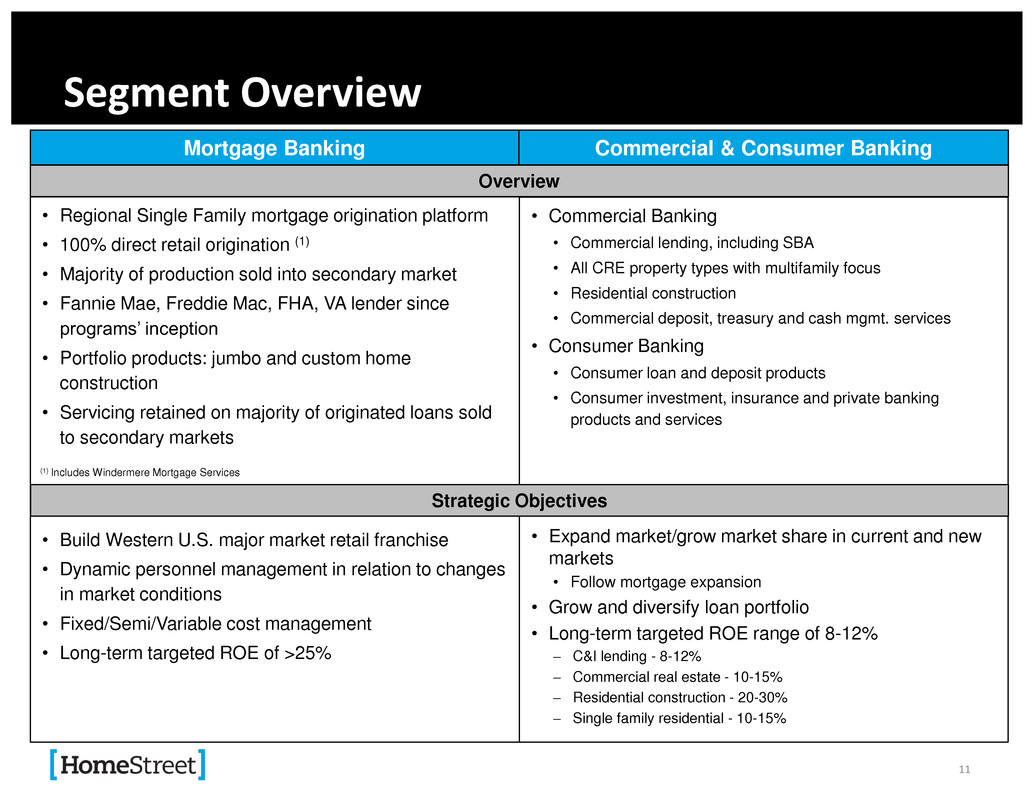

Segment Overview Mortgage Banking • Regional Single Family mortgage origination platform • 100% direct retail origination (1) • Majority of production sold into secondary market • Fannie Mae, Freddie Mac, FHA, VA lender since programs’ inception • Portfolio products: jumbo and custom home construction • Servicing retained on majority of originated loans sold to secondary markets • Build Western U.S. major market retail franchise • Dynamic personnel management in relation to changes in market conditions • Fixed/Semi/Variable cost management • Long-term targeted ROE of >25% Commercial & Consumer Banking 11 (1) Includes Windermere Mortgage Services Overview • Commercial Banking • Commercial lending, including SBA • All CRE property types with multifamily focus • Residential construction • Commercial deposit, treasury and cash mgmt. services • Consumer Banking • Consumer loan and deposit products • Consumer investment, insurance and private banking products and services • Expand market/grow market share in current and new markets • Follow mortgage expansion • Grow and diversify loan portfolio • Long-term targeted ROE range of 8-12% C&I lending - 8-12% Commercial real estate - 10-15% Residential construction - 20-30% Single family residential - 10-15% Strategic Objectives

12 Commercial & Consumer Banking

Commercial & Consumer Banking Segment 13 • Total earning assets increased $130 million or 6.6% in the quarter • Total new loan commitments of $242 million, compared to $211 million in Q2 • Deposit balances of $2.1 billion increased 7% from June 30, 2013 • NIM increased to 3.22%, an increase of 20 bps from the same period last year • Continued strong credit performance including significant reductions in classified assets, nonaccruals, delinquencies and TDRs (1) Equity allocated to segment based upon ‘as if effective’ Basel III regulatory capital regulations and related risk-based capital and risk-rating of assets. For the three months ended ($ in thousands) Sept. 30, 2013 Jun. 30, 2013 Mar. 31, 2013 Dec. 31, 2012 Sept. 30, 2012 Net interest income $ 15,919 $ 13,687 $ 11,081 $ 12,114 $ 12,096 Provision for loan losses (1,500) 400 2,000 4,000 5,500 Noninterest income 1,229 1,537 2,390 2,529 2,474 Noninterest expense 13,577 13,472 15,699 16,393 13,302 Net income before taxes 5,071 1,352 (4,228) (5,750) (4,232) Income taxes 1,219 31 (1,375) (1,373) (1,904) Net income $ 3,852 $ 1,321 $ (2,853) $ (4,377) $ (2,328) ROAA 0.73% 0.27% (0.62%) (0.95%) (0.50%) ROAE (1) 8.42% 2.81% (6.65%) (9.50%) (5.04%) Efficiency Ratio 79.18% 88.49% 116.54% 111.95% 91.30% Net Interest Margin 3.22% 3.00% 2.71% 2.96% 3.02% Total Earning Assets $ 2,093,182 $ 1,963,414 $ 1,789,914 $ 1,744,218 $ 1,695,692 Headcount 504 476 440 413 377

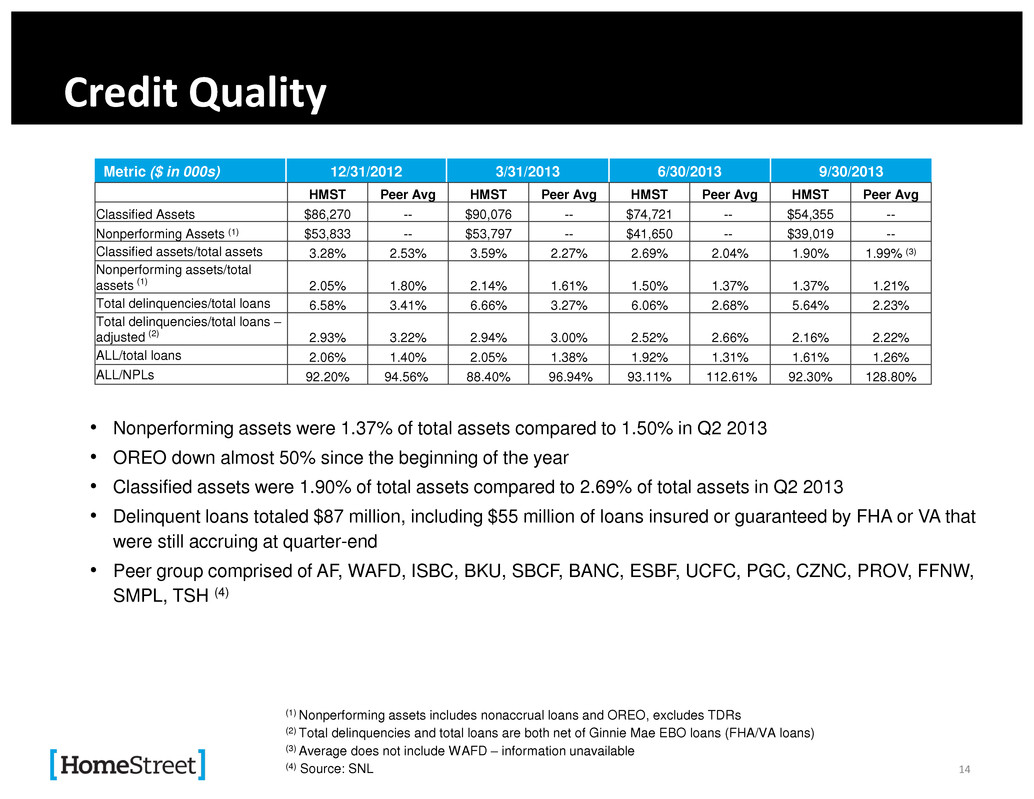

Credit Quality 14 • Nonperforming assets were 1.37% of total assets compared to 1.50% in Q2 2013 • OREO down almost 50% since the beginning of the year • Classified assets were 1.90% of total assets compared to 2.69% of total assets in Q2 2013 • Delinquent loans totaled $87 million, including $55 million of loans insured or guaranteed by FHA or VA that were still accruing at quarter-end • Peer group comprised of AF, WAFD, ISBC, BKU, SBCF, BANC, ESBF, UCFC, PGC, CZNC, PROV, FFNW, SMPL, TSH (4) Metric ($ in 000s) 12/31/2012 3/31/2013 6/30/2013 9/30/2013 HMST Peer Avg HMST Peer Avg HMST Peer Avg HMST Peer Avg Classified Assets $86,270 -- $90,076 -- $74,721 -- $54,355 -- Nonperforming Assets (1) $53,833 -- $53,797 -- $41,650 -- $39,019 -- Classified assets/total assets 3.28% 2.53% 3.59% 2.27% 2.69% 2.04% 1.90% 1.99% (3) Nonperforming assets/total assets (1) 2.05% 1.80% 2.14% 1.61% 1.50% 1.37% 1.37% 1.21% Total delinquencies/total loans 6.58% 3.41% 6.66% 3.27% 6.06% 2.68% 5.64% 2.23% Total delinquencies/total loans – adjusted (2) 2.93% 3.22% 2.94% 3.00% 2.52% 2.66% 2.16% 2.22% ALL/total loans 2.06% 1.40% 2.05% 1.38% 1.92% 1.31% 1.61% 1.26% ALL/NPLs 92.20% 94.56% 88.40% 96.94% 93.11% 112.61% 92.30% 128.80% (1) Nonperforming assets includes nonaccrual loans and OREO, excludes TDRs (2) Total delinquencies and total loans are both net of Ginnie Mae EBO loans (FHA/VA loans) (3) Average does not include WAFD – information unavailable (4) Source: SNL

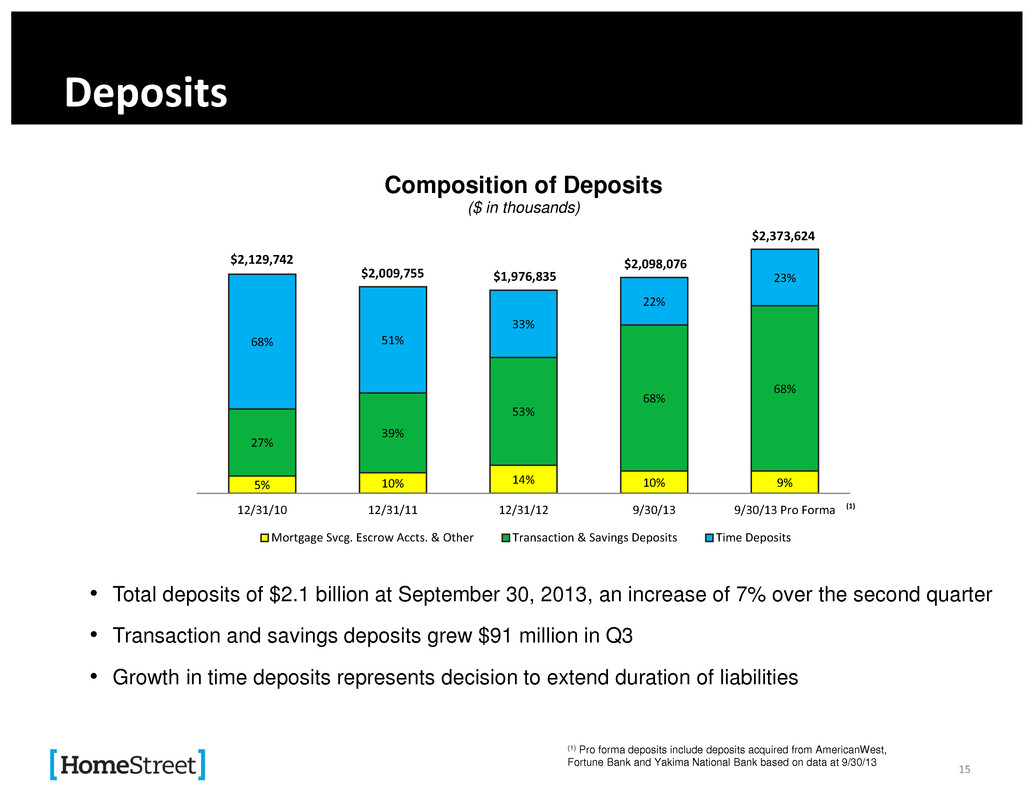

Deposits • Total deposits of $2.1 billion at September 30, 2013, an increase of 7% over the second quarter • Transaction and savings deposits grew $91 million in Q3 • Growth in time deposits represents decision to extend duration of liabilities 15 5% 10% 14% 10% 9% 27% 39% 53% 68% 68% 68% 51% 33% 22% 23% $2,129,742 $2,009,755 $1,976,835 $2,098,076 $2,373,624 12/31/10 12/31/11 12/31/12 9/30/13 9/30/13 Pro Forma Composition of Deposits ($ in thousands) Mortgage Svcg. Escrow Accts. & Other Transaction & Savings Deposits Time Deposits (1) Pro forma deposits include deposits acquired from AmericanWest, Fortune Bank and Yakima National Bank based on data at 9/30/13 (1)

Loan Portfolio • Net growth of $94 million, with $242 million in new commitments for the quarter compared to $211 million in the second quarter and $115 million in the first quarter 16 24% 20% 18% 10% 22% 6% CRE by Property Type (1) $ 442 million Retail Indust./Warehouse Mixed Use Multifamily Office Other (1) As of 9/30/13 (2) Not all loans under negotiation will close (3) Includes HELOCs (4) Represents rate locks for loans designated as Held For Investment, not adjusted for estimated fallout 11% 20% 3% 53% 8% 5% Loan Composition (1) $1.54 billion C&I/CRE Owner-Occupied CRE Non-Owner Occupied CRE - Multifamily Single Family Consumer Construction C&I Lending $17 million in commitments and originations $125 million pipeline (2) CRE $51 million in commitments and originations $360 million pipeline (2) Residential Construction $45 million in commitments and originations $110 million pipeline (2) Single Family (3) $130 million in originations $91 million pipeline (4) Q3 Origination Activity

Commercial & Consumer Banking – Earning Assets Growth Scenario • Scenario assumes average quarterly growth of 7% in earning assets and 1% in noninterest expense in 2014-2015 17 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 5,000 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 Earning Assets ($M) Efficiency Ratio ($ in m ill io n s )

18 Mortgage Banking

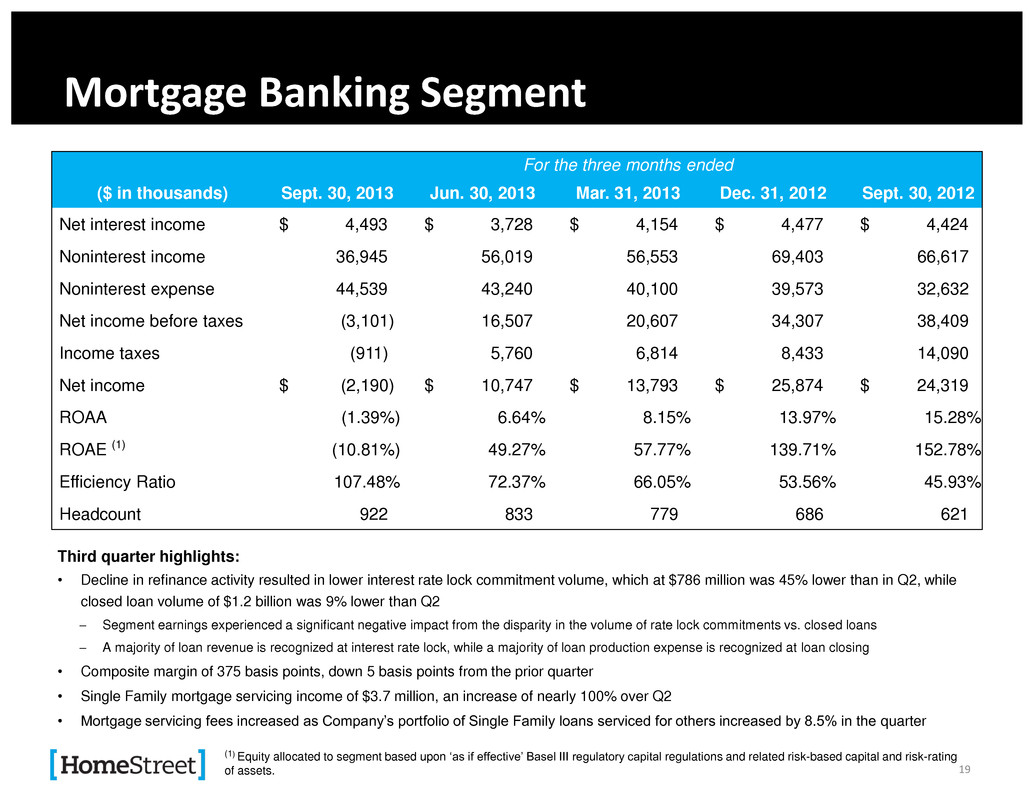

Mortgage Banking Segment 19 Third quarter highlights: • Decline in refinance activity resulted in lower interest rate lock commitment volume, which at $786 million was 45% lower than in Q2, while closed loan volume of $1.2 billion was 9% lower than Q2 Segment earnings experienced a significant negative impact from the disparity in the volume of rate lock commitments vs. closed loans A majority of loan revenue is recognized at interest rate lock, while a majority of loan production expense is recognized at loan closing • Composite margin of 375 basis points, down 5 basis points from the prior quarter • Single Family mortgage servicing income of $3.7 million, an increase of nearly 100% over Q2 • Mortgage servicing fees increased as Company’s portfolio of Single Family loans serviced for others increased by 8.5% in the quarter For the three months ended ($ in thousands) Sept. 30, 2013 Jun. 30, 2013 Mar. 31, 2013 Dec. 31, 2012 Sept. 30, 2012 Net interest income $ 4,493 $ 3,728 $ 4,154 $ 4,477 $ 4,424 Noninterest income 36,945 56,019 56,553 69,403 66,617 Noninterest expense 44,539 43,240 40,100 39,573 32,632 Net income before taxes (3,101) 16,507 20,607 34,307 38,409 Income taxes (911) 5,760 6,814 8,433 14,090 Net income $ (2,190) $ 10,747 $ 13,793 $ 25,874 $ 24,319 ROAA (1.39%) 6.64% 8.15% 13.97% 15.28% ROAE (1) (10.81%) 49.27% 57.77% 139.71% 152.78% Efficiency Ratio 107.48% 72.37% 66.05% 53.56% 45.93% Headcount 922 833 779 686 621 (1) Equity allocated to segment based upon ‘as if effective’ Basel III regulatory capital regulations and related risk-based capital and risk-rating of assets.

Mortgage Origination • Purchase volume increased significantly (includes Windermere Mortgage Services) 80% of interest rate lock commitments, compared to 59% in the second quarter 66% of closed loan volume, up from 59% in the second quarter 20 (1) Servicing value and secondary marketing gains have been aggregated and are stated as a percentage of interest rate lock commitments. In previous quarters, the value of originated MSRs was presented as a separate component of the composite margin and stated as a percentage of mortgage loans sold. Prior periods have been revised to conform to the current presentation. (2) Loan origination and funding fees stated as a percentage of mortgage originations from the retail channel and excludes loans purchased from WMS. (3) Excludes the impact of a $1.3 million correction that was recorded in secondary marketing gains in the fourth quarter of 2012 for the cumulative effect of an error in prior years related to the fair value measurement of loans held for sale. Including the impact of this correction, the secondary marketing gain margin and Composite Margin were 462 and 533 basis points, respectively, in the fourth quarter of 2012. (4) Excludes the impact of a $4.3 million upward adjustment related to a change in accounting estimate that resulted from a change in the application of the valuation technique used to value the Company's interest rate lock commitments. Including the impact of this cumulative effect adjustment, the secondary marketing gain margin and Composite Margin were 427 and 503 basis points, respectively, in the first quarter of 2013. $- $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 Q3 12 Q4 12 Q1 13 Q2 13 Q3 13 Single Family Closed Loan Production ($ in millions) HMST WMS Rate locks Bps 0 100 200 300 400 500 Q3 12 Q4 12 Q1 13 Q2 13 Q3 13 Single Family Composite Margin (bps) Secondary gains/rate locks Loan fees/closed loans Q3 12 Q4 12 Q1 13 Q2 13 Q3 13 HMST $1,123 $1,304 $1,024 $1,107 $1,020 WMS $245 $215 $168 $200 $167 Total production $1,368 $1,519 $1,192 $1,307 $1,187 Rate locks $1,313 $1,255 $1,036 $1,423 $786 3 12 Q4 12 Q1 13 Q2 13 Q3 13 Servicing value & secondary gains/rate locks(1) 424 452 (3) 385(4) 305 294 Loan fees/closed loans(2) 77 71 76 75 81 Composite Margin 501 523 461 380 375

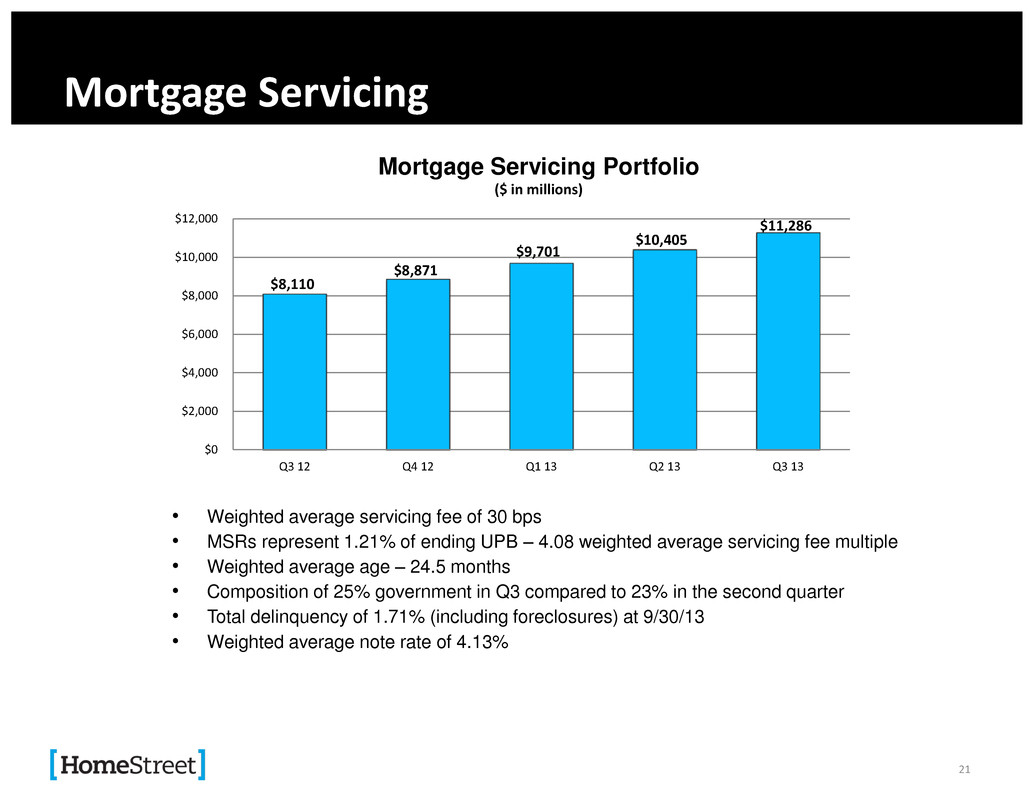

Mortgage Servicing • Weighted average servicing fee of 30 bps • MSRs represent 1.21% of ending UPB – 4.08 weighted average servicing fee multiple • Weighted average age – 24.5 months • Composition of 25% government in Q3 compared to 23% in the second quarter • Total delinquency of 1.71% (including foreclosures) at 9/30/13 • Weighted average note rate of 4.13% 21 $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 Q3 12 Q4 12 Q1 13 Q2 13 Q3 13 Mortgage Servicing Portfolio ($ in millions) $8,110 $8,871 $9,701 $10,405 $11,286

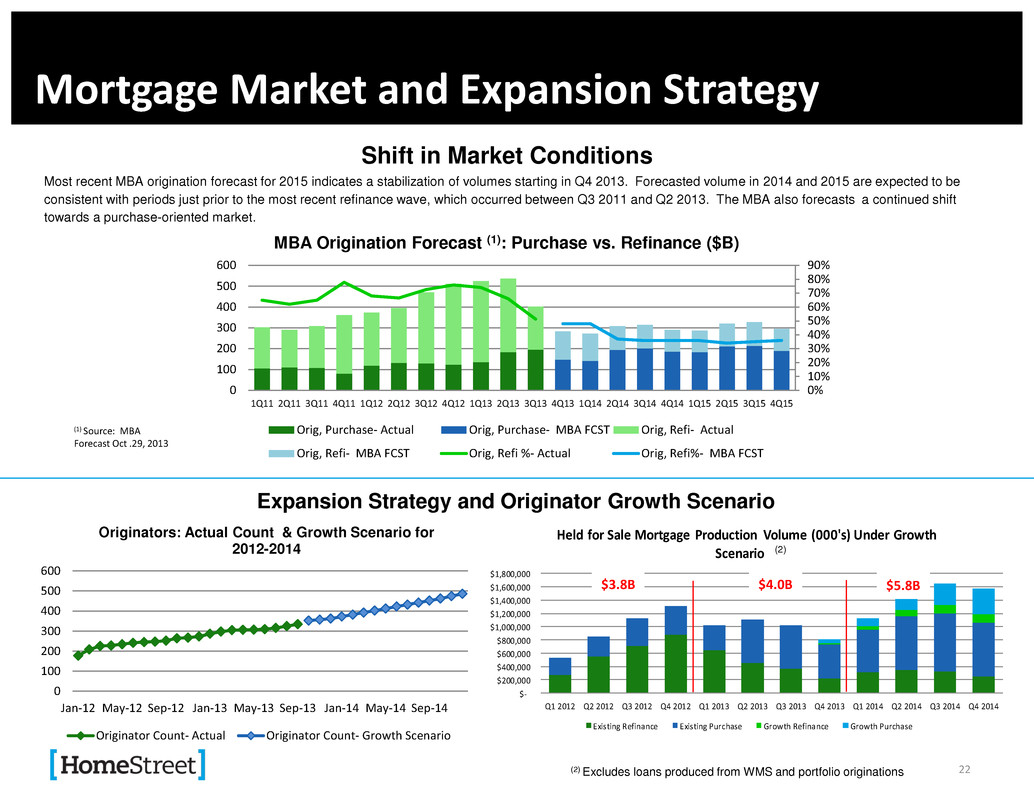

$- $200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 $1,400,000 $1,600,000 $1,800,000 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Held for Sale Mortgage Production Volume (000's) Under Growth Scenario (1) Existing Refinance Existing Purchase Growth Refinance Growth Purchase Mortgage Market and Expansion Strategy 22 Shift in Market Conditions Most recent MBA origination forecast for 2015 indicates a stabilization of volumes starting in Q4 2013. Forecasted volume in 2014 and 2015 are expected to be consistent with periods just prior to the most recent refinance wave, which occurred between Q3 2011 and Q2 2013. The MBA also forecasts a continued shift towards a purchase-oriented market. (1) Source: MBA Forecast Oct .29, 2013 Expansion Strategy and Originator Growth Scenario (2) Excludes loans produced from WMS and portfolio originations 0 100 200 300 400 500 600 Jan-12 May-12 Sep-12 Jan-13 May-13 Sep-13 Jan-14 May-14 Sep-14 Originators: Actual Count & Growth Scenario for 2012-2014 Originator Count- Actual Originator Count- Growth Scenario 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 0 100 200 300 400 500 600 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 MBA Origination Forecast (1): Purchase vs. Refinance ($B) Orig, Purchase- Actual Orig, Purchase- MBA FCST Orig, Refi- Actual Orig, Refi- MBA FCST Orig, Refi %- Actual Orig, Refi%- MBA FCST $3.8B $4.0B $5.8B (2)

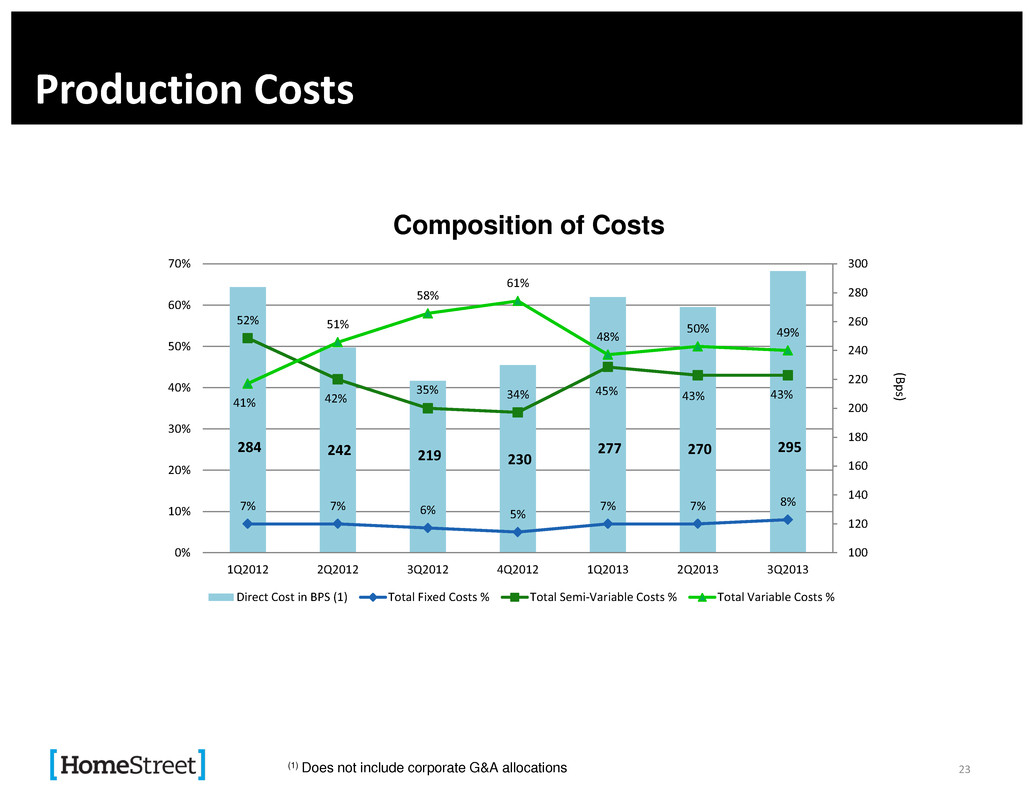

Production Costs 23 284 242 219 230 277 270 295 7% 7% 6% 5% 7% 7% 8% 52% 42% 35% 34% 45% 43% 43% 41% 51% 58% 61% 48% 50% 49% 100 120 140 160 180 200 220 240 260 280 300 0% 10% 20% 30% 40% 50% 60% 70% 1Q2012 2Q2012 3Q2012 4Q2012 1Q2013 2Q2013 3Q2013 Composition of Costs Direct Cost in BPS (1) Total Fixed Costs % Total Semi-Variable Costs % Total Variable Costs % (1) Does not include corporate G&A allocations (Bp s)

Franchise Value • Established and growing financial institution concentrated in the Pacific Northwest • Leading regional Single Family mortgage lender • Focus on business diversification: growth of Commercial & Consumer Banking to balance Mortgage Banking earnings • Superior historical returns on equity due to high noninterest income • Attractive valuation transition opportunity as company diversifies http://ir.homestreet.com ir@homestreet.com 24

. 25 Appendix

Management Team 26 Executive Joined Company Years in Industry Relevant Experience Mark K. Mason Director, Vice Chairman, President and Chief Executive Officer September 2009 27 • Seasoned banking executive with demonstrated success implementing turnaround and growth strategies • Former Chairman and CEO of Fidelity Federal Bank of Los Angeles Cory D. Stewart Executive Vice President, Chief Accounting Officer March 2012 13 • Extensive experience in finance, accounting and enterprise risk management roles in the financial industry including at Washington Mutual • MBA, CPA, CFA charter holder Darrell van Amen Executive Vice President, Chief Investment Officer March 2003 24 • Manages bank’s MSR and pipeline risk, secondary marketing and investment portfolio • Formerly with Royal Bank of Canada and Old Kent Financial Jay C. Iseman Executive Vice President, Chief Credit Officer August 2009 22 • Significant experience in credit administration and special assets for Bank of America and Key Bank • Chairs Bank Loan Committee Godfrey B. Evans Executive Vice President, General Counsel and Chief Administrative Officer November 2009 32 • Significant experience in banking, regulation, M&A and corporate securities law • Previously General Counsel and CAO at Fidelity Federal Bank and corporate lawyer at Gibson, Dunn & Crutcher

Management Team (cont.) 27 Executive Joined Company Years in Industry Relevant Experience Rose Marie David Executive Vice President, Single Family Lending Director March 2012 28 • Responsible for all aspects of mortgage banking originations, operations and servicing • Previously with MetLife Home Loans Richard W. H. Bennion Executive Vice President, Residential Lending Director June 1977 36 • Responsible for residential construction lending production • Chairman of the board of Windermere Mortgage Services (WMS) • Member of Fannie Mae Western Business Center Advisory Board Randy Daniels Executive Vice President, Commercial Real Estate Lending Director September 2012 26 • Oversees commercial real estate lending activities through portfolio and Fannie Mae DUS programs • Formerly led Bank of America’s commercial real estate division in the Northwest David Straus Executive Vice President, Commercial Banking November 2013 40 • Responsible for all aspects of commercial lending • Founder and past CEO of Fortune Bank • Past chairman of Washington Bankers Association Jeff Newgard Executive Vice President, Eastern Region President November 2013 16 • Responsible for management and strategic expansion in Central and Eastern Washington • Past CEO of Yakima National Bank

Basel III 28 Estimated Capital Ratios under Basel III – September 30, 2013 Under Current Rules Pro Forma Basel III Under Current Rules Pro Forma Basel III (fully implemented) Under Current Rules Pro Forma Basel III (fully implemented) Tier 1 Leverage 5.0% 5.0% (1) 10.9% 8.3% 11.7% 8.6% Tier 1 Risk-Based Capital 6.0% 8.5% (2) 17.3% 12.8% 14.6% 10.4% Total Risk-Based Capital 10.0% 10.5% (2) 18.5% 14.0% 15.7% 11.6% HomeStreet Bank HomeStreet, Inc. (1) Capital Conservation Buffer does not apply to Tier 1 Leverage Ratio under Basel III (2) Ratio includes 2.5% Capital Conservation Buffer required by Basel III for unrestricted payments of dividends, share buybacks and discretionary bonus payments Well-Capitalized Minimum