Attached files

| file | filename |

|---|---|

| EX-5.1 - EX-5.1 - CymaBay Therapeutics, Inc. | d620891dex51.htm |

| EX-23.1 - EX-23.1 - CymaBay Therapeutics, Inc. | d620891dex231.htm |

Table of Contents

As filed with the U.S. Securities and Exchange Commission on November 29, 2013

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CYMABAY THERAPEUTICS, INC.

(Exact name of Registrant as specified in its charter)

| Delaware | 2834 | 94-3103561 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

3876 Bay Center Place

Hayward, California 94545

(510) 293-8800

(Address, including zip code and telephone number, of Registrant’s principal executive offices)

Harold Van Wart, Ph.D.

President and Chief Executive Officer

CymaBay Therapeutics, Inc.

3876 Bay Center Place

Hayward, California 94545

(510) 293-8800

(Name, address, including zip code and telephone number, including area code, of agent for service)

Copies to:

Matthew B. Hemington

Brett D. White

Cooley LLP

3175 Hanover Street

Palo Alto, California 94304

(650) 843-5000

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be |

Proposed Maximum Offering Price Per Share(2) |

Proposed Offering Price(2) |

Amount of Registration Fee | ||||

| Common Stock, $0.0001 par value per share |

11,456,493 |

$5.00 | $57,282,465 | $7,378 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Represents shares offered by the selling stockholders. Includes an indeterminable number of additional shares of common stock, pursuant to Rule 416 under the Securities Act of 1933, as amended, that may be issued to prevent dilution from stock splits, stock dividends or similar transactions that could affect the shares to be offered by selling stockholder. |

| (2) | Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457 under the Securities Act of 1933, as amended. The price per share and aggregate offering price are based on the recent sale of shares of the Registrant’s common stock at a price per share of $5.00 in a private placement that signed on November 22, 2013. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, Dated November 29, 2013

PROSPECTUS

11,456,493 Shares

CYMABAY THERAPEUTICS, INC.

Common Stock

This prospectus relates to the sale or other disposition from time to time of up to 11,456,493 shares of our common stock, including shares issuable pursuant to warrants to purchase up to 1,626,398 shares of our common stock, to be sold by the selling stockholders named in this prospectus. The 9,830,095 shares of common stock covered by this prospectus, and the warrants to purchase 1,626,398 shares of our common stock covered by this prospectus, were sold by us in private placements of these securities and include 604,000 shares of our common stock and warrants to purchase up to 120,800 shares of our common stock to be sold immediately upon listing of our common stock on the over-the-counter market pursuant to an agreement with certain of the selling stockholders. We are not selling any common stock under this prospectus and will not receive any of the proceeds from the sale or other disposition of shares by the selling stockholders; however, to the extent the selling stockholders exercise the warrants, we will receive the aggregate exercise price from the exercise of the warrants.

The selling stockholders may sell or otherwise dispose of the shares of common stock covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the selling stockholders may sell or otherwise dispose of their shares of common stock in the section entitled “Plan of Distribution” on page 113. Discounts, concessions, commissions and similar selling expenses attributable to the sale of shares of common stock covered by this prospectus will be borne by the selling stockholders. We will pay all expenses (other than discounts, concessions, commissions and similar selling expenses) relating to the registration of the shares with the Securities and Exchange Commission.

Our common stock is not currently listed on any national securities exchange.

Investing in our common stock involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 6 of this prospectus, and under similar headings in any amendment or supplements to this prospectus or as updated by any subsequent filing with the Securities and Exchange Commission that is incorporated by reference herein.

We are an emerging growth company as that term is used in the Jumpstart Our Business Startups Act of 2012, as such, we have elected to take advantage of certain reduced public company reporting requirements for this prospectus and future filings.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

, 2013

Table of Contents

| 1 | ||||

| 6 | ||||

| 32 | ||||

| 32 | ||||

| 32 | ||||

| 32 | ||||

| 32 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

33 | |||

| 45 | ||||

| 76 | ||||

| 80 | ||||

| 86 | ||||

| 87 | ||||

| 107 | ||||

| 112 | ||||

| 113 | ||||

| 115 | ||||

| 115 | ||||

| 115 | ||||

| F-1 |

You should rely only on the information contained in this prospectus or contained in any free writing prospectus filed with the Securities and Exchange Commission. Neither we nor the selling stockholders have authorized anyone to provide you with additional information or information different from that contained in this prospectus filed with the Securities and Exchange Commission. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The selling stockholders are offering to sell, and seeking offers to buy, our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither we nor the selling stockholders, have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

Table of Contents

The following summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our financial statements and the related notes included in this prospectus and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

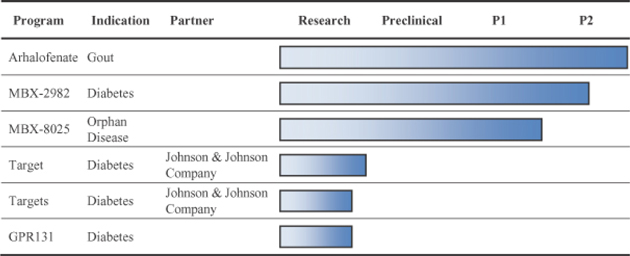

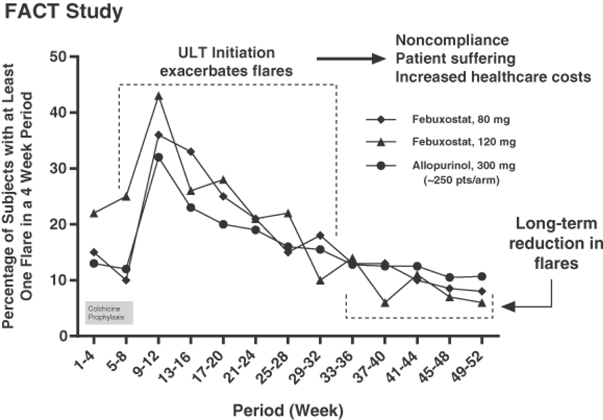

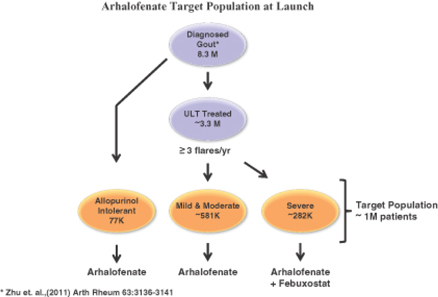

General

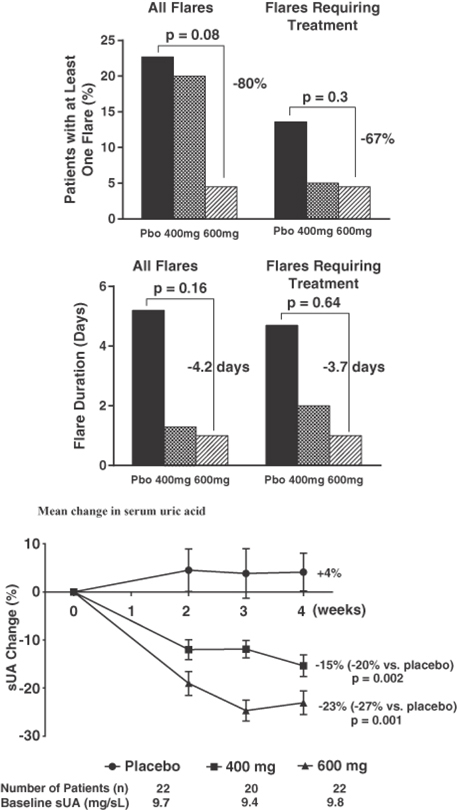

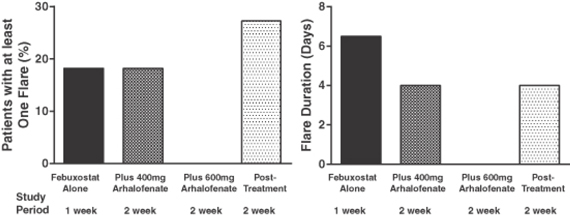

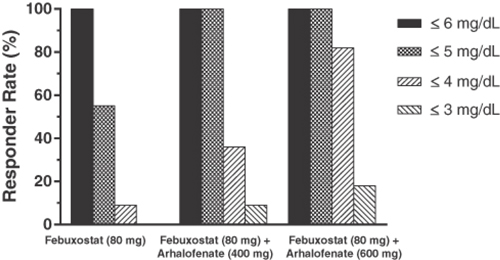

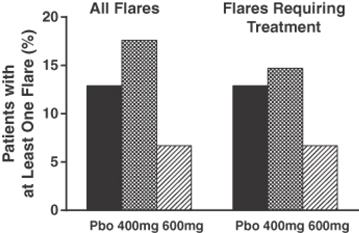

CymaBay Therapeutics Inc., formerly Metabolex, Inc., is focused on developing therapies to treat metabolic diseases. Arhalofenate, our lead product candidate, is being developed for the treatment of gout. Arhalofenate has demonstrated two therapeutic actions: the prevention of painful attacks of gout in joints (flares) and the lowering of serum uric acid (sUA) by promoting excretion of uric acid by the kidney. In addition, arhalofenate provides physicians with what they identified in a recent survey (TreatmentTrends®: Gout U.S. August 2011) as the most important attributes when selecting a gout therapy: no serious safety issues, well tolerated, minimize frequency of flares and use in patients with a broad range of comorbidities, (other diseases that individual patients have in addition to gout).

CymaBay has completed three Phase 2 studies of arhalofenate in gout patients in which it demonstrated a consistent pattern of reduction of flare incidence and duration and lowering of serum uric acid (sUA). Arhalofenate has established a safety profile in toxicology studies in animals and in clinical studies involving nearly 1,000 patients exposed to arhalofenate. One additional Phase 2b clinical study of 12 weeks duration is planned to confirm the safety and efficacy of a higher dose prior to initiating Phase 3 studies. Due to its safety profile and ability to both reduce flares and lower sUA, we believe that arhalofenate has a differentiated profile that is attractive for use in a large population, with significant advantages over marketed and emerging agents which have limitations in their efficacy, tolerability, and use in patients with common comorbidities. CymaBay is poised to follow arhalofenate with two additional clinical stage product candidates, one in diabetes and one that has potential utility in high unmet need (no existing or limited therapies) and/or orphan diseases (rare diseases).

As used in this prospectus, “CymaBay,” “we,” “us,” and “our” refer to CymaBay Therapeutics, Inc. and its subsidiaries taken as a whole. The word trademark “CymaBay” is registered on the Principal Register of the United States Patent and Trademark Office. This prospectus also contains trademarks and trade names of other companies, and those trademarks and trade names are the property of their respective owners. We do not intend our use or display of other companies’ trademarks or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies or products.

CymaBay Strategy

Our goal is to become a leading biopharmaceutical company focused on developing and commercializing proprietary new medicines for metabolic diseases. Key elements of our strategy are to:

| • | develop arhalofenate as a treatment for gout, including through a near-term Phase 2b study; |

| • | obtain U.S. Food and Drug Administration (FDA) approval for arhalofenate as a treatment for gout; |

| • | pursue partnerships to broadly commercialize arhalofenate; |

| • | develop our other product candidates subject to availability of resources; and |

| • | strengthen our patent portfolio and other means of protecting exclusivity. |

1

Table of Contents

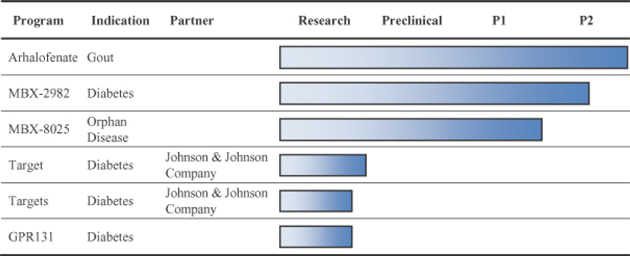

CymaBay Pipeline Overview

Our pipeline includes three unpartnered clinical stage programs and a number of partnered and unpartnered preclinical programs. Across this portfolio, a total of 21 clinical studies, including nine Phase 2 studies, have been completed. An investigational new drug application (IND) has been filed with the FDA for each clinical stage program. An IND for arhalofenate in gout was filed in April 2011. An IND for MBX-2982 in diabetes was filed in January 2008. The IND for MBX-8025 was filed by Johnson & Johnson Pharmaceutical Research & Development in July 2005 and transferred to CymaBay in March 2007.

2013 Financing and Selling Stockholders

On September 30, 2013, and October 31, 2013, we sold shares of our common stock and warrants to purchase shares of our common stock in a private placement for aggregate gross proceeds of $30.2 million, and raised an additional $5.0 million in venture debt financing, resulting in aggregate net proceeds to CymaBay of approximately $31.8 million after deducting placement agent fees and estimated offering expenses. In addition, on September 30, 2013, we issued shares of our common stock in cancellation of $16.9 million of debt owed to the holder of that debt. Further, on November 22, 2013, we entered into an agreement with investors to purchase shares of our common stock and warrants to purchase shares of our common stock as part of the private placement for aggregate gross proceeds of $3.0 million, which sales will occur shortly after our listing of our common stock on the over-the-counter market. We refer to the private placement, the venture debt financing, and the issuance of our common stock in cancellation of the $16.9 million of debt as the 2013 financing.

Our issuance of shares of our common stock and the warrants was and will be exempt from registration under Rule 506 of Regulation D promulgated under Section 4(2) of the Securities Act of 1933, or the Securities Act, as the shares and warrants were or will be issued to accredited investors without any form of general solicitation or general advertising.

In addition, on September 30, 2013, all of our then outstanding shares of preferred stock converted to shares of our common stock.

Implications of Being an “Emerging Growth Company”

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an “emerging growth company,” we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include:

| • | only two years of audited financial statements in addition to any required unaudited interim financial statements with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

2

Table of Contents

| • | reduced disclosure about our executive compensation arrangements; |

| • | no requirement that we solicit non-binding advisory votes on executive compensation or golden parachute arrangements; and |

| • | exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting. |

CymaBay intends to take advantage of the reduced disclosure obligations. Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in the Securities Act, or the Securities Act, for complying with new or revised accounting standards. In other words, an emerging growth company can elect to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. CymaBay has elected to avail itself of this exemption to take advantage of the extended transition period for complying with new or revised accounting standards.

CymaBay could remain an emerging growth company for up to five years, or until the earliest of (i) the last day of the first fiscal year in which CymaBay’s annual gross revenues exceed $1 billion, (ii) the date that CymaBay becomes a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, which would occur if the market value of CymaBay’s common stock that are held by non-affiliates exceeds $700 million as of the last business day of CymaBay’s most recently completed second fiscal quarter, (iii) the date on which CymaBay has issued more than $1 billion in non-convertible debt during the preceding three-year period and (iv) the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement under the Securities Act. At this time CymaBay expects to remain an “emerging growth company” for the foreseeable future.

CymaBay also qualifies as a “smaller reporting company” and thus has the advantage of not being required to provide the same level of disclosure as larger public companies.

Risks Related to Our Business

Our business is subject to numerous risks and uncertainties related to our financial condition and need for additional capital, the development and commercialization of our product candidates, our reliance on third parties, the operation of our business, our intellectual property and government regulation. These risks include those highlighted in the section entitled “Risk Factors” immediately following this summary, including the following:

| • | If we fail to obtain additional financing, we could be forced to delay, reduce or eliminate our product development programs, seek corporate partners for the development of our product development programs or relinquish or license on unfavorable terms, our rights to technologies or product candidates; |

| • | We have incurred significant losses since our inception. We anticipate that we will continue to incur significant losses for the foreseeable future, and we may never achieve or maintain profitability; |

| • | Our ability to generate future revenues from product sales is uncertain and depends upon our ability to successfully develop, obtain regulatory approval for, and commercialize our product candidates; |

| • | We depend on the success of our lead product candidate, arhalofenate, which is still under clinical development, and may not obtain regulatory approval or be successfully commercialized; |

| • | We have never obtained regulatory approval for a drug and we may be unable to obtain, or may be delayed in obtaining, regulatory approval for arhalofenate; |

3

Table of Contents

| • | Our product candidates may cause adverse effects or have other properties that could delay or prevent their regulatory approval or limit the scope of any approved label or market acceptance; |

| • | After the completion of our clinical trials, we cannot predict whether or when we will obtain regulatory approval to commercialize arhalofenate and we cannot, therefore, predict the timing of any future revenue from arhalofenate. Regulatory approval of an NDA is not guaranteed, and the approval process is expensive, uncertain and lengthy; |

| • | We rely on third-party manufacturers to produce our preclinical and clinical drug supplies, and we intend to rely on third parties to produce commercial supplies of any approved product candidates; |

| • | We rely on third parties to conduct, supervise and monitor our clinical studies, and if those third parties perform in an unsatisfactory manner, it may harm our business; |

| • | If we are unable to obtain or protect intellectual property rights related to our products and product candidates, we may not be able to compete effectively in our market; and |

| • | There is currently no market for our common stock, and a public market may not develop. Further, if a market does develop, the market price of our common stock may be highly volatile, and you may not be able to resell your shares at or above the price at which you purchase them. |

Corporate Information

CymaBay Therapeutics, Inc., formerly Metabolex, Inc., was incorporated under the laws of the State of Delaware on October 5, 1988, originally under the name Transtech Corporation. Our executive offices are located at 3876 Bay Center Place, Hayward, California 94545. The telephone number at our executive office is (510) 293-8800. Our corporate website address is www.cymabay.com. We do not incorporate the information contained on, or accessible through, our website into this prospectus, and you should not consider it part of this prospectus.

On September 30, 2013, we engaged in a 1-for-79.5 reverse split of our preferred stock and common stock, which we refer to as the reverse stock split, and all of the shares of our outstanding preferred stock converted to common stock. Unless otherwise noted in this registration statement on Form S-1 of which this prospectus forms a part and except as set forth in the financial statements included in this prospectus, all share numbers and prices are presented on a reverse stock split basis.

We are an emerging growth company as that term is used in the Jumpstart Our Business Startups Act of 2012, as such, we have elected to take advantage of certain reduced public company reporting requirements for this prospectus and future filings.

The Offering

This prospectus relates to the sale or other disposition from time to time of up to 11,456,493 shares of our common stock, which includes the shares of our common stock issued or to be issued in the 2013 financing, the shares of our common stock issuable upon exercise of the warrants issued or to be issued in the 2013 financing, and the shares of our common stock issued upon conversion of the shares of our preferred stock, all of which are held by the selling stockholders named in this prospectus.

| Issuer: | CymaBay Therapeutics, Inc. | |

| Shares offered by the selling stockholders | 11,456,493 | |

| Shares outstanding | 9,455,064 (1) | |

| Shares outstanding after this offering | 11,685,462 (2) | |

| Use of Proceeds | We will not receive any proceeds from the sale of the shares offered hereby. See “Use of Proceeds” in this prospectus. | |

| Risk Factors | See “Risk Factors” beginning on page 6 in this prospectus for a discussion of factors that you should carefully consider before deciding to invest in shares of our common stock. | |

4

Table of Contents

| (1) | The number of our shares outstanding is based on 9,455,064 shares outstanding as of November 22, 2013. |

| (2) | The number of our shares that will be outstanding after the offering is based on 9,455,064 shares outstanding as of November 22, 2013, plus sales of 604,000 of our shares which will occur shortly after our listing of our common stock on the over-the-counter market, plus 1,626,398 shares issuable upon the exercise of warrants held or to be held by the selling stockholders at an exercise price of $5.75 per share, but excludes (i) 411,130 shares issuable upon the exercise of outstanding stock options at a weighted average exercise price of $11.57 per share, (ii) 166,164 additional shares reserved for future issuance under our incentive compensation plans, (iii) 115,390 shares issuable upon the exercise of warrants held by National Securities Corporation at an exercise price of $5.75 per share, and (iv) 121,739 shares issuable upon the exercise of warrants held by our lenders at an exercise price of $5.00 per share. |

5

Table of Contents

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus, including the financial statements and the related notes appearing at the end of this prospectus, before deciding to invest in shares of our common stock. If any of the following risks actually occurs, our business, financial condition, results of operations and future prospects could be harmed. In that event, the market price of our common stock could decline and you could lose part or even all of your investment.

Risks Related to Our Financial Condition and Capital Requirements

If we fail to obtain additional financing, we could be forced to delay, reduce or eliminate our product development programs, seek corporate partners for the development of our product development programs or relinquish or license on unfavorable terms, our rights to technologies or product candidates.

As of September 30, 2013, we had net cash on hand of approximately $32.1 million, including approximately $28.9 million we raised in aggregate net proceeds on September 30, 2013, in the 2013 financing. On October 31, 2013, we raised additional aggregate net proceeds of $2.9 million and on November 22, 2013, we entered into an agreement with investors to purchase shares of our common stock and warrants to purchase shares of our common stock as part of the 2013 financing for aggregate gross proceeds of $3.0 million, which sales will occur shortly after our listing of our common stock on the over-the-counter market. After giving effect to the 2013 financing, we believe that our existing cash will allow us to continue operation through the third quarter of 2015. As set forth in the notes to our financial statements, our auditors expressed substantial doubt as to our ability to continue as a going concern if we are unable to raise additional capital without giving effect to the 2013 financing. Our monthly spending levels vary based on new and ongoing development and corporate activities.

Developing pharmaceutical products, including conducting preclinical studies and clinical trials, is a time-consuming, expensive and uncertain process that takes years to complete. We expect our research and development expenses to substantially increase in connection with our ongoing activities, particularly as we advance development of our lead clinical product candidate, arhalofenate, for the prevention of gout flares and the treatment of hyperuricemia in patients with gout.

In the event CymaBay does not successfully raise sufficient funds in financing(s), its product development activities, particularly related to the development of arhalofenate, will necessarily be curtailed commensurate with the magnitude of the shortfall or may cease altogether. To the extent that the costs of the planned Phase 2b study of arhalofenate in patients with gout exceed current estimates and CymaBay is unable to raise sufficient additional capital to cover such additional costs, CymaBay will need to reduce operating expenses, enter into a collaboration or other similar arrangement with respect to development and/or commercialization rights to arhalofenate, outlicense intellectual property rights to arhalofenate, sell assets or effect a combination of the above. No assurance can be given that CymaBay will be able to effect any of such transactions on acceptable terms, if at all. Failure to progress the development of arhalofenate will have a negative effect on CymaBay’s business, future prospects and ability to obtain further financing on acceptable terms (if at all).

Beyond the plan of operations outlined above, CymaBay’s future funding requirements and sources will depend on many factors, including but not limited to the following:

| • | the rate of progress and cost of its clinical studies, including in particular the Phase 3 studies of arhalofenate; |

| • | the need for additional or expanded clinical studies; |

| • | the rate of progress and cost of its Chemistry, Manufacturing and Control registration and validation program; |

| • | the timing, economic and other terms of any licensing, collaboration or other similar arrangement into which CymaBay may enter; |

| • | the costs and timing of seeking and obtaining FDA and other regulatory approvals; |

6

Table of Contents

| • | the extent of CymaBay’s other development activities; |

| • | the costs of filing, prosecuting, defending and enforcing any patent claims and other intellectual property rights; and |

| • | the effect of competing products and market developments. |

If we are unable to raise additional capital in sufficient amounts or on terms acceptable to us, we will be prevented from pursuing development and commercialization efforts, which will have a material adverse effect on our business, operating results and prospects and on our ability to develop our product candidates.

We have incurred significant losses since our inception. We anticipate that we will continue to incur significant losses for the foreseeable future, and we may never achieve or maintain profitability.

We are a biopharmaceutical company focused primarily on developing our lead product candidate, arhalofenate. We have incurred significant net losses in each year since our inception, including net losses of approximately $6.2 million, $11.3 million and $4.5 million for the nine months ended September 30, 2013, and for the fiscal years ended 2012 and 2011, respectively. As of September 30, 2013, we had an accumulated deficit of $344.9 million.

To date, we have financed our operations primarily through the sale of equity securities, licensing fees, issuance of debt and collaborations with third parties. We have devoted most of our financial resources to research and development, including our preclinical development activities and clinical trials. We have not completed development of any product candidates. We expect to continue to incur significant and increasing losses and negative cash flows for the foreseeable future. The size of our losses will depend, in part, on the rate of future expenditures and our ability to generate revenues. In particular, we expect to incur substantial and increased expenses as we:

| • | continue the development of our lead product candidate, arhalofenate, for the prevention of flares and treatment of hyperuricemia in patients with gout; |

| • | seek to obtain regulatory approvals for arhalofenate; |

| • | prepare for the potential commercialization of arhalofenate; |

| • | scale up manufacturing capabilities to commercialize arhalofenate for any indications for which we receive regulatory approval; |

| • | begin outsourcing of the commercial manufacturing of arhalofenate for any indications for which we receive regulatory approval; |

| • | establish an infrastructure for the sales, marketing and distribution of arhalofenate for any indications for which we receive regulatory approval; |

| • | expand our research and development activities and advance our clinical programs; |

| • | maintain, expand and protect our intellectual property portfolio; |

| • | continue our research and development efforts and seek to discover additional product candidates; and |

| • | add operational, financial and management information systems and personnel, including personnel to support our product development and commercialization efforts and operations as a public company. |

CymaBay does not anticipate that it will generate revenue from the sale of products for the foreseeable future. CymaBay’s ability to become profitable depends upon its ability to generate significant continuing revenues.

7

Table of Contents

In the absence of additional sources of capital, which may not be available to CymaBay on acceptable terms, or at all, the development of arhalofenate or future product candidates may be reduced in scope, delayed or terminated. If CymaBay’s product candidates or those of its collaborators fail in clinical studies or do not gain regulatory approval, or if its future products, if any, do not achieve market acceptance, CymaBay may never become profitable.

Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our failure to become and remain profitable would depress the value of our company and could impair our ability to raise capital, expand our business, diversify our product offerings or continue our operations.

Our ability to generate future revenues from product sales is uncertain and depends upon our ability to successfully develop, obtain regulatory approval for, and commercialize our product candidates.

Our ability to generate revenue and achieve profitability depends on our ability, alone or with collaborators, to successfully complete the development, obtain the necessary regulatory approvals and commercialize our product candidates. We do not anticipate generating revenues from sales of our product candidates for the foreseeable future, if ever. Our ability to generate future revenues from product sales depends heavily on our success in:

| • | obtaining favorable results for and advancing the development of arhalofenate, including successfully initiating and completing our Phase 2b and Phase 3 clinical development; |

| • | obtaining United States (U.S.) and foreign regulatory approvals for arhalofenate; |

| • | launching and commercializing arhalofenate, either on our own or with a partner, including building a sales force and collaborating with third parties; |

| • | achieving broad market acceptance of arhalofenate in the medical community and by third-party payors and patients; and |

| • | generating a pipeline of product candidates. |

Conducting preclinical testing and clinical trials is a time-consuming, expensive and uncertain process that takes years to complete, and we may never generate the necessary data required to obtain regulatory approval and achieve product sales. Our anticipated development costs would likely increase if we do not obtain favorable results or if development of our product candidates is delayed. In particular, we would likely incur higher costs than we currently anticipate if development of our product candidates is delayed because we are required by the U.S. FDA to perform studies or trials in addition to those that we currently anticipate. Because of the numerous risks and uncertainties associated with pharmaceutical product development, we are unable to predict the timing or amount of any increase in our anticipated development costs.

In addition, our product candidates, if approved, may not achieve commercial success. Our commercial revenues, if any, will be derived from sales of products that we do not expect to be commercially available for several years, if at all. Even if one or more of our product candidates is approved for commercial sale, we anticipate incurring significant costs in connection with commercialization. As a result, we cannot assure you that we will be able to generate revenues from sales of any approved product candidates, or that we will achieve or maintain profitability even if we do generate sales.

Raising additional capital may cause dilution to our existing stockholders, restrict our operations or require us to relinquish rights to our technologies or product candidates.

Until such time, if ever, as we can generate substantial product revenues, we expect to finance our cash needs through a combination of equity offerings, debt financings, collaborations, strategic alliances, licensing arrangements and other marketing and distribution arrangements. We do not have any committed external source of funds.

In order to raise additional funds to support our operations, we may sell additional equity or debt securities, enter into collaborations, strategic alliances, or licensing arrangements or other marketing or distribution arrangements. To the extent that we raise additional capital through the sale of equity or convertible debt securities, your ownership interest will be diluted, and the terms

8

Table of Contents

of these securities may include liquidation or other preferences that adversely affect your rights as a stockholder. Debt financing, if available, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures, and declaring dividends, and will impose limitations on our ability to acquire, sell or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business.

If we raise additional funds through collaborations, strategic alliances, or licensing arrangements or other marketing or distribution arrangements with third parties, we may have to relinquish valuable rights to our technologies, future revenue streams, research programs or product candidates, or grant licenses on terms that may not be favorable to us. If we are unable to expand our operations or otherwise capitalize on our business opportunities, our business, financial condition and results of operations could be materially adversely affected and we may not be able to meet our debt service obligations. If we are unable to raise additional funds through equity or debt financings when needed, we may be required to delay, limit, reduce or terminate our product development or commercialization efforts, or grant others rights to develop and market product candidates that we would otherwise prefer to develop and market ourselves.

We are an emerging growth company and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an emerging growth company. Under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We plan to avail ourselves of this exemption from new or revised accounting standards and, therefore, we may not be subject to the same new or revised accounting standards as other public companies that are not “emerging growth companies.”

For as long as we continue to be an emerging growth company, we also intend to take advantage of certain other exemptions from various reporting requirements that are applicable to other public companies including, but not limited to, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, exemptions from the requirements of holding a nonbinding advisory stockholder vote on executive compensation and any golden parachute payments not previously approved, exemption from the requirement of auditor attestation in the assessment of our internal control over financial reporting and exemption from any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (auditor discussion and analysis). If we do, the information that we provide stockholders may be different than what is available with respect to other public companies. We cannot predict if investors will find our common stock less attractive because we will rely on these exemptions. If investors find our common stock less attractive as a result of our status as an emerging growth company, there may be less liquidity for our common stock and our stock price may be more volatile.

We will remain an emerging growth company until the earliest of (i) the end of the fiscal year in which the market value of our common stock that is held by non-affiliates exceeds $700 million as of the end of the second fiscal quarter, (ii) the end of the fiscal year in which we have total annual gross revenues of $1 billion or more during such fiscal year, (iii) the date on which we issue more than $1 billion in non-convertible debt in a three-year period or (iv) the end of the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement filed under the Securities Act.

Risks Related to Clinical Development and Regulatory Approval

We depend on the success of our lead product candidate, arhalofenate, which is still under clinical development, and may not obtain regulatory approval or be successfully commercialized.

We have not marketed, distributed or sold any products. The success of our business depends upon our ability to develop and commercialize our lead product candidate, arhalofenate, which has completed seven Phase 1 and seven Phase 2 clinical trials, including three Phase 2 studies in gout. We plan to conduct a Phase 2b clinical trial for arhalofenate in preventing flares and reducing serum uric acid in gout patients prior to initiation of a Phase 3 program. There is no guarantee that our clinical trials will be completed or, if completed, will be successful. The success of arhalofenate will depend on several factors, including the following:

| • | successful enrollment and completion of clinical trials; |

| • | receipt of marketing approvals from the FDA and regulatory authorities outside the U.S. for our product candidate; |

9

Table of Contents

| • | establishing commercial manufacturing capabilities by making arrangements with third-party manufacturers; |

| • | launching commercial sales of the product, whether alone or in collaboration with others; |

| • | acceptance of the product by patients, the medical community and third-party payors; |

| • | effectively competing with other therapies; |

| • | a continued acceptable safety profile of the product following approval; and |

| • | obtaining, maintaining, enforcing and defending intellectual property rights and claims. |

If we do not achieve one or more of these factors in a timely manner or at all, we could experience significant delays or an inability to successfully commercialize arhalofenate, which would materially harm our business.

We have never obtained regulatory approval for a drug and we may be unable to obtain, or may be delayed in obtaining, regulatory approval for arhalofenate.

We have never obtained regulatory approval for a drug. In the U.S. it is possible that the FDA may refuse to accept our New Drug Application (NDA) for substantive review or may conclude after review of our data that our application is insufficient to obtain regulatory approval of arhalofenate. If the FDA does not accept or approve our NDA, it may require that we conduct additional clinical, nonclinical or manufacturing validation studies and submit that data before it will reconsider our application. Depending on the extent of these or any other FDA required studies, approval of any NDA or application that we submit may be delayed by several years, or may require us to expend more resources than we have available. It is also possible that additional studies, if performed and completed, may not be considered sufficient by the FDA to approve our NDA.

We currently do not know when we might commence our Phase 3 study of arhalofenate or achieve FDA approval of arhalofenate. We currently do not have the capital necessary to conduct or complete our Phase 3 study of arhalofenate and we may not be able to raise sufficient funds necessary to conduct this study. We believe that our existing cash will be sufficient to enable us to complete our Phase 2b study, which we anticipate completing the second quarter of 2015, and will allow us to continue operation through the third quarter of 2015. We currently believe that we will need to raise additional capital to continue our operations beyond the third quarter of 2015.

Any delay in obtaining, or an inability to obtain, regulatory approvals would prevent us from commercializing arhalofenate, generating revenues and achieving and sustaining profitability. If any of these outcomes occur, we may be forced to abandon our development efforts for arhalofenate, which would have a material adverse effect on our business and could potentially cause us to cease operations.

We depend on the successful completion of clinical trials for our product candidates, including arhalofenate. The positive clinical results obtained for our product candidates in prior clinical studies may not be repeated in future clinical studies.

Before obtaining regulatory approval for the sale of our product candidates, including arhalofenate, we must conduct additional clinical trials to demonstrate the safety and efficacy of our product candidates in humans. Clinical testing is expensive, difficult to design and implement, can take many years to complete and is uncertain as to outcome. A failure of one or more of our clinical trials can occur at any stage of testing. The outcome of preclinical testing and early clinical trials may not be predictive of the success of later clinical trials, and interim results of a clinical trial do not necessarily predict final results. Moreover, preclinical and clinical data are often susceptible to varying interpretations and analyses, and many companies that have believed their product candidates performed satisfactorily in preclinical studies and clinical trials have nonetheless failed to obtain marketing approval for their products.

We have completed three Phase 2 clinical studies of arhalofenate in gout. In addition, six clinical studies with MBX-8025 and five clinical studies with MBX-2982 have been completed. However, we have never conducted a Phase 3 clinical trial. The positive results we have seen to date in our Phase 2 clinical trials of arhalofenate for gout do not ensure that later clinical trials will

10

Table of Contents

demonstrate similar results. Product candidates in later stages of clinical trials may fail to show the desired safety and efficacy characteristics despite having progressed satisfactorily through preclinical studies and initial clinical testing. A number of companies in the pharmaceutical and biotechnology industries, including those with greater resources and experience, have suffered significant setbacks in Phase 3 clinical development, even after seeing promising results in earlier clinical trials.

We may experience a number of unforeseen events during clinical trials for our product candidates, including arhalofenate, that could delay or prevent the commencement and/or completion of our clinical trials, including the following:

| • | regulators or institutional review boards may not authorize us or our investigators to commence a clinical trial or conduct a clinical trial at a prospective trial site; |

| • | the clinical study protocol may require one or more amendments delaying study completion; |

| • | clinical trials of our product candidates may produce negative or inconclusive results, and we may decide, or regulators may require us, to conduct additional clinical trials or abandon product development programs; |

| • | the number of subjects required for clinical trials of our product candidates may be larger than we anticipate, enrollment in these clinical trials may be insufficient or slower than we anticipate or subjects may drop out of these clinical trials at a higher rate than we anticipate; |

| • | clinical investigators or study subjects fail to comply with clinical study protocols; |

| • | trial conduct and data analysis errors may occur, including, but not limited to, data entry and/or labeling errors; |

| • | our third-party contractors may fail to comply with regulatory requirements or meet their contractual obligations to us in a timely manner, or at all; |

| • | we might have to suspend or terminate clinical trials of our product candidates for various reasons, including a finding that the subjects are being exposed to unacceptable health risks; |

| • | regulators or institutional review boards may require that we or our investigators suspend or terminate clinical research for various reasons, including noncompliance with regulatory requirements; |

| • | the cost of clinical trials of our product candidates may be greater than we anticipate; |

| • | the supply or quality of our clinical trial materials or other materials necessary to conduct clinical trials of our product candidates may be insufficient or inadequate; and |

| • | our product candidates may have undesirable side effects or other unexpected characteristics, causing us or our investigators to suspend or terminate the trials. |

We expect our research and development expenses to increase in connection with our ongoing activities, particularly if we commence a Phase 3 clinical trial with arhalofenate and undertake additional clinical trials of our other product candidates MBX-8025 and MBX-2982. Before we commence a Phase 3 clinical trial for arhalofenate, we will need to raise substantial additional capital. We also will need to raise substantial additional capital in the future to complete the development and commercialization of MBX-8025 and MBX-2982, for which we currently have no planned clinical trials. Because successful development of our product candidates is uncertain, we are unable to estimate the actual funds required to complete research and development and commercialize our products under development.

Negative or inconclusive results of our future clinical trials of arhalofenate, or any other clinical trial we conduct, could cause the FDA to require that we repeat or conduct additional clinical studies. Despite the results reported in earlier clinical trials for arhalofenate, we do not know whether any clinical trials we may conduct will demonstrate adequate efficacy and safety to result in regulatory approval to market our product candidates, including arhalofenate. If later stage clinical trials do not produce favorable results, our ability to obtain regulatory approval for our product candidates, including arhalofenate, may be adversely impacted.

11

Table of Contents

We have never conducted a clinical trial of arhalofenate as a monotherapy for the treatment of gout flares. If arhalofenate does not demonstrate efficacy in the treatment of such flares in our planned Phase 2b clinical trial, our ability to successfully commercialize arhalofenate may be adversely affected.

We have not previously conducted a clinical trial of arhalofenate for the purpose of measuring its effect on flare reduction and control without the use of colchicine. We plan to conduct a Phase 2b clinical trial to investigate the potential benefit of arhalofenate monotherapy with regard to flare prevention and serum uric acid (sUA) lowering. In addition, our Phase 2b study will investigate the benefits of two doses of arhalofenate monotherapy, including a higher dose than we studied in previous gout studies, without colchicine. If we do not obtain favorable efficacy and safety results in the Phase 2b trial, our ability to successfully market arhalofenate could be adversely affected.

Delays in clinical trials are common and have many causes, and any delay could result in increased costs to us and jeopardize or delay our ability to obtain regulatory approval and commence product sales.

Clinical testing is expensive, difficult to design and implement, can take many years to complete, and is uncertain as to outcome. We may experience delays in clinical trials at any stage of development and testing of our product candidates. Our planned clinical trials may not begin on time, have an effective design, enroll a sufficient number of subjects, or be completed on schedule, if at all.

Events which may result in delays or unsuccessful completion of clinical trials, including our future clinical trials for arhalofenate, include the following:

| • | inability to raise funding necessary to initiate or continue a trial; |

| • | delays in obtaining regulatory approval to commence a trial; |

| • | delays in reaching agreement with the FDA on final trial design; |

| • | imposition of a clinical hold following an inspection of our clinical trial operations or trial sites by the FDA or other regulatory authorities; |

| • | delays in reaching agreement on acceptable terms with prospective contract research organizations (CROs) and clinical trial sites; |

| • | delays in obtaining required institutional review board (IRB) approval at each site; |

| • | delays in recruiting suitable patients to participate in a trial; |

| • | delays in having subjects complete participation in a trial or return for post-treatment follow-up; |

| • | delays caused by subjects dropping out of a trial due to side effects or otherwise; |

| • | delays caused by clinical sites dropping out of a trial; |

| • | time required to add new clinical sites; and |

| • | delays by our contract manufacturers to produce and deliver sufficient supply of clinical trial materials. |

If initiation or completion of any of our clinical trials for our product candidates, including arhalofenate, are delayed for any of the above reasons, our development costs may increase, the approval process could be delayed, any periods during which we may

12

Table of Contents

have the exclusive right to commercialize our product candidates may be reduced and our competitors may bring products to market before us. Any of these events could impair our ability to generate revenues from product sales and impair our ability to generate regulatory and commercialization milestones and royalties, all of which could have a material adverse effect on our business.

Our product candidates may cause adverse effects or have other properties that could delay or prevent their regulatory approval or limit the scope of any approved label or market acceptance.

Arhalofenate has been studied in a total of 15 clinical trials with nearly a thousand subjects. The emergence of adverse events (AEs) caused by arhalofenate in future studies could cause us, other reviewing entities, clinical study sites or regulatory authorities to interrupt, delay or halt clinical studies and could result in the denial of regulatory approval. There is also a risk that our other product candidates may induce AEs, many of which may be unknown at this time. If an unacceptable frequency and/or severity of AEs are reported in our clinical trials for our product candidates, our ability to obtain regulatory approval for product candidates, including arhalofenate, may be negatively impacted.

Furthermore, if any of our approved products cause serious or unexpected side effects after receiving market approval, a number of potentially significant negative consequences could result, including the following:

| • | regulatory authorities may withdraw their approval of the product or impose restrictions on its distribution in a form of a modified risk evaluation and mitigation strategy; |

| • | regulatory authorities may require the addition of labeling statements, such as warnings or contraindications that could diminish the usage of the product or otherwise limit the commercial success of the affected product; |

| • | we may be required to change the way the product is administered or to conduct additional clinical studies; |

| • | we may choose to discontinue sale of the product; |

| • | we could be sued and held liable for harm caused to patients; and |

| • | our reputation may suffer. |

Any of these events could prevent us from achieving or maintaining market acceptance of the affected product candidate and could substantially increase the costs of commercializing our product candidates.

If any product candidate that CymaBay successfully develops does not achieve broad market acceptance among physicians, patients, health care payors and the medical community, the revenues that it generates from its sales will be limited.

Even if arhalofenate or any other product candidates receive regulatory approval, the products may not gain market acceptance among physicians, patients, health care payors and the medical community. Coverage and reimbursement of CymaBay’s product candidates by third-party payors, including government payors, generally is also necessary for commercial success. The degree of market acceptance of any of CymaBay’s approved products will depend upon a number of factors, including:

| • | the efficacy and safety, as demonstrated in clinical studies; |

| • | the risk/benefit profile of CymaBay’s products such as arhalofenate; |

| • | the prevalence and severity of any side effects; |

| • | the clinical indications for which the product is approved; |

| • | acceptance of the product by physicians, other health care providers and patients as a safe and effective treatment; |

13

Table of Contents

| • | the potential and perceived advantages of product candidates over alternative treatments; |

| • | the safety of product candidates seen in a broader patient group, including its use outside the approved indications; |

| • | the cost of treatment in relation to alternative treatments; |

| • | the timing of market introduction of competitive products; |

| • | the availability of adequate reimbursement and pricing by third parties and government authorities; |

| • | relative convenience and ease of administration; and |

| • | the effectiveness of CymaBay’s or its partners’ sales, marketing and distribution efforts. |

If any product candidate is approved but does not achieve an adequate level of acceptance by physicians, hospitals, health care payors and patients, CymaBay may not generate sufficient revenue from these products and CymaBay may not become or remain profitable.

Potential conflicts of interest arising from relationships and any related compensation with respect to clinical studies could adversely affect the process.

Principal investigators for CymaBay’s clinical studies may serve as scientific advisors or consultants to CymaBay from time to time and receive cash compensation in connection with such services. If these relationships and any related compensation result in perceived or actual conflicts of interest, the integrity of the data generated at the applicable clinical study site may be questioned or jeopardized.

CymaBay may be subject to costly claims related to its clinical studies and may not be able to obtain adequate insurance.

Because CymaBay conducts clinical studies in humans, CymaBay faces the risk that the use of arhalofenate or future product candidates, will result in adverse side effects. CymaBay cannot predict the possible harms or side effects that may result from its clinical studies. Although CymaBay has clinical study liability insurance, CymaBay’s insurance may be insufficient to cover any such events. There is also a risk that CymaBay may not be able to continue to obtain clinical study coverage on acceptable terms. In addition, CymaBay may not have sufficient resources to pay for any liabilities resulting from a claim excluded from, or beyond the limit of, CymaBay’s insurance coverage. There is also a risk that third parties that CymaBay has agreed to indemnify could incur liability. Any litigation arising from its clinical studies, even if CymaBay is ultimately successful, would consume substantial amounts of CymaBay’s financial and managerial resources and may create adverse publicity.

After the completion of our clinical trials, we cannot predict whether or when we will obtain regulatory approval to commercialize arhalofenate and we cannot, therefore, predict the timing of any future revenue from arhalofenate. Regulatory approval of an NDA is not guaranteed, and the approval process is expensive, uncertain and lengthy.

We cannot commercialize our product candidates, including arhalofenate until the appropriate regulatory authorities, such as the FDA, have reviewed and approved the product candidate. The regulatory agencies may not complete their review processes in a timely manner, or we may not be able to obtain regulatory approval for arhalofenate. Additional delays may result if arhalofenate is brought before an FDA advisory committee, which could recommend restrictions on approval or recommend non-approval of the product candidate. In addition, we may experience delays or rejections based upon additional government regulation from future legislation or administrative action, or changes in regulatory agency policy during the period of product development, clinical studies and the review process. As a result, we cannot predict when, if at all, we will receive any future revenue from commercialization of any of our product candidates, including arhalofenate. The FDA has substantial discretion in the drug approval process, including the ability to delay, limit or deny approval of a product candidate for many reasons, including the following:

| • | CymaBay may be unable to demonstrate to the satisfaction of regulatory authorities that a product candidate is safe and effective for any indication; |

14

Table of Contents

| • | regulatory authorities may not find the data from nonclinical studies and clinical studies sufficient or may differ in the interpretation of the data; |

| • | regulatory authorities may require additional nonclinical or clinical studies; |

| • | the FDA or foreign regulatory authority might not approve CymaBay’s third party manufacturers’ processes or facilities for clinical or commercial product; |

| • | the FDA or foreign regulatory authority may change its approval policies or adopt new regulations; |

| • | the FDA or foreign regulatory authorities may disagree with the design or implementation of CymaBay’s clinical studies; |

| • | the FDA or foreign regulatory authority may not accept clinical data from studies that are conducted in countries where the standard of care is potentially different from that in the U.S.; |

| • | the results of clinical studies may not meet the level of statistical significance required by the FDA or foreign regulatory authorities for approval; |

| • | CymaBay may be unable to demonstrate that a product candidate’s clinical and other benefits outweigh its safety risks; and |

| • | the data collection from clinical studies of CymaBay’s product candidates may not be sufficient to support the submission of a NDA or other submission or to obtain regulatory approval in the U.S. or elsewhere. |

In addition, events raising questions about the safety of certain marketed pharmaceuticals may result in increased caution by the FDA and other regulatory authorities in reviewing new pharmaceuticals based on safety, efficacy or other regulatory considerations and may result in significant delays in obtaining regulatory approvals.

Even if we obtain regulatory approval for arhalofenate and our other product candidates, we will still face extensive regulatory requirements and our products may face future development and regulatory difficulties.

Even if we obtain regulatory approval in the U.S., the FDA may still impose significant restrictions on the indicated uses or marketing of our product candidates, including arhalofenate, or impose ongoing requirements for potentially costly post-approval studies or post-market surveillance. For example, the labeling ultimately approved for our product candidates, including arhalofenate, may include restrictions on use due to the specific patient population and manner of use in which the drug was evaluated and the safety and efficacy data obtained in those evaluations.

Arhalofenate and our other product candidates will also be subject to additional ongoing FDA requirements governing the labeling, packaging, storage, distribution, safety surveillance, advertising, promotion, record-keeping and reporting of safety and other post-market information. The holder of an approved NDA is obligated to monitor and report AEs and any failure of a product to meet the specifications in the NDA. The holder of an approved NDA must also submit new or supplemental applications and obtain FDA approval for certain changes to the approved product, product labeling or manufacturing process. Advertising and promotional materials must comply with FDA rules and are subject to FDA review, in addition to other potentially applicable federal and state laws. Furthermore, promotional materials must be approved by the FDA prior to use for any drug receiving accelerated approval, the pathway we are pursuing for arhalofenate in the U.S.

In addition, manufacturers of drug products and their facilities are subject to payment of user fees and continual review and periodic inspections by the FDA and other regulatory authorities for compliance with current Good Manufacturing Practices (cGMP), and adherence to commitments made in the NDA. If we, or a regulatory agency, discover previously unknown problems with a product, such as quality issues or AEs of unanticipated severity or frequency, or problems with the facility where the product is manufactured, a regulatory agency may impose restrictions relative to that product or the manufacturing facility, including requiring recall or withdrawal of the product from the market or suspension of manufacturing.

15

Table of Contents

If we, or our third party contractors, fail to comply with applicable regulatory requirements following approval of our product candidate, a regulatory agency may:

| • | issue an untitled or warning letter asserting violation of the law; |

| • | seek an injunction or impose civil or criminal penalties or monetary fines; |

| • | suspend or withdraw regulatory approval; |

| • | suspend any ongoing clinical trials; |

| • | refuse to approve a pending NDA or supplements to an NDA; or |

| • | recall and/or seize product. |

Any government investigation of alleged violations of law could require us to expend significant time and resources in response and could generate negative publicity. The occurrence of any event or penalty described above may inhibit our ability to commercialize arhalofenate and our other product candidates and inhibit our ability to generate revenues.

Even if we obtain FDA approval for arhalofenate or any of our other products in the U.S., we may never obtain approval for or commercialize arhalofenate or any of our other products outside of the U.S., which would limit our ability to realize their full market potential.

In order to market any products outside of the U.S., we must establish and comply with numerous and varying regulatory requirements on a country-by-country basis regarding safety and efficacy. Approval by the FDA does not ensure approval by regulatory authorities in other countries or jurisdictions. In addition, clinical trials conducted in one country may not be accepted by regulatory authorities in other countries, and regulatory approval in one country does not guarantee regulatory approval in any other country. Approval processes vary among countries and can involve additional product testing and validation and additional administrative review periods. Seeking foreign regulatory approval could result in difficulties and costs for us and require additional preclinical studies or clinical trials which could be costly and time consuming. Regulatory requirements can vary widely from country to country and could delay or prevent the introduction of our products in those countries. We do not have any product candidates approved for sale in any jurisdiction, including international markets, and we do not have experience in obtaining regulatory approval in international markets. If we fail to comply with regulatory requirements in international markets or to obtain and maintain required approvals, or if regulatory approvals in international markets are delayed, our target market will be reduced and our ability to realize the full market potential of our products will be unrealized.

Our relationships with customers and payors will be subject to applicable anti-kickback, fraud and abuse and other health care laws and regulations, which could expose us to criminal sanctions, civil penalties, contractual damages, reputational harm and diminished profits and future earnings.

Health care providers, physicians and others play a primary role in the recommendation and prescription of any products for which we obtain marketing approval. Our future arrangements with third-party payors and customers may expose us to broadly applicable fraud and abuse and other health care laws and regulations that may constrain the business or financial arrangements and relationships through which we market, sell and distribute our products for which we obtain marketing approval. Restrictions under applicable federal and state health care laws and regulations, include the following:

| • | the federal health care anti-kickback statute prohibits, among other things, persons from knowingly and willfully soliciting, offering, receiving or providing remuneration, directly or indirectly, in cash or in kind, to induce or reward either the referral of an individual for, or the purchase, order or recommendation of, any good or service, for which payment may be made under federal health care programs such as Medicare and Medicaid; |

| • | the federal False Claims Act imposes criminal and civil penalties, including civil whistleblower or qui tam actions, against individuals or entities for knowingly presenting, or causing to be presented, to the federal government, claims for payment that are false or fraudulent or making a false statement to avoid, decrease or conceal an obligation to pay money to the federal government; |

16

Table of Contents

| • | the federal Health Insurance Portability and Accountability Act of 1996, as amended by the Health Information Technology for Economic and Clinical Health Act, imposes criminal and civil liability for executing a scheme to defraud any health care benefit program and also imposes obligations, including mandatory contractual terms, with respect to safeguarding the privacy, security and transmission of individually identifiable health information; |

| • | the federal false statements statute prohibits knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false statement in connection with the delivery of or payment for health care benefits, items or services; |

| • | the federal transparency requirements under the Health Care and Education Reconciliation Act of 2010 (Health Care Reform Law) require manufacturers of drugs, devices, biologics and medical supplies to report to the Department of Health and Human Services information related to physician payments and other transfers of value and physician ownership and investment interests; and |

| • | analogous state laws and regulations, such as state anti-kickback and false claims laws, may apply to sales or marketing arrangements and claims involving health care items or services reimbursed by non-governmental third-party payors, including private insurers, and some state laws require pharmaceutical companies to comply with the pharmaceutical industry’s voluntary compliance guidelines and the relevant compliance guidance promulgated by the federal government in addition to requiring manufacturers to report information related to payments to physicians and other health care providers or marketing expenditures. |

Efforts to ensure that our business arrangements with third parties will comply with applicable health care laws and regulations will involve substantial costs. It is possible that governmental authorities will conclude that our business practices may not comply with current or future statutes, regulations or case law involving applicable fraud and abuse or other health care laws and regulations. If our operations are found to be in violation of any of these laws or any other governmental regulations that may apply to us, we may be subject to significant civil, criminal and administrative penalties, damages, fines, exclusion from government funded health care programs, such as Medicare and Medicaid, and the curtailment or restructuring of our operations. If any of the physicians or other providers or entities with whom we expect to do business are found to be not in compliance with applicable laws, they may be subject to criminal, civil or administrative sanctions, including exclusions from government funded health care programs.

Recently enacted and future legislation may increase the difficulty and cost for us to obtain marketing approval of and commercialize our product candidates and affect the prices we may obtain.

In the U.S. and some foreign jurisdictions, there have been a number of legislative and regulatory changes and proposed changes regarding the health care system that could prevent or delay marketing approval of our product candidates, restrict or regulate post-approval activities and affect our ability to profitably sell any products for which we obtain marketing approval.

In the U.S., the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (Medicare Modernization Act) changed the way Medicare covers and pays for pharmaceutical products. The legislation expanded Medicare coverage for drug purchases by the elderly and introduced a new reimbursement methodology based on average sales prices for physician administered drugs. In addition, this legislation provided authority for limiting the number of drugs that will be covered in any therapeutic class. Cost reduction initiatives and other provisions of this legislation could decrease the coverage and price that we receive for any approved products. While the Medicare Modernization Act applies only to drug benefits for Medicare beneficiaries, private payors often follow Medicare coverage policy and payment limitations in setting their own reimbursement rates. Therefore, any reduction in reimbursement that results from the Medicare Modernization Act may result in a similar reduction in payments from private payors.

More recently, in March 2010, the Health Care Reform Law was enacted to broaden access to health insurance, reduce or constrain the growth of health care spending, enhance remedies against fraud and abuse, add new transparency requirements for health care and health insurance industries, impose new taxes and fees on the health industry and impose additional health policy reforms. The Health Care Reform Law revises the definition of “average manufacturer price” for reporting purposes, which could increase the amount of Medicaid drug rebates to states. Further, the new law imposes a significant annual fee on companies that manufacture or

17

Table of Contents

import branded prescription drug products. New provisions affecting compliance have also been enacted, which may affect our business practices with health care practitioners. We will not know the full effects of the Health Care Reform Law until applicable federal and state agencies issue regulations or guidance under the new law. Although it is too early to determine the effect of the Health Care Reform Law, the new law appears likely to continue the pressure on pharmaceutical pricing, especially under the Medicare program, and may also increase our regulatory burdens and operating costs.

Legislative and regulatory proposals have been made to expand post-approval requirements and restrict sales and promotional activities for pharmaceutical products. We are not sure whether additional legislative changes will be enacted, or whether the FDA regulations, guidance or interpretations will be changed, or what the impact of such changes on the marketing approvals of our product candidates, if any, may be.

Risks Related to Our Reliance on Third Parties

We rely on third-party manufacturers to produce our preclinical and clinical drug supplies, and we intend to rely on third parties to produce commercial supplies of any approved product candidates.

We do not own or operate, and we do not expect to own or operate, facilities for product manufacturing, storage and distribution, or testing. In the past we have relied on third-party manufacturers for supply of our preclinical and clinical drug supplies. We expect that in the future we will continue to rely on such manufacturers for drug supplies that will be used in clinical trials of our product candidates, including arhalofenate, and for commercialization of any of our product candidates that receive regulatory approval.