Attached files

| file | filename |

|---|---|

| 8-K - MAINBODY - Xenetic Biosciences, Inc. | mainbody.htm |

| EX-9.2 - EX9_2 - Xenetic Biosciences, Inc. | ex9_2.htm |

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. PART 2 (EXPLANATORY STATEMENT) OF THIS DOCUMENT COMPRISES AN EXPLANATORY STATEMENT IN COMPLIANCE WITH SECTION 897 OF THE COMPANIES ACT 2006. THIS DOCUMENT CONTAINS DETAILS OF A PROPOSED ACQUISITION WHICH, IF IMPLEMENTED, WILL RESULT IN THE CANCELLATION OF THE XENETIC SHARES FROM ADMISSION TO TRADING ON AIM, A MARKET OPERATED BY THE LONDON STOCK EXCHANGE.

If you are in any doubt as to the action you should take, you are recommended to seek your own professional advice immediately from your stockbroker, bank manager, solicitor, accountant, tax adviser or other independent financial adviser who, if you are in the United Kingdom, should be authorised under the Financial Services and Markets Act 2000 (as amended), or from another appropriately authorised independent financial adviser if you are in a territory outside the United Kingdom.

If you have sold or otherwise transferred all your Shares, please forward this document (together with the related Forms of Proxy) at once to the purchaser or transferee, or to the stockbroker, bank or other agent through whom the sale or transfer was effected, for delivery to the purchaser or transferee. However, these documents should not be forwarded or transmitted in or into any jurisdiction in which such act would constitute a violation of the relevant laws in such jurisdiction. If you have sold or transferred only part of your holding of Shares, please retain these documents and consult the bank, stockbroker or other agent through whom the sale or transfer was effected.

The distribution of this document and the accompanying documents in jurisdictions other than the United Kingdom may be restricted by law and therefore persons into whose possession this document and the accompanying documents come should inform themselves about and observe any such restrictions. Any failure to comply with any such restrictions may constitute a violation of the securities laws of any such jurisdiction.

GSL’s common stock is quoted on OTCBB operated by the Financial Industry Regulatory Authority, Inc. (“FINRA”) and the OTCQB operated by OTC Markets Group, Inc. It is expected that quotation of the GSL Consideration Shares will become effective subject to the satisfaction of certain conditions, including the sanction of the Scheme by the Court, on 27 January 2014.

Shareholders should carefully read the whole of this document. In addition this document should be read in conjunction with the relevant sections of the documents listed as incorporated by reference on page 52, and the accompanying blue and white Forms of Proxy.

RECOMMENDED ACQUISITION

of

XENETIC BIOSCIENCES PLC

(Incorporated in England and Wales under the Companies Act 1985 with registered number 03213174)

by

GENERAL SALES & LEASING, INC.

(to be effected by a scheme of arrangement under Part 26 of the Companies Act 2006)

This document should be read as a whole. Your attention is drawn to the letter from the Chairman of Xenetic set out in Part 1 of this document, which contains the recommendation of the Xenetic Directors (save for Roman Knyazev) that you vote in favour of the Scheme at the Court Meeting and in favour of the Special Resolution to be proposed at the General Meeting. A letter from London Bridge Capital explaining the Acquisition appears in Part 2 of this document and constitutes an explanatory statement in accordance with section 897 of the Companies Act.

Notices of the Meetings, each of which will be held at the offices of Pinsent Masons LLP, 30 Crown Place, London EC2A 4ES, United Kingdom, on 17 December 2013, are set out at the end of this document. The Court Meeting will start at 10.00 a.m. GMT and the General Meeting will start at 10.30 a.m.GMT (or as soon thereafter as the Court Meeting shall have been concluded or adjourned).

Capitalised words and phrases used in this document have the meanings given to them in Part 9 of this document.

IMPORTANT NOTICE

The distribution of this document and/or the accompanying documents in jurisdictions other than the United Kingdom may be restricted by law and therefore persons into whose possession this document and the accompanying documents come should inform themselves about, and observe, such restrictions. Any failure to comply with the restrictions may constitute a violation of the securities laws of any such jurisdiction. Neither this document nor the accompanying documents constitute an offer or an invitation to purchase any securities or a solicitation of an offer to sell any securities pursuant to these documents or otherwise in any jurisdiction in which such offer or solicitation is unlawful. This document and the accompanying documents have been prepared in connection with a proposal in relation to a scheme of arrangement pursuant to and for the purpose of complying with English law and the Code and information disclosed may not be the same as that which would have been prepared in accordance with laws of jurisdictions outside England and Wales. Nothing in this document or the accompanying documents should be relied on for any other purpose.

The statements contained herein are made as at the date of this document, unless some other time is specified in relation to them, and service of this document will not give rise to any implication that there has been no change in the facts set forth herein since such date. Nothing contained herein will be deemed to be a forecast, projection or estimate of the future financial performance of the Company, the Xenetic Group, GSL or the GSL Group.

No person has been authorised to make representations on behalf of the Company or GSL concerning the Acquisition or the Scheme which are inconsistent with the statements contained in this document and any such representations, if made, may not be relied upon as having been so authorised. The summaries of the principal provisions of the Scheme contained in this document are qualified in their entirety by reference to the Scheme itself, the full text of which is set out in Part 4 of this document. Each Shareholder is advised to read and consider carefully the text of the Scheme itself.

No person should construe the contents of this document as legal, financial or tax advice but should consult their own advisers in connection with the matters contained herein, including without limitation in relation to holding US securities.

London Bridge Capital Limited, which is authorised and regulated in the United Kingdom by the Financial Conduct Authority, is acting exclusively for the Company as its financial adviser and no one else in connection with the Acquisition and will not be responsible to anyone other than the Company for providing the protections afforded to clients of London Bridge Capital Limited nor for providing advice in connection with the Acquisition or the content of, or any other matter or arrangement described or referred to in, this document. Neither London Bridge Capital Limited nor any of its directors, officers, subsidiaries or affiliates owes or accepts any duty, liability or responsibility whatsoever (whether direct or indirect, whether in contract, in tort, under statute or otherwise) to any person who is not a client of London Bridge Capital Limited in connection with the Acquisition or any other matter referred to in this document, any statement contained herein or otherwise.

N+1 Singer, which is authorised and regulated in the United Kingdom by the Financial Conduct Authority, is acting exclusively for the Company as its nominated adviser and broker only and no one else in connection with the Acquisition and will not be responsible to anyone other than the Company for providing the protections afforded to clients of N+1 Singer nor for providing advice in connection with the Acquisition or the content of, or any other matter or arrangement described or referred to in, this document. Neither N+1 Singer nor any of their respective directors, officers, subsidiaries or affiliates owes or accepts any duty, liability or responsibility whatsoever (whether direct or indirect, whether in contract, in tort, under statute or otherwise) to any person who is not a client of N+1 Singer in connection with the Acquisition or any other matter referred to in this document, any statement contained herein or otherwise.

Please be aware that addresses, electronic addresses and certain other information provided by Xenetic Shareholders, persons with information rights and other relevant persons in connection with the receipt of communications from Xenetic may be provided to GSL during the Offer Period as required under Section 4 of Appendix 4 to the City Code.

| 2 |

This document has been prepared for the purposes of complying with English law and the information disclosed may be different from that which would have been disclosed if this document had been prepared in accordance with the laws of jurisdictions outside England and Wales. Overseas Shareholders should consult their own legal and tax advisers with regard to the legal and tax consequences of the Scheme and the Acquisition on their particular circumstances.

The release, publication or distribution of this document in jurisdictions other than the United Kingdom and the availability of any offer to shareholders in Xenetic who are not resident in the United Kingdom may be affected by the laws or regulations of any such jurisdictions. Accordingly, any persons who are subject to the laws or regulations of any jurisdiction other than the United Kingdom should inform themselves of, and observe, any applicable requirements.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This document contains statements about Xenetic and GSL that are or may be forward-looking statements. All statements other than statements of historical facts included in this document may be forward-looking statements. Without limitation, any statements preceded or followed by or that include the words “targets”, “plans”, “believes”, “expects”, “aims”, “intends”, “will”, “may”, “anticipates”, “estimates”, “projects” or words or terms of similar substance or the negative thereof, are forward-looking statements. Forward-looking statements include statements relating to the following: (i) future capital expenditures, expenses, revenues, earnings, synergies, economic performance, indebtedness, financial condition, dividend policy, losses and future prospects; (ii) business and management strategies and the expansion and growth of Xenetic’s or GSL operations; and (iii) the effects of government or stock exchange regulation on Xenetic’s or GSL’s business or securities.

Such forward-looking statements involve risks and uncertainties that could significantly affect expected results and are based on certain key assumptions. Many factors could cause actual results to differ materially from those projected or implied in any forward-looking statements. Due to such uncertainties and risks, readers are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date hereof. Each of Xenetic and GSL disclaims any obligation to update any forward-looking or other statements contained in this document, except as required by applicable law.

DISCLOSURE REQUIREMENTS OF THE CITY CODE

Under Rule 8.3(a) of the Code, any person who is interested in 1 per cent. or more of any class of relevant securities of an offeree company or of any securities exchange offeror (being any offeror other than an offeror in respect of which it has been announced that its offer is, or is likely to be, solely in cash) must make an Opening Position Disclosure following the commencement of the offer period and, if later, following the announcement in which any securities exchange offeror is first identified.

An Opening Position Disclosure must contain details of the person’s interests and short positions in, and rights to subscribe for, any relevant securities of each of (i) the offeree company and (ii) any securities exchange offeror(s). An Opening Position Disclosure by a person to whom Rule 8.3(a) applies must be made by no later than 3.30 pm (London time) on the 10th business day following the commencement of the offer period and, if appropriate, by no later than 3.30 p.m. (London time) on the 10th business day following the announcement in which any securities exchange offeror is first identified. Relevant persons who deal in the relevant securities of the offeree company or of a securities exchange offeror prior to the deadline for making an Opening Position Disclosure must instead make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes, interested in 1 per cent. or more of any class of relevant securities of the offeree company or of any securities exchange offeror must make a Dealing Disclosure if the person deals in any relevant securities of the offeree company or of any securities exchange offeror. A Dealing Disclosure must contain details of the dealing concerned and of the person’s interests and short positions in, and rights to subscribe for, any relevant securities of each of (i) the offeree company and (ii) any securities exchange offeror, save to the extent that these details have previously been disclosed under Rule 8. A Dealing Disclosure by a person to whom Rule 8.3(b) applies must be made by no later than 3.30 p.m. (London time) on the business day following the date of the relevant dealing.

| 3 |

If two or more persons act together pursuant to an agreement or understanding, whether formal or informal, to acquire or control an interest in relevant securities of an offeree company or a securities exchange offeror, they will be deemed to be a single person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree company and by any offeror and Dealing Disclosures must also be made by the offeree company, by any offeror and by any persons acting in concert with any of them (see Rules 8.1, 8.2 and 8.4). Opening Position Disclosures have already been made both by GSL and by Xenetic.

Details of the offeree and offeror companies in respect of whose relevant securities Opening Position Disclosures and Dealing Disclosures must be made can be found in the Disclosure Table on the Takeover Panel’s website at www.thetakeoverpanel.org.uk, including details of the number of relevant securities in issue, when the offer period commenced and when any offeror was first identified. You should contact the Panel’s Market Surveillance Unit on +44 (0)20 7638 0129 if you are in any doubt as to whether you are required to make an Opening Position Disclosure or a Dealing Disclosure.

NOTICE TO OVERSEAS SHAREHOLDERS

The implications of the Scheme and the Acquisition for Overseas Shareholders may be affected by the laws of the relevant jurisdictions. Overseas Shareholders should inform themselves about and observe any applicable legal requirements. It is the responsibility of each Overseas Shareholder to satisfy himself as to the full observance of the laws of the relevant jurisdiction in connection therewith, including the obtaining of any governmental, exchange control or other consents which may be required, or the compliance with other necessary formalities which are required to be observed and the payment of any issue, transfer or other taxes due in such jurisdiction.

The Acquisition relates to the acquisition of shares in a UK public company and is proposed to be made by means of a scheme of arrangement under Part 26 of the Companies Act. In particular, with respect to investors in the United States, a transaction effected by means of a scheme of arrangement is not subject to the tender offer rules under the US Exchange Act. Accordingly, the Scheme is subject to the disclosure requirements, rules and practices applicable in the United Kingdom to schemes of arrangement, which differ from the requirements of US tender offer rules. Financial information on the Xenetic Group included in the relevant documentation has been prepared in accordance with accounting standards applicable to listed companies in the UK, being IFRS as adopted by the European Union. These may not be comparable to the financial statements of US companies.

Overseas Shareholders in the United States should note the matters set forth in paragraph 17 of Part 2 of this document.

The terms of the Scheme are set out in full in Part 4 of this document. The purpose of the Scheme is to enable GSL to become the owner of the entire issued and to be issued share capital of the Company. This is to be achieved by the cancellation of the Scheme Shares held by Scheme Shareholders and the application of the reserve arising from such cancellation in paying up in full New Shares which have an aggregate nominal value equal to the aggregate nominal value of the Scheme Shares cancelled and issuing the same to GSL. Scheme Shareholders will then receive 56 GSL Consideration Shares for every 175 Scheme Shares held by them on the basis of the Acquisition (as is more fully described herein).

As a result of the Scheme, Scheme Shareholders will be acquiring GSL Consideration Shares from General Sales & Leasing, Inc., a Nevada corporation, in accordance with United States securities laws and the Equivalent Document.

The GSL Consideration Shares to be issued under the Scheme have not been, and will not be, registered under the US Securities Act of 1933, as amended (the “Securities Act”), or under the securities laws of any state, district or other jurisdiction of the United States, the Republic of South Africa, Canada or Japan.

It is expected that the GSL Consideration Shares will be issued in reliance upon the exemption from the registration requirements of the Securities Act provided by Section 3(a)(10) thereof on the basis of the Court Meeting, which will consider, among other things, the fairness of the terms of the Scheme. Under applicable US securities laws, shareholders who are or will be deemed to be affiliates of Xenetic or GSL, prior to or after the Effective Date, will be subject to certain transaction restrictions relating to the GSL Consideration Shares received in connection with the Scheme.

| 4 |

PUBLICATION ON WEBSITE

A copy of this document is, and will be available, free of charge for inspection on the Company’s website at www.xeneticbio.com/investorrelations during the course of the Acquisition but should not be forwarded or transmitted in or into or from any Overseas Jurisdiction.

For the avoidance of doubt, the content of the website referred to above is not incorporated into and does not form part of this document.

COPIES OF THIS DOCUMENT

If you have received this document in electronic form or by it being published on Xenetic’s website: www.xeneticbio.com/investorrelations, you can obtain a hard copy of the document by contacting Share Registrars Limited on +44 (0) 1252 821390. Lines are open 9.00 a.m. to 5.00 p.m. (London time) Monday to Friday (except UK public holidays). The helpline cannot provide advice on the merits of the Acquisition or the Scheme nor give any financial, legal or tax advice. You will not receive a hard copy of this document unless you so request. You may also inform Share Registrars Limited that you wish all future documents, announcements and information in relation to the Acquisition or the Scheme to be sent to you in hard copy.

| 5 |

ACTION TO BE TAKEN

VOTING AT THE COURT MEETING AND THE GENERAL MEETING

There will be two separate meetings of Shareholders: the Court Meeting and the General Meeting. Scheme Shareholders will be entitled to vote at the Court Meeting and all Shareholders will be entitled to vote at the General Meeting. The Court Meeting and the General Meeting will be held at the offices of Pinsent Masons LLP, 30 Crown Place, London EC2A 4ES, United Kingdom, on 17 December 2013 at 10.00 GMT and 10.30 a.m. GMT respectively (or, in the case of the General Meeting, if later, as soon as the Court Meeting has been concluded or adjourned). The Scheme requires approval of the Scheme Resolutions to be tabled at both of these Meetings.

Please check that you have received the following with this document:

● a blue Form of Proxy for use in respect of the Court Meeting;

● a white Form of Proxy for use in respect of the General Meeting; and

● a reply-paid envelope for use in the UK for the return of the Forms of Proxy.

If you have not received all of these documents, please contact the Company’s Registrars, Share Registrars Limited of Suite E, First Floor, 9 Lion & Lamb Yard, Farnham, Surrey GU9 7LL, or call on +44 (0) 1252 821390 between 9.00 a.m. and 5.00 p.m. GMT Monday to Friday (except UK bank holidays).

To vote on the Scheme:

It is important that, for the Court Meeting in particular, as many votes as possible are cast so that the Court may be satisfied that there is a fair representation of Scheme Shareholder opinion. Whether or not you plan to attend the Meetings, each eligible Shareholder is requested to complete and sign both the blue and white Forms of Proxy and return them, in accordance with the instructions printed thereon, by post or, during normal business hours only, by hand to the Company’s Registrars, Share Registrars Limited of Suite E, First Floor, 9 Lion & Lamb Yard, Farnham, Surrey GU9 7LL or by fax to Share Registrars Limited on +44 (0) 1252 719232 or by scan and email to Share Registrars Limited at proxies@shareregistrars.uk.com, as soon as possible, but in any event so as to be received by no later than:

| ● in respect of the blue Form of Proxy for the Court Meeting: | 10.00 a.m. GMT on 15 December 2013 |

| ● in respect of the white Form of Proxy for the General Meeting: | 10.30 a.m. GMT on 15 December 2013 |

(or in the case of any adjournment, not later than 48 hours before the time fixed for the holding of the adjourned Meeting). If you wish to appoint more than one proxy you should request additional Forms of Proxy from Share Registrars Limited and submit them in accordance with the instructions set out in this document.

Returning the Forms of Proxy will enable your votes to be counted at the Meetings in the event of your absence. If the blue Form of Proxy for use at the Court Meeting is not returned by 10.00 a.m. GMT on 15 December 2013, it may be handed to the Chairman of the Court Meeting at the Court Meeting before the start of the Court Meeting. However, in the case of the General Meeting, unless the white Form of Proxy is returned by 10.30 a.m. GMT on 15 December 2013, it will be invalid. The completion and return of a Form of Proxy will not prevent you from attending and voting at the relevant Meeting, or any adjournment thereof, in person should you wish to do so and are so entitled.

Shareholders are encouraged to return their Forms of Proxy as soon as possible, to ensure they arrive before the relevant deadline.

To vote at the Meetings using a proxy appointment through CREST

CREST members who wish to appoint a proxy or proxies through the CREST electronic proxy appointment service may do so using the procedures described in the CREST Manual. CREST personal members or other CREST sponsored members, and those CREST members who have appointed a service provider(s), should refer to their CREST sponsor or voting service provider(s), who will be able to take the appropriate action on their behalf.

| 6 |

In order for a proxy appointment or instruction made using the CREST service to be valid, the appropriate CREST message (a “CREST Proxy Voting Instruction”) must be properly authenticated in accordance with Euroclear’s specifications, and must contain the information required for such instruction, as described in the CREST Manual (available via www.euroclear.com/CREST). The message, regardless of whether it constitutes the appointment of a proxy or is an amendment to the instruction given to a previously appointed proxy, must, in order to be valid, be transmitted so as to be received by the issuer’s agent (ID 7RA36 by 6.00 p.m. on 13 December 2013 in the case of the Court Meeting and by 6.00 p.m. on 13 December 2013 in the case of the General Meeting (or, in the case of any adjournment, no later than 6.00 p.m. on the day two days before the day of the adjourned meeting (excluding any day which is not a working day) in respect of the Court Meeting or by no later than 6.00 p.m. on the day two days before the adjourned meeting (excluding any day which is not a working day) in respect of the General Meeting)). For this purpose, the time of receipt will be taken to be the time (as determined by the time stamp applied to the message by the CREST Application Host) from which the issuer’s agent is able to retrieve the message by enquiry to CREST in the manner prescribed by CREST. After this time any change of instructions to proxies appointed through CREST should be communicated to the appointee through other means.

CREST members and, where applicable, their CREST sponsors or voting service providers should note that Euroclear does not make available special procedures in CREST for any particular message. Normal system timings and limitations will, therefore, apply in relation to the input of CREST Proxy Voting Instructions. It is the responsibility of the CREST member concerned to take (or if the CREST member is a CREST personal member, or sponsored member, or has appointed a voting service provider, to procure that his or her CREST sponsor or voting service provider(s) take(s)) such action as shall be necessary to ensure that a message is transmitted by means of the CREST system by any particular time. In connection with this, CREST members and, where applicable, their CREST sponsors or voting system providers are referred, in particular, to those sections of the CREST Manual concerning the practical limitations of the CREST system and timings.

Xenetic may treat as invalid a CREST Proxy Voting Instruction in the circumstances set out in Regulation 35(5)(a) of the Uncertificated Securities Regulations.

Appointment of multiple proxies and multiple proxy voting instructions

Shareholders are entitled to appoint a proxy in respect of some or all of their Shares. Shareholders are also entitled to appoint more than one proxy. A space has been included in the Forms of Proxy to allow you to specify the number of Shares in respect of which that proxy is appointed. If you return the blue Form of Proxy duly executed but leave this space blank, your blue Form of Proxy will be invalid. If you return the white Form of Proxy duly executed but leave this space blank, you will be deemed to have appointed the proxy in respect of all of your Shares. If you wish to appoint more than one proxy in respect of your shareholding you should contact the Company’s Registrars, Share Registrars Limited of Suite E, First Floor, 9 Lion & Lamb Yard, Farnham, Surrey GU9 7LL or call Share Registrars Limited on +44 (0) 1252 821390 between 9.00 a.m. and 5.00 p.m. GMT Monday to Friday (except UK bank holidays) for further Forms of Proxy or photocopy the Form of Proxy as required.

You may appoint more than one proxy in relation to a Meeting, provided that each proxy is appointed to exercise the rights attached to different Shares held by you. The following principles shall apply in relation to the appointment of multiple proxies:

| (a) | The Company will give effect to the intentions of Shareholders and include votes wherever and to the fullest extent possible. |

| (b) | Where a Form of Proxy does not state the number of Shares to which it applies (a “blank proxy”) then, subject to the following principles where more than one proxy is appointed, that proxy is deemed to have been appointed in relation to the total number of Shares registered in the name of the appointing member (the “member’s entire holding”). In the event of a conflict between a blank proxy and a proxy which does state the number of Shares to which it applies (a “specific proxy”), the specific proxy shall be counted first, regardless of the time it was delivered or received (on the basis that each white Form of Proxy was received prior to the deadline for receipt of white Forms of Proxy and, as far as possible, the conflicting white Form of Proxy should be judged to be in respect of different Shares) and remaining Shares will be apportioned to the blank proxy (pro rata if there is more than one). |

| 7 |

| (c) | Where there is more than one proxy appointed and the total number of Shares in respect of which proxies are appointed is no greater than the Shareholder’s entire holding, it is assumed that proxies are appointed in relation to different Shares, rather than that conflicting appointments have been made in relation to the same Shares. That is, there is only assumed to be a conflict where the aggregate number of Shares in respect of which proxies have been appointed exceeds the Shareholder’s entire holding. |

| (d) | When considering conflicting proxies, later proxies will prevail over earlier proxies, and which proxy is later will be determined on the basis of which proxy is last delivered (or received). Proxies in the same envelope will be treated as having been sent and received at the same time, to minimise the number of conflicting proxies. |

| (e) | If conflicting proxies are sent or received at the same time in respect of (or deemed to be in respect of) an entire holding, and if the Company is unable to determine which was delivered or received last, none of them will be treated as valid. |

| (f) | Where the aggregate number of Shares in respect of which proxies are appointed exceeds a Shareholder’s entire holding and it is not possible to determine the order in which they were delivered or received (or they were all delivered or received at the same time), the number of votes attributed to each proxy will be reduced pro rata. |

| (g) | Where the application of paragraph (f) above gives rise to fractions of Shares, such fractions will be rounded down. |

| (h) | If a Shareholder appoints a proxy or proxies and then decides to attend the Court Meeting or General Meeting in person and vote using his poll card, then the vote in person will override the proxy vote(s). If the vote in person is in respect of the Shareholder’s entire holding then all proxy votes will be disregarded. If, however, the Shareholder votes at the Meetings in respect of less than the Shareholder’s entire holding, then if the Shareholder indicates on his polling card that all proxies are to be disregarded, that shall be the case; but if the Shareholder does not specifically revoke proxies, then the vote in person will be treated in the same way as if it were the last received proxy and earlier proxies will only be disregarded to the extent that to count them would result in the number of votes being cast exceeding the Shareholder’s entire holding. |

| (i) | In

relation

to

paragraph

(h)

above,

in

the

event

that

a

Shareholder

does

not

specifically

revoke

proxies, it will not be possible for the Company to determine the intentions of the Shareholder in this regard. However, in light of the aim to include votes wherever and to the fullest extent possible, it will be assumed that earlier proxies should continue to apply to the fullest extent possible. |

Assistance

If you have any questions relating to the Meetings, this document or the completion and return of the Forms of Proxy, please address your questions in writing to the Company’s Registrars, Share Registrars Limited of Suite E, First Floor, 9 Lion & Lamb Yard, Farnham, Surrey GU9 7LL, or call Share Registrars Limited on +44 (0) 1252 821390 between 9.00 a.m. and 5.00 p.m. GMT Monday to Friday (except UK bank holidays). Please note that no advice on the merits of the matters described in this document or legal, tax or financial advice can or will be given by Share Registrars.

IT IS IMPORTANT THAT, FOR THE COURT MEETING, AS MANY VOTES AS POSSIBLE ARE CAST SO THAT THE COURT MAY BE SATISFIED THAT THERE IS A FAIR REPRESENTATION OF SCHEME SHAREHOLDER OPINION. SCHEME SHAREHOLDERS ARE THEREFORE STRONGLY URGED TO COMPLETE, SIGN AND RETURN THEIR FORMS OF PROXY AS SOON AS POSSIBLE.

Date

This document is dated 21 November 2013.

| 8 |

TABLE OF CONTENTS

| Page | ||

| EXPECTED TIMETABLE OF PRINCIPAL EVENTS | 10 | |

| PART 1 | LETTER FROM THE CHAIRMAN OF XENETIC BIOSCIENCES PLC | 11 |

| PART 2 | EXPLANATORY STATEMENT | 23 |

| PART 3 | CONDITIONS AND FURTHER TERMS OF THE ACQUISITION | 37 |

| PART 4 | THE SCHEME OF ARRANGEMENT | 48 |

| PART 5 | FINANCIAL INFORMATION RELATING TO THE XENETIC GROUP | 52 |

| PART 6 | UK TAXATION | 54 |

| PART 7 | INFORMATION RELATING TO GSL | 55 |

| PART 8 | ADDITIONAL INFORMATION | 79 |

| PART 9 | DEFINITIONS | 96 |

| PART 10 | NOTICE OF COURT MEETING | 101 |

| PART 11 | NOTICE OF GENERAL MEETING | 104 |

| 9 |

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

| Event | Time and/or date |

| Latest time for lodging blue Forms of Proxy | 10.00 a.m. on 15 December 2013(1) |

| for the Court Meeting | |

| Latest time for lodging white Forms of Proxy | 10.30 a.m. on 15 December 2013(1) |

| for the General Meeting | |

| Voting Record Time for Court Meeting and | 6.00 p.m. on 13 December 2013(2) |

| General Meeting | |

| Court Meeting | 17 December 2013 |

| General Meeting | 17 December 2013(3) |

| The folowing dates are subject to change, please see Note (4) below: | |

| Last day of dealings in, and for registration of | 22 January 2014 |

| transfers of, Xenetic Shares | |

| Scheme Record Time | 6.00 p.m. on 22 January 2014 |

| Suspension of Xenetic Shares from trading on AIM | 7.30 a.m. on 23 January 2014 |

| Court Hearing (Sanction of Scheme and | 23 January 2014 |

| Reduction of Capital) | |

| Effective Date of the Scheme | 23 January 2014 |

| Cancellation of admission of Xenetic Shares to | 7.00 a.m. on 24 January 2014 |

| trading on AIM | |

| Quotation of GSL Consideration Shares on OTCBB | 27 January 2014 |

| and OTCQB becomes effective | |

| Latest date for despatch of GSL Consideration Share | 7 February 2014 |

| certificates under the Scheme |

The Court Meeting and the General Meeting will each be held at the offices of Pinsent Masons LLP, 30 Crown Place, London EC2A 4ES, United Kingdom.

Notes:

| (1) | If the blue Form of Proxy for the Court Meeting is not returned by the above time, it may be handed to the Chairman of the Court Meeting before the start of that Meeting. However, the white Form of Proxy for the General Meeting must be lodged by 10.30 a.m. GMT on 15 December 2013 in order to be valid. Please see ‘Action To Be Taken’ in paragraph 15 of Part 1 of this document. |

| (2) | If either the Court Meeting or the General Meeting is adjourned, the Voting Record Time for the adjourned meeting will be 6.00 p.m. GMT on the date two working days before the date set for the adjourned Meeting. |

| (3) | The General Meeting will commence at 10.30 a.m. GMT or, if later, immediately after the conclusion of the Court Meeting or any adjournment thereof. |

| (4) | These times and dates are indicative only and will depend, among other things, on the date upon which the Court sanctions the Scheme and confirms the associated Reduction of Capital. |

Unless otherwise stated, all references in this document to times are to times in London, England.

The dates given are based on current expectations and may be subject to change. If any of the expected dates change, the Company will give adequate notice of the change by issuing an announcement through a Regulatory Information Service.

| 10 |

PART 1

LETTER FROM THE CHAIRMAN OF XENETIC BIOSCIENCES PLC

XENETIC BIOSCIENCES PLC

(Incorporated in England and Wales under the Companies Act 1985 with registered number 03213174)

| Directors: | Registered Office: |

| Sir Brian Richards (Non-executive Chairman) | London Bioscience Innovation Centre |

| M Scott Maguire (Chief Executive Officer) | 2 Royal College Street |

| Colin William Hill (Chief Financial Officer) | London |

| Professor Gregory Gregoriadis (Chief Scientific Officer) | NW1 0NH |

| Dr Dmitry D Genkin (Non-executive director) Firdaus Jal Dastoor (Non-executive director) Artur Isaev (Non-executive director) | |

| Roman Knyazev (Non-executive director) | |

| 21 November 2013 |

To: Shareholders and, for information only, to holders of options and warrants Dear Shareholder

RECOMMENDED

OFFER

BY

GENERAL SALES & LEASING, INC

FOR

XENETIC BIOSCIENCES PLC

(to

be effected by means of a Scheme of Arrangement

under Part 26 of the Companies Act 2006)

1. Introduction

On 12 November 2013, Xenetic announced that the boards of GSL and Xenetic had reached agreement on the terms of a recommended proposal for the Acquisition under which GSL will acquire the entire issued and to be issued share capital of Xenetic.

Xenetic has been implementing its longer term strategy to migrate its corporate seat to, and expand in, the US, noting the significant value gap that exists between the biotechnology sector in the UK and in the US, where Xenetic believes the sector is better understood and more widely followed. Completion of the Acquisition will be the first step in the intended process of achieving a subsequent listing on an Exchange in a manner which the Board believes can be achieved more easily, more quickly and in a more cost-effective manner than would be possible were Xenetic to apply for such a quotation itself.

I am writing to you to explain:

| (a) | the background to, and terms of, the Acquisition; |

| (b) | why the Xenetic Directors (except for Roman Knyazev) consider the Acquisition to be fair and reasonable to Shareholders; and |

| (c) | why the Xenetic Directors (except for Roman Knyazev) are recommending that Shareholders vote in favour of the Scheme at the Court Meeting and the Special Resolution at the General Meeting as such Xenetic Directors have irrevocably agreed to do (or procure to be done) in respect of the Xenetic Shares held beneficially by them. |

| 11 |

Roman Knyazev is an employee and investment manager of Rusnano (a significant shareholder in Synbio, the 45 per cent. shareholder of Xenetic). He was appointed to the Board as a nominated director by Synbio pursuant to the relationship agreement between Synbio and Xenetic dated 28 November 2011 (the “Relationship Agreement”). As a result of his employment by Rusnano, a Russian state-owned entity, Mr Knyazev is unable to express a view on any transaction involving a board recommendation for shareholders to vote either in favour or against any particular proposal.

Since his appointment, the Xenetic Board has been aware of this situation and is wholly supportive of it and such a situation has not arisen to date. This does not affect Mr Knyazev’s ability to participate as a director of Xenetic as regards day-to-day and operational matters. Dr Dmitry Genkin and Dr Artur Isaev are directors of both Xenetic and SynBio (but not of Rusnano) and, as stated below, have voted in favour of the Scheme and recommend it to Xenetic Shareholders along with the remainder of the Xenetic Board.

The Scheme is conditional, amongst other things, on the approval by Shareholders of the Scheme Resolutions, proposed at the General Meeting.

The purpose of this document is therefore to provide details of the Scheme and to convene the General Meeting at which the Scheme Resolutions required to effect the Scheme will be proposed. The Notice of General Meeting is set out on page 104 of this document.

Shareholders are strongly advised to read this document carefully and seek their own independent financial, tax and legal advice and to consider, amongst other matters, paragraph 5 below headed ‘Background to and reasons for the Xenetic Directors’ recommendation of the Acquisition’, before casting their votes.

2. Summary of the terms of the Acquisition

The Acquisition is to be implemented by means of a scheme of arrangement between Xenetic and Scheme Shareholders under Part 26 of the Companies Act and involves a reduction of capital under section 648 of the Companies Act. Details of the Acquisition (including the Conditions to which it is subject) are set out in Part 2, Part 3 and Part 4 of this document. The Scheme requires the requisite approval of the Scheme Shareholders at a meeting convened by the Court and the subsequent sanction of the Court. The Reduction of Capital requires the approval of Shareholders at the General Meeting and the subsequent confirmation of the Court. Once the Scheme becomes Effective, the terms will be binding on all Scheme Shareholders irrespective of whether or not they attend or vote at the Meetings (and if they attend and vote, whether or not they vote in favour).

The purpose of the Scheme is to enable GSL to become the holder of the entire issued and to be issued share capital of Xenetic. This is to be achieved by the cancellation of the Scheme Shares and the application of the reserve resulting from such cancellation in paying up in full such number of New Shares as is equal to the number of Scheme Shares cancelled, and issuing the same to GSL, in circumstances where the Scheme Shareholders on the register of members at the Scheme Record Time will receive:

for every 175 Scheme Shares: 56 GSL Consideration Shares

Xenetic Shareholders holding 174 Scheme Shares or less will be entitled to vote at the Meetings. They will not however receive any GSL Consideration Shares. The GSL Consideration Shares attributable to their Scheme Shares will be aggregated and sold for cash on behalf of such Xenetic Shareholders as soon as reasonably practicable following completion of the Acquisition at the then prevailing market price on the OTCBB or OTCQB. The proceeds will then be converted into sterling at the exchange rate prevailing at that time and Xenetic Shareholders with entitlements to proceeds of such sale of less than £1 will have their proceeds aggregated and donated to charity. Those with entitlements to proceeds of £1 or more will receive sterling cheques for their entitlements as soon as reasonably practicable after such sale. Xenetic Shareholders with entitlements to proceeds of £1 or more will be able to opt to have such proceeds donated to charity. The white Form of Proxy contains a box to tick should such a Scheme Shareholder wish to elect to donate his or her proceeds to charity.

Any Xenetic Shareholders to the extent holding a number of Scheme Shares not divisible by 175, will also have such Scheme Shares aggregated together with similar Scheme Shares of other Xenetic Shareholders to result in GSL Consideration Shares to be sold on behalf of such Xenetic Shareholders in the same manner as explained above. Again, Xenetic Shareholders with entitlements to proceeds of such sale of less than £1 will have their proceeds aggregated and donated to charity. Those with entitlements to proceeds of £1 or more will receive sterling cheques for their entitlements as soon as reasonably practicable after such sale. Xenetic Shareholders with entitlements to proceeds of £1 or more will also be able to opt to have such proceeds donated to charity on the same basis as above.

| 12 |

On the basis of the value of a GSL Consideration Share of 18.59 pence as at 11 November 2013 set out at Part 12 of this document, the Acquisition values the entire existing issued share capital of the Company at approximately £24.3 million and each Scheme Share at approximately 5.95 pence. This represents a premium or discount of approximately:

| ● | a premium of 8.18 per cent. to the Closing Price per Scheme Share of 5.5 pence on 20 November 2013 (being the latest practicable date prior to the posting of this document); |

| ● | a discount of 8.49 per cent. to the Closing Price per Scheme Share of 6.5 pence on 11 November 2013 (being the latest practicable date prior to the issue of the Announcement); |

| ● | a premium of 5.75 per cent. to the Closing Price per Scheme Share of 5.625 pence on 20 October 2013 (being the Business Day prior to the announcement that Xenetic was in discussions with GSL); and |

| ● | a premium of 5.75 per cent. to the Closing Price per Scheme Share of 5.625 pence on 15 July 2013 (being the Business Day prior to the commencement of the Offer Period). |

The expected transaction timetable is set out on page 10 of this document. It is expected that the Acquisition and the resolutions required to implement the Scheme will be put to Xenetic Shareholders at the Court Meeting and the General Meeting which are expected to be held on 17 December 2013. It is expected that, subject to satisfaction or waiver of the Conditions, the Effective Date will be 23 January 2014. If the Scheme becomes Effective, it will be binding on all Scheme Shareholders, irrespective of whether or not they attended or voted at the Court Meeting or the General Meeting. Further details of the Scheme, including the arrangements for settlement of the consideration payable to Scheme Shareholders, are set out in the Explanatory Statement in Part 2 of this document.

Application has been made in accordance with AIM Rule 41 to the London Stock Exchange to cancel the admission to trading on AIM of Xenetic Shares. Cancellation is conditional upon the Scheme (and therefore the Acquisition) having become Effective. The announcement to be issued by Xenetic on 22 November 2013 provides Xenetic Shareholders with due notice of the intended suspension from trading on AIM which is expected to take place at 7.30 a.m. on 23 January 2014, and of the intended cancellation of trading on AIM which is expected to take place at 7.00 a.m. on 24 January 2014.

Accordingly the last day of dealings in, and for registration of transfers of, Xenetic Shares is presently anticipated to be 22 January 2014. The result of the Court Hearing will be announced on 23 January 2014. No transfers of Xenetic Shares will be registered after market close on 22 January 2014.

3. GSL Consideration Shares

The GSL Consideration Shares to be issued as consideration for the Acquisition will be issued in certificated form only. There is expected to be issued 130,520,137 shares of US$0.01 par value each in the capital of GSL assuming no further shares are issued by Xenetic up to the Effective Date. Fractions of GSL Consideration Shares will not be allotted or issued pursuant to the Acquisition.

It is the intention of the Proposed Directors and Xenetic that GSL, following the completion of the Acquisition, will seek a listing of its shares on an Exchange at the earliest practicable opportunity.

The GSL Consideration Shares will, in the meantime be available for quotation on the OTCBB and the OTCQB and will be issued free from all liens, charges, encumbrances and other third party rights and/or interests of any nature whatsoever. It is expected that the GSL Consideration Shares to be issued will be entitled to be deposited, in the normal course, into an individual shareholder’s trading account and then available for immediate trading.

| 13 |

Xenetic Shareholders should, however, be aware that the deposit of their GSL Consideration Shares into their existing trading accounts within the UK or outside may be limited due to the internal rules of operations of the shareholder’s chosen broker-dealer or its clearing firm. It is not uncommon for some broker-dealers and/or their clearing firms to require, among other things, the following items to effectuate the deposit of newly issued OTCBB and OTCQB shares: (1) substantial information on the transaction in which the shareholder received the shares; and/or (2) a legal opinion related to the shares. Moreover, some firms may even outright refuse to accept the deposit of newly issued OTCBB and OTCQB shares, among other limitations, due to such internal rules. As a result, neither GSL, nor Xenetic, can assure any shareholder that they will be able to deposit their GSL Consideration Shares in their existing brokerage accounts or that they will not be required to provide additional information or documentation, not otherwise provided by either company with stock certificates. Consequently, shareholders may be required to set up a new trading account with a different broker-dealer or otherwise find themselves subject to delays and other issues in the deposit of their GSL Consideration Shares. The deposit of the GSL Consideration Shares will be the responsibility of the recipient shareholder.

After receipt of the certificates representing their GSL Consideration Shares, shareholders may deposit their GSL Consideration Shares, subject to the limitations discussed above regarding deposits, either by providing their certificate to the broker-dealer where their trading account is set up, or by arranging for their GSL Consideration Shares to be electronically transferred into the account. If delivered in electronic form at this later date, the shareholder will need to confirm that their broker-dealer allows for such transfers of OTCBB shares, and then provide the transfer agent with the necessary information regarding such Shares and their trading account to allow the electronic transfer to occur. Shares transferred in this manner will be tradable by the shareholder upon acceptance of the deposit into the trading account consistent with the rules of the broker-dealer with which such Shares are deposited. While Xenetic will assist where it can, because the deposit of the GSL Consideration Shares is dependent on the individual processing rules of the shareholder’s choice of broker-dealer, it will be the responsibility of the individual shareholder receiving their GSL Consideration Share certificate to process and facilitate the deposit of such Shares. Xenetic will take no responsibility or liability whatsoever for ensuring the deposit of the GSL Consideration Shares into a specific shareholder trading account or with a specific broker-dealer.

The GSL Consideration Shares will be capable of being held in both certificated and uncertificated form, and will be issued credited as fully paid and will rank pani passu in all respects with the New GSL Shares, including as to voting rights and the right to receive and retain all dividends and other distributions declared, paid or made after the Effective Date. The New GSL Shares and GSL Consideration Shares will be denominated in US Dollars.

The GSL Consideration Shares will be issued on implementation of the Scheme to Scheme Shareholders on the register immediately following the Scheme Record Time. Details of the rights attaching to the GSL Consideration Shares are set out in paragraph 4 of Part VIII of the Equivalent Document, the text of which is set out for convenience at Part 7 of this document, and in paragraph D of Part 3 of this document.

Upon the Scheme becoming Effective and the receipt by Xenetic Shareholders of their entitlements to GSL Consideration Shares, the protections contained within the City Code will not apply to such holdings. Please refer to paragraph C of Part 3 of this document.

4. Conditions to the Acquisition

The implementation of the Acquisition is subject to the Conditions set out in section A of Part 3 of this document. To become Effective, the Acquisition requires, amongst other things:

| (a) | the approval of the Scheme at the Court Meeting by the necessary majority of the Scheme Shareholders present and voting, either in person or by proxy; |

| (b) | the passing of the Special Resolution at the General Meeting; |

| (c) | the Court sanctioning the Scheme and confirming the Reduction of Capital at the Court Hearing; |

| (d) | the satisfaction or waiver of the other Condition; and |

| (e) | the delivery to the Registrar of Companies of copies of the Court Order(s) sanctioning the Scheme and confirming the Reduction of Capital together with a Statement of Capital. |

Shareholders are referred to Part 3 of this document for the full details of the Conditions.

| 14 |

5. Background to and reasons for the Xenetic Directors’ recommendation of the Acquisition

The Board believes that at the present time smaller quoted bioscience companies, in general, have a higher profile and a better investor following in the US than is found in European markets in general and in the UK market, in particular. The Xenetic Directors believe that by achieving a listing for Xenetic on an Exchange, significant benefits will accrue to Xenetic and its shareholders including, but not exclusively:

| (a) | the ability to attract and incentivise qualified US personnel with orphan drug development and launch experience; |

| (b) | easier access to finance on reasonable terms; |

| (c) | a better rating of Xenetic’s shares; and |

| (d) | higher levels of share trading liquidity. |

The Board has considered a number of options to achieve the goal of migration to the US, including seeking a quotation of Xenetic’s shares directly on an Exchange and seeking a merger with an existing US quoted biotechnology company with complementary activities. Following careful consideration of the issues, the Board has determined that the most appropriate way of achieving this outcome is to be acquired by an SEC-reporting company and then seek to achieve a quotation on an Exchange within a reasonable period; and to effect such an acquisition by the Scheme.

Xenetic’s plan is for it to be acquired on a share-for-share basis by GSL, where the level of effective dilution to Xenetic’s Shareholders does not exceed 3 per cent. as at the Effective Date. This means that, other than for such dilution and the fees and costs of the Acquisition (which are deemed to be the “cost” of achieving Xenetic’s aims), the group formed by the completion of the Acquisition will be effectively the same group as at present, with the same assets and liabilities, save that it will have a US holding company (GSL) with an enhanced ability to achieve a listing on an Exchange. Whilst Xenetic and GSL have commenced developing a plan regarding such a listing, there is no guarantee that such a listing can be achieved.

In particular, GSL is subject to various regulatory requirements, including those of the SEC and the various trading exchanges where its equity shares may trade. Any securities exchange (for example, NASDAQ) can and will apply its own rules and/or analysis to GSL’s eligibility for listing which may adversely impact the Enlarged Group’s attempt to be listed on a securities exchange or the tradability of its shares.

6. Irrevocable Undertakings

Xenetic has sought and received irrevocable undertakings from those Xenetic Directors who are beneficial owners of Xenetic Shares to vote in favour of the Scheme Resolutions in respect of their entire beneficial holdings of Xenetic Shares, a total of 11,271,086 Xenetic Shares, representing approximately 2.76 per cent. of the existing issued ordinary share capital of Xenetic, as at 20 November 2013 (being the latest practicable date prior to the publication of this document).

Xenetic has sought and received irrevocable undertakings from certain other Xenetic Shareholders who beneficially own or otherwise control Xenetic Shares to vote in favour of the Scheme Resolutions in relation to a total of 96,668,741 Xenetic Shares, representing approximately 23.7 per cent. of the existing issued ordinary share capital of Xenetic as at 20 November 2013 (being the latest practicable date prior to the publication of this document).

In relation to the Scheme Resolutions, Xenetic has therefore received total irrevocable undertakings in respect of 107,939,827 Xenetic Shares representing, in aggregate, 26.46 per cent. of the existing issued ordinary share capital of Xenetic as at 20 November 2013 (being the latest practicable date prior to the publication of this document).

Further details of the above irrevocable undertakings are set out in paragraph 7 of Part 8 of this document.

7. Information on Xenetic and current trading and prospects

Xenetic is committed to becoming a US-based and Exchange-listed speciality drug developer focused on achieving full value recognition of the Xenetic patent-protected portfolio with its core technologies and targeted therapeutic offerings.

| 15 |

Xenetic is currently a UK based biopharmaceutical company with core technology capabilities, intended to facilitate the development of a new generation of biological drugs, vaccines and oncology therapies.

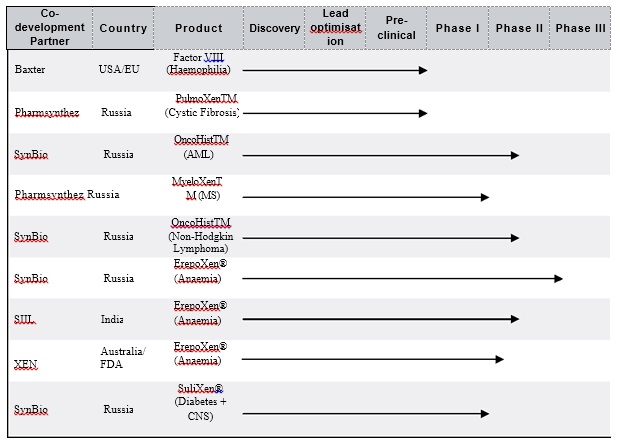

Together with its collaborative partners SynBio, Pharmasynthez, SIIL and Baxter, the Group is developing a pipeline of next generation biotherapeutics based on its proprietary PolyXen, Oncohist and ImuXen platform technologies. The Group is pursuing a development strategy of clinical advancement through its own efforts and those of its collaborative partners (such as SynBio, Pharmsynthez, SIIL and Baxter) as further described below.

As announced on 31 July 2013, the Group has received regulatory approval in Australia and New Zealand to commence its Phase II FDA/ICH-compliant clinical trial for ErepoXen®, the Group’s PolyXen®-based biologic candidate for anaemia in pre-dialysis patients with Chronic Kidney Disease (“CKD”). Since that date, the drug has been released for export from India (where it is produced by SIIL). It is now available at the Group’s 10 clinical sites in Australia and New Zealand ready for first patient dosing in the trial being managed by Novotech, the clinical research organisation chosen to conduct the trial. The Company expects that it will be able to provide guidance on its first interim trial results in H2-2014. The trial is expected to finally report completion of Phase II studies by H1-2015.

SynBio:

Phase III trials for ErepoXen® in Russia have progressed rather more slowly than originally anticipated due to patient recruitment limitations. SynBio has now both increased the number of clinical trial sites and made some changes to the trial protocol in order to increase the rate of recruitment. Accordingly, the Group retains a high degree of confidence in the ultimate clinical outcome and the resultant marketing of the product in Russia, the former CIS and elsewhere.

Clinical trials on OncoHistTM candidate for Acute Myeloid Leukaemia are ongoing. The Phase I/II(a) dose-ranging phase of the trial for Non-Hodgkin’s Lymphoma has been completed. In neither case have there been any reported Serious Adverse Events (“SAEs”).

In December 2011, Dmitry Genkin and Peter Kruglyakov undertook to use best endeavours to procure by 16 January 2012 the novation, licence and/or re-transfer back to the Group of certain Cryonix/Onchoist intellectual property previously transferred and/or licensed out of SymbioTech to SynBio or its connected persons. While progress has been made, the relevant documentation has not yet been signed.

Pharmsynthez:

The ImuXen®-based Multiple Sclerosis candidate, MyeloXenTM has completed Stage I trials in healthy volunteers with no SAEs. The trial has now entered the Stage II stage in patients. The dose-ranging phase has been completed with no SAEs reported. The dose confirmation studies in patients are expected to commence within 3 months.

Pre-clinical work on PulmoXenTM has been completed. Pharmsynthez imminently expects to receive Russian regulatory approval to move this PolyXen®-based biologic proprietary candidate for Cystic Fibrosis into the clinic.

SIIL:

The most recently announced advance in Indian clinical work on the Group’s ErepoXen® product candidate relates to the screening of patients for a Phase I/II trial, treating CKD patients on dialysis.

Dana-Farber:

Work on this previously announced collaborative agreement with Dana-Farber Cancer Institute in Boston, examining the novel mechanism of action of OncoHistTM, is still in progress. The Group is awaiting interim data from the SynBio Phase I/II(a) trial prior to submitting an Investigational New Drug (“IND”) filing with the US FDA.

Baxter:

The US$1m license extension fee receivable in June 2013 was duly settled by Baxter, thereby granting that company a 12-month extension to file an IND for their PSA-Factor VIII candidate for haemophilia.

| 16 |

Summary:

The primary objective of the Group is monetising the Group’s IP by transitioning out of the research phase and into product- and indication-specific product development. In summary, the Group’s product development pipeline is as follows:

The above table provides an aggregate overview of the drug development pipeline for the Group. To achieve the most rapid and effective development of the candidates most likely to make rapid progress into and through the clinic, it is Xenetic’s intention that, from completion of Xenetic’s move of all drug development activities to the US, there will be a distillation and concentration of its internal development programmes to three candidates, being:

(1) PSA-EPO (Anaemia)

(2) OncoHist (Leukaemia)

(3) PSA-Dnase (Cystic Fibrosis).

8. Funding Outlook

In the announcement of its interim report and unaudited condensed financial statements for the six months ended 30 June 2013 released on 30 September 2013, the Company stated:

“... new capital is planned to be raised in the last quarter of 2013 (whether or not the US listing process has been concluded by that time) and in the second or third quarter of 2014, to fund planned activities through September 2014.”

As at 20 November 2013, being the nearest practicable date prior to the publication of this document, the Group had cash reserves of approximately £3.3 million. As indicated in the interim report, due to the increase in operating costs arising from expenditures such as the stepping-up of the US transition process and the Australian PSA-EPO clinical trials, the monthly capital expenditure rate has risen from an historical rate of circa £250,000 to circa £450,000 per calendar month over the quarter ended June 2013; further increases are expected in the upcoming two quarters partly as a consequence of planned completion of the US transition but also to the expected roll-out of the PSA-EPO clinical trial.

| 17 |

This position is in line with the long-term strategy of the Group. It has not proven practicable to raise capital in the last quarter of 2013 given the Company’s preparation for the Scheme. New capital is planned to be raised in the first half of 2014, to fund planned activities through September 2014. Further announcements will be made by Xenetic (or GSL as the case may be) in due course.

9. Risk Factors

The business of the Group is subject to various risk factors, the principal ones being set out in Part 13 of this document. These risks will continue to apply after the Scheme becomes Effective, in relation to the Enlarged Group and the GSL Consideration Shares.

10. Information on GSL

GSL Shares are currently available for quotation on the OTCBB and OTCQB. There has been only limited trading recently in such shares and therefore they are not considered to have a public valuation or market.

GSL is not currently identified as a ‘shell company’ under relevant SEC rules and regulations, which means that its stock is not subject to certain limitations contained in these rules. There can be no assurance, however, that the SEC and/or various regulatory bodies in the US will not reject this classification and effectively apply the shell company rules to GSL in the future. Additionally, any Exchange may apply its own rules and/or analysis and reach the conclusion that GSL was or is a shell company.

Any such determination, either by the SEC, one of the regulatory bodies in the US or an Exchange could adversely impact the Enlarged Group’s attempt to be listed on an Exchange or the tradability of its shares, and/or the cost and time involved in doing so. This may include being subject to the “seasoning rules” of an Exchange prior to being quoted, in effect requiring GSL to wait a year or more before being allowed to obtain a listing on such Exchange.

GSL was incorporated in August 2011 for the purpose of owning and operating helicopters for use in sightseeing tours and as pilot training aircraft. Whilst there is demand for hourly helicopter rental in Las Vegas, GSL believes that it is in its best interests to enter into the Acquisition of Xenetic, and dispose of its current business operations.

Accordingly, on 12 November 2013, GSL entered into an agreement with its largest shareholder, Oxbridge Technology Partners, SA (“Oxbridge”), a Belize Corporation, pursuant to which Oxbridge will acquire the entirety of GSL’s existing business, which acquisition is conditional upon and will complete immediately after the Scheme becomes Effective and the New Shares in Xenetic have been issued to GSL. Under this disposition agreement Oxbridge will exchange its 100,000,000 GSL Shares for: (a) the shares of GSL’s two subsidiaries, Shift It Media and General Aircraft, Inc., and (b) the payment of US$430,000 in cash, subject to the Scheme becoming Effective. The assets and liabilities associated with such businesses will thereby pass to Oxbridge. Oxbridge’s 100,000,000 GSL Shares will be retired to treasury. Further details of this agreement are set out in paragraph 9(c) of Part VIII of the Equivalent Document, the text of which is set out in Part 7 of this document.

GSL will also undertake a share consolidation in advance of the Scheme becoming Effective whereby every holder of GSL Shares will receive 1 New GSL Share of US$0.01 par value for every 10 GSL Shares of US$0.001 par value held on the consolidation date.

Subject to fulfilment (or as the case may be waiver) of the Conditions, GSL will issue the GSL Consideration Shares to the Scheme Shareholders pursuant to the Scheme. In connection with this, GSL has on or about the date hereof published information on itself and its securities in a document equivalent to a prospectus for the purposes of the Prospectus Rules, for which GSL is responsible. The text of this Equivalent Document is reproduced for convenience in Part 7 of this document.

The GSL Director will resign from the board of GSL when the Scheme becomes Effective and will confirm that he has no outstanding claims against GSL. The Proposed Directors will thereupon be appointed as directors of GSL. After the Effective Date, the board of GSL will review the needs of the business regarding whether to appoint additional directors. Such directors, if appointed, may come from the existing group of Xenetic Directors, be appointed from within the Enlarged Group or be recruited externally, in each case on terms of be agreed at the time.

Pending its conversion to a private limited company, the board of Xenetic will be reduced in number to Mr Maguire and Mr Hill only. It is also the intention to change the name of GSL to Xenetic Biosciences, Inc. on or before the Effective Date.

| 18 |

11. GSL’s strategic plans for Xenetic’s management, employees and places of business

Immediately after the Effective Date, the GSL Director will resign and the Proposed Directors will join the board of GSL as directors with the intention that their service agreements and/or terms of appointment will be equivalent or substantially equivalent to their current terms, and, where relevant, subject to applicable US laws and regulations.

No material changes to the number of Xenetic Group employees (or their current terms of employment) are expected as a result of the conclusion of the transaction contemplated by the Scheme, or from the Enlarged Group’s ongoing business strategy- which will be maintained on the same business model as has been executed by the Company for some years.

The principal objectives of the project are to re-domicile Xenetic’s activities to the US in order for the Company more effectively to develop its proprietary product pipeline with greater access to both a productdevelopment-focused labour pool, and development capital, these being key factors in the successful monetisation of the Company’s intellectual property portfolio.

For those in the UK and European small-cap biotech sector, the United States is recognised globally as the sector leader, and, in the case of Xenetic, especially so in terms of the range of skills located within Massachusetts where the Company is currently establishing its new drug development centre. Also, in terms of access to the US capital markets, where the magnitude of development capital available to emerging companies is appreciably greater than that available in European markets.

Xenetic does not have any employee pension plans to which it contributes. Employees will remain employed by their current Xenetic employer, and their employment rights will be unaffected. However, independently of the Scheme, and in accordance with its stated strategy, in 2012 Xenetic initiated some operational restructuring (which is ongoing) in anticipation of the re-location of operations to the US. This is exemplified by the hiring of senior US-based staff in May 2012, followed by the identification of new office and laboratory facilities in Lexington, Massachusetts. These facilities, where possible utilising fixed assets transferred from the UK, will become fully operational in December 2013. Consequently, the UK laboratories will be closed as there is neither the need for (nor the capital available) to sustain two scientific sites. The corporate office of Xenetic is in London and the new Lexington facility will, in due course, become the corporate hub of the business.

It is important to recognise that these operational issues have been and will continue to be conducted wholly independently of the Scheme. The purpose of the Scheme is a technical mechanism to relocate the domicile of the holding company of the Xenetic Group from the UK to the US, by installing a US company as the new holding company for the Xenetic Group. GSL will not have any other business or operations to be affected by the Scheme after it has acquired Xenetic. There is expected to be no change to the business or strategy of Xenetic following completion of the Scheme.

The current sole director of GSL has played no part in developing the US strategy of Xenetic and will resign on completion of the Scheme. The Proposed Directors (and such other directors as join the board of GSL going forward) will then lead the business, of which GSL will become the holding company. The business will be conducted in substantially the same manner as hitherto.

It is GSL’s intention, if practicable, to establish a mechanism in due course whereby smaller UK-based shareholders will be able to trade out of their positions after the Scheme has become Effective. However, should such holders wish to retain their holdings in the longer term, they will be encouraged to do so notwithstanding that they will need to utilise the services of a UK broker with facilities for trading US shares.

The Scheme will apply to all Scheme Shares, which will be cancelled and the resulting New Shares issued to GSL. As Xenetic will be 100 per cent. owned by GSL, there will therefore not be any trading facilities maintained for securities in Xenetic after the Effective Date. Please refer to paragraph 14 of Part 2 of this document (Explanatory Statement) in relation to the proposed cancellation of trading of Xenetic Shares on AIM.

| 19 |

12. Xenetic Share Schemes, options and warrants

The effect of the Scheme on outstanding options held by directors, employees and others under the Xenetic Share Option Plans and on other options and warrants can be found at paragraphs 6 and 7 of Part 2 of this document. Xenetic also proposes to enter into certain new arrangements with related parties, also as described in paragraph 7 of Part 2 of this document.

13. Suspension and cancellation of admission of Xenetic Shares to trading on AIM

Application has been made in accordance with AIM Rule 41 to the London Stock Exchange to cancel the admission to trading on AIM of Xenetic Shares. Cancellation is conditional upon the Scheme (and therefore the Acquisition) having become Effective. The announcement to be issued by Xenetic on 22 November 2013 provides Xenetic Shareholders with due notice of the intended suspension from trading on AIM which is expected to take place at 7.30 a.m. on 23 January 2014, and of the intended cancellation of trading on AIM which is expected to take place at 7.00 a.m. on 24 January 2014.

Accordingly the last day of dealings in, and for registration of transfers of, Xenetic Shares is presently anticipated to be 22 January 2014. The result of the Court Hearing will be announced on 23 January 2014. No transfers of Xenetic Shares will be registered after market close on 22 January 2014.

Your attention is drawn to paragraph 14 of Part 2 (Explanatory Statement) of this document in relation to cancellation of Xenetic Shares from admission to trading on AIM.

14. Re-registration of Xenetic

It is intended that, as soon as reasonably practicable after the Scheme becomes Effective, the Company will be re-registered as a private limited company in accordance with the Companies Act.

15. Action to be Taken

The Scheme and the Acquisition are subject to the satisfaction (or as the case may be waiver) of the Conditions set out in section A of Part 3 of this document. In order to become Effective, the Scheme must be approved by a majority in number of those Scheme Shareholders who are present and vote either in person or by proxy at the Court Meeting and who represent 75 per cent. or more in value of all Scheme Shares held by such Shareholders. In addition, the Special Resolution to give effect to the Scheme must be passed at the General Meeting. Under the Companies Act, the Scheme is also subject to the approval of the Court. Once the Scheme becomes Effective, the terms will be binding on all Scheme Shareholders irrespective of whether or not they attend or vote at the Meetings (and if they attend and vote, whether or not they vote in favour).

You will find enclosed with this document:

(a) a blue Form of Proxy for use at the Court Meeting;

(b) a white Form of Proxy for use at the General Meeting; and

(c) a reply-paid envelope for use in the UK for the return of the Forms of Proxy.

To vote at the Meetings

Whether or not you intend to attend the Court Meeting and/or the General Meeting, you are requested to complete and sign the enclosed blue and white Forms of Proxy and return them in accordance with the instructions printed on them. Completed Forms of Proxy should be returned, in accordance with the instructions printed thereon, by post or, during normal business hours only, by hand to the Company’s Registrars, Share Registrars Limited of Suite E, First Floor, 9 Lion & Lamb Yard, Farnham, Surrey GU9 7LL or by fax to Share Registrars Limited on +44 (0) 1252 719232 or by scan and email to Share Registrars Limited at proxies@shareregistrars.uk.com, as soon as possible and, in any event, so as to be received by the times set out below:

(a) blue Forms of Proxy for the Court Meeting 10.00 a.m. GMT on 15 December 2013

(b) white Forms of Proxy for the General Meeting 10.30 a.m. GMT on 15 December 2013

| 20 |

(or in the case of any adjournment, not later than 48 hours before the time fixed for the holding of the adjourned Meeting).

If you wish to appoint more than one proxy you should request additional proxy forms from Share Registrars and submit them in accordance with the instructions set out in this document.

If you hold your Shares in uncertificated form, you may vote using the CREST Proxy Voting Service in accordance with the procedures set out in the CREST Manual (please also refer to the notes to the notices of the Court Meeting and the General Meeting set out in Parts 10 and 11 respectively of this document).

If the blue Form of Proxy for use at the Court Meeting is not lodged by the time specified above, it may be handed to the chairman of the Court Meeting at the start of the Court Meeting and will still be valid. However, in the case of the white Form of Proxy for the General Meeting, it will be invalid unless it is lodged by the time specified above with the Company’s Registrars, Share Registrars Limited, Suite E, First Floor, 9 Lion & Lamb Yard, Farnham, Surrey GU9 7LL. The completion and return of the relevant Form of Proxy will not prevent you from attending and voting in person at the relevant Meeting, or at any adjournment thereof, if you so wish and are so entitled.

It is important that, for the Court Meeting, as many votes as possible are cast so that the Court may be satisfied that there is a fair and reasonable representation of the opinions of the Scheme Shareholders. Therefore, whether or not you intend to attend the Meetings, you are strongly urged to sign and return your Forms of Proxy for both the Court Meeting and the General Meeting as soon as possible.

Notices convening the Court Meeting and the General Meeting are set out in Parts 10 and 11 of this document respectively.

If you have any questions relating to the Meetings, this document or the completion and return of the Forms of Proxy, please address your questions in writing to the Company’s Registrars, Share Registrars Limited, Suite E, First Floor, 9 Lion & Lamb Yard, Farnham, Surrey GU9 7LL, or call Share Registrars Limited on +44 (0) 1252 821390 between 9.00 a.m. and 5.00 p.m. GMT Monday to Friday (except U.K. bank holidays). Please note that no advice on the merits of the matters described in this document or legal, tax or financial advice can or will be given.

16. Overseas Shareholders

Overseas Shareholders should refer to paragraph 17 of Part 2 (Explanatory Statement) of this document.

17. Further information

The terms of the Scheme are set out in full in Part 4 of this document. Please read carefully the remainder of this document, including the letter from London Bridge Capital, financial adviser to the Company, set out in Part 2 of this document. Please note that the information contained in this letter is not a substitute for reading the remainder of this document.