Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Coeur Mining, Inc. | grcsupportagreement20138k.htm |

| EX-99.1 - EXHIBIT - Coeur Mining, Inc. | cdegrcpressrelease991.htm |

| EX-99.3 - EXHIBIT - Coeur Mining, Inc. | cdegrcqaexhibit993.htm |

NYSE: CDE | TSX: CDM November 24, 2013 Coeur Mining Creates Coeur Capital and Announces Definitive Agreement to Acquire Global Royalty Corporation

NYSE: CDE | TSX: CDM 2 Cautionary Statements This presentation contains numerous forward-looking statements within the meaning of securities legislation in the United States and Canada, including statements regarding the anticipated closing of the Global Royalty transaction, strategic priorities and initiatives and expectations regarding leverage to metals prices, risk exposures, valuations, margins, cash flow, growth, expenditures, yields, and anticipated production. Such forward-looking statements are identified by the use of words such as “believes,” “intends,” “expects,” “hopes,” “may,” “should,” “will,” “plan,” “projected,” “contemplates,” “anticipates” or similar words, and involve known and unknown risks, uncertainties and other factors which may cause Coeur's actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, the risks and hazards inherent in the mining business (including risks inherent in developing large-scale mining projects, environmental hazards, industrial accidents, weather or geologically related conditions), changes in the market prices of gold and silver and a sustained lower price environment, the uncertainties inherent in Coeur's production, exploratory and developmental activities, including risks relating to permitting and regulatory delays, ground conditions, grade variability, any future labor disputes or work stoppages, the uncertainties inherent in the estimation of gold and silver ore reserves, changes that could result from Coeur's future acquisition of new mining properties or businesses, reliance on third parties to operate certain mines where Coeur owns silver production and reserves, the absence of control over mining operations in which Coeur or Coeur Capital holds royalty or streaming interests and risks related to these mining operations including results of mining and exploration activities, environmental, economic and political risks of the jurisdictions in which the mining operations are located and changes in project parameters as plans continue to be refined; the loss of any third-party smelter to which Coeur markets silver and gold, the effects of environmental and other governmental regulations, the risks inherent in the ownership or operation of or investment in mining properties or businesses in foreign countries, Coeur's ability to raise additional financing necessary to conduct its business, make payments or refinance its debt, as well as other uncertainties and risk factors set out in filings made from time to time with the United States Securities and Exchange Commission, and the Canadian securities regulators, including, without limitation, Coeur's most recent reports on Form 10-K and Form 10- Q. Actual results, developments and timetables could vary significantly from the estimates presented. Readers are cautioned not to put undue reliance on forward-looking statements. Coeur disclaims any intent or obligation to update publicly such forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, Coeur undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Coeur, its financial or operating results or its securities. The information regarding the El Gallo complex disclosed herein has been previously disclosed by McEwen Mining Inc. in its November 8, 2013 press release and in the technical report dated August 30, 2013 on file at www.sedar.com. The information regarding the Zaruma project disclosed herein has been previously disclosed by Dynasty Metals & Mining Inc. in the technical report dated August 21, 2006 on file at www.sedar.com. The information regarding the Jerusalem project disclosed herein has been previously disclosed by Dynasty Metals & Mining Inc. in the technical report dated February 27, 2006 on file at www.sedar.com. The information regarding the Dynasty Goldfields project disclosed herein has been previously disclosed in the technical report dated Oct 30, 2007 on file at www.sedar.com. The information regarding the Cerro Bayo mine disclosed herein has been previously disclosed by Mandalay Resources Corp. in its November 5, 2013 press release and in the technical report dated March 20, 2013 on file at www.sedar.com. Mineral Reserves and Mineral Resources are reported as of June 30, 2013 for the El Gallo complex, October 21, 2005 for the Zaruma project, December 22, 2004 for the Jerusalem project, October 30, 2007 for the Dynasty Goldfields project, and December 31, 2012 for the Cerro Bayo mine. The information provided herein is based on information available to Coeur as of the date of this document, and therefore will not reflect updates, if any after such date. A qualified person of Coeur has not done sufficient work to classify this information as current Mineral Resources or Mineral Reserves for Coeur and they are not treated as such. Although Coeur has not independently verified the information, Coeur believes it to be relevant and reliable. Reference should be made to the applicable technical report for the data verification processes and quality assurance procedures related thereto. Paul Hohbach, Director of Exploration and a qualified person under Canadian National Instrument 43-101, reviewed and approved the scientific and technical disclosures concerning Coeur's mineral projects contained herein. For a description of the key assumptions, parameters and methods used to estimate mineral reserves and resources, as well as data verification procedures and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, socio-political, marketing or other relevant factors, please see the Technical Reports for each of Coeur's properties as filed on SEDAR at www.sedar.com. Cautionary Note to U.S. Investors – The United States Securities and Exchange Commission permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. We use certain terms in this presentation, such as “measured,” “indicated,” “inferred”, and “resources” that are recognized by Canadian regulations, but that SEC guidelines generally prohibit U.S. registered companies from including in their filings with the SEC. U.S. investors are urged to consider closely the disclosure in our most recent Form 10-K and Form 10-Q which may be obtained from us, or from the SEC’s website at http://www.sec.gov. Inferred mineral resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be characterized as mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral resource estimates do not account for minability, selectivity, mining loss and dilution. There is no certainty that the inferred mineral resources will be converted to the measured and indicated categories or that the measured and indicated mineral resources will be converted to the proven and probable mineral reserve categories. For additional information, please refer to the Canadian National Instrument 43-101-compliant Technical Reports for the applicable properties available on www.sedar.com or other publicly available disclosure of the applicable mine operators. Non-U.S. GAAP Measures – We supplement the reporting of our financial information determined under United States generally accepted accounting principles (U.S. GAAP) with certain non-U.S. GAAP financial measures, including cash costs and free cash flow. We believe that these adjusted measures provide meaningful information to assist management, investors and analysts in understanding our financial results and assessing our prospects for future performance. We believe these adjusted financial measures are important indicators of our recurring operations because they exclude items that may not be indicative of, or are unrelated to our core operating results, and provide a better baseline for analyzing trends in our underlying businesses. We believe cash costs and free cash flow are important measures in assessing the Company's overall financial performance. This presentation shall not constitute an offer to sell or a solicitation of an offer to purchase the Coeur shares and shall not constitute an offer, solicitation or sale in any jurisdiction, province or state in which such an offer, solicitation or sale would be unlawful.

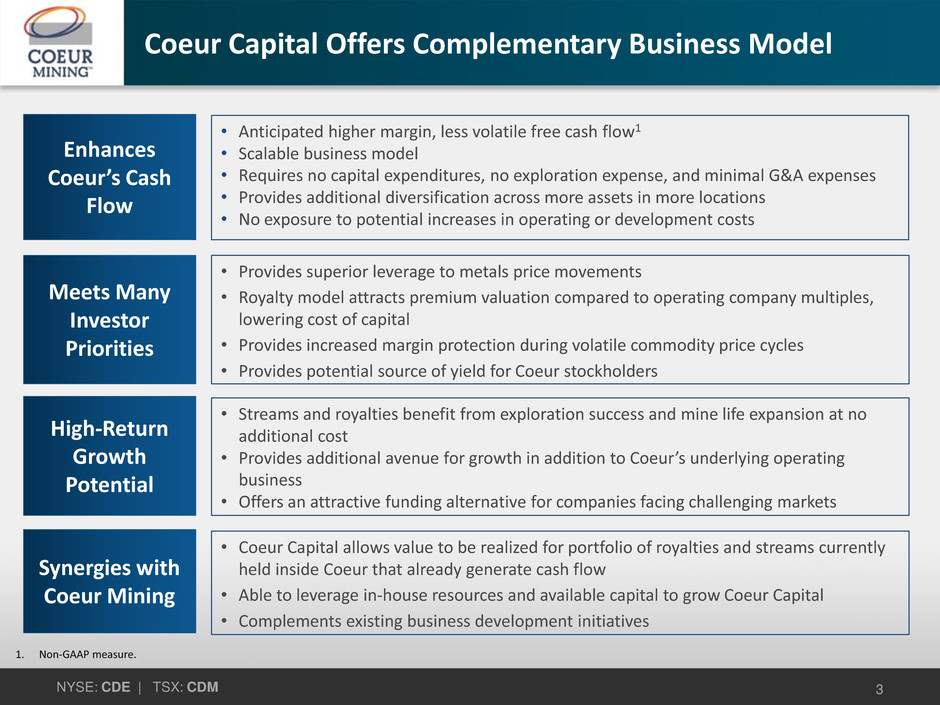

NYSE: CDE | TSX: CDM 3 Coeur Capital Offers Complementary Business Model Enhances Coeur’s Cash Flow • Anticipated higher margin, less volatile free cash flow1 • Scalable business model • Requires no capital expenditures, no exploration expense, and minimal G&A expenses • Provides additional diversification across more assets in more locations • No exposure to potential increases in operating or development costs Meets Many Investor Priorities High-Return Growth Potential • Provides superior leverage to metals price movements • Royalty model attracts premium valuation compared to operating company multiples, lowering cost of capital • Provides increased margin protection during volatile commodity price cycles • Provides potential source of yield for Coeur stockholders • Streams and royalties benefit from exploration success and mine life expansion at no additional cost • Provides additional avenue for growth in addition to Coeur’s underlying operating business • Offers an attractive funding alternative for companies facing challenging markets Synergies with Coeur Mining • Coeur Capital allows value to be realized for portfolio of royalties and streams currently held inside Coeur that already generate cash flow • Able to leverage in-house resources and available capital to grow Coeur Capital • Complements existing business development initiatives 1. Non-GAAP measure.

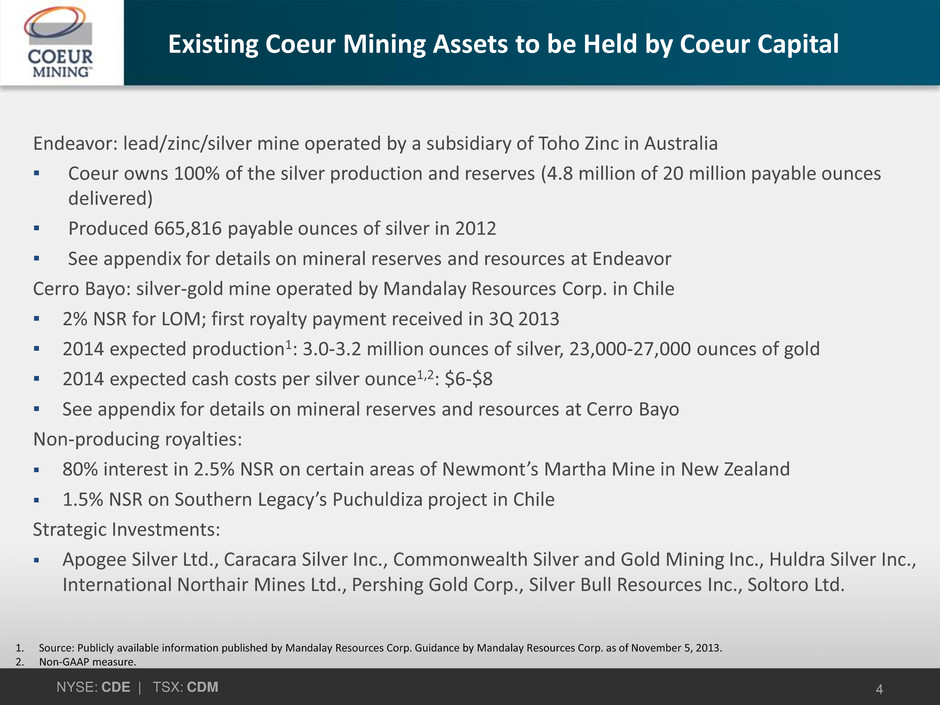

NYSE: CDE | TSX: CDM 4 Existing Coeur Mining Assets to be Held by Coeur Capital Endeavor: lead/zinc/silver mine operated by a subsidiary of Toho Zinc in Australia ▪ Coeur owns 100% of the silver production and reserves (4.8 million of 20 million payable ounces delivered) ▪ Produced 665,816 payable ounces of silver in 2012 ▪ See appendix for details on mineral reserves and resources at Endeavor Cerro Bayo: silver-gold mine operated by Mandalay Resources Corp. in Chile ▪ 2% NSR for LOM; first royalty payment received in 3Q 2013 ▪ 2014 expected production1: 3.0-3.2 million ounces of silver, 23,000-27,000 ounces of gold ▪ 2014 expected cash costs per silver ounce1,2: $6-$8 ▪ See appendix for details on mineral reserves and resources at Cerro Bayo Non-producing royalties: 80% interest in 2.5% NSR on certain areas of Newmont’s Martha Mine in New Zealand 1.5% NSR on Southern Legacy’s Puchuldiza project in Chile Strategic Investments: Apogee Silver Ltd., Caracara Silver Inc., Commonwealth Silver and Gold Mining Inc., Huldra Silver Inc., International Northair Mines Ltd., Pershing Gold Corp., Silver Bull Resources Inc., Soltoro Ltd. 1. Source: Publicly available information published by Mandalay Resources Corp. Guidance by Mandalay Resources Corp. as of November 5, 2013. 2. Non-GAAP measure.

NYSE: CDE | TSX: CDM 5 Global Royalty Corp (GRC) ▪ Privately held; based in Vancouver ▪ Key royalty assets: ▪ McEwen Mining’s El Gallo complex, Sinaloa State, Mexico (see slide 6) ▪ Dynasty Metals & Mining’s Zaruma project, Ecuador (see slide 7) ▪ Mark Kucher, CEO and Director ▪ 25 years of resource finance experience in investment banking, M&A, merchant banking, and institutional coverage ▪ Investment banking experience with BMO Harris Capital Markets, UBS Canada, and Sprott Securities ▪ Mining experience with Aurex Resources Inc., which merged with Cobre Mining Company Inc. ▪ Track record of creating shareholder value in the mining and royalty space. Created companies that were sold to Imperial Metals Corporation, Freeport McMoRan Copper and Gold, and Royal Gold ▪ Founder and significant owner of GRC ▪ Will become Managing Director of Coeur Capital and will have primary responsibility for its daily management and growth Mineral resource company focused on creating or acquiring metal royalty interests

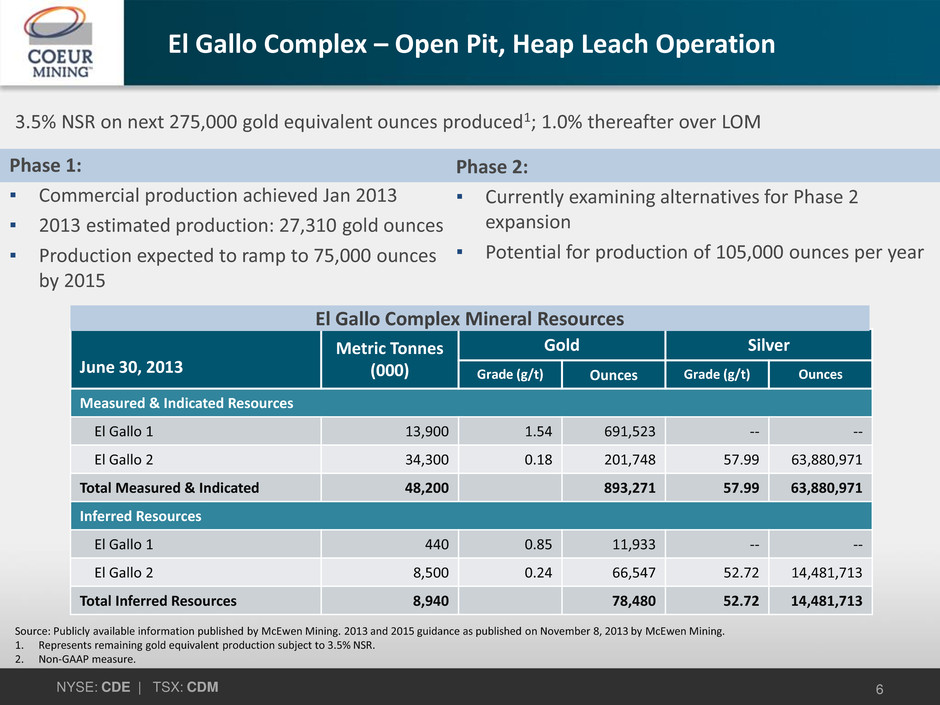

NYSE: CDE | TSX: CDM 6 El Gallo Complex – Open Pit, Heap Leach Operation 3.5% NSR on next 275,000 gold equivalent ounces produced1; 1.0% thereafter over LOM June 30, 2013 Metric Tonnes (000) Gold Silver Grade (g/t) Ounces Grade (g/t) Ounces Measured & Indicated Resources El Gallo 1 13,900 1.54 691,523 -- -- El Gallo 2 34,300 0.18 201,748 57.99 63,880,971 Total Measured & Indicated 48,200 893,271 57.99 63,880,971 Inferred Resources El Gallo 1 440 0.85 11,933 -- -- El Gallo 2 8,500 0.24 66,547 52.72 14,481,713 Total Inferred Resources 8,940 78,480 52.72 14,481,713 El Gallo Complex Mineral Resources Source: Publicly available information published by McEwen Mining. 2013 and 2015 guidance as published on November 8, 2013 by McEwen Mining. 1. Represents remaining gold equivalent production subject to 3.5% NSR. 2. Non-GAAP measure. Phase 2: ▪ Currently examining alternatives for Phase 2 expansion ▪ Potential for production of 105,000 ounces per year Phase 1: ▪ Commercial production achieved Jan 2013 ▪ 2013 estimated production: 27,310 gold ounces ▪ Production expected to ramp to 75,000 ounces by 2015

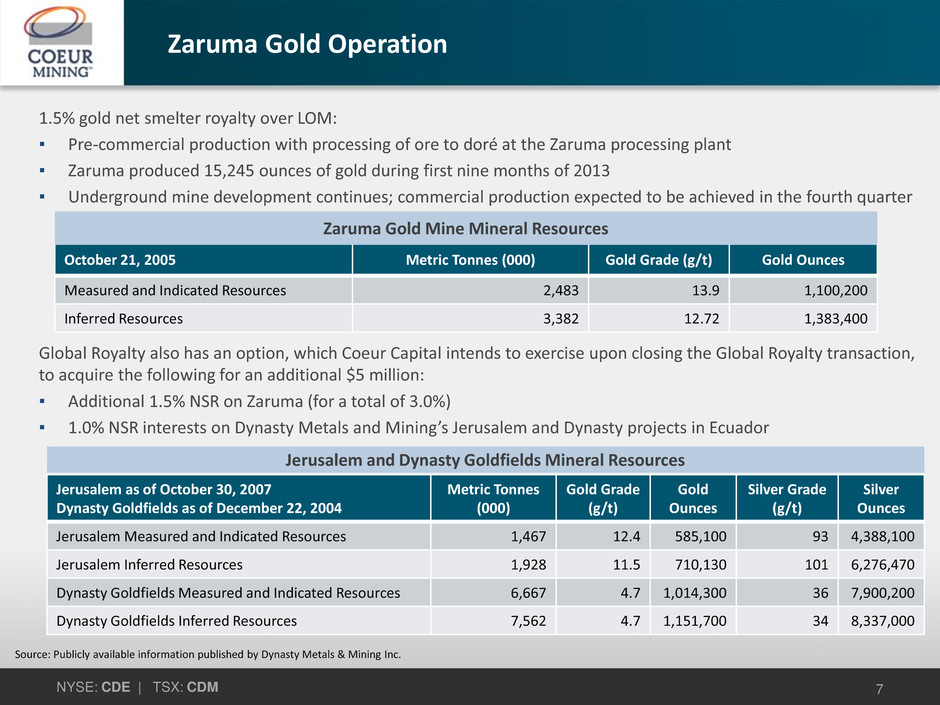

NYSE: CDE | TSX: CDM 7 Zaruma Gold Operation 1.5% gold net smelter royalty over LOM: ▪ Pre-commercial production with processing of ore to doré at the Zaruma processing plant ▪ Zaruma produced 15,245 ounces of gold during first nine months of 2013 ▪ Underground mine development continues; commercial production expected to be achieved in the fourth quarter October 21, 2005 Metric Tonnes (000) Gold Grade (g/t) Gold Ounces Measured and Indicated Resources 2,483 13.9 1,100,200 Inferred Resources 3,382 12.72 1,383,400 Zaruma Gold Mine Mineral Resources Source: Publicly available information published by Dynasty Metals & Mining Inc. Jerusalem as of October 30, 2007 Dynasty Goldfields as of December 22, 2004 Metric Tonnes (000) Gold Grade (g/t) Gold Ounces Silver Grade (g/t) Silver Ounces Jerusalem Measured and Indicated Resources 1,467 12.4 585,100 93 4,388,100 Jerusalem Inferred Resources 1,928 11.5 710,130 101 6,276,470 Dynasty Goldfields Measured and Indicated Resources 6,667 4.7 1,014,300 36 7,900,200 Dynasty Goldfields Inferred Resources 7,562 4.7 1,151,700 34 8,337,000 Jerusalem and Dynasty Goldfields Mineral Resources Global Royalty also has an option, which Coeur Capital intends to exercise upon closing the Global Royalty transaction, to acquire the following for an additional $5 million: ▪ Additional 1.5% NSR on Zaruma (for a total of 3.0%) ▪ 1.0% NSR interests on Dynasty Metals and Mining’s Jerusalem and Dynasty projects in Ecuador

NYSE: CDE | TSX: CDM 8 GRC Transaction Highlights Consideration ▪ Consideration of $23.8 million; payable in approximately $0.3 million in cash and $23.6 million in Coeur Mining common stock, approximately 2.1 million shares ▪ Coeur Capital will assume approximately $3.9 million of existing GRC liabilities ▪ Combine GRC’s assets with existing streams and royalties currently held by Coeur into Coeur Capital, Inc., a wholly-owned subsidiary of Coeur Mining, Inc. ▪ Coeur Capital will have four cash flowing royalty and stream interests expected to generate approximately $15 million annually of after-tax free cash flow1 for the next few years GRC is expected to provide Coeur Capital with additional leverage to metals price movements and geographic and asset diversity, with no additional CAPEX and minimal G&A expenses Structure ▪ Entered into definitive agreement November 22, 2013 ▪ Transaction expected to close in December 2013 Timing 1. Non-GAAP measure.

NYSE: CDE | TSX: CDM 9 Coeur Capital: Driving Returns with Minimal Capital ▪ Future growth expected to be largely self-funded and eminently financeable at a relatively low cost of capital ▪ Will seek high-return opportunities expected to improve the quality of Coeur’s cash flow and increase overall margins Small Companies undercapitalized; lack cash flow Large Companies require deals with considerable scale Coeur Capital target transaction size: $3-$30 mil Competitive Landscape Coeur Capital favorably positioned to fill an underserved segment of the royalty space

Appendix

NYSE: CDE | TSX: CDM 11 Year End 2012 Short tons Silver Grade (ounce/ton) Silver Ounces (contained) Proven Reserves 2,258,000 4.32 9,757,000 Probable Reserves 2,508,000 1.43 3,588,000 Total Proven and Probable Reserves 4,766,000 2.80 13,345,000 Measured Resources 10,639,000 1.98 21,088,000 Indicated Resources 302,000 10.23 3,090,000 Total Measured and Indicated Resources 10,941,000 2.21 24,179,000 Total Inferred Resources 3,527,000 1.09 3,836,000 Select Mineral Reserves and Resources Notes to the above mineral reserves and resources: 1. Effective December 31, 2012. 2. Metal prices used for mineral reserves and resources were $2,200 per metric ton of lead, $2,200 per metric ton of zinc and $34.00 per ounce of silver. 3. Mineral resources are in addition to mineral reserves and have not demonstrated economic viability. Inferred mineral resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be considered for estimation of mineral reserves. 4. Rounding of tons and ounces, as required by reporting guidelines, may result in apparent differences between tons, grade, and contained metal content. 5. For details on the estimation of mineral resources and reserves, please refer to the NI 43-101-compliant Technical Report on file at www.sedar.com. Year End 2012 Metric Tonnes (000) Silver Grade (g/t) Silver Ounces Gold Grade (g/t) Gold Ounces Proven and Probable Reserves 2,354 241 18,250,000 2.2 163,000 Measured and Indicated Resources 1,889 367 22,275,000 3.2 194,000 Inferred Resources 452 201 2,922,000 2.4 35,000 Cerro Bayo Mineral Reserves and Resources1 Endeavor Mineral Reserves and Resources 1. Source: Technical report dated March 20, 2013 on file at www.sedar.com.

NYSE: CDE | TSX: CDM 12 Head Office: Coeur Mining, Inc. 104 S. Michigan Avenue Chicago Main Tel: (312) 489-5800 Stock Tickers: CDE: NYSE; CDM: TSX Warrant Tickers: CDE.WS: NYSE; CDM.WT: TSX Website: www.coeur.com Bridget Freas Director, Investor Relations bfreas@coeur.com Contact Information Donna Mirandola Director, Corporate Communications dmirandola@coeur.com