Attached files

| file | filename |

|---|---|

| EX-23 - EXHIBIT 23.1 - BLUE CALYPSO, INC. | exhibit23_1.htm |

As filed with the Securities and Exchange Commission on November 22, 2013

Registration No. 333-192423

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO . 1 TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

BLUE CALYPSO, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

| 8200 |

| 20-8610073 |

| (State or other jurisdiction of |

| (Primary Standard Industrial |

| (I.R.S. Employer |

| incorporation or organization) |

| Classification Code Number) |

| Identification No.) |

19111 North Dallas Parkway, Suite 200

Dallas, TX 75287

(972) 695-4776

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

William Ogle, Chief Executive Officer

Blue Calypso, Inc.

19111 North Dallas Parkway, Suite 200

Dallas, TX 75287

(972) 695-4776

(Name, address, including zip code and telephone number, including area code, of agent for service)

Copies of all communications, including communications set to agent for service, should be sent to:

| Sean F. Reid, Esq. Tel. (609) 895-6719 Fax (609) 896-1469 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

i

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | . | Accelerated filer o | |

|

|

| ||

| Non-accelerated filer o | Smaller reporting company þ. |

| |

| (Do not check if a smaller reporting company) |

| ||

ii

|

|

|

|

| Proposed maximum offering price per share |

|

|

|

| |||

|

|

|

|

|

| maximum aggregate offering price |

|

| ||||

| (i) Title of each class of securities to be registered |

| Amount to be Registered (1) |

|

|

| Amount of registration fee | |||||

|

|

|

|

| ||||||||

| Common Stock, $0.0001 par value per share issuable upon exercise of warrants |

| 20,491,164 |

| $ | 0.17 | (2) | $ | 3,483,497.88 |

| $ | 448.67 |

| Common Stock, $0.0001 par value per share |

| 11,546,154 |

| $ | 0.17 | (2) | $ | 1,962,846.16 |

| $ | 252.81 |

| Total |

| 32,037,318 |

|

|

|

| $ | 5,446,344.06 |

| $ | 701.49 |

(1) Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), the shares of common stock offered hereby also include an indeterminate number of additional shares of common stock as may from time to time become issuable by reason of stock splits, stock dividends, recapitalizations or other similar transactions.

(2) Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(c) and 457(g) under the Act, using the average of the high and low price as reported on the OTC Bulletin Board on November 18, 2013 which was $0.19 per share.

(3) Previously paid on November 19, 2013.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

iii

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED November 22, 2013

PRELIMINARY PROSPECTUS

Blue Calypso, Inc.

20,491,164 Shares of Common Stock Underlying Warrants

11,546,154 Shares of Common Stock

This prospectus relates to the resale of: (i) up to 20,491,164 shares of our common stock to be offered by the selling stockholders upon the exercise of outstanding common stock purchase warrants, and (ii) up to 11,546,154 shares of our common stock to be offered by the selling stockholders.

The selling stockholders may sell shares of common stock from time to time in the principal market on which our common stock is traded at the prevailing market price or in privately negotiated transactions. See “Plan of Distribution” which begins on page 56.

We will not receive any of the proceeds from the sale of common stock by the selling stockholders. However, we will generate proceeds in the event of a cash exercise of the warrants by the selling stockholders. We intend to use those proceeds, if any, for general corporate purposes. We will pay the expenses of registering these shares.

All expenses of registration incurred in connection with this offering are being borne by us, but all selling and other expenses incurred by the selling stockholders will be borne by the selling stockholders.

Our common stock is quoted on the regulated quotation service of the OTC Bulletin Board under the symbol “BCYP.OB.” On November 18, 2013, the last reported sale price of our common stock as reported on the OTC Bulletin Board was $0.16 per share.

Investing in our common stock is highly speculative and involves a high degree of risk. You should carefully consider the risks and uncertainties in the section entitled “Risk Factors” beginning on page 3 of this prospectus before making a decision to purchase our stock.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2013

iv

| TABLE OF CONTENTS |

|

|

| Page |

|

|

|

| PROSPECTUS SUMMARY | 1 |

| THE OFFERING | 6 |

| RISK FACTORS | 7 |

| USE OF PROCEEDS | 18 |

| MARKET FOR OUR COMMON STOCK AND RELATED STOCKHOLDER MATTERS | 19 |

| DIVIDEND POLICY | 20 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION | 21 |

| BUSINESS | 29 |

| EXECUTIVE OFFICERS AND DIRECTORS | 40 |

| EXECUTIVE COMPENSATION | 43 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 45 |

| CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | 46 |

| SELLING STOCKHOLDERS | 47 |

| DESCRIPTION OF SECURITIES | 48 |

| LEGAL MATTERS | 54 |

| EXPERTS | 54 |

| WHERE YOU CAN FIND ADDITIONAL INFORMATION | 54 |

|

|

|

v

EXPLANATORY NOTE

This Amendment No. 1 to the Registration Statement on Form S-1 (File No. 333-192423) of Blue Calypso, Inc. is being filed solely to provide the updated consent of Montgomery Coscia Greilich LLP and to provide the signature of the Company’s principal financial and accounting officer.

FORWARD LOOKING STATEMENTS

This prospectus contains forward-looking statements about our expectations, beliefs or intentions regarding, among other things, our business, financial condition, strategies, prospects, product development efforts, and results of operations.. In addition, from time to time, our representatives or we have made or may make forward-looking statements, orally or in writing. Forward-looking statements can be identified by the use of forward-looking words such as “believe,” “expect,” “intend,” “plan,” “may,” “should” or “anticipate” or their negatives or other variations of these words or other comparable words or by the fact that these statements do not relate strictly to historical or current matters. These forward-looking statements may be included in, but are not limited to, various filings made by us with the U.S. Securities and Exchange Commission, or the SEC, press releases or oral statements made by or with the approval of one of our authorized executive officers. Forward-looking statements relate to anticipated or expected events, activities, trends or results as of the date they are made. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties that could cause our actual results to differ materially from any future results expressed or implied by the forward-looking statements. Many factors could cause our actual activities or results to differ materially from the activities and results anticipated in forward-looking statements, including, but not limited to, the factors summarized below.

This prospectus identifies important factors which could cause our actual results to differ materially from those indicated by the forward-looking statements, particularly those set forth under the heading “Risk Factors.”

The risk factors included in this prospectus are not necessarily all of the important factors that could cause actual results to differ materially from those expressed in any of our forward-looking statements. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

All forward-looking statements attributable to persons acting on our behalf or us speak only as of the date of this prospectus and are expressly qualified in their entirety by the cautionary statements included in this prospectus. We undertake no obligations to update or revise forward-looking statements to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. In evaluating forward-looking statements, you should consider these risks and uncertainties.

EXPLANATORY NOTE

Market data and certain industry data and forecasts used throughout this prospectus were obtained from internal company surveys, market research, consultant surveys, and publicly available information, reports of governmental agencies and industry publications and surveys. Industry surveys, publications, consultant surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. We have not independently verified any of the data from third party sources, nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, internal surveys, industry forecasts and market research, which we believe to be reliable, based on our management’s knowledge of the industry, have not been independently verified. Forecasts are particularly likely to be inaccurate, especially over long periods of time. In addition, we do not necessarily know what assumptions regarding general economic and industry growth were used in preparing the forecasts we cite. Statements as to our market position are based on the most currently available data. While we are not aware of any misstatements regarding the industry data presented in this prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus.

vi

POPSHARE™ is an applet that is easily installed anywhere on a client’s website where sharing might occur. The POPSHARE applet can be used in a variety of ways. It can be placed on new product pages, specific promotional content or on the purchase confirmation page. POPSHARE promotes sharing of branded content and enables consumers to customize it with a message, picture or video following a purchase through the client’s website. Immediate share confirmation from the brand to the advocate thanking them for sharing allows the brand to interact directly with the advocate for the first time.

DashTAGG™ is our mobile gamification technology. It is a unique social and mobile game of “tag” and is designed to increase in-store foot traffic and grow visitor-to-buyer conversion rates. We believe that mobile gamification has become increasingly important in brand development and DashTAGG combines both physical and digital participation and is designed to ensure the maximum engagement with brand advocates. DashTAGG players take pictures of each other to earn points and win prizes and awards. Retailers or events sponsor games and provide physical locations with QR codes which activate tags when scanned. Physical locations of players are identified via their GPS. Game sponsors may offer prizes, merchandise, trophies and access to exclusive events like parties, shows and concerts.

Blue Calypso Labs™ was recently launched to offer software innovation services to clients. Blue Calypso Lab’s mission is to help clients develop unique software solutions that solve strategic business problems, focus on integrating Blue Calypso’s sharing technologies as well as seek licensing revenue from Blue Calypso’s broad portfolio of intellectual property. Blue Calypso formed BC Labs to leverage the company’s significant engineering resources.

We intend to continue to develop new technology and expand on our intellectual property portfolio and product offerings to meet the needs of companies seeking to amplify their brand messages.

MARKET OPPORTUNITY

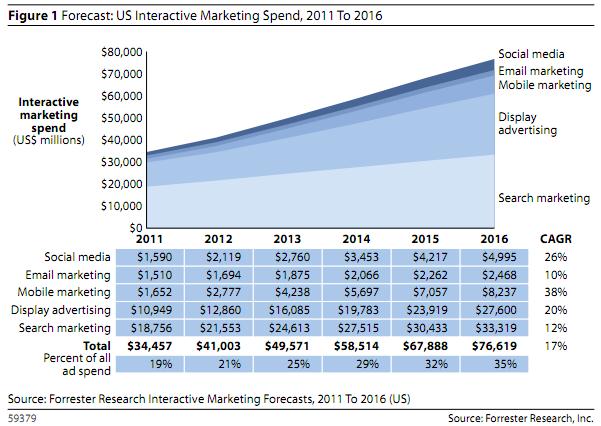

We believe that the market opportunity for our existing products and technology is significant and continuing to expand. Forrester Research estimates that in 2013, approximately $50 billion will be spent in the United States on interactive marketing. This category is growing at a 17% compounded annual growth rate. The sub-segment of social media marketing is significant at $2.8 billion and is growing at an even faster rate of 26% compounded annual growth rate. We believe social media marketing is experiencing rapid growth because consumers are much more receptive to recommendations from their friends and family. We believe that our platform offers an effective tool for advertisers seeking to enter or expand their advertising presence through social media and on mobile devices by leveraging existing relationships with consumers and employees. We believe that any consumer product, retail or consumer focused business, whether for-profit or non-profit, is a potential user of our platform.

COMPETITIVE STRENGTHS

Product advertising, awareness and branding through social media is an extremely competitive and fragmented industry. Adequate protection of intellectual property, successful product development, adequate funding and retention of experienced personnel are critical to our success. We believe that we have the following strengths:

· Prominent Intellectual Property Position. We believe that our patents provide us with broad and comprehensive coverage for the electronic delivery of advertisements and electronic offers on any electronic communication device. Our policy is to seek to protect our proprietary position by filing patent applications related to our proprietary technology and improvements that we believe are important to the development of our business. We will also pursue licensing agreements with companies that we believe are infringing on our intellectual property in order to maintain our competitive position.

· Extensive Knowledge and Experience in Product Advertising, Awareness and Branding. We believe that our management and personnel have extensive knowledge and experience in product advertising, awareness and branding which significantly adds to our competitive position.

· Highly Customizable Platform. We have the ability to rapidly customize products to meet our client’s needs. We believe that our current patents provide us with broad and comprehensive coverage and we intend to continue to expand upon our intellectual property portfolio as we develop new products and services in response to new opportunities in the market.

2

OUR STRATEGY

We intend to continue innovating and will attempt to maximize the economic benefits of our intellectual property. We currently have two key areas of operation:

· development and delivery of digital word-of-mouth technology solutions; and

· maximization of the economic benefits of our intellectual property.

We have developed a proprietary platform that enables brands to leverage customer and employee relationships to increase brand loyalty and drive revenue. We believe that our strong intellectual property and our extensive experience in product advertising, awareness and branding will enable us to continue to develop new products and services.

We intend to expand our intellectual property portfolio through both internal development and acquisition. We intend to monetize our intellectual property through licensing, strategic partnerships, and services.

RECENT DEVELOPMENTS

General

On May 6, 2013, we entered into a securities purchase agreement with an accredited investor pursuant to which we issued and sold a 10% Convertible Debenture in the principal amount of $2,400,000 and 1,200,000 shares of our common stock in consideration of gross proceeds to us of $2,400,000. The 10% Debenture bears interest at a rate of 10% per annum, is due two years from the issuance date and is convertible into shares of our common stock at a conversion price of $0.25 per share. On September 13, 2013, we entered into a series of agreements with the holder of our outstanding 10% Convertible Debenture and certain of our outstanding warrants. Pursuant to such agreements, we agreed to provide for a temporary reduction in the conversion price of the 10% Convertible Debenture from $0.25 to $0.13 per share through December 31, 2013 and the holder agreed to the elimination of certain restrictive covenants in the 10% Convertible Debenture. In addition, we agreed to amend the terms of certain of our outstanding warrants in order to induce the holder to exercise such warrants as well as to eliminate the cashless exercise feature and certain anti-dilution protections contained in such warrants. In exchange, we agreed to provide for a temporary reduction in the exercise price of such warrants from $0.10 to $0.05 through the later of December 31, 2013 or 45 days after a registration statement covering the underlying shares is declared effective by the Securities and Exchange Commission.

On September 12, 2013, we entered into an Asset Purchase Agreement with Picture Assassin, LLC, pursuant to which we acquired certain assets relating to Picture Assassin’s proprietary mobile gamification technology in consideration for 1,000,000 shares of our common stock.

On October 7, 2013, we entered into a securities purchase agreement with an accredited investor pursuant to which we issued and sold 7,700,000 shares of our common stock at a purchase price of $0.13 per share in consideration of gross proceeds of $1,001,000. On October 15, 2013, we entered into a securities purchase agreement with an accredited investor pursuant to which we issued and sold 3,846,154 shares of our common stock at a purchase price of $0.13 per share in consideration of gross proceeds of $500,000.

Litigation

We initiated litigation in the United States District Court, Eastern District of Texas, against Groupon, Inc., Living Social, Inc., YELP, Inc., IZEA, Inc., MyLikes Inc., and Foursquare Labs, Inc. for patent infringement of two of our patents (U.S. Patent Nos. 7,664,516 and 8,155,679), which cover peer-to-peer advertising. We subsequently amended our complaints to add claims of infringement on our three other patents (U.S. Patent Nos. 8,438,055, 8,452,646, and 8,457,670. A summary of each of the cases is set forth below. With the payment of all maintenance fees, all of our patents will expire on December 27, 2024.

3

On July 31, 2012, we filed a patent infringement complaint against Groupon, Inc. (Case No. 6:2012-cv-00486) alleging infringement of two of our patents, 7,664,516 and 8,155,679, focused on our peer-to-peer marketing technology. The complaint was filed in the U.S. District Court in the Eastern District of Texas, Tyler Division. On April 26, 2013, the Court issued a Scheduling Order setting the Markman hearing for November 7, 2013 and trial for July 9, 2014. On June 13, 2013, we moved to amend our complaint and add claims for infringement by Groupon of three additional patents, U.S Patent 8,438,055, U.S. Patent No. 8,452,646 and U.S. Patent 8,457,670. On July 19, 2013, the Court granted our motion. In addition, the Court extended the Markman hearing date to February 5, 2014 and the trial scheduling date to October 6, 2014 as a result of the three additional patents being added to the case. The case is presently in the early stages of discovery.

On August 24, 2012, we filed a patent infringement complaint against Living Social, Inc. (Case No. 2:2012-cv-00518) alleging infringement of two of our patents, U.S Patent 7,664,516 and U.S Patent 8,155,679. The complaint was filed in the U.S. District Court in the Eastern District of Texas, Marshall Division. In March 2013, the Court issued a Scheduling Order setting the Markman hearing date for August 27, 2013 and trial for August 7, 2014. On June 14, 2013, we amended our complaint and added claims for infringement by LivingSocial of three additional patents, U.S Patent No. 8,438,055, U.S. Patent No. 8,452,646 and U.S. Patent 8,457,670. Living Social had until August 19, 2013 to file an amended answer, affirmative defenses and any counterclaims related to the amended complaint. We provided our preliminary infringement contentions for all five asserted patents on June 25, 2013. The parties were to file proposals for a case schedule on or before August 29, 2013. As a result of the addition of the additional patents to the case, the Markman hearing was extended until February 11, 2014 as to all patents. A pretrial conference was set for September 25, 2014 with jury selection to follow on October 6, 2014. On August 16, 2013, we dismissed our patent infringement action against Living Social pursuant to the terms of an otherwise confidential settlement and license agreement.

On October 17, 2012, we filed patent infringement complaints against YELP, Inc. (Case No. 6:2012-cv-00788) and IZEA, Inc. (Case No. 6:2012-cv-00786) The suits allege infringement of two of our patents, 7,664,516 and 8,155,679. The complaints were filed in the U.S. District Court in the Eastern District of Texas, Tyler Division. On April 26, 2013, the Court issued a Scheduling Order setting the Markman hearing for November 7, 2013 and trial for July 9, 2014. On June 13, 2013, we moved to amend our complaint and add claims for infringement by Yelp and IZEA of three additional patents, U.S Patent 8,438,055, U.S. Patent No. 8,452,646 and U.S. Patent 8,457,670. On July 19, 2013, the Court granted our motion. In addition, the Court extended the Markman hearing date to February 5, 2014 and the trial scheduling date to October 6, 2014 due to the addition of the three new patents to the case. The cases are presently in the early stages of discovery.

On November 6, 2012, we filed patent infringement complaints against MyLikes (Case No. 6:2012-cv-00838) and Foursquare (Case No. 6:2012-cv-00837). The suits allege infringement of two of our patents, 7,664,516 and 8,155,679. The complaints were filed in the U.S. District Court in the Eastern District of Texas, Tyler Division. On April 26, 2013, the Court issued a Scheduling Order setting the Markman hearing for November 7, 2013 and trial for July 9, 2014. On June 13, 2013, we moved to amend our complaint and add claims for infringement by MyLikes and Foursquare of three additional patents, U.S Patent 8,438,055, U.S. Patent No. 8,452,646 and U.S. Patent 8,457,670. On July 19, 2013, the Court granted our motion. In addition, the Court extended the Markman hearing date to February 5, 2014 and the trial scheduling date to October 6, 2014 due to the addition of the three new patents to the case. In an ancillary action, Foursquare filed a declaratory judgment action against us in the Southern District of New York that alleged that U.S Patent 8,438,055, U.S. Patent No. 8,452,646 and U.S. Patent 8,457,670 were not infringed and were invalid. That case was transferred to the Eastern District of Texas on August 2, 2013. On July 23, 2013, we entered into a settlement agreement and license agreement with MyLikes to resolve the case. MyLikes agreed to pay us the equivalent of a 3.5% royalty for the use of our patents. The case against MyLikes was subsequently dismissed on July 31, 2013. The case against Foursquare is presently in the early stages of discovery.

The court dockets for each case, including the parties’ briefs are publicly available on the Public Access to Court Electronic Records website, or PACER, www.pacer.gov, which is operated by the Administrative Office of the U.S. Courts.

Corporate History

We were incorporated as a Nevada corporation on March 2, 2007 under the name JJ&R Ventures, Inc. for the purpose of developing and marketing an educational book series, consisting of books, presentations and flash cards focusing on healthy nutrition for children. On or about July 2011, we were presented with a business opportunity by the management of a privately held Texas company named Blue Calypso Holdings, Inc. that we determined to be more desirable than our business plan at that time. As a result, we suspended our efforts in relation to our original business plan and entered into negotiations with Blue Calypso Holdings, Inc. to consummate a reverse merger transaction.

4

Prior to September 1, 2011, we were a public shell company without material assets or liabilities. On September 1, 2011, Blue Calypso Holdings, Inc. completed a reverse merger with us, pursuant to which Blue Calypso Holdings, Inc. became our wholly-owned subsidiary and we succeeded to the business of Blue Calypso Holdings, Inc. as our sole line of business and the former security holders of Blue Calypso Holdings, Inc. became our controlling stockholders. For financial reporting purposes, Blue Calypso Holdings, Inc. is considered the accounting acquirer in the reverse merger and the former public shell company is considered the acquired company. We refer to this merger transaction as the “reverse merger.”

Immediately following the closing of the reverse merger, we transferred all of our pre-merger assets and liabilities to JJ&R Ventures Holdings, Inc., a wholly-owned subsidiary, and transferred all of the outstanding stock of JJ&R Ventures Holdings, Inc. to Deborah Flores, our then majority stockholder and our former president, secretary, treasurer and sole director, in exchange for the cancellation of 51,000,000 shares of our common stock then owned by Ms. Flores.

On October 17, 2011, we merged with and into Blue Calypso, Inc., a Delaware corporation and our wholly-owned subsidiary, for the sole purpose of changing our state of incorporation from Nevada to Delaware. We refer to this merger transaction as the “reincorporation merger.”

Our principal executive offices are located at 19111 North Dallas Parkway, Suite 200, Dallas Texas 75287. Our telephone number is (972) 695-4776. Our website address is http://www.bluecalypso.com. Information on or accessed through our website is not incorporated into this prospectus and is not a part of this prospectus.

5

THE OFFERING

| Common Stock Offered By The Selling Stockholders: |

| 51,429,518 shares |

|

|

|

|

| Common Stock Outstanding Prior To Offering: |

| 167,398,832 shares |

|

|

|

|

| Common Stock Outstanding After The Offering: |

| 187,889,996 shares (1) |

|

|

|

|

| Offering Price: |

| All or part of the shares of common stock offered hereby may be sold from time to time in amounts and on terms to be determined by the selling stockholders at the time of sale. |

|

|

|

|

| Use of Proceeds: |

| We will not receive any proceeds from the sale of the common stock offered by the selling stockholders. However, we will generate proceeds in the event of a cash exercise of the warrants by the selling stockholders. We intend to use those proceeds, if any, for general corporate purposes.

|

| Dividend Policy: |

| We have not in the past and do not anticipate declaring or paying any cash dividends on our common stock following this offering. |

|

|

|

|

| Risk Factors: |

| Investing in the Shares involves a high degree of risk. You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 4 of this prospectus before deciding whether or not to invest in shares of our common stock. |

|

|

|

|

| Trading Symbol: |

| The Company’s common stock currently trades on the OTC Bulletin Board and on the OTCQB under the symbol “BCYP.” |

(1) The number of shares of common stock outstanding after the offering is based upon 167,398,832 shares outstanding as of November 18, 2013 including 13,406,667 shares issued pursuant to restricted stock awards.

The number of shares of common stock outstanding after this offering excludes:

· 14,839,073 shares of common stock issuable to certain key employees, key contractors and non-employee directors upon the exercise of currently outstanding options;

· 29,537,675 shares of common stock available for future issuance to certain key employees, key contractors and non-employee directors under the Blue Calypso, Inc. 2011 Long-Term Incentive Plan;

· 11,045,655 shares of common stock issuable upon conversion of Series A Convertible Preferred Stock;

· 19,392,200 shares of common stock issuable upon conversion of our currently outstanding 10% convertible debenture in the principal amount of $2,400,000 which are currently convertible at $0.13 per share, including 930,664 shares issuable in lieu of accrued interest on such debentures;

· 3,000,000 shares of common stock issuable upon conversion or our currently outstanding 10% convertible debentures in the principal amount of $600,000 which are convertible at $0.20 per share; and

· 12,004,589 shares of common stock issuable upon exercise of currently outstanding warrants.

Unless otherwise specifically stated, all information in this prospectus assumes: (i) no exercise of outstanding stock options or warrants to purchase shares of our common stock, and (ii) no conversion of outstanding preferred stock or convertible debentures into shares of our common stock.

6

Trial judges and juries often find it difficult to understand complex patent enforcement litigation, and as a result, we may need to appeal adverse decisions by lower courts in order to successfully enforce our patents.

It is difficult to predict the outcome of patent enforcement litigation at the trial level. It is often difficult for juries and trial judges to understand complex, patented technologies, and as a result, there is a higher rate of successful appeals in patent enforcement litigation than more standard business litigation. Such appeals are expensive and time consuming, resulting in increased costs and delayed revenue. Although we will diligently pursue enforcement litigation, we cannot predict with significant reliability the decisions made by juries and trial courts.

Federal courts are becoming more crowded, and as a result, patent enforcement litigation is taking longer.

Federal trial courts that hear our patent enforcement actions also hear criminal cases. Criminal cases always take priority over patent enforcement actions. As a result, it is difficult to predict the length of time it will take to complete an enforcement action. Moreover, we believe there is a trend in increasing numbers of civil lawsuits and criminal proceedings before federal judges, and as a result, we believe that the risk of delays in our patent enforcement actions will have a greater effect on our business in the future unless this trend changes.

As patent enforcement litigation becomes more prevalent, it may become more difficult for us to voluntarily license our patents.

We believe that the more prevalent patent enforcement actions become, the more difficult it will be for us to voluntarily license our patents. As a result, we may need to increase the number of our patent enforcement actions to cause infringing companies to license the patent or pay damages for lost royalties. This may increase the risks associated with an investment in our company.

If a court finds that any of our patents are invalid or narrows their scope over the course of a re-examination or we are otherwise unable to protect our proprietary rights, our ability to competitively conduct our business will be adversely effected.

We rely on our proprietary rights to deliver our platform. To protect our proprietary rights, we rely on a combination of patent and trade secret laws, confidentiality agreements, and protective contractual provisions. Despite these efforts, our patents and intellectual property relating to our business may not provide us with adequate protection of our platform or any competitive advantages.

Our five issued patents may be subject to challenge and possibly invalidated by third parties. Changes in either the patent laws or in the interpretations of patent laws in the United States or other countries may diminish the value of our intellectual property.

We own five pending patent applications in the United States. We cannot assure that these patent applications will be issued, in whole or in part, as patents. Patent applications in the United States are maintained in secrecy until the patents are published or issued. Since publication of discoveries in the scientific or patent literature tends to lag behind actual discoveries by several months, we cannot be certain that we are the first creator of the inventions covered by pending patent applications.

The status of patents involves complex legal and factual questions and the breadth of claims allowed is uncertain. Accordingly, we cannot be certain that the patent applications that we file will actually afford protection against competitors with similar technology. Others may independently develop similar or alternative products and technologies that may be outside the scope of our intellectual property. In addition, patents issued to us may be infringed upon or designed around by others and others may obtain blocking patents that we need to license or design around, either of which would increase costs and may adversely affect our operations.

Further, effective protection of intellectual property rights may be unavailable or limited in some foreign countries. Our inability to adequately protect our proprietary rights would have an adverse impact on our ability to competitively market our platform on a world-wide basis.

9

We also rely on trade secrets law to protect our technology. Trade secrets, however, are difficult to protect. While we believe that we use reasonable efforts to protect our trade secrets, our or our strategic partners’ employees, consultants, contractors or advisors may unintentionally or willfully disclose our information to competitors. We seek to protect this information, in part, through the use of non-disclosure and confidentiality agreements with employees, consultants, advisors, and others. However, these agreements may be breached and we may not have adequate remedies for a breach. In addition, we cannot ensure that those agreements will provide adequate protection for our trade secrets, know-how or other proprietary information or prevent their unauthorized use or disclosure.

If our trade secrets become known to competitors with greater experience and financial resources, the competitors may copy or use our trade secrets and other proprietary information in the advancement of their products, methods or technologies. If we were to prosecute a claim that a third party had illegally obtained and was using our trade secrets, it could be expensive and time consuming and the outcome could be unpredictable. In addition, courts outside the United States are sometimes less willing to protect trade secrets than courts in the United States. Moreover, if our competitors independently develop equivalent knowledge, we would lack any contractual claim to this information, and our business could be harmed.

To the extent that consultants and key employees apply technological information independently developed by them or by others to our potential products, disputes may arise as to the proprietary rights of the information, which may not be resolved in our favor. Consultants and key employees that work with our confidential and proprietary technologies are required to assign all intellectual property rights in their discoveries to us. However, these consultants and key employees may terminate their relationship with us, and we cannot preclude them indefinitely from dealing with our competitors.

We may seek to internally develop additional new inventions and intellectual property, which would take time and would be costly. Moreover, the failure to obtain or maintain intellectual property rights for such inventions could lead to the loss of our investments in such activities.

Members of our management team have significant experience as inventors. As such, part of our business may include the internal development of new inventions or intellectual property that we will seek to monetize. However, this aspect of our business would likely require significant capital and would be time consuming. Such activities could also distract our management team from its present business initiatives, which could have a material and adverse effect on our business. There is also the risk that our initiatives in this regard would not yield any viable new inventions or technology, which would lead to a loss of our investments in time and resources in such activities.

In addition, even if we are able to internally develop new inventions, in order for those inventions to be viable and to compete effectively, we would need to develop and maintain a proprietary position with respect to such inventions and intellectual property. However, there are significant risks associated with any such intellectual property we may develop principally including the following:

· patent applications we file may not result in issued patents or may take longer than we expect to result in issued patents;

· we may be subject to interference proceedings;

· we may be subject to opposition proceedings in the U.S. or foreign countries;

· any patents that are issued to us may not provide meaningful protection;

· we may not be able to develop additional proprietary technologies that are patentable;

· other companies may challenge patents issued to us;

· other companies may have independently developed and/or patented (or may in the future independently develop and patent) similar or alternative technologies, or duplicate our technologies;

· other companies may design around technologies we have developed; and

· enforcement of our patents would be complex, uncertain and very expensive.

On June 4, 2013, the Obama administration issued a fact sheet detailing a set of legislative recommendations and executive actions aimed at addressing abusive patent infringement lawsuits brought by patent assertion entities (entities that use patents primarily to obtain license fees rather than to support the development or transfer of technology). The White House announced that its actions are intended to protect innovators from frivolous patent litigation, ensure high-quality patents, and improve incentives for future innovation in high tech patents. The Obama administration recommended that Congress pursue several legislative measures which would:

· Require patentees and applicants to disclose the real Party-in-Interest in USPTO proceedings and in patent lawsuits.

· Give courts more discretion to award fees to the winning parties in patent cases.

· Expand the USPTO’s program that allows the review and (possible invalidation) of business method patents.

· Protect off-the-shelf use of technology by end-user consumers and businesses by providing them with better legal protection against liability. This measure includes halting judicial proceedings against such end-users when an infringement suit has also been brought against a vendor, retailer, or manufacturer of the technology being used.

· Change the International Trade Commission's, or ITC, standard for awarding injunctions so that the ITC has more discretion in awarding injunctions to patentees. This would reflect recent changes in the law used by District Courts.

· Incentivize public filing of demand/threat letters to make them accessible and searchable to the public in order to help curb abusive suits.

· Ensure that the ITC has adequate flexibility in hiring judges.

The Obama administration also announced five executive actions that would help bring greater transparency to the patent system. These actions would:

· Identify the real party interest in USPTO proceedings. The USPTO will begin a rulemaking process to require patent applicants and owners to regularly update ownership information when they are involved in proceedings before the USPTO. The rules would require designating the ultimate parent entity in control of the patent or application.

· Provide additional training to patent examiners in the USPTO to scrutinize functional claiming, which the Obama administration believes will help clarify the scope of patents.

· Require the USPTO to provide education and outreach materials to end-users of technology about how to deal with demands from patent trolls.

· Institute new, high-profile events by the USPTO, the U.S. Department of Justice, or DOJ, and the Federal Trade Commission, or FTC, to develop new ideas and consensus around updates to patent policies and laws.

· Review and improve existing procedures that the Customs and Border Protection and the ITC use to evaluate the scope of ITC exclusion orders that prevent infringing goods from being brought into the U.S.

In addition to these actions, Congress is also currently considering other legislation on patent reform. This legislation includes the bipartisan reintroduction of the SHIELD Act (Saving High-Tech Innovators from Egregious Legal Disputes Act of 2013), that would force non-practicing entities to pay for instituting patent lawsuits that are unsuccessful. The Patent Abuse Reduction Act is another recently introduced patent reform bill with similar provisions. As of the date of this prospectus, neither the SHIELD Act nor the Patent Abuse Reduction Act has been passed out of committee for consideration by the full House of Representatives or Senate.

Recently, United States patent laws were amended with the enactment of the Leahy-Smith America Invents Act, or the America Invents Act, which took effect on March 16, 2013. The America Invents Act includes a number of significant changes to U.S. patent law. In general, the legislation attempts to address issues surrounding the enforceability of patents and the increase in patent litigation by, among other things, establishing new procedures for patent litigation. For example, the America Invents Act changes the way that parties may be joined in patent infringement actions, increasing the likelihood that such actions will need to be brought against individual parties allegedly infringing by their respective individual actions or activities. At this time, it is not clear what, if any, impact the America Invents Act will have on the operation of our enforcement business. However, the America Invents Act and its implementation could increase the uncertainties and costs surrounding the enforcement of our patented technologies, which could have a material adverse effect on our business and financial condition.

Further, and in general, it is impossible to determine the extent of the impact of any new laws, regulations or initiatives that may be proposed, or whether any of the proposals will become enacted as laws. Compliance with any new or existing laws or regulations could be difficult and expensive, affect the manner in which we conduct our business and negatively impact our business, prospects, financial condition and results of operations.

Our dependence on the continued growth in the use of the web and mobile smartphone networking could adversely affect our results of operations.

12

Our business depends on consumers continuing to increase their use of the mobile smartphone for social networking, to obtain product content, reward type offers as well as for conducting commercial transactions. The rapid growth and use of the smartphone as an information conduit is a relatively recent phenomenon. As a result, the acceptance and use of smartphones may not continue to develop at historical rates. Mobile web usage may be inhibited for a number of reasons, such as inadequate network infrastructure, security concerns, inconsistent quality of service and availability of cost-effective, high-speed service or smart mobile devices.

If mobile web usage grows, the mobile Internet infrastructure may not be able to support the demands placed on it by this growth or its performance and reliability may decline. In addition, websites and mobile networks have experienced interruptions in their service as a result of outages and other delays occurring throughout the Internet and mobile network infrastructure. If these outages and delays occur frequently in the future, web usage, as well as usage of our website, could grow more slowly or decline, which could adversely affect our results of operations.

Difficulty accommodating increases in the number of users of our services and Internet service problems outside of our control ultimately could result in the reduction of users.

Our website must accommodate a high volume of traffic and deliver frequently updated information. Our website may in the future experience slower response times or other problems for a variety of reasons. In addition, our website could experience disruptions or interruptions in service due to the failure or delay in the transmission or receipt of this information. In addition, our users depend on Internet service providers, online service providers and other website operators for access to our website. Each of them has experienced significant outages in the past, and could experience outages, delays and other difficulties due to system failures unrelated to our systems.

Given our early stage of development, we are still developing our regulatory compliance program and our failure to comply with existing and future regulatory requirements could adversely affect our business, results of operations and financial condition.

Aspects of the digital marketing and advertising industry and how our business operates are highly regulated. We are subject to a number of domestic and, to the extent our operations are conducted outside the U.S., foreign laws and regulations that affect companies conducting business on the Internet and through other electronic means, many of which are still evolving and could be interpreted in ways that could harm our business. In particular, we are subject to rules of the FTC, the Federal Communications Commission (FCC) and potentially other federal agencies and state laws related to our advertising content and methods, the Controlling the Assault of Non-Solicited Pornography and Marketing Act of 2003, or CAN-SPAM Act, which establishes certain requirements for commercial electronic mail messages and specifies penalties for the transmission of commercial electronic mail messages that follow a recipient’s opt-out request or are intended to deceive the recipient as to source or content, federal and state regulations covering the treatment of member data that we collect from endorsers.

U.S. and foreign regulations and laws potentially affecting our business are evolving frequently. We are, and will continue to update and improve our regulatory compliance features and functionality, and we will need to continue to identify and determine how to effectively comply with all the regulations to which we are subject now or in the future. If we are unable to identify all regulations to which our business is subject and implement effective means of compliance, we could be subject to enforcement actions, lawsuits and penalties, including but not limited to fines and other monetary liability or injunction that could prevent us from operating our business or certain aspects of our business. In addition, compliance with the regulations to which we are subject now or in the future may require changes to our products or services, restrict or impose additional costs upon the conduct of our business or cause users to abandon material aspects of our services. Any such action could have a material adverse effect on our business, results of operations and financial condition.

Existing federal, state and foreign laws regulating email and text messaging marketing practices impose certain obligations on the senders of commercial emails and text messages, which could minimize the effectiveness of our on-demand software or increase our operating expenses to the extent financial penalties are triggered.

If we do not develop new and enhanced services and features, we may not be able to attract and retain a sufficient number of users.

We believe that our platform will be more attractive to advertisers if we develop a larger audience comprised of demographically favorable subscribers. Accordingly, we intend to introduce additional or enhanced services in the future in order to retain and attract new users. If we introduce a service that is not favorably received, the current users may not continue using our service as frequently. New users could also choose a competitive service over ours.

We may also experience difficulties that could delay or prevent us from introducing new services. Furthermore, these services may contain errors that are discovered after the services are introduced. We may need to significantly modify the design of these services on our website to correct these errors. Our business could be adversely affected if it experiences difficulties in introducing new services or if users do not accept these new services.

Risks Relating to Our Common Stock

We have not paid dividends in the past and do not expect to pay dividends in the future. Any return on investment may be limited to the value of our common stock.

We have never paid cash dividends on our common stock and do not anticipate doing so in the foreseeable future. The payment of dividends on our common stock will depend on earnings, financial condition and other business and economic factors affecting us at such time as our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on your investment will only occur if our stock price appreciates.

Ineffective internal controls could impact our business and operating results. Any inability to report and file our financial results accurately and timely could harm our reputation and adversely impact the trading price of our common stock.

Effective internal control is necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment existed, and our business and reputation with investors may be harmed. As a result, our small size and any current internal control deficiencies may adversely affect our financial condition, results of operation and access to capital.

As of December 31, 2012, we had identified certain matters that constituted a material weakness in our internal controls over financial reporting that continued to exist as of September 30, 2013. Specifically, we have limited segregation of duties within our accounting and financial reporting functions. Segregation of duties within our company is limited due to the small number of employees that are assigned to positions that involve the processing of financial information.

On August 27, 2013, after consulting with our Audit Committee and with our newly appointed Independent Registered Public Accounting Firm, Marcum LLP, management changed its accounting for certain of our warrants and conversion features related to previously issued convertible notes and preferred stock which were recorded in periods prior to the engagement of Marcum LLP in order to comply with US GAAP. Such warrants and the embedded conversion options should have been reflected as liabilities on the consolidated balance sheets included in our previously filed Annual Report on Form 10-K for the year ended December 31, 2012 and the Quarterly Reports on Form 10-Q for the periods ended March 31, 2012, June 30, 2012, September 30, 2012 and March 31, 2013, rather than as a component of equity. In addition, we determined that we had not properly accreted compensation expense for certain restricted stock grants in 2012.

Since the determination regarding this deficiency, we have devoted significant effort and resources to remediation and improvement of our internal control over financial reporting. While we had processes in place to identify and apply developments in accounting standards, we enhanced these processes to better evaluate our research of the nuances of complex accounting standards and engaged a third party financial reporting and consulting firm to assist the Company in its financial reporting compliance. Our enhancements included retaining a third party consultant, who is a technical accounting professional, to assist us in the interpretation and application of new and complex accounting guidance. The firm has been engaged to assist in the analysis of complex financial instruments. Management will continue to review and make necessary changes to the overall design of our internal control environment.

In addition, prior to the engagement of an outside financial reporting consultant in August 2013, we lacked adequately trained accounting personnel with appropriate expertise in complex transactions under United States generally accepted accounting principles. While we believe that the addition of a consultant with such experience has assisted us in mitigating this weakness as of September 30, 2013, we need to perform a full evaluation of our disclosure controls and procedures before we deem the weakness to be fully remediated. Management is currently in the process of determining how to implement a more effective system to insure that information required to be disclosed in our periodic reports has been recorded, processed, summarized and reported accurately. Our management acknowledges the existence of this problem, and intends to develop procedures to address them to the extent possible given limitations in manpower resources. While management is working on a plan, no assurance can be made at this point that the implementation of such controls and procedures will be completed in a timely manner or that they will be adequate once implemented.

Because we became public by means of a reverse merger, we may not be able to attract the attention of major brokerage firms.

There may be risks associated with us becoming public through a “reverse merger” with a shell company. Although the shell company did not have recent or past operations or assets and we performed a due diligence review of the shell company, there can be no assurance that we will not be exposed to undisclosed liabilities resulting from the prior operations of the shell company. Securities analysts of major brokerage firms and securities institutions may also not provide coverage of us because there were no broker-dealers who sold our stock in a public offering that would be incentivized to follow or recommend the purchase of our common stock. The absence of such research coverage could limit investor interest in our common stock, resulting in decreased liquidity. No assurance can be given that established brokerage firms will, in the future, want to cover our securities or conduct any secondary offerings or other financings on our behalf.

15

The public trading market for our common stock is volatile and may result in higher spreads in stock prices, which may limit the ability of our investors to sell their Shares at a profit, if at all.

Our common stock trades in the over-the-counter market and is quoted on the Over-the-Counter Bulletin Board, or OTCBB, and in the Over-the-Counter Markets on the OTCQB. The over-the-counter market for securities has historically experienced extreme price and volume fluctuations during certain periods. These broad market fluctuations may adversely affect the market price of our common stock and result in substantial losses to our investors. In addition, the spreads on stock traded through the over-the-counter market are generally unregulated and higher than on national stock exchanges, which means that the difference between the price at which shares could be purchased by investors in the over-the-counter market compared to the price at which they could be subsequently sold would be greater than on these exchanges. Significant spreads between the bid and asked prices of the stock could continue during any period in which a sufficient volume of trading is unavailable or if the stock is quoted by an insignificant number of market makers. Historically our trading volume has been insufficient to significantly reduce this spread and we have had a limited number of market makers sufficient to affect this spread. These higher spreads could adversely affect investors who purchase the shares at the higher price at which the shares are sold, but subsequently sell the shares at the lower bid prices quoted by the brokers. Unless the bid price for the stock exceeds the price paid for the shares by the investor, plus brokerage commissions or charges, the investor could lose money on the sale. For higher spreads such as those on over-the-counter stocks, this is likely a much greater percentage of the price of the stock than for exchange listed stocks. There is no assurance that at the time an investor in our common stock wishes to sell the shares, the bid price will have sufficiently increased to create a profit on the sale.

We do not know whether a market for our common stock will be sustained or what the market price of our common stock will be and as a result it may be difficult for you to sell your shares of our common stock.

Although our common stock now trades on the OTCBB and OTCQB, an active trading market for our shares may not be sustained. It may be difficult for you to sell your shares without depressing the market price for the Shares or at all. As a result of these and other factors, you may not be able to sell your Shares at or above the offering price or at all. Further, an inactive market may also impair our ability to raise capital by selling shares of our common stock and may impair our ability to enter into strategic partnerships or acquire companies or products by using our shares of common stock as consideration. If an active market for our common stock does not develop or is not sustained, it may be difficult to sell your common stock.

The market price for our common stock may fluctuate significantly, which could result in substantial losses by our investors.

The market price of our common stock may fluctuate significantly in response to numerous factors, some of which are beyond our control, such as:

· increase in the number of shareholders from this offering;

· the outcomes of our current and potential future patent litigation;

· our ability to monetize our patents;

· changes in our industry;

· announcements of technological innovations, new products or product enhancements by us or others;

· announcements by us of significant strategic partnerships, out-licensing, in-licensing, joint ventures, acquisitions or capital commitments;

· changes in earnings estimates or recommendations by security analysts, if our common stock is covered by analysts;

· investors’ general perception of us;

· future issuances of common stock;

· the addition or departure of key personnel;

· general market conditions, including the volatility of market prices for shares of technology companies, generally, and other factors, including factors unrelated to our operating performance; and

· the other factors described in this “Risk Factors” section.

These factors and any corresponding price fluctuations may materially and adversely affect the markt price of our common stock and result in substantial losses by our investors.

Further, the stock market in general, and the market for technology companies in particular, has experienced extreme price and volume fluctuations in the past. Continued market fluctuations could result in extreme volatility in the price of our common stock, which could cause a decline in the value of our common stock. Price volatility of our common stock might be worse if the trading volume of our common stock is low. In the past, following periods of market volatility, stockholders have often instituted securities class action litigation. If we were involved in securities litigation, it could have a substantial cost and divert resources and attention of management from our business, even if we are successful. Future sales of our common stock could also reduce the market price of such stock.

16

Moreover, the liquidity of our common stock is limited, not only in terms of the number of shares that can be bought and sold at a given price, but by delays in the timing of transactions and reduction in security analysts’ and the media’s coverage of us, if any. These factors may result in lower prices for our common stock than might otherwise be obtained and could also result in a larger spread between the bid and ask prices for our common stock. In addition, without a large float, our common stock is less liquid than the stock of companies with broader public ownership and, as a result, the trading prices of our common stock may be more volatile. In the absence of an active public trading market, an investor may be unable to liquidate its investment in our common stock. Trading of a relatively small volume of our common stock may have a greater impact on the trading price of our stock than would be the case if our public float were larger. We cannot predict the prices at which our common stock will trade in the future.

Some or all of the “restricted” shares of our common stock issued in connection with the closing of the reverse acquisition transaction in September 2011 or held by other of our stockholders may be offered from time to time in the open market pursuant to an effective registration statement or Rule 144 promulgated under Regulation D of the Securities Act, or Rule 144, and these sales may have a depressive effect on the market for our common stock.

Our common stock is a “penny stock,” which makes it more difficult for our investors to sell their shares.

Our common stock is subject to the “penny stock” rules adopted under Section 15(g) of the Securities Exchange Act of 1934, as amended. The penny stock rules generally apply to companies whose common stock is not listed on The NASDAQ Stock Market or other national securities exchange and trades at less than $5.00 per share, other than companies that have had average revenue of at least $6,000,000 for the last three years or that have tangible net worth of at least $5,000,000 ($2,000,000 if the company has been operating for three or more years). These rules require, among other things, that brokers who trade penny stock to persons other than “established customers” complete certain documentation, make suitability inquiries of investors and provide investors with certain information concerning trading in the security, including a risk disclosure document and quote information under certain circumstances. Many brokers have decided not to trade penny stocks because of the requirements of the penny stock rules and, as a result, the number of broker-dealers willing to act as market makers in such securities is limited. If we remain subject to the penny stock rules for any significant period, it could have an adverse effect on the market, if any, for our securities. If our securities are subject to the penny stock rules, investors will find it more difficult to dispose of our securities.

Offers or availability for sale of a substantial number of shares of our common stock may cause the price of our common stock to decline.

If our stockholders sell substantial amounts of our common stock in the public market, including the shares covered by this prospectus, or upon the expiration of any statutory holding period under Rule 144, it could create a circumstance commonly referred to as an “overhang,” in anticipation of which the market price of our common stock could fall. The existence of an overhang, whether or not sales have occurred or are occurring, also could make more difficult our ability to raise additional financing through the sale of equity or equity-related securities in the future at a time and price that we deem reasonable or appropriate.

Our stockholders may experience substantial dilution as a result of the conversion of outstanding convertible preferred stock, convertible debentures, convertible notes, or the exercise of options and warrants to purchase shares of our common stock.

As of November 18, 2013, we have granted options to purchase 14,839,073 shares of common stock and have reserved 29,537,675 shares of our common stock for issuance upon the exercise of options pursuant to our 2011 Long-Term Incentive Plan. In addition, as of November 18, 2013, we have reserved for issuance 11,045,655 shares of our common stock for issuance upon conversion or outstanding convertible preferred stock and 32,495,753 shares of our common stock for issuance upon exercise of outstanding warrants. As of November 18, 2013, we have also reserved 22,392,202 shares of our common stock for issuance upon conversion of outstanding convertible debentures, including 930,664 shares issuable in lieu of accrued interest on such debentures.

Because our directors and executive officers are among our largest stockholders, they can exert significant control over our business and affairs and have actual or potential interests that may depart from those of our other stockholders.

Our directors and executive officers own or control a significant percentage of our common stock. Additionally, the holdings of our directors and executive officers may increase in the future upon vesting or other maturation of exercise rights under any of the options or warrants they may hold or in the future be granted or if they otherwise acquire additional shares of our common stock. As of November 18, 2013, our officers and directors beneficially own approximately 30% of the outstanding shares of our common stock. The interests of such persons may differ from the interests of our other stockholders. As a result, in addition to their board seats and offices, such persons will have significant influence over and control all corporate actions requiring stockholder approval, irrespective of how our other stockholders may vote, including the following actions:

· to elect or defeat the election of our directors;

· to amend or prevent amendment of our certificate of incorporation or bylaws;

· to effect or prevent a merger, sale of assets or other corporate transaction; and

· to control the outcome of any other matter submitted to our stockholders for vote.

In addition, such persons’ stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

USE OF PROCEEDS

All shares of our common stock offered by this prospectus are being registered for the accounts of the selling stockholders and we will not receive any proceeds from the sale of these shares.

A total of 20,491,164 shares of common stock offered by this prospectus are issuable upon the exercise of common stock purchase warrants. If a selling stockholder exercises all or any portion of its warrants, we will receive the aggregate exercise price paid by such selling stockholder. The maximum amount of proceeds we would receive upon the exercise of all the warrants on a cash basis would be $1,024,558. We expect to use the proceeds received from the exercise of the warrants, if any, for general working capital purposes.

18

MARKET FOR OUR COMMON STOCK AND RELATED STOCKHOLDER MATTERS

Our common stock was originally approved for quotation on the OTC Bulletin Board on July 13, 2010 and since August 8, 2011, our common stock has been quoted under the trading symbol BCYP.OB. Prior to September 14, 2011, our common stock did not trade regularly. The following table sets forth the high and low bid prices for our common stock for the periods indicated, as reported by the OTC Bulletin Board. The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission, and may not represent actual transactions.

| Fiscal Year 2011 |

| High |

| Low |

| Third Quarter (commencing September 14, 2011) | $ | 3.00 |

| 3.00 |

| Fourth Quarter | $ | 1.10 |

| 1.01 |

|

|

|

|

|

|

|

|

| High |

| Low |

| Fiscal Year 2012 |

|

|

|

|

| First Quarter | $ | 1.05 | $ | 1.01 |

| Second Quarter | $ | 0.92 | $ | 0.40 |

| Third Quarter | $ | 0.98 | $ | 0.65 |

| Fourth Quarter | $ | 0.87 | $ | 0.30 |

|

|

|

|

|

|

| Fiscal Year 2013 |

| High |

| Low |

| First Quarter | $ | 0.45 | $ | 0.10 |

| Second Quarter | $ | 0.37 | $ | 0.09 |

| Third Quarter | $ | 0.19 | $ | 0.11 |

| Fourth Quarter (through November 18, 2013) | $ | 0.24 | $ | 0.15 |

The last reported sales price of our common stock on the OTC Bulletin Board on November 18, 2013, was $0.16 per share. As of November 18, 2013, there were approximately 50 holders of record of our common stock.

19

DIVIDEND POLICY

In the past, we have not declared or paid cash dividends on our common stock, and we do not intend to pay any cash dividends on our common stock. Rather, we intend to retain future earnings, if any, to fund the operation and expansion of our business and for general corporate purposes.

Securities Authorized for Issuance UnderEquity Compensation Plans

On August 31, 2011, the board adopted, subject to stockholder approval, the Blue Calypso, Inc. 2011 Long-Term Incentive Plan, or the Plan. Our stockholders approved the Plan on September 9, 2011. The Plan is intended to enable us to remain competitive and innovative in our ability to attract, motivate, reward and retain the services of key employees, certain key contractors, and non-employee directors. The Plan provides for the granting of incentive stock options, nonqualified stock options, stock appreciation rights, restricted stock, restricted stock units, performance awards, dividend equivalent rights, and other awards which may be granted singly, in combination, or in tandem, and which may be paid in cash or shares of common stock. The Plan is expected to provide flexibility to our compensation methods in order to adapt the compensation of employees, contractors, and non-employee directors to a changing business environment, after giving due consideration to competitive conditions and the impact of federal tax laws. Subject to certain adjustments, the maximum number of shares of our common stock that may be delivered pursuant to awards under the Plan is 35,000,000 shares.

As of December 31, 2012, securities issued and securities available for future issuance under the Blue Calypso 2011 Long-Term Incentive Plan were as follows:

|

| Number of securities to be issued upon exercise of outstanding options, warrants and rights |

| Weighted-average exercise price of outstanding options, warrants and rights |

| Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

| Equity compensation plans approved by security holders | 4,329,992 |

| $0.1135 |

| 30,670,008 |

| Equity compensation plans not approved by security holders |

|

|

|

|

|

20

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATION

You should read the following discussion and analysis of our financial condition and results of operations in conjunction with our consolidated financial statements and the related notes thereto that are included in this prospectus. In addition to historical information, the following discussion and analysis includes forward-looking information that involves risks, uncertainties, and assumptions. Actual results and the timing of events could differ materially from those anticipated by these forward looking statements as a result of many factors, including those discussed under “Risk Factors.” See also “Special Note Regarding Forward-Looking Statements.”

Business Overview

We are engaged in the innovation, development and monetization of technology and intellectual property focused on digital word-of-mouth marketing and advertising. We have developed a patented platform which enables brands to leverage customer and employee relationships in order to to increase brand loyalty and drive revenue. Our intellectual property portfolio consists of five patents and four pending patent applications that cover methods and systems for communicating advertisements and electronic offers between communication devices, including mobile and desktop devices.

We have developed a proprietary technology platform that facilitates the delivery of advertising campaigns, content and promotions across social media channels using multiple device types. Our technology facilitates the connection of brands to consumers and matches them using attributes such as geo-location or demographic profile. Our platform tracks performance, monitors engagement and deploys robust analytics that deliver acute insight regarding the return on investment of our client’s promotions. Our technology is designed to help clients spread their marketing messages, acquire new customers, increase awareness and drive product sales. Campaigns facilitated through our platform can encourage consumers to learn more about our client’s products and watch promotional videos about particular products. Our platform can also assist in increasing “likes” on Facebook, followers on Twitter encouraging consumers to join our client’s email lists. All of this is accomplished by encouraging advocates of a company to interact and personalize messages to people that they think would like to hear about a particular brand or product. Our clients are able to thank advocates for sharing, including offering incentives, coupons and other perks to advocates who share. Our technology platform creates multiple opportunities for companies to interact with their most vocal brand advocates and reward them for their loyalty.

Recent Developments

General