Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CARRIAGE SERVICES INC | a8-kxcarriageinvestorprese.htm |

Carriage Services Investor Presentation November 2013

Confidential Certain statements made herein or elsewhere by, or on behalf of, the Company that are not historical facts are intended to be forward‐looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are based on assumptions that the Company believes are reasonable; however, many important factors, as discussed under “Forward‐Looking Statements” in the Company’s Annual Report on Form 10‐K for the year ended December 31, 2012 and the Quarterly Report on Form 10-Q for the quarter ended September 30, 2013, could cause the Company’s results in the future to differ materially from the forward‐looking statements made herein and in any other documents or oral presentations made by, or on behalf of, the Company. Forward-looking statements contained herein regarding acquisitions include assumptions about the pricing, timing, and terms and conditions of such acquisitions. We can provide no assurances that our growth strategy will be successfully implemented. In particular, we can provide no assurances that we will find attractive acquisition targets, that we will succeed in negotiating the terms and conditions reflected in the model, or that we will execute any acquisitions during the next five years (including 2013). Forward- looking statements contained herein regarding the performance of our acquisition and same store businesses include assumptions related to future revenue growth. We can provide no assurances that our acquisition and same store businesses will generate the revenue growth set forth herein, or any revenue growth at all. The Company assumes no obligation to update or publicly release any revisions to forward-looking statements made herein or any other forward‐looking statements made by, or on behalf of, the Company. A copy of the Company’s Form 10‐K and Form 10-Q, and other Carriage Services information and news releases, are available at www.carriageservices.com. 2

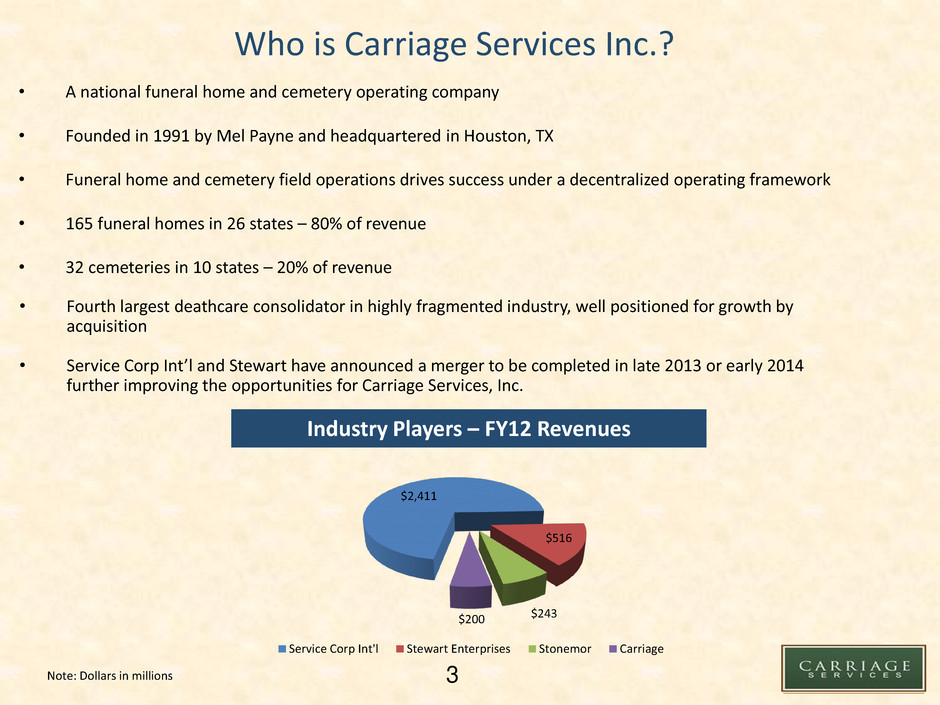

Who is Carriage Services Inc.? • A national funeral home and cemetery operating company • Founded in 1991 by Mel Payne and headquartered in Houston, TX • Funeral home and cemetery field operations drives success under a decentralized operating framework • 165 funeral homes in 26 states – 80% of revenue • 32 cemeteries in 10 states – 20% of revenue 3 Industry Players – FY12 Revenues • Fourth largest deathcare consolidator in highly fragmented industry, well positioned for growth by acquisition • Service Corp Int’l and Stewart have announced a merger to be completed in late 2013 or early 2014 further improving the opportunities for Carriage Services, Inc. Note: Dollars in millions $2,411 $516 $243 $200 Service Corp Int'l Stewart Enterprises Stonemor Carriage

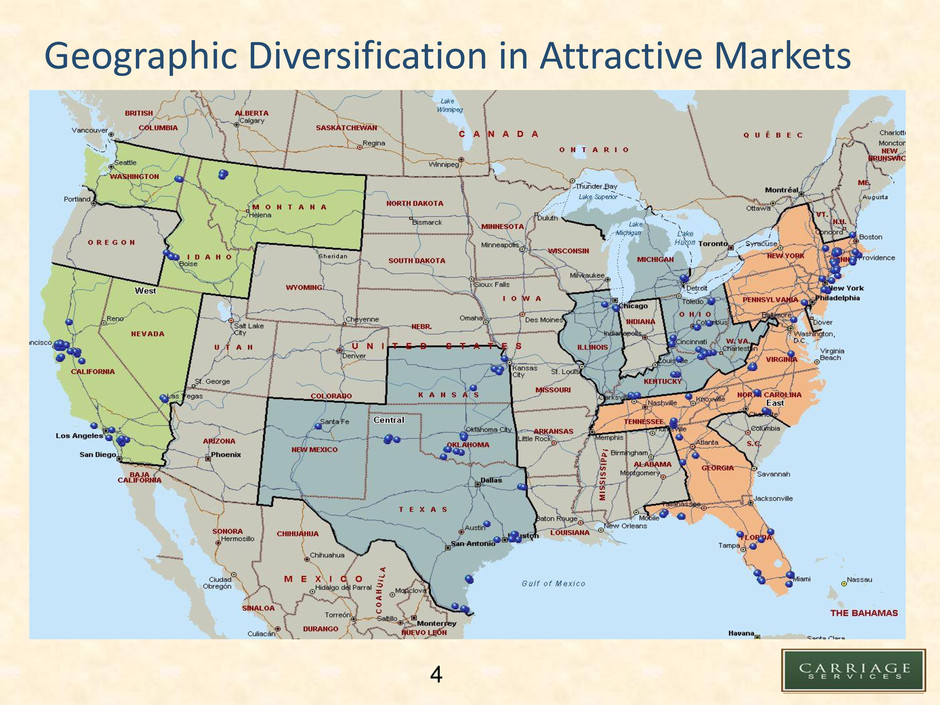

Geographic Diversification in Attractive Markets 4

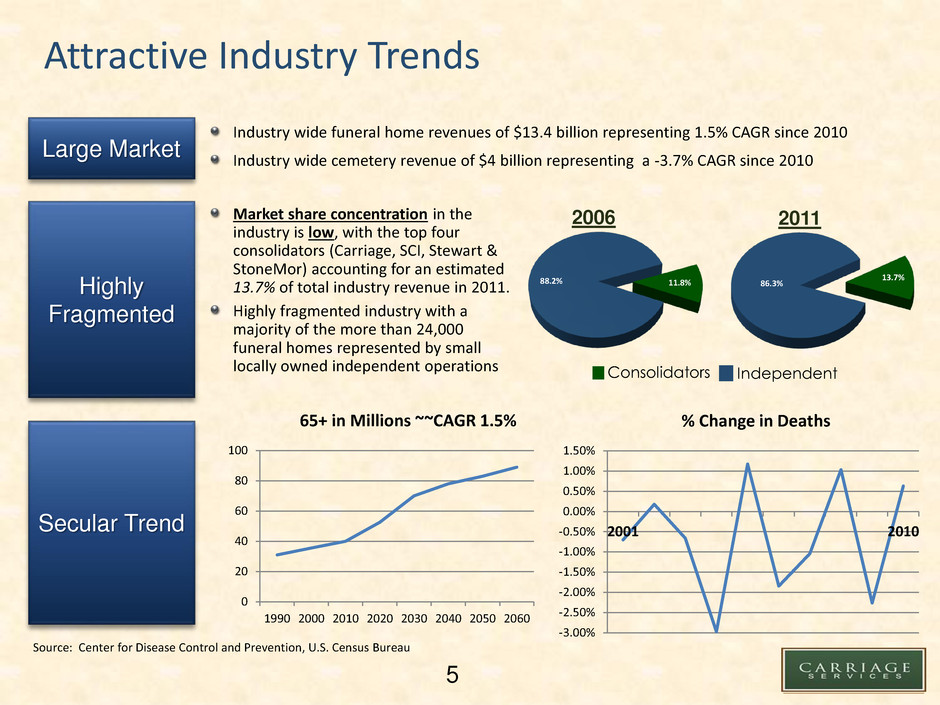

Industry wide funeral home revenues of $13.4 billion representing 1.5% CAGR since 2010 Industry wide cemetery revenue of $4 billion representing a -3.7% CAGR since 2010 Attractive Industry Trends Market share concentration in the industry is low, with the top four consolidators (Carriage, SCI, Stewart & StoneMor) accounting for an estimated 13.7% of total industry revenue in 2011. Highly fragmented industry with a majority of the more than 24,000 funeral homes represented by small locally owned independent operations 11.8% 88.2% 13.7% 86.3% 2006 2011 Consolidators Independent % Change in Deaths Source: Center for Disease Control and Prevention, U.S. Census Bureau 65+ in Millions ~~CAGR 1.5% Large Market Highly Fragmented Secular Trend 5 0 20 40 60 80 100 1990 2000 2010 2020 2030 2040 2050 2060 -3.00% -2.50% -2.00% -1.50% -1.00% -0.50% 0.00% 0.50% 1.00% 1.50% 2001 2010

Our Growth Strategy • Adopt a pro-growth business model within an industry that is characterized by its low growth • Implement Standards Operating Model for modest growth in same store sales and improving and maintaining margins • Operating Leverage allows for modest increases in Same Store Sales and EBITDA to have greater impact on Free Cash Flow • Implement Strategic Acquisition Model & Valuation Model to target strategic acquisitions in order to accelerate growth while maintaining financial discipline 6

• Same Store Sales & Improving Operating Performance • Cemetery Sales including Preneed Sales Growth & Improving Operating Performance • Acquisitions • Financial Revenue Differentiation in Stable Funeral & Cemetery Industry • Carriage’s success has and will continue to be defined by three strategic models: • Standards Operating Model • Strategic Acquisition Model • 4E Leadership Model Standards Operating Model 7

• Our Operating Plan: Standards Operating Model • Focuses on growing market share and employing high performance people which together drive long term operating and financial performance • Designed to achieve modest same store revenue growth and strong and sustainable Field EBITDA Margins at the local business level • Designed to have the Managing Partner and staff share in Field EBITDA growth • Our Leadership Plan: 4E Leadership Model (Energy, Energize, Edge, Execution) • Standards Operating Model requires strong leadership to grow an entrepreneurial, high value, local personal service and sales business • 4E Leaders have a winning, competitive spirit and want to make a difference not only in their business and community but in Carriage’s performance and reputation 8

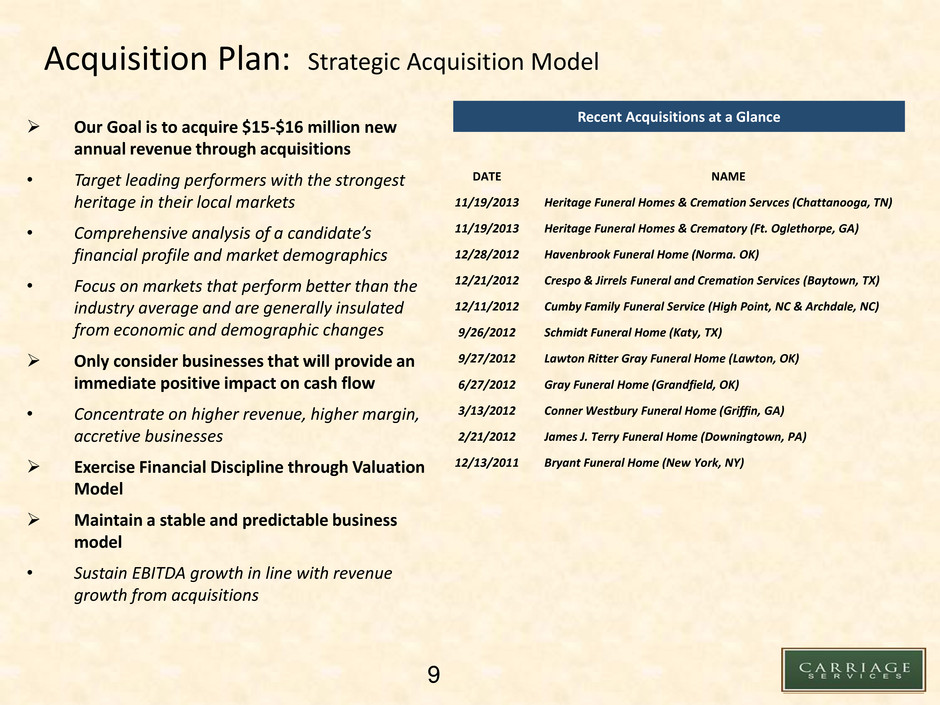

Acquisition Plan: Strategic Acquisition Model Our Goal is to acquire $15-$16 million new annual revenue through acquisitions • Target leading performers with the strongest heritage in their local markets • Comprehensive analysis of a candidate’s financial profile and market demographics • Focus on markets that perform better than the industry average and are generally insulated from economic and demographic changes Only consider businesses that will provide an immediate positive impact on cash flow • Concentrate on higher revenue, higher margin, accretive businesses Exercise Financial Discipline through Valuation Model Maintain a stable and predictable business model • Sustain EBITDA growth in line with revenue growth from acquisitions Recent Acquisitions at a Glance 9 DATE NAME 11/19/2013 Heritage Funeral Homes & Cremation Servces (Chattanooga, TN) 11/19/2013 Heritage Funeral Homes & Crematory (Ft. Oglethorpe, GA) 12/28/2012 Havenbrook Funeral Home (Norma. OK) 12/21/2012 Crespo & Jirrels Funeral and Cremation Services (Baytown, TX) 12/11/2012 Cumby Family Funeral Service (High Point, NC & Archdale, NC) 9/26/2012 Schmidt Funeral Home (Katy, TX) 9/27/2012 Lawton Ritter Gray Funeral Home (Lawton, OK) 6/27/2012 Gray Funeral Home (Grandfield, OK) 3/13/2012 Conner Westbury Funeral Home (Griffin, GA) 2/21/2012 James J. Terry Funeral Home (Downingtown, PA) 12/13/2011 Bryant Funeral Home (New York, NY)

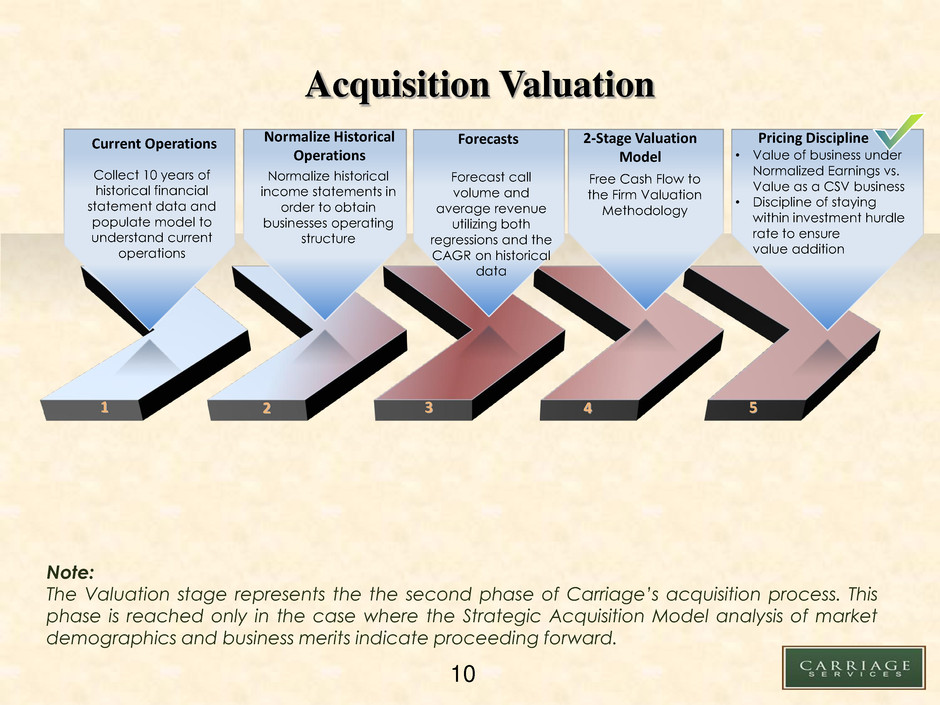

Pricing Discipline • Value of business under Normalized Earnings vs. Value as a CSV business • Discipline of staying within investment hurdle rate to ensure value addition 2-Stage Valuation Model Forecasts Forecast call volume and average revenue utilizing both regressions and the CAGR on historical data Normalize Historical Operations Current Operations 1 2 3 4 5 Acquisition Valuation Note: The Valuation stage represents the the second phase of Carriage’s acquisition process. This phase is reached only in the case where the Strategic Acquisition Model analysis of market demographics and business merits indicate proceeding forward. Collect 10 years of historical financial statement data and populate model to understand current operations Normalize historical income statements in order to obtain businesses operating structure Free Cash Flow to the Firm Valuation Methodology 10 10

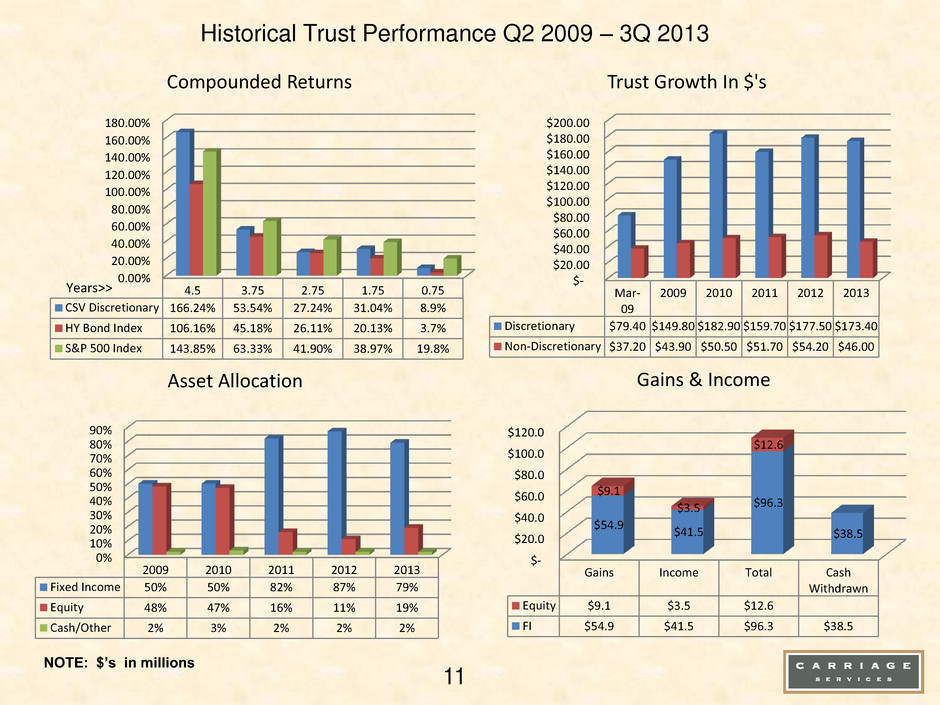

Historical Trust Performance Q2 2009 – 3Q 2013 $- $20.00 $40.00 $60.00 $80.00 $100.00 $120.00 $140.00 $160.00 $180.00 $200.00 Mar- 09 2009 2010 2011 2012 2013 Discretionary $79.40 $149.80 $182.90 $159.70 $177.50 $173.40 Non-Discretionary $37.20 $43.90 $50.50 $51.70 $54.20 $46.00 Trust Growth In $'s 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 2009 2010 2011 2012 2013 Fixed Income 50% 50% 82% 87% 79% Equity 48% 47% 16% 11% 19% Cash/Other 2% 3% 2% 2% 2% Asset Allocation $- $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 Gains Income Total Cash Withdrawn Equity $9.1 $3.5 $12.6 FI $54.9 $41.5 $96.3 $38.5 $54.9 $41.5 $96.3 $38.5 $9.1 $3.5 $12.6 Gains & Income 11 0.00% 20.00% 40.00% 60.00% 80.00% 100.00% 120.00% 140.00% 160.00% 180.00% 4.5 3.75 2.75 1.75 0.75 CSV Discretionary 166.24% 53.54% 27.24% 31.04% 8.9% HY Bond Index 106.16% 45.18% 26.11% 20.13% 3.7% S&P 500 Index 143.85% 63.33% 41.90% 38.97% 19.8% Compounded Returns Years>> NOTE: $’s in millions

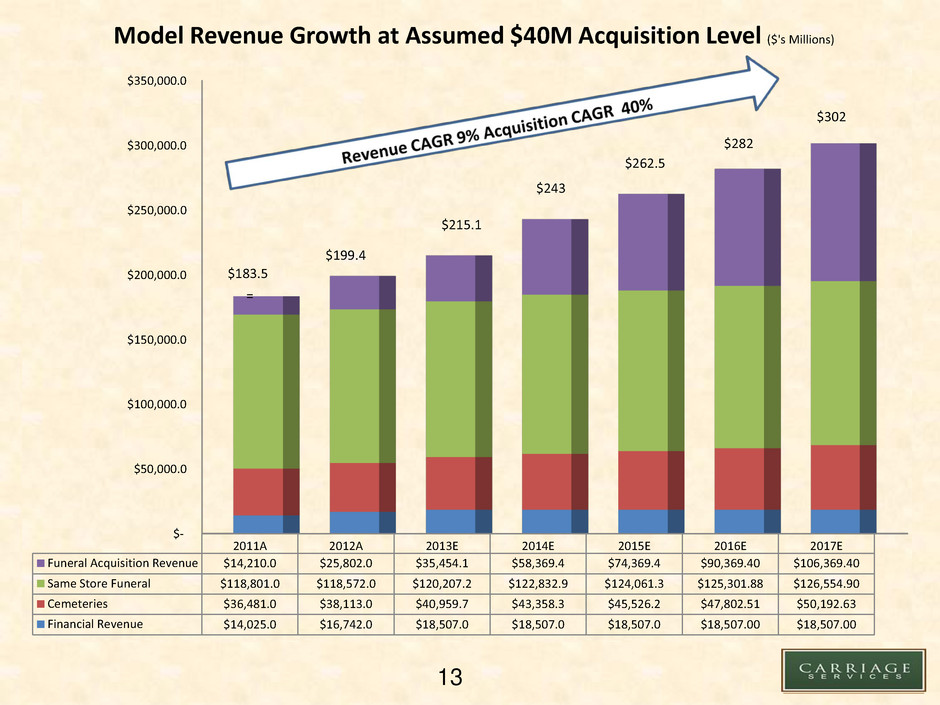

Financial Overview These slides are solely intended to demonstrate the possible impact on our financial results of the successful implementation of our growth strategy by the hypothetical acquisition of businesses aggregating $40 million in assets per year for each of the next five years (including 2013). The model presented on these slides incorporates several assumptions regarding the pricing, timing, and terms and conditions of such acquisitions, as well as the financial performance of both acquisition and same store businesses. We can provide no assurances that our growth strategy will be successfully implemented. In particular, we can provide no assurances that we will find attractive acquisition targets, that we will succeed in negotiating the terms and conditions reflected in the model, or that we will execute any acquisitions during the next five years (including 2013). Additionally, we can provide no assurances that our acquisition and same store businesses will generate the revenue growth reflected in the model, or any revenue growth at all. 12

13 $- $50,000.0 $100,000.0 $150,000.0 $200,000.0 $250,000.0 $300,000.0 $350,000.0 2011A 2012A 2013E 2014E 2015E 2016E 2017E Funeral Acquisition Revenue $14,210.0 $25,802.0 $35,454.1 $58,369.4 $74,369.4 $90,369.40 $106,369.40 Same Store Funeral $118,801.0 $118,572.0 $120,207.2 $122,832.9 $124,061.3 $125,301.88 $126,554.90 Cemeteries $36,481.0 $38,113.0 $40,959.7 $43,358.3 $45,526.2 $47,802.51 $50,192.63 Financial Revenue $14,025.0 $16,742.0 $18,507.0 $18,507.0 $18,507.0 $18,507.00 $18,507.00 Model Revenue Growth at Assumed $40M Acquisition Level ($'s Millions) = $183.5 $199.4 $215.1 $243 $262.5 $282 $302

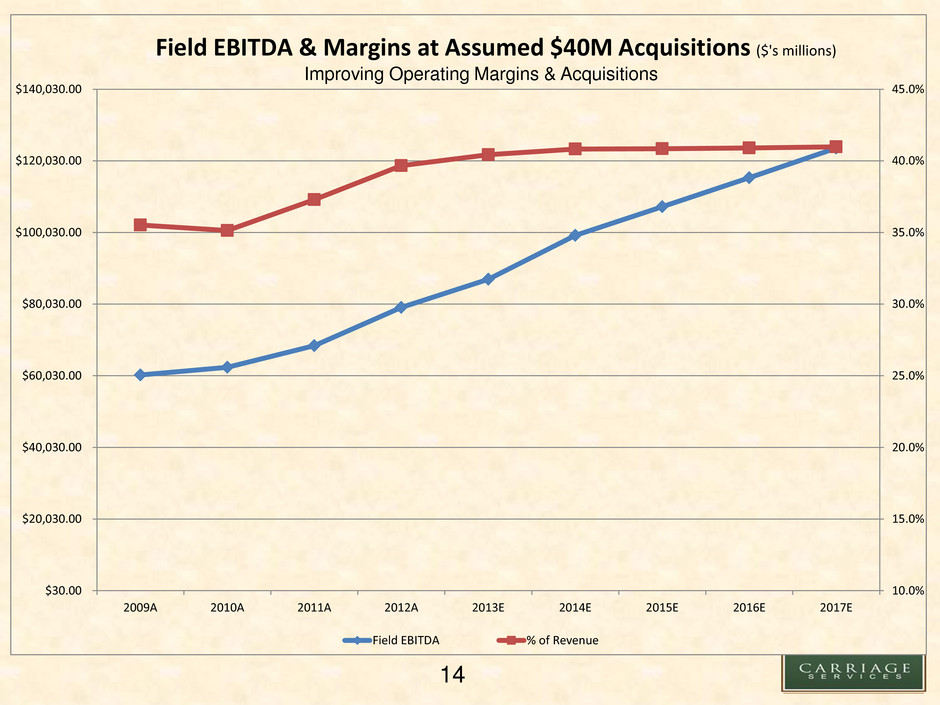

14 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% $30.00 $20,030.00 $40,030.00 $60,030.00 $80,030.00 $100,030.00 $120,030.00 $140,030.00 2009A 2010A 2011A 2012A 2013E 2014E 2015E 2016E 2017E Field EBITDA % of Revenue Field EBITDA & Margins at Assumed $40M Acquisitions ($'s millions) Improving Operating Margins & Acquisitions

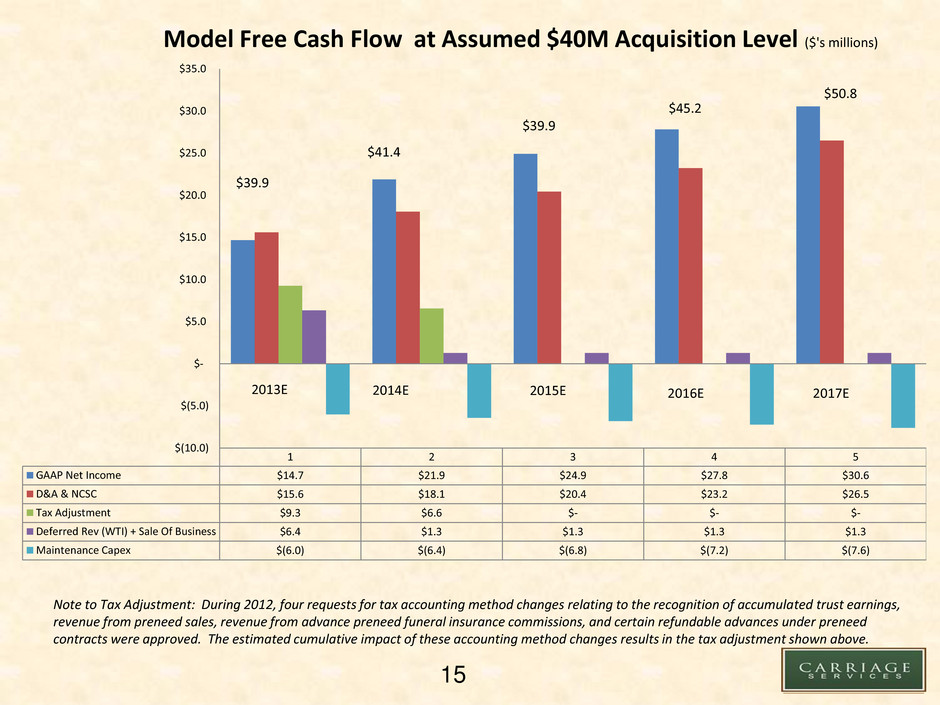

15 1 2 3 4 5 GAAP Net Income $14.7 $21.9 $24.9 $27.8 $30.6 D&A & NCSC $15.6 $18.1 $20.4 $23.2 $26.5 Tax Adjustment $9.3 $6.6 $- $- $- Deferred Rev (WTI) + Sale Of Business $6.4 $1.3 $1.3 $1.3 $1.3 Maintenance Capex $(6.0) $(6.4) $(6.8) $(7.2) $(7.6) $(10.0) $(5.0) $- $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 Model Free Cash Flow at Assumed $40M Acquisition Level ($'s millions) 2013E 2014E 2015E 2016E 2017E $39.9 $41.4 $39.9 $45.2 $50.8 Note to Tax Adjustment: During 2012, four requests for tax accounting method changes relating to the recognition of accumulated trust earnings, revenue from preneed sales, revenue from advance preneed funeral insurance commissions, and certain refundable advances under preneed contracts were approved. The estimated cumulative impact of these accounting method changes results in the tax adjustment shown above.

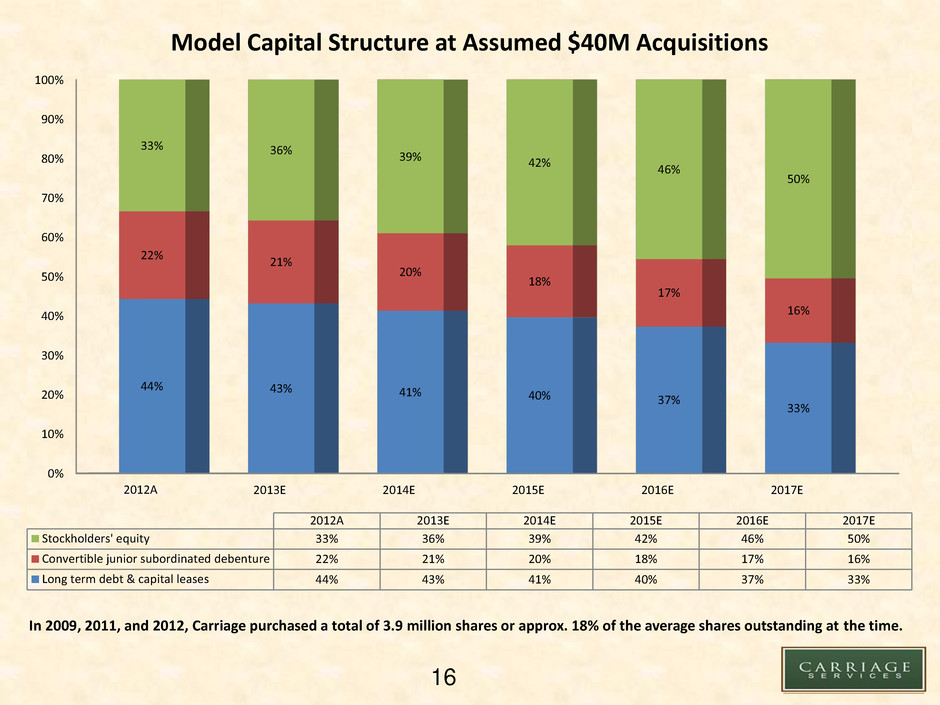

16 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2012A 2013E 2014E 2015E 2016E 2017E 44% 43% 41% 40% 37% 33% 22% 21% 20% 18% 17% 16% 33% 36% 39% 42% 46% 50% 2012A 2013E 2014E 2015E 2016E 2017E Stockholders' equity 33% 36% 39% 42% 46% 50% Convertible junior subordinated debenture 22% 21% 20% 18% 17% 16% Long term debt & capital leases 44% 43% 41% 40% 37% 33% Model Capital Structure at Assumed $40M Acquisitions In 2009, 2011, and 2012, Carriage purchased a total of 3.9 million shares or approx. 18% of the average shares outstanding at the time.

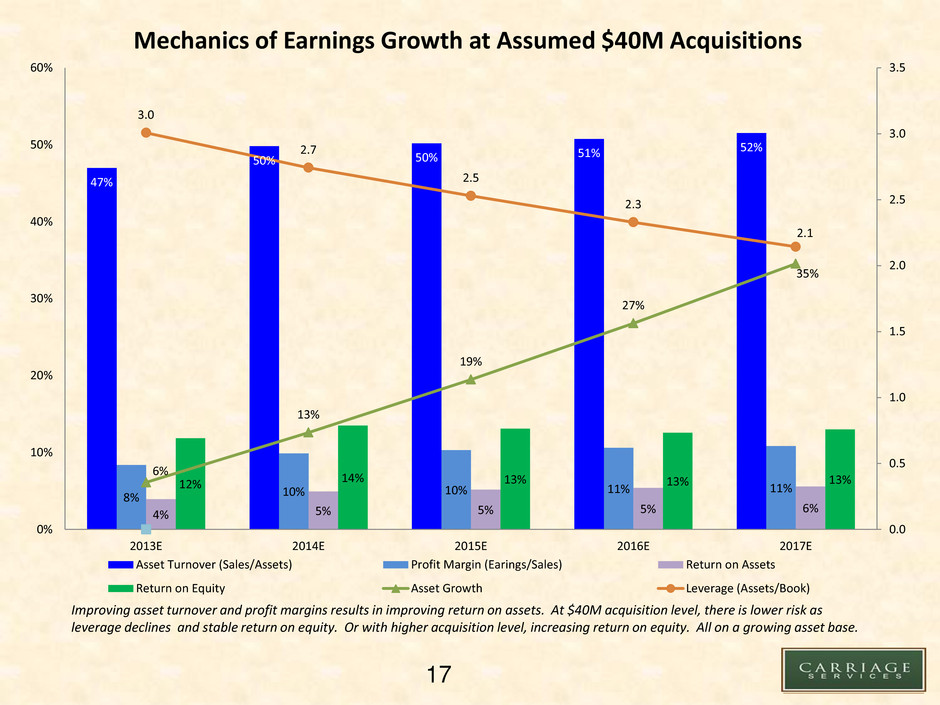

17 47% 50% 50% 51% 52% 8% 10% 10% 11% 11% 4% 5% 5% 5% 6% 12% 14% 13% 13% 13% 6% 13% 19% 27% 35% 3.0 2.7 2.5 2.3 2.1 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 0% 10% 20% 30% 40% 50% 60% 2013E 2014E 2015E 2016E 2017E Mechanics of Earnings Growth at Assumed $40M Acquisitions Asset Turnover (Sales/Assets) Profit Margin (Earings/Sales) Return on Assets Return on Equity Asset Growth Leverage (Assets/Book) Improving asset turnover and profit margins results in improving return on assets. At $40M acquisition level, there is lower risk as leverage declines and stable return on equity. Or with higher acquisition level, increasing return on equity. All on a growing asset base.

Appendix The forward looking numbers in the following slides are solely intended to demonstrate the possible impact on our financial results of the successful implementation of our growth strategy by the hypothetical acquisition of businesses aggregating $40 million in assets per year for each of the next five years (including 2013). The numbers presented on these slides incorporate several assumptions regarding the pricing, timing, and terms and conditions of such acquisitions, as well as the financial performance of both acquisition and same store businesses. We can provide no assurances that our growth strategy will be successfully implemented. In particular, we can provide no assurances that we will find attractive acquisition targets, that we will succeed in negotiating the terms and conditions reflected in the model, or that we will execute any acquisitions during the next five years (including 2013). Additionally, we can provide no assurances that our acquisition and same store businesses will generate the revenue growth reflected in the model, or any revenue growth at all. 18

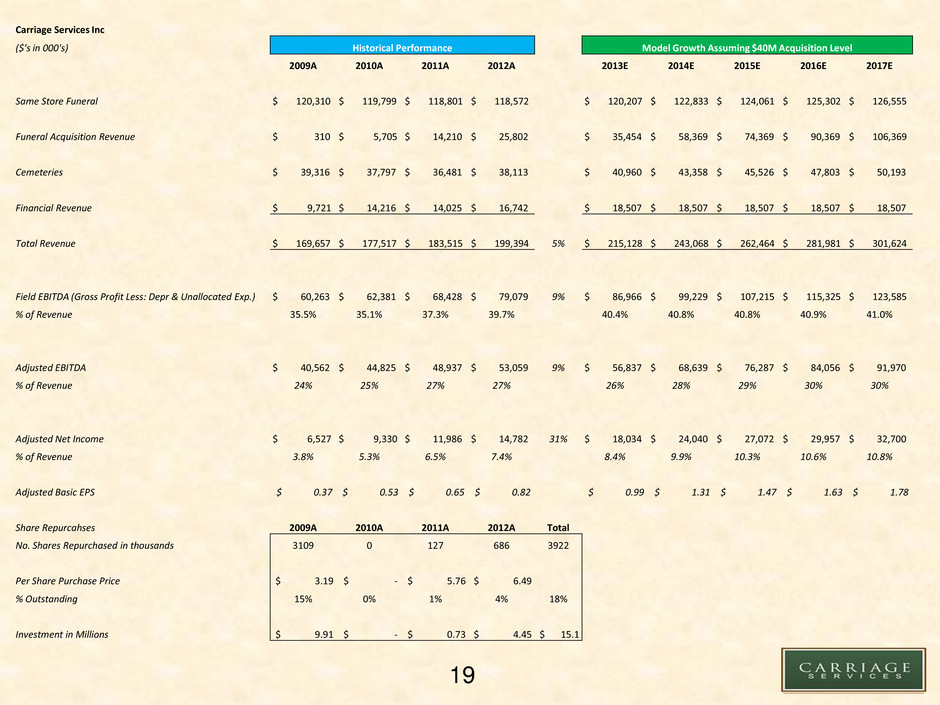

19 Carriage Services Inc ($'s in 000's) Historical Performance Model Growth Assuming $40M Acquisition Level 2009A 2010A 2011A 2012A 2013E 2014E 2015E 2016E 2017E Same Store Funeral $ 120,310 $ 119,799 $ 118,801 $ 118,572 $ 120,207 $ 122,833 $ 124,061 $ 125,302 $ 126,555 Funeral Acquisition Revenue $ 310 $ 5,705 $ 14,210 $ 25,802 $ 35,454 $ 58,369 $ 74,369 $ 90,369 $ 106,369 Cemeteries $ 39,316 $ 37,797 $ 36,481 $ 38,113 $ 40,960 $ 43,358 $ 45,526 $ 47,803 $ 50,193 Financial Revenue $ 9,721 $ 14,216 $ 14,025 $ 16,742 $ 18,507 $ 18,507 $ 18,507 $ 18,507 $ 18,507 Total Revenue $ 169,657 $ 177,517 $ 183,515 $ 199,394 5% $ 215,128 $ 243,068 $ 262,464 $ 281,981 $ 301,624 Field EBITDA (Gross Profit Less: Depr & Unallocated Exp.) $ 60,263 $ 62,381 $ 68,428 $ 79,079 9% $ 86,966 $ 99,229 $ 107,215 $ 115,325 $ 123,585 % of Revenue 35.5% 35.1% 37.3% 39.7% 40.4% 40.8% 40.8% 40.9% 41.0% Adjusted EBITDA $ 40,562 $ 44,825 $ 48,937 $ 53,059 9% $ 56,837 $ 68,639 $ 76,287 $ 84,056 $ 91,970 % of Revenue 24% 25% 27% 27% 26% 28% 29% 30% 30% Adjusted Net Income $ 6,527 $ 9,330 $ 11,986 $ 14,782 31% $ 18,034 $ 24,040 $ 27,072 $ 29,957 $ 32,700 % of Revenue 3.8% 5.3% 6.5% 7.4% 8.4% 9.9% 10.3% 10.6% 10.8% Adjusted Basic EPS $ 0.37 $ 0.53 $ 0.65 $ 0.82 $ 0.99 $ 1.31 $ 1.47 $ 1.63 $ 1.78 Share Repurcahses 2009A 2010A 2011A 2012A Total No. Shares Repurchased in thousands 3109 0 127 686 3922 Per Share Purchase Price $ 3.19 $ - $ 5.76 $ 6.49 % Outstanding 15% 0% 1% 4% 18% Investment in Millions $ 9.91 $ - $ 0.73 $ 4.45 $ 15.1

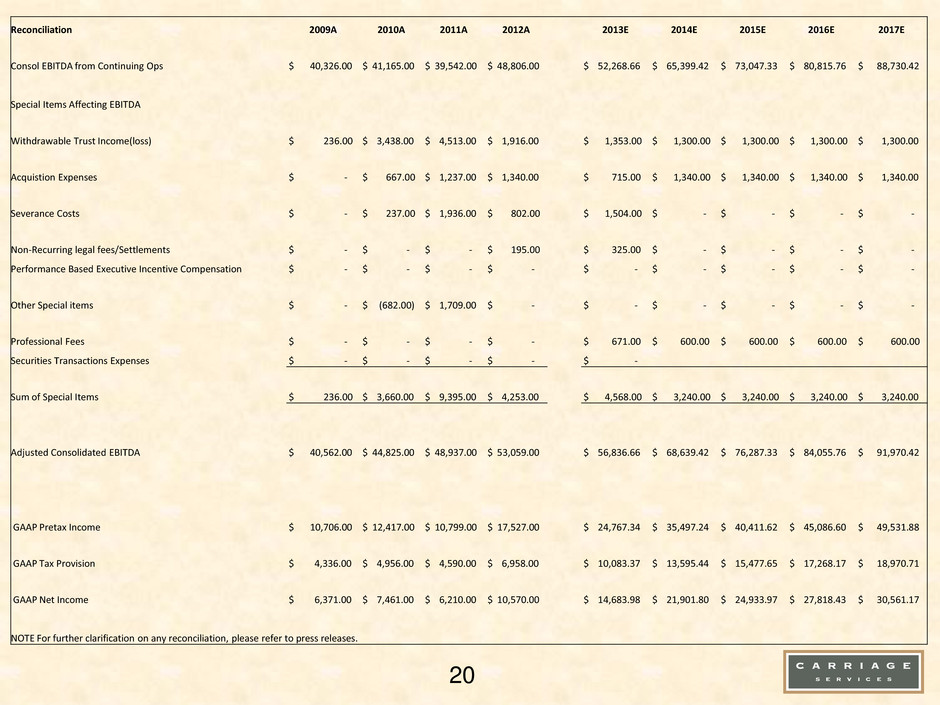

Reconciliation 2009A 2010A 2011A 2012A 2013E 2014E 2015E 2016E 2017E Consol EBITDA from Continuing Ops $ 40,326.00 $ 41,165.00 $ 39,542.00 $ 48,806.00 $ 52,268.66 $ 65,399.42 $ 73,047.33 $ 80,815.76 $ 88,730.42 Special Items Affecting EBITDA Withdrawable Trust Income(loss) $ 236.00 $ 3,438.00 $ 4,513.00 $ 1,916.00 $ 1,353.00 $ 1,300.00 $ 1,300.00 $ 1,300.00 $ 1,300.00 Acquistion Expenses $ - $ 667.00 $ 1,237.00 $ 1,340.00 $ 715.00 $ 1,340.00 $ 1,340.00 $ 1,340.00 $ 1,340.00 Severance Costs $ - $ 237.00 $ 1,936.00 $ 802.00 $ 1,504.00 $ - $ - $ - $ - Non-Recurring legal fees/Settlements $ - $ - $ - $ 195.00 $ 325.00 $ - $ - $ - $ - Performance Based Executive Incentive Compensation $ - $ - $ - $ - $ - $ - $ - $ - $ - Other Special items $ - $ (682.00) $ 1,709.00 $ - $ - $ - $ - $ - $ - Professional Fees $ - $ - $ - $ - $ 671.00 $ 600.00 $ 600.00 $ 600.00 $ 600.00 Securities Transactions Expenses $ - $ - $ - $ - $ - Sum of Special Items $ 236.00 $ 3,660.00 $ 9,395.00 $ 4,253.00 $ 4,568.00 $ 3,240.00 $ 3,240.00 $ 3,240.00 $ 3,240.00 Adjusted Consolidated EBITDA $ 40,562.00 $ 44,825.00 $ 48,937.00 $ 53,059.00 $ 56,836.66 $ 68,639.42 $ 76,287.33 $ 84,055.76 $ 91,970.42 GAAP Pretax Income $ 10,706.00 $ 12,417.00 $ 10,799.00 $ 17,527.00 $ 24,767.34 $ 35,497.24 $ 40,411.62 $ 45,086.60 $ 49,531.88 GAAP Tax Provision $ 4,336.00 $ 4,956.00 $ 4,590.00 $ 6,958.00 $ 10,083.37 $ 13,595.44 $ 15,477.65 $ 17,268.17 $ 18,970.71 GAAP Net Income $ 6,371.00 $ 7,461.00 $ 6,210.00 $ 10,570.00 $ 14,683.98 $ 21,901.80 $ 24,933.97 $ 27,818.43 $ 30,561.17 NOTE For further clarification on any reconciliation, please refer to press releases. 20