Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - NTS, INC. | nts_8k.htm |

Exhibit 99.1

NTS, Inc.

(Formerly Xfone, Inc.)

Annual Monitoring Report | November 2013

Author:

Tal Tutnauer, Analyst

talt@midroog.co.il

Contact:

Sigal Issachar, Head of Corporate

i.sigal@midroog.co.il

1

NTS, Inc.

|

Series Rating

|

Ba1

|

Outlook: Developing

|

Midroog reconfirms a Ba1 rating for the Series A bonds issued by NTS Inc. (“NTS” or “the Company”), while changing the rating outlook from stable to developing.1

Bond series rated by Midroog:

|

Series

|

Stock No.

|

Issue Date

|

Coupon

|

Linkage

|

Value in Books of Bond Balance as of June 30, 2013 (NIS M)*

|

Bond Repayment Years

|

||||||

|

A

|

1112721

|

12/2007

|

8.00%

|

CPI

|

44

|

2013-2015

|

The USD balance of the bonds in the Company books was $12 million, and was translated into NIS at the exchange rate for June 30, 2013.

Significant Events

On October 21, 2013, the Company published an announcement that an agreement had been signed for the acquisition of the Company through a merger by Tower Three Partners, an American private investment fund. The closing is subject to a number of conditions, including approval by the Company shareholders and obtaining special authorization from third parties (the Ministry of Communications, regulators and others). The transaction will take place as a value of $2 per share, giving the Company a value of $83 million (undiluted). After completing the transaction, the Company will become private.

The "developing" rating outlook was given because at this stage, we are unable to properly assess the effect of this transaction, in the event that it is carried out, on the rating of the Company bonds. Among other things, we will examine the effect on the rating in view of the new shareholders’ business and financial strategy, including plans for changing the nature of the Company’s business, mergers and acquisitions, financing plans, etc. If we can assume that the change in ownership can improve the Company’s financial flexibility, the effect on its rating is likely to be positive, while all other factors remain unchanged. Conversely, if the transaction does not go through, a negative effect is possible, as we believe that the Company will have to obtain outside sources for funding its operations and liabilities of 2014.

__________________________

1 A developing rating outlook means that the direction in which the rating will develop depends on a specific event.

2

Main Rating Rationale

The Company operates in the US communications market, which features a relatively low sector risk. The Company’s business profile is weak, due to its small absolute and relative size and its stage of growth, which require large investment that have not yet been reflected in revenue increase. Simultaneously, a rising trend in EBITDA is emerging, due to higher revenue in the fiber sector, which features a higher gross profit rate. The fiber sector is growing by 2,000 new customers a year; as of June 30, 2013, there were 11,000 customers in the sector. ARPU is stable, while the Company is still in the process of connecting customers in some regions. The average take rate is 23% of all potential customers.

The Company’s profitability is low, due to expenses for leased infrastructure from external concerns. This situation is gradually changing as the Company sets up its own independent fiber infrastructure, which is expected to improve its profitability in the medium term. High SG&A expense margins are also having a negative impact on profitability.

Given the rise in growth investments, the free cash flow generated by the Company in recent years has been negligible or negative, which makes it difficult to service its obligations from its FFO, and the Company therefore relies mainly on external sources to pay its debt. According to Midroog’s assessment, free cash flow will remain minor in 2013-2014. As a result, leverage has increased, with the ratio of debt to cap increased from 62% to 73% over the past 18 months. We believe that continued investment in 2013-2014 will cause a further rise in the level of debt.

The Company’s coverage ratios are stable, but are slow in comparison with the sector. In our opinion, the coverage ratios are expected to improve in the medium term. The recent debt raised has improved the Company’s liquidity, but in our opinion is unlikely to meet the requirements for Company’s uses until the end of 2014, as it will therefore require external sources.

3

NTS (Consolidated) – Key Financial Data ($ K)

| H1 2013 | H1 2012 |

FY 2012

|

FY 2011

|

FY 2010

|

||||||||||||||||

|

Revenues

|

30,122 | 30,008 | 59,870 | 57,658 | 58,944 | |||||||||||||||

|

Operating profit

|

2,015 | 2,506 | 5,304 | 3,241 | 2,128 | |||||||||||||||

|

Net profit (loss)

|

(798 | ) | (266 | ) | (547 | ) | (1,167 | ) | (4,473 | ) | ||||||||||

|

EBITDA

|

5,363 | 5,492 | 11,579 | 8,592 | 6,582 | |||||||||||||||

|

% EBITDA

|

17.8 | % | 18.3 | % | 19.3 | % | 14.9 | % | 11.2 | % | ||||||||||

|

CAPEX

|

4,715 | 1,179 | 3,226 | 2,472 | 2,378 | |||||||||||||||

|

RUS2 CAPEX

|

7,244 | 6,491 | 17,187 | 13,822 | 6,724 | |||||||||||||||

|

FCF

|

1,910 | 122 | 300 | (59 | ) | 927 | ||||||||||||||

|

Fixed assets

|

98,295 | 78,895 | 89,468 | 71,250 | 58,545 | |||||||||||||||

|

Equity

|

26,980 | 27,480 | 27,404 | 27,667 | 22,506 | |||||||||||||||

|

Equity to Total balance sheet

|

22.1 | % | 27.2 | % | 25.3 | % | 30.2 | % | 30.6 | % | ||||||||||

|

Cash and cash equivalents

|

9,937 | 7,663 | 3,909 | 6,564 | 1,217 | |||||||||||||||

|

RUS debt

|

41,310 | 29,571 | 35,520 | 21,380 | 9,492 | |||||||||||||||

|

Total debt

|

75,460 | 57,381 | 63,126 | 49,080 | 35,426 | |||||||||||||||

|

Debt-to-EBITDA (LTM)

|

6.6 | 5.7 | 5.5 | 5.7 | 5.4 | |||||||||||||||

|

Debt-to-FFO (LTM)

|

11.9 | 10.8 | 10.6 | 10.3 | 10.4 | |||||||||||||||

Breakdown of Key Rating Factors

A Weak Business Profile Resulting from the Company’s Small Size, offset by the low-risk sector

The Company operates in the telecommunications market in Texas, Mississippi, and Louisiana in southern US; its share of the American market is negligible. The smallness of the Company constitutes a risk, due to its lack of room for maneuver in dealing with non-routine events. Midroog estimates the risk in the US telecommunications market as fairly low, due to consistent and growing demand for all types of communications, combined with continued economic recovery. Local regulation supports the Company with loans and grants for setting up infrastructure in the regions where the Company operates. The large investments required and the long time needed to set up infrastructure make the entry barriers high for this sector.

The Company is in the midst of establishing a fiber-optic network to provide communications services using fiber-to-the-premise network (“FTTP” or “fiber”), including television, telephone, and broadband Internet services. The expansion of the Company’s fiber network is being carried out both independently, including deployment in regions where it is already operating with rented infrastructure and in projects with government financing, in which the Company is penetrating into new regions. This measure is accompanied by large investments, which are expected to continue in the short and medium term as well. Most of the Company’s efforts are directed towards activity financed by the government; the three projects deployed by the Company on behalf of the US Department of Agriculture in 2010, with a total investment of $100 million, are in the advanced stages. The Company receives 55% of its investment as government loans, and the remainder as grants. The loans are non-recourse loans in the framework of closed projects, and are secured by a lien on the projects’ assets.

___________________________

2 RUS – Rural Utilities Service. The American Department of Agriculture, through which the Company receives financing for government projects. Investments in government projects are carried out with financing loans and grants. The Company books list the net investments in the project, after deducting the grants.

4

Growth in Revenue is Projected to Gradually Improve Low Profitability

The growth rate of customers in the fiber sector stands at 2,000 new customers per year. There were 11,000 customers as of June 30, 2013, 27% of which were businesses. The weighted ARPU in the sector as of this date was $180, about the same as a year ago. ARPU for businesses is $390, compared with $100 for private customers. The average take rate in the sector is 23% of the potential customers.

We believe that the Company is in growth stages, while heavily investing in infrastructure, andwill post 30% growth in revenue in the fiber sector in both 2013 and 2014, which will be partially offset by lower revenue in the Local-Loop sector, mainly retail business based on leased infrastructure. Expansion of the fiber network is expected to continue, thereby boosting the Company’s profit ratios, since this sector, in which the Company uses its own network, yields a significantly higher gross profit ratio than the Local-Loop sector.

Marketing and management expenses are relatively high and have averaged 37% of revenue over the past three years. This is a significantly higher figure than the sector average, and is having a negative impact on the Company’s profitability. This figure is expected to gradually improve, but the Company’s small size is expected to keep the ratio of these expenses to revenue at a high level.

The Company’s EBITDA margins, which have been improving in recent years, were around 18% over the past year, while the corresponding margins for the leading communications operators in the sector are 33%-37%. Midroog believes that the Company’s EBITDA ratio will rise to 23% in 2014 as a result of a higher proportion of revenue derived from the fiber sector, for which profit ratios are higher.

The Company has continued to post losses in recent years. Among other things, these are due to its recent substantial investments, accompanied by high depreciation and financing expenses, with no compensating growth. The continuing losses have detracted from the Company’s financial flexibility since its last capital injection in 2011.

5

Weak FCF and Slow Coverage Ratios that are not Expected to Improve in the Short Term

The Company’s debt (primarily government debt), which is used to finance infrastructure investments, is increasing, using up cash, and having a negative impact on free cash flow. At the same time, funds from operations (FFO) continue to grow, totaling $6.3 million over the past year, compared with $5.3 million in the preceding year. Nevertheless, the free cash flow, net of payments on the principal of its debt to the government (RUS), has been negligible or negative in recent years, and this is not expected to change in the short term. The Company therefore relies on external sources to service its debt, while its capital raising options are quite limited.

The coverage ratio Debt-to-EBITDA over the past two years has been at 5.5-6.6. Midroog predicts a slight improvement in the coverage ratios to 5.3 in 2014.

The interest coverage ratio, which is calculated as (FFO + interest expense) / interest expense, has been around 2.2 during the past two years. This figure might create problems for the Company in refinancing its debt in the future. According to Midroog, this figure should improve to 2.8 in 2014, but is still quite slow.

Poor Financial Strength and Liquidity, Continued Reliance on External Financing Sources

Since its most recent capital injection in 2011, the Company has consistently increased its rate of leverage, increasing government debt (RUS) and its private debt from ICON. The Company is not increasing its equity through bottom line profit, so its Capital-to-Total balance sheet ratios have gradually deteriorated from 30% in 2011 to 22% at present. The Company has $18 million left from its RUS loans credit line, which will be utilized in the short term; without growth in its bottom line and/or capital injection, the Company’s financial strength is therefore expected to continue its decline.

Raising $6 million in debt from ICON in the first half of 2013 has improved the Company’s liquidity, but this cash is earmarked for non-governmental investments. After paying the principal on its bonds in December, the Company will therefore be left with $5 million in its treasury at the end of 2013, which is not expected to suffice for its uses in 2014. Midroog believes that the Company will have to raise more capital during the coming year.

The Company’s financial flexibility is poor. It has no available lines of credit, and all of its assets are encumbered.

6

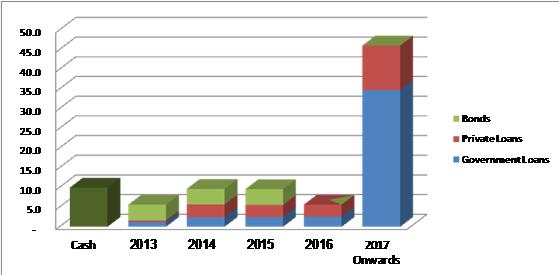

Debt Repayment Schedule ($ M)

Rating Outlook

Factors that could improve the rating:

|

●

|

A significant improvement in cash flow from activities that is reflected in surplus cash flow, net of debt repayments

|

|

●

|

An improvement in financial strength through a reinforcement of capital

|

Factors that could lower the rating:

|

●

|

A significant decline in free cash flow

|

|

●

|

Failure to improve liquidity for debt servicing purposes

|

About the Company

NTS provides communications services in southern US. The Company’s services include local and international calls, video, and broadband Internet services. The Company sold its activity in Israel in 2010, and currently focuses on two main lines of business in the US: (1) communications services (telephony, Internet, and TV) over existing infrastructure in a number of US states, and (2) projects for deploying communications infrastructure in regions in the US with little or no infrastructure, while receiving support from the US government, and providing communications services over this network.

7

The Company offices are located in Lubbock, Texas. Its ordinary shares are listed on the New York Stock Exchange (NYSE) and the Tel Aviv Stock Exchange (TASE) (in the “dual listing” framework). The Company bonds are listed only on the TASE. Company shareholders include CEO Guy Nissenson, who holds a 7.73% stake. The public holds 27.83%.

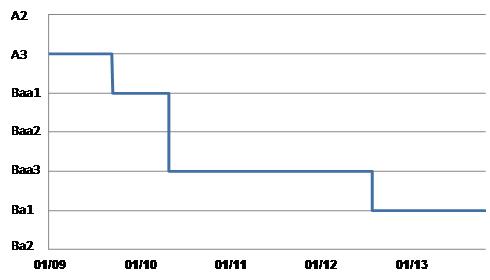

Rating History

Related Reports

Previous monitoring report – Monitoring Report, August 2012

Date of report: November 14, 2013

8

Key Financial Terms

|

Interest expenses

|

Net financing expenses from Income Statement

|

|

|

Cash flow interest expenses

|

Financing expenses from income statement after adjustments for non-cash flow expenditures from statement of cash flows.

|

|

|

Operating profit (EBIT)

|

Pre-tax profit + financing + non-recurring expenses/profits.

|

|

|

Operating profit before amortizations (EBITA)

|

EBIT + amortization of intangible assets.

|

|

|

Operating profit before depreciation and amortizations (EBITDA)

|

EBIT + depreciation + amortization of intangible assets.

|

|

|

Operating profit before depreciation, amortization and rent/leasing (EBITDAR)

|

EBIT + depreciation + amortization of intangible assets + rent + operational leasing.

|

|

|

Assets

|

Company's total balance sheet assets.

|

|

|

Debt

|

Short term debt + current maturities of long-term loans + long-term debt + liabilities on operational leasing

|

|

|

Net debt

|

Debt - cash and cash equivalent – long-term investments

|

|

|

Capitalization (CAP)

|

Debt + total shareholders' equity (including minority interest) + long-term deferred taxes in balance sheet

|

|

|

Capital Expenditures (Capex)

|

Gross investments in equipment, machinery and intangible assets

|

|

|

Funds from Operations (FFO)*

|

Cash flow from operations before changes in working capital and before changes in other asset and liabilities items

|

|

|

Cash flow from operating activity* (CFO)

|

Cash flow from operating activity according to consolidated cash flow statements

|

|

|

Retained Cash Flow (RCF)

|

Funds from operations (FFO) less dividend paid to shareholders

|

|

|

Free Cash Flow (FCF)*

|

Cash flow from operating activity (CFO) - CAPEX - dividends

|

* It should be noted that in IFRS reports, interest payments and receipts, tax and dividends from investees will be included in the calculation of the operating cash flows, even if they are not entered in cash flow from operating activity.

9

Obligations Rating Scale

|

Investment grade

|

Aaa

|

Obligations rated Aaa are those, which in Midroog's judgment, are of the highest quality and involve minimal credit risk.

|

|

Aa

|

Obligations rated Aa are those, which in Midroog's judgment, are of high quality and involve very low credit risk.

|

|

|

A

|

Obligations rated A are considered by Midroog to be in the upper-end of the middle rating, and involve low credit risk.

|

|

|

Baa

|

Obligations rated Baa are those, which in Midroog's judgment, involve moderate credit risk. They are considered medium grade obligations and could have certain speculative characteristics.

|

|

|

Speculative Investment

|

Ba

|

Obligations rated Ba are those, which in Midroog's judgment, are speculative and involve a high degree of credit risk.

|

|

B

|

Obligations rated B are those which, in Midroog's judgment, are speculative and involve a high credit risk.

|

|

|

Caa

|

Obligations rated Caa are those, which in Midroog's judgment, have weak standing and involve very high credit risk.

|

|

|

Ca

|

Obligations rated Ca are very speculative investments and are likely in, or very near, default, with some prospect of recovery of principal and interest.

|

|

|

C

|

Obligations rated C are assigned the lowest rating and are generally in a situation of insolvency with remote prospects of repayment of principal and interest.

|

Midroog applies numerical modifiers 1, 2 and 3 in each of the rating categories from Aa to Caa. Modifier 1 indicates that the bond ranks in the higher end of the letter-rating category. Modifier 2 indicates that the bonds are at the higher end of the letter-rating category; and modifier 3 indicates that the bonds are in the lower end of the letter-rating category.

10

Report No: CCNO31013000M

Midroog Ltd., Millennium 17 Ha’Arba'a Street, Tel-Aviv 64739

Tel: 03-6844700, Fax: 03-6855002, www.midroog.co.il

© Copyright 2013, Midroog Ltd. (“Midroog”). All rights reserved.

This document (including the contents thereof) is the property of Midroog and is protected by copyright and other intellectual property laws. There is to be no copying, photocopying, reproduction, modification, distribution, or display of this document for any commercial purpose without the express written consent of Midroog.

All the information contained herein on which Midroog relied was submitted to it by sources it believes to be reliable and accurate. Midroog does not independently check the correctness, completeness, compliance, accuracy or reliability of the information (hereinafter: the "information") submitted to it, and it relies on the information submitted to it by the rated Company for assigning the rating.

The rating is subject to change as a result of changes in the information obtained or for any other reason, and therefore it is recommended to monitor its revision or modification on Midroog's website www.midroog.co.il. The ratings assigned by Midroog express a subjective opinion, and they do not constitute a recommendation to buy or not to buy bonds or other rated instruments. The ratings should not be referred as endorsements of the accuracy of any of the data or opinions, or attempts to independently assess or vouch for the financial condition of any company. The ratings should not be construed as an opinion on the attractiveness of their price or the return of bonds or other rated instruments. Midroog's ratings relate directly only to credit risks and not to any other risk, such as the risk that the market value of the rated debt will drop due to changes in interest rates or due to other factors impacting the capital market. Any other rating or opinion given by Midroog must be considered as an individual element in any investment decision made by the user of the Information contained in this document or by someone on his behalf. Accordingly, any user of the information contained in this document must conduct his own investment feasibility study on the Issuer, guarantor, debenture or other rated document that he intends to hold, buy or sell. Midroog's ratings are not designed to meet the investment needs of any particular investor. The investor should always seek the assistance of a professional for advice on investments, the law, or other professional matters. Midroog hereby declares that the Issuers of bonds or of other rated instruments or in connection with the issue thereof the rating is being assigned, have undertaken, even prior to performing the rating, to render Midroog a payment for valuation and rating services provided by Midroog.

Midroog is a 51% subsidiary of Moody’s. Midroog's rating process is entirely independent of Moody's and Midroog has its own policies, procedures and independent rating committee; however, its methodologies are based on those of Moody’s. For more information on Midroog's rating process, please see the relevant pages of this website.

For further information on the rating procedures of Midroog or of its rating committee, please refer to the relevant pages on Midroog's website.

11