Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - Adynxx, Inc. | alqa_ex991.htm |

| EX-99.2 - PRESS RELEASE - Adynxx, Inc. | alqa_ex992.htm |

| 8-K - CURRENT REPORT - Adynxx, Inc. | alqa_8k.htm |

| EX-3.1 - ARTICLES OF AMENDMENT - Adynxx, Inc. | alqa_ex31.htm |

Exhibit 99.3

Investor Presentation

November 2013 Ticker: ALQA

1

2

This presentation contains forward-looking statements. Forward-looking statements are generally

identifiable by the use of words like "may," "will," "should," "could," "expect," "anticipate," "estimate,"

"believe," "intend," or "project" or the negative of these words or other variations on these words or

comparable terminology. The reader is cautioned not to put undue reliance on these forward-looking

statements, as these statements are subject to numerous factors and uncertainties outside of our control

that can make such statements untrue, including, but not limited to, inadequate capital, adverse economic

conditions, intense competition, lack of meaningful research results, entry of new competitors and

products, adverse federal, state and local government regulation, termination of contracts or agreements,

technological obsolescence of our products, technical problems with our research and products, price

increases for supplies and components, inability to carry out research, development and commercialization

plans, loss or retirement of key executives and research scientists and other specific risks. We currently

have no commercial products intended to diagnose, treat, prevent or cure any disease. The statements

contained in this presentation regarding our ongoing research and development and the results attained by

us to-date have not been evaluated by the Food and Drug Administration. There can be no assurance that

further research and development, and/or whether clinical trial results, if any, will validate and support the

results of our preliminary research and studies. Further, there can be no assurance that the necessary

regulatory approvals will be obtained or that we will be able to develop new products on the basis of our

technologies. In addition, other factors that could cause actual results to differ materially are discussed in

our Annual Report on Form 10-K/A filed with the SEC on May 16, 2013 and our most recent Form 10-Q

filings with the SEC. Investors and security holders are urged to read these documents free of charge on the

SEC's web site at www.sec.gov. We undertake no obligation to publicly update or revise our forward-

looking statements as a result of new information, future events or otherwise.

identifiable by the use of words like "may," "will," "should," "could," "expect," "anticipate," "estimate,"

"believe," "intend," or "project" or the negative of these words or other variations on these words or

comparable terminology. The reader is cautioned not to put undue reliance on these forward-looking

statements, as these statements are subject to numerous factors and uncertainties outside of our control

that can make such statements untrue, including, but not limited to, inadequate capital, adverse economic

conditions, intense competition, lack of meaningful research results, entry of new competitors and

products, adverse federal, state and local government regulation, termination of contracts or agreements,

technological obsolescence of our products, technical problems with our research and products, price

increases for supplies and components, inability to carry out research, development and commercialization

plans, loss or retirement of key executives and research scientists and other specific risks. We currently

have no commercial products intended to diagnose, treat, prevent or cure any disease. The statements

contained in this presentation regarding our ongoing research and development and the results attained by

us to-date have not been evaluated by the Food and Drug Administration. There can be no assurance that

further research and development, and/or whether clinical trial results, if any, will validate and support the

results of our preliminary research and studies. Further, there can be no assurance that the necessary

regulatory approvals will be obtained or that we will be able to develop new products on the basis of our

technologies. In addition, other factors that could cause actual results to differ materially are discussed in

our Annual Report on Form 10-K/A filed with the SEC on May 16, 2013 and our most recent Form 10-Q

filings with the SEC. Investors and security holders are urged to read these documents free of charge on the

SEC's web site at www.sec.gov. We undertake no obligation to publicly update or revise our forward-

looking statements as a result of new information, future events or otherwise.

Forward-Looking Statement Disclaimer

2

3

About Alliqua Biomedical

Alliqua Biomedical, Inc. (OTCQB: ALQA) is an advanced wound

management and drug delivery company that strives to deliver superior

outcomes to patients, providers, and partners through its platform

technologies and unique, proprietary wound care products.

management and drug delivery company that strives to deliver superior

outcomes to patients, providers, and partners through its platform

technologies and unique, proprietary wound care products.

CORE BUSINESS UNITS

Advanced Wound Management

A growing suite of proven

technologies for wound care practitioners that

seek to address the full spectrum of patient

needs.

technologies for wound care practitioners that

seek to address the full spectrum of patient

needs.

Supported by a world class sales

organization that markets and distributes

Alliqua's exclusive products.

organization that markets and distributes

Alliqua's exclusive products.

Transdermal / Topical Drug Delivery

Developing a platform to deliver

pharmaceutical ingredients through the skin.

pharmaceutical ingredients through the skin.

Custom Hydrogel Manufacturing

Custom hydrogels for the OEM market

with a focus on medical applications.

with a focus on medical applications.

3

4

Growth Strategy

Beginning in February 2013, Alliqua has been pursuing a growth strategy

that leverages the knowledge and experience of CEO Dave Johnson and

Chairman Dr. Jerry Zeldis.

that leverages the knowledge and experience of CEO Dave Johnson and

Chairman Dr. Jerry Zeldis.

STRATEGIC INITIATIVES NOW UNDERWAY

§Building a world class sales organization to market and distribute Alliqua's

proprietary products while making the company attractive to partners and

licensors seeking to penetrate the highly fragmented wound care space.

proprietary products while making the company attractive to partners and

licensors seeking to penetrate the highly fragmented wound care space.

§Assembling a suite of advanced wound care products that are superior, FDA

approved, reimbursed, and can address the spectrum of needs facing the wound

care practitioner.

approved, reimbursed, and can address the spectrum of needs facing the wound

care practitioner.

§ The ability to offer practitioners multiple wound management solutions

makes Alliqua’s sales organization more efficient and effective.

makes Alliqua’s sales organization more efficient and effective.

§Developing topical and transdermal drug delivery capabilities using Alliqua’s

hydrogel manufacturing capabilities.

hydrogel manufacturing capabilities.

4

5

BACKGROUND IN BRIEF

1998 Aquamed - A private OEM Hydrogel Manufacturer

2010 Investor Acquires Aquamed, Takes Public, and Renames

2012 FDA Clearance - SilverSeal® and Hydress®

2013 New Leadership - Led by David Johnson and Jerry Zeldis

2013 New Focus - Wound Management and Drug Delivery

2013 New Wound Care Technologies - Partnerships with Celgene and Sorbion

ANTICPATED FUTURE MILESTONES

2014 Uplist - to a National Exchange

2014 Add Technologies - Expand Wound Management Product Portfolio

2014 Expand Selling Organization and Distribution Network - Grow Revenues

2014 Pursue Drug Delivery - Accelerate Commercialization

Corporate History

5

6

New Senior Management

In 2013, Alliqua introduced new leadership comprised of healthcare and

life sciences industry veterans.

life sciences industry veterans.

DAVID JOHNSON, CEO OF ALLIQUA

Former CEO of ConvaTec where he grew revenues to $1.7B and

oversaw its sale for $4.1B. Senior positions at Zimmer, Fisher

Scientific, and Baxter Corporation. 32 years in medical devices

and 25 years leading companies.

oversaw its sale for $4.1B. Senior positions at Zimmer, Fisher

Scientific, and Baxter Corporation. 32 years in medical devices

and 25 years leading companies.

DR. JERRY ZELDIS, CHAIRMAN OF ALLIQUA

Chief Medical Officer of Celgene Corporation since 1997.

Celgene’s market cap grew from $100M to $55B during this

period. CEO of Celgene Global Health where he creates new

therapeutics for diseases of the developing world.

Celgene’s market cap grew from $100M to $55B during this

period. CEO of Celgene Global Health where he creates new

therapeutics for diseases of the developing world.

6

7

New Senior Management Cont.

PHILLIP FORMAN

VP CLINICAL

AFFAIRS

GREGORY ROBB

VP OPERATIONS

JAMES SAPIRSTEIN

CEO, THERAPEUTICS

CEO, THERAPEUTICS

DIVISION

BRAD BARTON

CHIEF OPERATING

OFFICER

LORI TONER

CHIEF MARKETING

OFFICER

BRIAN POSNER

CHIEF FINANCIAL

OFFICER

7

8

Key Corporate Milestones

ACHIEVED UNDER NEW MANAGEMENT

üWorld-class team in place with deep domain experience in the field of advanced wound

care.

care.

ü$17M raised in 2013; led by Board and Management, Celgene, and new investors.

üStrategic partnership with Celgene whereby Alliqua received the exclusive rights to two

Celgene Cellular Therapeutics advanced wound care products, Biovance® and ECM.

Celgene Cellular Therapeutics advanced wound care products, Biovance® and ECM.

üStrategic partnership with Sorbion whereby Alliqua acquired the exclusive Americas’

distribution rights to Sorbion Sana Gentle® and Sorbion Sachet S®.

distribution rights to Sorbion Sana Gentle® and Sorbion Sachet S®.

üCompleted SilverSeal® Clinical Study demonstrating a reduction of incision

complications, including infection and scarring, in foot and ankle surgery patients.

complications, including infection and scarring, in foot and ankle surgery patients.

üEarly validation of topical and transdermal drug delivery technology in porcine study

examining lidocaine delivery.

examining lidocaine delivery.

8

Advanced

Wound Care

9

10

Advanced Wound Care Market Opportunity

The global market for advanced wound care products was $6.0B+ in

2011 with approximately 60% of sales in the U.S.

2011 with approximately 60% of sales in the U.S.

MARKET SEGMENTS

Source: Worldwide Wound Management Market, Size and Growth to 2021 by Segment, MedMarket Diligence.

CHRONIC WOUNDS

§Diabetic Ulcers

§Venus Stasis Ulcers

§Pressure Ulcers

ACUTE WOUNDS

§Surgical Wounds

§Trauma

§Burns

10

11

Advanced Wound Management Vision

Acquire a suite of technological solutions to enable wound care

practitioners to deal with the challenges of acute and chronic wounds.

practitioners to deal with the challenges of acute and chronic wounds.

EXPAND PRODUCT PORTFOLIO AND DRIVE SALES

§ Integrate multiple technologies into Alliqua’s offering through licensing

agreements, distribution agreements, and acquisitions.

agreements, distribution agreements, and acquisitions.

§ Build a world-class sales force of knowledgeable, professional, and

committed individuals with a background in wound care.

committed individuals with a background in wound care.

§ Extensive selling model including direct and independent agents.

§ Extensive channel reach through network of distributors.

§ Attractive compensation for sales specialists.

11

12

Advanced Wound Management Vision Cont.

Expand the wound care portfolio through business development.

|

PRODUCTS

|

|

ACUTE WOUNDS

|

|

CHRONIC WOUNDS

|

|||||||

|

Current Products

|

|

Cosmetic

|

Surgical

|

Skin

Tears |

Trauma

(Other) |

Burns

|

|

Pressure

Ulcers |

Diabetic

Ulcers |

Venous

Leg Ulcers |

Arterial

Ulcers |

|

SilverSeal®

|

|

X

|

X

|

X

|

X

|

X

|

|

X

|

X

|

|

X

|

|

Hydress®

|

|

|

|

X

|

|

X

|

|

X

|

|

|

X

|

|

Sorbion Sana

|

|

|

X

|

|

X

|

X

|

|

X

|

X

|

X

|

X

|

|

Planned Product Introductions

|

|

|

|

|

|

|

|

|

|

|

|

|

Biovance® (Q2 2014)

|

|

X

|

X

|

|

X

|

X

|

|

X

|

X

|

X

|

X

|

|

Extracellular Matrix (~Q2 2015)

|

|

X

|

X

|

|

X

|

X

|

|

X

|

X

|

X

|

X

|

|

Q1 2014 (Partner Prospect)

|

|

X

|

X

|

|

X

|

X

|

|

X

|

X

|

X

|

X

|

Dry to Low Draining Wounds Moderate to High Risk of Infection Recalcitrant

Hydress® / SilverSeal® Sorbion Sache / Sana SilverSeal® Biovance® / ECM

|

PRODUCT FIT

|

|

Anticipated New Products

|

12

13

Advanced Wound Care Product Portfolio

Our suite of differentiated products enhance a clinician’s ability to

effectively and efficiently manage a variety of wound indications.

effectively and efficiently manage a variety of wound indications.

Extracellular Matrix®

Biovance®

13

14

Advanced Wound Care Product Portfolio Cont.

HYDRESS® AND SILVERSEAL®

§SilverSeal® Clinical Study demonstrated a reduction

in infection and scarring in foot and ankle surgery

patients as compared to standard petroleum-based

dressings.

in infection and scarring in foot and ankle surgery

patients as compared to standard petroleum-based

dressings.

§FDA clearance with Medicare reimbursement.

§Controls the volume of wound fluid; absorbs wound

exudate (up to 2x its own weight).

exudate (up to 2x its own weight).

§SilverSeal® offers broad spectrum antimicrobial

activity.

activity.

§Made at Alliqua’s Langhorne, PA manufacturing

facility; low COGS with high margins.

facility; low COGS with high margins.

Hydress® and SilverSeal® leverage Alliqua’s core hydrogel

manufacturing capabilities.

manufacturing capabilities.

14

15

Advanced Wound Care Product Portfolio Cont.

SORBION SACHET S® AND SANA®

§510k approved with Medicare reimbursement.

§Hydroactive wound dressing for the management of

moderately to heavily exuding wounds.

moderately to heavily exuding wounds.

§Designed for wounds with a heterogeneous

production of exudate during granulation.

production of exudate during granulation.

§Ideal dressing for patients with contact sensitivities.

§Expanded sales and distribution infrastructure opens

up a $500M opportunity in the wound management

space.

up a $500M opportunity in the wound management

space.

In September 2013, Alliqua became the exclusive distributor of sorbion-

branded products in the Americas.

branded products in the Americas.

15

16

Extracellular Matrix®

Biovance®

Advanced Wound Care Product Portfolio Cont.

CELGENE BIOVANCE® AND ECM®

§Biovance® is a collagen-based decellularized and

dehydrated biologic wound covering produced from human

amniotic membrane.

dehydrated biologic wound covering produced from human

amniotic membrane.

§Biovance® is indicated for the management of non-infected

partial- and full-thickness wounds.

partial- and full-thickness wounds.

§Biovance® is ready for commercial use and a Q2 2014

launch is anticipated.

launch is anticipated.

§ECM is a suite of advanced wound management products

made from extracellular matrix derived from the human

placenta.

made from extracellular matrix derived from the human

placenta.

§Alliqua anticipates a Q2 2015 launch of ECM, pending

regulatory approvals.

regulatory approvals.

In November 2013, Alliqua acquired the exclusive right to develop and

market Celgene’s Biovance® and Extracellular Matrix (“ECM”).

market Celgene’s Biovance® and Extracellular Matrix (“ECM”).

16

17

Advanced Wound Care Milestones

ACHIEVED UNDER NEW MANAGEMENT

üCompleted a SilverSeal® Clinical Study demonstrating a reduction of incision

complications, including infection and scarring, in foot and ankle surgery patients

(May 2013).

complications, including infection and scarring, in foot and ankle surgery patients

(May 2013).

üSecured strategic wholesale distributor relationships with Team Distribution

International, World Health Industries, and McKesson Medical-Surgical, Medline,

O&M, Cardinal, and PSS (2013).

International, World Health Industries, and McKesson Medical-Surgical, Medline,

O&M, Cardinal, and PSS (2013).

üAssembled sales and marketing team with more than 50 independent agents and

three direct sales reps (2013).

three direct sales reps (2013).

üAdded to the Wound Care Portfolio with key partnerships and acquisitions.

§ Strategic partnerships with sorbion GmbH & Co. KG that made Alliqua the

exclusive sales agent of sorbion products in the Americas (Sept 2013).

exclusive sales agent of sorbion products in the Americas (Sept 2013).

§ Strategic partnerships with Celgene Cellular Therapeutics bringing two

novel advanced wound care technologies, Biovance® and Extracellular

Matrix (Nov 2013).

novel advanced wound care technologies, Biovance® and Extracellular

Matrix (Nov 2013).

17

18

Media Excitement Surrounding Alliqua

18

Topical / Transdermal

Drug Delivery

19

20

Topical and Transdermal Drug Delivery

Alliqua is using its hydrogel technology platform to deliver active

pharmaceutical ingredients, initially lidocaine, through the skin.

pharmaceutical ingredients, initially lidocaine, through the skin.

DRUG DELIVERY OVERVIEW

§Alliqua plans to develop lidocaine hydrogel patches for the treatment of localized acute

pain, including post-operative pain, back pain, as well as pain associated with sports

injuries and arthritis.

pain, including post-operative pain, back pain, as well as pain associated with sports

injuries and arthritis.

§Beyond lidocaine, Alliqua plans to explore transdermal delivery of dermatologic,

oncologic, antibiotic, and neurologic products.

oncologic, antibiotic, and neurologic products.

§Key advantages of Alliqua’s delivery platform include:

§ Patient comfort (94% water with less potential for skin irritation).

§ Stability of form and composition.

§ Purity and reproducibility.

§ Compatibility with various active ingredients.

§ High product margins.

20

Topical and Transdermal Drug Delivery Cont.

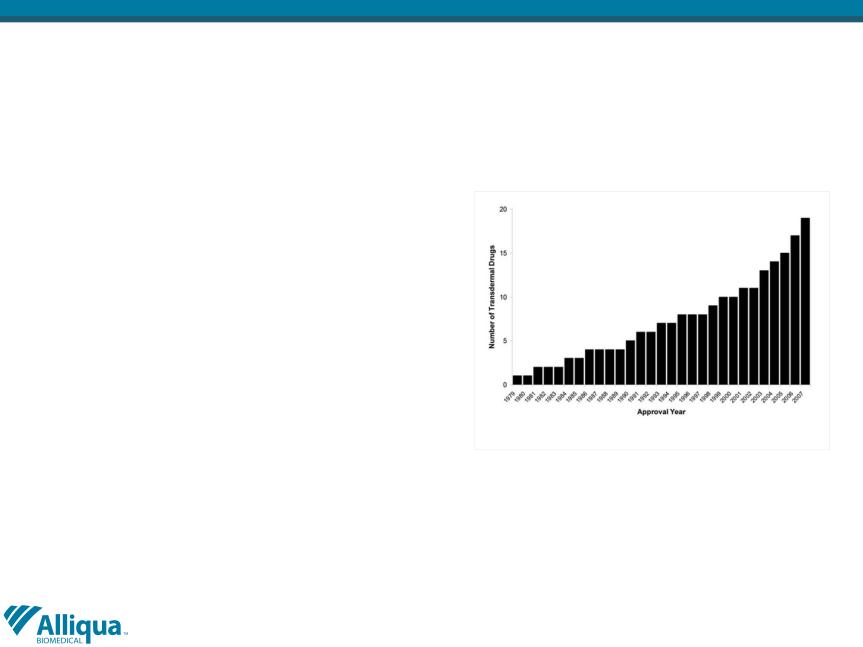

The global transdermal and topical drug delivery market was valued at

$21.5B in 2010 and is expected to grow to $31.5B by 2015.

$21.5B in 2010 and is expected to grow to $31.5B by 2015.

Sources: FDA Orange Book; UBM Canon Data Products, September 2011

MARKET OVERVIEW

§Transdermal drug delivery accounts for

more than 12% of the global drug

delivery market.

more than 12% of the global drug

delivery market.

§The annual U.S. market for transdermal

patches is estimated at $3B+.

patches is estimated at $3B+.

§Today there are more than 20 types of

transdermal drug delivery patches

available; substantial unmet need still

exist in the area of pain management

and women's health.

transdermal drug delivery patches

available; substantial unmet need still

exist in the area of pain management

and women's health.

Cumulative number of transdermal drugs approved by the

FDA.

FDA.

21

22

Lidocaine Patch

In October 2013, Alliqua completed a proof-of-principle study designed

to examine the use of hydrogel technology as a topical drug delivery

vehicle for lidocaine.

to examine the use of hydrogel technology as a topical drug delivery

vehicle for lidocaine.

LIDOCAINE STUDY OUTCOME

§Safety and tolerability of Alliqua's lidocaine hydrogel patches were explored in

an animal model.

an animal model.

§Alliqua’s investigational lidocaine transdermal patch compared favorably to the

Lidoderm® patch currently on the market.

Lidoderm® patch currently on the market.

§Alliqua's patch was able to deliver in a pig slightly higher amounts of lidocaine

than Lidoderm® and reached maximum delivery within a comparable period.

than Lidoderm® and reached maximum delivery within a comparable period.

§Further development could result in Alliqua creating a generic version of the

Lidoderm® patch or providing better drug delivery resulting in 505 (b)(2)

approval.

Lidoderm® patch or providing better drug delivery resulting in 505 (b)(2)

approval.

22

23

Lidocaine Patch Cont.

Lidocaine patches are a large and growing market with over $1.4B in

annual sales.

annual sales.

MARKET OPPORTUNITY

§In 1999, Lidoderm was approved by FDA. In September 2013, Actavis

introduced a competing generic (early release negotiated with Endo

Pharmaceuticals) product at 87% of the branded price.

introduced a competing generic (early release negotiated with Endo

Pharmaceuticals) product at 87% of the branded price.

§Lidocaine patches are indicated for the treatment of post-herpetic neuralgia

(PHN), also called post-shingles pain.

(PHN), also called post-shingles pain.

§ PHN is the most common complication of herpes zoster (shingles), a

condition that affects 1.1M individuals annually in the U.S.

condition that affects 1.1M individuals annually in the U.S.

§ Approximately 13% of shingles sufferers over 60 years experience PHN.

§ An aging population is expected to drive demand for the product.

23

Custom Hydrogel

Manufacturing

24

25

Custom Hydrogel Manufacturing

Alliqua serves as a contract

manufacturer, supplying its hydrogels to

third parties who incorporate them into

their own products.

manufacturer, supplying its hydrogels to

third parties who incorporate them into

their own products.

Alliqua’s Langhorne, PA facility.

ADDRESSABLE SEGMENTS

§Transdermal and topical delivery of

prescription and OTC Drugs.

prescription and OTC Drugs.

§ Proof-of-Concept established in

Lidocaine.

Lidocaine.

§Moist wound and burn dressings.

§Components of medical devices.

§Cosmetic applications.

25

26

Proprietary Hydrogel Technology Platform

The hydrogel technology platform provides Alliqua with key competitive

advantages.

advantages.

PROPRIETARY TECHNOLOGIES

§Proprietary Mixing: Alliqua is able to manufacture hydrogel feed mixes with far

greater homogeneity than those of its competition. This manufacturing

advantage is critical for transdermal drug delivery.

greater homogeneity than those of its competition. This manufacturing

advantage is critical for transdermal drug delivery.

§Proprietary Cross-Linking: Alliqua cross-links its hydrogels using an electron

beam accelerator. The creation of longer chains of the polymer in the gel

increases its molecular integrity, giving the gel characteristics that make it useful

in a variety of products.

beam accelerator. The creation of longer chains of the polymer in the gel

increases its molecular integrity, giving the gel characteristics that make it useful

in a variety of products.

§Proprietary Coating: Thickness controls are critical to the performance of

medical electrodes, transdermal delivery patches, and cosmetic patches.

medical electrodes, transdermal delivery patches, and cosmetic patches.

26

27

Manufacturing and Development Facility

Alliqua operates a 16,000 square foot manufacturing facility in

Langhorne, PA. The facility features an Industrial Electron Accelerator,

or RDI Accelerator; this RDI Accelerator has been extensively

customized to meet Alliqua’s needs.

Langhorne, PA. The facility features an Industrial Electron Accelerator,

or RDI Accelerator; this RDI Accelerator has been extensively

customized to meet Alliqua’s needs.

COMPETITIVE BARRIERS

§Alliqua developed, acquired and sells applications that require tight tolerances

and/or incorporate active ingredients. Barriers to entry for competitors include:

and/or incorporate active ingredients. Barriers to entry for competitors include:

§ Costs of acquiring an electron beam ($7M - $10M).

§ Time required to install the beam of 2 - 3 years.

§ Trade and process secrets.

§ Portfolio of intellectual property.

27

Ticker: ALQA

Alliqua, Inc.

info@alliqua.com

2150 Cabot Blvd West

Langhorne, PA 19047

(215) 702-8550

28