Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SEALED AIR CORP/DE | d629788d8k.htm |

Lender Presentation

November 18, 2013

Carol P. Lowe –

Senior Vice President & CFO

Tod S. Christie –

Treasurer

Exhibit 99.1 |

| Safe Harbor and Regulation G Statement

2

This presentation contains “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by

such words as “anticipates,” “believes,” “plan,” “assumes,”

“could,” “estimates,” “expects,” “intends,” “may,”

“plans to,” “will” and similar expressions. These statements reflect our

beliefs and expectations as to future events and trends affecting our business, our consolidated

financial position and our results of operations. Examples of these forward-looking

statements include expectations regarding our anticipated effective income tax rate, the

potential cash tax benefits associated with the W.R. Grace settlement, potential volume,

revenue and operating growth for future periods, expectations and assumptions associated with our

restructuring programs, availability and pricing of raw materials, success of our growth

initiatives, economic conditions, and the success of pricing actions. A variety of factors

may cause actual results to differ materially from these expectations, including general

domestic and international economic and political conditions; changes in our raw material and energy costs; credit

ratings; the success of restructuring plans; currency translation and devaluation effects, including

Venezuela; the competitive environment; the effects of animal and food-related health

issues; environmental matters; and regulatory actions and legal matters. For more

extensive information, see “Risk Factors” and “Cautionary Notice Regarding

Forward-Looking Statements,” which appear in our most recent Annual Report on Form 10-K,

as filed with the Securities and Exchange Commission, and as revised and updated by our

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. While we may elect to

update these forward-looking statements at some point in the future, we specifically

disclaim any obligation to do so, whether as a result of new information, future events, or otherwise.

Our management uses non-U.S. GAAP financial measures to evaluate the Company’s performance,

which exclude items we consider unusual or special items. We believe the use of such financial

measures and information may be useful to investors. We believe that the use of non-U.S.

GAAP measures helps investors to gain a better understanding of core operating results and

future prospects, consistent with how management measures and forecasts the Company's

performance, especially when comparing such results to previous periods or forecasts. For important

information on our use of non-U.S. GAAP financial measures and information, including

reconciliations of such non-U.S. GAAP financial measures and information to comparable U.S.

GAAP measures and information, please refer to the financial tables and information provided in

our earnings release. |

Sealed Air Overview |

A

Company Focused on Sustainability WHO WE ARE

We Re-imagine™

the industries we serve to create a world that feels, tastes and works better.

We deliver consistent, superior solutions in:

4

We help sustain healthy communities by ensuring the safety and

quality of what people eat and drink by creating sustainable

innovative solutions. These solutions provide measurable results

to our business partners through increased shelf life, food

safety, operational efficiency and help in building their brands.

We help our customers win by minimizing damage, maximizing

efficiency and reducing cost with sustainable, engineered,

protective packaging solutions.

We create a cleaner and a healthier future by delivering to

customers integrated sustainable solutions that drive operational

efficiency, improve performance, protect brands and enhance

end user experience and satisfaction.

(~49% of sales)

(~21% of sales)

(~28% of sales) |

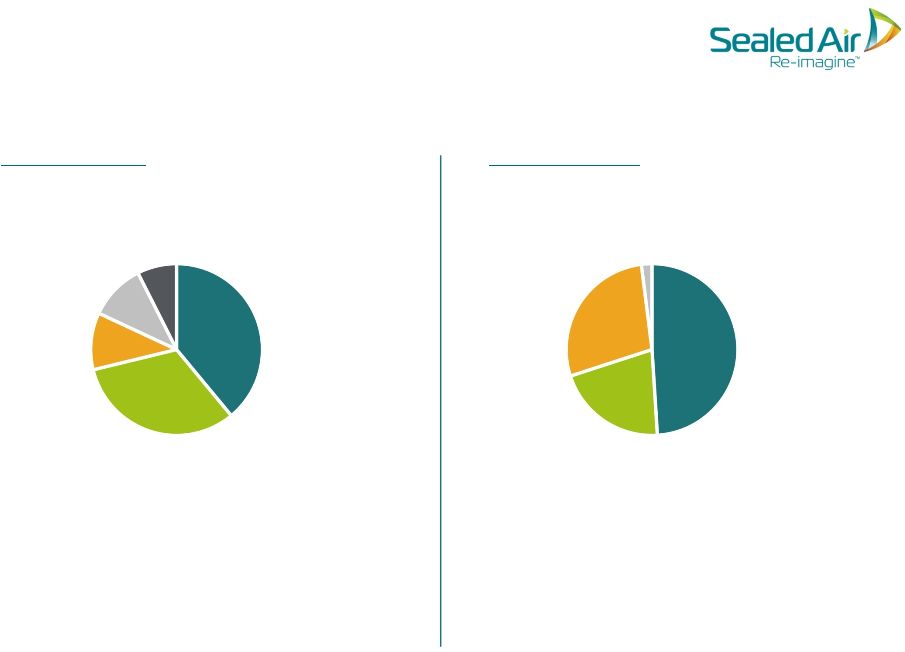

JANZ

7%

AMAT

11%

Latin

America

11%

Europe

32%

North

America

39%

Other

2%

Diversey

Care

28%

Product

Care

21%

Food

Care

49%

(2)

(1)

LTM $7.7B Diversified Revenue Base

By Geography

By Businesses

5

(1)

Asia, Middle East, Africa and Turkey.

(2)

Japan, Australia, and New Zealand. |

Net

Sales (1)

Credit Facility EBITDA

(1)

LTM Net Sales: $7,729M

LTM Credit Facility EBITDA:

$1,090M

% of

Net Sales

(2)

12.7%

11.9%

14.7%

13.8%

13.1%

14.3%

14.5%

6

Discontinued Operations

Discontinued Operations

Net Sales and Credit Facility EBITDA

$235

$229

$279

$273

$8

$14

$13

$13

$243

$243

$292

$286

$242

$281

$281

Q1'12

Q2'12

Q3'12

Q4'12

Q1'13

Q2'13

Q3'13

$1,845

$1,924

$1,900

$73

$80

$79

$1,918

$2,004

$1,979

$1,978

$1,853

$1,962

$1,936

Q1'12

Q2'12

Q3'12

Q4'12

Q1'13

Q2'13

Q3'13

($ in million)

Note: Credit Facility EBITDA defined by Credit Facility agreement. Diversey Japan was divested during

Q4 2012 and classified as discontinued operations during Q3 2012.

(1) Includes the results of the rigid medical packaging business. Please see Sealed Air’s

November 13, 2013 press release for information about the sale of this business.

(2) Credit Facility EBITDA as a percentage of continuing operations / reported net sales. |

UPDATE ON RESTRUCTURING PROGRAMS

Realigning Cost Structure

RESTRUCTURING

PROGRAMS

2012 –

2014

INTEGRATION &

OPTIMIZATION

2013 –

2015

EARNINGS QUALITY

IMPROVEMENT

Annualized Cost

Synergies and

Savings

Over $200M compared

to 2011

$80 -

$110M compared

to 2012

Estimated Time of

Completion

End of 2014

End of 2015

Total Costs of

Program

Approx. $240M

(Excl. Approx. $30M

capex)

$130 -

$150M

(Excl. Approx. $50M

capex)

Employee Head

Count Reduction

Approx. 1,700

Approx. 450

7 |

Financial Overview |

Key

Takeaways THIRD QUARTER 2013

9

Q3 Performance Summary

•

Sales $1.9B

–

Up 2.0% as reported

–

Up 2.7% constant currency

–

Volume increased 1.2%

–

Price/mix favorable 1.5%

•

Adj. EBITDA: $282M, 14.6% of sales

Excluding SARs expense:

•

Q3 2013 Adj. EBITDA: $290.7M, 15.0% of sales

•

Q3 2012 Adj. EBITDA: $277.5M, 14.6% of sales

•

Delivered year over year constant currency

sales growth in all regions except for

Europe

•

Developing regions constant currency sales

increased 9%, accounting for 26% of total

net sales

•

Favorable product price/mix across all

divisions and all regions, except Europe

•

EBITDA margin expansion due to higher

volumes and cost savings initiatives

•

Core Tax Rate of 23.3%

Reported U.S. GAAP Measures

Q3-13 Net Sales: $1.9B; Operating Profit: $140M

Q3-12 Net Sales: $1.9B; Operating Loss*: ($1.2B)

Q3-13 Effective tax rate: 24.6%

*Includes impairment of goodwill and certain intangible assets associated with the

Diversey acquisition Please see Sealed Air’s 10-Q filed on November 8, 2013 for

important information about the use of non-U.S. GAAP financial measures, including

applicable reconciliations to U.S. GAAP financial measures. |

Q3

2013 Net Sales Bridge ($ in millions)

Foreign

Exchange

Price/Mix

-15

Q3 2012

Net Sales

Q3 2013

Net Sales

Volume

10

1,936

+23

+28

+2%

1,900 |

11

Q3 2013 Adj. EBITDA Bridge

($ in millions)

Please see Sealed Air’s 10-Q filed on November 8, 2013 for important

information about the use of non-U.S. GAAP financial measures, including applicable

reconciliations to U.S. GAAP financial measures.

0

-6

-13

-1

6

+2.7%

275

22

282

Q3 2012

Adj.

EBITDA

Cost

Synergies

Volume

Mix & Price/

Cost Spread

SG&A/

Other

SARs

Foreign

Exchange

Q3 2013

Adj.

EBITDA |

SIGNIFICANT YoY IMPROVEMENT

YTD Free Cash Flow

12

($ in millions)

($ in millions)

Nine Months Ended

September 30,

Free Cash Flow

2012

2013

U.S. GAAP Cash Flow from

Operating Activities

$ 65

$ 278

Capital Expenditures

(98)

(80)

Free Cash Flow

$ (33)

$ 198

2012

Year-Over-Year Improvement

2013

Nine Months Ended September 30

•

Higher net earnings

•

Net Improvement in working capital metrics

•

Lower Capital Expenditures

Please see Sealed Air’s 10-Q filed on November 8, 2013 for important information about the

use of non-U.S. GAAP financial measures, including applicable reconciliations to U.S. GAAP

financial measures. ($33)

$198 |

Liquidity & Net Debt

13

($ in millions)

Liquidity

Position

1,677

Net Debt

Lower net debt as a result of cash generated

from operating activities, partially offset by

dividend payments

777

700

200

Sept 2013

Cash & Cash Equivalents

Revolving Credit Facility

A/R Securitization

4,779

4,727

Dec 2012

Sept 2013

Please see Sealed Air’s 10-Q filed on November 8, 2013 for important information about the

use of non-U.S. GAAP financial measures, including applicable reconciliations to U.S. GAAP

financial measures. |

Adjusted EBITDA: Approx. $1.055B

(Depreciation and Amortization: $310M; interest expense: $355M; non-cash profit

sharing: $40M) Net Sales: Approx. $7.7B or 1% YoY Growth

(includes approx. 1% unfavorable FX & approx. $100M expected contribution from

rigid medical packaging business)

2013 Revised Outlook

Free Cash Flow: Approx. $375M

(assumes: $140M cash restructuring; $130M capex; $290M cash interest expense

) Note: Adjusted EBITDA, EPS and D&A guidance excludes the impact of

special items, and assumes an estimated core tax rate of 20% –

23%.

Please see Sealed Air’s 10-Q filed on November 8, 2013 for important

information about the use of non-U.S. GAAP financial measures, including applicable

reconciliations to U.S. GAAP financial measures.

14

Adjusted EPS: $1.25 –

$1.30

(includes approx. $0.04 per share expected contribution from rigid medical

packaging business) |

W.R.

Grace Update 15

•

Third Circuit Court of Appeals has rejected four of the five appeals, but we are

still waiting on a decision related to objections to Grace’s plan brought by

certain holders of Grace's pre-bankruptcy debt

•

Grace indicated that it would expect to emerge from bankruptcy by the end of

January 2014 if the Third Circuit ruled on the lender appeal but that its

emergence could be further delayed by 2 to 3 months if further appeals were

filed; we cannot provide assurance that this timing will be correct or will not be

revised

•

Sealed Air is prepared to make its settlement payment once all funding

conditions are met but has not waived any condition, including that Grace’s plan

not be subject to appeal

•

We continue to monitor the bankruptcy process

•

Estimated cash liability of $925 million as of December 31, 2013 – partially

offset by related tax benefits

|

Adjusted Debt Maturity

16

As of 9/30/13 ($ millions)

89

319

394

2

691

150

750

425

750

425

450

925

79

2013

2014

2015

2016

2017

2018

2019

2020

2021

2023

2033

W.R. Grace Settlement*

Senior Secured Credit Facilities (term loans) = $1.49B

Short Term Borrowings and Other Debt

Bonds = $2.95B

*Reflects estimated cash liability at December 31, 2013. Exact timing of the

resolution is unknown. Note: As adjusted for November 15, 2013 pay down of

Term Loan B. |

Q&A |

Appendix |

Non-U.S. GAAP Reconciliation

19

Credit Facility EBITDA Reconciliation

(Unaudited)

(In Millions)

December 31, 2012

March 31, 2013

June 30, 2013

September 30, 2013

U.S. GAAP net earnings from continuing operations

(10.9)

$

2.7

$

56.3

$

37.7

$

Special items

109.2

51.4

19.0

46.7

U.S. GAAP adjusted net earnings from continuing operations

98.3

$

54.1

$

75.3

$

84.4

$

Interest Expense

93.5

90.8

89.7

88.9

Income tax provision (benefit)

(2.6)

(8.5)

23.5

25.6

189.2

$

136.4

$

188.5

$

198.9

$

Depreciation and amortization

73.1

80.5

82.6

73.5

Non-cash profit sharing expense

4.6

9.9

10.0

9.7

Write down of non-strategic assets, included in depreciation and

amortization -

-

(4.8)

(0.1)

Total non-U.S. GAAP adjusted EBITDA

266.9

$

226.8

$

276.3

$

282.0

$

Less: Stock appreciation rights

-

-

(0.1)

(8.7)

Less: Cash portion on loss on debt redemption

(6.4)

-

-

-

Less: European manufacturing facility closure charges

(0.8)

-

-

-

Less: Settlement agreement related costs

(0.1)

-

-

-

Less: Legacy Diversey non-recurring restructuring charges

(1.8)

-

-

-

Add: Non cash contributons -

Pensions

5.3

4.6

4.6

4.6

Add: Commissions, fees and expenses paid in cash in connection with the repayment

of any Indebtedness, any Permitted Acquisition, any Disposition, any Debt

Incurrence, the Transactions or any equity issuance

7.4

10.4

-

-

Add: EBITDA from discontinued operations

13.0

-

-

-

Add: EBITDA (loss) from unrestricted subsidiaries

3.5

1.9

1.4

0.6

Other

(1.5)

(1.7)

(1.5)

2.8

Total Credit Facility EBITDA

285.5

$

242.0

$

280.7

$

281.3

$

Three months ended,

Please see Sealed Air’s 10-Q filed on November 8, 2013 for important information about the

use of non-U.S. GAAP financial measures, including applicable reconciliations to U.S. GAAP

financial measures. Non-U.S.

GAAP adjusted

EBIT

-

continuing

operations |