Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Allegion plc | d630005d8k.htm |

PROPRIETARY AND CONFIDENTIAL

Equity Roadshow Presentation

November 2013

Exhibit 99.1 |

PROPRIETARY AND CONFIDENTIAL

This

presentation

includes

“forward-looking

statements,”

which

are

statements

that

are

not

historical

facts,

including

statements that relate to the mix of and demand for our products, trends and

performance of the markets in which we operate, the proposed spinoff of the

commercial and residential security businesses from Ingersoll-Rand plc, our growth

strategy, our capital allocation strategy and our future financial

performance. The words “anticipate”, “may”, “can”, “plans”,

“believes”,

“estimates”,

“experts”,

“contends”,

“likely”,

“will”,

“should”,

“to

be”

and

any

similar

expressions

or

other

words

of

similar meaning are intended to identify those assertions as forward-looking

statements. These forward-looking statements are based on our current

expectations and are subject to risks and uncertainties, which may cause actual results to differ

materially from our current expectations. Such factors include, but are not limited

to, our ability to successfully, if ever, complete the proposed spinoff; our

ability to fully realize the expected benefits of the proposed spinoff; global economic

conditions; demand for our products and services; and tax law changes. Additional

factors that could cause such differences

can

be

found

in

our

Form

10.

We

assume

no

obligation

to

update

these

forward-looking

statements.

All data for beyond the third quarter of 2013 are estimates.

Non-GAAP Financial Measures

Included in this presentation are certain non-GAAP financial measures,

including Adjusted Operating Income, Adjusted Operating Income margin

percent, Adjusted EBITDA, Adjusted EBITDA margin percent and Free Cash Flow, designed to

complement the financial information presented in accordance with generally

accepted accounting principles in the United States

of

America

(GAAP).

Management

believes

such

measures

provide

useful

supplemental

information

to

both

management

and

investors

regarding

financial

and

business

trends

used

in

assessing

our

financial

condition

and

results

of

operations. The non-GAAP measures should be considered supplemental to, not a

substitute for or superior to, financial measures calculated in accordance

with GAAP. They have limitations in that they do not reflect all of the cost associated

with the operation of our business as determined in accordance with GAAP. In

addition, our non-GAAP financial measures are not necessarily comparable

to other similarly titled captions of other companies due to potential inconsistencies in the

metrics of calculation. For a reconciliation of net income to Operating Income,

Operating Income to Adjusted Operating Income, and Adjusted Operating Income

to Adjusted EBITDA, and Operating Income margin percentage to Adjusted

Operating Income margin percent, and Adjusted Operating Income margin percent to

Adjusted EBITDA margin percentage, see the appendix to this presentation.

2

Safe

Harbor |

PROPRIETARY AND CONFIDENTIAL

IRS approved the tax-free spin transaction

Form 10 Registration Statement for Allegion declared effective by SEC

Transaction Overview

Ticker

ALLE

Exchange

NYSE

Exchange ratio

1 share of Allegion for every 3 shares of Ingersoll Rand

Expected number of shares

96.2mm

November 11

Record date declared

November 18

When issued trading date

November 22

Record date

December 1

Distribution of Allegion shares

December 2

First day of regular-way trading

3

th

th

st

nd

nd |

PROPRIETARY AND CONFIDENTIAL

Company Overview

4

4

XXX

XXX

XXX

XXX |

PROPRIETARY AND CONFIDENTIAL

Annual revenue ~$2B+, EBITDA ~$400m

Leading global provider of security solutions that help

keep people safe where they live, work and visit

Well-positioned in attractive security industry

Strong growth drivers and ability to compete worldwide

Organic and M&A growth opportunities

Overview

We create peace of mind through pioneering safety and security

5 |

PROPRIETARY AND CONFIDENTIAL

Investment Highlights

Robust portfolio of industry leading products and brands

Teams of global experts driving innovation and customer

solutions

Positioned for organic and acquisition-led growth

Industry-leading financial performance and strong cash

flow

Broad distribution with over 7,000 channel partners

Vision for continued global expansion

6 |

PROPRIETARY AND CONFIDENTIAL

Robust Security Industry Growth Drivers

New construction commercial verticals improving

Institutional verticals stabilizing, driving increased opportunities

Single-family and multi-family starts continue recovery

Large installed base supports replacement demand

Geographic expansion opportunities in emerging markets

Macro-economic

Security needs

Technology

convergence

Continued evolution of security requirements and

sophistication creates opportunity for growth

Enhanced living standards and urbanization in emerging

markets increasing security requirements

End-users adopting electronic security solutions

including readers, credentials and biometrics

Electronic products growing faster than the rate of

traditional mechanical products

Industry fundamentals support long-term growth strategy

7 |

PROPRIETARY AND CONFIDENTIAL

Overview of Allegion’s Key Markets

Electronic Security: Access Control

Mechanical Security: Locks

Est. $2.2 billion market

1

Long-term growth rate

2

: 6-7%

Est. $21-23 billion market

1

Long-term growth rate

3

: 5-6%

North

America 35%

RoW

35%

EMEIA

30%

North

America 14%

Asia Pacific

43%

Western

Europe

23%

RoW

20%

Source: IMS, Freedonia 2013

1

Electronic

market

and

mechanical

market

sizes

indicative

of

2012

and

2011

data,

respectively

2

Represents 2012 –

2017E CAGR

3

Represents 2011 –

2021E CAGR

~$25B Global market; highly fragmented with significant growth potential

8 |

PROPRIETARY AND CONFIDENTIAL

Key Allegion Products

Diverse

portfolio

spanning

mechanical,

electrical,

and

systems

&

services

Residential

Secure the Door

Electronic Locks

Handlesets

Deadbolts

Home Intelligence

Hinges

Protect the Door

Kick Plates

Lock Guards

Edge Guards

Portable Security

Pad Locks

Cable Locks

Bike Locks

Exit Devices

Mechanical Locks

Key Systems

Electronic Locks

Readers

Credentials

Electronic Strikes

Door

Frame

Hinges

Accessories

Protect the Door

Kick Plates

Door Pulls

Edge Guards

Secure the Door

System Design

Access Control

Video Systems

Workforce Management

Project Management

Installation

Commercial & Institutional

Systems and Services

Control the Door

Mechanical Closers

Automatic Operators

Coordinators

9 |

PROPRIETARY AND CONFIDENTIAL

Leading Brands with Strong Global Market Positions

#1 in North America

(Commercial and Residential)

#3 in China

#1 in Italy

1

#2 in France

#3 in U.K.

2

#2 in Germany

3

Market-leading positions across the portfolio

1

Source:

Databank

–

Cerved

Group;

2

Source:

AMA

Research;

3

Source:

IMS

Workforce

productivity

report

Market Leading Brands

Allegion’s Market Position

10 |

PROPRIETARY AND CONFIDENTIAL

Diverse Revenue Base

Strong product portfolio and global presence

Revenue by Product Category (2012 ~$2B)

Revenue by Geography (2012 ~$2B)

Balanced portfolio

Award winning product designs

Opportunity for extension into

emerging markets leveraging

Allegion strengths (brand, channel,

product)

Combining product breadth and

depth with functionality and

aesthetics

Strong relationships with a

diversified distribution channel

Deep building code expertise to

solve complex national, regional

and local safety requirements

11 |

PROPRIETARY AND CONFIDENTIAL

Global Presence with Robust Network of Channel Partners

Developed network of more than 7,000 channel partners

End User

Consumer

Recognized End

Users

Allegion

Wholesaler

Systems

Integrator

Retail /

Big Box

OEM

Distribution

E-

Comm

Distribution / Retail

Developer / End user

National

Builders

12 |

PROPRIETARY AND CONFIDENTIAL

Seasoned Management Team and Strong Board Leadership

Geographic Leaders

Significant experience possessed by Management and Board of Directors

David Petratis

CEO & Chairman

Tim Eckersley

Senior Vice

President

Americas

William Yu

Senior Vice

President

Asia Pacific

Todd Graves

Vice President

Engineering &

Technology

Chris

Muhlenkamp

Vice

President

Global

Operations &

Supply Chain

Tracy Kemp

Vice President

Chief

Information

Officer

Barbara

Santoro

Senior Vice

President

General

Counsel &

Secretary

Raymond

Lewis Jr.

Senior Vice

President

Human

Relations

Patrick

Shannon

Senior Vice-

President

Chief

Financial

Officer

Functional Leaders

Carla Cico

Director

Michael

Chesser

Chair of

Compensation

Kirk

Hachigian

Lead Director

Chair of

Corporate

Governance

and

Nominating

David

Petratis

Chairman

Board of Directors

Martin

Welch III

Chair of Audit

and Finance

John Stanley

Vice President

of Finance and

Interim Leader

EMEIA

13 |

PROPRIETARY AND CONFIDENTIAL

Strategic Priorities

14 |

PROPRIETARY AND CONFIDENTIAL

Overview of Allegion Growth Strategy

Growth in Emerging

Markets

Opportunistic

Acquisitions

Expand In Core Markets

Operational Excellence

Innovation in Existing

and New Product

Categories

15 |

PROPRIETARY AND CONFIDENTIAL

Expand In Core Markets

Leverage existing capabilities for growth in core markets

Vertical Markets

Product Portfolio

Existing Distribution

Strategic Markets

Strong institutional presence: education, healthcare,

government

Expand in commercial: office, hospitality, multi-family

Grow electronic security solutions

Portfolio expansion

Channel development (locksmith and wholesaler)

Fill out product segments

Increase channel development in under penetrated integrator

and wholesale channels

Accelerate e-commerce success with all e-tail customers

Drive retail expansion with “feet on the street”

Enhance specification capability in key EMEIA and Asia Pacific

markets

16 |

PROPRIETARY AND CONFIDENTIAL

Innovation in Existing and New Product Categories

Strong pipeline of new product innovation

Key Recent Product Launches –

Electronic Security

Schlage Touchscreen

Deadbolt Lock

CISA eSigno

Platform

Interflex eVayo

Platform

aptiQ Credential and Reader Platform

Schlage AD/CO Electronic Products

17 |

PROPRIETARY AND CONFIDENTIAL

Innovation in Existing and New Product Categories (cont’d)

Strong pipeline of new product innovation

Key Recent Product Launches –

Mechanical Security

Von Duprin Concealed

Vertical Cable System

LS/FS Series Steel Doors

and Frames

Continuous Hinge

Everest Key Systems

18 |

PROPRIETARY AND CONFIDENTIAL

Growth in Emerging Markets

China

Latin America

Middle East

Growth opportunity in emerging markets

Market

Strategies

Expand distribution

Enhance product

portfolio

Develop local

channel support

Localize product

and supply chains

Market

Fundamentals

Rising standards of

living

Continued

urbanization

Increasing safety

demands

Opportunity to

shape industry

standards

19 |

PROPRIETARY AND CONFIDENTIAL

Operational Excellence

Value Stream Approach –

End to End Waste Out

Operational Excellence creates strong competitive advantage

Continue value stream efforts

Drive localization efforts in China

Leverage North America strengths to accelerate European operational

excellence initiatives

Front End

Sales Excellence

Customer Care

Growth/Value

Integrated Supply/Ops

Plan

Supply

Build

Deliver

Invoice

Service

Functional

Human Resources

Engineering

Information Tech

Improved customer delivery time

Growth, Productivity, Employee Engagement

20 |

PROPRIETARY AND CONFIDENTIAL

Opportunistic Acquisitions

Platforms

Strategy

Well-positioned to pursue opportunistic acquisitions

Emerging markets

Emerging technology

Expand product

portfolio

Utilize strong free cash flow to

fund acquisitions

Target acquisition profile:

Broadens product portfolio

Expands geographic footprint

Provides synergy opportunities

Provides solid returns on

invested capital

Disciplined valuation and

integration methodology

21 |

PROPRIETARY AND CONFIDENTIAL

Financial Overview

22 |

PROPRIETARY AND CONFIDENTIAL

Strong Track Record of Financial Performance

Solid historical performance

Industry dynamics support stable and consistent growth

Robust pipeline of organic growth opportunities

EBITDA margins have remained resilient through past economic cycles

Margin improvement opportunities in Europe and Asia Pacific

Low working capital and capital expenditure requirements

Strong balance sheet with solid financial policies in place

Completed $500M revolving credit facility and $1.3B in term loans and bond

financing

Solid and consistent free cash flow generation to invest and grow the

business 23 |

PROPRIETARY AND CONFIDENTIAL

Revenue ($M)

Solid Growth and Margin Expansion

Expanding operating margin

Operational excellence initiatives

Price and productivity offsetting inflation

(YOY)

2011

2012

Pricing

2.3%

2.3%

Volume / Product mix

(1.3)%

0.3%

FX

1.7%

(1.3)%

Total

2.7%

1.3%

Revenue Growth

Adj EBITDA¹

$375

$405

$420

Adj EBITDA %¹

19.1%

20.1%

20.5%

Adjusted Operating Income & Margin ($M)¹

Focused on profitable growth

¹

Excludes $3.0, $0.3 and $7.5mm of restructuring costs in 2010, 2011 and 2012,

respectively 24 |

PROPRIETARY AND CONFIDENTIAL

Best-in-class margin profile

Note: EBITDA margins represent a historical, non-GAAP measure for each company.

Peer margins per public filings and company investor documents ¹

EBITDA defined as operating income plus D&A; excludes restructuring expenses

Industry-Leading Financial Performance

2012A EBITDA Margins¹

25 |

PROPRIETARY AND CONFIDENTIAL

Overview of 2013 Year-to-date Performance

Revenue ($M)

Adjusted Operating Income & Margin ($M)¹

September ’13 YTD

Volume / product mix

2.4%

Pricing

1.5%

FX

(0.3)%

Acquisitions / divestitures

(0.8)%

Total

2.8%

9 Months 2013 Revenue Growth vs. 9. Months 2012

Adj EBITDA¹

$310

$302

Adj EBITDA %¹

20.6%

19.6%

¹

Sept’

13 YTD OI/Margin/EBITDA excludes $137.6mm of non-cash pre-tax goodwill

impairment charge, $5.6mm of restructuring expenses, and a $21.5mm gain on a property sale in China;

Sept’

12 YTD OI/Margin/EBITDA excludes $7.8mm in restructuring expenses

17.4%

Inflation

26 |

PROPRIETARY AND CONFIDENTIAL

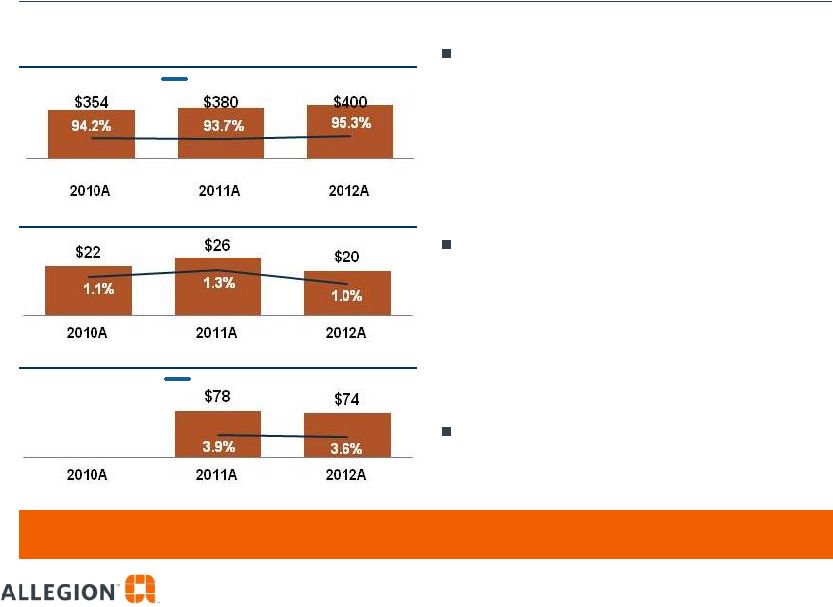

Strong Cash Conversion and Cash Flow Generation

Capital Expenditures and % of Sales ($mm)

Free Cash Flow¹

and Conversion ($mm)

1

Free Cash Flow calculated as Adj. EBITDA less capital expenditures

2

Working capital defined as accounts receivable and inventories less accounts

payable, accrued compensation and benefits, and accrued expenses and other current liabilities

Consistent cash generation and conversion

—

Free cash flow conversion close to 100%

—

Maintain high conversion ratio as business

grows

Minimal capital expenditure requirements

—

Capacity to grow without significant capital

investment

—

Invest in productivity programs

Low working capital requirements

—

Maintain ratio as business grows

% of EBITDA

Working Capital²

($mm)

% of Revenue

Consistent

cash

flow

generation

provides

opportunities

to

invest

in

growth

N/A

27 |

PROPRIETARY AND CONFIDENTIAL

Well Capitalized Balance Sheet and Strong Liquidity Position

Proforma Capital Structure and Leverage

($mm)

Amount

x LTM

EBITDA¹

Cash and Cash Equivalents

$100

New Indebtedness

$500mm Revolving Credit Facility

–

–

Term Loan A due in 2018

500

1.2x

Term Loan B due in 2020

500

1.2x

Total Secured Debt

$1,000

2.4x

Senior Unsecured Notes

300

0.8x

Total Debt²

$1,300

3.2x

Key Financial Policies

Strong capital structure supported by disciplined financial approach

Liquidity

$500mm revolver

$200mm+ of ACF annually

M&A

Target opportunistic acquisitions

Primarily to extend product portfolio

or geographic footprint

Distribution

Policy

Targeting initial payout ratio of

10-20% of earnings, subject to

Board approval

Share repurchases to offset dilution

Leverage

2.75-3.25x range of unadjusted debt

/ EBITDA

Maintain leverage over time with

cash generation utilized to grow and

support the business

1

LTM 09/30/13 EBITDA of $412mm (excludes restructuring expenses, impairment and

gain) 2

Total debt does not include existing $5mm of capital leases and working capital

debt 28 |

PROPRIETARY AND CONFIDENTIAL

Investment Highlights

Robust portfolio of industry leading products and brands

Teams of global experts driving innovation and customer

solutions

Positioned for organic and acquisition-led growth

Industry-leading financial performance and strong cash flow

Broad distribution with over 7,000 channel partners

Vision for continued global expansion

29 |

PROPRIETARY AND CONFIDENTIAL

Appendix

30 |

PROPRIETARY AND CONFIDENTIAL

Overview of Business Segments

Americas

EMEIA

Asia-Pacific

Source: Company filings

1

Source:

Hanley

Wood

2013

Brand

Use

Survey

(Remodeling

/

Builder);

Source:

Databank

–

Cerved

Group;

3

Source:

AMA

Research;

4

Source:

IMS

Workforce

productivity

report

Market leading brands

—

–

#1 locking brand

—

–

#1 closer brand

—

–

#1 exit device brand

—

—

#1 brand specified / used most

among professional builders and

remodelers¹

Key products: mechanical locks,

door closers, exit devices, doors and

frames, credentials and readers,

electronics and accessories

Security products & solutions in

30+ countries in the Americas

300+ sales people, 100+

specification writers, 23+ branch

sales offices

Two divisions: Commercial and

Residential Products & Solutions

Revenue: $1,472 million

Strong legacy brands

—

–

#1 in Italy²

—

–

#2 in France

—

–

#3 in United Kingdom³

Interflex –

#2 in Germany

4

in

customized access control / time &

attendance solutions

Key products: mechanical locks,

door closers, exit devices, doors /

door frames, electronic locks /

readers and workforce

management solutions

Security products & solutions in

~85 countries

7 production sites across Europe

Revenue: $428 million

Operate

—

China systems integrator expert

—

Airports / metro / Safe City

Projects / events (e.g.

Olympics)

Key products: mechanical locks,

electronic locks, door closers, exit

devices, electronic access control,

system integration and accessories

15+ years in Asia-Pacific region

Security products & solutions in

~14 countries.

>650 employees, 25+ locations

2 production sites across Asia-

Pacific

Revenue: $146 million

72% of

sales

21% of

sales

7% of

sales

31

2 |

PROPRIETARY AND CONFIDENTIAL

2005

Acquires ITO, Astrum, Bricard,

CISA and Bocom

Corporate Timeline & History of Allegion

Long history of security product innovation and leadership

1909

Von Duprin,

is awarded the

first exit device

patent

1926

LCN creates

the door closer

1926

CISA devises

the first

electrically

controlled lock

1908

1920

1940

1950

1960

1970

1980

1990

2000

2005

1909

2008

1997

Acquires Newman Tonks, including

Briton, Legge, and Normbau brands

1942

Steelcraft Doors,

established in 1927,

develops the first

mass-produced

hollow metal door

1920

Schlage wins the first

patents granted for

the cylindrical lock

and the pushbutton

lock

1974

Ingersoll Rand acquires Schlage,

including Von Duprin, and LCN

brands

2008

Acquires

XceedID

1996

Acquires

Steelcraft

2001

Acquires

Kryptonite

2000

Acquires

Interflex

32 |

PROPRIETARY AND CONFIDENTIAL

Allegion Management Team

David Petratis

Chairman, President and CEO

Former Chairman, President and CEO of Quanex Building Products Corporation

Member of the board of directors at the University of California, Irvine Graduate

School of Management, the California State (Fullerton) Quality Advisory

Board and the Costa Mesa community agency Project Independence

Bachelor’s degree in industrial management from the University of Northern

Iowa MBA from Pepperdine University

Tim Eckersley

Senior Vice President, Americas

Former President Security Technologies of Ingersoll Rand Commercial Americas

Twenty-five years of experience in high growth technology industries

Bachelor’s degree in electrical engineering from the University of Texas at

Arlington MBA from the University of Texas at Arlington

Todd Graves

Vice President, Engineering & Technology

Former Vice President Engineering and Technology for Ingersoll Rand Security

Technologies Strong background in engineering and 23 years of experience in

research and development Certified Design for Six Sigma Master Black

Belt Bachelor’s and master’s degrees in aerospace engineering from

the University of Notre Dame 33 |

PROPRIETARY AND CONFIDENTIAL

Allegion Management Team

Ray Lewis, Jr.

Senior Vice President, Human Relations and Communications

Former Vice President of Human Resources and Communications for Ingersoll Rand

Industrial Technologies Strong background in global manufacturing and 20

years of experience in diverse human resource and communication roles

Bachelor’s degree in engineering and leadership/organizational development

from the United States Military Academy

Master’s degree in global human resource leadership from Rutgers

University Tracy Kemp

Vice President, Chief Information Officer

Former Vice President Information Technology for the Ingersoll Rand Security

Technologies and Residential Solutions sectors

23 years of experience in information technology and telecommunications

Bachelor’s degree in computer science and mathematics from Oklahoma Christian

University Chris Muhlenkamp

Vice President, Global Operations & Supply Chain

Former Vice President Global Operations for Ingersoll Rand Security

Technologies Bachelor’s degree from the University of Notre Dame

MBA from Ball State University

34 |

PROPRIETARY AND CONFIDENTIAL

Allegion Management Team

Patrick Shannon

Senior Vice President and Chief Financial Officer

Former Vice President and Treasurer of Ingersoll Rand

Prior public and private company CFO experience

Twenty-five+ years of financial experience in Operations Finance,

Controllership, Treasury, Audit, Strategy and Business Development

Bachelor’s degree in business administration from the University of

Georgia MBA from Mercer University

Barbara Santoro

Senior Vice President, General Counsel & Secretary

Former Vice President of Corporate Governance and Secretary of Ingersoll

Rand Member of the American Bar Association, the American Corporate Council

Association and the Society of Corporate Secretaries and Governance

Professionals Bachelor’s degree in criminal justice from Arizona State

University Juris doctor degree from Fordham University School of Law

John Stanley

Vice President Finance, Interim EMEIA Leader

Former Vice President Finance and Business Transformation EMEIA for Ingersoll Rand

Security Technologies Deep experience with the EMEIA business from a finance

and operations perspective Professional designation from the Chartered

Institute of Management Accountants (ACMA) at the University of

Staffordshire

William Yu

Senior Vice President, Asia Pacific

Former President Security Technologies of Ingersoll Rand Asia Pacific

National committee member of China’s LSS and Vice Chairman of the Shanghai

Institute of Management Science Committee

Bachelor’s degree from Shanghai University of Technology

MBA from China-Europe International Business School

35 |

PROPRIETARY AND CONFIDENTIAL

Adjusted EBITDA Reconciliation

Adjusted EBITDA Reconciliation ($mm)

LTM Sept. 30

9 months ended Sept. 30

Full-Year

2013

2013

2012

2012

2011

2010

Revenue

$2,089.1

$1,542.9

$1,500.4

$2,046.6

$2,021.2

$1,967.7

Net Income

$80.3

$21.6

$160.9

$219.6

$218.1

$191.8

Adjustments to arrive at operating income

Income tax provision (benefit)

138.6

101.9

99.2

135.9

130.5

125.7

Interest expense, net

1.8

1.4

1.1

1.5

1.4

1.8

Other (income) / expense

7.5

6.9

2.6

3.2

(4.6)

(3.5)

Noncontrolling interest

15.7

13.9

3.9

5.7

6.3

6.7

Discontinued earnings

1.5

0.3

1.5

2.7

7.3

2.5

One-time gains / expenses

116.1

116.1

-

-

-

-

Operating income

$361.5

$262.1

$269.2

$368.6

$359.0

$325.0

% margin

17.3%

17.0%

17.9%

18.0%

17.8%

16.5%

Restructuring costs

5.3

5.6

7.8

7.5

0.3

3.0

Adjusted Operating income

$367.0

$267.9

$277.2

$376.3

$359.5

$328.2

% margin

17.6%

17.4%

18.5%

18.4%

17.8%

16.7%

Depreciation & amortization

45.4

34.2

32.6

43.8

46.0

47.3

Adjusted EBITDA

$412.4

$302.1

$309.8

$420.1

$405.5

$375.5

% margin

19.7%

19.6%

20.6%

20.5%

20.1%

19.1%

36 |