Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HOLOGIC INC | d627497d8k.htm |

| EX-99.2 - EX-99.2 - HOLOGIC INC | d627497dex992.htm |

-

-

Financial results and company highlights

Financial results and company highlights

-

-

First quarter and fiscal year 2014 outlook

First quarter and fiscal year 2014 outlook

Fourth

Fourth

Quarter

Quarter

Fiscal

Fiscal

2013

2013

Performance

Performance

–

–

September

September

28,

28,

2013

2013

Exhibit 99.3 |

This

presentation contains forward-looking information that involves risks and uncertainties, including statements about the Company’s plans, objectives,

expectations and intentions. Such statements include, without limitation: financial or other

information included herein based upon or otherwise incorporating judgments

or

estimates

relating

to

future

performance,

events

or

expectations;

the

Company’s

strategies,

positioning,

resources,

capabilities,

and

expectations

for

future performance; and the Company's outlook and financial and other guidance. These

forward-looking statements are based upon assumptions made by the Company as of the

date hereof and are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those

anticipated.

Risks and uncertainties that could adversely affect the Company’s business and prospects,

and otherwise cause actual results to differ materially from those anticipated, include

without limitation: the ability of the Company to successfully manage recent and ongoing leadership and organizational changes, including the

ability of the Company to attract, motivate and retain key employees; U.S., European and

general worldwide economic conditions and related uncertainties; the Company’s

reliance on third-party reimbursement policies to support the sales and market acceptance of its products, including the possible adverse impact of

government

regulation

and

changes

in

the

availability

and

amount

of

reimbursement

and

uncertainties

for

new

products

or

product

enhancements;

uncertainties

regarding

the

recently

enacted

or

future

healthcare

reform

legislation,

including

associated

tax

provisions,

or

budget

reduction

or

other

cost

containment

efforts;

changes in guidelines, recommendations and studies published by various organizations that

could affect the use of the Company’s products; uncertainties inherent in the

development of new products and the enhancement of existing products, including FDA approval and/or clearance and other regulatory risks, technical risks,

cost overruns and delays; the risk that products may contain undetected errors or defects or

otherwise not perform as anticipated; risks associated with strategic alliances

and

the

ability

of

the

Company

to

realize

anticipated

benefits

of

those

alliances;

risks

associated

with

acquisitions,

including

without

limitation,

the

Company’s ability to successfully integrate acquired businesses, the risks that the

acquired businesses may not operate as effectively and efficiently as expected even if

otherwise successfully integrated, the risks that acquisitions may involve unexpected costs or unexpected liabilities, including the risks and challenges

associated with the Company’s recent acquisition of Gen-Probe and operations in

China; the risks of conducting business internationally, including the effect of

exchange rate fluctuations on those operations; manufacturing risks, including the

Company’s reliance on a single or limited source of supply for key components, and

the need to comply with especially high standards for the manufacture of many of its products; the Company’s ability to predict accurately the demand for its

products, and products under development, and to develop strategies to address its markets

successfully; the early stage of market development for certain of the

Company’s

products;

the

Company’s

leverage

risks,

including

the

Company’s

obligation

to

meet

payment

obligations

and

financial

covenants

associated

with

its

debt; risks related to the use and protection of intellectual property; expenses,

uncertainties and potential liabilities relating to litigation, including, without

limitation, commercial, intellectual property, employment and product liability litigation;

technical innovations that could render products marketed or under development by the

Company obsolete; competition; and the Company’s ability to attract and retain qualified personnel.

The risks included above are not exhaustive. Other factors that could adversely affect the

company's business and prospects are described in the filings made by the Company

with

the

SEC.

The

Company

expressly

disclaims

any

obligation

or

undertaking

to

release

publicly

any

updates

or

revisions

to

any

such

statements

presented herein to reflect any change in expectations or any change in events, conditions or

circumstances on which any such statements are based. Hologic,

Adiana,

Aptima,

fFn,

Gen-Probe,

MammoSite,

Mini

C-Arm,

MyoSure,

NovaSure,

and

Panther

and

associated

logos,

as

may

be

used

throughout

this

presentation, are trademarks and/or registered trademarks of Hologic, Inc. and/or its

subsidiaries in the United States and/or other countries. Safe Harbor Statement

2 |

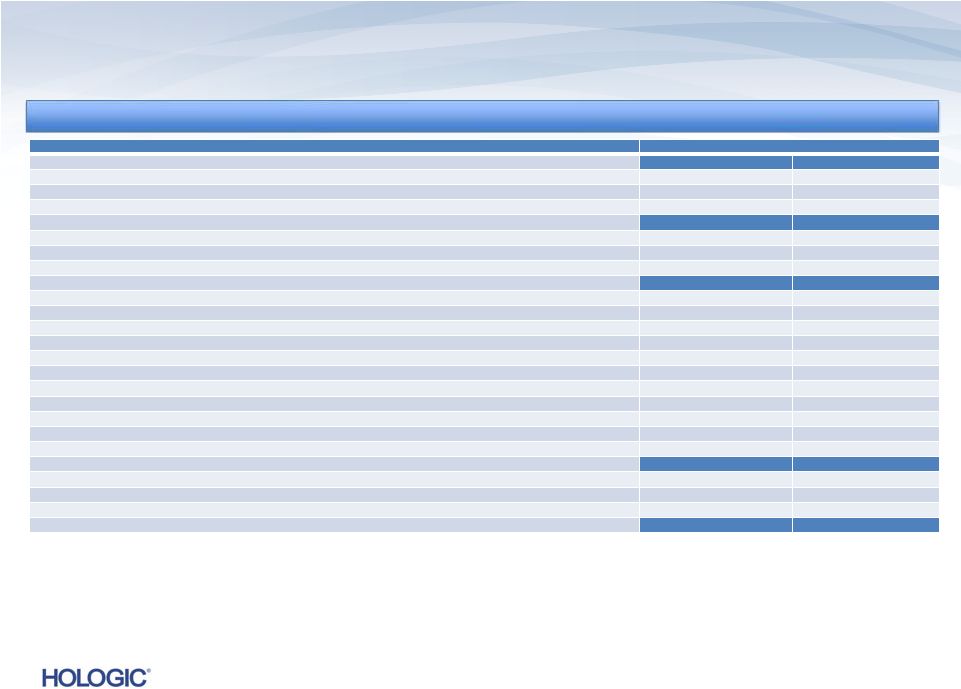

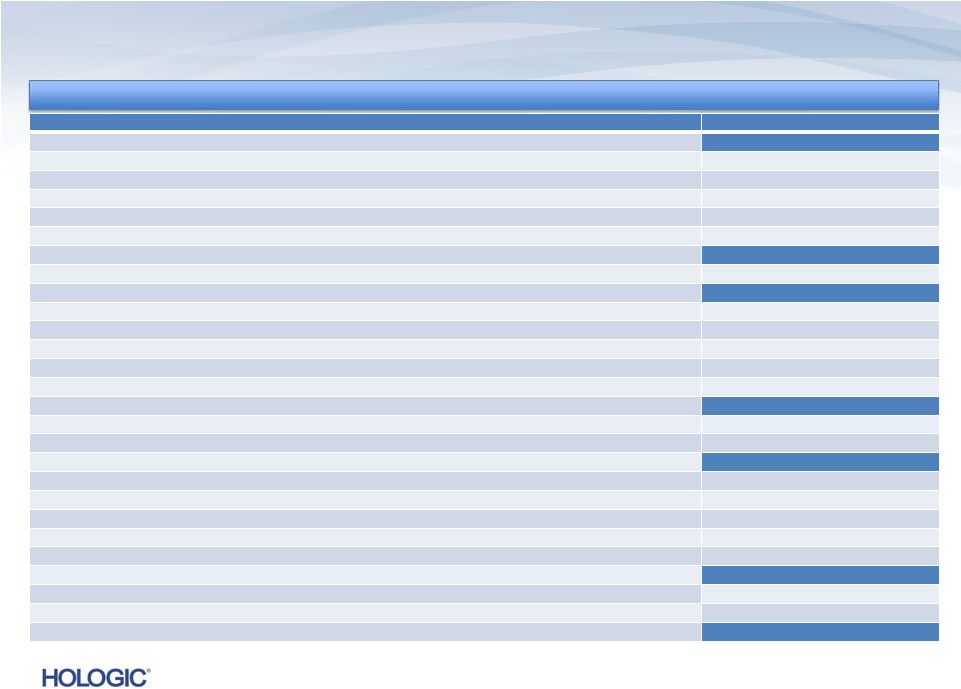

Q4 FY 2013

Overview Key Performance Metrics

Key Performance Metrics

Q4 FY 2013

Q4 FY 2013

Revenues*

Revenues of $622.1 million

•

Revenues up $33.6 million, or 5.7%, vs. Q4’12

1

(and up $21.9 million or 3.7% vs.

Q4’12 non-GAAP revenues)

•

Revenues down $(4.0) million, or (0.6)%, vs. Q3’13

Net Income*

GAAP net loss of $1.1 billion and

non-GAAP net income of $107.6 million

•

Non-GAAP net income up $9.3 million, or 9.4%, vs. Q4’12

•

Non-GAAP net income up $4.4 million, or 4.3%, vs. Q3’13

•

GAAP net loss includes a $1.1 billion goodwill impairment charge

Adjusted EBITDA*

$231.4 million

•

Up $21.4 million, or 10.2%, vs. Q4’12

•

Up $4.0 million, or 1.7%, vs. Q3’13

3

1

On a constant currency basis, total revenues would have increased to $621.4M*, or 5.6%

compared to Q4’12. The constant currency revenue amount for Q4’13 is a non-GAAP number that reflects

what revenues in that quarter would have been had the Company applied the foreign currency

exchange rates it used for determining its revenues in Q4’12. *

See

the

definition

of

the

non-GAAP

financial

measures

and

the

reconciliation

of

those

measures

to

the

comparable

GAAP

financial

measures

on

pages

5-13

of

this

presentation.

Quarter Ended September 28, 2013 (unaudited)

Quarter Ended September 28, 2013 (unaudited) |

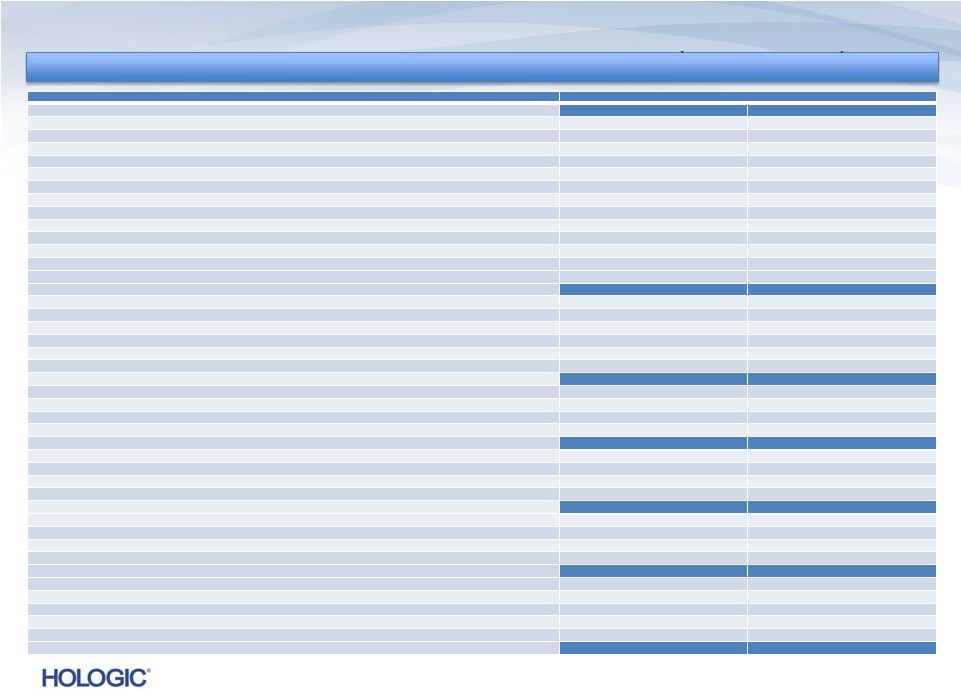

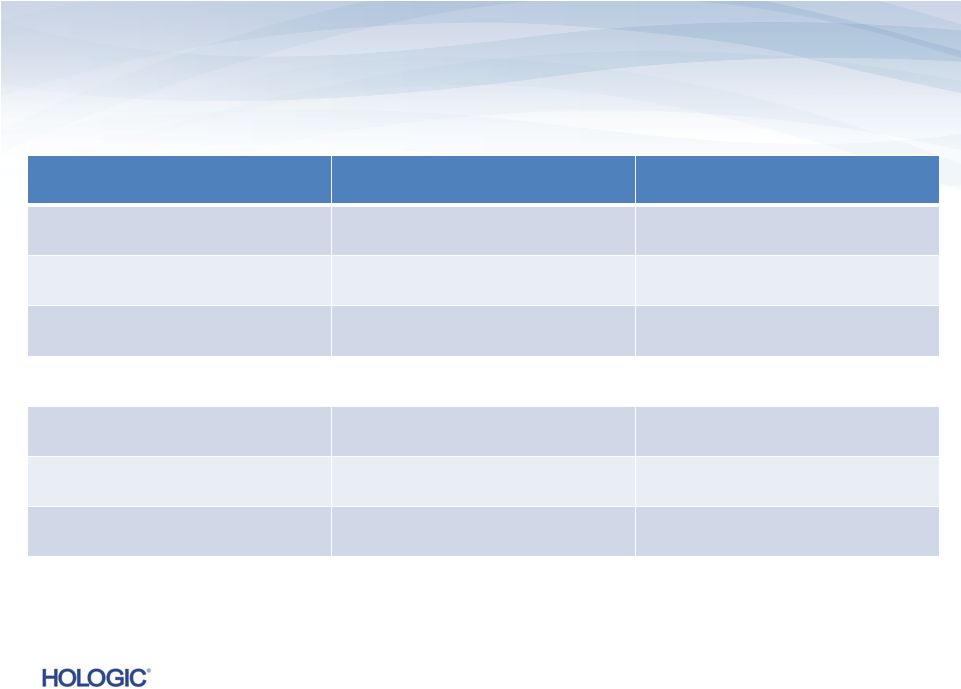

Q4 FY 2013

Financial Performance * See the definition of the non-GAAP financial

measures and the reconciliation of those measures

to the comparable GAAP financial measures on

pages 5-13 of this presentation.

GAAP

NON-GAAP*

$s in millions,

except EPS

Q4’13

Q4’12

Change

Q3’13

Change

Q4’13

Q4’12

Change

Q3’13

Change

Revenues

$622.1

$588.5

5.7%

$626.1

(0.6)%

$622.1

$600.2

3.7%

$626.1

(0.6)%

Gross Margins

46.7%

46.6%

10 bps

49.5%

(280) bps

61.5%

62.2%

(70) bps

62.4%

(90) bps

Operating Expenses

$1,326.8

$318.0

nmf

$248.6

nmf

$174.9

$186.6

(6.3)%

$185.0

(5.4)%

Pre-Tax (Loss) Income

$(1,104.9)

$(98.0)

nmf

$(6.9)

nmf

$158.3

$149.0

6.2%

$151.8

4.3%

Net (Loss) Income

$(1,113.9)

$(77.8)

nmf

$(11.0)

nmf

$107.6

$98.3

9.4%

$103.2

4.3%

Diluted EPS

$(4.11)

$(0.29)

nmf

$(0.04)

nmf

$0.39

$0.37

$0.02

$0.38

$0.01

4

Note: nmf denotes “not meaningful”

GAAP costs and expenses include:

Stock-based

compensation-

$10.4M,

$14.2M

and

$10.8M

in

Q4’13,

Q4’12

and

Q3’13,

respectively

Goodwill Impairment charge of $1.1 billion

Quarter Ended September 28, 2013 (unaudited)

Quarter Ended September 28, 2013 (unaudited) |

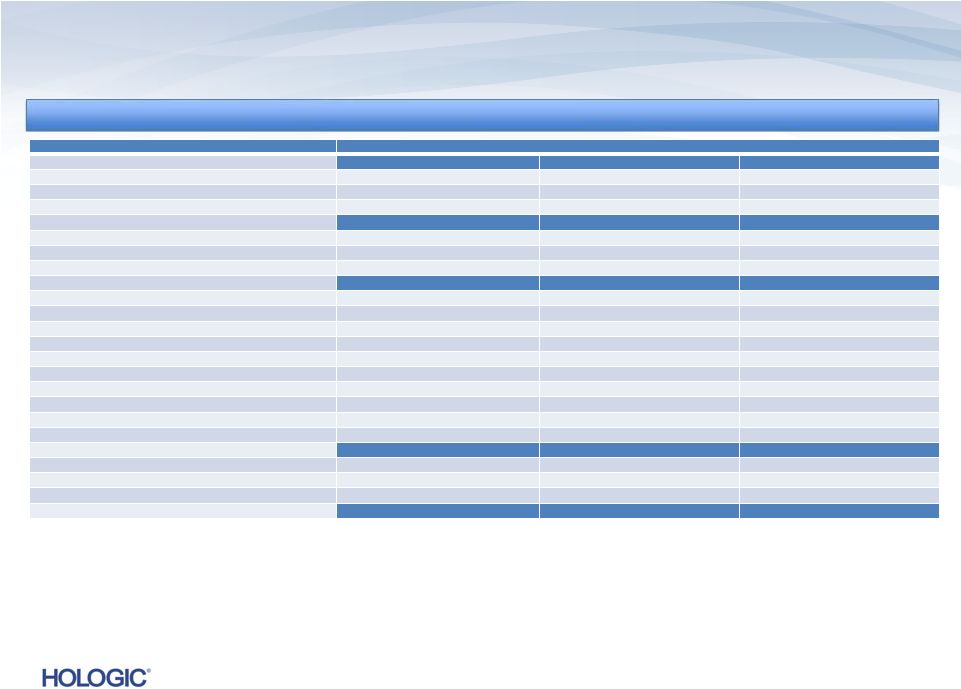

Reconciliation

of GAAP to Non-GAAP (unaudited) 5

Three Months Ended

Three Months Ended

September 28, 2013

September 28, 2013

September 29, 2012

September 29, 2012

June 29, 2013

June 29, 2013

REVENUES

GAAP revenues

$622,118

$588,548

$626,136

Adjustments related to Novartis collaboration

-

11,606

-

Non-GAAP revenues

$622,118

$622,118

$600,154 ¹

$626,136

$626,136

EARNINGS PER SHARE

GAAP

loss

per

share

-

Diluted

$(4.11)

$(0.29)

$(0.04)

Adjustments to net loss (as detailed below)

4.50

0.66

0.42

Non-GAAP

earnings

per

share

-

Diluted

$0.39²

$0.37 ²

$0.38²

GROSS MARGINS

GAAP gross margins

$290,631

$274,317

$309,758

Adjustments:

Contingent revenue from Novartis collaboration

-

11,606

-

Amortization of intangible assets

80,885

66,072

75,990

Fair value write-up of acquired inventory sold

-

19,918

-

Fair value adjustment to depreciation expense

1,741

1,203

1,771

Impairment of intangible assets

-

-

1,714

Acquisition and integration-related costs

7,993

612

1,268

Other

1,308

(427)

-

Non-GAAP gross margins

$382,558

$382,558

$373,301

$373,301

$390,501

$390,501

GROSS MARGIN PERCENTAGE

GAAP gross margin percentage

46.7%

46.6%

49.5%

Impact of adjustments above

14.8%

15.6%

12.9%

Non-GAAP gross margin percentage

61.5%

61.5%

62.2%

62.2%

62.4%

62.4%

Continued on next page

In thousands, except earnings per share

In thousands, except earnings per share |

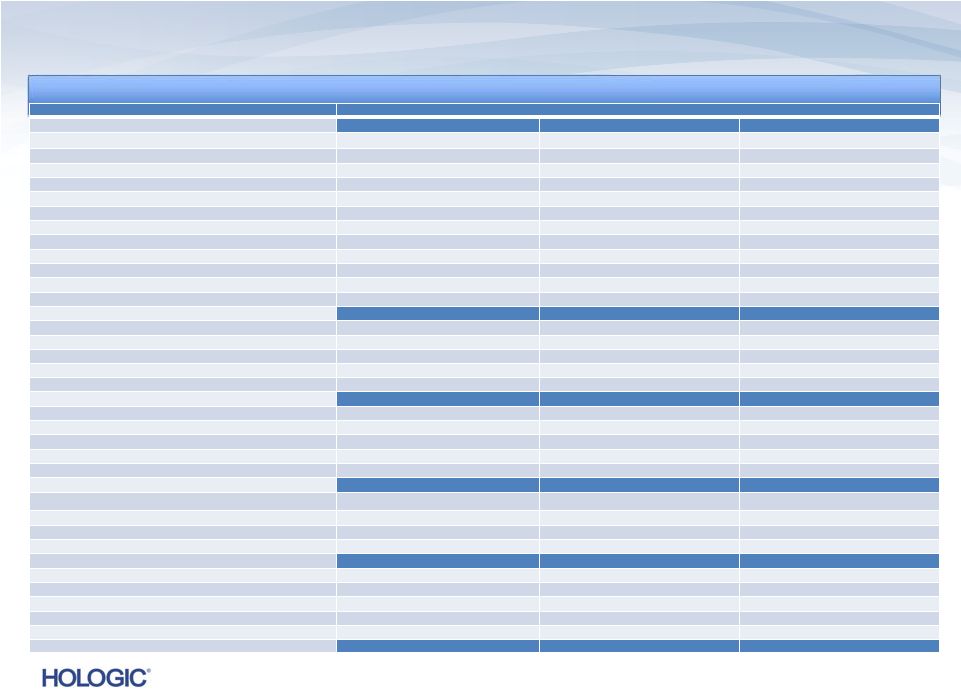

In thousands,

except earnings per share In thousands, except earnings per share

6

Three Months Ended

Three Months Ended

September 28, 2013

September 28, 2013

September 29, 2012

September 29, 2012

June 29, 2013

June 29, 2013

OPERATING EXPENSES

GAAP operating expenses

$1,326,836

$318,020

$248,606

Adjustments:

Amortization of intangible assets

(26,726)

(24,832)

(28,678)

Contingent consideration

465

(40,399)

(22,072)

Acquisition and integration-related costs

(2,979)

4

(37,901)

4

(4,660)

4

Restructuring and divestiture charges

(9,720)

(16,687)

(6,690)

Impairment of goodwill

(1,117,369)

(5,826)

-

In-process research and development

-

(4,500)

-

Fair value adjustment to depreciation expense

(1,329)

4

(1,300)

4

(1,338)

4

Litigation benefit

5,721

-

-

Other

-

(12)

(214)

Non-GAAP operating expenses

$174,899

$174,899

$186,563

$186,563

$184,954

$184,954

INTEREST EXPENSE

GAAP interest expense

$65,783

$56,673

$67,162

Adjustments:

Non-cash interest expense relating to convertible notes

(11,829)

(16,514)

(11,638)

Debt transaction costs

(1,055)

-

-

Non-GAAP interest expense

$52,899

$52,899

$40,159

$40,159

$55,524

$55,524

PRE-TAX INCOME

GAAP pre-tax loss

$(1,104,937)

$(97,964)

$(6,923)

Adjustments to pre-tax loss as detailed above

1,256,748

246,955

156,033

Debt extinguishment loss

5,962

-

-

Other

500

-

2,701

Non-GAAP pre-tax income

$158,273

$158,273

$148,991

$148,991

$151,811

$151,811

NET INCOME

GAAP net loss

$(1,113,902)

$(77,767)

$(10,950)

Adjustments to pre-tax loss as detailed above

1,263,210

246,955

158,734

Income tax effect of reconciling items

(41,682)³

(70,854)³

(44,553)³

Non-GAAP net income

$107,626

$107,626

$98,334

$98,334

$103,231

$103,231

EBITDA

Non-GAAP net income

$107,626

$98,334

$103,231

Interest expense, net, not adjusted above

52,368

39,766

55,220

Provision for income taxes

50,647

50,657

48,580

Depreciation expense, not adjusted above

20,782

21,241

20,427

Adjusted EBITDA

$231,423

$231,423

$209,998

$209,998

$227,458

$227,458

Reconciliation of GAAP to Non-GAAP (unaudited)

Continued on next page |

Reconciliation

of GAAP to Non-GAAP (unaudited) 7

Year Ended

Year Ended

September 28,2013

September 28,2013

September 29, 2012

September 29, 2012

REVENUES

GAAP revenues

$2,492,279

$2,002,652

Net adjustments primarily related to Novartis collaboration

19,704

11,606

Non-GAAP revenues

$2,511,983¹

$2,014,258¹

EARNINGS PER SHARE

GAAP

loss

per

share

-

Diluted

$(4.36)

$(0.28)

Adjustments to net (loss) income (as detailed below)

5.86

1.66

Non-GAAP

earnings

per

share

-

Diluted

$1.50²

$1.38²

GROSS MARGINS

GAAP gross margins

$1,161,388

$994,437

Adjustments:

Contingent revenue from Novartis collaboration and other, net

19,704

11,606

Amortization of intangible assets

307,895

201,864

Fair value write-up of acquired inventory sold

52,397

19,918

Fair value adjustment to depreciation expense

7,100

1,203

Impairment of intangible assets

1,714

-

Acquisition and integration-related costs

11,868

800

Adiana closure costs

-

19,064

Other

1,308

-

Non-GAAP gross margins

$1,563,374

$1,563,374

$1,248,892

$1,248,892

GROSS MARGIN PERCENTAGE

GAAP gross margin percentage

46.6%

49.7%

Impact of adjustments above

15.6%

12.3%

Non-GAAP gross margin percentage

62.2%

62.2%

62.0%

62.0%

Continued on next page

In thousands, except earnings per share

In thousands, except earnings per share |

8

Year Ended

Year Ended

September 28, 2013

September 28, 2013

September 29, 2012

September 29, 2012

OPERATING EXPENSES

GAAP operating expenses

$2,067,670

$880,720

Adjustments:

Amortization of intangible assets

(112,597)

(72,036)

Contingent consideration

(91,320)

(119,497)

Acquisition and integration-related costs

(17,984)

4

(44,305)

4

Restructuring and divestiture charges

(32,805)

(17,036)

Impairment of goodwill

(1,117,369)

(5,826)

Gain on sale of intellectual property, net

53,884

12,424

Fair value adjustment to depreciation expense

(4,957)

4

(1,300)

4

Litigation benefit

8,584

-

In-process research and development

-

(4,500)

Other

-

(931)

Non-GAAP operating expenses

$753,106

$753,106

$627,713

$627,713

INTEREST EXPENSE

GAAP interest expense

$281,075

$140,287

Adjustments:

Non-cash interest expense relating to convertible notes

(52,732)

(68,532)

Debt transaction costs

(7,469)

-

Other

-

(528)

Non-GAAP interest expense

$220,874

$220,874

$71,227

$71,227

OTHER INCOME, NET

GAAP other income, net

$3,605

$7,256

Cost method investment loss

4,466

-

Other

301

-

Non-GAAP other income, net

$8,372

$8,372

$7,256

$7,256

PRE-TAX INCOME

GAAP pre-tax loss

$(1,192,961)

$(61,661)

Adjustments to pre-tax loss as detailed above

1,781,518

576,522

Debt extinguishment loss

9,209

42,347

Non-GAAP pre-tax income

$597,766

$597,766

$557,208

$557,208

NET INCOME

GAAP net loss

$(1,172,838)

$(73,634)

Adjustments to pre-tax loss as detailed above

1,790,727

618,869

Income tax effect of reconciling items

(211,408)

3

(177,478)

3

Non-GAAP net income

$406,481

$406,481

$367,757

$367,757

EBITDA

Non-GAAP net income

$406,481

$367,757

Interest expense, net, not adjusted above

219,572

68,887

Provision for income taxes

191,285

189,451

Depreciation expense, not adjusted above

80,825

69,348

Adjusted EBITDA

$898,163

$898,163

$695,443

$695,443

Reconciliation of GAAP to Non-GAAP (unaudited)

Continued on next page

In thousands, except earnings per share

In thousands, except earnings per share |

9

Reconciliation of GAAP to Non-GAAP (unaudited)

Footnotes:

1

To primarily reflect a fair value adjustment recorded in purchase accounting

relating to contingent revenue earned and received under the Novartis

collaboration post acquisition, which was eliminated under purchase accounting.

2

Non-GAAP earnings per share was calculated based on: 273,925; 268,106; and

272,531 weighted average diluted shares outstanding for the three months

ended September 28, 2013, September 29, 2012, and June 29, 2013, respectively, and

271,869 and 266,795 weighted average diluted shares outstanding for the years ended

September 28, 2013 and September 29, 2012, respectively.

3

To reflect an annual effective tax rate of 32.0%, 34.0% and 32.0% on a non-GAAP

basis for the three months ended September 28, 2013, September 29, 2012, and

June 29, 2013, respectively, and 32.0% and 34.0% on a non-GAAP basis for

the years ended September 28, 2013 and September 29, 2012, respectively.

4

The breakdown of this expense by P&L line item is as follows:

Three Months Ended

Three Months Ended

Year Ended

Year Ended

September 28, 2013

September 28, 2013

September 29, 2012

September 29, 2012

June 29, 2013

June 29, 2013

September 28, 2013

September 28, 2013

September 29, 2012

September 29, 2012

Acquisition-related costs

R&D

$686

$805

$1,337

$4,684

$1,038

S&M

600

691

1,229

4,873

725

G&A

1,693

36,405

2,094

8,427

42,542

Total OpEx

$2,979

$37,901

$4,660

$17,984

$44,305

COGS

7,993

612

1,268

11,868

800

Total Adjustment

$10,972

$38,513

$5,928

$29,852

$45,105

Fair value adjustment for

depreciation expense

R&D

$431

$293

$434

$1,741

$293

S&M

65

44

66

262

44

G&A

833

963

838

2,954

963

Total OpEx

$1,329

$1,300

$1,338

$4,957

$1,300

COGS

1,741

1,203

1,771

7,100

1,203

Total Adjustment

$3,070

$2,503

$3,109

$12,057

$2,503

In thousands, except tax rates

In thousands, except tax rates |

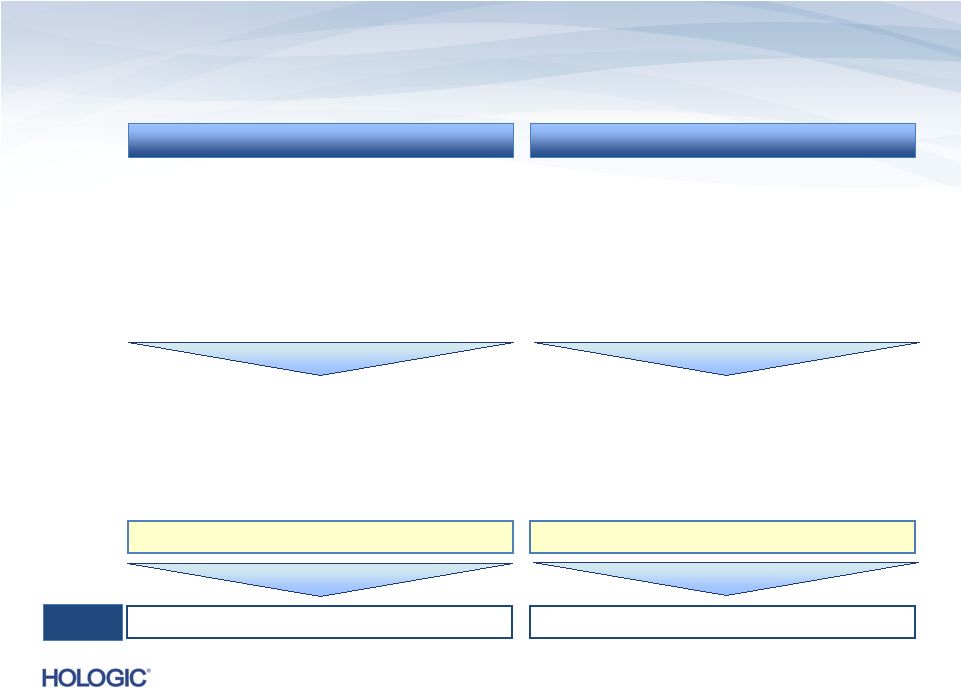

Overview of

Operating Cash Flow and Return on Invested Capital

¹

Adjustments for OCF include contingent consideration paid for acquisition.

²

Average

net

debt

and

stockholders’

equity

during

the

period.

³

For

2013,

calculated

inclusive

of

impairment

charge;

stockholders’

equity

and

ROIC

are

$3.0B

and

7.6%,

respectively,

excluding

impairment

charge.

Operating Cash Flow (OCF)

Return on Invested Capital (ROIC)

•

Measures the cash flow available for

deleveraging, shareholder return and

incremental investment in the business

•

Hologic uses operating cash flow for

evaluating and executing on its

deleveraging and capital return objectives

•

Measures the after-tax returns generated by

the company relative to the total invested

capital base (equity and debt)

•

Hologic uses ROIC for evaluating investment

decisions relative to cost of capital and as a

key element of Hologic’s performance-based

executive compensation plan

OCF = CFO + Adj. (1)

ROIC = NOPAT / (Net debt + S/H Equity)

FY13

Results

$630.8M

8.26%

•

Key building blocks:

–

Cash flow from operations (CFO)

–

Non-operating adjustments¹

(Adj.)

•

Key building blocks

–

Net operating profit after tax (NOPAT)

–

Net debt²

–

Stockholders’

equity

(S/H

Equity)

²

,

³

10 |

11

Year Ended

Year Ended

September 28, 2013

September 28, 2013

NET OPERATING PROFIT AFTER TAX (NON-GAAP)

Non-GAAP net income

$406,481

Provision for income taxes

191,285

Non-GAAP interest expense

220,874

Non-GAAP other income

(8,372)

Adjusted net operating profit before tax (Non-GAAP)

$810,268

$810,268

Non-GAAP effective tax rate

32.0 %

Adjusted net operating profit after tax (Non-GAAP)

$550,982

$550,982

AVERAGE NET DEBT PLUS AVERAGE STOCKHOLDER'S EQUITY

Average cash, cash equivalents and restricted cash

$(697,765)

Average total debt

4,920,762

Average stockholder’s equity

2,451,272

Average net debt plus average stockholder's equity

$6,674,269

$6,674,269

ADJUSTED ROIC

Adjusted ROIC (adjusted net operating profit after tax above divided by average net debt plus

S/E above) 8.26%

8.26%

AVERAGE NET DEBT PLUS AVERAGE STOCKHOLDER'S EQUITY (PRE-IMPAIRMENT CHARGE)

Average cash, cash equivalents and restricted cash

$(697,765)

Average total debt

4,920,762

Average stockholder’s equity (pre-impairment charge)

3,009,957

Average net debt plus average stockholder's equity (pre-impairment charge)

$7,232,954

$7,232,954

ADJUSTED ROIC (PRE-IMPAIRMENT CHARGE)

Adjusted ROIC (pre-Impairment charge)

7.62%

7.62%

Return on Invested Capital (unaudited)

In thousands

In thousands |

12

Operating Cash Flow (unaudited)

(1) Operating cash flow represents operating cash flow within operating activities, but before

Investing/Financing Activities (which include capital expenditures). (2) Former

operating cash flow represents operating cash flow within operating activities, including capital expenditures, and excluding interest paid on debt acquired in Fiscal 2012.

In thousands

In thousands |

Hologic has

presented the following non-GAAP financial measures in this presentation: revenues; net income; EPS; and adjusted EBITDA. Hologic

defines its non-GAAP revenues to primarily include contingent revenue earned under the

Novartis collaboration post-acquisition which was eliminated under purchase

accounting. Hologic defines adjusted EBITDA as its non-GAAP net income plus net interest expense, income taxes, and

depreciation and amortization expense included in its non-GAAP net income. Hologic defines

its non-GAAP net income and EPS to exclude: (i) the amortization of intangible

assets; (ii) acquisition-related charges and effects, such as charges for contingent consideration (comprised of (a)

adjustments

for

changes

in

the

fair

value

of

the

contingent

consideration

liabilities

initially

recorded

as

part

of

the

purchase

price

of

an

acquisition

as required by GAAP, and (b) contingent consideration that is tied to continuing employment of

the former shareholders and employees which is recorded as compensation expense),

transaction costs, integration costs including retention, and credits and/or charges associated with the write-up

of acquired inventory and fixed assets to fair value, and the effect of a reduction in revenue

primarily related to contingent revenue under the Novartis collaboration, described

above; (iii) non-cash interest expense related to amortization of the debt discount for convertible debt securities;

(iv) restructuring and divestiture charges; (v) non-cash extinguishment losses and debt

transaction costs; (vi) litigation settlement charges (benefits); (vii)

other-than-temporary impairment losses on investments; and (viii) other one-time, nonrecurring, unusual or infrequent charges, expenses or

gains that may not be indicative of the Hologic’s core business results; and include

income taxes related to such adjustments. Hologic believes the use of non-GAAP

revenues is useful to investors as it eliminates certain effects of purchase accounting on its recognition of

revenue.

Hologic

believes

the

use

of

non-GAAP

net

income

is

useful

to

investors

by

eliminating

certain

of

the

more

significant

effects

of

its

acquisitions and related activities, non-cash charges resulting from the application of

GAAP to convertible debt instruments with cash settlement features, charges related to

debt extinguishment losses, investment impairments, litigation settlements, and restructuring and divestiture initiatives.

These non-GAAP measures also reflect how Hologic manages its businesses internally. In

addition to the adjustments set forth in the calculation of Hologic’s non-GAAP

net income and EPS, its adjusted EBITDA eliminates the effects of financing, income taxes and the accounting effects of capital

spending. As with the items eliminated in its calculation of non-GAAP net income, these

items may vary for different companies for reasons unrelated to the overall operating

performance of Hologic’s business. When analyzing Hologic’s operating performance, investors should not consider these

non-GAAP financial measures as a substitute for net income prepared in accordance with

GAAP. Use of Non-GAAP Financial Measures

13 |

Consolidated

Balance Sheet Data (unaudited)

$s in millions

$s in millions

September 28, 2013

September 28, 2013

September 29, 2012

September 29, 2012

Cash

$829.4

$566.1

Working Capital

$535.7

$901.7

Total Assets

$9,000.8

$10,477.1

Long-Term Liabilities

$5,970.9

$6,854.7

Total Liabilities

$7,059.3

$7,516.1

Stockholders’

Equity

$1,941.5

$2,961.0

14 |

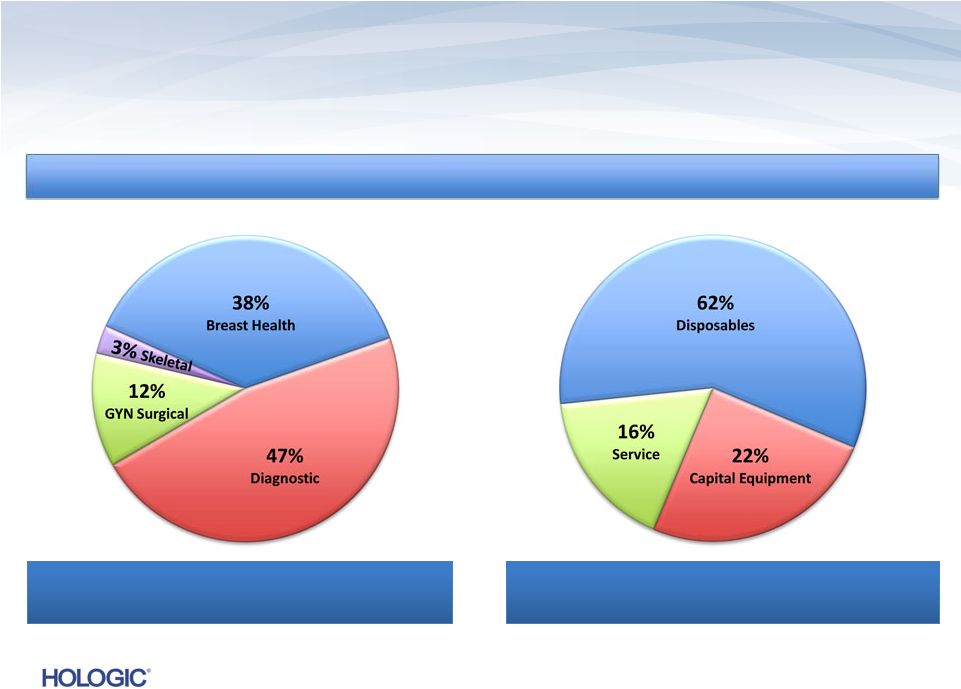

U.S.

Revenues ~ 77% U.S. Revenues ~ 77%

International Revenues ~ 23%

International Revenues ~ 23%

Four Business Segments

Disposables/Service ~ 78%

Disposables/Service ~ 78%

Capital Equipment ~ 22%

Capital Equipment ~ 22%

15

Breakdown of Q4 FY 2013 Revenues of $622.1M (unaudited)

Breakdown of Q4 FY 2013 Revenues of $622.1M (unaudited) |

Q4 FY 2013

Segment Highlights Diagnostics (unaudited)

Diagnostics revenues represent 47% of total revenues and 54% of total product revenues in

Q4’13 –

On

a

constant

currency

basis,

Diagnostics

revenues

would

have

increased

to

$289.5M¹,

or

14.2%,

compared

to

Q4’12

GAAP costs and expenses include:

•

Stock-based compensation of $5.3M, $8.1M and $5.4M in Q4’13, Q4’12 and

Q3’13, respectively Non-GAAP* revenues, costs and expenses primarily

exclude: •

Impairment of goodwill of $1,117.4M in Q4’13

•

Amortization of intangible assets of $78.3M, $60.7M and $74.4M in Q4’13, Q4’12 and

Q3’13, respectively –

In Q4’13, $58.4M was in COGS and $19.9M in OpEx

–

In Q4’12, $43.7M was in COGS and $17.0M in OpEx

–

In Q3’13, $53.4M was in COGS and $21.0M in OpEx

•

Acquisition and integration-related costs of $10.5M, $38.5M and $5.5M in Q4’13,

Q4’12 and Q3’13, respectively –

In Q4’13, $7.6M was in COGS and $2.9M in OpEx

–

In Q4’12, $0.6M was in COGS and $37.9M in OpEx

–

In Q3’13, $1.0M was in COGS and $4.5M in OpEx

•

Restructuring

and

divestiture

charges

of

$4.1M,

$14.8M

and

$3.1M

in

Q4’13,

Q4’12

and

Q3’13,

respectively

•

Fair value adjustment to depreciation expense of $3.1M, $2.5M and $3.1M in Q4’13,

Q4’12 and Q3’13, respectively –

$1.7M was in COGS and $1.4M in OpEx in Q4’13

–

$1.2M was in COGS and $1.3M in OpEx in Q4’12

–

$1.8M was in COGS and $1.3M in OpEx in Q3’13

•

Contingent consideration of $(0.5M), $32.9M, and $21.6M in Q4’13, Q4’12 and

Q3’13, respectively •

Fair value write-up of acquired inventory sold of $19.9M in Q4’12 (COGS)

•

Purchase accounting and other adjustments, net, reducing revenues by $11.6M in

Q4’12 Thin Prep, fFN and Molecular Diagnostics

GAAP

GAAP

$s in millions

Q4’13

Q4’12

Change

Q3’13

Change

Revenues

$290.0

$253.5

14.4%

$297.4

(2.5)%

Gross Margins

40.0%

40.1%

(20) bps

47.8%

(790) bps

Operating Loss

$(1,115.4)

$(86.0)

nmf

$(1.1)

nmf

16

* See the definition of these non-GAAP financial measures on

page 13 of this presentation.

1

The constant currency revenue amount for Q4’13 is a non-GAAP

number that reflects what revenues in that quarter would have

been had the Company applied the foreign currency exchange

rates it used for determining its revenues in Q4’12.

Note: nmf denotes “not meaningful” |

Q4 FY 2013

Segment Highlights Breast Health (unaudited)

Breast Health revenues represent 38% of total revenues and 28% of total product revenues in

Q4’13 –

On

a

constant

currency

basis,

Breast

Health

revenues

would

have

increased

to

$233.9M¹

,

or

1.6%,

compared

to

Q4’12

GAAP costs and expenses include:

•

Stock-based compensation of $3.9M, $4.6M and $4.3M in Q4’13, Q4’12 and

Q3’13, respectively Non-GAAP* costs and expenses primarily exclude:

•

Amortization of intangible assets of $5.9M, $6.6M and $6.0M in Q4’13, Q4’12 and

Q3’13, respectively –

In Q4’13, $4.1M was in COGS and $1.8M in OpEx

–

In Q4‘12, $4.6M was in COGS and $2.0M in OpEx

–

In Q3’13, $4.1M was in COGS and $1.9M in OpEx

•

Litigation benefit of $5.7M in Q4’13

•

Restructuring and divestiture charges of $1.9M, $1.9M and $2.8M in Q4’13, Q4’12 and

Q3’13, respectively •

Acquisition and integration-related costs of $0.5M and $0.4M in Q4’13 and Q3’13,

respectively –

In Q4’13, $0.4M was in COGS and $0.1M in OpEx

–

In Q3’13, $0.3M was in COGS and $0.1M in OpEx

•

Impairment of goodwill of $5.8M in Q4’12

•

Contingent consideration of $3.4M in Q4’12

•

Impairment of intangible asset of $1.7M in Q3’13 (COGS)

Mammography, Breast Biopsy, MRI Coils, and

MammoSite

GAAP

GAAP

$s in millions

Q4’13

Q4’12

Change

Q3’13

Change

Revenues

$234.2

$230.3

1.7%

$230.0

1.8%

Gross Margins

52.4%

49.9%

250 bps

49.7%

270 bps

Operating Income

$70.0

$40.9

71.2%

$53.2

31.6%

17

* See the definition of these non-GAAP financial measures on

page 13 of this presentation.

1

The constant currency revenue amount for Q4’13 is a non-GAAP

number that reflects what revenues in that quarter would

have been had the Company applied the foreign currency

exchange rates it used for determining its revenues in Q4’12.

|

Q4 FY 2013

Segment Highlights GYN Surgical (unaudited)

GYN Surgical revenues represent 12% of total revenues and 15% of

total product revenues in Q4’13

–

On a constant currency basis, GYN Surgical revenues would have decreased to $76.9M¹, or (3.5)%, compared to Q4’12

GAAP and non-GAAP costs and expenses include:

•

Stock-based compensation of $0.8M, $1.1M and $0.8M in Q4’13, Q4’12 and

Q3’13, respectively Non-GAAP* costs and expenses primarily exclude:

•

Amortization of intangible assets of $23.5M, $23.6M and $24.3M in Q4’13, Q4’12 and

Q3’13, respectively –

In Q4’13, $18.5M was in COGS and $5.0M in OpEx

–

In Q4‘12, $17.8M was in COGS and $5.8M in OpEx

–

In Q3’13, $18.5M was in COGS and $5.8M in OpEx

•

Restructuring and divestiture charges of $0.4M and $0.4M in Q4’13 and Q3’13,

respectively •

Contingent consideration of $4.1M, and $0.5M in Q4’12 and Q3’13, respectively

•

In-process research and development of $4.5M in Q4’12

NovaSure and MyoSure

GAAP

GAAP

$s in millions

Q4’13

Q4’12

Change

Q3’13

Change

Revenues

$76.7

$79.7

(3.8)%

$75.8

1.1%

Gross Margins

55.5%

58.6%

(310) bps

56.8%

(130) bps

Operating Income (Loss)

$10.5

$(1.2)

nmf

$6.3

67.8%

18

* See the definition of these non-GAAP financial measures on

page 13 of this presentation.

1

The

constant

currency

revenue

amount

for

Q4’13is

a

non-GAAP

number that reflects what revenues in that quarter would have

been had the Company applied the foreign currency exchange

rates it used for determining its revenues in Q4’12.

Note: nmf denotes “not meaningful” |

Q4 FY 2013

Segment Highlights Skeletal (unaudited)

Skeletal revenues represent 3% of total revenues and 3% of total

product revenues in Q4’13

–

On a constant currency basis, Skeletal revenues would have decreased to

$21.1M¹, or (15.9)%, compared to Q4’12

GAAP costs and expenses include:

•

Stock-based compensation of $0.4M, $0.5M and $0.4M in Q4’13, Q4’12 and

Q3’13, respectively Non-GAAP* costs and expenses primarily exclude

•

Restructuring and divestiture charges of $3.4M and $0.4M in Q4’13 and Q3’13,

respectively Osteoporosis Assessment and Mini C-Arm

GAAP

GAAP

$s in millions

Q4’13

Q4’12

Change

Q3’13

Change

Revenues

$21.2

$25.1

(15.3)%

$22.9

(7.1)%

Gross Margins

44.2%

43.9%

30 bps

45.0%

(80) bps

Operating (Loss) Income

$(1.4)

$2.6

nmf

$2.8

nmf

19

* See the definition of these non-GAAP financial measures

on page 13 of this presentation.

1

The constant currency revenue amount for Q4’13 is a non-

GAAP number that reflects what revenues in that quarter

would have been had the Company applied the foreign

currency exchange rates it used for determining its

revenues in Q4’12.

Note: nmf denotes “not meaningful” |

20

The Company’s guidance includes current operations, including revenues from its

approved/cleared products and its recently

acquired

businesses.

This

guidance

does

not

include

any

stock

repurchases,

acquisitions,

divestitures

or

additional voluntary debt payments that may occur during fiscal 2014.

Hologic may not generate expected revenues and may incur expenses or charges, realize income

or gains, or execute transactions in fiscal 2014 that could cause actual results to

vary from the guidance above. In addition, the Company is continuing to monitor the

effects of the U.S., European and general worldwide economic and regulatory conditions

and related uncertainties, including the implementation of healthcare cost containment

measures and healthcare reform legislation, as well as foreign currency fluctuations,

which, along with other uncertainties facing the Company’s business including

those referenced elsewhere herein and its filings with the Securities and Exchange

Commission, could adversely affect anticipated results.

Future Non-GAAP Adjustments:

Future GAAP EPS may be affected by changes in ongoing assumptions and judgments relating to

the Company’s acquired businesses, and may also be affected by nonrecurring,

unusual or unanticipated charges, expenses or gains, all of which are excluded in the

calculation of non-GAAP EPS as described in this presentation. It is therefore not

practicable to reconcile non-GAAP EPS guidance to the most comparable GAAP measure.

FINANCIAL GUIDANCE |

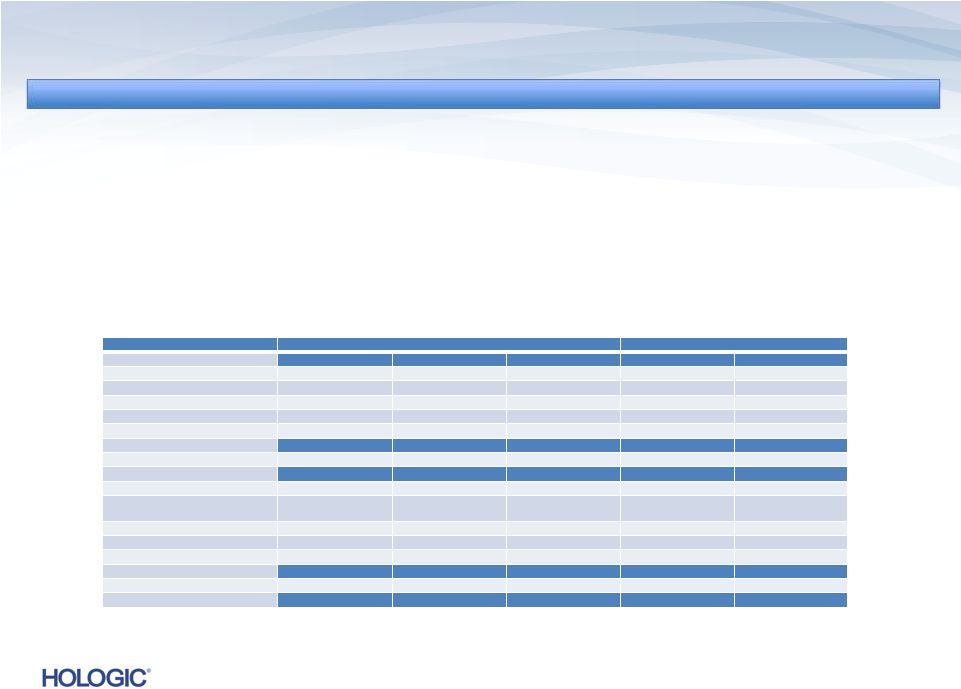

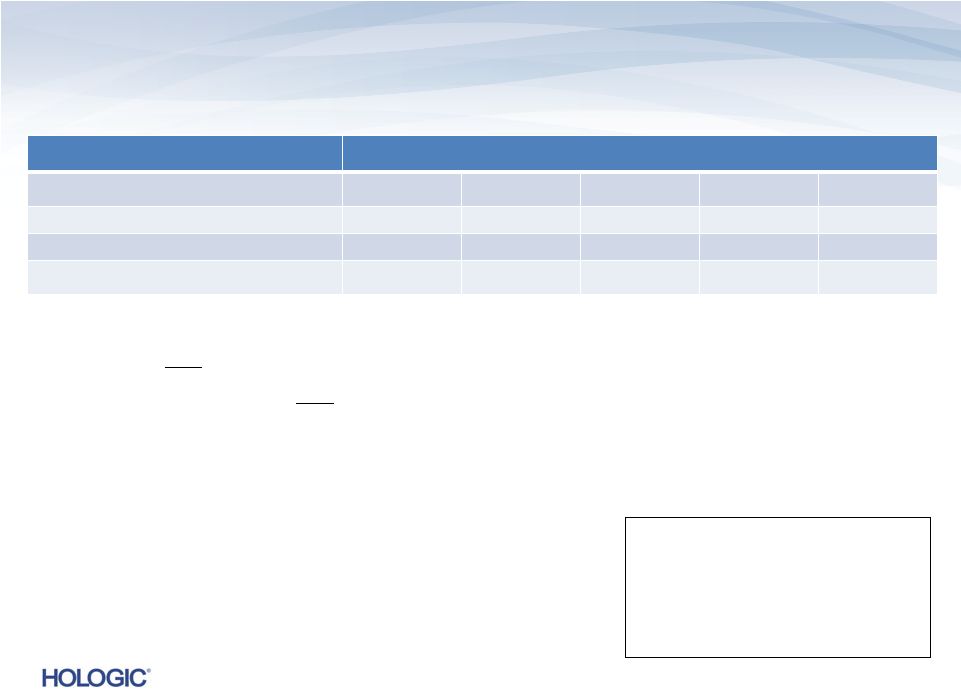

Non-GAAP

Guidance for Q1 FY 2014 $s in millions

$s in millions

(except EPS)

(except EPS)

Q1 2013

Q1 2013

Actual

Actual

Q1 2014

Q1 2014

Guidance*

Guidance*

Commentary

Commentary

(compared to Q1 2013)

(compared to Q1 2013)

Revenues*

$644.6

$600 -

$610

We expect a decline in reported revenues of 5% to 7% and a pro forma decline of 3% to 5% (pro

forma excludes Lifecodes revenues of $12.6 million).

Gross margins*

62.5%

61.5% -

62.0%

We

expect

non-GAAP

gross

margins

to

be

lower

as

a

result

of

lower

revenues

and

a

shift

in

product mix, including lower sales of consumable products and higher sales of mammography

systems.

Operating expenses*

$198.3

$195 -

$200

We expect non-GAAP operating expenses to decrease primarily as a result of recent

cost-cutting measuresand

completion

of

Gen-Probe

integration,

offset

by

an

estimated

$5

-

$6

million

for

the

medical device excise tax.

Interest expense*

$56.4

~ $50

Includes cash and non-cash interest on our Senior Notes, Term Loans and convertible

debt. EPS*

$0.38

$0.30 -

$0.31

We expect non-GAAP EPS to be lower primarily as a result of lower revenues. This includes

incremental reductions in EPS of $0.01 from the impact of the medical device excise

tax and $0.01 from an increase in the expected annual effective tax rate.

Quarter ending December 28, 2013

Quarter ending December 28, 2013

21

NOTE: Guidance assumes constant foreign currency rates with Q4’13.

NOTE: For Q1’14, we estimate diluted shares outstanding of approximately 275 million and

a 34% annual effective tax rate. * See the definition of non-GAAP financial measures

on page 13 and the discussion of future non-GAAP adjustments on page 20 of this presentation. |

Non-GAAP

Guidance for FY 2014 $s in millions

$s in millions

(except EPS)

(except EPS)

Fiscal 2013

Fiscal 2013

Actual

Actual

Fiscal 2014

Fiscal 2014

Guidance

Guidance

Commentary

Commentary

(compared to Fiscal 2013)

(compared to Fiscal 2013)

Revenues*

$2,512.0

$2,425 -

$2,475

We expect a decline in reported revenues of 1% to 3%. On a pro forma basis, adjusting for

Lifecodes revenues of $23 million, total revenues are expected to be flat to down

2%. Gross margins*

62.2%

61.5% -

62.0%

We

expect

non-GAAP

gross

margins

to

be

lower

as

a

result

of

lower

revenues

and

a

shift

in

product mix, including lower sales of consumable products and higher sales of

mammography systems.

Operating

expenses*

$753.1

$750 -

$770

We expect non-GAAP operating expenses to increase modestly as a result of recent

cost-cutting measures and completion of Gen-Probe integration, offset by an

increase in variable compensation.

In

addition,

FY

2014

includes

an

estimated

$21

-

$22

million

for

the

medical

device

excise tax.

Interest expense*

$220.9

~ $190

Includes cash and non-cash interest on our Senior Notes, Term Loans and convertible

debt. EPS*

$1.50

$1.32 -

$1.38

We expect non-GAAP EPS to be lower primarily as a result of lower revenues. This includes

incremental

reductions

of

$0.04

from

an

increase

in

the

expected

annual

effective

tax

rate

and

$0.02 from the impact of the medical device excise tax.

Year ending September 27, 2014

Year ending September 27, 2014

22

NOTE: Guidance assumes constant foreign currency rates with Q4’13.

NOTE: For Fiscal 2014, we estimate diluted shares outstanding of approximately 278 million and

a 34% annual effective tax rate. * See the definition of non-GAAP financial measures on page 13 and the discussion of

future non-GAAP adjustments on page 20 of this presentation. |

Q4 FY 2013 and

Subsequent Events Summary •

Q4 FY 2013 Highlights:

–

Revenues in line with and EPS exceeding guidance

–

Appointment of Jack Cumming as President and Chief Executive Officer (July 18)

–

Term B refinancing, reducing interest rate by 75 basis points and increasing flexibility to

return capital to shareholders; also voluntarily prepaid $200 million of the Term B

(August 2)

–

Announced FDA approval of Aptima HPV on Panther (July 23)

•

Subsequent Events:

–

AuntMinnie.com named digital breast tomosynthesis the “Hottest Clinical

Procedure” for the fourth consecutive year (October 30)

–

Voluntarily prepaid additional $100 million on Term Loan B (October 31)

–

Announced

FDA

approval

of

Aptima

HPV

16

18/45

genotype

assay

for

use

on

Panther

System (November 7)

–

Announced Board of Directors authorized a $250 million, three-year stock repurchase

program (November 11) |

|