Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - TELKONET INC | Financial_Report.xls |

| EX-32.1 - CERTIFICATION - TELKONET INC | telkonet_10q-ex3201.htm |

| EX-32.2 - CERTIFICATION - TELKONET INC | telkonet_10q-ex3202.htm |

| EX-31.2 - CERTIFICATION - TELKONET INC | telkonet_10q-ex3102.htm |

| EX-31.1 - CERTIFICATION - TELKONET INC | telkonet_10q-ex3101.htm |

| 10-Q - QUARTERLY REPORT - TELKONET INC | telkonet_10q-093013.htm |

EXHIBIT 10.1

BUSINESS FINANCING MODIFICATION AGREEMENT

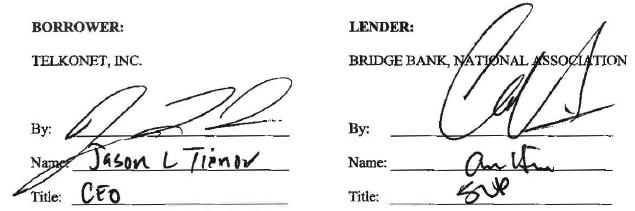

This Business Financing Modification Agreement is entered into as of August 1, 2013, by and between Telkonet, Inc. (the "Borrower") and Bridge Bank, National Association ("Lender").

1. DESCRIPTION OF EXISTING INDEBTEDNESS: Among other indebtedness which may be owing by Borrower to Lender, Borrower is indebted to Lender pursuant to, among other documents, a Business Financing Agreement, dated May 31, 2013, by and between Borrower and Lender, as may be amended from time to time (the "Business Financing Agreement"). Capitalized terms used without definition herein shall have the meanings assigned to them in the Business Financing Agreement.

Hereinafter, all indebtedness owing by Borrower to Lender shall be referred to as the "Indebtedness" and the Business Financing Agreement and any and all other documents executed by Borrower in favor of Lender shall be referred to as the "Existing Documents."

2. DESCRIPTION OF CHANGE IN TERMS.

A. Modification(s) to Business Financing Agreement:

1) The following definition in Section 12.1 entitled "Definitions" is amended to read as follows:

“Advance Rate” means 80% in case of the Eligible Receivables (except for Receivables from the Account Debtor EthoStream), or 75% in case of the Eligible Receivables from the Account Debtor EthoStream, and 25% in the case of the Eligible Inventory, or in each case, such greater or lesser percentage as Lender may from time to time establish in its sole discretion upon notice to Borrower.

2) Clauses (n) and (o) under the defined term "Eligible Receivable" in Section 12.1 entitled "Definitions is hereby amended to read as follows:

(n) The Receivable is otherwise acceptable to Lender.

3. CONSISTENT CHANGES. The Existing Documents are each hereby amended wherever necessary to reflect the changes described above.

4. INTENTIONALLY OMITTED.

5. NO DEFENSES OF BORROWER/GENERAL RELEASE. Borrower agrees that, as of this date, it has no defenses against the obligations to pay any amounts under the Indebtedness. Each of Borrower and Guarantor (each, a "Releasing Party'') acknowledges that Lender would not enter into this Business Financing Modification Agreement without Releasing Party's assurance that it has no claims against Lender or any of Lender's officers, directors, employees or agents. Except for the obligations arising hereafter under this Business Financing Modification Agreement, each Releasing Party releases Lender, and each of Lender's and entity's officers, directors and employees from any known or unknown claims that Releasing Party now has against Lender of any nature, including any claims that Releasing Party, its successors, counsel, and advisors may in the future discover they would have now had if they had known facts not now known to them, whether· founded in contract, in tort or pursuant to any other theory of liability, including but not limited to any claims arising out of or related to the Agreement or the transactions contemplated thereby. Releasing Party waives the provisions of California Civil Code section 1542, which states:

A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS WHICH THE CREDITOR DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING THE RELEASE, WHICH IF KNOWN BY HIM OR HER, MUST HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR.

| 1 |

The provisions, waivers and releases set forth in this section are binding upon each Releasing Party and its shareholders, agents, employees, assigns and successors in interest. The provisions, waivers and releases of this section shall inure to the benefit of Lender and its agents, employees, officers, directors, assigns and successors in interest. The provisions of this section. shall survive payment in full of the Obligations, full performance of all the terms of this Business Financing Modification Agreement and the Agreement, and/or Lender's actions to exercise any remedy available under the Agreement or otherwise.

6. CONTINUING VALIDITY. Borrower understands and agrees that in modifying the existing Indebtedness, Lender is relying upon Borrower's representations, warranties, and agreements, as set forth in the Existing Documents. Except as expressly modified pursuant to this Business Financing Modification Agreement, the terns of the Existing Documents remain unchanged and in full force and effect. Lender's agreement to modifications to the existing Indebtedness pursuant to this Business Financing Modification Agreement in no way shall obligate Lender to make any future modifications to the Indebtedness. Nothing in this Business Financing Modification Agreement shall constitute a satisfaction of the Indebtedness. It is the intention of Lender and Borrower to retain as liable parties all makers and endorsers of Existing Documents, unless the party is expressly released by Lender in writing. No maker, endorser, or guarantor will be released by virtue of this Business Financing Modification Agreement. The terms of this paragraph apply not only to this Business Financing Modification Agreement, but also to any subsequent Business Financing modification agreements.

7. INTENTIONALLY OMITTED.

8. NOTICE OF FINAL AGREEMENT. BY SIGNING THIS DOCUMENT EACH PARTY REPRESENTS AND AGREES THAT: (A) THIS WRITTEN AGREEMENT REPRESENTS THE FINAL AGREEMENT BETWEEN THE PARTIES, (B) THERE ARE NO UNWRITTEN ORAL AGREEMENTS BETWEEN THE PARTIES, AND (C) THIS WRITTEN AGREEMENT MAY NOT BE CONTRADICTED BY EVIDENCE OF ANY PRIOR, CONTEMPORANEOUS, OR SUBSEQUENT ORAL AGREEMENTS OR UNDERSTANDINGS OF THE PARTIES.

9. COUNTER SIGNATURE. This Business Financing Modification Agreement shall become effective only when executed by Lender, Borrower, and Guarantor.

2