Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - EyePoint Pharmaceuticals, Inc. | Financial_Report.xls |

| 10-Q - FORM 10-Q - EyePoint Pharmaceuticals, Inc. | d616544d10q.htm |

| EX-32.1 - EX-32.1 - EyePoint Pharmaceuticals, Inc. | d616544dex321.htm |

| EX-31.2 - EX-31.2 - EyePoint Pharmaceuticals, Inc. | d616544dex312.htm |

| EX-32.2 - EX-32.2 - EyePoint Pharmaceuticals, Inc. | d616544dex322.htm |

| EX-31.1 - EX-31.1 - EyePoint Pharmaceuticals, Inc. | d616544dex311.htm |

Exhibit 10.1

LEASE

Landlord:

Farley White Aetna Mills, LLC

Tenant:

pSivida Corp.

Date of Lease: As of November 1, 2013

TABLE OF CONTENTS

| Page | ||||

| ARTICLE I—DEMISING CLAUSE AND DEFINED TERMS |

1 | |||

| 1.1 Demising Clause |

1 | |||

| 1.2 Defined Terms |

1 | |||

| ARTICLE II—PREMISES AND TERM |

2 | |||

| 2.1 The Premises, Common Areas and Parking |

2 | |||

| 2.2 Term |

3 | |||

| ARTICLE III—RENT |

4 | |||

| 3.1 Base Rent |

4 | |||

| 3.2 Adjustment for Operating Expenses |

4 | |||

| 3.3 Tenant’s Electricity |

7 | |||

| ARTICLE IV—CONSTRUCTION |

7 | |||

| 4.1 Leasehold Improvements by Landlord |

7 | |||

| 4.2 Moving Allowance |

8 | |||

| 4.3 Alterations by Tenant |

9 | |||

| ARTICLE V—LANDLORD’S OBLIGATIONS AND RIGHTS |

9 | |||

| 5.1 Services Furnished by Landlord |

9 | |||

| 5.2 Repairs and Maintenance |

10 | |||

| 5.3 Quiet Enjoyment |

10 | |||

| 5.4 Insurance |

10 | |||

| 5.5 Access to Premises |

10 | |||

| 5.6 Right to Cease Providing Services |

10 | |||

| 5.7 Failure to Provide Services and Repairs |

11 | |||

| ARTICLE VI—TENANT’S COVENANTS |

11 | |||

| 6.1 Repair and Yield Up |

11 | |||

| 6.2 Use |

11 | |||

| 6.3 Assignment; Sublease |

12 | |||

| 6.4 Indemnity; Assumption of Risk |

14 | |||

| 6.5 Tenant’s Insurance |

14 | |||

| 6.6 Right of Entry |

15 | |||

| 6.7 Payment of Taxes |

15 | |||

| 6.8 Environmental Compliance |

15 | |||

| ARTICLE VII—DEFAULT |

16 | |||

| 7.1 Events of Default |

16 | |||

| 7.2 Damages |

16 | |||

| ARTICLE VIII—CASUALTY AND EMINENT DOMAIN |

17 | |||

| 8.1 Termination or Restoration; Rent Adjustment |

17 | |||

| 8.2 Eminent Domain Damages |

18 | |||

| 8.3 Temporary Taking |

18 | |||

| ARTICLE IX—RIGHTS OF PARTIES HOLDING PRIOR INTERESTS |

18 | |||

| 9.1 Lease Subordinate - Superior |

18 | |||

| 9.2 Rights of Mortgagee to Cure |

19 | |||

| ARTICLE X—MISCELLANEOUS |

19 | |||

| 10.1 Representations by Tenant |

19 | |||

| 10.2 Notices |

19 | |||

| 10.3 No Waiver or Oral Modification |

19 | |||

| 10.4 Partial Invalidity |

20 | |||

| 10.5 Certain Landlord Remedies |

20 | |||

| 10.6 Tenant’s Estoppel Certificate |

20 | |||

| 10.7 Waiver of Subrogation |

20 | |||

| 10.8 All Agreements; No Representations |

21 | |||

| 10.9 Brokerage |

21 | |||

| 10.10 Successors and Assigns |

21 | |||

| 10.11 Construction of Document |

21 | |||

| 10.12 Disputes Provisions |

21 | |||

| 10.13 Surrender |

21 | |||

| 10.14 Holdover |

22 | |||

| 10.15 Late Payment |

22 | |||

| 10.16 Force Majeure |

22 | |||

| 10.17 Limitation On Liability |

22 | |||

| 10.18 Submission Not An Option |

23 | |||

| 10.19 Security Deposit |

23 | |||

| 10.20 Evidence of Authority |

23 | |||

| 10.21 Relocation |

23 | |||

| 10.22 Notice of Lease |

24 | |||

| 10.23 Option to Extend |

24 |

EXHIBITS

There are attached hereto and incorporated as a part of this Lease:

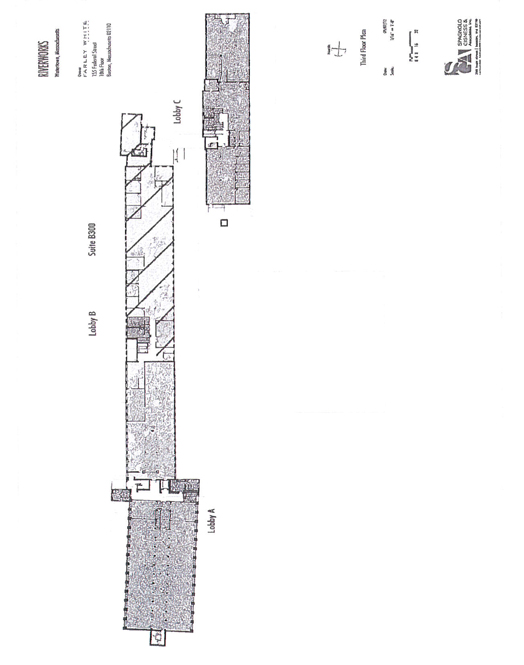

EXHIBIT A — Premises

EXHIBIT B — Leasehold Improvements

EXHIBIT C — Cleaning Services

EXHIBIT D — Rules and Regulations

ARTICLE I—DEMISING CLAUSE AND DEFINED TERMS

1.1 Demising Clause.

This lease (the “Lease”) is made and entered into by and between the Landlord and the Tenant, as defined below, as of the date of this Lease (“Effective Date”). In consideration of the mutual covenants made herein, Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, the Premises as defined below, on all of the terms and conditions set forth herein.

1.2 Defined Terms.

The terms listed below shall have the following meanings throughout this Lease:

(a) “LANDLORD”: Farley White Aetna Mills, LLC, a Massachusetts limited liability company

(b) “LANDLORD’S ADDRESS”: c/o Farley White Management Company, 155 Federal Street, 18th Floor, Boston, MA 02110

(c) “TENANT”: pSivida Corp., a Delaware corporation.

(d) “TENANT’S ADDRESS”: Prior to the Commencement Date: 400 Pleasant Street, Watertown, MA 02472. After the Commencement Date: 480 Pleasant Street, Suite B300, Watertown, MA 02472.

(e) “BUILDING”: Approximately 195,423 square foot building located on the Property at 480 Pleasant Street, Watertown, Massachusetts.

(f) “PROPERTY”: The Building and the legal parcels on which it is situated having the address of 480 Pleasant Street, 452 Pleasant Street, 5 Bridge Street, 525 Pleasant Street, 541 Pleasant Street and 76 Stanley Avenue, Watertown, Massachusetts.

(g) “PREMISES”: The portion of the Third (3rd) Floor of the Building known as Suite B300 and as shown on Exhibit A.

(h) “RENTABLE SQUARE FEET IN THE PREMISES”: Approximately 13,650 Rentable Square Feet (RSF).

(i) “TENANT’S PERCENTAGE”: 6.99% which is based on the 13,650 Rentable Square Feet (RSF) the Premises over the total RSF of the Building and shall be adjusted if the RSF of the Building shall increase or decrease. In no event shall Tenant’s Percentage be adjusted in the event of a re-measurement of the Building.

(j) “SCHEDULED COMMENCEMENT DATE”: March 1, 2014

(k) “TERM”: The period beginning on the Commencement Date (as defined in Section 2.2(a) of the Lease) and ending on the last day of the sixty-first (61st) full calendar month after the Commencement Date.

(l) “BASE RENT”:

| Month 1: |

Free Rent | |

| Months 2-13: |

$375,375.00 per annum; $31,281.25 per month, $27.50 per RSF; | |

| Months 14-25: |

$389,025.00 per annum; $32,418.75 per month; $28.50 per RSF; | |

| Months 26-37: |

$402,675.00 per annum; $33,556.25 per month; $29.50 per RSF; | |

| Months 38-49: |

$416,325.00 per annum; $34,693.75 per month; $30.50 per RSF; | |

| Months 50 and thereafter: |

$429,975.00 per annum; $35,831.25 per month; $31.50 per RSF. |

(m) “LEASE YEAR”: As used in this Lease, “Lease Year” shall mean twelve (12) one month periods with the first such Lease Year beginning on the Commencement Date, unless the Commencement Date is on a day other than the first Day of a calendar month, in which event the first Lease Year shall commence on the first day of the first calendar month after the Commencement Date, and, thereafter, on each anniversary of the first day of the first Lease Year throughout the term of this Lease and any renewals or extensions.

(n) “OPERATING EXPENSE BASE”: The actual Operating Expenses allocable to the Premises during calendar year 2014.

(o) “REAL ESTATE TAX BASE”: The actual Taxes allocable to the Premises during tax fiscal year 2014.

(p) “PERMITTED USES”: General office and research and development laboratories purposes and uses ancillary and incidental thereto.

(q) “BROKER(S)”: Cassidy Turley and Jones Lang LaSalle

(r) “SECURITY DEPOSIT”: $150,000.00 Letter of Credit due upon Lease signing, in accordance with and subject to the terms and conditions of Section 10.19 hereof.

ARTICLE II—PREMISES AND TERM

2.1 The Premises, Common Areas and Parking.

(a) Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, the Premises. The Premises leased hereby are comprised of the space shown on Exhibit A. The Premises extend from the top surface of the subfloor to the bottom surface of the ceiling, but do not include exterior faces of exterior walls and exterior window glass, anything beyond the interior face of demising walls, and pipes, ducts, conduits, wires and fixtures serving other parts of the Building; provided, however, that Tenant shall have the right to use the space, if any, between the top surface of the ceiling and the bottom surface of the floor slab of the floor above such ceiling, and to drill into the floor slab of any floor encompassed within the Premises, all for the purpose of installing ducts, cables and conduits, so long as (i) Tenant obtains the prior written consent of Landlord (which consent shall not be unreasonably withheld or delayed); and (ii) such installation does not interfere with the Building systems and with the quiet enjoyment of other tenants in the Building.

(b) Tenant shall have the right to use the Common Areas in common with other tenants. The Common Areas include the Building’s common lobbies, corridors, stairways, and elevators necessary for access to the Premises, and the common walkways and driveways necessary for access to the Building, the fitness center, the cafeteria, the common toilets, corridors and elevator lobbies of any multi-tenant floor, and the parking area for the Building. All use of the Common Areas shall be subject to the reasonable rules and regulations of Landlord generally applicable to all tenants of the Building from time to time of which Tenant has written notice.

(c) The parking areas serving the Building are located on the south and north side of Pleasant Street. Tenant shall have the right to use, free of charge, forty-eight (48) surface parking spaces on an unreserved, first-come-first-served, non-exclusive basis, of which eight (8) spaces shall be allocated to the lower lot located on the south side of Pleasant Street (“Lower Lot”) and forty (40) spaces allocated to the upper lot located on the north side of Pleasant Street (“Upper Lot”). Tenant acknowledges that the parking spaces shall be used solely for Tenant’s employees and visitors. The Lower Lot will be operated pursuant to a sticker program. Tenant may elect to have the stickers transferred to rotating employees or visitors to the Building. Landlord reserves the right from time to time to implement alternative parking access programs, including, without limitation, an access card system, to operate the Lower Lot and Upper Lot and to impose reasonable, non-discriminatory rules and regulations from time

2

to time to govern the operation of all of the parking on the Property. It is understood that Landlord shall not be responsible for policing any parking areas. Tenant shall reasonably cooperate with Landlord to assure that Tenant and its employees and visitors observe all reasonable parking regulations established by Landlord from time to time of which Tenant has written notice and to assure that Tenant and its employees and visitors do not use more parking spaces than the number of parking spaces provided to Tenant hereunder. Landlord shall not be liable to Tenant, and this Lease shall not be affected, if any parking rights of Tenant hereunder are impaired by any law, ordinance or other governmental regulation imposed after the Effective Date.

(d) Landlord reserves the right, at any time and from time to time: (i) to change the name and street address of the Building; (ii) to grant, modify and terminate easements and other encumbrances, (iii) to make such changes, alterations, additions, improvements, repairs or replacements in or to the Property (including the Premises but, with respect to the Premises, only for purposes of repairs, maintenance, replacements and other rights expressly reserved to Landlord herein) and the fixtures and equipment therein, as well as in or to the street entrances and/or the Common Areas; (iv) to designate and change from time to time areas of the Property and facilities so to be used, as it may reasonably deem necessary or desirable, provided, however, in each case, that there be no material obstruction of access to or egress from, or material interference with the Tenant’s use or enjoyment of the Premises. Landlord may at any time or from time to time construct additional improvements in all or any part of the Property, including, without limitation, adding additional buildings or changing the location or arrangement of any improvement in or on the Property or all or any part of the Common Areas, or add or deduct any land to or from the Property, including without limitation Lot C as shown on the plan entitled “Overall Layout Plan,” prepared by DeVellis Zrein Inc., dated June 16, 2011, last revised August 25, 2011; provided that there shall be no increase in Tenant’s obligations or material interference with Tenant’s rights under this Lease and that the exercise of such rights does not interfere with Tenant’s use and enjoyment of the Premises.

2.2 Term.

(a) Both parties shall be bound by all the terms of this Lease as of the Effective Date. The Term shall begin on the Commencement Date, and shall continue for the length of the Term set forth in Section 1.2 unless sooner terminated as hereinafter provided. The Commencement Date shall be the later of: 1) the Scheduled Commencement Date; or, 2) the date the Premises are Ready for Occupancy. However, if the Tenant occupies any portion of the Premises and begins conducting its business operations therefrom, the Commencement Date shall be immediate upon such occupancy. The Premises shall be Ready for Occupancy when Landlord achieves Substantial Completion of the construction of the Leasehold Improvements in accordance with the final plans and specifications pursuant to Section 4.1. Substantial Completion shall mean that the Tenant Improvement Work has been completed in accordance with Exhibit B, in accordance with the final plans and specifications approved by both Landlord and Tenant so that a certificate of occupancy can be issued, subject to minor items of repair, correction, adjustment or completion set forth in a so-called “punch list” signed by Landlord and Tenant, the incompletion of which do not and the subsequent completion of which will not, adversely affect or interfere with Tenant’s use of the Premises. Landlord will complete the punch list items within thirty (30) days after the Commencement Date.

(b) Landlord shall use reasonable efforts to have the Premises Ready for Occupancy on the Scheduled Commencement Date. As used in this Lease, Ready for Occupancy shall mean on the Commencement Date, Landlord shall deliver to Tenant the Premises with all base building mechanical, electrical, life safety and plumbing systems in good operating condition and repair, free and clear of all tenants and occupants and otherwise in the condition required by this Lease. Landlord shall use good faith, commercially reasonable efforts to obtain possession of the Premises for Tenant’s occupancy. If the Premises are not Ready for Occupancy on the Scheduled Commencement Date, Landlord shall not be subject to any liability for such failure, and such failure shall not affect the validity of this Lease, but Tenant shall not be liable for any rent until the Commencement Date. However, if the Premises are not Ready for Occupancy because Tenant has failed to comply with Tenant’s obligations under Section 4.1 or under any work letter or construction agreement between the parties, or has otherwise delayed Landlord in preparing the Premises or in obtaining a certificate of occupancy for the Premises, then the Commencement Date shall be the date that the Premises would have been Ready for Occupancy except for such Tenant-caused delay, as reasonably determined by Landlord.

3

(c) If the Premises are not Ready for Occupancy on or before May 1, 2014, Tenant shall receive a rent credit equal to the per diem rent multiplied by the number of days after May 1, 2014 until the date on which the Premises are Ready for Occupancy, except that the May 1, 2014 date shall be extended by the aggregate number of days of delays caused by force majeure and Tenant-caused delay. If the Premises are not Ready for Occupancy on or before July 15, 2014 and such failure is not due to force majeure or Tenant-caused delay, Tenant may elect to terminate this Lease upon written notice to Landlord on or before July 18, 2014.

(d) Within fifteen (15) days of the date the Commencement Date has been established, Landlord and Tenant shall confirm the Commencement Date by mutually executing a certificate of commencement in a form to be prepared by Landlord.

ARTICLE III—RENT

3.1 Base Rent.

(a) Tenant shall pay the Base Rent each month in advance on the first day of each calendar month during the Term. For any partial month at the beginning or end of the Term, Tenant shall pay a proportional share of the amount that would be due for a full month, and with respect to a partial month at the beginning of the Term, Tenant shall pay such proportional share on the Commencement Date. In addition to the Base Rent, Tenant shall pay all additional rent and rental adjustments provided herein at the times set forth herein, or if no time for payment is specified, then payment shall be made within thirty (30) days after Tenant’s receipt of an invoice from Landlord or another billing authority. All payments shall be made to Landlord at Landlord’s Address or such other place as Landlord may designate in writing, without prior demand and without abatement, deduction or offset except as may be specifically set forth herein. Tenant shall not pay, and Landlord shall not accept, any rental payment more than one month in advance. All charges to be paid by Tenant hereunder, other than Base Rent, shall be considered additional rent for the purpose of this Lease, and the words “rent” or “Rent” as used in this Lease shall mean both Base Rent and such additional rent unless the context specifically or clearly indicates that only the Base Rent is referenced.

3.2 Adjustment for Operating Expenses and Taxes.

(a) Tenant shall pay, as additional rent, Tenant’s Share of Operating Expenses and Taxes for the Property. For each calendar year, Tenant’s Share of Operating Expenses shall consist of the sum of (x) the excess of total Operating Expenses for the Property for that calendar year over the Operating Expense Base multiplied by the Tenant’s Percentage and (y) a commercially reasonable charge for the provision of services to operate the Building during periods other than 8:00 am. to 5:00 pm. on weekdays and 9:00 a.m. to 1:00 p.m. on Saturdays and to operate the Building on holidays (which are all days on which commercial banks in Boston, Massachusetts are authorized or required by law to close) (such periods being referred to herein as “Non-Business Hours”) that are fairly allocable to the Premises, if such services are requested by Tenant or are necessary, in Landlord’s reasonable judgment, for Tenant’s operations during Non-Business Hours. For each fiscal year, Tenant’s Share of Taxes shall consist of the excess of total Taxes for the Property for that fiscal year over the Real Estate Tax Base multiplied by the Tenant’s Percentage. For any partial calendar year or fiscal year at the beginning or end of the Term, Tenant’s Share of Operating Expenses and Taxes shall be adjusted proportionately for the part of the calendar year or fiscal year falling within the Term. Tenant’s Percentage may be reduced if the Property is changed or reconfigured (but not in the event the Building is re-measured), but shall in all cases not exceed the percentage that the Rentable Square Feet in the Premises bears to the total rentable square footage in the Property, calculated on a consistent basis. In addition, Tenant shall pay, as additional rent, one hundred percent (100%) of any increase in Taxes not otherwise billed to Tenant which may result from any alteration, addition or improvement to the Premises that is made by or on behalf of Tenant other than the Leasehold Improvements, but only as and to the extent it is reasonably determinable from the records of the assessing authority that such increase in Taxes are based solely upon such alteration, addition or improvement. Landlord, at its discretion, may also assess Tenant for any extraordinary item of cost or expense which may actually occur as a direct result of Tenant’s own distinct uses or activities which shall be itemized, invoiced separately, and paid by Tenant within thirty (30) days of its receipt of the invoice

(b) Before each calendar and fiscal year, Landlord shall give Tenant a reasonable estimate of the expected Operating Expenses and Taxes for the Property, and Tenant’s Share thereof, for the coming calendar year and fiscal year, respectively (excluding Landlord’s cost for services provided during Non-Business Hours), and a calculation of the estimated amount of Tenant’s Share of Expenses. Tenant shall pay one-twelfth of the estimated

4

amount of Tenant’s Share of Operating Expenses and Taxes with each monthly payment of Base Rent. Within one-hundred twenty (120) days after the end of each calendar and fiscal year, Landlord shall give Tenant a statement (the “Statement”) showing the actual Operating Expenses and Taxes for that calendar year and fiscal year, respectively, a calculation of the actual amount of Tenant’s Share of Operating Expenses and Taxes, and a summary of amounts already paid by Tenant pursuant to this Section 3.2. Such Statement shall be in line-item detail, consistently applied throughout the Term in accordance with generally accepted accounting principles consistently applied. Any underpayment by Tenant shall be made up by cash payment to Landlord within thirty (30) days after delivery of the Statement; any overpayment shall be paid to Tenant within thirty (30) days after delivery of the Statement or, at Landlord’s option, shall be credited against the next due Base Rent, provided that any overpayment shall be paid in cash to Tenant within thirty (30) days if the Term has ended. No delay by Landlord in providing any Statement shall be deemed a waiver of Tenant’s obligation to pay Tenant’s Share of Operating Expenses and Taxes.

(c) The following terms used in this Section 3.2(c) shall have the following meanings for purposes of this Lease:

(i) The term “fiscal year” with respect to Taxes means any twelve-month period commencing on July 1st and expiring on June 30th during the term.

(ii) The term “Operating Expenses” means the total necessary out-of–pocket cost of operation of the Property that under generally accepted accounting principles consistently applied would be considered normal maintenance, management and operating expenses, including, without limitation: (i) all costs of supplies, materials, equipment, and utilities used in or related to the operation, maintenance, and repair of the Property or any part thereof (other than the cost of any electricity which is to be paid for separately by Tenant pursuant to Section 3.3); (ii) all labor costs, including without limitation, salaries, wages, payroll and other taxes, unemployment insurance costs and employee benefits in connection with the on-site management, operation and maintenance of the Property or any part thereof; (iii) all maintenance, management, janitorial, legal (excluding those legal costs arising out of defaults of Landlord or other tenants in the Building), accounting, insurance, and service agreement costs related to the Property or any part thereof, including, without limitation, service contracts with independent contractors; and (iv) costs (including financing charges) of improvements to the Property that are designed to increase safety or reduce Operating Expenses or are required to comply with legal requirements imposed after the Commencement Date of the Lease, all such improvements to be amortized on a straight line basis with level payments of principal and interest (at an annual interest rate equal to 2% over the prime rate published as such in the Wall Street Journal) over the reasonable life of such improvements as determined in accordance with generally accepted accounting principles. Any of the above services may be performed by Landlord or its affiliates, provided that fees for the performance of such services shall be reasonable and competitive with fees charged by unaffiliated entities for the performance of such services in comparable buildings in the area. All Operating Expenses shall be adjusted based on the Calculation (as defined below).

“Operating Expenses” shall not include:

(a) Any ground rent;

(b) Bad debt expenses and interest, principal, points and fees on debts or amortization on any mortgage or other debt instrument encumbering the Property;

(c) Costs incurred by Landlord to the extent that Landlord is reimbursed by insurance proceeds, taking awards, or is otherwise reimbursed by third-parties;

(d) Depreciation, amortization, interest payments or capital expenditures except as expressly set forth herein;

5

(e) Marketing costs, including lease commission, attorneys’ fees (in connection with the negotiation and preparation of letters of intent, leases, subleases and/or assignments), space planning costs, and other costs and expenses incurred in connection with lease, sublease and/or assignment negotiations and transactions with present or prospective tenants or other occupants of the Property, and costs incurred with respect to the installation of tenant improvements;

(f) Expenses in connection with the enforcement of Landlord’s rights against Tenant or other tenants and occupants of the Property;

(g) Expenses in connection with services or other benefits that are not offered to Tenant or for which Tenant is charged for directly;

(h) Salaries of executives and other personnel above the grade of building, property or asset manager;

(i) Amounts paid to affiliates or subsidiaries of Landlord for goods or services at the Property, to the extent the same exceeds the costs of such goods and/or services rendered by unaffiliated third parties on a competitive basis;

(j) wages, salaries and benefits paid to any persons not directly involved with the management of the Building or the oversight thereof;

(k) costs in the nature of penalties or fines;

(l) the costs of installing, operating and maintaining a specialty improvement, including lodging or a private dining facility, or an athletic (other than maintenance and operation of the Building fitness or health center), luncheon or recreational club unless Tenant is permitted to make use of such facility without additional cost or on a subsidized basis consistent with other users, in which event only costs to the extent greater than net revenues received by Landlord from such facility shall be included;

(m) costs incurred in connection with the survey, testing, removal, encapsulation, remediation or other treatment of asbestos or any other Hazardous Materials at the Building or elsewhere;

(n) costs directly resulting from the willful misconduct of Landlord or its agents, contractor or employees;

(o) costs of repairs incurred by reason of fire (other than for any reasonable deductible) or other casualty or condemnation; and

(p) increased insurance premiums caused by Landlord or any other tenant bringing any Hazardous Materials (other than normal office and building operation materials) to the Building.

(iii) The term “Calculation” means that if the Building is less than 95% occupied in any calendar year during the Term (including, without limitation, the Base Expense years), Operating Expenses shall be calculated as though the Building had been 95% occupied, and the result shall constitute the Operating Expenses for all purposes hereunder. In addition, if during all or part of any calendar year, Landlord is not performing or furnishing any item or service to any portion of the Property (the cost of which, if performed or furnished by Landlord to such portion of the Property, would constitute a part of Operating Expenses), on account of (a) such item or service not being required or desired by a tenant, or (b) any tenant obtaining or providing such item or service itself, then, Operating Expenses shall be deemed to be increased by an amount equal to the additional costs and expenses which would reasonably have been incurred during such period by Landlord if it had performed or furnished such item or service to 100% of the Building.

(iv) The term “Taxes” means any form of assessment, rental tax, license tax, business license fee, levy, charge, tax or similar imposition, imposed by any authority having the power to tax, including any city, county, state or federal government, or any school, agricultural, lighting, library, drainage or other

6

improvement or special assessment district, as against the Property or any part thereof or any legal or equitable interest of Landlord therein, or against Landlord by virtue of its interest therein, and any reasonable costs incurred by Landlord in any proceeding for abatement thereof, including, without limitation, attorneys’ and consultants’ fees. The following shall not be included in “Taxes”: (i) Landlord’s income, franchise taxes, gift, transfer, excise, capital stock, estate, inheritance or succession taxes, and assessments for off-site improvements, (ii) penalties or interest for late payment of Taxes, and (iii) the portion of Taxes allocable to any Building capital improvements made after the Building was fully assessed as a completed and occupied unit and the Lease was signed except to the extent the additional improvements directly benefit all tenants or at least directly benefit Tenant. Landlord shall reimburse Tenant for Tenant’s Share of any Tax abatements received by Landlord less legal, appraisal and other fees and expenses incurred by Landlord in obtaining such abatement.

(v) As to any assessments payable in installments, Tenant shall only pay its Percentage of installments allocable to the Lease Term. Landlord shall elect to pay such assessments in the maximum number of installments permitted by law.

Provided that Tenant shall have first paid all of amounts due and payable by Tenant pursuant to this Article III and upon written notice of Tenant within 60 days of the receipt of a final certificate (but not more than once with respect to any calendar year), Tenant may cause Landlord’s books and records to be audited with respect to operating costs applicable to the Building for such calendar year. The audit shall be performed within 30 days of Landlord’s receipt of notice by a certified public accountant, not to be compensated on a contingent fee basis, selected by Tenant at Tenant’s sole cost and expense and at a mutually agreeable time and place where the books and records are customarily kept by the Landlord (or property manager) in the ordinary course. During such time of audit Tenant shall pay its full share of operating expenses. If it is determined that there are any amounts owed Tenant or Landlord as a result of said audit, such amount shall be reimbursed to the other within 30 days of said audit results. If the audit reveals an overstatement of operating costs of 5% or more, Landlord shall reimburse Tenant for its out-of-pocket costs of the audit. Tenant shall keep the results of any such audit confidential and shall not disclose the results of such inspection nor the content of such books and records with any third party other than Tenant’s consultants and attorneys. Failure of Tenant to provide Landlord with a written request to review such books and records in a timely manner pursuant to this Article 3 with respect to each calendar year shall be deemed a waiver of Tenant’s rights hereunder with respect to such calendar year.

3.3 Tenant’s Electricity.

With respect to electricity for heating, ventilation, air conditioning, lighting and equipment in the Premises, Tenant agrees to pay all charges therefor. As part of the Leasehold Improvements described in Section 4.1, Landlord shall cause a submeter to be installed, at Landlord’s cost, whereupon Tenant shall pay to Landlord, as additional rent, the cost of all electricity consumed in the Premises as shown on the submeter as and when bills are rendered by Landlord. Tenant agrees that it will not allow its demand requirements to adversely affect the Building’s electrical system.

ARTICLE IV—CONSTRUCTION

4.1 Leasehold Improvements by Landlord.

(a) Prior to the delivery of the Premises to Tenant, Landlord shall cause to be designed and constructed at its own expense the improvements (“Leasehold Improvements”) to the Premises depicted and described in the plans and specifications referenced in the attached Exhibit B. All work shall be performed in a good and workmanlike manner using building standard materials and finishes as set forth on Exhibit B. Once installed, the Leasehold Improvements shall be part of the Premises and the sole property of Landlord. Except as set forth herein, Landlord shall have no obligation to improve the Premises.

(b) Tenant may request reasonable changes to the preliminary plans provided, however, that no such changes shall require or cause a structural change in the Building, render the Premises or the Building in violation of applicable laws, or materially change the size or configuration of the Premises. Tenant shall pay any additional costs required to implement any such changes, including without limitation, architectural fees and construction cost

7

increases (including costs of delay) plus a fee equal to five percent (5%) of such costs; Tenant shall pay Landlord for such costs as additional rent within fifteen (15) days after written notice from Landlord of the amount due. Any requests by Tenant for changes in the final plans shall constitute an agreement by Tenant to any delay in completion of the Leasehold Improvements caused by reviewing, processing, and implementing such changes; any such delay shall be deemed a delay caused by Tenant for purposes of calculating the Commencement Date under Section 2.2(b).

(c) Landlord shall not be required to furnish professional interior design services to Tenant and shall not be required to pay for professional interior design services engaged by Tenant. Further, Tenant’s interior furnishings, i.e., specification, supply and installation of furniture, furnishings, telephones, and moveable equipment, shall be the sole responsibility of Tenant. Tenant may access the Premises prior to the date on which the Premises are Ready for Occupancy in order to install Tenant’s furniture, furnishings, telephones and movable equipment, in coordination with Landlord’s contractor. All of the Tenant’s installation of interior furnishings and equipment shall be coordinated with any work being performed by Landlord in the Premises or elsewhere in the Building in such manner as to maintain harmonious labor relations and not damage the Building or the Premises or interfere with Building operations.

(d) If Landlord’s contractor is delayed in completion of the Leasehold Improvements as a result of Tenant-caused delays as described in Section 2.2(b) of the Lease, then Tenant shall be responsible for and shall pay to Landlord upon completion of the Leasehold Improvements as additional rent the reasonable additional supervisory and general conditions out-of-pocket costs incurred by Landlord.

4.2 Alterations by Tenant.

(a) Tenant shall not make any alterations, decorations, additions, installations, substitutes or improvements (hereinafter collectively called “Alterations”) in and to the Premises, without first obtaining Landlord’s written consent, which consent shall not be unreasonably withheld, conditioned or delayed. No Alteration shall violate the Certificate of Occupancy for the Premises or any applicable law, code or ordinance, or the terms of any superior lease or mortgage affecting the Property, affect the exterior appearance of the Building, adversely affect the value or structure of the Building, require excessive removal expenses, adversely affect any other part of the Building, adversely affect the mechanical, electrical, sanitary or other service systems of the Building, or involve the installation of any materials subject to any liens or conditional sales contracts (the “Approval Review Matters”). Tenant shall pay Landlord’s reasonable out-of-pocket costs of reviewing or inspecting any proposed Alterations. Notwithstanding anything to the contrary contained in this Lease, Landlord’s consent shall not be required with respect to interior, non-structural Alterations costing less than $25,000.00 in each instance, provided the same do not impact any building electrical, plumbing or mechanical systems.

(b) All work on any Alterations shall be done at reasonable times in a first-class workmanlike manner, by contractors reasonably approved by Landlord, according to plans and specifications reasonably approved by Landlord. All work shall be done in compliance with all applicable laws, regulations, and rules of any government agency with jurisdiction, and with all regulations of the Board of Fire Underwriters or any similar insurance body or bodies. Tenant shall be solely responsible for the effect of any Alterations on the Building’s structure and systems, whether or not Landlord has consented to the Alterations, and shall reimburse Landlord within fifteen (15) days of demand for any costs incurred by Landlord by reason of any faulty work done by Tenant or its contractors. Upon completion of any Alterations, Tenant shall provide Landlord with a complete set of “as-built” plans, if applicable for the Alterations in question.

(c) Tenant shall use its best efforts to keep the Property and Tenant’s leasehold interest therein free of any liens or claims of liens arising from acts or omissions of Tenant, or its subtenants, contractors or others claiming by, through or under Tenant, and shall discharge or bond any such liens within thirty (30) days of their filing. Before commencement of any work, upon Landlord’s request, Tenant’s contractor shall provide any payment, performance and lien indemnity bond reasonably required by Landlord. Tenant shall provide evidence of such insurance as Landlord may reasonably require, naming Landlord as an additional insured. Tenant shall indemnify Landlord and hold it harmless from and against any cost, claim, or liability arising from any work done by or at the direction of Tenant. All work shall be done so as to minimize interference with other tenants and with Landlord’s operation of the Building or other construction work being done by Landlord. Landlord may post any notices it considers necessary to protect it from responsibility or liability for any Alterations, and Tenant shall give sufficient notice to Landlord to permit such posting.

8

(d) All Alterations affixed to the Premises shall become part thereof and remain therein at the end of the Term. However, if Landlord gives Tenant a notice, at the time Tenant requests Landlord’s consent to any Alteration, that such Alteration must be removed upon the expiration or earlier termination of this Lease, Tenant shall do so and shall pay the cost of removal and any repair required by such removal. Notwithstanding anything in this Lease to the contrary, Landlord shall not require Tenant to remove (i) any Alterations, fixtures or equipment in the Premises as of the Commencement Date, (ii) standard office fit-up or (iii) any other tenant improvements not involving materially increased demolition costs. All of Tenant’s personal property, trade fixtures, equipment, furniture, movable partitions, and any Alterations not affixed to the Premises shall remain Tenant’s property, removable at any time. If Tenant fails to remove any such materials at the end of the Term, Landlord may do so and store them at Tenant’s expense, without liability to Tenant, and may sell them at public or private sale and apply the proceeds to any amounts due hereunder, including costs of removal, storage and sale.

ARTICLE V—LANDLORD’S OBLIGATIONS AND RIGHTS

5.1 Services Furnished by Landlord.

(a) Landlord shall furnish services, utilities, facilities and supplies equal in quality to those customarily provided by landlords in high quality office buildings of a similar design in the general Watertown area. Such services, facilities and supplies shall include the services described in subsection 5.1(b) and 5.1(c) and Section 5.2 and the following: (i) cleaning services for Building Common Areas and the Premises as described in Exhibit C, (ii) rubbish removal, (iii) window cleaning, (iv) restroom supplies, (v) sewer and water service to the Building’s restrooms, (vi) landscape maintenance, (vii) snow removal for walks, driveways and parking areas, (viii) maintenance of plantings in interior Common Areas, (ix) Building security, (x) elevator service from the existing elevator, and (xi) such other services, utilities, facilities and supplies as may be deemed necessary in Landlord’s reasonable judgment.

(b) Subject to the provisions of this subsection 5.1(b), Landlord shall furnish space heating and cooling as normal seasonal changes may require to provide reasonably comfortable space temperature and ventilation for occupants of the Premises under normal business operation. However, Tenant acknowledges that if the operation of its business in the Premises requires additional cooling, then it is solely Tenant’s responsibility to install and maintain the additional cooling equipment following the procedures set forth in Section 4.2(b).

Landlord shall furnish space heating and cooling during normal business hours of Monday through Friday from 8:00 a.m. to 5:00 p.m. and, upon Tenant’s request received prior to 2:00 p.m. on the immediately preceding business day, on Saturday from 9:00 a.m. to 1:00 p.m., without additional cost to Tenant. If Tenant requests space heating and cooling beyond the aforementioned times, Landlord shall assess a commercially reasonable charge for the provision of such services consistent with the rates Landlord charges other tenants in the Building. If more than one tenant directly benefits from these services then the cost shall be allocated proportionately between or among the benefiting tenants based upon the amount of time each tenant benefits and the square footage each lease.

(c) Subject to the provisions of Section 3.3, Landlord shall provide electric power for lighting and office machine use under normal business operation. Tenant’s use of electrical energy in the Premises shall not at any time exceed the capacity of any of the electrical conductors or equipment in or otherwise serving the Premises. In order to ensure that such capacity is not exceeded and to avert possible adverse effect upon the Building electric service, Tenant shall not, without prior consent of Landlord in each instance (which consent shall not be unreasonably withheld or delayed), make any alteration or addition to the electric system of the Premises.

(d) Landlord shall furnish, at Tenant’s expense, reasonable additional Building operation services which are usual and customary in similar office buildings in the general Watertown area upon reasonable advance request of Tenant at reasonable and equitable rates from time to time established by Landlord; such charges, if any, shall be considered to be additional rent.

9

(e) Landlord shall provide and install, at Landlord’s expense with respect to the first such installation and at Tenant’s expense with respect to any subsequent installation, letters or numerals on the door to the Premises and in the lobby directory of the Building and on directories on the Property to identify Tenant’s name, the name of entities affiliated with Tenant, the Building address, and letters in the lobby directory to identify a reasonable number of names of Tenant’s executives; all such letters and numerals shall be in the building standard graphics and no others shall be used or permitted on the Premises.

5.2 Repairs and Maintenance.

Landlord shall repair and maintain the Common Areas and structural portions of the Building and the basic plumbing, electrical, mechanical and heating, ventilating and air-conditioning systems therein and life safety systems, except for damage resulting from a casualty or an eminent domain taking, which shall be governed by Article VIII. Landlord shall make the repairs and replacements to maintain the Building in a condition comparable to other similar class office buildings in the Watertown area. Subject to Section 10.7, if any maintenance, repair or replacement is required because of any act, omission or neglect of duty by Tenant or its agents, employees, invitees or contractors, the cost thereof shall be paid by Tenant to Landlord as additional rent within thirty (30) days after billing therefor.

5.3 Quiet Enjoyment.

Upon Tenant’s paying the rent and performing its other obligations after notice to Tenant and expiration of applicable grace and cure periods, Landlord shall permit Tenant to peacefully and quietly hold and enjoy the Premises, subject to the provisions hereof.

5.4 Insurance.

Landlord shall insure the Property, including the Building and the Leasehold Improvements, against damage by fire and standard extended coverage perils, including “all-risks” coverage, and shall carry commercial general liability insurance all in such reasonable amounts with such reasonable deductibles as would be carried by a prudent owner of a similar building in the area. Landlord may carry any other forms of insurance as it or its mortgagee may deem advisable. Tenant shall have no right to any proceeds from such policies. Landlord shall not carry any insurance on any of Tenant’s property, and shall not be obligated to repair or replace any of it.

5.5 Access to Premises.

Landlord shall have reasonable access to the Premises to inspect Tenant’s performance hereunder and to perform any acts required of or permitted to Landlord herein. Landlord shall at all times have a key or access card to the Premises, and Tenant shall not install any additional lock without Landlord’s consent. Any entry into the Premises by Landlord, under this section or any other section of this Lease permitting such entry, shall be on reasonable advance notice, shall be done so as not to unreasonably interfere with Tenant’s use of the Premises, and shall be accompanied by a representative of Tenant if Tenant so requests; provided, however, that such restrictions shall not apply to any situation that Landlord in good faith believes to be an emergency.

Subject to reasonable security procedures that Landlord may institute from time to time to prevent unauthorized access to the Building, Tenant shall have access to the Premises, twenty-four (24) hours per day, seven (7) days per week.

5.6 Right to Cease Providing Services.

In connection with any repairs, alterations or additions to the Property or the Premises, or any other acts required of or permitted to Landlord herein, Landlord may, if necessary, reduce or suspend service of the Building’s utilities and mechanical systems, or any of the other services, facilities or supplies required to be provided by Landlord hereunder, provided that Landlord shall use best efforts to restore such services, facilities or supplies as soon as possible, and provided further that Landlord shall give Tenant advance notice of such reduction or suspension if such reduction or suspension is planned in advance or if it is reasonably possible for Landlord to do so.

10

In addition, Landlord may reduce or suspend such services, facilities or supplies in case of Force Majeure, as defined below. No such reduction or suspension permitted by this Section 5.6 shall constitute an actual or constructive eviction or disturbance of Tenant’s use or possession of the Premises, or an ejection of Tenant from the Premises, or a breach by Landlord of any of its obligations, and no such reduction or suspension shall render Landlord liable for any damages, including but not limited to any damages, compensation or claims arising from any interruption or cessation of Tenant’s business, or entitle Tenant to be relieved from any of its obligations under this Lease, or result in any abatement or reduction of rent, except as set forth in Section 5.7.

5.7 Failure to Provide Services and Repairs.

Notwithstanding anything to the contrary contained in this Lease, if any essential services (such as HVAC, electricity, water, passenger elevators if necessary for reasonable access to the Premises, etc.) supplied by Landlord are interrupted rendering a material portion of the Premises untenantable, or if a material portion of the Premises are rendered untenantable in whole or in part as a result of actions of or a default by Landlord, a constructive eviction, contamination of the Premises, Building or Property, and such untenantability does not result from the negligence or willful misconduct of Tenant, its employees, contractors, or agents, Tenant shall be entitled to an equitable abatement of Base Rent and additional rent beginning ten (10) days after the day on which Tenant notifies Landlord that a material portion of the Premises are rendered untenantable in whole or in part. The abatement shall end when tenantability is restored and Tenant is able to use the entire Premises to conduct its business operations therein. During any such untenantability, Landlord shall use commercially reasonable efforts to restore the services and render the entire Premises tenantable. Landlord shall not be in default or liable for any failure to perform any act or obligation or provide any service required hereunder unless Tenant shall have given notice of such failure, and such failure continues for at least thirty (30) days thereafter; provided, however, that if the nature of Landlord’s obligation is such that more than thirty (30) days are required for its performance, then Landlord shall not be liable or in default if it commences such performance within thirty (30) days and thereafter diligently pursues such performance to completion. Tenant hereby waives any right under any law, ordinance, regulation or judicial decision to make repairs or provide maintenance or perform any of Landlord’s other obligations hereunder at Landlord’s expense.

ARTICLE VI—TENANT’S COVENANTS

6.1 Repair and Yield Up.

Tenant shall keep the Premises in the same order and condition as delivered to Tenant on the Commencement Date, reasonable wear and tear, and damage by fire, other casualty, and/or taking excepted, and subject to Section 10.7, shall promptly repair any damage to the Premises or the rest of the Property caused by the negligence or willful misconduct of Tenant or its agents, employees, or invitees, licensees or independent contractors. Landlord may require such repair to be done by a contractor reasonably designated by Landlord at Tenant’s cost, provided that costs to be charged to Tenant are reasonable and competitive. At the end of the Term, Tenant shall peaceably yield up the Premises in the same order, repair and condition, as it is required to maintain during the Lease Term, reasonable wear and tear, and damage by fire, other casualty, and/or taking excepted. Tenant shall remove its own property and (if required by Landlord, which requirement Landlord shall notify Tenant of at the time Landlord consents to any proposed Alterations by Tenant) any Alterations, repairing any damage caused by such removal and restoring the Premises and leaving them clean and neat. Nothing herein shall require Tenant to remove the Leasehold Improvements. Tenant shall not cut Tenant’s telecommunications cables and wiring or remove Tenant’s telecommunication patch panel and shall label all telephone and data cable terminals accordingly.

6.2 Use.

(a) Tenant shall use the Premises only for the Permitted Uses, and shall not use or permit the Premises to be used for any other purpose. Tenant shall not use or occupy the Premises in violation of: (i) any recorded covenants, conditions and restrictions affecting the Property of which Tenant has been given written notice by Landlord (Landlord hereby representing that there are no such covenants, conditions or restrictions currently on record which will affect Tenant’s use of the Premises for the Permitted Uses), provided that such covenants, conditions and restrictions do not increase Tenant’s obligations or decrease Tenant’s rights under this Lease, (ii) any

11

law or ordinance or any Certificate of Occupancy issued for the Building or the Premises, or (iii) any reasonable Rules and Regulations of uniform application of which Tenant has notice issued by Landlord for the Building and attached hereto as Exhibit D. In the event of any conflict between the Rules and Regulations and this Lease this Lease shall control. Tenant shall comply with any directive of any governmental authority with respect to Tenant’s particular manner of use or occupancy of the Premises (as opposed to general office uses or the common areas for which Landlord shall be responsible). Tenant shall not do or permit anything in or about the Premises which will in any way damage the Premises, obstruct or interfere with the rights of other tenants or occupants of the Building, or injure them, or use the Premises or allow them to be used for any unlawful purpose. Tenant shall not cause, maintain or permit any nuisance in, on or about the Premises, or commit or allow any waste in or upon the Premises. Notwithstanding anything to the contrary contained in this Lease, Tenant shall not be responsible for ensuring the Premises complies with law when (i) a notice of violation or order was issued prior to the date Tenant is given possession of the Premises or (ii) such legal requirements require investigating, certifying, monitoring, encapsulating, removing or in any way dealing with asbestos or hazardous substances unless such asbestos or hazardous substances were introduced into the Premises by Tenant.

(b) Tenant shall not obstruct any of the Common Areas or any portion of the Property outside the Premises, and shall not place or permit any signs (other than those permitted under Section 5.1(e)), curtains, blinds, shades, awnings, aerials or flagpoles, or the like, visible from outside the Premises.

(c) Tenant shall keep the Premises equipped with all safety appliances required by law because of any particular manner of use made by Tenant other than office use with customary office equipment, and shall procure all licenses and permits required because of such use. This provision shall not broaden the Permitted Uses.

(d) Tenant shall not place a load upon the floor of the Premises exceeding 100 pounds per square foot. Partitions shall be considered as part of the load. Landlord may reasonably prescribe the weight and position of all safes, files and heavy equipment that Tenant desires to place in the Premises, so as properly to distribute their weight. Tenant’s business machines and mechanical equipment shall be installed and maintained so as not to transmit noise or vibration to the Building structure or to any other space in the Building. Tenant shall be responsible for the cost of all structural engineering required to determine structural load and all acoustical engineering required to address any noise or vibration caused by Tenant.

(e) Tenant shall not have vending machines on the Property without the prior written consent of Landlord.

(f) Tenant shall not keep or use any article in the Premises, or permit any activity therein, which is prohibited by a standard insurance policy covering buildings and improvements similar to the Building and Leasehold Improvements, or would result in an increase in the premiums thereunder unless Tenant pays for such increase. In determining whether increased premiums are a result of Tenant’s activity, a schedule issued by the organization computing the insurance rate on the Building or the Leasehold Improvements, showing the various components of the rate, shall be conclusive evidence. Tenant shall promptly comply with all reasonable requirements of the insurance authority or of any insurer relating to the Premises. If the use or occupation of the Premises by Tenant or by anyone Tenant allows on the Premises causes or threatens cancellation or reduction of any insurance carried by Landlord, Tenant shall remedy the condition immediately upon notice thereof. Upon Tenant’s failure to do so, Landlord may, in addition to any other remedy it has under this Lease but subject to the provisions of Section 5.5, enter the Premises and remedy the condition, at Tenant’s cost, which Tenant shall promptly pay as additional rent. Landlord shall not be liable for any damage or injury caused as a result of such an entry, and shall not waive its rights to declare a default because of Tenant’s failure.

6.3 Assignment; Sublease.

(a) Tenant shall not assign, mortgage, pledge or otherwise transfer this Lease or make any sublease of the Premises, or permit occupancy of any part thereof by anyone other than Tenant (any such act being referred to herein as a “Transfer” and the other party with whom Tenant undertakes such act being referred to herein as a “Transferee”) without the prior written consent of Landlord, which consent shall not be unreasonably withheld or delayed, subject to the other provisions of this Section 6.3. Any Transfer or attempted Transfer not in compliance with all of the terms and conditions set forth in this Section 6.3 shall be void, and shall be a default under this Lease.

12

(b) Any request by Tenant for Landlord’s consent to a Transfer shall include the name of the proposed Transferee, the nature of its business and proposed use of the Premises, reasonable information as to its financial condition, and the terms and conditions of the proposed Transfer. Tenant shall supply such additional information about the proposed Transfer and Transferee as the Landlord reasonably requests. It shall be reasonable for Landlord to refuse consent to any Transfer to any governmental agency, or to any other Transferee who by reputation or expected use is not comparable to other types of tenants in the Building, or to any transferee whose financial strength is not at least equivalent to that of Tenant at the time of the Transfer, or to any Transferee that is an existing tenant in the Building or a prospective tenant with whom Landlord has been in discussions in the preceding six (6) months.

(c) Any Transfer shall specifically make applicable to the Transferee all of the provisions of this Section so that Landlord shall have against the Transferee all rights with respect to any further Transfer which are set forth herein. No Transfer shall affect the continuing primary liability of Tenant (which shall be joint and several with Transferee). Consent to a Transfer in a specific instance shall not be deemed consent to any subsequent Transfer or a waiver of the requirement of consent to any future Transfer. No assignment shall be binding upon Landlord or any of Landlord’s mortgagees, unless Tenant shall deliver to Landlord a recordable instrument containing a covenant of assumption by the Transferee running to Landlord and all persons claiming by, through or under Landlord. The Transferee’s failure to execute such instrument shall not, however, release or discharge Transferee from its liability as a Transferee hereunder. Tenant shall not enter into any Transfer that provides for rental or other payment based on the net income or profits derived from the Premises. With respect to any Transfer, Landlord shall be entitled to receive fifty percent (50%) of all “Bonus Rent,” which Bonus Rent shall be payable by Tenant to Landlord on a monthly basis. For purposes of this Lease, Bonus Rent shall mean all amounts received by Tenant in excess of the Base Rent and additional rent reserved in this Lease and applicable to the space Transferred for the period of the Transfer, minus Tenant’s reasonable expenses in connection with such Transfer for brokerage commissions, legal fees, advertising expenses, improvement allowances, free rent, Alterations and other rental concessions for the benefit of the Transferee.

(d) Notwithstanding any contrary provision of this Section 6.3, in connection with any intent to Transfer, Landlord shall have an option to cancel and terminate this Lease if the request is to assign the Lease or to sublet all of the Premises; or, if the request is to sublet a portion of the Premises only, to cancel and terminate this Lease with respect to such portion for the proposed term of such sublease or for the balance of the Term if, within fifteen (15) days after Landlord receives written notice from Tenant that Tenant intends to make space available for a Transfer, Landlord notifies Tenant that it has elected to exercise such option. Landlord may exercise said option in writing within fifteen (15) days after Landlord’s receipt from Tenant of such request, and in each case such cancellation or termination shall occur as of the date set forth in Landlord’s notice of exercise of such option, which shall not be less than sixty (60) days nor more than one hundred twenty (120) days following the giving of such notice. If Landlord exercises Landlord’s option to cancel this Lease or any portion thereof, Tenant shall surrender possession of the Premises, or the portion thereof which is the subject of the option, as the case may be, on the date set forth in such notice in accordance with the provisions of this Lease relating to surrender of the Premises at the expiration of the Term. If this Lease is cancelled as to a portion of the Premises only, Base Rent after the date of cancellation shall be abated on a pro rata basis, and Tenant’s Percentage. If Landlord does not exercise Landlord’s option to cancel this Lease or any portion thereof pursuant to the foregoing provisions, Landlord’s consent to a Transfer shall continue to be required in accordance with the other provisions of this Section 6.3.

(e) Any agreement by which Tenant agrees to enter into or execute any Transfer at the direction of any other party, or assigns its rights in the income arising from any Transfer to any other party, shall itself constitute a Transfer hereunder. If Tenant is a corporation, partnership, or other business organization, the transfer of ownership interests, whether in one transaction or a series, forming a majority of the equity interests in Tenant, shall constitute a Transfer, unless Tenant is a corporation whose stock is traded on an exchange or over the counter.

(f) Notwithstanding any contrary provision of this Lease, Tenant shall have no right to assign this Lease or sublet all or any portion of the Premises and any such assignment or sublease shall be void unless on (i) the date on which Tenant notifies Landlord of its intention to enter into any assignment or sublease or (ii) the date on which such assignment or sublease is to take effect, Tenant is not in default of any of its obligations under this Lease after notice to Tenant and expiration of applicable grace and cure periods.

13

(g) Notwithstanding anything to the contrary contained in this Lease, Tenant may assign this Lease or sublet all or a portion of the Premises without Landlord’s consent, any right of recapture by Landlord or any sharing of any consideration with Landlord to an entity into or with which Tenant is merged or consolidated or to which substantially all of Tenant’s assets or stock or membership interests are transferred or to any entity which controls, is controlled by or is under common control with Tenant.

6.4 Indemnity; Assumption of Risk.

(a) Tenant, at its expense, shall defend (with counsel satisfactory to Landlord), indemnify and hold harmless Landlord and its agents, employees, invitees, licensees and contractors from and against any cost, claim, action, liability or damage of any kind arising from any bodily injury, death or property damage to the extent arising from (i) Tenant’s use and occupancy of the Premises or any activity done or permitted by Tenant in, on, or about the Premises, (ii) the destruction of or damage to Tenant’s personal property, (iii) any Event of Default by Tenant of its obligations under this Lease, or (iv) any negligent, tortious or illegal act or omission or willful misconduct of Tenant, its agents, employees, invitees, licensees or contractors, provided that such cost, claim, action, liability or damage is not caused by the negligence or willful misconduct of Landlord or its agents, employees, invitees, licensees and contractors (except as otherwise provided in the last sentence of subsection 6.5(a)).

(b) As a material consideration to Landlord for executing this Lease, Tenant assumes all risk of damage or injury to any person or property in, on, or about the Premises from any cause including, without limitation, injury or damage which may be sustained by the person or property of Tenant, its employees, invitees, or any other person in or about the Premises, caused by or resulting from fire, steam, electricity, gas, water or rain which may leak or flow from or into any part of the Premises, or from the breakage, leakage, obstruction, or other defects of pipes, sprinklers, wires, appliances, plumbing, air-conditioning or lighting fixtures, whether such damage or injury results from conditions arising upon the Premises, any other portion of the Property, or other sources, provided that such damage or injury is not caused by the negligence or willful misconduct of Landlord or its agents, employees, invitees, licensees and contractors (except as otherwise provided in the last sentence of subsection 6.5(a)). Landlord shall not be liable to Tenant or any other person or entity for any damages arising from any act or omission of any other tenant of the Building.

6.5 Tenant’s Insurance.

(a) Tenant shall maintain the following insurance at its own expense throughout the Term: (i) Property insurance including standard fire and extended coverage insurance, vandalism and malicious mischief endorsements, and “all-risks” coverage upon all property owned by Tenant and located in the Building, in the full replacement cost thereof; (ii) Commercial General Liability Insurance against any liability arising out of the use, occupancy or maintenance of the Premises or the Property, which insurance may be by a blanket insurance policy and shall provide the following coverages and endorsements: personal injury, broad form property damage, automobile (by separate policy, if necessary), premises/operations, additional insured landlord endorsement and broad form contractual liability, in limits not less than One Million Dollars ($1,000,000.00) per occurrence and Three Million Dollars ($3,000,000) in the aggregate, with a deductible not to exceed Ten Thousand Dollars ($10,000.00); (iii) any other forms of insurance as Landlord may reasonably require from time to time in form, in amounts and for insurance risks against which a prudent tenant would protect itself in similar facilities in the general area of the Premises. Tenant acknowledges and agrees that such property owned by Tenant shall be at the sole risk and hazard of Tenant, and if the whole or any part thereof shall be destroyed or damaged by fire, water or otherwise, or by the leakage or bursting of water pipes, steam pipes, or other pipes, by theft or from any other cause, no part of said loss or damage is to be charged to or be borne by Landlord regardless of any fault of Landlord.

(b) All policies shall (i) be taken out with insurers reasonably acceptable to Landlord, in form reasonably satisfactory to Landlord, (ii) include Landlord and any mortgagee of Landlord as additional insureds, as their interests may appear, and (iii) contain a provision that any coverage afforded thereby shall be primary and noncontributing with respect to any insurance carried by Landlord, and any insurance carried by Landlord shall be excess and non-contributing. Landlord may upon thirty (30) days’ notice to Tenant require an increase of the limits of the policies carried by Tenant if Landlord reasonably deems such limits to be inadequate when compared to the then existing customary insurance practice in the area. Tenant shall provide certificates of insurance in form reasonably satisfactory to Landlord before the Commencement Date, and shall provide certificates evidencing

14

renewal at least ten (10) days before the expiration of any such policy. All policies shall contain an endorsement requiring at least thirty (30) days’ prior written notice to Landlord and any mortgagee of Landlord prior to any material change, reduction, cancellation or other termination.

(c) Upon termination of this Lease pursuant to any casualty, Tenant shall retain any proceeds attributable to Tenant’s personal property, trade fixtures, movable partitions, equipment and Alterations not affixed to the Premises, but Tenant shall immediately pay to Landlord any insurance proceeds received by Tenant relating to any Alterations affixed to the Premises unless Landlord has required their removal, which removal requirement Landlord shall convey to Tenant when Tenant requests Landlord’s consent to such Alterations.

6.6 Right of Entry.

Subject to the provisions of Section 5.5 hereof, Tenant shall permit Landlord and its agents to examine the Premises at reasonable times and to make any repairs or replacements Landlord deems reasonably necessary; to remove, at Tenant’s expense, after reasonable written notice to Tenant (except in the case of an emergency in which no notice shall be required), any Alterations, signs, curtains, blinds or the like not consented to by Landlord; and to show the Premises to prospective tenants during the last nine (9) months of the Term and to prospective purchasers and mortgagees at all times.

6.7 Payment of Taxes.

Tenant shall pay before delinquency all taxes levied against Tenant’s personal property or trade fixtures in the Premises and any Alterations installed by or on behalf of Tenant. If any such taxes are levied against Landlord or its property, or if the assessed value of the Premises is increased by the inclusion of a value placed on Tenant’s property, Landlord may pay such taxes, and Tenant shall upon demand repay to Landlord the portion of such taxes resulting from such increase. Tenant may bring suit against the taxing authority to recover the amount of any such taxes, and Landlord shall cooperate therein. The records of the City Assessor shall determine the assessed valuation, if available and sufficiently detailed. If not so available or detailed, the actual cost of construction shall be used.

6.8 Environmental Compliance.

Tenant shall not cause any hazardous or toxic wastes, hazardous or toxic substances or hazardous or toxic materials (collectively, “Hazardous Materials”) to be used, generated, stored or disposed of on, under or about, or transported to or from, the Premises (collectively, “Hazardous Materials Activities”) without first receiving Landlord’s written consent, which may be withheld for any reason and revoked at any time. If Landlord consents to any such Hazardous Materials Activities, Tenant shall conduct them in strict compliance (at Tenant’s expense) with all applicable Regulations, as hereinafter defined, and using all necessary and appropriate precautions. Landlord shall not be liable to Tenant for any Hazardous Materials Activities by Tenant, Tenant’s employees, agents, contractors, licensees or invitees, whether or not consented to by Landlord. Tenant shall indemnify, defend with counsel acceptable to Landlord and hold Landlord harmless from and against any claims, damages, costs and liabilities arising out of Tenant’s Hazardous Materials Activities. For purposes hereof, Hazardous Materials shall include but not be limited to substances defined as “hazardous substances,” “toxic substances,” or “hazardous wastes” in the federal Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended; the federal Hazardous Materials Transportation Act, as amended; and the federal Resource Conservation and Recovery Act, as amended (“RCRA”); those substances defined as “hazardous wastes” in the Massachusetts Hazardous Waste Facility Siting Act, as amended (Massachusetts General Laws Chapter 21D); those substances defined as “hazardous materials” or “oil” in Massachusetts General Laws Chapter 21E, as amended; and as such substances are defined in any regulations adopted and publications promulgated pursuant to said laws (collectively, “Regulations”). Prior to using, storing or maintaining any Hazardous Materials on or about the Premises, Tenant shall provide Landlord with a list of the types and quantities thereof, and shall update such list as necessary for continued accuracy. Tenant shall also provide Landlord with a copy of any Hazardous Materials inventory statement required by any applicable Regulations, and any update filed in accordance with any applicable Regulations. If Tenant’s activities violate or create a risk of violation of any Regulations, Tenant shall cease such activities immediately upon notice from Landlord. Tenant shall immediately notify Landlord both by telephone and in writing of any spill or unauthorized discharge of Hazardous Materials or of any condition constituting an imminent hazard under any Regulations. Landlord, Landlord’s representatives and employees may enter the

15

Premises at any time during the Term after prior notice to inspect Tenant’s compliance herewith, and may disclose any violation of any Regulations to any governmental agency with jurisdiction. Nothing herein shall prohibit Tenant from using minimal quantities of cleaning fluid and office supplies which may constitute Hazardous Materials but which are customarily present in premises devoted to office use, provided that such use is in compliance with all applicable laws and subject to all of the other provisions of this Section 6.8.

ARTICLE VII—DEFAULT

7.1 Events of Default.

(a) The occurrence of any one or more of the following events (each, an “Event of Default”) shall constitute a default hereunder by Tenant:

(i) The failure by Tenant to make any payment of Base Rent or additional rent or any other payment required hereunder, as and when due, where such failure shall continue for a period of five (5) business days after written notice thereof from Landlord to Tenant.

(ii) (Intentionally omitted).

(iii) The failure by Tenant to observe or perform any of the express or implied covenants or provisions of this Lease to be observed or performed by Tenant, other than as specified in clauses (i) and (ii) above, where such failure shall continue for a period of more than thirty (30) days after written notice thereof from Landlord to Tenant; provided, however, that if the nature of Tenant’s default is such that more than thirty (30) days are reasonably required for its cure, then Tenant shall not be deemed to be in default if Tenant shall commence such cure within said thirty-day period and thereafter diligently prosecute such cure to completion, which completion shall occur not later than ninety (90) days from the date of such notice from Landlord.

(iv) The failure by Tenant or any guarantor of any of Tenant’s obligations under this Lease to pay its debts as they become due, or Tenant or any such guarantor becoming insolvent, filing or having filed against it a petition under any chapter of the United States Bankruptcy Code, 11 U.S.C. Section 101 et seq. (or any similar petition under any insolvency law of any jurisdiction), proposing any dissolution, liquidation, composition, financial reorganization or recapitalization with creditors, making an assignment or trust mortgage for the benefit of creditors, or if a receiver, trustee, custodian or similar agent is appointed or takes possession with respect to any property or business of Tenant or such guarantor.

(b) In the event of any such default by Tenant, whether or not the Term shall have begun, in addition to any other remedies available to Landlord at law or in equity, Landlord shall have the immediate option, or the option at any time while such default exists and without further notice, to terminate this Lease and all rights of Tenant hereunder by notice to Tenant; and this Lease shall thereupon come to an end as fully and completely as if the date such notice is given were the date herein originally fixed for the expiration of the Term, and Tenant shall then quit and surrender the Premises to Landlord, but Tenant shall remain liable as hereinafter provided.

7.2 Damages.

(a) In the event that this Lease is terminated under any of the provisions contained in Section 7.1 or shall be otherwise terminated for breach of any obligation of Tenant, Tenant covenants to pay forthwith to Landlord, as compensation, the excess of the total rent reserved for the residue of the Term over the rental value of the Premises for said residue of the Term. In calculating the rent reserved there shall be included, in addition to the Base Rent and all additional rent, the value of all other considerations agreed to be paid or performed by Tenant for said residue. Tenant further covenants as an additional and cumulative obligation after any such termination to pay punctually to Landlord all the sums and perform all the obligations which Tenant covenants in this Lease to pay and to perform in the same manner and to the same extent and at the same time as if this Lease had not been terminated. In calculating the amounts to be paid by Tenant under the immediately preceding covenant Tenant shall be credited with any amount paid to Landlord as compensation as in this Section 7.2 provided and also with the net proceeds of

16