Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OCEANFIRST FINANCIAL CORP | d627789d8k.htm |

NASDAQ: OCFC

1

OceanFirst Financial Corp.

OceanFirst Financial Corp.

INVESTOR PRESENTATION

INVESTOR PRESENTATION

NOVEMBER/DECEMBER

NOVEMBER/DECEMBER

2013

2013

Exhibit 99.1 |

NASDAQ: OCFC

2

OceanFirst Financial Corp.

OceanFirst Financial Corp.

Forward Looking Statements:

This

presentation

contains

certain

forward-looking

statements

within

the

meaning

of

the

Private

Securities

Reform

Act

of

1995

which

are

based

on

certain

assumptions

and

describe

future

plans,

strategies

and

expectations

of

the

Company.

These

forward-looking

statements

are

generally

identified

by

use

of

the

words

"believe,"

"expect,"

"intend,"

"anticipate,"

"estimate,"

"project,"

"will,"

"should,"

"may,"

"view,"

"opportunity,"

"potential,"

or

similar

expressions

or

expressions

of

confidence.

The

Company's

ability

to

predict

results

or

the

actual

effect

of

future

plans

or

strategies

is

inherently

uncertain.

Factors

which

could

have

a

material

adverse

effect

on

the

operations

of

the

Company

and

its

subsidiaries

include,

but

are

not

limited

to,

changes

in

interest

rates,

general

economic

conditions,

levels

of

unemployment

in

the

Bank’s

lending

area,

real

estate

market

values

in

the

Bank’s

lending

area,

the

level

of

prepayments

on

loans

and

mortgage-backed

securities,

legislative/regulatory

changes,

monetary

and

fiscal

policies

of

the

U.S.

Government

including

policies

of

the

U.S.

Treasury

and

the

Board

of

Governors

of

the

Federal

Reserve

System,

the

quality

or

composition

of

the

loan

or

investment

portfolios,

demand

for

loan

products,

deposit

flows,

competition,

demand

for

financial

services

in

the

Company's

market

area

and

accounting

principles

and

guidelines.

These

risks

and

uncertainties

are

further

discussed

in

the

Company’s

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2012

and

should

be

considered

in

evaluating

forward-looking

statements

and

undue

reliance

should

not

be

placed

on

such

statements.

The

Company

does

not

undertake

-

and

specifically

disclaims

any

obligation

-

to

publicly

release

the

result

of

any

revisions

which

may

be

made

to

any

forward-looking

statements

to

reflect

events

or

circumstances

after

the

date

of

such

statements

or

to

reflect

the

occurrence

of

anticipated

or

unanticipated

events. |

NASDAQ: OCFC

3

111 Years of Growth and Capital Management

111 Years of Growth and Capital Management

Founded

in

Point

Pleasant,

NJ,

in

1902,

OceanFirst

has

grown

from

a

small

one-town

savings

and

loan

to

a

full-service

community

bank

serving

the

Central

New

Jersey

shore.

Rebuilt

capital

from

6.05%

to

9.57%

through

the

Great

Recession

with

retained

earnings

and

completion

of

a

follow-on

common

stock

offering

in

November

2009.

Demutualized

in

1996

and

over

the

ensuing

11

years

generated

value

for

shareholders,

largely

through

the

successful

implementation

and

execution

of

our

community

bank

model,

and

the

strategic

repurchase

of

62.4%

of

original

IPO

shares.

Since

late

2011

utilized

share

repurchases

to

again

strategically

redeploy

surplus

capital

until

growth

prospects

improved.

Under

the

current

authorization,

301,766

shares

remain

available

for

repurchase. |

NASDAQ: OCFC

4

Community Bank serving the Central

Jersey Shore -

$2.3 billion in assets and

25 branch offices

Two

branches

(

)

to

be

consolidated into local offices in 4Q

Market Cap $315.2 million

Core deposits –

88.0%

of total deposits

Locally

originated

loan

portfolio

-

no

SNCs

Residential and commercial

mortgages

Consumer equity loans and lines

C&I loans and lines

Corporate Profile

Corporate Profile

Note: See Appendix 1 for Market Demographic information.

!

(

Ocean

Burlington

Morris

Sussex

Atlantic

Salem

Warren

Monmouth

Hunterdon

Cumberland

Bergen

Mercer

Somerset

Middlesex

Gloucester

Camden

Passaic

Cape May

Essex

Union

Hudson

Philadelphia

New York |

NASDAQ: OCFC

5

Experienced Executive Management Team

Experienced Executive Management Team

OceanFirst Bank ESOP 10.5%

Directors & Senior Executive Officers 9.7% (CEO 5.7%)

Director and Proxy Officer Stock Ownership Guidelines

OceanFirst Foundation 7.1%

As of the March 12, 2013 proxy

record date.

Name

Position

# of Years in

Banking

# of Years

at OCFC

John R. Garbarino

Chairman, Chief Executive Officer

42

42

Christopher D. Maher

President, Chief Operating Officer

25

-

Michael J. Fitzpatrick

Executive Vice President, Chief Financial Officer

31

20

Joseph R. Iantosca

*Executive Vice President, Chief Administrative Officer

35

9

Joseph J. Lebel III

*Executive Vice President, Chief Lending Officer

29

7

Substantial insider ownership of 27.3% –

aligned with shareholders’

interests

Succession planning refreshed in 2013 –

new President recruited

and 2 new

Executive Vice Presidents promoted* |

NASDAQ: OCFC

6

Our Strategy

Our Strategy

Positioned as the leading Community Bank in attractive Central Jersey

Shore market –

growing revenue and creating additional value for our

shareholders

Strategically focused on revenue growth in commercial lending, trust

and asset management, and Bankcard services

Guarding credit quality in ALL business cycles

Growing diversified streams of non-interest income to decrease

reliance on Net Interest Margin (NIM)

On the watch for roll-up opportunities presented by local “regulatory

fatigued”

community banks |

NASDAQ: OCFC

7

Significant Primary Market Deposit Share

Significant Primary Market Deposit Share

Competing Favorably Against Banking Behemoths

June 30, 2013

# of

Dep. In Mkt.

Mkt. Shr.

Rank

Institution

Branches

($000)

(%)

Ocean County, NJ

1

TD Bank, National Association (Canada)

21

2,460,349

16.88

2

Hudson City Bancorp Inc. (NJ)

(1)

14

2,415,792

16.57

3

Wells Fargo Bank NA (CA)

26

2,315,657

15.89

4

OceanFirst Financial Corp. (NJ)

20

1,488,197

10.21

5

Banco Santander S.A. (Spain)

23

1,438,132

9.87

6

Bank of America Corp. (NC)

17

1,292,963

8.87

Total For Institutions In Market

192

14,577,615

Source: FDIC Summary of Deposits

(1)

Pending acquisition by M&T Bank (NY) |

NASDAQ: OCFC

8

Strategic Deposit Composition Transition

Strategic Deposit Composition Transition |

NASDAQ: OCFC

9

Strategic Loan Composition Transition

Strategic Loan Composition Transition |

NASDAQ: OCFC

10

Earnings per share of $0.29 –

9.2% ROE

Net interest margin stabilized at 3.20%, from 3.21% in linked quarter

Grew commercial loan portfolio by $18.5 million, 13.6% annualized

Credit quality improving with NPL’s decreasing $4.3 million

Strong capital position –

tangible common equity of 9.4% of assets

Returning Excess Capital –

533,018 shares repurchased YTD

Announced fourth quarter consolidation of two branches and restructure

of FHLB Advances

Highlights –

Highlights –

Third Quarter 2013

Third Quarter 2013 |

NASDAQ: OCFC

11

Stabilized NPL’s in a Diversified Portfolio

Stabilized NPL’s in a Diversified Portfolio

Data as of December 31, unless otherwise noted.

(1)

Increase attributable to Superstorm Sandy.

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

2009

2010

2011

2012

9/30/2013

Residential

Consumer

Commercial Real Estate and Construction

Commercial

Exposure Primarily in Lower Risk Residential

$2.7M

Sandy Impact

(1) |

NASDAQ: OCFC

12

Prudently Provisioning for Credit Costs

Prudently Provisioning for Credit Costs

$0

$1

$2

$3

$4

$5

$6

$7

$8

$9

$10

Recoveries

Residential & Consumer C/O's

Commercial C/O's

Provision for Loan Losses

(1)

Spike in charge-offs was due to a change in charge-off policy to recognize

the charge-off when the loan is deemed uncollectible rather than when

the foreclosure process is complete. The additional charge-off relating to the change in

policy through 2011 was $5.7 million, all of which had been previously

specifically reserved. (2)

Increase attributable to Superstorm Sandy.

$1.8M

Sandy

Provision

(2)

12/31/09

12/31/10

12/31/11

(1)

12/31/12

9/30/13

(Annualized) |

NASDAQ: OCFC

13

Net Interest Margin

Net Interest Margin

Stabilizing at Historical Levels

2013 Quarterly

Trend

Historical Average Net Interest Margin (3.28%) |

NASDAQ: OCFC

14

Diversified Streams of Non-Interest Income

Diversified Streams of Non-Interest Income

2011

0.00%

0.10%

0.20%

0.30%

0.40%

0.50%

0.60%

0.70%

0.80%

0.90%

1996

9/30/13 (Annualized)

Fees and Service Charges

Gain on Sale of Loans

BOLI

Other

BankCard Services

Investment Services

Trust

Non-Interest Income excludes gain/loss from other real estate operations, gain

on sale of equity securities and provision for repurchased loans.

$2.5M

$18.3M

Targeted

Growth

Areas |

NASDAQ: OCFC

15

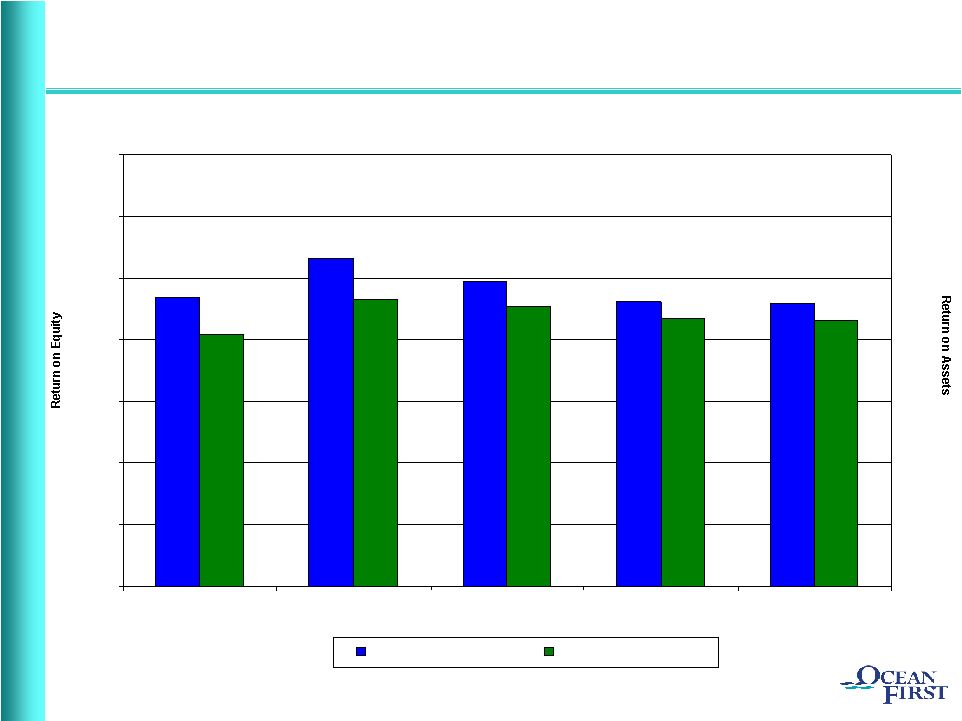

Generating Consistent Attractive Returns

Generating Consistent Attractive Returns

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

2009

2010

2011

2012

9/30/13

(Annualized)

Return on Equity

Return on Assets

0.0%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40% |

NASDAQ: OCFC

16

Challenge Today is to Grow Revenue

Challenge Today is to Grow Revenue

Build Shareholder Value

Build Shareholder Value

Target growth within existing market –

increasing share

Continuing Strategic Execution

Initiated a restructure of $159 million in FHLB Advances in Q4, incurring a charge

of $0.16 per share to improve Net Interest Margin and reduce sensitivity to

further rate increases Rationalizing Branch Network

Expanded presence in Monmouth County with opening of Red Bank Financial Solutions

Center 14 Denovos since 2000; opportunity for additional growth

Consolidating two overlapping branches in Q4; reinvesting cost savings to support

revenue growth Opportunity to meet extraordinary loan demand from Superstorm

Sandy recovery Growing and diversifying non-interest income streams;

reducing reliance on NIM Assessing opportunistic roll-up of local

community banks Strategic share repurchases safely deploy surplus capital in

the short term

Financial performance develops value proposition for shareholders and preserves

the right to remain independent |

NASDAQ: OCFC

17

(1)

Peers include: DCOM, FFIC, FLIC, HVB, LBAI, ORIT, PGC, RCKB, SNBC, SUBK, UVSP

and WSFS Note:Financial data as of the most recent period available; market

data as of November 8, 2013. Source: Sandler O’Neill.

Peer Valuation Metrics

Peer Valuation Metrics

OCFC

Peers

(1)

Valuation

Price / Tang. Book Value

147%

147%

Price / LQA EPS

15.6x

16.4x

Price / Estimated EPS

17.7x

17.2x

Cash Dividend Yield

2.6%

2.6% |

NASDAQ: OCFC

18

Why OCFC…?

Why OCFC…?

Fundamental franchise value –

superior market demographics

Crisis tested management team

Sandy response and experience

Substantial

insider

ownership

–

aligned

with

shareholders’

interests

Succession

planning

refreshed

–

2013

Attractive deposit mix and market share

Conservative credit culture and profile

Solid financial performance –

developing shareholder value

Strong balance sheet and capital base

Strategic restructuring in Q4; reinvesting cost savings in support of revenue

growth |

NASDAQ: OCFC

19

THANK YOU

THANK YOU

FOR YOUR INTEREST IN

FOR YOUR INTEREST IN

OCEANFIRST FINANCIAL CORP.

OCEANFIRST FINANCIAL CORP. |

NASDAQ: OCFC

20

Market Demographics

Market Demographics

APPENDIX 1

Ocean

Monmouth

Middlesex

New Jersey

National

Number of Offices

20

5

1

% of OceanFirst Deposits

86.6

10.3

3.1

Market Rank

4

18

36

Market Share (%)

10.2

0.9

0.2

Population

577,000

635,000

816,000

Projected 2012-2017

Population Growth (%)

1.6

1.0

2.1

1.2

3.5

Median Household Income ($)

59,000

81,000

77,000

67,000

50,000

Projected 2012-2017 Median

Household Income Growth (%)

22.6

14.0

13.1

18.9

13.4

Deposit data as of June 30, 2013.

Demographic data as of December 31, 2012.

Source: SNL Financial |

NASDAQ: OCFC

21

One-to-Four Family (1-4)

Average size of mortgage loans

$189,000

Interest-only loans

$33.0 million

- % of total 1-4 family loans

4.2%

- Weighted average loan-to-value ratio

(using original or most recent appraisal) 61%

Stated income loans

$40.4 million

- % of total 1-4 family

loans 5.1%

Portfolio weighted average loan-to-value ratio (using original or most recent appraisal)

56%

- Originated for the nine months ended September

30, 2013 61%

Portfolio average FICO score

748

- Loans originated for the nine months ended

September 30, 2013 764

% of loans outside the New York/New Jersey market

4.3%

% of loans outside Ocean/Monmouth Counties

32.0%

% of loans exceeding agency conforming amounts

44.3%

% of loans for second homes

7.8%

APPENDIX 2

Residential Portfolio Metrics

Residential Portfolio Metrics

As of September 30, 2013, unless

otherwise noted. |

NASDAQ: OCFC

22

APPENDIX 2

(Cont’d)

Commercial Portfolio Metrics

Commercial Portfolio Metrics

As of September 30, 2013.

(1)

Combined commercial relationships total 389.

Commercial Real Estate (CRE)

Total portfolio

(1)

$497.5 million

Average size of CRE loans

$797,000

Largest CRE loan

$16.0 million

(Secured by local university dormitory housing)

Current Pipeline

$33.6 million

Weighted Average Yield

3.93%

Weighted Average Repricing Term

4.2 years

Commercial Loans

Total portfolio

(1)

$65.6 million

Average size of commercial loan

$266,000

Largest commercial loan

$4.4 million

Current Pipeline

$4.8 million

Weighted Average Yield

4.21%

Weighted Average Repricing Term

1.6 years

|

NASDAQ: OCFC

23

Commercial Portfolio Segmentation

Commercial Portfolio Segmentation

Total Commercial Loan Exposure

by Industry Classification

Real Estate Investment by

Property Classification

As of September 30, 2013.

APPENDIX 2

(Cont’d)

Diversified portfolio provides

protection against industry-

specific credit events. |

NASDAQ: OCFC

24

Impact of Superstorm Sandy

Impact of Superstorm Sandy

APPENDIX 3

Residential Loan Portfolio:

March 31, 2013

June 30, 2013

September 30, 2013

Loan Status:

Balance

Balance

Borrowers

Balance

Total loans impacted

$ 30.1

$ 30.1

124

$ 30.1

Loans repaid or brought current

(19.4)

(24.0)

110

(26.9)

Less Borrower performing on repayment plan

(4.5)

-

-

-

Remaining delinquencies

$ 6.2

$ 6.1

14

$ 3.2

Using conservative assumptions, specific impairments total $471,000 at September

30, 2013. These impairments are covered by a year-end

provision

of

$1.8

million

related

to

the

adverse

impact

of

Sandy

and

expectation

of

increasing

levels

of

non-performing

loans

in

the

recovery

period.

Commercial Loan Portfolio:

No commercial credit issues

attributable to Superstorm Sandy.

All commercial borrowers have demonstrated an ability to meet obligations.

CONSERVATIVE CREDIT UNDERWRITING AND ACTIVE PORTFOLIO

MANAGEMENT COMBINED TO PROTECT THE BALANCE SHEET FROM

THE IMPACT OF A MEGA-STORM |