Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NTELOS HOLDINGS CORP. | d627380d8k.htm |

NASDAQ: NTLS

INVESTOR PRESENTATION

November 13, 2013

Exhibit 99.1 |

Presentation of Financial and Other Important Information

2

NASDAQ: NTLS

USE OF NON-GAAP FINANCIAL MEASURES

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Included in this presentation are certain non-GAAP financial measures that are not determined in

accordance with US generally accepted accounting principles (“GAAP”). These financial

performance measures are not indicative of cash provided or used by operating activities and exclude the effects of certain operating,

capital and financing costs and may differ from comparable information provided by other companies,

and they should not be considered in isolation, as an alternative to, or more meaningful than

measures of financial performance determined in accordance with US generally accepted accounting principles. These

financial performance measures are commonly used in the industry and are presented because NTELOS

believes they provide relevant and useful information to investors. NTELOS utilizes these

financial performance measures to assess its ability to meet future capital expenditure and working capital requirements, to incur

indebtedness if necessary, and to fund continued growth. NTELOS also uses these financial

performance measures to evaluate the performance of its business, for budget planning purposes

and as factors in its employee compensation programs. Adjusted EBITDA is defined as net income attributable to NTELOS Holdings

Corp. before interest, income taxes, depreciation and amortization, accretion of asset retirement

obligations, gain/loss on derivatives, net income attributable to non-controlling

interests, other expenses/income, equity based compensation charges, business separation charges, gain/loss on sale of assets and net loss from

discontinued operations and costs related to the separation of the wireless and wireline companies.

Please review the reconciliations and other definitions of non- GAAP financial measures

contained in the press releases filed by the Company with the SEC, including those filed on Form 8-K on November 8, 2012, February

28, 2013, May 7, 2013, July 30, 2013 and November 5, 2013.

Any statements contained in this presentation that are not statements of historical fact, including

statements about our beliefs and expectations, are forward- looking statements and should be

evaluated as such. The words “anticipates,” “believes,” “expects,” “intends,” “plans,” “estimates,” “targets,” “projects,” “should,”

“may,” “will” and similar words and expressions are intended to identify

forward-looking statements. Such forward-looking statements reflect, among other things,

our current expectations, plans and strategies, and anticipated financial results, all of which are

subject to known and unknown risks, uncertainties and factors that may cause our actual results

to differ materially from those expressed or implied by these forward-looking statements. Many of these risks are beyond our ability to

control or predict. Because of these risks, uncertainties and assumptions, you should not place undue

reliance on these forward-looking statements. Furthermore, forward-looking statements

speak only as of the date they are made. We do not undertake any obligation to update or review any forward-looking information,

whether as a result of new information, future events or otherwise. Important factors with

respect to any such forward-looking statements, including certain risks and uncertainties

that could cause actual results to differ from those contained in the forward-looking statements, include, but are not limited to: our ability to

attract and retain retail subscribers to our services; our dependence on our strategic relationship

with Sprint Corporation (“Sprint”); a potential increase in roaming rates and

wireless handset subsidy costs; rapid development and intense competition in the telecommunications industry; our ability to finance, design, construct

and realize the benefits of any planned network technology upgrade; our ability to acquire or gain

access to additional spectrum; the potential to experience a high rate of customer turnover;

the potential for Sprint and others to build networks in our markets; cash and capital requirements; operating and financial restrictions

imposed by our senior credit facility; adverse economic conditions; federal and state regulatory fees,

requirements and developments; loss of ability to use our current cell sites; our continued

reliance on indirect channels of retail distribution; our reliance on certain suppliers and vendors; and other unforeseen difficulties

that may occur. These risks and uncertainties are not intended to represent a complete list of all

risks and uncertainties inherent in our business, and should be read in conjunction with the

more detailed cautionary statements and risk factors included in our SEC filings, including our most recent Annual Report filed on

Form 10-K.

|

Company Overview

3

Leading “pure-play”

wireless carrier in mid-Atlantic region

Headquartered in Waynesboro, VA

Exclusive CDMA Network provider for Sprint in WV and Western VA

NTELOS-branded retail postpay and prepay subscribers; robust wholesale

business NASDAQ: NTLS

NASDAQ:

NTLS

–

Market

Capitalization

approximately

$461

million¹

7.9 million licensed POPs; covered POPs of 6.0 million; 457,100 subscribers

¹

As of market close 11/11/13 |

Investment Considerations

Leading “pure-play”

regional wireless company

4

Strategic asset set

Strong free cash flow

Broad geographic and network technology footprint

Experienced management team

NASDAQ: NTLS

Competitive and diversified business model |

Key

Operating Strategies 5

Elevate brand & best value in wireless position to improve quality of

subscriber base and grow market share

Enhance

customer

experience

at

all

touch

points

by

focusing

on

core

differentiators

of

Savings,

Simplicity

and

Service

to

improve

customer

satisfaction

and

reduce

subscriber

churn

Leverage disciplined network investments to expand revenues and margins

Drive Smartphone and data services penetration to increase ARPU

NASDAQ: NTLS

Manage cost structure to improve profitability |

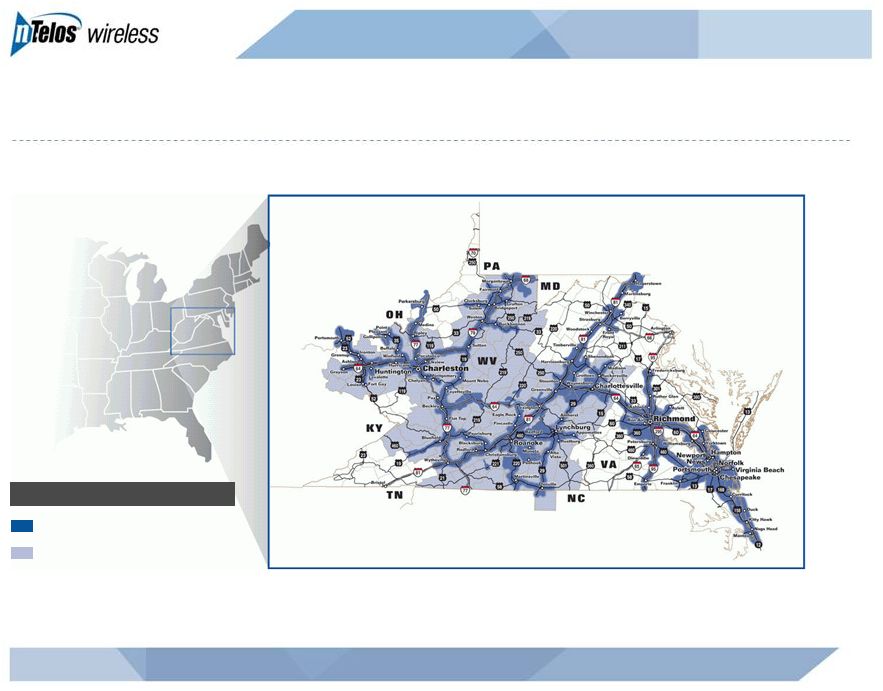

Regional Wireless Service Provider

NASDAQ: NTLS

6

Ntelos Covered Network

Sprint Wholesale Markets

STRATEGIC NETWORK ASSETS |

7

NASDAQ: NTLS

Virginia East

Leap³

US Cellular

¹Sprint’s retail business runs on NTELOS’s Network in West Virginia

and portions of Virginia ²US Cellular has network assets and retail

business within a portion of NTELOS’s footprint ³Pending

acquisition by AT&T Carriers Without Network Assets in NTELOS’s

Footprint West Virginia / Virginia West

Leap³

Sprint¹

T-Mobile

US Cellular² |

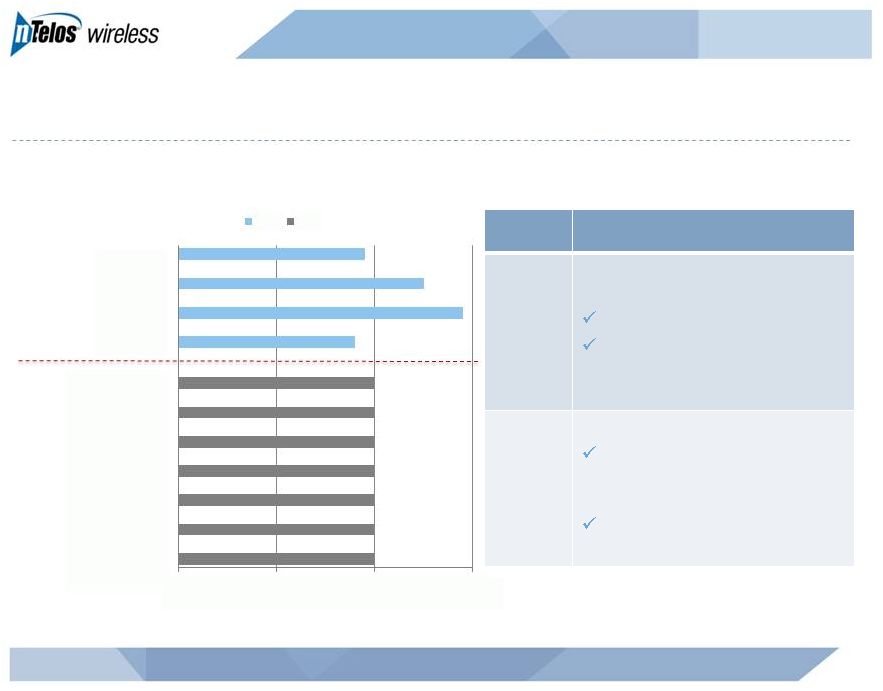

Attractive Spectrum Portfolio

8

NASDAQ: NTLS

Average Spectrum Depth in Key Markets

Band

Commentary

PCS

Average depth of 23 MHz

Scarce strategic asset

AWS

Significant spectrum

holdings in contiguous

markets in western Virginia

Currently undeployed

MHZ

3,673

2,710

1,767

1,016

Licensed POPs

(000’s)

302

200

209

216

205

278

66

0

10

20

30

Virginia East

Virginia West

West Virginia

Other

Roanoke, VA

Highland, VA

Bedford, VA

Giles, VA

Charlottesville, VA

Lynchburg, VA

Bath, VA

PCS

AWS

Source: Map Info: Custom Data, Total Population – Current Year and Five Year USA by Block

Group: United States, SO215245 |

Closing the Device Gap on Competition

9

NASDAQ: NTLS

Best

Q4 2009

Q4 2010

Q4 2013

Better

Good

LG Optimus

Plus

Motorola

Defy XT

Alcatel One

Touch Ultra

ZTE

Director

Samsung Galaxy S II

Samsung

Galaxy III

LG Optimus

Select

iPhone 4S

iPhone 5c

BlackBerry

Curve 8330

BlackBerry

Pearl Flip

8230

HTC Hero

Android

BlackBerry

Pearl

8130

HTC 6800

HTC Touch

Diamond

BlackBerry

Curve 8330

BlackBerry

Pearl Flip

8230

HTC Snap

HTC Hero

Android

BlackBerry

Tour 9630

iPhone 5s |

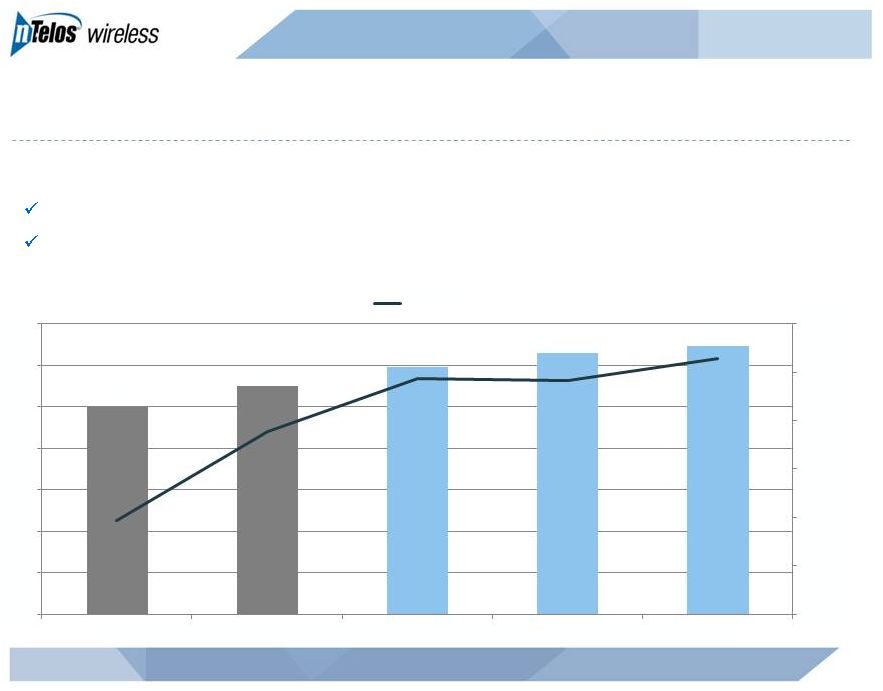

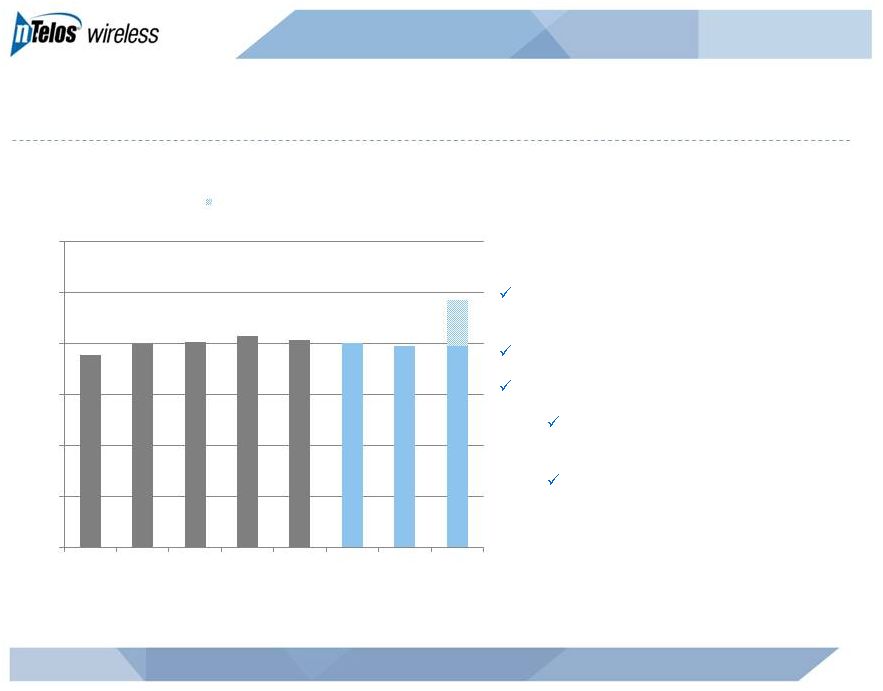

Smartphone Penetration

10

NASDAQ: NTLS

As of September 30, 2013:

69% of postpaid subscribers have a smartphone

57% of prepaid subscribers have a smartphone

Smartphone Penetration

ARPU

$49.00

$50.00

$51.00

$52.00

$53.00

$54.00

$55.00

0%

10%

20%

30%

40%

50%

60%

70%

3Q 2012

4Q 2012

1Q 2013

2Q 2013

3Q 2013

Blended ARPU

50%

55%

60%

63%

65% |

NTELOS Branding Resonating With Consumers

11

NASDAQ: NTLS

(4,000)

(2,000)

0

2,000

4,000

6,000

8,000

1Q

2010

2Q

2010

3Q

2010

4Q

2010

1Q

2011

2Q

2011

3Q

2011

4Q

2011

1Q

2012

2Q

2012

3Q

2012

4Q

2012

1Q

2013

2Q

2013

3Q

2013

Net Ports

3Q11

3Q12

3Q13

Unaided

Awareness

24%

32%

31%

Unaided

Recall

18%

28%

29%

Purchase

Consideration

12%

21%

13%

Positive net ports

vs. all other carriers

Source: Independent third-party research studies. |

Churn Remains Stable

12

NASDAQ: NTLS

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

3Q 2012

4Q 2012

1Q 2013

2Q 2013

3Q 2013

Prepaid Churn

Postpaid Churn |

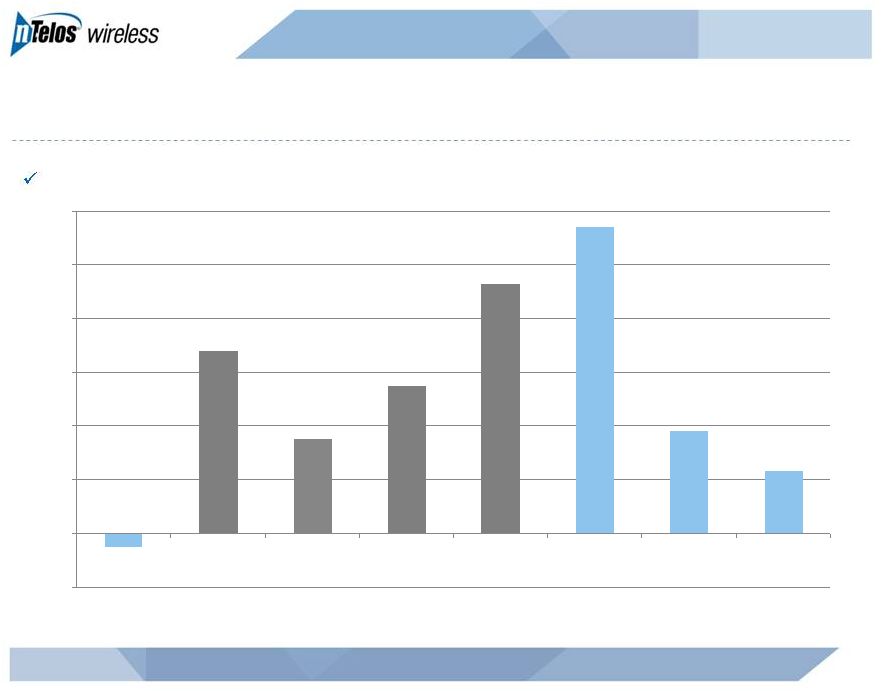

Subscribers –

Net Additions Trend (Continued)

13

NASDAQ: NTLS

Seventh consecutive quarter of positive net adds

(500)

6,800

3,500

5,500

9,300

11,400

3,800

2,300

(2,000)

0

2,000

4,000

6,000

8,000

10,000

12,000

4Q 2011

1Q 2012

2Q 2012

3Q 2012

4Q 2012

1Q 2013

2Q 2013

3Q 2013 |

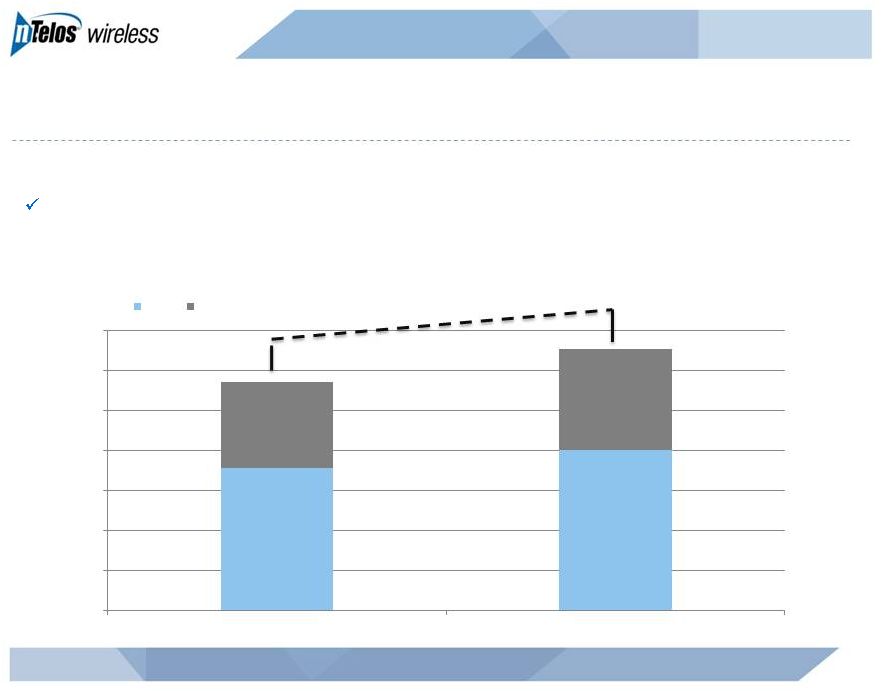

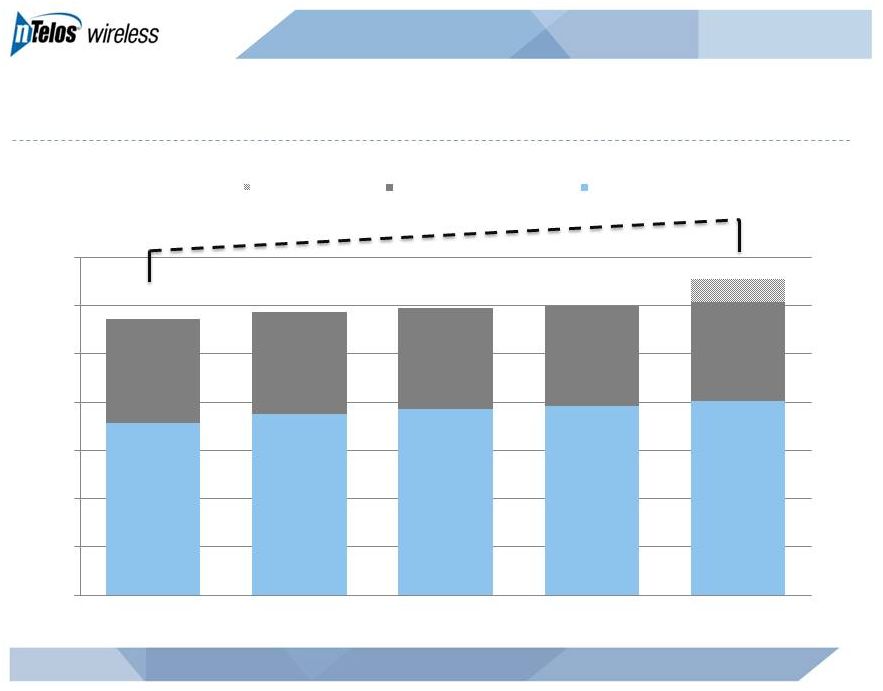

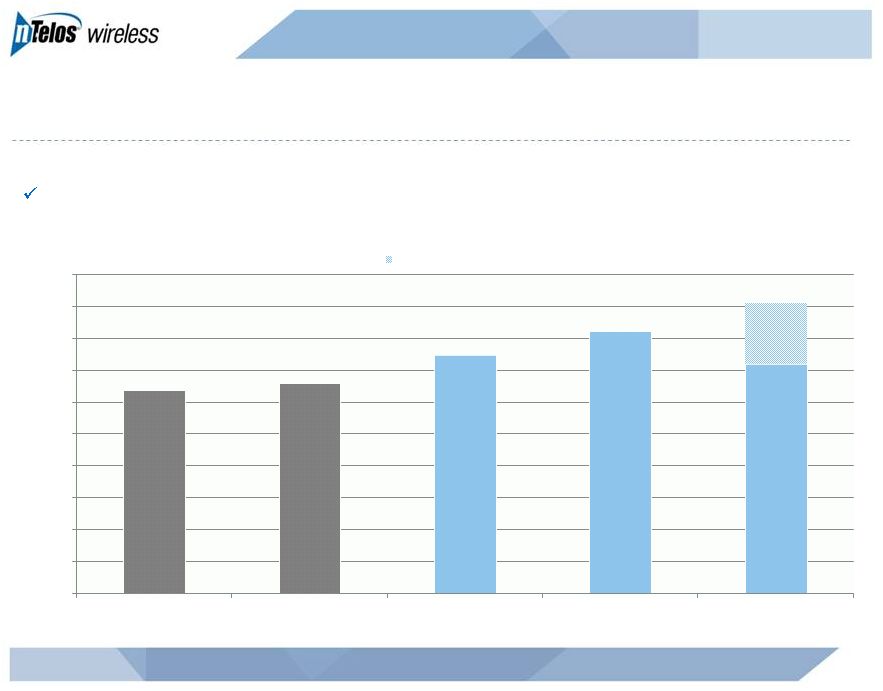

Continuing Growth in Operating Revenues

14

NASDAQ: NTLS

3Q13 revenue increased 14% from 3Q12 to $130.9 million

millions

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

3Q 2012

3Q 2013

Retail

Wholesale & Other

+14% |

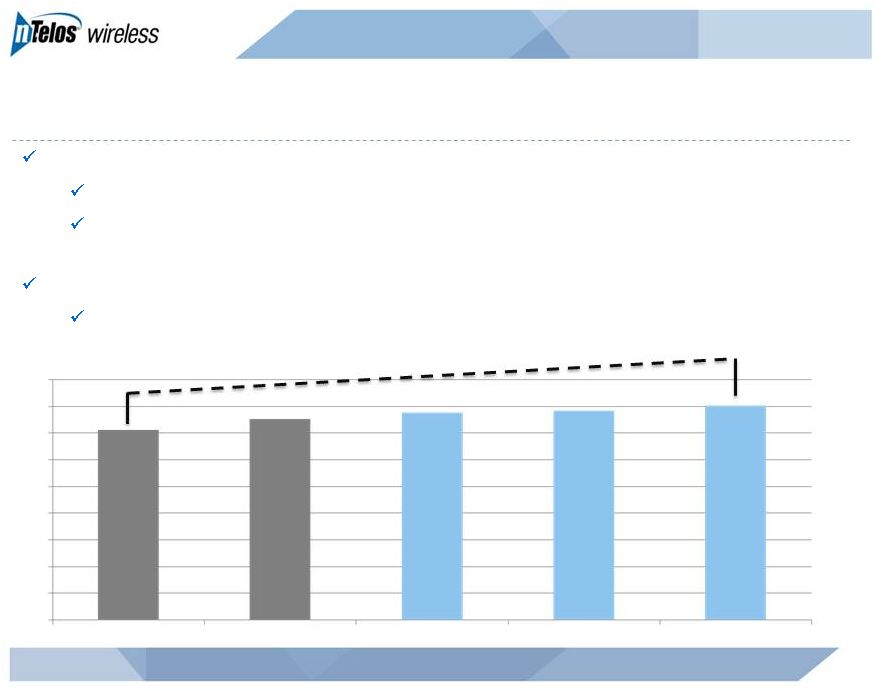

Retail Revenue Gains Continue

15

NASDAQ: NTLS

Subscriber revenue growth driven by both:

ARPU growth

Subscriber growth

2Q13 retail revenue increased 2% sequentially and 13% from 2Q12 to $78.4

million Highest level in company history

+13%

millions

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

$80.0

$90.0

3Q 2012

4Q 2012

1Q 2013

2Q 2013

3Q 2013 |

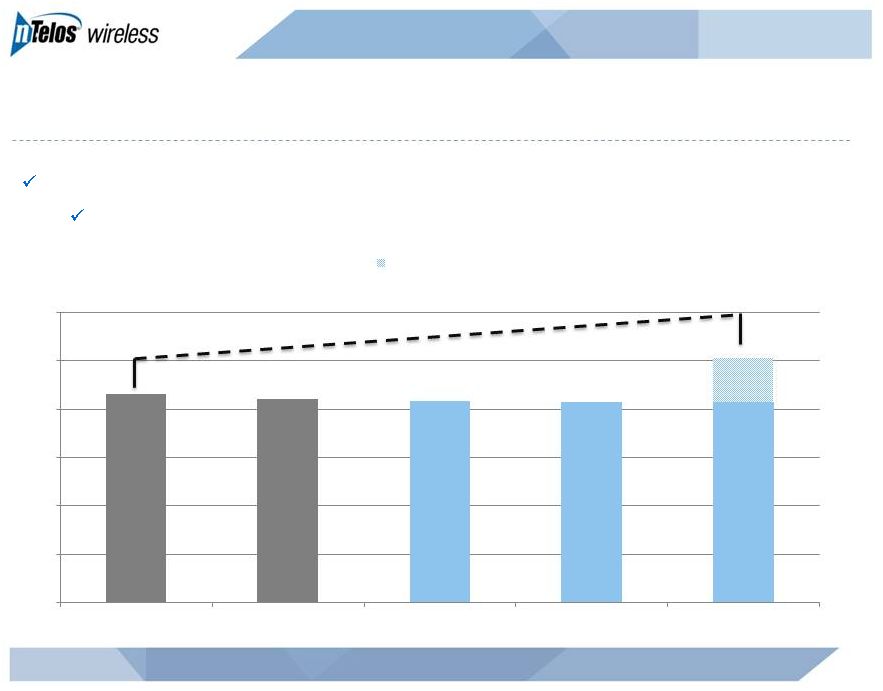

Wholesale/Other Revenue Remains Strong

16

NASDAQ: NTLS

3Q13 wholesale/other revenue increased 17% from 3Q12 to $50.6 million

Increase reflects incremental revenue recognized from SNA settlement

millions

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

3Q 2012

4Q 2012

1Q 2013

2Q 2013

3Q 2013

SNA Settlement

+17% |

Capital Investment

17

NASDAQ: NTLS

Status:

1,434 cell sites as of Sept. 30, 2013

Pending launch of first LTE markets

millions

Catalysts:

2011-2012 Cell site expansion

2013 Initial LTE deployment

$52

$58

$72

$53

$65

$0

$10

$20

$30

$40

$50

$60

$70

$80

FY 2010

FY 2011

FY 2012

YTD 2012

YTD 2013 |

Network Evolution

18

•

6.0mm covered POPs; 7.9 mm licensed

POPs

•

100% of covered POPs are served with 3G

EV-DO

Rev.

A

•

Primarily Alcatel Lucent equipment

•

1,432 cell sites deployed

•

Market level spectrum holdings ranging from

10 MHz to 50 MHz

•

PCS average depth of 23 MHz

•

AWS average depth of 20 MHz

•

Additional spectrum includes

•

Small amount of BRS

•

Opportunities for additional spectrum

and spectrum sharing being evaluated

•

Upgrade history

•

1xRTT launched in 2002

•

EV-DO Rev A launched in 2008

•

LTE Drivers

•

Serve the needs of our retail

subscribers

•

Maintain competitive position in

marketplace

•

Optimize long-term network

operating cost with new technology

•

Serve the needs of our largest

wholesale customer, Sprint

•

Deployment Plan

•

Launch of first LTE is imminent

•

Complete initial build-out by year-end

2014; 70% of covered POPs

•

Devices supporting Band Classes 2,

4 and 25

•

Estimated network CapEx of

approximately $65mm to $70mm

Current network

4G LTE upgrade plans

NASDAQ: NTLS |

Sprint Strategic Network Alliance Evolution

19

NASDAQ: NTLS

8/1999:

Agreement

with Horizon PCS

(Sprint affiliate)

10/2010:

Sprint

announces

Network Vision

8/2004:

Horizon

bankruptcy; Sprint

agreement signed

8/2007:

Amends

agreement with Sprint

10/2006:

Sprint

launches EV-DO

Rev A in San Diego

9/2012:

Sprint has 19

metropolitan areas

with 4G LTE

3/2008:

Launch

of EV-DO

11/2008:

Completes

EV-DO build

9/2013:

Settles

disputes with Sprint

and amends

agreement

1999

1999

2010

2010

2006

2006

2012

2012

2008

2008

2013

2013

2008

2008

2004

2004 |

Sprint Strategic Network Alliance Service

20

Exclusively provides 3G services to large number of Sprint home and travel

subscribers

Encompasses approximately

•

2.0mm covered POPs in WV and Western VA

•

846 cell sites

•

36,800 square miles

Provides ~$40mm in quarterly revenues

NASDAQ: NTLS |

Sprint Strategic Network Alliance Leverages NTELOS’s Network

NASDAQ: NTLS

Strategic

Network

Alliance

revenues

(1)

(1) Excludes roaming

Sprint Nextel Strategic Network Alliance

through at least July 2015

Attractive contribution to margin

Growing Usage

Significant growth in data usage

since EV-DO launched

Voice continues to grow

millions

21

$38

$40

$40

$42

$41

$40

$40

$49

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

4Q 2011

1Q 2012

2Q 2012

3Q 2012

4Q 2012

1Q 2013

2Q 2013

3Q 2013

SNA Settlement |

Financial Summary |

Operating Revenues

23

NASDAQ: NTLS

+14%

millions

$131

$71

$75

$77

$78

$80

$43

$42

$42

$41

$41

$114

$117

$119

$120

$0

$20

$40

$60

$80

$100

$120

$140

3Q 2012

4Q 2012

1Q 2013

2Q 2013

3Q 2013

SNA Settlement

Sprint, Wholesale & Other

Retail

$10 |

Adjusted EBITDA

24

NASDAQ: NTLS

(millions)

Continued investments in the business resulted in higher Adjusted EBITDA

$32

$33

$37

$41

$46

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

$50

3Q 2012

4Q 2012

1Q 2013

2Q 2013

3Q 2013

SNA Settlement |

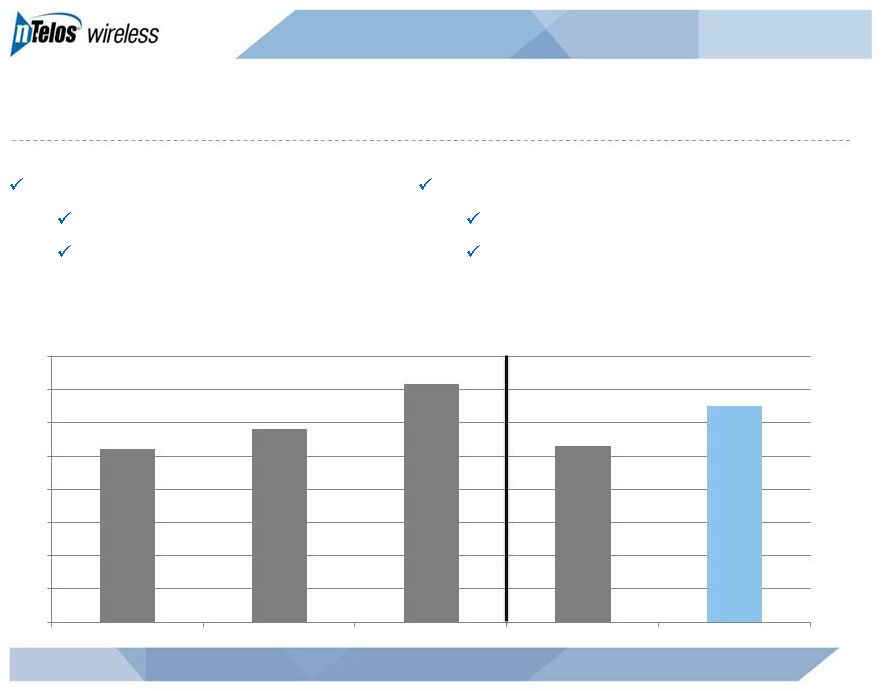

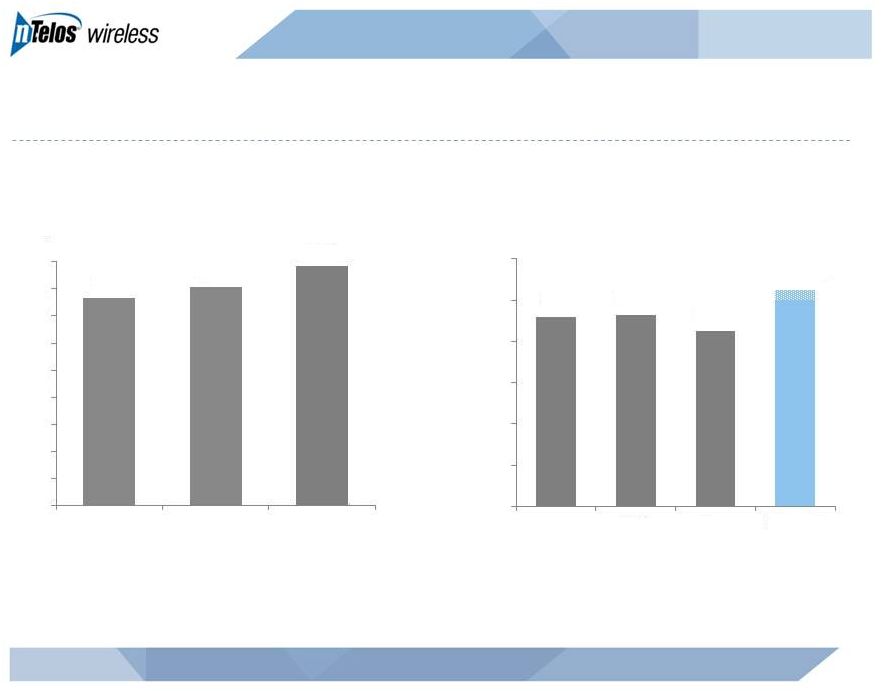

Historical Financial Performance

25

NASDAQ: NTLS

Revenue

Adjusted EBITDA

millions

millions

(1) Updated as of November 5, 2013 (includes $9.6 million in Adjusted EBITDA in

connection with the SNA dispute settlement) $407

$423

$454

$100

$140

$180

$220

$260

$300

$340

$380

$420

$460

2010

2011

2012

$142

$143

$135

$150 -

$155

$50

$70

$90

$110

$130

$150

$170

2010

2011

2012

2013 G (1) |

Managing Free Cash Flow with Disciplined Capital Investment

26

NASDAQ: NTLS

CapEx

millions

millions

CapEx

Free Cash Flow

(Adjusted EBITDA Less CapEx)

(1)

As of November 5, 2013

Note: Excludes wireline and related capex incurred prior to business separation

Revenue

Revenue

millions

~$80

$85

$97

$71

$52

$58

$72

$350

$375

$400

$425

$450

$475

$0

$25

$50

$75

$100

2007

2008

2009

2010

2011

2012

2013 G (1)

$70-$75

$59

$60

$85

$90

$85

$63

$0

$25

$50

$75

$100

2007

2008

2009

2010

2011

2012

2013 G (1)

Maintenance, IT & Other

Capacity

Growth

EV-DO |

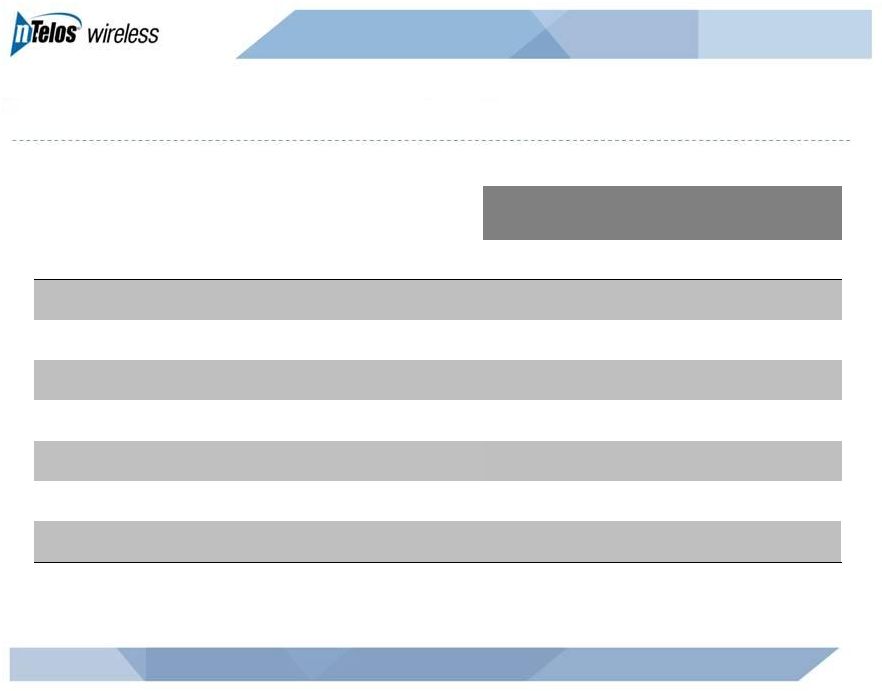

Capitalization Overview

NASDAQ: NTLS

27

($ in millions)

September 30, 2013

Cash, unrestricted

$110.9

Total Debt

$491.5

Net Debt

$380.6

LTM Adjusted EBITDA

$157.2

Secured Term Loan

$490.4

Net Debt Leverage

2.4x |

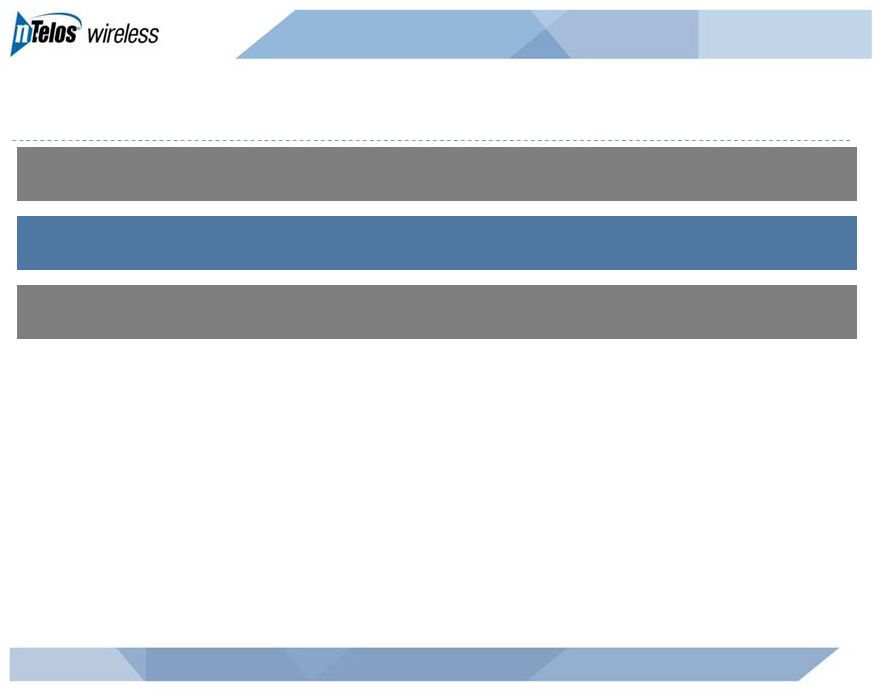

Guidance (as of November 5)

NASDAQ: NTLS

28

FY

2013

Adjusted

EBITDA

of

$150

million

-

$155

million

FY 2013 CapEx of ~$80 million

2013 net adds expected to be at or about 2012 net adds

|

Senior Executives—Wireless Veterans

JIM HYDE

CEO, President and Director

STEB CHANDOR

EVP, CFO and Treasurer

CONRAD HUNTER

EVP, COO

Former CEO, T-Mobile UK

Former T-Mobile USA /

Western Wireless /

VoiceStream Sr. Exec

18 years industry experience

Former CFO, iPCS Wireless

Former CFO, Metro One

Telecommunications

17 years industry experience

Former COO, iPCS Wireless

Former VP of Midwest

Operations, U.S. Cellular

Corporation

33 years industry experience

29

NASDAQ: NTLS

ROBERT McAVOY

EVP, CTO

Former Market General

Manager, PrimeCo

Began career at Bell Atlantic

25 years industry experience |

Summary

Leading “pure-play”

regional wireless company

30

Strategic asset set

Strong free cash flow

Broad geographic and network technology footprint

Experienced management team

NASDAQ: NTLS

Competitive and diversified business model |

Appendix |

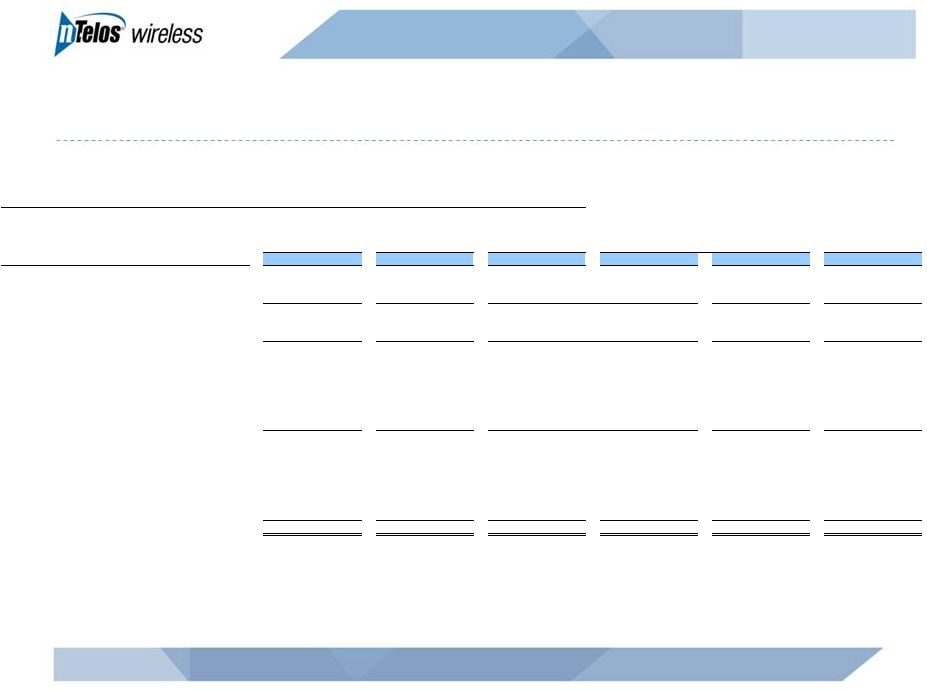

32

NASDAQ: NTLS

NTELOS Holdings Corp.

Reconciliation of Net Income Attributable to NTELOS Holdings Corp. to Adjusted EBITDA

Year Ended:

(In thousands)

2012

2011

2010

2009

2008

2007

Net Income Attributable to NTELOS Holdings Corp.

18,387

$

(23,715)

$

44,808

$

63,285

$

44,829

$

32,453

$

Net income attributable to noncontrolling interests

1,941

(1,769)

(1,417)

(851)

Net Income

20,328

(21,946)

46,225

64,136

44,829

32,453

Discontinued operations, net

-

(45,386)

16,882

18,054

16,002

12,638

Income from continuing operations

20,328

23,440

29,343

46,082

28,827

19,815

Interest expense

22,944

23,380

24,728

15,922

17,024

24,520

Loss (gain) on derivatives

-

264

147

(2,100)

9,531

3,527

Income taxes

12,676

16,363

20,251

26,526

20,787

17,161

Corporate financing fees

-

1,567

Other expense (income), net

7,194

1,240

413

971

1,402

2,953

Operating income

63,142

66,254

74,882

87,401

77,571

67,976

Depreciation and amortization

63,258

63,083

58,016

63,015

75,982

70,102

Accretion of asset retirement obligations

637

658

770

695

914

746

Equity-based compensation

6,029

6,072

5,270

3,227

2,729

4,328

Acquisition related charges

-

-

2,815

1,477

570

Business separation charges

1

1,660

6,997

352

Adjusted EBITDA

134,726

$

143,064

$

142,105

$

155,815

$

157,196

$

143,721

$

1

Charges for legal and consulting services costs in connection with the separation of

the wireless and wireline operations. |

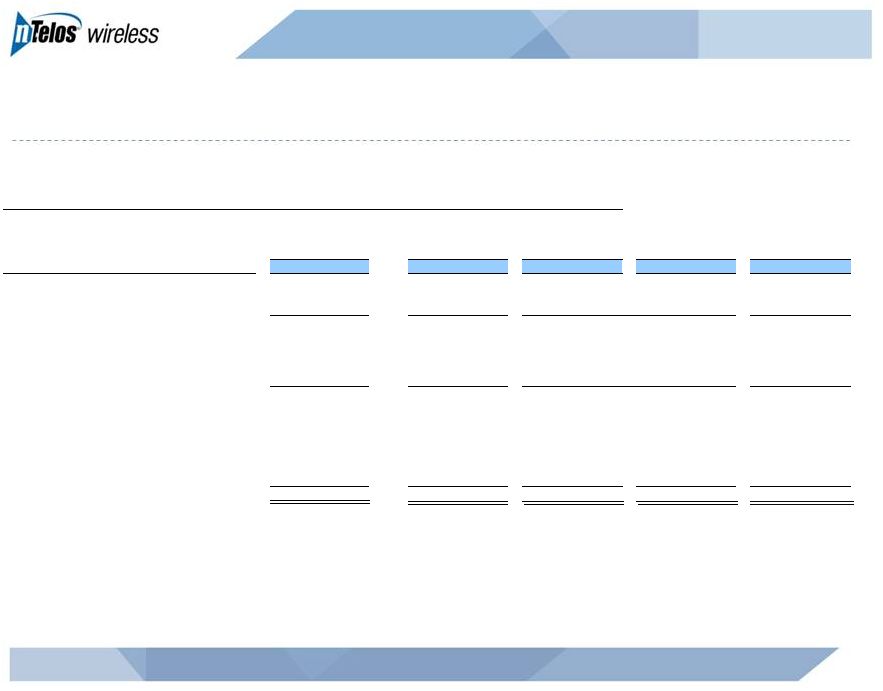

33

NASDAQ: NTLS

NTELOS Holdings Corp.

Reconciliation of Net Income Attributable to NTELOS Holdings Corp. to Adjusted EBITDA

(In thousands)

3Q13

2Q13

1Q13

4Q12

3Q12

Net Income Attributable to NTELOS Holdings Corp.

10,583

$

9,386

$

5,493

$

321

$

4,608

$

Net income attributable to noncontrolling interests

588

541

529

443

488

Net Income

11,171

9,927

6,022

764

5,096

Interest expense

7,480

7,398

7,361

6,651

5,432

Income taxes

8,340

6,380

3,744

(454)

3,141

Other expense (income), net

431

(151)

369

7,038

50

Operating income

27,422

23,554

17,496

13,999

13,719

Depreciation and amortization

16,559

20,443

18,456

17,440

15,810

Gain on sale of intangible assets

-

(4,442)

-

-

-

Accretion of asset retirement obligations

135

173

143

174

163

Equity-based compensation

1,442

1,460

1,321

1,346

1,478

Business

separation

charges

1

-

-

-

56

684

Adjusted EBITDA

45,558

$

41,188

$

37,416

$

33,015

$

31,854

$

1

Charges for legal and consulting services costs in connection with the separation of

the wireless and wireline operations. |

34

NASDAQ: NTLS

NTELOS Holdings Corp.

ARPU Reconciliation

Average Monthly Revenue per User (ARPU) ¹

3Q13

2Q13

1Q13

4Q12

3Q12

FY 2012

FY 2011

(In thousands, except for subscribers and ARPU)

Operating Revenues

130,912

$

119,859

$

119,345

$

117,398

$

114,466

$

453,989

$

422,629

$

Less: Equipment revenue from sales to new customers

(3,595)

(3,104)

(3,521)

(3,808)

(3,333)

(15,041)

(9,091)

Less: Equipment revenue from sales to existing customers

(2,946)

(2,395)

(3,117)

(3,315)

(3,416)

(15,037)

(17,793)

Less: Wholesale, other and adjustments

(50,142)

(41,179)

(40,918)

(41,488)

(42,380)

(165,765)

(143,477)

Gross subscriber revenue

74,229

73,181

71,789

68,787

65,337

258,146

252,268

Less: prepay subscriber revenue

(16,248)

(15,879)

(15,205)

(14,823)

(14,103)

(56,330)

(48,758)

Less: adjustments to prepay subscriber revenue

(230)

(303)

(479)

(237)

(434)

(1,706)

(1,175)

Gross postpay subscriber revenue

57,751

$

56,999

$

56,105

$

53,727

$

50,800

$

200,110

$

202,335

$

Prepay subscriber revenue

16,248

15,879

15,205

14,823

14,103

56,330

48,758

Plus: adjustments to prepay subscriber revenue

230

303

479

237

434

1,706

1,175

Gross prepay subscriber revenue

16,478

$

16,182

$

15,684

$

15,060

$

14,537

$

58,036

$

49,933

$

Average number of subscribers

455,724

453,262

444,244

434,457

427,610

425,377

422,256

Total ARPU

54.29

$

53.82

$

53.87

$

52.78

$

50.93

$

50.57

$

49.79

$

Average number of postpay subscribers

297,900

299,304

298,414

292,668

287,165

288,428

298,992

Postpay ARPU

64.62

$

63.48

$

62.67

$

61.19

$

58.97

$

57.82

$

56.39

$

Average number of prepay subscribers

157,824

153,958

145,831

141,789

140,446

136,949

123,264

Prepay ARPU

34.80

$

35.04

$

35.85

$

35.41

$

34.50

$

35.31

$

33.76

$

Gross subscriber revenue

74,229

73,181

71,789

68,787

65,337

258,146

252,268

Less: voice and other feature revenue

(43,672)

(43,078)

(42,658)

(41,379)

(39,366)

(156,032)

(171,882)

Data revenue

30,557

$

30,103

$

29,131

$

27,408

$

25,971

$

102,114

$

80,386

$

Average number of subscribers

455,724

453,262

444,244

434,457

427,610

425,377

422,256

Total Data ARPU

22.35

$

22.14

$

21.86

$

21.03

$

20.25

$

20.00

$

15.86

$

Gross postpay subscriber revenue

57,751

56,999

56,105

53,727

50,800

200,110

202,335

Less: postpay voice and other feature revenue

(36,652)

(36,170)

(35,952)

(34,651)

(33,028)

(130,601)

(144,114)

Postpay data revenue

21,099

$

20,829

$

20,153

$

19,076

$

17,772

$

69,509

$

58,221

$

Gross prepay subscriber revenue

16,478

16,182

15,684

15,060

14,537

58,036

49,933

Less: prepay voice and other feature revenue

(7,020)

(6,908)

(6,706)

(6,728)

(6,338)

(25,431)

(27,768)

Prepay data revenue

9,458

$

9,274

$

8,978

$

8,332

$

8,199

$

32,605

$

22,165

$

Average number of postpay subscribers

297,900

299,304

298,414

292,668

287,165

288,428

298,992

Postpay data ARPU

23.61

$

23.20

$

22.51

$

21.73

$

20.63

$

20.08

$

16.23

$

Average number of prepay subscribers

157,824

153,958

145,831

141,789

140,445

136,949

123,264

Prepay data ARPU

19.98

$

20.08

$

20.52

$

19.59

$

19.46

$

19.84

$

14.99

$

1

Average monthly revenue per user (ARPU) is computed by dividing service

revenues per period by the average number of subscribers during that period. ARPU as defined may not be similar to ARPU measures of other companies, is not a measurement under GAAP and should be

considered in addition to, but not as a substitute for, the information

contained in the Company’s consolidated statements of operations. The Company closely monitors the effects of new rate plans and service offerings on ARPU in order to determine their effectiveness. ARPU

provides management useful information concerning the appeal of NTELOS

rate plans and service offerings and the Company’s performance in attracting and retaining high-value customers.

|